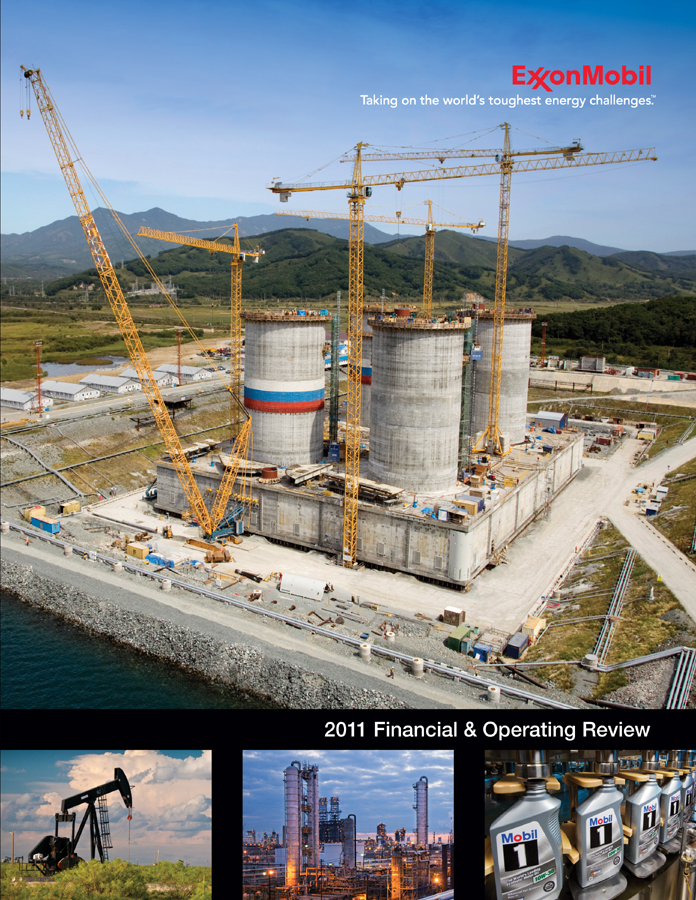

| ExxonMobil Taking on the world’s toughest energy challenges. 2011 Financial & Operating Review |

|

| Financial & Operating Summary | 1 | |||

| Business Model | 2 | |||

| Competitive Advantages | 3 | |||

| Global Operations | 4 | |||

| Upstream | 6 | |||

| Downstream | 52 | |||

| Chemical | 70 | |||

| Financial Information | 84 | |||

| Frequently Used Terms | 93 | |||

| Index | 96 | |||

| General Information | 97 |

On the Cover:Fabrication of the offshore platform for the

Arkutun-Dagi phase of the Sakhalin-1 project in Russia is nearing completion.

Arkutun-Dagi phase of the Sakhalin-1 project in Russia is nearing completion.

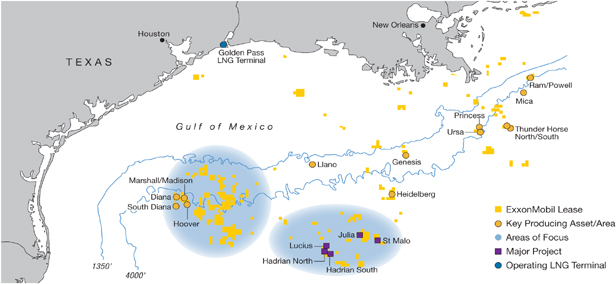

Inside Cover:In the U.S. Gulf of Mexico, we made a significant oil discovery with the Hadrian-5

exploration well. We estimate a recoverable resource in this area of more than 700 million oil-equivalent barrels,

making this one of the largest discoveries in the Gulf of Mexico in the last decade.

exploration well. We estimate a recoverable resource in this area of more than 700 million oil-equivalent barrels,

making this one of the largest discoveries in the Gulf of Mexico in the last decade.

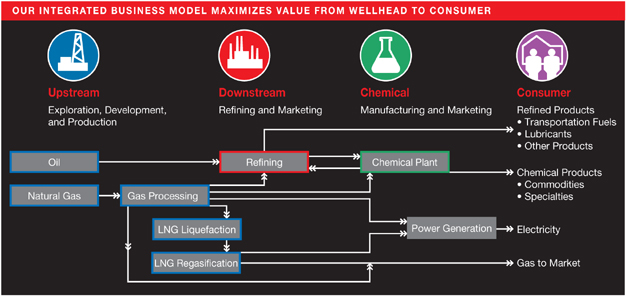

The termUpstream refers to exploration, development, production, and gas and power marketing.Downstream refers to the refining and marketing of petroleum products such as motor fuels and lubricants.

Statements of future events or conditions in this report, including projections, targets, expectations, estimates, and business plans, are forward-looking statements. Actual future results, including demand growth and energy mix; capacity growth; the impact of new technologies; capital expenditures; project plans, dates, costs, and capacities; production rates and resource recoveries; efficiency gains; cost savings; product sales; and financial results could differ materially due to, for example, changes in oil and gas prices or other market conditions affecting the oil and gas industry; reservoir performance; timely completion of development projects; war and other political or security disturbances; changes in law or government regulation; the actions of competitors and customers; unexpected technological developments; the occurrence and duration of economic recessions; the outcome of commercial negotiations; unforeseen technical difficulties; unanticipated operational disruptions; and other factors discussed in this report and in Item 1A of ExxonMobil’s most recent Form 10-K.

Definition of certain financial and operating measures and other terms used in this report are contained in the section titled “Frequently Used Terms” on pages 93 through 95. In the case of financial measures, the definitions also include information required by SEC Regulation G.

“Factors Affecting Future Results” and “Frequently Used Terms” are also available on the “investors” section of our website.

Prior years’ data have been reclassified in certain cases to conform to the 2011 presentation basis.

|

2011: Financial & Operating Summary

Our competitive advantages formed the framework for solid financial and operating results across all key measures and businesses in 2011. We achieved strong earnings and generated robust returns for our shareholders. We also continued to invest in attractive projects that position the company for sustained long-term growth and profitability.

FINANCIAL HIGHLIGHTS

| Average | Return on | Capital and | ||||||||||||||

| Earnings After | Capital | Average Capital | Exploration | |||||||||||||

| (millions of dollars, unless noted) | Income Taxes | Employed | (1) | Employed (%) | (1) | Expenditures | (1) | |||||||||

| Upstream | 34,439 | 129,807 | 26.5 | 33,091 | ||||||||||||

| Downstream | 4,459 | 23,388 | 19.1 | 2,120 | ||||||||||||

| Chemical | 4,383 | 19,798 | 22.1 | 1,450 | ||||||||||||

| Corporate and Financing | (2,221 | ) | (2,272 | ) | N.A. | 105 | ||||||||||

Total | 41,060 | 170,721 | 24.2 | 36,766 | ||||||||||||

OPERATING HIGHLIGHTS

Liquids production(net, thousands of barrels per day) | 2,312 | |||

Natural gas production available for sale(net, millions of cubic feet per day) | 13,162 | |||

Oil-equivalent production(2)(net, thousands of oil-equivalent barrels per day) | 4,506 | |||

Refinery throughput(thousands of barrels per day) | 5,214 | |||

Petroleum product sales(thousands of barrels per day) | 6,413 | |||

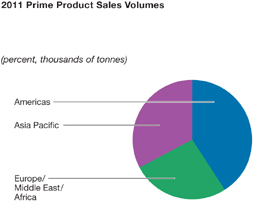

Chemical prime product sales(thousands of tonnes) | 25,006 |

OTHER RESULTS & HIGHLIGHTS

| Safety performance remains strong in industry | Total shareholder return of 19 percent(1) | |

Strong cash flow from operations and asset sales of $66.5 billion(1) | Total shareholder distributions of $29 billion(1) | |

Proved oil and gas reserve additions of 2.0 billion oil-equivalent barrels, replacing 116 percent of production, excluding asset sales(1) | Annual dividend per share growth of 6 percent versus 2010, the 29th consecutive year of dividend per share increases |

(1) See Frequently Used Terms on pages 93 through 95.

(2) Natural gas converted to oil-equivalent at 6 million cubic feet per 1 thousand barrels.

2 | ExxonMobil• 2011 Financial & Operating Review |

Business Model We employ a business model focused on achieving excellence in our daily operations, generating superior cash flow, and creating long-term shareholder value. As a result of the consistent application of this proven business model, we possess competitive advantages that support strong results today and position us well for decades to come. Rex W. Tillerson Chairman and CEO |  |

OUR BUSINESS MODEL IS SUPPORTED BY THE FOLLOWING FUNDAMENTAL ELEMENTS:

Operate in a Safe and Environmentally Responsible Manner

ExxonMobil employees are committed to excellence in safety, health, and the environment. Safety is a core value for us, one that shapes our decisions every day and at every level in our operations. A commitment to safety is the cornerstone of responsible operations and leads to better business results. In addition, in the area of environmental protection, we expect each of our businesses to deliver superior performance, lower incidents toward zero, and achieve industry-leading results.

We conduct business using an approach that is compatible with both the environmental and economic needs of the communities in which we operate. We have a number of programs to help advance the skills of local populations. These programs improve local business environments, lead to economic growth, and build stronger communities.

Uphold High Standards

We know that how we achieve results is as important as the results themselves. We choose the course of highest integrity in all of our business interactions. To support this objective, we have established a wide range of management systems that address critical aspects of our business. We expect disciplined application of these systems throughout the organization. Directors, officers, and employees must comply with our Standards of Business Conduct. ExxonMobil adheres to all applicable laws and regulations, and, when requirements do not exist, we apply responsible standards to our operations. We believe that a well-founded reputation for high ethical standards, strong business controls, and good corporate governance is a priceless asset.

Attract and Retain Exceptional People

Our goal is to develop our employees to have the best technical and leadership capabilities in the industry. We focus on merit-based, long-term career development and are committed to maintaining a diverse workforce. We recruit talented people from around the world and provide them with formal training and a broad range of global experiences to develop them into the next generation of ExxonMobil leaders. We know that delivering outstanding performance requires exceptional people.

Maintain Financial Strength

We maintain a financial position unparalleled in industry. Rating agencies Moody’s and Standard & Poor’s recognize our superior financial strength by assigning the highest credit rating to our financial obligations. We are one of very few public companies that have maintained this credit rating consistently for decades. Our financial strength gives us the capacity to pursue and finance attractive investment opportunities.

