Exhibit 99.2

TECO ENERGY

TECO Energy

Acquisition of New Mexico Gas Company

New Mexico

GAS COMPANY

May 28, 2013

1

TECO ENERGY

Presenters

John Ramil

President and Chief Executive Officer

Sandra Callahan

Chief Financial Officer

2

TECO ENERGY

Forward Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a

“safe harbor” for forward-looking statements. Certain information included in this presentation contains statements that are forward-looking, including statements relating to an acquisition transaction and financing plans. Such statements are based on the company’s current expectations, and the company does not undertake any obligation to update or revise such statements, except as may be required by law. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future, including the risk that the transaction described herein may not be consummated or that the anticipated benefits from the transaction cannot be fully realized, and, accordingly, such results may differ from those expressed in any forward-looking statements made by TECO Energy.

For more information regarding these risks and uncertainties, review the Risk Factors section of the TECO Energy Annual Report on Form 10-K for the period ended Dec. 31, 2012 as filed with the SEC.

3

TECO ENERGY

“I see New Mexico Gas Company as a well-run business with as yet untapped growth potential. We look forward to sharing with New Mexico Gas Company our significant marketing expertise and our commitment to economic development.”

- John Ramil

4

TECO ENERGY

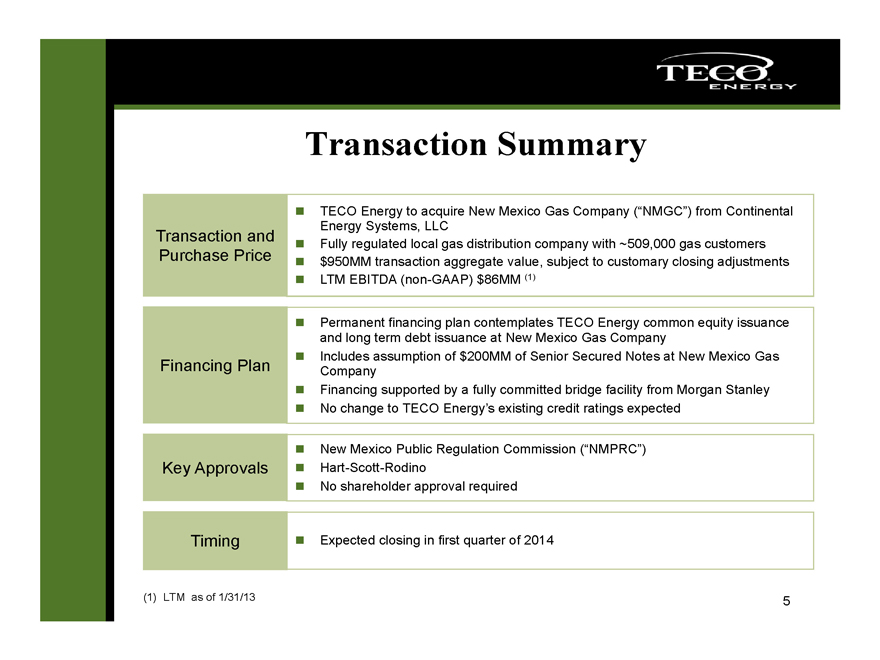

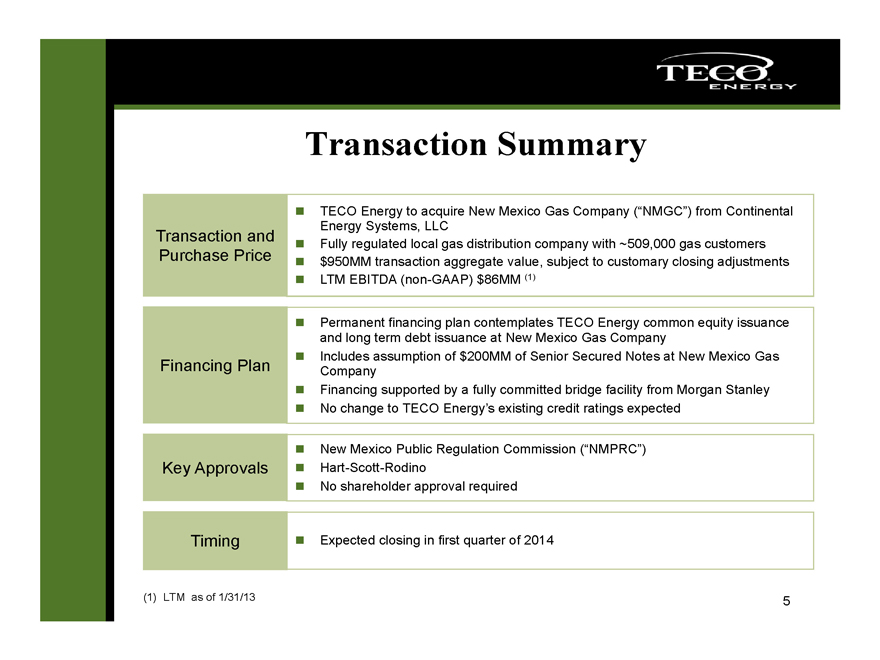

Transaction Summary

Transaction and Purchase Price

TECO Energy to acquire New Mexico Gas Company (“NMGC”) from Continental Energy Systems, LLC

Fully regulated local gas distribution company with ~509,000 gas customers $950MM transaction aggregate value, subject to customary closing adjustments LTM EBITDA (non-GAAP) $86MM (1)

Financing Plan

Permanent financing plan contemplates TECO Energy common equity issuance and long term debt issuance at New Mexico Gas Company Includes assumption of $200MM of Senior Secured Notes at New Mexico Gas Company Financing supported by a fully committed bridge facility from Morgan Stanley No change to TECO Energy’s existing credit ratings expected

Key Approvals

New Mexico Public Regulation Commission (“NMPRC”) Hart-Scott-Rodino No shareholder approval required

