— A Strategic Combination —

Creating a Leading

Midwestern Franchise

Citizens Republic Bancorp

Exhibit 99.2

Safe Harbor Statement

Safe Harbor Statement

Discussions in this release that are not statements of historical fact (including statements that include terms such as “will,” “may,” “should,” “believe,”

“expect,” “anticipate,” “estimate,” “intend,” and “plan”) are forward-looking statements that involve risks and uncertainties. Any forward-looking

statement is not a guarantee of future performance and actual results could differ materially from those contained in the forward-looking information.

Such forward-looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Citizens

and Republic, including future financial and operating results, the new company’s plans, objectives, expectations and intentions and other statements that

are not historical facts.

The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: the ability to obtain

regulatory approvals of the transaction on the proposed terms and schedule; the failure of Citizens or Republic shareholders to approve the transaction;

the risk that the businesses will not be integrated successfully; deposit attrition and disruption from the transaction making it more difficult to maintain

relationships with customers, employees or suppliers; the risk that the cost savings and any other synergies from the transaction may not be fully realized

or may take longer to realize than expected; competition and its effect on pricing, spending, third-party relationships and revenues; movements in market

interest rates and secondary market volatility; divestitures assumed and/or required; potential conditions that may affect the tax-free status of the

Republic stock exchange for Citizens’ common shares; and unfavorable changes in economic and business conditions or the regulatory environment.

Additional factors that may affect future results are contained in Citizens’ and Republic’s filings with the SEC, which are available at the SEC's web site

http://www.sec.gov. Citizens and Republic disclaim any obligation to update and revise statements contained in these materials based on new information

or otherwise.

Additional Information

In connection with the proposed merger, Citizens and Republic will file a joint proxy statement/prospectus with the Securities and Exchange Commission

(“SEC”). Investors and security holders are advised to read the joint proxy statement/prospectus when it becomes available because it

will contain important information. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus (when available)

and other documents filed by Citizens and Republic with the SEC at the SEC’s website at http://www.sec.gov. Free copies of the joint proxy

statement/prospectus (when available) and each company’s other filings with the SEC may also be obtained by accessing Citizens’ website at

http://www.citizensonline.com under the Investor Relations section or by accessing Republic’s website at http://www.republicbancorp.com under the

Investor Relations section.

Citizens and Republic and their respective directors, executive officers and other members of their management may be soliciting proxies from their

respective shareholders in favor of the merger. Information concerning persons who may be considered participants in the solicitation of Citizens’

shareholders under the rules of the SEC is set forth in the Proxy Statement filed by Citizens with the SEC on March 22, 2006, and information concerning

persons who may be considered participants in the solicitation of Republic’s shareholders under the rules of the SEC is set forth in the Proxy Statement

filed by Republic with the SEC on March 14, 2006. Additional information regarding the interests of those participants and other persons who may be

deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed merger when it becomes

available. You may obtain free copies of these documents as described above.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any

jurisdiction in which such solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such jurisdiction.

2

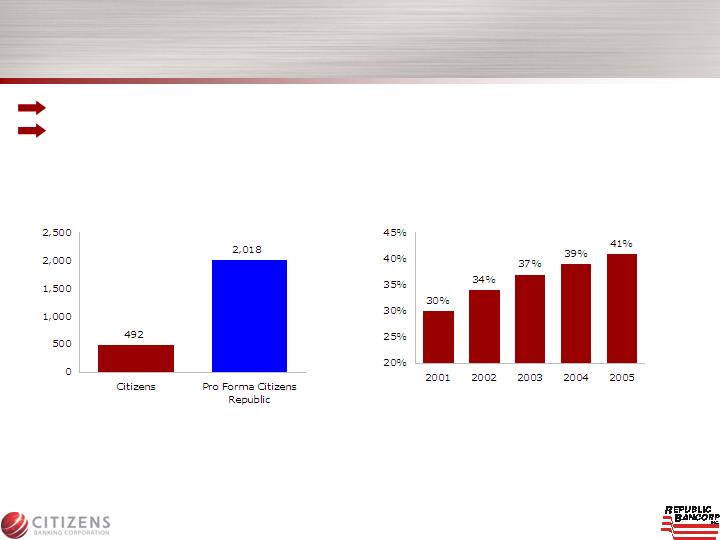

Immediately GAAP and cash accretive to EPS for all shareholders

Financial returns improved - utilizes existing operating capacity for improved efficiency

