Exhibit 99.1

1st Source Corporation Keefe, Bruyette & Woods Community Bank Investor Conference July 29, 2008

KBW Conference Who is 1st Source? Financials Why Invest in 1st Source?

Except for historical information contained herein, the matters discussed in this document express “forward-looking statements.” Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will” and similar expressions indicate forward-looking statements. Those statements, including statements, projections, estimates or assumptions concerning future events or performance, and other statements that are other than statements of historical fact, are subject to material risks and uncertainties. 1st Source cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made. 1st Source may make other written or oral forward-looking statements from time to time. Readers are advised that various important factors could cause 1st Source’s actual results or circumstances for future periods to differ materially from those anticipated or projected in such forward-looking statements. Forward-looking Statement Disclosure

Corporate Overview Banking, specialty finance, leasing, investment management, trust & estate planning, insurance sales, mortgage banking $4.5 billion bank holding company headquartered in South Bend, Indiana SRCE – Nasdaq Global Select Market Market cap over $500 Million

1st Source Strategy Deliver personalized, community banking to individuals, businesses and institutions within northern Indiana and southwestern Michigan through knowledgeable, local members of the community Diversify and add growth through our national specialty finance markets of aircraft, construction equipment, trucks, rental agency cars and environmental equipment

Who is 1st Source? 79 banking centers 24 Specialty Finance locations nationwide 6 1st Source Insurance offices 7 Trust & Wealth Management locations

The Markets Body: 1st Source: No sub-prime exposure No high growth real estate market Majority of commercial real estate lending is owner occupied Banks, Banks, Banks - not all are the same.

1st Source Bank Market

Center for Higher Education University of Notre Dame Indiana University South Bend Saint Mary’s College Purdue University Bethel College Goshen College Holy Cross College Ivy Tech Community College

Industry Regional medical hub Agriculture Steel production Medical devices Recreational vehicle manufacturing Distribution hub

Business Mix 6/30/08 Local/Personal $535 million Regional/Business $1.1 billion National / Specialty Finance $1.6 billion

National / Specialty Finance 6/30/08 Auto, Light truck, Environmental Equipment $349 million Medium & Heavy Duty Truck $270 million Aircraft Financing $579 million Construction Equipment $399 million

Trust and Investments Assets under management: $3.0 billion Monogram Income Equity Fund: 5-star rating from Morningstar Ranked #1 over 10 years by Lipper Monogram Long/Short Fund: 4-star rating from Morningstar Monogram Income Fund: 3-star rating from Morningstar

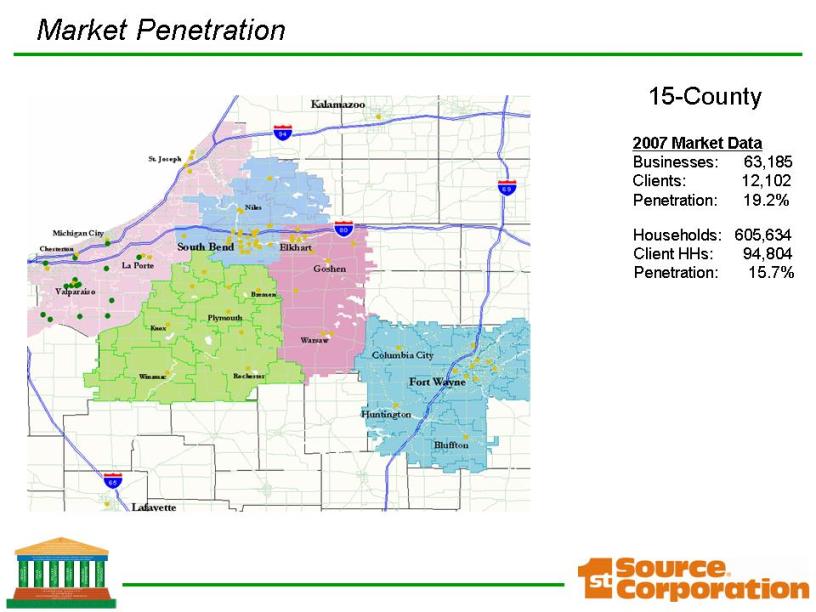

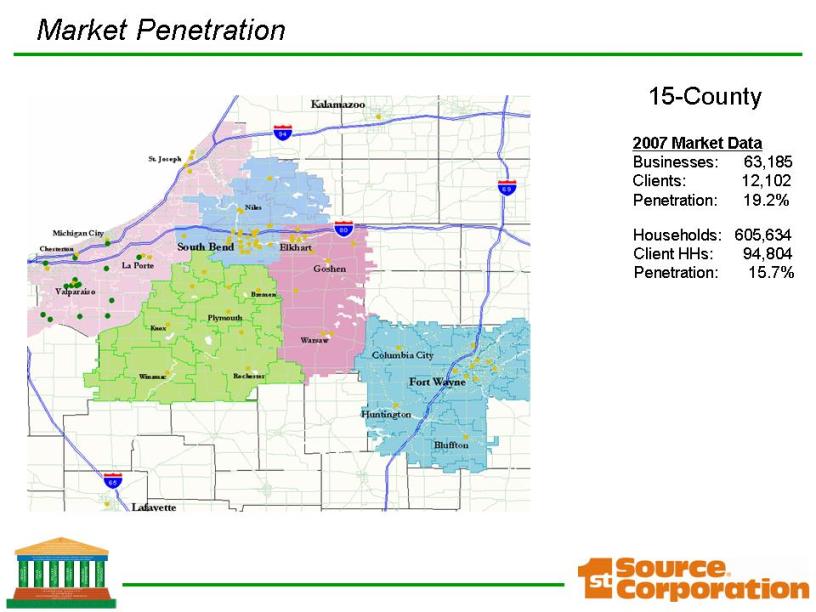

Market Penetration 15-County 2007 Market Data Businesses: 63,185 Clients: 12,102 Penetration: 19.2% Households: 605,634 Client HHs: 94,804 Penetration: 15.7% St. Joseph Michigan City Chesterton Valparaiso La Porte Knox Plymouth Rochester Warsaw Columbia City Fort Wayne Huntington bluffton Lafayette Kalamazoo Niles Goshen Bremen South Bend Elkhart Winamac

