QuickLinks -- Click here to rapidly navigate through this documentDear Stockholder:

The boards of directors of Covista Communications, Inc. and Capsule Communications, Inc. have approved a stock merger transaction in which Covista will acquire Capsule in exchange for shares of Covista common stock (and cash in lieu of fractional shares). In the merger, all stockholders of Capsule other than its majority stockholder, Henry G. Luken, III, will receive not more than $0.6696 of Covista common stock for each share of Capsule common stock, and Mr. Luken will receive not more than $0.5028 of Covista common stock for each share of Capsule common stock. At the close of business on January 8, 2002, the value of the merger consideration to Capsule stockholders (other than Mr. Luken) was $0.5822 per share based on a conversion ratio of 0.0737 and a price of Covista common stock of $7.90 per share.

Covista and Capsule are affiliated entities by virtue of the share ownership of their principal stockholder, Henry G. Luken, III. Mr. Luken, who is the Chairman of the Board of Covista, beneficially owns 3,466,708 shares of Covista common stock, representing approximately 32.0 percent of the outstanding Covista common stock, and 15,471,301 shares of Capsule common stock, representing approximately 68.3 percent of the outstanding Capsule common stock. Mr. Luken acquired all such shares of Capsule common stock during March 2001 at a purchase price of $.20 per share, for an aggregate purchase price of $3,094,260. Upon the completion of the merger, Mr. Luken will beneficially own 4,322,909 shares of Covista common stock (assuming an exchange ratio of 0.0553 for his Capsule shares), which will represent approximately 35.4 percent of the outstanding Covista common stock. At the close of business on January 8, 2002, the value of the merger consideration to Mr. Luken, in his capacity as a Capsule stockholder, was $0.4372 per share and $6,763,980 in the aggregate, based on a conversion ratio of 0.0553 and a price of Covista common stock of $7.90 per share.

The exchange of shares of Covista for shares of Capsule in connection with the merger may be partially taxable to Capsule stockholders. Tax matters are very complicated and the tax consequences of the merger to Capsule stockholders will depend on many factors, including stockholders' personal circumstances. We urge Capsule stockholders to consult their own tax advisors to understand fully the tax consequences to them.

This document constitutes:

- •

- a proxy statement for the annual meeting of Covista stockholders to consider and vote upon the shares of Covista common stock to be issued in connection with Covista's acquisition of Capsule and certain other matters, including the election of eight directors and the adoption of a new equity incentive plan;

- •

- a proxy statement for the special meeting of Capsule stockholders to consider and vote upon the merger; and

- •

- a prospectus for all of the shares of Covista common stock to be issued in connection with Covista's acquisition of Capsule.

This document provides you with detailed information about the merger. We encourage you to read this entire document carefully. In addition, you may obtain information about our companies from documents that we have filed with the Securities and Exchange Commission.

Very truly yours,

A. John Leach, Jr.

President and Chief Executive Officer

Covista Communications, Inc. | | David B. Hurwitz

President and Chief Executive Officer

Capsule Communications, Inc. |

See "Risk Factors" beginning on page 18 for a discussion of risks associated with the merger and the combined company.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the shares of Covista common stock to be issued under this document or determined if this document is accurate or complete. Any representation to the contrary is a criminal offense.

This joint proxy statement/prospectus is dated January 9, 2002 and is first being mailed to stockholders on or about January 11, 2002.

COVISTA COMMUNICATIONS, INC.

150 Clove Road

Little Falls, New Jersey 07424

Notice of Annual Meeting of Stockholders

To Be Held on February 8, 2002

To Covista Stockholders:

You are cordially invited to attend the annual meeting of stockholders of Covista Communications, Inc. to be held on Friday, February 8, 2002, at Covista's offices at 4803 Highway 58 North, Chattanooga, Tennessee, beginning at 10:00 a.m., local time. The purpose of the annual meeting is to:

- 1.

- consider and vote upon the proposal to issue shares of Covista common stock to the stockholders of Capsule Communications pursuant to the proposed merger set forth in the Agreement and Plan of Reorganization dated as of July 17, 2001, by and among Covista, CCI Acquisitions Corp., a wholly owned subsidiary of Covista, and Capsule Communications, Inc;

- 2.

- consider and vote upon the proposal to elect eight directors of Covista for a term of one year and until their successors are duly elected and qualified;

- 3.

- consider and vote upon the proposal to adopt the Covista Communications, Inc. 2001 Equity Incentive Plan;

- 4.

- consider and vote upon the proposal to ratify the selection of Deloitte & Touche LLP as independent auditors of Covista for the fiscal year ending January 31, 2002; and

- 5.

- transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

Only Covista stockholders of record at the close of business on December 11, 2001 are entitled to notice of and to vote at the annual meeting or any adjournment or postponement thereof.

Your vote is important. Whether or not you plan to attend the annual meeting, please complete, sign, date and promptly return the enclosed proxy card in the enclosed envelope.Your proxy may be revoked at any time before it is voted. If your shares are not registered in your own name, you will need additional documentation from the record holder in order to vote personally at the annual meeting.

| | | By Order of the Board of Directors |

|

|

A. John Leach, Jr.

President and Chief Executive Officer |

Little Falls, New Jersey

January 9, 2002 | | | | |

CAPSULE COMMUNICATIONS, INC.

3331 Street Road, Suite 275

Two Greenwood Square

Bensalem, Pennsylvania 19020

Notice of Special Meeting of Stockholders

To Be Held on February 8, 2002

To Capsule Stockholders:

You are cordially invited to attend a special meeting of stockholders of Capsule Communications, Inc. on Friday, February 8, 2002, at Capsule's offices at 331 Street Road, Suite 275, Bensalem, Pennsylvania, beginning at 11:00 a.m., local time, to approve the following:

- 1.

- The adoption of the Agreement and Plan of Reorganization dated as of July 17, 2001, by and among Covista Communications, Inc., CCI Acquisitions Corp., a wholly owned subsidiary of Covista, and Capsule Communications, Inc. As a result of the merger, Capsule will become a wholly owned subsidiary of Covista and Capsule stockholders will become Covista stockholders.

- 2.

- The transaction of such other business as may properly be brought before the meeting or any adjournment or postponement of the meeting, including potential adjournments for the purpose of soliciting additional proxies in order to approve the matter described in paragraph 1 above.

Only Capsule stockholders of record at the close of business on December 11, 2001 are entitled to notice of and to vote at the special meeting or any adjournments or postponements of the special meeting.

Your vote is important. Whether or not you plan to attend the special meeting, please complete, sign, date and promptly return the enclosed proxy card in the enclosed envelope. Your proxy may be revoked at any time before it is voted. If your shares are not registered in your own name, you will need additional documentation from the record holder in order to vote personally at the special meeting.

| | | By Order of the Board of Directors |

|

|

Arthur Regan

Secretary |

Bensalem, Pennsylvania

January 9, 2002 | | | | |

TABLE OF CONTENTS

| | Page

|

|---|

| QUESTIONS AND ANSWERS ABOUT THE MERGER | | 1 |

| SUMMARY | | 3 |

| | THE COMPANIES | | 3 |

| | HISTORY OF SIGNIFICANT OPERATING LOSSES, WORKING CAPITAL DEFICITS AND GOING CONCERN QUALIFICATION | | 4 |

| | THE MERGER | | 4 |

| | SHARE INFORMATION AND MARKET PRICES | | 7 |

| SELECTED HISTORICAL CONSOLIDATED AND PRO FORMA COMBINED FINANCIAL DATA | | 8 |

| | | Covista Communications, Inc. | | 8 |

| | | Capsule Communications, Inc. | | 9 |

| | UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | | 10 |

| | NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | | 15 |

| | | Comparative Per Share Data | | 16 |

| RISK FACTORS | | 18 |

| | | Risks Related to the Merger | | 18 |

| | | The value of the merger consideration that Capsule stockholders will receive will be reduced if the value of Covista common stock prior to the effective time of the merger is less than $6.00 | | 18 |

| | | Capsule may terminate the merger agreement if Covista's stock price is less than $2.00 per share | | 18 |

| | | We have a history of operating losses and working capital deficits, and Capsule's auditors have issued a going concern qualification to their audit report | | 18 |

| | | Covista may not realize anticipated operating efficiencies, which could hurt Covista's profitability | | 19 |

| | | A portion of the Covista common stock received by minority stockholders of Capsule may be taxable income | | 19 |

| | | Covista and Capsule will incur significant transaction expenses and integration-related costs in connection with the merger transaction | | 19 |

| | | Unanticipated costs relating to the merger could reduce Covista's future earnings per share | | 19 |

| | | Obtaining required regulatory approvals and satisfying closing conditions may delay or prevent completion of the merger | | 19 |

| | | The merger constitutes a transaction involving affiliated entities, and the parties' principal stockholder may have interests in the transaction that are different from the interests of other stockholders | | 20 |

