SEI Investments Company (NASDAQ: SEIC) Q4 2024 Earnings Presentation

This presentation contains forward-looking statements within the meaning or the rules and regulations of the Securities and Exchange Commission. In some cases you can identify forward-looking statements by terminology, such as "may," "will," "expect," "believe," ”remain” and "continue" or "appear." Our forward-looking statements include our current expectations as to: • our ability to maintain our sales momentum; • the strength of our core businesses; • our strategic priorities and the strength of our execution against these priorities; • our investment priorities; • the demand for our products and services, including alternative investment products, the outsourcing services of our Investment Managers business, Data Cloud and Integration Transition Services; • the degree to which, if any, new sales events will result in revenue; • the duration and extent of our competitive advantages and differentiations; • the headwinds that may affect our businesses; • the opportunities available to us for growth and to gain share in the markets in which we currently, and seek to, participate; • the performance of our various businesses, including the margins and profitability of such businesses and the events that may affect the margins, profitability and growth prospects of these businesses; • the benefits, if any, that we or our clients may derive from acquired assets; • the strength and elements of our balance sheet; • the strength of our pipelines and the momentum that each may have; • the benefits of our expense management efforts and our focus on these efforts; • our run rate and the stability of the elements of that run rate; • the effects of any change to the federal funds rate on our businesses or products and the revenue associated with these items; • the amount of revenue we may generate from the cash balances in our Integrated Cash Program, the degree to which the revenue we generate will moderate and the potential causation of this moderation, if any; • the amount, if any, of management fees that may be received by LSV and the contribution of such management fees to our equity income; and • the market dynamics affecting our businesses. You should not place undue reliance on our forward-looking statements, as they are based on the current beliefs and expectations of our management and subject to significant risks and uncertainties, many of which are beyond our control or are subject to change. Although we believe the assumptions upon which we base our forward-looking statements are reasonable, they could be inaccurate. Some of the risks and important factors that could cause actual results to differ from those described in our forward- looking statements can be found in the "Risk Factors" section of our Annual Report on Form 10-K for the year ended Dec. 31, 2023, filed with the Securities and Exchange Commission. Past performance does not guarantee future results. Safe Harbor Statement 2 SEI Earnings PresentationQ4 2024

Q4 2024 vs. Q4 '23 vs. Q3 '24 Revenues 557.2 14.9% 3.7% Operating Income 145.5 43.1% 1.2% Net Income 155.8 29.0% 0.6% EPS $1.19 30.8% 0.0% Net Sales Events 38.2 178.6% -17.7% Operating Margin 26.1% 5.1% -0.6% Assets Under Management ($B) 476.7 10.4% -3.4% Administration, Platform & Advisement ($B) 1,091.7 12.6% 0.8% % Change Q4 2024 highlights. SEI Earnings PresentationQ4 2024 Second consecutive quarter in which SEI has realized significant growth in net sales, revenue, and earnings Net sales events reflect second highest quarter in SEI history, matched only by Q3 2024 Combined client assets are nearly flat with prior quarter despite modest market valuation pressure in Q4 SEI has made meaningful and consistent progress over the last 18 months and remains focused on maintaining and growing this momentum $ in millions except EPS; AUM; and Assets under administration, platform-only, and under advisement Operating margin % change represents improvement or decline in margin rate vs. prior period Q4 2024 reflects strong continued momentum Q4 2024 Financial Snapshot 3

