January 2025 SEI Investor Overview. Notice: The End Notes and disclosure regarding forward-looking statements appearing at the end of this presentation are an integral part of this presentation and should be read in conjunction with the relevant materials. See slides 15, 17 and 18 at the back of this presentation for information related to the financial metrics and defined terms in this presentation. This presentation is not an offer to buy or sell any security.

56 $11B 5,000 $1.6T 8 & 43$6.9T Clients include 8 of top 20 U.S. banks and 43 of top 100 investment managers worldwide AUM/AUAGlobal employees Market capitalization Years since founding Assets processed on our wealth management platforms About SEI. Helping our clients more effectively deploy their capital Endnotes are provided at the end of the presentation

©2024 SEI Headquarters Operating with global reach. U.S. Canada U.K. Ireland India Luxembourg South Africa Offices in: 2023 GLOBAL REVENUE U.S. 85% NON-U.S. 15%

Technology and Operations • Unified front-to-back-office technology infrastructure (SEI Wealth PlatformSM) • End-to-end platform for traditional and alternative investments, including fund administration and investment accounting • Custody/sub-custody processing • Investment processing platforms offered in either SaaS or PaaS modes • Infrastructure, cybersecurity, regulatory, and compliance services Asset Management • $493B of assets under management • Suite of internally-managed and third-party products: ETFs, SMAs, mutual funds, UMAs • More than four decades of experience with manager research, asset allocation, and portfolio construction • Investment expertise in direct indexing, factor-based strategies, alternatives, and tax management • Discretionary investment management for institutions in need of expertise, infrastructure, and enhanced governance Robust capabilities for a diverse base of clients. INVESTMENT MANAGERS BANKS INSTITUTIONS FINANCIAL ADVISORS Endnotes are provided at the end of the presentation

Serving the financial services industry. INVESTMENT ADVISORS INSTITUTIONAL INVESTORS PRIVATE BANKING INVESTMENT MANAGERS Technology & operations Asset management Other revenue Example clients 13% 20%7% Consolidated SEI Assets under management, advisement, & administration % of Total SEI revenue YTD as of Q3 2024 $637M $73M $1,227B $38B $89B $81B $1,576B 33% 18% $858M Example competitors 2% 1% 1%1% Reconciliations and end notes are provided at the end of the presentation 1%

Drivers of future revenue, margin, and earnings growth. Expand Asset Management focus. Expand asset management businesses well beyond current two market niches Deploy excess capital into opportunities well above SEI’s cost of capital Unlock cross-selling and underpenetrated market opportunities Leverage Investment Managers alternatives strength across enterprise, including SEI AccessTM Shared support functions and AI enablement to drive cost leverage and margin enhancement Capitalize on alts momentum. Disciplined capital allocation. Enterprise mindset. Operational excellence.