Combines strong credit cultures

Attractive dividend yield of 4.3%

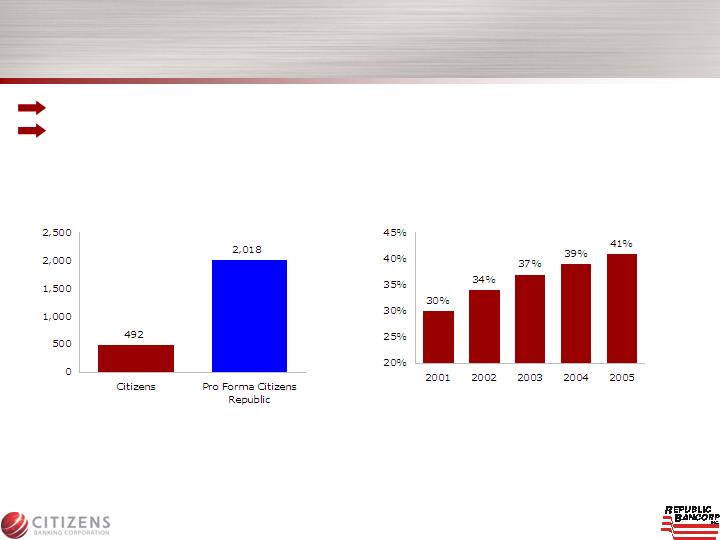

45th largest bank holding company in the United States

$2.0 billion in combined market capitalization (1)

275 branches in five states

$13.9 billion in assets, $8.6 billion in deposits and $2.6 billion in trust assets

Well positioned for further growth

The New Citizens Republic Bancorp

Company Profile

Enhanced Scale

Complementary

Business Mix

Combined sales and service culture enhances product suite and distribution channels

Broader retail, commercial banking, and commercial real estate businesses

Expanded wealth management capabilities and scale

Balanced and focused mortgage banking business

Attractive SBA, RV/Marine and asset-based lending businesses

Geographically

Diversified

Footprint

Improves existing MI footprint while expanding presence into new, attractive markets

Well positioned to compete with super regionals and community banks

Significantly increases SE Michigan presence - almost 5% of total Michigan deposits

Stable niche franchises in WI, OH, IA and IN

Key social issues decided - new executive management focused on execution

Familiar markets and businesses

In-market transaction - reasonable cost savings assumptions

Manageable

Execution Risk

Financially

Attractive

(1) Based on CBCF average closing price for 10 trading days ended 6/26/06

3

Transaction Summary

Implied Per Share Consideration(1):

$2.08 cash plus 0.4378 shares of CBCF common stock per

RBNC share

$13.86 / share (1)

Implied Transaction Price:

RBNC shareholders to elect between CBCF stock and cash,

subject to proration

Stock / Cash Election:

Flint, Michigan

Corporate Headquarters:

Chairman—Jerry Campbell (until YE 2007) when Bill Hartman

succeeds (until YE 2012)

CEO—Bill Hartman (until YE 2010) when Dana Cluckey

succeeds

President & COO—Dana Cluckey

Executive Management:

9 Citizens directors / 7 Republic directors

Board of Directors Composition:

Fourth quarter 2006

Expected Closing:

$36mm (3.5% of transaction value)

Termination Fee (mutual):

Completed

Due Diligence:

(1) Based on CBCF average closing price for 10 trading

days ended 6/26/06. Includes net options.

