Exhibit 99.1 Confidential Information Memorandum P H I , I N C . J U N E 2019Exhibit 99.1 Confidential Information Memorandum P H I , I N C . J U N E 2019

Disclaimer Limitations of Report This fiscal year 2019 budget of PHI, Inc. (“PHI” or the “Company”) and the related information contained herein has been prepared based upon financial and other data provided to FTI Consulting, Inc. (“FTI”) from the Company’s management, staff and advisors and from the Company’s publicly filed periodic reports and other public sources FTI deemed to be reliable. FTI further relied on the assurance of management and staff of the Company and its advisors that they were unaware of any facts that would make the information provided to FTI by them incomplete or misleading. FTI has not subjected the information contained herein to an audit in accordance with generally accepted auditing or attestation standards or the Statement on Standards for Prospective Financial Information issued by the AICPA. Further, the work involved did not include a detailed review of any transactions, and cannot be expected to identify errors, irregularities or illegal acts, including fraud or defalcations that may exist. Accordingly, FTI cannot express an opinion or any other form of assurance on, and assumes no responsibility for, the accuracy or correctness of the historical information or the completeness and achievability of the projected financial data, information and assessments upon which the enclosed report (the “Report”) is presented. This Report contains certain non-GAAP financial measures, including EBITDA. Use of these non-GAAP measures may differ from similar measures reported by other companies. Each of these non- GAAP measures has its limitations as an analytical tool, and the recipient should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Forward Looking Statements The forecasts and certain other statements in this Report constitute or may be deemed to constitute “Forward-Looking Statements”(as defined in the U.S. Private Securities Litigation Reform Act of 1995). Such Forward-Looking Statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of the Company, or industry results, to differ materially from any future results, performance or achievement stated or implied by such Forward-Looking Statements. Statements in this Report that are forward- looking are based on the Company’s current beliefs regarding a large number of factors affecting its business. Actual results may differ materially from expected results. The words “believe,” “expect,” “anticipate,” “intend”, “forecast”, and other similar expressions generally identify Forward-Looking Statements. You are cautioned not to place undue reliance on these Forward-Looking Statements, which only speak as of their dates. There can be no assurance that (i) the Company has correctly measured or identified all of the factors affecting its business or the extent of their likely impact, (ii) the publicly available information with respect to these factors on which the Company’s analysis is based is complete or accurate, (iii) the Company’s analysis is correct or (iv) the Company’s strategy, which is based in part on this analysis, will be successful. Forward-Looking Statements involve numerous risks and uncertainties, including those set forth in the Company’s filings under the Federal Securities Laws, that could cause actual results to differ materially from expected results. Limitations of Access and Distribution This Report contains information on the Company and is being provided on a strictly confidential basis. Distribution of this Report is prohibited without FTI’s written consent. By accepting a copy of this Report, each reader agrees to keep all information contained herein confidential and to not distribute this Report or any portion thereof to any other party, except to the extent expressly permitted by the Company. Each person that should obtain and read this Report agrees to the following terms: The reader acknowledges that much of the information contained within this Report is non-public and should be considered confidential The reader agrees that he/she does not acquire any rights as a result of such access that it would not otherwise have had and acknowledges that FTI does not assume any duties or obligations to the reader in connection with such access The reader agrees to release FTI and its personnel from any claim by the reader that arises as a result of the reader having inappropriate and/or unlawful access to the Report FTI has no responsibility to update the Report for events or circumstances occurring after the date of the Report Nothing herein is intended to constitute an offer to sell any securities of PHI, or the solicitation of any offer to buy any such securities The information contained herein is not comprehensive, and the recipient agrees to conduct its own independent investigation of the Company, including a review of the Company’s reports filed under the Federal Securities Laws (including the “Risk Factors” disclosures contained therein). In the event of any discrepancy between this report and PHI’s Annual Report on Form 10-K for the year ended December 31, 2018 and its subsequent quarterly reports on Form 10-Q, you should rely on those 10-K and 10-Q reports. 1Disclaimer Limitations of Report This fiscal year 2019 budget of PHI, Inc. (“PHI” or the “Company”) and the related information contained herein has been prepared based upon financial and other data provided to FTI Consulting, Inc. (“FTI”) from the Company’s management, staff and advisors and from the Company’s publicly filed periodic reports and other public sources FTI deemed to be reliable. FTI further relied on the assurance of management and staff of the Company and its advisors that they were unaware of any facts that would make the information provided to FTI by them incomplete or misleading. FTI has not subjected the information contained herein to an audit in accordance with generally accepted auditing or attestation standards or the Statement on Standards for Prospective Financial Information issued by the AICPA. Further, the work involved did not include a detailed review of any transactions, and cannot be expected to identify errors, irregularities or illegal acts, including fraud or defalcations that may exist. Accordingly, FTI cannot express an opinion or any other form of assurance on, and assumes no responsibility for, the accuracy or correctness of the historical information or the completeness and achievability of the projected financial data, information and assessments upon which the enclosed report (the “Report”) is presented. This Report contains certain non-GAAP financial measures, including EBITDA. Use of these non-GAAP measures may differ from similar measures reported by other companies. Each of these non- GAAP measures has its limitations as an analytical tool, and the recipient should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Forward Looking Statements The forecasts and certain other statements in this Report constitute or may be deemed to constitute “Forward-Looking Statements”(as defined in the U.S. Private Securities Litigation Reform Act of 1995). Such Forward-Looking Statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of the Company, or industry results, to differ materially from any future results, performance or achievement stated or implied by such Forward-Looking Statements. Statements in this Report that are forward- looking are based on the Company’s current beliefs regarding a large number of factors affecting its business. Actual results may differ materially from expected results. The words “believe,” “expect,” “anticipate,” “intend”, “forecast”, and other similar expressions generally identify Forward-Looking Statements. You are cautioned not to place undue reliance on these Forward-Looking Statements, which only speak as of their dates. There can be no assurance that (i) the Company has correctly measured or identified all of the factors affecting its business or the extent of their likely impact, (ii) the publicly available information with respect to these factors on which the Company’s analysis is based is complete or accurate, (iii) the Company’s analysis is correct or (iv) the Company’s strategy, which is based in part on this analysis, will be successful. Forward-Looking Statements involve numerous risks and uncertainties, including those set forth in the Company’s filings under the Federal Securities Laws, that could cause actual results to differ materially from expected results. Limitations of Access and Distribution This Report contains information on the Company and is being provided on a strictly confidential basis. Distribution of this Report is prohibited without FTI’s written consent. By accepting a copy of this Report, each reader agrees to keep all information contained herein confidential and to not distribute this Report or any portion thereof to any other party, except to the extent expressly permitted by the Company. Each person that should obtain and read this Report agrees to the following terms: The reader acknowledges that much of the information contained within this Report is non-public and should be considered confidential The reader agrees that he/she does not acquire any rights as a result of such access that it would not otherwise have had and acknowledges that FTI does not assume any duties or obligations to the reader in connection with such access The reader agrees to release FTI and its personnel from any claim by the reader that arises as a result of the reader having inappropriate and/or unlawful access to the Report FTI has no responsibility to update the Report for events or circumstances occurring after the date of the Report Nothing herein is intended to constitute an offer to sell any securities of PHI, or the solicitation of any offer to buy any such securities The information contained herein is not comprehensive, and the recipient agrees to conduct its own independent investigation of the Company, including a review of the Company’s reports filed under the Federal Securities Laws (including the “Risk Factors” disclosures contained therein). In the event of any discrepancy between this report and PHI’s Annual Report on Form 10-K for the year ended December 31, 2018 and its subsequent quarterly reports on Form 10-Q, you should rely on those 10-K and 10-Q reports. 1

Table of Contents Chapter Page Company Overview 6 Oil & Gas Business Overview 19 Air Medical Business Overview 37 Technical Services Business Overview 56 Corporate 63 Appendix 67 2Table of Contents Chapter Page Company Overview 6 Oil & Gas Business Overview 19 Air Medical Business Overview 37 Technical Services Business Overview 56 Corporate 63 Appendix 67 2

Historical and Projected Financial Summary Revenue ($mm) $1,000 $836 $804 $741 $722 $800 $700 $674 $666 $634 $580 $600 $400 $200 $0 FY 2014A FY 2015A FY 2016A FY 2017A FY 2018A LTM Mar-19 FY 2019B FY 2020P FY 2021P (1) EBITDA ($mm) $200 $174 $150 $128 $100 $74 $64 $51 $46 $40 $39 $37 $50 $0 FY 2014A FY 2015A FY 2016A FY 2017A FY 2018A LTM Mar-19 FY 2019B FY 2020P FY 2021P Capital Expenditures ($mm) $180 $158 $135 $82 $90 $57 $57 $48 $43 $43 $44 $33 $45 $0 FY 2014A FY 2015A FY 2016A FY 2017A FY 2018A LTM Mar-19 FY 2019B FY 2020P FY 2021P (1) FY 2018A and LTM Mar-2019 EBITDA figures include further adjustments described throughout the presentation, including (i) process-related professional fees & expenses, (ii) aircraft donation expenses and (iii) 3 severance expensesHistorical and Projected Financial Summary Revenue ($mm) $1,000 $836 $804 $741 $722 $800 $700 $674 $666 $634 $580 $600 $400 $200 $0 FY 2014A FY 2015A FY 2016A FY 2017A FY 2018A LTM Mar-19 FY 2019B FY 2020P FY 2021P (1) EBITDA ($mm) $200 $174 $150 $128 $100 $74 $64 $51 $46 $40 $39 $37 $50 $0 FY 2014A FY 2015A FY 2016A FY 2017A FY 2018A LTM Mar-19 FY 2019B FY 2020P FY 2021P Capital Expenditures ($mm) $180 $158 $135 $82 $90 $57 $57 $48 $43 $43 $44 $33 $45 $0 FY 2014A FY 2015A FY 2016A FY 2017A FY 2018A LTM Mar-19 FY 2019B FY 2020P FY 2021P (1) FY 2018A and LTM Mar-2019 EBITDA figures include further adjustments described throughout the presentation, including (i) process-related professional fees & expenses, (ii) aircraft donation expenses and (iii) 3 severance expenses

Historical A/R and Inventory Balances Historical A/R Balances ($mm) FY2016A Average: $148mm FY 2016A FY 2017A FY 2018A FY2017A Average: $146mm $220 FY2018A Average: $191mm $180 $140 $100 January February March April May June July August September October November December Inventory Balances ($mm) FY2016A Average: $70mm FY 2016A FY 2017A FY 2018A FY2017A Average: $75mm $90 FY2018A Average: $75mm $80 $70 $60 $50 January February March April May June July August September October November December 4Historical A/R and Inventory Balances Historical A/R Balances ($mm) FY2016A Average: $148mm FY 2016A FY 2017A FY 2018A FY2017A Average: $146mm $220 FY2018A Average: $191mm $180 $140 $100 January February March April May June July August September October November December Inventory Balances ($mm) FY2016A Average: $70mm FY 2016A FY 2017A FY 2018A FY2017A Average: $75mm $90 FY2018A Average: $75mm $80 $70 $60 $50 January February March April May June July August September October November December 4

EBITDA Adjustments Overview Adjusted EBITDA Bridge Commentary Regarding Adjustments 1. Includes various legal and professional fees LTM and expenses associated with the M&A FY 2018 Mar-19 ($ in thousands) process, the Blue Torch financing and EBITDA $40,844 $22,048 restructuring negotiations with lenders Adjustments 2. Addback in connection with the donation of an 1 Plus: Professional Fees & Expenses $5,095 $15,539 S-76 aircraft to the Lone Star Flight Museum in 2 Plus: Aircraft Donation Addback 500 - March 2018 3 Plus: Severance Expenses - 1,838 3. Reflects non-recurring severance expenses Total Adjustments $5,595 $17,377 incurred in Q1 2019 Adjusted EBITDA $46,439 $39,425 5EBITDA Adjustments Overview Adjusted EBITDA Bridge Commentary Regarding Adjustments 1. Includes various legal and professional fees LTM and expenses associated with the M&A FY 2018 Mar-19 ($ in thousands) process, the Blue Torch financing and EBITDA $40,844 $22,048 restructuring negotiations with lenders Adjustments 2. Addback in connection with the donation of an 1 Plus: Professional Fees & Expenses $5,095 $15,539 S-76 aircraft to the Lone Star Flight Museum in 2 Plus: Aircraft Donation Addback 500 - March 2018 3 Plus: Severance Expenses - 1,838 3. Reflects non-recurring severance expenses Total Adjustments $5,595 $17,377 incurred in Q1 2019 Adjusted EBITDA $46,439 $39,425 5