Competitive Advantages

As a result of our proven business model, ExxonMobil has established competitive advantages that are evident across all three of our business lines – Upstream, Downstream, and Chemical. These competitive advantages set us apart from industry and serve as the foundation for ongoing superior performance and the creation of long-term shareholder value.

Balanced Portfolio The quality, size, and diversity of our portfolio of resources, projects, products, and assets are unparalleled. The portfolio provides economies of scale and contains a large inventory of high-quality investment options across all business lines. It also provides us with the flexibility to take advantage of opportunities, supports future growth, and leads to strong financial and operating results.

Disciplined Investing We carefully assess investments over a range of potential market conditions and across time horizons that can span decades. Our approach to investing is to advance only those opportunities that are likely to provide long-term shareholder value. We focus on the efficient use of capital to achieve superior investment returns.

High-Impact Technologies ExxonMobil is an industry leader in the development and application of technology. We pursue high-impact technologies that can significantly improve our projects, operations, and products. Our ongoing technology investments, supported by dedicated technology centers, provide the company with competitive advantages in key aspects of our business.

Operational Excellence We employ management systems that are rigorously applied to our worldwide operations. These systems are designed to enable the consistent application of the highest operational standards. We also focus on maximizing value and enhancing efficiency in each of our businesses.

Global Integration The global integration of our business lines and functional organizations allows us to capture significant value across the supply chain, at manufacturing sites, and more broadly, in the management of critical, shared activities. The level of integration results in structural advantages that are difficult for competitors to replicate.

3 |

| Global Operations |

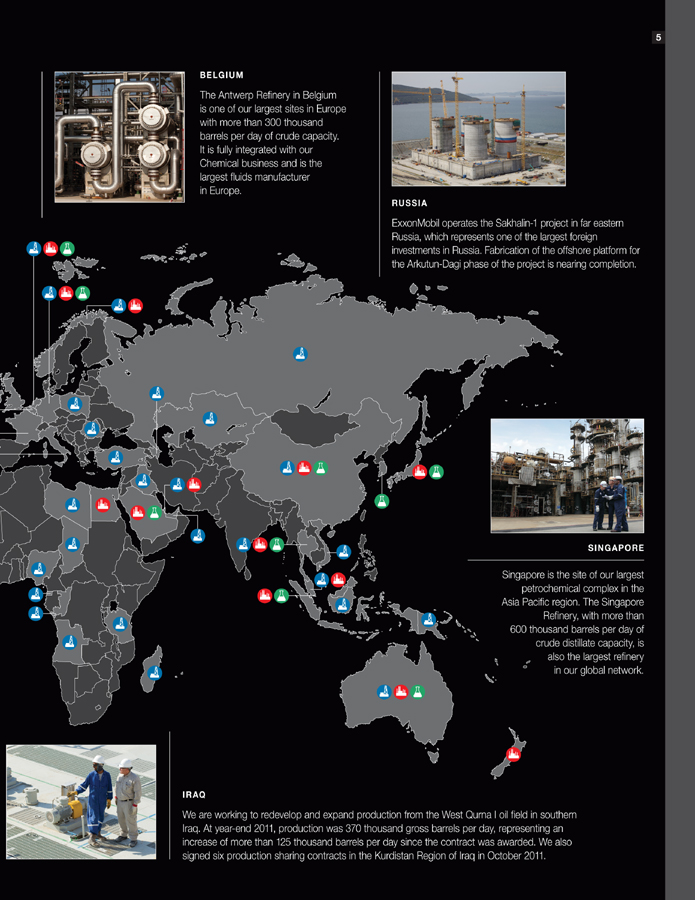

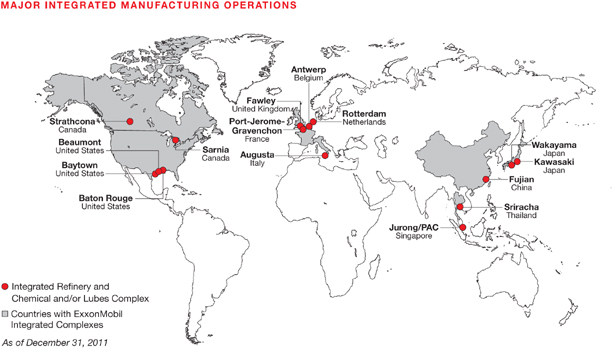

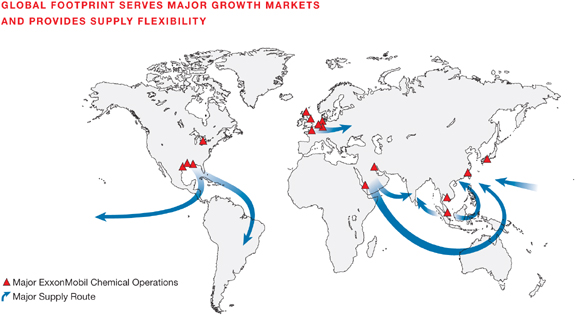

| ExxonMobil• 2011 Financial & Global Operations As the world’s largest publicly held oil and gas company, ExxonMobil has a diverse and balanced portfolio of high-quality resources, projects, and assets across our Upstream, Downstream, and Chemical businesses. CANADA The Kearl oil sands project in Canada is developing a world-class resource in northern Alberta expected to exceed 4 billion barrels. Construction and fabrication activities are progressing on the Kearl Initial Development project with start-up scheduled for 2012. Initial production is projected to be approximately 110 thousand barrels of bitumen per day with future debottlenecking and expansion increasing production to 345 thousand barrels of bitumen per day. ARGENTINA We have an interest in the Chihuidos concession and the Aguarague concession in Argentina. In addition, we acquired 767,900 net acres in the Neuquen Basin through license rounds and joint ventures in 2010 and 2011. Exploration drilling on this acreage commenced in late 2011. Upstream Downstream Chemical As of December 31, 2011 |

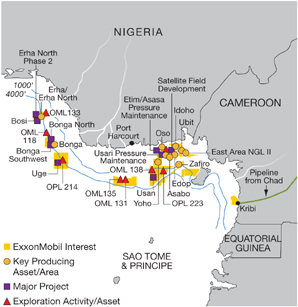

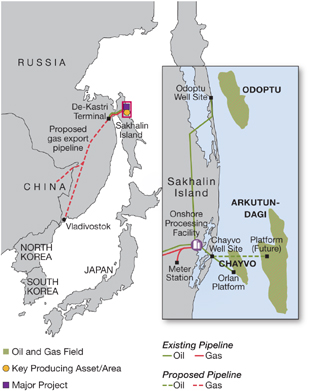

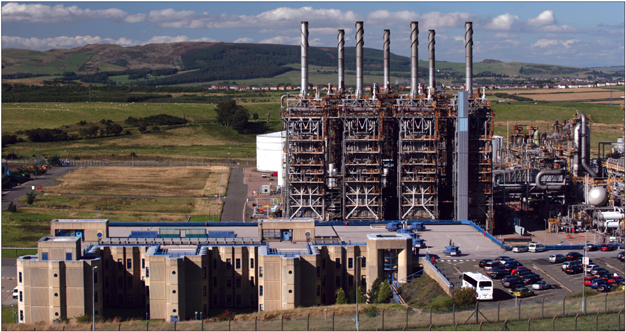

| BELGIUM The Antwerp Refinery in Belgium is one of our largest sites in Europe with more than 300 thousand barrels per day of crude capacity. It is fully integrated with our Chemical business and is the largest fluids manufacturer in Europe. RUSSIA ExxonMobil operates the Sakhalin-1 project in far eastern Russia, which represents one of the largest foreign investments in Russia. Fabrication of the offshore platform for the Arkutun-Dagi phase of the project is nearing completion. SINGAPORE Singapore is the site of our largest petrochemical complex in the Asia Pacific region. The Singapore Refinery, with more than 600 thousand barrels per day of crude distillate capacity, is also the largest refinery in our global network. IRAQ We are working to redevelop and expand production from the West Qurna I oil field in southern Iraq. At year-end 2011, production was 370 thousand gross barrels per day, representing an increase of more than 125 thousand barrels per day since the contract was awarded. We also signed six production sharing contracts in the Kurdistan Region of Iraq in October 2011. |

| In the U.S. Gulf of Mexico, we made a significant oil discovery in 2011 with the Hadrian-5 exploration well. The well encountered more than 1000 feet of net pay. |

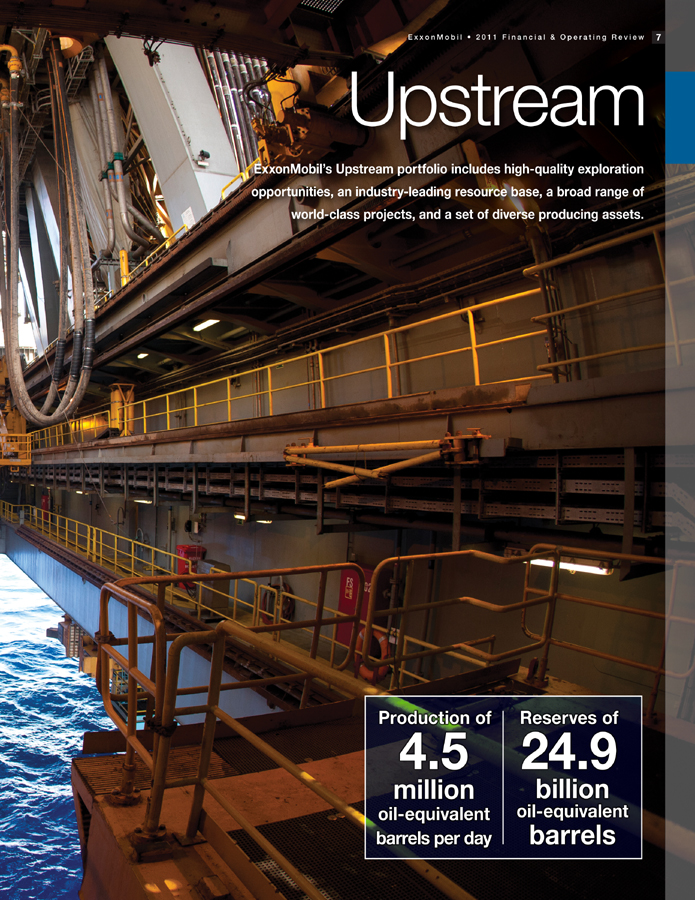

| Upstream |

| ExxonMobil• 2011 Financial & 7 Upstream ExxonMobil’s Upstream portfolio includes high-quality exploration opportunities, an industry-leading resource base, a broad range of world-class projects, and a set of diverse producing assets. Production of Reserves of 4.5 24.9 million billion oil-equivalent oil-equivalent barrels per day barrels |

| 8 |

ExxonMobil• 2011 Financial & Operating Review

ExxonMobil’s 2011 Upstream financial and operating results included strong safety and environmental performance, high facility reliability, continued operational and capital spending discipline, and solid production volume growth.