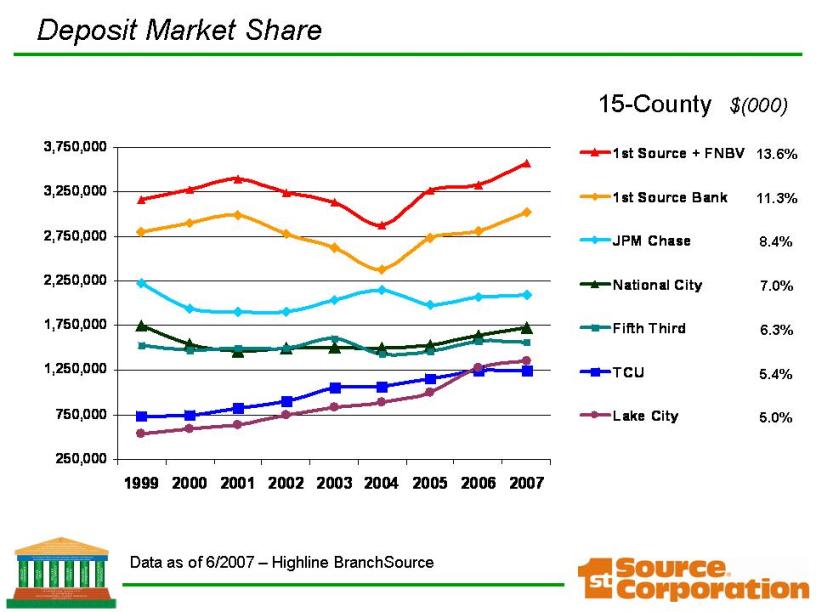

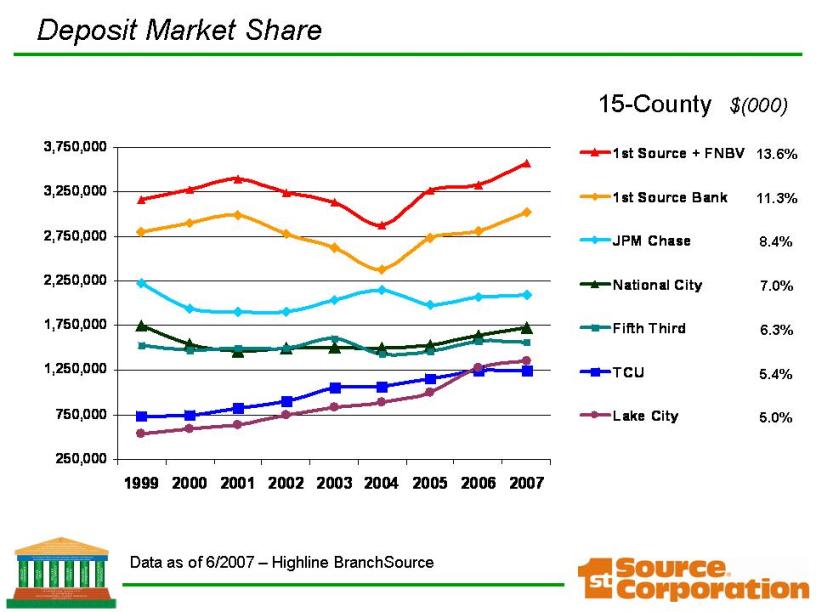

Deposit Market Share 15-County $(000) 13.6% 8.4% 7.0% 6.3% Data as of 6/2007 – Highline BranchSource 11.3% 5.4% 5.0% 1999 2000 2001 2002 2003 2004 2005 2006 2007 250,00 750,00 1,250,00 1,750,00 2,250,00 2,750,00 3,250,00 3,750,00 1st Source + FNBV 1st source Bank JPM Chase National City Fifth Third TCU Lake City

Market Share #2 provider of loans for home improvement #1 provider of SBA loans in northwest Indiana and southwest Michigan #3 market share in mortgage loans

Growth Computer Conversion Installed new Core System last summer Increasing our effectiveness & efficiencies Standardize, modernize Allowing us to grow in the future Still learning, still adding

Growth Recent market entries: Kalamazoo, MI Lafayette, IN Full service in Fort Wayne, IN Commercial / Small Business Agriculture Banking Personal Asset Management Downtown Regional Headquarters

Growth Purchased First National Bank, Valparaiso Acquired June 1, 2007 Merged June 9, 2008 $700 Million in Assets, 14 Banking Centers NW Indiana – Chicago, Lake Michigan “High” population growth for our region

