UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2008

OR

r TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition from _________ to ____________

Commission file number 0-6233

1 ST SOURCE CORPORATION

(Exact name of registrant as specified in its charter)

| Indiana | | 35-1068133 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 100 North Michigan Street | | |

| South Bend, Indiana | | 46601 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (574) 235-2000

Securities registered pursuant to Section 12(b) of the Act:

Title of Class Name of Each Exchange on Which Registered

Common Stock-wihout par value The NASDAQ Stock Market LLC

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No r

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | o | Accelerated filer | x | Non-accelerated filer | o | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes r No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant as of June 30, 2008 was $218,217,564

The number of shares outstanding of each of the registrant’s classes of stock as of February 16, 2009:

Common Stock, without par value –– 24,176,342 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the annual proxy statement for the 2009 annual meeting of shareholders to be held April 23, 2009, are incorporated by reference into Part III.

Part I

1st Source Corporation, an Indiana corporation incorporated in 1971, is a bank holding company headquartered in South Bend, Indiana that provides, through our subsidiaries (collectively referred to as "1st Source"), a broad array of financial products and services. 1st Source Bank ("Bank"), our banking subsidiary, offers commercial and consumer banking services, trust and investment management services, and insurance to individual and business clients through most of our 79 banking center locations in 17 counties in Indiana and Michigan. 1st Source Bank's Specialty Finance Group, with 24 locations nationwide, offers specialized financing services for new and used private and cargo aircraft, automobiles and light trucks for leasing and rental agencies, medium and heavy duty trucks, construction equipment, and environmental equipment. While concentrated in certain equipment types, we enjoy serving a very diverse client base. We are not dependent upon any single industry or client. At December 31, 2008, we had consolidated total assets of $4.46 billion, loans and leases of $3.30 billion, deposits of $3.51 billion, and total shareholders’ equity of $453.66 million.

Consumer Services — 1st Source Bank provides a full range of consumer banking services, including checking accounts, on-line banking including bill payment, telephone banking, savings programs, installment and real estate loans, home equity loans and lines of credit, drive-through and night deposit services, safe deposit facilities, automated teller machines, overdraft facilities, debit and credit card services, financial literacy seminars and brokerage services.

Construction equipment financing includes financing of equipment (i.e., asphalt and concrete plants, bulldozers, excavators, cranes, and loaders, etc.) to the construction industry. Construction equipment finance receivables generally range from $100,000 to $15 million with fixed or variable interest rates and terms of three to seven years.

We also generate equipment rental income through the leasing of construction equipment, various trucks, and other equipment to clients through operating leases.

Specialty Finance Group Subsidiaries

The Specialty Finance Group also consists of separate wholly owned subsidiaries of 1st Source Bank which include: Michigan Transportation Finance Corporation, 1st Source Specialty Finance, Inc., SFG Equipment Leasing, Inc., 1st Source Intermediate Holding, LLC, 1st Source Commercial Aircraft Leasing, Inc., and SFG Equipment Leasing Corporation I.

First National Bank, Valparaiso

First National Bank, Valparaiso (First National) was a wholly owned subsidiary of 1st Source Corporation that was acquired on May 31, 2007. On June 9, 2008, First National was merged with 1st Source Bank.

Trustcorp Mortgage Company

Trustcorp Mortgage Company (Trustcorp) is a mortgage banking company and is a wholly owned subsidiary of 1st Source Corporation. During 2007, its mortgage activity was merged with 1st Source Bank.

1st Source Insurance, Inc.

1st Source Insurance, Inc. is a wholly owned subsidiary of 1st Source Bank that provides insurance products and services to individuals and businesses covering corporate and personal property, casualty insurance, and individual and group health and life insurance. 1st Source Insurance, Inc. has seven offices.

1st Source Corporation Investment Advisors, Inc.

1st Source Corporation Investment Advisors, Inc. (Investment Advisors) is a wholly owned subsidiary of 1st Source Bank that provides investment advisory services to trust and investment clients of 1st Source Bank. Investment Advisors is registered as an investment advisor with the Securities and Exchange Commission under the Investment Advisors Act of 1940. Investment Advisors serves strictly in an advisory capacity and, as such, does not hold any client securities.

Other Consolidated Subsidiaries

We have other subsidiaries that are not significant to the consolidated entity.

1st Source Capital Trust IV and 1st Source Master Trust

Our unconsolidated subsidiaries include 1st Source Capital Trust IV and 1st Source Master Trust. These subsidiaries were created for the purposes of issuing $30.00 million and $57.00 million of trust preferred securities, respectively, and lending the proceeds to 1st Source. We guarantee, on a limited basis, payments of distributions on the trust preferred securities and payments on redemption of the trust preferred securities. 1st Source Capital Trust II and 1st Source Capital Trust III were dissolved during 2008.

Competition

The activities in which we and the Bank engage in are highly competitive. Our businesses and the geographic markets we serve match us against other banks, some of which are affiliated with large bank holding companies headquartered outside of our principal market. We generally compete on the basis of client service and responsiveness to client needs, available loan and deposit products, the rates of interest charged on loans and leases, the rates of interest paid for funds, other credit and service charges, the quality of services rendered, the convenience of banking facilities, and in the case of loans and leases to large commercial borrowers, relative lending limits.

In addition to competing with other banks within our primary service areas, the Bank also competes with other financial service companies, such as credit unions, industrial loan associations, securities firms, insurance companies, small loan companies, finance companies, mortgage companies, real estate investment trusts, certain governmental agencies, credit organizations, and other enterprises.

Additional competition for depositors’ funds comes from United States Government securities, private issuers of debt obligations, and suppliers of other investment alternatives for depositors. Many of our non-bank competitors are not subject to the same extensive Federal regulations that govern bank holding companies and banks. Such non-bank competitors may, as a result, have certain advantages over us in providing some services.

We compete against these financial institutions by being convenient to do business with, and by taking the time to listen and understand our clients needs. We deliver personalized, one on one banking through knowledgeable local members of the community, offering a full array of products and highly personalized services. We rely on our history and our reputation in northern Indiana dating back to 1863.

Employees

At December 31, 2008, we had approximately 1,280 employees on a full-time equivalent basis. We provide a wide range of employee benefits and consider employee relations to be good.

Regulation and Supervision

General — 1st Source and the Bank are extensively regulated under Federal and State law. To the extent that the following information describes statutory or regulatory provisions, it is qualified in its entirety by reference to the particular statutory and regulatory provisions. Any change in applicable laws or regulations may have a material effect on our business and our prospective business. Our operations may be affected by legislative changes and by the policies of various regulatory authorities. We are unable to predict the nature or the extent of the effects on our business and earnings that fiscal or monetary policies, economic controls, or new Federal or State legislation may have in the future.

We are a registered bank holding company under the Bank Holding Company Act of 1956 (BHCA) and, as such, we are subject to regulation, supervision, and examination by the Board of Governors of the Federal Reserve System (Federal Reserve). We are required to file annual reports with the Federal Reserve and to provide the Federal Reserve such additional information as it may require.

1st Source Bank, as an Indiana state bank and member of the Federal Reserve System, is supervised by the Indiana Department of Financial Institutions (DFI) and the Federal Reserve. As such, 1st Source Bank is regularly examined by and subject to regulations promulgated by the DFI and the Federal Reserve. Because the Federal Deposit Insurance Corporation (FDIC) provides deposit insurance to 1st Source Bank, we are also subject to supervision and regulation by the FDIC (even though the FDIC is not our primary Federal regulator).