RESULTS & HIGHLIGHTS

Strong safety and operations performance supported by effective risk management

Industry-leading earnings of $34.4 billion

Return on average capital employed of 26.5 percent, averaging 33.7 percent over the last five years

Earnings per oil-equivalent barrel of $20.94

Total net production of 4.5 million oil-equivalent barrels per day, an increase of 1 percent versus 2010

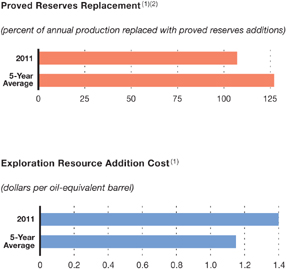

Proved oil and natural gas reserve additions of 2.0 billion oil-equivalent barrels, replacing 116 percent of production, excluding asset sales

Resource base additions totaling 4.1 billion oil-equivalent barrels, increasing the overall resource base to 87 billion oil-equivalent barrels

Exploration resource addition cost of $1.40 per oil-equivalent barrel

Upstream capital and exploration spending of $33.1 billion with total investment over the past five years at more than $116 billion

Made a significant oil discovery in the U.S. Gulf of Mexico with the Hadrian-5 exploration well

Signed a strategic cooperation agreement with Rosneft

| UPSTREAM STATISTICAL RECAP | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

Earnings(millions of dollars) | 34,439 | 24,097 | 17,107 | 35,402 | 26,497 | |||||||||||||||

Liquids production(net, thousands of barrels per day) | 2,312 | 2,422 | 2,387 | 2,405 | 2,616 | |||||||||||||||

Natural gas production available for sale(net, millions of cubic feet per day) | 13,162 | 12,148 | 9,273 | 9,095 | 9,384 | |||||||||||||||

Oil-equivalent production(1)(net, thousands of barrels per day) | 4,506 | 4,447 | 3,932 | 3,921 | 4,180 | |||||||||||||||

Proved reserves replacement(2)(3)(percent) | 116 | 211 | 100 | 143 | 107 | |||||||||||||||

Resource additions(2)(millions of oil-equivalent barrels) | 4,086 | 14,580 | 2,860 | 2,230 | 2,010 | |||||||||||||||

Average capital employed(2)(millions of dollars) | 129,807 | 103,287 | 73,201 | 66,064 | 63,565 | |||||||||||||||

Return on average capital employed(2)(percent) | 26.5 | 23.3 | 23.4 | 53.6 | 41.7 | |||||||||||||||

Capital and exploration expenditures(2)(millions of dollars) | 33,091 | 27,319 | 20,704 | 19,734 | 15,724 | |||||||||||||||

| (1) | Natural gas converted to oil-equivalent at 6 million cubic feet per 1 thousand barrels. | |

| (2) | See Frequently Used Terms on pages 93 through 95. | |

| (3) | Proved reserves exclude asset sales and the 2007 Venezuela expropriation. Includes non-consolidated interests and Canadian oil sands. | |

| Note: Unless otherwise stated, production rates, project capacities, and acreage values referred to on pages 8 through 41 are gross. | ||

BUSINESS OVERVIEW

Our Upstream business includes exploration, development, production, natural gas and power marketing, and research activities. ExxonMobil pursues a balanced global exploration program designed to test new high-potential exploration areas, explore emerging unconventional opportunities, and add resources through ongoing activity in established areas. We have an industry-leading resource base and a diverse portfolio of projects that span a broad range of environments, resource types, and geographies. We continue to grow our resource base through successful by-the-bit drilling, capture of undeveloped resources, strategic acquisitions, and increased recovery from existing fields. Our approach to investing is to advance opportunities that are likely to provide competitive returns across a broad range of potential market conditions. We have nine projects expected to come online during 2012 and 2013, including three in Nigeria, one in Australia, one in Canada, one in Angola, and one in Malaysia. During this time frame, we also expect to start up the Kearl Initial Development project in Canada and the first phase of the Kashagan development in Kazakhstan. These projects will provide us with a strong foundation for future production growth and add to our existing world-class global portfolio of producing assets.

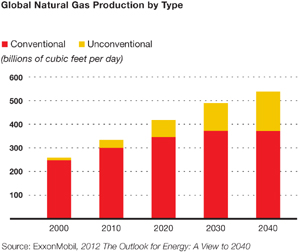

By 2040, unconventional natural gas is forecast

to account for 30 percent of global natural gas

production, up from 10 percent in 2010.

to account for 30 percent of global natural gas

production, up from 10 percent in 2010.

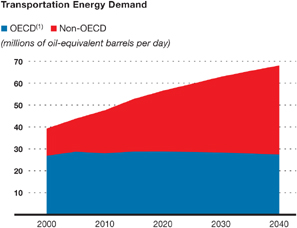

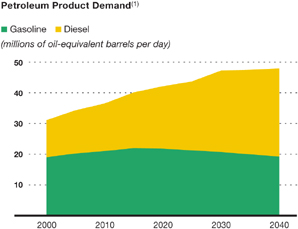

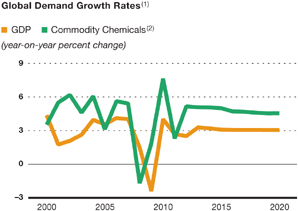

BUSINESS ENVIRONMENT

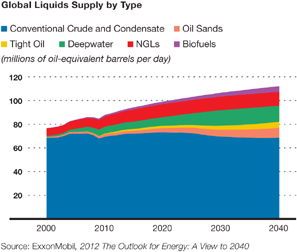

Oil and natural gas are expected to continue to play a leading role in meeting the world’s growing demand for energy. In fact, by 2040, oil and natural gas are projected to be the world’s top two energy sources, accounting for about 60 percent of global demand, versus about 55 percent today.

Demand for oil and other liquid fuels is forecast to increase by almost 30 percent over the next 30 years. As conventional oil production holds relatively flat through 2040, demand growth is expected to be met by new sources. The largest volume gain is likely to come from global deepwater production, which is estimated to more than double through 2040. We also project significant growth in production from oil sands, tight oil, and natural gas liquids. As a result of the growth in these newer resources, we anticipate that conventional oil will account for only about 60 percent of liquid fuels supply by 2040, down from 80 percent in 2010.

Natural gas is expected to be the fastest-growing major fuel through 2040, with demand increasing by more than 60 percent. A rising share of global natural gas demand will likely be met by unconventional gas supplies, such as those produced from shale and other rock formations.

9 |  |

| 10 |

ExxonMobil• 2011 Financial & Operating Review

UPSTREAM:

Balanced Portfolio

ExxonMobil’s Upstream portfolio includes high-quality exploration opportunities, an industry-leading resource base, a broad range of world-class development projects, and a set of diverse producing assets.

OVERVIEW

Our fundamental exploration strategy is to identify, evaluate, pursue, and capture the highest-quality opportunities across all resource types and in any environment. The combination of technical expertise, extensive global databases, and industry-leading research facilities provides us with a distinct competitive advantage in the pursuit, capture, and commercialization of new resources. In fact, recognition of these capabilities creates opportunities for us as other organizations seek a partner with our broad skills and experience.

We screen prospects for quality, materiality, and commercial viability. Technical capabilities and knowledge of the global hydrocarbon endowment allow us to identify and evaluate quality resources in the highest-potential basins. Careful consideration is given to ensure diversity and balance in our exploration portfolio with respect to resource type and risk. Only the best opportunities are selected for further investment. Once an opportunity is captured, we evaluate it in the most cost-effective manner and then apply what we learn to future investment decisions. This approach has led to the successful capture of new, high-potential resource opportunities every year.

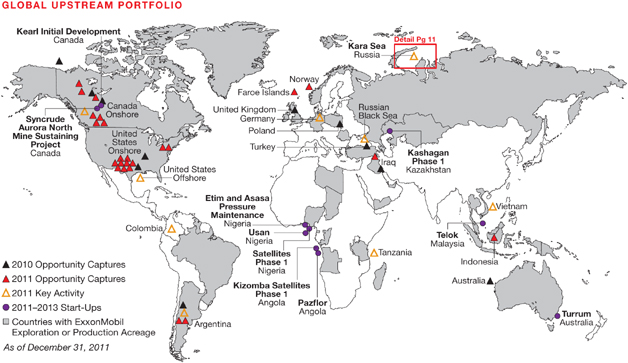

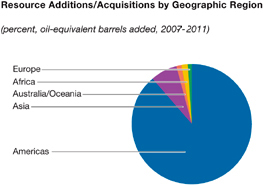

We significantly expanded our prospective exploration portfolio in 2011 with the successful capture of 24 new opportunities in seven countries. At year-end 2011, net exploration acreage totaled 61 million acres in 32 countries. This strong position provides us with a high-quality, geographically and geologically diverse portfolio of prospects that underpins future resource additions and production growth. We participated in exploration drilling in 2011 involving conventional opportunities in established basins such as the Gulf of Mexico, frontier basins in the Black Sea, liquefied natural gas (LNG) opportunities in Australia, and unconventional oil and gas assets in the United States and Canada. We added approximately 4.1 billion oil-equivalent barrels to our resource base as a result of these successful efforts to identify, capture, and test new opportunities.

Our global portfolio of high-quality development projects and producing assets reflects a diverse range of resource types and operating environments. These projects and producing assets also span a broad range of maturities including new greenfield developments such as Kearl, Papua New Guinea (PNG) LNG, and Gorgon Jansz; early production assets like Odoptu in Sakhalin; and long-life assets such as Qatar, Tengiz, and Cold Lake.

