UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | |

Filed by the Registrantx | | Filed by a Party other than the Registrant¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

TECO Energy, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

March 20, 2013

Notice of Annual Meeting of Shareholders

| | | | |

| | Date: | | | May 1, 2013 |

| |

| | Time: | | | 11:00 a.m. |

| |

| | Place: | | | TECO Plaza 702 North Franklin Street Tampa, Florida 33602 |

| |

| | Purpose: | | | We are holding the annual meeting of the shareholders of TECO Energy, Inc. for shareholders to consider and vote upon the following matters: |

| |

| | 1. | | | The election of three director nominees named in the accompanying proxy statement. |

| |

| | 2. | | | The ratification of the selection of our independent auditor. |

| |

| | 3. | | | An advisory vote to approve named executive officer compensation. |

| |

| | 4. | | | Such other matters, including the shareholder proposal on pages 30-31 of the accompanying proxy statement, as may properly come before the meeting. |

Shareholders of record at the close of business on February 22, 2013 will be entitled to vote at the meeting.

Even if you plan to attend the meeting, please either (i) vote by telephone or internet by following the instructions on the proxy card or the Notice of Internet Availability of Proxy Materials or (ii) mark, sign and date the proxy card and return it promptly in the accompanying envelope (if you received these materials by mail). If you received only a Notice of Internet Availability of Proxy Materials, you may also request a paper copy of the proxy card and submit your vote by mail, if you prefer. If you attend the meeting and wish to vote in person, your proxy will not be used.

|

| By order of the Board of Directors, |

|

|

David E. Schwartz Corporate Secretary |

TECO ENERGY, INC.

P.O. Box 111 Tampa, Florida 33601 (813) 228-1111

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to Be Held on May 1, 2013:

The proxy statement and annual report to security holders are available

on our website at http://AR.tecoenergy.com and at www.proxyvote.com.

As permitted by rules adopted by the Securities and Exchange Commission, we are making our proxy materials available to our shareholders electronically via the internet. On or about March 20, 2013, we mailed many of our shareholders a notice containing instructions on how to access this proxy statement and our annual report and vote online. If you received such a notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report. The notice also instructs you on how you may submit your voting instructions over the internet. If you received a notice by mail and would like to receive a printed copy of our proxy materials, free of charge, you should follow the instructions for requesting such materials included in the notice.

Table of Contents

Proxy Statement

TECO Energy, Inc.

P.O. Box 111, Tampa, FL 33601

2013 Annual Meeting of Shareholders

We are soliciting proxies on behalf of our Board of Directors to be voted at the May 1, 2013 Annual Meeting of Shareholders. This proxy statement explains the agenda, voting information and procedures and provides information to assist you in voting your shares. It and the accompanying proxy are being distributed to shareholders beginning on or about March 20, 2013.

Throughout this proxy statement, the terms “we,” “us,” “our,” “the company,” and “TECO Energy” refer to TECO Energy, Inc.

Voting and Attendance Information

How to vote: You may vote by proxy by internet, telephone or mail, or you may attend the meeting and vote in person. Please see your proxy card or Notice of Internet Availability for more detailed voting instructions, or refer to the information your bank, broker or other nominee provided to you. If you vote by proxy before the meeting, you may revoke your proxy at any time before it is exercised at the meeting by filing with our Corporate Secretary a written notice of revocation, submitting a proxy bearing a later date or attending the meeting and voting in person. Please see “Attending the Meeting in Person” below for information about attending the meeting. Even if you plan to attend, we request that you vote by proxy promptly. If you attend the meeting and wish to vote in person, your proxy will not be used.

Who can vote: Only shareholders of record of TECO Energy common stock at the close of business on February 22, 2013 are entitled to vote at the meeting. As of that date, we had outstanding 217,255,694 shares of common stock, the only class of stock outstanding and entitled to vote at the meeting. The holders of common stock are entitled to one vote for each share registered in their names on the record date with respect to all matters to be acted upon at the meeting. If your shares are held through a bank, broker or other nominee, see “Voting by street name holders” below regarding directing your record holder on how to vote your shares.

Quorum: The presence at the meeting, in person or by proxy, of a majority of the shares outstanding on the record date will constitute a quorum. Abstentions and broker non-votes (defined below) will be considered as shares present for purposes of determining the presence of a quorum.

Voting by street name holders: If your shares are held through a bank, broker or other nominee, you are considered the “beneficial owner” of shares held in “street name,” and these proxy materials are being forwarded to you by your bank, broker or nominee (the “record holder”) along with a voting instruction card. As the beneficial owner, you have the right to direct your record holder how to vote your shares, and the record holder is required to vote your shares in accordance with your instructions. If you do not give instructions to your record holder at least ten days before the meeting, the record holder will be entitled to vote your shares in its discretion on Proposal 2 (Ratification of Independent Auditor), but will not be able to vote your shares on any other proposal, and your shares will be counted as “broker non-votes” on Proposals 1 and 3, and on the shareholder proposal.

How your votes are counted and the votes required for approval: Shares represented by valid proxies received will be voted in the manner specified on the proxies. If no instructions are indicated on the proxy, the proxy will be voted as recommended by our Board of Directors. If other matters are properly presented at the meeting for consideration, the persons appointed as proxies on your proxy card will have the discretion to vote on these matters for you. The affirmative vote of a majority of the shares voted on each matter will be required to elect each director, to ratify the selection of our independent auditor, to approve on an advisory basis the compensation of our named executive officers, and to approve the shareholder proposal. Abstentions and broker non-votes will not be considered as votes cast with respect to the applicable matter and, therefore, will have no effect on the voting results.

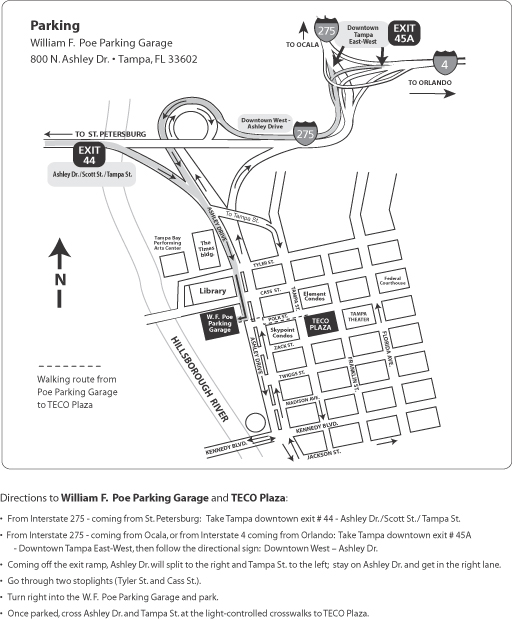

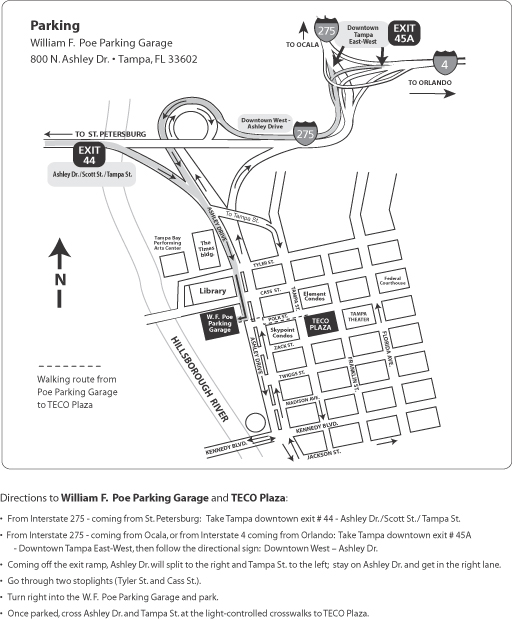

Attending the meeting in person: Only shareholders or their proxy holders and our guests may attend the meeting, and personal photo identification will be required to enter the meeting. At the end of this proxy statement, we have provided additional information regarding required documentation necessary for admission to the meeting and directions to the meeting, which will be held at TECO Plaza, 702 N. Franklin Street, Tampa, Florida. Admission will be on a first-come, first-served basis. Cameras will not be allowed in the meeting. For safety and security reasons, bags, briefcases and other items will be subject to security check.