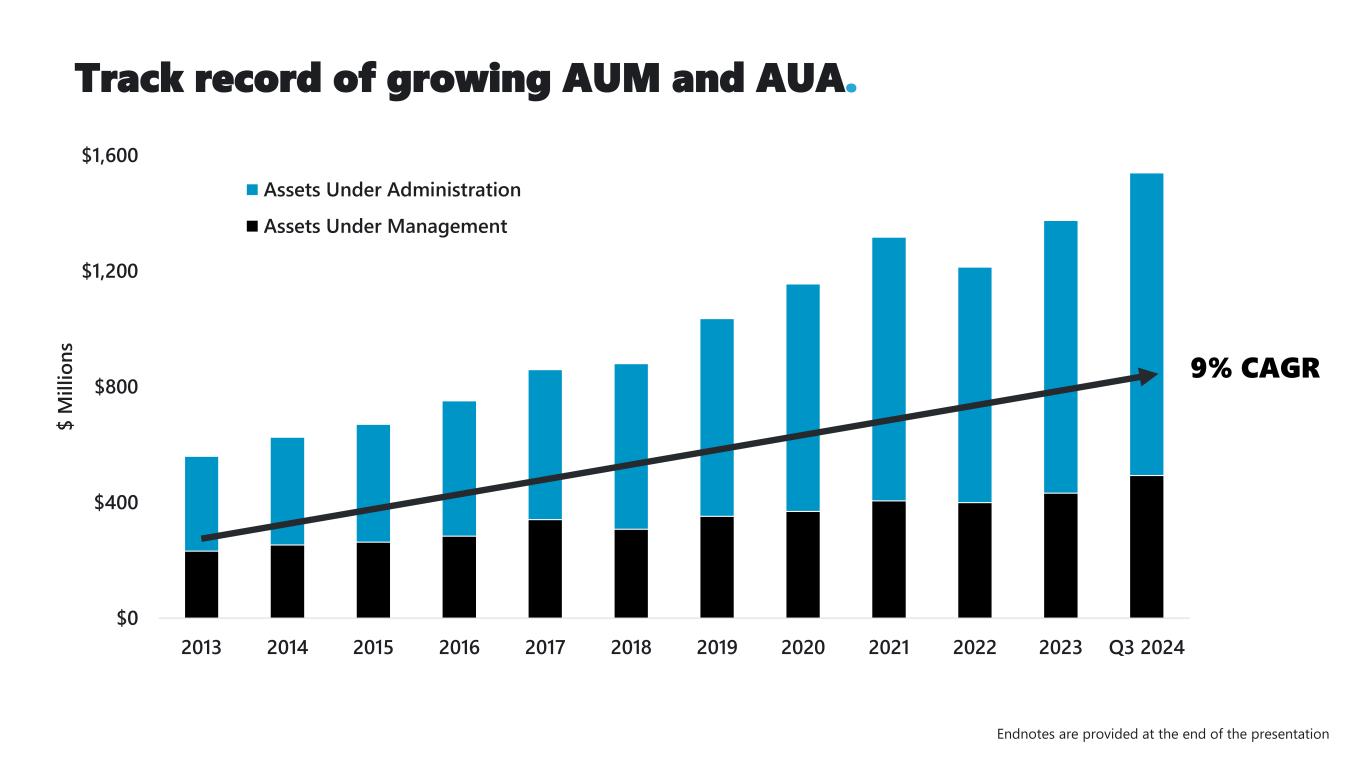

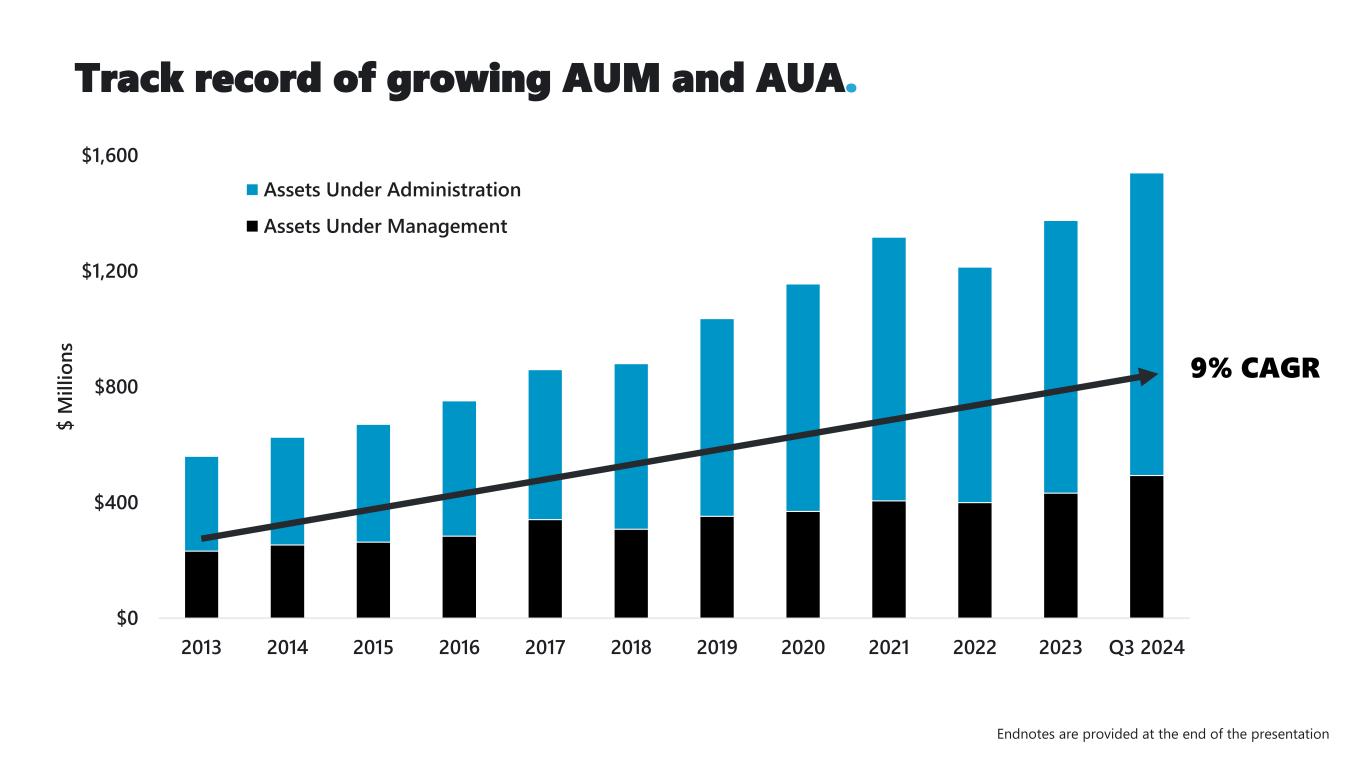

Track record of growing AUM and AUA. Endnotes are provided at the end of the presentation $0 $400 $800 $1,200 $1,600 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q3 2024 $ M il li o n s Assets Under Administration Assets Under Management 9% CAGR

