- TENX Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Tenax Therapeutics (TENX) DEF 14ADefinitive proxy

Filed: 27 Aug 10, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

OXYGEN BIOTHERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

OXYGEN BIOTHERAPEUTICS, INC.

2530 Meridian Parkway

Suite 3078

Durham, North Carolina 27713

August 27, 2010

Dear Stockholders:

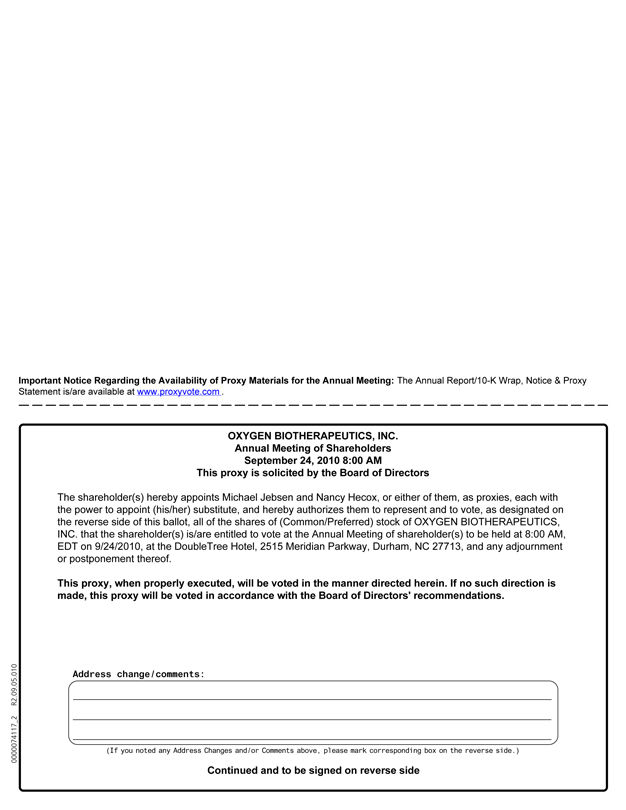

It is my pleasure to invite you to the Annual Meeting of Stockholders of Oxygen Biotherapeutics, Inc., to be held on Friday, September 24, 2010, at 8:00 a.m. at the DoubleTree Hotel, 2515 Meridian Parkway, Durham, North Carolina 27713. This booklet includes the Notice of Annual Meeting and Proxy Statement. The Proxy Statement provides information about the business we will conduct at the meeting. We hope you will be able to attend the meeting, where you can vote in person.

The matters to be acted upon at the meeting are described in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Whether or not you plan to attend the Annual Meeting personally, and regardless of the number of shares you own, it is important that your shares be represented at the Annual Meeting. We need more than half of our outstanding common shares to be represented at the annual meeting to establish a quorum. Every vote counts! Accordingly, we urge you to complete the enclosed proxy and return it to our vote tabulators promptly in the envelope provided. If you do attend the Annual Meeting and wish to vote in person, you may withdraw your proxy at that time. You may also elect to vote your shares by telephone or electronically via the Internet. With respect to shares held through a broker, bank or nominee, please follow the separate instructions from your broker, bank or nominee on how to vote your shares.

Sincerely,

Chris J. Stern

Chairman of the Board

YOUR SHARES CANNOT BE VOTED UNLESS YOU SIGN AND RETURN THE ENCLOSED PROXY, VOTE YOUR SHARES BY TELEPHONE OR INTERNET, OR ATTEND THE ANNUAL MEETING IN PERSON.

OXYGEN BIOTHERAPEUTICS, INC.

2530 Meridian Parkway

Suite 3078

Durham, North Carolina 27713

Notice of Annual Meeting of Stockholders

To Be Held on September 24, 2010

August 27, 2010

To the Stockholders:

The stockholders of Oxygen Biotherapeutics, Inc. will hold an annual meeting (the “Annual Meeting”) on Friday, September 24, 2010, at 8:00 a.m., at the DoubleTree Hotel, 2515 Meridian Parkway, Durham, North Carolina 27713.

The purpose of the meeting is to propose and act upon the following matters:

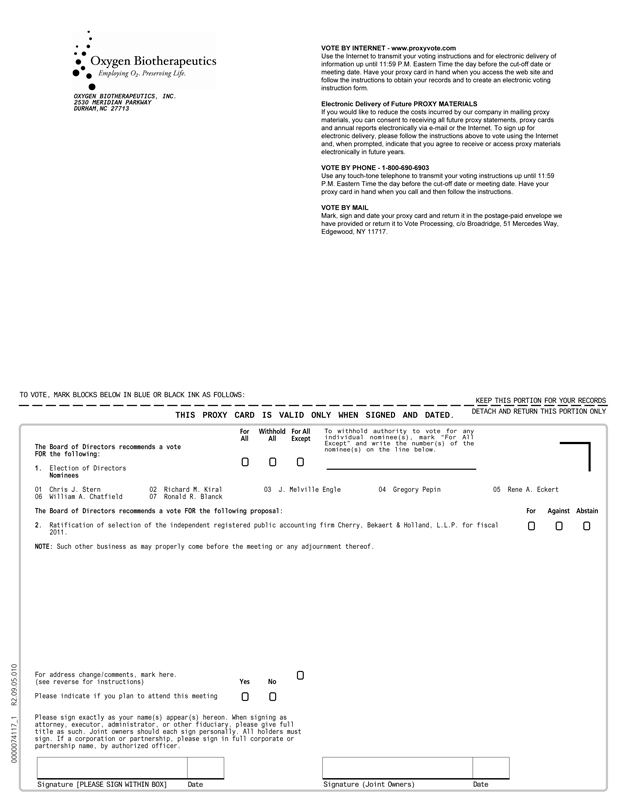

| 1. | To elect seven directors to serve until the sooner of the election and qualification of their successors or the next Annual Meeting of our Stockholders; |

| 2. | To ratify the appointment of Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm for the fiscal year ended April 30, 2011. |

At the Annual Meeting we may transact such other business as may properly come before the meeting.

The above matters are described in the Proxy Statement accompanying this notice.

The Board has fixed the close of business on August 20, 2010, as the record date for determining those stockholders who will be entitled to notice of and to vote at the Annual Meeting. Representation of at least a majority in voting interest of our common stock, either in person or by proxy, is required to constitute a quorum for purposes of voting on the proposals set forth above.

It is important that your shares be represented at the Annual Meeting to establish a quorum.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE. Your proxy may be revoked at any time prior to the time it is voted at the Annual Meeting.

Your vote is important, and we appreciate your cooperation in considering and acting on the matters presented.

By order of the Board of Directors,

Michael B. Jebsen, Corporate Secretary

August 27, 2010

OXYGEN BIOTHERAPEUTICS, INC.

PROXY STATEMENT

Important Notice Regarding the Availability of Proxy Materials

For the Stockholder Meeting to be held on September 24, 2010

The Notice of Annual Meeting of Shareholders, Proxy Statement, Form of Proxy, and 2010 Annual Report to Shareholders are available at http://www.proxyvote.com.

The board of directors (the “Board of Directors” or the “Board”) of Oxygen Biotherapeutics, Inc. is asking for your proxy for use at the 2010 Annual Meeting of Stockholders (the “Annual Meeting”) and any adjournments of the meeting. The meeting will be held at the DoubleTree Hotel, 2515 Meridian Parkway, Durham, North Carolina 27713 on Friday, September 24, 2010, at 8:00 a.m. local time, to elect seven directors, to ratify the appointment of Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm, and to conduct such other business as may be properly brought before the meeting.

The Board of Directors recommends that you vote FOR the election of the director nominees listed in this proxy statement and FOR ratification of the appointment of Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm.

This proxy statement and the accompanying proxy card are first being delivered to shareholders on or about August 27, 2010.

All references in this Proxy Statement to “Oxygen,” “we,” “our,” and “us” mean Oxygen Biotherapeutics, Inc. All numbers of shares or share prices relating to our common stock in this Proxy reflect the 1-for-15 reverse stock split of our common stock on November 9, 2009.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name as the stockholder of record. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Interwest Transfer Company (“Interwest”), you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by Interwest on our behalf. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting. We have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name and the proxy materials are being sent to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker or nominee on how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the meeting unless you receive a proxy from your broker or nominee. Your broker or nominee has enclosed a voting instruction card for you to use. If you wish to attend the Annual Meeting and vote in person, please mark the box on the voting instruction card received from your broker or nominee and return it to them so that you can receive a legal proxy to present at the Annual Meeting.

