Second quarter fiscal 2024 letter to shareholders

February 8, 2024

Dear shareholders,

As we continue to transition our operation to focus solely on direct store delivery (DSD), we are pleased to see early momentum in several of our operational and financial metrics.

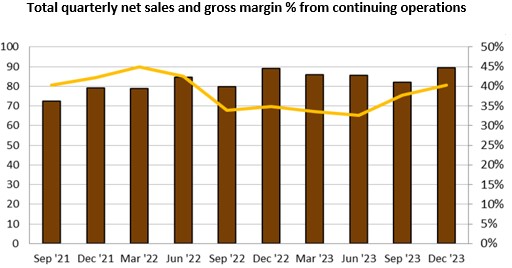

Overall, during the second quarter of fiscal 2024 we saw meaningful improvements in gross margin and adjusted EBITDA. Our gross margin during the quarter rose above 40% for the first time in more than a year. While we do anticipate some one-time items and pressures in the near future which could impact gross margin, we expect to be able to capture additional upside as we have now sold through the majority of our older, higher cost inventory. We believe the company is now positioned to generate sustainable gross margin in excess of 40%.

In addition, we are continuing to make progress on centralizing our roasting and production operations to our Portland, Oregon facility. We remain confident we are well on our way to being free cash flow1 positive by early fiscal 2025.

Second quarter fiscal 2024 financial results

Please note, results for the fiscal 2024 second quarter are reported on a continuing operations basis, reflecting the performance of our DSD business in the current and prior year periods. You should refer to our Form 10-Q, which was filed with the Securities and Exchange Commission (SEC) today, Feb. 8, 2024, for further information regarding the respective performance of our discontinued and continuing operations.

Second quarter fiscal 2024 sales increased $600,000 to $89.5 million compared to $88.9 million in the second quarter of fiscal 2023. Overall, net sales were positively impacted by higher pricing compared to prior periods, but were offset by a decrease in year-over-year coffee and allied product volume.

Gross margin increased 550 basis points on a year-over-year basis to 40.4% compared to 34.9% for the second quarter of the prior year. Gross profit during the quarter increased $5.1 million to $36.1 million, or 16% on a year-over-year basis, compared to $31 million for the second quarter of fiscal 2023. The increase in gross margin was primarily due to improved pricing and a decrease in underlying commodities cost compared to the prior year period.

Operating expenses decreased $2.6 million from $34.3 million in the second quarter of fiscal 2023 to $31.7 million in the second quarter of fiscal 2024. We saw a $1.1 million increase in general and administrative (G&A) expense and a $2.5 million increase in selling expense, which

1 Free cash flow is a non-GAAP measure defined as net cash (used in) provided by operating activities less capital expenditures. 2

was offset by a $6.2 million increase in net gains from the sale of branch properties and other assets during the quarter. The selling expense increase was primarily due to additional costs related to healthcare benefits, rent and a year-over-year increase in incentive compensation expense, partially offset by a decrease in advertising related expense. The increase in G&A expense was also driven by an increase in incentive compensation expense and severance related costs, partially offset by a decrease in IT and consulting related costs compared to the prior year.

Net income from continuing operations moved from a loss of $8.7 million during the prior year period to a gain of $2.7 million in the second quarter of fiscal 2024, an improvement of $11.4 million.

Our capital expenditures for the quarter were $3.3 million compared to $4.7 million in the prior year period. In fiscal 2024, we anticipate between $12 and $15 million in capital expenditures. We expect to finance these expenditures through cash flow from operations and borrowings under our credit facility.

Adjusted EBITDA2 for the second quarter of fiscal 2024 was $2.3 million, an increase of $4.5 million compared to a loss of $2.2 million in the second quarter of fiscal 2023.

As of Dec. 31, 2023, we had $6.9 million of unrestricted cash and cash equivalents. Additionally, we had outstanding borrowings of $23.3 million, utilized $4.6 million of the letters of credit sub-limit and had $24.5 million of availability under our credit facility. We believe we are adequately capitalized to finance our operations in fiscal 2024 and expect to achieve our goal to be free cash flow positive by early fiscal 2025.

