INVESTOR PRESENTATION 4th Quarter 2023 NASDAQ: SRCE | www.1stsource.com

DISCLOSURES Forward-Looking Statements Except for historical information, the matters discussed may include “forward-looking statements.” Those statements are subject to material risks and uncertainties. 1st Source cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. The audience is advised that various important factors could cause 1st Source’s actual results or circumstances for future periods to differ materially from those anticipated or projected in such forward-looking statements. Please refer to our press releases, Form 10-Qs, and 10-Ks concerning factors that could cause actual results to differ materially from any forward-looking statements of which we undertake no obligation to publicly update or revise. Non-GAAP Financial Measures The accounting and reporting policies of 1st Source conform to generally accepted accounting principles (“GAAP”) in the United States and prevailing practices in the banking industry. However, certain non-GAAP performance measures are used by management to evaluate and measure the Company’s performance. Although these non-GAAP financial measures are frequently used by investors to evaluate a financial institution, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. These include taxable-equivalent net interest income (including its individual components), net interest margin (including its individual components), the efficiency ratio, tangible common equity-to-tangible assets ratio, pre-tax pre-provision income and tangible book value per common share. Management believes that these measures provide users of the Company’s financial information a more meaningful view of the performance of the interest-earning assets and interest- bearing liabilities and of the Company’s operating efficiency. Other financial holding companies may define or calculate these measures differently. See the slides titled “Reconciliation of Non-GAAP Financial Measures” for a reconciliation of certain non-GAAP financial measures used by the Company with their most closely related GAAP measures. 2page

CORPORATE OVERVIEW Founded in 1863 $8.7 billion Community Bank with International Reach headquartered in South Bend, Indiana Community Banking Locations throughout northern Indiana and southwestern Michigan Business and personal banking, payment services, lending, mortgage, and leasing Investment management, wealth advisory, estate planning, and retirement planning services Business and consumer insurance sales Renewable Energy Financing National footprint Construction loans, permanent loans and tax equity investments Community solar, commercial and industrial, small utility scale, university and municipal projects Specialty Finance National and international footprint Construction machinery Corporate and personal aircraft Auto rental and leasing Truck rental and leasing 3page

MISSION & VISION 4page Mission To help our clients achieve security, build wealth and realize their dreams by offering straight talk, sound advice and keeping their best interests in mind for the long-term. Vision Offer our clients the highest quality service Support a proud family of colleagues who personify the 1st Source spirit of partnership Be the financial institution of choice in each market we serve Remain independent and nurture pride of ownership among all 1st Source colleagues Achieve long-term, superior financial results

MARKET AREA 5page Specialty Finance Loans & Leases $3.46 billion Community Bank Loans & Leases $3.08 billion

BUSINESS MIX Loans & Leases 6page COMMUNITY BANKING 47% SPECIALTY FINANCE 53% Business 75% Personal 25%

COMMUNITY BANKING 78 Banking Centers 97 Twenty-four-hour ATMs 9 Trust & Wealth Advisory locations with approximately $5.5 billion of assets under management 10 1st Source Insurance offices 7page In person OnlineOver the phone Mobile

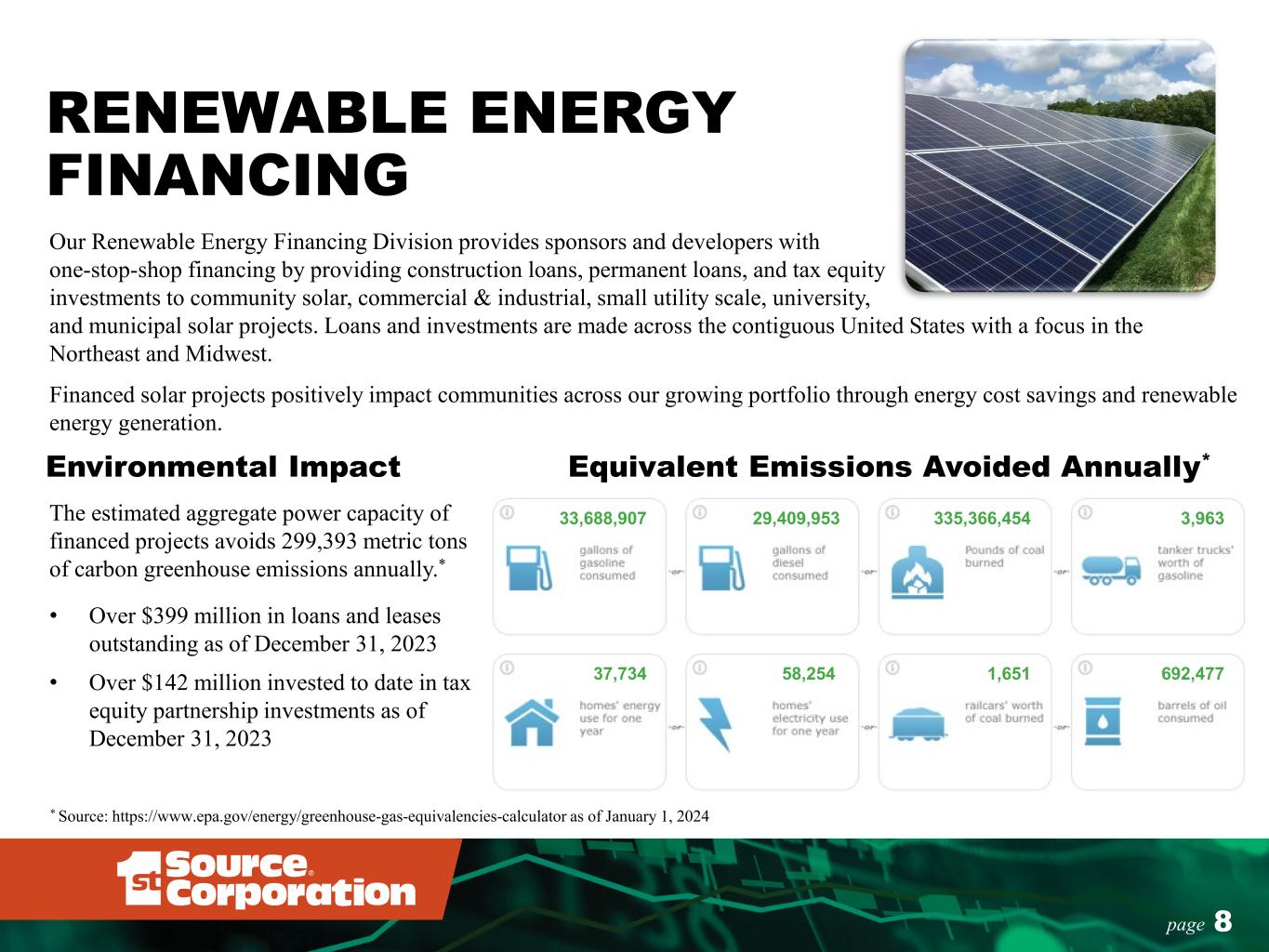

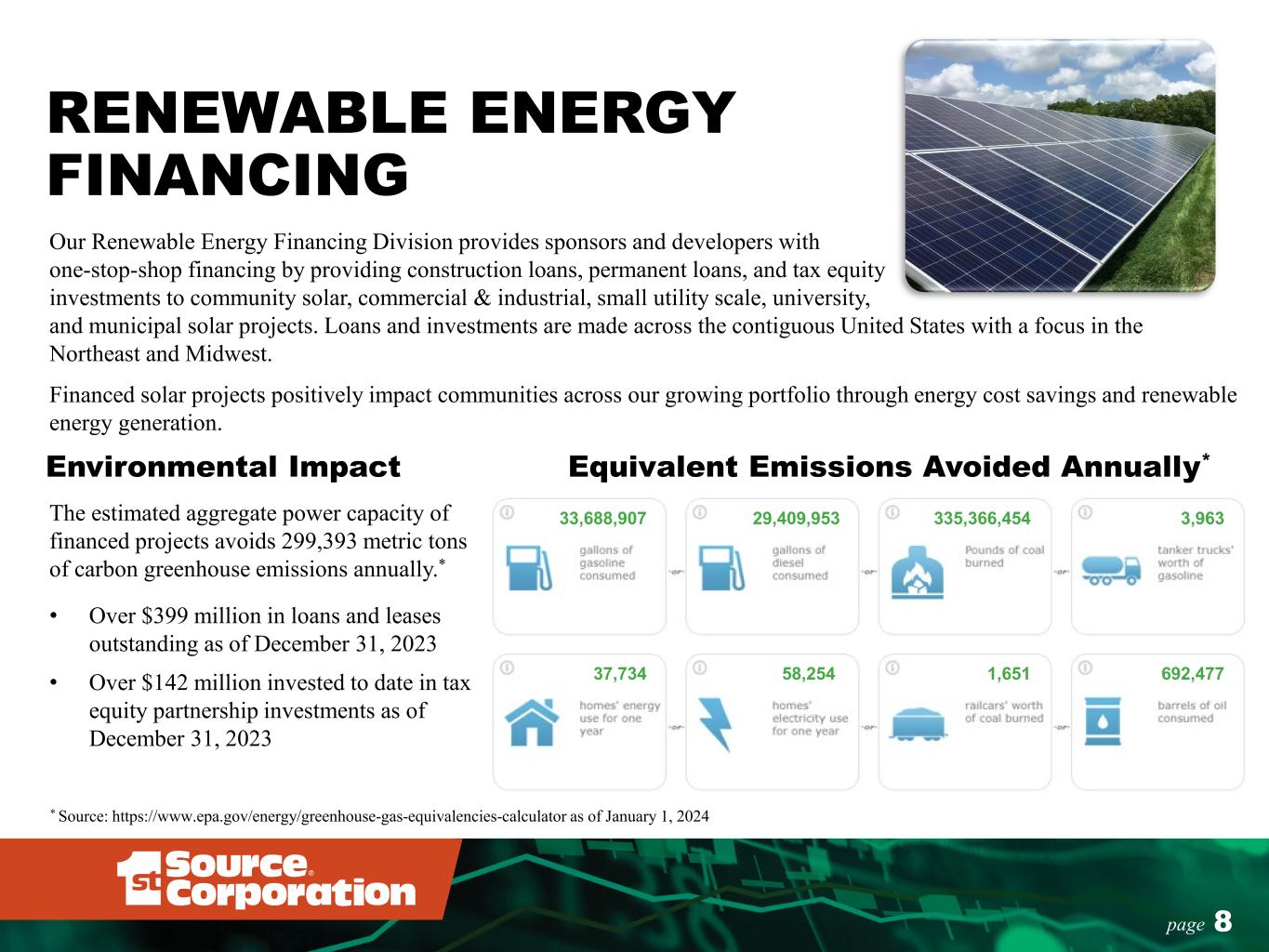

8page RENEWABLE ENERGY FINANCING Our Renewable Energy Financing Division provides sponsors and developers with one-stop-shop financing by providing construction loans, permanent loans, and tax equity investments to community solar, commercial & industrial, small utility scale, university, and municipal solar projects. Loans and investments are made across the contiguous United States with a focus in the Northeast and Midwest. Financed solar projects positively impact communities across our growing portfolio through energy cost savings and renewable energy generation. Environmental Impact The estimated aggregate power capacity of financed projects avoids 299,393 metric tons of carbon greenhouse emissions annually.* • Over $399 million in loans and leases outstanding as of December 31, 2023 • Over $142 million invested to date in tax equity partnership investments as of December 31, 2023 * Source: https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator as of January 1, 2024 Equivalent Emissions Avoided Annually* 33,688,907 29,409,953 335,366,454 3,963 37,734 58,254 1,651 692,477

SPECIALTY FINANCE GROUP Aircraft Division Aircraft division provides financing primarily for new and pre-owned general aviation aircraft (including helicopters) for private and corporate users, some for aircraft distributors and dealers, air charter operators, air cargo carriers, and other aircraft operators. See Appendix for NAICS industry detail. Construction Equipment Division Construction equipment division provides financing for infrastructure projects (i.e., asphalt and concrete plants, bulldozers, excavators, cranes, and loaders, etc.) Auto and Light Truck Division Auto/light truck division provides financing for automobile rental and commercial auto leasing companies, and light truck rental and leasing companies. Medium and Heavy Duty Truck Division The medium and heavy duty truck division finances highway tractors and trailers and delivery trucks for the commercial trucking industry and trash and recycling equipment for municipalities and private businesses as well as equipment for landfills. 9page

Zelle (P2P) HIGHLY RATED, FEATURE-RICH MOBILE APP Budget & Account Aggregation 57% 60% 63% 65% 16% 15% 14% 13% 27% 25% 23% 22% 0% 25% 50% 75% 100% Q4 20 Q4 21 Q4 22 Q4 23 Digital Adoption¹ Mobile & Online Online Only Non-Digital 13% 24% 24% 31% 23% 29% 28% 24% 35% 23% 24% 25% 29% 24% 24% 20% 0% 25% 50% 75% 100% Q4 20 Q4 21 Q4 22 Q4 23 Service Usage³ 4+ 3 2 1 Other Services: Balance & Transfers, Pay Bills / eBills, Mobile Deposit, A2A Transfers 58.5 62.7 67.0 70.7 45.0 50.0 55.0 60.0 65.0 70.0 75.0 Q4 20 Q4 21 Q4 22 Q4 23 Mobile Users (000s)² Credit Score Mgmt.⁴ Debit Card Control Digital Wallet ⁵ 42.9 65.8 103.8 130.5 0 25 50 75 100 125 150 Q4 20 Q4 21 Q4 22 Q4 23 Zelle Transactions (000s)7 1 “Digital Adoption” is based on the primary deposit account holders’ usage of our online/mobile banking platforms 2 “Mobile Users” is based on activity within the Mobile App within the last 90 days 3 “Service Usage” are the number of distinct services (presented on the left) used by a digital user 4 Launched service in May 2022 5 1st Source Debit Cards can be loaded into Apple Pay, Samsung Pay & Google Wallet Apps 6. Based on Apple’s App Store rating at quarter-end 7. Some previously reported quarterly transactions have been modified. .. page 10 8K RATINGS 9.0K RATINGS 4.8 9.0K RATINGS 6

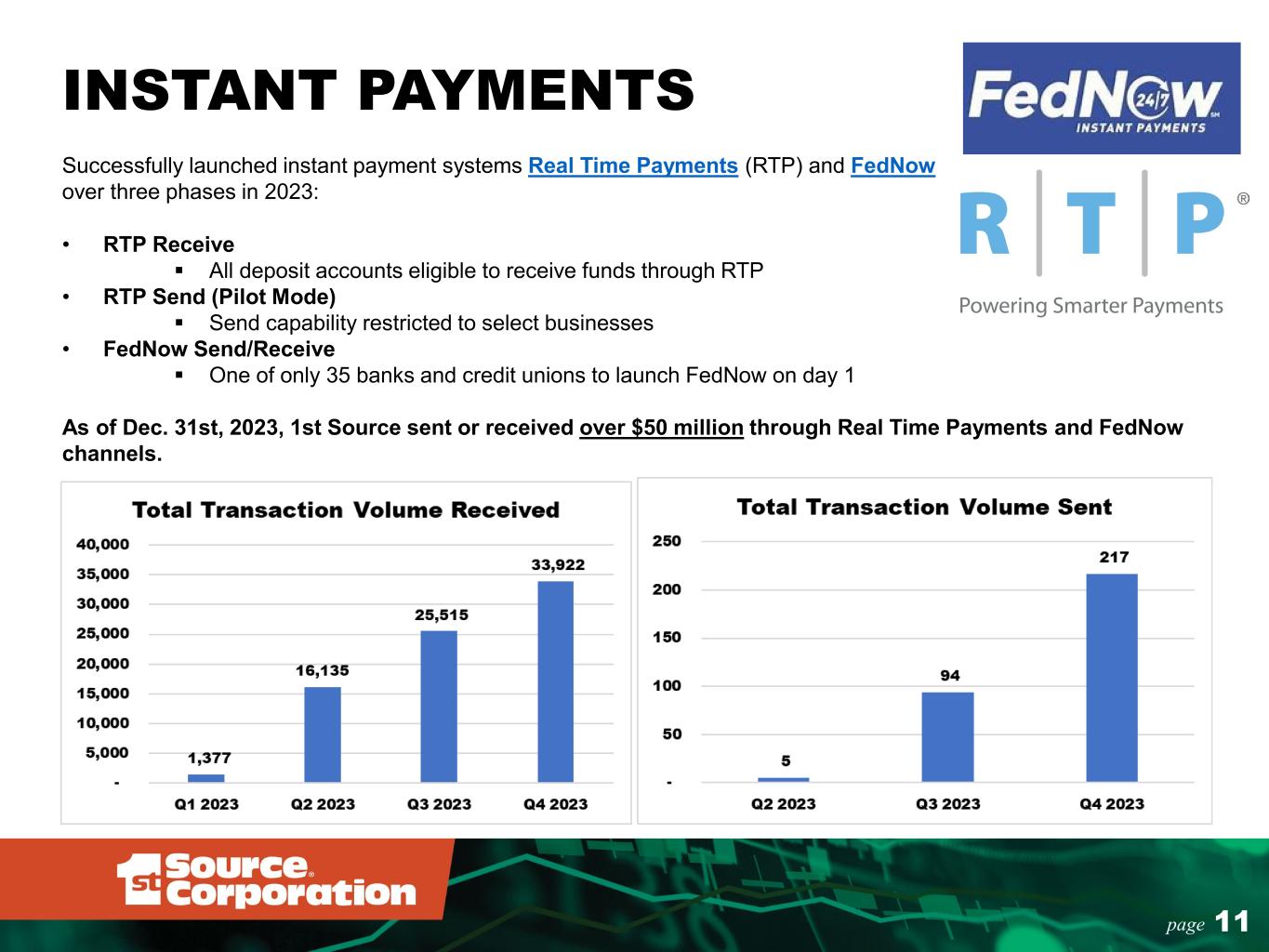

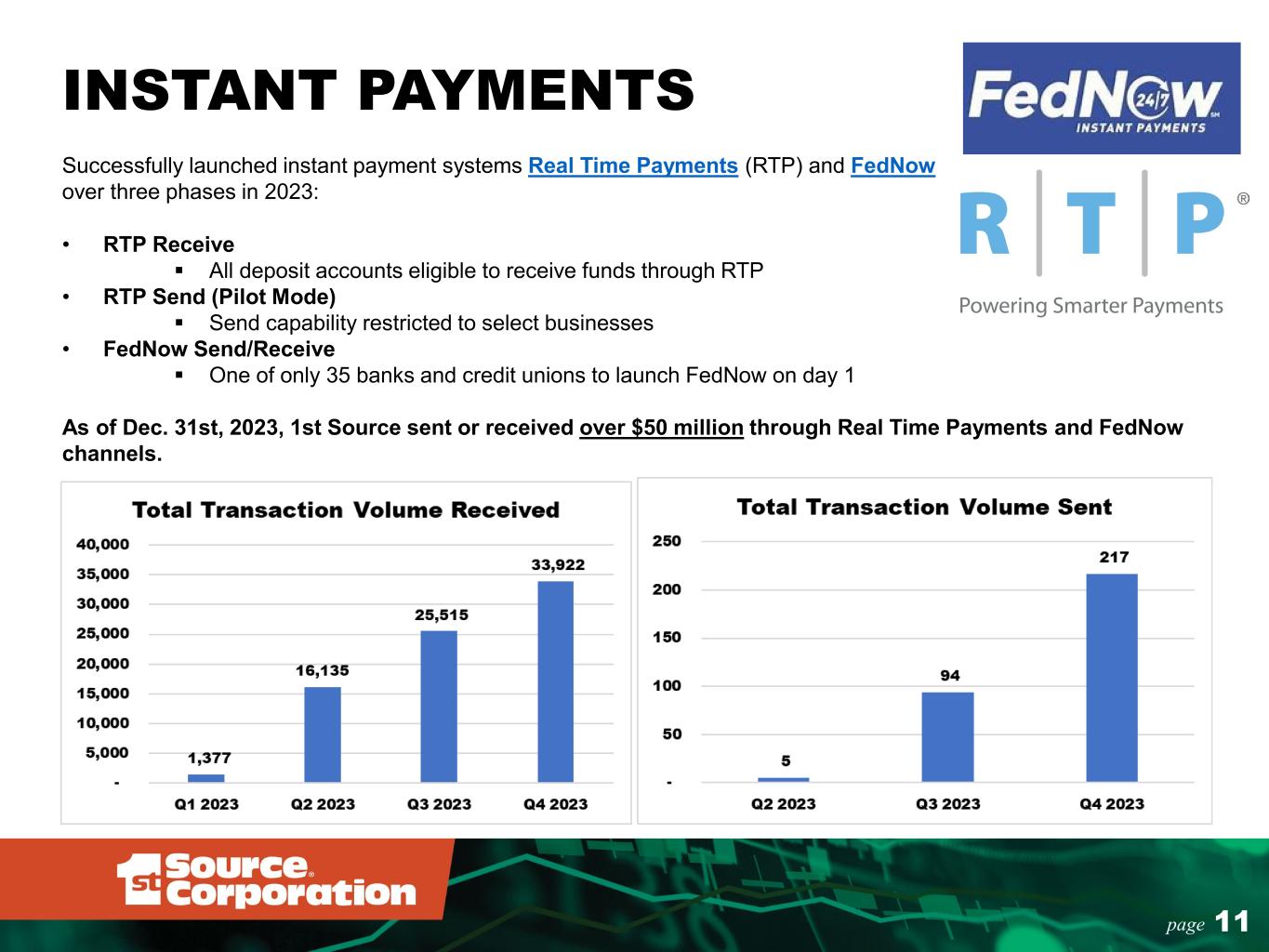

page 11 INSTANT PAYMENTS Successfully launched instant payment systems Real Time Payments (RTP) and FedNow over three phases in 2023: • RTP Receive All deposit accounts eligible to receive funds through RTP • RTP Send (Pilot Mode) Send capability restricted to select businesses • FedNow Send/Receive One of only 35 banks and credit unions to launch FedNow on day 1 As of Dec. 31st, 2023, 1st Source sent or received over $50 million through Real Time Payments and FedNow channels.