Larry Lentych Chief Financial Officer

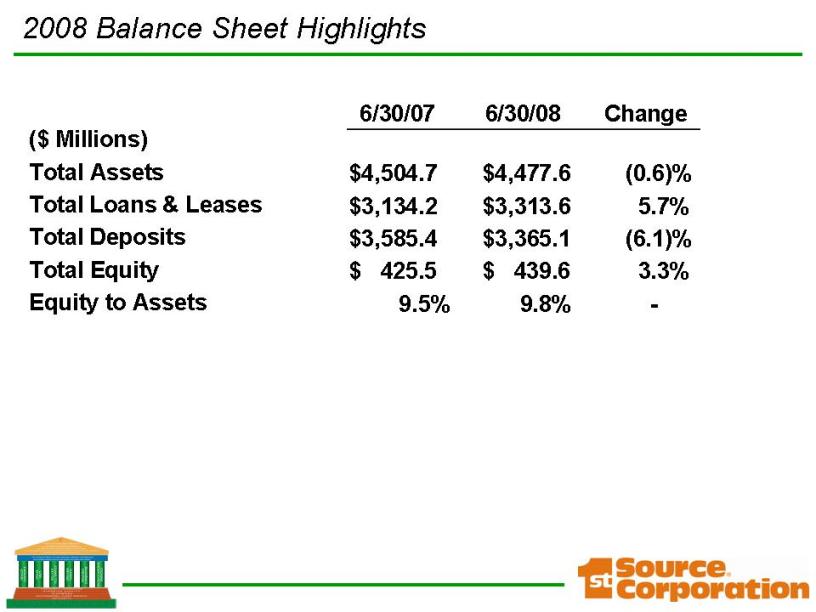

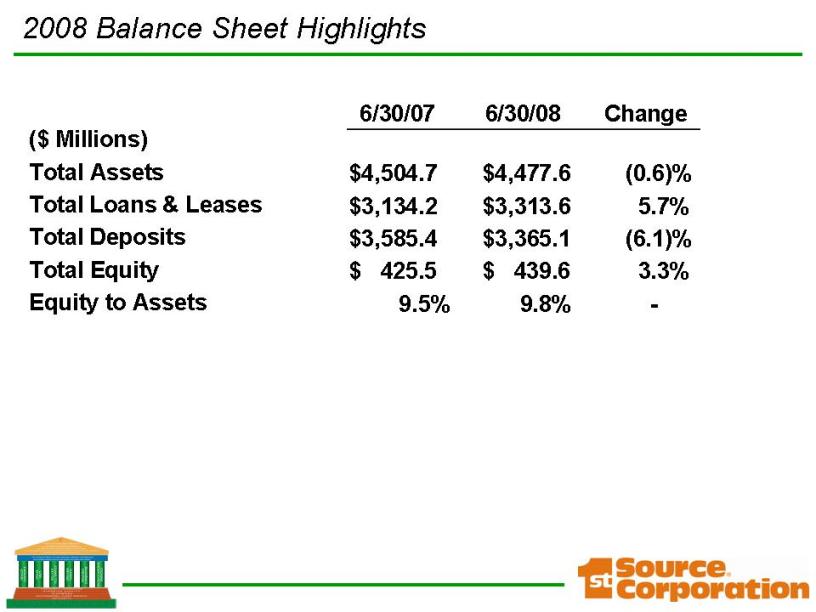

($ Millions) Total Assets Total Loans & Leases Total Deposits Total Equity Equity to Assets $4,504.7 $4,477.6 (0.6)% $3,134.2 $3,313.6 5.7% $3,585.4 $3,365.1 (6.1)% $ 425.5 $ 439.6 3.3% 9.5% 9.8% - 6/30/07 6/30/08 Change 2008 Balance Sheet Highlights