Strategic and operational update

From providing traditional and on-trend product options to world-class equipment service and support, Farmer Brothers’ nationwide network is backed by the local expertise necessary to meet the unique needs of our extensive DSD customer base.

We are seeing improvements in customer retention and believe we are in a solid position to grow our customer base in the future. Leveraging insights from our AI-backed technology, we are focusing on improving key portions of our value proposition that best retain and gain customers.

As we highlighted last quarter, we continue to reduce brand and SKU redundancies across our coffee line in an effort to simplify our offerings and streamline our procurement, production and sales operations. By removing redundancies across our catalog, our planning and production teams will be able to improve scheduling and focus on producing our most popular and profitable items. This will ultimately improve our in-stock and delivery capabilities and allow us to realize additional efficiencies and cost savings.

We are continuing to invest in technology as part of what we are internally calling “Project Symphony” to improve our customer experience. Currently, we are enhancing our field inventory management tools and have recently launched a new customer relationship management (CRM) system. These tools will help our teams better track, communicate and meet the needs of our DSD customer base.

Our national equipment and field service continues to be a critical driver of our customer retention efforts. Our highly trained and certified technicians provide 24/7 preventive and emergency maintenance services, as well as access to new and refurbished beverage equipment.

2 Adjusted EBITDA is a non-GAAP measure. Please refer to “Non-GAAP Financial Measures” below for an explanation and reconciliation of Adjusted EBITDA and other related non-GAAP measures to comparable GAAP measures.

3

Outlook and closing

Overall, we continue to see positive momentum, highlighted by our gross margin and adjusted EBITDA performance. We know there is still work to be done as we complete our transition to a DSD-focused business. During the second half of fiscal 2024, we are focused on further improvement as we:

•Improve our cost structure and deliver incremental margin improvement

•Drive customer growth and retention

•Increase market penetration for new, on-trend products

•Complete the transitional services associated with our direct ship sale

While we do not expect results to be linear on a quarter-over-quarter basis, we believe we are in a better position to generate sustainable top-line growth. We firmly believe we will achieve our goal of being free cash flow positive by early fiscal 2025 and want to thank our team members, partners, customers and shareholders for their continued dedication and support. Together, we will continue to drive success and create long-term value for our shareholders.

Investor conference call

Farmer Brothers (NASDAQ: FARM) will publish its fiscal second quarter 2024 financial results for the period ended Dec. 31, 2023 with the filing of its 10-Q and the issuing of its quarterly shareholder letter, both of which will be posted on the Investor Relations section of its website after the close of market Thursday, Feb. 8.

The company will also host an audio-only investor conference call and webcast at 5 p.m. Eastern on Thursday, Feb. 8 to provide a review of the quarter and business update. Callers who pre-register will be emailed dial-in details and a unique PIN to gain immediate access to the call and bypass the live operator. An audio-only replay of the webcast will be archived for at least 30 days on the Investor Relations section of the company’s website and will be available approximately two hours after the end of the live webcast.

About Farmer Brothers

Founded in 1912, Farmer Brothers is a national coffee roaster, wholesaler, equipment servicer and distributor of coffee, tea and culinary products. The company’s product lines include organic, Direct Trade and sustainably produced coffee, as well as tea, cappuccino mixes, spices and baking/biscuit mixes.

Farmer Brothers delivers extensive beverage planning services and culinary products to a wide variety of U.S.-based customers, ranging from small independent restaurants and foodservice operators to large institutional buyers, such as restaurant, department and convenience store chains, hotels, casinos, healthcare facilities and gourmet coffee houses, as well as grocery chains with private brand coffee and consumer branded coffee and tea products and foodservice distributors. The company’s primary brands include Farmer Brothers, Boyd’s, Cain’s, China Mist and West Coast Coffee.