AN EXPERIENCED AND PROVEN TEAM Executive Team 6 executives with an average 35 years each of banking experience and 26 years with 1st Source Business Banking Officers 41 business banking officers with an average 20 years each of lending experience and with 1st Source from 1 to 34 years Specialty Finance Group Officers 24 specialty finance officers with an average 24 years each of lending experience and with 1st Source from 1 to 33 years 12page

PERFORMANCE CLIENT Indiana SBA Community Lender Award 2013-2023 #1 SBA Lender in our Indiana footprint #1 SBA Lender Headquartered in State of Indiana #1 Deposit share in our 16 contiguous county market #5 Lender of Community Development Loans (Total Dollars) in State of Indiana by Banks Headquartered in Indiana. 2022 CRA data by FFIEC. #3 Lender of Community Development Loans (# of Loans) in State of Indiana by Banks Headquartered in Indiana. 2022 CRA data by FFIEC. #20 On Monitor Magazine’s 2023 Top 50 Bank Finance/Leasing Companies in the U.S. #35 On Monitor Magazine’s 2023 Top 100 Largest Equipment Finance/Leasing Companies in the U.S. 13page

PERFORMANCE LEADERSHIP Newsweek 2023 America’s Greatest Workplaces for Parents and Families Forbes’ Best in State Banks 2023 Indiana Rank #1 Forbes’ 500 Best Midsize Employers 2021-2023 Forbes’ 500 Best Employers for Diversity 2022 Notre Dame Lucy Family Institute for Data & Society 2023 Lucy Breakthrough Award: Student Experiential Learning with 1st Source Bank Indianapolis Business Journal’s 250 Most Influential Business Leaders Christopher J. Murphy III Chairman, President, and CEO, 1st Source Corporation Tracy D. Graham & Isaac P. Torres Board Members 14page

FINANCIAL REVIEW

16page 4502 5128 5987 6426 6121 775 609 356 285 836 0.96% 0.53% 0.19% 0.38% 1.77% 0.00% 0.70% 1.40% 2.10% 2.80% 0 2,000 4,000 6,000 8,000 2019 2020 2021 2022 2023 Core Deposits ($MM) Non-core Deposits ($MM) Effective Rate on Deposits (%) CORE DEPOSIT FRANCHISE TOTAL AVERAGE DEPOSITS *Non-core deposits include CDs over $250,000, brokered CDs, and national listing service CDs. 5737 6343 6711 6957 5277

17page Time 25% Noninterest- bearing demand 23% Interest- bearing demand 35% Savings 17% Public Fund 18% Brokered 9% Business 26% Consumer (1) 47% (1) Includes business customer certificates of deposit which were immaterial Approximately 228,300 deposit accounts with an average balance of $30,800. Account Type Owner Classification Diversified Deposit Mix End of Period Balances

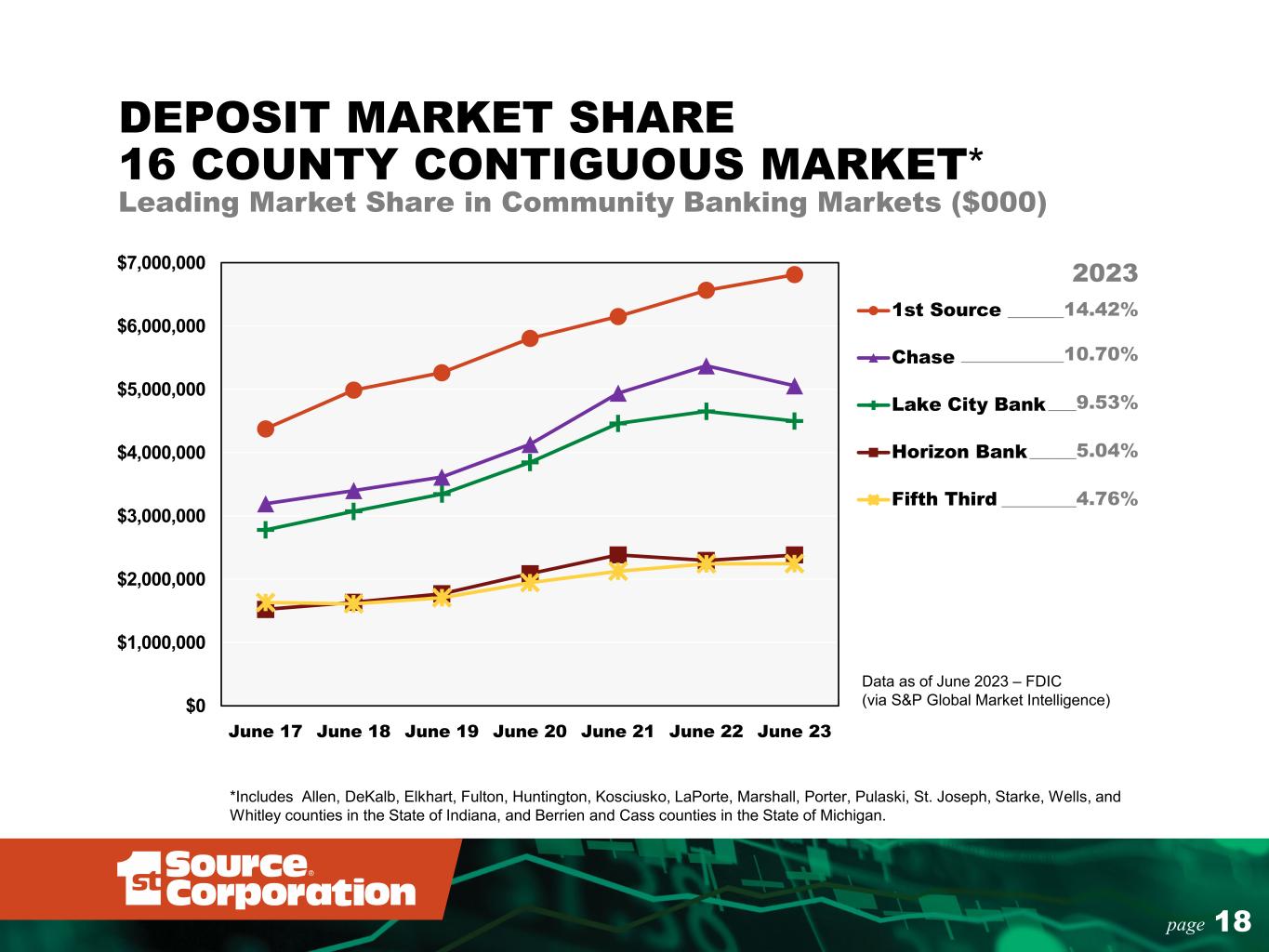

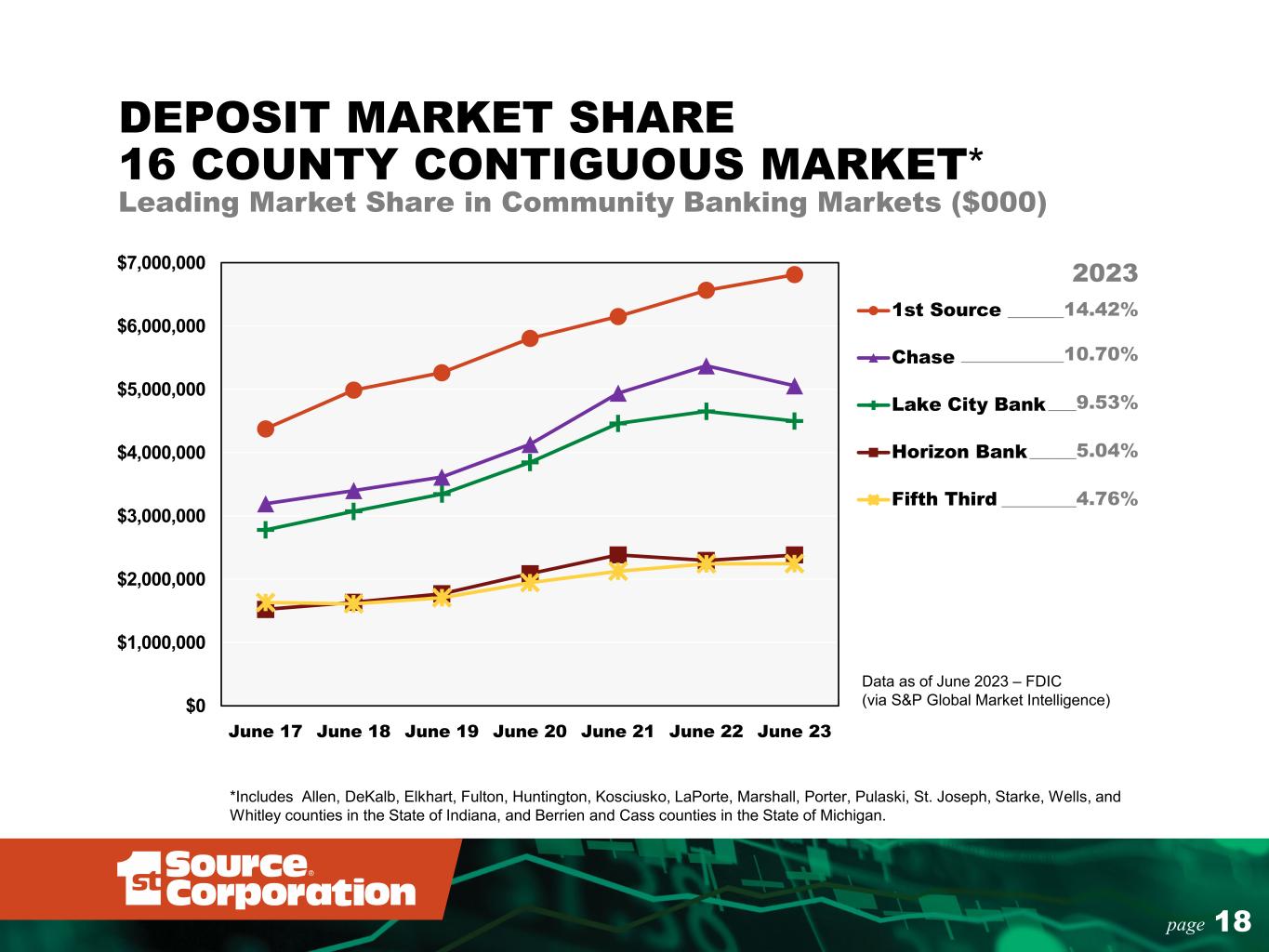

18page $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 June 17 June 18 June 19 June 20 June 21 June 22 June 23 1st Source Chase Lake City Bank Horizon Bank Fifth Third DEPOSIT MARKET SHARE 16 COUNTY CONTIGUOUS MARKET* Leading Market Share in Community Banking Markets ($000) Data as of June 2023 – FDIC (via S&P Global Market Intelligence) *Includes Allen, DeKalb, Elkhart, Fulton, Huntington, Kosciusko, LaPorte, Marshall, Porter, Pulaski, St. Joseph, Starke, Wells, and Whitley counties in the State of Indiana, and Berrien and Cass counties in the State of Michigan. 2023 ______14.42% ___________10.70% ___9.53% _____5.04% ________4.76%

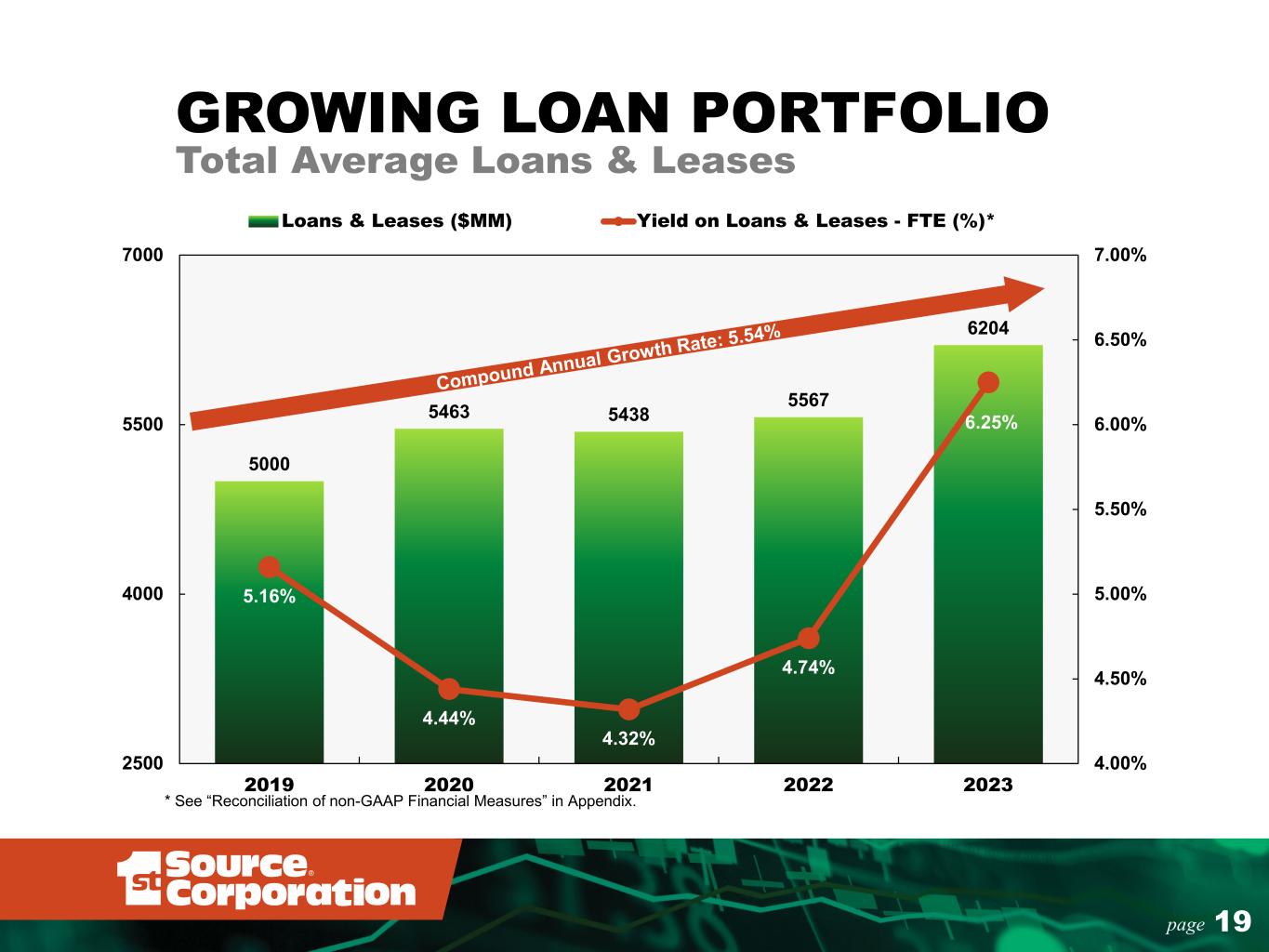

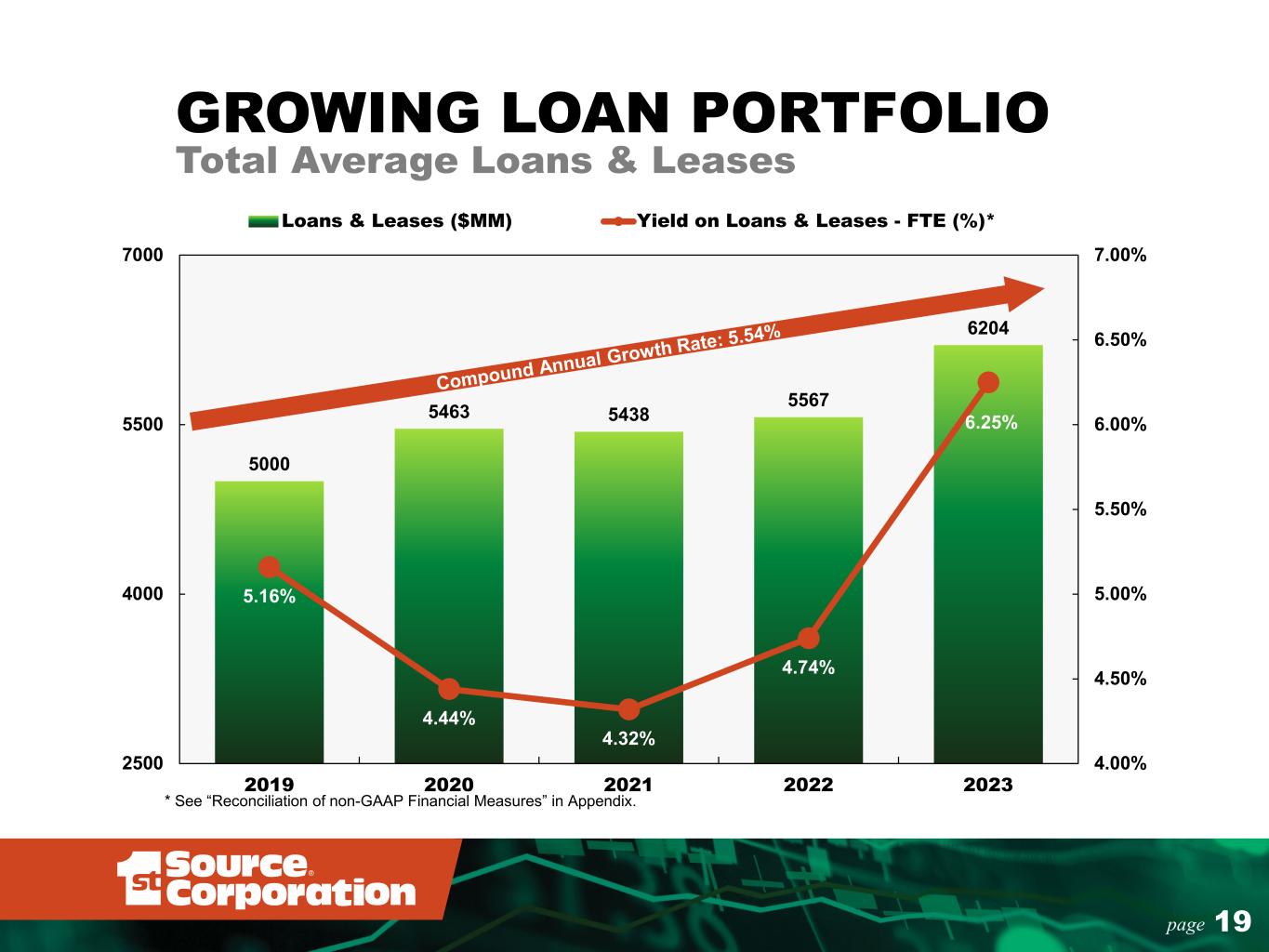

19page 5000 5463 5438 5567 6204 5.16% 4.44% 4.32% 4.74% 6.25% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 2500 4000 5500 7000 2019 2020 2021 2022 2023 Loans & Leases ($MM) Yield on Loans & Leases - FTE (%)* GROWING LOAN PORTFOLIO Total Average Loans & Leases * See “Reconciliation of non-GAAP Financial Measures” in Appendix.