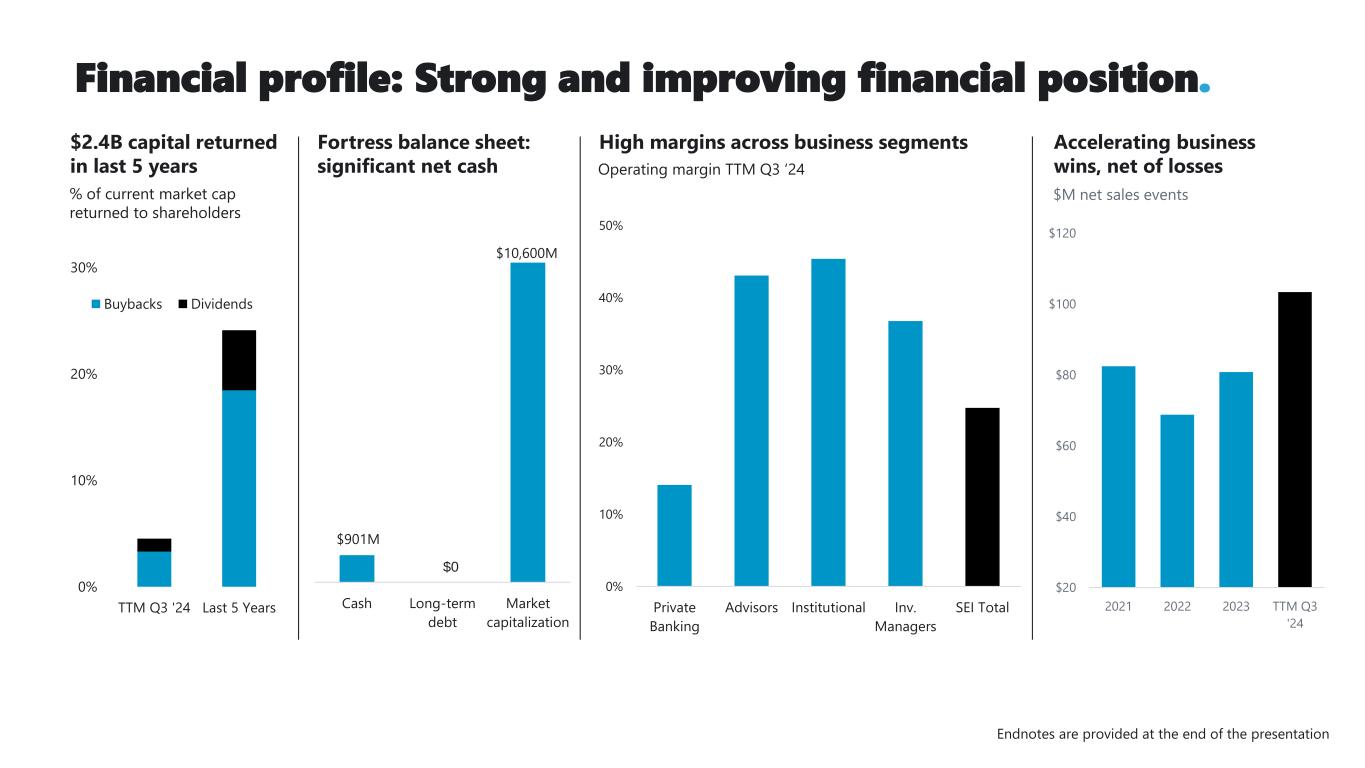

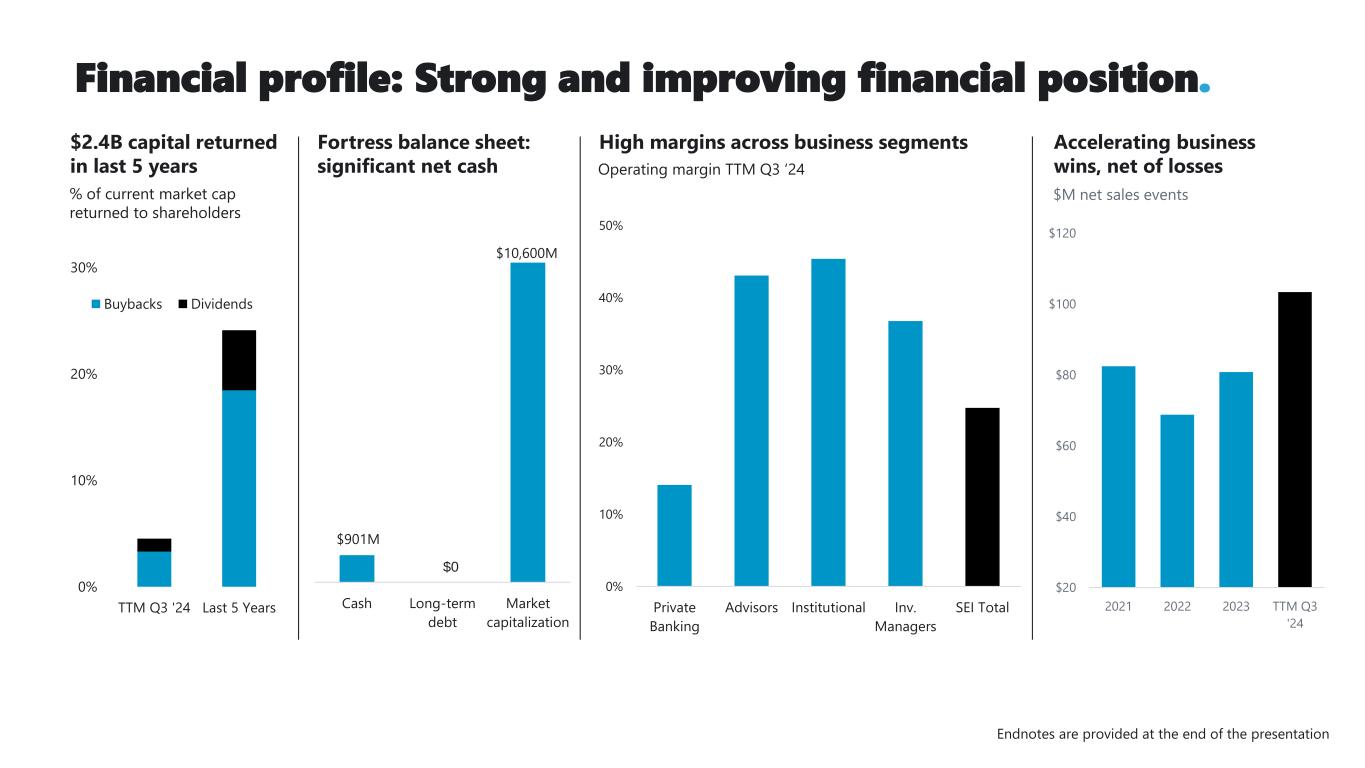

Financial profile: Strong and improving financial position. $2.4B capital returned in last 5 years 0% 10% 20% 30% 40% 50% Private Banking Advisors Institutional Inv. Managers SEI Total 0% 10% 20% 30% TTM Q3 '24 Last 5 Years Buybacks Dividends Cash Long-term debt Market capitalization $901M $0 $10,600M Fortress balance sheet: significant net cash % of current market cap returned to shareholders High margins across business segments Accelerating business wins, net of lossesOperating margin TTM Q3 ‘24 $M net sales events Endnotes are provided at the end of the presentation $20 $40 $60 $80 $100 $120 2021 2022 2023 TTM Q3 '24