| | | Henry G. Luken, III, who is the majority stockholder of Capsule and the Chairman of the Board and a significant stockholder of Covista, may realize a significant increase in the value of his investment in Capsule upon the closing of the merger | | 20 |

| | | Directors and executive officers of Capsule may receive change of control benefits even if the merger is not consummated | | 20 |

| | | Covista and Capsule will incur substantial expenses and payments if the merger does not occur | | 20 |

| | | Risks Related to the Combined Company | | 20 |

i

| | | Because we may not be able to compete effectively against others in the telecommunications industry that have significantly greater resources than we do, we might lose customers and our ability to attract new ones may be limited. | | 20 |

| | | If third parties terminate their relations with us or fail to renew or perform their material agreements with us, we may incur significant costs in developing or replacing their technology and infrastructure. | | 21 |

| | | Recent industry and market developments and our working capital deficits may adversely affect our ability to raise capital | | 21 |

| | | If we are not able to obtain additional capital, we may not be able to implement our business plan. | | 22 |

| | | The launch of our new residential long distance service may be delayed, or may not achieve the market penetration that we anticipate | | 22 |

| | | We may incur substantial cost to comply with telecommunciations regulation by state and federal agencies | | 23 |

| | | We may face significant liability under such state and federal regulation | | 23 |

| | | The regulatory environment is uncertain and our business may be significantly affected by future changes | | 24 |

| | | If we experience a network system failure, our service could be delayed or interrupted and that could cause us to lose existing customers or limit our ability to attract new ones | | 24 |

| | | Because we depend on the transmission facilities of long-distance carriers, we may experience unanticipated price increases and service cancellation | | 24 |

| | | Because our success depends upon the continued contribution of our management team, the loss of any of our executive officers, key employees or other skilled personnel could adversely affect our business | | 24 |

| | | Because our executive officers, directors and significant stockholders are able to exercise significant influence over our company, our business and stock price could be adversely affected | | 25 |

| | | A Warning About Forward-Looking Statements | | 25 |

| THE COVISTA ANNUAL MEETING | | 26 |

| | | Joint Proxy Statement/Prospectus | | 26 |

| | | Date, Time and Place of Annual Meeting | | 26 |

| | | Record Date and Outstanding Shares | | 26 |

| | | Purpose of the Annual Meeting | | 26 |

| | | Vote Required; Quorum | | 26 |

| | | Voting of Proxies | | 27 |

| | | Authorization to Vote on Adjournment and Other Matters | | 28 |

| | | Revocation of Proxies | | 28 |

| | | Solicitation of Proxies | | 28 |

| THE CAPSULE SPECIAL MEETING | | 29 |

| | | Joint Proxy Statement/Prospectus | | 29 |

| | | Date, Time and Place of the Special Meeting | | 29 |

| | | Record Date and Outstanding Shares | | 29 |

| | | Purpose of the Special Meeting | | 29 |

| | | Vote Required; Quorum | | 29 |

| | | Voting of Proxies | | 30 |

| | | Authorization to Vote on Adjournment and Other Matters | | 30 |

| | | Revocation of Proxies | | 31 |

| | | Solicitation of Proxies | | 31 |

| | | Capsule Common Stock Ownership | | 31 |

ii

| PROPOSAL NUMBER ONE FOR COVISTA STOCKHOLDERS—APPROVAL OF ISSUANCE OF COVISTA COMMON STOCK IN CONNECTION WITH THE MERGER; AND PROPOSAL NUMBER ONE FOR CAPSULE STOCKHOLDERS—APPROVAL OF THE MERGER AGREEMENT | | 34 |

| | | GENERAL DESCRIPTION OF THE MERGER | | 34 |

| | | Background of the Merger | | 34 |

| | | Covista's Reasons for the Merger | | 39 |

| | | Capsule's Reasons for the Merger | | 41 |

| | | Opinion of Capsule's Financial Advisor | | 43 |

| | | Interested Nature of the Merger Transaction | | 46 |

| | | Interests of Certain Persons in the Merger | | 47 |

| | | Procedures for Exchange of Capsule Stock Certificates | | 49 |

| | | Exchange of Capsule Stock Options | | 50 |

| | | Accounting Treatment | | 50 |

| | | Covista Loans to Capsule | | 51 |

| | | Material Federal Income Tax Considerations | | 51 |

| | | Possible Loss of Net Operating Loss Carryovers | | 53 |

| | | Regulatory Approvals Required | | 53 |

| | | Nasdaq Stock Market Listing | | 54 |

| | | Appraisal Rights | | 54 |

| | | Resale of Covista Common Stock After the Merger | | 56 |

| | THE MERGER AGREEMENT | | 58 |

| | | General | | 58 |

| | | Conversion Ratio; Fractional Shares | | 58 |

| | | Representations and Warranties | | 58 |

| | | Covenants | | 59 |

| | | Conditions to the Merger | | 60 |

| | | Termination | | 60 |

| | | Amendment; Waiver | | 61 |

| | | Expenses | | 61 |

| | COMPARISON OF THE RIGHTS OF HOLDERS OF COVISTA COMMON STOCK AND CAPSULE COMMON STOCK | | 62 |

| | | General | | 62 |

| | | Voting Rights and Election of Directors | | 62 |

| | | Quorum | | 62 |

| | | Dividends | | 63 |

| | | Removal of Directors | | 63 |

| | | Number and Classification of the Board of Directors | | 63 |

| | | Vacancies on the Board of Directors | | 64 |

| | | Amendments to Certificate of Incorporation | | 64 |

| | | Amendments to Bylaws | | 64 |

| | | Stockholder Vote by Written Consent | | 65 |

| | | Stockholders' Meetings | | 65 |

| | | Limitation of Liability | | 65 |

| | | Indemnification | | 66 |

| | | Business Combination Statutes | | 67 |

| | DESCRIPTION OF COVISTA CAPITAL STOCK | | 69 |

| | | General | | 69 |

| | | Common Stock | | 69 |

| | | Transfer Agent | | 69 |

iii

| ADDITIONAL MATTERS BEING SUBMITTED TO A VOTE OF ONLY COVISTA'S STOCKHOLDERS—PROPOSAL NUMBER TWO: ELECTION OF DIRECTORS | | 69 |

| | | Nominees | | 70 |

| | | Board Meetings and Committees | | 71 |

| | | Audit Committee Report | | 72 |

| | | Executive Compensation | | 73 |

| | | Compensation of Directors | | 74 |

| | | Employment Contracts, Termination of Employment and Change of Control Arrangements | | 74 |

| | | Report on Repricing of Options | | 76 |

| | | Compensation Committee Interlocks and Insider Participation | | 76 |

| | | Report on Executive Compensation | | 76 |

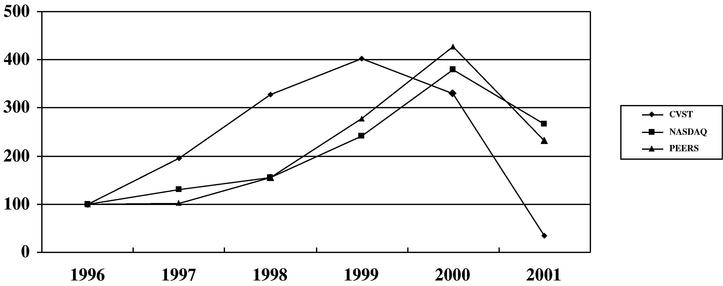

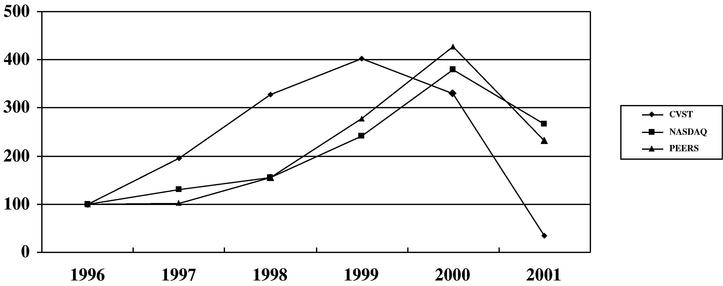

| | | Stock Performance Chart | | 78 |

| | | Section 16(a) Compliance | | 78 |

| | | Certain Transactions | | 78 |

| | | Security Ownership of Certain Beneficial Owners and Management of Covista | | 79 |

| ADDITIONAL MATTERS BEING SUBMITTED TO A VOTE OF ONLY COVISTA'S STOCKHOLDERS—PROPOSAL NUMBER THREE: ADOPTION OF THE COVISTA COMMUNICATIONS, INC. 2001 EQUITY INCENTIVE PLAN | | 82 |