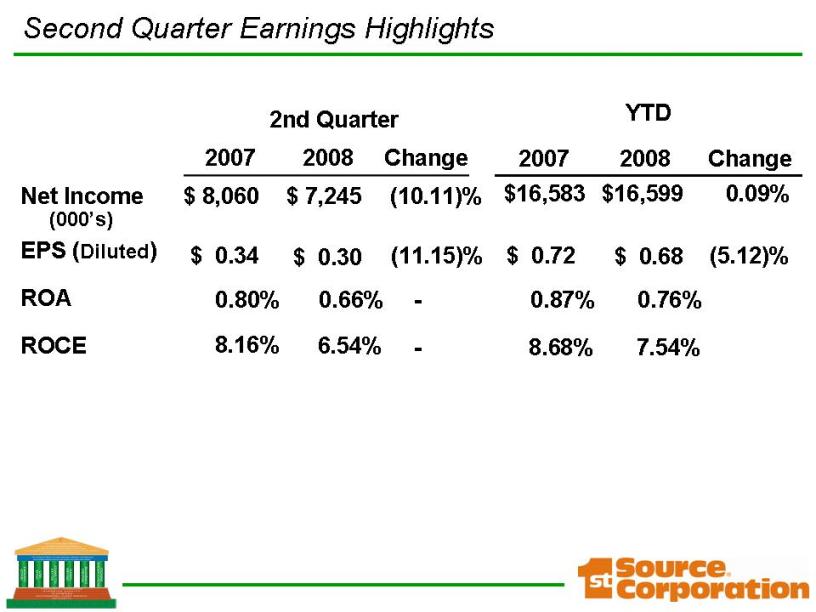

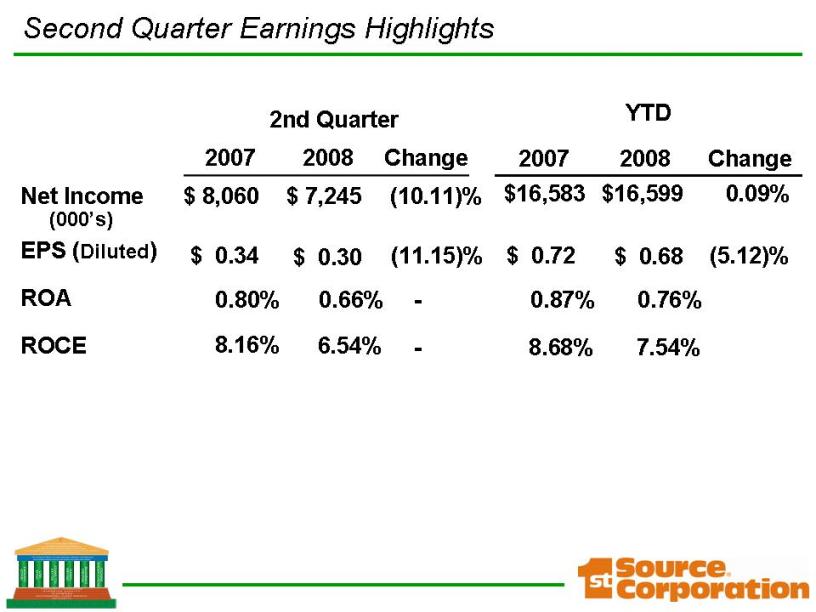

Second Quarter Earnings Highlights Net Income EPS (Diluted) ROA ROCE 2007 2008 Change 2nd Quarter $ 8,060 (10.11)% 0.80% 8.16% - - (11.15)% $ 0.34 $ 7,245 0.66% 6.54% $ 0.30 (000’s) 0.87% 8.68% 0.76% 7.54% $ 0.72 $ 0.68 (5.12)%

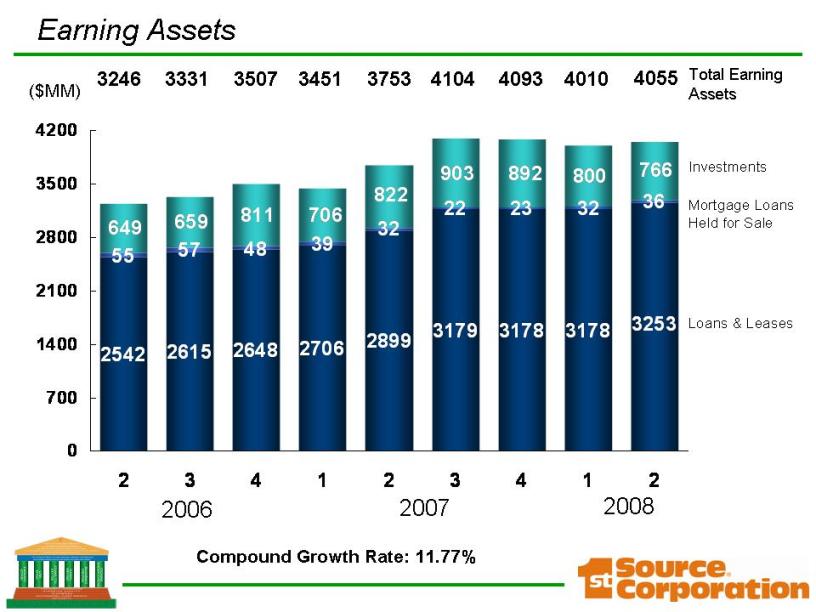

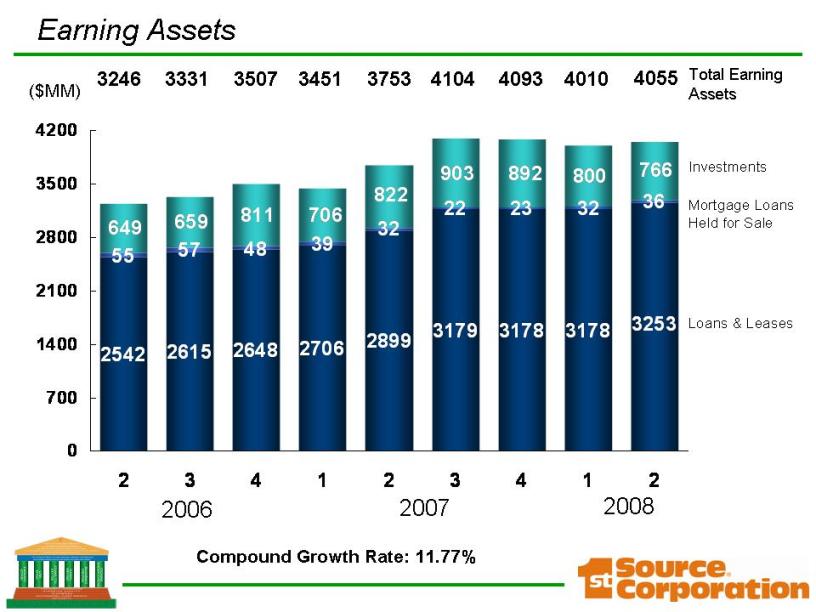

Total Earning Assets ($MM) 2006 Investments 2007 Mortgage Loans Held for Sale Loans & Leases 3246 3331 3507 3451 3753 4104 4093 2008 4010 Earning Assets 4055 Compound Growth Rate: 11.77% 2542 2615 2648 2706 2899 3179 3178 3178 3253 36 32 23 22 32 39 48 57 55 903 649 659 811 706 822 892 800 766 0 700 1400 2100 2800 3500 4200 2 3 4 1 2 3 4 1 2