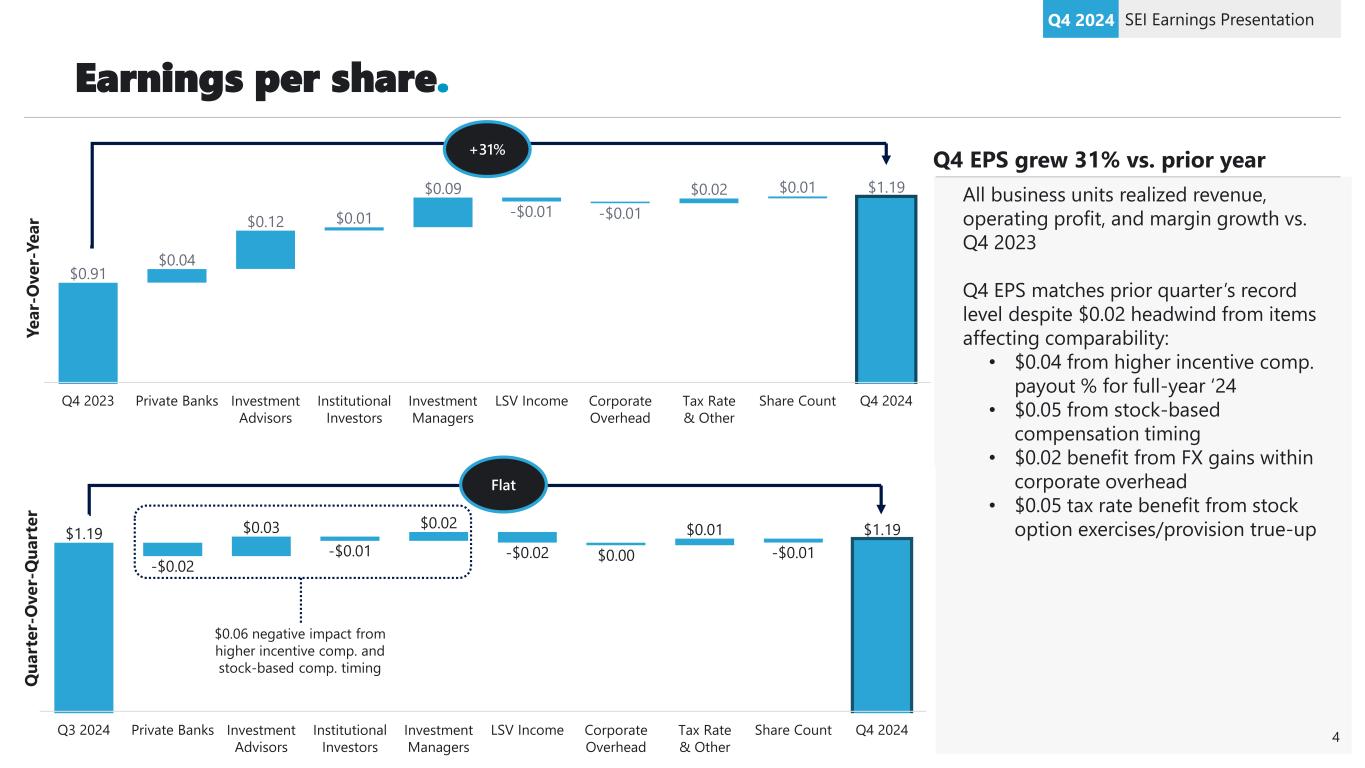

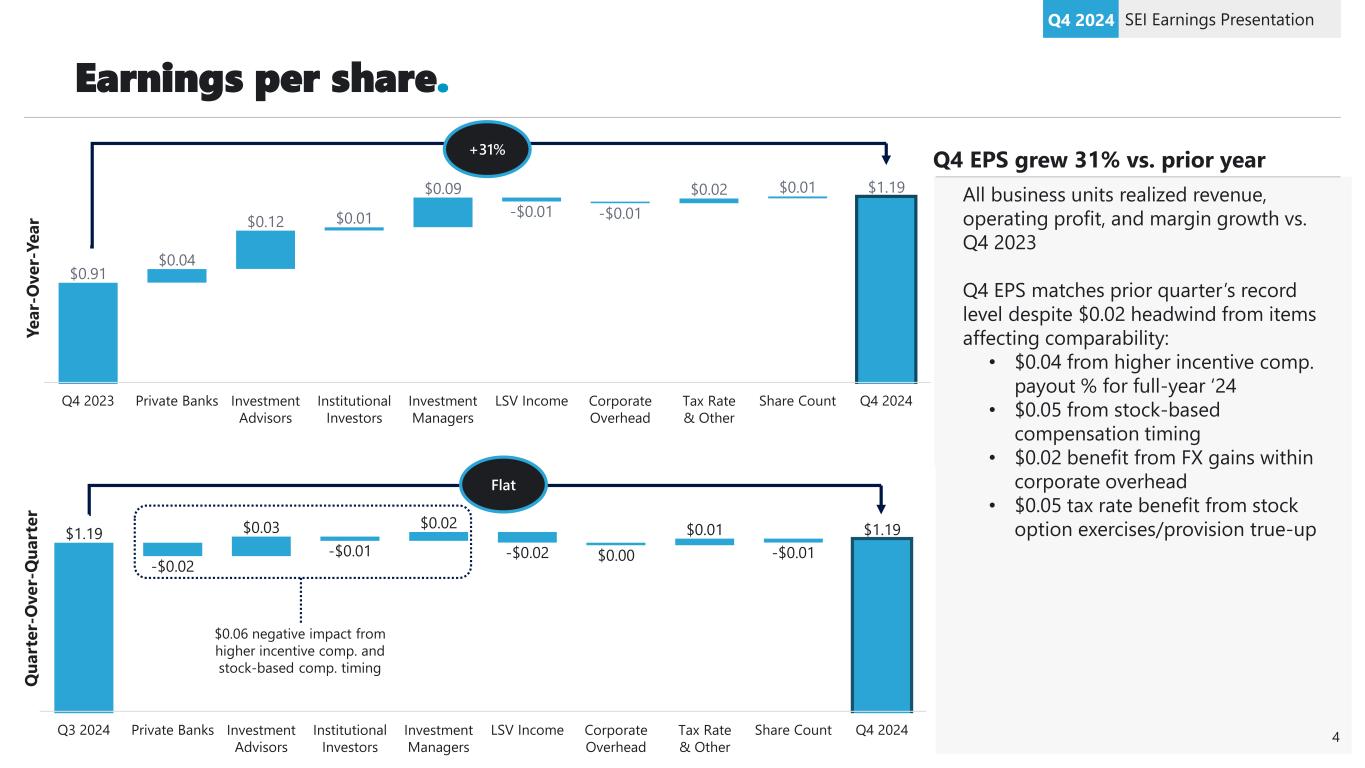

Earnings per share. SEI Earnings PresentationQ4 2024 All business units realized revenue, operating profit, and margin growth vs. Q4 2023 Q4 EPS matches prior quarter’s record level despite $0.02 headwind from items affecting comparability: • $0.04 from higher incentive comp. payout % for full-year ‘24 • $0.05 from stock-based compensation timing • $0.02 benefit from FX gains within corporate overhead • $0.05 tax rate benefit from stock option exercises/provision true-up Q4 EPS grew 31% vs. prior year $0.91 $0.04 $0.12 $0.01 $0.09 -$0.01 -$0.01 $0.02 $0.01 $1.19 Q4 2023 Private Banks Investment Advisors Institutional Investors Investment Managers LSV Income Corporate Overhead Tax Rate & Other Share Count Q4 2024 +31% $1.19 -$0.02 $0.03 -$0.01 $0.02 -$0.02 $0.00 $0.01 -$0.01 $1.19 Q3 2024 Private Banks Investment Advisors Institutional Investors Investment Managers LSV Income Corporate Overhead Tax Rate & Other Share Count Q4 2024 Flat Y e a r- O v e r- Y e a r Q u a rt e r- O v e r- Q u a rt e r $0.06 negative impact from higher incentive comp. and stock-based comp. timing 4

Business unit performance. SEI Earnings PresentationQ4 2024 Revenue ($M) Private Banking growth supported by recent sales events, client retention and conversion of client backlog Investment Managers growth driven by continued