Inter-Tel Supplemental Discussion Slides

October 2006

1

Review of Key Themes

Where is the Plan to enhance stockholder value?

Lots of generic, qualitative points which amount in our view to a “Just Trust Us” plan

No detailed financial guidance in our view for stockholders to evaluate vs. proposed $23.25 offer (or

higher potential competing offer)

We believe our Resolution calls for a fair sale process to maximize stockholder value

Not a “fire sale”; plenty of time to demonstrate to buyers the “full value” of INTL

Company has stated that they have been “actively exploring strategic options” since August 11,

allowing for plenty of time including time allowed under the Resolution

What has the Board been doing since Mr. Mihaylo’s first 13D on March 3?

We believe our proposed offer of $23.25 delivers compelling value TODAY

Significant premium across a number of valuation metrics

INTL would have to significantly outperform consensus estimates to support stand-alone values

at/above $23.25

We believe adopting the Resolution is in stockholders’ best interests

Consistent with Special Committee’s statement to explore options

Steve Mihaylo, and his 19.4% vote, will support higher offers from other parties, should they exist

We believe if the Company is not sold, INTL will give back a meaningful acquisition premium

INTL stock up nearly twice the S&P500 -- and other indices are actually down – since Mr. Mihaylo’s

initial 13D

Current PE multiples suggest nearly a 20% decline based on where INTL has historically traded

2

How Can the Special Committee Not Support the

Resolution?

INTL has not provided data or financial guidance to support their opposition to

the Resolution in our view

We did not even receive projections in our due diligence

Thus, we are left with having to figure out what the Board must believe in order

to not support the Resolution

Based on its historical 17x forward PE multiple, INTL would have to believe

that it can generate 2007 EPS of at least $1.37 to support standalone value of

$23.25 per share

Consensus estimate = $1.17(1)

The Special Committee must believe that INTL will outperform consensus

expectations by nearly 20% -- even before factoring in risk and timing to achieve

these results

This translates to 2007 revenue of ~ $550 million(2), which is $62 million more

than the consensus estimate of $488 million(1)

We are only left to conclude that the Special Committee believes INTL can significantly

outperform revenue and EPS estimates -- this seems highly risky to us, and more

importantly, where is the plan to support this conclusion?

(1) I/B/E/S consensus estimate as of 10/5/06.

(2) Assumes 28.6M shares, 35% tax rate and ~$8M in other income and D&A.