Forward-looking statements

This letter and other documents we file with the Securities and Exchange Commission (SEC) contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act), that are based on current expectations, estimates, forecasts and projections about us, our future performance, financial condition, products, business strategy, beliefs and management’s assumptions. In addition, we, or others on our behalf, may make forward-looking statements in press releases or written statements, or in our communications and discussions with investors and analysts in the normal course of business through meetings, webcasts, phone calls and conference calls. These forward-looking statements can be identified by the use of words, such as anticipates, estimates, projects, expects, plans, believes, intends, will, could, may, assumes and other words of similar meaning. These statements are based on management’s beliefs, assumptions, estimates and observations of future events based on information available to our management at the time the statements are made and include any statements that do not relate to any historical or current fact. These statements are not guarantees of future performance and they involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from what is expressed, implied or forecast by our forward-looking statements due in part to the risks, uncertainties and assumptions set forth in this letter and Part I, Item 1A. Risk Factors as well as Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, of our annual report on Form 10-K for the fiscal year ended June 30, 2023, filed with the SEC on Sept. 2, 2023, as amended the 10-K/A on Oct. 27, 2023, as amended, the 2023 Form 10-K), as well as those discussed elsewhere in this letter and other factors described from time to time in our filings with the SEC.

Factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, severe weather, levels of consumer confidence in national and local economic business conditions, the impact of labor market conditions, the increase of costs due to inflation, an economic downturn caused by any pandemic, epidemic or other disease outbreak, comparable or similar to COVID-19, the success of our turnaround strategy, the impact of capital improvement projects, the adequacy and availability of capital resources to fund our existing and planned business operations and our capital expenditure requirements, our ability to meet financial covenant requirements in our credit facility, which could impact, among other things, our liquidity, the relative effectiveness of compensation-based employee incentives in causing improvements in our performance, the capacity to meet the demands of our large national account customers, the extent of execution of plans for the growth of our business and achievement of financial metrics related to those plans, our success in retaining and/or attracting qualified employees, our success in adapting to technology and new commerce channels, the effect of the capital markets, as well as other external factors on stockholder value, fluctuations in availability and cost of green coffee, competition, organizational changes, the effectiveness of our hedging strategies in reducing price and interest rate risk, changes in consumer preferences, our ability to provide sustainability in ways that do not materially impair profitability, changes in the strength of the economy, including any effects from inflation, business conditions in the coffee industry and food industry in general, our continued success in attracting new customers, variances from budgeted sales mix and growth rates, weather and special or unusual events, as well as other risks, uncertainties and assumptions described in the 2023 Form 10-K or otherwise described from time to time in our filings with the SEC.

Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this letter and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise, except as required under federal securities laws and the rules and regulations of the SEC.

FARMER BROS. CO.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Six Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Net sales | | $ | 89,453 | | | $ | 88,919 | | | $ | 171,340 | | | $ | 168,746 | |

| Cost of goods sold | | 53,344 | | | 57,896 | | | 104,444 | | | 110,704 | |

| Gross profit | | 36,109 | | | 31,023 | | | 66,896 | | | 58,042 | |

| | | | | | | | |

| Selling expenses | | 28,141 | | | 25,632 | | | 54,969 | | | 51,388 | |

| General and administrative expenses | | 9,655 | | | 8,587 | | | 22,486 | | | 17,815 | |

| | | | | | | | |

| | | | | | | | |

| Net (gains) losses from sale of assets | | (6,138) | | | 55 | | | (12,922) | | | (7,127) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Operating expenses | | 31,658 | | | 34,274 | | | 64,533 | | | 62,076 | |

| | | | | | | | |

| Income (loss) from operations | | 4,451 | | | (3,251) | | | 2,363 | | | (4,034) | |

| Other (expense) income: | | — | | | — | | | — | | | — | |

| | | | | | | | |

| | | | | | | | |

| Interest expense | | (1,907) | | | (1,858) | | | (4,129) | | | (3,928) | |

| | | | | | | | |

| Other, net | | 324 | | | (3,533) | | | 3,195 | | | (2,217) | |

| Total other expense | | (1,583) | | | (5,391) | | | (934) | | | (6,145) | |

| Income (loss) before taxes | | 2,868 | | | (8,642) | | | 1,429 | | | (10,179) | |

| Income tax expense | | 164 | | | 40 | | | 32 | | | 83 | |

| Income (loss) from continuing operations | | 2,704 | | | (8,682) | | | 1,397 | | | (10,262) | |