2

How many votes do I have?

You are entitled to one vote for each share of our common stock that you hold.

How is the vote counted?

Votes cast by proxy or in person at the Annual Meeting will be counted by persons appointed by us to act as tellers for the meeting. The tellers will count shares represented by proxies that withhold authority to vote for a nominee for election as a director only as shares that are present and entitled to vote for purposes of determining the presence of a quorum. None of the withheld votes will be counted as votes “for” a director. Shares properly voted to “abstain” and broker non-votes on a particular matter are considered as shares that are entitled to vote for the purpose of determining a quorum but are treated as having voted against the matter. A broker non-vote occurs when a broker holding shares for a customer does not vote on a particular proposal because the broker has not received voting instructions on the matter from its customer and is barred by stock exchange rules from exercising discretionary authority to vote on the matter.

How do I vote?

If you are a stockholder of record, you may vote using any of the following methods:

| • | Proxy Vote by Mail. Return the enclosed proxy form by mail using the enclosed prepaid envelope. Be sure to complete, sign and date the form before mailing. If you are a stockholder of record and you return your signed proxy form but do not indicate your voting preferences, the persons named in the proxy form will voteFOR the election of each director nominated by the board of directors,FOR the ratification of the appointment of Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm, and at the discretion of the persons named in the proxy on any other matter that comes before the meeting for a vote. |

| • | Proxy Vote by Internet. You may use the Internet to transmit your voting instructions up until 11:59 P.M. Eastern Daylight Time on September 23, 2010 by going to the website http://www.proxyvote.com. Please have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| • | Proxy Vote by Phone. You may use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Daylight Time on September 23, 2010 by calling the toll-free number 1-800-690-6903. Have your proxy card in hand when you call and then follow the instructions. |

| • | In person at the Annual Meeting. All stockholders may vote in person at the Annual Meeting. You may also be represented by another person at the meeting by executing a proper proxy designating that person. |

If you are a beneficial owner because your shares are held in a stock brokerage account or by a bank or other nominee, you cannot vote your shares by any of the methods described above because your broker, bank or nominee is the stockholder of record. To vote your shares you must direct your broker, bank or nominee how to vote your shares by using the voting instructions included in the mailing you received.

What can I do if I change my mind after I vote my shares?

If you are a stockholder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by:

| • | sending written notice of revocation to our Corporate Secretary; |

| • | submitting a new, proper proxy by mail (not by Internet or phone) after the date of the revoked proxy; or |

| • | attending the Annual Meeting and voting in person. |

3

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or nominee.

When is the record date for the Annual Meeting?

The Board has fixed the record date for the Annual Meeting as of the close of business on August 20, 2010.

How many votes can be cast by all stockholders?

There were 23,387,030 shares of our common stock outstanding on the record date and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote on each matter.

What constitutes a quorum?

A majority of the outstanding shares present or represented by proxy, or 11,693,516 shares, constitutes a quorum for the purpose of adopting proposals at the Annual Meeting. If you submit a properly executed proxy, then you will be considered part of the quorum.

What vote is required to approve each item?

For the election of the directors, the seven directors who receive the greatest number of votes cast in person or by proxy will be elected directors.

The proposal to ratify the appointment of Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm requires approval by a majority of the votes cast in person or by proxy. Although ratification is not required by our By-Laws or otherwise, the Board is submitting the selection of Cherry, Bekaert & Holland, L.L.P. to our stockholders for ratification as a matter of good corporate practice. If our stockholders do not ratify the appointment, the Audit and Compliance Committee will reconsider whether or not to retain Cherry, Bekaert & Holland, L.L.P. but still may retain them. Even if the selection is ratified, the Audit Committee may change the appointment at any time during the year if it determines that such change would be in the best interests of us and our stockholders.

If there are insufficient votes to approve the ratification of the appointment of Cherry, Bekaert & Holland, L.L.P. as our independent registered public accounting firm, your proxy may be voted by the persons named in the proxy to adjourn the Annual Meeting in order to solicit additional proxies in favor of the approval of such proposals. If the Annual Meeting is adjourned or postponed for any purpose, at any subsequent reconvening of the Annual Meeting your proxy will be voted in the same manner as it would have been voted at the original convening of the Annual Meeting unless you withdraw or revoke your proxy. Your proxy may be voted in this manner even though it may have been voted on the same or any other matter at a previous session of the Annual Meeting.

Who can attend the Annual Meeting?

All stockholders as of August 20, 2010 may attend the Annual Meeting. If you are listed as stockholder of record you may attend the Annual Meeting if you bring proof of identification. If you are the beneficial owner of shares held in street name, you will need to bring proof of identification and provide proof of ownership by bringing either a copy of a brokerage statement or a letter from the record holder indicating that you owned the shares as of August 20, 2010.

What does it mean if I receive more than one proxy card or voting instruction form?

It means that you have multiple accounts at the transfer agent or with brokers. Please complete and return all proxy cards or voting instruction forms to ensure that all of your shares are voted.

4

Where can I find more information about Oxygen Biotherapeutics?

We file periodic reports with the Securities and Exchange Commission (the “SEC”) pursuant to Section 15(d) of the Securities Exchange Act of 1934. Our SEC filings are available from the SEC’s Internet site athttp://www.sec.gov, which contains reports and other information regarding issuers that file electronically. Our filings with the SEC are available without charge on our website (www.oxybiomed.com) as soon as reasonably practicable after filing. Further, the reports filed with the SEC may be inspected without charge at the SEC’s Public Reference Room at 100 F Street N.E., Washington, D.C. 20549. Please call the SEC at (800) 732-0330 for further information on the Public Reference Room.

Who can help answer my questions about the Annual Meeting or how to submit or revoke my proxy?

If you are the stockholder of record, please contact:

Oxygen Biotherapeutics, Inc.

Attn: Investor Relations

2530 Meridian Parkway, Suite 3078

Durham, NC 27713

Telephone: (800) 809-6054

If your shares are held in street name, please call the telephone number provided on your voting instruction form or contact your broker directly.

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees for Election as Directors

All seven of the persons nominated for election to the Board of Directors at the Annual Meeting are currently serving as our directors. We are not aware of any nominee who will be unable or will decline to serve as a director. If a nominee becomes unable or declines to serve, the accompanying proxy may be voted for a substitute nominee, if any, designated by the Board of Directors. The term of office of each person elected as a director will continue until the sooner of the election and qualification of their successors or the next Annual Meeting of our stockholders.

The following table lists the nominees for election and information about each:

Name | Age | Position(s) with Oxygen Biotherapeutics, Inc. | Director Since | |||

Chris J. Stern, DBA | 53 | Chairman and Chief Executive Officer | November 2007 | |||

Richard M. Kiral, Ph.D. | 69 | President, Chief Operating Officer, and Director | March 2008 | |||

J. Melville Engle | 60 | Director | March 2009 | |||

Gregory Pepin | 27 | Director | August 2009 | |||

Rene A. Eckert | 65 | Director | October 2009 | |||

William A. Chatfield | 59 | Director | October 2009 | |||

Ronald R. Blanck, DO | 68 | Director | December 2009 |

Chris J. Stern, DBA joined Oxygen in November 2007 as Chairman of the Board. He became Chief Executive Officer in March 2008, and served briefly as Chief Financial Officer ad interim for the three months ending September 30, 2008. For the past thirteen years, Dr. Stern has been the principal of the Institute for Efficient Management, which he founded in 1996 to provide consulting services to businesses on strategic planning and global marketing. Since May 2001, Dr. Stern has served as a non-executive director on the Board of Directors of Klocke of America (contract packaging) in Ft. Myers, FL. From April 2000 to March 2007, he also served as a Director of Boehme Filatex, Inc. in Reidsville, NC (specialty chemicals). In January 1996, Dr. Stern became a faculty member and associate partner of the St. Gallen Business School and St. Gallen Management

5

Institute, two Swiss institutions for which he still selectively teaches executive seminars. From 1997 to 1999, he took over the position of chief executive officer of a billion dollar urban and private development company in Germany for restructuring. Dr. Stern developed his strategic management and planning skills during his tenure at the consulting practice of Diebold from January 1990 until December 1995. Dr. Stern’s first engagements were in the textile industry where he was President and Chief Executive Officer of Textile Dynamics Corporation from 1985 to 1990, and had various positions in a small conglomerate from 1977 until 1984. Dr. Stern is a United States citizen born in Switzerland and, therefore, American and Swiss dual national. He holds an MBA from the Graduate School of Business Administration in Zurich, which is affiliated with the State University of New York at Albany, and a doctorate in business administration from Trinity University.