20page Commercial Real Estate 16% Residential Real Estate 10% Consumer 3% Medium and Heavy Duty Truck 5% Auto and Light Truck 14% Construction Equipment 16% Aircraft 17% Commercial and Agriculture 19% DIVERSIFIED LOAN PORTFOLIO 2023 Average Loans by Type

21page 2.19% 2.56% 2.38% 2.32% 2.26% 2019 2020 2021 2022 2023 STRONG CREDIT QUALITY % of Net Loans and Leases Loan & Lease Loss Allowance 0.37% 1.16% 0.77% 0.45% 0.37% 2019 2020 2021 2022 2023 Low Nonperforming Assets 0.10% 0.17% 0.16% 0.03% -0.04% 2019 2020 2021 2022 2023 Limited Losses Nonperforming Assets Net Charge-Offs (Recoveries) Solid Reserves

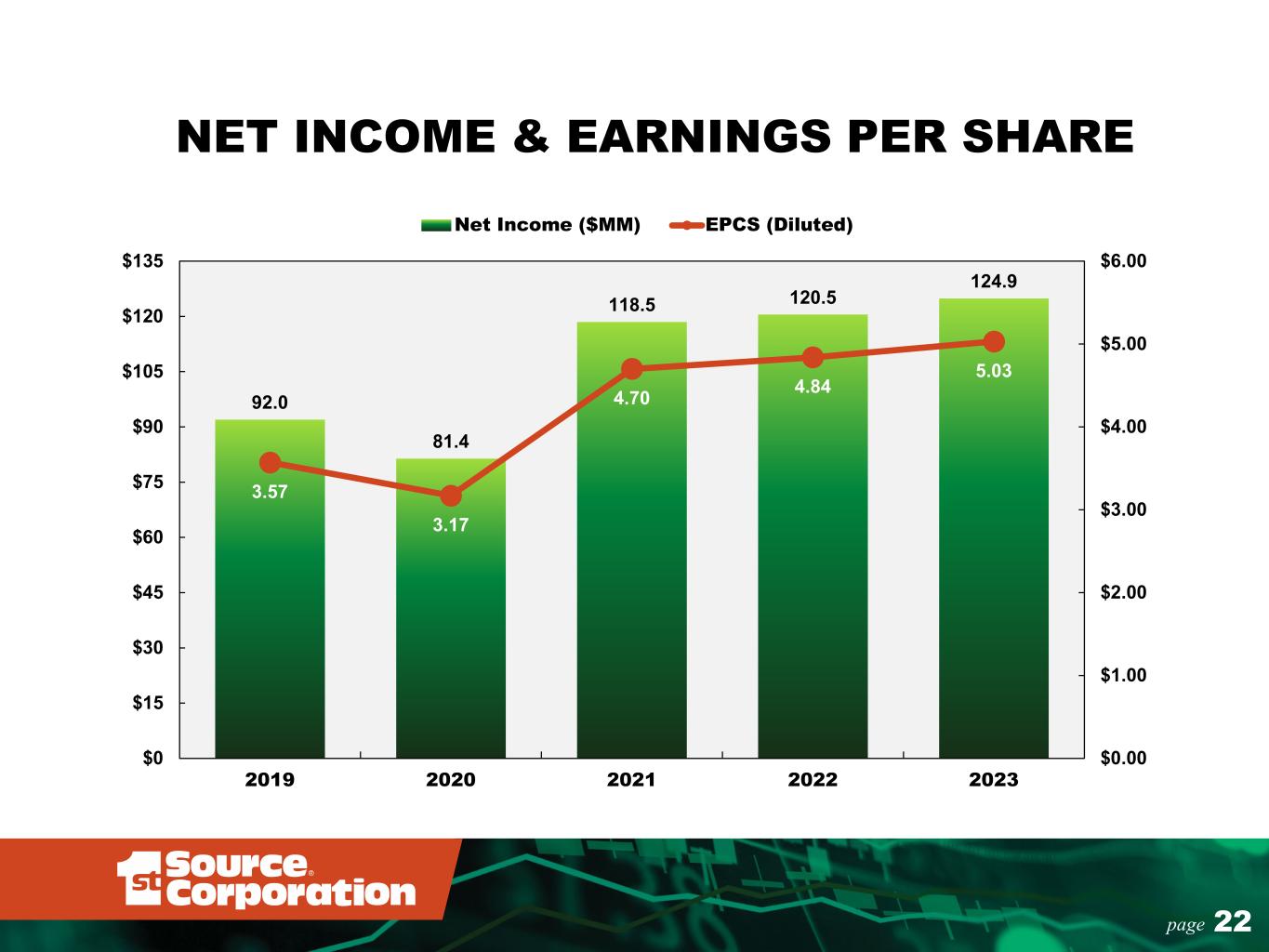

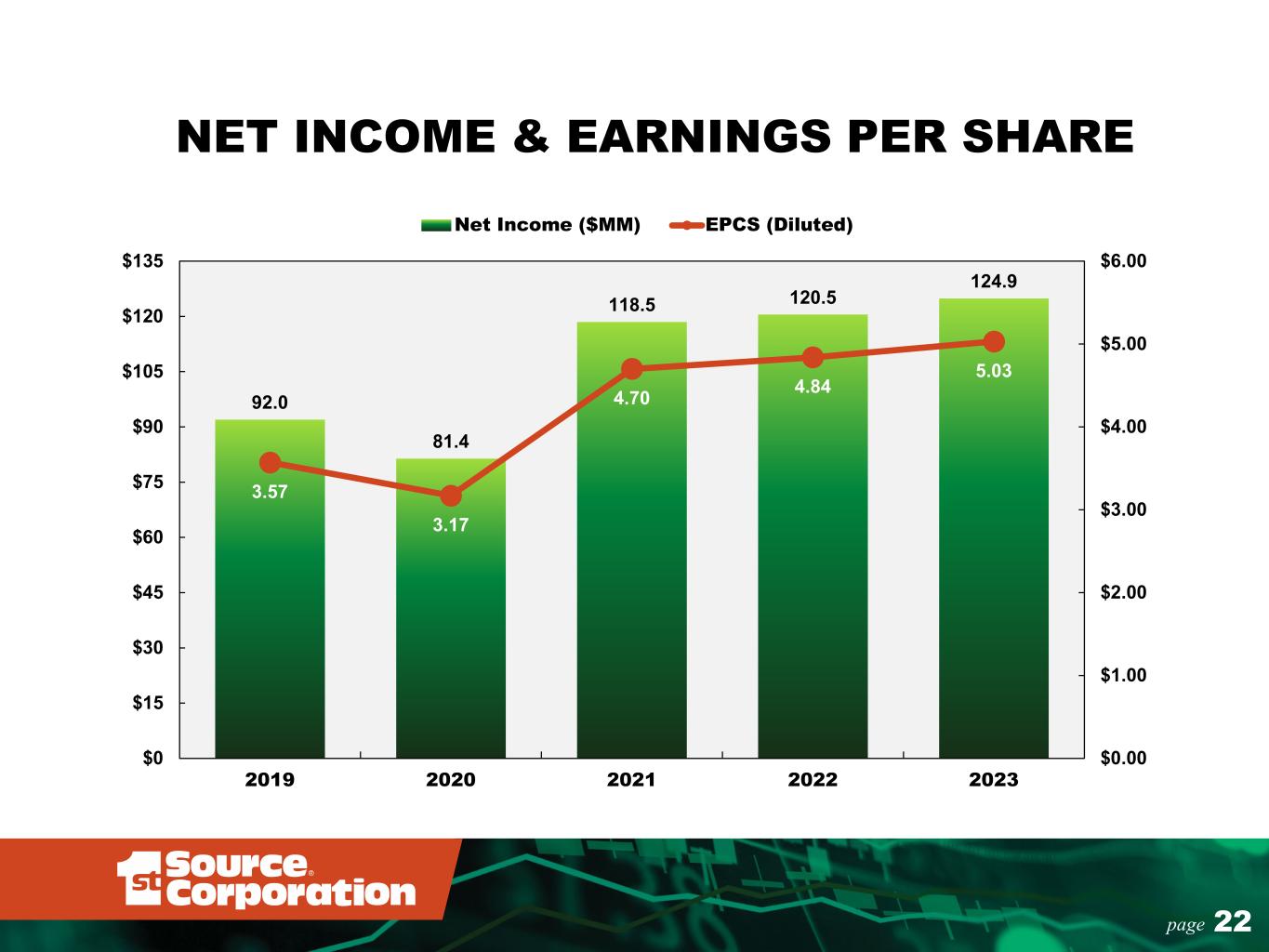

22page 92.0 81.4 118.5 120.5 124.9 3.57 3.17 4.70 4.84 5.03 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $0 $15 $30 $45 $60 $75 $90 $105 $120 $135 2019 2020 2021 2022 2023 Net Income ($MM) EPCS (Diluted) NET INCOME & EARNINGS PER SHARE

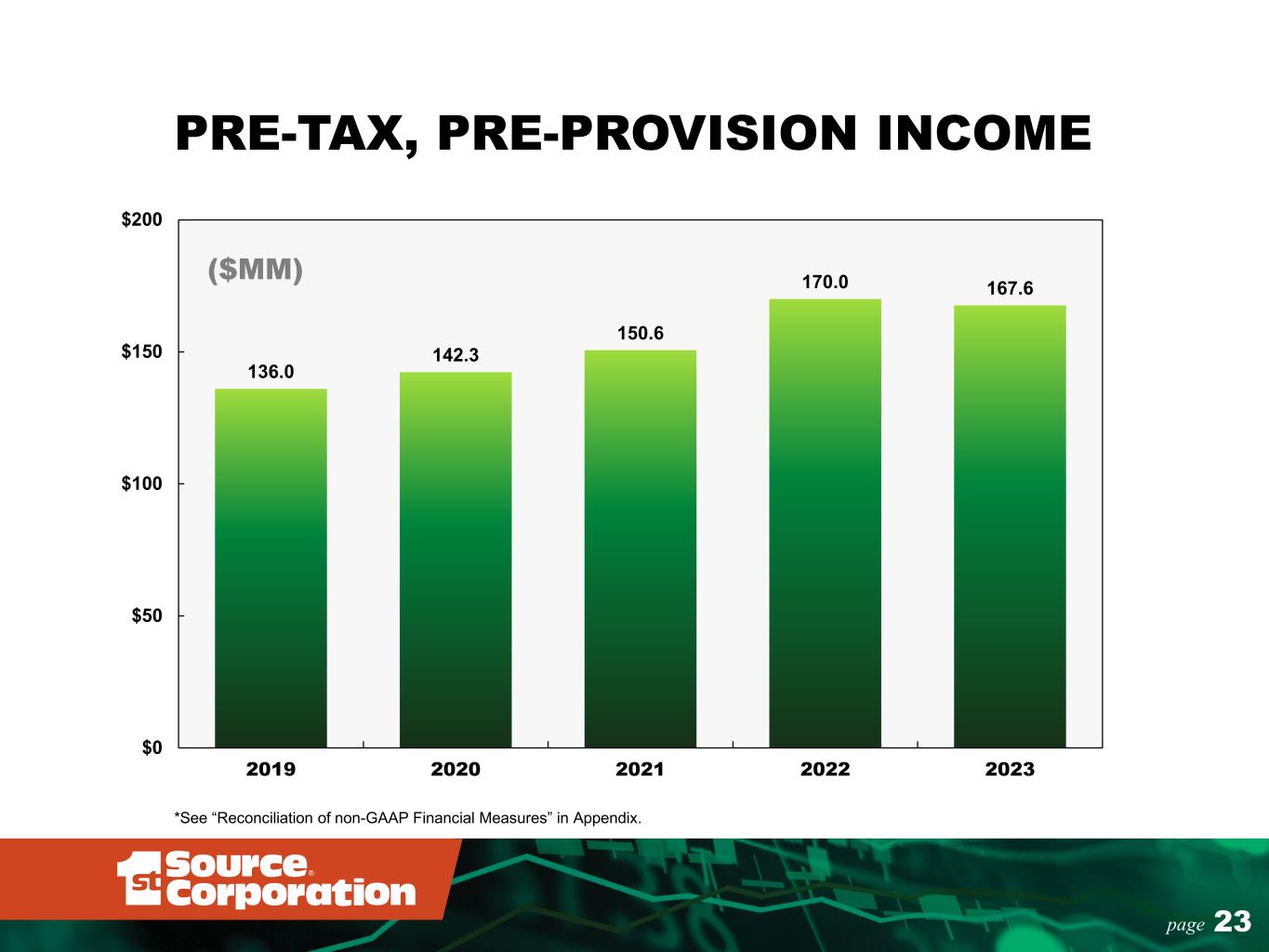

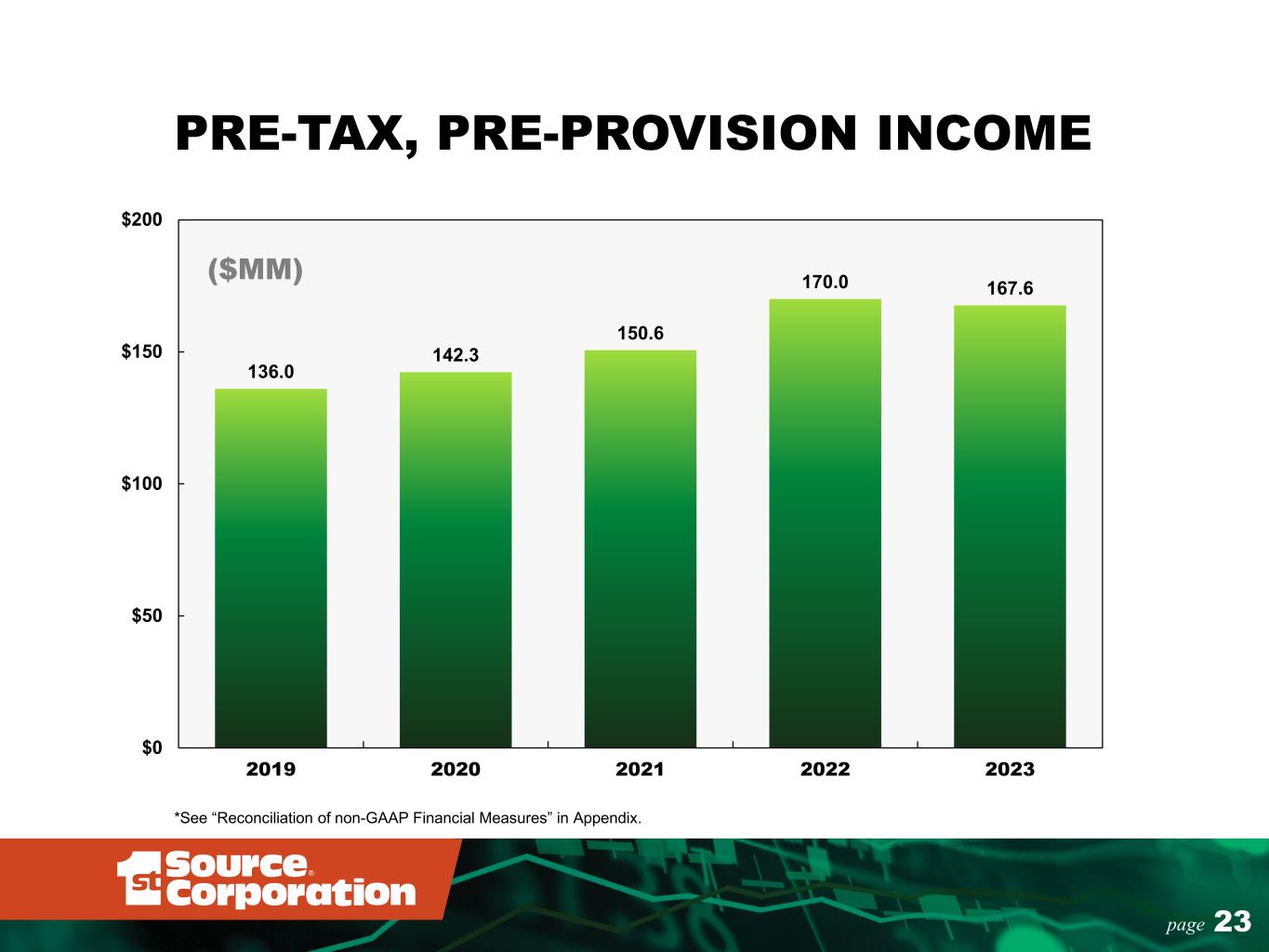

23page 136.0 142.3 150.6 170.0 167.6 $0 $50 $100 $150 $200 2019 2020 2021 2022 2023 PRE-TAX, PRE-PROVISION INCOME ($MM) *See “Reconciliation of non-GAAP Financial Measures” in Appendix.

