As filed with the Securities and Exchange Commission on December 12, 2018

1933 Act Registration No. 333-________

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

| | ¨ | Pre-Effective | ¨ | Post-Effective |

| | | Amendment No. | | Amendment No. |

VIRTUS EQUITY TRUST

(Virtus Tactical Allocation Fund)

[Exact Name of Registrant as Specified in Charter]

Area Code and Telephone Number: (800) 243-1574

101 Munson Street

Greenfield, Massachusetts 01301

(Address of Principal Executive Offices)

Kevin J. Carr, Esq.

Senior Vice President, Chief Legal Officer,

Counsel and Secretary for the Registrant

Virtus Investment Partners, Inc.

100 Pearl Street

Hartford, Connecticut 06103

(Name and Address of Agent for Service)

Copies of All Correspondence to:

David C. Mahaffey, Esq.

Sullivan & Worcester LLP

1666 K Street, N.W.

Washington, D.C. 20006

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

Title of Securities Being Registered: Shares of beneficial interest, no par value per share.

No filing fee is due because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on January 11, 2019, pursuant to Rule 488 of the Securities Act of 1933.

| Virtus Mutual Funds

P.O. Box 9874 Providence, RI 02940-8074 | Toll Free 800-243-1574

Virtus.com |

January __, 2019

Dear Shareholder:

The Board of Trustees of Virtus Equity Trust (the “Trust”) has approved the reorganization of Virtus Strategic Allocation Fund (“Strategic Allocation”), a series of the Trust, into Virtus Tactical Allocation Fund (“Tactical Allocation”), a separate series of the Trust. The reorganization is expected to be completed on or about January __, 2019. Once the reorganization is completed, you will become a shareholder of Tactical Allocation and will receive shares of the corresponding class of Tactical Allocation with an aggregate net asset value equal to the aggregate net asset value of your investment in Strategic Allocation. You will not incur any sales charges in connection with the reorganization.

The Board of Trustees of the Trust has carefully considered and unanimously approved the reorganization, as set forth in the Plan and described in the accompanying materials, and believes that the reorganization is in the best interests of Strategic Allocation and its shareholders. The Board of Trustees believes that the reorganization offers you the opportunity to pursue your investment goals in a larger fund with lower expenses. Tactical Allocation’s investment objective and its investment strategies are similar to those of Strategic Allocation. The expenses associated with the reorganization will be paid by Strategic Allocation and Tactical Allocation, and will be allocated pro rata based on their assets under management.

You are not being asked to vote on, or take any other action in connection with, the reorganization.

If you have any questions, please call (800) 243-1574 between 8:30 a.m. and 6:00 p.m. Eastern time, Monday through Thursday, Friday until 5:00 p.m. We are committed to serving you and appreciate your continued investment in Virtus Mutual Funds.

Sincerely,

George R. Aylward

President, Virtus Mutual Funds

Mutual Funds distributed by VP Distributors, LLC

ACQUISITION OF ASSETS OF

VIRTUS STRATEGIC ALLOCATION FUND

a series of

Virtus Equity Trust

c/o VP Distributors, LLC

101 Munson Street

Greenfield, Massachusetts 01301

(800) 243-1574

BY AND IN EXCHANGE FOR SHARES OF

VIRTUS TACTICAL ALLOCATION FUND

a series of

Virtus Equity Trust

c/o VP Distributors, LLC

101 Munson Street

Greenfield, Massachusetts 01301

(800) 243-1574

PROSPECTUS/INFORMATION STATEMENT

DATED JANUARY __, 2019

This Prospectus/Information Statement is being furnished in connection with the reorganization of Virtus Strategic Allocation Fund (“Strategic Allocation”), a series of Virtus Equity Trust (the “Trust”), into the Virtus Tactical Allocation Fund (“Tactical Allocation”), another series of the Trust. This Prospectus/Information Statement is being mailed on or about January __, 2019.

GENERAL

The Board of Trustees of the Trust has approved the reorganization of Strategic Allocation into Tactical Allocation. Tactical Allocation and Strategic Allocation are sometimes referred to in this Prospectus/Information Statement individually as a "Fund" and collectively as the "Funds."

In the reorganization, all of the assets of Strategic Allocation will be acquired by Tactical Allocation in exchange for Class A and Class C shares of Tactical Allocation and the assumption by Tactical Allocation of the liabilities of Strategic Allocation (the “Reorganization”). Class A and Class C shares of Tactical Allocation will be distributed to each shareholder in liquidation of Strategic Allocation, and Strategic Allocation will be terminated as a series of the Trust. You will then hold that number of full and fractional shares of Tactical Allocation which have an aggregate net asset value equal to the aggregate net asset value of your shares of Strategic Allocation.

Each of Tactical Allocation and Strategic Allocation is a separate diversified series of the Trust, a Delaware statutory trust, which is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The investment objective of Tactical Allocation is similar to that of Strategic Allocation, as follows:

| Fund | Investment Objective |

| | |

| Strategic Allocation | Reasonable income, long-term capital growth and conservation of capital. |

| | |

| Tactical Allocation | Capital appreciation and income. |

The investment strategies for Tactical Allocation are similar to those for Strategic Allocation, but there are some differences. Strategic Allocation targets an asset allocation consisting of approximately 45% in U.S. equity securities, 15% in non-U.S. equity securities and 40% in fixed income securities, while Tactical Allocation uses a tactical allocation approach applying the following percentages: 25% to 60% invested in U.S. equity securities, 5% to 30% invested in non-U.S. equity securities and 35% to 60% invested in fixed income securities. For their U.S. equity allocations, both Funds invest in equity securities of large market capitalization companies, but Tactical Allocation has an investment policy of investing 65% of its assets in large market capitalization companies that may be changed only upon 60 days' written notice to shareholders. While both Funds’ fixed income allocations may be invested in all sectors of fixed income securities, but primarily in investment grade bonds, only Strategic Allocation endeavors to minimize its risk exposure by monitoring portfolio characteristics such as sector concentration and portfolio duration and by investing no more than 5% of the fixed income portion of the Fund’s total assets in securities of any single issuer (excluding the U.S. government, its agencies, authorities or instrumentalities).

Virtus Investment Advisers, Inc. (“VIA”) serves as the investment adviser for both Funds, and Duff & Phelps Investment Management Co. (“Duff & Phelps”) (international equity portion), Kayne Anderson Rudnick Investment Management, LLC (“KAR”) (domestic equity portion) and Newfleet Asset Management, LLC (“Newfleet”) (fixed income portion), each an affiliate of VIA, serve as the investment subadvisers for both Funds.

This Prospectus/Information Statement explains concisely the information about Tactical Allocation that you should know. Please read it carefully and keep it for future reference. Additional information concerning each Fund and the Reorganization is contained in the documents described below, all of which have been filed with the Securities and Exchange Commission (“SEC”):

| Information about Strategic Allocation: | | How to Obtain this Information: |

| | | |

Prospectus of the Trust relating to Strategic Allocation, dated March 6, 2018, as supplemented Statement of Additional Information of the Trust relating to Strategic Allocation, dated March 6, 2018, as supplemented Annual Report of the Trust relating to Strategic Allocation for the year ended September 30, 2018 | | Copies are available upon request and without charge if you: · Visit www.virtus.com on the Internet; · Write to VP Distributors, LLC 100 Pearl Street Hartford, CT 06103; or · Call (800) 243-1574 toll-free. |

| | | |

| Information about Tactical Allocation: | | How to Obtain this Information: |

| | | |

Prospectus of the Trust relating to Tactical Allocation, dated March 6, 2018, as supplemented, which accompanies this Prospectus/Information Statement Statement of Additional Information of the Trust relating to Tactical Allocation, dated March 6, 2018, as supplemented Annual Report of the Trust relating to Tactical Allocation for the year ended September 30, 2018 | | Copies are available upon request and without charge if you: · Visit www.virtus.com on the Internet; · Write to VP Distributors, LLC 100 Pearl Street Hartford, CT 06103; or · Call (800) 243-1574 toll-free. |

| | | |

| Information about the Reorganization: | | How to Obtain this Information: |

| | | |

| Statement of Additional Information dated January __, 2019, which relates to this Prospectus/Information Statement and the Reorganization | | Copies are available upon request and without charge if you: · Write to VP Distributors, LLC 100 Pearl Street Hartford, CT 06103; or · Call (800) 243-1574 toll-free. |

You can also obtain copies of any of these documents without charge on the EDGAR database on the SEC’s Internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549.