| | | General | | 82 |

| | | Administration and Eligibility | | 82 |

| | | Awards Under the 2001 Plan—Available Shares | | 83 |

| | | Terms of Awards | | 83 |

| | | Change in Control | | 84 |

| | | Adjustments | | 85 |

| | | Limits on Transferability | | 85 |

| | | Amendment and Termination | | 85 |

| | | Withholding | | 85 |

| | | Term of 2001 Plan | | 86 |

| | | Certain Federal Income Tax Consequences | | 86 |

| ADDITIONAL MATTERS BEING SUBMITTED TO A VOTE OF ONLY COVISTA'S STOCKHOLDERS—PROPOSAL NUMBER FOUR: RATIFICATION OF THE SELECTION OF INDEPENDENT AUDITORS | | 87 |

| FUTURE STOCKHOLDER PROPOSALS | | 87 |

| OTHER MATTERS | | 88 |

| LEGAL MATTERS | | 88 |

| EXPERTS | | 88 |

| WHERE YOU CAN FIND MORE INFORMATION | | 89 |

ANNEXES TO JOINT PROXY STATEMENT/PROSPECTUS |

|

|

| ANNEX A—AGREEMENT AND PLAN OF REORGANIZATION | | A-1 |

| ANNEX B—SECTION 262 OF THE DELAWARE GENERAL CORPORATION LAW | | B-1 |

| ANNEX C—OPINION OF FERRIS, BAKER WATTS, INCORPORATED | | C-1 |

| ANNEX D—COVISTA AUDIT COMMITTEE CHARTER | | D-1 |

| ANNEX E—COVISTA COMMUNICATIONS, INC. 2001 EQUITY INCENTIVE PLAN | | E-1 |

iv

QUESTIONS AND ANSWERS ABOUT THE MERGER

- Q:

- What will Capsule stockholders receive in the merger?

- A:

- The minority stockholders of Capsule will receive 0.1116 shares of Covista common stock for each share of Capsule common stock, and Henry G. Luken, III, the majority stockholder of Capsule, will receive 0.0838 shares of Covista common stock for each share of Capsule common stock, in each case subject to reduction as provided in the merger agreement. The adjustment mechanism is designed to provide that the minority stockholders of Capsule will receive not more than $0.6696 of Covista common stock for each share of Capsule common stock, and that the majority stockholder of Capsule will receive not more than $0.5028 of Covista common stock for each share of Capsule common stock, in each case based on the weighted average daily high and low sale prices of Covista common stock for the 15 trading days ending one trading day before the closing date of the merger. Capsule stockholders will also receive cash instead of fractional shares of Covista common stock.

- Q:

- What will Capsule stock option holders receive in the merger?

- A:

- After the merger, each Capsule stock option, whether vested or unvested, will be converted at the applicable conversion ratio into an option to purchase shares of Covista common stock and will no longer represent a right to acquire shares of Capsule common stock.

- Q:

- Will all Capsule stockholders receive the same consideration in merger?

- A:

- No. Henry G. Luken, III, who beneficially owns approximately 68.3 percent of the outstanding shares of Capsule common stock, has agreed that he will receive 0.0838 shares of Covista common stock for each share of Capsule common stock, and all other stockholders of Capsule will receive 0.1116 shares of Covista common stock for each share of Capsule common stock, in each case subject to reduction as provided in the merger agreement.

- Q:

- What should I do?

- A:

- After you have carefully read this document, mail your signed proxy card in the enclosed envelope. The instructions on the accompanying proxy card will give you more information on how to vote by mail. This will enable your shares to be represented at the Covista annual meeting or the Capsule special meeting, as applicable.

- Q:

- If my shares are held in "street name" by my broker, will my broker vote my shares for me?

- A:

- Maybe. Your broker will not be able to vote your shares without instructions from you. You should instruct your broker to vote your shares, following the directions your broker provides. Your failure to instruct your broker to vote your shares will result in your shares not being voted.

- Q:

- Should Capsule stockholders send in their stock certificates?

- A:

- No. Capsule stockholders should not send in their stock certificates at this time. Capsule stockholders will exchange their Capsule common stock certificates for Covista common stock certificates after we complete the merger. Instructions for the exchange will be sent to Capsule stockholders as promptly as practicable after the merger is completed.

- Q:

- Can I change my vote after I have submitted my proxy with voting instructions?

- A:

- Yes. You can change your vote at any time before the annual meeting or special meeting, as applicable, by mailing a later-dated signed proxy card or by attending the annual meeting or special meeting, as applicable, and voting in person.

1

- Q:

- Where can I find more information about the companies?

- A:

- Both companies file reports and other information with the Securities and Exchange Commission. You may read and copy this information at the SEC's public reference facilities. Please call the SEC at 1-800-SEC-0330 for information about these facilities. This information is also available at the web site the SEC maintains at www.sec.gov. You can also request copies of these documents from us. See "Where You Can Find More Information" on page 89.

- Q:

- May dissenting Capsule stockholders seek appraisal rights in merger?

- A:

- Yes. Capsule stockholders have appraisal rights under Delaware law in the merger. To perfect their appraisal rights, Capsule stockholders must strictly comply with the procedures in Section 262 of the Delaware General Corporation Law. Failure to comply strictly with these procedures will result in the loss of appraisal rights. We have attached a copy of Section 262 of the Delaware General Corporation Law as Annex B. See "Appraisal Rights" on page 54.

- Q:

- Who should I call if I have questions?

- A:

- Covista stockholders should call Thomas P. Gunning, Secretary, at (973) 812-1100, with any questions about the merger or the related transactions.

Capsule stockholders should call David B. Hurwitz, President and Chief Executive Officer, at (215) 244-3433, with any questions about the merger or the related transactions.

2

SUMMARY

This summary highlights selected information from this document and may not contain all of the information that is important to you. To understand the merger fully, you should read carefully this entire document and the attached documents. For more information about the companies, see "Where You Can Find More Information" on page 89. For your convenience, we have included page references to direct you to more complete descriptions of the topics presented in this summary.

The Companies

Covista Communications, Inc.

150 Clove Road

Little Falls, NJ 07424

(973) 812-1100

Covista is a long distance telecommunications, Internet and data services provider with a substantial customer base in both the commercial and wholesale market segments utilizing its own switching equipment and leased fiber optic transmission cable. Covista's products and services include a broad range of voice, data and Internet solutions, including long distance and toll-free services, calling cards, data, Internet access, virtual private network, directory assistance and teleconferencing services. The wholesale division provides domestic and international termination services to carriers worldwide at competitive rates. Covista currently owns and operates two switches, one in New York City and one in Newark, New Jersey, and previously has announced plans to expand to additional switch sites in Chicago, Dallas and Chattanooga. In July 2001, Covista announced that it had acquired long-term access to nationwide network facilities comprising 2,822,400,000 channel miles of telecommunications capacity measured by length of voice-grade circuits. In addition, Covista currently offers Internet services using two routers that it owns and operates located in New York City and Northern New Jersey. Covista processes approximately 95 percent of all its call volume through its own facilities. Covista also operates a network operations center in northern New Jersey to monitor and control its New Jersey network and to coordinate its various services. In October 2001, Covista announced the opening of a new call center facility in Chattanooga, Tennessee, and that it is planning to relocate its corporate headquarters to Chattanooga from its current location in Little Falls, New Jersey. Covista previously was known as Total-Tel USA Communications, Inc. Covista's common stock is quoted on the OTC Bulletin Board under the symbol "CVST."

Capsule Communications, Inc.

Two Greenwood Square

3331 Street Road, Suite 275

Bensalem, Pennsylvania 19020

(215) 633-9400

Capsule is a telecommunications carrier providing local and long-distance telephone communications services primarily to small- and medium-size business customers as well as residential customers utilizing its own equipment. Capsule provides inbound long-distance services and local resale services as well as other telecommunications services including calling cards, cellular, paging, Internet service, dedicated access, data services, and carrier termination services. Capsule uses its own switch located in Philadelphia to originate, transport and terminate calls for customers generally located in the Mid-Atlantic region and in California. For calls originating or terminating outside its own network, Capsule resells services provided by other long-distance companies. Capsule is the successor corporation to US Wats, Inc. Capsule's common stock is quoted on the OTC Bulletin Board under the symbol "CAPS.OB."

3

History of Significant Operating Losses, Working Capital Deficits and Going Concern Qualification

Covista has experienced significant losses in each of its last three fiscal years, Capsule has experienced significant losses in each of its last four fiscal years, both companies have experienced significant losses thus far in their current fiscal years, and both companies have significant working capital deficits. Capsule's independent accountants included a qualification in their most recent audit report as to the ability of Capsule to continue as a going concern. The companies expect to achieve substantial savings as a result of the combination of their operations by eliminating duplicate overhead costs. Nevertheless, there can be no assurance as to when, if ever, the combined company will achieve profitability. The failure of the combined company to achieve profitability could have a material adverse effect upon its ability to continue as a going concern, and upon the market value of Covista common stock. See generally "Risk Factors" beginning on page 18 for a description of the risks associated with Covista and the merger transaction.