UP CLOSE:

ROSNEFT STRATEGIC COOPERATION AGREEMENT

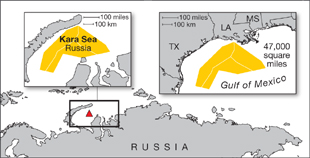

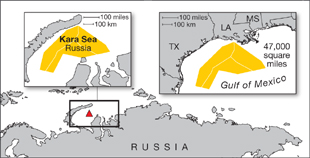

Rosneft and ExxonMobil signed a Strategic Cooperation Agreement on August 30, 2011, to jointly participate in exploration and development activities in Russia, the United States, and other parts of the world. Both companies will share their expertise and technology to address the challenges of oil and natural gas exploration and production associated with diverse resource types including conventional reservoirs located in offshore arctic regions and unconventional reservoirs found onshore. A key aspect of this agreement involves 31 million acres in the Kara Sea, which is one of the world’s most prospective hydrocarbon provinces with a high potential for liquids. The Kara Sea is a very large area similar in size to the entire central U.S. Gulf of Mexico or the central North Sea. Seismic surveys are planned in the Kara Sea for 2012. Also included in the scope of the agreement is a 3-million-acre Black Sea block where seismic surveys are already under way. The partnership includes establishment of an Arctic Research and Design Center for Offshore Developments. An integral part of this research effort is the development of new, state-of-the-art, safety and environmental protection systems. In addition, a Joint Technical Study team will evaluate a tight oil project in the West Siberia Basin.

oil and natural gas exploration and production associated with diverse resource types including conventional reservoirs located in offshore arctic regions and unconventional reservoirs found onshore. A key aspect of this agreement involves 31 million acres in the Kara Sea, which is one of the world’s most prospective hydrocarbon provinces with a high potential for liquids. The Kara Sea is a very large area similar in size to the entire central U.S. Gulf of Mexico or the central North Sea. Seismic surveys are planned in the Kara Sea for 2012. Also included in the scope of the agreement is a 3-million-acre Black Sea block where seismic surveys are already under way. The partnership includes establishment of an Arctic Research and Design Center for Offshore Developments. An integral part of this research effort is the development of new, state-of-the-art, safety and environmental protection systems. In addition, a Joint Technical Study team will evaluate a tight oil project in the West Siberia Basin.

2011 OPPORTUNITY CAPTURES

In 2011, we continued to build on our already strong and diverse resource position with the capture of 24 new opportunities. These opportunities included both unconventional and conventional play types. As part of this successful effort, we leveraged experience gained in unconventional plays in North America to capture new acreage positions in both Argentina and Indonesia.

Argentina • ExxonMobil acquired an additional 636,000 net acres in the potentially liquids-rich portion of the Neuquen Basin in Argentina through strategic joint ventures. Two wells to evaluate the potential of this acreage commenced drilling in late 2011.

Canada • We expanded our position in the unconventional plays of the Western Canada Basin by adding 499,000 net acres through various provincial lease sales during the year. Exploration drilling also continued to test these highly-prospective plays.

Faroe Islands • In March 2011, ExxonMobil acquired a 49-percent interest in license L006 and a 50-percent interest in licenses L009 and L011 in the Faroe Islands, covering 1.1 million acres. The Statoil-operated Brugdan-2 wildcat is scheduled to be drilled on license L006 in 2012.

Indonesia • Early in 2011, we joined a production sharing contract to explore 700,000 net acres in Kalimantan to evaluate coal bed methane potential.

Iraq • In October 2011, ExxonMobil signed production sharing contracts for six blocks covering 848,000 acres in the Kurdistan Region of Iraq.

Norway • In May 2011, we acquired a 35-percent operating interest in the PL596 Møre Vest license, covering 787,000 acres, and a 30-percent interest in the PL598 Ygg High license, covering 409,000 acres.

U.S. Onshore • During the year, we increased by 80 percent our position in the Marcellus Shale gas play in the United States by acquiring approximately 310,000 net acres. Acquisitions also included roughly 45,000 net acres in the emerging, liquids-rich Utica Shale play in eastern Ohio, bringing our total position in that play to roughly 75,000 net acres at year-end 2011. In addition, through leasing and multiple acquisitions, we captured an industry-leading position of 172,000 net acres in the liquids-rich Woodford Ardmore Shale play of southern Oklahoma. ExxonMobil also added more than 154,000 net acres in the prospective tight oil plays of the Permian Basin in West Texas.

11 |  |

| 12 |

ExxonMobil• 2011 Financial & Operating Review

Upstream: Balanced Portfolio, continued

RESOURCES AND PROVED RESERVES

Resources

ExxonMobil has a diverse, global portfolio of resources and reserves. We expanded our industry-leading resource base in 2011 by adding 4.1 billion oil-equivalent barrels. After adjusting for production, asset sales, and revisions to existing fields, the

The Hadrian-5 well in Keathley Canyon Block 919 was the first exploration

well permitted and drilled following the U.S. Outer Continental Shelf Drilling

Moratorium.

well permitted and drilled following the U.S. Outer Continental Shelf Drilling

Moratorium.

resource base now totals more than 87 billion oil-equivalent barrels. Proved reserves comprise approximately 29 percent of the resource base, or 24.9 billion oil-equivalent barrels.

The success of our global strategy to identify, evaluate, pursue, and capture opportunities is demonstrated by the addition of an average of 5.2 billion oil-equivalent barrels to our resource base per year over the past five years. ExxonMobil’s resource base is the largest among international oil companies, resulting in a significant competitive advantage. The size and diversity also support risk management and investment flexibility.

We continue to grow the resource base through successful by-the-bit drilling, capture of undeveloped resources, strategic acquisitions, and increased recovery from existing fields. We added resources in 2011 from the deepwater

Gulf of Mexico, Australia, Indonesia, Vietnam, the Athabasca and Horn River plays in Canada, and onshore fields in the United States.

The success of our global strategy to identify, evaluate, pursue, and capture opportunities is demonstrated by the addition of an average of 5.2 billion oil-equivalent barrels to our resource base per year over the past five years. ExxonMobil’s resource base is the largest among international oil companies, resulting in a significant competitive advantage. The size and diversity also support risk management and investment flexibility.

We continue to grow the resource base through successful by-the-bit drilling, capture of undeveloped resources, strategic acquisitions, and increased recovery from existing fields. We added resources in 2011 from the deepwater

Gulf of Mexico, Australia, Indonesia, Vietnam, the Athabasca and Horn River plays in Canada, and onshore fields in the United States.

Our exploration by-the-bit drilling program added 2.3 billion oil-equivalent barrels in 2011 with additions from multiple resource types around the world. Additions from exploration drilling averaged approximately 2 billion oil-equivalent barrels per year over the past decade. The resource base managed by XTO Energy totaled approximately 13.6 billion oil-equivalent barrels at year-end 2011, and included shale gas, tight gas, shale oil, coal bed methane, and conventional resources.

Resource Base Changes(1)

| 5-Year | ||||||||

| (billions of oil-equivalent barrels) | 2011 | Average | ||||||

| Resource additions/acquisitions | 4.1 | 5.2 | ||||||

| Revisions to existing fields | 0.9 | (0.3 | ) | |||||

| Production | (1.7 | ) | (1.6 | ) | ||||

| Sales | (0.6 | ) | (0.6 | )(2) | ||||

| Net change versus year-end 2010 | 2.7 | 2.7 | ||||||

| (1) | See Frequently Used Terms on pages 93 through 95. | |

| (2) | Includes impact of the Venezuela expropriation in 2007. |

Our resource base is updated annually for new discoveries and changes in estimates for existing resources. These changes may result from additional drilling, revisions to recovery estimates, or the application of new technology. Updates may occur due to changes in fiscal regime, equity, or depletion plans. They also come from ongoing and rigorous geoscience and engineering technical evaluations. The volumes we produce during the year and the resources associated with asset divestments are also removed from the resource base at year end.

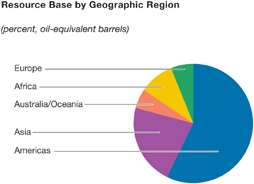

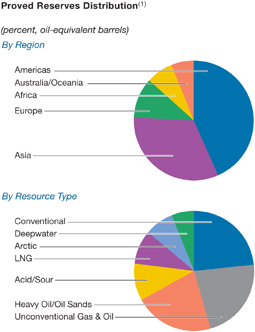

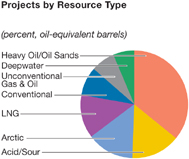

The largest component of ExxonMobil’s resource base remains conventional oil and gas and deepwater, which comprises 29 percent of the total. Heavy oil, predominantly located in Canada, accounts for just over 21 percent. Over the last decade, our position in both liquefied natural gas and unconventional gas and oil has increased significantly and makes up about 31 percent of total resources. The remainder is made up of arctic and acid/sour gas resources.

Application of proprietary processes and best practices has resulted in consistently low exploration resource addition costs. For example, in 2011, our exploration resource addition cost was $1.40 per oil-equivalent barrel, with the five-year average cost at $1.15 per oil-equivalent barrel. The 2011 resource additions provide us with an attractive set of future development opportunities.

Proved Reserves

ExxonMobil’s resource base includes 24.9 billion oil-equivalent barrels of proved oil and gas reserves, equating to 15 years of reserves life at current production rates. These reserves represent a diverse global portfolio distributed across all geographic regions and resource types, with an almost equal split between oil and natural gas.

We replaced 107 percent of the reserves we produced in 2011, including the impact of asset sales. We added 1.8 billion oil-equivalent barrels to proved reserves while producing 1.7 billion oil-equivalent barrels. Excluding asset sales, our proved reserves replacement ratio was 116 percent. Key proved reserve additions came from the Kearl Expansion project, which was sanctioned in 2011, and from unconventional assets in North America.

ExxonMobil has added 10 billion oil-equivalent barrels to proved reserves over the last five years, more than replacing production in that time frame. The development of new fields and extensions of existing fields have resulted in the addition of an average of 1 billion oil-equivalent barrels per year to proved reserves. Revisions to proved reserves have averaged about 0.7 billion oil-equivalent barrels per year over the last five years, driven by effective reservoir management and the application of new technology. We have more than replaced our production for 18 consecutive years. Proved reserve estimates are managed by a team of experienced reserve experts, and are the result of a rigorous and structured management review process.

| (1) | See Frequently Used Terms on pages 93 through 95. | |

| (2) | Includes asset sales and the 2007 Venezuela expropriation. |

13 |  |

| 14 |

E x x o n M o b i l • 2 0 1 1 F i n a n c i a l & O p e r a t i n g R e v i e w

UPSTREAM:

Disciplined Investing

A disciplined approach to investing combines effective project assessment and development with technical and commercial expertise. We apply this approach to initial resource capture, project execution, and ongoing operations to achieve superior returns on investment.