Information relating to both Tactical Allocation and Strategic Allocation is contained in the Prospectus of the Trust dated March 6, 2018, as supplemented (SEC File No. 811-00945; 002-16590) and is incorporated by reference in this document. (This means that such information is legally considered to be part of this Prospectus/Information Statement.) The Statement of Additional Information dated January __, 2019 relating to this Prospectus/Information Statement and the Reorganization, which includes the financial statements of the Trust relating to Tactical Allocation and Strategic Allocation for the year ended September 30, 2018, and pro forma financial information of the Trust relating to Tactical Allocation for the 12-month period ended September 30, 2018, is incorporated by reference in its entirety in this document.

| The Securities and Exchange Commission has not determined that the information in this Prospectus/Information Statement is accurate or adequate, nor has it approved or disapproved these securities. Anyone who tells you otherwise is committing a criminal offense. |

An investment in Tactical Allocation:

| · | is not a deposit of, or guaranteed by, any bank |

| · | is not insured by the FDIC, the Federal Reserve Board or any other government agency |

| · | is not endorsed by any bank or government agency |

| · | involves investment risk, including possible loss of the purchase payment of your original investment |

Table of Contents

SUMMARY

THIS SECTION SUMMARIZES THE PRIMARY FEATURES AND CONSEQUENCES

OF THE REORGANIZATION. IT MAY NOT CONTAIN ALL OF THE

INFORMATION THAT IS IMPORTANT TO YOU. TO UNDERSTAND THE

REORGANIZATION, YOU SHOULD READ THIS ENTIRE

PROSPECTUS/INFORMATION STATEMENT AND THE EXHIBIT.

This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Information Statement, the Prospectuses and Statement of Additional Information relating to the Funds and the form of the Plan, which is attached to this Prospectus/Information Statement as Exhibit A.

Why is the Reorganization being proposed?

The proposed Reorganization will allow shareholders of Strategic Allocation to own a fund that is similar in style and with a greater amount of combined assets after the Reorganization. Tactical Allocation has a similar investment objective and investment strategies and identical risks to those of Strategic Allocation, but Tactical Allocation will have lower total fund operating expenses than Strategic Allocation on a pro forma basis after the Reorganization. The Reorganization is also expected to create better efficiencies for the portfolio management team and perhaps lower expenses for Tactical Allocation as assets grow, which will also benefit shareholders of Strategic Allocation.

What are the key features of the Reorganization?

The Plan sets forth the key features of the Reorganization. For a complete description of the Reorganization, see Exhibit A. The Plan generally provides for the following:

| · | the transfer in-kind of all of the assets of Strategic Allocation to Tactical Allocation in exchange for Class A and Class C shares of Tactical Allocation; |

| · | the assumption by Tactical Allocation of all of the liabilities of Strategic Allocation; |

| · | the liquidation of Strategic Allocation by distribution of Class A and Class C shares of Tactical Allocation to Strategic Allocation’s shareholders; and |

| · | the structuring of the Reorganization in a manner intended to qualify as a tax-free reorganization for U.S. federal income tax purposes. |

The Reorganization is expected to be completed on or about January 25, 2019.

After the Reorganization, what shares will I own?

If you own Class A and Class C shares of Strategic Allocation, you will own Class A and Class C shares, respectively, of Tactical Allocation. The new shares you receive will have the same total value as your shares of Strategic Allocation, as of the close of business on the day immediately prior to the Reorganization.

How will the Reorganization affect me?

It is anticipated that the Reorganization will result in better operating efficiencies. Upon the reorganization of Strategic Allocation into Tactical Allocation, operating efficiencies may be achieved by Tactical Allocation because it will have a greater level of assets. As of June 30, 2018, Tactical Allocation’s net assets were approximately $150.1 million and Strategic Allocation’s net assets were approximately $477.7 million. It is believed that a larger, combined fund will have a greater likelihood of gaining additional assets, which may lead to greater economies of scale. For the 12 months ended September 30, 2018, Tactical Allocation’s management fee was 0.70% and total gross fund operating expenses for Class A and Class C shares were 1.28% and 2.06%, respectively, while Strategic Allocation’s management fee was 0.55% and total gross operating expenses for Class A and Class C shares were 1.09% and 1.86%, respectively; however, as of December 1, 2018, Tactical Allocation’s management fee was reduced to 0.55%, and total operating expenses are expected to be reduced to 1.10% and 1.86% for the Class A and Class C shares, respectively, on a pro forma basis. In addition, Tactical Allocation will implement contractual expense limits that will limit total operating expenses to 1.15% for Class A and 1.90% for Class C shares.

After the Reorganization, the value of your shares will depend on the performance of Tactical Allocation rather than that of Strategic Allocation. The Board of Trustees of the Trust believes that the Reorganization will benefit both Tactical Allocation and Strategic Allocation. The costs of the Reorganization, including the cost of mailing this Prospectus/Information Statement, are estimated to be $52,500 and will be paid by Tactical Allocation and Strategic Allocation, allocated pro rata based on assets under management.

Like Strategic Allocation, Tactical Allocation pays dividends from net investment income on a quarterly basis and distributes net realized capital gains, if any, at least annually. These dividends and distributions will continue to be automatically reinvested in additional Class A and Class C shares of Tactical Allocation or distributed in cash, in accordance with your election.

Will I be able to purchase, exchange and redeem shares and receive distributions in the same way?

The Reorganization will not affect your right to purchase and redeem shares, to exchange shares or to receive distributions. After the Reorganization, you will be able to purchase additional Class A and Class C shares, as applicable, of Tactical Allocation in the same manner as you did for your shares of Strategic Allocation before the Reorganization. For more information, see “Purchase and Redemption Procedures,” “Exchange Privileges” and “Dividend Policy” below.

How do the Funds’ investment objectives and principal investment strategies compare?

The investment objective of Tactical Allocation is similar to that of Strategic Allocation in that both Funds seek income and capital appreciation or capital growth, but Strategic Allocation also seeks conservation of capital. The investment objectives of both Tactical Allocation and Strategic Allocation are non-fundamental, which means that each may be changed by vote of the respective Fund’s Trustees and without shareholder approval, upon 60 days’ notice to shareholders. The investment strategies of the Funds are also similar.

The following tables summarize a comparison of Tactical Allocation and Strategic Allocation with respect to their investment objectives and principal investment strategies, as set forth in the Prospectuses and Statement of Additional Information relating to the Funds.