Timing

Expected closing in first quarter of 2014

(1) LTM as of 1/31/13

5

TECO ENERGY

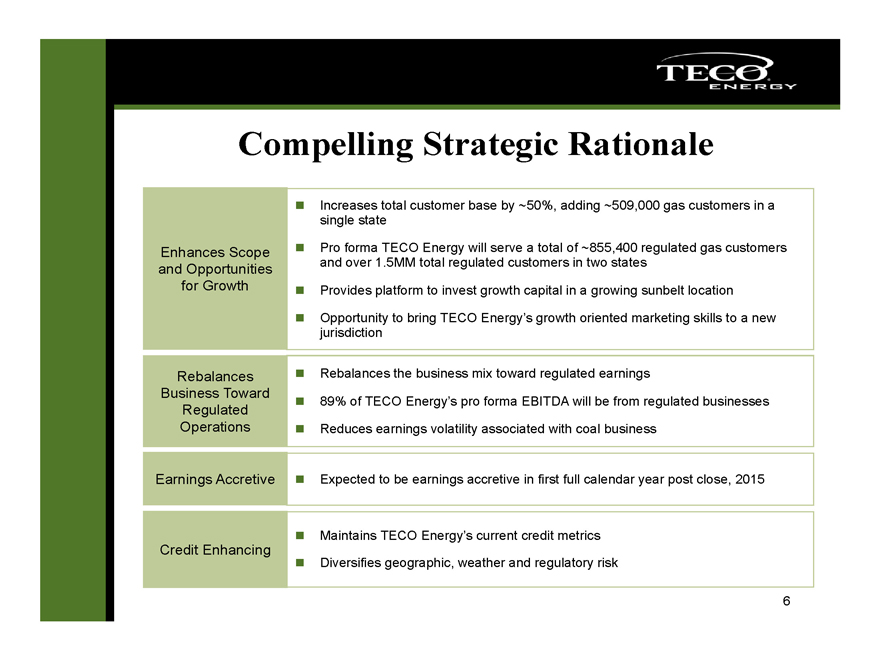

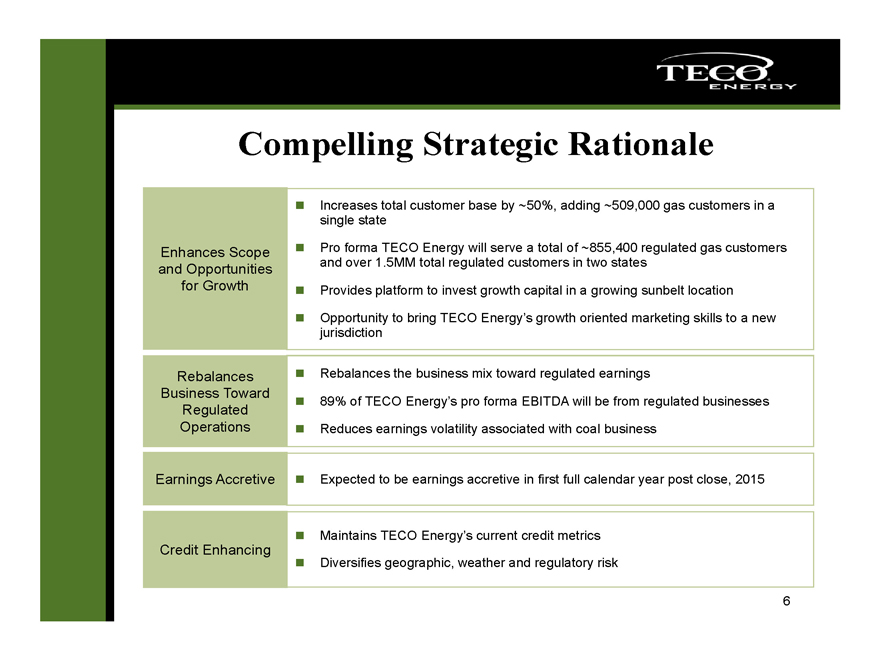

Compelling Strategic Rationale

Enhances Scope and Opportunities for Growth

Increases total customer base by ~50%, adding ~509,000 gas customers in a single state

Pro forma TECO Energy will serve a total of ~855,400 regulated gas customers and over 1.5MM total regulated customers in two states

Provides platform to invest growth capital in a growing sunbelt location

Opportunity to bring TECO Energy’s growth oriented marketing skills to a new jurisdiction