3

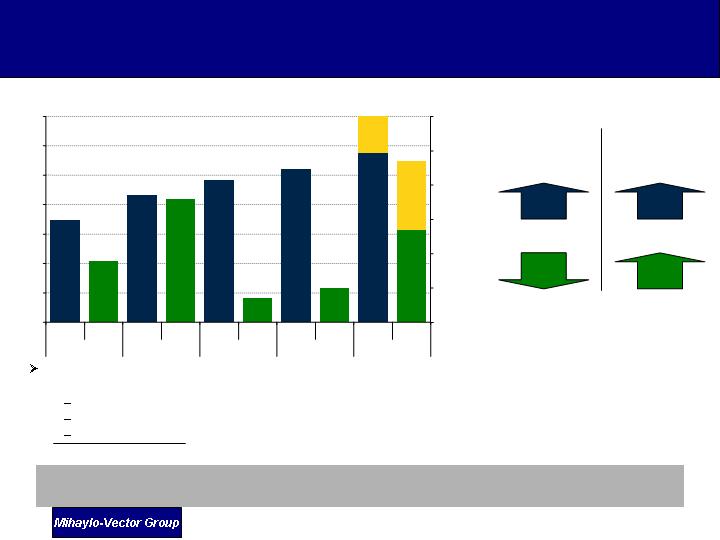

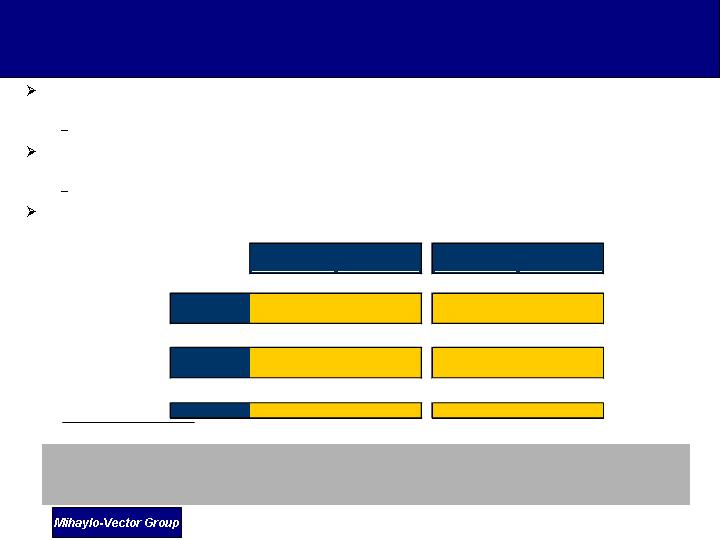

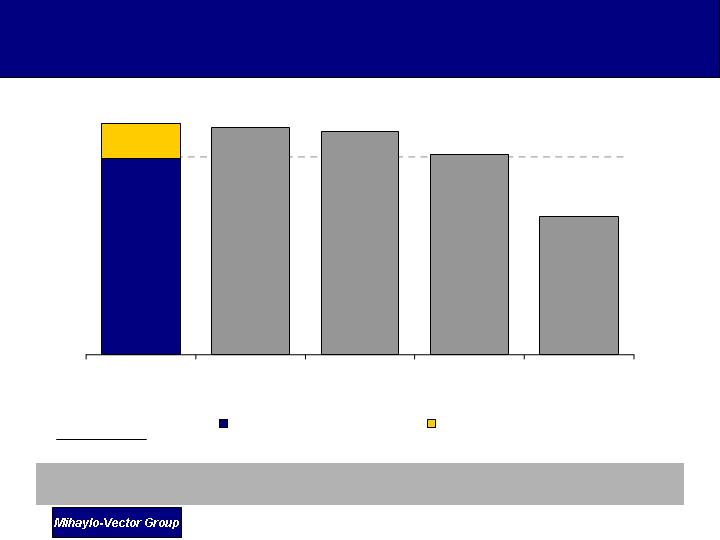

Putting INTL’s “Just Trust Us” In To Perspective

We believe INTL would need to believe that 2007 EPS = $1.37 to support stand-alone value equal to

our offer

17% above consensus estimates of $1.17 (1)

37% above 2006 consensus estimates of $1.00(1)

Implies nearly 20% revenue growth over 2007

INTL Revenue and EPS(1)

Where’s the plan for this?

EPS

Revenue

(2)

37.0%

(2.5%)

19.2%

7.3%

EPS

Revs

Growth needed

to match our

proposed offer

(2006E-2007E)

CAGR

(2003-2006E)

(1) Forward revenues and EPS from I/B/E/S as of 10/5/06. Historical EPS are consensus estimates from FactSet as of 10/6/06.

(2) Assumes 28.6M shares, 35% tax rate and ~$8M in other income and D&A.

