June 1, 2007

Inter-Tel Leveraged Recapitalization Analysis

Disclaimer

The following materials have been prepared by RBC Capital Markets Corporation (“RBC”) for the sole use of Steven Mihaylo.

These materials are for discussion and informational purposes only. The information contained in these materials is based upon

or derived from publicly available information, including from documents publicly-filed by Inter-Tel (Delaware), Incorporated (“Inter-

Tel”). RBC makes no representation or warranty in respect of the accuracy or completeness of such information (or any other

information that RBC may provide in connection with the transactions contemplated by these materials) and does not assume

responsibility for independent verification of any such information. RBC shall not have any liability for any errors in or omissions

from these materials or any related written or oral communications. Any estimates and projections contained herein have been

based upon the estimates and projections contained in such publicly-filed documents, and there is no assurance that such

estimates and projections will be realized. RBC makes no recommendation with respect to the transactions contemplated by

these materials and expresses no opinion with respect to the price at which the securities of Inter-Tel will trade at any time or

under any particular circumstances.

These materials are prepared as of June 1, 2007 and speak only as of such date. Any views expressed in these materials (or any

other information that RBC may provide in connection with the transactions contemplated by these materials) are subject to

change based upon a number of factors, including market conditions and Inter-Tel’s business and prospects.

These materials were not intended or written to be used, and cannot be used by any taxpayer, for the purpose of avoiding

penalties that may be imposed on the taxpayer under U.S. Federal tax law.

2

Executive Summary

I.

Transaction Overview

II.

Buyback Transaction Impact Analysis

3

I. Transaction Overview

Transaction Overview

Steven Mihaylo (“Mihaylo”) has asked RBC to evaluate a share repurchase

(“Buyback”) by Inter-Tel (“Company”), given the following parameters:

Transaction

$400 million share repurchase by Company

Offer Price

per Share

$28.00 per share assuming a share tender

Source of

Funds

$200 million from cash on Company Balance Sheet

$200 million in new Term debt raised by Company

Other

Mitel Networks Corporation (“Mitel”) acquisition not consummated

$20 million break-up fee paid to Mitel

5

Sources & Uses

________________________

(1) Per the Agreement and Plan of Merger dated April 26, 2007 among Inter-Tel, Mitel and Arsenal Acquisition Corp. (“Agreement and Plan of Merger”)

(2) Assumes fees of 2.5% of total debt capital raised.

Sources of Funds

Uses of Funds

Cash from Balance Sheet

$200.0

Repurchase of Company Shares

$375.0

New Term Loan Debt

200.0

Mitel Breakup Fee

(1)

20.0

Transaction Expenses

(2)

5.0

Total Sources

$400.0

Total Uses

$400.0

6

II. Buyback Transaction Impact Analysis

Buyback Transaction Assumptions

Transaction assumed to close on 9/30/2007

Analysis included for 2008 to review a full-year impact

Financial projections based on Inter-Tel Management’s projections in the Inter-Tel proxy filed May

29, 2007

$20 million break-up fee payment to Mitel

Implied interest income on Balance Sheet cash of 3.1% assuming an average 2008 cash balance

of $242 million (1)

Interest rate on debt of 7.86% (LIBOR + 250bps)(2)

P/E multiple pre- and post- Buyback assumed to be similar

P/E multiple of 16.5x based on unaffected closing price of $23.79 on April 26, 2007, the last closing price before the

Mitel offer and the financial projections based on Inter-Tel Management’s projections in the Inter-Tel proxy filed May

29, 2007(3)

_______________________

(1) Average cash balance based on average of research estimates for 2008.

(2) Indicative terms provided by RBC Debt Capital Markets as of June 1, 2007, in conjunction with the Highly Confident letter provided by RBC.

(3) RBC compared the Company’s price/earnings multiple of 16.5x used for purposes of the analysis with price/earnings multiples at which the Company shares traded

relative to the consensus equity analysis earnings estimates as reported by FactSet for (1) the spot price/earnings multiple on April 26, 2007 which was 18.3x, (2) the

average daily price/earnings multiple over the one year period ending on April 26, 2007 which was 18.6x, and (3) the average daily price/earnings multiple over the two year

periods ending on April 26, 2007 which was 17.9x. RBC notes that all three price/earnings metrics were higher than the 16.5x used for the purposes of the analysis herein.

The difference in the spot price/earnings multiple on April 26, 2007 was due to RBC calculating the price/earnings multiple based upon Inter-Tel’s projections in its proxy filed

May 29, 2007 and FactSet calculating the price/earnings multiples based upon consensus street estimates. Importantly, the spot price/earnings multiple on April 26, 2007

fell within the range provided by the daily average price/earnings multiples over the preceding 12 month and 24 month periods.

8

Financial Projections

___________________________

(1) From Inter-Tel’s proxy dated May 29, 2007.