Bank Holding Company Act — Under the BHCA, as amended, our activities are limited to business so closely related to banking, managing, or controlling banks as to be a proper incident thereto. We are also subject to capital requirements applied on a consolidated basis in a form substantially similar to those required of the Bank. The BHCA also requires a bank holding company to obtain approval from the Federal Reserve before (i) acquiring, or holding more than 5% voting interest in any bank or bank holding company, (ii) acquiring all or substantially all of the assets of another bank or bank holding company, or (iii) merging or consolidating with another bank holding company.

The BHCA also restricts non-bank activities to those which, by statute or by Federal Reserve regulation or order, have been identified as activities closely related to the business of banking or of managing or controlling banks. As discussed below, the Gramm-Leach-Bliley Act, which was enacted in 1999, established a new type of bank holding company known as a "financial holding company" that has powers that are not otherwise available to bank holding companies.

Financial Institutions Reform, Recovery and Enforcement Act of 1989 — The Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA) reorganized and reformed the regulatory structure applicable to financial institutions generally.

The Federal Deposit Insurance Corporation Improvement Act of 1991 — The Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA) was adopted to supervise and regulate a wide variety of banking issues. In general, FDICIA provides for the recapitalization of the Bank Insurance Fund (BIF), deposit

insurance reform, including the implementation of risk-based deposit insurance premiums, the establishment of five capital levels for financial institutions ("well capitalized," "adequately capitalized," "undercapitalized," "significantly undercapitalized," and "critically undercapitalized") that would impose more scrutiny and restrictions on less capitalized institutions, along with a number of other supervisory and regulatory issues. At December 31, 2008, the Bank was categorized as "well capitalized," meaning that our total risk-based capital ratio exceeded 10.00%, our Tier 1 risk-based capital ratio exceeded 6.00%, our leverage ratio exceeded 5.00%, and we are not subject to a regulatory order, agreement, or directive to meet and maintain a specific capital level for any capital measure.

Federal Deposit Insurance Reform Act — On February 1, 2006, Congress approved the Federal Deposit Insurance Reform Act of 2005 (FDIRA). Among other things, the FDIRA provides for the merger of the Bank Insurance Fund with the Savings Association Insurance Fund and for an immediate increase in Federal deposit insurance for certain retirement accounts up to $250,000. The statute further provides for the indexing of the maximum deposit insurance coverage for all types of deposit accounts in the future to account for inflation. The FDIRA also requires the FDIC to provide certain banks and thrifts that were in existence prior to December 31, 1996 with one-time credits against future premiums based on the amount of their payments to the Bank Insurance Fund or Savings Association Insurance Fund prior to that date.

FDIC Deposit Insurance Assessments — On October 16, 2008, in response to the recent problems facing the financial markets and the economy, the Federal Deposit Insurance Corporation published a restoration plan designed to replenish the Deposit Insurance Fund over a period of five years and to increase the deposit insurance reserve ratio. On December 16, 2008, the FDIC adopted a final rule increasing risk-based assessment rates uniformly by 7 basis points, on an annual basis, for the first quarter 2009. The FDIC indicated that it will issue another final rule early in 2009, to take effect on April 1, 2009, to change the way that the FDIC's assessment system differentiates for risk, make corresponding changes to assessment rates beginning with the second quarter of 2009, and make certain technical and other changes to the assessment rules.

Temporary Liquidity Guarantee Program — On November 21, 2008, the FDIC Board of Directors adopted a final rule implementing the Temporary Liquidity Guarantee Program (TLG Program). The TLG Program consists of two basic components: a guarantee of newly issued senior unsecured debt of banks, thrifts, and certain holding companies (the debt guarantee program) and full guarantee of non-interest bearing deposit transaction accounts, such as business payroll accounts, regardless of dollar amount (the transaction account guarantee program). The purpose of the guarantee of transaction accounts and the debt guarantee is to reduce funding costs and allow banks and thrifts to increase lending to consumers and businesses. All insured depository institutions were automatically enrolled in both programs unless they elected to opt out by a specified date. 1st Source did not elect to opt out and thus participates in both programs.

Emergency Economic Stabilization Act of 2008 — On October 3, 2008, President George W. Bush signed the Emergency Economic Stabilization Act of 2008 (EESA). This Act temporarily raises the basic limit on federal deposit insurance coverage from $100,000 to $250,000 per depositor effective immediately. This temporary increase in the deposit insurance limit expires on December 31, 2009.

Under the Troubled Asset Relief Program established by EESA, the U.S. Treasury Department announced a Capital Purchase Program (CPP). CPP is designed to encourage U.S. financial institutions to build capital to increase the flow of financing to U.S. businesses and consumers and support the U.S. economy. Under the program, Treasury will purchase up to $250 billion of senior preferred shares on standardized terms as described in the program's term sheet. The program is available to qualifying U.S. controlled banks, savings associations, and certain bank and savings and loan holding companies engaged only in financial activities that elect submitted applications to Treasury by November 14, 2008. EESA provides for Treasury to determine an applicant’s eligibility to participate in the CPP after consulting with the appropriate federal banking agency.

1st Source submitted an application to participate in the CPP and obtained Treasury approval on December 11, 2008. On January 23, 2009, 1st Source issued preferred stock valued at $111.00 million and a warrant to acquire 837,947 shares of its common stock to Treasury pursuant to the CPP. The warrant is exercisable at any time during the ten-year period following issuance at an exercise price of $19.87.

Securities and Exchange Commission (SEC) and The Nasdaq Stock Market (Nasdaq) — We are under the jurisdiction of the SEC and certain state securities commissions for matters relating to the offering and sale of our securities and our investment advisory services. We are subject to the disclosure and regulatory requirements of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, as administered by the SEC. We are listed on the Nasdaq Global Select Market under the trading symbol "SRCE," and we are subject to the rules of Nasdaq for listed companies.

Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 — Congress enacted the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 (Interstate Act) in September 1994. Beginning in September 1995, bank holding companies have the right to expand, by acquiring existing banks, into all states, even those which had theretofore restricted entry. The legislation also provides that, subject to future action by individual states, a holding company has the right to convert the banks which it owns in different states to branches of a single bank. The states of Indiana and Michigan have adopted the interstate branching provisions of the Interstate Act.

Economic Growth and Regulatory Paperwork Reduction Act of 1996 — The Economic Growth and Regulatory Paperwork Reduction Act of 1996 (EGRPRA) was signed into law on September 30, 1996. Among other things, EGRPRA streamlined the non-banking activities application process for well-capitalized and well-managed bank holding companies.