Dr. Stern brings leadership to the Board, as well as substantial business and operating experience. These qualifications enable him in his role as our Chairman to manage the diverse viewpoints of our directors and ensure that the Board functions efficiently. As a result of Dr. Stern’s past experience in managing both large and small companies, we believe he provides first-hand experience in shaping strategic direction as we continue in our efforts to become a product revenue-generating company.

Richard Kiral, Ph.D. has served as a director since March 2008. Dr. Kiral became our President and Chief Operating Officer in March 2008. For over five years prior to March 2008, he served as our vice president of research and development and has been responsible for developing products from our perfluorocarbon technology platforms. Throughout his career, Dr. Kiral has held senior management, research, and product development positions at leading pharmaceutical and medical device companies for more than 35 years. He began his career at Miles Laboratories (now Bayer) as a quality control chemist and advanced to the position of Manager of Analytical Systems Development for the company’s consumer healthcare and medical diagnostics divisions. As Director of Pharmaceutical Product Development at the McGaw division of American Hospital Supply Corporation, Dr. Kiral was responsible for the development of intravenous pharmaceuticals, infusion systems and clinically-based oral nutrition products. After leaving McGaw, Dr. Kiral joined Allergan Pharmaceuticals, a leading developer and manufacturer of vision care and dermatology products, where he held several senior management positions, including Vice President of R&D for the company’s Optical Division. While at Allergan, Dr. Kiral led a 100-person interdisciplinary R&D team in four US and European locations in the development of contact lenses and lens care products, many of which became market leaders. Prior to joining us, Dr. Kiral served as Vice President of R&D for Ioptex Research, a division of Smith & Nephew, which manufactured and marketed intraocular lenses and associated ophthalmic surgical products. In his position he was responsible for product development, R&D engineering, pilot manufacturing, and technical liaison with ophthalmologists. Dr. Kiral holds a Ph.D. in Analytical Chemistry from the University of Notre Dame in South Bend, Indiana and a B.S. degree in Chemistry from St. Vincent College in Latrobe, Pennsylvania. He is a cofounder PrimaPharm Inc., a pharmaceutical contract manufacturer in San Diego and currently serves on its Board of Directors.

Dr. Kiral, as an early collaborator in the development of our core technology with substantial academic, industrial research and development management experience, brings to the Board a deep knowledge of our company’s business and expertise in the science and methodologies of our product lines and intellectual property.

J. Melville Engle has served as a director since March 2009. Mr. Engle has over 28 years experience in leading both large and small companies. Mr. Engle is currently the Chief Executive Officer and a member of to the Board of Directors of ThermoGenesis Corp., a stem cell, wound care, and biopreservation research and development company. Prior to joining ThermoGenesis, Mr. Engle was Chief Executive Officer of Raydiance, Inc., a laser technology company. For six years he served as President and Chief Executive Officer of Dey LP, a $600 million specialty pharmaceutical company, and affiliate of Merck KGaA. While at Dey, he served as Regional Director, North America, for the Merck Generics Group. He also served as Chairman, President and Chief Executive Officer of Anika Therapeutics, Inc., a publicly traded medical device company, and held senior financial, operations and sales positions at Allergan, Inc. In 2002, the Securities and Exchange Commission advised Mr. Engle it intended to institute a cease and desist proceeding against him alleging violations of

6

Sections 13(a), 13(b)(2)(A) and 13(b)(2)(B) of the Securities Exchange Act of 1934, and Rules 12b-20, 13a-1, and 13a-13 thereunder, which pertain to the filing of periodic reports without false or misleading statements, proper and accurate recording and accounting for revenue and financial transactions, and establishing and maintaining internal accounting control procedures and processes designed to correctly record and report financial information and prevent fraud. Without admitting or denying allegations, Mr. Engle agreed under a settlement offer to the entry of an order in January 2003 requiring him to cease and desist from committing or causing any future violations of the statutory provisions and rules noted above and Rule 13b2-1. Mr. Engle holds a B.S. in Accounting from the University of Colorado and an M.B.A. in Finance from the University of Southern California.

Mr. Engle’s strong financial background, developed through his leadership of other companies operating within our industry, qualifies him to serve on our Board, as well as the Audit and Compliance and the Compensation Committees.

Gregory Pepin has served as a director since August 2009. From July 2008 until April 2010, he was engaged as a Senior Vice President at Melixia SA, an investment management company based in Gland, Switzerland (“Melixia”). In that position he participated in the formation of JP SPC 1 Vatea, Segregated Portfolio (“Vatea Fund”), one of our principal stockholders, and serves as an Investment Manager for that fund. From September 2005 through the end of June 2008, Mr. Pepin was employed as a consultant in finance and insurance by Winter & Associates located in Paris, France. In July 2005, Mr. Pepin earned the degree of Master of Science and Economy, Finance and Actuaries, from HEC Lausanne.

Mr. Pepin’s investment management experience and skills qualify him to serve on our Board and Development Committee, and provide the Board with valuable insight into the investment community.

Rene A. Eckerthas served as a director since October 2009. Mr. Eckert was Chairman, Chief Executive Officer and a Partner at Boehme Filatex Inc. of Reidsville, NC from 1981 to 2007. He started the specialty chemical company with two partners in 1981. They formed the company into a leading North American textile chemical corporation with subsidiaries in Canada and Mexico. In 2007 the corporation was sold to Dystar, an international dyestuff company.

Mr. Eckert brings to the Board extensive experience in the manufacturing, business development and strategic planning fields. His diverse qualifications benefit both the Board and the committees he serves upon.

William A. Chatfieldhas served as a director since October 2009. Mr. Chatfield most recently served as the Director of the U. S. Selective Service System from November of 2004 to May of 2009, having been nominated by President George W. Bush and confirmed by the U.S. Senate. He was directly responsible to the President for the management of the Selective Service System. His background includes more than 30 years of experience working with the executive and legislative branches of the Federal government.

We believe that Mr. Chatfield’s unique background working within the political framework of our government benefits the Board and our Development Committee. Mr. Chatfield’s qualifications and experience also assist us in developing pathways for additional sources of funding through grants and other government sponsored programs.

Ronald R. Blanck, DOhas served as a director since December 2009. Dr. Blanck is chairman of Martin, Blanck & Associates, a federal health services consulting firm based in Falls Church, VA. He began his military career in 1968 as a medical officer and battalion surgeon in Vietnam, retiring 32 years later as a Lieutenant General and Surgeon General of the U.S. Army and commander of the U.S. Army Medical Command. He also served as commander of Walter Reed Medical Center and the North Atlantic Region Medical Command. His background also includes serving as president of the University of North Texas Health Science Center at Fort Worth.

7

Dr. Blanck brings to the Board an intimate knowledge of our military system and the unique health care challenges they face. As a director, Dr. Blanck has provided invaluable assistance to the Board as our company strives to bring innovative medical products to our wounded military men and women.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES.

8

CORPORATE GOVERNANCE MATTERS

Code of Ethics

We have adopted a Code of Ethics applicable to our Chief Executive Officer and Chief Financial Officer, a copy of which will be provided to any person, free of charge, upon request. A request for a copy of the Code of Ethics should be in writing and sent to Oxygen Biotherapeutics, Inc., Attn: Corporate Secretary, 2530 Meridian Parkway, Suite 3078, Durham, North Carolina 27713.

