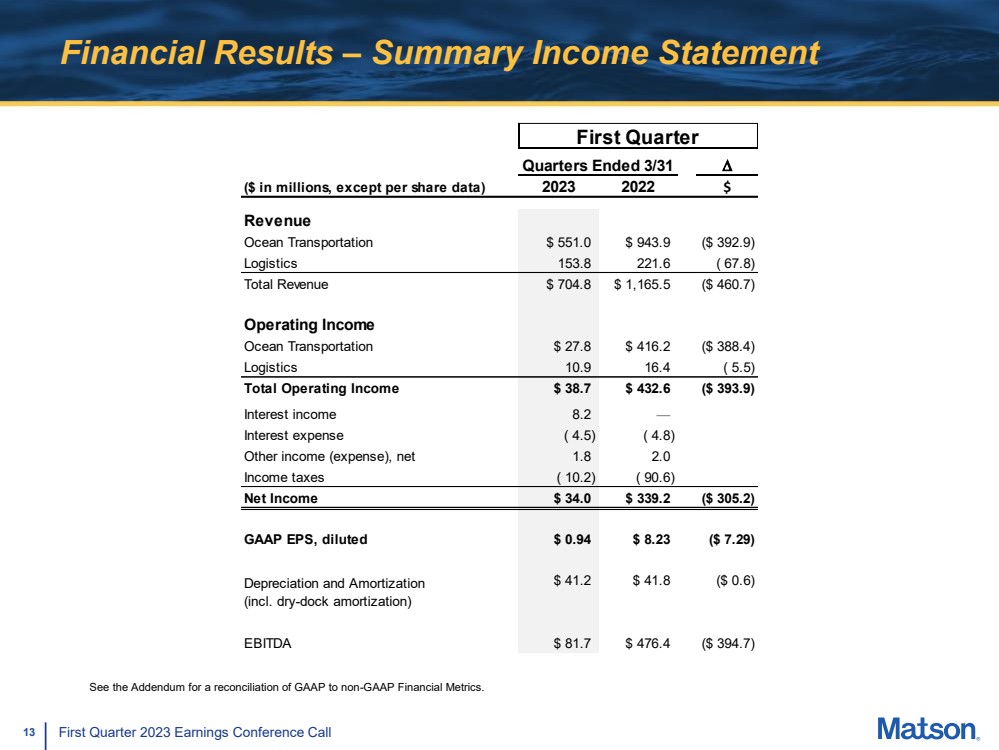

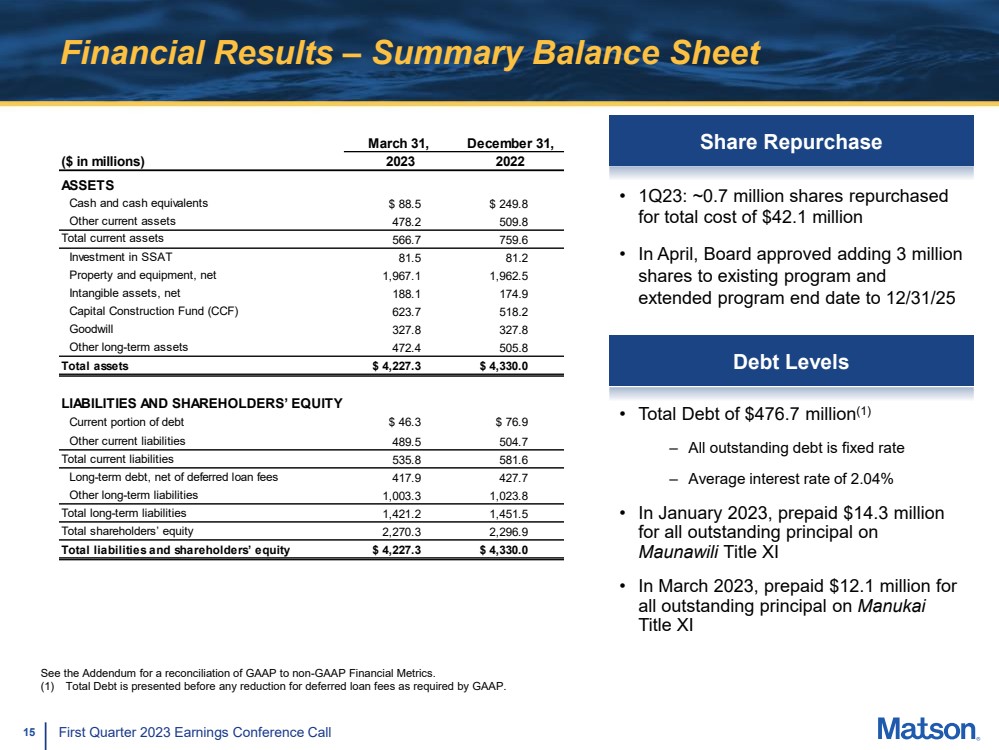

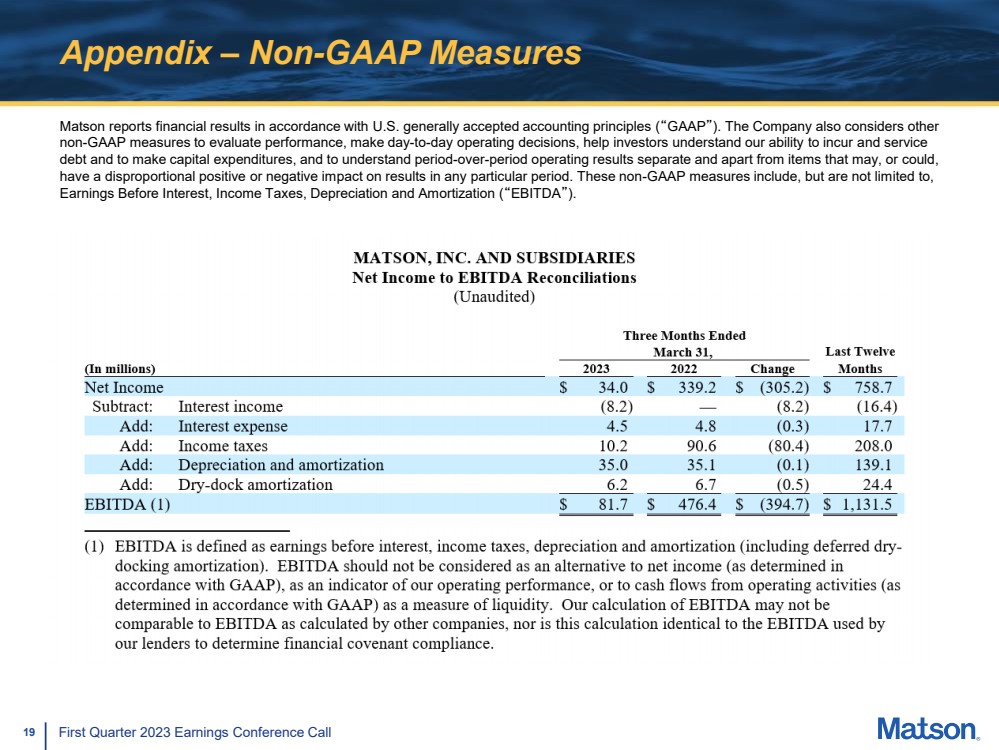

| 15 First Quarter 2023 Earnings Conference Call Financial Results – Summary Balance Sheet • Total Debt of $476.7 million(1) – All outstanding debt is fixed rate – Average interest rate of 2.04% • In January 2023, prepaid $14.3 million for all outstanding principal on Maunawili Title XI • In March 2023, prepaid $12.1 million for all outstanding principal on Manukai Title XI See the Addendum for a reconciliation of GAAP to non-GAAP Financial Metrics. (1) Total Debt is presented before any reduction for deferred loan fees as required by GAAP. Debt Levels Share Repurchase • 1Q23: ~0.7 million shares repurchased for total cost of $42.1 million • In April, Board approved adding 3 million shares to existing program and extended program end date to 12/31/25 ($ in millions) ASSETS Cash and cash equivalents $ 88.5 $ 249.8 Other current assets 478.2 509.8 Total current assets 566.7 759.6 Investment in SSAT 81.5 81.2 Property and equipment, net 1,967.1 1,962.5 Intangible assets, net 188.1 174.9 Capital Construction Fund (CCF) 623.7 518.2 Goodwill 327.8 327.8 Other long-term assets 472.4 505.8 Total assets $ 4,227.3 $ 4,330.0 LIABILITIES AND SHAREHOLDERS’ EQUITY Current portion of debt $ 46.3 $ 76.9 Other current liabilities 489.5 504.7 Total current liabilities 535.8 581.6 Long-term debt, net of deferred loan fees 417.9 427.7 Other long-term liabilities 1,003.3 1,023.8 Total long-term liabilities 1,421.2 1,451.5 Total shareholders’ equity 2,270.3 2,296.9 Total liabilities and shareholders’ equity $ 4,227.3 $ 4,330.0 March 31, December 31, 2023 2022 |