1

Item 1 – Election of Directors

Our Amended and Restated Articles of Incorporation and Bylaws provide for the Board of Directors to be elected to one year terms beginning with the election to occur at the 2013 Annual Shareholders’ Meeting. Messrs. Ramil, Rankin and Rockford have been nominated for reelection with a term expiring at the 2014 Annual Shareholders’ Meeting. Each of these nominees has consented to serve if elected. If any nominee is unable to serve, the shares represented by valid proxies will be voted for the election of such other person as the Board may designate. Our Amended and Restated Articles of Incorporation and Bylaws also provide that all directors, including any director in office at the time of the adoption of the Amended and Restated Articles of Incorporation, which was approved at the 2012 Annual Shareholders’ Meeting and became effective May 3, 2012, shall hold office until the expiration of the term for which he or she was elected, and until his or her successor is elected and qualified. Prior to the Amendment and Restatement of the Articles of Incorporation, members of the Board of Directors were generally elected to three-year terms. The expiration of each director’s present term is shown below.

The Board of Directors recommends a vote FOR each of these nominees to hold office for the term indicated above and until their successors are elected and qualified.

The Board of Directors

Below is information about the nominees and directors whose terms continue after the meeting. All of our directors also serve as directors of our wholly owned subsidiary, Tampa Electric Company. Information on the share ownership of each director is included under “Share Ownership” on page 32. Nominees for election as directors at this meeting are marked with an asterisk (*).

Each of our directors brings expertise and skills to our Board which led to the conclusion that the person should serve as a director, given the mix of experience and other relevant qualifications represented on the Board as a whole. This information, in addition to the director’s principal occupation and directorships held during the past five years, is described for each director below.

James L. Ferman, Jr., age 69, has been the President of Ferman Motor Car Company, Inc., an automobile dealership business headquartered in Tampa, Florida, since prior to 2008. Mr. Ferman is also a director of Florida Investment Advisors, Inc. and Chairman of The Bank of Tampa and its holding company, The Tampa Bay Banking Company, and serves on the Board of Trustees of Emory University and the University of Tampa. Mr. Ferman has been a director since 1985, and his present term expires in 2014.

Key Attributes, Experience and Skills: As a result of Mr. Ferman’s position as President of Ferman Motor Car Company, one of the largest vehicle dealership groups in the United States, Mr. Ferman brings significant business management and leadership experience to the Board. Also, his position at such a prominent Tampa-area business and his trustee position at the University of Tampa, as well as former chairman positions he has held at several local charitable and business organizations, such as at the Greater Tampa Chamber of Commerce, brings significant community involvement and recognition to the Board. These positions, and his membership on the Governance Committee of the Board of Trustees of Emory University, also provide additional leadership experience to the Board and additional insight to our Governance and Nominating Committee. Through his long tenure on our Board, he has gained significant industry knowledge and a long-term perspective on our businesses. His other directorships also provide experience in finance and risk management.

Evelyn V. Follit, age 66, has been the President of Follit Associates, a corporate technology and executive assessment consulting firm based in Tarpon Springs, Florida, since she founded the firm in 2007. From 1997 to 2005, she was an executive of RadioShack Corporation, a consumer electronics retail company, where she held the positions of Senior Vice President, Chief Information Officer, and Chief Organizational Enabling Services Officer. Ms. Follit is also a director of Beall’s Inc. She was previously a director of Winn-Dixie Stores, Inc., Linens-n-Things, Nautilus, Inc. and Catalina Marketing, Inc. Ms. Follit has been a director since January 2012, and her present term expires in 2014.

Key Attributes, Experience and Skills: As a result of Ms. Follit’s over 20 years’ experience in leadership positions with major corporations, Ms. Follit brings significant business management and leadership experience to the Board, and in particular brings executive-level expertise to the Board in the areas of information technology, human resources and operations management. Her current consulting practice also allows her to provide the Board with her insight into the other industries her firm serves and current business trends. These positions, and her positions on the Audit Committee of the Board of Beall’s Inc., also provide additional leadership experience to the Board, and additional insight to our Audit Committee. Her current and former directorships also provide experience in finance and knowledge of local markets.

2

Sherrill W. Hudson, age 70, has been the Company’s non-executive Chairman of the Board since January 1, 2013, and prior to that was its Executive Chairman of the Board from August 2010 to December 31, 2012. Mr. Hudson was our Chief Executive Officer from 2004 until August 2010. He was formerly the Managing Partner for the South Florida offices of the public accounting firm, Deloitte & Touche LLP, in Miami, Florida. Mr. Hudson is also a director of Lennar Corporation and Publix Super Markets, Inc. He was previously a director of The Standard Register Company. Mr. Hudson has been a director since 2003, and his present term expires in 2015.

Key Attributes, Experience and Skills: Mr. Hudson brings significant leadership and business, finance and accounting experience and expertise gained through both his positions at TECO Energy and through his 37-year tenure at Deloitte & Touche, which included 19 years as the Managing Partner for the South Florida offices. His former position as our CEO also provides valuable industry knowledge and risk management experience, which he also obtained through his oversight and advising of clients in the utility and other industries while at Deloitte & Touche. Also through his work at Deloitte & Touche, he has experience working with and exposure to many Board and management structures, and insight into the issues facing businesses, from financial and accounting, as well as operational, perspectives. His community service in both the Tampa and Miami areas, through membership on the boards of several charitable and business organizations and committees, brings additional community involvement and recognition and leadership experience to the Board. Through his other Board memberships, he is familiar with several other significant Florida companies, their governance and management structures, and the local business environment.

Joseph P. Lacher, age 67, is the former President of Florida operations for BellSouth Telecommunications, Inc., a telecommunications services company in Miami, Florida, serving in such role from 1991 until his retirement in 2005. He is also a director of Perry Ellis International, Inc. Mr. Lacher has been a director since 2006, and his present term expires in 2015.

Key Attributes, Experience and Skills: Mr. Lacher’s tenure as former President of Florida operations for BellSouth Telecommunications, Inc. provides significant leadership and management experience. This experience is especially relevant for our Board as it involved a business regulated by the same entity that regulates our electric and gas businesses, and therefore, he is familiar with the unique issues presented in this area. In addition, through this work, he has experience in dealing with deregulation issues. He is also the lead director and Chair of the Audit and Governance Committees at Perry Ellis International, Inc., and Chairman of the Board of Goodwill Industries of South Florida, which provide additional insight for our Audit and Governance and Nominating Committees, as well as additional board leadership experience.

Loretta A. Penn, age 63, is the former President of Spherion Staffing Services, a division of SFN Group, Inc. (formerly known as Spherion Corporation), a staffing and professional services company, in McLean, Virginia, where she served in such role from December 2008 to December 2011. Ms. Penn also served as the Senior Vice President of SFN Group from November 2007 to December 2011, and was also its Chief Service Excellence Officer from November 2007 to December 2008. In addition to other executive-level experience in the recruiting and staffing industry, Ms. Penn was previously associated with the IBM Corporation for ten years in regional executive management, sales and marketing. Ms. Penn has been a director since 2005, and her present term expires in 2015.

Key Attributes, Experience and Skills: Ms. Penn’s increasing levels of responsibility and seniority at Spherion, including her most recent position as the President of its largest division, provided valuable business, leadership and management experience. Her role at Spherion brought her into contact with executives in a diverse array of industries and areas of the country, and her insight into these other industries and current business trends is valuable to the Board. Her many years of experience in the recruiting and staffing industry provide expertise in human resources issues, which are important issues to our businesses and to our Compensation Committee. Through her decade-long tenure at IBM Corporation, she also has experience in the technology industry, which is also an important area for our current operations and plans for the future.