Rebalances Business Toward Regulated Operations

Rebalances the business mix toward regulated earnings

89% of TECO Energy’s pro forma EBITDA will be from regulated businesses

Reduces earnings volatility associated with coal business

Earnings Accretive

Expected to be earnings accretive in first full calendar year post close, 2015

Credit Enhancing

Maintains TECO Energy’s current credit metrics

Diversifies geographic, weather and regulatory risk

6

TECO ENERGY

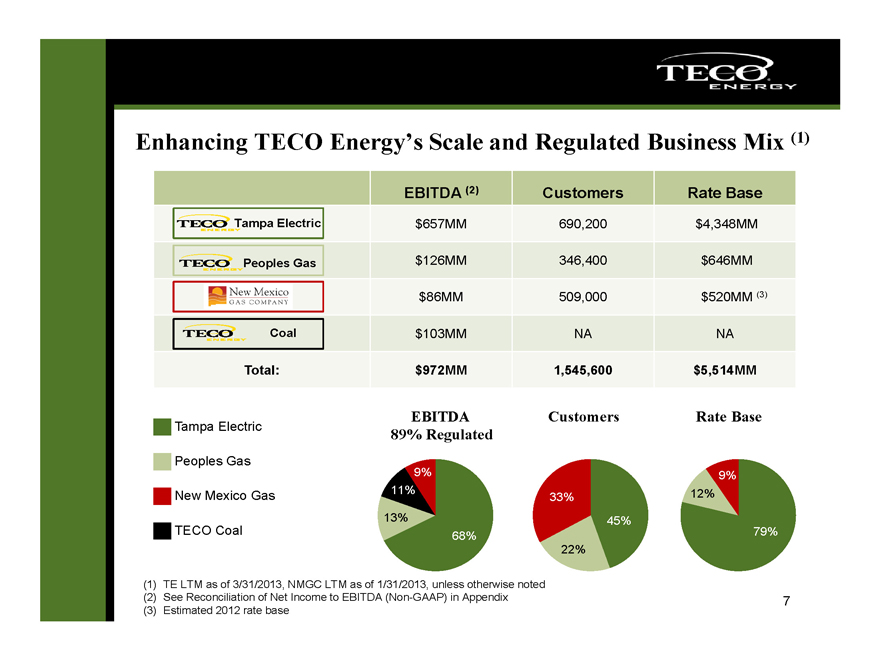

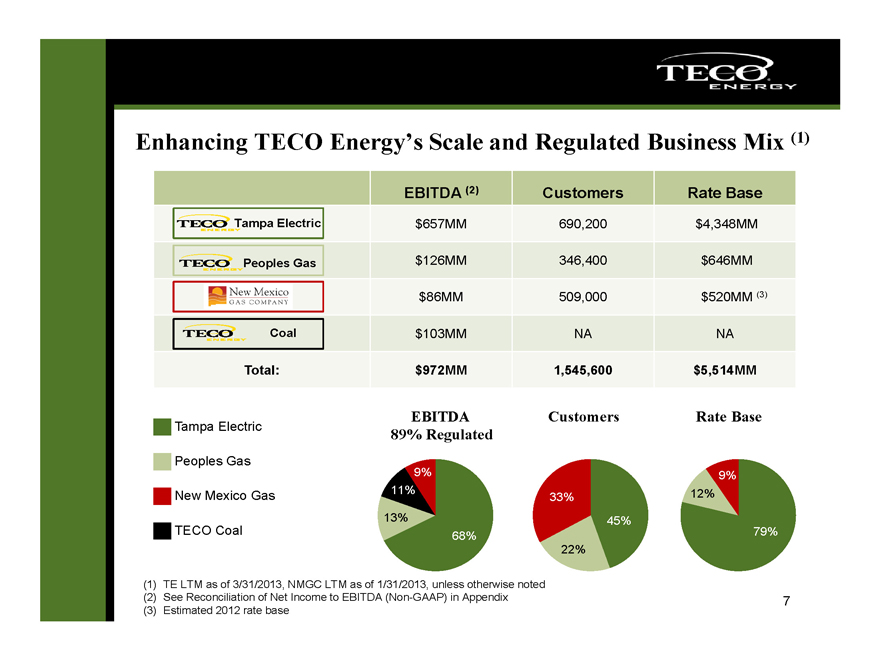

Enhancing TECO Energy’s Scale and Regulated Business Mix (1)

EBITDA (2) Customers Rate Base

TECO ENERGY Tampa Electric $657MM 690,200 $4,348MM

TECO ENERGY Peoples Gas $126MM 346,400 $646MM

New Mexico GAS COMPANY $86MM 509,000 $520MM (3)