Approximately 85% stock / 15% cash

Fixed number of CBCF shares—approximately 33.2 million

Fixed cash amount of approximately $155 million

Consideration Mix:

Stock Component to RBNC Shareholders:

Cash Component to RBNC Shareholders:

Transaction Value at Announcement:

$1.048 billion (1)

56% Citizens / 44% Republic

Pro Forma Ownership:

Regulatory; Citizens and Republic shareholders

Approvals:

4

Merger Caps Turnaround Efforts

Initiated in 2002

Republic adds significant senior management depth and talent to current Citizens leadership

team

Long-term track record of consistent financial performance and shareholder value creation

Republic ranked #17 in Fortune’s 2006 “100 Best Companies to Work For” - 6 th year on list

and Working Mother magazine’s list of “100 Best Companies For Working Mothers” - 5th year

in a row

Build a Strong

Management Team

and Corporate

Culture

Enhance Product

Array to Compete

at All Levels

Adds #1 SBA bank lender based in Michigan - 11 consecutive years

Adds exceptional mortgage banking and commercial real estate capabilities and expertise

Potential to leverage Citizens’ wealth management, commercial and cash management

products across Republic’s customers and markets

Rigorous and

Disciplined Sales

Management

Focus

Republic operates a streamlined operating model emphasizing high touch and high

quality service - aligned with Citizens’ new strategy

Further leverages sales culture and processes to gain market share and growth

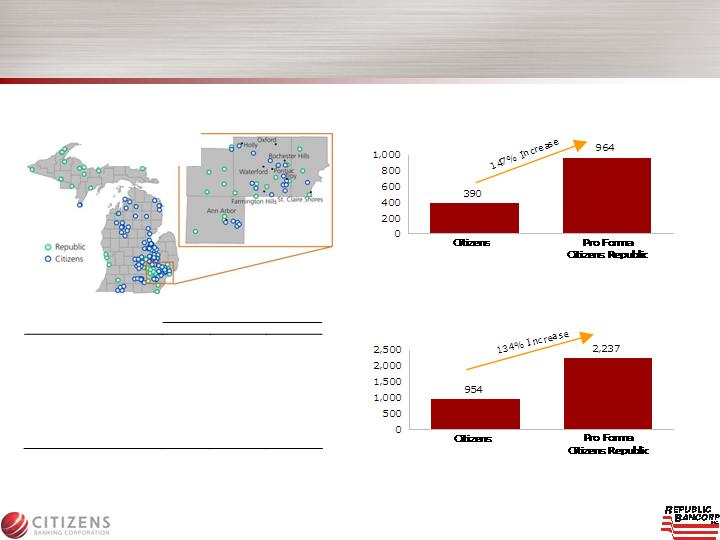

19% of Republic’s deposits are from Southeast Michigan

Significantly increases Southeast Michigan presence from 20 to 39 locations

Increases % of deposits in large MSAs from 54% to 64%

Republic also adds $375+ million in deposits and 14 branches in Cleveland and Akron, Ohio

Invest in High

Growth Markets/

Enhance Footprint

Establish Core

Competency in

Balance Sheet

Management

Republic maintains a lower risk credit profile - 48% of loans in residential mortgages

Republic’s historical charge-off metrics among the best in Midwest

peer group (14 bps on average over past 3 years)