Gramm-Leach-Bliley Act of 1999 — The Gramm-Leach-Bliley Act of 1999 (GLBA) is intended to modernize the banking industry by removing barriers to affiliation among banks, insurance companies, the securities industry, and other financial service providers. It provides financial organizations with the flexibility of structuring such affiliations through a holding company structure or through a financial subsidiary of a bank, subject to certain limitations. The GLBA establishes a new type of bank holding company, known as a financial holding company, which may engage in an expanded list of activities that are "financial in nature," which include securities and insurance brokerage, securities underwriting, insurance underwriting, and merchant banking. The GLBA also sets forth a system of functional regulation that makes the Federal Reserve the "umbrella supervisor" for holding companies, while providing for the supervision of the holding company’s subsidiaries by other Federal and state agencies. A bank holding company may not become a financial holding company if any of its subsidiary financial institutions are not well-capitalized or well-managed. Further, each bank subsidiary of the holding company must have received at least a satisfactory Community Reinvestment Act (CRA) rating. The GLBA also expands the types of financial activities a national bank may conduct through a financial subsidiary, addresses state regulation of insurance, generally prohibits unitary thrift holding companies organized after May 4, 1999 from participating in new activities that are not financial in nature, provides privacy protection for nonpublic customer information of financial institutions, modernizes the Federal Home Loan Bank system, and makes miscellaneous regulatory improvements. The Federal Reserve and the Secretary of the Treasury must coordinate their supervision regarding approval of new financial activities to be conducted through a financial holding company or through a financial subsidiary of a bank. While the provisions of the GLBA regarding activities that may be conducted through a financial subsidiary directly apply only to national banks, those provisions indirectly apply to state-

chartered banks. In addition, the Bank is subject to other provisions of the GLBA, including those relating to CRA and privacy, regardless of whether we elect to become a financial holding company or to conduct activities through a financial subsidiary. We do not, however, currently intend to file notice with the Board to become a financial holding company or to engage in expanded financial activities through a financial subsidiary.

Financial Privacy — In accordance with the GLBA, Federal banking regulators adopted rules that limit the ability of banks and other financial institutions to disclose non-public information about customers to nonaffiliated third parties. These limitations require disclosure of privacy policies to consumers and, in some circumstances, allow consumers to prevent disclosure of certain personal information to a nonaffiliated third party. The privacy provisions of the GLBA affect how consumer information is transmitted through diversified financial companies and conveyed to outside vendors.

USA Patriot Act of 2001 — The USA Patriot Act of 2001 (USA Patriot Act) was signed into law following the terrorist attacks of September 11, 2001. The USA Patriot Act is comprehensive anti-terrorism legislation that, among other things, substantially broadened the scope of anti-money laundering laws and regulations by imposing significant new compliance and due diligence obligations on financial institutions.

The regulations adopted by the United States Treasury Department under the USA Patriot Act impose new obligations on financial institutions to maintain appropriate policies, procedures and controls to detect, prevent and report money laundering, and terrorist financing. Additionally, the regulations require that we, upon request from the appropriate Federal regulatory agency, provide records related to anti-money laundering, perform due diligence of private banking and correspondent accounts, establish standards for verifying customer identity, and perform other related duties.

Failure of a financial institution to comply with the USA Patriot Act's requirements could have serious legal and reputational consequences for the institution.

Regulations Governing Capital Adequacy — The Federal bank regulatory agencies use capital adequacy guidelines in their examination and regulation of bank holding companies and banks. If capital falls below the minimum levels established by these guidelines, a bank holding company or bank will be required to submit an acceptable plan for achieving compliance with the capital guidelines and will be subject to denial of applications and appropriate supervisory enforcement actions. The various regulatory capital requirements that we are subject to are disclosed in Part II, Item 8, Financial Statements and Supplementary Data — Note R of the Notes to Consolidated Financial Statements. Our management believes that the risk-weighting of assets and the risk-based capital guidelines do not have a material adverse impact on our operations or on the operations of the Bank.

Community Reinvestment Act — The Community Reinvestment Act of 1977 requires that, in connection with examinations of financial institutions within their jurisdiction, the Federal banking regulators must evaluate the record of the financial institutions in meeting the credit needs of their local communities, including low and moderate income neighborhoods, consistent with the safe and sound operation of those banks. Federal banking regulators are required to consider a financial institution's performance in these areas as they review applications filed by the institution to engage in mergers or acquisitions or to open a branch or facility.

Regulations Governing Extensions of Credit — 1st Source Bank is subject to certain restrictions imposed by the Federal Reserve Act on extensions of credit to 1st Source or our subsidiaries, or investments in our securities and on the use of our securities as collateral for loans to any borrowers. These regulations and restrictions may limit our ability to obtain funds from the Bank for our cash needs, including funds for acquisitions and for payment of dividends, interest and operating expenses. Further, the BHCA, certain regulations of the Federal Reserve, state laws and many other Federal laws govern the extensions of credit and generally prohibit a bank from extending credit, engaging in a lease or sale of property, or furnishing services to a customer on the condition that the customer obtain additional services from the bank’s holding company or from one of its subsidiaries.

1st Source Bank is also subject to certain restrictions imposed by the Federal Reserve Act on extensions of credit to executive officers, directors, principal shareholders, or any related interest of such persons. Extensions of credit (i) must be made on substantially the same terms, including interest rates and collateral, and subject to credit underwriting procedures that are at least as stringent as those prevailing at the time for comparable transactions with non affiliates, and (ii) must not involve more than the normal risk of repayment or present other unfavorable features. The Bank is also subject to certain lending limits and restrictions on overdrafts to such persons.

Reserve Requirements — The Federal Reserve requires all depository institutions to maintain reserves against their transaction account deposits. The Bank must maintain reserves of 3.00% against net transaction accounts greater than $10.30 million and up to $44.40 million (subject to adjustment by the Federal Reserve) and reserves of 10.00% must be maintained against that portion of net transaction accounts in excess of $44.40 million.

Dividends — The ability of the Bank to pay dividends is limited by state and Federal Regulations that require 1st Source Bank to obtain the prior approval of the DFI before paying a dividend that, together with other dividends it has paid during a calendar year, would exceed the sum of its retained net income for the year to date combined with its retained net income for the previous two years. The amount of dividends the Bank may pay may also be limited by certain covenant agreements and by the principles of prudent bank management. See Part II, Item 5, Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities for further discussion of dividend limitations.

Monetary Policy and Economic Control — The commercial banking business in which we engage is affected not only by general economic conditions, but also by the monetary policies of the Federal Reserve. Changes in the discount rate on member bank borrowing, availability of borrowing at the "discount window," open market operations, the imposition of changes in reserve requirements against member banks deposits and assets of foreign branches, and the imposition of, and changes in, reserve requirements against certain borrowings by banks and their affiliates are some of the instruments of monetary policy available to the Federal Reserve. These monetary policies are used in varying combinations to influence overall growth and distributions of bank loans, investments, and deposits, and such use may affect interest rates charged on loans and leases or paid on deposits. The monetary policies of the Federal Reserve have had a significant effect on the operating results of commercial banks and are expected to do so in the future. The monetary policies of the Federal Reserve are influenced by various factors, including inflation, unemployment, short-term and long-term changes in the international trade balance, and in the fiscal policies of the U.S. Government. Future monetary policies and the effect of such policies on our future business and earnings, and the effect on the future business and earnings of the Bank cannot be predicted.

Sarbanes-Oxley Act of 2002 — On July 30, 2002, the Sarbanes-Oxley Act of 2002 (SOA) was signed into law. The SOA's stated goals include enhancing corporate responsibility, increasing penalties for accounting and auditing improprieties at publicly traded companies and protecting investors by improving the accuracy and reliability of corporate disclosures pursuant to the securities laws. The SOA generally applies to all companies that file or are required to file periodic reports with the SEC under the Securities Exchange Act of 1934 (Exchange Act.)