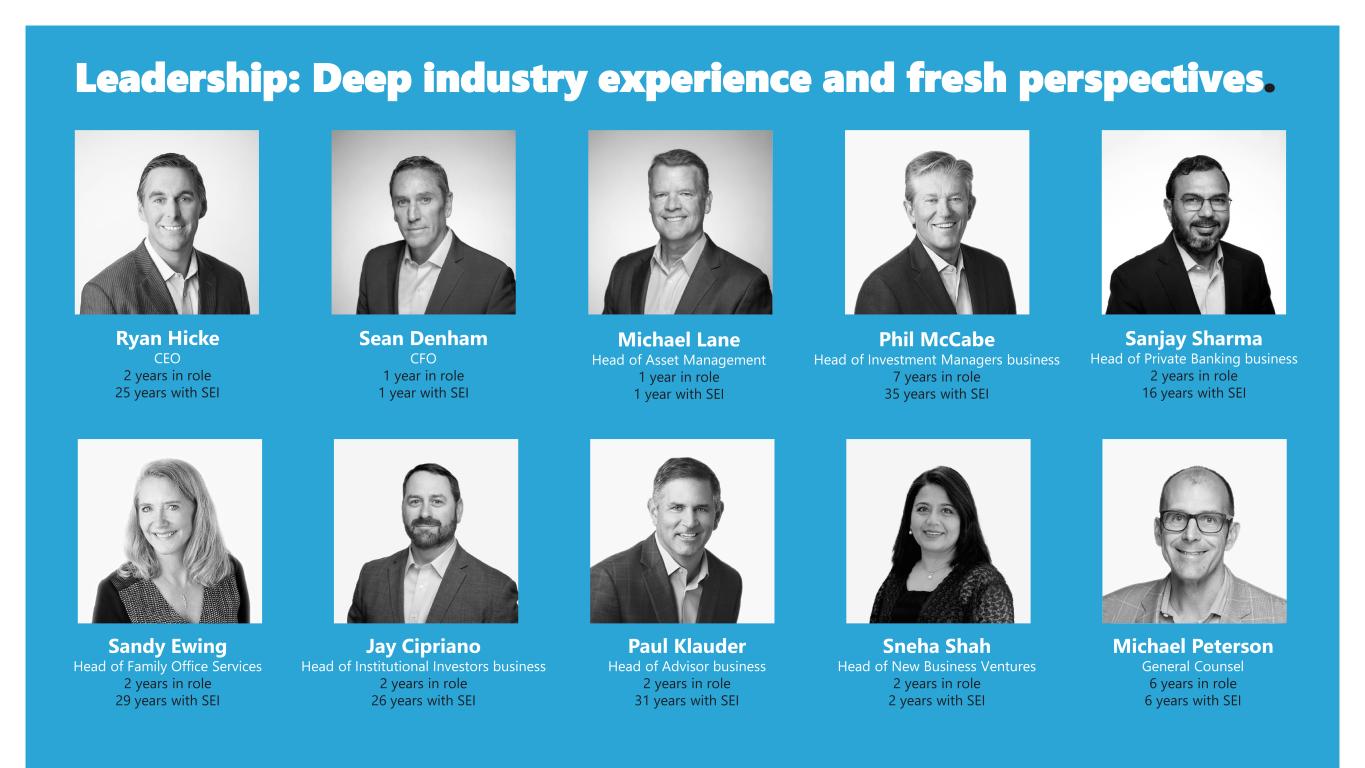

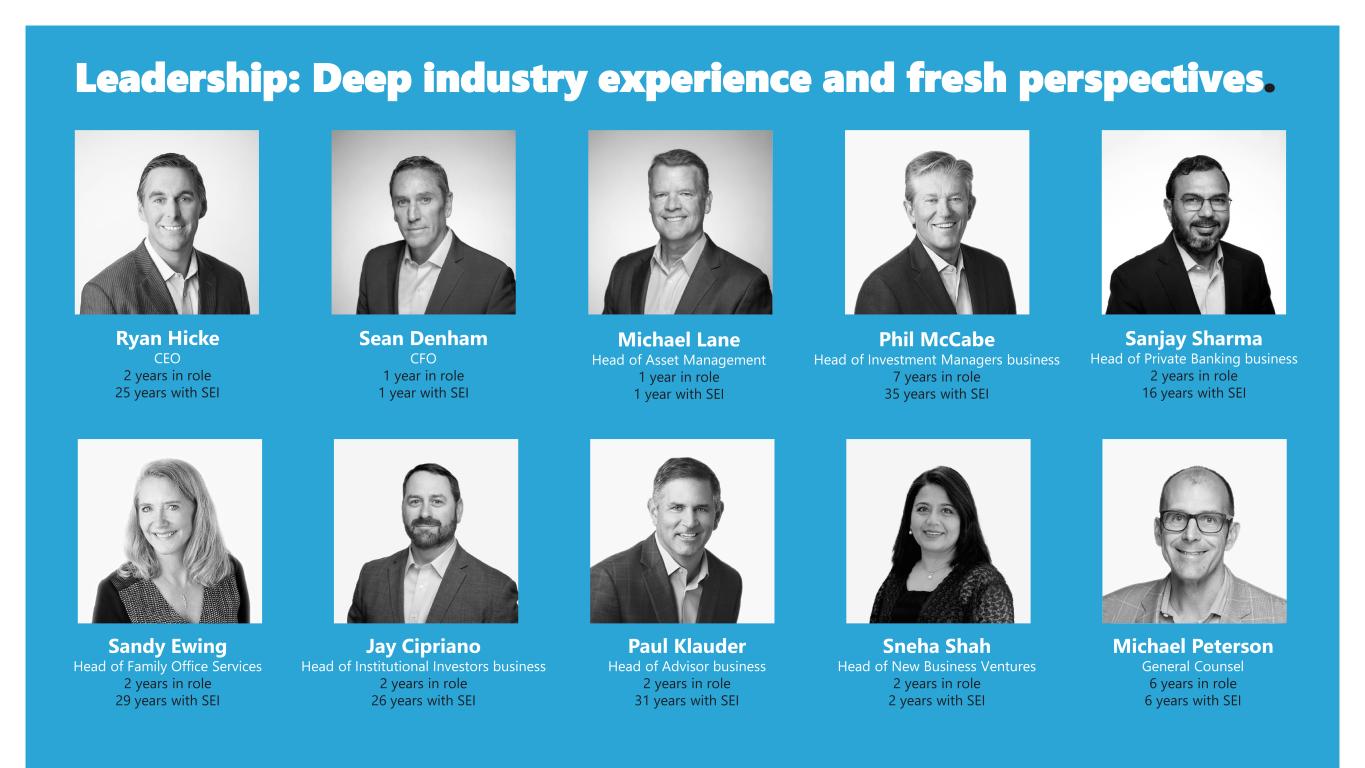

9©2024 SEI Ryan Hicke CEO 2 years in role 25 years with SEI Sean Denham CFO 1 year in role 1 year with SEI Sandy Ewing Head of Family Office Services 2 years in role 29 years with SEI Phil McCabe Head of Investment Managers business 7 years in role 35 years with SEI Sanjay Sharma Head of Private Banking business 2 years in role 16 years with SEI Michael Lane Head of Asset Management 1 year in role 1 year with SEI Jay Cipriano Head of Institutional Investors business 2 years in role 26 years with SEI Paul Klauder Head of Advisor business 2 years in role 31 years with SEI Sneha Shah Head of New Business Ventures 2 years in role 2 years with SEI Michael Peterson General Counsel 6 years in role 6 years with SEI Leadership: Deep industry experience and fresh perspectives.

For institutional investor and financial advisor use only. Not for distribution to general public. Business segment summaries.

Outsourced services: Front-to-back office CRM integration: Investor reporting and analytics Fund administration and accounting Trade settlement Performance measurement Contract terms: 3-5 years (99% renewal rate) Fee structure: Bps charged on assets under administration, plus additional fees for added services. Accounts have minimum fee level to cover base costs. • Comprehensive solution (front-, middle-, and back-office outsourcing) • Best-in-breed, integrated tech platform • Blue-chip, referenceable client base Competitive differentiation Alternatives Traditional Global $0 $50 $100 $150 $200 $250 $300 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 TTM Q3 '24 O p e ra ti n g I n co m e $ M Growth reflects competitive differentiation and industry trends. 2023 Revenue %: Fund Type • Strong and growing investment manager demand for outsourcing non- core services and technology • Rapid growth in alternative investments– a relative strength for SEI • Largest and most complex managers gaining share, driving demand for SEI’s operational capabilities Favorable market trends INVESTMENT MANAGERS Comprehensive investment management operating platform.