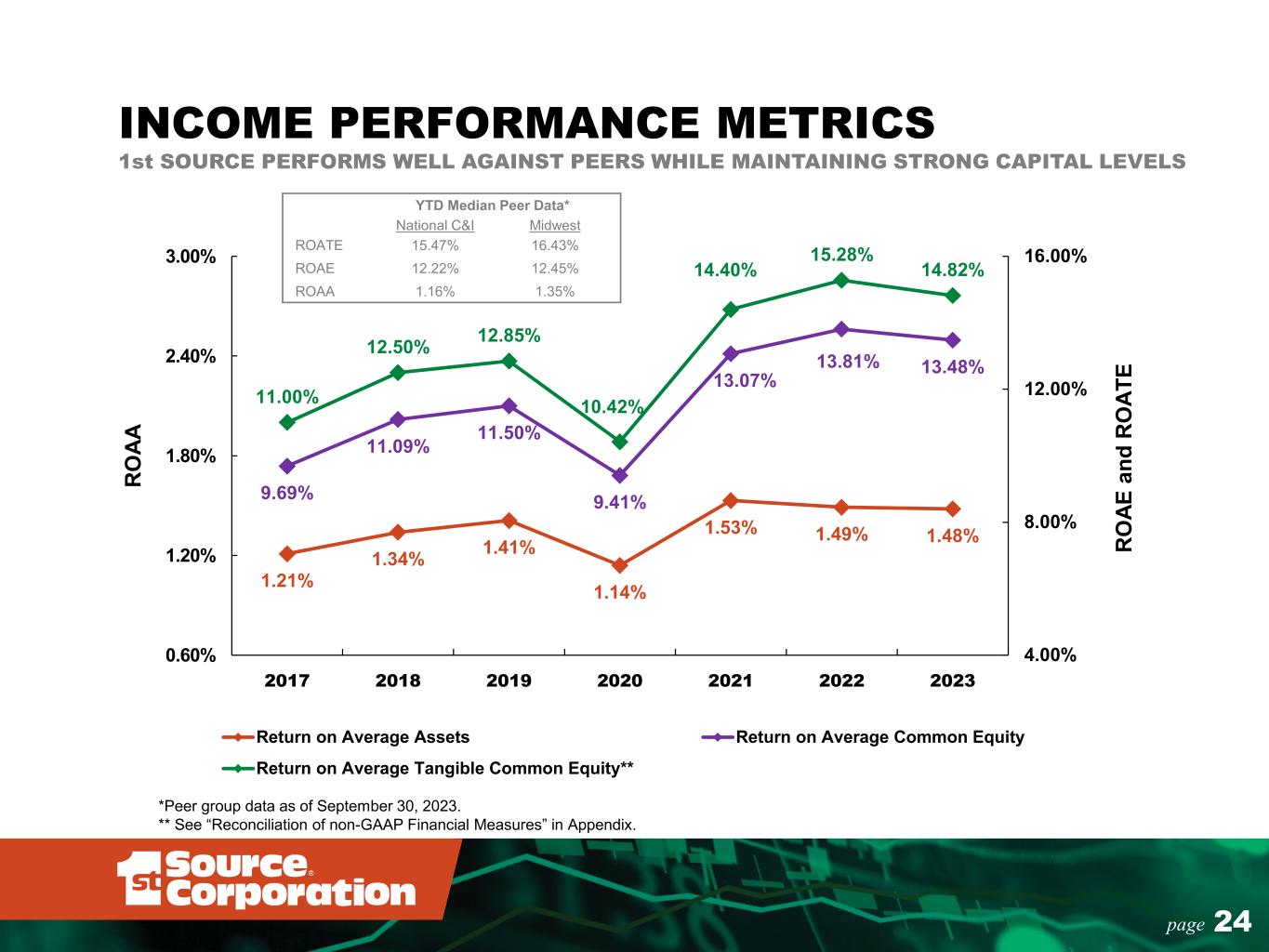

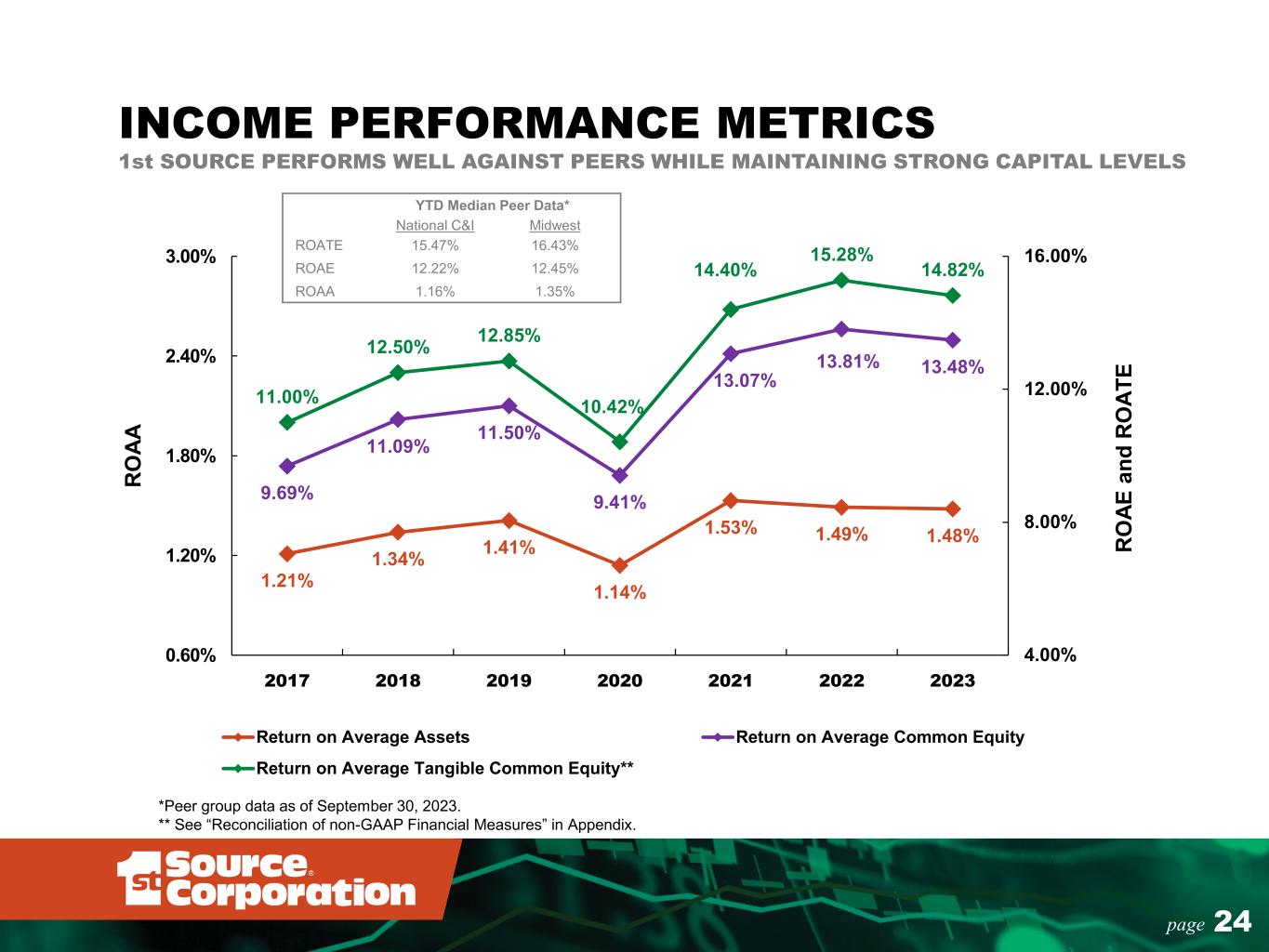

24page 1.21% 1.34% 1.41% 1.14% 1.53% 1.49% 1.48% 9.69% 11.09% 11.50% 9.41% 13.07% 13.81% 13.48% 11.00% 12.50% 12.85% 10.42% 14.40% 15.28% 14.82% 4.00% 8.00% 12.00% 16.00% 0.60% 1.20% 1.80% 2.40% 3.00% 2017 2018 2019 2020 2021 2022 2023 R O AE a nd R O AT E R O AA Return on Average Assets Return on Average Common Equity Return on Average Tangible Common Equity** INCOME PERFORMANCE METRICS 1st SOURCE PERFORMS WELL AGAINST PEERS WHILE MAINTAINING STRONG CAPITAL LEVELS *Peer group data as of September 30, 2023. ** See “Reconciliation of non-GAAP Financial Measures” in Appendix. YTD Median Peer Data* National C&I Midwest ROATE 15.47% 16.43% ROAE 12.22% 12.45% ROAA 1.16% 1.35%

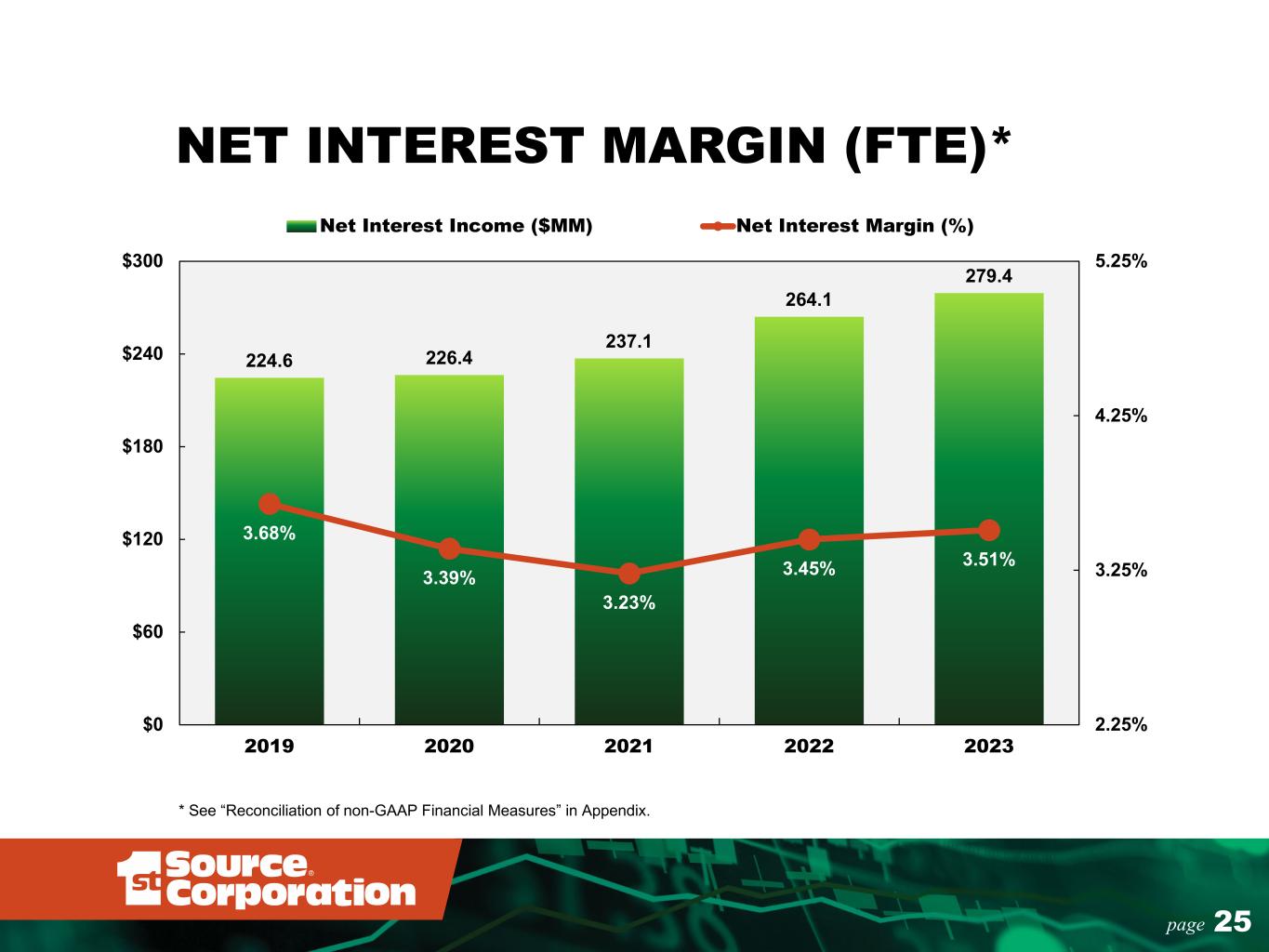

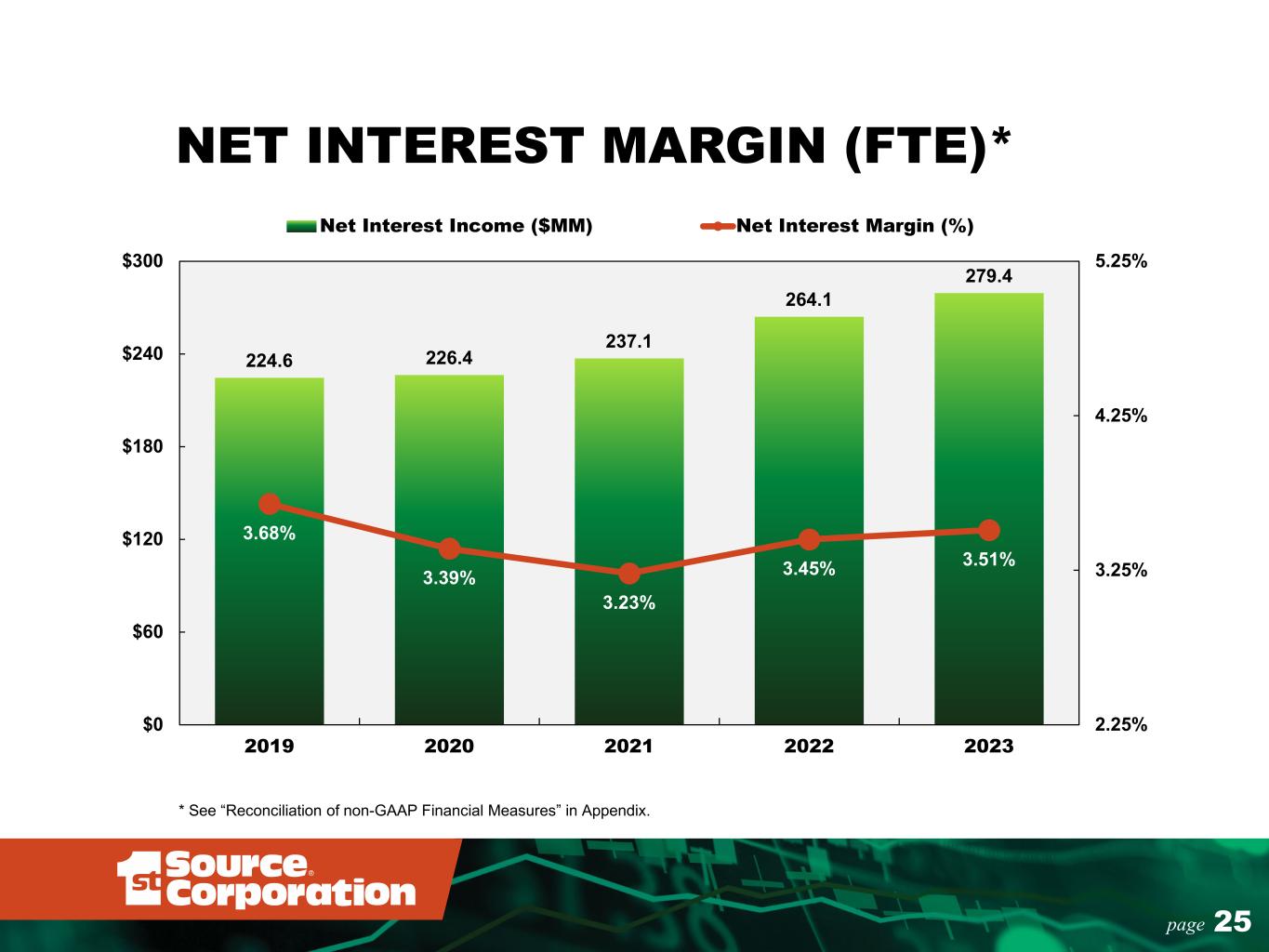

25page 224.6 226.4 237.1 264.1 279.4 3.68% 3.39% 3.23% 3.45% 3.51% 2.25% 3.25% 4.25% 5.25% $0 $60 $120 $180 $240 $300 2019 2020 2021 2022 2023 Net Interest Income ($MM) Net Interest Margin (%) NET INTEREST MARGIN (FTE)* * See “Reconciliation of non-GAAP Financial Measures” in Appendix.

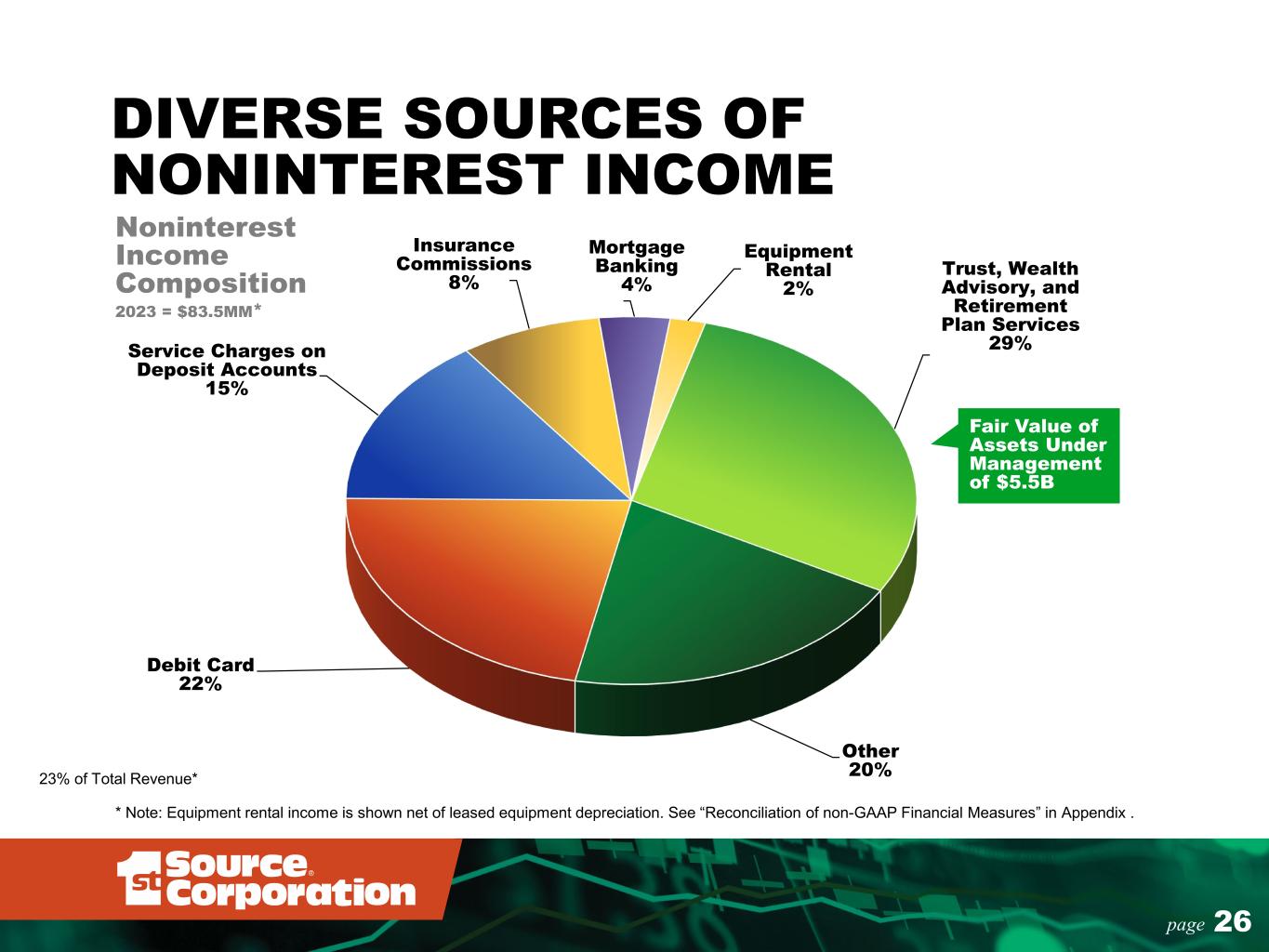

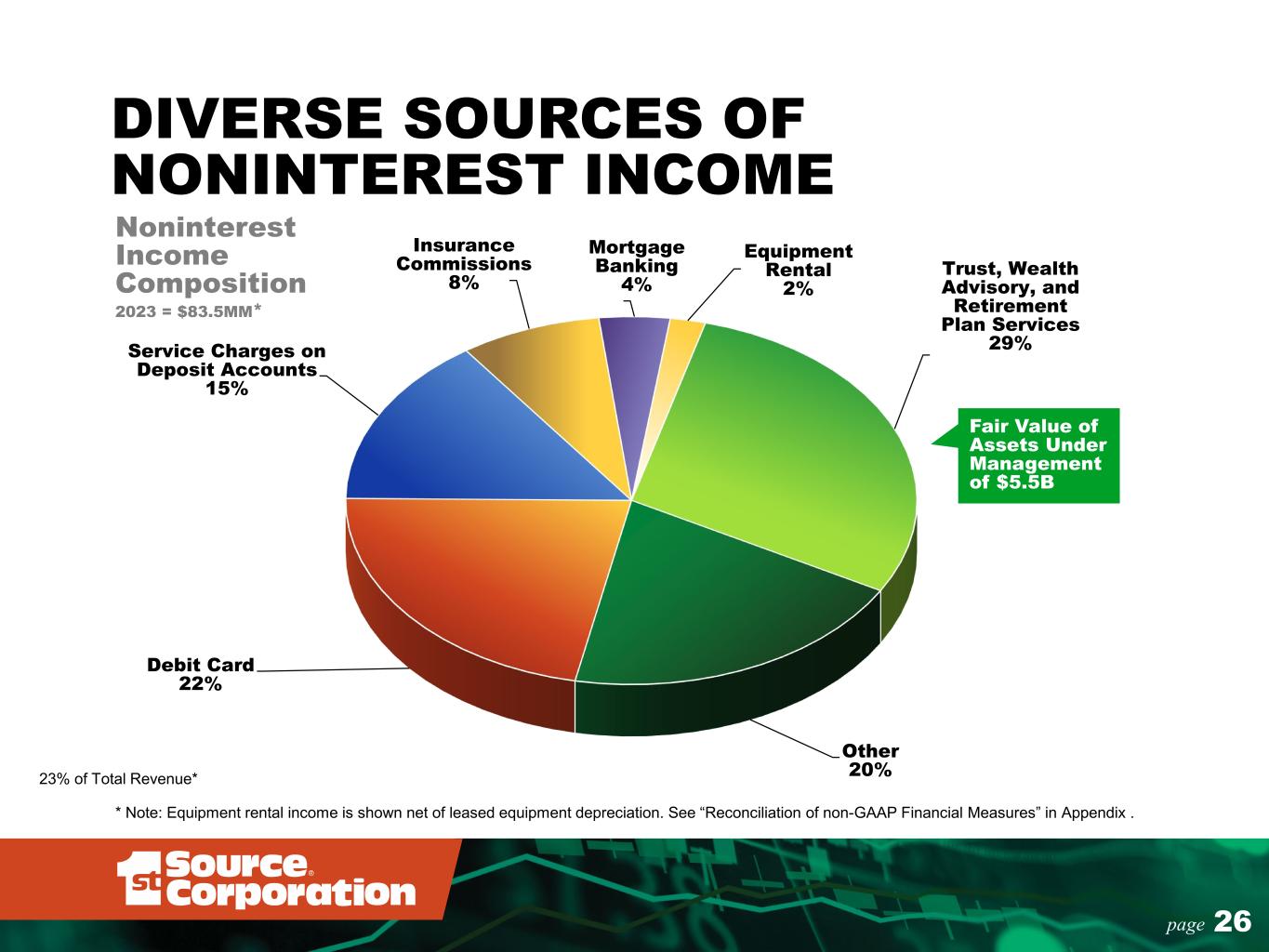

26page Trust, Wealth Advisory, and Retirement Plan Services 29% Other 20% Debit Card 22% Service Charges on Deposit Accounts 15% Insurance Commissions 8% Mortgage Banking 4% Equipment Rental 2% DIVERSE SOURCES OF NONINTEREST INCOME Fair Value of Assets Under Management of $5.5B * Note: Equipment rental income is shown net of leased equipment depreciation. See “Reconciliation of non-GAAP Financial Measures” in Appendix . Noninterest Income Composition 2023 = $83.5MM* 23% of Total Revenue*

27page 163.9 167.2 172.5 174.7 194.6 54.7% 54.2% 53.5% 51.1% 54.2% 40.0% 50.0% 60.0% 70.0% 80.0% $0.0 $70.0 $140.0 $210.0 2019 2020 2021 2022 2023 Noninterest Expense ($MM)* Efficiency - Adjusted (%)* OPERATING EXPENSES * Note: Noninterest expense is shown net of leased equipment depreciation. See “Reconciliation of non-GAAP Financial Measures” in Appendix.

