UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material Pursuant to §240.14a-12 | |

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

March 8, 2021

Dear Shareholder,

For more than 135 years, ExxonMobil has helped produce the energy and products the world needs to prosper. Our ability to innovate and adapt to meet the changing needs of society and provide products and services essential to the health and welfare of billions of people around the world is the foundation of our success.

Today, our ability to innovate and adapt is more important than ever before. It played a critical role in responding to the pandemic and overcoming the most challenging market conditions our company has ever faced. We maintained the uninterrupted supply of essential energy and products, delivered record safety results, implemented key spending reductions, progressed cost-advantaged investments to support future earnings, and met meaningful emission reduction goals – all while maintaining our strong dividend.

Innovation and adaptation will also play a vital role in addressing the risks of climate change – one of the most important societal challenges we face today. Meeting the world’s growing demand for the energy necessary for economic growth while mitigating environmental impacts and lowering emissions is key to a prosperous future.

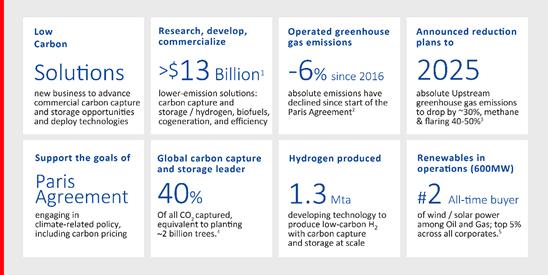

We embrace our role in reducing emissions and developing innovative solutions to help address climate change, and believe we are well positioned to help support society’s goal of a lower carbon future.

Advancing the transition to a lower carbon future

Our near-term strategy is to meet the world’s growing demand for energy while mitigating emissions from our operations; producing cleaner, more advanced products; developing lower-carbon technology solutions; and engaging constructively in policy discussions that set the conditions for a global low carbon, reliable energy system.

To learn more visit XOMDrivingValue.com

All credible analyses conclude that oil and gas will continue to play a major role in meeting the world’s growing demand for energy for decades to come.6 We are committed to providing that energy, while at the same time managing the emissions from our operations and working to help others reduce their emissions.

We have supported the Paris Agreement since it went into effect in 2016, and have reduced our operating greenhouse gas emissions by 6 percent since that time, significantly outpacing the progress made by society as a whole.2 Last year, we established new emissions-reduction plans that are projected to be consistent with the goals of the Paris Agreement.3 Our forward plans are expected to reduce upstream greenhouse gas emissions by 30 percent in 2025 compared to 2016, and by the end of the decade, deliver industry-leading greenhouse gas performance and align our operations with the World Bank’s initiative to eliminate routine flaring.

To meet society’s longer term ambitions of net-zero emissions, additional solutions are needed. Creating the lower carbon energy system of the future will require unprecedented innovation. This is underscored by the International Energy Agency’s finding that only 6 out of the 46 technologies and sectors needed to achieve the Paris Agreement climate goals are on track. We are working to address this shortfall through our commitment to invest in and develop scalable, low-carbon technologies.

Since 2000, we’ve invested more than $10 billion on lower-emission energy solutions – and have plans for an additional $3 billion of investments through 2025. Whether it’s in hydrogen, natural gas, carbon capture and storage (CCS), direct air capture, or fuel cell technology, we are developing solutions, through our extensive lower-emission technology R&D portfolio, that will have the most positive societal impact. We created a new ExxonMobil Low Carbon Solutions business specifically to commercialize and deploy lower-emission technologies, with an initial focus on CCS.

We fully describe our environmental efforts each year in our Energy & Carbon Summary, which includes our plans for a lower carbon future and provides details on emissions, including Scope 3 emissions.