Among other things, the SOA creates the Public Company Accounting Oversight Board as an independent body subject to SEC supervision with responsibility for setting auditing, quality control, and ethical standards for auditors of public companies. The SOA also requires public companies to make faster and more-extensive financial disclosures, requires the chief executive officer and the chief financial officer of public companies to provide signed certifications as to the accuracy and completeness of financial information filed with the SEC, and provides enhanced criminal and civil penalties for violations of the Federal securities laws.

The SOA also addresses functions and responsibilities of audit committees of public companies. The statute, by mandating certain stock exchange listing rules, makes the audit committee directly responsible for the appointment, compensation, and oversight of the work of the company's outside auditor, and requires the auditor to report directly to the audit committee. The SOA authorizes each audit committee to engage independent counsel and other advisors, and requires a public company to provide the appropriate funding, as determined by its audit committee, to pay the company's auditors and any advisors that its audit committee retains. The SOA also requires public companies to prepare an internal control report and assessment by management, along with an attestation to this report prepared by the company's registered public accounting firm, in their annual reports to stockholders.

Pending Legislation — Because of concerns relating to competitiveness and the safety and soundness of the banking industry, Congress often considers a number of wide-ranging proposals for altering the structure, regulation, and competitive relationships of the nation’s financial institutions. We cannot predict whether or in what form any proposals will be adopted or the extent to which our business may be affected thereby.

Fluctuations in interest rates could reduce our profitability and affect the value of our assets — Like other financial institutions, we are subject to interest rate risk. Our primary source of income is net interest income, which is the difference between interest earned on loans and leases and investments, and interest paid on deposits and borrowings. We expect that we will periodically experience imbalances in the interest rate sensitivities of our assets and liabilities and the relationships of various interest rates to each other. Over any defined period of time, our interest-earning assets may be more sensitive to changes in market interest rates than our interest-bearing liabilities, or vice-versa. In addition, the individual market interest rates underlying our loan and lease and deposit products may not change to the same degree over a given time period. In any event, if market interest rates should move contrary to our position, earnings may be negatively affected. In addition, loan and lease volume and quality and deposit volume and mix can be affected by market interest rates as can the businesses of our clients. Changes in levels of market interest rates could have a material adverse affect on our net interest spread, asset quality, origination volume, and overall profitability.

Market interest rates are beyond our control, and they fluctuate in response to general economic conditions and the policies of various governmental and regulatory agencies, in particular, the Federal Reserve Board. Changes in monetary policy, including changes in interest rates, may negatively affect our ability to originate loans and leases, the value of our assets and our ability to realize gains from the sale of our assets, all of which ultimately could affect our earnings.

Future expansion involves risks — In the future, we may acquire all or part of other financial institutions and we may establish de novo branch offices. There could be considerable costs involved in executing our growth strategy. For instance, new branches generally require a period of time to generate sufficient revenues to offset their costs, especially in areas in which we do not have an established presence. Accordingly, any new branch expansion could be expected to negatively impact earnings for some period of time until the branch reaches certain economies of scale. Acquisitions and mergers involve a number of risks, including the risk that:

| · | We may incur substantial costs identifying and evaluating potential acquisitions and merger partners, or in evaluating new markets, hiring experienced local managers, and opening new offices; |

| · | Our estimates and judgments used to evaluate credit, operations, management, and market risks relating to target institutions may not be accurate; |

| · | There may be substantial lag-time between completing an acquisition or opening a new office and generating sufficient assets and deposits to support costs of the expansion; |

| · | We may not be able to finance an acquisition, or the financing we obtain may have an adverse effect on our operating results or dilution of our existing shareholders; |

| · | The attention of our management in negotiating a transaction and integrating the operations and personnel of the combining businesses may be diverted from our existing business; |

| · | Acquisitions typically involve the payment of a premium over book and market values and; therefore, some dilution of our tangible book value and net income per common share may occur in connection with any future transaction; |

| · | We may enter new markets where we lack local experience; |

| · | We may incur goodwill in connection with an acquisition, or the goodwill we incur may become impaired, which results in adverse short-term effects on our operating results; or |

| · | We may lose key employees and clients. |

Competition from other financial services providers could adversely impact our results of operations — The banking and financial services business is highly competitive. We face competition in making loans and leases, attracting deposits and providing insurance, investment, trust, and other financial services. Increased competition in the banking and financial services businesses may reduce our market share, impair our growth or cause the prices we charge for our services to decline. Our results of operations may be adversely impacted in future periods depending upon the level and nature of competition we encounter in our various market areas.

We are dependent upon the services of our management team — Our future success and profitability is substantially dependent upon our management and the banking abilities of our senior executives. We believe that our future results will also depend in part upon our ability to attract and retain highly skilled and qualified management. We are especially dependent on a limited number of key management personnel, many of whom do not have employment agreements with us. The loss of the chief executive officer and other senior management and key personnel could have a material adverse impact on our operations because other officers may not have the experience and expertise to readily replace these individuals. Many of these senior officers have primary contact with our clients and are important in maintaining personalized relationships with our client base. The unexpected loss of services of one or more of these key employees could have a material adverse effect on our operations and possibly result in reduced revenues if we were unable to find suitable replacements promptly. Competition for senior personnel is intense, and we may not be successful in attracting and retaining such personnel. Changes in key personnel and their responsibilities may be disruptive to our businesses and could have a material adverse effect on our businesses, financial condition, and results of operations.

Technology security breaches and constant technological change — Any compromise of our security also could deter our clients from using our internet

banking services that involve the transmission of confidential information. We rely on standard internet security systems to provide the security and authentication necessary to effect secure transmission of data. These precautions may not protect our systems from compromises or breaches of our security measures that could result in damage to our reputation and business.

The financial services industry is constantly undergoing rapid technological change with frequent introductions of new technology-driven products and services. The effective use of technology increases efficiency and enables financial institutions to better service clients and reduce costs. Our future success depends, in part, upon our ability to address the needs of our clients by using technology to provide products and services that will satisfy client demands, as well as create additional efficiencies within our operations. Many of our competitors have substantially greater resources to invest in technological improvements. We may not be able to effectively implement new technology-driven products and services or be successful in marketing these products and services to our clients. Failure to successfully keep pace with technological change affecting the financial services industry could have a material adverse impact on our business and, in turn, our financial condition and results of operations.

We are subject to credit risks relating to our loan and lease portfolios — We have certain lending policies and procedures in place that are designed to optimize loan and lease income within an acceptable level of risk. Our management reviews and approves these policies and procedures on a regular basis. A reporting system supplements the review process by providing our management with frequent reports related to loan and lease production, loan quality, concentrations of credit, loan and lease delinquencies, and nonperforming and potential problem loans and leases. Diversification in the loan and lease portfolios is a means of managing risk associated with fluctuations and economic conditions.

We maintain an independent loan review department that reviews and validates the credit risk program on a periodic basis. Results of these reviews are presented to our management. The loan and lease review process complements and reinforces the risk identification and assessment decisions made by lenders and credit personnel, as well as our policies and procedures.

In the financial services industry, there is always a risk that certain borrowers may not repay borrowings. Our reserve for loan and lease losses may not be sufficient to cover the loan and lease losses that we may actually incur. If we experience defaults by borrowers in any of our businesses, our earnings could be negatively affected. Changes in local economic conditions could adversely affect credit quality, particularly in our local business loan and lease portfolio. Changes in national economic conditions could also adversely affect the quality of our loan and lease portfolio and negate, to some extent, the benefits of national diversification through our Specialty Finance Group’s portfolio.