Company OverviewCompany Overview

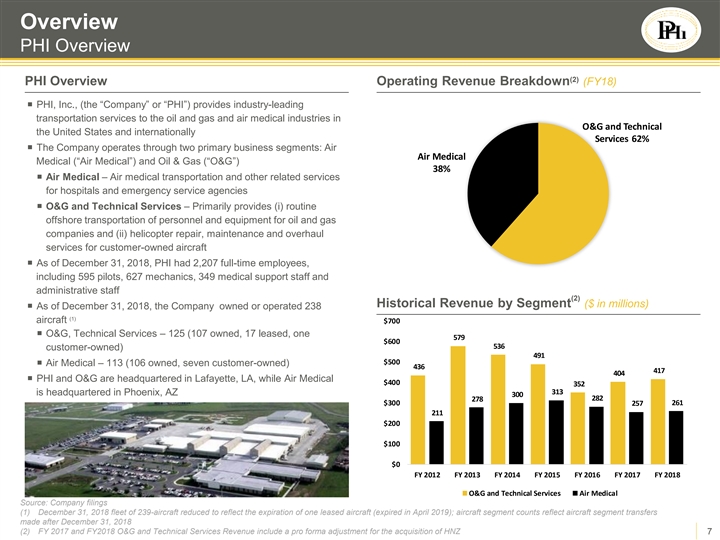

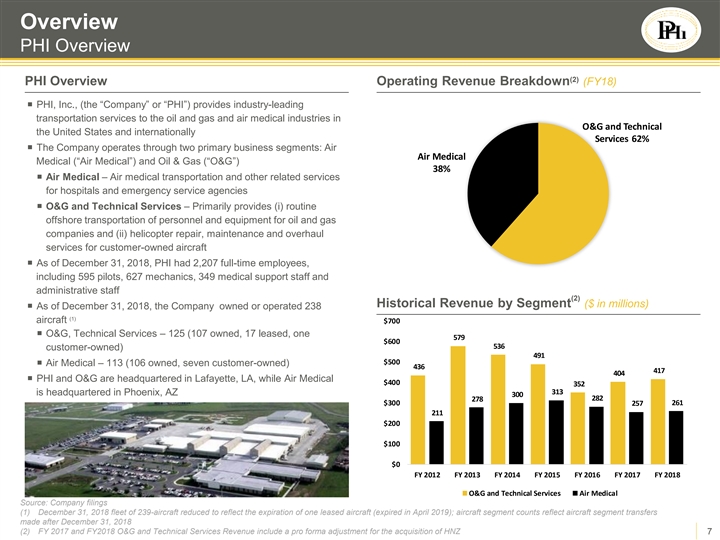

Overview PHI Overview (2) PHI Overview Operating Revenue Breakdown (FY18) ¡ PHI, Inc., (the “Company” or “PHI”) provides industry-leading transportation services to the oil and gas and air medical industries in O&G and Technical the United States and internationally Services 62% ¡ The Company operates through two primary business segments: Air Air Medical Medical (“Air Medical”) and Oil & Gas (“O&G”) 38% ¡ Air Medical – Air medical transportation and other related services for hospitals and emergency service agencies ¡ O&G and Technical Services – Primarily provides (i) routine offshore transportation of personnel and equipment for oil and gas companies and (ii) helicopter repair, maintenance and overhaul services for customer-owned aircraft ¡ As of December 31, 2018, PHI had 2,207 full-time employees, including 595 pilots, 627 mechanics, 349 medical support staff and administrative staff (2) Historical Revenue by Segment ($ in millions) ¡ As of December 31, 2018, the Company owned or operated 238 (1) aircraft $700 ¡ O&G, Technical Services – 125 (107 owned, 17 leased, one 579 $600 536 customer-owned) 491 $500 ¡ Air Medical – 113 (106 owned, seven customer-owned) 436 417 404 ¡ PHI and O&G are headquartered in Lafayette, LA, while Air Medical $400 352 313 is headquartered in Phoenix, AZ 300 282 278 261 $300 257 211 $200 $100 $0 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 O&G and Technical Services Air Medical Source: Company filings (1) December 31, 2018 fleet of 239-aircraft reduced to reflect the expiration of one leased aircraft (expired in April 2019); aircraft segment counts reflect aircraft segment transfers made after December 31, 2018 (2) FY 2017 and FY2018 O&G and Technical Services Revenue include a pro forma adjustment for the acquisition of HNZ 7Overview PHI Overview (2) PHI Overview Operating Revenue Breakdown (FY18) ¡ PHI, Inc., (the “Company” or “PHI”) provides industry-leading transportation services to the oil and gas and air medical industries in O&G and Technical the United States and internationally Services 62% ¡ The Company operates through two primary business segments: Air Air Medical Medical (“Air Medical”) and Oil & Gas (“O&G”) 38% ¡ Air Medical – Air medical transportation and other related services for hospitals and emergency service agencies ¡ O&G and Technical Services – Primarily provides (i) routine offshore transportation of personnel and equipment for oil and gas companies and (ii) helicopter repair, maintenance and overhaul services for customer-owned aircraft ¡ As of December 31, 2018, PHI had 2,207 full-time employees, including 595 pilots, 627 mechanics, 349 medical support staff and administrative staff (2) Historical Revenue by Segment ($ in millions) ¡ As of December 31, 2018, the Company owned or operated 238 (1) aircraft $700 ¡ O&G, Technical Services – 125 (107 owned, 17 leased, one 579 $600 536 customer-owned) 491 $500 ¡ Air Medical – 113 (106 owned, seven customer-owned) 436 417 404 ¡ PHI and O&G are headquartered in Lafayette, LA, while Air Medical $400 352 313 is headquartered in Phoenix, AZ 300 282 278 261 $300 257 211 $200 $100 $0 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 O&G and Technical Services Air Medical Source: Company filings (1) December 31, 2018 fleet of 239-aircraft reduced to reflect the expiration of one leased aircraft (expired in April 2019); aircraft segment counts reflect aircraft segment transfers made after December 31, 2018 (2) FY 2017 and FY2018 O&G and Technical Services Revenue include a pro forma adjustment for the acquisition of HNZ 7

Overview Management Team PHI’s management team is comprised of seasoned industry experts with proven track records of success § In September 2001, Mr. Gonsoulin purchased a controlling interest in Petroleum Helicopters, Inc. (now known as PHI, Inc.), assuming AI Gonsoulin the role of Chairman. He was appointed CEO in 2004, a position which he currently maintains § In 1977, Mr. Gonsoulin founded his own company, Sea Mar, Inc., a marine transportation firm which he built and operated as CEO Chairman and before selling the company in 1998 § Mr. Gonsoulin began his career in 1965, working his way to executive management positions with established companies in the oil Chief Executive Officer and gas services sector Lance Bospflug§ Mr. Bospflug has served as Chief Operating Officer and President of PHI since 2009 and 2010, respectively § In 2004, Mr. Bospflug moved to private practice while assuming a role as a Director for PHI, before rejoining PHI full-time in 2009 President and § Mr. Bospflug originally joined PHI in October 2000 as President and became Chief Executive Officer from August 2001 to May 2004 Chief Operating Officer§ Prior to joining PHI, he served as Executive Vice President, CFO and CEO at T.L. James and Company § Ms. McConnaughhay has served as PHI's Chief Financial Officer, Principal Accounting Officer, Treasurer and Secretary since 2012 Trudy McConnaughhay § Prior to joining PHI, Ms. McConnaughhay was the Chief Financial Officer of Dynamic Industries International, a private company servicing the offshore and onshore oil and gas industry Chief Financial Officer, § Ms. McConnaughhay previously held numerous accounting and finance positions at Global Industries, Ltd., a leading provider of Treasurer and Secretary offshore construction and support services to the oil and gas industry § Since 2013, Mr. Motzkin has served as President of PHI Air Medical David Motzkin § Mr. Motzkin is a recognized leader in the air medical industry and has been part of the PHI leadership team since 2004 § In 1995, Mr. Motzkin joined Rocky Mountain Helicopters and, as the Arizona based director, helped to establish the LifeNet brand. In President 2002, Mr. Motzkin became a member of Air Methods’ leadership team via the Rocky Mountain Helicopters acquisition PHI Air Medical Group § Mr. Motzkin began his career over 30 years ago in public safety, working as a firefighter / paramedic David Stepanek § Mr. Stepanek has served as President of Domestic Oil & Gas since January 2018 § In 2010, Mr. Stepanek joined PHI as Director, Corporate Business Development (later retitled Chief Commercial Officer) President § Mr. Stepanek has over 34 years of experience in the helicopter industry including 20 years with Sikorsky Aircraft and leadership roles with Era Group and the United States Marine Corps PHI Americas Keith Mullett § Mr. Mullett has served as President of International Oil & Gas since January 2018 § In 2011, Mr. Mullett joined HNZ as Executive Vice President for international offshore operations President § Mr. Mullett previously served as a Director and Managing Director of European Operations at CHC PHI International 8Overview Management Team PHI’s management team is comprised of seasoned industry experts with proven track records of success § In September 2001, Mr. Gonsoulin purchased a controlling interest in Petroleum Helicopters, Inc. (now known as PHI, Inc.), assuming AI Gonsoulin the role of Chairman. He was appointed CEO in 2004, a position which he currently maintains § In 1977, Mr. Gonsoulin founded his own company, Sea Mar, Inc., a marine transportation firm which he built and operated as CEO Chairman and before selling the company in 1998 § Mr. Gonsoulin began his career in 1965, working his way to executive management positions with established companies in the oil Chief Executive Officer and gas services sector Lance Bospflug§ Mr. Bospflug has served as Chief Operating Officer and President of PHI since 2009 and 2010, respectively § In 2004, Mr. Bospflug moved to private practice while assuming a role as a Director for PHI, before rejoining PHI full-time in 2009 President and § Mr. Bospflug originally joined PHI in October 2000 as President and became Chief Executive Officer from August 2001 to May 2004 Chief Operating Officer§ Prior to joining PHI, he served as Executive Vice President, CFO and CEO at T.L. James and Company § Ms. McConnaughhay has served as PHI's Chief Financial Officer, Principal Accounting Officer, Treasurer and Secretary since 2012 Trudy McConnaughhay § Prior to joining PHI, Ms. McConnaughhay was the Chief Financial Officer of Dynamic Industries International, a private company servicing the offshore and onshore oil and gas industry Chief Financial Officer, § Ms. McConnaughhay previously held numerous accounting and finance positions at Global Industries, Ltd., a leading provider of Treasurer and Secretary offshore construction and support services to the oil and gas industry § Since 2013, Mr. Motzkin has served as President of PHI Air Medical David Motzkin § Mr. Motzkin is a recognized leader in the air medical industry and has been part of the PHI leadership team since 2004 § In 1995, Mr. Motzkin joined Rocky Mountain Helicopters and, as the Arizona based director, helped to establish the LifeNet brand. In President 2002, Mr. Motzkin became a member of Air Methods’ leadership team via the Rocky Mountain Helicopters acquisition PHI Air Medical Group § Mr. Motzkin began his career over 30 years ago in public safety, working as a firefighter / paramedic David Stepanek § Mr. Stepanek has served as President of Domestic Oil & Gas since January 2018 § In 2010, Mr. Stepanek joined PHI as Director, Corporate Business Development (later retitled Chief Commercial Officer) President § Mr. Stepanek has over 34 years of experience in the helicopter industry including 20 years with Sikorsky Aircraft and leadership roles with Era Group and the United States Marine Corps PHI Americas Keith Mullett § Mr. Mullett has served as President of International Oil & Gas since January 2018 § In 2011, Mr. Mullett joined HNZ as Executive Vice President for international offshore operations President § Mr. Mullett previously served as a Director and Managing Director of European Operations at CHC PHI International 8

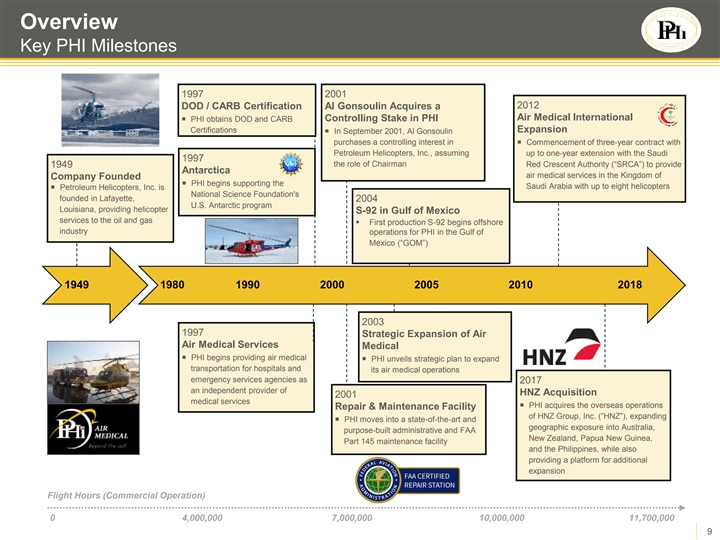

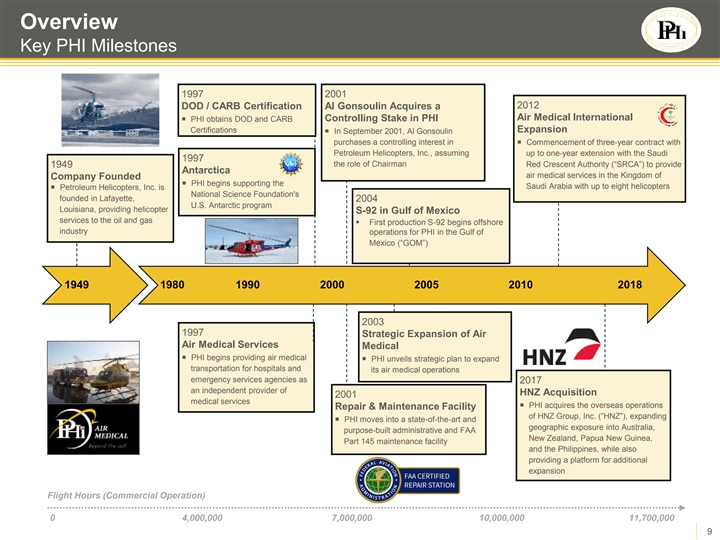

Overview Key PHI Milestones 1997 2001 DOD / CARB Certification Al Gonsoulin Acquires a 2012 Controlling Stake in PHI Air Medical International ¡ PHI obtains DOD and CARB Certifications Expansion ¡ In September 2001, Al Gonsoulin purchases a controlling interest in ¡ Commencement of three-year contract with Petroleum Helicopters, Inc., assuming up to one-year extension with the Saudi 1997 the role of Chairman Red Crescent Authority (“SRCA”) to provide 1949 Antarctica air medical services in the Kingdom of Company Founded ¡ PHI begins supporting the Saudi Arabia with up to eight helicopters ¡ Petroleum Helicopters, Inc. is National Science Foundation's founded in Lafayette, 2004 U.S. Antarctic program Louisiana, providing helicopter S-92 in Gulf of Mexico services to the oil and gas § First production S-92 begins offshore industry operations for PHI in the Gulf of Mexico (“GOM”) 1949 1980 1990 2000 2005 2010 2018 2003 1997 Strategic Expansion of Air Air Medical Services Medical ¡ PHI begins providing air medical ¡ PHI unveils strategic plan to expand transportation for hospitals and its air medical operations emergency services agencies as 2017 an independent provider of HNZ Acquisition 2001 medical services ¡ PHI acquires the overseas operations Repair & Maintenance Facility of HNZ Group, Inc. (“HNZ”), expanding ¡ PHI moves into a state-of-the-art and geographic exposure into Australia, purpose-built administrative and FAA New Zealand, Papua New Guinea, Part 145 maintenance facility and the Philippines, while also providing a platform for additional expansion Flight Hours (Commercial Operation) 0 4,000,000 7,000,000 10,000,000 11,700,000 9Overview Key PHI Milestones 1997 2001 DOD / CARB Certification Al Gonsoulin Acquires a 2012 Controlling Stake in PHI Air Medical International ¡ PHI obtains DOD and CARB Certifications Expansion ¡ In September 2001, Al Gonsoulin purchases a controlling interest in ¡ Commencement of three-year contract with Petroleum Helicopters, Inc., assuming up to one-year extension with the Saudi 1997 the role of Chairman Red Crescent Authority (“SRCA”) to provide 1949 Antarctica air medical services in the Kingdom of Company Founded ¡ PHI begins supporting the Saudi Arabia with up to eight helicopters ¡ Petroleum Helicopters, Inc. is National Science Foundation's founded in Lafayette, 2004 U.S. Antarctic program Louisiana, providing helicopter S-92 in Gulf of Mexico services to the oil and gas § First production S-92 begins offshore industry operations for PHI in the Gulf of Mexico (“GOM”) 1949 1980 1990 2000 2005 2010 2018 2003 1997 Strategic Expansion of Air Air Medical Services Medical ¡ PHI begins providing air medical ¡ PHI unveils strategic plan to expand transportation for hospitals and its air medical operations emergency services agencies as 2017 an independent provider of HNZ Acquisition 2001 medical services ¡ PHI acquires the overseas operations Repair & Maintenance Facility of HNZ Group, Inc. (“HNZ”), expanding ¡ PHI moves into a state-of-the-art and geographic exposure into Australia, purpose-built administrative and FAA New Zealand, Papua New Guinea, Part 145 maintenance facility and the Philippines, while also providing a platform for additional expansion Flight Hours (Commercial Operation) 0 4,000,000 7,000,000 10,000,000 11,700,000 9

