| | |

Exxon Mobil Corporation 5959 Las Colinas Boulevard Irving, TX 75039-2298 | | Jennifer Driscoll Vice President, Investor Relations |

| |

| |

|

| |

| | May 10, 2023 |

Re: Supplemental Information Related to Item 3 -Advisory Vote to Approve Executive Compensation

Dear Investor,

The 2023 Proxy Statement outlines ExxonMobil’s executive compensation program, which ties compensation to long-term shareholder value creation and success in a lower-emissions future, and 2022 pay decisions.

At time of filing, 2022 data for compensation benchmark companies was not yet available. The following charts, included on page 59 of the CD&A, have been updated for the most recent 1 - and 10-year time periods. This also updates all other references to ExxonMobil’s rank percentile in the CD&A.

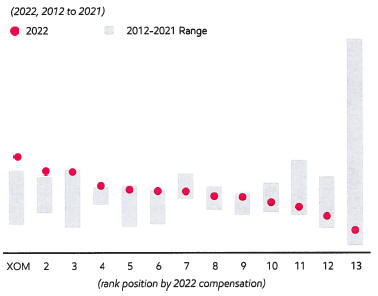

The evolution of pay during 2020 to 2022 demonstrates the strength of the program; highly performance based, tied to business and individual performance, and resulting in a greater degree of volatility versus compensation programs of benchmark companies.

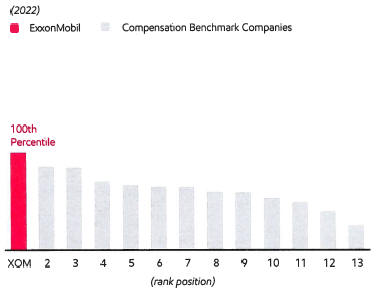

2022 Total Direct Compensation, as displayed below, is reflective of exceptional business results across all performance dimensions.

| | • | | 80 percent of the increase is tied to strong stock price performance - $110.84 at 2022 grant, up from $62.82 in 2021 - resulting in a high grant value of long-term awards. Performance shares have uniquely long restriction periods, 50% vests in 5 years and 50% in 10 years from grant date with no acceleration at time of retirement. |

| | • | | 20 percent of the increase is tied to earnings. ExxonMobil’s bonus program is based on year-over-year change in earnings; 2022 reflected a year of record earnings - compared to $0 in 2020. |

For reference, 2021 Total Direct Compensation, as included in the CD&A at time of filing, was at the 4th percentile of compensation benchmark companies and followed 2020 with bonus suspension and low value of long-term award. Three-year average Total Direct Compensation of $20.4 million and 3-year average Realized Pay at $10.3 million are within historic range.

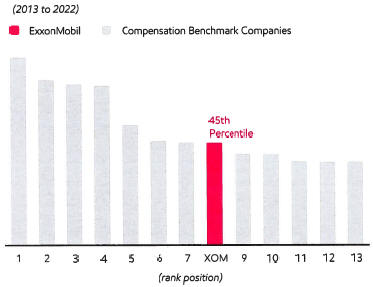

Combined 10-year Realized and Unrealized Pay normalizes for different award types and restriction periods. ExxonMobil’s share-denominated approach coupled with long restriction periods defines the risk/reward profile of stock-based performance awards and results in a greater degree of volatility versus programs common among benchmark companies.

As such, while 1-year Total Direct Compensation is at the 100th percentile of compensation benchmark companies, 10-year Realized and Unrealized Pay is at the 45th percentile, as demonstrated below.

The relative position on 10-year Realized Pay further underscores the impact of long restriction periods, the longest across all industries. For more information on the design of the long-term incentive program, please refer to page 52 of the CD&A.