14.90% 15.99% 16.76% 16.10% 16.25% 2019 2020 2021 2022 2023 28page 12.19% 12.15% 11.89% 12.63% 13.26% 2019 2020 2021 2022 2023 STRONG CAPITAL POSITION Tier 1 Leverage Ratio 13.64% 14.73% 15.50% 14.84% 14.99% 2019 2020 2021 2022 2023 Tier 1 Risk Based Ratio Total Risk Based Capital Ratio Tangible Common Equity / Tangible Assets* 11.38% 11.10% 10.39% 9.45% 10.48% 2019 2020 2021 2022 2023 5% Well Capitalized 8% Well Capitalized 10% Well Capitalized * See “Reconciliation of non-GAAP Financial Measures” in Appendix. Note: 2023 shares repurchased were 310,522 shares

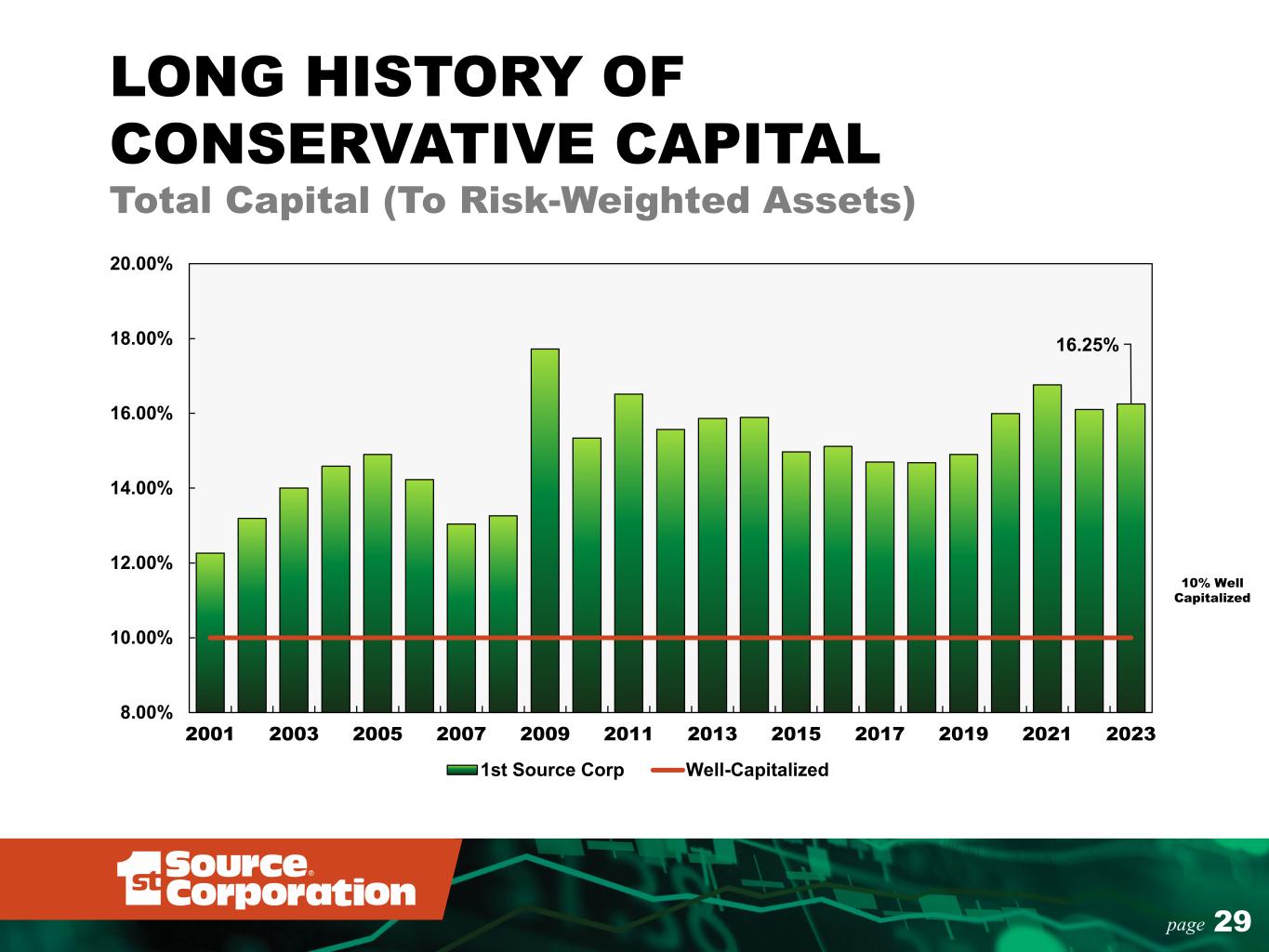

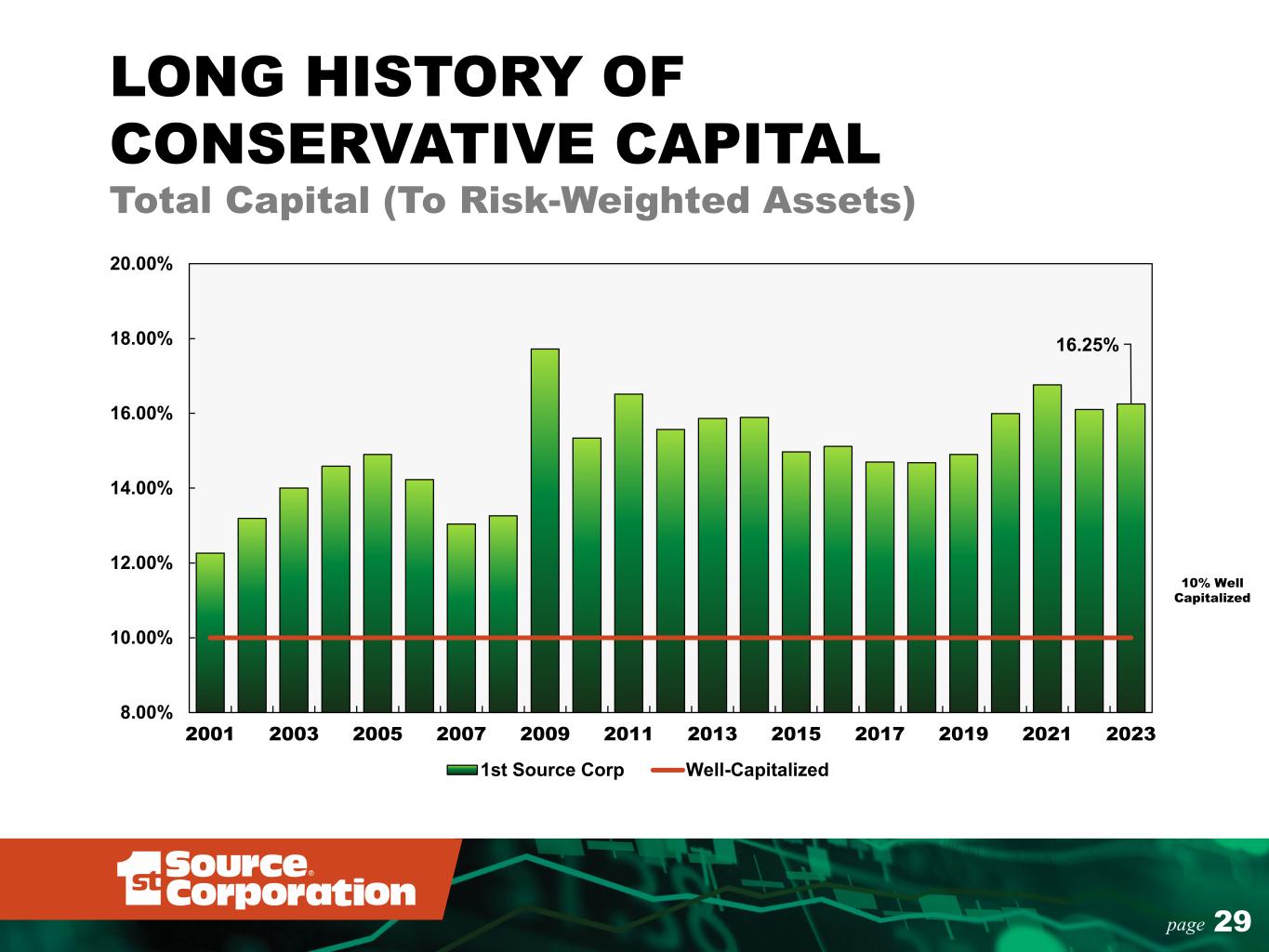

29page 16.25% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 2021 2023 1st Source Corp Well-Capitalized LONG HISTORY OF CONSERVATIVE CAPITAL Total Capital (To Risk-Weighted Assets) 10% Well Capitalized

30page $22.75 $24.47 $26.30 $29.18 $31.62 $33.64 $31.63 $37.06 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 2016 2017 2018 2019 2020 2021 2022 2023 TANGIBLE BOOK VALUE PER COMMON SHARE* * See “Reconciliation of non-GAAP Financial Measures” in Appendix.

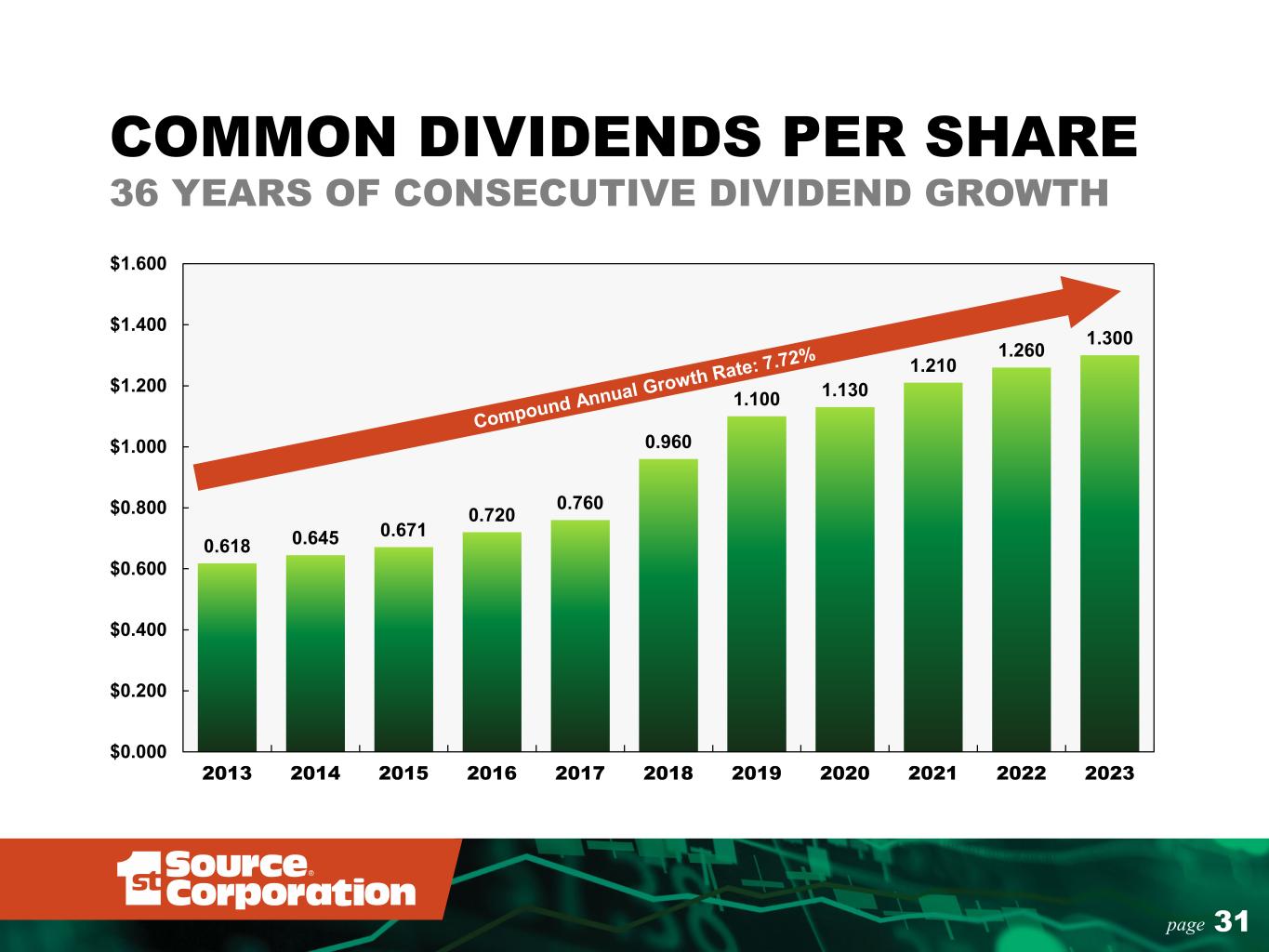

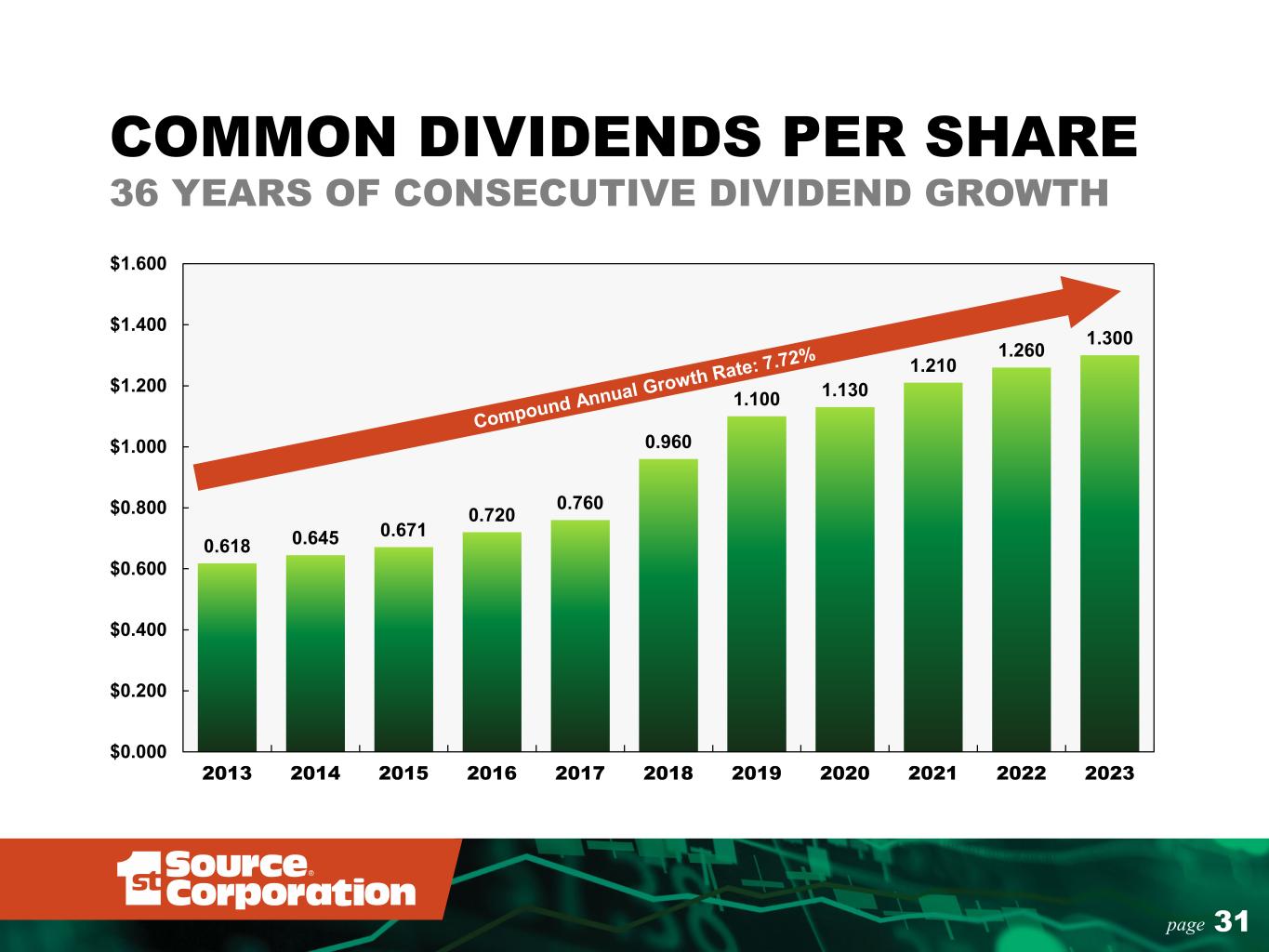

31page 0.618 0.645 0.671 0.720 0.760 0.960 1.100 1.130 1.210 1.260 1.300 $0.000 $0.200 $0.400 $0.600 $0.800 $1.000 $1.200 $1.400 $1.600 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 COMMON DIVIDENDS PER SHARE 36 YEARS OF CONSECUTIVE DIVIDEND GROWTH