Inter-Tel Projections from Proxy

(1)

Q2-Q4 2007E

CY 2007E

CY 2008E

INCOME STATEMENT

Net Sales

$388.7

$498.1

$530.4

Cost of Sales

189.4

245.5

263.1

Gross Profit

199.3

252.6

267.3

R&D

27.8

35.8

35.0

SG&A

130.7

171.2

176.3

Operating Expenses

158.5

207.0

211.3

Operating Income

40.8

45.6

56.0

Other Income

4.2

6.0

7.5

PreTax Income

45.0

51.6

63.5

Taxes

(16.5)

(18.6)

(22.9)

% Tax Rate

36.6%

36.0%

36.0%

Net Income

$28.5

$33.0

$40.6

Fully Diluted Shares

28.1

28.0

28.2

Diluted EPS

$1.01

$1.18

$1.44

9

Impact of Buyback on FY2008 Income Statement Projections

____________________________________

(1) From Inter-Tel’s proxy dated May 29, 2007.

(2) Assumes $375 million Buyback using $200 million of balance sheet cash and $200 million of debt. $5 million of transaction expenses and $20 million of break-up fee also paid.

(3) Assumes average cash balance for Q4 2007 and CY 2008 of $19.7 million, calculated as average Q4 2007 cash balance from research less $200 million of cash used for Buyback.

(4) Assumes $7.2 million of principal is paid down in Q4 2007 and an average debt balance of $177 million in 2008. Q4 2007 financial projections calculated as 1/3rd of Q2-Q4 2007 projections in Inter-Tel’s May 29, 2007 proxy.

(5) Assumes 13.4 million shares repurchased at $28.00 per share for a total amount of $375 million.

(6) Based on unaffected closing price of $23.79 on April 26, 2007.

2008 Projections per Inter-Tel Proxy

(1)

2008 Projections Post-Buyback

(2)

Total Revenue

$530.4

Total Revenue

$530.4

COGS

263.1

COGS

263.1

Gross Margin

$267.3

Gross Margin

$267.3

R&D

$35.0

R&D

$35.0

SG&A

176.3

SG&A

176.3

Total Operating Expenses

$211.3

Total Operating Expenses

$211.3

Operating Income

$56.0

Operating Income

$56.0

Interest Income

$7.5

Interest Income

(3)

$0.6

Interest Expense

---

Interest Expense

(4)

(13.9)

Total Other Income (Expenses)

$7.5

Total Other Income (Expenses)

($13.3)

Income Before Taxes

$63.5

Income Before Taxes

$42.7

Income Taxes

($22.9)

Income Taxes

($15.4)

Income Tax Rate

36.0%

Income Tax Rate

36.0%

Net Income

$40.6

Net Income

$27.3

Diluted Shares Outstanding

28.2

Diluted Shares Outstanding

(5)

14.8

EPS - Diluted (Non-GAAP)

$1.44

EPS - Diluted (Non-GAAP)

$1.84

2008E Accretion / Dilution

Stock Price Analysis

2008 Diluted EPS from Proxy

(1)

$1.44

2008E P/E from Proxy

(6)

16.5x

Pro Forma Diluted EPS

$1.84

Pro Forma Diluted EPS

$1.84

Accretion (Dilution)

$0.40

Assumed 2008E P/E Post-Buyback

16.5x

Accretion (Dilution) %

28.0%

Pro Forma Stock Price

$30.46

% Change from Unaffected Price

28.0%

10

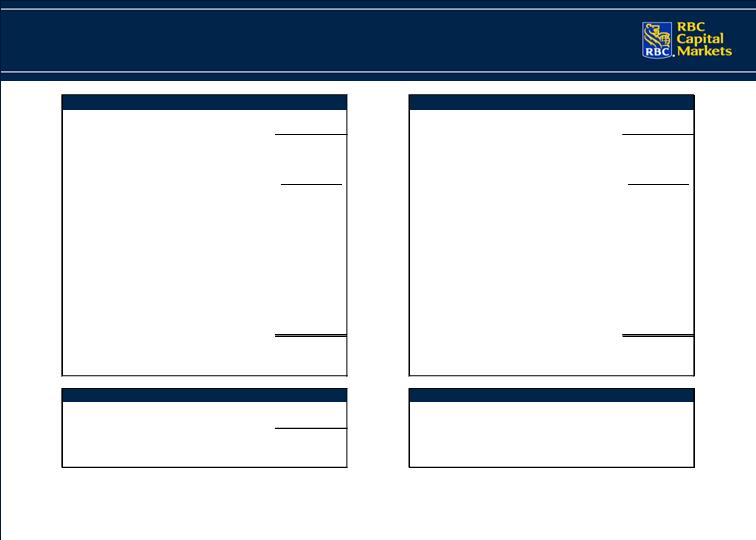

Sensitivity Analyses

_______________________________

(1) Cash from Balance Sheet of $200 million is assumed fixed. Any amount above or below $400 million is achieved by adjusting the debt amount. Actual Buyback amount equals sources of funds less

transaction fees and breakup fee.