Board Composition and Independence of Directors

Our Board of Directors has seven members. Dr. Chris J. Stern is our Chairman and Chief Executive Officer, Dr. Richard M. Kiral is our President and Chief Operating Officer, and J. Melville Engle, Gregory Pepin, Rene A. Eckert, William A. Chatfield and Dr. Ronald R. Blanck are Directors.

In accordance with the listing rules of The NASDAQ Stock Market LLC (“NASDAQ”), our Board of Directors must consist of a majority of “independent directors,” as determined in accordance with NASDAQ Rule 5605(a)(2). The Board has determined that Messrs. Blanck, Chatfield, Eckert and Engle are independent directors in accordance with applicable NASDAQ listing rules. The Board performed a review to determine the independence of the director nominees and made a subjective determination as to each of these independent director nominees that no transactions, relationships, or arrangements exist that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director of our company. In making these determinations, the Board reviewed the information provided by the director nominees with regard to each individual’s business and personal activities as they may relate to us and our management.

Attendance at Meetings

In the fiscal year ended April 30, 2010, the Board met six times and these meetings were attended by all of the directors. From time to time the Board also acted through written consents. We have no formal policy requiring director attendance at the Annual Meeting, although all directors are expected to attend the Annual Meeting if they are able to do so. Five directors attended the Annual Meeting in 2009.

Board Leadership Structure

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The Board understands that there is no single, generally accepted approach to providing Board leadership and that given the dynamic and competitive environment in which we operate, the right Board leadership structure may vary as circumstances warrant. Consistent with this understanding, the independent Directors consider the Board’s leadership structure on an annual basis. This consideration includes the pros and cons of alternative leadership structures in light of the Company’s operating and governance environment at the time, with the goal of achieving the optimal model for effective oversight of management by the Board.

Dr. Stern has served as our Chairman of the Board and Chief Executive Officer since 2008. Based on the Board’s most recent review of our Board leadership structure, the Board has determined that this leadership structure is optimal for the Company because it provides our company with strong and consistent leadership. Given the current regulatory and market environment, the Board believes that having one leader serving as both the Chairman and Chief Executive Officer provides decisive and effective leadership.

In considering its leadership structure, the Board has taken a number of factors into account. The Board, which consists of highly qualified and experienced directors, a majority of whom are independent, exercises a strong, independent oversight function. This oversight function is enhanced by the fact that all of the Board’s key Committees—Audit and Compliance, Compensation and Corporate Governance and Nominating—are

9

comprised entirely of independent directors. Further, the Board has designated one of its independent members, Mr. Engle, as Lead Independent Director, with significant responsibilities. A number of Board and Committee processes and procedures, including regular executive sessions of non-management directors, periodic executive sessions of the independent directors, and annual evaluations of our Chairman and Chief Executive Officer’s performance against pre-determined goals, provide substantial independent oversight of our Chief Executive Officer’s performance. The Board believes that these factors provide the appropriate balance between the authority of those who oversee the Company and those who manage it on a day-to-day basis.

Board’s Role in Risk Oversight

We operate in a highly complex and regulated industry and are subject to a number of significant risks. The Board plays a key role with respect to our risk oversight, such as determining whether and under what circumstances we will engage in financing transactions or enter into strategic alliances and collaborations. The Board is also involved in our management of risks related to our financial condition or to the development and commercialization of our product candidates.

One of the Board’s risk oversight roles is to provide guidance to management. The Board receives regular business updates from various members of senior management in order to identify matters that involve operational, financial, legal or regulatory risks.

To facilitate its oversight of our company, the Board of Directors has delegated certain functions (including the oversight of risks related to these functions) to Board committees. The Audit and Compliance Committee reviews and discusses with management our major financial risk exposures and the steps management has taken to monitor and control such exposures, the Compensation Committee evaluates the risks presented by our compensation programs and analyzes these risks when making compensation decisions, and the Corporate Governance and Nominating Committee evaluates whether the composition of the Board is appropriate to respond to the risks that we face. The roles of these committees are discussed in more detail below.

Although the Board of Directors has delegated certain functions to various committees, each of these committees regularly reports to and solicits input from the full Board regarding its activities.

Standing Committees

Our Board of Directors has four standing committees: the Audit and Compliance Committee, the Compensation Committee, the Corporate Governance and Nominating Committee and the Development Committee. Copies of the charters of the Audit and Compliance, Compensation, and Corporate Governance and Nominating Committees, as they may be amended from time to time, are available on our website atwww.oxybiomed.com.

The Board has determined that all of the members of each of the Audit and Compliance, Compensation, and Corporate Governance and Nominating Committees are independent as defined under NASDAQ rules, and, in the case of all members of the Audit Committee, that they meet the additional independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934.

Audit and Compliance Committee.

The Audit and Compliance Committee’s principal responsibilities include:

| • | reviewing, evaluating, and discussing our financial statements and other financial information prepared on our behalf; |

| • | selecting, retaining, and monitoring the independence and performance of our outside auditors, including overseeing the audits of our financial statements and approving any non-audit services; |

10

| • | assisting the Board in fulfilling its oversight responsibilities, primarily through overseeing management’s conduct of our accounting and financial reporting process and systems of internal accounting and financial controls; |

| • | providing an avenue of communication among the outside auditors, management and the Board; and |

| • | preparing an annual report of the Audit Committee for inclusion in our proxy statement. |

The members of the Audit and Compliance Committee are Messrs. Engle, Eckert and Blanck. Mr. Engle serves as chair of the Audit Committee. The Board of Directors has determined that Mr. Engle is an “audit committee financial expert” as defined by applicable SEC rules. The Audit Committee met four times in fiscal 2010.

Compensation Committee.

The Compensation Committee’s primary responsibilities include:

| • | determining and approving the Chief Executive Officer’s compensation; |

| • | reviewing and making recommendations to the Board with respect to compensation of all other key senior executives and elected corporate officers at appropriate time periods; |

| • | reviewing, and if appropriate, approving employment agreements, severance agreements, retirement arrangements, change in control agreements and provisions, and any special or supplemental benefits for each of our executive officers; |

| • | working with the Chief Executive Officer to plan for Chief Executive Officer succession; |

| • | exercising the powers and authorities vested in the administrator or similar delegate of the Board provided by the stock option, restricted stock, incentive, and other of our compensation plans; and |

| • | preparing an annual report on executive compensation for inclusion in our proxy statement. |

The members of the Compensation Committee are Messrs. Eckert and Engle. Mr. Engle serves as chair of the Compensation Committee. The Compensation Committee met one time in fiscal 2010.

Corporate Governance and Nominating Committee.

The Corporate Governance and Nominating Committee’s primary responsibilities include:

| • | identifying and evaluating director candidates and recommending to the Board proposed nominees for Board membership; |

| • | recommending to the Board proposed directors to serve on each Board committee; |

| • | leading the Board in its annual review of the Board’s performance; |

| • | developing and recommending to the Board a set of Corporate Governance Guidelines; |

| • | considering issues involving possible conflicts of interest of directors; and |

| • | recommending and reviewing all matters pertaining to fees and retainers paid to directors for Board and committee service and for serving as chair of a Board committee. |

The members of the Corporate Governance and Nominating Committee are Messrs. Chatfield, Eckert and Blanck. Mr. Chatfield serves as chair of the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee met one time in fiscal 2010.

11

Development Committee

The Development Committee’s primary responsibilities include:

| • | Periodically examining management’s direction of and investment in our pharmaceutical and biotechnology research; |

| • | Establishing development and technology initiatives, including evaluation of the quality and direction of our research and development programs; |

| • | Reviewing our approaches to acquiring and maintaining technology, and evaluating the technology that we are researching and developing; and |

| • | Reviewing our patent strategy. |

The members of the Development Committee are Messrs. Blanck, Pepin and Kiral. Dr. Blanck serves as chair of the Development Committee. The Development Committee met one time in fiscal 2010.