| Loss from discontinued operations, net of income taxes | | — | | | (4,926) | | | — | | | (10,720) | |

| Net income (loss) | | $ | 2,704 | | | $ | (13,608) | | | $ | 1,397 | | | $ | (20,982) | |

| Income (loss) from continuing operations available to common stockholders per common share, basic and diluted | | $ | 0.13 | | | $ | (0.47) | | | $ | 0.07 | | | $ | (0.53) | |

| Loss from discontinued operations available to common stockholders per common share, basic and diluted | | $ | — | | | $ | (0.26) | | | $ | — | | | $ | (0.56) | |

| Net income (loss) available to common stockholders per common share, basic and diluted | | $ | 0.13 | | | $ | (0.73) | | | $ | 0.07 | | | $ | (1.09) | |

| Weighted average common shares outstanding—basic | | 20,728,699 | | | 18,723,957 | | | 20,565,492 | | | 19,243,707 | |

| Weighted average common shares outstanding—diluted | | 20,917,562 | | | 18,723,957 | | | 20,740,303 | | | 19,243,707 | |

| | | | | | | | |

FARMER BROS. CO.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(In thousands, except share and per share data)

| | | | | | | | | | | | | |

| | | | | |

| December 31, 2023 | | June 30, 2023 | | |

| ASSETS | | | | | |

| Current assets: | | | | | |

| Cash and cash equivalents | $ | 6,932 | | | $ | 5,244 | | | |

| Restricted cash | 175 | | | 175 | | | |

| | | | | |

| Accounts receivable, net of allowance for credit losses of $710 and $416, respectively | 32,850 | | | 45,129 | | | |

| Inventories | 55,469 | | | 49,276 | | | |

| | | | | |

| | | | | |

| Short-term derivative assets | 279 | | | 68 | | | |

| Prepaid expenses | 5,140 | | | 5,334 | | | |

| Assets held for sale | 3,573 | | | 7,770 | | | |

| Total current assets | 104,418 | | | 112,996 | | | |

| Property, plant and equipment, net | 33,933 | | | 33,782 | | | |

| | | | | |

| Intangible assets, net | 12,330 | | | 13,493 | | | |

| Other assets | 2,023 | | | 2,917 | | | |

| | | | | |

| | | | | |

| Right-of-use operating lease assets | 29,142 | | | 24,593 | | | |

| Total assets | $ | 181,846 | | | $ | 187,781 | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | |

| Current liabilities: | | | | | |

| Accounts payable | 44,204 | | | 60,088 | | | |

| Accrued payroll expenses | 12,681 | | | 10,082 | | | |

| | | | | |

| Right-of-use operating lease liabilities - current | 12,404 | | | 8,040 | | | |

| | | | | |

| Short-term derivative liability | 498 | | | 2,636 | | | |

| | | | | |

| Other current liabilities | 3,757 | | | 4,519 | | | |

| Total current liabilities | 73,544 | | | 85,365 | | | |

| Long-term borrowings under revolving credit facility | 23,300 | | | 23,021 | | | |

| | | | | |

| Accrued pension liabilities | 19,354 | | | 19,761 | | | |

| Accrued postretirement benefits | 785 | | | 763 | | | |

| Accrued workers’ compensation liabilities | 2,504 | | | 3,065 | | | |

| Right-of-use operating lease liabilities | 17,346 | | | 17,157 | | | |

| Other long-term liabilities | 1,752 | | | 537 | | | |

| | | | | |

| Total liabilities | $ | 138,585 | | | $ | 149,669 | | | |

| Commitments and contingencies | | | | | |

| Stockholders’ equity: | | | | | |

| | | | | |

| Common stock, $1.00 par value, 25,000,000 shares authorized; 20,793,956 and 20,142,973 shares issued and outstanding at December 31, 2023 and June 30, 2023, respectively | 20,795 | | | 20,144 | | | |