Overview Investment Thesis PHI is a diversified transportation services provider with two principal operating segments which constitute fully-standalone platforms with shared investment criteria representative of PHI’s overarching corporate identity Third Largest Full-Scope Air Provider of Mission Critical Ambulance Operator Services to Energy companies Strong, Long-Term Industry Exceptional Safety Culture Built for Higher Throughput Fundamentals Driven by Engaged Workforce for People and Systems Well-Positioned for Growth Forefront of Global Standards Best-in-Class 86% Owned (1) Opportunities and Procedures Fleet Balanced Investment in Seasoned Best-in-Class Strong Financial Profile Technology, Systems and Management Team Human Factors Largest Operator in the Gulf Established International of Mexico with Further Global Execution Capabilities Capabilities (1) Excludes one customer-owned aircraft 10Overview Investment Thesis PHI is a diversified transportation services provider with two principal operating segments which constitute fully-standalone platforms with shared investment criteria representative of PHI’s overarching corporate identity Third Largest Full-Scope Air Provider of Mission Critical Ambulance Operator Services to Energy companies Strong, Long-Term Industry Exceptional Safety Culture Built for Higher Throughput Fundamentals Driven by Engaged Workforce for People and Systems Well-Positioned for Growth Forefront of Global Standards Best-in-Class 86% Owned (1) Opportunities and Procedures Fleet Balanced Investment in Seasoned Best-in-Class Strong Financial Profile Technology, Systems and Management Team Human Factors Largest Operator in the Gulf Established International of Mexico with Further Global Execution Capabilities Capabilities (1) Excludes one customer-owned aircraft 10

Overview Legal Entity Structure The below represents the Company’s legal entity structure as of 12/31/18 • All ownership 100% unless otherwise noted PHI-LE 9691 • Omits immaterial entities PHI, Inc. (Louisiana) IHTI-LE 9720/2516 9692 PHIINTLHC-LE PHIAEL-LE ENERGYRISK-LE 9683 9698 PHI Tech Services, PHI International Energy Risk, Ltd PHI Air Europe AM Equity Inc. Holdco Private (Bermuda) Limited Holdings, LLC Limited (Louisiana) (Cyprus) 49% (Louisiana) (Singapore) 99.9% [1] 9725/6512 HELIMGMT-LE 9696/9699 AIREVAC-LE PHIAME-LE HNZSINGPL-LE 9693 .01% 9684 HNZ Singapore PHI Americas Ltd Helicopter Private Limited 49% (Trindad) PHI Air Management, L.L.C Medical, LLC (Singapore) (Louisiana) [2] CR-AIRMED-LE 49% PO-AIRMED-LE HELEX-LE 9697 9690 9700/3400 PHINZHC-LE 9685 PHIAUS-LE 9730/6517 Petroleum Branch PHI Air Petroleum Helicopters 49% Helex, L.L.C Personnel PHI NZ Holdco Helicopters Angola Medical, LLC - Australia Pty Limited Outsourcing, Ltd (Florida) Limited Limitada Saudi Branch (Australia) (Cayman Islands) (New Zealand) (Angola) [3] [5] EQUITY METHOD HNZAUSHLD-LE HNZNZLTD-LE PHI Century Limited 9686 49% 9680 PHI Helipass, L.L.C. HNZ Australia (Ghana) HNZ New Zealand (Louisiana) Limited Holdings Pty [4] Limited (New Zealand) (Australia) HNZAUSPL-LE 9682 HNZ Australia Pty [1] 51% owned by a European partner (510/1000 shares) Limited (Australia) [2] 51% 51 Class A Ordinary Shares owned by Helitech Limited [3] 51% owned by Comsky LTA (Angola) (Commission Agreement) PHIHNZAPL-LE 50% [4] 51% owned by Century Aviation Company Limited (Ghana) 9688 PHI-HNZ Australia [5] 51% owned by Alario & Associates, L.L.C. - 25,500 nominee shares Pty (Australia) 50% 11Overview Legal Entity Structure The below represents the Company’s legal entity structure as of 12/31/18 • All ownership 100% unless otherwise noted PHI-LE 9691 • Omits immaterial entities PHI, Inc. (Louisiana) IHTI-LE 9720/2516 9692 PHIINTLHC-LE PHIAEL-LE ENERGYRISK-LE 9683 9698 PHI Tech Services, PHI International Energy Risk, Ltd PHI Air Europe AM Equity Inc. Holdco Private (Bermuda) Limited Holdings, LLC Limited (Louisiana) (Cyprus) 49% (Louisiana) (Singapore) 99.9% [1] 9725/6512 HELIMGMT-LE 9696/9699 AIREVAC-LE PHIAME-LE HNZSINGPL-LE 9693 .01% 9684 HNZ Singapore PHI Americas Ltd Helicopter Private Limited 49% (Trindad) PHI Air Management, L.L.C Medical, LLC (Singapore) (Louisiana) [2] CR-AIRMED-LE 49% PO-AIRMED-LE HELEX-LE 9697 9690 9700/3400 PHINZHC-LE 9685 PHIAUS-LE 9730/6517 Petroleum Branch PHI Air Petroleum Helicopters 49% Helex, L.L.C Personnel PHI NZ Holdco Helicopters Angola Medical, LLC - Australia Pty Limited Outsourcing, Ltd (Florida) Limited Limitada Saudi Branch (Australia) (Cayman Islands) (New Zealand) (Angola) [3] [5] EQUITY METHOD HNZAUSHLD-LE HNZNZLTD-LE PHI Century Limited 9686 49% 9680 PHI Helipass, L.L.C. HNZ Australia (Ghana) HNZ New Zealand (Louisiana) Limited Holdings Pty [4] Limited (New Zealand) (Australia) HNZAUSPL-LE 9682 HNZ Australia Pty [1] 51% owned by a European partner (510/1000 shares) Limited (Australia) [2] 51% 51 Class A Ordinary Shares owned by Helitech Limited [3] 51% owned by Comsky LTA (Angola) (Commission Agreement) PHIHNZAPL-LE 50% [4] 51% owned by Century Aviation Company Limited (Ghana) 9688 PHI-HNZ Australia [5] 51% owned by Alario & Associates, L.L.C. - 25,500 nominee shares Pty (Australia) 50% 11

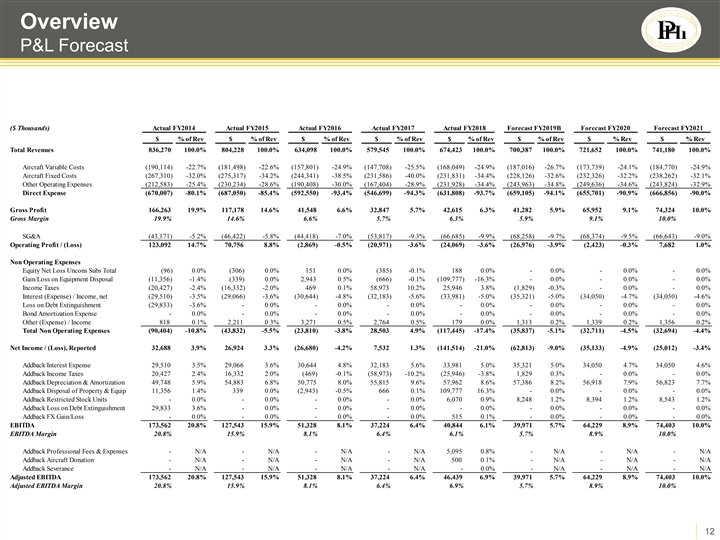

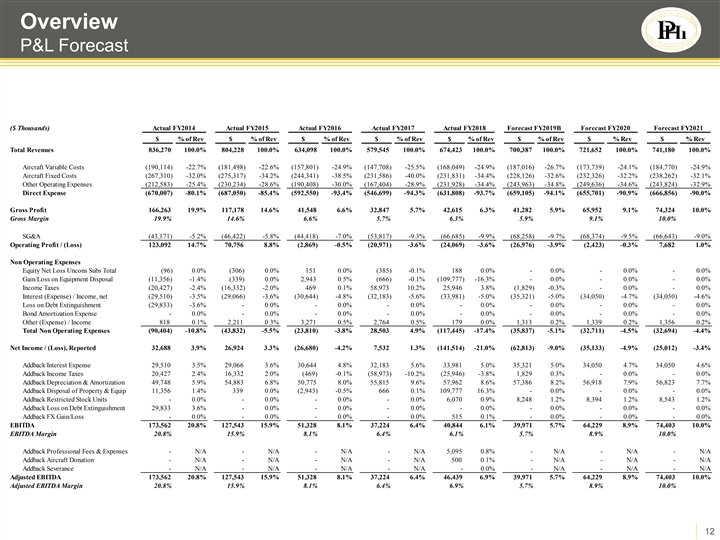

Overview P&L Forecast ($ Thousands) Actual FY2014 Actual FY2015 Actual FY2016 Actual FY2017 Actual FY2018 Forecast FY2019B Forecast FY2020 Forecast FY2021 $ % of Rev $ % of Rev $ % of Rev $ % of Rev $ % of Rev $ % of Rev $ % Rev $ % Rev Total Revenues 836,270 100.0% 804,228 100.0% 634,098 100.0% 5 79,545 100.0% 6 74,423 100.0% 7 00,387 100.0% 721,652 100.0% 741,180 100.0% Aircraft Variable Costs (190,114) -22.7% (181,498) -22.6% (157,801) -24.9% (147,708) -25.5% (168,049) -24.9% (187,016) -26.7% (173,739) -24.1% (184,770) -24.9% Aircraft Fixed Costs (267,310) -32.0% (275,317) -34.2% (244,341) -38.5% (231,586) -40.0% (231,831) -34.4% (228,126) -32.6% (232,326) -32.2% (238,262) -32.1% Other Operating Expenses (212,583) -25.4% (230,234) -28.6% (190,408) -30.0% (167,404) -28.9% (231,928) -34.4% (243,963) -34.8% (249,636) -34.6% (243,824) -32.9% Direct Expense (670,007) -80.1% (687,050) -85.4% (592,550) -93.4% (546,699) -94.3% (631,808) -93.7% (659,105) -94.1% (655,701) -90.9% (666,856) -90.0% Gross Profit 166,263 19.9% 117,178 14.6% 41,548 6.6% 32,847 5.7% 42,615 6.3% 41,282 5.9% 65,952 9.1% 74,324 10.0% Gross Margin 19.9% 14.6% 6.6% 5.7% 6.3% 5.9% 9.1% 10.0% SG&A (43,171) -5.2% (46,422) -5.8% (44,418) -7.0% (53,817) -9.3% (66,685) -9.9% (68,258) -9.7% (68,374) -9.5% (66,643) -9.0% Operating Profit / (Loss) 123,092 14.7% 70,756 8.8% (2,869) -0.5% (20,971) -3.6% (24,069) -3.6% (26,976) -3.9% ( 2,423) -0.3% 7,682 1.0% Non Operating Expenses Equity Net Loss Uncons Subs Total (96) 0.0% (306) 0.0% 151 0.0% (385) -0.1% 188 0.0% - 0.0% - 0.0% - 0.0% Gain/Loss on Equipment Disposal (11,356) -1.4% (339) 0.0% 2,943 0.5% (666) -0.1% (109,777) -16.3% - 0.0% - 0.0% - 0.0% Income Taxes (20,427) -2.4% (16,332) -2.0% 469 0.1% 58,973 10.2% 25,946 3.8% ( 1,829) -0.3% - 0.0% - 0.0% Interest (Expense) / Income, net (29,510) -3.5% (29,066) -3.6% (30,644) -4.8% (32,183) -5.6% (33,981) -5.0% (35,321) -5.0% (34,050) -4.7% (34,050) -4.6% Loss on Debt Extinguishment (29,833) -3.6% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% Bond Amortization Expense - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% Other (Expense) / Income 818 0.1% 2,211 0.3% 3,271 0.5% 2,764 0.5% 179 0.0% 1,313 0.2% 1,339 0.2% 1,356 0.2% Total Non Operating Expenses (90,404) -10.8% (43,832) -5.5% (23,810) -3.8% 28,503 4.9% (117,445) -17.4% (35,837) -5.1% (32,711) -4.5% (32,694) -4.4% Net Income / (Loss), Reported 32,688 3.9% 26,924 3.3% (26,680) -4.2% 7,532 1.3% (141,514) -21.0% (62,813) -9.0% (35,133) -4.9% (25,012) -3.4% Addback Interest Expense 29,510 3.5% 29,066 3.6% 30,644 4.8% 32,183 5.6% 33,981 5.0% 35,321 5.0% 34,050 4.7% 34,050 4.6% Addback Income Taxes 20,427 2.4% 16,332 2.0% (469) -0.1% (58,973) -10.2% (25,946) -3.8% 1,829 0.3% - 0.0% - 0.0% Addback Depreciation & Amortization 49,748 5.9% 54,883 6.8% 50,775 8.0% 55,815 9.6% 57,962 8.6% 57,386 8.2% 56,918 7.9% 56,823 7.7% Addback Disposal of Property & Equip 11,356 1.4% 339 0.0% (2,943) -0.5% 666 0.1% 109,777 16.3% - 0.0% - 0.0% - 0.0% Addback Restricted Stock Units - 0.0% - 0.0% - 0.0% - 0.0% 6,070 0.9% 8,248 1.2% 8,394 1.2% 8,543 1.2% Addback Loss on Debt Extinguishment 29,833 3.6% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% Addback FX Gain/Loss - 0.0% - 0.0% - 0.0% - 0.0% 515 0.1% - 0.0% - 0.0% - 0.0% EBITDA 173,562 20.8% 127,543 15.9% 51,328 8.1% 37,224 6.4% 40,844 6.1% 39,971 5.7% 64,229 8.9% 74,403 10.0% EBITDA Margin 20.8% 15.9% 8.1% 6.4% 6.1% 5.7% 8.9% 10.0% Addback Professional Fees & Expenses - N/A - N/A - N/A - N/A 5,095 0.8% - N/A - N/A - N/A Addback Aircraft Donation - N/A - N/A - N/A - N/A 500 0.1% - N/A - N/A - N/A Addback Severance - N/A - N/A - N/A - N/A - 0.0% - N/A - N/A - N/A Adjusted EBITDA 173,562 20.8% 127,543 15.9% 51,328 8.1% 37,224 6.4% 46,439 6.9% 39,971 5.7% 64,229 8.9% 74,403 10.0% Adjusted EBITDA Margin 20.8% 15.9% 8.1% 6.4% 6.9% 5.7% 8.9% 10.0% 12Overview P&L Forecast ($ Thousands) Actual FY2014 Actual FY2015 Actual FY2016 Actual FY2017 Actual FY2018 Forecast FY2019B Forecast FY2020 Forecast FY2021 $ % of Rev $ % of Rev $ % of Rev $ % of Rev $ % of Rev $ % of Rev $ % Rev $ % Rev Total Revenues 836,270 100.0% 804,228 100.0% 634,098 100.0% 5 79,545 100.0% 6 74,423 100.0% 7 00,387 100.0% 721,652 100.0% 741,180 100.0% Aircraft Variable Costs (190,114) -22.7% (181,498) -22.6% (157,801) -24.9% (147,708) -25.5% (168,049) -24.9% (187,016) -26.7% (173,739) -24.1% (184,770) -24.9% Aircraft Fixed Costs (267,310) -32.0% (275,317) -34.2% (244,341) -38.5% (231,586) -40.0% (231,831) -34.4% (228,126) -32.6% (232,326) -32.2% (238,262) -32.1% Other Operating Expenses (212,583) -25.4% (230,234) -28.6% (190,408) -30.0% (167,404) -28.9% (231,928) -34.4% (243,963) -34.8% (249,636) -34.6% (243,824) -32.9% Direct Expense (670,007) -80.1% (687,050) -85.4% (592,550) -93.4% (546,699) -94.3% (631,808) -93.7% (659,105) -94.1% (655,701) -90.9% (666,856) -90.0% Gross Profit 166,263 19.9% 117,178 14.6% 41,548 6.6% 32,847 5.7% 42,615 6.3% 41,282 5.9% 65,952 9.1% 74,324 10.0% Gross Margin 19.9% 14.6% 6.6% 5.7% 6.3% 5.9% 9.1% 10.0% SG&A (43,171) -5.2% (46,422) -5.8% (44,418) -7.0% (53,817) -9.3% (66,685) -9.9% (68,258) -9.7% (68,374) -9.5% (66,643) -9.0% Operating Profit / (Loss) 123,092 14.7% 70,756 8.8% (2,869) -0.5% (20,971) -3.6% (24,069) -3.6% (26,976) -3.9% ( 2,423) -0.3% 7,682 1.0% Non Operating Expenses Equity Net Loss Uncons Subs Total (96) 0.0% (306) 0.0% 151 0.0% (385) -0.1% 188 0.0% - 0.0% - 0.0% - 0.0% Gain/Loss on Equipment Disposal (11,356) -1.4% (339) 0.0% 2,943 0.5% (666) -0.1% (109,777) -16.3% - 0.0% - 0.0% - 0.0% Income Taxes (20,427) -2.4% (16,332) -2.0% 469 0.1% 58,973 10.2% 25,946 3.8% ( 1,829) -0.3% - 0.0% - 0.0% Interest (Expense) / Income, net (29,510) -3.5% (29,066) -3.6% (30,644) -4.8% (32,183) -5.6% (33,981) -5.0% (35,321) -5.0% (34,050) -4.7% (34,050) -4.6% Loss on Debt Extinguishment (29,833) -3.6% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% Bond Amortization Expense - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% Other (Expense) / Income 818 0.1% 2,211 0.3% 3,271 0.5% 2,764 0.5% 179 0.0% 1,313 0.2% 1,339 0.2% 1,356 0.2% Total Non Operating Expenses (90,404) -10.8% (43,832) -5.5% (23,810) -3.8% 28,503 4.9% (117,445) -17.4% (35,837) -5.1% (32,711) -4.5% (32,694) -4.4% Net Income / (Loss), Reported 32,688 3.9% 26,924 3.3% (26,680) -4.2% 7,532 1.3% (141,514) -21.0% (62,813) -9.0% (35,133) -4.9% (25,012) -3.4% Addback Interest Expense 29,510 3.5% 29,066 3.6% 30,644 4.8% 32,183 5.6% 33,981 5.0% 35,321 5.0% 34,050 4.7% 34,050 4.6% Addback Income Taxes 20,427 2.4% 16,332 2.0% (469) -0.1% (58,973) -10.2% (25,946) -3.8% 1,829 0.3% - 0.0% - 0.0% Addback Depreciation & Amortization 49,748 5.9% 54,883 6.8% 50,775 8.0% 55,815 9.6% 57,962 8.6% 57,386 8.2% 56,918 7.9% 56,823 7.7% Addback Disposal of Property & Equip 11,356 1.4% 339 0.0% (2,943) -0.5% 666 0.1% 109,777 16.3% - 0.0% - 0.0% - 0.0% Addback Restricted Stock Units - 0.0% - 0.0% - 0.0% - 0.0% 6,070 0.9% 8,248 1.2% 8,394 1.2% 8,543 1.2% Addback Loss on Debt Extinguishment 29,833 3.6% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% - 0.0% Addback FX Gain/Loss - 0.0% - 0.0% - 0.0% - 0.0% 515 0.1% - 0.0% - 0.0% - 0.0% EBITDA 173,562 20.8% 127,543 15.9% 51,328 8.1% 37,224 6.4% 40,844 6.1% 39,971 5.7% 64,229 8.9% 74,403 10.0% EBITDA Margin 20.8% 15.9% 8.1% 6.4% 6.1% 5.7% 8.9% 10.0% Addback Professional Fees & Expenses - N/A - N/A - N/A - N/A 5,095 0.8% - N/A - N/A - N/A Addback Aircraft Donation - N/A - N/A - N/A - N/A 500 0.1% - N/A - N/A - N/A Addback Severance - N/A - N/A - N/A - N/A - 0.0% - N/A - N/A - N/A Adjusted EBITDA 173,562 20.8% 127,543 15.9% 51,328 8.1% 37,224 6.4% 46,439 6.9% 39,971 5.7% 64,229 8.9% 74,403 10.0% Adjusted EBITDA Margin 20.8% 15.9% 8.1% 6.4% 6.9% 5.7% 8.9% 10.0% 12