* John B. Ramil, age 57, has been TECO Energy’s President and Chief Executive Officer since August 2010. During his over 30-year career with the company, he has held several leadership positions, including as President and Chief Operating Officer of TECO Energy from 2004 until August 2010, President of Tampa Electric Company, Executive Vice President of TECO Energy, Chief Financial Officer for TECO Energy, and earlier as Vice President-Energy Services & Planning for Tampa Electric. He has also held a variety of positions in engineering, operations, marketing, customer service and environmental, and has also served as president of various other TECO Energy subsidiaries. Mr. Ramil is also a director of Blue Cross Blue Shield of Florida, Inc., where he serves as the Chairman of its Audit and Compliance Committee. Mr. Ramil has been a director since 2008, and his present term expires in 2013.

Key Attributes, Experience and Skills: Mr. Ramil’s long tenure with the company, in a variety of positions, brings extensive knowledge of our businesses, our industry, and significant business, operating and leadership experience to the Board. His experience as TECO Energy’s Chief Financial Officer also provides additional financial expertise, and several of his positions, including his current role as Chief Executive Officer, bring risk management experience to the Board. In addition, through his work with non-profit and business groups, including his positions as Chairman of the Board of the University of South Florida and a Board member of the Edison Electric Institute, Mr. Ramil provides community and industry involvement and recognition for the company, as well as expertise in leadership development and governance issues.

3

* Tom L. Rankin, age 72, has been an Independent Investment Manager in Tampa, Florida, since prior to 2008. Mr. Rankin is the former Chairman of the Board and Chief Executive Officer of Lykes Energy, Inc. and Lykes Bros. Inc. Mr. Rankin is also a director of Media General, Inc. Mr. Rankin has been a director since 1997, and his present term expires in 2013.

Key Attributes, Experience and Skills: Mr. Rankin brings significant industry experience to the Board through his leadership positions at Lykes Energy, Inc., the former holding company for Peoples Gas System. In addition to his knowledge of the gas utility industry, he has gained valuable experience in the electric utility industry and our other businesses through his tenure on our Board. His leadership role at Lykes Bros. Inc. provides experience in managing the operations of several other types of businesses, as well. His position at Lykes, as well as his current occupation as an investment manager, also provides important finance experience. He is also on the Governance Committee and was previously on the Audit Committee of Media General, Inc., which provides additional insight and experience for the issues faced by our Board and its committees.

* William D. Rockford, age 67, is the former President, Chief Financial Officer and Chief Operating Officer of Primary Energy Ventures LLC, a power generation company located in Oak Brook, Illinois, serving in such role until his retirement in 2006. He is also a former Managing Director of the financial services company, Chase Securities Inc., in New York, New York, where his responsibilities included the Global Power, Project Finance and Environmental Group. Mr. Rockford has been a director since 2000, and his present term expires in 2013.

Key Attributes, Experience and Skills: Mr. Rockford provides valuable leadership, management and energy industry experience, obtained through his positions at Primary Energy Ventures. Through his nearly 30-year career at Chase, Mr. Rockford has experience in providing capital, corporate finance, project finance and merger and acquisition advice to the regulated utility industry and independent power industry, which adds valuable expertise in these areas to both the Board and to the Finance Committee. Mr. Rockford also has experience in commercial banking, which provides additional finance and risk management expertise.

Paul L. Whiting, age 69, has been the President of Seabreeze Holdings, Inc., a private investments company located in Tampa, Florida, since prior to 2008. Previously, Mr. Whiting held various positions within Spalding & Evenflo Companies, Inc., including Chairman, Chief Executive Officer and Chief Financial Officer. He is also Chairman of the Board of Sykes Enterprises, Incorporated, and a director of Florida Investment Advisors, Inc., The Bank of Tampa and its holding company, The Tampa Bay Banking Company. Mr. Whiting has been a director since 2004, and his present term expires in 2014.

Key Attributes, Experience and Skills: As a result of his experience at the Spalding & Evenflo Companies, Mr. Whiting provides leadership, financial and business experience and expertise. His other board and committee memberships, including as Chairman of the Board and member of the Audit Committee at Sykes Enterprises, provide additional leadership experience, as well as exposure to other governance structures, and additional financial and risk management experience. His notable community service, including as Board President of the Academy Prep Center of Tampa, Inc., a full scholarship, private college preparatory middle school for low-income children, and Director of Florida West Coast Public Broadcasting, Inc. (WEDU), is important to a business such as ours which values involvement in the communities we serve.

Information about the Board and its Committees

Board Meetings and Attendance

The Board of Directors held eight meetings in 2012. All directors attended at least 75% of the meetings of the Board and committees on which they served. Our policy is for directors to attend our Annual Meeting of Shareholders; in 2012, all of the directors attended that meeting. In 2012, the non-management directors met in executive session at least quarterly, and the independent directors met in executive session at least once. The presiding director for the executive sessions is elected by the independent directors.

Committees of the Board

The Board has standing Audit, Compensation, Finance, and Governance and Nominating Committees. The Audit, Compensation and Governance and Nominating Committees are comprised exclusively of independent directors as defined by the listing standards of the New York Stock Exchange. The current membership of each Committee and other descriptive information is summarized below.

4

| | | | | | | | |

| Director | | Audit Committee | | Compensation

Committee | | Finance

Committee | | Governance and

Nominating Committee |

| | | | | | | | | |

DuBose Ausley1 | | — | | — | | X | | — |

| | | | | | | | | |

James L. Ferman, Jr. | | — | | X | | — | | Chair |

| | | | | | | | | |

Evelyn V. Follit | | X | | — | | — | | — |

| | | | | | | | | |

Sherrill W. Hudson | | — | | — | | X | | — |

| | | | | | | | | |

Joseph P. Lacher | | Chair | | — | | — | | X |

| | | | | | | | | |

Loretta A. Penn | | — | | X | | — | | X |

| | | | | | | | | |

John B. Ramil | | — | | — | | X | | — |

| | | | | | | | | |

Tom L. Rankin | | X | | — | | Chair | | — |

| | | | | | | | | |

William D. Rockford | | — | | X | | X | | — |

| | | | | | | | | |

Paul L. Whiting | | X | | Chair | | — | | — |

| | | | | | | | | |

| (1) | Mr. Ausley is retiring from the Board effective as of the date of the annual meeting. |

TheAudit Committee met five times in 2012. Its members are Ms. Follit and Messrs. Lacher (Chair), Rankin and Whiting. The Board of Directors has determined that Messrs. Lacher, Rankin and Whiting are audit committee financial experts as that term has been defined by the Securities and Exchange Commission, and that all of the members are independent as defined by the listing standards of the New York Stock Exchange. Additional information about the Audit Committee is included in the Audit Committee Report on page 29.