The Merger

The Covista Annual Meeting (page 26)

The annual meeting of Covista stockholders will be held on Friday, February 8, 2002, at 10:00 a.m., local time. Notice of the Covista annual meeting is being sent to all holders of record of Covista common stock. The record date for Covista stockholders entitled to receive notice of and to vote at the Covista annual meeting was the close of business on December 11, 2001. On that date, 10,819,405 shares of Covista common stock were issued and outstanding. See "The Covista Annual Meeting."

The Capsule Special Meeting (page 29)

The special meeting of Capsule stockholders will be held on Friday, February 8, 2002, at 11:00 a.m., local time. Notice of the Capsule special meeting is being sent to all holders of record of Capsule common stock. The record date for Capsule stockholders entitled to receive notice of and to vote at the Capsule special meeting was the close of business on December 11, 2001. On that date, 22,667,444 shares of Capsule common stock were issued and outstanding. See "The Capsule Annual Meeting."

Required Covista Stockholder Approval (page 26)

Under the rules governing the Nasdaq National Market, the affirmative vote of the majority of shares of Covista common stock present in person or represented by proxy at the annual meeting and entitled to vote is required to approve the issuance of shares of Covista common stock in connection with the merger. Henry G. Luken, III, who on the record date owned 3,466,708 shares of Covista common stock, representing approximately 32.0 percent of the Covista common stock then outstanding, has stated that he intends to vote such shares to approve the issuance of shares of Covista common stock in connection with the merger. On the record date, directors and executive officers of Covista, other than Henry G. Luken, III, and their affiliates were entitled to vote 3,485,035 shares of Covista common stock, representing approximately 32.2 percent of the shares of Covista common stock then outstanding. The foregoing includes 725,329 shares of Covista common stock owned by the Foundation for the International Non-Governmental Development of Space, of which Walt Anderson, a Covista director, is the President and a director, and as to which Mr. Anderson disclaims beneficial ownership.

As to the other matters to be considered by the Covista stockholders at the Covista annual meeting, under New Jersey law directors are subject to election by a plurality of the shares voted, so the eight nominees receiving the greatest number of votes will be elected. Stockholders and any proxy holders for such stockholders are entitled to exercise the right to cumulative voting for the election of directors, as described in "Vote Required; Quorum." New Jersey law also requires the affirmative vote of a majority of the shares represented and entitled to vote at the meeting to approve the adoption of

4

the Covista 2001 Equity Incentive Plan and the ratification of the appointment of Deloitte & Touche LLP as Covista's independent auditors.

Required Capsule Stockholder Approval (page 29)

Under Delaware law, the affirmative vote, in person or by proxy, of the majority of the outstanding shares of Capsule common stock entitled to vote is required to approve the merger by adoption of the merger agreement. Henry G. Luken, III, who owns 15,471,301 shares of Capsule common stock, representing approximately 68.3 percent of the outstanding Capsule common stock, has stated that he intends to vote such shares to approve the merger by adoption of the merger agreement. On the record date, directors and executive officers of Capsule and their affiliates were entitled to vote 2,524,616 shares of Capsule common stock, representing approximately 11.1 percent of the shares of Capsule common stock then outstanding. The foregoing includes 2,186,433 shares of Capsule common stock owned by the Foundation for the International Non-Governmental Development of Space, of which Walt Anderson, a Capsule director, is the President and a director, and as to which Mr. Anderson disclaims beneficial ownership.

What Capsule Stockholders Will Receive in the Merger (page 58)

If the merger is completed, the minority stockholders of Capsule will receive 0.1116 shares of Covista common stock for each share of Capsule common stock, and Henry G. Luken, III, the majority stockholder of Capsule, will receive 0.0838 shares of Covista common stock for each share of Capsule common stock, in each case subject to reduction as provided in the merger agreement. The adjustment mechanism in the merger agreement is designed to provide that the minority stockholders of Capsule will receive not more than $0.6696 of Covista common stock for each share of Capsule common stock, and that the majority stockholder of Capsule will receive not more than $0.5028 of Covista common stock for each share of Capsule common stock, in each case based on the weighted average daily high and low sale prices of Covista common stock for the 15 trading days ending one trading day before the closing date of the merger. Capsule stockholders will also receive cash instead of fractional shares of Covista common stock.

The following chart illustrates the value of the Covista common stock to be received per share of Capsule common stock and in the aggregate on the closing of the merger by Capsule's minority stockholders and Henry G. Luken, III, respectively, under various assumed market prices for the Covista common stock.

| | Capsule Minority Stockholders

| | Henry G. Luken, III

|

|---|

Covista Stock Price

| | Exchange Ratio

| | Value of Merger

Consideration

Per Share/Aggregate

| | Exchange Ratio

| | Value of Merger

Consideration

Per Share/Aggregate

|

|---|

| $ 2.00 | | .1116 | | $0.2232/$1,606,179 | | .0838 | | $0.1676/$2,592,990 |

| 3.00 | | .1116 | | 0.3348/2,409,269 | | .0838 | | 0.2514/3,889,485 |

| 4.00 | | .1116 | | 0.4464/3,312,758 | | .0838 | | 0.3352/5,185,980 |

| 5.00 | | .1116 | | 0.5580/4,015,448 | | .0838 | | 0.4190/6,482,475 |

| 6.00 | | .1116 | | 0.6696/4,818,537 | | .0838 | | 0.5028/7,778,970 |

| 7.00 | | .0957 | | 0.6696/4,818,537 | | .0718 | | 0.5028/7,778,970 |

| 8.00 | | .0837 | | 0.6696/4,818,537 | | .0629 | | 0.5028/7,778,970 |

| 9.00 | | .0744 | | 0.6696/4,818,537 | | .0559 | | 0.5028/7,778,970 |

| 10.00 | | .0670 | | 0.6696/4,818,537 | | .0503 | | 0.5028/7,778,970 |

Interests of Certain Persons in the Merger (page 47)

Stockholders should be aware that some of the executive officers and directors of Capsule and Covista have interests in the merger that are different from, or are in addition to, the interests of the

5

stockholders of Capsule and Covista generally. See "General Description of the Merger—Interests of Certain Persons in the Merger."

Henry G. Luken, III, who is the Chairman of the Board of Covista, beneficially owns 3,466,708 shares of Covista common stock, representing approximately 32.0 percent of the outstanding Covista common stock. Mr. Luken also beneficially owns 15,471,301 shares of Capsule common stock, representing approximately 68.3 percent of the outstanding Capsule common stock. Mr. Luken acquired all such shares of Capsule common stock during March 2001 at a purchase price of $.20 per share, for an aggregate purchase price of $3,094,260. At the close of business on January 8, 2002, the value of the merger consideration to Mr. Luken, in his capacity as a Capsule stockholder, was $0.4372 per share and $6,763,980 in the aggregate, based on a conversion ratio of 0.0553 and a price of Covista common stock of $7.90 per share.

Directors and executive officers of Capsule hold stock option agreements for a total of 760,000 shares of Capsule common stock that will become immediately and automatically exercisable if the Capsule stockholders approve the merger. The unvested stock options held by the directors and executive officers will become fully vested when the Capsule stockholders approve the merger. These stock options will remain fully vested even if the merger were not consummated.

Covista's Reasons for the Merger (page 39)

The Covista board of directors has approved the merger, the adoption of the merger agreement and the issuance of shares of Covista common stock in connection with the merger. The Covista board of directors recommends that its stockholders vote to approve the issuance of shares of Covista common stock in connection with the merger. See "General Description of the Merger—Covista's Reasons for the Merger."

Capsule's Reasons for the Merger (page 41)

The Capsule board of directors believes that the merger is advisable and in the best interests of Capsule and its stockholders. The members of the Capsule board of directors approved the merger and the adoption of the merger agreement and recommend that Capsule stockholders vote to approve the merger agreement and the merger. See "General Description of the Merger—Capsule's Reasons for the Merger."

Fairness of the Consideration to be Paid to Capsule Stockholders (page 43)

In deciding to approve the merger, the Capsule board of directors received and considered the opinion dated July 17, 2001 of Ferris, Baker Watts, Incorporated as to the fairness from a financial point of view of the consideration to be paid to all Capsule stockholders except Henry G. Luken, III in connection with the merger. Ferris, Baker Watts has opined that, based upon and subject to the considerations and limitations set forth in its opinion, the consideration to be received by all stockholders of Capsule except Mr. Luken in the merger is fair from a financial point of view.

The opinion of Ferris, Baker Watts is directed to the Capsule board of directors and does not constitute a recommendation as to how any Capsule stockholder should vote with respect to the merger. You should read the opinion in its entirety to understand the assumptions made, matters considered and limitations of the review undertaken by Ferris, Baker Watts in providing its opinion. A copy of Ferris, Baker Watts' opinion is attached to this document as Annex C. Ferris, Baker Watts will receive total fees of $100,000 for its services as financial advisor to Capsule in connection with the merger. See "General Description of the Merger—Opinion of Capsule's Financial Advisor."