| | Tactical Allocation | | Strategic Allocation |

| | | | |

| Investment Objective | Capital appreciation and income. | | Reasonable income, long-term capital growth and conservation of capital. |

| | | | |

| Principal Investment Strategies | Diversified across equity and fixed income securities, the fund’s tactical allocation approach seeks to generate a combination of capital appreciation and income. For the fund’s U.S. equity allocation, the subadviser invests in a select group of large market capitalization growth companies believed by the fund's subadviser to be undervalued relative to their future growth potential. The investment strategy emphasizes companies the subadviser believes to have a sustainable competitive advantage, strong management and low financial risk, and to be able to grow over market cycles. For the fund’s non-U.S. equity exposure, which may be implemented through American Depositary Receipts (ADRs), the subadviser’s process is driven by bottom-up fundamental research and informed by top-down macro views. For the fixed income allocation, the subadviser employs a time-tested approach of active sector rotation, extensive credit research, and disciplined risk management designed to capitalize on opportunities across the fixed income markets. | | The fund targets an asset allocation consisting of approximately 45% in U.S. equity securities, 15% in non-U.S. equity securities and 40% in fixed income securities. For the fund’s U.S equity allocation, the subadviser invests in a select group of large market capitalization growth companies believed by the fund's subadviser to be undervalued relative to their future growth potential. The investment strategy emphasizes companies the subadviser believes to have a sustainable competitive advantage, strong management and low financial risk, and to be able to grow over market cycles. For the fund's non-U.S. equity exposure, which may be implemented through American Depositary Receipts (ADRs), the subadviser's process is driven by bottom-up fundamental research and informed by top-down macro views. For the fixed income allocation, the subadviser employs a time-tested approach of active sector rotation, extensive credit research, and disciplined risk management designed to capitalize on opportunities across the fixed income markets. Allocation percentages are measured at time of purchase. |

| | The fund invests in U.S. equity, non-U.S. equity and fixed income securities using a tactical allocation approach. Generally, the following percentages apply: 25% to 60% invested in U.S. equity securities, 5% to 30% invested in non-U.S. equity securities and 35% to 60% invested in fixed income securities. The equity allocation is invested in common, preferred, and ADR securities. The fund invests the fixed income portion of the portfolio in all sectors of fixed income securities, primarily in investment grade bonds; however, it may invest in high-yield/high-risk (“junk bonds”), bank loans (which are generally floating rate), mortgage-backed and asset-backed, government, corporate, and municipal debt obligations. Normally, the fund’s fixed income allocation has a dollar-weighted average duration of between two and eight years. The fund may invest in both U.S. and foreign (non-U.S.) securities, including those of issuers in emerging market countries, and may invest in issuers of any size. Allocation percentages are measured at time of purchase. Generally, the fund’s U.S. equity investments are in large market capitalization companies. Temporary Defensive Strategy: During periods of adverse market conditions, the fund may take temporary defensive positions that are inconsistent with its principal investment strategies by holding all or part of its assets in cash or short-term money market instruments including obligations of the U.S. Government, high-quality commercial paper, certificates of deposit, bankers acceptances, bank interest-bearing demand accounts, and repurchase agreements secured by U.S. Government securities. When this allocation happens, the fund may not achieve its objectives. | | Under normal market circumstances, the fund invests at least 65% of its assets in common stocks and fixed income securities of both U.S. and foreign issuers, including issuers in emerging market countries, and may invest in issuers of any size. The equity allocation is invested in common, preferred, and ADR securities. The fund invests the fixed income portion of its portfolio in all sectors of fixed income securities, primarily in investment grade bonds; however, it may invest in high-yield/high-risk fixed income securities ("junk bonds"), including bank loans (which are generally floating rate). These sectors include, but are not limited to mortgage- and asset-backed, government, corporate, and municipal debt obligations. Normally, the fund’s fixed income allocation has a dollar-weighted average duration of between two and eight years. Temporary Defensive Strategy: During periods of adverse market conditions, the fund may take temporary defensive positions that are inconsistent with its principal investment strategies by holding all or part of its assets in cash or short-term money market instruments including obligations of the U.S. Government, high-quality commercial paper, certificates of deposit, bankers acceptances, bank interest-bearing demand accounts, and repurchase agreements secured by U.S. Government securities. When this allocation happens, the fund may not achieve its objectives. |

While the investment strategies for Tactical Allocation are similar to those for Strategic Allocation, there are some differences. Strategic Allocation targets an asset allocation consisting of approximately 45% in U.S. equity securities, 15% in non-U.S. equity securities and 40% in fixed income securities, while Tactical Allocation uses a tactical allocation approach applying the following percentages: 25% to 60% invested in U.S. equity securities, 5% to 30% invested in non-U.S. equity securities and 35% to 60% invested in fixed income securities. For their U.S. equity allocations, both Funds invest in equity securities of large market capitalization companies, but Tactical Allocation has an investment policy of investing 65% of its assets in large market capitalization companies that may be changed only upon 60 days' written notice to shareholders. While both Funds’ fixed income allocations may be invested in all sectors of fixed income securities, but primarily in investment grade bonds, only Strategic Allocation endeavors to minimize its risk exposure by monitoring portfolio characteristics such as sector concentration and portfolio duration and by investing no more than 5% of the fixed income portion of the fund’s total assets in securities of any single issuer (excluding the U.S. government, its agencies, authorities or instrumentalities).

The principal risks of the Funds are identical. For a discussion of the Funds’ principal risks, see the section entitled “Risks” below.

The Funds have other investment policies, practices and restrictions which, together with their related risks, are also set forth in the Prospectuses and Statement of Additional Information of the Funds.

Although Tactical Allocation and Strategic Allocation have similar investment objectives and principal investment strategies, some of the securities held by Strategic Allocation may be sold after the Reorganization in order to comply with the investment practices of Tactical Allocation in connection with the Reorganization. For any such sales, the transaction costs will be borne by Tactical Allocation. Such costs are ultimately borne by the combined Fund’s shareholders. In addition, the disposition of assets acquired through the Reorganization by Tactical Allocation may result in taxable gains or losses on those assets, which will accrue to all of the combined Fund’s shareholders.

The Trust and the Adviser have received an exemptive order from the Securities and Exchange Commission that permits the Adviser, subject to certain conditions, and without the approval of shareholders, to: (a) select both unaffiliated subadvisers and certain wholly-owned affiliated subadvisers to manage all or a portion of the assets of a fund, and enter into subadvisory agreements with such subadvisers, and (b) materially amend subadvisory agreements with such subadvisers. In such circumstances, shareholders would receive notice of such action, including the information concerning the new subadviser that normally is provided in a proxy statement.

How do the Funds’ fees and expenses compare?

Tactical Allocation offers two classes of shares (Class A and Class C). Strategic Allocation also offers two classes of shares (Class A and Class C). Both Funds have also registered Class T shares, but they are not currently available for purchase. The Funds’ Class T shares are not part of this Reorganization and are not discussed in this document; however, you may refer to each Fund’s Prospectus and Statement of Additional Information for more information on its Class T shares. You will not pay any initial or deferred sales charge in connection with the Reorganization.

The following tables allow you to compare the various fees and expenses that you may pay for buying and holding Class A and Class C shares of each of the Funds. The columns entitled “Tactical Allocation (Pro Forma)” show you what fees and expenses are estimated to be assuming the Reorganization takes place.

The amounts for the Class A and Class C shares of Tactical Allocation and Strategic Allocation, set forth in the following tables and in the examples, are based on the expenses for the 12-month period ended September 30, 2018. The amounts for Class A and Class C shares of Tactical Allocation (Pro Forma) set forth in the following tables and in the examples are based on what the estimated expenses of Tactical Allocation would have been for the 12-month period ended September 30, 2018, assuming the Reorganization had taken place on October 1, 2017.

Shareholder Fees (fees paid directly from your investment)

| | Strategic

Allocation

Class A | Tactical

Allocation

Class A | Tactical

Allocation

(Pro Forma)

Class A |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 5.75% | 5.75% | 5.75% |

| Maximum Deferred Sales Charge (Load) | None | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | Strategic

Allocation

Class A | Tactical

Allocation

Class A | Tactical

Allocation

(Pro Forma)

Class A |

| Management Fees | 0.55% | 0.70% | 0.55% |

| Distribution and Shareholder Servicing (12b-1) Fees | 0.25% | 0.25% | 0.25% |

| Other Expenses | 0.28%(b) | 0.32%(b) | 0.29% |

| Acquired Fund Fees and Expenses | 0.01% | 0.01% | 0.01% |

| Total Annual Fund Operating Expenses | 1.09% | 1.28% | 1.10% |

Shareholder Fees (fees paid directly from your investment)

| | Strategic

Allocation

Class C | Tactical

Allocation

Class C | Tactical

Allocation

(Pro Forma)

Class C |

| Maximum Sales Charge (Load) Imposed on Purchases | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of purchase price or redemption proceeds) | 1.00%(a) | 1.00%(a) | 1.00%(a) |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Strategic

Allocation

Class C | Tactical

Allocation

Class C | Tactical

Allocation

(Pro Forma)

Class C |

| Management Fees | 0.55% | 0.70% | 0.55% |

| Distribution and Shareholder Servicing (12b-1) Fees | 1.00% | 1.00% | 1.00% |

| Other Expenses | 0.30%(b) | 0.35%(b) | 0.30% |

| Acquired Fund Fees and Expenses | 0.01% | 0.01% | 0.01% |

| Total Annual Fund Operating Expenses | 1.86% | 2.06% | 1.86% |

(a) The deferred sales charge is imposed on Class C shares redeemed during the first year only.