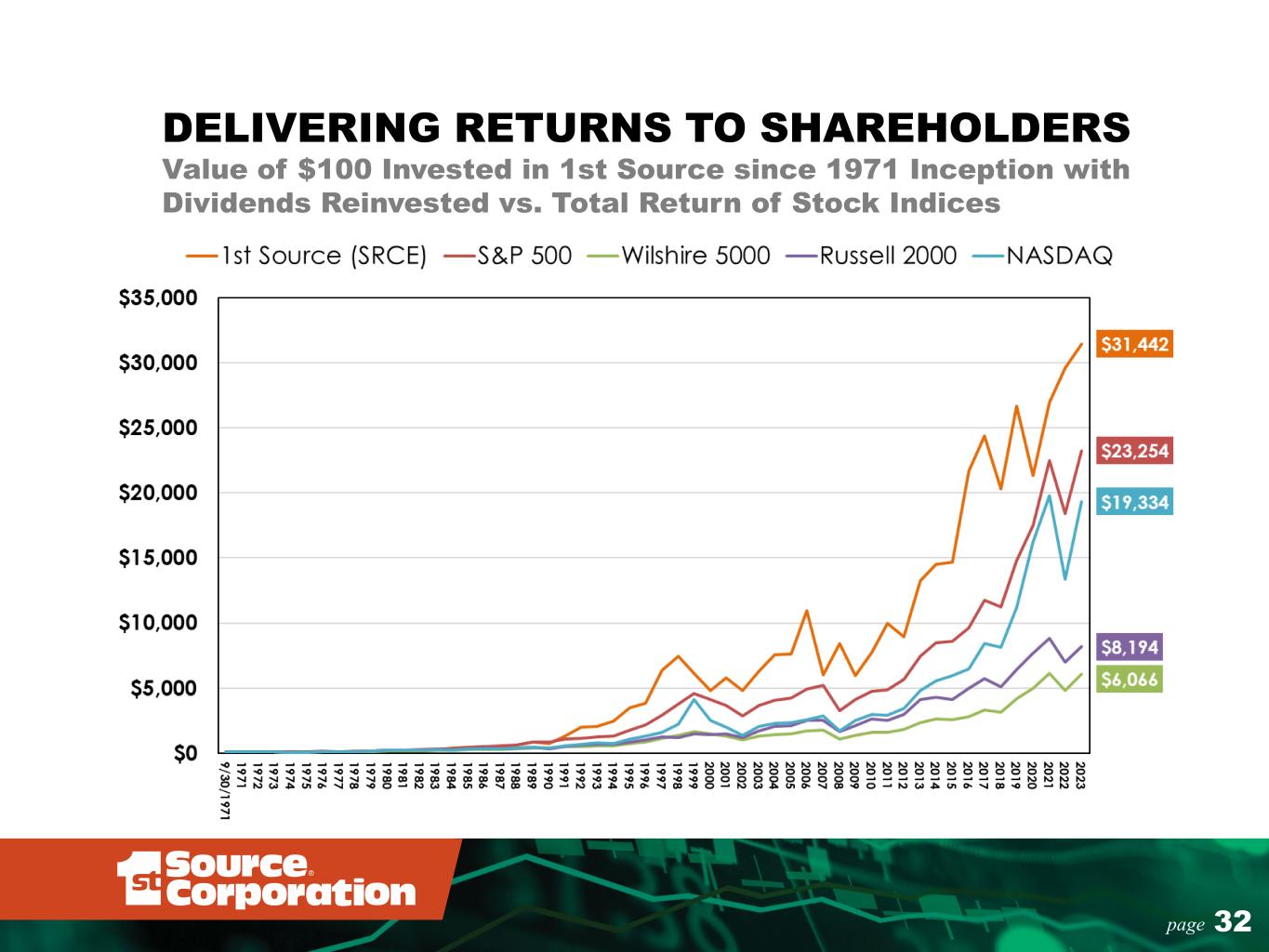

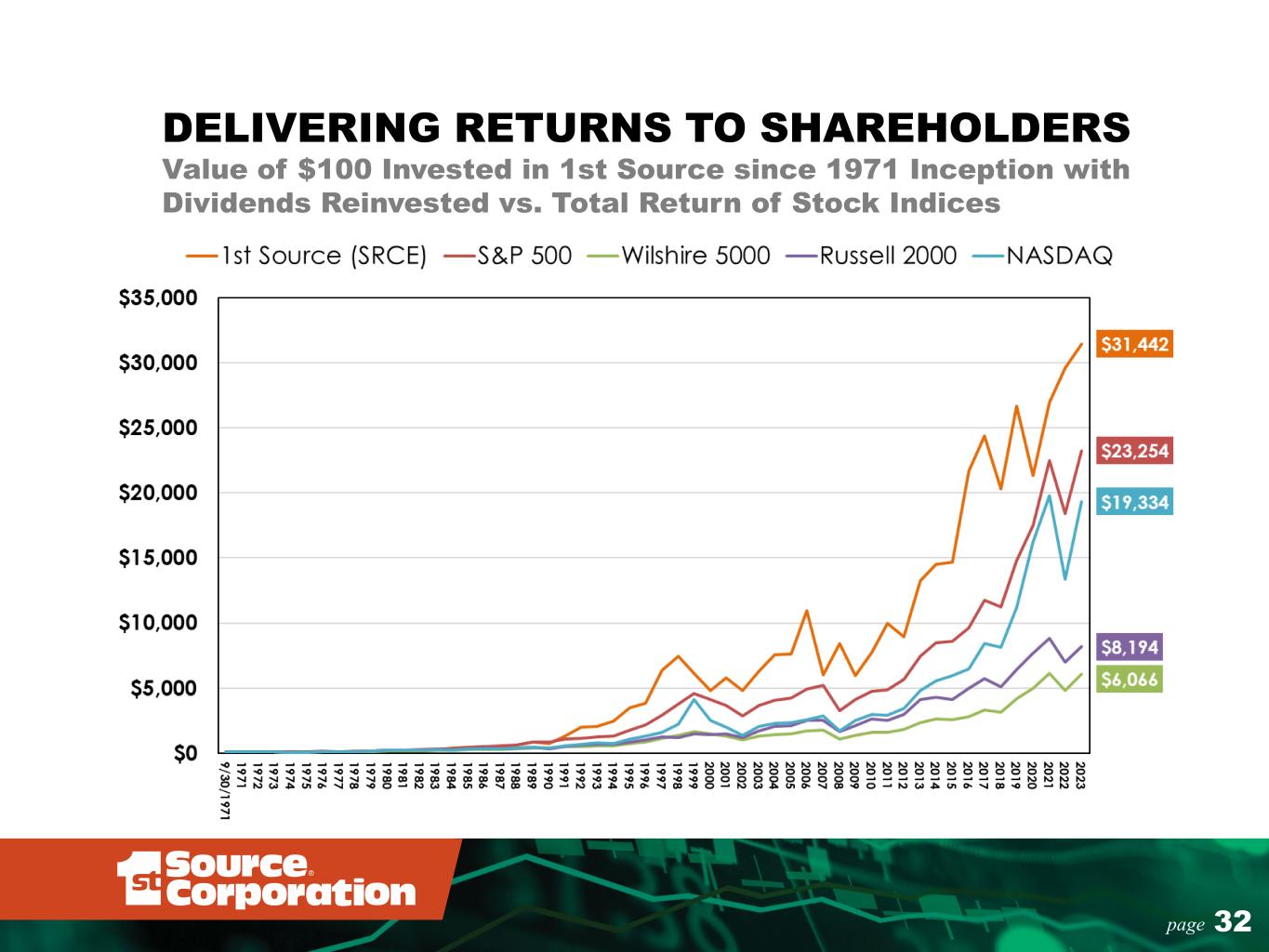

32page DELIVERING RETURNS TO SHAREHOLDERS Value of $100 Invested in 1st Source since 1971 Inception with Dividends Reinvested vs. Total Return of Stock Indices

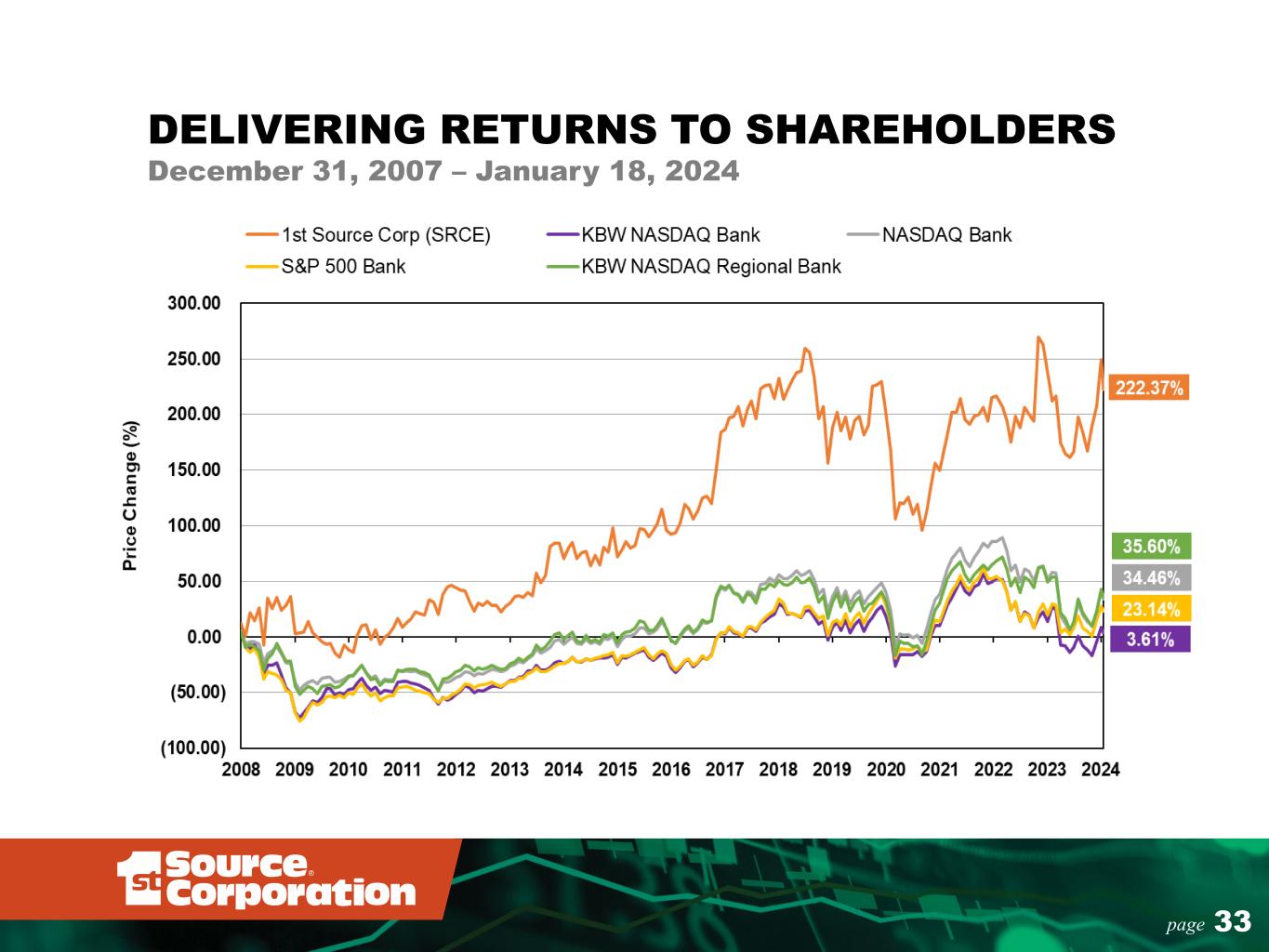

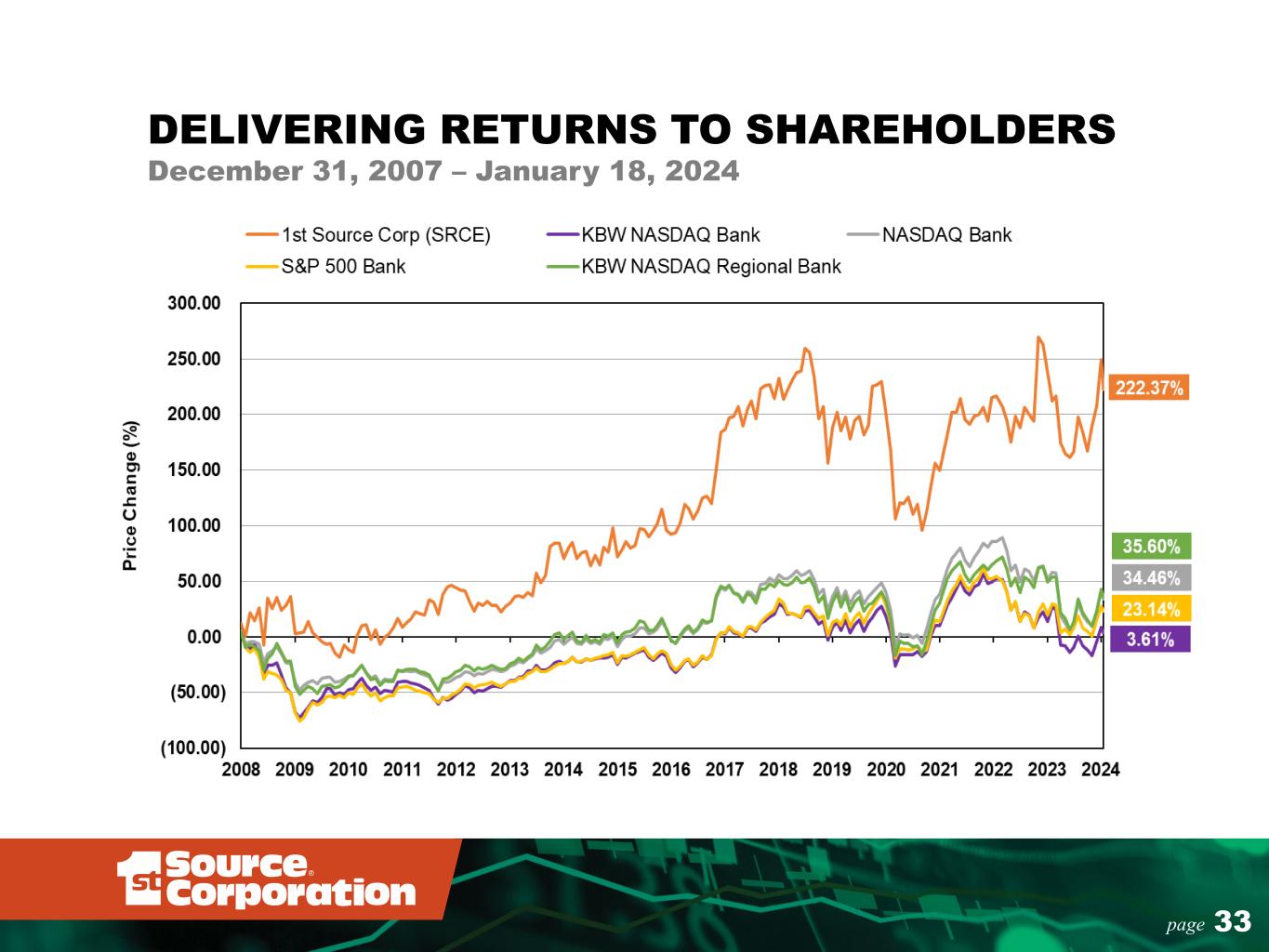

33page DELIVERING RETURNS TO SHAREHOLDERS December 31, 2007 – January 18, 2024

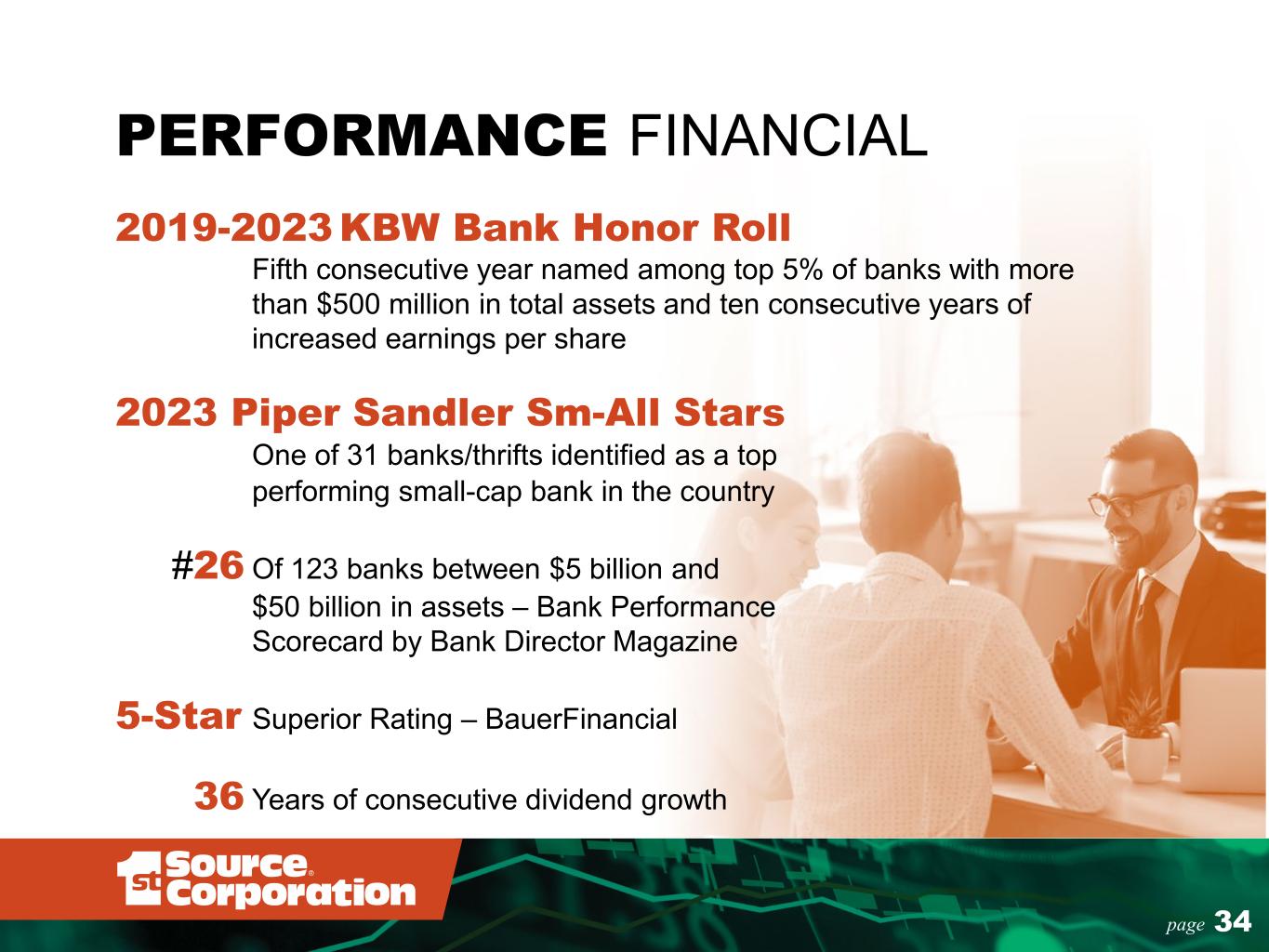

PERFORMANCE FINANCIAL 2019-2023 KBW Bank Honor Roll Fifth consecutive year named among top 5% of banks with more than $500 million in total assets and ten consecutive years of increased earnings per share 2023 Piper Sandler Sm-All Stars One of 31 banks/thrifts identified as a top performing small-cap bank in the country #26 Of 123 banks between $5 billion and $50 billion in assets – Bank Performance Scorecard by Bank Director Magazine 5-Star Superior Rating – BauerFinancial 36 Years of consecutive dividend growth 34page

INVESTMENT CONSIDERATIONS Consistent and superior financial performance with a focus on long-term earnings per share and tangible book value growth Experienced and proven team with significant investment in bank Diversification of product mix and geography with asset generation capability Leading market share in community banking markets Stable credit quality, strongly reserved Strong capital and liquidity position and 36 consecutive years of dividend growth 35page

CONTACT INFORMATION Christopher J. Murphy III Chairman of the Board, President and CEO 1st Source Corporation (574) 235-2711 Murphy-c@1stsource.com Andrea G. Short President and CEO 1st Source Bank (574) 235-2348 shorta@1stsource.com Brett A. Bauer CFO and Treasurer (574) 235-2638 bauerb@1stsource.com 36page