6

Conditions to the Merger (page 60)

The merger will not be completed unless several conditions are satisfied or waived, including the receipt of requisite stockholder approvals, consents and governmental and regulatory approvals. See "The Merger Agreement—Conditions to the Merger."

Termination and Amendment of the Merger Agreement (page 60)

Covista and Capsule may mutually agree at any time to terminate the merger agreement without completing the merger. Either company may also terminate the merger agreement if the merger has not been completed by January 31, 2002, unless the failure to complete the merger is the result of a breach of the merger agreement by the party seeking to terminate the merger agreement, and for other customary reasons. Capsule may terminate the merger agreement prior to the completion of the merger if the weighted average daily high and low sale prices of Covista common stock for the 15 trading days ending one trading day before the closing date of the merger is less than $2.00 per share. See "The Merger Agreement—Termination."

At any time prior to the completion of the merger, Covista and Capsule may amend the merger agreement. However, after stockholder approval of the merger agreement, Covista and Capsule may not amend the merger agreement to change the consideration to be received upon exchange of the Capsule common stock for Covista common stock or make any change that would adversely affect the rights of Capsule or Covista stockholders. See "The Merger Agreement—Amendment; Waiver."

Material Federal Income Tax Considerations (page 51)

Pepper Hamilton LLP, counsel to Capsule, has rendered its opinion that the merger will be a reorganization for United States federal income tax purposes. Except as noted in "General Description of the Merger—Material Federal Income Tax Considerations," the exchange of Capsule shares for Covista shares will be a tax free transaction to the Capsule stockholders. The minority stockholders will receive more Covista shares than they would receive if the exchange were on a pro rata basis. There is a risk that the Covista shares that a minority stockholder receives that are in excess of what would have been received in a pro rata exchange will be taxable income to the minority stockholder. Pepper Hamilton LLP has not expressed an opinion on the taxability of the excess shares received by a minority stockholder. See "General Description of the Merger—Material Federal Income Tax Considerations."

Share Information and Market Prices

Covista common stock is quoted on the Nasdaq National Market under the symbol "CVST." Covista will list the additional shares of its common stock to be issued in connection with the merger on the Nasdaq National Market. Capsule common stock is quoted on the OTC Bulletin Board under the symbol "CAPS.OB." The following table shows, for the periods indicated, the closing sale prices per share of Covista and Capsule common stock, and the equivalent merger consideration per share of Capsule common stock on July 17, 2001, the last trading day before the merger was announced, and on January 8, 2002, the latest practicable date before this document was mailed. The market prices of both Covista and Capsule common stock will probably fluctuate prior to the merger.

| | Covista

Common Stock

| | Capsule

Common Stock

| | Value of Merger Consideration Per Share of Capsule Common Stock(1)

|

|---|

| July 17, 2001 | | $ | 5.99 | | $ | 0.20 | | $ | 0.67 |

| January 8, 2002 | | | 7.90 | | | 0.53 | | | 0.5822 |

- (1)

- Value of merger consideration per share of Capsule common stock held by minority stockholders of Capsule.

7

SELECTED HISTORICAL CONSOLIDATED AND PRO FORMA COMBINED FINANCIAL DATA

Covista Communications, Inc.

The selected historical consolidated operating and balance sheet data of Covista are derived from the audited historical financial statements of Covista contained in Covista's Annual Reports on Form 10-K for each of the years in the five-year period ended January 31, 2001 and from the unaudited financial statements of Covista contained in Covista's Quarterly Reports on Form 10-Q for the nine-month periods ended October 31, 2001 and 2000. The historical data is only a summary, and should be read in conjunction with the historical financial statements and related notes contained in the Form 10-K for the year ended January 31, 2001 and the Form 10-Q for the quarter ended October 31, 2001. In the opinion of management, the unaudited consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and include all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial position and results of operations for such periods. The results of operations as of and for the nine months ended October 31, 2001 are not necessarily indicative of Covista's results for any other interim period or for the full year. You should read this financial information in conjunction with the information in the Covista reports and other information incorporated by reference in this document. See "Where You Can Find More Information" on page 89.

COVISTA COMMUNICATIONS, INC. AND SUBSIDIARIES

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

| | Year ended January 31,

| | Nine months ended October 31,

| |

|---|

| | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | 2000

| | 2001

| |

|---|

| | (in thousands, except per share amounts)

| |

|---|

| Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | |

| Net Revenues | | $ | 89,326 | | $ | 123,286 | | $ | 137,283 | | $ | 139,760 | | $ | 133,230 | | $ | 99,804 | | $ | 78,803 | |

| Income (loss) from operations | | | 653 | | | 1,548 | | | (5,921 | ) | | (6,680 | ) | | (8,734 | ) | | (5,428 | ) | | (6,611 | ) |

| Interest income (expense), net | | | 73 | | | (82 | ) | | (92 | ) | | (32 | ) | | 62 | | | 42 | | | (60 | ) |

| Income (loss) before taxes and extraordinary items | | | 777 | | | 1,825 | | | (5,859 | ) | | (6,711 | ) | | (8,629 | ) | | (5,349 | ) | | (6,366 | ) |

| Net income (loss) | | | 492 | | | 1,094 | | | (3,418 | ) | | (9,414 | ) | | (8,629 | ) | | (5,283 | ) | | (6,366 | ) |

| Basic earnings (loss) per common share(1) | | | | | | | | | | | | | | | | | | | | | | |

| | Weighted average common shares outstanding—basic | | | 5,883 | | | 6,213 | | | 6,818 | | | 7,069 | | | 7,324 | | | 7,304 | | | 9,991 | |

| | Net income (loss) per common share—basic | | $ | 0.08 | | $ | 0.18 | | $ | (0.50 | ) | $ | (1.33 | ) | $ | (1.18 | ) | $ | (0.72 | ) | $ | (0.64 | ) |

| Diluted earnings (loss) per common share(1) | | | | | | | | | | | | | | | | | | | | | | |

| | Weighted average common shares outstanding-diluted | | | 6,739 | | | 6,842 | | | 6,818 | | | 7,069 | | | 7,324 | | | 7,304 | | | 9,991 | |

| | Net income (loss) per common share-diluted | | $ | 0.07 | | $ | 0.16 | | $ | (0.50 | ) | $ | (1.33 | ) | $ | (1.18 | ) | $ | (0.72 | ) | $ | (0.64 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents | | $ | 2,589 | | $ | 3,417 | | $ | 6,052 | | $ | 4,374 | | $ | 2,692 | | $ | 3,576 | | $ | 3,116 | |

| Working capital (deficit) | | | (5,419 | ) | | (7,936 | ) | | 1,261 | | | 1,222 | | | (7,734 | ) | | (5,109 | ) | | (6,037 | ) |

| Total assets | | | 31,029 | | | 40,245 | | | 45,692 | | | 45,184 | | | 39,097 | | | 42,243 | | | 37,443 | |

| Long-term obligations, net current position | | | 2,940 | | | 2,092 | | | 1,566 | | | 997 | | | 382 | | | 540 | | | 4,000 | |

| Stockholders' equity | | | 14,772 | | | 18,598 | | | 16,442 | | | 14,007 | | | 5,777 | | | 8,969 | | | 7,097 | |

- (1)

- Basic earnings (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding. Diluted earnings (loss) per common share is computed by dividing net income (loss) by the weighted average number of common shares outstanding plus other dilutive securities.

8

Capsule Communications, Inc.

The selected historical consolidated operating and balance sheet data of Capsule are derived from the audited historical financial statements of Capsule contained in Capsule's Annual Reports on Form 10-K for each of the years in the five-year period ended December 31, 2000 and from the unaudited financial statements of Capsule contained in Capsule's Quarterly Reports on Form 10-Q for the nine-month periods ended September 30, 2001 and 2000. The historical data is only a summary, and should be read in conjunction with the historical financial statements and related notes contained in the Form 10-K for the year ended December 31, 2000 and the Form 10-Q for the quarter ended September 30, 2001. In the opinion of management, the unaudited consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and include all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial position and results of operations for such periods. The results of operations as of and for the nine months ended September 30, 2001 are not necessarily indicative of Capsule's results for any other interim period or for the full year. You should read this financial information in conjunction with the information in the Capsule reports and other information incorporated by reference in this document. See "Where You Can Find More Information" on page 89.