Commercial and commercial real estate loans generally involve higher credit risks than residential real estate and consumer loans. Because payments on loans secured by commercial real estate or equipment are often dependent upon the successful operation and management of the underlying assets, repayment of such loans may be influenced to a great extent by conditions in the market or the economy. We seek to minimize these risks through our underwriting standards. We obtain financial information and perform credit risk analysis on our customers. Credit criteria may include, but are not limited to, assessments of income, cash flows, and net worth; asset ownership; bank and trade credit reference; credit bureau report; and operational history.

Commercial real estate or equipment loans are underwritten after evaluating and understanding the borrower's ability to operate profitably and generate positive cash flows. Our management examines current and projected cash flows of the borrower to determine the ability of the borrower to repay their obligations as agreed. Underwriting standards are designed to promote relationship banking rather than transactional banking. Most commercial and industrial loans are secured by the assets being financed or other business assets; however, some loans may be made on an unsecured basis. Our credit policy sets different maximum exposure limits both by business sector and our current and historical relationship and previous experience with each customer.

We offer both fixed-rate and adjustable-rate consumer mortgage loans secured by properties, substantially all of which are located in our primary market area. Adjustable-rate mortgage loans help reduce our exposure to changes in interest rates; however, during periods of rising interest rates, the risk of default on adjustable-rate mortgage loans may increase as a result of repricing and the increased payments required from the borrower. Additionally, most residential mortgages are sold into the secondary market and serviced by our principal banking subsidiary, 1st Source Bank.

Consumer loans are primarily all other non-real estate loans to individuals in our regional market area. Consumer loans can entail risk, particularly in the case of loans that are unsecured or secured by rapidly depreciating assets. In these cases, any repossessed collateral may not provide an adequate source of repayment of the outstanding loan balance. The remaining deficiency often does not warrant further substantial collection efforts against the borrower beyond obtaining a deficiency judgment. In addition, consumer loan collections are dependent on the borrower’s continuing financial stability, and thus are more likely to be adversely affected by job loss, divorce, illness, or personal bankruptcy.

The 1st Source Specialty Finance Group loan and lease portfolio consists of commercial loans and leases secured by construction and transportation equipment, including aircraft, autos, trucks, and vans. Finance receivables for this Group generally provide for monthly payments and may include prepayment penalty provisions.

Our construction and transportation related businesses could be adversely affected by slow downs in the economy. Clients who rely on the use of assets financed through the Specialty Finance Group to produce income could be negatively affected, and we could experience substantial loan and lease losses. By the nature of the businesses these clients operate in, we could be adversely affected by continued rapid increases of fuel costs. Since some of the relationships in these industries are large (up to $25 million), a slow down could have a significant adverse impact on our performance.

Our construction and transportation related businesses could be adversely impacted by the negative effects caused by high fuel costs, terrorist and other potential attacks, and other destabilizing events. These factors could contribute to the deterioration of the quality of our loan and lease portfolio, as they could have a negative impact on the travel sensitive businesses for which our specialty finance businesses provide financing.

In addition, our leasing and equipment financing activity is subject to the risk of cyclical downturns, industry concentration and clumping, and other adverse economic developments affecting these industries and markets. This area of lending, with transportation in particular, is dependent upon general economic conditions and the strength of the travel, construction, and transportation industries.

The soundness of other financial institutions could adversely affect us — Financial services institutions are interrelated as a result of trading, clearing, counterparty, or other relationships. We have exposure to many different industries and counterparties, and we routinely execute transactions with counterparties in the financial services industry, including commercial banks, brokers and dealers, investment banks, and other institutional clients. Many of these transactions expose us to credit risk in the event of a default by our counterparty or client. In addition, our credit risk may be exacerbated when the collateral held by us cannot be realized or is liquidated at prices not sufficient to recover the full amount of the credit or derivative exposure due us. Any such losses could have a material adverse affect on our financial condition and results of operations.

Economic conditions and current levels of market volatility are unprecedented — We are impacted by general business and economic conditions in the United States and abroad. These conditions include short-term and long-term interest rates, inflation, money supply, political issues, legislative and regulatory changes, fluctuations in both debt and equity capital markets, broad trends in industry and finance, unemployment, and the strength of the U.S. economy and the local economies in which we operate, all of which are beyond our control. A deterioration in economic conditions could result in an increase in loan delinquencies and non-performing assets, decreases in loan collateral values and a decrease in demand for our products and services.

The capital and credit markets have been experiencing extreme volatility and disruption for more than 12 months. The volatility and disruption have reached unprecedented levels. In some cases, the markets have exerted downward pressure on stock prices, security prices and credit capacity for certain issuers without regard to those issuers’ underlying financial strength. If the current levels of market disruption and volatility continue or worsen, there can be no assurance that we will not experience adverse effects, which may be material, on our ability to access capital and on our results of operations.

We are subject to extensive government regulation and supervision — Our operations are subject to extensive federal and state regulation and supervision. Banking regulations are primarily intended to protect depositors' funds, federal deposit insurance funds and the banking system as a whole, not security holders. These regulations affect our lending practices, capital structure, investment practices, dividend policy and growth, among other things. Congress and federal regulatory agencies continually review banking laws, regulations and policies for possible change. Changes to statutes, regulations or regulatory policies, including changes in interpretation or implementation of statutes, regulation or policies, could affect us in substantial and unpredictable ways. Such changes could subject us to additional costs and limit the types of financial services and products we may offer. Failure to comply with laws, regulations or policies could result in sanctions by regulatory agencies, civil money penalties and/or reputation damage, which could have a material adverse effect on our business, financial condition and results of operations. While we have policies and procedures designed to prevent any such violations, there can be no assurance that such violations will not occur.

Reliance on dividends from our subsidiaries — Our parent company, 1st Source Corporation, receives substantially all of its revenue from dividends from our subsidiaries. These dividends are the principal source of funds to pay dividends on our common stock and interest and principal on our debt. Various federal and/or state laws and regulations limit the amount of dividends that our subsidiaries may pay to our parent company. In the event our subsidiaries are unable to pay dividends to our parent company, we may not be able to service debt, pay obligations or pay dividends on our common stock. The inability to receive dividends from our subsidiaries could have a material adverse affect on our business, financial condition and results of operations.

Changes in accounting standards could impact reported earnings — Current accounting and tax rules, standards, policies and interpretations influence the methods by which financial institutions conduct business, implement strategic initiatives and tax compliance, and govern financial reporting and disclosures. These laws, regulations, rules, standards, policies and interpretations are constantly evolving and may change significantly over time. Events that may not have a direct impact on us, such as bankruptcy of major U.S. companies, have resulted in legislators, regulators, and authoritative bodies, such as the Financial Accounting Standards Board, the Securities and Exchange Commission, the Public Company Accounting Oversight Board and various taxing authorities, responding by adopting and/or proposing substantive revision to laws, regulations, rules, standards, policies and interpretations. New accounting pronouncements and varying interpretations of accounting pronouncements have occurred and may occur in the future. A change in accounting standards may adversely affect reported financial condition and results of operations.