APPENDIX

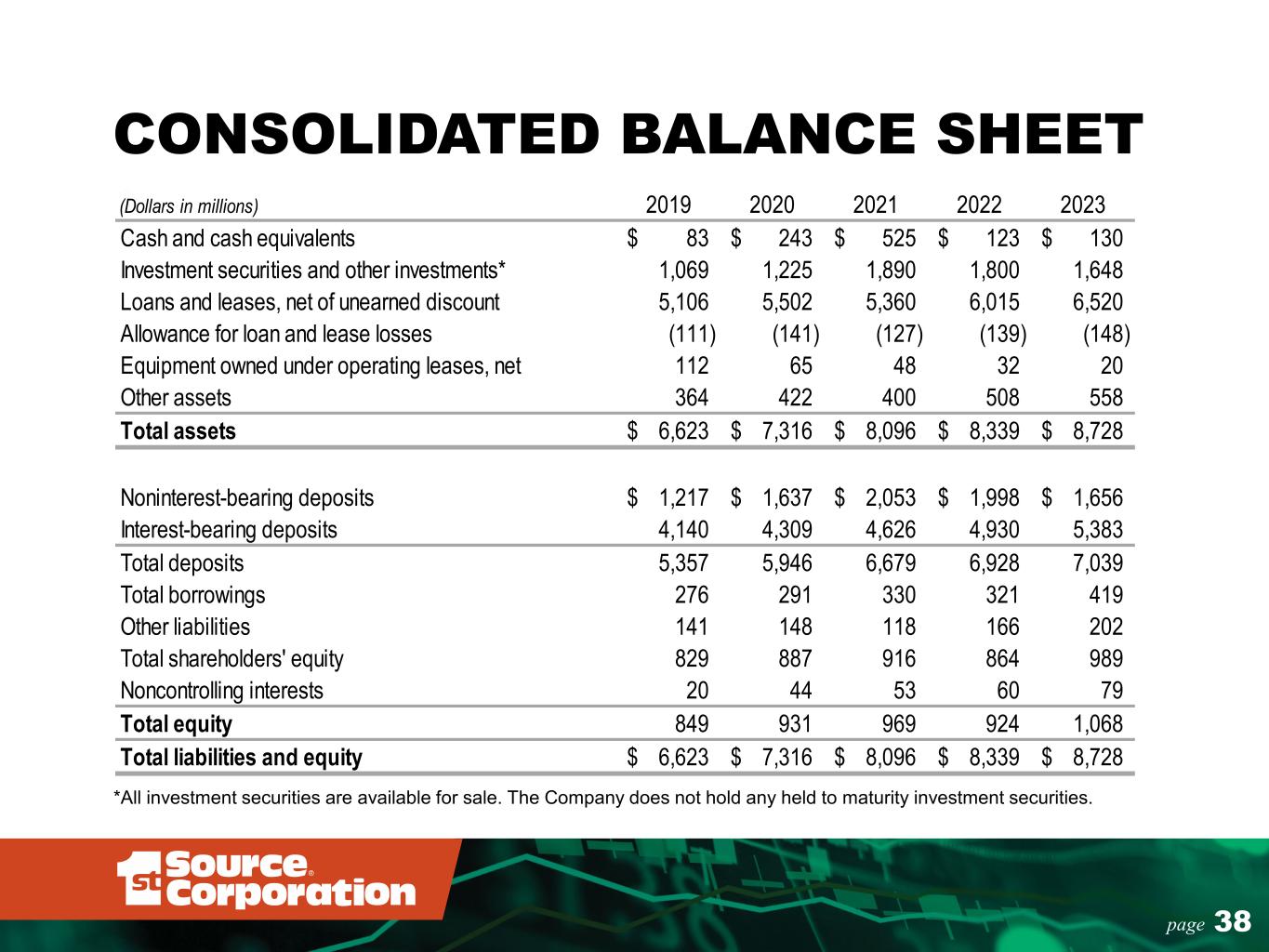

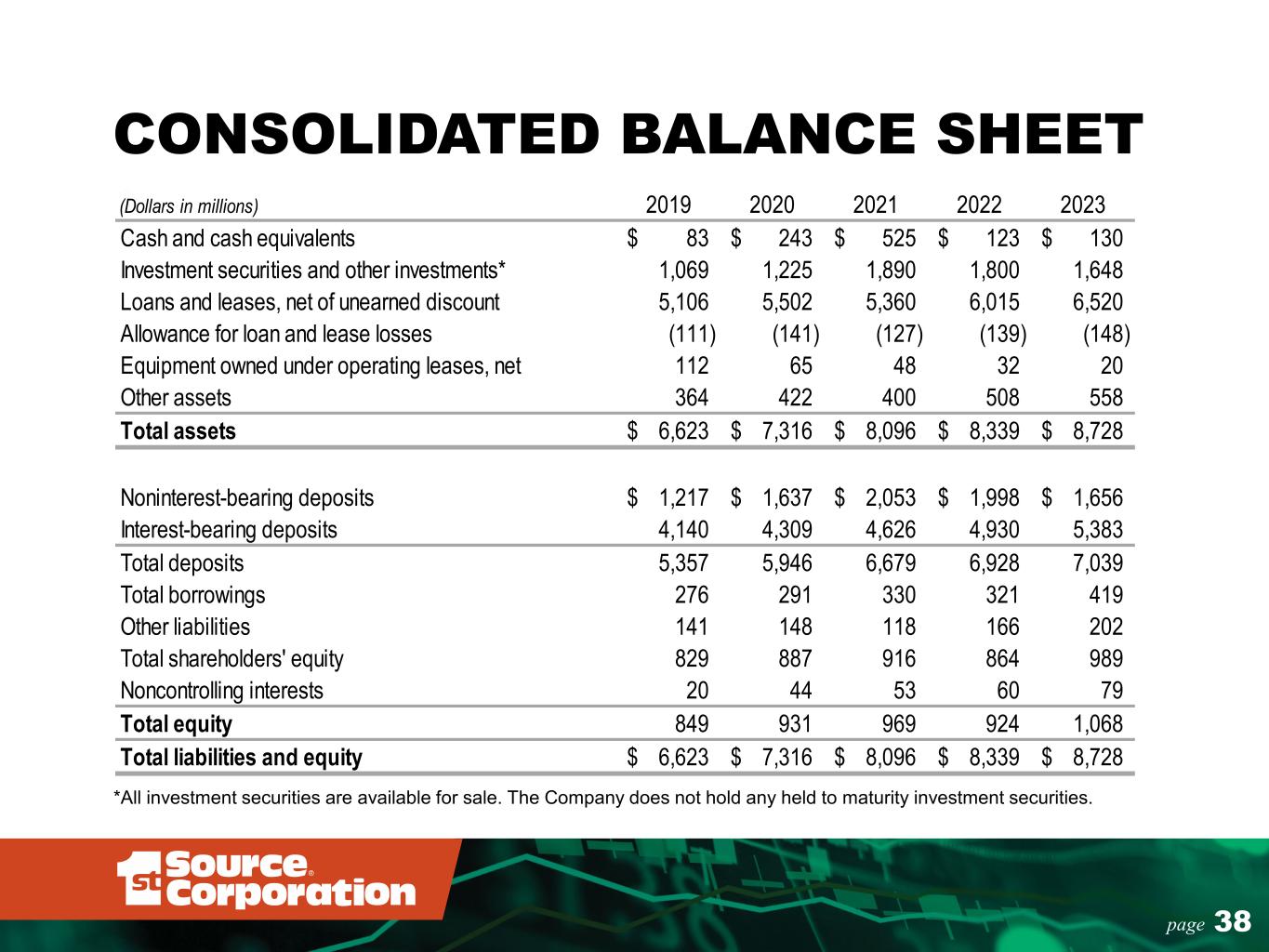

CONSOLIDATED BALANCE SHEET 38page (Dollars in millions) 2019 2020 2021 2022 2023 Cash and cash equivalents 83$ 243$ 525$ 123$ 130$ Investment securities and other investments* 1,069 1,225 1,890 1,800 1,648 Loans and leases, net of unearned discount 5,106 5,502 5,360 6,015 6,520 Allowance for loan and lease losses (111) (141) (127) (139) (148) Equipment owned under operating leases, net 112 65 48 32 20 Other assets 364 422 400 508 558 Total assets 6,623$ 7,316$ 8,096$ 8,339$ 8,728$ Noninterest-bearing deposits 1,217$ 1,637$ 2,053$ 1,998$ 1,656$ Interest-bearing deposits 4,140 4,309 4,626 4,930 5,383 Total deposits 5,357 5,946 6,679 6,928 7,039 Total borrowings 276 291 330 321 419 Other liabilities 141 148 118 166 202 Total shareholders' equity 829 887 916 864 989 Noncontrolling interests 20 44 53 60 79 Total equity 849 931 969 924 1,068 Total liabilities and equity 6,623$ 7,316$ 8,096$ 8,339$ 8,728$ *All investment securities are available for sale. The Company does not hold any held to maturity investment securities.

CONSOLIDATED INCOME STATEMENT 39page (Dollars in millions) 2019 2020 2021 2022 2023 Net interest income 224$ 226$ 237$ 263$ 279$ Provision (recovery of provision) for credit losses 16 36 (4) 13 6 Noninterest income* 76 83 86 81 84 Noninterest expense* 164 167 172 174 195 Income before income taxes 120 106 155 157 162 Income tax expense 28 25 36 36 37 Net income 92 81 119 121 125 Net income attributable to noncontrolling interests - - - - - Net income available to common shareholders 92$ 81$ 119$ 121$ 125$ Diluted net income per common share 3.57$ 3.17$ 4.70$ 4.84$ 5.03$ * Note: Noninterest income and Noninterest expense are shown net of leased equipment depreciation. See Reconciliation of non-GAAP Financial Measures" in Appendix.

40page Transportation & Warehousing 17% Finance & Insurance and Real Estate 18% Services 19% Retail Trade 7% Construction 13% Manufacturing 9% Ag, Forestry, Fishing & Hunting 8% Wholesale Trade 4% Other* 5% * Other includes: Mining, Utilities, and Information AIRCRAFT PORTFOLIO INDUSTRIES BY NAICS

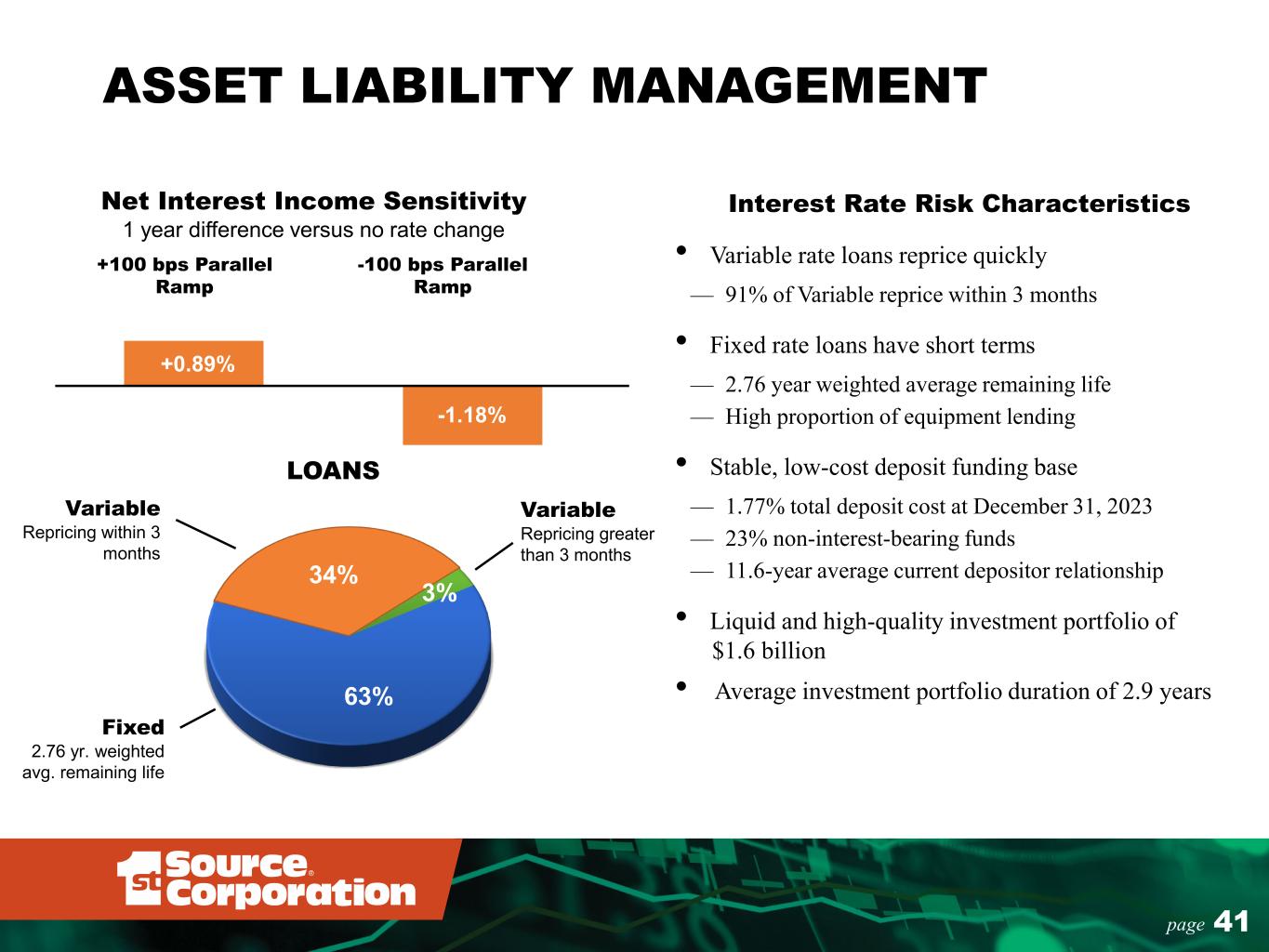

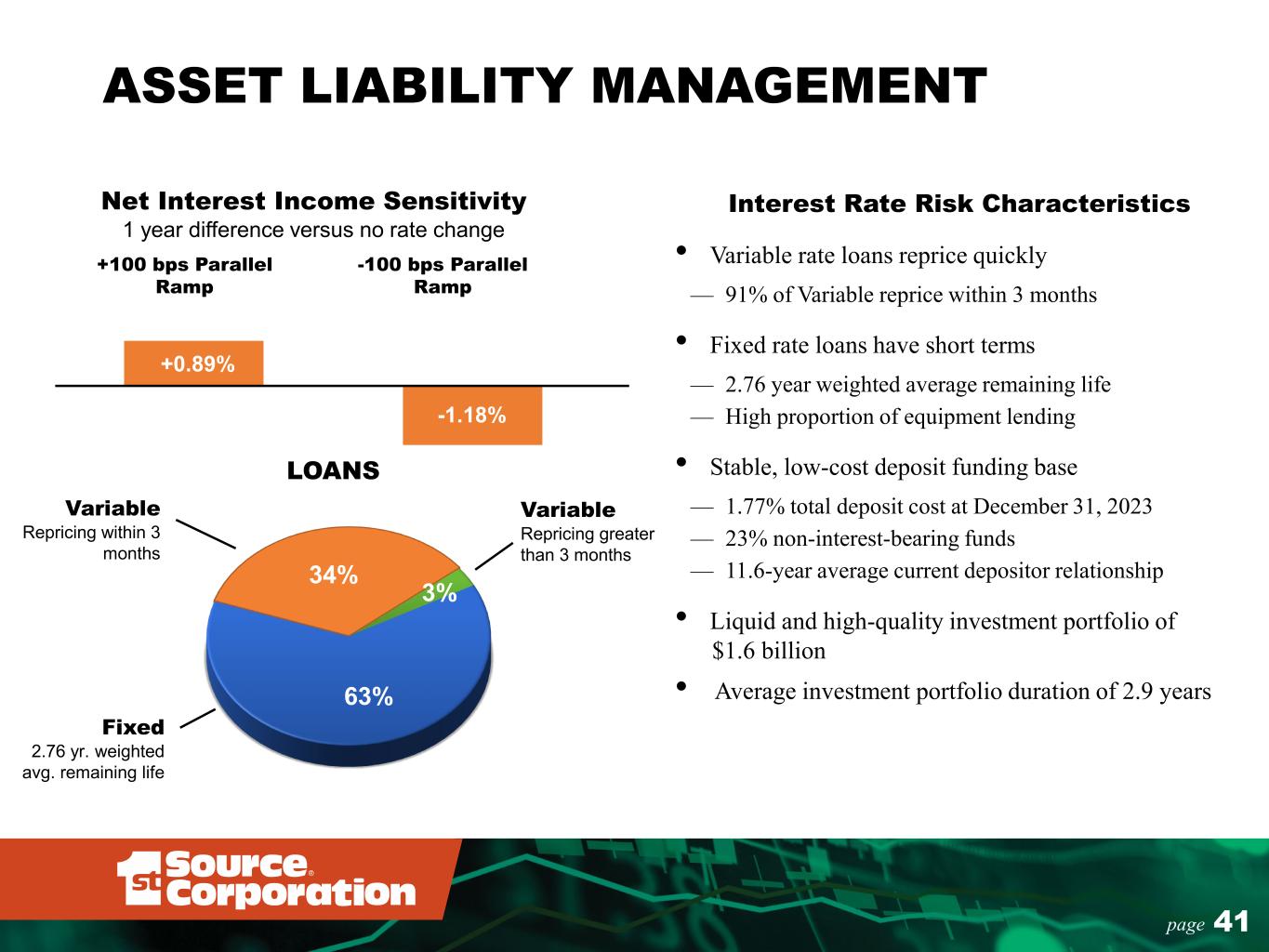

63% 34% 3% 41page Interest Rate Risk Characteristics • Variable rate loans reprice quickly — 91% of Variable reprice within 3 months • Fixed rate loans have short terms — 2.76 year weighted average remaining life — High proportion of equipment lending • Stable, low-cost deposit funding base — 1.77% total deposit cost at December 31, 2023 — 23% non-interest-bearing funds — 11.6-year average current depositor relationship • Liquid and high-quality investment portfolio of $1.6 billion • Average investment portfolio duration of 2.9 years Net Interest Income Sensitivity 1 year difference versus no rate change +100 bps Parallel Ramp -100 bps Parallel Ramp +0.89% -1.18% LOANS Fixed 2.76 yr. weighted avg. remaining life Variable Repricing within 3 months Variable Repricing greater than 3 months ASSET LIABILITY MANAGEMENT

42page OWNERSHIP SUMMARY Institutional 10,857,320 44.4% Insiders 7,802,652 31.9% Retail/Other 5,067,228 20.8% 1st Source ESOP 707,404 2.9% Total Shares Outstanding(1) 24,434,604 100.0% Institution (Top 10 Institutions) Shares % of Total Dimensional Fund Advisors LP 1,591,256 6.5% BlackRock Inc. 1,369,062 5.6% Wellington Management Group LLP 906,064 3.7% Vanguard Group Inc. 842,338 3.4% AllianceBernstein LP 708,918 2.9% State Street Global Advisors Inc. 499,621 2.0% Charles Schwab Investment Mgmt 465,284 1.9% Boston Trust Walden Co. 417,096 1.7% Geode Capital Management LLC 354,254 1.5% Manulife Asset Management 315,297 1.3% Top 10 Institutions(2) 7,469,190 30.5% Other 3,388,130 13.9% Total Institutional Ownership(2) 10,857,320 44.4% Institutional, 44.4% Insiders, 31.9% Retail/Other, 20.8% 1st Source ESOP, 2.9% (1) As of December 31, 2023 (2) As of September 30, 2023 or most recently reported data Source: S&P Global Market Intelligence and Company filings