Citizens Goals

Republic Impact

5

Strong, Experienced Management Team

Jerry Campbell

Chairman

Charlie Christy

CFO

Tom Menacher

Merger Integration

Roy Eon

Operations/

Technology

Debra Hanses

Human

Resources

Clint Sampson

Regional Chairman –

MI Commercial

Banking

John Schwab

Chief Credit Officer

Cathy Nash

Retail Banking

Jim Schmelter

Wealth

Management

Bill Hartman

CEO

Dana Cluckey

President & COO

Randy Peterson

Regional Chairman—

Wisconsin and Iowa

Cathy Rosenthal

Corporate

General Auditor

6

7

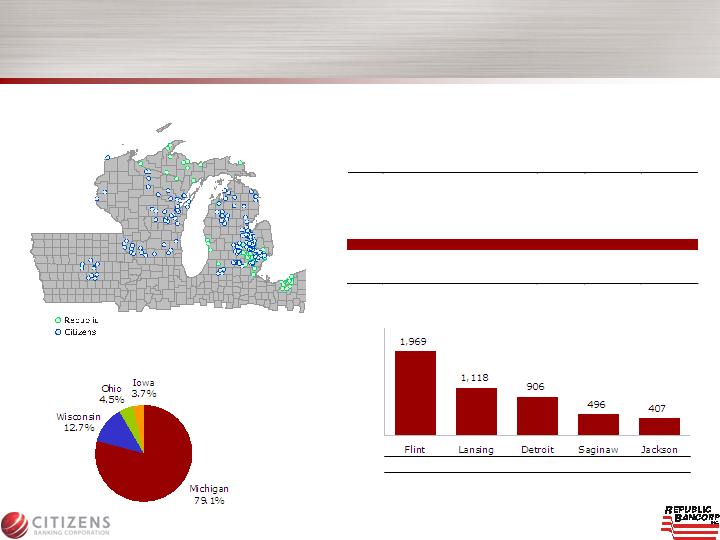

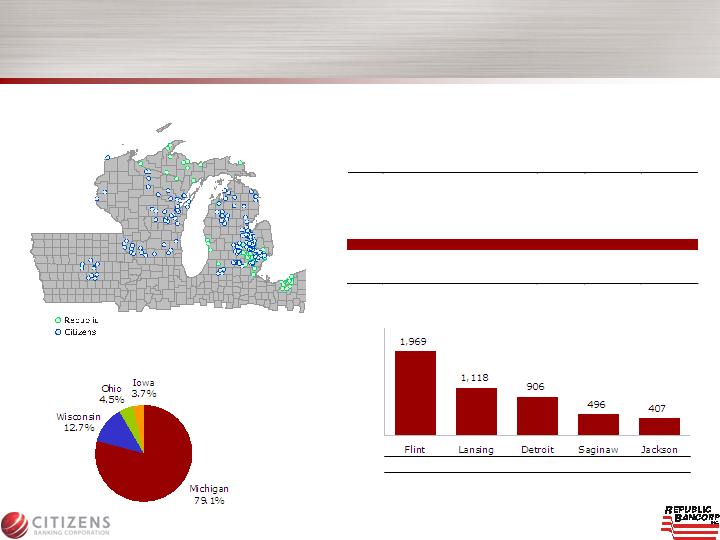

Top Markets — Total Deposits(1)

(in millions)

Source: SNL Financial as of 6/30/05

(2) Includes Corporate Public Funds deposit balances

(1) Does not include the impact of potential divestitures

(2)

(2)

Creates Leading Michigan Franchise with Capacity for

Additional Deposit Growth

Note: Excludes RBNC’s Indianapolis LPO

Rank 1 1 9 1 2

Deposits by State

Complementary Geographic Footprints

Total Deposits — Michigan

Rank

Institution

Branches

Deposits

($mm)

Mkt Share

(%)