Processes and Procedures for Executive and Director Compensation

The Compensation Committee has the authority to determine and approve the compensation of the Chief Executive Officer and to review and make recommendations to the Board with respect to the compensation of all other executive officers. The Corporate Governance and Nominating Committee has authority to recommend and review all matters pertaining to compensation of our directors. In making its determination with respect to the Chief Executive Officer, the Compensation Committee considers, among other things, our performance, overall shareholder return, compensation of chief executive officers at other companies, and the awards given to the Chief Executive Officer in past years. In reviewing and making recommendations with respect to the compensation of other executive officers, the Compensation Committee takes into account, among other things, each individual’s performance, our overall performance, and comparable compensation paid to similarly-situated officers in comparable companies. The Chief Executive Officer may make recommendations to the Compensation Committee regarding the compensation of other executive officers, but has no input and may not be present during voting or deliberations about his compensation. In making its recommendations with respect to director compensation, the Corporate Governance and Nominating Committee considers, among other things, the Board’s overall level of performance, the individual director’s participation in committees, the compensation paid to other director’s in similarly situated companies, and our financial growth.

The Compensation and Corporate Governance and Nominating Committees have the authority to retain compensation consultants and other outside advisors to assist in discharging their responsibilities. The recommendations of such consultants are considered in conjunction with the other considerations listed above. During fiscal 2010, the Compensation Committee engaged Blaise Group International to conduct a compensation survey. They were instructed to analyze industry data on peer groups who were similar to our company in size, market capitalization and composition and provide compensation ranges for standard director and executive positions. The aggregate fees paid to Blaise Group International for compensation consulting services was approximately $33,600 in cash, while the aggregate fees paid for other additional services totaled approximately $245,302 in cash and $70,694 in the form of warrants. The Compensation Committee approved the compensation and non-compensation related services.

Procedures for Director Nominations

Under the charter of the Corporate Governance and Nominating Committee, the Committee is responsible for identifying and selecting or recommending qualified candidates for membership on the Board of Directors. In evaluating the suitability of individual director candidates, the Committee takes into account many factors, including, but not limited to: (a) general understanding of marketing, financial and other disciplines relevant to the success of a publicly-traded company in today’s business environment, (b) understanding of our business on a technical level, (c) educational and professional background, (d) integrity and commitment to devote the time

12

and attention necessary to fulfill his or her duties, and (e) diversity of race, ethnicity, gender and age. The Corporate Governance and Nominating Committee implements and assesses the effectiveness of these factors and the Board’s commitment to diversity by considering these factors in our assessment of potential director nominees and the overall make-up of our Board. In determining whether to recommend a director for re-election, the Committee will consider the director’s past attendance at meetings and participation in and contributions to the activities of the Board.

The Corporate Governance and Nominating Committee does not set specific, minimum qualifications that nominees must meet in order to be recommended to the Board, but rather the Board believes that each nominee should be evaluated based on his or her individual merits, taking into account the needs of our company and the composition of the Board. The Corporate Governance and Nominating Committee conducts appropriate inquiries into the backgrounds and qualifications of possible nominees, and investigates and reviews each proposed nominee’s qualifications for service on the Board.

The Corporate Governance and Nominating Committee will consider candidates recommended by stockholders. It is the policy of the Corporate Governance and Nominating Committee that candidates recommended by stockholders will be given appropriate consideration in the same manner as other candidates. The procedure for submitting candidates for consideration by the Corporate Governance and Nominating Committee for election at our 2011 Annual Meeting is described under “Other Matters—Stockholder Proposals.”

Stockholder Communications with Directors

It is the policy of our company and the Board to encourage free and open communication between shareholders and the Board. Any shareholder wishing to communicate with the Board should send any communication to Oxygen Biotherapeutics, Inc., Attn: Corporate Secretary, 2530 Meridian Parkway, Suite 3078, Durham, North Carolina 27713. Any such communication must be in writing and must state the number of shares beneficially owned by the shareholder making the communication. Our Corporate Secretary will forward such communication to the full Board or to any individual director or directors to whom the communication is directed unless the communication is unduly hostile, threatening, illegal, or similarly inappropriate, in which case the Corporate Secretary has the authority to discard the communication or take appropriate legal action regarding the communication. This policy is not designed to preclude other communications between the Board and shareholders on an informal basis.

13

AUDIT COMMITTEE REPORT

The Audit and Compliance Committee has reviewed our audited financial statements for 2010, and has discussed these statements with management. The Audit Committee has also discussed with Cherry, Bekaert & Holland, L.L.P., our independent registered public accounting firm during the 2010 fiscal year, the matters required to be discussed by Statement of Auditing Standards No. 61, as amended and as adopted by the Public Company Accounting Oversight Board in Rule 3000T (Communication with Audit and Finance Committees).

The Audit Committee also received from Cherry, Bekaert & Holland, L.L.P. the written disclosures and the letter required by PCAOB Ethics and Independence Rule 3526 (Communication with Audit Committees Concerning Independence), and discussed with them their independence.

Based on the review and discussions noted above, the Audit Committee recommended to the Board that the 2010 audited financial statements be included in our Annual Report on Form 10-K for 2010, for filing with the SEC.

With respect to the above matters, the Audit Committee submits this report.

J. Melville Engle

Rene Eckert

Ronald Blanck

14

MANAGEMENT

The names of our current executive officers are listed below. Our executive officers are appointed by our Board of Directors to hold office until their successors are appointed.

Name | Age | Position | ||

Chris J. Stern, DBA | 53 | Chairman of the Board, Chief Executive Officer and Director | ||

Richard M. Kiral, Ph. D. | 69 | President, Chief Operating Officer, and Director | ||

Michael B. Jebsen, CPA | 39 | Chief Financial Officer and Executive Vice President Finance and Administration | ||

Gerald Klein, MD | 63 | Chief Medical Officer | ||

Kirk Harrington | 42 | Chief of Staff |

Michael B Jebsen joined Oxygen as our Accounting Manager in April 2009, and was elected Chief Financial Officer, Executive Vice President Finance and Administration, and Corporate Secretary in August 2009. Before joining us, he was an auditor with Grant Thornton, LLP from July 2003 through December 2005 and from April 2008 through April 2009. In addition, he held various positions, including Chief Ethics Officer, Senior Internal Auditor, and Senior Financial Analyst with RTI International, a non-profit research and development organization, from January 2006 to February 2008. Mr. Jebsen holds a Master of Science in Accounting from East Carolina University and is a Certified Public Accountant, licensed in North Carolina.

Dr. Gerald Klein has served as our Chief Medical Officer since June 2010. He was a director of Oxygen from March 2008 until May 2010. Previously, he served as Vice President of Global Medical and Clinical Affairs and Chief Medical Officer for Talecris Biotherapeutics, headquartered in Research Triangle Park, North Carolina, since September 2005. His responsibilities there include global clinical development and medical affairs. For two years prior to September 2005, he was Vice President of Medical Affairs and Clinical Research at Dey LP in Napa, California. Dr. Klein earned his medical degree from the University of Brussels Medical School in Belgium, and holds board certifications issued by the American Board of Pediatrics and the American Board of Allergy and Clinical Immunology. Dr. Klein completed his undergraduate work at the University of Florida and medical degree at the Free University of Brussels. He completed a pediatric residence at New Jersey College of Medicine and fellowship in Allergy and Immunology at the University of California, Irvine. Dr. Klein practiced Allergy in San Diego Country while being on the faculty of the University CA, Irvine. He became a professor of Clinical Medicine and Pediatrics, at that institution. While being on the clinical faculty, Dr. Klein published numerous peer reviewed papers in allergy and asthma. He was also very active in national medical organizations and served on the Board of Regents of the American College of Allergy, Asthma, and Clinical Immunology. While in practice, Dr. Klein founded San Diego Clinical Research Associates, a site management organization that he sold to Research Across America, as well as founding SDCRA, a contract research organization which was sold to Quintiles. He then joined Quintiles, as a Senior Vice President, of clinical development. Dr. Klein spent four years there working on domestic as well as international clinical trials. After leaving Quintiles, Dr. Klein became an Executive Vice President at Clingenics, a combination of a contract research organization and pharmacogenomics company. During this time Dr. Klein founded Externa Pharmaceutical Company, where he served as Chief Executive Officer. Dr. Klein was recruited to Specialty Laboratory, a large commercial and central laboratory, where he served as Vice President of Clinical Trials. Dr. Klein, together with some former employees from Specialty Labs, and Bay City Capital, founded Pathway Diagnostic and served as its Executive Vice President. He than moved to Napa, CA to join Dey LP as Vice President of Medical and Clinical Affairs in October 2003 and served there until September 2005 as described above.