DISCIPLINED PROCESSES

Investment decisions in the energy industry are characterized by a time horizon measured in decades. As such, our projects are tested over a wide range of economic scenarios to ensure risks are properly identified, evaluated, and managed. ExxonMobil’s approach to investing in this cyclical business is to advance opportunities that will provide the most attractive returns across a broad range of potential market conditions, while maintaining a focus on the efficient use of capital. Proven project management systems incorporate best practices and are applied consistently around the world. Utilizing a disciplined gate review process, experienced global project teams rigorously manage our project portfolio from initial discovery to start-up.

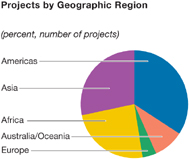

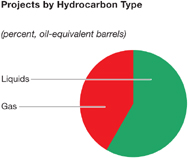

We have a large, geographically diverse portfolio of more than 120 projects targeting development of 23 billion oil-equivalent barrels. These projects span a wide range of environments, resource types, and geographies, and provide us with the ability to selectively invest in those projects that are likely to deliver robust financial performance and profitable volumes growth.

Portfolio management is also a key aspect of disciplined investing. In 2010 and 2011, we completed sales involving interests in the Beryl field in the North Sea, the Gassled Transportation System in Norway, a gas storage business in Germany, conventional gas properties in western Canada, XTO’s legacy Gulf of Mexico properties, more than 50 shallow-water platforms in the Gulf of Mexico, and the Tempa Rossa joint venture in Italy.

MAJOR DEVELOPMENT PROJECTS

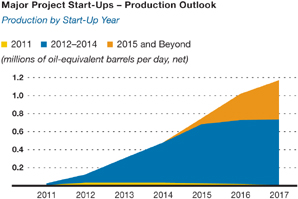

ExxonMobil participated in the start-up of one major project in 2011 and plans to bring 21 major projects online before year-end 2014. An additional 34 major projects are in various stages of planning, design, and execution.

Project Execution Performance – ExxonMobil Projects

| (Percent of plan, 2007-2011 Average) | Cost | Schedule | ||||||

| ExxonMobil Operated | 103 | 109 | ||||||

| Operated by Others | 109 | 114 | ||||||

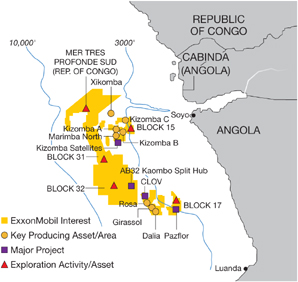

Pazflor• (ExxonMobil interest, 20 percent) Pazflor started up in August 2011 utilizing a floating production, storage, and offloading (FPSO) vessel located approximately 100 miles offshore Angola in Block 17. The facility is expected to produce approximately 220 thousand barrels of oil per day through three subsea separation units.

Kizomba Satellites Phase 1• (ExxonMobil interest, 40 percent) Kizomba Satellites Phase 1 is scheduled to start up in the third quarter 2012 as a subsea tie back to the existing FPSO facilities in Angola Block 15. The project is expected to drill 18 wells and recover nearly 250 million barrels of oil, with a peak production rate of 100 thousand barrels of oil per day.

Kearl Initial Development• Kearl Initial Development (combined ExxonMobil and Imperial Oil interest, 100 percent) is expected to start up by year-end 2012. The Initial Development is anticipated to produce 110 thousand barrels of bitumen per day, with future potential of up to 170 thousand barrels of bitumen per day after debottlenecking. Kearl represents the first mining operation to employ a new proprietary paraffinic froth treatment technology, which produces a salable crude oil without an upgrader. As a result, Kearl’s life cycle greenhouse gas emissions will be no greater than that of the average crude oil consumed in the United States.

MAJOR PROJECT START-UPS

| Target Peak | ||||||||||||||||

| Production (Gross) | ExxonMobil | |||||||||||||||

| Liquids | Gas | Working | ||||||||||||||

| (KBD) | (MCFD) | Interest (%) | ||||||||||||||

| 2011(Actual) | ||||||||||||||||

| Angola | Pazflor | 220 | – | 20 | l | |||||||||||

| 2012-2014(Projected) | ||||||||||||||||

| Angola | Cravo-Lirio-Orquidea-Violeta | 160 | – | 20 | l | |||||||||||

| Kizomba Satellites Phase 1 | 100 | – | 40 | n | ||||||||||||

| Australia | Kipper/Tuna | 15 | 175 | 40 | n | |||||||||||

| Turrum | 20 | 200 | 50 | n | ||||||||||||

| Canada | Cold Lake Nabiye Expansion | 40 | – | 100 | n | |||||||||||

| Hibernia Southern Extension | 55 | – | 27 | n | ||||||||||||

| Kearl Initial Development | 170 | – | 100 | n | ||||||||||||

| Syncrude Aurora North | 215 | – | 25 | ▲ | ||||||||||||

| Mine Sustaining Project | ||||||||||||||||

| Syncrude Mildred Lake | 180 | – | 25 | ▲ | ||||||||||||

| Mine Sustaining Project | ||||||||||||||||

| Indonesia | Banyu Urip | 165 | 15 | 45 | n | |||||||||||

| Kazakhstan | Kashagan Phase 1 | 290 | – | 17 | l | |||||||||||

| Malaysia | Damar Gas | 5 | 200 | 50 | n | |||||||||||

| Telok | – | 370 | 50 | n | ||||||||||||

| Nigeria | Etim/Asasa Pressure Maintenance | 50 | – | 40 | n | |||||||||||

| Usan | 180 | – | 30 | l | ||||||||||||

| Satellite Field Development Phase 1 | 70 | – | 40 | n | ||||||||||||

| Papua New Guinea | PNG LNG | 30 | 940 | 33 | n | |||||||||||

| Russia | Sakhalin-1 Arkutun-Dagi | 90 | – | 30 | n | |||||||||||

| Qatar | Barzan | 85 | 1400 | 7 | ▲ | |||||||||||

| U.S. | Hadrian South | – | 300 | 47 | n | |||||||||||

| Lucius | 100 | 90 | 25 | l | ||||||||||||

| 2015+(Projected) | ||||||||||||||||

| Angola | AB32 Kaombo Split Hub | 210 | – | 15 | l | |||||||||||

| Kizomba Satellites Phase 2 | 65 | – | 40 | n | ||||||||||||

| Australia | Gorgon Area Expansion | 10 | 850 | 25 | l | |||||||||||

| Gorgon Jansz | 20 | 2835 | 25 | l | ||||||||||||

| Scarborough | – | 1190 | 50 | n | ||||||||||||

| Target Peak | ||||||||||||||||

| Production (Gross) | ExxonMobil | |||||||||||||||

| Liquids | Gas | Working | ||||||||||||||

| (KBD) | (MCFD) | Interest (%) | ||||||||||||||

| 2015+(Projected, continued) | ||||||||||||||||

Canada | Aspen | 80 | – | 100 | n | |||||||||||

| Firebag | 280 | – | 80 | n | ||||||||||||

| Hebron | 130 | – | 36 | n | ||||||||||||

| Kearl Expansion | 175 | – | 100 | n | ||||||||||||

| Mackenzie Gas Project | 10 | 830 | 56 | n | ||||||||||||

| Syncrude Aurora South Phase 1 and 2 | 200 | – | 25 | ▲ | ||||||||||||

Indonesia | Cepu Gas | – | 210 | 41 | n | |||||||||||

| Natuna | – | 1100 | ** | n | ||||||||||||

Iraq | West Qurna I* | 2825 | – | 60 | ▲ | |||||||||||

Kazakhstan | Kashagan Future Phases | 1260 | – | 17 | l | |||||||||||

| Aktote | 50 | 850 | 17 | l | ||||||||||||

| Tengiz Expansion | 250 | – | 25 | l | ||||||||||||

Nigeria | Bonga North | 100 | 60 | 20 | l | |||||||||||

| Bonga Southwest | 200 | 15 | 16 | l | ||||||||||||

| Bosi | 135 | 140 | 56 | n | ||||||||||||

| Erha North Phase 2 | 60 | – | 56 | n | ||||||||||||

| Satellite Field Development Phase 2 | 80 | – | 40 | n | ||||||||||||

| Uge | 110 | 20 | 20 | n | ||||||||||||

| Usan Future Phases | 50 | – | 30 | l | ||||||||||||

| Usari Pressure Maintenance | 50 | – | 40 | n | ||||||||||||

Norway | Aasgard Subsea Compression | 35 | 360 | 14 | l | |||||||||||

| Dagny | 65 | 185 | 33 | l | ||||||||||||

| Luva | – | 600 | 15 | l | ||||||||||||

Russia | Sakhalin-1 Future Phases | 30 | 800 | 30 | n | |||||||||||

United Arab Emirates | Upper Zakum 750 | 750 | – | 28 | ▲ | |||||||||||

U.K. | Fram | 20 | 140 | 69 | l | |||||||||||

U.S. | Alaska Gas/Point Thomson | 70 | 4500 | 36 | ** | |||||||||||

| Hadrian North | 100 | 100 | 50 | n | ||||||||||||

| Julia Phase 1 | 30 | – | 50 | n | ||||||||||||

KBD = Thousand barrels per day MCFD = Million cubic feet per day

n ExxonMobil Operated ▲ Joint Operation l Co-Venturer Operated

* Field debottlenecking in 2012 ** Pending Final Agreements

15 |  |

| 16 |

E x x o n M o b i l • 2 0 1 1 F i n a n c i a l & O p e r a t i n g R e v i e w

UPSTREAM:

High-Impact Technologies

ExxonMobil’s commitment to invest in technology enables us to develop innovative solutions to improve safety, minimize environmental impact, reduce costs, increase reliability, and maximize resource value. Integrated technologies have unlocked value from previously uneconomic resources, including heavy oil and those trapped in tight reservoirs, as well as in difficult environments such as the Arctic and deep water.