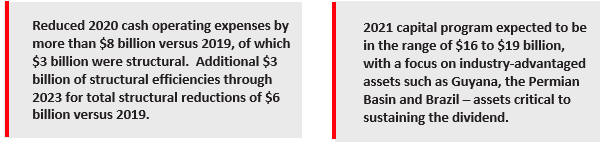

ExxonMobil’s flexible investment plan to create long-term value while prioritizing strong cash flow and dividend

|  |  |  |

More than ever, all of our plans are focused on delivering long-term, sustainable value for you, our shareholder.

Today, we have the best portfolio of assets since the Exxon and Mobil merger, and we continue to strengthen that portfolio through disciplined investment, rigorous cost management and strong operational execution. We are focusing our capital investments on the highest-return opportunities, and have the flexibility to adjust to market conditions over time. Over the past 12 months, we’ve

To learn more visit XOMDrivingValue.com

aggressively reduced spending, lowering 2020 cash operating expenses by more than $8 billion compared to 2019. These actions will enable us to drive greater cash flow, pay the dividend, and increase the earnings potential of our business in the near and longer term.

Strong independent board of directors

Overseeing ExxonMobil’s corporate strategy is a strong, independent board of highly qualified directors. The board has an active and ongoing refreshment program and our average director nominee tenure is under five years, compared to the average tenure of eight years for the S&P 500.

The board benefits from a wide range of backgrounds, knowledge and skills relevant to the company’s business and future direction. We have recently added three new directors, who bring skill sets and qualifications important for the future success of the company.

Your board is highly engaged in overseeing risk management, including the risk of climate change and the energy transition. The board evaluates climate change risk in the context of enterprise risk, including other operational, strategic, and financial risks, and considers the interactions among these factors.

Driving value for shareholders, protecting the environment – including emissions reductions and lower-carbon technology development – and meeting the world’s demands for reliable energy remain our top priorities. I look forward to continuing to update you on our progress in advance of the 2021 Annual Shareholders Meeting.

Thank you for your support of ExxonMobil.

Sincerely,

Darren W. Woods

Chairman and Chief Executive Officer

To learn more visit XOMDrivingValue.com

Cautionary Statement

Outlooks; projections; goals; estimates; descriptions of strategic plans and objectives; planned capital and cash operating expense reductions and the ability to meet or exceed announced reduction objectives; plans to reduce future emissions intensity and the expected resulting absolute emissions reductions; emission profiles of future developments; carbon capture results and the impact of operational and technology efforts; future business markets like carbon capture or hydrogen; energy market evolution; product mix and sales growth; and other statements of future events or conditions in this letter are forward-looking statements. Actual future results could differ materially due to a number of factors. These include global and regional changes in the demand, supply, prices, differentials or other market conditions affecting oil, gas, petroleum, petrochemicals and feedstocks; company actions to protect the health and safety of employees, vendors, customers, and communities; the ability to access short- and long-term debt markets on a timely and affordable basis; the severity, length and ultimate impact of COVID-19 and government responses on people and economies; global population and economic growth; changes in law, taxes or regulation, including environmental regulations, taxes, political sanctions and international treaties; the timely granting or freeze, suspension or revocation of government permits; the impact of fiscal and commercial terms and the outcome of commercial negotiations; feasibility and timing for regulatory approval of potential investments or divestments; the actions of competitors and preferences of customers; the capture of efficiencies within and between business lines; unexpected technological developments; general economic conditions, including the occurrence and duration of economic recessions; unforeseen technical or operating difficulties; the ability to bring new technologies to commercial scale on a cost-competitive basis, including large-scale hydraulic fracturing projects and carbon capture projects; and other factors discussed here, in Item 1A. Risk Factors in our Form 10-K for the year ended December 31, 2020 and under the heading “Factors Affecting Future Results” on the Investors page of our website at www.exxonmobil.com under the heading News & Resources. For more information concerning the forward-looking statements, terms, and other information contained in this letter, please refer to the complete Analysts’ Meeting presentation which is available live and in archive form through ExxonMobil’s website at www.exxonmobil.com.