Kirk Harrington became an officer of Oxygen in March 2009. He is an 18-year U.S. Army veteran who in 2006 was appointed by the United States Department of State as a senior advisor to the Government of Iraq. During this appointment, Mr. Harrington served as the sole diplomat to the Iraqi Ministries of Transportation, and Construction and Housing. In this role he oversaw every facet of Iraqi reconstruction efforts to include new implementation of roads, bridges, ports, airfields, and railroads. His background also includes lecturing on Middle Eastern affairs at the US Military Academy, West Point and he is a founding member of Emerging Foreign Market Collaboration, LLC, which is a New-York based government consulting firm.

15

EXECUTIVE COMPENSATION

Summary of Compensation

The following table provides certain summary information concerning compensation earned for services rendered in all capacities to us for the fiscal years ended April 30, 2010, 2009 and 2008, by its Chief Executive Officer and our two other most highly compensated executive officers (“Named Executive Officers”). This information includes the dollar amount of base salaries, bonus awards, stock options and all other compensation, if any, whether paid or deferred.

Summary Compensation Table

Name and Principal | Year | Salary ($) | Non-Equity Incentive Plan($)(2) | Bonus ($) | Stock Awards ($)(1) | Option Awards ($)(1) | All Other Compensation ($) | Total ($) | |||||||||

Dr. Chris J. Stern Chairman and Chief Executive Officer | 2010 2009 | 300,000 89,919 | 100,000 | — — | 160,207 77,433 | (3)

| — 1,275,138 | 9,600 2,400 | 569,807 1,444,890 | ||||||||

Dr. Richard Kiral President and Chief Operating Officer | 2010 2009 | 247,000 293,128 | 80,275 | — 1,015 | 43,225 — | (4)

| 74,041 130,437 | 9,600 9,600 | 454,141 434,180 | ||||||||

Kirk Harrington Chief of Staff | 2010 2009 | 180,000 7,500 | 30,000 — | — — |

| 6,600 — | — — | 216,600 7,500 |

| (1) | The amounts in these columns reflect the aggregate grant date fair value of awards granted during the year computed in accordance with Financial Accounting Standards Board ASC Topic 718, Compensation — Stock Compensation. The assumptions made in determining the fair values of our stock and option awards are set forth in Note G to our Consolidated Financial Statements included in the our Form 10-K for the year ended April 30, 2010, filed with the SEC on July 23, 2010. |

| (2) | These payments were made based on achievement of milestones in accordance with Dr. Stern’s and Dr. Kiral’s employment agreements, which are described below in the section entitled “Employment Agreements.” |

| (3) | Represents $102,000 for the grant date fair value of the shares that were awarded as part of Dr. Stern’s annual bonus and an aggregate of $58,207 for the grant date fair value of the shares issued on a monthly basis as part of his annual compensation. Dr. Stern’s annual compensation and bonus were paid in accordance with the terms of his employment agreement, which is described below in the section entitled “Employment Agreements.” |

| (4) | This award was granted as part of Dr. Kiral’s annual bonus in accordance with the terms of his employment agreement, which is described below in the section entitled “Employment Agreements.” |

Option grants

In September 1999, our Board of Directors approved the 1999 Stock Plan (the “1999 Plan”) which provided for the granting of incentive and nonstatutory stock options to employees and directors to purchase up to 266,667 shares of our common stock. The 1999 Plan was approved by stockholders on October 10, 2000. Options granted under the 1999 Plan are exercisable at various dates up to four years and have expiration periods of generally ten years. On June 17, 2008, our stockholders approved an amendment to the 1999 Plan to increase the number of shares of common stock available for awards under the plan from 266,667 to 800,000, to increase the maximum number of shares covered by awards granted under the 1999 Plan to an eligible participant from 266,667 to 333,333 shares, and to make additional technical changes to update the plan. Persons eligible to receive grants under the 1999 Plan consist of all of our employees, including executive officers and employee directors. As of April 30, 2010 and 2009, we had 585,172 and 445,336 outstanding options under the 1999 Plan, respectively. As of April 30, 2010 and 2009, there were 182,424 and 351,260, respectively, options available for grant under the 1999 Plan.

16

In addition, we have issued options outside the 1999 Plan. At April 30, 2010 the total non-qualified options outstanding were 396,667 with a weighted average exercise price of $3.72.

The following table summarizes certain information as of April 30, 2010 concerning the stock options granted to the Named Executive Officers during the fiscal year ended April 30, 2010. No stock appreciation rights, restricted stock awards or long-term performance awards have been granted as of April 30, 2010.

Name | Grant Date | Number of Securities Underlying Options (1) | Exercise Price of Option ($/Sh) | Grant Date Fair Value of Option Awards ($)(2) | ||||

Dr. Chris J. Stern | — | — | — | — | ||||

Chairman and Chief Executive Officer | ||||||||

Dr. Richard Kiral | 5/1/2009 | 1,333 | 3.30 | 4,024 | ||||

President and Chief Operating Officer | 6/1/2009 | 1,333 | 3.53 | 4,344 | ||||

| 7/1/2009 | 1,333 | 3.78 | 4,660 | |||||

| 8/1/2009 | 1,333 | 6.38 | 7,416 | |||||

| 9/1/2009 | 1,333 | 6.38 | 7,876 | |||||

| 10/1/2009 | 1,333 | 5.85 | 7,264 | |||||

| 11/1/2009 | 1,333 | 6.45 | 7,972 | |||||

| 12/1/2009 | 1,333 | 5.58 | 6,888 | |||||

| 1/1/2010 | 1,333 | 5.79 | 7,164 | |||||

| 2/1/2010 | 1,334 | 5.73 | 5,944 | |||||

| 3/1/2010 | 1,334 | 5.10 | 5,292 | |||||

| 4/1/2010 | 1,334 | 5.00 | 5,197 | |||||

Kirk Harrington | 6/19/2009 | 2,000 | 3.60 | 6,600 | ||||

Chief of Staff | ||||||||

| (1) | Each option listed in the table vests over a period ranging from immediate to one-year from the grant date and is exercisable over a ten-year period. |

| (2) | The amounts in this column reflects the aggregate grant date fair value of awards granted during the year computed in accordance with Financial Accounting Standards Board ASC Topic 718, Compensation — Stock Compensation. The assumptions made in determining the fair values of our option awards are set forth in Note G to our Consolidated Financial Statements included in the our Form 10-K for the year ended April 30, 2010, filed with the SEC on July 23, 2010. |

17

Outstanding Equity Awards

The following table provides information about outstanding equity awards held by the Named Executive Officers as of April 30, 2010.

Outstanding Equity Awards at 2010 Fiscal Year-End

| Option awards(1) | Stock awards | |||||||||||||

Name | Number of securities underlying unexercised options (Exercisable) (#) | Number of securities underlying unexercised options (Unexercisable) (#) | Option exercise price ($/Sh) | Option expiration date | Number of shares or units of stock that have not vested (#) | Market value of shares or units of stock that have not vested ($) | ||||||||