TheCompensation Committee, met five times in 2012. Its members are Ms. Penn and Messrs. Ferman, Rockford and Whiting (Chair), all of whom are independent directors. Its primary responsibilities are to:

| | Ÿ | | review and approve the goals and objectives relevant to CEO compensation; |

| | Ÿ | | evaluate the CEO’s performance in light of those goals and objectives; |

| | Ÿ | | determine and approve the CEO’s compensation level based on this evaluation; |

| | Ÿ | | make recommendations to the Board with respect to the compensation of other executive officers, incentive compensation plans and equity-based plans; |

| | Ÿ | | review and discuss the Compensation Discussion and Analysis in the company’s proxy statement with management; |

| | Ÿ | | administer and make awards under the company’s equity incentive plan; and |

| | Ÿ | | make recommendations on any proposed executive employment, severance or change-in-control agreements. |

The Compensation Committee carries out these responsibilities by (a) evaluating the executive officers’ performance annually, (b) reviewing peer group compensation as compared to the compensation of the company’s executive officers and tally sheet information showing the total compensation for each executive officer, (c) reviewing and discussing information regarding the company’s business plans and (d) then recommending (or approving, in the case of the CEO) salaries and annual incentive goals and target incentive awards based on the Committee’s review and evaluation of this information. The Committee also reviews the company’s performance and the level of achievement of the annual incentive goals, and it recommends (or approves, in the case of the CEO) the level of payment for the annual incentive awards based on this review of company and individual performance. The Committee also reviews information with respect to equity incentive awards, such as market data, and makes such awards (or recommends such awards, with respect to non-employee directors). The Committee also meets to consider other compensation-related issues, such as the design of the equity incentive plan and awards made under that plan, the director compensation program and external developments related to executive compensation, such as new or pending laws or regulations. Decisions made with respect to executive compensation for 2012 are discussed in detail under “Compensation Discussion and Analysis” beginning on page 11.

The Compensation Committee has exclusive authority to retain and terminate any compensation consulting firm to assist in the evaluation of director or executive officer compensation and to approve the consulting firm’s fees and other retention terms. The Committee has engaged Steven Hall & Partners (“SH&P”) as its independent compensation consultant to help the Committee identify market trends in executive compensation, provide market data to help the Committee determine appropriate compensation levels and components, and aid the Committee in its overall assessment of the executive compensation program, taking that data and information into account. Representatives of SH&P attend Committee meetings at the invitation of the Committee Chairman, and are also in contact directly with him from time to time. They provide the Committee with significant assistance and advice in the review of the company’s salary structure, annual and equity incentive awards, and other related executive pay issues. In addition, they provide expertise regarding marketplace trends and best practices relating to competitive pay

5

levels. SH&P did not provide any other services to the company in 2012 other than its services as the Committee’s independent compensation consultant, and SH&P did not receive any fees or compensation from the company other than the fees it received as the Committee’s independent compensation consultant. The Committee confirmed that SH&P’s work for the Committee did not raise any conflicts of interest.

Management (primarily the CEO and Chief Human Resources Officer) provides the Compensation Committee with information and its ideas and input regarding compensation decisions, discusses this information and the recommendations of SH&P in detail with the Committee, and answers questions. To carry out this role, with the Committee Chairman’s knowledge and approval, management may interface directly with the Committee’s executive compensation consultant to give its input on the design of compensation programs and policies, and the development of compensation recommendations. The Committee’s charter allows the Committee to form and delegate authority to subcommittees, and the equity incentive plan allows the Committee to delegate to one or more executive officers of the company the power to make equity incentive awards to employees (other than executive officers). The Committee has delegated authority to management to make small restricted stock grants to non-executive officers and key employees and to allow previously granted options to be exercised for their full term and time-vested restricted stock to vest following the termination of employment by certain employees. Management provides a report to the Committee when it exercises this delegated authority.

TheFinance Committee met three times in 2012. Its members are Messrs. Ausley, Hudson, Ramil, Rankin (Chair) and Rockford. (Mr. Ausley is retiring from the Board effective as of the date of the 2013 Annual Meeting.) The Finance Committee assists the Board in formulating our financial policies and evaluating our significant investments and other financial commitments. The Committee’s charter also grants it authority to review and make recommendations to the Board with respect to strategic financial policies of the company, including those relating to debt ratings, debt/equity ratios, dividends, debt and equity limits, securities issuances or repurchases, policies relating to the use of derivatives, and proposed acquisitions, divestitures or investments by the company or its subsidiaries that require Board approval. The Committee has authority pursuant to its charter to approve certain transactions on behalf of the Board.

TheGovernance and Nominating Committee met twice in 2012. Its members are Ms. Penn and Messrs. Ferman (Chair) and Lacher, all of whom are independent directors. The Committee assists the Board with respect to corporate governance matters, including the composition and functioning of the Board. The Committee has the responsibilities set forth in its charter with respect to:

| | Ÿ | | identifying individuals qualified to become members of the Board; |

| | Ÿ | | recommending to the Board when new members should be added to the Board; |

| | Ÿ | | recommending to the Board individuals to fill vacancies and nominees for the next annual meeting of shareholders; |

| | Ÿ | | reviewing and making recommendations with respect to Board and Committee leadership and structure; |

| | Ÿ | | periodically developing and recommending to the Board updates to the Corporate Governance Guidelines; |

| | Ÿ | | overseeing the annual evaluation of the Board and its committees; |

| | Ÿ | | assisting the Board in planning for succession to the position of Chief Executive Officer, as well as other senior management positions; |

| | Ÿ | | recommending to the Board the policy for Board compensation; |

| | Ÿ | | reviewing environmental issues and other significant corporate responsibility issues for the Board; and |

| | Ÿ | | generally advising the Board on governance matters and practices, including with respect to the structure and conduct of board meetings, and shareholder proposals and amendments to organizational documents that relate to governance or corporate responsibility issues. |

The Governance and Nominating Committee’s process for evaluating nominees for director, including nominees recommended by shareholders, is to consider an individual’s character and professional ethics, judgment, business and financial experience, expertise and acumen, familiarity with issues affecting business, and other relevant criteria, including the diversity, age, skills and experience of the Board of Directors as a whole. The Committee considers racial, ethnic, gender and geographic diversity, as well as diversity of experience, expertise and skills, as relevant characteristics when reviewing and recommending director nominees. As part of the Board’s annual evaluation process, members are asked to assess whether outside directors represent a sufficiently wide range of talents, expertise, and occupational and personal backgrounds. The Governance and Nominating Committee considers suggestions from many sources, including shareholders, regarding possible candidates for director, and it has sole authority to retain a search firm to identify potential director candidates and assist in their evaluation. The Governance and Nominating Committee reviews the qualifications and backgrounds of candidates, as well as the overall composition of the Board (including its diversity, as described above), and recommends to the Board the slate of candidates to be nominated for election at the annual meeting of shareholders and the composition of the Board’s committees. Shareholder recommendations for nominees for membership on the Board are given due consideration by the Committee for recommendation to the Board based on the nominee’s qualifications in the same

6

manner as all other candidates. Shareholder nominee recommendations should be submitted in writing to the Chairman of the Governance and Nominating Committee in care of the Corporate Secretary, TECO Energy, Inc., P.O. Box 111, Tampa, Florida 33601.

Committee Charters and Other Corporate Governance Documents

The Charters of each Committee, the Corporate Governance Guidelines, and the Code of Ethics and Business Conduct applicable to all directors, officers and employees are available in the Corporate Governance section of the Investor Relations page of our website, www.tecoenergy.com, and will be sent to any shareholder who requests them from the Director of Investor Relations, TECO Energy, Inc., P.O. Box 111, Tampa, Florida 33601. Our Corporate Sustainability Report is also available on the Investors page of our website.

Board Leadership Structure and Risk Oversight

TECO Energy currently operates under a leadership structure in which the positions of Chief Executive Officer and Chairman of the Board have been separated, such that each position is held by a different person. In August 2010, Sherrill Hudson, who was previously our CEO and Chairman, was named Executive Chairman of the Board, and John Ramil, who was previously our President and Chief Operating Officer, was named President and Chief Executive Officer. Mr. Hudson’s term as Executive Chairman of the Board ended on December 31, 2012, and the Board designated Mr. Hudson to serve as non-executive Chairman effective as of that date. Our Board is comprised of Messrs. Hudson and Ramil and eight other directors (including Mr. Ausley, who is retiring as of the date of the annual meeting), seven of whom are independent directors. The independent directors elect a presiding director who is responsible for establishing the agenda for and scheduling of executive sessions, and approving meeting agendas and information sent to the Board for regularly scheduled meetings. The presiding director is also available to discuss concerns of any Board member or senior executive and to supplement the direct lines of communication between the Chairman and the independent directors by serving as a liaison, as necessary. Our current presiding director is Mr. Lacher, who will serve in this capacity until our 2013 Annual Meeting of Shareholders; Mr. Whiting has been elected to serve as presiding director at that time.