Impact of recently enacted legislation and our participation in the programs — The Emergency Economic Stabilization Act of 2008 (the "EESA") is intended to stabilize and provide liquidity to the U.S. financial markets. There can be no assurance, however, as to the actual impact that the EESA and its regulations and other governmental programs will have on the financial markets. The failure of the financial markets to stabilize and a continuation or worsening of current financial market conditions could adversely affect our business, financial condition and results of operations. The programs established or to be established under the EESA and Troubled Asset Relief Program may have adverse effects on us. We may face increased regulation of our industry. Compliance with such regulation may increase our costs and limit our ability to pursue business opportunities.

Our participation in the Treasury’s Capital Purchase Program may adversely affect the value of our common stock and the rights of our common shareholders — The terms of the preferred stock we issued under the Treasury’s Capital Purchase Program could reduce investment returns to our common shareholders by restricting dividends, diluting existing shareholders’ ownership interests, and restricting capital management practices. Without the prior consent of the Treasury, we will be prohibited from increasing our common stock dividends for the first three years while the Treasury holds the preferred stock.

Also, the preferred stock requires quarterly dividends to be paid at the rate of 5% per annum for the first five years and 9% per annum thereafter until the stock is redeemed by us. The payments of these dividends will decrease the excess cash we otherwise have available to pay dividends on our common stock and to use for general corporate purposes, including working capital.

Finally, we will be prohibited from continuing to pay dividends on our common stock unless we have fully paid all required dividends on the preferred stock issued to the Treasury. Although we fully expect to be able to pay all required dividends on the preferred stock (and to continue to pay dividends on our common stock at current levels), there is no guarantee that we will be able to do so in the future.

Our deposit insurance premiums could be substantially higher in the future which will have an adverse effect on our future earnings — Under the Federal Deposit Insurance Act, the FDIC, absent extraordinary circumstances, must establish and implement a plan to restore the deposit insurance reserve ratio to 1.15% of insured deposits, over a five-year period, at any time that the reserve ratio falls below 1.15%. The recent failures of a large financial institution and several smaller ones have significantly increased the Deposit Insurance Fund’s loss provisions, resulting in a decline in the reserve ratio to 1.01% as of June 30, 2008, 18 basis points below the reserve ratio as of March 31, 2008. The FDIC expects a higher rate of insured institution failures in the next few years, which may result in a continued decline in the reserve ratio.

On October 7, 2008, the FDIC released a five-year recapitalization plan and a proposal to raise premiums to recapitalize the fund. In order to implement the restoration plan, the FDIC proposed to change both its risk-based assessment system and its base assessment rates. Assessment rates would increase by seven basis points across the range of risk weightings. In December 2008, the FDIC adopted its rule, uniformly increasing the risk-based assessment rates by seven basis points, annually, resulting in a range of risk-based assessment of 12 basis points to 50 basis points. Changes to the risk-based assessment system would include increasing premiums for institutions that rely on excessive amounts of brokered deposits, increasing premiums for excessive use of secured liabilities, and lowering premiums for smaller institutions with very high capital levels.

As a member institution of the FDIC, we are required to pay quarterly deposit insurance premium assessments to the FDIC. Due to the continued failures of unaffiliated FDIC insured depository institutions, we anticipate that our FDIC deposit insurance premiums will increase in the future, perhaps significantly, which will adversely impact our future earnings.

None

Our headquarters building is located in downtown South Bend. In 1982, the land was leased from the City of South Bend on a 49-year lease, with a 50-year renewal option. The building is part of a larger complex, including a 300-room hotel and a 500-car parking garage. Also, in 1982, we sold the building and entered into a leaseback agreement with the purchaser for a term of 30 years. The building is a structure of approximately 160,000 square feet, with 1st Source and our subsidiaries occupying approximately 65% of the available office space and approximately 35% subleased to unrelated tenants.

At December 31, 2008, we also owned property and/or buildings on which 55 of the 1st Source Bank's 79 banking centers were located, including the facilities in Allen, Elkhart, Fulton, Huntington, Kosciusko, LaPorte, Marshall, Porter, St. Joseph, Starke, and Wells Counties in the State of Indiana and Berrien and Cass Counties in the State of Michigan, as well as an operations center, training facility, warehouse, and our former headquarters building, which is utilized for additional business operations. The Bank leases additional property and/or buildings to and from third parties under lease agreements negotiated at arms-length.

1st Source and our subsidiaries are involved in various legal proceedings incidental to the conduct of our businesses. Our management does not expect that the outcome of any such proceedings will have a material adverse effect on our consolidated financial position or results of operations.

None

Part II

Our common stock is traded on the Nasdaq Global Select Market under the symbol "SRCE." The following table sets forth for each quarter the high and low sales prices for our common stock, as reported by Nasdaq, and the cash dividends paid per share for each quarter.

| | | 2008 Sales Price | | Cash Dividends | | 2007 Sales Price | | Cash Dividends |

Common Stock Prices (quarter ended) | | High | | Low | | Paid | | High | | Low | | Paid |

| March 31 | $ | 21.81 | $ | 15.13 | $ | .14 | $ | 32.62 | $ | 24.27 | $ | .14 |

| June 30 | | 22.62 | | 16.10 | | .14 | | 27.92 | | 23.32 | | .14 |

| September 30 | | 30.00 | | 14.54 | | .14 | | 27.00 | | 18.41 | | .14 |

| December 31 | | 25.56 | | 12.61 | | .16 | | 24.47 | | 16.28 | | .14 |

| As of December 31, 2008, there were 1,012 holders of record of 1st Source common stock | | | | |

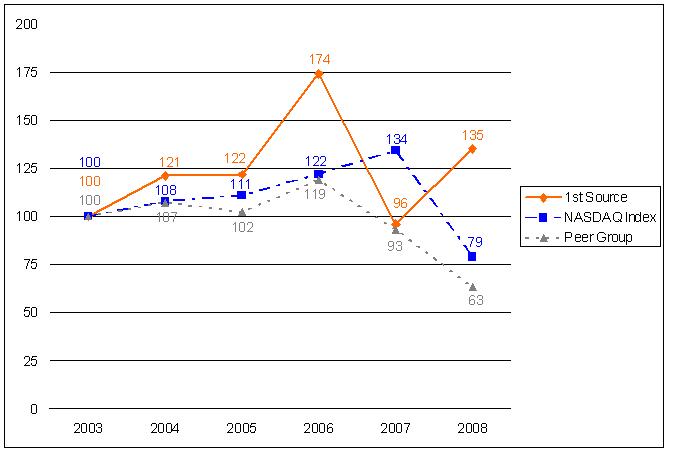

Comparison of Five Year Cumulative Total Return*

Among 1st Source, Morningstar Market Weighted NASDAQ Index** and Peer Group Index***

* Assumes $100 invested on December 31, 2003, in 1st Source Corporation common stock, NASDAQ market index, and peer group index.

** The Morningstar Weighted NASDAQ Index Return is calculated using all companies which trade as NASD Capital Markets, NASD Global Markets or NASD Global Select It includes both domestic and foreign companies. The index is weighted by the then current shares outstanding and assumes dividends reinvested. The return is calculated on a monthly basis.

*** The peer group is a market-capitalization-weighted stock index of 59 banking companies in Indiana, Michigan, Ohio, and Wisconsin.

NOTE: Total return assumes reinvestment of dividends.