CAPSULE COMMUNICATIONS, INC. AND SUBSIDIARIES

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

| | Year ended December 31,

| | Nine months ended

September 30,

| |

|---|

| | 1996

| | 1997

| | 1998

| | 1999

| | 2000

| | 2000

| | 2001

| |

|---|

| | (in thousands, except per share amounts)

| |

|---|

| Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | |

| Net Revenues | | $ | 40,304 | | $ | 56,467 | | $ | 44,679 | | $ | 39,777 | | $ | 37,368 | | $ | 28,033 | | $ | 28,323 | |

| Income (loss) from operations | | | 306 | | | (3,449 | ) | | (1,750 | ) | | (2,910 | ) | | (4,526 | ) | | (3,144 | ) | | (1,330 | ) |

| Income (loss) before taxes and extraordinary items | | | 96 | | | (3,700 | ) | | (1,818 | ) | | (2,956 | ) | | (4,764 | ) | | (3,166 | ) | | (1,432 | ) |

| Net income (loss) applicable to common stockholders | | | 62 | | | (3,757 | ) | | (1,855 | ) | | (2,964 | ) | | (4,764 | ) | | (3,166 | ) | | (1,432 | ) |

| Basic earnings (loss) per common share(1) | | | | | | | | | | | | | | | | | | | | | | |

| | Weighted average common shares outstanding—basic | | | 15,878 | | | 16,085 | | | 18,786 | | | 20,010 | | | 21,695 | | | 21,444 | | | 22,667 | |

| | Net income (loss) per common share—basic | | $ | 0.00 | | $ | (0.23 | ) | $ | (0.10 | ) | $ | (0.15 | ) | $ | (0.22 | ) | $ | (0.15 | ) | $ | (0.07 | ) |

| Diluted earnings (loss) per common share(1) | | | | | | | | | | | | | | | | | | | | | | |

| | Weighted average common shares Outstanding—diluted | | | 15,878 | | | 16,085 | | | 18,786 | | | 20,010 | | | 21,695 | | | 21,444 | | | 22,667 | |

| | Net income (loss) per common share—diluted | | $ | 0.00 | | $ | (0.23 | ) | $ | (0.10 | ) | $ | (0.15 | ) | $ | (0.22 | ) | $ | (0.15 | ) | $ | (0.07 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents | | | 1,455 | | | 1,588 | | | 1,665 | | | 827 | | | 1,569 | | | 2,408 | | | 802 | |

| Working capital (deficit) | | | (2,214 | ) | | (2,664 | ) | | (369 | ) | | (1,549 | ) | | (3,057 | ) | | (2,011 | ) | | (3,702 | ) |

| Total assets | | | 11,992 | | | 11,813 | | | 11,021 | | | 10,906 | | | 11,158 | | | 12,573 | | | 8,592 | |

| Long-term obligations, net current position | | | 509 | | | 380 | | | 150 | | | — | | | — | | | — | | | — | |

| Redeemable preferred stock | | | 300 | | | 330 | | | 330 | | | — | | | — | | | — | | | — | |

| Stockholders' equity (deficit) | | | 862 | | | (157 | ) | | 2,174 | | | 1,785 | | | (196 | ) | | 1,187 | | | (1,628 | ) |

- (1)

- Basic earnings (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding. Diluted earnings (loss) per common share is computed by dividing net income (loss) by the weighted average number of common shares outstanding plus other dilutive securities.

9

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The unaudited pro forma condensed statements of consolidated operations for the nine-months ended October 31, 2001 and the year ended January 31, 2001 give effect to the acquisition of all of the outstanding common stock of Capsule as if it had occurred on February 1, 2000. The unaudited pro forma consolidated condensed balance sheet as of October 31, 2001 gives effect to the acquisition of Capsule as if it had occurred on October 31, 2001 based on the purchase method of accounting.

Covista believes the accounting used for the pro forma adjustments provides a reasonable basis on which to present the unaudited pro forma consolidated condensed financial statements. The pro forma adjustments do not include any synergies expected to be derived from the merger. The pro forma condensed statements of consolidated operations and pro forma condensed consolidated balance sheet are unaudited and were derived by adjusting the historical consolidated financial statements of Covista and Capsule.

The purchase price has been allocated based on management's best estimate of the fair value of the assets to be acquired and the liabilities to be assumed based on the historical financial statements of Capsule as of September 30, 2001. The excess purchase price over the fair value of net tangible assets to be acquired has been allocated to customer lists and goodwill. Covista has, on a preliminary basis, valued the customer list by taking the net present value of the cash flow expected to be received from Capsule's existing customer list. This adjustment is based upon preliminary estimates to reflect the allocation of purchase consideration to the acquired assets and liabilities of Capsule. The final allocation of the purchase consideration will be determined after the completion of the merger and will be based on a comprehensive final evaluation of the fair values and useful lives of Capsule's tangible assets acquired, identifiable intangible assets and excess of purchase price over net assets acquired at the time of the merger. The final determination may result in asset and liability fair values that are different than the preliminary estimates of these amounts. However, Covista does not believe that there will be a material change to the allocation of the final purchase price from that described in the unaudited pro forma condensed financial statements.

The unaudited pro forma condensed consolidated financial statements are provided for informational purposes only and should not be construed to be indicative of Covista's consolidated financial position or results of operations had the transaction been consummated on the date assumed and do not project Covista's consolidated financial position or results of operations for any future date or period.

The unaudited pro forma consolidated condensed financial statements and accompanying notes should be read in conjunction with the Covista historical consolidated financial statements and notes thereto included in Covista's Annual Report on Form 10-K for the year ended January 31, 2001 and in Covista's Quarterly Report on Form 10-Q for the quarter ended October 31, 2001, as well as the Capsule historical consolidated financial statements and notes thereto included in Capsule's Annual Report on Form 10-K for the year ended December 31, 2000 and in Capsule's Quarterly Report on Form 10-Q for the quarter ended September 30, 2001.

10

COVISTA COMMUNICATIONS, INC AND SUBSIDIARIES

UNAUDITED PROFORMA CONDENSED CONSOLIDATED BALANCE SHEET

AT OCTOBER 31, 2001

| | Historical

| |

| |

|

|---|

| | Covista

10/31/01

| | Capsule

09/30/01

| | Pro Forma

Adjustments

| | Pro Forma

Consolidated

|

|---|

| ASSETS | | | | | | | | | | | | |

| CURRENT ASSETS: | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 3,116,004 | | $ | 801,888 | | $ | 387,200 | (a) | $ | 4,305,092 |

| Investments available for sale | | | 25,000 | | | — | | | | | | 25,000 |

| Accounts receivable, net | | | 13,328,709 | | | 5,621,360 | | | | | | 18,950,069 |

| Prepaid expenses and other current assets | | | 3,618,683 | | | 95,577 | | | (500,000 | )(f) | | 3,214,260 |

| | |

| |

| |

| |

|

| TOTAL CURRENT ASSETS | | | 20,088,396 | | | 6,518,825 | | | (112,800 | ) | | 26,494,421 |

| PROPERTY AND EQUIPMENT, NET | | | 12,193,096 | | | 1,835,067 | | | | | | 14,028,163 |

| OTHER ASSETS: | | | | | | | | | | | | |

| Prepaid line costs — long term | | | 3,600,000 | | | | | | | | | 3,600,000 |

| Deferred line installation costs, less accumulated amortization | | | 177,929 | | | | | | | | | 177,929 |

| Other assets | | | 851,157 | | | 238,354 | | | | | | 1,089,511 |

| Customer list, net | | | 532,224 | | | | | | 13,000,000 | (a) | | 13,532,224 |

| Goodwill | | | | | | | | | 1,826,358 | (a) | | 1,826,358 |

| | |

| |

| |

| |

|

| TOTAL ASSETS | | $ | 37,442,802 | | $ | 8,592,246 | | $ | 14,713,558 | | $ | 60,748,606 |

| | |

| |

| |

| |

|

See notes to unaudited pro forma condensed consolidated financial statements

11

COVISTA COMMUNICATIONS, INC AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