As discussed above, we have four standing Board committees, three of which are comprised entirely of independent directors, and all of which are chaired by an independent director. All Board members, through the presiding director and committee chairs, have input into the meeting agendas and the other important responsibilities discussed above. While we believe this structure is currently the most effective for our company, the Board has no mandatory policy with respect to the separation of the offices of Chairman and the Chief Executive Officer.

The Board of Directors, both as a whole and through its Committees, is responsible for the oversight of the company’s risk management processes. At least annually, the Board reviews and discusses with management information regarding the company’s enterprise-wide risk assessment process. This review includes information on how the assessment was conducted, the most significant strategic, operational, financial, and compliance risks that were identified through the assessment, the potential exposures of those risks, and how they are being mitigated. The Board’s oversight of risk management is supplemented by the work of its Committees, which oversee risk management in each of their areas of responsibility. The Audit Committee assists the Board in overseeing the company’s policies and procedures for risk assessment and risk management by reviewing and discussing with management annually the company’s enterprise-wide risk assessment and risk management policies, focusing on the company’s major financial, accounting, and compliance risk exposures and the steps management has taken to monitor and control such exposures. The Audit Committee also reviews quarterly reports regarding compliance and legal matters and receives reports periodically on specific risk areas identified through the risk assessment. The Finance Committee considers risks with respect to the company’s capital structure generally and risks involved with specific financing activities or projects, the Compensation Committee reviews our executive compensation program to ensure it does not encourage excessive risk taking, and the Governance and Nominating Committee oversees risks related to succession planning, environmental and other significant corporate responsibility issues and other corporate governance-related matters. The chair of each committee reports to the Board regarding its respective risk management oversight activities.

We believe that our Board leadership structure is effective for the company and promotes effective oversight of the company’s risk management by providing balanced leadership through the separated Chairman and CEO positions, and by having strong independent leaders on the Board, all of whom are fully engaged and provide significant input in Board deliberations and decisions.

7

Director Resignation Policy

Under our bylaws, a majority vote of shareholders is required to elect each of the nominees named above, meaning the number of votes cast in favor of the nominee must exceed the number of votes cast against that nominee’s election. Under the director resignation policy adopted by the Board as part of our Corporate Governance Guidelines, each director nominee has submitted an advance, contingent, irrevocable resignation that the Board may accept if the shareholders do not elect the director. In that situation, our Governance and Nominating Committee would make a recommendation to the Board about whether to accept or reject the resignation. The Board would act on the Governance and Nominating Committee’s recommendation and publicly disclose its decision regarding the resignation within 90 days from the date that the election results were certified. In the event of a contested director election (where there are more director nominees than positions to be filled on the Board), our bylaws provide that directors are to be elected by a plurality of the votes cast, instead of a majority.

Director Independence

The Board has determined that all of the directors except Messrs. Ausley, Hudson and Ramil meet the independence standards of the New York Stock Exchange and those set forth in our Corporate Governance Guidelines. The Board annually reviews business and charitable relationships of directors in order to make a determination as to the independence of each director. Only those directors who the Board affirmatively determines have no relationship with us that would impair their independent judgment are considered independent directors. After performing such a review, the Board determined that (i) Mss. Penn and Follit and Messrs. Rankin and Rockford have no relationships with us and (ii) Messrs. Ferman, Lacher and Whiting only have relationships with us of the type that the Board has determined to be categorically immaterial (as defined below), and these relationships were therefore not considered by the Board as relationships that would affect their independence. In 2012, we made charitable contributions in amounts below $100,000 to organizations of which Messrs. Ferman, Lacher and Whiting are trustees.

Our Corporate Governance Guidelines adopted by the Board define the following types of relationships as being categorically immaterial:

| 1. | If a director is an employee, or if the immediate family member of the director is an executive officer, of another company that does business with us and the annual sales to, or purchases from, us are less than the greater of $1 million or 1% of the consolidated annual gross revenues of the company for which he or she serves as an executive officer or employee; |

| 2. | If a director is an executive officer of another company which is indebted to us, or to which we are indebted, and the total amount of either company’s indebtedness to the other is less than 1% of the total consolidated assets of the company for which he or she serves as an executive officer; and |

| 3. | If a director is an executive officer, director or trustee of a charitable organization and our discretionary annual charitable contributions to the organization do not exceed the greater of $1 million or 1% of that organization’s total annual charitable receipts. |

Category 3 above recognizes the Board’s view that its members should not avoid volunteering as directors or trustees of charitable organizations and that we should not cease ordinary course contributions to organizations for which a director has volunteered.

In addition to defining categorically immaterial relationships, the Board has also adopted the following guidelines to assist it in making the determination of whether a relationship with a Board member is material or immaterial:

| 1. | A director shall not be independent if, within the preceding three years: (i) the director was employed by us; (ii) an immediate family member of the director was employed by us as an executive officer; (iii) the director or an immediate family member of the director received more than $120,000 in direct compensation from us, other than director fees, pension, or other deferred compensation for prior service in any 12-month period; or (iv) one of our executive officers was on the compensation committee of a company which during that same time period employed the director, or which employed an immediate family member of the director, as an executive officer. |

| 2. | A director shall not be independent if (i) the director is a current employee or partner of our independent or internal auditor; (ii) an immediate family member of the director is a current partner of our independent or internal auditor, or is a current employee who |

8

| | personally works on our audit; or (iii) the director or an immediate family member was a partner or an employee of the independent auditor and personally worked on our audit within the last three years. |

For relationships the character of which are not included in the categories in paragraphs 1 or 2 above or do not meet the categorically immaterial standards described above, the determination of whether the relationship is material or not and, therefore, whether the director would be independent or not, shall be made by the directors who satisfy these independence guidelines.

Certain Relationships and Related Person Transactions

Our Board has adopted a written policy regarding the review, approval or ratification of related person transactions. A related person transaction for the purposes of the policy is a transaction between the company and one of our directors, executive officers or 5% shareholders, or a member of one of these person’s immediate family, in which such person has a direct or indirect material interest and involves more than $120,000. Under this policy, related person transactions are prohibited unless the Audit Committee has determined in advance that the transaction is fair and reasonable to the company. The policy contains procedures that require the Audit Committee receive the following information regarding the transaction and consider the following factors before deciding whether to approve a proposed transaction:

| | Ÿ | | information regarding the parties involved in the transaction and their relationship to the company, |

| | Ÿ | | a complete description of the material terms of the transaction, including economic and non-economic features, |

| | Ÿ | | the direct and indirect interests present in the proposed transaction, |

| | Ÿ | | the relationships present in the proposed transaction, and |

| | Ÿ | | the conflicts or potential conflicts present in the proposed transaction. |

After receiving such information and considering the above factors, the policy calls for the Committee to determine, in its judgment, whether the transaction is fair and reasonable to the company, and whether or not such transaction should be approved on such basis. In the event the company enters into such a transaction without Audit Committee approval, the Audit Committee must promptly review its terms and may ratify the transaction if it determines it is fair and reasonable to the company and any failure to comply with the pre-approval policy was not due to fraud or deceit.

TECO Energy paid legal fees of $1,316,435 for 2012 to Ausley & McMullen, P.A., of which Mr. Ausley is an employee. This firm, which has unique expertise in Florida regulatory and legislative matters related to the utility industry, had already been providing the company legal services when Mr. Ausley became a director. The terms of these services were comparable to what could be obtained from an unrelated third party, and the services were approved by the Audit Committee pursuant to the policy described above. Mr. Ausley does not perform any legal services for the company and does not receive any compensation related to these services.