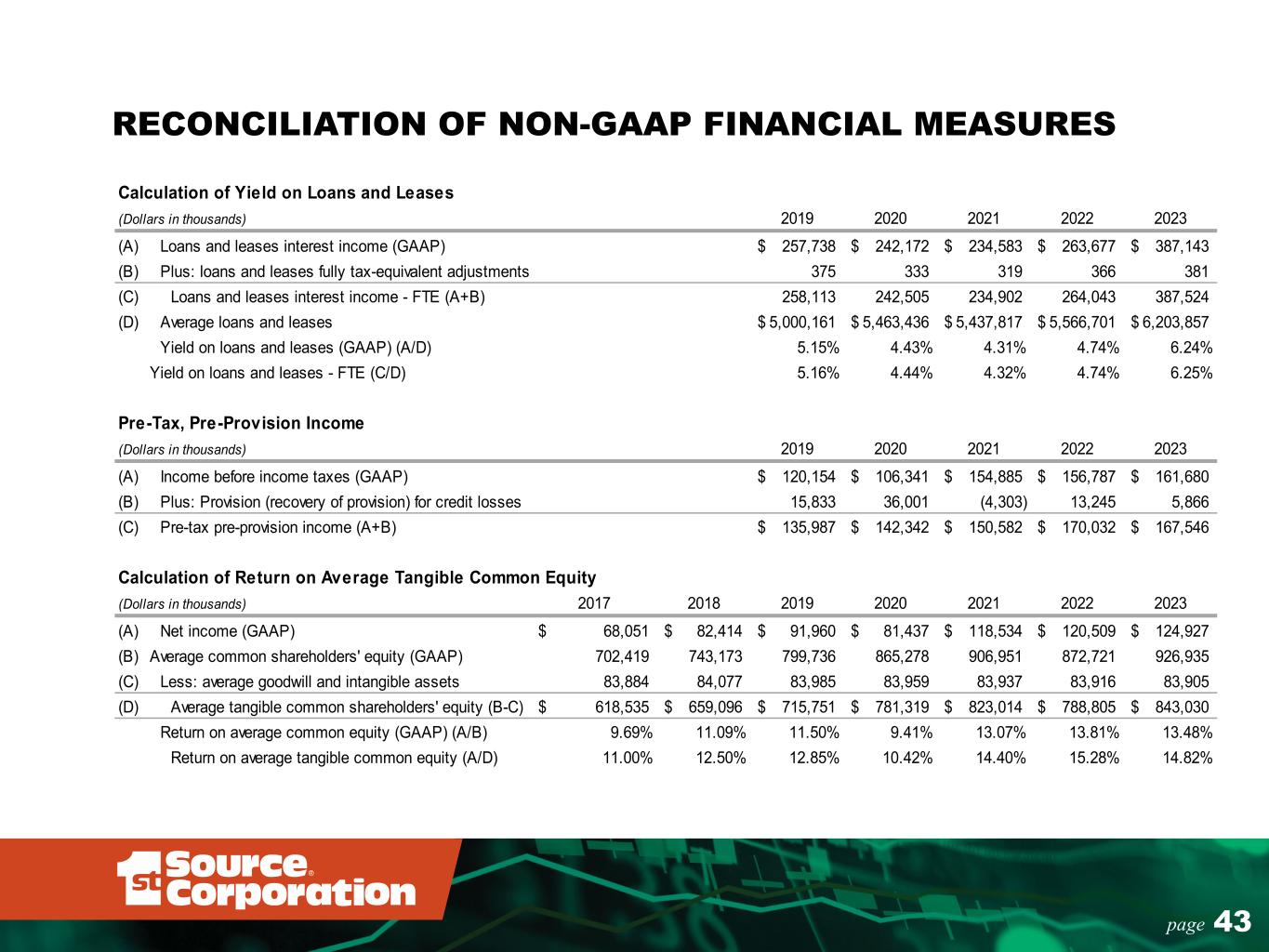

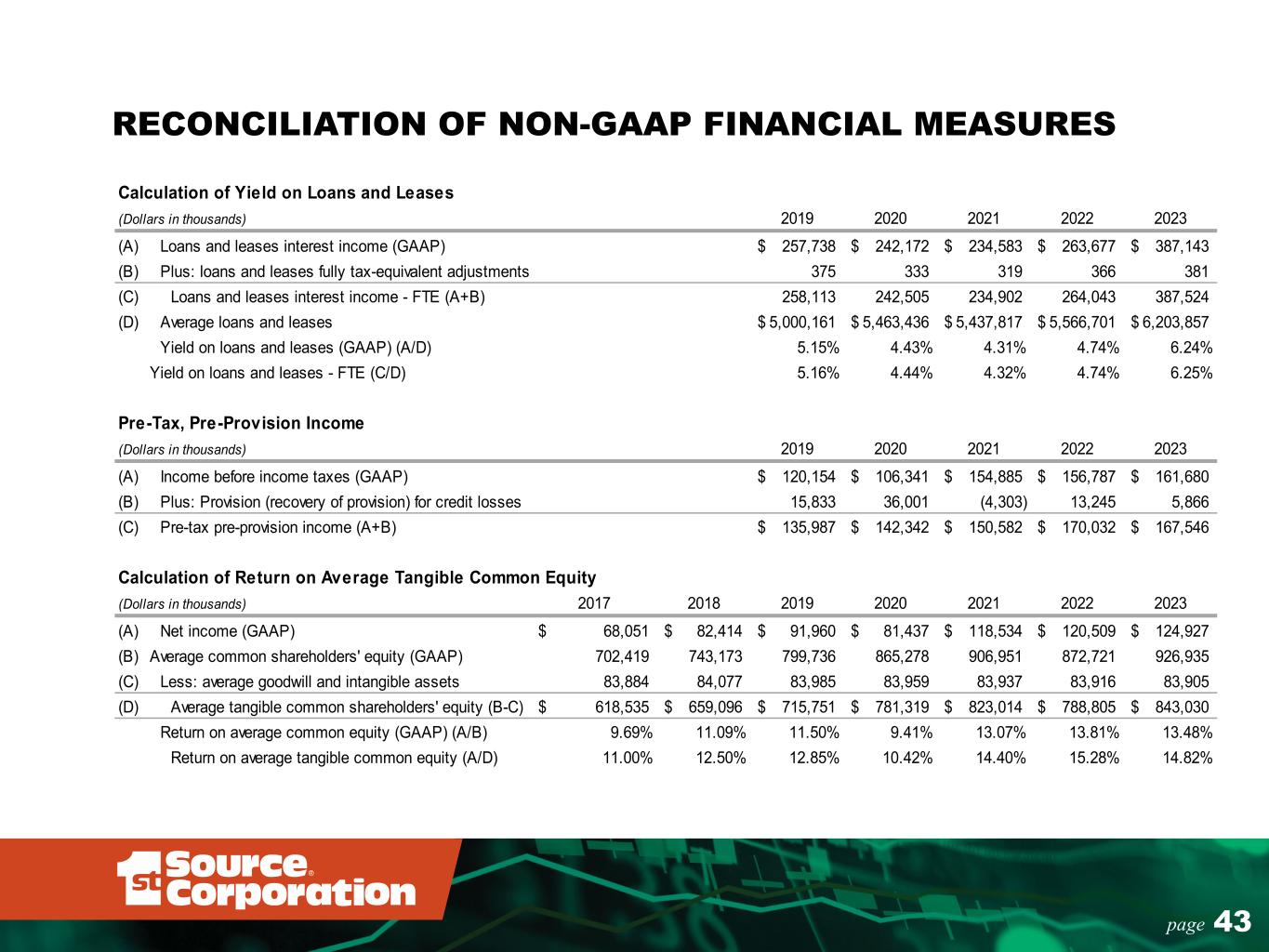

43page RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Calculation of Yield on Loans and Leases (Dollars in thousands) 2019 2020 2021 2022 2023 (A) Loans and leases interest income (GAAP) 257,738$ 242,172$ 234,583$ 263,677$ 387,143$ (B) Plus: loans and leases fully tax-equivalent adjustments 375 333 319 366 381 (C) Loans and leases interest income - FTE (A+B) 258,113 242,505 234,902 264,043 387,524 (D) Average loans and leases 5,000,161$ 5,463,436$ 5,437,817$ 5,566,701$ 6,203,857$ Yield on loans and leases (GAAP) (A/D) 5.15% 4.43% 4.31% 4.74% 6.24% Yield on loans and leases - FTE (C/D) 5.16% 4.44% 4.32% 4.74% 6.25% Pre-Tax, Pre-Provision Income (Dollars in thousands) 2019 2020 2021 2022 2023 (A) Income before income taxes (GAAP) 120,154$ 106,341$ 154,885$ 156,787$ 161,680$ (B) Plus: Provision (recovery of provision) for credit losses 15,833 36,001 (4,303) 13,245 5,866 (C) Pre-tax pre-provision income (A+B) 135,987$ 142,342$ 150,582$ 170,032$ 167,546$ Calculation of Return on Average Tangible Common Equity (Dollars in thousands) 2017 2018 2019 2020 2021 2022 2023 (A) Net income (GAAP) 68,051$ 82,414$ 91,960$ 81,437$ 118,534$ 120,509$ 124,927$ (B) 702,419 743,173 799,736 865,278 906,951 872,721 926,935 (C) Less: average goodwill and intangible assets 83,884 84,077 83,985 83,959 83,937 83,916 83,905 (D) Average tangible common shareholders' equity (B-C) 618,535$ 659,096$ 715,751$ 781,319$ 823,014$ 788,805$ 843,030$ Return on average common equity (GAAP) (A/B) 9.69% 11.09% 11.50% 9.41% 13.07% 13.81% 13.48% Return on average tangible common equity (A/D) 11.00% 12.50% 12.85% 10.42% 14.40% 15.28% 14.82% Average common shareholders' equity (GAAP)

44page RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Calculation of Net Interest Margin (Dollars in thousands) 2019 2020 2021 2022 2023 (A) Interest income (GAAP) 282,877$ 263,031$ 254,772$ 293,816$ 416,907$ (B) Plus: fully tax-equivalent adjustments 686 543 459 628 741 (C) Interest income - FTE (A+B) 283,563 263,574 255,231 294,444 417,648 (D) Interest expense (GAAP) 59,011 37,211 18,134 30,347 138,260 (E) Net interest income (GAAP) (A-D) 223,866 225,820 236,638 263,469 278,647 (F) Net interest income - FTE (C-D) 224,552 226,363 237,097 264,097 279,388 (G) Average earning assets 6,104,673$ 6,684,246$ 7,338,639$ 7,661,168$ 7,956,604$ Net interest margin (GAAP) (E/G) 3.67% 3.38% 3.22% 3.44% 3.50% Net interest margin - FTE (F/G) 3.68% 3.39% 3.23% 3.45% 3.51% Noninterest Income (Dollars in thousands) 2019 2020 2021 2022 2023 (A) Noninterest income (GAAP) 101,130$ 103,889$ 100,092$ 91,262$ 90,623$ (B) Less: depreciation - leased equipment (25,128) (20,203) (13,694) (10,023) (7,093) (C) Noninterest income - adjusted (A-B) 76,002$ 83,686$ 86,398$ 81,239$ 83,530$ Noninterest Expense (Dollars in thousands) 2019 2020 2021 2022 2023 (A) Noninterest expense (GAAP) 189,009$ 187,367$ 186,148$ 184,699$ 201,724$ (B) Less: depreciation - leased equipment (25,128) (20,203) (13,694) (10,023) (7,093) (C) Noninterest expense - adjusted (A-B) 163,881$ 167,164$ 172,454$ 174,676$ 194,631$

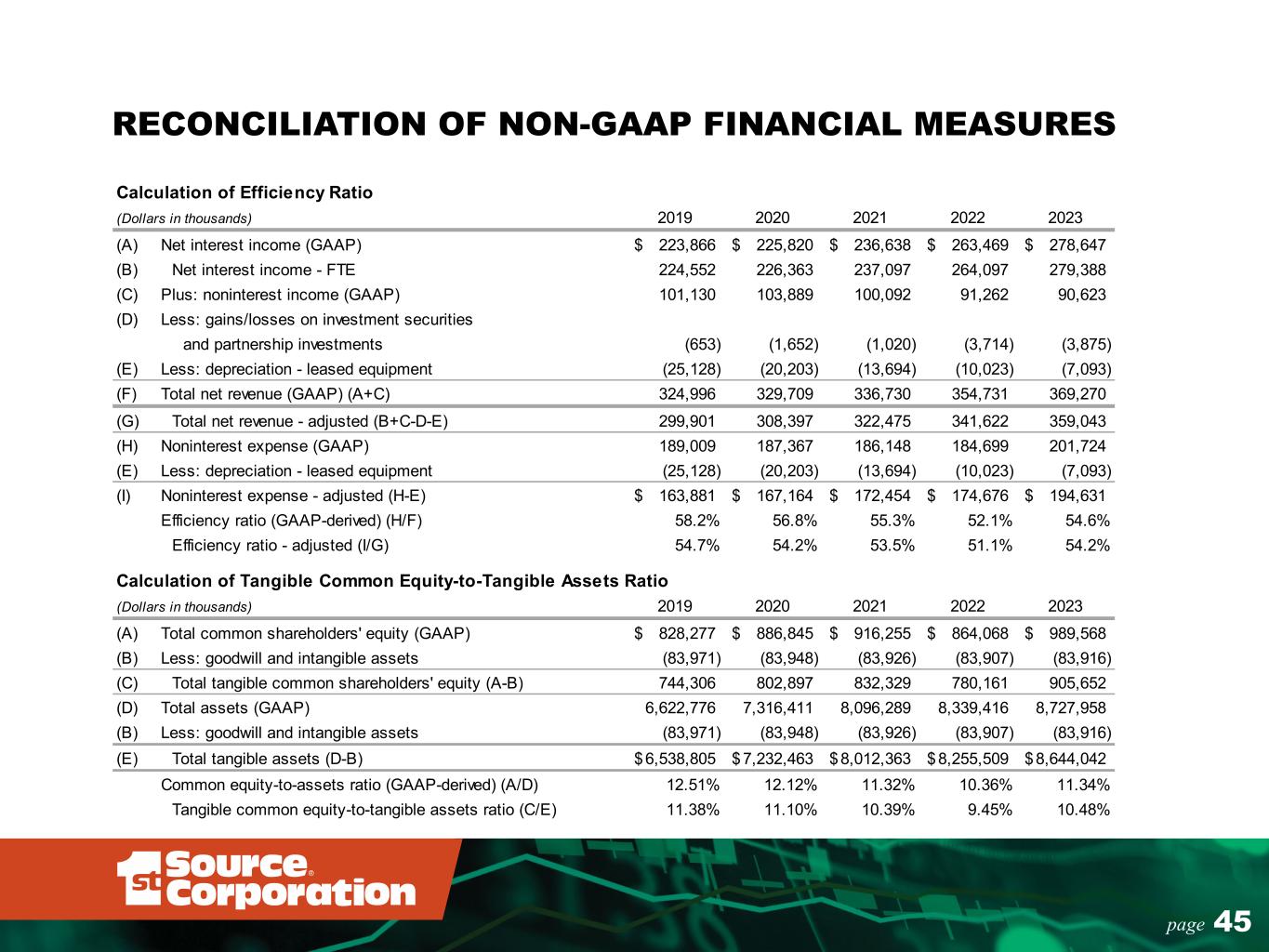

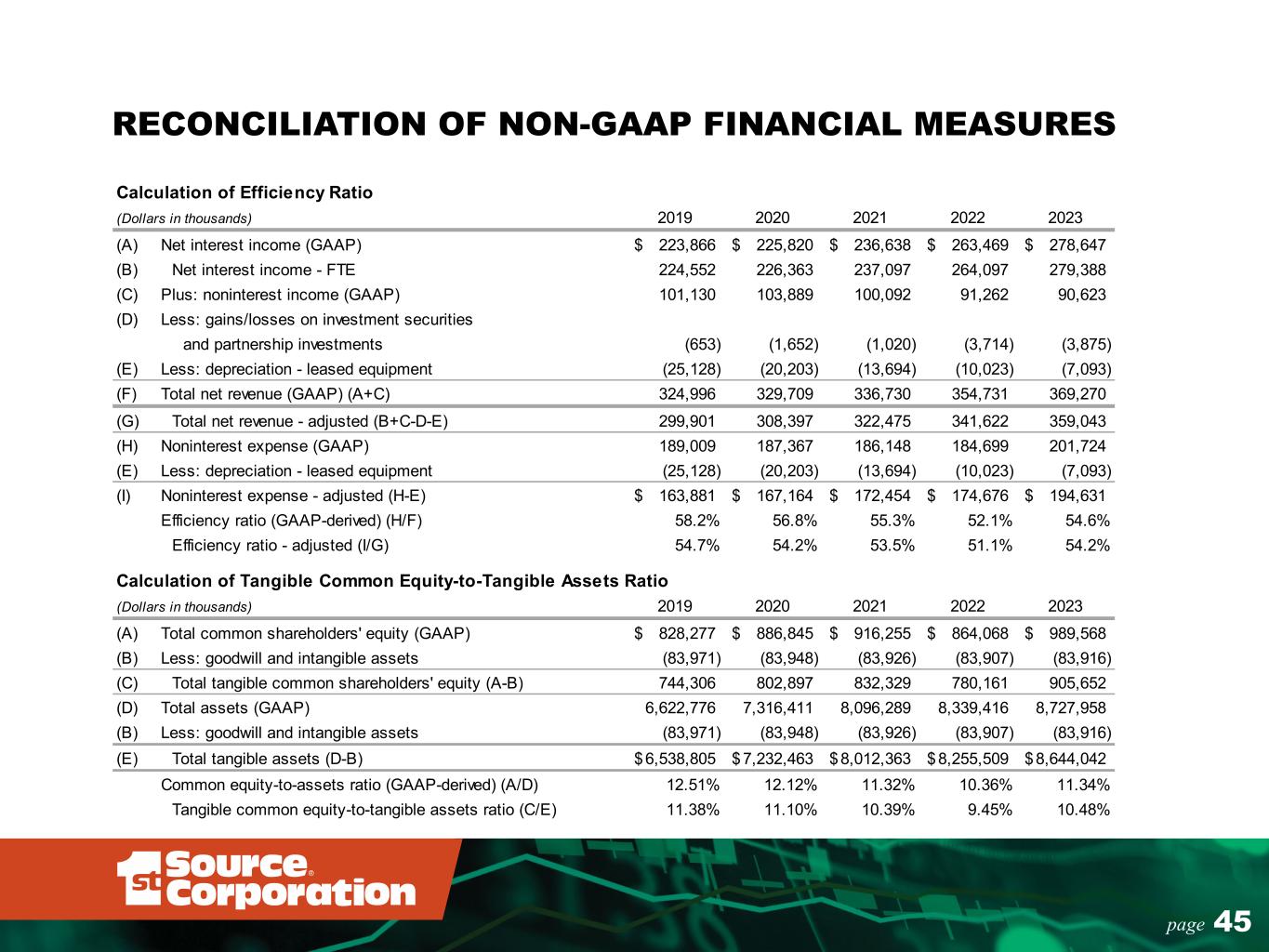

45page RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Calculation of Efficiency Ratio (Dollars in thousands) 2019 2020 2021 2022 2023 (A) Net interest income (GAAP) 223,866$ 225,820$ 236,638$ 263,469$ 278,647$ (B) Net interest income - FTE 224,552 226,363 237,097 264,097 279,388 (C) Plus: noninterest income (GAAP) 101,130 103,889 100,092 91,262 90,623 (D) Less: gains/losses on investment securities and partnership investments (653) (1,652) (1,020) (3,714) (3,875) (E) Less: depreciation - leased equipment (25,128) (20,203) (13,694) (10,023) (7,093) (F) Total net revenue (GAAP) (A+C) 324,996 329,709 336,730 354,731 369,270 (G) Total net revenue - adjusted (B+C-D-E) 299,901 308,397 322,475 341,622 359,043 (H) Noninterest expense (GAAP) 189,009 187,367 186,148 184,699 201,724 (E) Less: depreciation - leased equipment (25,128) (20,203) (13,694) (10,023) (7,093) (I) Noninterest expense - adjusted (H-E) 163,881$ 167,164$ 172,454$ 174,676$ 194,631$ Efficiency ratio (GAAP-derived) (H/F) 58.2% 56.8% 55.3% 52.1% 54.6% Efficiency ratio - adjusted (I/G) 54.7% 54.2% 53.5% 51.1% 54.2% Calculation of Tangible Common Equity-to-Tangible Assets Ratio (Dollars in thousands) 2019 2020 2021 2022 2023 (A) Total common shareholders' equity (GAAP) 828,277$ 886,845$ 916,255$ 864,068$ 989,568$ (B) Less: goodwill and intangible assets (83,971) (83,948) (83,926) (83,907) (83,916) (C) Total tangible common shareholders' equity (A-B) 744,306 802,897 832,329 780,161 905,652 (D) Total assets (GAAP) 6,622,776 7,316,411 8,096,289 8,339,416 8,727,958 (B) Less: goodwill and intangible assets (83,971) (83,948) (83,926) (83,907) (83,916) (E) Total tangible assets (D-B) 6,538,805$ 7,232,463$ 8,012,363$ 8,255,509$ 8,644,042$ Common equity-to-assets ratio (GAAP-derived) (A/D) 12.51% 12.12% 11.32% 10.36% 11.34% Tangible common equity-to-tangible assets ratio (C/E) 11.38% 11.10% 10.39% 9.45% 10.48%

46page RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Calculation of Tangible Book Value per Common Share (Dollars in thousands, except for per share data) 2016 2017 2018 2019 2020 2021 2022 2023 (A) Total common shareholders' equity (GAAP) 672,650$ 718,537$ 762,082$ 828,277$ 886,845$ 916,255$ 864,068$ 989,568$ (B) Less: goodwill and intangible assets (84,102) (83,742) (83,998) (83,971) (83,948) (83,926) (83,907) (83,916) (C) Total tangible common shareholders' equity (A-B) 588,548$ 634,795$ 678,084$ 744,306$ 802,897$ 832,329$ 780,161$ 905,652$ (D) Actual common shares outstanding 25,875,765 25,936,764 25,783,728 25,509,474 25,389,117 24,739,512 24,662,286 24,434,604 Book value per common share (GAAP-derived) (A/D)*1000 26.00$ 27.70$ 29.56$ 32.47$ 34.93$ 37.04$ 35.04$ 40.50$ Tangible common book value per share (C/D)*1000 22.75$ 24.47$ 26.30$ 29.18$ 31.62$ 33.64$ 31.63$ 37.06$