Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

Related financial report

MATX similar filings

- 29 Jan 13 Departure of Directors or Certain Officers

- 20 Dec 12 Departure of Directors or Certain Officers

- 14 Nov 12 Regulation FD Disclosure

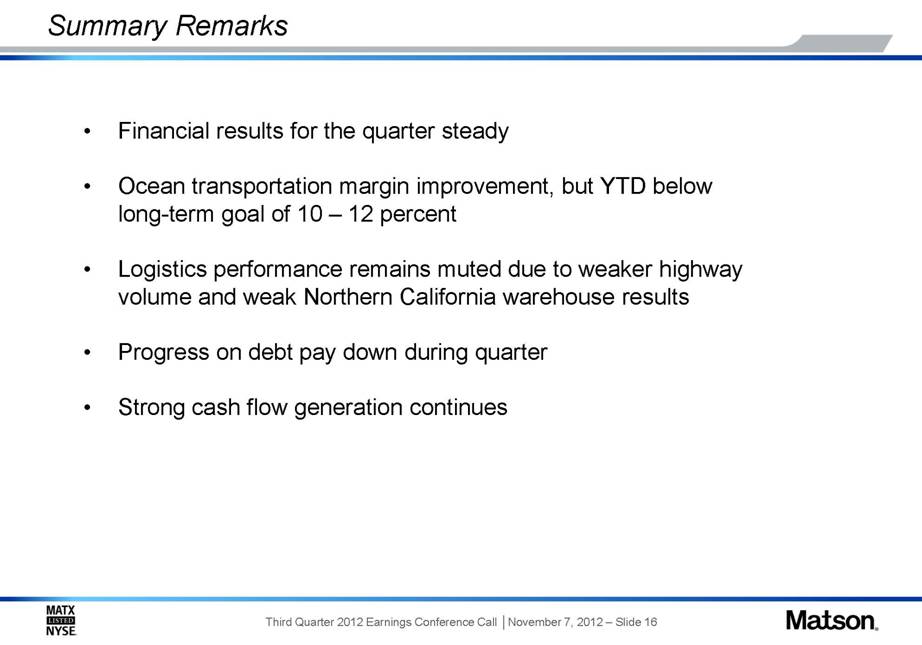

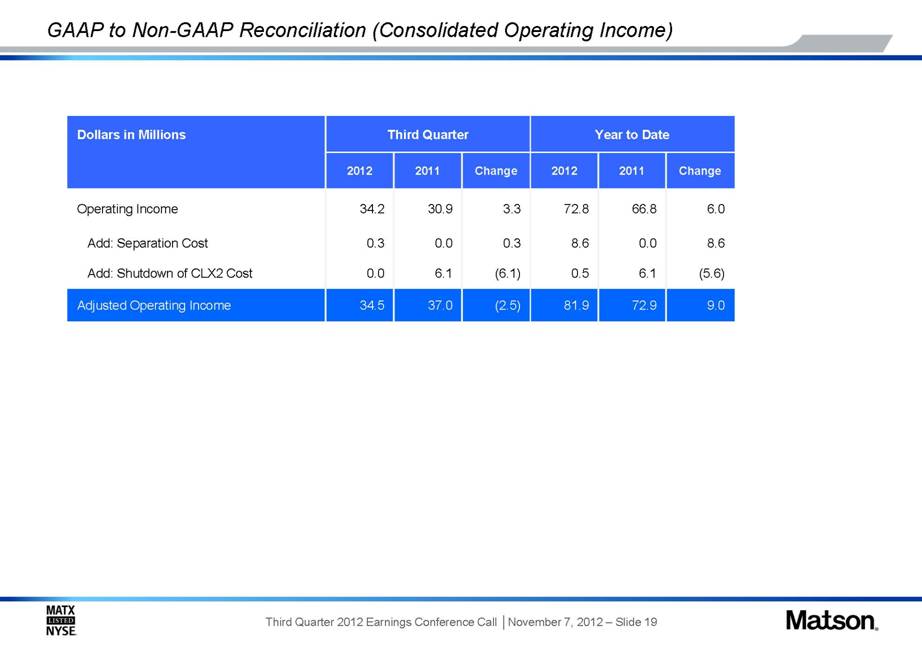

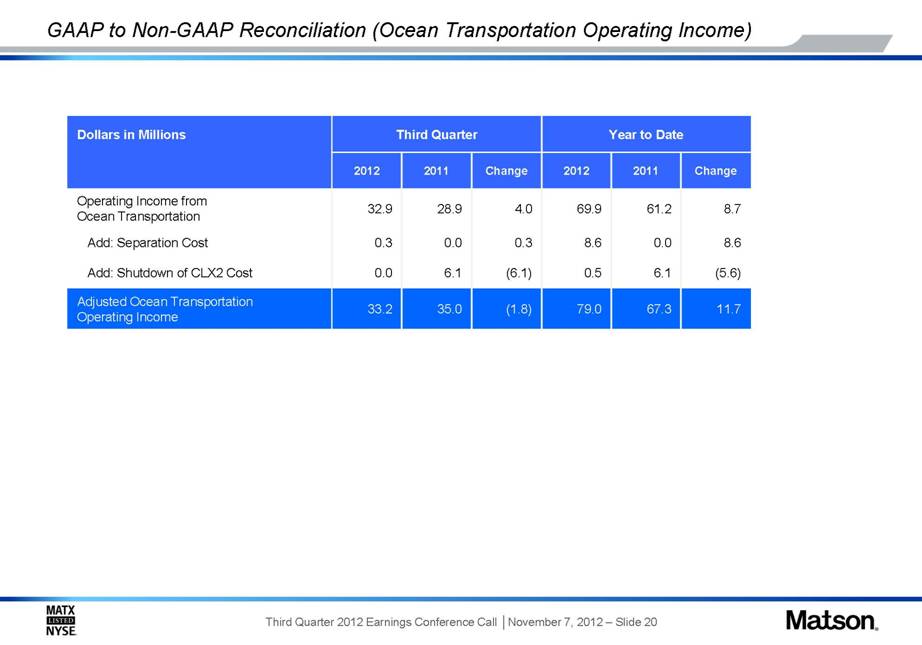

- 7 Nov 12 Results of Operations and Financial Condition

- 2 Aug 12 Results of Operations and Financial Condition

- 5 Jul 12 Unaudited Pro Forma Condensed Consolidated Financial Statements

- 3 Jul 12 Other Events

Filing view

External links