TECO ENERGY Coal $103MM NA NA

Total: $972MM 1,545,600 $5,514MM

Tampa Electric

Peoples Gas

New Mexico Gas

TECO Coal

EBITDA 89% Regulated

9% 11% 13% 68%

Customers

33% 45% 22%

Rate Base 9% 12% 79%

(1) TE LTM as of 3/31/2013, NMGC LTM as of 1/31/2013, unless otherwise noted

(2) See Reconciliation of Net Income to EBITDA (Non-GAAP) in Appendix

(3) Estimated 2012 rate base

7

TECO ENERGY

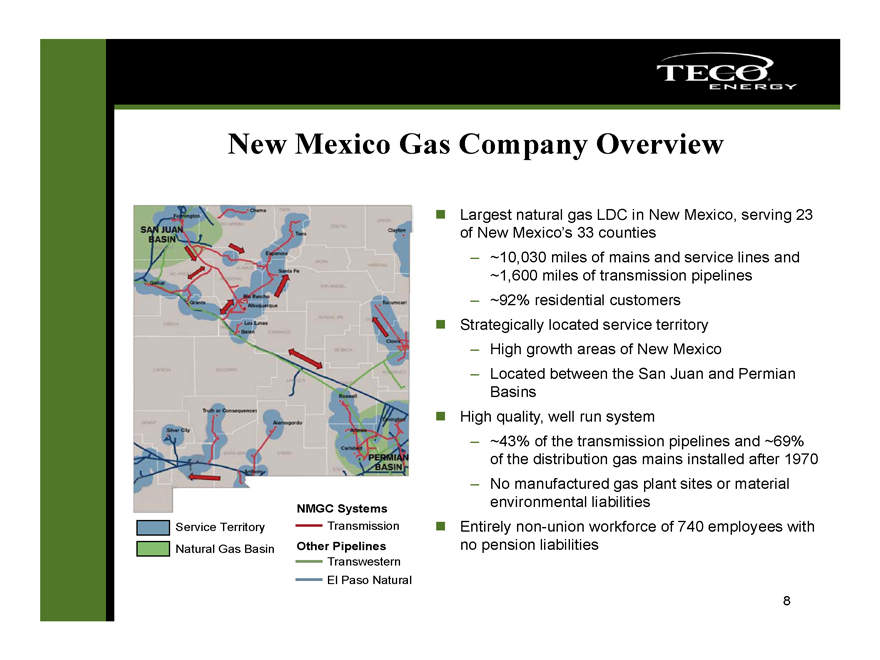

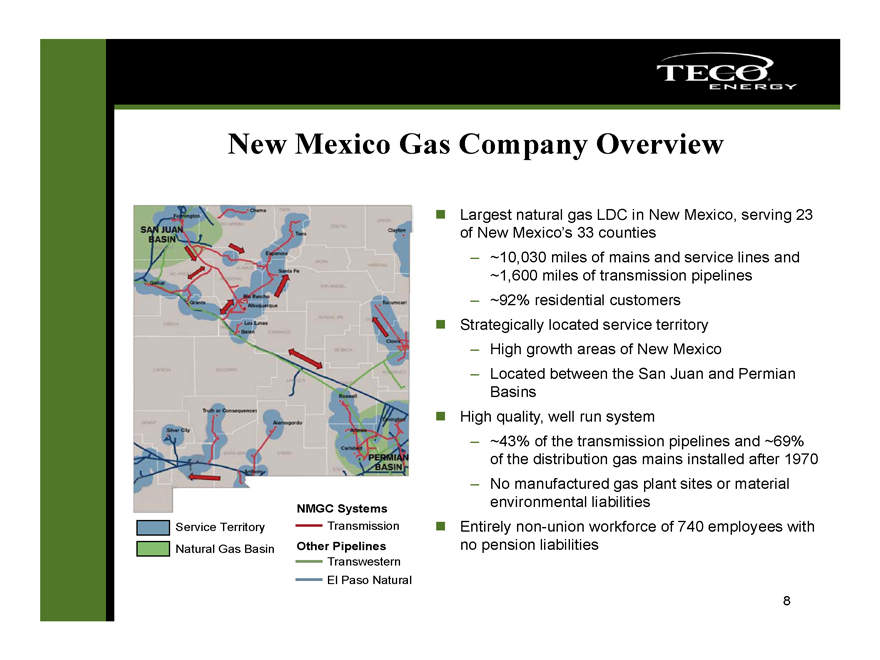

New Mexico Gas Company Overview

Largest natural gas LDC in New Mexico, serving 23 of New Mexico’s 33 counties

- ~10,030 miles of mains and service lines and

~1,600 miles of transmission pipelines

- ~92% residential customers Strategically located service territory

- High growth areas of New Mexico

- Located between the San Juan and Permian Basins High quality, well run system

- ~43% of the transmission pipelines and

~69% of the distribution gas mains installed after 1970

- No manufactured gas plant sites or material environmental liabilities Entirely non-union workforce of 740 employees with no pension liabilities