1st Source maintains a stock repurchase plan that was authorized by the Board of Directors on April 26, 2007. Under the terms of the plan, 1st Source may repurchase up to 2,000,000 shares of its common stock when favorable conditions exist on the open market or through private transactions at various prices from time to time. Since the inception of the plan, 1st Source has repurchased a total of 552,552 shares. No shares were repurchased during the three months ended December 31, 2008.

Federal laws and regulations contain restrictions on the ability of 1st Source and the Bank to pay dividends. For information regarding restrictions on dividends, see Part I, Item 1, Business - Regulation and Supervision - Dividends and Part II, Item 8, Financial Statements and Supplementary Data - Note R of the Notes to Consolidated Financial Statements. In addition, as a result of our participation in the TARP Capital Purchase Program, we may not increase the quarterly dividends we pay on our common stock above $0.16 per share during the three-year period ending January 23, 2012, without the consent of the Treasury Department, unless the Treasury Department no longer holds shares of the Series A Preferred Stock we issued in the TARP Capital Purchase Program.

The following selected financial data should be read in conjunction with our Consolidated Financial Statements and the accompanying notes presented elsewhere herein.

| (Dollars in thousands, except per share amounts) | | 2008 | | | 2007 (2) | | | 2006 | | | 2005 | | | 2004 | |

| | $ | 235,308 | | | $ | 253,587 | | | $ | 208,994 | | | $ | 168,532 | | | $ | 151,437 | |

| Interest expense | | | 103,148 | | | | 134,677 | | | | 102,561 | | | | 70,104 | | | | 52,749 | |

| Net interest income | | | 132,160 | | | | 118,910 | | | | 106,433 | | | | 98,428 | | | | 98,688 | |

| Provision for (recovery of) loan and lease losses | | | 16,648 | | | | 7,534 | | | | (2,736 | ) | | | (5,855 | ) | | | 229 | |

| Net interest income after provision for (recovery of) | | | | | | | | | | | | | | | | | | | | |

| loan and lease losses | | | 115,512 | | | | 111,376 | | | | 109,169 | | | | 104,283 | | | | 98,459 | |

| Noninterest income | | | 84,003 | | | | 70,619 | | | | 76,585 | | | | 68,533 | | | | 62,733 | |

| Noninterest expense | | | 153,114 | | | | 140,312 | | | | 126,211 | | | | 123,439 | | | | 127,091 | |

| Income before income taxes | | | 46,401 | | | | 41,683 | | | | 59,543 | | | | 49,377 | | | | 34,101 | |

| Income taxes | | | 13,015 | | | | 11,144 | | | | 20,246 | | | | 15,626 | | | | 9,136 | |

| Net income | | $ | 33,386 | | | $ | 30,539 | | | $ | 39,297 | | | $ | 33,751 | | | $ | 24,965 | |

| Assets at year-end | | $ | 4,464,174 | | | $ | 4,447,104 | | | $ | 3,807,315 | | | $ | 3,511,277 | | | $ | 3,563,715 | |

| Long-term debt and mandatorily redeemable | | | | | | | | | | | | | | | | | | | | |

| securities at year-end | | | 29,832 | | | | 34,702 | | | | 43,761 | | | | 23,237 | | | | 17,964 | |

| Shareholders’ equity at year-end | | | 453,664 | | | | 430,504 | | | | 368,904 | | | | 345,576 | | | | 326,600 | |

| Basic net income per common share (1) | | | 1.38 | | | | 1.30 | | | | 1.74 | | | | 1.48 | | | | 1.10 | |

| Diluted net income per common share (1) | | | 1.37 | | | | 1.28 | | | | 1.72 | | | | 1.46 | | | | 1.08 | |

| Cash dividends per common share (1) | | | .580 | | | | .560 | | | | .534 | | | | .445 | | | | .382 | |

| Dividend payout ratio | | | 42.34 | % | | | 43.75 | % | | | 31.05 | % | | | 30.48 | % | | | 35.37 | % |

| Return on average assets | | | 0.76 | % | | | 0.74 | % | | | 1.11 | % | | | 1.00 | % | | | 0.75 | % |

| Return on average common equity | | | 7.52 | % | | | 7.47 | % | | | 10.98 | % | | | 10.12 | % | | | 7.81 | % |

| Average common equity to average assets | | | 10.09 | % | | | 9.85 | % | | | 10.07 | % | | | 9.89 | % | | | 9.55 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (1) The computation of per common share data gives retroactive recognition to a 10% stock dividend declared July 27, 2006. | | | | | | | | | |

| (2) Results for 2007 and later include the acquisition of FINA Bancorp, Inc. Refer to Note C of the Notes to Consolidated Financial Statements for further details. | | | | | |

The purpose of this analysis is to provide the reader with information relevant to understanding and assessing our results of operations for each of the past three years and financial condition for each of the past two years. In order to fully appreciate this analysis the reader is encouraged to review the consolidated financial statements and statistical data presented in this document.

Forward-Looking Statements

This report, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains forward-looking statements. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions, and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements.

All statements other than statements of historical fact are statements that could be forward-looking statements. Words such as “believe”, “contemplate”, “seek”, “estimate”, “plan”, “project”, “anticipate”, “possible”, “assume”, “expect”, “intend”, “targeted”, “continue”, “remain”, “will”, “should”, “indicate”, “would”, “may” and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Forward-

looking statements provide current expectations or forecasts of future events and are not guarantees of future performance, nor should they be relied upon as representing management’s views as of any subsequent date. The forward-looking statements are based on our expectations and are subject to a number of risks and uncertainties.

All written or oral forward-looking statements that are made by or attributable to us are expressly qualified in their entirety by this cautionary notice. We have no obligation and do not undertake to update, revise, or correct any of the forward-looking statements after the date of this report, or after the respective dates on which such statements otherwise are made. We have expressed our expectations, beliefs, and projections in good faith and we believe they have a reasonable basis. However, we make no assurances that our expectations, beliefs, or projections will be achieved or accomplished. These forward-looking statements may not be realized due to a variety of factors, including, without limitation, the following:

| · | Local, regional, national, and international economic conditions and the impact they may have on us and our clients and our assessment of that impact. |

| · | Changes in the level of nonperforming assets and charge-offs. |

| · | Changes in estimates of future cash reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements. |

| · | The effects of and changes in trade and monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve Board. |

| · | Inflation, interest rate, securities market, and monetary fluctuations. |

| · | Acts of war or terrorism. |

| · | Substantial increases in the cost of fuel. |

| · | The timely development and acceptance of new products and services and perceived overall value of these products and services by others. |

| · | Changes in consumer spending, borrowings, and savings habits. |

| · | Changes in the financial performance and/or condition of our borrowers. |

| · | Acquisitions and integration of acquired businesses. |

| · | The ability to increase market share and control expenses. |

| · | Changes in the competitive environment among bank holding companies. |

| · | The effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities, and insurance) with which we and our subsidiaries must comply. |

| · | The effect of changes in accounting policies and practices and auditing requirements, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board, and other accounting standard setters. |

| · | Changes in our organization, compensation, and benefit plans. |

| · | The costs and effects of legal and regulatory developments including the resolution of legal proceedings or regulatory or other governmental inquires and the results of regulatory examinations or reviews. |

| · | Greater than expected costs or difficulties related to the integration of new products and lines of business. |

| · | Our success at managing the risks described in Item 1A. Risk Factors. |

Application of Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with U. S. generally accepted accounting principles and follow general practices within the industries in which we operate. Application of these principles requires our management to make estimates or judgments that affect the amounts reported in the financial statements and accompanying notes. These estimates or judgments reflect our management’s view of the most appropriate manner in which to record and report our overall financial performance. Because these estimates or judgments are based on current circumstances, they may change over time or prove to be inaccurate based on actual experience. As such, changes in these estimates, judgments, and/or assumptions may have a significant impact on our financial statements. All accounting policies are important, and all policies described in Part II, Item 8, Financial Statements and Supplementary Data, Note A (Note A), should be reviewed for a greater understanding of how our financial performance is recorded and reported.