| Additional paid-in capital | 79,598 | | | 77,278 | | | |

| Accumulated deficit | (25,082) | | | (26,479) | | | |

| | | | | |

| Accumulated other comprehensive loss | (32,050) | | | (32,831) | | | |

| Total stockholders’ equity | $ | 43,261 | | | $ | 38,112 | | | |

| Total liabilities and stockholders’ equity | $ | 181,846 | | | $ | 187,781 | | | |

| | | | | |

| | | | | | | | | | | | | |

| FARMER BROS. CO. |

| CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) |

| (In thousands) |

| | Six Months Ended December 31, | | |

| 2023 | | 2022 | | |

| Cash flows from operating activities: | | | | | |

| Net income (loss) | $ | 1,397 | | | $ | (20,982) | | | |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities | | | | | |

| Depreciation and amortization | 5,792 | | | 11,316 | | | |

| | | | | |

| Gain on settlement related to Boyd's acquisition | — | | | (1,917) | | | |

| | | | | |

| Net gains from sale of assets | (14,136) | | | (7,127) | | | |

| Net losses (gains) on derivative instruments | 429 | | | 2,074 | | | |

| | | | | |

| 401(k) and share-based compensation expense | 2,970 | | | 4,665 | | | |

| Provision for credit losses | 450 | | | 211 | | | |

| Change in operating assets and liabilities: | | | | | |

| Accounts receivable, net | 13,044 | | | (3,589) | | | |

| Inventories | (6,193) | | | 16,081 | | | |

| Derivative (liabilities) assets, net | (779) | | | (1,668) | | | |

| Other assets | 1,146 | | | (219) | | | |

| | | | | |

| | | | | |

| Accounts payable | (15,936) | | | 9,877 | | | |

| Accrued expenses and other | 949 | | | (5,159) | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash (used in) provided by operating activities | $ | (10,867) | | | $ | 3,563 | | | |

| | | | | |

| Cash flows from investing activities: | | | | | |

| Sale of business | (1,214) | | | — | | | |

| Purchases of property, plant and equipment | (6,853) | | | (7,714) | | | |

| Proceeds from sales of property, plant and equipment | 20,497 | | | 9,933 | | | |

| Net cash provided by investing activities | $ | 12,430 | | | $ | 2,219 | | | |

| | | | | |

| Cash flows from financing activities: | | | | | |

| Proceeds from Credit Facilities | 2,279 | | | 54,000 | | | |

| Repayments on Credit Facilities | (2,000) | | | (49,383) | | | |

| Payments of finance lease obligations | (96) | | | (96) | | | |

| Payment of financing costs | (58) | | | (357) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash provided by financing activities | $ | 125 | | | $ | 4,164 | | | |

| Net increase in cash and cash equivalents and restricted cash | 1,688 | | | 9,946 | | | |

| Cash and cash equivalents and restricted cash at beginning of period | 5,419 | | | 9,994 | | | |

| Cash and cash equivalents and restricted cash at end of period | $ | 7,107 | | | $ | 19,940 | | | |

| | | | | |

| | | | | | | | | | | |

| Supplemental disclosure of non-cash investing and financing activities: | | | |

| | | |

| Right-of-use assets obtained in exchange for new operating lease liabilities | $ | 6,456 | | | $ | 2,965 | |

| Non-cash issuance of ESOP and 401(K) common stock | 326 | | | 522 | |

| Non cash additions to property, plant and equipment | 52 | | | 138 | |

| | | |

Non-GAAP Financial Measures

In addition to net loss determined in accordance with U.S. generally accepted accounting principles (“GAAP”), we use the following non-GAAP financial measures in assessing our operating performance:

“EBITDA” is defined as net loss from continuing operations excluding the impact of:

•income tax expense;

•interest expense; and

•depreciation and amortization expense.

“EBITDA Margin” is defined as EBITDA expressed as a percentage of net sales.

“Adjusted EBITDA” is defined as net loss from continuing operations excluding the impact of:

•income tax expense;

•interest expense;

•depreciation and amortization expense;

•401(k), ESOP and share-based compensation expense;

•gain on settlement with Boyd’s sellers;

•net (gains) losses from sales of assets;

•loss related to sale of business;

•severance costs.

