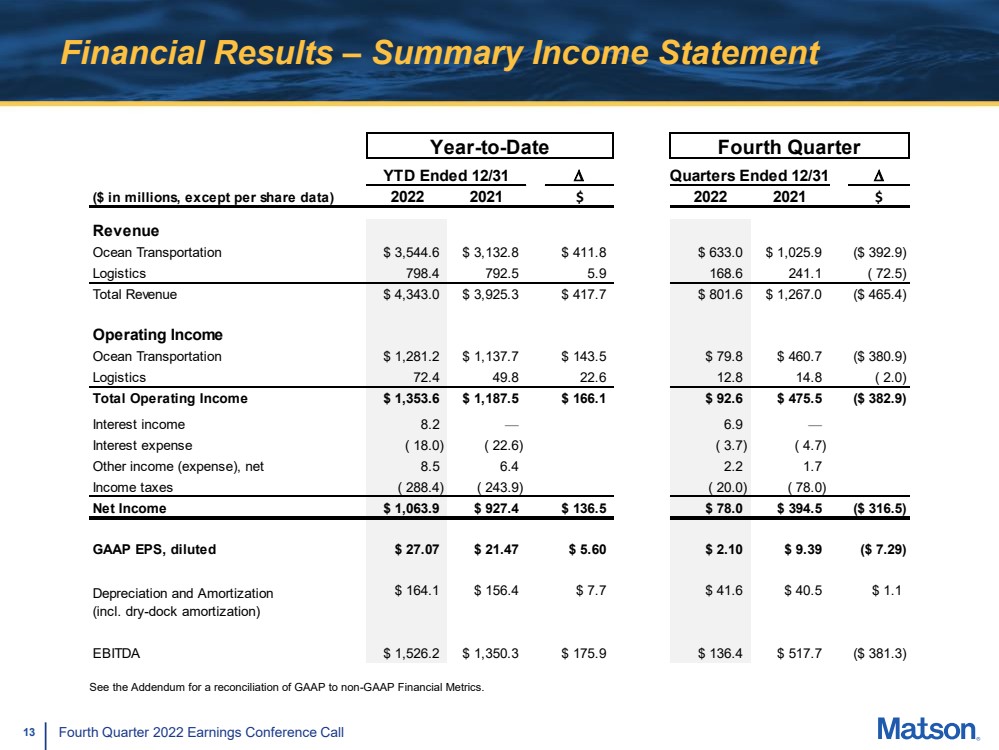

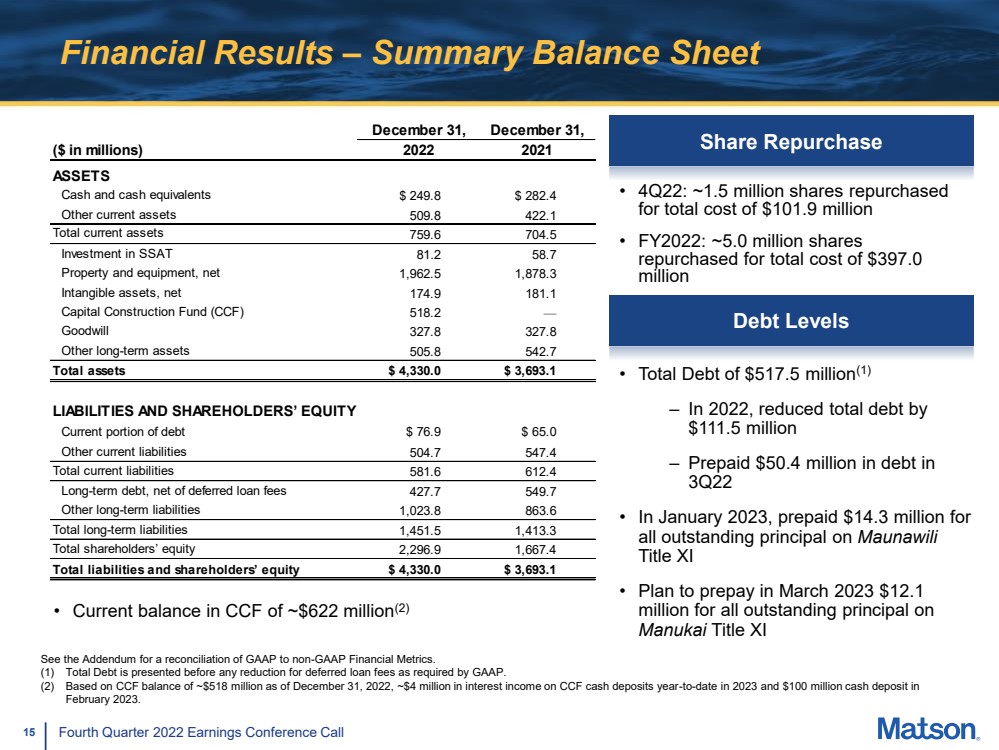

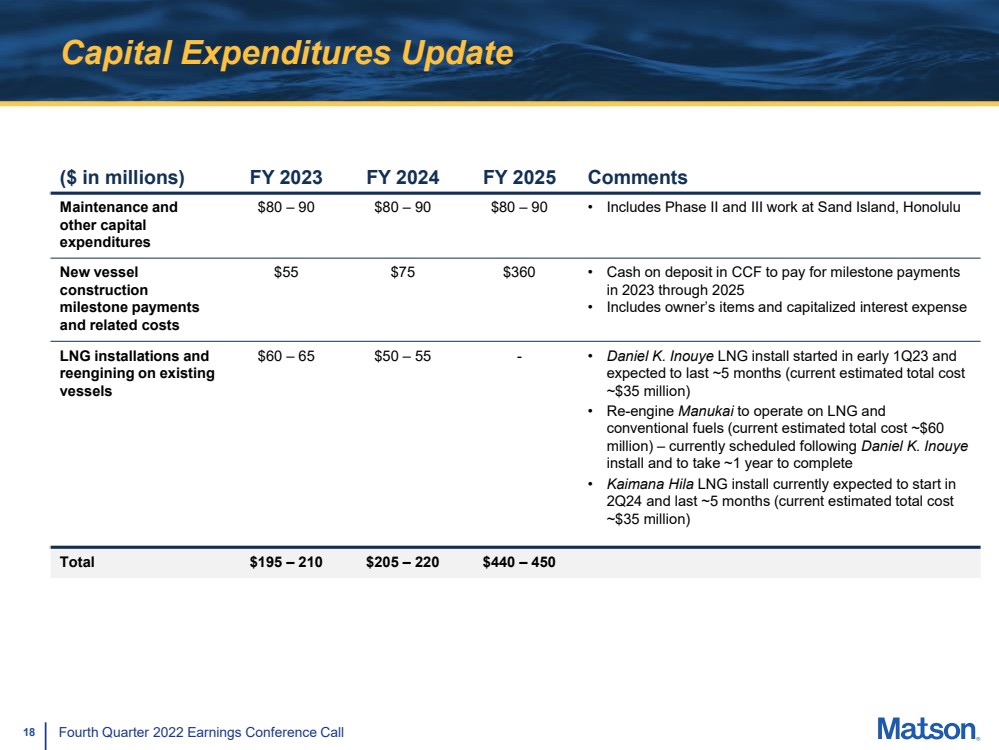

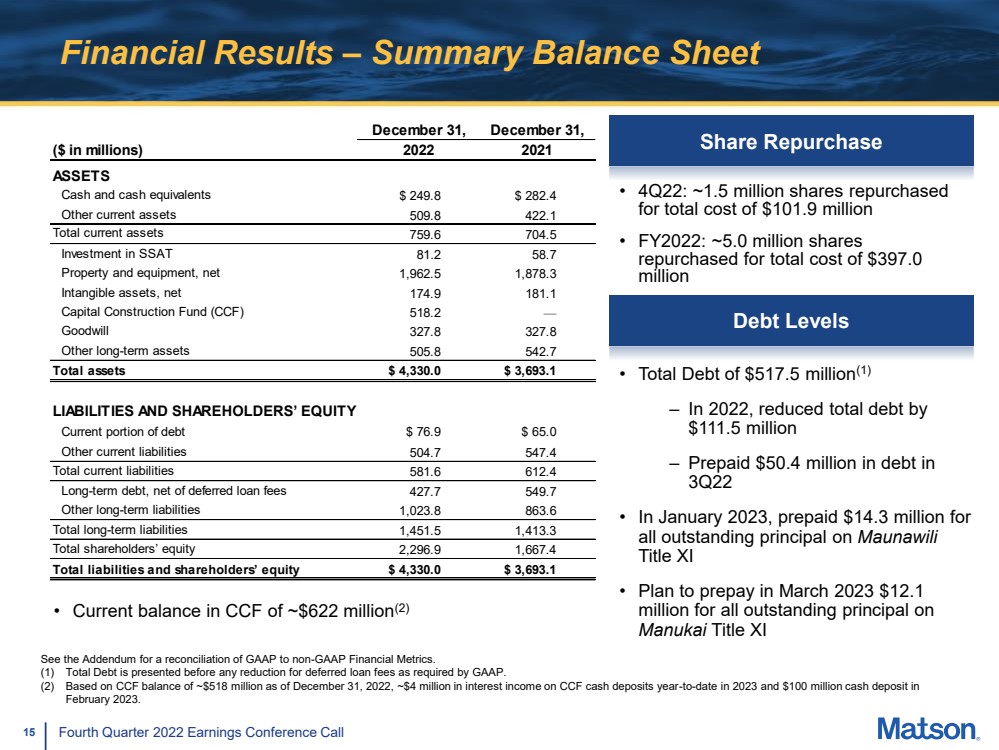

| 15 Fourth Quarter 2022 Earnings Conference Call Financial Results – Summary Balance Sheet • Total Debt of $517.5 million(1) – In 2022, reduced total debt by $111.5 million – Prepaid $50.4 million in debt in 3Q22 • In January 2023, prepaid $14.3 million for all outstanding principal on Maunawili Title XI • Plan to prepay in March 2023 $12.1 million for all outstanding principal on Manukai Title XI See the Addendum for a reconciliation of GAAP to non-GAAP Financial Metrics. (1) Total