(b) Restated to reflect certain contract and expense allocation changes.

The tables below show examples of the total expenses you would pay on a $10,000 investment over one-, three-, five- and ten-year periods. The examples are intended to help you compare the cost of investing in the Funds and Tactical Allocation (Pro Forma), assuming the Reorganization takes place, with the cost of investing in other funds. They show your costs if you sold your shares at the end of the period or continued to hold them. The examples also assume that your investment has a 5% return each year and that each Fund’s operating expenses remain the same. The examples are for illustration only, and your actual costs may be higher or lower.

Examples of Fund Expenses

| | Class A |

| | One Year | Three Years | Five Years | Ten Years |

| Strategic Allocation | $680 | $902 | $1,141 | $1,827 |

| Tactical Allocation | $698 | $958 | $1,237 | $2,031 |

| Tactical Allocation (Pro Forma) | $681 | $905 | $1,146 | $1,838 |

| | Class C |

| | One Year | Three Years | Five Years | Ten Years |

| Strategic Allocation | $289 | $585 | $1,006 | $2,180 |

| Tactical Allocation | $309 | $646 | $1,108 | $2,390 |

| Tactical Allocation (Pro Forma) | $289 | $585 | $1,006 | $2,180 |

You would pay the following expenses if you did not redeem your shares:

| | Class C |

| | One Year | Three Years | Five Years | Ten Years |

| Strategic Allocation | $189 | $585 | $1,006 | $2,180 |

| Tactical Allocation | $209 | $646 | $1,108 | $2,390 |

| Tactical Allocation (Pro Forma) | $189 | $585 | $1,006 | $2,180 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the examples, affect the Funds’ performance. During the most recent fiscal year, Strategic Allocation’s portfolio turnover rate was 34% of the average value of its portfolio, while Tactical Allocation’s portfolio turnover rate was 41% of the average value of its portfolio.

How do the Funds’ performance records compare?

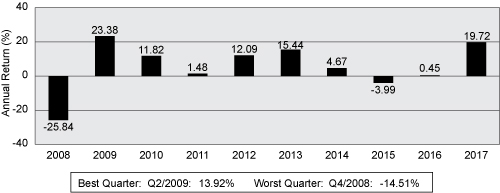

The following charts show how the shares of Strategic Allocation and Tactical Allocation have performed in the past. Performance for Class T Shares is not shown here as Class T shares of the Funds have not begun operations. The Class A shares of Strategic Allocation commenced operations on December 31, 1975, and the Class C shares commenced operations on April 19, 2005. The Class A shares of Tactical Allocation commenced operations on September 6, 1940, and the Class C shares commenced operations on August 26, 1999. Past performance, before and after taxes, is not an indication of future results.

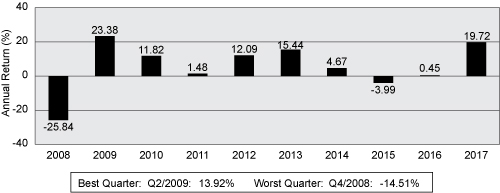

Year-by-Year Total Return (%)

The charts below show the percentage gain or loss year to year over a 10-year period for the Class A shares of Strategic Allocation and Tactical Allocation.

These charts should give you a general idea of the risks of investing in each Fund by showing how the Fund’s return has varied from year to year. These charts include the effects of fund expenses. Each Fund's average annual returns in the charts below do not reflect the deduction of any sales charges. The returns would have been less than those shown if sales charges were deducted. Each Fund can also experience short-term performance swings as indicated in the high and low quarter information at the bottom of each chart.

Strategic Allocation – Class A

Year-to-date performance (through September 30, 2018) is 6.60%

Tactical Allocation – Class A

Year-to-date performance (through September 30, 2018) is 6.47%

The next set of tables lists the average annual total return by share class of Strategic Allocation and Tactical Allocation for the past one, five and ten years (through December 31, 2017). The after-tax returns shown are for Class A shares of Strategic Allocation and Tactical Allocation; after-tax returns for other classes of the Funds will vary. These tables include the effects of sales charges (where applicable) and fund expenses and are intended to provide you with some indication of the risks of investing in each Fund by comparing its performance with three broad-based securities market indexes and a composite benchmark that reflects the target allocation of the fund, a description of each of which can be found following the table. An index does not reflect fees, expenses or any taxes. It is not possible to invest directly in an index.

Average Annual Total Return (for the period ended 12/31/2017)(1)

| Strategic Allocation | 1 Year

Ended

12/31/17 | 5 Years

Ended

12/31/17 | 10 Years

Ended

12/31/17 |

| Class A shares | | | |

| Return Before Taxes | 12.84% | 5.63% | 4.35% |

| Return After Taxes on Distributions(2) | 12.12% | 3.72% | 3.15% |

| Return After Taxes on Distributions and Sale of Fund Shares(2) | 7.56% | 3.98% | 3.16% |

| Class C shares | | | |

| Return Before Taxes | 18.82% | 6.09% | 4.18% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 3.54% | 2.10% | 4.01% |

| MSCI EAFE® Index (net) | 25.03% | 7.90% | 1.94% |

| Russell 1000® Growth Index | 30.21% | 17.33% | 10.00% |

| Strategic Allocation Fund Linked Benchmark | 18.18% | 10.58% | 7.14% |

| Tactical Allocation | 1 Year

Ended

12/31/17 | 5 Years

Ended

12/31/17 | 10 Years

Ended

12/31/17 |

| Class A shares | | | |

| Return Before Taxes | 12.95% | 6.07% | 4.73% |

| Return After Taxes on Distributions(2) | 12.03% | 3.92% | 3.34% |

| Return After Taxes on Distributions and Sale of Fund Shares(2) | 7.68% | 4.25% | 3.40% |

| Class C shares | | | |

| Return Before Taxes | 19.00% | 6.54% | 4.58% |

| Bloomberg Barclays U.S. Aggregate Bond Index | 3.54% | 2.10% | 4.01% |

| MSCI EAFE® Index (net) | 25.03% | 7.90% | 1.94% |

| Russell 1000® Growth Index | 30.21% | 17.33% | 10.00% |

| Tactical Allocation Fund Linked Benchmark | 18.18% | 9.70% | 6.94% |

| (1) | The Funds’ average annual returns in the tables above reflect the deduction of the maximum sales charge for an investment in each Fund’s Class A shares and a full redemption in each Fund’s Class C shares. |

| (2) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. In certain cases, the Return After Taxes on Distributions and Sale of Fund Shares for a period may be higher than other return figures for the same period. This will occur when a capital loss is realized upon the sale of fund shares and provides an assumed tax benefit that increases the return. |

The Bloomberg Barclays U.S. Aggregate Bond Index measures the U.S. investment grade fixed rate bond market. The index is calculated on a total-return basis. The MSCI EAFE® Index (net) is a free float-adjusted market capitalization-weighted index that measures developed foreign market equity performance, excluding the U.S. and Canada. The index is calculated on a total return basis with net dividends reinvested. The Russell 1000® Growth Index is a market capitalization-weighted index of growth-oriented stocks of the 1,000 largest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. Effective September 7, 2016, the Strategic Allocation Fund Linked Benchmark and the Tactical Allocation Fund Linked Benchmark both consist of 45% Russell 1000® Growth Index, 15% MSCI EAFE® Index, and 40% Bloomberg Barclays U.S. Aggregate Bond Index. Performance of the Strategic Allocation Linked Benchmark prior to September 7, 2016 represents an allocation consisting of 60% S&P 500® Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index. Performance of the Tactical Allocation Fund Linked Benchmark prior to September 7, 2016 represents an allocation consisting of 50% S&P 500® Index and 50% Bloomberg Barclays U.S. Aggregate Bond Index. The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the fees, expenses or taxes associated with the active management of an actual portfolio.