0% 4% 8% 12% 16% 2018 2019 2020 2021 2022 2023 TTM Q3 '24 O p e ra ti n g M a rg in SEI operates at a premium price point in the banking segment: • Unified, modern, technology • Purpose-built wealth platform for operational outsourcing • Reputation as industry gold standard Competitive differentiation Operations Asset Management SEI Wealth PlatformSM: Significant client relationships with 77 wealth management organizations in the U.S. and U.K. TRUST 3000®: Serving 40 banks and trust institutions in the U.S. Technology Outsourced middle and back office: • Client & account administration • Cash processing & asset transfer • Portfolio accounting, custody, asset servicing Leverages SEI’s in-house team of investment management experts SEI goes to market with a complete, integrated suite of capabilities Drivers of margin expansion • Improved client retention • Accelerated client conversion: Compressing the time between contract signing and service delivery by focusing on core segments • Solution expansion: Now winning professional services where we previously didn’t participate • Right-sizing organizational cost structure • Tiered basis points on AUM • Transactional processing fees based on volume & complexity • Optional services (custody, performance measurement, etc.) • One-time implementation fees • Average contract length: 5 to 7 years Pricing model * * 2022 excludes 1x client termination fee – see slide 18 for reconciliation PRIVATE BANKING Technology, operations, and asset management for wealth managers.