HIGH-PERFORMANCE COMPUTING

High-performance computing (HPC) is a key enabling technology for our Upstream business. We are investing in massively parallel computational capability to support advanced seismic imaging and other research. Successful results at ExxonMobil’s Upstream Research Company have created demand in our business lines for early application of these technologies. Based on continued success, a next-generation petascale computing facility is being constructed. This new system will allow us to take on technical and computational challenges that until recently were considered impossible to solve.

3D Geomechanical Models

HPC capabilities allow us to run advanced numerical models to predict the stress field near salt bodies that are located in areas where significant exploration, development, and production activities take place. This new capability enhances our understanding of the irregular stress field around

| Our petascale computational capability allows 1015 operations per second |

salt and is critical for planning safe and economic drilling programs. These predictions help us to identify optimum drilling trajectories, reduce drilling-related wellbore instabilities, and decrease the likelihood of sidetrack drilling.

This approach requires high-performance computing to enable the development of 3D full-field model solutions on a schedule compatible with well planning. We are applying this emerging geomechanical modeling technology to salt provinces in the Caspian Sea, Angola, and the Gulf of Mexico. Recent applications of this technology resulted in the elimination of hole-related, nonproductive rig time in wells located near salt. This compares with five to eight days of nonproductive rig time for previously drilled wells nearby.

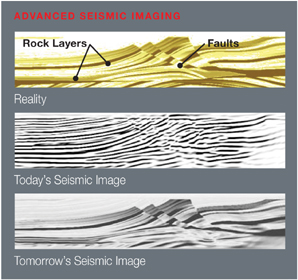

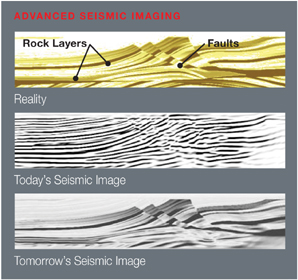

Advanced Seismic Imaging

One of the key technologies enabled by ExxonMobil’s petascale high-performance computing facility is our industry-leading seismic imaging capability.

Our researchers are developing seismic imaging technology that will generate high-definition subsurface models of geologic structures and rock properties. Proprietary computer algorithms accelerate massive computational tasks allowing our geophysicists to incorporate the full physics response, which is well beyond what is possible by conventional methods today. One such advance is the ability to simulate the full complexity of seismic wave propagation in the earth. ExxonMobil’s proprietary inversion methodology, which usesiterative inversion of data from simultaneous sources,is the basis for ourEMPrisetechnology. This recently patented seismic imaging technology positions us to be the industry leader in full wavefield inversion.

response, which is well beyond what is possible by conventional methods today. One such advance is the ability to simulate the full complexity of seismic wave propagation in the earth. ExxonMobil’s proprietary inversion methodology, which usesiterative inversion of data from simultaneous sources,is the basis for ourEMPrisetechnology. This recently patented seismic imaging technology positions us to be the industry leader in full wavefield inversion.

Full wavefield inversion will provide our geoscientists with focused 3D models of subsurface rock properties, predicted from seismic data, well in advance of drilling activities. At the initiation of this research program, we estimated that a single project would take tens of thousands of years to compute using the fastest computing technology then

High-performance computing enables advanced seismic

imaging, providing high-resolution images of the subsurface.

Our researchers are developing new recovery methods to increase the amount of bitumen

extracted from oil sand deposits with a fraction of the current water use.

extracted from oil sand deposits with a fraction of the current water use.

available. Capitalizing on advances in computing, and with proprietary technologies, we expect to produce high-fidelity subsurface images that are unmatched in industry, and in a time frame that is practical for business application.

EXTENDED-REACH DRILLING

We have an impressive record of completing successful developments in challenging environments, with over 90 years of experience in the Arctic, and a suite of patented technologies that position us as the industry leader in extended-reach drilling (ERD). We have drilled 23 of the world’s 27 longest-reach wells. These long-reach wells enable development of oil and gas with a reduced footprint and less environmental impact.

We continue to advance ERD by progressing several additional drilling and completion technologies. ExxonMobil’s patented Internal Shunt Alternate Path Technology (ISAPT) saw its first commercial application with zonal isolation in 2011. ISAPT enables reliable long horizontal well completions in

ExxonMobil has drilled 23 of the 27 longest-reach

wells in the world, the longest exceeding 7.1 miles.

wells in the world, the longest exceeding 7.1 miles.

unconsolidated sandstone formations. Our cuttings transport approach is supported by large-scale experiments and advanced physics-based modeling. In addition, ExxonMobil’s patented VYBS technology reduces drill string vibration.

OIL SANDS RESEARCH

We are developing technologies to reduce both the environmental impact and the cost of extracting bitumen, a heavy oil resource that is either mined or developed in situ.

New stratigraphic and geologic modeling technologies allow for more accurate predictions of the oil sands resources in place, reducing the number of core holes drilled for development. New land and shallow seismic methods are also providing low-cost geophysical data for resource characterization.

As a founding member of the Oil Sands Tailings Consortium (OSTC), Imperial Oil, an ExxonMobil affiliate, is working to accelerate industry-wide solutions to one of the largest environmental challenges for heavy oil assets. This unique partnership opens the door for collaboration in the development of next-generation reclamation technologies. We are leveraging the OSTC to evaluate new tailings treatment technologies prior to start-up of our Kearl oil sands project in late 2012. Additionally, we are progressing the development of proprietary technology to allow for nonaqueous extraction of bitumen, which has the potential to significantly reduce water usage and ultimately eliminate the need for wet-tailings ponds.

ExxonMobil and Imperial Oil are also advancing bitumen recovery technologies to facilitate commercial development of additional in situ bitumen resources, which are buried too deep for mining, while improving environmental performance. Current efforts are focused on the use of solvents to access undeveloped resources, improve bitumen recovery, and reduce greenhouse gas emissions. The patentedLiquid Assisted Steam Enhanced Recovery (LASER)technology, first commercially applied at Cold Lake, increases bitumen recovery rates by adding a small amount of solvent to an existing high-pressure cyclic steam injection technology application. Additionally, we are progressing a Cyclic Solvent Process field pilot, which is scheduled for a 2013 start-up. Results from pre-commercial trials and pilots of these technologies will provide invaluable information, allowing us to optimize our long-term resource development plan and increase bitumen production.

17 |  |

| 18 |

E x x o n M o b i l • 2 0 1 1 F i n a n c i a l & O p e r a t i n g R e v i e w

UPSTREAM:

Operational Excellence

We rigorously apply management systems worldwide to enable consistent application of the highest operational standards. We maximize the value of existing assets through strong reliability performance and selective investment.

OPERATIONAL INTEGRITY AND RISK MANAGEMENT

Operational integrity is an essential aspect of our ongoing success. ExxonMobil’s Operations Integrity Management System (OIMS) encompasses all aspects of our operations and enables us to understand and minimize risks. OIMS is used consistently around the world with compliance tested on a regular basis.

In addition to OIMS, ExxonMobil employs a comprehensive set of risk management systems to address the risks found in all aspects of our operations. For example, we have risk management systems tomonitor drilling, construction and project management, facility integrity, and well work. We also manage the risks associated with supporting activities such as aviation and logistics, business controls, and the oversight of joint-venture assets.

We employ a comprehensive set of risk

management systems to minimize the risks

inherent in our business.

management systems to minimize the risks

inherent in our business.

RELIABILITY

ExxonMobil achieves high facility uptime by leveraging a suite of equipment maintenance best practices that we have developed over our considerable operational history. Large-scale maintenance activities are rigorously planned and executed using a globally consistent shutdown management process to minimize production impact.

MANAGING THE BASE

We focus on the effective management of base performance through rigorous operational surveillance and optimization. Through effective reservoir management and depletion planning, we increase economic resource recovery, maximize profitability, and ensure optimum long-term field performance. New production volumes are added through drill wells, workovers of existing wells, and secondary and tertiary recovery programs. These programs increase resource recovery using water, gas, or carbon dioxide, heavy oil steam flooding, and sour gas injection techniques. We continue to selectively progress an inventory of investment opportunities to derive the most value from existing assets. ExxonMobil also seeks to maximize efficiencies and cost savings in drilling operations with the application of our proprietaryFast Drillprocess and extended-reach drilling capabilities.

We develop and deploy management systems across the various aspects of our business to maximize the efficiency and value of our assets.

UP CLOSE:

MARINE WELL CONTAINMENT

ExxonMobil, along with other companies, is leading the development of a rapid-response oil spill containment system for the Gulf of Mexico. The system involves a commitment in excess of $1 billion on behalf of 10 member companies of the Marine Well Containment Company (MWCC), a not-for-profit industry organization. The system will be adaptable for a wide range of well designs, oil flow rates, and environmental conditions. It will be available to initiate deployment within 24 hours of notification, and able to capture, store, and offload up to 100 thousand barrels of oil per day in water as deep as 10,000 feet. Engineering and construction activities are progressing for this purpose-built system which, when complete, will be owned and operated by MWCC.

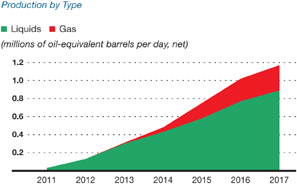

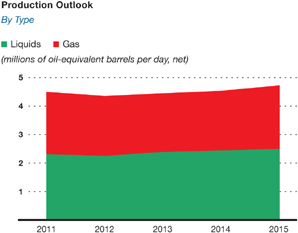

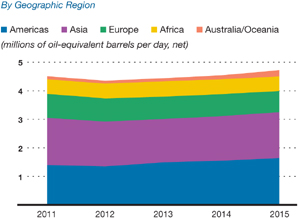

PRODUCTION VOLUMES

ExxonMobil’s approach to operational excellence allows us to deliver consistent volumes growth and maximize the profitability of existing oil and gas production. Net oil-equivalent production in 2011 of 4.5 million barrels per day increased by 1 percent over 2010 levels. Excluding the impacts associated with entitlement volume effects, quotas, and divestments, our net oil-equivalent production increased by more than 4 percent versus 2010, primarily driven by unconventional activities in the United States and project activity in Qatar, Angola, Russia, and Iraq, which more than offset field decline.

Near-term volume growth will focus on large liquids projects in Iraq and Canada, liquefied natural gas projects in Papua New Guinea and Australia, and unconventional gas and liquids activity in the United States. Longer-term growth will leverage our technical expertise in developing a diverse global project portfolio. We are already pursuing a number of these projects, many of which will result in long-plateau production profiles that run for decades.