For a detailed discussion of the manner of calculating total return, please see the Funds’ Statement of Additional Information. Generally, the calculations of total return assume the reinvestment of all dividends and capital gain distributions on the reinvestment date and the deduction of all recurring expenses that were charged to shareholders’ accounts.

Who will be the Adviser and Subadvisers of my Fund after the Reorganization? What will the advisory and subadvisory fees be after the Reorganization?

Management of the Funds

The overall management of Tactical Allocation and Strategic Allocation is the responsibility of, and is supervised by, the Board of Trustees of the Trust.

Adviser

Virtus Investment Advisers, Inc. (“VIA” or the “Adviser”) is the investment adviser for the Funds and is responsible for managing each Fund’s investment program and for the general operations of the Funds, including oversight of the Funds’ Subadvisers and recommending their hiring, termination and replacement.

Facts about the Adviser:

| | · | The Adviser is an indirect, wholly-owned subsidiary of Virtus Investment Partners, Inc. |

| | | |

| | · | The Adviser acts as the investment adviser for over 40 open- and closed-end funds, with assets under management of approximately $31.7 billion as of September 30, 2018. |

| | | |

| | · | The Adviser is located at 100 Pearl Street, Hartford, Connecticut 06103. |

Subadvisers

The Funds’ subadvisers are Duff & Phelps Investment Management Co. (“Duff & Phelps”) (international equity portion), Kayne Anderson Rudnick Investment Management, LLC (“KAR”) (domestic equity portion) and Newfleet Asset Management, LLC (“Newfleet”) (fixed income portion) (each, a “Subadviser”). Pursuant to separate Subadvisory Agreements with the Adviser, each Subadviser is responsible for the day-to-day management of the portion of the Funds’ portfolios allocated to it.

Facts about the Subadvisers:

| · | Duff & Phelps, an affiliate of VIA, is located at 200 South Wacker Drive, Suite 500, Chicago, IL 60606. Duff & Phelps acts as subadviser to mutual funds and as adviser or subadviser to closed-end mutual funds and to institutional clients. Duff & Phelps (together with its predecessor) has been in the investment advisory business for more than 70 years. As of September 30, 2018, Duff & Phelps had approximately $9.9 billion in assets under management. |

| | | |

| · | KAR, an affiliate of VIA, is located at 1800 Avenue of the Stars, 2nd Floor, Los Angeles, CA 90067. KAR acts as subadviser to mutual funds and as investment adviser to institutions and individuals. As of September 30, 2018, KAR had approximately $26.8 billion in assets under management. |

| | | |

| · | Newfleet, an affiliate of VIA, is located at 100 Pearl Street, Hartford, CT 06103. Newfleet acts as subadviser to mutual funds and as adviser to institutions and individuals. As of September 30, 2018, Newfleet had approximately $11.4 billion in assets under management. |

The Trust and the Adviser have received an exemptive order from the Securities and Exchange Commission that permits the Adviser, subject to certain conditions, and without the approval of shareholders, to: (a) select both unaffiliated subadvisers and certain wholly-owned affiliated subadvisers to manage all or a portion of the assets of a fund, and enter into subadvisory agreements with such subadvisers, and (b) materially amend subadvisory agreements with such subadvisers. In such circumstances, shareholders would receive notice of such action, including the information concerning the new subadviser that normally is provided in a proxy statement.

Portfolio Management

David L. Albrycht, CFA. Mr. Albrycht has served as a Portfolio Manager of Strategic Allocation since 2012 and of Tactical Allocation since 2011. He is President and Chief Investment Officer at Newfleet (since June 2011). Until June 2011, he was executive managing director (2008 to 2011) and vice president (2005 to 2008), fixed income, of Goodwin Capital Advisers, Inc. (“Goodwin”). Previously, he was associated with VIA, at which time it was an affiliate of Goodwin. He managed fixed income portfolios for Goodwin affiliates beginning in 1991.

Frederick A. Brimberg. Mr. Brimberg has served as a Portfolio Manager of Strategic Allocation and of Tactical Allocation since 2012. He is Senior Managing Director and Senior Portfolio Manager at Duff & Phelps (since August 2016), an affiliate of VIA. He was previously Senior Managing Director and Senior Portfolio Manager (2012 to 2017) at Euclid Advisors LLC (“Euclid”), a former affilliate of Duff & Phelps and VIA. Prior to joining Euclid, he was senior vice president and international portfolio manager at Avatar Associates (2006 to 2012), where he started the international strategy in 2006. Earlier, he was vice president and portfolio manager at ING Investment Management and its predecessor Lexington Management, with a focus on global equity investing. Mr. Brimberg’s career spans 30-plus years in investment management, trading, and capital markets, with positions at Brimberg & Co., and Lehman Brothers.

Doug Foreman, CFA. Mr. Foreman has served as a Portfolio Manager of Strategic Allocation and of Tactical Allocation since 2016. He is Chief Investment Officer (since January 2014), and previously was Co-Chief Investment Officer (2013), playing a leadership role in KAR's equity investment operations and is a member of KAR’s Executive Management Committee. Before joining KAR in 2011, he was director of equities at HighMark Capital Management (2009 to 2011). Prior to HighMark, Mr. Foreman was retired for two years (2007 to 2008) and was group managing director and chief investment officer of U.S. equities at Trust Company of the West (TCW) (1994 to 2006).

Stephen H. Hooker, CFA. Mr. Hooker has served as a Portfolio Manager of Strategic Allocation since 2017 and of Tactical Allocation since 2018. He is a Managing Director and Portfolio Manager at Newfleet (since 2011). He is responsible for the paper and packaging and chemicals industry sectors, and the Eastern Europe, Middle East, and Africa sovereign credit sector. From 2005 until 2011, Mr. Hooker was vice president, senior credit analyst at Aladdin Capital Management and Global Plus Investment Management, respectively, both of which specialize in high yield and structured credit products. Prior to 2005, he was at Goodwin for 12 years, serving in various capacities, including as a senior credit analyst and emerging markets sector manager on its fixed income team.

Please refer to the Statement of Additional Information for additional information about Tactical Allocation’s portfolio managers, including the structure of and method of computing compensation, other accounts they manage and their ownership of shares of Tactical Allocation.

Advisory Fees

For its management and supervision of the daily business affairs of Tactical Allocation, the Adviser is entitled to receive a monthly fee that is accrued daily against the value of Tactical Allocation’s net assets at the following annual rates:

| First $1 billion | 0.55% |

| Over $1 billion up to $2 billion | 0.50% |

| Over $2 billion | 0.45% |

In addition, the Adviser will implement contractual expense limits that will limit total operating expenses to 1.15% for Class A and 1.90% for Class C shares of Tactical Allocation.

Subadvisory Fees

Under the terms of the Subadvisory Agreements, each Subadviser is paid by the Adviser for providing advisory services to Tactical Allocation. The Fund does not pay fees to the Subadvisers. The Adviser pays each Subadviser a subadvisory fee at the rate of 50% of the net advisory fee for the portion of Tactical Allocation’s assets that are allocated to it.

What will be the primary federal tax consequences of the Reorganization?

Prior to or at the completion of the Reorganization, the Funds will have received an opinion from the law firm of Sullivan & Worcester LLP that, for U.S. federal income tax purposes, the Reorganization contemplated by the Plan should qualify as a tax-free reorganization described in section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and that each Fund should be “a party to a reorganization,” within the meaning of section 368(b) of the Code.