ExxonMobil-operated emissions, reductions and avoidance performance data are based on a combination of measured and estimated data using best available information. Calculations are based on industry standards and best practices, including guidance from the American Petroleum Institute (API) and IPIECA. The uncertainty associated with the emissions, reductions and avoidance performance data depends on variation in the processes and operations, the availability of sufficient data, the quality of those data and methodology used for measurement and estimation. Changes to the performance data may be reported as updated data and/or emission methodologies become available. ExxonMobil works with industry, including API and IPIECA, to improve emission factors and methodologies. Emissions, reductions and avoidance estimates from non-ExxonMobil operated facilities are included in the equity data and similarly may be updated as changes to the performance data are reported. The data includes XTO Energy performance beginning in 2011.

Important Additional Information Regarding Proxy Solicitation

Exxon Mobil Corporation (“ExxonMobil”) has filed a preliminary proxy statement and form of associated BLUE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for ExxonMobil’s 2021 Annual Meeting (the “Preliminary Proxy Statement”). ExxonMobil, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the 2021 Annual Meeting. Information regarding the names of ExxonMobil’s directors and executive officers and their respective interests in ExxonMobil by security holdings or otherwise is set forth in the Preliminary Proxy Statement. To the extent holdings of such participants in ExxonMobil’s securities are not reported, or have changed since the amounts described, in the Preliminary Proxy Statement, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. Details concerning the nominees of ExxonMobil’s Board of Directors for election at the 2021 Annual Meeting are included in the Preliminary Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING BLUE PROXY CARD WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders will be able to obtain a copy of the definitive proxy statement and other relevant documents filed by ExxonMobil free of charge from the SEC’s website, www.sec.gov. ExxonMobil’s shareholders will also be able to obtain, without charge, a copy of the definitive proxy statement and other relevant filed documents by directing a request by mail to ExxonMobil Shareholder Services at 5959 Las Colinas Boulevard, Irving, Texas, 75039-2298 or at shareholderrelations@exxonmobil.com or from the investor relations section of ExxonMobil’s website, www.exxonmobil.com/investor.

End Notes:

| 1. | Represents investments since 2000 and currently identified future investment opportunities through 2025, consistent with past practice, results, and announced plans. |

| 2. | ExxonMobil GHG emissions, absolute (operated CO2-equivalent Scope 1 & 2) from 2016—2019. |

| 3. | Emission reduction plans announced in December 2020 include a 15 to 20 percent reduction in greenhouse gas intensity of upstream operations by 2025 compared to 2016 levels. This will be supported by a 40 to 50 percent reduction in methane intensity and 35 to 45 percent reduction in flaring intensity. The 2025 emissions reduction plans are expected to reduce absolute greenhouse gas emissions of Upstream operations by an estimated 30 percent and absolute flaring and methane emissions by 40 to 50 percent. Plans cover Scope 1 and Scope 2 emissions for assets operated by the company by the end of 2025, consistent with approved corporate plans. |

| 4. | Global CCS Institute. Data updated as of April 2020 and based on cumulative anthropogenic carbon dioxide capture volume. Anthropogenic CO2, for the purposes of this calculation, means CO2 that without carbon capture and storage would have been emitted to the atmosphere, including, but not limited to: reservoir CO2 from gas fields; CO2 emitted during production and CO2 emitted during combustion. It does not include natural CO2produced solely for enhanced oil recovery. Tree statistic calculated with U.S. EPA GHG equivalency calculator. |

| 5. | All-time, based on total wind and solar power purchase agreements signed from BloombergNEF download Feb 22, 2021. |

| 6. | For example, the Intergovernmental Panel on Climate Change (IPCC) Lower 2°C scenarios project that oil and gas, on average, will account for approximately 48 percent of the energy mix in 2040. The IPCC report identified 74 scenarios as Lower 2°C, which are pathways limiting peak warming to below 2°C during the entire 21st century with greater than 66 percent likelihood. |

To learn more visit XOMDrivingValue.com