The forward-looking projections of production volumes in this document are reflective of our best assumptions regarding technical, commercial, and regulatory aspects of existing operations and new projects. Factors that could impact actual volumes include project start-up timing, regulatory changes, quotas, changes in market conditions, asset sales, operational outages, severe weather, and entitlement volume effects under certain production sharing contracts and royalty agreements.

19 |  |

| 20 |

E x x o n M o b i l • 2 0 1 1 F i n a n c i a l & O p e r a t i n g R e v i e w

UPSTREAM:

Global Integration

The benefit we derive from a globally integrated business model is one of the primary reasons we are able to successfully develop some of the most challenging energy projects. Global functional organizations, robust management processes, and best practices combined with an ability to leverage expertise across ExxonMobil’s Upstream, Downstream, and Chemical businesses enable us to identify and deliver innovative solutions for our operations and projects.

GLOBAL FUNCTIONAL ORGANIZATION

Our global functional organization allows us to leverage expertise and knowledge in every location where we conduct business. In doing so, we combine the strengths of local affiliates and centralized locations to maximize the value of our global portfolio. Utilizing global engineering organizations, we deploy technical expertise to develop optimal solutions to the operational challenges we face around the world. For example, Maximizing Recovery Workshops are designed to identify opportunities to profitably capture additional hydrocarbons in existing assets. Over the past four years, we have conducted these workshops on many of the major fields operated by ExxonMobil, which has led to resource additions of approximately 1.8 billion oil-equivalent barrels. As a result, we defined and

documented numerous potential activities with several of the more material opportunities now progressing through the project review process.

The benefits of a global functional organization extend to our operations as well, where we are

Global functional organizations, processes, and best practices enable us to deliver innovative solutions.

deploying a global Work Management System. This system helps to ensure work activities at operating sites are planned and executed in a structured and controlled manner, allowing us to effectively manage risks and safety exposures. We developed the Work Management System by utilizing an electronic work permit process, and by leveraging operational experience from around the globe. We anticipate the system will deliver additional work execution efficiencies and improvements in safety performance.

In addition, ExxonMobil employs a worldwide team of commercial experts, armed with detailed knowledge of global energy markets, to maximize the value of our natural gas and natural gas liquids production.

INTEGRATION ACROSS THE VALUE CHAIN

Integrated commercial activities across the resource value chain support development of our Upstream projects. For example, the mega-train ventures in Qatar demonstrated the importance of economies of scale and the competitive advantages obtained through the integrated development of large gas resources. The integration of field development, liquefaction, shipping, and regasification in key global markets resulted in significant benefits for the Qatar projects.

We also continue to find innovative ways to further integrate our natural gas and natural gas liquids production activities. Well-established business teams, with representatives from across ExxonMobil, work together to ensure that the value of natural gas and natural gas liquids production is maximized through integration with our refining and chemical facilities. For example, in the United Kingdom, we maximize the throughput from our North Sea natural gas liquids extraction plants to provide ethane feedstock to processing facilities at our Fife ethylene plant. In the United States, we also optimize our portfolio of natural gas and natural gas liquids to provide a secure supply for ExxonMobil’s refining and chemical facilities. In North America, we are expanding these activities with the increase in natural gas liquids volumes from liquids-rich unconventional production from our extensive portfolio of resources.

Our internal power requirements also provide another opportunity for integration. Power generation and purchasing expertise enable us to capture additional value while increasing efficiency and reducing emissions. We are an industry leader in the application of cogeneration technology with interests in almost 5 gigawatts of capacity across 100 installations. We continue to pursue cogeneration opportunities around the world to efficiently supply the power and steam demands of ExxonMobil’s Upstream, Downstream, and Chemical facilities. In 2011, we progressed construction of 220 megawatts of additional cogeneration capacity in Singapore. Similar projects in Canada and Europe are in the advanced stages of development.

| Worldwide Upstream Operations Construction and fabrication activities are progressing on the Kearl Initial Development project with start-up scheduled for late 2012. |

| 22 |

ExxonMobil• 2011 Financial & Operating Review

UPSTREAM:

Worldwide Upstream Operations

ExxonMobil has an interest in exploration and production acreage in 36 countries and production operations in 23 countries.

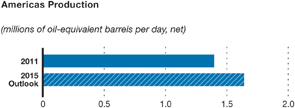

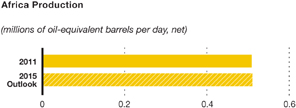

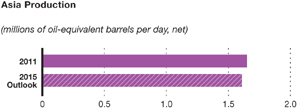

THE AMERICAS

Our portfolio in the Americas includes conventional fields onshore, ultra-deepwater developments, various unconventional gas and oil opportunities, and oil sands and heavy oil plays. Operations in the Americas contributed 31 percent of net oil-equivalent production and 23 percent of Upstream earnings in 2011.

UNITED STATES

ExxonMobil is a leading reserves holder and producer of oil and natural gas in the United States.

We maintain a significant position in all major producing regions, including the offshore Gulf of Mexico, the Gulf Coast, the mid-continent, California, and Alaska. Technological improvements, operational efficiency, and high-quality drilling programs are extending the lives of our base producing fields, some of which have been onstream for decades. Our portfolio is further augmented by activity in unconventional gas and oil plays and future developments arising from ExxonMobil’s extensive deepwater Gulf of Mexico acreage position.

Gulf of Mexico/Gulf Coast

We produced oil and gas in the offshore Gulf of Mexico with average net production of 57 thousand barrels of liquids per day and 254 million cubic feet of gas per day in 2011.

Over the past two years, we highgraded our Gulf of Mexico portfolio through three separate transactions, including the sale of selected properties to Energy XXI, which closed in late 2010 with operatorship transferred in 2011, the sale of Eugene Island block 314 to Arena Energy in June 2011, and the divestment of XTO Energy’s legacy offshore Gulf of Mexico properties to a private operator in August 2011.

| Americas Highlights | 2011 | 2010 | 2009 | |||||||||

Earnings(billions of dollars) | 7.8 | 5.9 | 3.8 | |||||||||

Proved Reserves(BOEB) | 10.8 | 9.8 | 7.1 | |||||||||

Acreage(gross acres, million) | 50.2 | 51.4 | 49.5 | |||||||||

Net Liquids Production(MBD) | 0.7 | 0.7 | 0.7 | |||||||||

Net Gas Available for Sale(BCFD) | 4.3 | 3.2 | 1.9 | |||||||||

Deepwater • In the deepwater Gulf of Mexico, drilling operations on the Hoover platform (ExxonMobil interest, 67 percent) resumed on September 19, 2011, following a delay resulting from the Outer Continental Shelf Drilling Moratorium in 2010. The Hoover platform is located in more than 4800 feet of water, and produces oil and gas from the Hoover field and several subsea tiebacks.

Activity also continues at the Hadrian discovery (ExxonMobil interest, 50 percent) in Keathley Canyon (KC). The resource size in the Hadrian area has grown with additional discoveries. The Hadrian-5 exploration well in KC919 discovered more than 1000 feet of net pay in a compartment adjacent to the Hadrian North discovery. We will develop the Hadrian-5 discovery under a unit agreement as part of the Anadarko-operated Lucius field. ExxonMobil and the co-venturers in the field are progressing engineering and design activities

for the Hadrian North oil discovery, which is situated on blocks KC918 and KC919. We also funded the Hadrian South project for subsea tie-back to Anadarko’s Lucius platform with start-up planned for mid-2014. Engineering and technology qualification activities for the Julia discovery (ExxonMobil interest, 50 percent) in Walker Ridge are also progressing.

Additionally, we have a substantial exploration portfolio of 1.3 million net acres in the deepwater Gulf of Mexico and continue to make significant investments in advanced seismic data to further enhance our position. ExxonMobil was also the high bidder on 50 Offshore Continental Shelf (OCS) blocks in Sale 218 held in December 2011.

Conventional • The Mobile Bay development offshore Alabama contributed net production of 137 million cubic feet of gas per day during 2011. We realized significant cost efficiency and environmental benefits in 2011 with the completion of a project to consolidate sour gas treating plants in late 2010.

LNG • The Golden Pass liquefied natural gas (LNG) regasification terminal (ExxonMobil interest, 18 percent) in Sabine Pass, Texas, completed commissioning in June 2011. The terminal has the capacity to supply up to 2 billion cubic feet of natural gas per day to the U.S. market.

U.S. Onshore Texas and Louisiana

ExxonMobil is a leading producer in Louisiana and Texas with a strong position in multiple unconventional gas plays and in the Permian Basin. Onshore net production in Texas and Louisiana added 97 thousand barrels of liquids per day and 2 billion cubic feet of gas per day in 2011.

Conventional • During the year, we shifted drilling activity to liquids opportunities to take advantage of strong realizations. In the liquids-rich Permian Basin, we completed 63 wells across multiple legacy fields, primarily Goldsmith, Russell, and University Block 9. Across our portfolio, we are developing several enhanced oil recovery projects to extend the life of mature assets, including the Means, Talco, and Hawkins fields. The Means Residual Oil Zone project in West Texas commenced in 2011 with the first carbon dioxide injection in December. ExxonMobil also constructed the Hawkins Nitrogen Recovery Unit in 2011, with start-up anticipated in early 2012. We finalized partial unitization of the Talco field in 2011, laying the foundation for future projects. In South Texas, the King Ranch gas plant processed an average of more than 500 million cubic feet of inlet gas per day.

Unconventional • ExxonMobil holds 250,000 net acres in the Haynesville/Bossier Shale of East Texas and Louisiana, one of our strongest onshore production growth areas. Average production more than doubled in 2011, driven by the completion of 66 wells, mainly in the southern core area. By-the-bit drilling success also included completion of seven wells in the overlying Bossier Shale reservoir, which is in place across much of the southern area of the Haynesville play.

In the Barnett Shale play in North Texas, we completed 180 wells in 2011 across a leasehold of 235,000 net acres. Despite a 14-percent increase in per-well measured depth, resulting from longer laterals, we have reduced drilling days per well by 58 percent over the past six years as a result of continuous improvements in efficiency.

23 |  |

| 24 |

ExxonMobil• 2011 Financial & Operating Review

Upstream: Worldwide Upstream Operations, continued

In the Freestone tight gas trend, ExxonMobil has approximately 305,000 net acres under lease. We brought 154 wells online in the Freestone in 2011, balancing traditional, multipay vertical well completions with increasing horizontal development of the prolific Cotton Valley Lime and Bossier horizons.