sales event growth and client cross-selling Advisor growth driven by Integrated Cash Program ($21M revenue), a $10.5M increase over Q3 Modest Institutional revenue growth in Q4 (+1%) represents improvement vs. H1 2024 (-4%) due to focus on offsetting Corporate DB plan termination headwinds Business unit highlightsOperating profit ($M) $123 $169 $110 $70 $139 $185 $127 $72 $140 $191 $139 $71 Private Banking Investment Managers Investment Advisors Institutional Investors Q4 2023 Q3 2024 Q4 2024 $13 $58 $43 $31 $24 $70 $57 $34 $20 $73 $62 $32 Private Banking Investment Managers Investment Advisors Institutional Investors Q4 2023 Q3 2024 Q4 2024 +14% +13% +27% +1% +56% +26% +47% +6% 5

Operating margins. SEI Earnings PresentationQ4 2024 -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% Private Banking Investment Managers Investment Advisors Institutional Investors Quarter-Over-Quarter Year-Over-Year Business unit margin changes HighlightsConsolidated operating margin 10.0% 20.0% 30.0% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Management is pleased with Q4 margin performance, vs. both prior year and Q3 2024 SEI’s consolidated operating margin declined by 70bps from Q3 2024, driven by items affecting comparability, which had a 210bps impact on Q4 2024 Absent these items, SEI’s consolidated margin would have increased on both a year-over-year AND sequential basis 6