If the Reorganization qualifies as a tax-free reorganization and each of the Funds is a party to a reorganization, as described above, then, as a result, for U.S. federal income tax purposes, no gain or loss will be recognized by Strategic Allocation or its shareholders as a result of receiving shares of Tactical Allocation in connection with the Reorganization. The holding period and aggregate tax basis of the shares of Tactical Allocation that are received by the shareholders of Strategic Allocation will be the same as the holding period and aggregate tax basis of the shares of Strategic Allocation previously held by such shareholders, provided that such shares of Strategic Allocation are held as capital assets. In addition, no gain or loss will be recognized by Tactical Allocation upon the receipt of the assets of Strategic Allocation in exchange for shares of Tactical Allocation and the assumption by Tactical Allocation of Strategic Allocation’s liabilities, and the holding period and tax basis of the assets of Strategic Allocation in the hands of Tactical Allocation as a result of the Reorganization will be the same as in the hands of Strategic Allocation immediately prior to the Reorganization.

RISKS

Are the risk factors for the Funds similar?

Yes. The risk factors are the same due to the similar investment objectives and investment policies of the Funds. The risks of Tactical Allocation are described in greater detail in that Fund’s Prospectus and Statement of Additional Information.

What are the primary risks of investing in each Fund?

An investment in each Fund is subject to certain risks. There is no assurance that investment performance of either Fund will be positive or that the Funds will meet their investment objectives. The following disclosure highlights the primary risks associated with investment in each of the Funds.

Each of the Funds is subject to Credit Risk, Currency Rate Risk, Depositary Receipts Risk, Emerging Market Investing Risk, Equity Securities Risk, Foreign Investing Risk, Growth Stocks Risk, High-Yield/High-Risk Fixed Income Securities (Junk Bonds) Risk, Interest Rate Risk, Large Market Capitalization Companies Risk, Loan Risk, Long-Term Maturities/Durations Risk, Market Volatility Risk, Mortgage-Backed and Asset-Backed Securities Risk, Municipal Bond Market Risk, Preferred Stock Risk and U.S. Government Securities Risk.

| · | Credit Risk – The risk that the issuer of a security will fail to pay interest or principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of the security to decline. Debt securities rated below investment-grade are especially susceptible to this risk. |

| · | Currency Rate Risk – Because the foreign securities in which the fund invests generally trade in currencies other than the U.S. dollar, changes in currency exchange rates will affect the fund’s net asset value, the value of dividends and interest earned, and gains and losses realized on the sale of securities. Because the value of the fund’s shares is calculated in U.S. dollars, it is possible for the fund to lose money by investing in a foreign security if the local currency of a foreign market depreciates against the U.S. dollar, even if the local currency value of the fund’s holdings goes up. Generally, a strong U.S. dollar relative to such other currencies will adversely affect the value of the fund’s holdings in foreign securities. |

| · | Depositary Receipts Risk – The fund may invest in American Depositary Receipts (ADRs) sponsored by U.S. banks, European Depositary Receipts (EDRs), Global Depositary Receipts (GDRs), ADRs not sponsored by U.S. banks, other types of depositary receipts (including non-voting depositary receipts), and other similar instruments representing securities of foreign companies. Although certain depositary receipts may reduce or eliminate some of the risks associated with foreign investing, these types of securities generally are subject to many of the same risks as direct investment in securities of foreign issuers. |

| · | Emerging Market Investing Risk – The risks of foreign investments are generally greater in countries whose markets are still developing than they are in more developed markets. Emerging market countries typically have economic and political systems that are less fully developed, and can be expected to be less stable than those of more developed countries. For example, the economies of such countries can be subject to rapid and unpredictable rates of inflation or deflation. Since these markets are often small, they may be more likely to suffer sharp and frequent price changes or long-term price depression because of adverse publicity, investor perceptions or the actions of a few large investors. They may also have policies that restrict investment by foreigners, or that prevent foreign investors from withdrawing their money at will. Certain emerging markets may also face other significant internal or external risks, including the risk of war and civil unrest. For all of these reasons, investments in emerging markets may be considered speculative. To the extent that the fund invests a significant portion of its assets in a particular emerging market, the fund will be more vulnerable to financial, economic, political and other developments in that country, and conditions that negatively impact that country will have a greater impact on the fund as compared with a fund that does not have its holdings concentrated in a particular country. |

| · | Equity Securities Risk – Equity securities are subject to the risk that, generally, prices of equity securities are more volatile than those of fixed income securities. The prices of equity securities will rise and fall in response to a number of different factors. In particular, equity securities will respond to events that affect entire financial markets or industries (such as changes in inflation or consumer demand) and to events that affect particular issuers (such as news about the success or failure of a new product). Equity securities also are subject to “stock market risk,” meaning that stock prices in general may decline over short or extended periods of time. When the value of the stocks held by the fund goes down, the value of the fund’s shares will be affected. |

| · | Foreign Investing Risk – Investing in securities of non-U.S. companies involves special risks and considerations not typically associated with investing in U.S. companies, and the values of non-U.S. securities may be more volatile than those of U.S. securities. The values of non-U.S. securities are subject to economic and political developments in countries and regions where the issuers operate or are domiciled, or where the securities are traded, such as changes in economic or monetary policies, and to changes in currency exchange rates. Values may also be affected by restrictions on receiving the investment proceeds from a non-U.S. country. In general, less information is publicly available about non-U.S. companies than about U.S. companies. Non-U.S. companies are generally not subject to the same accounting, auditing and financial reporting standards as are U.S. companies. Certain foreign issuers classified as passive foreign investment companies may be subject to additional taxation risk. |

| · | Growth Stocks Risk – Growth stocks can react differently to issuer, political, market, and economic developments than the market as a whole and other types of stocks. Growth stocks also tend to be more expensive relative to their earnings or assets compared to other types of stocks, and as a result they tend to be sensitive to changes in their earnings and more volatile than other types of stocks. |

| · | High-Yield/High-Risk Fixed Income Securities (Junk Bonds) Risk – Securities rated “BB” or below by S&P or Fitch, or “Ba” or below by Moody’s, may be known as “high-yield” securities and are commonly referred to as “junk bonds.” The highest of the ratings among S&P, Fitch and Moody's is used to determine the security's classification. Such securities entail greater price volatility and credit and interest rate risk than investment-grade securities. Analysis of the creditworthiness of high-yield/high-risk issuers is more complex than for higher-rated securities, making it more difficult for the fund's subadviser to accurately predict risk. There is a greater risk with high-yield/high-risk fixed income securities that an issuer will not be able to make principal and interest payments when due. If the fund pursues missed payments, there is a risk that fund expenses could increase. In addition, lower-rated securities may not trade as often and may be less liquid than higher-rated securities, especially during periods of economic uncertainty or change. As a result of all of these factors, these bonds are generally considered to be speculative. |

| · | Interest Rate Risk – The values of debt securities usually rise and fall in response to changes in interest rates. Declining interest rates generally increase the value of existing debt instruments, and rising interest rates generally decrease the value of existing debt instruments. Changes in a debt instrument’s value usually will not affect the amount of interest income paid to the fund, but will affect the value of the fund’s shares. Interest rate risk is generally greater for investments with longer maturities. |

Certain securities pay interest at variable or floating rates. Variable rate securities reset at specified intervals, while floating rate securities reset whenever there is a change in a specified index rate. In most cases, these reset provisions reduce the effect of changes in market interest rates on the value of the security. However, some securities do not track the underlying index directly, but reset based on formulas that can produce an effect similar to leveraging; others may also provide for interest payments that vary inversely with market rates. The market prices of these securities may fluctuate significantly when interest rates change.