Dr. Chris J. Stern | 66,667 | 3.68 | 11/20/2017 | |||||||||||

Chairman and | 266,667 | 3.68 | 9/22/2018 | |||||||||||

Chief Executive Officer | ||||||||||||||

Dr. Richard Kiral | 6,667 | (2) | 3.08 | 4/20/2011 | ||||||||||

President and | 10,000 | 3.08 | 4/20/2011 | |||||||||||

Chief Operating Officer | 5,000 | (2) | 4.50 | 2/1/2012 | ||||||||||

| 5,000 | (2) | 2.25 | 2/1/2013 | |||||||||||

| 5,000 | (2) | 2.25 | 3/1/2014 | |||||||||||

| 5,000 | (2) | 3.60 | 2/1/2015 | |||||||||||

| 5,000 | (2) | 1.35 | 3/28/2016 | |||||||||||

| 5,000 | (2) | 1.80 | 3/9/2017 | |||||||||||

| 6,670 | 3,330 | (2) | 4.20 | 1/9/2018 | ||||||||||

| 1,333 | (3) | 12.75 | 4/1/2018 | |||||||||||

| 1,333 | (3) | 11.55 | 5/1/2018 | |||||||||||

| 1,333 | (3) | 13.20 | 6/1/2018 | |||||||||||

| 1,333 | (3) | 12.30 | 7/1/2018 | |||||||||||

| 1,333 | (3) | 10.80 | 8/1/2018 | |||||||||||

| 1,333 | (3) | 9.60 | 9/1/2018 | |||||||||||

| 1,333 | (3) | 6.30 | 10/1/2018 | |||||||||||

| 1,333 | (3) | 5.93 | 11/1/2018 | |||||||||||

| 1,333 | (3) | 4.73 | 12/1/2018 | |||||||||||

| 1,333 | (3) | 3.90 | 1/1/2019 | |||||||||||

| 10,000 | 3.90 | 1/9/2019 | ||||||||||||

| 1,333 | (3) | 4.65 | 2/2/2019 | |||||||||||

| 1,333 | (3) | 3.90 | 3/1/2019 | |||||||||||

| 1,333 | (3) | 3.45 | 4/1/2019 | |||||||||||

| 1,333 | 3.30 | 5/1/2019 | ||||||||||||

| 1,333 | 3.53 | 6/1/2019 | ||||||||||||

| 1,333 | 3.78 | 7/1/2019 | ||||||||||||

| 1,333 | (3) | 6.38 | 7/31/2019 | |||||||||||

| 1,333 | (3) | 6.38 | 8/31/2019 | |||||||||||

| 1,333 | (3) | 5.85 | 9/30/2019 | |||||||||||

| 1,333 | 6.45 | 10/31/2019 | ||||||||||||

| 1,333 | 5.58 | 11/30/2019 | ||||||||||||

| 1,333 | 5.79 | 1/1/2020 | ||||||||||||

| 1,334 | 5.73 | 2/1/2020 | ||||||||||||

| 1,334 | 5.10 | 3/1/2020 | ||||||||||||

| 1,334 | 5.00 | 4/1/2020 | ||||||||||||

Kirk Harrington | 2,000 | (3) | 3.60 | 6/16/2009 | ||||||||||

Chief of Staff | ||||||||||||||

18

| (1) | Except as otherwise noted, the option awards reflected in these columns vested immediately on the date of grant. The date of grant for each of these options is the date 10 years prior to the expiration date reflected in this table. |

| (2) | These options were granted with the following vesting schedule: 34% on the first anniversary of the grant date, 33% on the second anniversary of the grant date and 33% on the third anniversary of the grant date. |

| (3) | These options were granted with the following vesting schedule: 100% on the first anniversary of the grant date. |

Employment Contracts

The Board of Directors approved a new employment agreement with Dr. Chris Stern effective February 1, 2009, that supersedes all prior compensatory arrangements with Dr. Stern and his associates. The agreement is effective for a one-year term commencing February 1, 2009, and automatically renews for additional one-year terms, unless Dr. Stern terminates the agreement in advance of renewal or we give Dr. Stern at least 120 days advance notice that we elect not to renew at the end of the then current term. Under the agreement Dr. Stern will receive as compensation an annual base salary of $300,000; a cash bonus equal to one percent of base salary for each two percent of our annual goals and/or milestones achieved, which are established annually by the Board of Directors; 934 shares of our restricted common stock issued monthly; fixed monthly automobile allowance of $800; and fixed payment to his company IFEM Management Consultants, Inc of $2,500 per month for secretarial and related office support, and fixed payment of $500 per month if he chooses not to participate in the company medical and dental benefits program. Dr. Stern will also receive four weeks paid vacation each year.

If prior to expiration of the agreement Dr. Stern ceases to be a director for any reason, he is entitled to receive $200,000 in cash and 6,667 restricted common shares. Furthermore, if Dr. Stern is terminated without cause or Dr. Stern terminates the agreement for good reason, then he is entitled to receive one-year of base salary, all bonuses then payable, and the economic value of the replacement cost for one-year of the other benefits under the agreement, and he has the right to exercise immediately all outstanding options, vested and unvested, on the terms set forth in the options he holds, including “cashless exercise” through conversion of the options to common shares based on the difference between market price and exercise price.

For purposes of the agreement “cause” means willful misconduct, conflict of interest or breach of fiduciary duty or a material breach of any provision of the employment agreement, and “good reason” includes us giving notice to Dr. Stern we do not intend to renew the agreement at the end of the then current term, any person or group acquires 25% or more in the outstanding stock ownership, there is a change in a majority of the Board, there is a merger or sale of substantially all the assets, or there is a breach of certain terms of the agreement by us.

In connection with the adoption of this agreement, we agreed that options previously issued to Dr. Stern to purchase 66,667 common shares at an exercise price of $3.675 per share and a three-year term are extended to November 2017, options to purchase 266,667 common shares at an exercise price of $3.675 per share and a three-year term are extended to September 2018, and all of the options are amended to allow for “cashless exercise” through conversion of the options to common shares based on the difference between market price and exercise price. In the fourth quarter of the year ending April 30, 2009, we recognized an additional expense of $408,868 due to the revaluation of these previously granted option agreements.

Dr. Richard Kiral served as Vice President of Product Development through much of fiscal year 2008 for which he was compensated at the rate of $167,000 per year and was paid additional compensation in the form of an automobile allowance, medical and dental coverage, participation in the Executive Bonus Plan, $200,000 life insurance paid for by the corporation and payable to a beneficiary named by the insured, and the grant of an option for 5,000 shares annually. Effective March 25, 2008, the Board appointed Dr. Kiral to serve as President and Chief Operating Officer of the Company.

19

Pursuant to an agreement executed on March 26, 2008 and restated February 1, 2009, Dr. Kiral’s employment with us is for an initial one-year term renewing February 1, 2009 and automatically renewing for an additional one-year term unless Dr. Kiral terminates the agreement in advance of the renewal or we give Dr. Kiral at least 120 days advance notice that we elect not to renew for another term.

Under the agreement Dr. Kiral will receive as compensation an annual base salary of $247,000; a cash bonus equal to one percent of base salary for each two percent of our annual goals and/or milestones achieved, which are established annually by the Board of Directors; options to purchase approximately 1,333 common shares with the exercise price based on market value issued monthly; an annual grant of options to purchase 10,000 common shares with an exercise price based on market value; fixed monthly automobile allowance of $800; medical and dental insurance under plans for our other officers; and a right to participate in pension, retirement, insurance stock, and other plans established from time to time for the participation of all of our full-time employees. Dr. Kiral will also receive four weeks paid vacation each year.

If prior to the expiration of the agreement Dr. Kiral ceases to be a director for any reason, he is entitled to receive $200,000 in cash and 6,667 restricted common shares. Furthermore, if Dr. Kiral is terminated without cause or Dr. Kiral terminates the agreement for good reason, then he is entitled to receive one-year of base salary, all bonuses then payable, and the economic value of the replacement cost for one-year benefits under the agreement, and he has the right to exercise immediately all outstanding options, vested and unvested on the terms set forth in the options he holds, including “cashless exercise” through conversion of the options to common shares based on the difference between market price and exercise price.

For purposes of the agreement “cause” means willful misconduct, conflict of interest or breach of fiduciary duty or a material breach of any provision of the employment agreement, and “good reason” includes us giving notice to Dr. Kiral that we do not intend to renew the agreement at the end of the then current term, any person or group acquires 25% or more in the outstanding stock ownership, there is a change in a majority of the Board, there is a merger or sale of substantially all the assets, or there is a breach of certain terms of the agreement by us.

Pursuant to Kirk Harrington’s offer letter, his compensation consists of a base salary of $180,000 per year with a commission based bonus. Mr. Harrington also receives 2,000 options each year on the anniversary of his employment start date. These options vest one-year from the grant date. Additionally he received 2,000 options three months after beginning employment, which also vested one year from the grant date. Mr. Harrington’s offer letter does not contain any severance or change of control provisions.

1999 Amended Stock Plan

Each of our named executive officers has option awards under our 1999 Amended Stock Plan, which provide for accelerated vesting of such options under certain circumstances. If a named executive officer is terminated other than as a result of his death or disability, his unvested options will terminate on the officer’s termination date and his vested options will remain exercisable until 3 months after the termination date. If the named executive officer is terminated as a result of his death or disability, his unvested options will vest in full and remain exercisable until the first anniversary of such termination.