We have identified three policies as being critical because they require our management to make particularly difficult, subjective, and/or complex estimates or judgments about matters that are inherently uncertain and because of the likelihood that materially different amounts would be reported under different conditions or using different assumptions. These policies relate to the determination of the reserve for loan and lease losses, the valuation of mortgage servicing rights, and the valuation of securities. Our management has used the best information available to make the estimations or judgments necessary to value the related assets and liabilities. Actual performance that differs from estimates or judgments and future changes in the key variables could change future valuations and impact net income. Our management has reviewed the application of these policies with the Audit Committee of the Board of Directors. Following is a discussion of the areas we view as our most critical accounting policies.

Reserve for Loan and Lease Losses — The reserve for loan and lease losses represents our management’s estimate of probable losses inherent in the loan and lease portfolio and the establishment of a reserve that is sufficient to absorb those losses. In determining an adequate reserve, our management makes numerous judgments, assumptions, and estimates based on continuous review of the loan and lease portfolio, estimates of client performance, collateral values, and disposition, as well as historical loss rates and expected cash flows. In assessing these factors, our management benefits from a lengthy organizational history and experience with credit decisions and related outcomes. Nonetheless, if our management’s underlying assumptions prove to be inaccurate, the reserve for loan and lease losses would have to be adjusted. Our accounting policy related to the reserve is disclosed in Note A under the heading "Reserve for Loan and Lease Losses."

Fair Value Measurements: — We use fair value measurements to record certain financial instruments and to determine fair value disclosures. Available-for-sale securities, mortgage loans held for sale, and interest rate swap agreements are financial instruments recorded at fair value on a recurring basis. Additionally,

from time to time, we may be required to record at fair value other financial assets on a nonrecurring basis. These nonrecurring fair value adjustments typically involve write-downs of, or specific reserves against, individual assets. SFAS No. 157, Fair Value Measurements establishes a three-level hierarchy for disclosure of assets and liabilities recorded at fair value. The classification of assets and liabilities within the hierarchy is based on whether the inputs to the valuation methodology used in the measurement are observable or unobservable. Observable inputs reflect market-driven or market-based information obtained from independent sources, while unobservable inputs reflect our estimates about market data.

The degree of management judgment involved in determining the fair value of a financial instrument is dependent upon the availability of quoted market prices or observable market data. For financial instruments that trade actively and have quoted market prices or observable market data, there is minimal subjectivity involved in measuring fair value. When observable market prices and data are not fully available, management judgment is necessary to estimate fair value. In addition, changes in the market conditions may reduce the availability of quoted prices or observable data. For example, reduced liquidity in the capital markets or changes in secondary market activities could result in observable market inputs becoming unavailable. Therefore, when market data is not available, we use valuation techniques that require more management judgment to estimate the appropriate fair value measurement. Fair value is discussed further in Note A under the heading "Fair Value Measurements" and in Note S, "Fair Values of Financial Instruments."

Mortgage Servicing Rights Valuation — We recognize as assets the rights to service mortgage loans for others, known as mortgage servicing rights, whether the servicing rights are acquired through purchases or through originated loans. Mortgage servicing rights do not trade in an active open market with readily observable market prices. Although sales of mortgage servicing rights do occur, the precise terms and conditions may not be readily available. As such, the value of mortgage servicing assets are established and valued using discounted cash flow modeling techniques which require management to make estimates regarding estimated future net servicing cash flows, taking into consideration actual and expected mortgage loan prepayment rates, discount rates, servicing costs, and other economic factors. The expected rates of mortgage loan prepayments are the most significant factors driving the value of mortgage servicing assets. Increases in mortgage loan prepayments reduce estimated future net servicing cash flows because the life of the underlying loan is reduced. In determining the fair value of the mortgage servicing assets, mortgage interest rates (which are used to determine prepayment rates), and discount rates are held constant over the estimated life of the portfolio. Expected mortgage loan prepayment rates are derived from a third-party model and adjusted to reflect our actual prepayment experience. Mortgage servicing assets are carried at the lower of the initial capitalized amount, net of accumulated amortization, or fair value. The values of these assets are sensitive to changes in the assumptions used and readily available market pricing does not exist. The valuation of mortgage servicing assets is discussed further in Note A under the heading "Mortgage Banking Activities."

Recent Market Developments

The global and U.S. economies are experiencing significantly reduced business activity as a result of, among other factors, disruptions in the financial system during the past year. Dramatic declines in the housing market during the past year, with falling home prices and increasing foreclosures and unemployment, have resulted in significant write-downs of asset values by financial institutions, including government-sponsored entities and major commercial and investment banks. These write-downs, initially of residential-related loans and mortgage-backed securities, but spreading to credit default swaps and other derivative securities, have caused many financial institutions to seek additional capital, to merge with larger and stronger institutions and, in some cases, to fail.

Reflecting concern about the stability of the financial markets generally and the strength of counterparties, many lenders and institutional investors have reduced, and in some cases, ceased to provide funding to borrowers, including other financial institutions. The availability of credit, confidence in the financial sector, and level of volatility in the financial markets have been significantly adversely affected as a result. In recent months, volatility and disruption in the capital and credit markets have reached unprecedented levels. In some cases, the markets have produced downward pressure on stock prices and credit capacity for certain issuers without regard to those issuers’ underlying financial strength.

In response to the financial crises affecting the banking system and financial markets and going concern threats to investment banks and other financial institutions, the Emergency Economic Stabilization Act of 2008 ("EESA") was signed into law on October 3, 2008. The EESA authorizes the Treasury to, among other things, purchase up to $700 billion of mortgages, mortgage-backed securities and certain other financial instruments from financial institutions for the purpose of stabilizing and providing liquidity to the U.S. financial markets. The EESA also provided a temporary increase in deposit insurance coverage from $100,000 to $250,000 per insured account until December 31, 2009.

On October 14, 2008, Secretary Paulson, after consulting with the Federal Reserve and the FDIC, announced that the Treasury will purchase equity stakes in certain banks and thrifts. Under this program, known as the Troubled Asset Relief Program Capital Purchase Program (the "TARP Capital Purchase Program"), the Treasury will make $250 billion of capital available to U.S. financial institutions in the form of preferred stock (from the $700 billion authorized by the EESA). In conjunction with the purchase of preferred stock, the Treasury will receive warrants to purchase common stock with an aggregate market price equal to 15% of the preferred investment. Participating financial institutions will be required to adopt the Treasury’s standards for executive compensation and corporate governance for the period during which the Treasury holds equity issued under the TARP Capital Purchase Program.