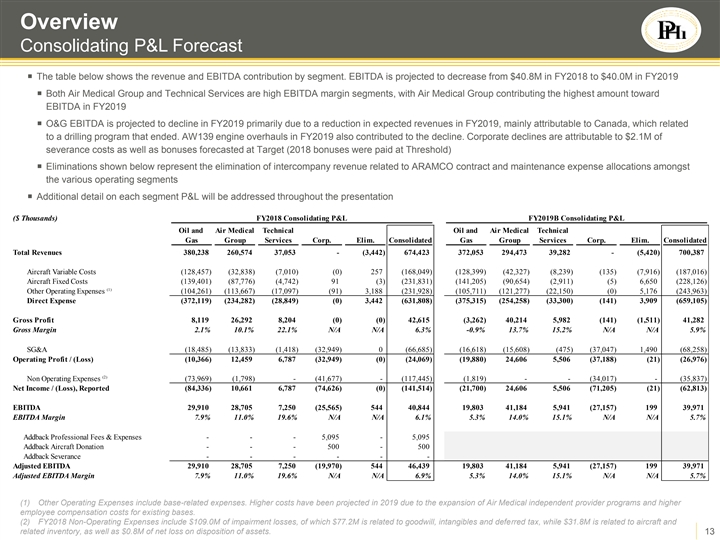

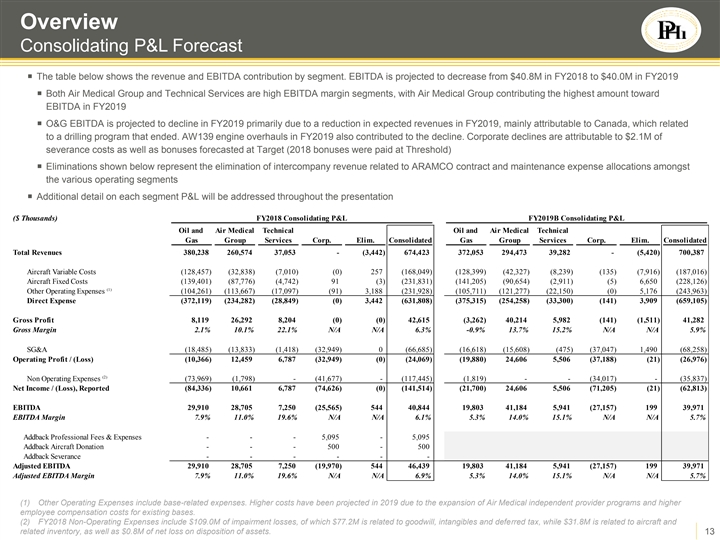

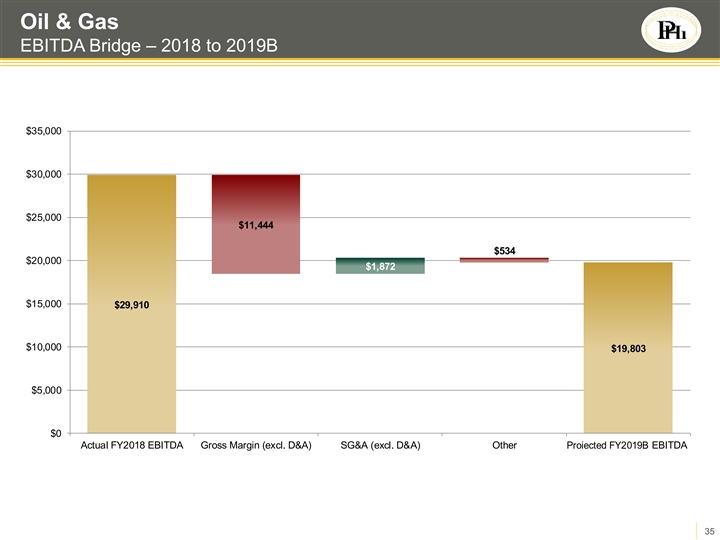

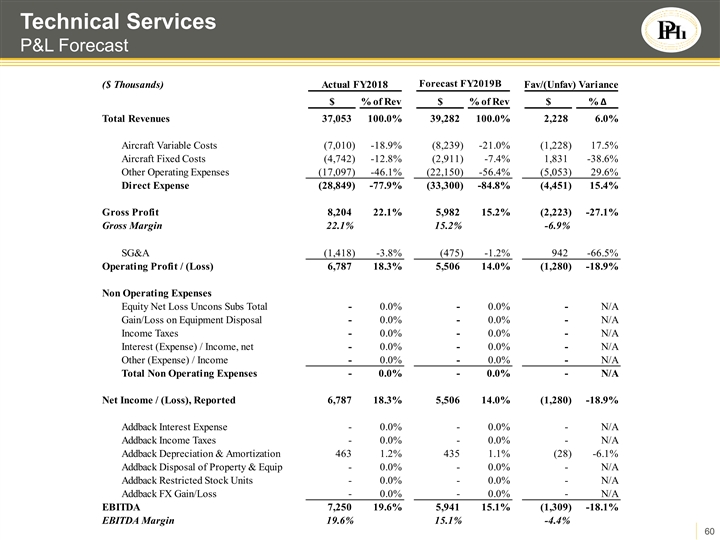

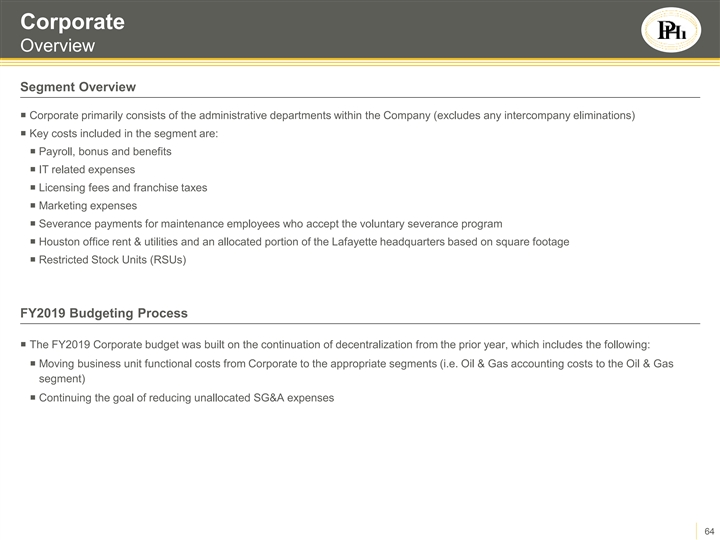

Overview Consolidating P&L Forecast ¡ The table below shows the revenue and EBITDA contribution by segment. EBITDA is projected to decrease from $40.8M in FY2018 to $40.0M in FY2019 ¡ Both Air Medical Group and Technical Services are high EBITDA margin segments, with Air Medical Group contributing the highest amount toward EBITDA in FY2019 ¡ O&G EBITDA is projected to decline in FY2019 primarily due to a reduction in expected revenues in FY2019, mainly attributable to Canada, which related to a drilling program that ended. AW139 engine overhauls in FY2019 also contributed to the decline. Corporate declines are attributable to $2.1M of severance costs as well as bonuses forecasted at Target (2018 bonuses were paid at Threshold) ¡ Eliminations shown below represent the elimination of intercompany revenue related to ARAMCO contract and maintenance expense allocations amongst the various operating segments ¡ Additional detail on each segment P&L will be addressed throughout the presentation ($ Thousands) FY2018 Consolidating P&L FY2019B Consolidating P&L Oil and Air Medical Technical Oil and Air Medical Technical Gas Group Services Corp. Elim. Consolidated Gas Group Services Corp. Elim. Consolidated Total Revenues 380,238 260,574 37,053 - (3,442) 674,423 372,053 294,473 39,282 - (5,420) 700,387 Aircraft Variable Costs ( 128,457) (32,838) (7,010) (0) 257 (168,049) ( 128,399) (42,327) (8,239) (135) (7,916) (187,016) Aircraft Fixed Costs (139,401) (87,776) (4,742) 91 (3) (231,831) ( 141,205) (90,654) (2,911) (5) 6 ,650 (228,126) (1) Other Operating Expenses ( 104,261) (113,667) (17,097) ( 91) 3 ,188 (231,928) (105,711) (121,277) (22,150) (0) 5,176 (243,963) Direct Expense (372,119) (234,282) (28,849) (0) 3,442 (631,808) ( 375,315) ( 254,258) (33,300) (141) 3 ,909 (659,105) Gross Profit 8,119 26,292 8,204 (0) (0) 42,615 (3,262) 40,214 5,982 (141) (1,511) 41,282 Gross Margin 2.1% 10.1% 22.1% N/A N/A 6.3% -0.9% 13.7% 15.2% N/A N/A 5.9% SG&A (18,485) (13,833) (1,418) (32,949) 0 (66,685) (16,618) (15,608) (475) (37,047) 1 ,490 (68,258) Operating Profit / (Loss) (10,366) 12,459 6,787 (32,949) (0) (24,069) (19,880) 24,606 5,506 (37,188) ( 21) (26,976) (2) Non Operating Expenses (73,969) (1,798) - (41,677) - (117,445) (1,819) - - (34,017) - (35,837) Net Income / (Loss), Reported (84,336) 10,661 6 ,787 (74,626) (0) (141,514) (21,700) 24,606 5,506 (71,205) ( 21) (62,813) EBITDA 29,910 28,705 7,250 (25,565) 544 40,844 19,803 41,184 5,941 (27,157) 199 39,971 EBITDA Margin 7.9% 11.0% 19.6% N/A N/A 6.1% 5.3% 14.0% 15.1% N/A N/A 5.7% Addback Professional Fees & Expenses - - - 5,095 - 5,095 Addback Aircraft Donation - - - 500 - 500 Addback Severance - - - - - - Adjusted EBITDA 29,910 28,705 7,250 (19,970) 544 46,439 19,803 41,184 5 ,941 (27,157) 199 39,971 Adjusted EBITDA Margin 7.9% 11.0% 19.6% N/A N/A 6.9% 5.3% 14.0% 15.1% N/A N/A 5.7% (1) Other Operating Expenses include base-related expenses. Higher costs have been projected in 2019 due to the expansion of Air Medical independent provider programs and higher employee compensation costs for existing bases. (2) FY2018 Non-Operating Expenses include $109.0M of impairment losses, of which $77.2M is related to goodwill, intangibles and deferred tax, while $31.8M is related to aircraft and related inventory, as well as $0.8M of net loss on disposition of assets. 13Overview Consolidating P&L Forecast ¡ The table below shows the revenue and EBITDA contribution by segment. EBITDA is projected to decrease from $40.8M in FY2018 to $40.0M in FY2019 ¡ Both Air Medical Group and Technical Services are high EBITDA margin segments, with Air Medical Group contributing the highest amount toward EBITDA in FY2019 ¡ O&G EBITDA is projected to decline in FY2019 primarily due to a reduction in expected revenues in FY2019, mainly attributable to Canada, which related to a drilling program that ended. AW139 engine overhauls in FY2019 also contributed to the decline. Corporate declines are attributable to $2.1M of severance costs as well as bonuses forecasted at Target (2018 bonuses were paid at Threshold) ¡ Eliminations shown below represent the elimination of intercompany revenue related to ARAMCO contract and maintenance expense allocations amongst the various operating segments ¡ Additional detail on each segment P&L will be addressed throughout the presentation ($ Thousands) FY2018 Consolidating P&L FY2019B Consolidating P&L Oil and Air Medical Technical Oil and Air Medical Technical Gas Group Services Corp. Elim. Consolidated Gas Group Services Corp. Elim. Consolidated Total Revenues 380,238 260,574 37,053 - (3,442) 674,423 372,053 294,473 39,282 - (5,420) 700,387 Aircraft Variable Costs ( 128,457) (32,838) (7,010) (0) 257 (168,049) ( 128,399) (42,327) (8,239) (135) (7,916) (187,016) Aircraft Fixed Costs (139,401) (87,776) (4,742) 91 (3) (231,831) ( 141,205) (90,654) (2,911) (5) 6 ,650 (228,126) (1) Other Operating Expenses ( 104,261) (113,667) (17,097) ( 91) 3 ,188 (231,928) (105,711) (121,277) (22,150) (0) 5,176 (243,963) Direct Expense (372,119) (234,282) (28,849) (0) 3,442 (631,808) ( 375,315) ( 254,258) (33,300) (141) 3 ,909 (659,105) Gross Profit 8,119 26,292 8,204 (0) (0) 42,615 (3,262) 40,214 5,982 (141) (1,511) 41,282 Gross Margin 2.1% 10.1% 22.1% N/A N/A 6.3% -0.9% 13.7% 15.2% N/A N/A 5.9% SG&A (18,485) (13,833) (1,418) (32,949) 0 (66,685) (16,618) (15,608) (475) (37,047) 1 ,490 (68,258) Operating Profit / (Loss) (10,366) 12,459 6,787 (32,949) (0) (24,069) (19,880) 24,606 5,506 (37,188) ( 21) (26,976) (2) Non Operating Expenses (73,969) (1,798) - (41,677) - (117,445) (1,819) - - (34,017) - (35,837) Net Income / (Loss), Reported (84,336) 10,661 6 ,787 (74,626) (0) (141,514) (21,700) 24,606 5,506 (71,205) ( 21) (62,813) EBITDA 29,910 28,705 7,250 (25,565) 544 40,844 19,803 41,184 5,941 (27,157) 199 39,971 EBITDA Margin 7.9% 11.0% 19.6% N/A N/A 6.1% 5.3% 14.0% 15.1% N/A N/A 5.7% Addback Professional Fees & Expenses - - - 5,095 - 5,095 Addback Aircraft Donation - - - 500 - 500 Addback Severance - - - - - - Adjusted EBITDA 29,910 28,705 7,250 (19,970) 544 46,439 19,803 41,184 5 ,941 (27,157) 199 39,971 Adjusted EBITDA Margin 7.9% 11.0% 19.6% N/A N/A 6.9% 5.3% 14.0% 15.1% N/A N/A 5.7% (1) Other Operating Expenses include base-related expenses. Higher costs have been projected in 2019 due to the expansion of Air Medical independent provider programs and higher employee compensation costs for existing bases. (2) FY2018 Non-Operating Expenses include $109.0M of impairment losses, of which $77.2M is related to goodwill, intangibles and deferred tax, while $31.8M is related to aircraft and related inventory, as well as $0.8M of net loss on disposition of assets. 13