AT OCTOBER 31, 2001

| | Historical

| |

| |

| |

|---|

| | Covista

10/31/01

| | Capsule

09/30/01

| | Pro Forma

Adjustments

| | Pro Forma

Consolidated

| |

|---|

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | |

| CURRENT LIABILITIES: | | | | | | | | | | | | | |

| Current portion of long-term debt | | $ | 540,128 | | $ | 2,289,298 | | $ | (500,000 | )(f) | $ | 2,329,426 | |

| Accounts payable | | | 21,096,626 | | | 4,916,140 | | | | | | 26,012,766 | |

| Other current and accrued liabilities | | | 4,488,776 | | | 3,014,986 | | | 200,000 | (a) | | 7,703,762 | |

| | |

| |

| |

| |

| |

| TOTAL CURRENT LIABILITIES | | | 26,125,530 | | | 10,220,424 | | | (300,000 | )(a) | | 36,045,954 | |

| OTHER LONG-TERM LIABILITIES | | | 220,664 | | | — | | | | | | 220,664 | |

| LOAN FROM SHAREHOLDER | | | 4,000,000 | | | — | | | | | | 4,000,000 | |

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock | | | 618,458 | | | 22,667 | | | (22,667 | )(b) | | 730,189 | |

| | | | | | | | | | 111,731 | (a) | | | |

| Additional paid-in-capital | | | 25,575,166 | | | 14,868,673 | | | (14,868,673 | )(b) | | 38,848,815 | |

| | | | | | | | | | 13,273,649 | (a) | | | |

| Retained earnings | | | (17,651,576 | ) | | (16,519,299 | ) | | 16,519,299 | (b) | | (17,651,576 | ) |

| | |

| |

| |

| |

| |

| | | | 8,542,048 | | | (1,627,959 | ) | | 15,013,339 | | | 21,927,428 | |

| Treasury stock | | | (1,445,440 | ) | | (219 | ) | | 219 | (b) | | (1,445,440 | ) |

| | |

| |

| |

| |

| |

| Total Shareholders' Equity | | | 7,096,608 | | | (1,628,178 | ) | | 15,013,568 | | | 20,481,988 | |

| TOTAL LIABILITIES & STOCKHOLDERS EQUITY | | $ | 37,442,802 | | $ | 8,592,246 | | $ | 14,713,558 | | $ | 60,748,606 | |

| | |

| |

| |

| |

| |

See notes to unaudited pro forma condensed consolidated financial statements

12

COVISTA COMMUNICATIONS, INC AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED STATEMENT OF CONSOLIDATED OPERATIONS

FOR THE NINE MONTHS ENDED OCTOBER 31, 2001

| | Historical

| |

| |

| |

|---|

| | Pro Forma

Adjustments

| | Pro Forma

Consolidated

| |

|---|

| | Covista

| | Capsule

| |

|---|

| Revenues | | $ | 78,803,039 | | $ | 28,322,980 | | $ | (399,868 | )(d) | $ | 106,726,151 | |

| Cost of Sales | | | 64,423,267 | | | 19,790,735 | | | (399,868 | )(d) | | 83,814,134 | |

| Selling, general and administration | | | 20,990,705 | | | 9,862,182 | | | 4,333,500 | (e) | | 35,186,387 | |

| | |

| |

| |

| |

| |

| Total costs and expenses | | | 85,413,972 | | | 29,652,917 | | | 3,933,632 | | | 119,000,521 | |

| Operating Loss | | | (6,610,933 | ) | | (1,329,937 | ) | | (4,333,500 | ) | | (12,274,370 | ) |

| Other Income (expense) | | | | | | | | | | | | | |

| Interest Income | | | 94,392 | | | 48,228 | | | | | | 142,620 | |

| Other income (expense) | | | 305,267 | | | — | | | | | | 305,267 | |

| Interest Expense | | | (154,783 | ) | | (150,569 | ) | | — | | | (305,352 | ) |

| | |

| |

| |

| |

| |

| Total other income | | | 244,876 | | | (102,341 | ) | | — | | | 142,535 | |

| Income (loss) before Income Taxes | | | (6,366,057 | ) | | (1,432,278 | ) | | (4,333,500 | ) | | (12,131,835 | ) |

| Income Taxes | | | — | | | — | | | — | | | — | |

| Net Loss | | $ | (6,366,057 | ) | $ | (1,432,278 | ) | $ | (4,333,500 | ) | $ | (12,131,835 | ) |

| | |

| |

| |

| |

| |

| Basic and diluted loss per common share | | $ | (0.64 | ) | $ | (0.06 | ) | | | | $ | (0.99 | ) |

| | |

| |

| | | | |

| |

| Basic and diluted common shares outstanding | | | 9,990,562 | | | 22,667,444 | | | (22,667,444 | )(b) | | 12,225,183 | |

| | |

| |

| | | | |

| |

| | | | | | | | | | 2,234,621 | (c) | | | |

| | | | | | | | |

| | | | |

See notes to unaudited pro forma condensed consolidated financial statements

13

COVISTA COMMUNICATIONS, INC AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED STATEMENT OF CONSOLIDATED OPERATIONS

FOR THE YEAR ENDED JANUARY 31, 2001

| | Historical

| |

| |

| |

|---|

| | Pro Forma

Adjustments

| | Pro Forma

Consolidated

| |

|---|

| | Covista

| | Capsule

| |

|---|

| Revenues | | $ | 133,230,437 | | $ | 37,368,359 | | $ | (1,039,614 | )(d) | $ | 169,559,182 | |

| Cost of Sales | | | 114,794,519 | | | 27,228,782 | | | (1,039,614 | )(d) | | 140,983,687 | |

| Selling, general and administration | | | 27,169,527 | | | 14,665,119 | | | 8,667,000 | (e) | | 50,501,646 | |

| | |

| |

| |

| |

| |

| Total costs and expenses | | | 141,964,046 | | | 41,893,901 | | | 7,627,386 | | | 191,485,333 | |

| Operating Loss | | | (8,733,609 | ) | | (4,525,542 | ) | | (8,667,000 | ) | | (21,926,151 | ) |

| Other Income (expense): | | | | | | | | | | | | | |

| Interest Income | | | 167,583 | | | 141,841 | | | | | | 309,424 | |

| Other income (expense) | | | 41,994 | | | | | | | | | 41,994 | |

| Interest Expense | | | (105,272 | ) | | (380,069 | ) | | — | | | (485,341 | ) |

| | |

| |

| |

| |

| |

| Total other income | | | 104,305 | | | (238,228 | ) | | — | | | (133,923 | ) |

| Income (loss) before Income Taxes | | | (8,629,304 | ) | | (4,763,770 | ) | | (8,667,000 | ) | | (22,060,074 | ) |

| Income Taxes | | | — | | | — | | | — | | | — | |

| Net Loss | | $ | (8,629,304 | ) | $ | (4,763,770 | ) | $ | (8,667,000 | ) | $ | (22,060,074 | ) |

| | |

| |

| |

| |

| |

| Basic and diluted loss per common share | | $ | (1.18 | ) | $ | (0.22 | ) | | | | $ | (2.31 | ) |

| | |

| |

| | | | |

| |

| Basic and diluted common shares outstanding | | | 7,324,085 | | | 21,694,726 | | | (21,694,726 | )(b) | | 9,558,706 | |

| | |

| |

| | | | |

| |

| | | | | | | | | | 2,234,621 | (c) | | | |

| | | | | | | | |

| | | | |

See notes to unaudited pro forma condensed consolidated financial statements

14

NOTES TO UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(a) For purposes of these pro forma condensed consolidated financial statements, Covista has assumed that the value of the total purchase consideration based on shares to be issued in order to consummate the acquisition of Capsule would be approximately $13,385,377. Covista has assumed that it will issue 2,234,621 shares of Covista common stock in exhange for 23,877,444 shares of Capsule common stock. Covista has assumed that the value of its shares of common stock to be issued will be $5.99 per share, based on the closing market price on July 17, 2001, which may be subject to change based on the terms of the merger agreement. Included in the 2,234,621 shares of Covista common stock is the assumed conversion of certain options previously granted to Capsule management which will become vested and exercisable,upon completion of the merger.

The following table contains a summary of the calculation of the purchase price and the allocation of the purchase price to the fair value of the net assets acquired as described above, as well as calculations for a range of possible outcomes assuming different fair market values of Covista's common stock:

Assumed price

| | @ $5.99

| | @ $4.00

| | @ $8.00

| | @ $9.00

|

|---|

| Total number of Capsule common stock to be converted | | | 23,877,444 | | | 23,877,444 | | | 23,877,444 | | | 23,877,444 |

| Henry Luken shares held | | | 15,471,301 | | | 15,471,301 | | | 15,471,301 | | | 15,471,301 |

| Minority shares held | | | 8,406,143 | | | 8,406,143 | | | 8,406,143 | | | 8,406,143 |

| Conversion ratio (rounded) Henry Luken | | | 0.0838 | | | 0.0838 | | | 0.0629 | | | 0.0559 |

| Minority shareholders | | | 0.1116 | | | 0.1116 | | | 0.0837 | | | 0.0744 |

| | |

| |

| |

| |

|

| Share of Covista common stock to be issued to consummate the acquisition | | | 2,234,621 | | | 2,234,621 | | | 1,675,965 | | | 1,489,747 |

| Assumed fair value per share of Covista common stock | | $ | 5.99 | | $ | 4.00 | | $ | 8.00 | | $ | 9.00 |

| | |

| |

| |

| |

|

| Value of shares issued | | $ | 13,385,377 | | $ | 8,938,482 | | $ | 13,407,723 | | $ | 13,407,723 |

| Estimated direct merger costs | | | 200,000 | | | 200,000 | | | 200,000 | | | 200,000 |

| | |

| |

| |

| |

|

| Total purchase price | | | 13,585,377 | | | 9,138,482 | | | 13,607,723 | | | 13,607,723 |

| Less: estimated cash proceeds from the exercise of stock options which are vested or will become vested prior to or as a result of the merger | | | 387,200 | | | 387,200 | | | 387,200 | | | 387,200 |

| Add: Fair value of liabilities over tangible assets of Capsule | | | 1,628,178 | | | 1,628,178 | | | 1,628,178 | | | 1,628,178 |

| | |

| |

| |

| |

|

| Excess of purchase price over net tangible assets acquired | | $ | 14,826,355 | | $ | 10,379,460 | | $ | 14,848,701 | | $ | 14,848,701 |

| | |

| |

| |

| |

|

Covista's management determined that the utilization of Capsule's historical net operating losses was not likely. Therefore, no deferred tax assets have been recorded in connection with the merger.