Communications with the Board

The Board provides a process by which shareholders and interested parties may communicate with its members, which is described in the Corporate Governance section of the Investor Relations page of our website, www.tecoenergy.com. Any shareholder or interested party wishing to contact our Board, the non-management directors as a group or any of the non-management directors separately, including the presiding director, may do so by mail at P.O. Box 1648, Tampa, Florida 33601, or by e-mail through the Corporate Governance section of the Investor Relations page of our website, www.tecoenergy.com. Each such communication should state the full name of the shareholder and, if the shareholder is not a record holder of TECO stock, should be accompanied by appropriate evidence of stock ownership, such as an account statement showing ownership of TECO stock. If the communication is from an interested party who is not a shareholder, the communication should state the nature of the party’s interest in the company.

Compensation of Directors

In 2012, non-management directors were paid the following compensation:

| Ÿ | | an annual retainer of $50,000; |

| Ÿ | | attendance fees of $750 for each TECO Energy Board meeting; |

| Ÿ | | attendance fees of $750 for each Tampa Electric Company Board meeting; |

| Ÿ | | attendance fees of $1,500 for each meeting of a committee of the Board on which they serve; |

9

| Ÿ | | an additional annual retainer of $10,000 for the Chair of the Audit Committee, and an additional annual retainer of $7,500 for each other Committee Chair; and |

| Ÿ | | an annual grant of 3,000 shares of restricted stock vesting on the anniversary date of the grant, which is prorated for directors who join after the annual grant date. |

Directors may elect to receive all or a portion of their compensation in the form of common stock. Directors may also elect to defer any of their cash compensation with a return calculated at either 1% above the prime rate or a rate equal to the total return on our common stock. We pay for or reimburse directors for their meeting-related expenses and expenses associated with their duties as our directors, such as attending educational conferences.

Pursuant to our share ownership guideline, non-management directors are required to own within five years of their election an amount of common stock with a value of five times their annual retainer. The Compensation Committee reviewed share ownership as of December 31, 2012 and determined that all non-management directors were in compliance with the guideline. Directors are included in the company’s policy that prohibits engaging in hedging transactions with respect to our stock.

Non-management directors are eligible to participate in the Director Matching Contributions Program, pursuant to which contributions by non-management directors to eligible non-profit organizations are matched dollar-for-dollar by the company, in an amount not to exceed $10,000 per calendar year for each such director. Matching contributions made under this program are reported in the “All Other Compensation” column of the Director Compensation table below.

The purpose of our director compensation program is to allow us to continue to attract and retain qualified Board members, tie a portion of their compensation to our long-term success, and recognize the significant commitment required of our directors. The 2012 director compensation program was based on the Compensation Committee’s recommendations to the Board after reviewing information provided by its compensation consultant that compared the total compensation provided to our directors to total director compensation provided by the same peer group of companies used for executive compensation analysis, listed on page 15.

The following table gives information regarding the compensation we provided to the non-management directors in 2012:

Director Compensation for the 2012 Fiscal Year

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) 1 | | | Stock Awards ($) 2 | | | Option Awards ($)3 | | | All Other Compensation 4 | | | Total ($) | |

DuBose Ausley | | | 65,750 | | | | 53,940 | | | | 0 | | | | 10,000 | | | | 129,690 | |

James L. Ferman, Jr. | | | 77,750 | | | | 53,940 | | | | 0 | | | | 10,000 | | | | 141,690 | |

Evelyn V. Follit | | | 63,083 | | | | 67,477 | | | | 0 | | | | 0 | | | | 130,560 | |

Joseph P. Lacher | | | 81,750 | 5 | | | 53,940 | | | | 0 | | | | 10,000 | | | | 145,690 | |

Loretta A. Penn | | | 71,750 | | | | 53,940 | | | | 0 | | | | 0 | | | | 125,690 | |

Tom L. Rankin | | | 77,750 | | | | 53,940 | | | | 0 | | | | 0 | | | | 131,690 | |

William D. Rockford | | | 71,750 | | | | 53,940 | | | | 0 | | | | 0 | | | | 125,690 | |

Paul L. Whiting | | | 83,750 | 6 | | | 53,940 | | | | 0 | | | | 10,000 | | | | 147,690 | |

| (1) | Includes amounts that may be deferred or paid in stock, at the election of the director. |

| (2) | This column includes the aggregate grant date fair value for the stock awards made to the directors in 2012, computed in accordance with FASB ASC Topic 718. See Note 9, Common Stock, to the TECO Energy Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2012 for a discussion of the assumptions made in valuations of stock awards. On May 2, 2012, each director who was continuing service after that date received 3,000 shares of restricted stock, which vest on May 2, 2013. As of December 31, 2012, each director had 4,000 shares of restricted stock outstanding, except Ms. Follit who had 3,000 shares of restricted stock outstanding. Holders of time-vested restricted stock receive the same dividends as holders of other shares of our common stock. |

| (3) | As of December 31, 2012, Messrs. Ausley, Ferman, and Rankin each had option awards outstanding as to 7,500 shares, Ms. Penn had option awards outstanding as to 10,000 shares, and the remaining directors had no option awards outstanding. Stock options have not been issued to non-management directors since 2005. |

| (4) | All amounts under All Other Compensation are for matching contributions made under the Director Matching Contributions Program described above. |

| (5) | Includes $40,875 paid in the form of shares of common stock at Mr. Lacher’s election (2,334 shares). |

| (6) | All fees were paid in the form of shares of common stock at Mr. Whiting’s election (4,779 shares). |

10

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion & Analysis set forth below with management and, based on this review and discussion, has recommended to the Board that it be included in this proxy statement.

By the Compensation Committee:

Paul L. Whiting (Chairman)

James L. Ferman, Jr.

Loretta A. Penn

William D. Rockford

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (or “CD&A”) explains how we use different elements of compensation to achieve the goals of our executive compensation program and how we determine the amounts of each component to pay.

The term “named executive officers” as used throughout this CD&A refers to the following executive officers named in the Summary Compensation Table on page 22:

| | • | | John B. Ramil, President and Chief Executive Officer |

| | • | | Gordon L. Gillette, President, Tampa Electric Company |

| | • | | Sandra W. Callahan, Senior Vice President – Finance and Accounting and Chief Financial Officer |

| | • | | Clinton E. Childress, Formerly Senior Vice President – Corporate Services and Chief Human Resources Officer |

| | • | | Charles A. Attal, Senior Vice President – General Counsel and Chief Legal Officer |

The Compensation Committee makes decisions with respect to CEO compensation and equity-based incentives, after consultation with the Board. The Board makes all other executive compensation decisions after hearing the recommendations of the Compensation Committee. Therefore, in all cases where we refer to the Committee’s actions (except with respect to CEO compensation or equity-based incentives), such actions are carried out through Board approval, upon the recommendation of the Compensation Committee.

Executive Summary

Pay for Performance

Our executive compensation program ties a significant portion of executive pay directly to company performance in order to link the interests of our executives to the long-term interests of our shareholders.