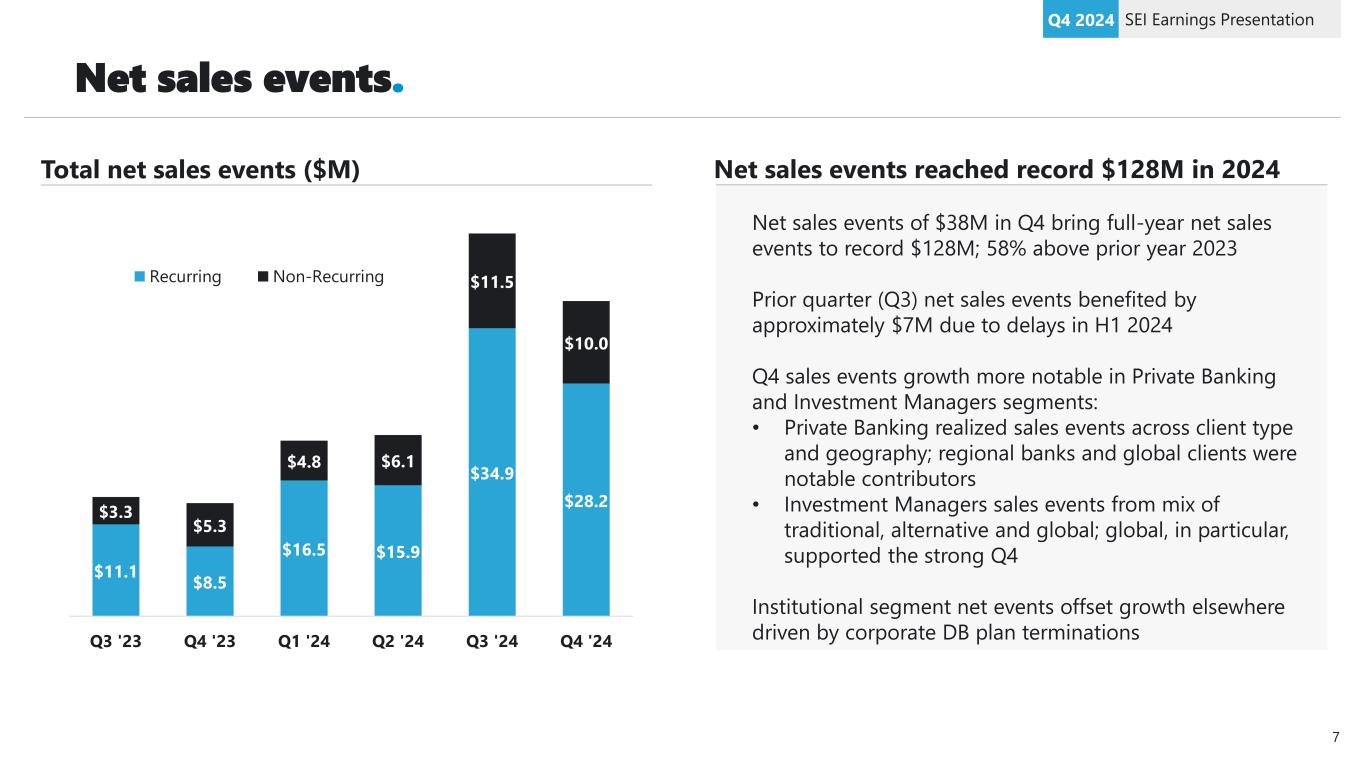

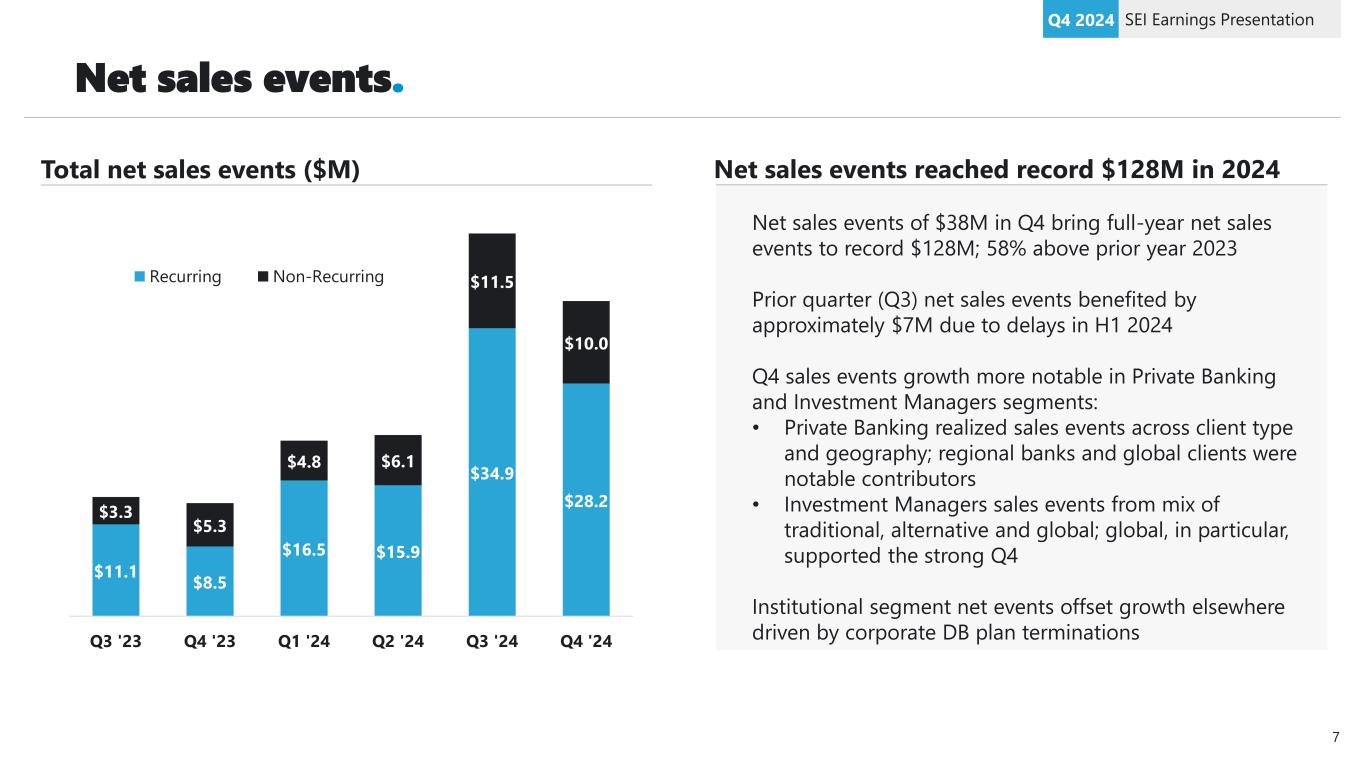

Net sales events. SEI Earnings PresentationQ4 2024 $11.1 $8.5 $16.5 $15.9 $34.9 $28.2 $3.3 $5.3 $4.8 $6.1 $11.5 $10.0 Q3 '23 Q4 '23 Q1 '24 Q2 '24 Q3 '24 Q4 '24 Recurring Non-Recurring Total net sales events ($M) Net sales events of $38M in Q4 bring full-year net sales events to record $128M; 58% above prior year 2023 Prior quarter (Q3) net sales events benefited by approximately $7M due to delays in H1 2024 Q4 sales events growth more notable in Private Banking and Investment Managers segments: • Private Banking realized sales events across client type and geography; regional banks and global clients were notable contributors • Investment Managers sales events from mix of traditional, alternative and global; global, in particular, supported the strong Q4 Institutional segment net events offset growth elsewhere driven by corporate DB plan terminations Net sales events reached record $128M in 2024 7