Debt is presented before any reduction for deferred loan fees as required by GAAP. (2) Based on CCF balance of ~$518 million as of December 31, 2022, ~$4 million in interest income on CCF cash deposits year-to-date in 2023 and $100 million cash deposit in February 2023. Debt Levels Share Repurchase • 4Q22: ~1.5 million shares repurchased for total cost of $101.9 million • FY2022: ~5.0 million shares repurchased for total cost of $397.0 million • Current balance in CCF of ~$622 million(2) ($ in millions) ASSETS Cash and cash equivalents $ 249.8 $ 282.4 Other current assets 509.8 422.1 Total current assets 759.6 704.5 Investment in SSAT 81.2 58.7 Property and equipment, net 1,962.5 1,878.3 Intangible assets, net 174.9 181.1 Capital Construction Fund (CCF) 518.2 — Goodwill 327.8 327.8 Other long-term assets 505.8 542.7 Total assets $ 4,330.0 $ 3,693.1 LIABILITIES AND SHAREHOLDERS’ EQUITY Current portion of debt $ 76.9 $ 65.0 Other current liabilities 504.7 547.4 Total current liabilities 581.6 612.4 Long-term debt, net of deferred loan fees 427.7 549.7 Other long-term liabilities 1,023.8 863.6 Total long-term liabilities 1,451.5 1,413.3 Total shareholders’ equity 2,296.9 1,667.4 Total liabilities and shareholders’ equity $ 4,330.0 $ 3,693.1 December 31, December 31, 2022 2021 |