Service Territory Natural Gas Basin

NMGC Systems

Transmission

Other Pipelines

Transwestern El Paso Natural

8

TECO ENERGY

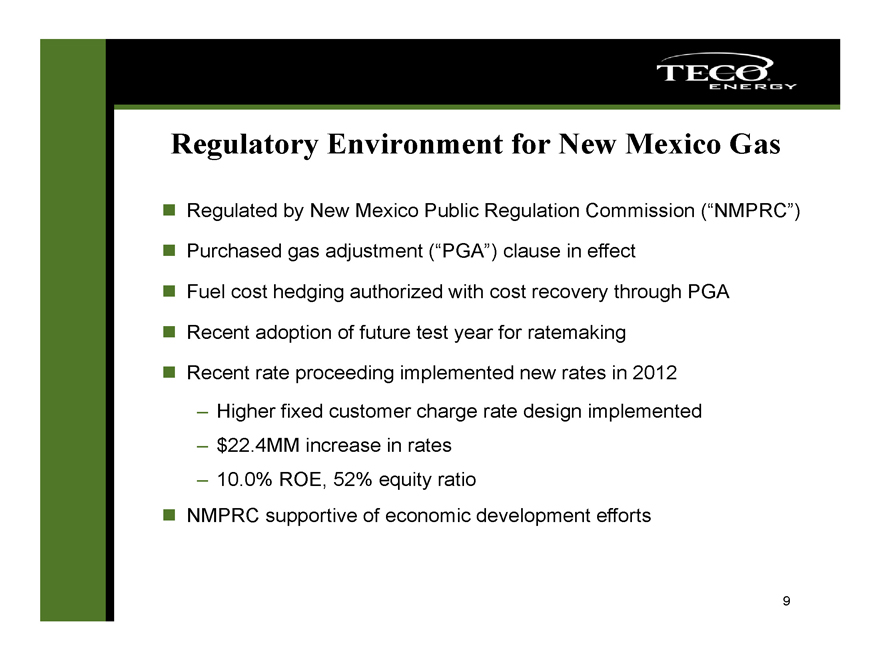

Regulatory Environment for New Mexico Gas

Regulated by New Mexico Public Regulation Commission (“NMPRC”)

Purchased gas adjustment (“PGA”) clause in effect

Fuel cost hedging authorized with cost recovery through PGA

Recent adoption of future test year for ratemaking

Recent rate proceeding implemented new rates in 2012

- Higher fixed customer charge rate design implemented

- $22.4MM increase in rates

- 10.0% ROE, 52% equity ratio

NMPRC supportive of economic development efforts

9

TECO ENERGY

Significant Opportunities for Growth

Residential

Propane conversion

System expansion

Commercial

Commercial and industrial conversions

Economic development to attract new customers

CNG for transportation

Other

Storage opportunities

Midstream development

10

TECO ENERGY

Financing Strategy

Transaction aggregate value of $950MM

Supported by fully committed bridge facility from Morgan Stanley

Purchase price to be financed with:

– Cash at TECO Energy

– TECO Energy common equity

– Assumption of $200MM of senior secured notes at NMGC

– Long-term debt issuances at NMGC

Financing strategy consistent with TECO Energy’s existing credit metrics and NMGC’s existing capital structure

11

TECO ENERGY

Ready to Execute

History of forging constructive regulatory outcomes

- Will work with NMPRC to achieve timely approvals

- Long term owner with focus on customers, regulators, employees, communities and shareholders

Experienced in acquiring and integrating gas LDC operations

- Integration planning well underway

- Strong cultural fit between organizations

Seasoned marketing capabilities transferable to NMGC to deliver growth

Best practices focused organization will drive results at NMGC

12

TECO ENERGY

“I see New Mexico Gas Company as a well-run business with as yet untapped growth potential. We look forward to sharing with New Mexico Gas Company our significant marketing expertise and our commitment to economic development.”