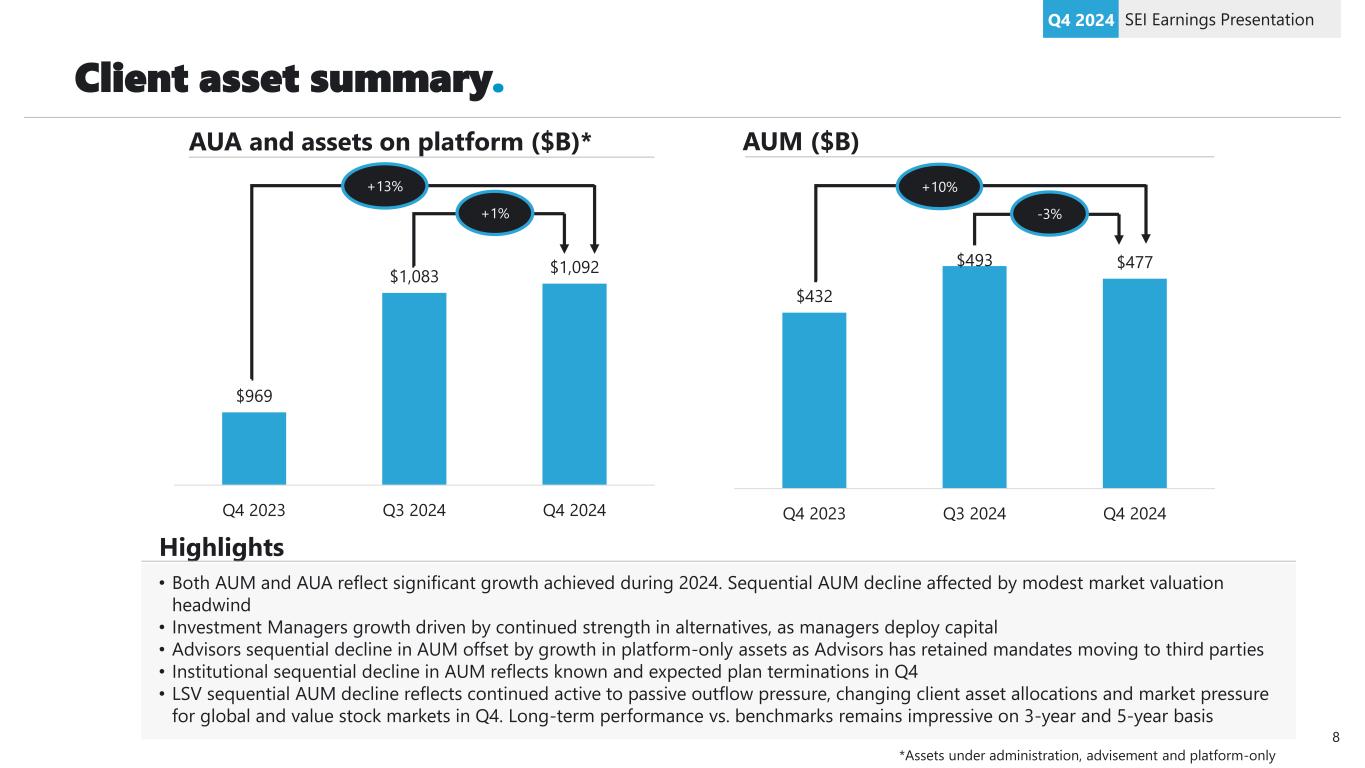

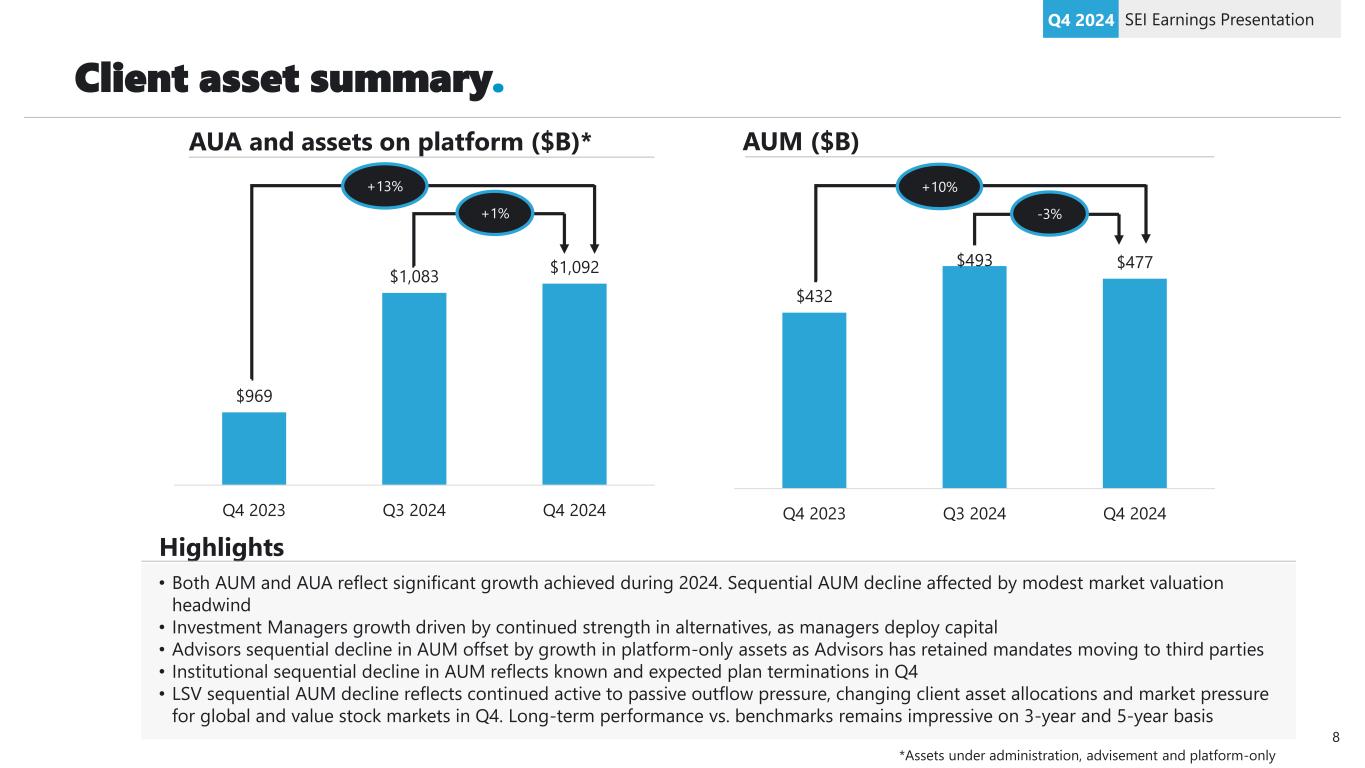

Client asset summary. SEI Earnings PresentationQ4 2024 AUA and assets on platform ($B)* AUM ($B) $969 $1,083 $1,092 Q4 2023 Q3 2024 Q4 2024 +13% +1% $432 $493 $477 Q4 2023 Q3 2024 Q4 2024 +10% -3% Highlights • Both AUM and AUA reflect significant growth achieved during 2024. Sequential AUM decline affected by modest market valuation headwind • Investment Managers growth driven by continued strength in alternatives, as managers deploy capital • Advisors sequential decline in AUM offset by growth in platform-only assets as Advisors has retained mandates moving to third parties • Institutional sequential decline in AUM reflects known and expected plan terminations in Q4 • LSV sequential AUM decline reflects continued active to passive outflow pressure, changing client asset allocations and market pressure for global and value stock markets in Q4. Long-term performance vs. benchmarks remains impressive on 3-year and 5-year basis *Assets under administration, advisement and platform-only 8