In the South Texas Eagle Ford Shale play, we drilled 23 wells as delineation progressed across our 90,000 net acres. We are processing the liquids-rich gas through our King Ranch facility. In the Permian Basin, ExxonMobil is evaluating the unconventional potential across roughly half of our approximately 800,000 net acres of leasehold. We also acquired an additional 154,000 acres in 2011 and commenced a drilling program to test new tight liquids plays.

Evaluation of unconventional potential continues across our liquids-rich Permian Basin acreage.

Mid-Continent and Appalachia

ExxonMobil produces oil and gas throughout the mid-continent states, including Wyoming, Utah, North Dakota, Montana, Colorado, Kansas, Oklahoma, Arkansas, and New Mexico, and the Appalachian states of Pennsylvania and West Virginia. Average net production from these areas in 2011 was 25 thousand barrels of liquids per day and 480 million cubic feet of gas per day.

Conventional• The LaBarge development (ExxonMobil interest, 100 percent) in Wyoming comprises the Madison, Tip Top, and Hogsback fields, and the Shute Creek gas processing plant. It includes the longest sour gas pipeline in the United States and the world’s largest helium recovery and physical solvent gas sweetening plants. The operation celebrated its 25th anniversary in 2011. Implementation of a project to improve environmental performance of the Shute Creek plant’s compressor engines is progressing, with expected start-up in early 2012. The LaBarge facilities processed an average of 705 million cubic feet of inlet gas per day in 2011.

A demonstration plant at the Shute Creek facility tested ExxonMobil’s proprietaryControlled Freeze Zone(CFZ) technology in 2011, with testing continuing in 2012. By using a single-step cryogenic separation process, CFZ could lower the cost of removing carbon dioxide and hydrogen sulfide from natural gas. It could also assist in the application of carbon capture and storage to help reduce greenhouse gas emissions.

Unconventional• Following an acquisition in late 2010 and the completion of 185 wells, gas production from the Fayetteville Shale doubled in 2011. Pad drilling, optimized well spacing, and improved drilling processes are increasing efficiencies as development proceeds on ExxonMobil’s 535,000 net acres of leasehold. For example, using mud drilling instead of air drilling has reduced both well costs and environmental footprint. In addition, a pilot is under way to apply ExxonMobil’sJust-In-Time-Perforating(JITP) fracture stimulation process to horizontal wells, which holds significant potential for further efficiency improvement.

We are involved in several emerging liquids-rich shale plays, the most active of which is the Woodford Shale in the southern Oklahoma Ardmore Basin. By year-end 2011, ExxonMobil established a leadership position of 172,000 net acres in the Woodford Ardmore, and tripled both operated rig count and production. In addition, 31 Ardmore wells were brought on production during the year.

In the tight oil reservoirs of the Bakken Shale, we completed 51 wells in 2011 to delineate multiple core areas across our 395,000 net acre leasehold. We plan to move the play from delineation to development in 2012, using optimized drilling, spacing, and proprietary completion processes.

In the Marcellus Shale, ExxonMobil completed the acquisition of the Phillips Companies in June 2011, which coupled with the purchase of additional assets in West Virginia, increased our Marcellus acreage position to approximately 660,000 net acres. Following these acquisitions and the completion of 38 wells, production in the Marcellus Shale increased more than threefold during the year. In addition, the acquisition of the Phillips Companies provided an entry into the liquids-rich Utica Shale play of eastern Ohio, a position that was increased to roughly 75,000 net acres by year-end 2011 through additional leasing. We expect to drill and complete our first wells in the Utica Shale in 2012.

In Colorado, the Piceance development (ExxonMobil interest, 100 percent) contributed net production of 133 million cubic feet of gas per day in 2011. ExxonMobil has approximately 300,000 net acres under lease in the Piceance Basin. During 2011, we made significant progress to enhance drilling technology to reduce the overall footprint of future drilling well pads, thereby reducing development costs and environmental impacts. For example, we completed the first pitless fracturing operation in October 2011.

California

Net production from fields both onshore and offshore California averaged 92 thousand barrels of liquids per day and 26 million cubic feet of gas per day during 2011.

The Santa Ynez development (ExxonMobil interest, 100 percent) consists of three platforms located 5 miles offshore Santa Barbara and a processing plant in Las Flores Canyon. We continue to successfully employ world-class extended-reach drilling from these platforms to increase recovery. In offshore California, drilling operations resumed in November 2011 following delays resulting from the Outer Continental Shelf Drilling Moratorium in 2010. In onshore California, continuous single rig drilling commenced in late 2010. ExxonMobil also has a 48-percent equity share in Aera Energy LLC’s operations, comprising eight fields and about 11,000 wells that produce 66 thousand net oil-equivalent barrels per day of a mixture of heavy and conventional oil with associated natural gas.

Alaska

Average net production in Alaska was 114 thousand barrels of liquids per day in 2011. ExxonMobil is the largest holder of discovered natural gas resources on the North Slope of Alaska. ExxonMobil and the State of Alaska are working on a comprehensive plan to bring Point Thomson on production, including options for full development of Alaska’s gas resources over the long term. ExxonMobil and other working interest owners are identifying resource development alternatives and progressing associated agreements.

CANADA

We are one of the leading oil and gas producers in Canada through our wholly owned affiliate, ExxonMobil Canada, and majority-owned affiliate Imperial Oil (ExxonMobil interest, 69.6 percent). Through these entities, we have one of the largest resource positions in Canada and possess a significant portfolio of major projects, both onshore and offshore.

Offshore Canada Operations

The Hibernia field (ExxonMobil interest, 33 percent) offshore Newfoundland is operated by Hibernia Management and Development Company Ltd., using ExxonMobil personnel and processes. Hibernia’s production averaged 154 thousand barrels of oil per day in 2011.

In February 2011, ExxonMobil signed final commercial agreements allowing the co-venturers to proceed with development of the Hibernia Southern Extension project (ExxonMobil interest, 27 percent). The project will include a subsea tieback to the existing Hibernia platform, and will access recoverable resources of approximately 140 million oil-equivalent barrels. Early oil production from platform wells started in June 2011. Contracts were awarded in 2011 and detailed design and fabrication are progressing.

The co-venturer-operated Terra Nova development (ExxonMobil interest, 19 percent) produced 43 thousand barrels of oil per day in 2011. Located in 300 feet of water, Terra Nova consists of a unique, harsh-environment-equipped floating production, storage, and offloading vessel and 28 subsea wells that are expected to recover approximately 400 million oil-equivalent barrels.

The ExxonMobil-operated Sable Offshore Energy project (ExxonMobil interest, 51 percent; Imperial Oil interest, 9 percent) in Nova Scotia consists of five producing fields. Production in 2011 averaged 248 million cubic feet of gas per day and 12 thousand barrels of associated natural gas liquids per day.

The Hebron project (ExxonMobil interest, 36 percent) is an ExxonMobil-operated oil development located in 300 feet of water offshore Newfoundland. Engineering and contracting activities are progressing, as we leverage our extensive global experience with gravity-based facilities and project execution expertise in challenging arctic conditions. We submitted the Hebron project development plan to the Canada-Newfoundland and Labrador Offshore Petroleum Board, and the public review process is now complete. In addition, we initiated site preparation activities for construction of the gravity-based structure in eastern Canada. The development is expected to recover more than 650 million barrels of oil.

Early oil production from the Hibernia Southern Extension project started in 2011.

25 |  |

| 26 |

ExxonMobil• 2011 Financial & Operating Review

Upstream: Worldwide Upstream Operations, continued

In 2007, ExxonMobil and Imperial Oil acquired interests in the EL 446 Block located in the Beaufort Sea (ExxonMobil interest, 50 percent; Imperial Oil interest, 50 percent). The block covers 500,000 acres and is 75 miles offshore. In 2010, ExxonMobil and Imperial Oil entered into a Joint Operating Agreement resulting in a 50-percent interest in EL 446 and an adjoining block, EL 449. The combined blocks cover approximately 1 million acres. Interpretation of 3D seismic data collected on EL 446 in 2008 and on EL 449 in 2009 is ongoing while plans for the first exploration well in this operationally challenging arctic area are progressing.

Onshore Canada Operations

The majority of ExxonMobil’s liquids production in western Canada is from heavy oil and oil sands, areas in which we are considered leaders in research to identify methods to improve efficiency and reduce environmental footprint.

The Kearl oil sands project will develop more than 4 billion barrels of bitumen and will start up by year-end 2012.

In 2011, the Cold Lake heavy oil field in Alberta (Imperial Oil interest, 100 percent) achieved record production of 160 thousand barrels of oil per day. Cold Lake is the largest thermal in situ heavy oil project in the world. It has over 4000 wells directionally drilled from multiple satellite pads tied back to central facilities, which reduces surface land requirements. Cyclic steam stimulation is used to recover bitumen, and recovery is increased through the use of leading-edge thermal recovery technologies. Engineering is nearing completion and early construction work has commenced on the Nabiye project, the next expansion phase of Cold Lake. Steam injection will produce an additional 40 thousand barrels of bitumen per day at peak rate.

The Syncrude oil sands mining operation (Imperial Oil interest, 25 percent) produced synthetic crude averaging 290 thousand barrels per day in 2011.

The Kearl oil sands project (combined ExxonMobil and Imperial Oil interest, 100 percent) is developing a world-class resource in northern Alberta expected to exceed 4 billion barrels. Construction and fabrication activities are well-advanced on the Kearl Initial Development project with mining and extraction facilities scheduled for start-up by year-end 2012. Initial production will start at approximately 110 thousand barrels of bitumen per day with future debottlenecking and expansion increasing production to 345 thousand barrels of bitumen per day with full development. The Kearl Expansion project was sanctioned in 2011.

We also continue to evaluate oil sands acreage in the Athabasca region with the completion of core hole and seismic programs on both in situ and mining leases in 2011. ExxonMobil acquired an additional 12,000 acres of oil sands leasehold in 2011 through Imperial Oil.

The Mackenzie Gas project received regulatory approvals from the Canadian government in 2011. Once sanctioned, the project will develop three fields (ExxonMobil and Imperial Oil hold interests in two of the three fields) containing approximately 6 trillion cubic feet of natural gas and will deliver natural gas to

North American markets through a 740-mile pipeline system across the Mackenzie Valley.