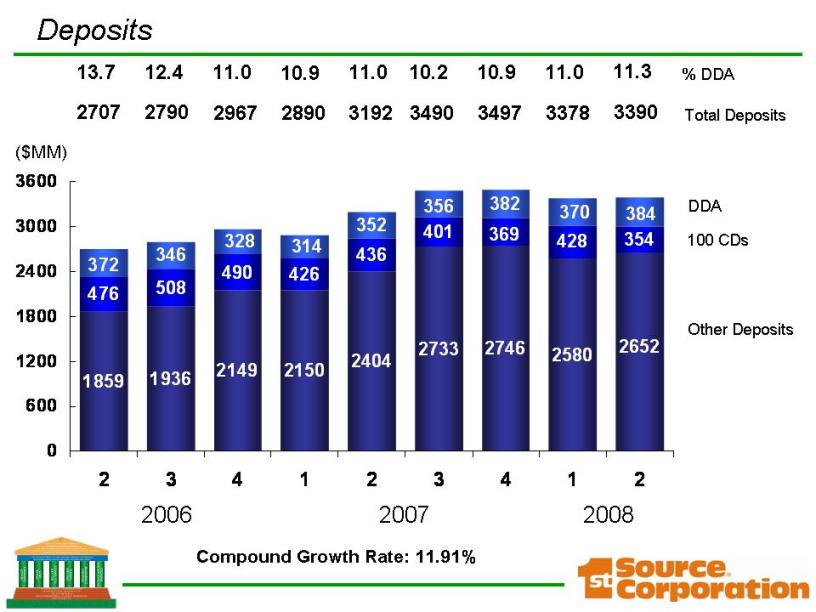

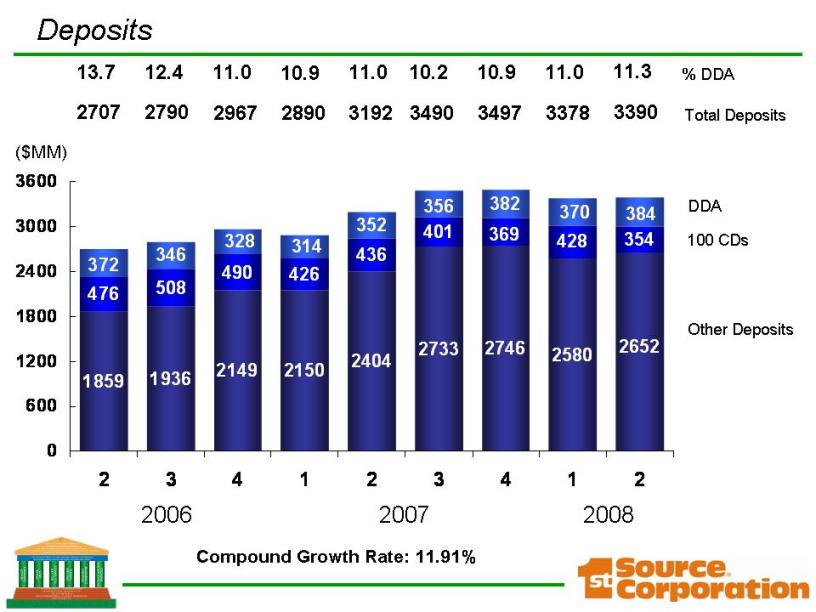

2008 % DDA DDA 100 CDs Other Deposits Total Deposits ($MM) 2006 2007 13.7 2707 2790 12.4 2967 11.0 2890 10.9 3192 11.0 3490 10.2 10.9 3497 3378 11.0 Deposits 3390 11.3 Compound Growth Rate: 11.91% 1859 1936 2149 2150 2733 2746 2580 476 508 490 426 436 401 2404 2652 428 354 369 370 384 372 346 328 314 352 356 382 0 600 1200 1800 2400 3000 3600 2006 2007 2008 2 3 4 1 2 3 4 1 2