Overview Consolidating P&L Forecast (cont’d) ($ Thousands) FY2020 Consolidating P&L FY2021 Consolidating P&L Oil and Air Medical Technical Oil and Air Medical Technical Gas Group Services Corp. Elim. Consolidated Gas Group Services Corp. Elim. Consolidated Total Revenues 397,316 300,272 30,080 - (6,015) 721,652 414,358 317,129 15,811 - (6,118) 741,180 Aircraft Variable Costs (130,094) (42,042) (1,603) - - (173,739) (139,630) (43,497) (1,643) - - (184,770) Aircraft Fixed Costs (137,526) (94,770) (30) - - (232,326) ( 138,836) (99,426) - - - (238,262) (1) Other Operating Expenses ( 112,835) (119,922) (22,895) - 6,015 ( 249,636) (114,404) (125,941) (9,597) - 6,118 ( 243,824) Direct Expense ( 380,455) (256,733) (24,528) - 6 ,015 ( 655,701) (392,870) (268,864) (11,240) - 6,118 (666,856) Gross Profit 16,861 43,539 5 ,552 - - 65,952 21,488 48,265 4,571 - - 74,324 Gross Margin 4.2% 14.5% 18.5% N/A N/A 9.1% 5.2% 15.2% 28.9% N/A N/A 10.0% SG&A (17,913) (15,691) (487) (34,283) - (68,374) (18,267) (15,865) (501) (32,010) - (66,643) Operating Profit / (Loss) (1,052) 27,848 5,065 (34,283) - (2,423) 3 ,221 32,400 4,070 (32,010) - 7 ,682 Non Operating Expenses 10 - - (32,721) - (32,711) - - - (32,694) - (32,694) Net Income / (Loss), Reported (1,042) 27,848 5 ,065 (67,004) - (35,133) 3,221 32,400 4,070 (64,704) - (25,012) EBITDA 38,015 45,011 5,255 (24,052) - 64,229 42,281 49,460 4 ,235 (21,573) - 74,403 EBITDA Margin 9.6% 15.0% 17.5% N/A N/A 8.9% 10.2% 15.6% 26.8% N/A N/A 10.0% (1) Other Operating Expenses include base-related expenses. Higher costs have been projected in 2019 due to the expansion of Air Medical independent provider programs and higher employee compensation costs for existing bases. 14Overview Consolidating P&L Forecast (cont’d) ($ Thousands) FY2020 Consolidating P&L FY2021 Consolidating P&L Oil and Air Medical Technical Oil and Air Medical Technical Gas Group Services Corp. Elim. Consolidated Gas Group Services Corp. Elim. Consolidated Total Revenues 397,316 300,272 30,080 - (6,015) 721,652 414,358 317,129 15,811 - (6,118) 741,180 Aircraft Variable Costs (130,094) (42,042) (1,603) - - (173,739) (139,630) (43,497) (1,643) - - (184,770) Aircraft Fixed Costs (137,526) (94,770) (30) - - (232,326) ( 138,836) (99,426) - - - (238,262) (1) Other Operating Expenses ( 112,835) (119,922) (22,895) - 6,015 ( 249,636) (114,404) (125,941) (9,597) - 6,118 ( 243,824) Direct Expense ( 380,455) (256,733) (24,528) - 6 ,015 ( 655,701) (392,870) (268,864) (11,240) - 6,118 (666,856) Gross Profit 16,861 43,539 5 ,552 - - 65,952 21,488 48,265 4,571 - - 74,324 Gross Margin 4.2% 14.5% 18.5% N/A N/A 9.1% 5.2% 15.2% 28.9% N/A N/A 10.0% SG&A (17,913) (15,691) (487) (34,283) - (68,374) (18,267) (15,865) (501) (32,010) - (66,643) Operating Profit / (Loss) (1,052) 27,848 5,065 (34,283) - (2,423) 3 ,221 32,400 4,070 (32,010) - 7 ,682 Non Operating Expenses 10 - - (32,721) - (32,711) - - - (32,694) - (32,694) Net Income / (Loss), Reported (1,042) 27,848 5 ,065 (67,004) - (35,133) 3,221 32,400 4,070 (64,704) - (25,012) EBITDA 38,015 45,011 5,255 (24,052) - 64,229 42,281 49,460 4 ,235 (21,573) - 74,403 EBITDA Margin 9.6% 15.0% 17.5% N/A N/A 8.9% 10.2% 15.6% 26.8% N/A N/A 10.0% (1) Other Operating Expenses include base-related expenses. Higher costs have been projected in 2019 due to the expansion of Air Medical independent provider programs and higher employee compensation costs for existing bases. 14

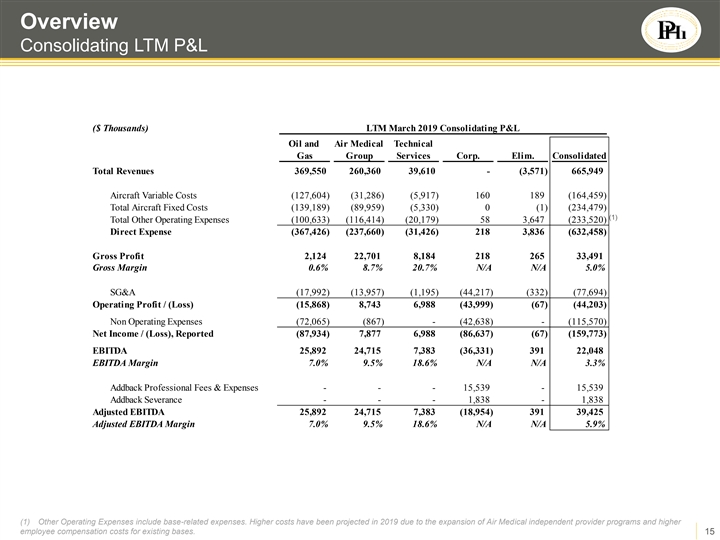

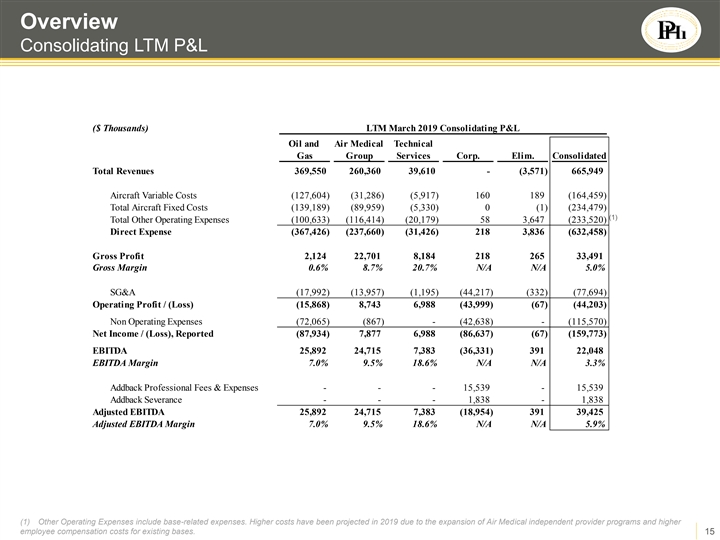

Overview Consolidating LTM P&L ($ Thousands) LTM March 2019 Consolidating P&L Oil and Air Medical Technical Gas Group Services Corp. Elim. Consolidated Total Revenues 369,550 260,360 39,610 - (3,571) 665,949 Aircraft Variable Costs (127,604) (31,286) (5,917) 160 189 ( 164,459) Total Aircraft Fixed Costs (139,189) (89,959) (5,330) 0 (1) (234,479) (1) Total Other Operating Expenses (100,633) ( 116,414) (20,179) 58 3 ,647 (233,520) Direct Expense (367,426) (237,660) (31,426) 218 3,836 (632,458) Gross Profit 2,124 22,701 8,184 218 265 33,491 Gross Margin 0.6% 8.7% 20.7% N/A N/A 5.0% SG&A (17,992) (13,957) (1,195) (44,217) (332) (77,694) Operating Profit / (Loss) (15,868) 8,743 6 ,988 (43,999) (67) (44,203) Non Operating Expenses (72,065) (867) - (42,638) - (115,570) Net Income / (Loss), Reported (87,934) 7,877 6,988 (86,637) (67) (159,773) EBITDA 25,892 24,715 7 ,383 (36,331) 391 22,048 EBITDA Margin 7.0% 9.5% 18.6% N/A N/A 3.3% Addback Professional Fees & Expenses - - - 15,539 - 15,539 Addback Severance - - - 1,838 - 1 ,838 Adjusted EBITDA 25,892 24,715 7,383 (18,954) 391 39,425 Adjusted EBITDA Margin 7.0% 9.5% 18.6% N/A N/A 5.9% (1) Other Operating Expenses include base-related expenses. Higher costs have been projected in 2019 due to the expansion of Air Medical independent provider programs and higher employee compensation costs for existing bases. 15Overview Consolidating LTM P&L ($ Thousands) LTM March 2019 Consolidating P&L Oil and Air Medical Technical Gas Group Services Corp. Elim. Consolidated Total Revenues 369,550 260,360 39,610 - (3,571) 665,949 Aircraft Variable Costs (127,604) (31,286) (5,917) 160 189 ( 164,459) Total Aircraft Fixed Costs (139,189) (89,959) (5,330) 0 (1) (234,479) (1) Total Other Operating Expenses (100,633) ( 116,414) (20,179) 58 3 ,647 (233,520) Direct Expense (367,426) (237,660) (31,426) 218 3,836 (632,458) Gross Profit 2,124 22,701 8,184 218 265 33,491 Gross Margin 0.6% 8.7% 20.7% N/A N/A 5.0% SG&A (17,992) (13,957) (1,195) (44,217) (332) (77,694) Operating Profit / (Loss) (15,868) 8,743 6 ,988 (43,999) (67) (44,203) Non Operating Expenses (72,065) (867) - (42,638) - (115,570) Net Income / (Loss), Reported (87,934) 7,877 6,988 (86,637) (67) (159,773) EBITDA 25,892 24,715 7 ,383 (36,331) 391 22,048 EBITDA Margin 7.0% 9.5% 18.6% N/A N/A 3.3% Addback Professional Fees & Expenses - - - 15,539 - 15,539 Addback Severance - - - 1,838 - 1 ,838 Adjusted EBITDA 25,892 24,715 7,383 (18,954) 391 39,425 Adjusted EBITDA Margin 7.0% 9.5% 18.6% N/A N/A 5.9% (1) Other Operating Expenses include base-related expenses. Higher costs have been projected in 2019 due to the expansion of Air Medical independent provider programs and higher employee compensation costs for existing bases. 15