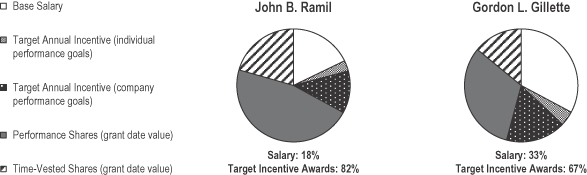

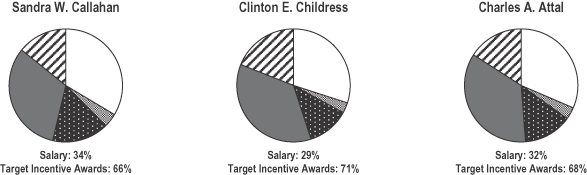

| | Ø | | Over 80% of our CEO’s compensation and, on average, over two-thirds of the other named executive officers’ compensation, is at risk and variable depending on corporate and individual performance |

| | Ø | | 70% of long-term incentive awards are tied to relative total shareholder return |

| | Ø | | 80% of annual incentive plan awards are based on the achievement of challenging corporate financial goals |

| | Ø | | No annual incentive awards are paid unless a threshold level of income is achieved |

We set well-defined, challenging goals for the annual incentive program and performance-based long-term incentives.

| | Ø | | Annual incentive goals are tied to business plans in order to provide incentives to management to create value consistent with the company’s business strategy |

| | Ø | | Long-term incentive goals are tied to total shareholder return relative to other companies in the industry to link executives’ interests with the long-term interests of shareholders |

We continually evaluate and update the executive compensation program.

| | Ø | | Our Compensation Committee and the Board monitor the program to ensure that best practices are being considered and that the program is operating as intended, while maintaining consistency within the key elements of compensation |

11

Impact of 2012 Company Performance on Pay

Linking pay with performance means that there is the opportunity to receive more compensation in years with above-target company and individual performance, and vice versa. In 2012, management produced strong results despite unfavorable weather throughout the year impacting sales for the Florida utilities and the changing market conditions impacting the coal company described below. Management also executed significant transactions and other actions that better position the company for the future, such as the completion of the sales of its Guatemalan subsidiaries, allowing the company to sharpen its focus on its regulated utilities, and the Florida Public Service Commission approval of the need for generation expansion at Tampa Electric’s Polk Power Station. Based on such results, 2012 annual incentive awards were paid to the named executive officers at near target levels (see page 18 for more information regarding the financial results and annual incentive payout amounts for 2012). Please see our Annual Report on Form 10-K for the year ended December 31, 2012 for additional information regarding the company’s 2012 financial results.

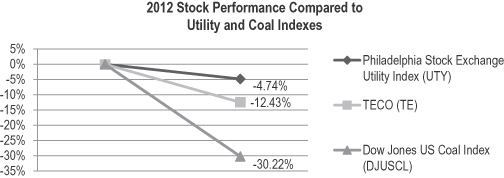

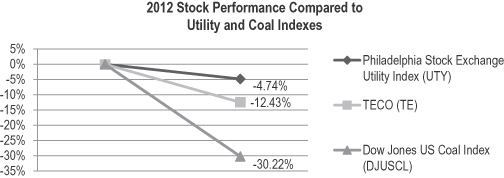

Impact of Relative Stock Performance on Realized Pay

Our relative total shareholder return for the three-year period ended March 31, 2012 was at the 66th percentile of the companies in the Dow Jones Electricity and Multiutility Groups (described on page 34) resulting in a payout of 121% for the performance shares that vested in 2012. While shareholder return was strong compared to utilities over this three-year period, the company’s stock underperformed the utility industry over the past year. This was mainly attributable to the negative effect of the significantly weaker coal markets on the company’s coal production subsidiary, which over the years has grown to be a significant source of income for the company. While the company took actions at its coal subsidiary to respond to these conditions, such as reducing production levels and personnel as part of its efforts to focus on margins rather than volumes, and, as illustrated by the graph below, the company’s stock significantly outperformed the coal industry, the poor coal industry conditions still had a substantial impact on the company’s stock during 2012.

While management took actions to mitigate the impact of the weakening coal industry on our operations and results, and produced strong results at the utilities despite challenging conditions, we understand that our shareholders are negatively impacted when our stock price underperforms the utility industry. In light of this, seventy percent of the long-term incentive awards granted to named executive officers, which make up a significant portion of our executives’ total compensation opportunity, is performance-based restricted stock that is dependent on our total shareholder return compared to companies in our industry. Based on our total shareholder return compared to peer companies as of December 31, 2012, all of the performance-based restricted stock granted in 2010, 2011, and 2012 would be forfeited, resulting in realizable compensation for those grants of $0 as of that date.

Governance and Risk-Mitigating Factors

Our Compensation Committee and the Board are committed to maintaining corporate governance protections as part of the executive compensation program, which further strengthen the tie between executive compensation and company performance.

| | Ø | | We have an incentive compensation recovery policy (“claw-back” policy), which applies to all officers in the event of any financial restatement (described in more detail on page 13). |

| | Ø | | We have a policy prohibiting all executive officers from engaging in hedging transactions with respect to our stock, we have strong stock ownership guidelines (these policies are described in more detail below) and, as shown in the Stock Ownership Table on page 32, there are no company shares pledged by any of these officers. |

| | Ø | | All restricted stock awards have “double-trigger” vesting, meaning that in the event of a change-in-control, vesting of shares is accelerated only if the grantee is also terminated without cause or terminates employment with good reason. |

12

| | Ø | | Payouts under the annual incentive award plan are capped at 150% of the target amount. |

| | Ø | | Payouts under the annual incentive award plan are based on both financial goals and individual business plan goals, and payouts under the performance share awards are based on relative performance goals. This mix of goals ensures that multiple aspects of business success are considered in determining compensation. |

| | Ø | | We annually review the compensation program in light of key business risks to ensure that the program provides appropriate incentives, does not encourage executives to take excessive business risks, and contains risk-mitigating elements. |

Competitive Pay Program

We provide compensation that is competitive and reasonable in order to attract and retain the talent needed to successfully manage and build our businesses.

| | Ø | | Total compensation is targeted at the 50th percentile of companies of similar size in our industry, which allows compensation to remain competitive for the executives and cost-effective for the company. |

| | Ø | | While compensation is targeted at the 50th percentile, the Committee uses its discretion in applying market data to take into account individual performance, responsibilities and experience levels. For example, compensation is sometimes set below the 50th percentile when executives are promoted to a new position to allow them to grow into their new role; conversely, executives could be paid above the 50th percentile when they have demonstrated a successful track record in a position for a significant period of time. |

Other Notable Policies and Practices

| | Ø | | We have Stock Ownership Guidelines of five times base salary for the CEO and three times base salary for other executive officers. |

Effective January 2013, the guidelines require that officers hold at least 50% of net, after-tax shares obtained through the vesting or exercise of long-term incentive awards until the share ownership guidelines are met. In addition, the Committee strengthened the guidelines by providing that unvested performance shares are not included in the total shares owned for purposes of the guidelines. The Committee reviews share ownership on an annual basis to ensure continued compliance with these guidelines and determined that, as of December 31, 2012, all executive officers were in compliance.

| | Ø | | Our Claw-Back Policy applies to all officers in the event of any financial restatement if a lower payment would have been made to the officer based upon the restated financial results, regardless of the cause of the restatement (whether or not due to fraud or the fault of the officer). |

The claw-back policy applies to annual incentive awards in the case of any financial restatements, and to proceeds from stock and option sales if an officer engaged in an act of embezzlement, fraud or breach of fiduciary duty that contributed to the need to restate the company’s financials. The full text of the policy is included in the company’s Corporate Governance Guidelines available in the Corporate Governance section of the Investor Relations page of our website, www.tecoenergy.com.

| | Ø | | Our Hedging Policy prohibits officers and directors from entering into hedging transactions with respect to our stock. |

The policy prohibits hedging transactions such as zero-cost collars and forward sale contracts, which would allow the person to continue to own the covered securities, but without the full risks and rewards of ownership, potentially causing that person’s objectives to diverge from our other shareholders.

| | Ø | | Dividends are not paid on unvested performance shares, unless and until such shares vest |

| | Ø | | We do not have employment agreements with our officers |

| | Ø | | We do not provide extra pension service credits to executives |

| | Ø | | We do not provide tax gross-ups on any benefits or perquisites, and our Compensation Committee determined not to provide any new excise tax gross-ups |

| | Ø | | We do not have any corporate aircraft, therefore personal travel on corporate aircraft is not an issue for us |

| | Ø | | We provide minimal perquisites; in 2012, perquisites or personal benefits or payments not available to all employees were less than $10,000 for each named executive officer |

| | Ø | | The Compensation Committee has an independent compensation consultant, Steven Hall & Partners (“SH&P”), that performs no other services for the company |