$488.0

$461.3

$442.9

$416.8

$373.6

$550.0

$1.17

$1.08

$1.26

$0.97

$1.00

$1.37

$200.0

$250.0

$300.0

$350.0

$400.0

$450.0

$500.0

$550.0

Revenue

EPS

Revenue

EPS

Revenue

EPS

Revenue

EPS

Revenue

EPS

2003A

2004A

2005A

2006E

2007E

$0.90

$1.00

$1.10

$1.20

$1.30

$1.40

$1.50

4

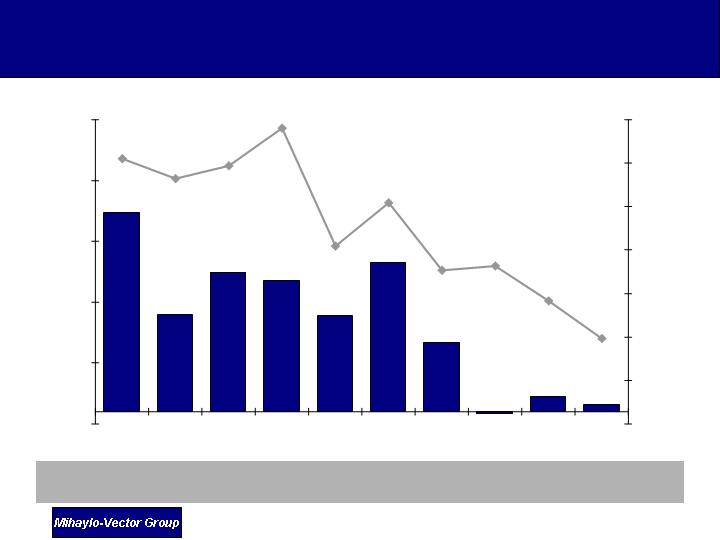

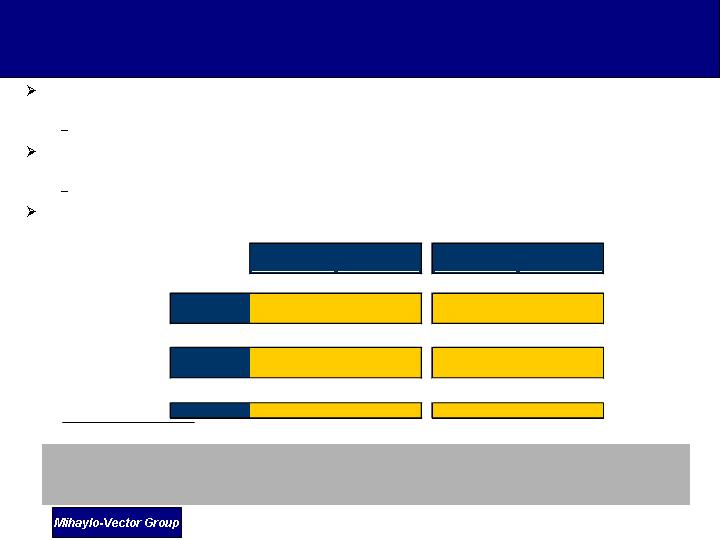

Gross Margin

YoY Revenue

Growth

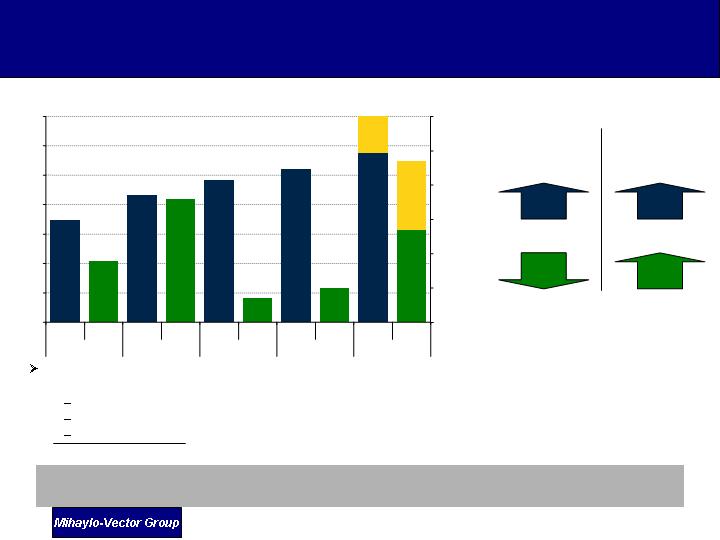

We believe that Inter-Tel has not performed like a company that deserves your trust

to grow revenues by 20% and EPS by 37% in 2007

Recent Financial Performance of Inter-Tel

16.3%

7.9%

11.4%

10.8%

7.9%

12.3%

5.7%

(0.1%)

1.2%

0.6%

53.1%

52.6%

52.9%

53.8%

51.1%

52.1%

50.5%

50.6%

49.8%

49.0%

(1.0%)

4.0%

9.0%

14.0%

19.0%

24.0%

Q1 '04

Q2 '04

Q3 '04

Q4 '04

Q1 '05

Q2 '05

Q3 '05

Q4 '05

Q1 '06

Q2 '06

47.0%

48.0%

49.0%

50.0%

51.0%

52.0%

53.0%

54.0%

5

Compelling Proposed Offer vs. What Plan?

26% premium to Enterprise Value, which adjusts for the distorting effects of

current cash balance

Premium valuation to peer group – 17% premium above the average of peer

group

Even a premium to the comparables group (presumably selectively chosen by the

Special Committee) used to benchmark value in the Special Committee’s

presentation

Premium valuation to INTL’s own historic PE multiples – 25% premium to the

one year average prior to original 13D

Higher premium than the average for all comparably sized LBOs in the last

year

Premium to a majority of analyst price targets

Moreover, Resolution allows the Company to seek even higher offers in a sale

process – consistent with stated “exploration of alternatives”

The Special Committee is asking you to oppose the Resolution in return for a

“Just Trust Us ” plan that they will not disclose that we can only believe must be

based on forecasts that are well ahead of consensus estimates

6

Our Proposed Offer is a Premium to INTL’s Own

Selected Valuation Benchmark

Source: Consensus estimates from FactSet as of 10/5/06.