Overview Revenue Bridge – 2018 to 2019B $750,000 $390,000 $3,057 $370,000 $0 $2,228 $1,979 $700,000 $33,899 $350,000 $8,185 $650,000 $330,000 $380,238 $374,032 $310,000 $600,000 $700,387 $674,423 $290,000 $550,000 $270,000 $250,000 $500,000 Actual FY2018 Revenues Flight Revenue - Fixed Flight Revenue - Variable Miscellaneous Income Projected FY2019B Actual FY2018 Oil and Gas Air Medical Group Technical Services Corp. Elim. Projected FY2019 Revenues Revenues Revenues 16Overview Revenue Bridge – 2018 to 2019B $750,000 $390,000 $3,057 $370,000 $0 $2,228 $1,979 $700,000 $33,899 $350,000 $8,185 $650,000 $330,000 $380,238 $374,032 $310,000 $600,000 $700,387 $674,423 $290,000 $550,000 $270,000 $250,000 $500,000 Actual FY2018 Revenues Flight Revenue - Fixed Flight Revenue - Variable Miscellaneous Income Projected FY2019B Actual FY2018 Oil and Gas Air Medical Group Technical Services Corp. Elim. Projected FY2019 Revenues Revenues Revenues 16

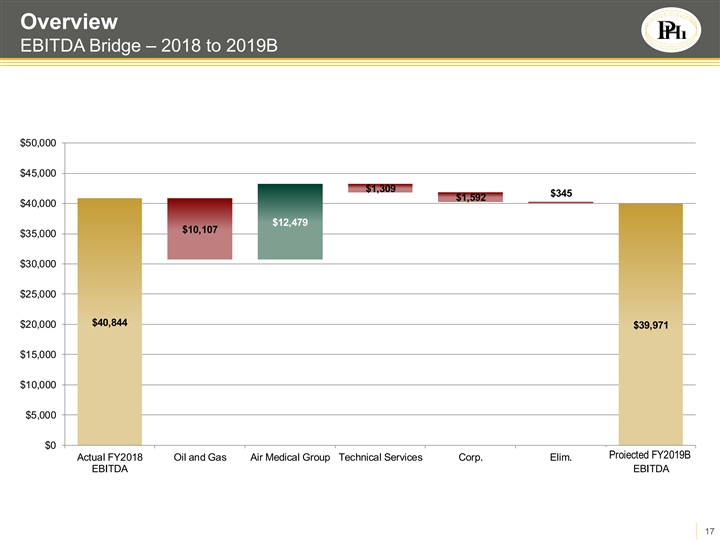

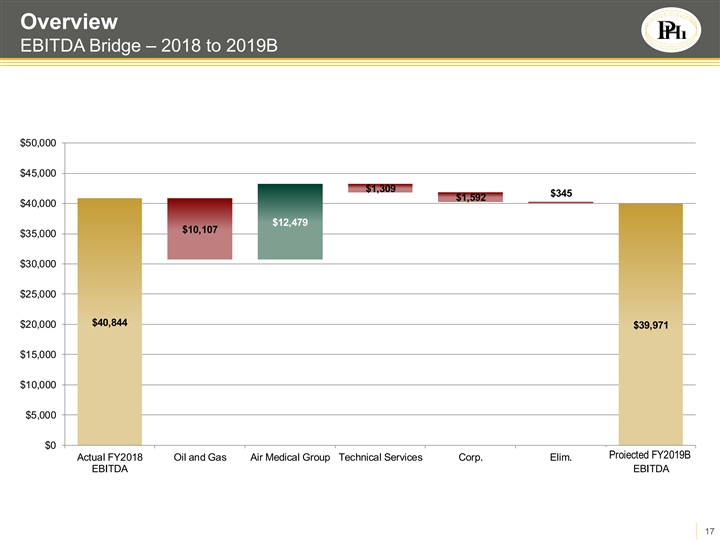

Overview EBITDA Bridge – 2018 to 2019B $390,000 $3,057 $50,000 $370,000 $45,000 $1,309 $345 $1,592 $40,000 $350,000 $12,479 $10,107 $35,000 $330,000 $30,000 $380,238 $25,000 $374,032 $310,000 $40,844 $20,000 $39,971 $290,000 $15,000 $10,000 $270,000 $5,000 $250,000 $0 Actual FY2018 Revenues Flight Revenue - Fixed Flight Revenue - Variable Miscellaneous Income Projected FY2019B Actual FY2018 Oil and Gas Air Medical Group Technical Services Corp. Elim. Projected FY2019 Revenues EBITDA EBITDA 17Overview EBITDA Bridge – 2018 to 2019B $390,000 $3,057 $50,000 $370,000 $45,000 $1,309 $345 $1,592 $40,000 $350,000 $12,479 $10,107 $35,000 $330,000 $30,000 $380,238 $25,000 $374,032 $310,000 $40,844 $20,000 $39,971 $290,000 $15,000 $10,000 $270,000 $5,000 $250,000 $0 Actual FY2018 Revenues Flight Revenue - Fixed Flight Revenue - Variable Miscellaneous Income Projected FY2019B Actual FY2018 Oil and Gas Air Medical Group Technical Services Corp. Elim. Projected FY2019 Revenues EBITDA EBITDA 17

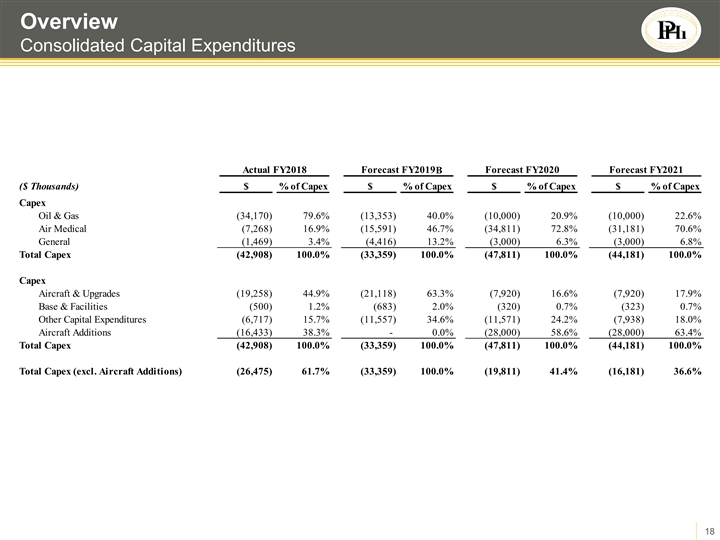

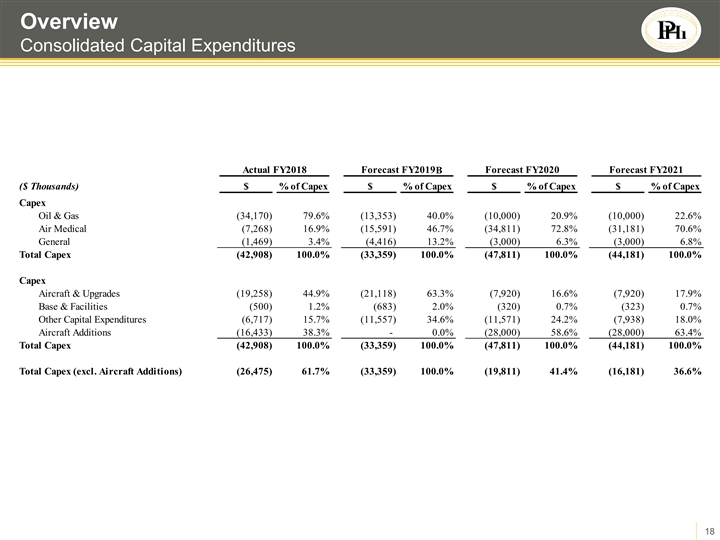

Overview Consolidated Capital Expenditures Actual FY2018 Forecast FY2019 Forecast FY2020 Forecast FY2021 B ($ Thousands) $ % of Capex $ % of Capex $ % of Capex $ % of Capex Capex Oil & Gas (34,170) 79.6% (13,353) 40.0% (10,000) 20.9% (10,000) 22.6% Air Medical ( 7,268) 16.9% (15,591) 46.7% (34,811) 72.8% (31,181) 70.6% General (1,469) 3.4% (4,416) 13.2% ( 3,000) 6.3% ( 3,000) 6.8% Total Capex (42,908) 100.0% (33,359) 100.0% (47,811) 100.0% (44,181) 100.0% Capex Aircraft & Upgrades (19,258) 44.9% (21,118) 63.3% (7,920) 16.6% (7,920) 17.9% Base & Facilities (500) 1.2% (683) 2.0% (320) 0.7% (323) 0.7% Other Capital Expenditures (6,717) 15.7% (11,557) 34.6% (11,571) 24.2% (7,938) 18.0% Aircraft Additions (16,433) 38.3% - 0.0% (28,000) 58.6% (28,000) 63.4% Total Capex (42,908) 100.0% (33,359) 100.0% (47,811) 100.0% (44,181) 100.0% Total Capex (excl. Aircraft Additions) (26,475) 61.7% (33,359) 100.0% (19,811) 41.4% (16,181) 36.6% 18Overview Consolidated Capital Expenditures Actual FY2018 Forecast FY2019 Forecast FY2020 Forecast FY2021 B ($ Thousands) $ % of Capex $ % of Capex $ % of Capex $ % of Capex Capex Oil & Gas (34,170) 79.6% (13,353) 40.0% (10,000) 20.9% (10,000) 22.6% Air Medical ( 7,268) 16.9% (15,591) 46.7% (34,811) 72.8% (31,181) 70.6% General (1,469) 3.4% (4,416) 13.2% ( 3,000) 6.3% ( 3,000) 6.8% Total Capex (42,908) 100.0% (33,359) 100.0% (47,811) 100.0% (44,181) 100.0% Capex Aircraft & Upgrades (19,258) 44.9% (21,118) 63.3% (7,920) 16.6% (7,920) 17.9% Base & Facilities (500) 1.2% (683) 2.0% (320) 0.7% (323) 0.7% Other Capital Expenditures (6,717) 15.7% (11,557) 34.6% (11,571) 24.2% (7,938) 18.0% Aircraft Additions (16,433) 38.3% - 0.0% (28,000) 58.6% (28,000) 63.4% Total Capex (42,908) 100.0% (33,359) 100.0% (47,811) 100.0% (44,181) 100.0% Total Capex (excl. Aircraft Additions) (26,475) 61.7% (33,359) 100.0% (19,811) 41.4% (16,181) 36.6% 18

Oil & Gas Business OverviewOil & Gas Business Overview

Oil & Gas Provider of Mission Critical Services To Energy Companies Leader in providing offshore helicopter support to global energy companies (1) Segment Overview Flight Hours Over Time (in thousands) 140 ¡ Since its founding in 1949, PHI’s primary business has been the 116 120 transportation of personnel to, from, and between offshore platforms 100 engaged in the oil and gas industry 100 ¡ Long-term customers (35+ years) include oil majors such as: 82 79 79 80 60 60 years 40 ¡ Most oil companies, like PHI’s customers, traditionally contract for 20 helicopter services; however certain customers operate or have the capability to operate their own helicopter fleets but elect to partner - FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 with PHI given the company’s dedication to safety and client service (2) Financials Summary ($ in millions) ¡ Given the top-down focus on the importance of culture, technology, $600 30.0% and safety the Company did not cut investment in these areas during 517 the downturn and is now well positioned to take advantage of a 25.4% $500 25.0% 460 rebound 380 380 $400 20.0% 19.5% ¡ First U.S. oil and gas aviation company to reach FAA Level 4 Safety 324 Management System $300 15.0% ¡ While the fleet is still under-utilized compared to historical levels, the $200 10.0% Company is developing ways to improve utilization through creative 131 7.9% 3.3% 90 service models and geographic expansion $100 5.0% 3.0% 30 13 10 $0 - FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 Source: Company filings Revenue EBITDA EBITDA Margin (1) Periods before LTM Q3’18 do not include pro forma adjustments for the acquisition of HNZ (2) FY 2017 and FY2018 include pro forma adjustments to Revenue and EBITDA for the acquisition of HNZ; HNZ EBITDA includes addbacks of ~$6.2mm and 20 ~$1.2mm of mobilization costs for FY 2017 and LTM Q3’18 periods, respectivelyOil & Gas Provider of Mission Critical Services To Energy Companies Leader in providing offshore helicopter support to global energy companies (1) Segment Overview Flight Hours Over Time (in thousands) 140 ¡ Since its founding in 1949, PHI’s primary business has been the 116 120 transportation of personnel to, from, and between offshore platforms 100 engaged in the oil and gas industry 100 ¡ Long-term customers (35+ years) include oil majors such as: 82 79 79 80 60 60 years 40 ¡ Most oil companies, like PHI’s customers, traditionally contract for 20 helicopter services; however certain customers operate or have the capability to operate their own helicopter fleets but elect to partner - FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 with PHI given the company’s dedication to safety and client service (2) Financials Summary ($ in millions) ¡ Given the top-down focus on the importance of culture, technology, $600 30.0% and safety the Company did not cut investment in these areas during 517 the downturn and is now well positioned to take advantage of a 25.4% $500 25.0% 460 rebound 380 380 $400 20.0% 19.5% ¡ First U.S. oil and gas aviation company to reach FAA Level 4 Safety 324 Management System $300 15.0% ¡ While the fleet is still under-utilized compared to historical levels, the $200 10.0% Company is developing ways to improve utilization through creative 131 7.9% 3.3% 90 service models and geographic expansion $100 5.0% 3.0% 30 13 10 $0 - FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 Source: Company filings Revenue EBITDA EBITDA Margin (1) Periods before LTM Q3’18 do not include pro forma adjustments for the acquisition of HNZ (2) FY 2017 and FY2018 include pro forma adjustments to Revenue and EBITDA for the acquisition of HNZ; HNZ EBITDA includes addbacks of ~$6.2mm and 20 ~$1.2mm of mobilization costs for FY 2017 and LTM Q3’18 periods, respectively