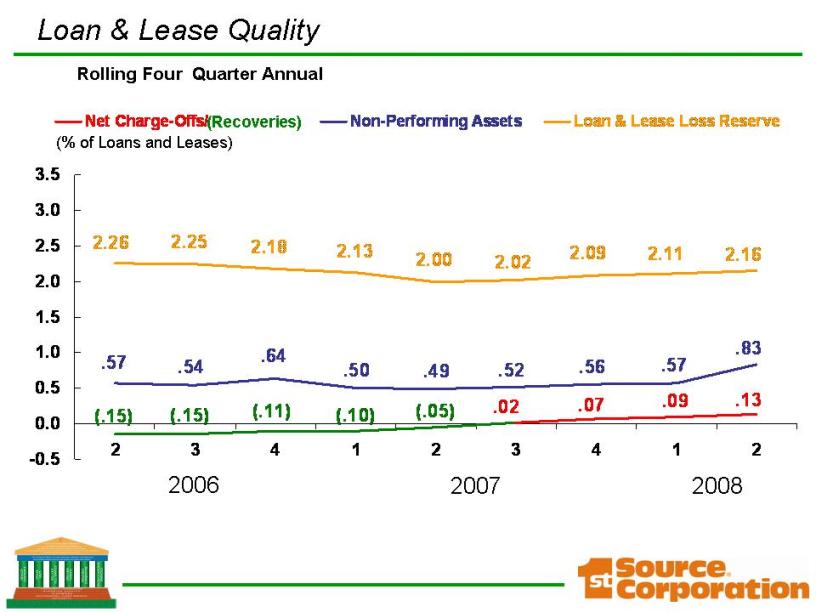

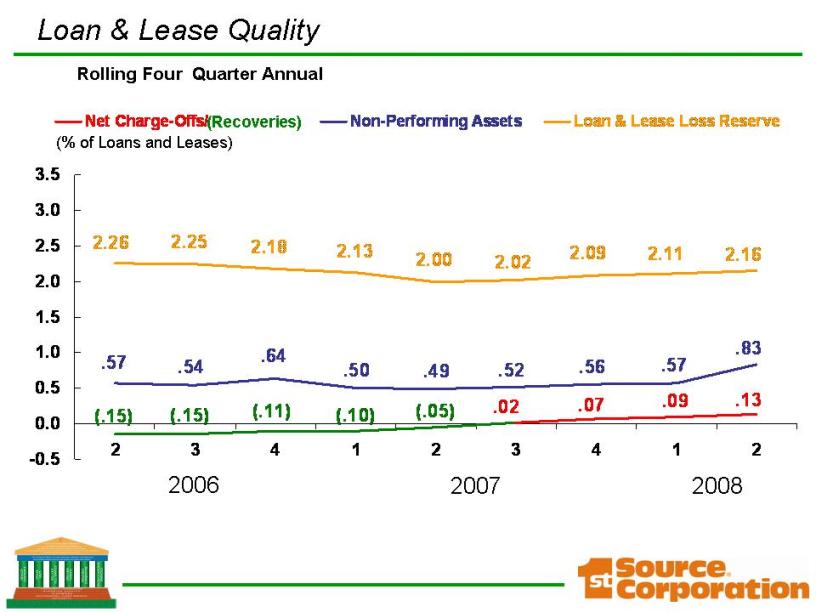

2008 2006 (% of Loans and Leases) Rolling Four Quarter Annual 2007 Loan & Lease Quality (Recoveries) (.15) (.15) (.11) (.10) (.05) .02 .07 .09 .13 .57 .54 .64 .50 .49 .52 .56 .57 .83 2.16 2.11 2.09 2.02 2.00 2.13 2.18 2.25 2.26 -0.5 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 2 3 4 1 2 3 4 1 2 2006 2007 2008

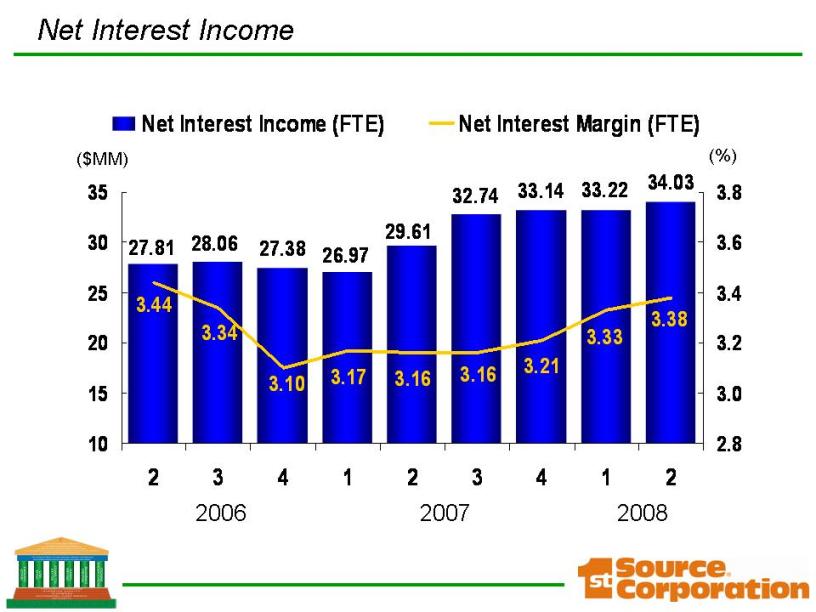

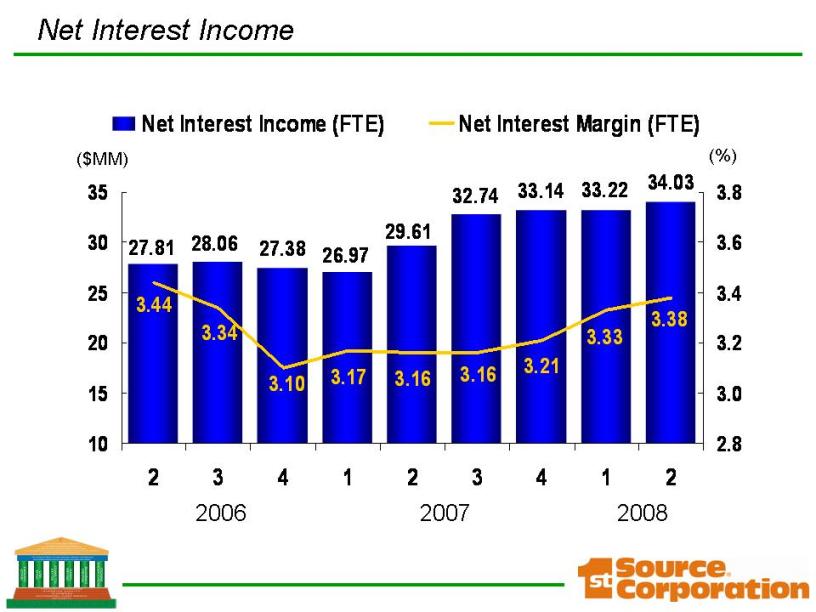

2008 ($MM) (%) 2006 2007 Net Interest Income 34.03 33.22 33.14 27.81 28.06 27.38 26.97 29.61 32.74 3.44 3.34 3.10 3.17 3.16 3.16 3.21 3.33 3.38 10 15 20 25 30 35 2 3 4 1 2 3 4 1 2 2.8 3.0 3.2 3.4 3.6 3.8 Net Net Interest Income (FTE) Net Interest Margin (FTE) ($MM) 35