Additionally, upon a change of control, except as otherwise determined by the Board of Directors in its discretion, all options will become fully vested and exercisable. For this purpose, a “change of control” means: (i) the acquisition of shares of our stock representing fifty percent (50%) or more of the combined voting power of the shares entitled to vote on the election of directors; (ii) the consummation of a merger, share exchange, consolidation or reorganization involving us and any other company or other entity as a result of which less than fifty percent (50%) of the combined voting power of the surviving or resulting company or entity after such transaction is held in the aggregate by the holders of the combined voting power of our outstanding shares immediately prior to such transaction; (iii) the approval by our stockholders of an agreement for the sale or

20

disposition by the Company of all or substantially all of our assets; or (iv) a change in the composition of the Board of Directors occurring within a two-year period, as a result of which fewer than a majority of directors were current directors.

Compensation of Directors

The following table summarizes the compensation paid to non-employee directors for the fiscal year ended April 30, 2010.

2010 Director Compensation

Director | Fees Earned or Paid in Cash ($) | Option Awards ($)(1) (4) | Total ($) | |||

J. Melville Engle | 83,000 | 83,000 | ||||

Gregory Pepin | 50,000 | 150,240 | 200,240 | |||

Rene A. Eckert | 35,000 | 175,440 | 210,440 | |||

William A. Chatfield | 34,500 | 175,440 | 209,940 | |||

Ronald R. Blanck, DO | 20,875 | 130,278 | 151,153 | |||

Dr. Bruce Spiess, MD, FAHA (2) | 94,000 | 94,000 | ||||

Dr. Gerald L. Klein, MD (3) | 106,500 | 106,500 | ||||

| (1) | The amounts in these columns reflect the aggregate grant date fair value of awards granted during the fiscal year computed in accordance with Financial Accounting Standards Board ASC Topic 718, Compensation — Stock Compensation. The assumptions made in determining the fair values of our stock and option awards are set forth in Note G to our Consolidated Financial Statements included in the our Form 10-K for the year ended April 30, 2010, filed with the SEC on July 23, 2010. |

| (2) | Dr. Spiess resigned as a director on the Board effective March 1, 2010. |

| (3) | Dr. Klein resigned as a director on the Board effective May 30, 2010, after which he became our Chief Medical Officer. |

| (4) | As of April 30, 2010, each director held an aggregate of 40,000 options. |

For the period beginning May 1, 2009 and ending August 31, 2009, all of our non-employee directors were paid a monthly cash fee of $9,000. Commencing September 1, 2009, we agreed to pay each of our non-employee directors the following compensation for service on the Board and Board Committees:

| • | An annual cash director fee in each fiscal year of $45,000 ($65,000 for our lead independent director), which is paid in equal monthly installments in arrears on the last day of each month; |

| • | A cash fee for attending each meeting of the Board in the amount of $4,000; |

| • | A cash fee for attending each committee meeting of which the Director is a member in the amount of $500; and |

| • | Reimbursement of travel and related expenses for attending Board and Committee meetings, as incurred. |

In addition to the cash compensation described above, each non-employee director is granted a 40,000 stock option award on their initial nomination to the Board. The options may vest immediately or up to one year later, and are exercisable for a period of three years. We shall maintain an appropriate director’s and officer’s insurance policy at all times for our non-employee directors.

21

OWNERSHIP OF SECURITIES

Principal Stockholders and Share Ownership by Management

The following table sets forth, as of August 20, 2010 the number and percentage of the outstanding shares of common stock and warrants and options that, according to the information supplied to us, were beneficially owned by (i) each person who is currently a director, (ii) each named executive officer, (iii) all current directors and executive officers as a group and (iv) each person who, to our knowledge, is the beneficial owner of more than five percent of the outstanding common stock. Except as otherwise indicated, the persons named in the table have sole voting and dispositive power with respect to all shares beneficially owned, subject to community property laws where applicable.

Beneficial Owner Name and Address(1) | Amount and Nature of Beneficial Ownership | Percent of Class | |||

Principal Stockholders | |||||

Vatea Fund, Segregated Portfolio (2) | 3,200,002 | 13.68 | % | ||

Rue Du Borgeaud 10-B | |||||

Gland, Switzerland 1196 | |||||

Officers and Directors | |||||

Dr. Chris J. Stern (3) | 366,403 | 1.57 | % | ||

Dr. Richard Kiral (3) | 127,682 | * | |||

J. Melville Engle (3) | 40,000 | * | |||

Gregory Pepin (2) (3) | 3,286,668 | 14.05 | % | ||

Rene A. Eckert (3) | 40,000 | * | |||

William A. Chatfield (3) | 40,000 | * | |||

Ronald R. Blanck, DO (3) | 40,000 | * | |||

Kirk Harrington (3) | 4,067 | * | |||

All officers and directors as a group (10 persons) (3) | 4,003,724 | 17.12 | % | ||

| * | Less than 1% |

| (1) | Unless otherwise noted, all addresses are in care of the Company at 2530 Meridian Parkway, Suite 3078, Durham, North Carolina 27713. |

| (2) | Includes 3,200,002 shares of common stock held by Vatea Fund. Mr. Pepin is an Investment Manager for Vatea Fund, and consequently he may be deemed to be the beneficial owner of shares held by Vatea Fund. Mr. Pepin disclaims beneficial ownership of the shares held by Vatea Fund except to the extent of his pecuniary interest therein. |

| (3) | With respect to Dr. Stern, includes 333,334 shares of common stock subject to options exercisable within 60 days of August 20, 2010. With respect to Dr. Kiral, includes 96,665 shares of common stock subject to options exercisable within 60 days of August 20, 2010. With respect to Dr. Blanck and Messrs. Engle, Chatfield, and Pepin includes 40,000 shares each of common stock subject to options exercisable within 60 days of August 20, 2010. With respect to Mr. Harrington, includes 2,000 shares of common stock subject to options exercisable within 60 days of August 20, 2010. With respect to all officers and directors as a group, includes 643,336 shares of common stock subject to options exercisable within 60 days of August 20, 2010. |

22

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Related Party Transactions

Securities Purchase Agreement with Vatea Fund

As discussed above, Mr. Pepin, one of our directors, is Investment Manager to Vatea Fund and was a Senior Vice President at Melixia until April 2010.

On June 8, 2009, we entered into a securities purchase agreement (the “Securities Purchase Agreement”) with Vatea Fund. The Securities Purchase Agreement establishes milestones for the achievement of product development and regulatory targets and other objectives, after which Vatea Fund is required to purchase up to 4 million additional shares of common stock at a price of $3.75 per share. If a milestone is not achieved by its corresponding target date, then the date is automatically extended for three months. Thereafter, if a milestone is not achieved by its extended target date, we and Vatea Fund shall negotiate in good faith agreement on a new target date for the milestone, but if no agreement is reached within 30 days Vatea Fund has no obligation to purchase any shares with respect to that milestone should it subsequently be achieved. The obligation of Vatea Fund to purchase any additional shares upon achieving milestones ends for any milestones not achieved by September 30, 2011. Including the initial investment in July 2009, and assuming all milestones are achieved in a timely manner, the Securities Purchase Agreement provides for a maximum of 5,333,334 shares being sold for $20 million. The number of shares issued is subject to adjustment for stock dividends, stock splits, reverse stock splits, and similar transactions.

Under the terms of the Securities Purchase Agreement, Vatea Fund purchased on July 10, 2009, 1,333,334 shares of our restricted common stock at a price of $3.75 per share, or a total of $5 million.

In connection with the closing, we paid a consulting fee to Melixia for services provided as facilitating agent, which consisted of $500,000 in cash and 66,667 shares of restricted common stock valued at $350,002. We also paid $75,000 in fees to another consultant who assisted with the Securities Purchase Agreement.

On August 24, 2009, we agreed to accelerate the election of Mr. Pepin to the Board of Directors, under the terms of the Securities Purchase Agreement, to enhance our relationship with Vatea Fund.

On September 2, 2009, we and the Vatea Fund amended the Securities Purchase Agreement providing an alternative milestone schedule.