Oil & Gas Key Highlights 1 2 Exceptional Safety Culture Forefront of Global Standards Driven by Engaged Workforce and Procedures 8 3 Seasoned Best-in-Class Provider of Mission Critical Management Team Services to Energy Companies 7 4 Largest Operator in the Gulf of Built for Higher Throughput for Mexico (“GOM”) with Further People and Systems Global Capabilities 5 6 Balanced Investment in Best-in-Class 86% Owned Technology, Systems and (1) Fleet Human Factors 1 2 3 4 5 6 7 8 Safety is a core Since inception, Demand for Underutilized 86% of Comprehensive Highest capacity Executive value – O&G has helicopters high quality and aircraft to focus on key in the Gulf of management (1) institutional-wide implemented reliable owned with an Mexico with team has a support operational accountability numerous transportation increased average age of pillars that ability to further deep- builds a culture of innovative 13 years and services industry needs maintain PHI’s expand understanding safety which processes and underpinned by in a rebounding majority of the industry-leading internationally, of the industry creates behaviors procedures, fleet in PBH; no heightened oil and gas reputation and bolstered by with several that lead to which have since public scrutiny, 225’s and no HNZ platform decades of market; drive overall excellence and been adopted as increased safety business scaled order-book performance and combined mitigate risk industry-wide overhang expectations to support enhancement internationally industry precedents and regulatory $1bn+ in experienced experience requirements revenue management team (1) Excludes one customer-owned aircraft 21Oil & Gas Key Highlights 1 2 Exceptional Safety Culture Forefront of Global Standards Driven by Engaged Workforce and Procedures 8 3 Seasoned Best-in-Class Provider of Mission Critical Management Team Services to Energy Companies 7 4 Largest Operator in the Gulf of Built for Higher Throughput for Mexico (“GOM”) with Further People and Systems Global Capabilities 5 6 Balanced Investment in Best-in-Class 86% Owned Technology, Systems and (1) Fleet Human Factors 1 2 3 4 5 6 7 8 Safety is a core Since inception, Demand for Underutilized 86% of Comprehensive Highest capacity Executive value – O&G has helicopters high quality and aircraft to focus on key in the Gulf of management (1) institutional-wide implemented reliable owned with an Mexico with team has a support operational accountability numerous transportation increased average age of pillars that ability to further deep- builds a culture of innovative 13 years and services industry needs maintain PHI’s expand understanding safety which processes and underpinned by in a rebounding majority of the industry-leading internationally, of the industry creates behaviors procedures, fleet in PBH; no heightened oil and gas reputation and bolstered by with several that lead to which have since public scrutiny, 225’s and no HNZ platform decades of market; drive overall excellence and been adopted as increased safety business scaled order-book performance and combined mitigate risk industry-wide overhang expectations to support enhancement internationally industry precedents and regulatory $1bn+ in experienced experience requirements revenue management team (1) Excludes one customer-owned aircraft 21

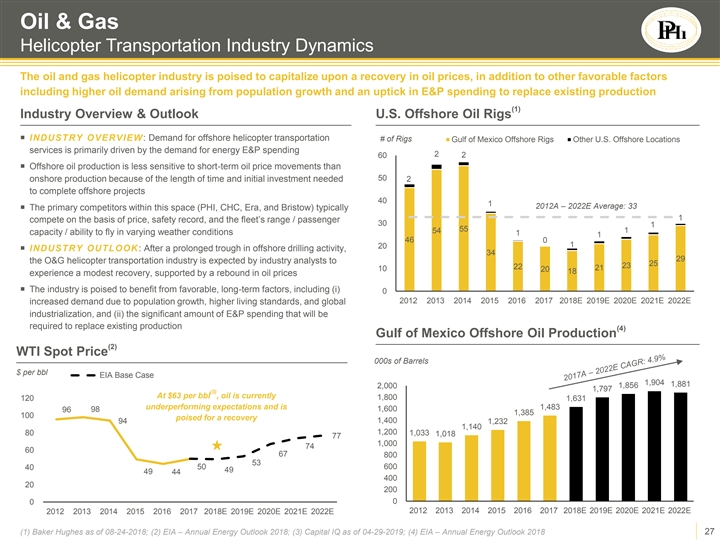

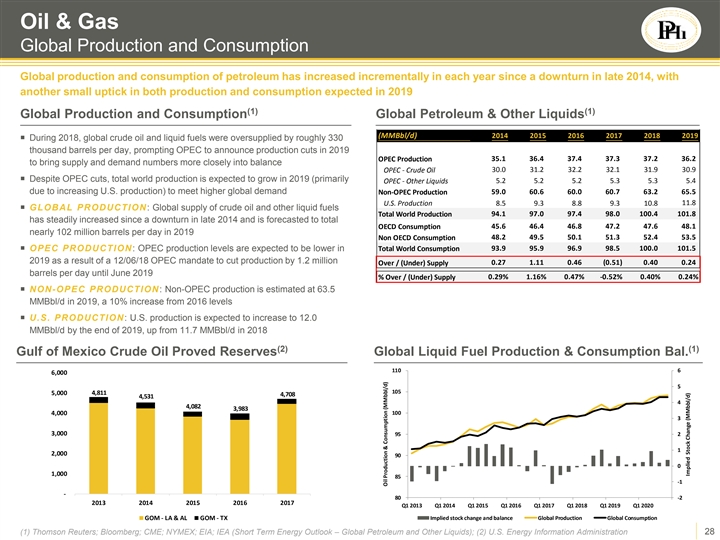

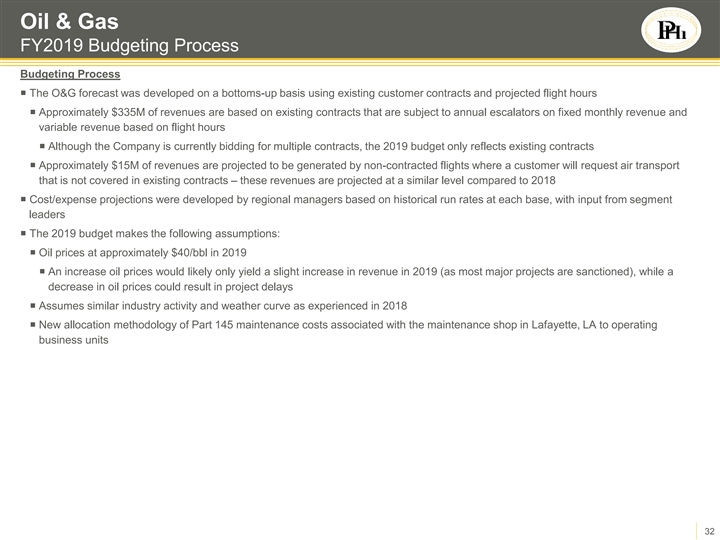

Oil & Gas Key Customers The Company relies on industry leading customers to drive a significant amount of revenues for the Oil & Gas sector Key Customer Overview ¡ KEY CUSTOMERS: The Company’s key customers include Shell, BP and ExxonMobil (each of whom PHI has worked with for 35 or more years), ENI Petroleum (20+ year customer relationship), Fieldwood Energy (9+ years) and Inpex Corp. ¡ Many of the Company’s key customers represent the largest players in the global oil and gas sector, with a particular focus on operations in the Gulf of Mexico ¡ Despite the significant size of these customers within the market, many are continuing to expand and represent the top operators in North America for offshore rig startups on both a historical and forecasted basis ¡ With many third party experts expecting oil prices to stabilize in 2019, many of PHI’s key customers appear to be poised to significantly increase capex spending in 2019 and beyond – in particular, Shell and Exxon have proclaimed they will spend over $20 billion on U.S. Capex in the next five years ¡ Other primary customers have also continued to identify additional drilling opportunities in the Gulf of Mexico, with BP in particular having identified an additional 1 billion barrels of oil potential to its U.S. Gulf of Mexico hubs in early 2019 Chart Title (1) (2) 600 Top 10 Oil Producers in Gulf of Mexico Offshore Rig Startups – Top Operators (North Am.) 500 2.5 400 2 300 1.5 200 1 0.5 100 0 0 (1) Evercore ISI Oil & Gas Exploration & Production Report, 1/21/19; (2) J.P. Morgan Global Oil Services Monthly report, 1/24/19 22 Series1 Series2Oil & Gas Key Customers The Company relies on industry leading customers to drive a significant amount of revenues for the Oil & Gas sector Key Customer Overview ¡ KEY CUSTOMERS: The Company’s key customers include Shell, BP and ExxonMobil (each of whom PHI has worked with for 35 or more years), ENI Petroleum (20+ year customer relationship), Fieldwood Energy (9+ years) and Inpex Corp. ¡ Many of the Company’s key customers represent the largest players in the global oil and gas sector, with a particular focus on operations in the Gulf of Mexico ¡ Despite the significant size of these customers within the market, many are continuing to expand and represent the top operators in North America for offshore rig startups on both a historical and forecasted basis ¡ With many third party experts expecting oil prices to stabilize in 2019, many of PHI’s key customers appear to be poised to significantly increase capex spending in 2019 and beyond – in particular, Shell and Exxon have proclaimed they will spend over $20 billion on U.S. Capex in the next five years ¡ Other primary customers have also continued to identify additional drilling opportunities in the Gulf of Mexico, with BP in particular having identified an additional 1 billion barrels of oil potential to its U.S. Gulf of Mexico hubs in early 2019 Chart Title (1) (2) 600 Top 10 Oil Producers in Gulf of Mexico Offshore Rig Startups – Top Operators (North Am.) 500 2.5 400 2 300 1.5 200 1 0.5 100 0 0 (1) Evercore ISI Oil & Gas Exploration & Production Report, 1/21/19; (2) J.P. Morgan Global Oil Services Monthly report, 1/24/19 22 Series1 Series2

Oil & Gas Global Operations Operating in numerous countries around the globe ¡ Primary focus of flight operations has historically been in the Gulf of Mexico; however, in December 2017, PHI acquired HNZ Group Inc.’s (“HNZ”) offshore business, expanding its reach internationally ¡ The Company classifies its Oil & Gas operating regions as PHI Americas vs. PHI International, broken out below. At 2/13/19, the Company had 631 PHI Americas employees, with 236 PHI International employees (including 36 pilots, 27 engineers, and 10 support personnel that are fixed term and aligned to operational contracts) ¡ PHI Americas: Domestic, Canada, Mexico, Saudi Arabia and Trinidad | PHI International: Asia Pacific (including HNZ), Cyprus, Ghana and Israel ¡ Segment operates six bases in the GoM alongside two separate hangars, one office and the global headquarters in Lafayette, LA ¡ Segment operates 14 international bases across the globe alongside the international headquarters facility in Nelson, New Zealand and stand-alone corporate offices in Perth, Australia and Nicosia, Cyprus Operating Base Hangar Corporate Office Operating Base / Corporate Office Global Headquarters PHI International O&G Headquarters 23Oil & Gas Global Operations Operating in numerous countries around the globe ¡ Primary focus of flight operations has historically been in the Gulf of Mexico; however, in December 2017, PHI acquired HNZ Group Inc.’s (“HNZ”) offshore business, expanding its reach internationally ¡ The Company classifies its Oil & Gas operating regions as PHI Americas vs. PHI International, broken out below. At 2/13/19, the Company had 631 PHI Americas employees, with 236 PHI International employees (including 36 pilots, 27 engineers, and 10 support personnel that are fixed term and aligned to operational contracts) ¡ PHI Americas: Domestic, Canada, Mexico, Saudi Arabia and Trinidad | PHI International: Asia Pacific (including HNZ), Cyprus, Ghana and Israel ¡ Segment operates six bases in the GoM alongside two separate hangars, one office and the global headquarters in Lafayette, LA ¡ Segment operates 14 international bases across the globe alongside the international headquarters facility in Nelson, New Zealand and stand-alone corporate offices in Perth, Australia and Nicosia, Cyprus Operating Base Hangar Corporate Office Operating Base / Corporate Office Global Headquarters PHI International O&G Headquarters 23

Oil & Gas Expanded International Footprint and Capabilities via HNZ Acquisition The acquisition of HNZ’s offshore business expands PHI’s platform in support of its global customers, and provides additional opportunities across which to deploy the fleet and increase aircraft utilization Attractive Carve-Out Acquisition Opportunity… …With Robust Strategic Rationale For PHI ¡ HNZ was an international provider of onshore and offshore helicopter ü Establishment of Global Offering With transportation and related support services Diversification of Customer Base and ¡ Headquartered in Montreal, with 600 employees across 36 locations Geographic Footprint ¡ Fleet of 104 owned and 13 leased aircraft ¡ In December 2017, the CEO of HNZ Group acquired all voting shares of HNZ at a 43.4% premium to the October 30, 2017 closing price ü Provides International Expansion ¡ Contemporaneously, PHI acquired HNZ's offshore operations located in Opportunities to Increase Aircraft Utilization Australia, New Zealand, Papua New Guinea and the Philippines ¡ HNZ CEO acquired the onshore operations and remaining portion of offshore operations (i.e. Canadian and Norwegian operations) ü Pro Forma Geographic Footprint (Full Company) Shared Commitment to Safety Ensures Continuity of Global Brand Image ü Positions PHI For Further Expansion In Deep- Water Drilling With Existing and New Customers ü Prior Relationship and Proven Track Record With HNZ Supports Smooth Integration PHI locations HNZ locations Source: Company filings and press releases 24Oil & Gas Expanded International Footprint and Capabilities via HNZ Acquisition The acquisition of HNZ’s offshore business expands PHI’s platform in support of its global customers, and provides additional opportunities across which to deploy the fleet and increase aircraft utilization Attractive Carve-Out Acquisition Opportunity… …With Robust Strategic Rationale For PHI ¡ HNZ was an international provider of onshore and offshore helicopter ü Establishment of Global Offering With transportation and related support services Diversification of Customer Base and ¡ Headquartered in Montreal, with 600 employees across 36 locations Geographic Footprint ¡ Fleet of 104 owned and 13 leased aircraft ¡ In December 2017, the CEO of HNZ Group acquired all voting shares of HNZ at a 43.4% premium to the October 30, 2017 closing price ü Provides International Expansion ¡ Contemporaneously, PHI acquired HNZ's offshore operations located in Opportunities to Increase Aircraft Utilization Australia, New Zealand, Papua New Guinea and the Philippines ¡ HNZ CEO acquired the onshore operations and remaining portion of offshore operations (i.e. Canadian and Norwegian operations) ü Pro Forma Geographic Footprint (Full Company) Shared Commitment to Safety Ensures Continuity of Global Brand Image ü Positions PHI For Further Expansion In Deep- Water Drilling With Existing and New Customers ü Prior Relationship and Proven Track Record With HNZ Supports Smooth Integration PHI locations HNZ locations Source: Company filings and press releases 24