Some investments give the issuer the option to call or redeem an investment before its maturity date. If an issuer calls or redeems an investment during a time of declining interest rates, the fund might have to reinvest the proceeds in an investment offering a lower yield, and therefore it might not benefit from any increase in value as a result of declining interest rates.

| · | Large Market Capitalization Companies Risk – The value of investments in larger companies may not rise as much as investments in smaller companies, and larger companies may be unable to respond quickly to competitive challenges, such as changes in technology and consumer tastes. |

| · | Loan Risk – Investing in loans carries certain risks in addition to the risks typically associated with high-yield/high-risk fixed income securities. Loans may be unsecured or not fully collateralized, may be subject to restrictions on resale and sometimes trade infrequently on the secondary market. In the event a borrower defaults, the fund’s access to the collateral may be limited or delayed by bankruptcy or other insolvency laws. There is a risk that the value of the collateral securing the loan may decline after the fund invests and that the collateral may not be sufficient to cover the amount owed to the fund. If the loan is unsecured, there is no specific collateral on which the fund can foreclose. In addition, if a secured loan is foreclosed, the fund may bear the costs and liabilities associated with owning and disposing of the collateral, including the risk that collateral may be difficult to sell. |

Transactions in many loans settle on a delayed basis that may take more than seven days. As a result, sale proceeds related to the sale of loans may not be available to make additional investments or to meet the fund’s redemption obligations until potentially a substantial period of time after the sale of the loans. No active trading market may exist for some loans, which may impact the ability of the fund to realize full value in the event of the need to liquidate such assets. Adverse market conditions may impair the liquidity of some actively traded loans. Loans also may be subject to restrictions on resale, which can delay the sale and adversely impact the sale price. Difficulty in selling a loan can result in a loss. Loans made to finance highly leveraged corporate acquisitions may be especially vulnerable to adverse changes in economic or market conditions. Certain loans may not be considered “securities,” and purchasers, such as the fund, therefore may not be entitled to rely on the strong anti-fraud protections of the federal securities laws. With loan participations, the fund may not be able to control the exercise of any remedies that the lender would have under the loan and likely would not have any rights against the borrower directly, so that delays and expense may be greater than those that would be involved if the fund could enforce its rights directly against the borrower.

| · | Long-Term Maturities/Durations Risk – Fixed income securities with longer maturities or durations may be subject to greater price fluctuations due to interest rate, tax law, and general market changes than securities with shorter maturities or durations. |

| · | Market Volatility Risk – The risk that the value of the securities in which the fund invests may go up or down in response to the prospects of individual issuers and/or general economic conditions. Such price changes may be temporary or may last for extended periods. Instability in the financial markets has exposed each fund to greater market and liquidity risk and potential difficulty in valuing portfolio instruments that it holds. In response to financial markets that experienced extreme volatility, and in some cases a lack of liquidity, the U.S. Government and other governments have taken a number of unprecedented actions, including acquiring distressed assets from financial institutions and acquiring ownership interests in those institutions. The implications of government ownership and disposition of these assets are unclear. Additional legislation or government regulation may also change the way in which funds themselves are regulated, which could limit or preclude a fund’s ability to achieve its investment objective. |

| · | Mortgage-Backed and Asset-Backed Securities Risk – The impairment of the value of collateral or other assets underlying a mortgage-backed or asset-backed security, such as that resulting from non-payment of loans, may result in a reduction in the value of such security and losses to the fund. Early payoffs in the loans underlying such securities may result in the fund receiving less income than originally anticipated. The variability in prepayments will tend to limit price gains when interest rates drop and exaggerate price declines when interest rates rise. In the event of high prepayments, the fund may be required to invest proceeds at lower interest rates, causing the fund to earn less than if the prepayments had not occurred. Conversely, rising interest rates may cause prepayments to occur at a slower than expected rate, which may effectively change a security that was considered short- or intermediate-term into a long-term security. Long-term securities tend to fluctuate in value more widely in response to changes in interest rates than shorter-term securities. |

| · | Municipal Bond Market Risk – The amount of public information available about municipal bonds is generally less than that for corporate equities or bonds, and the investment performance of the fund may be more dependent on the analytical abilities of the investment adviser than would be the case for a fund that does not invest in municipal bonds. The secondary market for municipal bonds also tends to be less well-developed and less liquid than many other securities markets, which may adversely affect the fund’s ability to sell its bonds at attractive prices. In addition, municipal obligations can experience downturns in trading activity, and the supply of municipal obligations may exceed the demand in the market. During such periods, the spread can widen between the price at which an obligation can be purchased and the price at which it can be sold. Less liquid obligations can become more difficult to value and be subject to erratic price movements. Economic and other events (whether real or perceived) can reduce the demand for certain investments or for investments generally, which may reduce market prices and cause the value of the fund’s shares to fall. The frequency and magnitude of such changes cannot be predicted. The fund may invest in municipal obligations that do not appear to be related, but in fact depend on the financial rating or support of a single government unit, in which case, events that affect one of the obligations will also affect the others and will impact the fund’s portfolio to a greater degree than if the fund’s investments were not so related. The increased presence of non-traditional participants in the municipal markets may lead to greater volatility in the markets. |

| · | Preferred Stock Risk – Preferred stocks may provide a higher dividend rate than the interest yield on debt securities of the same issuer, but are subject to greater risk of fluctuation in market value and greater risk of non-receipt of income. Unlike interest on debt securities, dividends on preferred stocks must be declared by the issuer’s board of directors before becoming payable. Preferred stocks are in many ways like perpetual debt securities, providing a stream of income but without stated maturity date. Because they often lack a fixed maturity or redemption date, preferred stocks are likely to fluctuate substantially in price when interest rates change. Such fluctuations generally are comparable to or exceed those of long-term government or corporate bonds (those with maturities of fifteen to thirty years). Preferred stocks have claims on assets and earnings of the issuer which are subordinate to the claims of all creditors but senior to the claims of common stockholders. A preferred stock rating differs from a bond rating because it applies to an equity issue which is intrinsically different from, and subordinated to, a debt issue. Preferred stock ratings generally represent an assessment of the capacity and willingness of an issuer to pay preferred stock dividends and any applicable sinking fund obligations. Preferred stock also may be subject to optional or mandatory redemption provisions, and may be significantly less liquid than many other securities, such as U.S. Government securities, corporate debt or common stock. |

| · | U.S. Government Securities Risk – Obligations issued or guaranteed by the U.S. Government, its agencies, authorities and instrumentalities and backed by the full faith and credit of the United States only guarantee principal and interest will be timely paid to holders of the securities. The entities do not guarantee that the value of fund shares will increase, and in fact, the market values of such obligations may fluctuate. In addition, not all U.S. Government securities are backed by the full faith and credit of the United States; some are the obligation solely of the entity through which they are issued. There is no guarantee that the U.S. Government would provide financial support to its agencies and instrumentalities if not required to do so by law. |

Please refer to each Fund’s Prospectus and Statement of Additional Information for more information on risks.

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

The Funds have similar investment objectives. The Reorganization will allow shareholders of Strategic Allocation to own a fund that is similar in style, and with a greater amount of assets. The Reorganization could create better efficiencies for the portfolio management team and perhaps lower expenses for Tactical Allocation, which could benefit shareholders of Strategic Allocation.

At a Board meeting held on November 13-15, 2018, all of the Trustees of the Trust on behalf of Strategic Allocation, including the Trustees who are not interested persons of the Trust as defined in Section 2(a)(19) of the 1940 Act (the “Disinterested Trustees”), considered and approved the Reorganization as set forth in the Plan. They determined that the Reorganization was in the best interests of Strategic Allocation and its shareholders, and that the interests of existing shareholders of Strategic Allocation will not be diluted as a result of the transactions contemplated by the Reorganization.

Before approving the Plan, the Trustees evaluated extensive information provided with respect to the management of the Funds and reviewed various factors about the Funds and the proposed Reorganization. The Trustees noted that Tactical Allocation has similar investment objectives and similar investment strategies as Strategic Allocation. They further noted that Tactical Allocation’s pro forma fund operating expenses were expected to be lower than those for Strategic Allocation.

The Trustees considered the relative asset size of each Fund, including the benefits of investing in a fund with a higher combined level of assets for current shareholders of Strategic Allocation.