13

Elements of Compensation

The table below shows the elements of our executive compensation program and briefly describes the purpose of each element.

| | |

Base Salary | | Fixed amount of compensation targeted at the median of the marketplace in order to provide a competitive amount of fixed annual compensation. Permits us to continue to attract and retain highly qualified executives, and also provides stability for the executives, which allows them to stay focused on business issues. Performance review determines merit based increases. |

Annual Incentive Awards | | Annual cash incentive award based on the achievement of quantitative corporate financial goals (80%) and qualitative individual business plan goals (20%). Intended to encourage actions by the executives that contribute to our operating and financial results and to achieve other goals that the Board has recognized as important for the success of our businesses. |

Long-Term Incentive Awards | | Restricted stock: 70% performance shares; 30% time-vested shares. Designed to create a mutuality of interest with shareholders by motivating the executive officers and key personnel to manage the company’s business so that the shareholders’ investment will grow in value over time. |

- Performance-Based Restricted Stock (referred to throughout as “performance shares”) | | Vests after three years based on total shareholder return compared to other companies in our industry. These awards will be forfeited if our performance is in the bottom quartile of our peers or upon voluntary departure from the company or termination with cause within this period. Directly ties a portion of compensation to a long-term performance measure relative to other companies in our industry, and aids in the retention of our executives. |

- Time-Vested

Restricted Stock | | Vests after three years if still employed at the company. The ultimate value is dependent on our stock price, which aligns the executives’ interest in stock value appreciation with our shareholders’, and the three-year vesting period aids in the retention of our executives. |

Pension Plan | | Tax-qualified defined benefit pension plan available to all of our employees, which aids in attracting and retaining highly qualified employees. |

Supplemental Retirement Plan | | Supplements retirement benefits not available under the tax-qualified plan, which further strengthens the retention component of the pension plan by providing a meaningful incentive to stay with the company to retirement. |

Change-in-Control Agreements | | Provide severance payments if there is a change in control and executive is terminated without cause or terminates employment with good reason (“double-trigger”). These protections help to ensure retention and focus during times when the company could be acquired and executives could lose their jobs. |

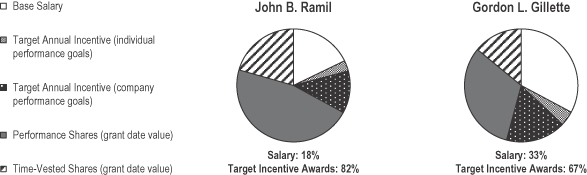

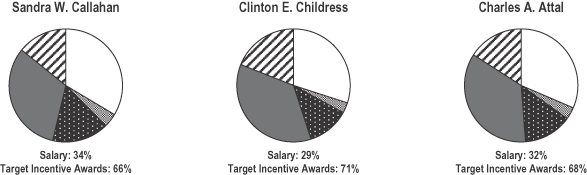

Proportion of Performance-Based Pay

Our compensation program is structured so that a significant portion of each named executive officer’s direct compensation is variable and at risk dependent on performance, and as a result, the value of pay opportunities is variable and may ultimately not be delivered. The charts below show the amounts of compensation tied to company performance relative to other elements of direct compensation in 2012, based on target values of each element. The white area on the charts (base salary) is fixed compensation, while the remaining components of compensation are annual and long-term incentive awards, which have variable values and are at-risk, dependent upon the financial performance of the company, its stock price and the individual performance of the officers.

Mr. Ramil’s 2012 base salary was well below the median salary of the pay peer group described below, while his total compensation was closer to (but still below) the median of that group, meaning that, compared to peer companies, a greater proportion of his compensation is at-risk, based on performance.

14

Pay Peer Group

The Compensation Committee reviews market data provided by its independent compensation consultant to help establish executive compensation levels, in order to provide compensation packages competitive with those of our industry peers. This market data includes compensation data and pay practices from both the company’s peer group identified below and broader compensation survey data. For 2012, the market data that the Compensation Committee reviewed included publicly disclosed compensation data from the following peer group (the “Pay Peer Group”), which was comprised of publicly-traded electric or electric and gas utility companies with revenues ranging between one-half and two-times the company’s revenues:

| | | | | | |

Alliant Energy Corp. | | Great Plains Energy Inc. | | OGE Energy Corp. | | Portland General Electric Co. |

CMS Energy Corp. | | Hawaiian Electric Industries Inc. | | Pinnacle West Capital Corp. | | SCANA Corp. |

DPL Inc. | | NV Energy Inc. | | PNM Resources, Inc. | | Westar Energy, Inc. |

| | | | | | Wisconsin Energy Corp. |

Performance Share Peer Group

We use a pre-established industry index to determine our relative performance for determining the payout of the performance shares granted as a part of our long-term incentive awards. The payout of those awards is based on our total shareholder return compared to the companies listed in the Dow Jones Conventional Electricity and Multiutility subsectors of its Utilities index, referred to throughout this proxy statement as the Dow Jones Electricity and Multiutility Groups, which companies are listed on Appendix A to this proxy statement.

Compensation Review Process

After reviewing market data from its independent compensation consultant and other information described below, management developed total 2012 targeted compensation recommendations for each executive officer (other than for the CEO, for whom management did not provide a recommendation), which were then submitted to the Committee for approval. These recommendations were based on a review and assessment of the following:

| | Ø | | Proxy data from the companies in our Pay Peer Group |

| | Ø | | Factors previously identified by the Committee, such as individual performance, time in position, scope of responsibility and experience |

Total compensation for each named executive officer is generally targeted at the median of the market data for similar positions, while also taking into consideration the factors noted above. How market data is used in determining levels of compensation is discussed in more detail with respect to each element of compensation below.

For each executive officer, the Compensation Committee annually reviews a tally sheet, which shows each element of compensation discussed above, the total compensation paid to each executive officer for the past three years, and percentage changes year over year with respect to each element. The tally sheets also show the value of each executive officer’s total equity holdings, for both vested and unvested or restricted holdings, and the amounts that would be payable to each executive officer in the event of voluntary termination, termination for cause, termination without cause, and termination in connection with a change in control of the company. This information provides the Committee with a clear picture of (i) how its decisions with respect to one element of compensation affect the total compensation package, (ii) how current compensation relates to compensation in previous years, and (iii) the total amount executive officers would receive, including the value of equity awards, under various termination scenarios. The Committee also reviews the total value of each executive officer’s proposed salary, target

15

bonus and grant date value of equity awards for the year compared to the median total compensation of individuals in similar positions as described above. Reviewing this information allows the Committee to make an overall assessment of the reasonableness of the total compensation that the company is providing to its executive officers.

As part of this review, the Committee also considers internal pay equity, both in terms of the total compensation of each executive officer as compared to the CEO, and within the officer group as compared to each other, considering individual responsibilities and experience levels. The Committee believes the executive compensation program should be internally consistent and equitable in order for it to achieve the objectives as outlined in the “Executive Summary” of this CD&A.

At the 2012 annual meeting of stockholders, shareholders were asked to cast an advisory vote on the compensation of our named executive officers as disclosed in the proxy statement for the 2012 annual meeting, and our shareholders overwhelmingly approved the proposal, with 94% of the votes cast in favor. The Committee reviewed the vote results, and in keeping with its commitment to continually evaluate and update the executive compensation program to ensure that best practices are being considered and that it is operating as intended, made some minor modifications to the program, such as strengthening the stock ownership guidelines, as described on page 13.

Discussion and Analysis of Each Element of Compensation

Base Salary