- John Ramil

13

TECO ENERGY

Q&A

14

TECO ENERGY

TECO Energy

15

TECO ENERGY

Appendix

16

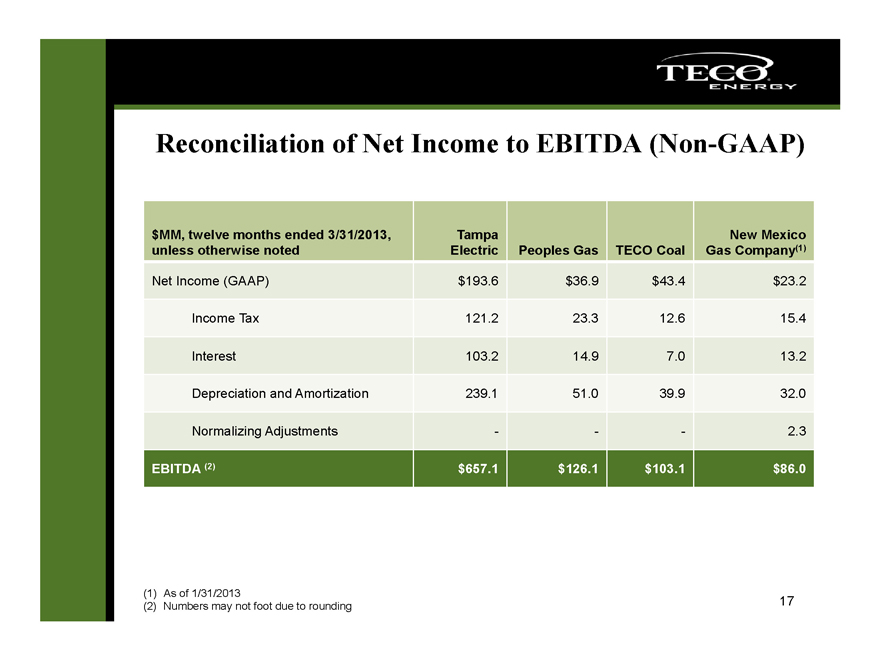

TECO ENERGY

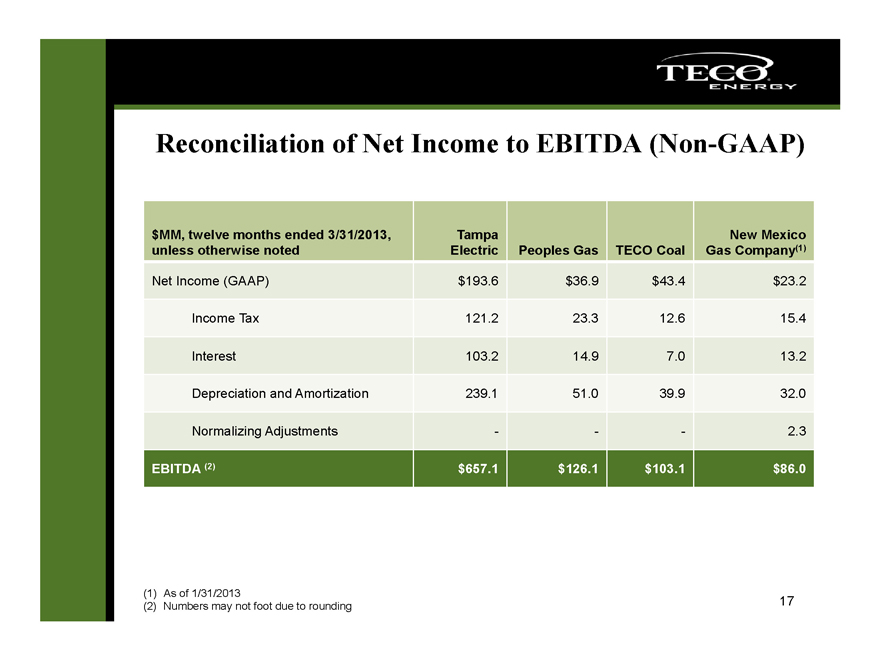

Reconciliation of Net Income to EBITDA (Non-GAAP)

$MM, twelve months ended 3/31/2013, unless otherwise noted

Tampa Electric

Peoples Gas

TECO Coal

New Mexico Gas Company(1)

Net Income (GAAP) $193.6 $36.9 $43.4 $23.2

Income Tax 121.2 23.3 12.6 15.4 Interest 103.2 14.9 7.0 13.2

Depreciation and Amortization 239.1 51.0 39.9 32.0

Normalizing Adjustments - - - 2.3

EBITDA (2) $657.1 $126.1 $103.1 $86.0

(1) As of 1/31/2013

(2) Numbers may not foot due to rounding

17