In addition, the Trustees considered, among other things:

| · | the terms and conditions of the Reorganization; |

| · | the fact that the Reorganization would not result in the dilution of shareholders’ interests; |

| · | the fact that Strategic Allocation and Tactical Allocation have similar investment objectives and principal investment strategies; |

| · | the fact that the Funds will share the expenses incurred in connection with the Reorganization pro rata based on assets under management; |

| · | the benefits to shareholders, including from operating efficiencies, which may be achieved from combining the Funds; |

| · | the fact that Tactical Allocation will assume all of the liabilities of Strategic Allocation; |

| · | the fact that the Reorganization is expected to be a tax-free transaction for U.S. federal income tax purposes; and |

| · | alternatives available to shareholders of Strategic Allocation, including the ability to redeem their shares. |

During their consideration of the Reorganization, the Disinterested Trustees consulted with their independent legal counsel, as appropriate.

After consideration of the factors noted above, together with other factors and information considered to be relevant, and recognizing that there can be no assurance that any operating efficiencies or other benefits will in fact be realized, the Trustees of the Trust concluded that the proposed Reorganization would be in the best interests of Strategic Allocation and its shareholders. Consequently, they unanimously approved the Plan.

The Trustees of the Trust have also approved the Plan on behalf of Tactical Allocation, after concluding that the proposed Reorganization would be in the best interests of Tactical Allocation and its shareholders.

Agreement and Plan of Reorganization

The following summary is qualified in its entirety by reference to the Plan (the form of which is attached as Exhibit A to this Prospectus/Information Statement).

The Plan provides that all of the assets of Strategic Allocation will be acquired by Tactical Allocation in exchange for Class A and Class C shares of Tactical Allocation and the assumption by Tactical Allocation of all of the liabilities of Strategic Allocation on or about January 25, 2019, or such other date as may be agreed upon by the parties (the “Closing Date”). Prior to the Closing Date, Strategic Allocation will endeavor to discharge all of its known liabilities and obligations. Strategic Allocation will prepare an unaudited statement of its assets and liabilities as of the Closing Date.

At or prior to the Closing Date, Strategic Allocation will declare and pay a distribution or distributions that, together with all previous distributions, shall have the effect of distributing to its shareholders (i) all of its investment company taxable income and all of its net realized capital gains, if any, for the period from the close of its last fiscal year to 4:00 p.m. Eastern time on the Closing Date; and (ii) any undistributed investment company taxable income and net realized capital gains from any period to the extent not otherwise already distributed.

The number of full and fractional shares of each class of Tactical Allocation to be received by the shareholders of Strategic Allocation will be determined by dividing the net assets of Strategic Allocation by the net asset value of a share of Tactical Allocation. These computations will take place as of immediately after the close of business on the New York Stock Exchange and after the declaration of any dividends at or prior to the Closing Date (the “Valuation Date”). The net asset value per share of each class will be determined by dividing assets, less liabilities, in each case attributable to the respective class, by the total number of outstanding shares.

Virtus Fund Services, LLC (“Virtus Fund Services”), the administrator for both Funds, will compute the value of each Fund’s respective portfolio of securities. The method of valuation employed will be consistent with the procedures set forth in the Prospectus and Statement of Additional Information of Tactical Allocation, Rule 22c-1 under the 1940 Act, and with the interpretations of that Rule by the SEC’s Division of Investment Management.

Immediately after the transfer of its assets to Tactical Allocation, Strategic Allocation will liquidate and distribute pro rata to its shareholders as of the close of business on the Closing Date the full and fractional shares of Tactical Allocation received by Strategic Allocation. The liquidation and distribution will be accomplished by the establishment of accounts in the names of Strategic Allocation’s shareholders on the share records of Tactical Allocation or its transfer agent. Each account will represent the respective pro rata number of full and fractional shares of Tactical Allocation due to Strategic Allocation’s shareholders. All issued and outstanding shares of Strategic Allocation will be canceled. The shares of Tactical Allocation to be issued will have no preemptive or conversion rights and no share certificates will be issued. After these distributions and the winding up of its affairs, Strategic Allocation will be terminated as a series of the Trust.

The consummation of the Reorganization is subject to the conditions set forth in the Plan, including accuracy of various representations and warranties, and receipt of opinions of counsel. The Plan may be terminated (a) by the mutual agreement of the Funds; (b) by either Tactical Allocation or Strategic Allocation if the Reorganization has not occurred on or before June 30, 2019, unless such date is extended by mutual agreement of Tactical Allocation and Strategic Allocation; or (c) by either party if the other party materially breaches its obligations under the Plan or made a material and intentional misrepresentation in the Plan or in connection with the Plan.

If the Reorganization is not consummated, then the officers of the Funds, or an affiliate, shall, based on the reasons for not consummating the transaction, agree on a reasonable allocation of expenses.

If the Reorganization is not consummated, the Trustees of the Trust will consider other possible courses of action in the best interests of Strategic Allocation and its shareholders.

Federal Income Tax Consequences

The Reorganization is intended to qualify for U.S. federal income tax purposes as a tax-free reorganization under section 368 of the Code. As a condition to the closing of the Reorganization, the Funds will receive an opinion from the law firm of Sullivan & Worcester LLP to the effect that, for U.S. federal income tax purposes and based upon certain facts, assumptions, and representations, the Reorganization contemplated by the Plan should qualify as a tax-free reorganization described in section 368(a) of the Code, and that each Fund should be “a party to a reorganization,” within the meaning of section 368(b) of the Code.

If the Reorganization qualifies as a tax-free reorganization and each of the Funds is a party to a reorganization, as described above, then, as a result:

| 1. | No gain or loss will be recognized by Tactical Allocation upon the receipt of the assets of Strategic Allocation solely in exchange for the shares of Tactical Allocation and the assumption by Tactical Allocation of the liabilities of Strategic Allocation; |

| 2. | No gain or loss will be recognized by Strategic Allocation on the transfer of its assets to Tactical Allocation in exchange for Tactical Allocation’s shares and the assumption by Tactical Allocation of the liabilities of Strategic Allocation or upon the distribution of Tactical Allocation’s shares to Strategic Allocation’s shareholders in exchange for their shares of Strategic Allocation; |

| 3. | No gain or loss will be recognized by Strategic Allocation's shareholders upon the exchange of their shares of Strategic Allocation for shares of Tactical Allocation in liquidation of Strategic Allocation; |

| 4. | The aggregate tax basis of the shares of Tactical Allocation received by each shareholder of Strategic Allocation pursuant to the Reorganization will be the same as the aggregate tax basis of the shares of Strategic Allocation held by such shareholder immediately prior to the Reorganization, and the holding period of the shares of Tactical Allocation received by each shareholder of Strategic Allocation will include the period during which the shares of Strategic Allocation exchanged therefor were held by such shareholder (provided that the shares of Strategic Allocation are held as capital assets on the date of the Reorganization); and |

| 5. | The tax basis of the assets of Strategic Allocation acquired by Tactical Allocation will be the same as the tax basis of such assets to Strategic Allocation immediately prior to the Reorganization, and the holding period of such assets in the hands of Tactical Allocation will include the period during which the assets were held by Strategic Allocation. |

Opinions of counsel are not binding upon the Internal Revenue Service or the courts. If the Reorganization is consummated, but does not qualify as a tax-free reorganization under the Code, Strategic Allocation would recognize gain or loss on the transfer of its assets to Tactical Allocation and each shareholder of Strategic Allocation would recognize a taxable gain or loss equal to the difference between its tax basis in its Strategic Allocation shares and the fair market value of the shares of Tactical Allocation it received.

Tactical Allocation’s utilization after the Reorganization of any pre-Reorganization losses realized by Tactical Allocation to offset income or gain realized by Strategic Allocation could be subject to limitation. Shareholders of Strategic Allocation should consult their tax advisers regarding the effect of the Reorganization in light of their individual circumstances.