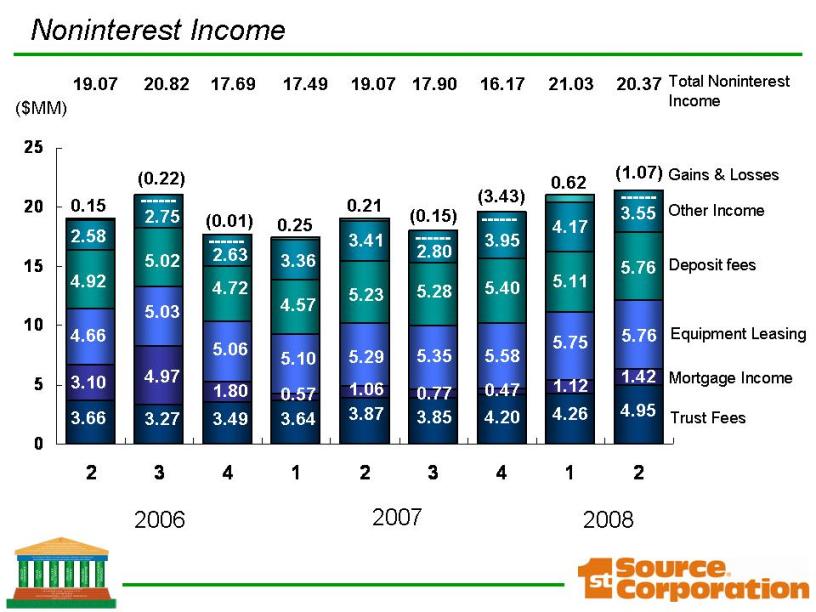

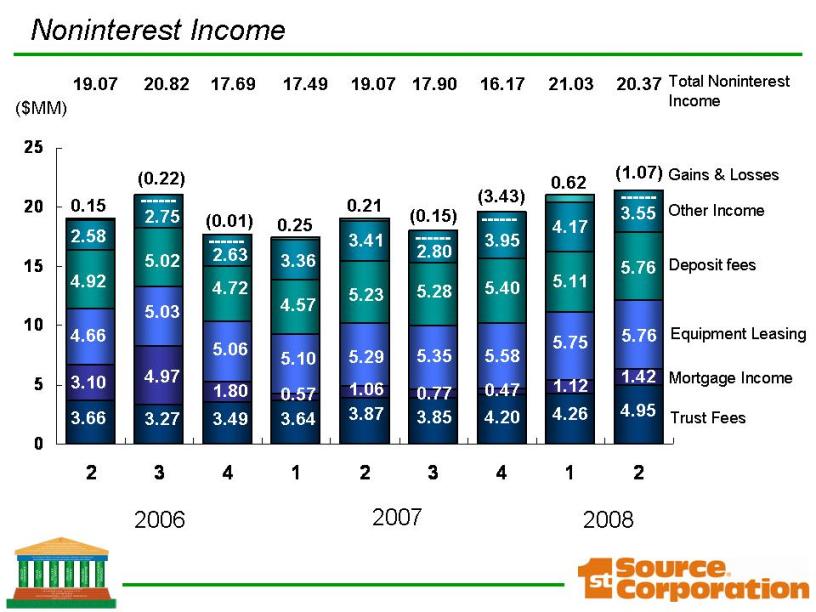

5 10 15 20 25 2 3 4 1 2 3 4 1 2 2008 Trust Fees Mortgage Income Other Income Total Noninterest Income ($MM) Equipment Leasing 2006 Gains & Losses 2007 2.58 4.66 3.10 3.66 0.15 19.07 (0.01) 5.03 4.97 3.27 ------ (0.22) 20.82 2.63 5.06 1.80 3.49 17.69 3.36 5.10 0.57 3.64 0.25 17.49 0.21 3.41 5.35 1.06 3.87 19.07 2.80 0.77 3.85 (0.15) ------ 17.90 5.29 ------ (3.43) ------ 3.95 5.58 0.47 4.20 16.17 4.17 5.75 1.12 4.26 0.62 Deposit fees 21.03 4.92 5.02 4.72 5.23 4.57 5.28 5.40 5.11 Noninterest 0 (1.07) ------ 3.55 5.76 5.76 1.42 4.95 20.37 Income