The purchase price has been allocated based on management's best estimate of the fair value of assets acquired and the liabilities assumed based on the historical financial statements of Capsule as of September 30, 2001. The excess purchase price over the fair value of net tangible assets acquired has been allocated to customer list and goodwill. Covista has, on a preliminary basis, valued the customer list by taking the net present value of the cash flow expected to be received from Capsule's existing customer list. This adjustment is based upon preliminary estimates to reflect the allocation of purchase consideration to the acquired assets and liabilities of Capsule. The final allocation of the purchase

15

consideration will be determined after the completion of the merger and will be based on a comprehensive final evaluation of the fair values and useful lives of Capsule's tangible assets acquired, identifiable intangible assets and excess of purchase price over net assets acquired at the time of the merger. The final determination may result in asset and liability fair values that are different than the preliminary estimates of these amounts. However, Covista does not believe that there will be a material change to the allocation of the purchase price from that described in the unaudited pro forma financial statements.

In July 2001, the FASB issued Statement of Financial Accounting Standards No. 142, "SFAS 142", "Goodwill and Other Intangible Assets", which is effective January 1, 2002. SFAS 142 requires, among other things, the discontinuance of goodwill amortization. In addition, the standard includes provisions for the reclassification of certain existing recognized intangibles as goodwill, reassessment of the useful lives of existing recognized intangibles, reclassification of certain intangibles out of previously reported goodwill and the identification of reporting units for purposes of assessing potential future impairments of goodwill. SFAS 142 also requires the Company to complete a transitional goodwill impairment test six months from the date of adoption. For purposes of these pro forma condensed consolidated financial statements, goodwill has not been amortized, as prescribed by SFAS 142. However, seperately identified Intangible Assets, such as customer lists will be amortized over their useful lives.

(b) To eliminate the historical equity accounts of Capsule.

(c) The pro forma adjustments reflect the additional shares to be issued based on the exchange ratio used to consummate the merger, and also include the additional shares to be issued in connection with options that will become vested prior to or as a result of the merger. Pro forma loss per share has been determined based on pro forma net loss after preferred stock dividends divided by the weighted average number of shares of Covista common stock outstanding for all periods presented. Stock options were not included in the computation of pro forma loss per share because the effect of their inclusion would be antidilutive.

(d) To eliminate sales and purchases of services between Covista and Capsule.

(e) To record amortization expense of the customer list, estimated value of $13,000,000, assuming the use of the double-declining balance method for three years.

(f) To eliminate $500,000 Capsule note due to Covista.

Comparative Per Share Data

The following table sets forth historical and unaudited pro forma combined per share data of Covista and Capsule as well as equivalent per share data with respect to one share of Capsule common stock and one share of Covista common stock, on a pro forma combined basis for the merger. You should read the data presented below together with the unaudited pro forma combined financial data,

16

and related notes, and historical financial statements, and related notes, of Covista and Capsule that are incorporated by reference in this document or included elsewhere in this document.

| | January 31, 2001

| | October 31, 2001

| |

|---|

| Covista—historical | | | | | | | |

| Basic and diluted loss per share | | $ | (1.18 | ) | $ | (0.64 | ) |

| Tangible book value per share(1) | | | | | $ | 0.66 | |

| | December 31, 2000

| | September 30, 2001

| |

|---|

| Capsule—historical | | | | | | | |

| Basic and diluted loss per share | | $ | (0.22 | ) | $ | (0.06 | ) |

| Tangible book value per share(1) | | | | | $ | (0.07 | ) |

| | January 31, 2001

| | October 31, 2001

| |

|---|

| Pro Forma Combined(2) | | | | | | | |

| Pro forma basic and diluted loss per share | | $ | (2.31 | ) | $ | (0.99 | ) |

| Pro forma tangible book value per share(1) | | | | | $ | (0.42 | ) |

Pro Forma Capsule Equivalent Shares(2) |

|

|

|

|

|

|

|

| Pro forma basic and diluted loss per share | | $ | (0.23 | ) | $ | (0.10 | ) |

| Pro forma tangible book value per share | | | | | $ | (0.04 | ) |

- (1)

- Tangible and pro forma tangible book value is computed by dividing total stockholders' equity, less goodwill and other intangible assets, by the weighted average number of shares of common stock outstanding.

- (2)

- The Pro Forma Capsule Equivalent Shares shows the effect of the merger from the perspective of an owner of Capsule common stock. The Pro Forma Capsule Equivalent Share information was computed in all cases by multiplying the Pro Forma Combined Amounts for the merger by 0.10, the weighted average exchange ratio for the merger transaction.

17

RISK FACTORS

In addition to the other information provided or incorporated by reference in this document, you should consider the following information carefully.

Risks Related to the Merger

The value of the merger consideration that Capsule stockholders will receive will be reduced if the value of Covista common stock prior to the effective time of the merger is less than $6.00.

In the merger, all Capsule stockholders except Mr. Luken will receive 0.1116 shares of Covista common stock for each share of Capsule common stock that they hold, and Mr. Luken will receive 0.0838 shares of Covista common stock for each share of Capsule common stock that he holds, subject to reduction as provided in the merger agreement. The adjustment mechanism is designed to provide that the minority stockholders of Capsule will receive not more than $0.6696 of Covista common stock for each share of Capsule common stock, and that the majority stockholder of Capsule will receive not more than $0.5028 of Covista common stock for each share of Capsule common stock, in each case based on the weighted average daily high and low sale prices of Covista common stock for the 15 trading days ending one trading day before the closing date of the merger. If the market value of Covista common stock declines below $6.00 prior to the effective time of the merger, then the value of the merger consideration to be received by Capsule stockholders in the merger will correspondingly decline.

Because the value of the merger consideration depends on the market value of a Covista common share at the time of the merger, the value of the merger consideration that Capsule stockholders will receive in the merger cannot now be determined. During the period from the announcement of the merger agreement on July 18, 2001 to January 8, 2002, the last full trading date before the date of this proxy statement/prospectus, the market prices of Covista common stock have fluctuated between a low of $4.80 per share and a high of $10.25 per share. During the one year ending July 17, 2001, the market prices of Covista common stock have fluctuated between a low of $0.625 per share and a high of $9.859 per share. Thus, the market prices of Covista common stock have been subject to significant fluctuation, and may be less than or greater than $0.5822 per share of Capsule common stock, which is the value of the merger consideration to Capsule stockholders (other than Mr. Luken) based upon the closing price of Covista common stock on The Nasdaq National Market of $7.90 on January 8, 2002, the last full trading day prior to the date of this proxy statement/prospectus.

Capsule may terminate the merger agreement if Covista's stock price is less than $2.00 per share.

Capsule may terminate the merger agreement if the weighted average daily high and low sale prices of Covista common stock for the 15 trading days ending one trading day before the closing date of the merger is less than $2.00 per share. However, Capsule will not necessarily terminate the merger agreement even if the foregoing condition occurs.

We have a history of operating losses and working capital deficits, and Capsule's auditors have issued a going concern qualification to their audit report.

Covista has experienced significant losses in each of its last three fiscal years, and Capsule has experienced significant losses in each of its last four fiscal years. On a pro forma consolidated basis, Covista and Capsule experienced a net loss of $22,060,074 for the year ended January 31, 2001, and a net loss of $12,131,835 for the nine months ended October 31, 2001. On a pro forma consolidated basis, Covista and Capsule had a working capital deficit of $9,551,533 at October 31, 2001. Moreover, the report of Capsule's independent accountants concerning Capsule's financial statements for the year ended December 31, 2000 contained a qualification as to the ability of Capsule to continue as a going concern, based upon Capsule's recurring net losses, negative working capital, financing requirements and negative cash flows from operations. The failure of the combined company to achieve profitability

18

could have a material adverse effect upon its ability to continue as a going concern, and upon the market prices for Covista common stock.

Covista may not realize anticipated operating efficiencies, which could hurt Covista's profitability.

A principal rationale for the merger is that Covista expects to improve Capsule's operations by reducing costs, expanding services and integrating administrative functions. Covista may not realize these operating efficiencies or may not realize them as soon as anticipated. In other words, if the merger is completed, the earnings per share of Covista common stock could be less than they would have been if the merger had not been completed.

A portion of the Covista common stock received by minority stockholders of Capsule may be taxable income.