(1) Peer group represents comparable companies used for Inter-Tel by the Morgan Keegan research analyst.

Our proposed offer is higher than the median

of the Morgan Keegan peer group on every

relevant date

We believe:

They say:

INTL alluded to our proposed offer being a

discount to Morgan Keegan peer group

Calendar Year 2006E P/E as of:

06/16/06

09/21/06

10/03/06

10/05/06

Morgan Keegan

Report

Mihaylo-Vector

Presentation

Inter-Tel

Presentation

Current

Morgan Keegan Peers Median

(1)

:

19.6x

21.3x

20.8x

21.3x

Inter-Tel @ $23.25

INTL

23.1x

23.5x

23.5x

23.5x

Inter-Tel Premium to Morgan Keegan Peers

18.2%

10.5%

13.0%

10.2%

7

Offer represents 17% premium to the average of this peer group

Source: FactSet and I/B/E/S estimates as of 10/5/06.

(1) INTL’s unaffected stock price based on pre-13D closing price of $19.74 on March 3, 2006.

(1)

Non- Inter-Tel

Average: 17.4x

2007E PE Multiple

Proposed Offer Also a Significant Premium to More

Relevant Peer Group

20.0x

17.3x

19.7x

17.7x

12.2x

20.4x

Inter-Tel at

Proposed

$23.25 Offer

Nortel

Avaya

Cisco

Aastra

Unaffected INTL P/E Multiple

Premium

8

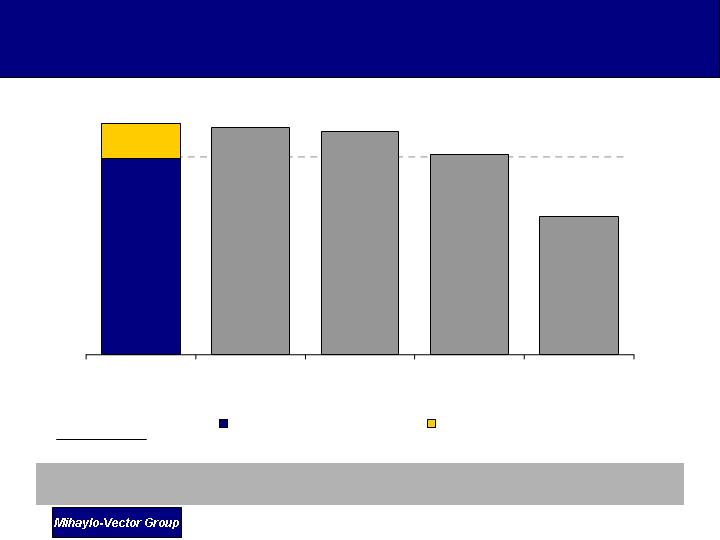

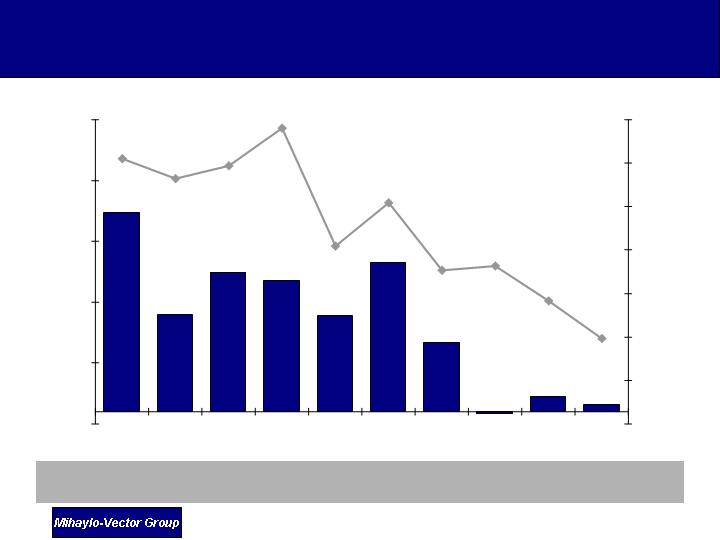

25% premium to Inter-Tel’s average NTM PE for the 12 months prior to the 13D

Further, Our Proposed Offer is a Meaningful

Premium to Inter-Tel’s own Historical Multiples

Source: FactSet as of 10/5/06.