(2) Assumes P/E multiple pre- and post-Buyback remains constant at 16.5x.

(3) Assumes $400 million in sources of funds.

(4) Number of shares bought back based on total Buyback amount less transaction expenses and breakup fee. Calculated as the weighted-average of shares tendered in the Buyback multiplied by Buyback

price per share and basic shares remaining after Buyback multiplied by post-Buyback price.

11

26.6%

25.3%

24.2%

23.1%

22.2%

29.00

29.0%

27.4%

26.0%

24.8%

23.7%

28.50

31.7%

29.7%

28.0%

26.5%

25.2%

28.00

34.5%

32.2%

30.2%

28.4%

26.8%

27.50

37.6%

34.9%

32.5%

30.4%

28.5%

$27.00

$450.0

$425.0

$400.0

$375.0

$350.0

28.0%

(1)

Total Sources of Funds

Price

Buyback

2008 Accretion (Dilution)

31.15

30.21

29.28

28.35

27.41

29.00

31.13

30.19

29.26

28.33

27.40

28.50

31.10

30.17

29.24

28.31

27.38

28.00

31.08

30.15

29.22

28.29

27.36

27.50

$31.05

$30.12

$29.20

$28.27

$27.34

$27.00

18.5x

17.5x

16.5x

15.5x

14.5x

P/E Multiple Post-Buyback

Price

Buyback

(3), (4)

Blended Share Price

30.11

29.81

29.54

29.29

29.08

29.00

30.69

30.32

29.98

29.68

29.42

28.50

31.32

30.86

30.46

30.10

29.78

28.00

32.00

31.45

30.97

30.54

30.16

27.50

$32.73

$32.08

$31.51

$31.01

$30.57

$27.00

$450.0

$425.0

$400.0

$375.0

$350.0

3045.7%

(1)

Total Sources of Funds

Price

Buyback

(2)

Post-Buyback Stock Price

33.11

31.32

29.54

27.75

25.96

29.00

33.61

31.80

29.98

28.16

26.35

28.50

34.15

32.30

30.46

28.61

26.77

28.00

34.72

32.84

30.97

29.09

27.21

27.50

$35.33

$33.42

$31.51

$29.60

$27.69

$27.00

18.5x

17.5x

16.5x

15.5x

14.5x

3045.7%

P/E Multiple Post-Buyback

Price

Buyback

(3)

Post-Buyback Stock Price

Blended Share Price

(2), (4)

Buyback

Price

Total Sources of Funds

(1)

$350.0

$375.0

$400.0

$425.0

$450.0

$27.00

$28.98

$29.09

$29.20

$29.30

$29.40

27.50

29.00

29.11

29.22

29.33

29.43

28.00

29.02

29.13

29.24

29.35

29.46

28.50

29.03

29.15

29.26

29.37

29.48

29.00

29.04

29.16

29.28

29.40

29.51

Certain Information Concerning Participants

CERTAIN INFORMATION CONCERNING PARTICIPANTS

Steven G. Mihaylo (“Mr. Mihaylo”), Summit Growth Management LLC and the Steven G. Mihaylo Trust are participants (the “Participants”) in the

solicitation of proxies by Mr. Mihaylo from stockholders of Inter-Tel (Delaware), Incorporated (the “Company”) in connection with the Special Meeting of

Stockholders of the Company to be held on June 29, 2007 (the “Special Meeting”). The Participants have filed a preliminary proxy statement with the

Securities and Exchange Commission in connection with the Special Meeting, and plan to mail a definitive proxy statement and accompanying proxy card to

the Company’s stockholders when completed.

THE PARTICIPANTS STRONGLY ADVISE ALL STOCKHOLDERS OF THE COMPANY TO READ THE PRELIMINARY PROXY STATEMENT

THAT HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, AND THE DEFINITIVE PROXY STATEMENT AND OTHER

PROXY MATERIALS THAT ARE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION AS THEY BECOME AVAILABLE, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. THE PRELIMINARY PROXY STATEMENT IS, AND THE DEFINITIVE PROXY

STATEMENT AND SUCH OTHER PROXY MATERIALS WILL BE, AVAILABLE AT NO CHARGE ON THE SECURITIES AND EXCHANGE

COMMISSION’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THE SOLICITATION WILL PROVIDE COPIES

OF THE DEFINITIVE PROXY STATEMENT (WHEN AVAILABLE), WITHOUT CHARGE, UPON REQUEST. REQUESTS FOR COPIES OF THE

DEFINITIVE PROXY STATEMENT SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR, MACKENZIE PARTNERS, INC., AT

ITS TOLL FREE NUMBER: 1 (800) 322-2885.

Information relating to the Participants is contained in the preliminary proxy statement filed by the participants with the Securities and Exchange

Commission.

12