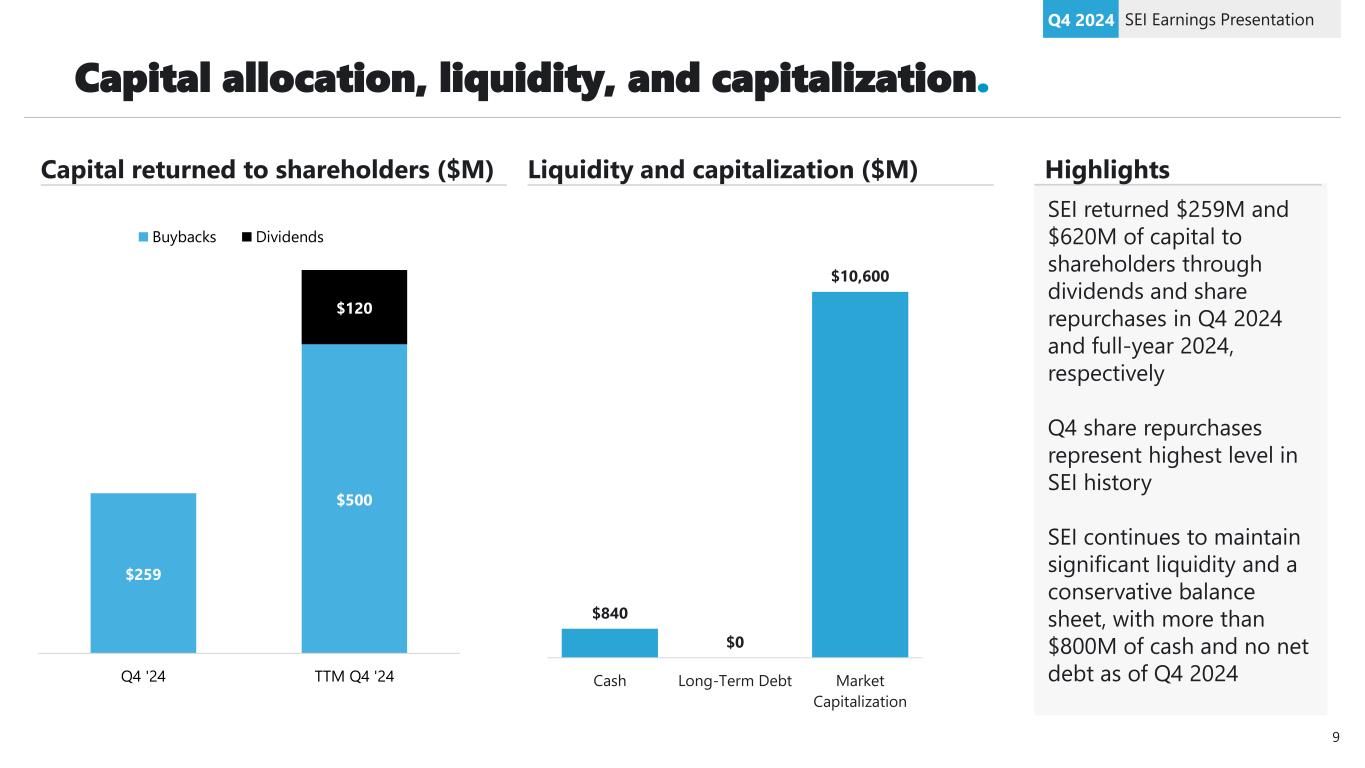

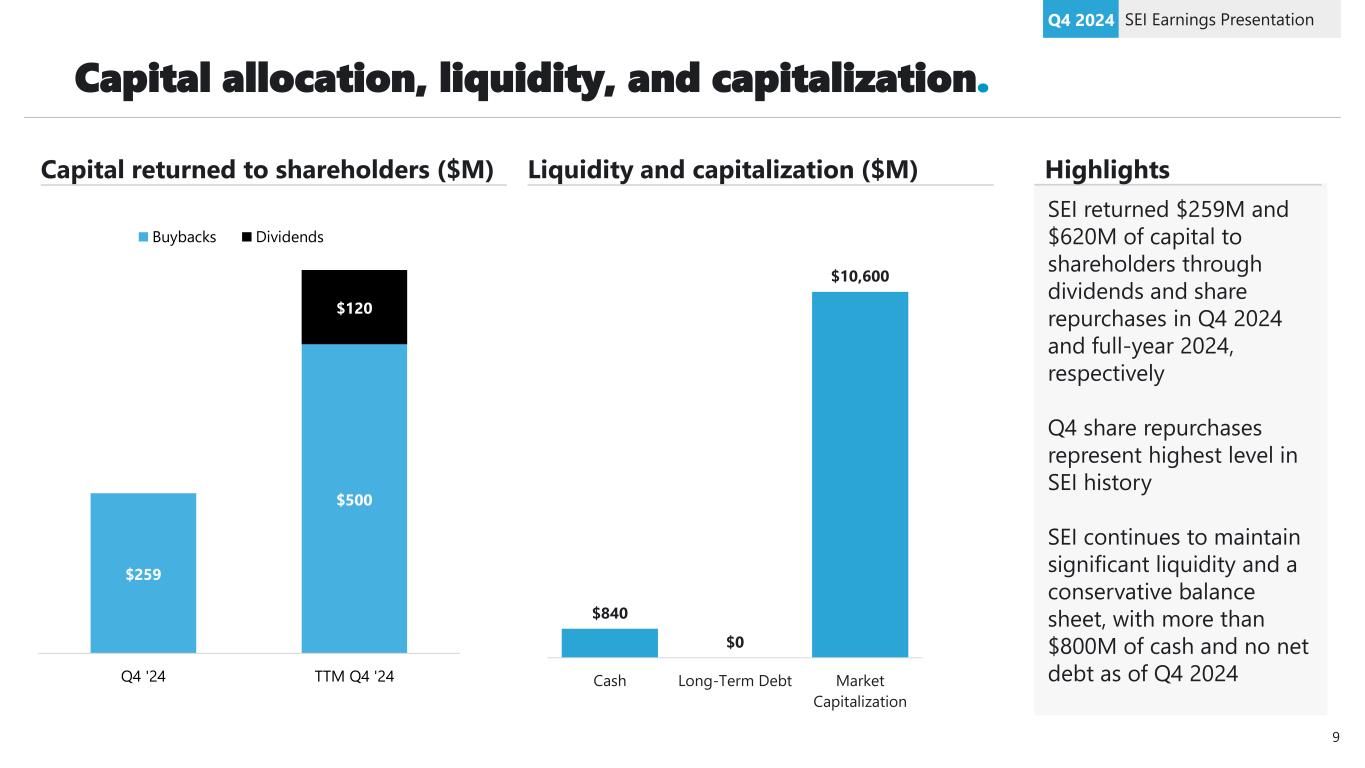

Capital allocation, liquidity, and capitalization. SEI Earnings PresentationQ4 2024 $259 $500 $0 $120 Q4 '24 TTM Q4 '24 Buybacks Dividends Capital returned to shareholders ($M) Liquidity and capitalization ($M) $840 $0 $10,600 Cash Long-Term Debt Market Capitalization SEI returned $259M and $620M of capital to shareholders through dividends and share repurchases in Q4 2024 and full-year 2024, respectively Q4 share repurchases represent highest level in SEI history SEI continues to maintain significant liquidity and a conservative balance sheet, with more than $800M of cash and no net debt as of Q4 2024 Highlights 9

For institutional investor and financial advisor use only. Not for distribution to general public. Thank You 10