NTM PE Multiples

21.1x

18.0x

16.9x

16.9x

10.0x

13.0x

16.0x

19.0x

22.0x

25.0x

Mihaylo-Vector

Proposed $23.25

Offer

24 Months Average

Pre-13D

12 Month Average

Pre-13D

1 Day Prior to 13D

9

Our offer is a significantly higher premium over enterprise value than the average for

comparable LBOs in the last year – and even given the large component of cash --

represents a premium to the average based on equity value

Premia Comparison vs. the Relevant Transaction Set(1)

(1) Source: Dealogic as of 10/5/06. Based on 35 LBO transactions > $500M and 14 transactions between $500M and $1.5B in the last 12 months.

(2) Enterprise values sourced from FactSet as of 10/5/06.

We believe comparing INTL to a broad list of technology precedent transactions is

inappropriate

Includes stock/stock deals, strategic acquirers, smaller transactions, etc.

If INTL believes this “selected” group is the appropriate premium, then in our opinion they

should find a strategic acquirer to pay such prices

Our resolution allows for a process to sell to other buyers

Given an LBO appears in our view to be the most viable alternative for INTL, we believe a

premium comparison to comparably sized LBO transactions is more appropriate

Equity Premium

Enterprise Value Premium

(2)

1 Day

1 Week

1 Day

1 Week

All LBOs > $500M

Median:

14.0%

16.2%

9.6%

10.3%

Mean:

16.9%

18.8%

10.1%

10.5%

All LBOs $500M - $1.5B

Median:

14.8%

19.1%

9.9%

10.3%

Mean:

17.0%

18.4%

9.3%

9.7%

Inter-Tel @ $23.25

Inter-Tel:

17.8%

16.3%

25.9%

25.1%

10

Proposed Offer Above Most Analyst Price Targets

Most analysts have 12 month price targets below the Mihaylo-Vector proposed offer

Proposed Mihaylo-Vector Offer: $23.25

Avg. 12 Mo. Price Target: $21.75

___________________________

(1) Companies, ratings and price targets sourced from Thomson Analytics and Thomson Research.

Company

(1)

Last Update

Rating

Price Target

Wedbush Morgan

8/28/06

Hold

$21.00

Morgan Keegan

8/28/06

Outperform

N/A

Kaufman Bros.

8/22/06

Hold

$22.00

Brean Murray

8/14/06

Stong Buy

$26.00

JP Morgan

8/11/06

Underweight

N/A

Canaccord Adams

7/27/06

Hold

N/A

Bear Stearns

7/27/06

Peer Perform

N/A

Lehman Brothers

7/27/06

Equal Weight

$18.00

11

Appendix

12

2007 EPS needed to support share price at historical multiples

What Do You Need to Believe to Not Vote for the

Resolution?

(1) Source: I/B/E/S consensus estimate as of 10/5/06.

(2) Source: FactSet as of 10/5/06.

At 1-year average NTM PE multiple of ~17x, INTL would need to deliver FY2007

EPS of $1.37 to support a share price of $23.25

$1.37 is 17% higher than FY2007 consensus EPS estimates of $1.17(1)

We feel that our proposed offer of $23.25 delivers considerable cash value TODAY

FY2007 EPS would have to be >17% above consensus estimates to generate values

in excess of our proposed offer

13

1 Day Prior to 13D

Pre-13D

12 Month Average

Pre-13D

24 Months Average

20.0x

18.0x

16.0x

14.0x

12.0x

10.0x

16.9x

16.9x

18.0x

INTL’s NTM PE Multiples

(2)

2007

PE

Stock Price

$23.25

$25.00

$27.00

16.0x

$1.45

$1.56

$1.69

17.0x

$1.37

$1.47

$1.59

18.0x

$1.29

$1.39

$1.50

What Would INTL Have to Do to Outperform EPS

by 20%?

Target 2007 EPS of $1.37 * 17x PE = $23.25 per share

Implies ~ $68M of EBITDA(1)

Consensus(2)

At the consensus EBITDA margin estimate of 12%, INTL would need to generate

revenue of approximately $550 million to generate EBITDA of $68 million, which is

consistent with 2007 EPS of $1.37. Again, where is the plan to do this?

_______________________

(1) Assumes 28.6M shares, 35% tax rate and ~$8M in other income and D&A.

(2) I/B/E/S consensus estimates as of 10/5/06.

Revenue

Target EBITDA

Implied EBITDA

Margin

$488

$68

14%

$550

$68

12%

14

Revenue

=

$488M

EBITDA

=

$60M

EBITDA Margin

=

12%