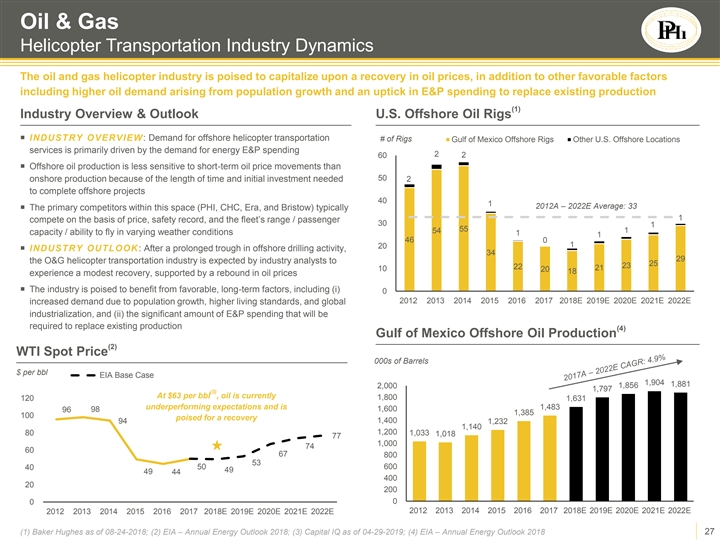

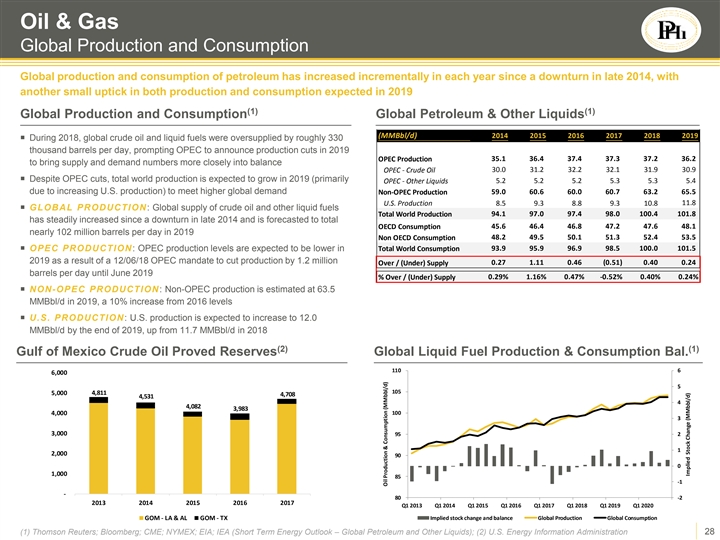

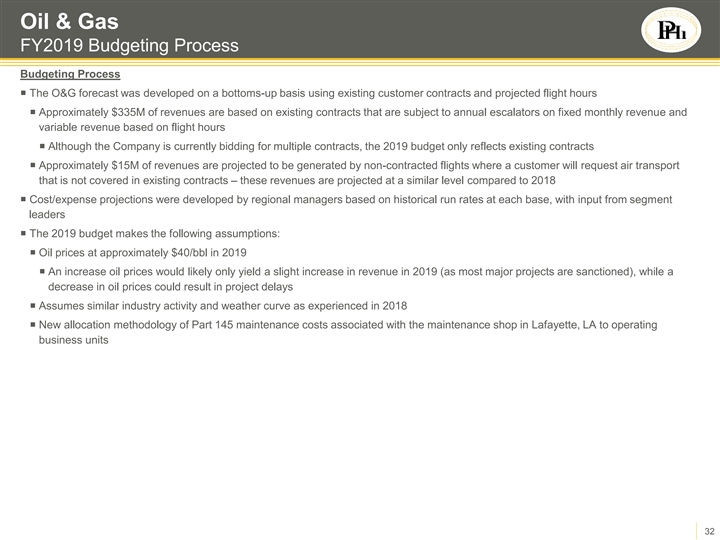

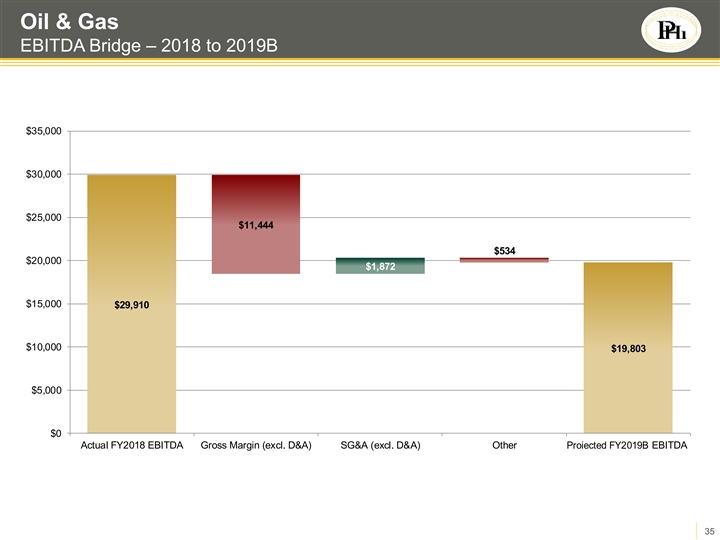

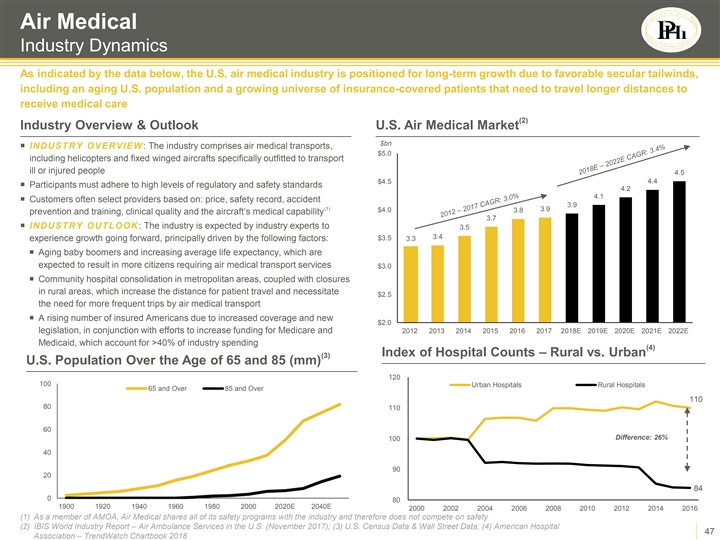

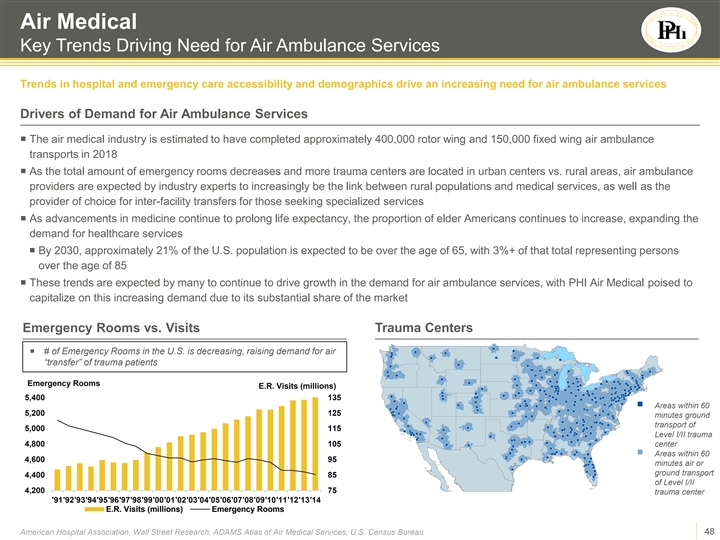

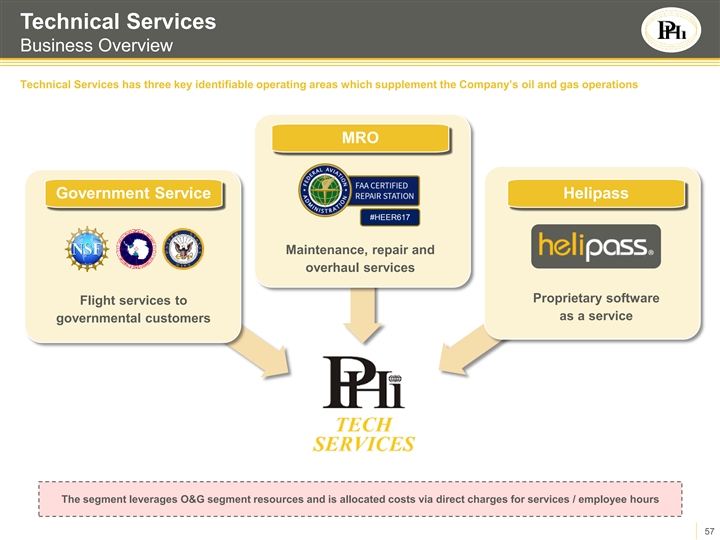

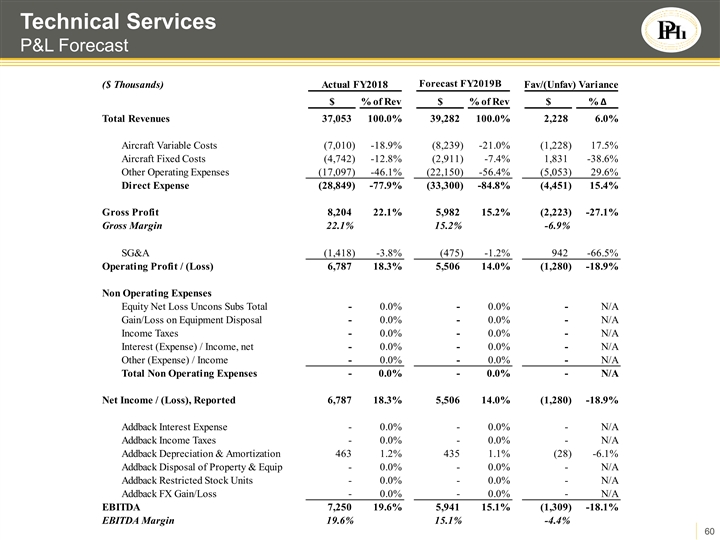

Oil & Gas Fleet Composition (2) Fleet Snapshot Operated Aircraft Overview Ownership Status ¡ As of 12/31/18, the O&G Fleet was comprised of 125 aircraft with Appraised Avg. Cust. Value of an average age of 14 years, including 107 Company-owned (1) Manufacturer Type Age Owned Leased Oper. Total Owned (1)(2) aircraft with a market value of approximately $645 million Light Airbus EC135 13 2 - - 2 $5 (2) ¡ Operated 17 leased aircraft: 16 S-92’s and two AW139’s AS350 23 2 - - 2 2 BK117 34 2 - - 2 1 ¡ Two additional leased S-92s will be returned in 2019 following H145 2 2 - - 2 16 EC145 - - - - - - the expiration of the respective lease agreements (2) Bell Bell 206 28 5 - - 5 5 Bell 407 16 35 - - 35 51 ¡ Operated one partner-owned Bell 412 Total Light Aircraft 17 48 - - 48 $80 ¡ MRO work on light, medium and heavy helicopters is typically Medium AgustaWestland AW109 6 3 - - 3 13 performed in-house AW139 9 13 2 - 15 124 Bell Bell 212 37 4 - - 4 7 Bell 412 5 2 - - 2 20 B412EP 20 1 - 1 2 3 BK117C2 - - - - - - Fleet by Aircraft Type Fleet by Ownership Sikorsky S-76 15 17 - - 17 69 Based on fleet count Total Medium Aircraft 14 40 2 1 43 $236 Heavy Fixed Wing Customer-Owned Sikorsky S-92 8 17 15 - 32 323 Heavy 2% 1% Light 26% Total Heavy Aircraft 8 17 15 - 32 $323 Leased 38% 14% Fixed Bombardier Learjet 40 13 1 - - 1 2 Hawker Beechcraft King Air 200 6 1 - - 1 3 Total Fixed Wing Aircraft 10 2 - - 2 $6 Total Aircraft 14 107 17 1 125 $645 Medium Company- 34% Owned 85% Source: Data provided by Company S-92 AW139 S-76 Note: Appraised value does not include value of one recently acquired S-92 aircraft (1) Market value of aircraft based on Ascend desktop valuation report as of November 27, 2018. Market values are representative of the fleet’s maintenance status; values shown represent “Adjusted Half-Life” values 25 (2) Aircraft segment counts reflect aircraft segment transfers made after December 31, 2018 and the expiration of one leased aircraft (expired in April 2019)Oil & Gas Fleet Composition (2) Fleet Snapshot Operated Aircraft Overview Ownership Status ¡ As of 12/31/18, the O&G Fleet was comprised of 125 aircraft with Appraised Avg. Cust. Value of an average age of 14 years, including 107 Company-owned (1) Manufacturer Type Age Owned Leased Oper. Total Owned (1)(2) aircraft with a market value of approximately $645 million Light Airbus EC135 13 2 - - 2 $5 (2) ¡ Operated 17 leased aircraft: 16 S-92’s and two AW139’s AS350 23 2 - - 2 2 BK117 34 2 - - 2 1 ¡ Two additional leased S-92s will be returned in 2019 following H145 2 2 - - 2 16 EC145 - - - - - - the expiration of the respective lease agreements (2) Bell Bell 206 28 5 - - 5 5 Bell 407 16 35 - - 35 51 ¡ Operated one partner-owned Bell 412 Total Light Aircraft 17 48 - - 48 $80 ¡ MRO work on light, medium and heavy helicopters is typically Medium AgustaWestland AW109 6 3 - - 3 13 performed in-house AW139 9 13 2 - 15 124 Bell Bell 212 37 4 - - 4 7 Bell 412 5 2 - - 2 20 B412EP 20 1 - 1 2 3 BK117C2 - - - - - - Fleet by Aircraft Type Fleet by Ownership Sikorsky S-76 15 17 - - 17 69 Based on fleet count Total Medium Aircraft 14 40 2 1 43 $236 Heavy Fixed Wing Customer-Owned Sikorsky S-92 8 17 15 - 32 323 Heavy 2% 1% Light 26% Total Heavy Aircraft 8 17 15 - 32 $323 Leased 38% 14% Fixed Bombardier Learjet 40 13 1 - - 1 2 Hawker Beechcraft King Air 200 6 1 - - 1 3 Total Fixed Wing Aircraft 10 2 - - 2 $6 Total Aircraft 14 107 17 1 125 $645 Medium Company- 34% Owned 85% Source: Data provided by Company S-92 AW139 S-76 Note: Appraised value does not include value of one recently acquired S-92 aircraft (1) Market value of aircraft based on Ascend desktop valuation report as of November 27, 2018. Market values are representative of the fleet’s maintenance status; values shown represent “Adjusted Half-Life” values 25 (2) Aircraft segment counts reflect aircraft segment transfers made after December 31, 2018 and the expiration of one leased aircraft (expired in April 2019)