“Adjusted EBITDA Margin” is defined as Adjusted EBITDA expressed as a percentage of net sales.

For purposes of calculating EBITDA and EBITDA Margin and Adjusted EBITDA and Adjusted EBITDA Margin, we have not adjusted for the impact of interest expense on our pension and postretirement benefit plans.

We believe these non-GAAP financial measures provide a useful measure of the Company’s operating results, a meaningful comparison with historical results and with the results of other companies, and insight into the Company’s ongoing operating performance. Further, management utilizes these measures, in addition to GAAP measures, when evaluating and comparing the Company’s operating performance against internal financial forecasts and budgets.

We believe that EBITDA facilitates operating performance comparisons from period to period by isolating the effects of certain items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies. These potential differences may be caused by variations in capital structures (affecting interest expense), tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses) and the age and book depreciation of facilities and equipment (affecting relative depreciation expense). We also present EBITDA and EBITDA Margin because (i) we believe that these measures are frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry, (ii) we believe that investors will find these measures useful in assessing our ability to service or incur indebtedness, and (iii) we use these measures internally as benchmarks to compare our performance to that of our competitors.

EBITDA, EBITDA Margin, Adjusted EBITDA and Adjusted EBITDA Margin, as defined by us, may not be comparable to similarly titled measures reported by other companies. We do not intend for non-GAAP financial measures to be considered in isolation or as a substitute for other measures prepared in accordance with GAAP.

Set forth below is a reconciliation of reported net loss to EBITDA (unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Six Months Ended December 31, |

| (In thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net loss from continuing operations, as reported | | $ | 2,704 | | | $ | (8,682) | | | $ | 1,397 | | | $ | (10,262) | |

| Income tax (benefit) expense | | 164 | | | 40 | | | 32 | | | 83 | |

| Interest expense (1) | | 692 | | | 693 | | | 1,699 | | | 1,597 | |

| Depreciation and amortization expense | | 2,844 | | | 3,324 | | | 5,792 | | | 6,705 | |

| EBITDA | | $ | 6,404 | | | $ | (4,625) | | | $ | 8,920 | | | $ | (1,877) | |

| EBITDA Margin | | 7.2 | % | | (5.2) | % | | 5.2 | % | | (1.1) | % |

____________

(1)Excludes interest expense related to pension plans and postretirement benefit plan.

Set forth below is a reconciliation of reported net loss to Adjusted EBITDA (unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Six Months Ended December 31, |

| (In thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) from continuing operations, as reported | | $ | 2,704 | | | $ | (8,682) | | | $ | 1,397 | | | $ | (10,262) | |

| Income tax expense | | 164 | | | 40 | | | 32 | | | 83 | |

| Interest expense (1) | | 692 | | | 693 | | | 1,699 | | | 1,597 | |

| Depreciation and amortization expense | | 2,844 | | | 3,324 | | | 5,792 | | | 6,705 | |

| 401(k), ESOP and share-based compensation expense | | 1,350 | | | 2,302 | | | 2,902 | | | 4,499 | |

| Gain on settlement with Boyd's sellers (2) | | — | | | — | | | — | | | (1,917) | |

| Net (gains) losses from sale of assets | | (7,352) | | | 55 | | | (14,136) | | | (7,127) | |

| Loss related to sale of business (3) | | 1,214 | | | — | | | 1,214 | | | — | |

| | | | | | | | |

| | | | | | | | |

| Severance costs | | 695 | | | 58 | | | 2,960 | | | 292 | |

| Adjusted EBITDA | | $ | 2,311 | | | $ | (2,210) | | | $ | 1,860 | | | $ | (6,130) | |

| Adjusted EBITDA Margin | | 2.6 | % | | (2.5) | % | | 1.1 | % | | (3.6) | % |

________

(1) Excludes interest expense related to pension plans and postretirement benefit plans.

(2) Result of the settlement related to the acquisition of Boyd Coffee Company which included the cancellation of shares of Series A Preferred Stock and settlement of liabilities.

(3) Result of the settlements related to the divestiture of Direct Ship business which included gains related to coffee hedges and settlement of liabilities.