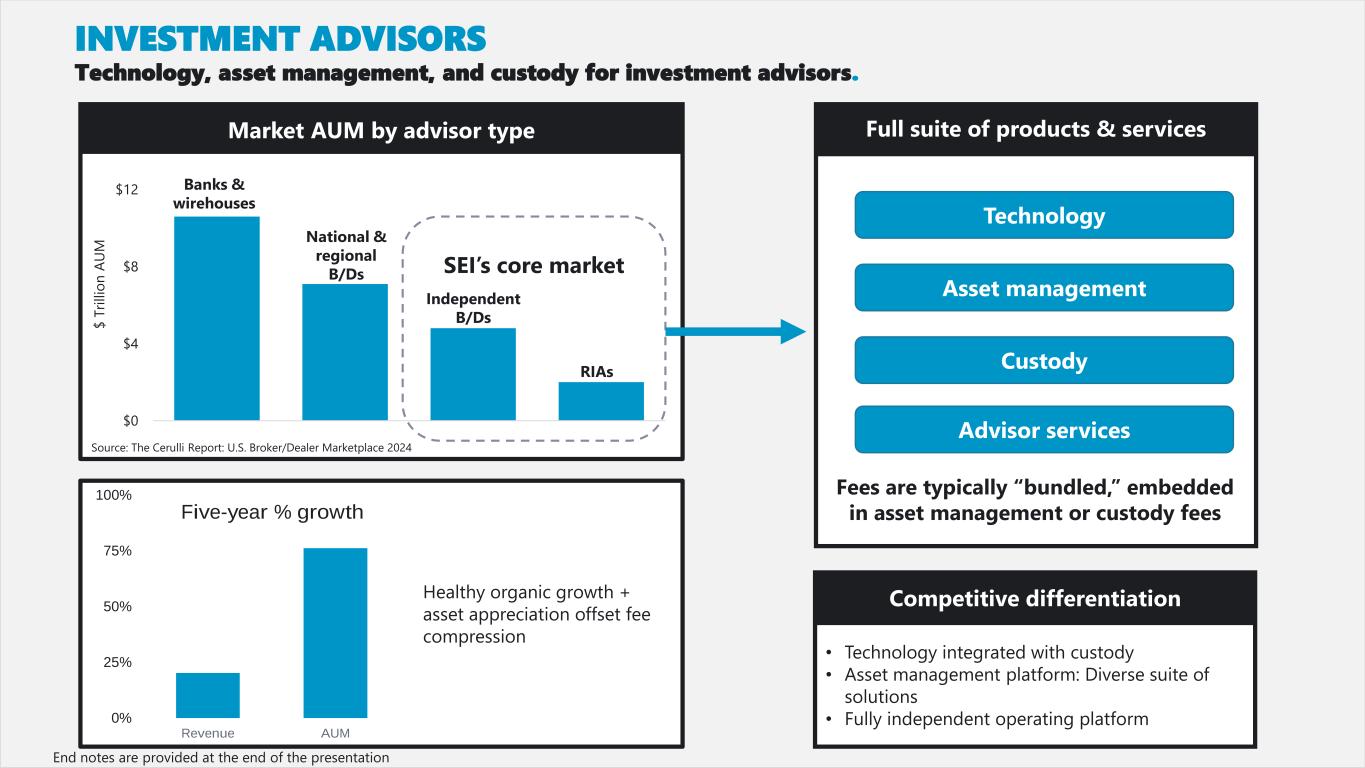

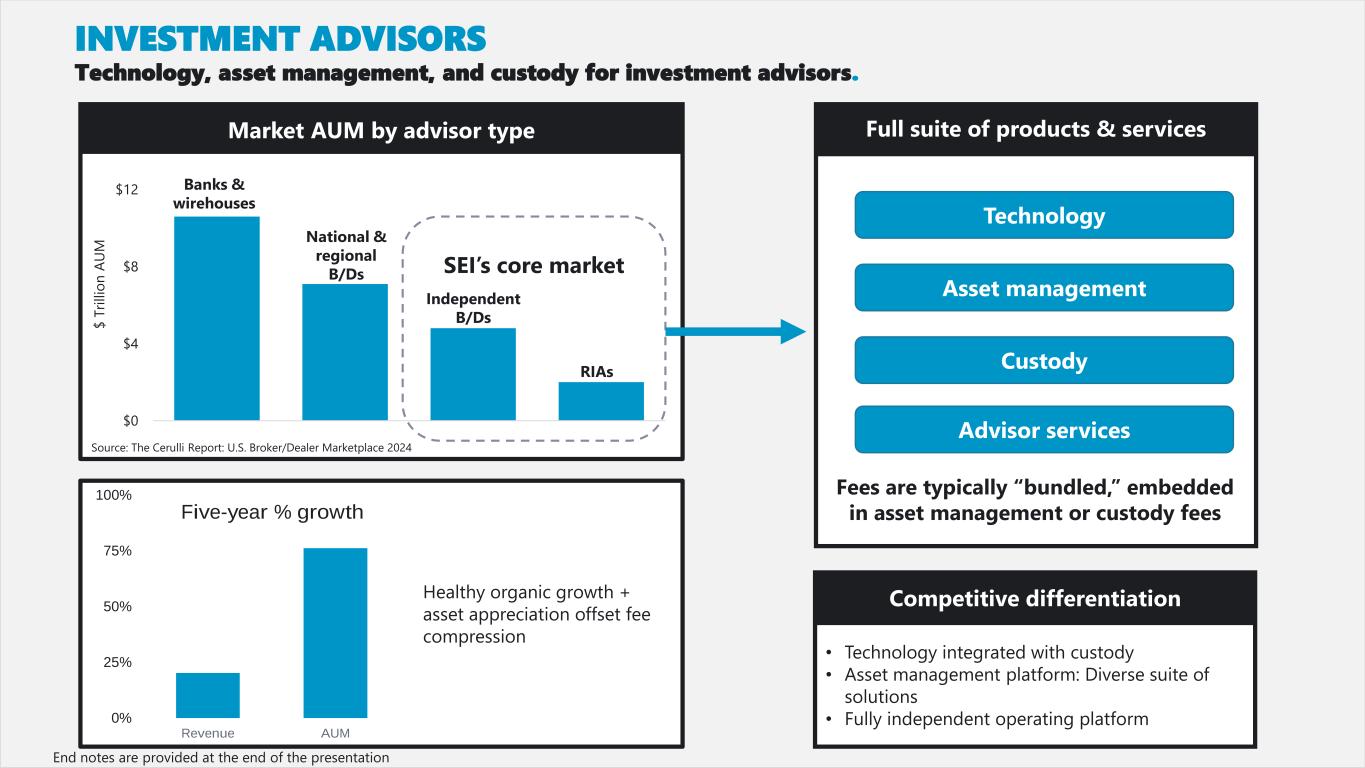

$0 $4 $8 $12 US Bank/Wirehouses Nationa/Regional B/D Independent B/D RIAs $ T ri ll io n A U M Banks & wirehouses National & regional B/Ds Independent B/Ds RIAs SEI’s core market Full suite of products & services Technology Asset management Custody Advisor services Fees are typically “bundled,” embedded in asset management or custody fees • Technology integrated with custody • Asset management platform: Diverse suite of solutions • Fully independent operating platform Competitive differentiation 0% 25% 50% 75% 100% Revenue AUM Five-year % growth Healthy organic growth + asset appreciation offset fee compression Market AUM by advisor type INVESTMENT ADVISORS Technology, asset management, and custody for investment advisors. Source: The Cerulli Report: U.S. Broker/Dealer Marketplace 2024 End notes are provided at the end of the presentation

• >30-year track record • Investment options in difficult-to-access managers (mostly alternatives) • Manager research capabilities • Mitigate pain points with SEI’s three pillars of asset management, operations, and technology Competitive differentiation Unbundled OCIO Asset management: Custom traditional & alternative solutions to meet unique investor needs Data, tech, & services: Data, analytics, and services to make internal client teams more effective Pricing: Bps applied to AUM. Data & analytics is subscription-based Outsourced CIO (OCIO) Discretionary investment management for institutions in need of advice, expertise, infrastructure and governance Pricing: Bps applied to AUM, customized based on client size $0 $35 $70 $105 2019 Q3 2024 $ B o f A U M Corporate DB Clients Clients ex-Corporate DB Mitigating structural headwinds Corporate DB Healthcare Union/Gov't Non-Profits Other Annualized revenue % by institution type INSTITUTIONAL INVESTORS Offering a continuum of tailored outsourced CIO services. Two delivery solutions Corporate defined benefit plan terminations, driven by asset returns and higher rates, have pressured corporate DB business SEI has increased focus on non- corporate DB investors; partially offsetting corporate DB plan terminations Mitigating headwinds End notes are provided at the end of the presentation