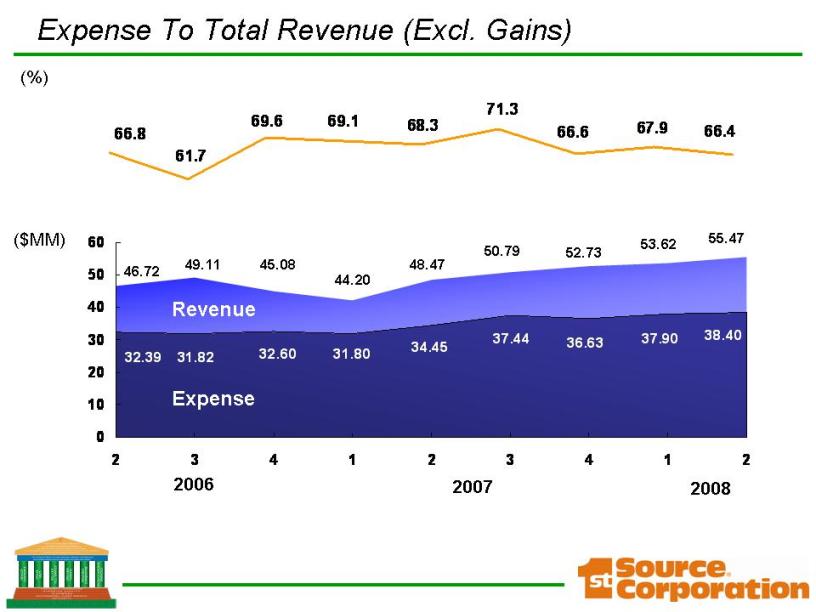

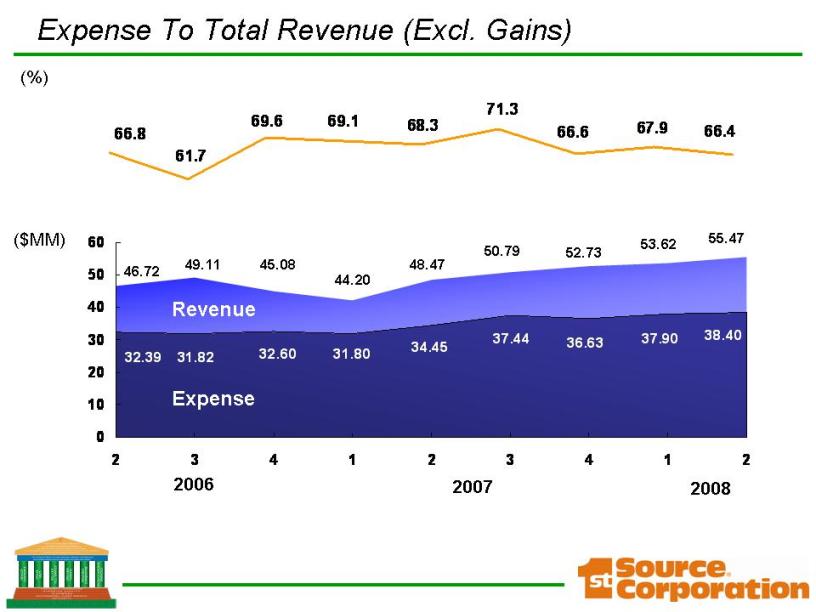

66.8 61.7 69.6 69.1 68.3 71.3 66.6 67.9 66.4 (%) ($MM) 2007 46.72 49.11 45.08 44.20 48.47 50.79 52.73 2008 53.62 Expense To Total Revenue (Excl. Gains) 55.47 2006 0 10 20 30 40 50 60 2 3 4 1 2 3 4 1 2 32.39 31.82 32.60 31.80 34.45 38.40 37.90 36.63 37.44 Revenue Expense

0.72 0.68 1.72 1.46 1.08 0.82 0.43 1.65 1.63 1.28 1.53 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 1.34 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2Q08 Compound Growth Rate: 0.16%

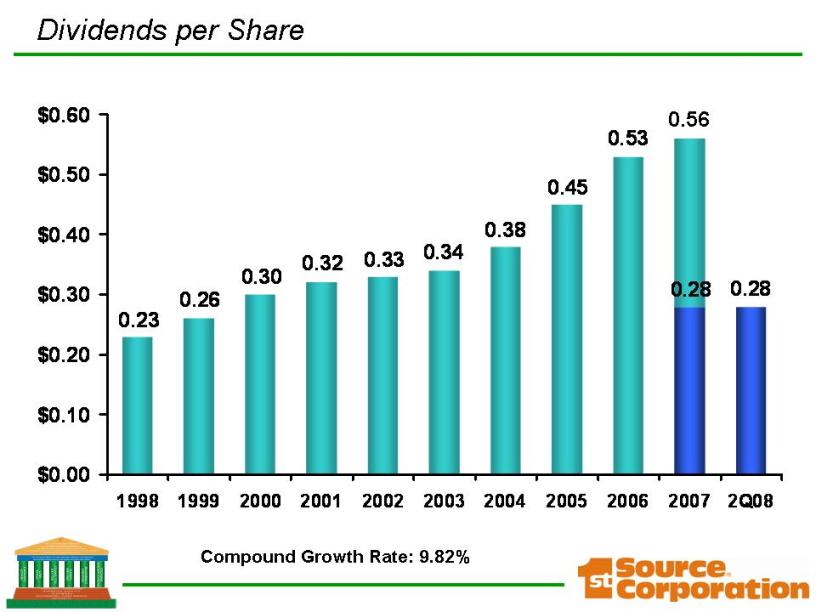

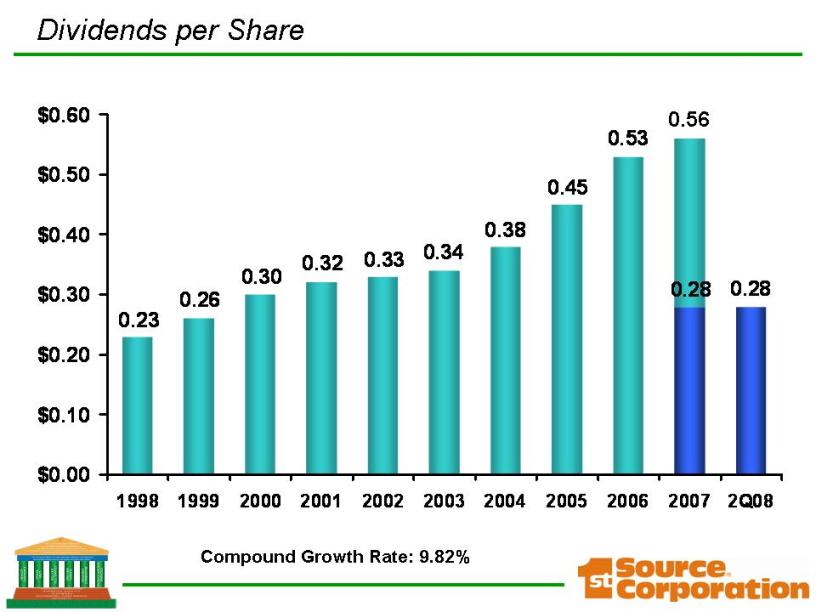

0.28 0.28 0.26 0.23 0.30 0.32 0.33 0.34 0.38 0.45 0.53 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2Q08 0.56 Compound Growth Rate: 9.82% Dividends per Share

Dividend Growth Honored for 19 years of consecutive dividend growth Publisher of Mergent Manuals and Investment Guides, a preferred source for business and financial information.

Investment Strongly capitalized 12.77% total risk based capital Stable credit quality, strongly reserved 2.5 times coverage of NPAs 2.16% loan loss reserve Diversification of income mix 38% of total revenue in fee income Diversification of product mix & geography Asset generation capability Why invest in 1st Source?

Investment Dominant local market share #1 Deposit market share Improving cost efficiencies FNBV merger Consistent and growing dividend 9.8% 10 yr CGR Why invest in 1st Source?

1st Source Corporation Questions?