15©2024 SEI This communication, as well as the presentations and documents referenced in this communication, contain forward-looking statements within the meaning or the rules and regulations of the Securities and Exchange Commission that are based on management’s current expectations and assumptions that involve risks and uncertainties, many of which are beyond our control or are subject to change. Although we believe the assumptions upon which we base our forward- looking statements are reasonable, they could be inaccurate. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the results of SEI Investments and its consolidated subsidiaries may differ materially from those expressed or implied by such forward-looking statements and assumptions. In some cases you may be able to identify forward-looking statements by terminology, such as “may,” “will,” “expect,” “believe” and “continue” or “appear.” All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including, but not limited to, statements as to: • the market trends that we believe exist and the opportunities that these conditions may afford us, • whether we turn challenges into opportunities, meaningfully engage clients and employees, drive mutual growth, or leverage our financial strength, • our ability to expand our relationships and revenue opportunities with new and existing clients, • the margins that our businesses may generate and the degree to which our reported margins will decline, increase or normalize, • the strategic initiatives and business segments that we will pursue and those in which we will invest, • our commitment to driving greater topline revenue growth and the success of such commitment, • the success, if any, of the sales and strategic initiatives we pursue, • the competitive differentiators of our business units, • whether we will focus on maintaining and accelerating growth in existing businesses, expanding our focus on new growth engines, or reinvigorating our culture and talent strategies across the company, • the size of the markets and opportunities we will pursue, • the organic and inorganic opportunities that will drive our growth, • the degree to which we will be able to successfully integrate the assets or businesses that we may acquire, • the strength of our balance sheet, • the degree to which our current practices with respect to stock-buybacks and dividend payments will continue, and • the success and benefits of our strategic investments. Some of the risks and important factors that could cause actual results to differ from those described in our forward-looking statements can be found in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended Dec. 31, 2023, filed with the Securities and Exchange Commission. The Company does not undertake to update the forward- looking statements to reflect the impact of circumstances or events that may arise after the date of forward-looking statements. Forward-looking statements.

For institutional investor and financial advisor use only. Not for distribution to general public. End notes and reconciliation tables.

©2024 SEI End Notes Slide 2: Market capitalization as of Dec. 31, 2024 per FactSet. As of Sept. 30, 2024, through its subsidiaries and partnerships in which the company has a significant interest, SEI manages, advises, or administers approximately $1.6 trillion in hedge, private equity, mutual fund, and pooled or separately managed assets. Assets processed on wealth management platforms is as of Dec. 31, 2023. Number of employees is approximate and is as of Sept. 30, 2024. Bank client statistics are as of Sept. 30, 2024 and collected by American Bankers Association. Investment manager client statistics are as of Dec. 31, 2023 and based on Pensions & Investments’ “Largest Money Managers”. Slide 4: Assets under management are total assets of our clients or their customers invested in our equity and fixed-income investment programs, collective trust fund programs, and liquidity funds for which we provide asset management services through our subsidiaries and partnerships in which we have a significant interest. Collective trust fund program average assets are included in assets under management since SEI is the trustee. Fees earned on this product are less than fees earned on customized asset management programs. Assets Under Management balance as of Sept. 30, 2024. Slide 5: As of Sept. 30, 2024, through its subsidiaries and partnerships in which the company has a significant interest, SEI manages, advises or administers approximately $1.6 trillion in hedge, private equity, mutual fund and pooled or separately managed assets. Slide 7: As of Sept. 30, 2024, through its subsidiaries and partnerships in which the company has a significant interest, SEI manages, advises or administers approximately $1.6 trillion in hedge, private equity, mutual fund and pooled or separately managed assets. Slide 8: Market capitalization as of Dec. 31, 2024 per FactSet. Balance sheet cash and debt balances as of Sept. 30, 2024. Slide 13: Revenue growth rate from the year-ended 2018 to the trailing-twelve-months ended September 30, 2024. AUM growth rate from Dec. 31, 2018 to Sept. 30, 2024. Slide 14: Revenue by institution type reflects annualized rate for Q3 2024.

©2024 SEI Reconciliations Slide 5: The following tables provide additional information pertaining to our revenues disaggregated by major product line for each of the Company’s business segments for the year-to- date September 30, 2024. $ in ‘000. Slide 12: Reconciliation of GAAP Operating Profit Margin for Private Banks segment in fiscal 2022 to adjusted metric excluding a client termination fee. $ in ‘000. Private Investment Institutional Investment Investments in Banks Advisors Investors Managers New Business Total Investment management fees from pooled investment products 99,913 176,368 36,185 273 1,323 314,062 Investment management fees from investment management agreements 3,229 144,203 162,046 - 13,663 323,141 Asset Management Revenue 103,142 320,571 198,231 273 14,986 637,203 Investment operations fees 1,650 30,397 - 511,203 3,561 546,811 Investment processing fees - PaaS 214,001 4,109 1,081 3,772 26 222,989 Investment processing fees - SaaS 66,065 - 6,335 19 15,459 87,878 Investment Technology & Operations 281,716 34,506 7,416 514,994 19,046 857,678 Professional services fees 14,042 - - 2,749 2,337 19,128 Account fees and other 2,372 15,064 9,264 19,112 8,140 53,952 Other revenue 16,414 15,064 9,264 21,861 10,477 73,080 Total Revenues $401,272 $ 370,141 $ 214,911 $ 537,128 $ 44,509 $1,567,961