1

LaSalle Bank

263

19,098

13.7

2

Comerica

254

18,305

13.1

3

JPMorgan Chase

256

17,166

12.3

4

Fifth Third

263

12,670

9.1

5

National City

264

9,916

7.1

6

Flagstar Bancorp

108

8,151

5.9

7

Pro Forma Citizens/Republic

1

89

6,581

4.7

8

Royal Bank of Scotland

127

5,197

3.7

9

Huntington Bancshares

117

4,943

3.6

10

Chemical Financial

134

2,878

2.1

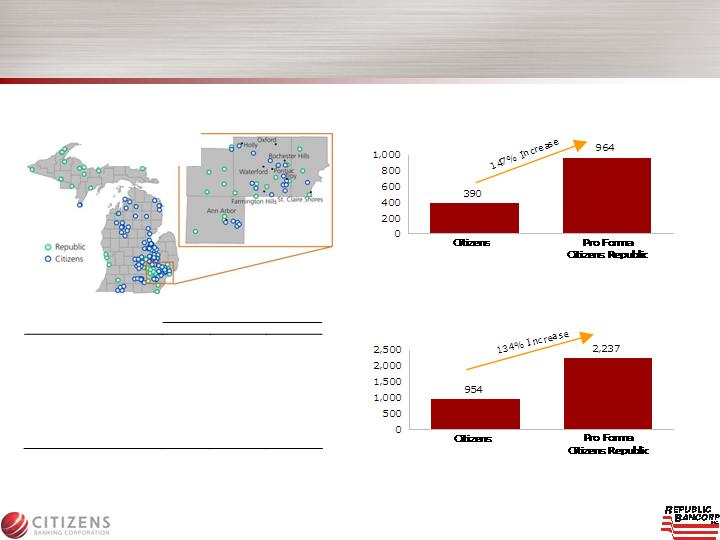

Attractive Southeast Michigan

Presence

8

(2) Deposit data as of 6/30/05

(3) Loan data as of 3/31/06

Source: SNL Financial and management data

Southeast Michigan Deposits (39 Branches(1)(2))

(in millions)

Southeast Michigan Loans(1)(3)

(in millions)

Southeast Michigan Demographics

Growth

2005

‘0

0

–

‘

05

E

‘05

–

‘10

E

Population

Southeastern MI Average

(

1

)

6.26

%

6.73

%

Michigan

3.74

4.08

National

6.15

6.26

Household Income

Southeastern MI Average

(1)

$

84,674

15.09

%

17.97

%

Michigan

Median

50,118

12.16

10.95

National

Me

dian

49,747

17.98

17.36

(1)

Selected Southeast

ern Michigan counties include:

Livingston, Macomb, Oakland

and Washtenaw

Overall Demographics Compare

Favorably to Midwest Peers

% of Deposits in High Growth MSAs (1)

(1) High Growth MSAs defined as MSAs with projected 2005–2010 household growth in excess of the US average of 6.7%

(2) Projected 2005-2010 Household Growth computed on a weighted average by MSA

Source: SNL Financial

Projected 2005-2010 Household Growth (%) (2)

9

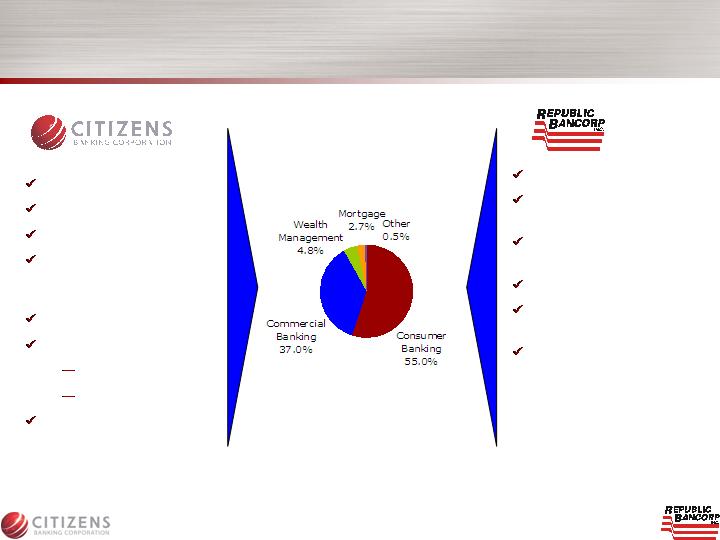

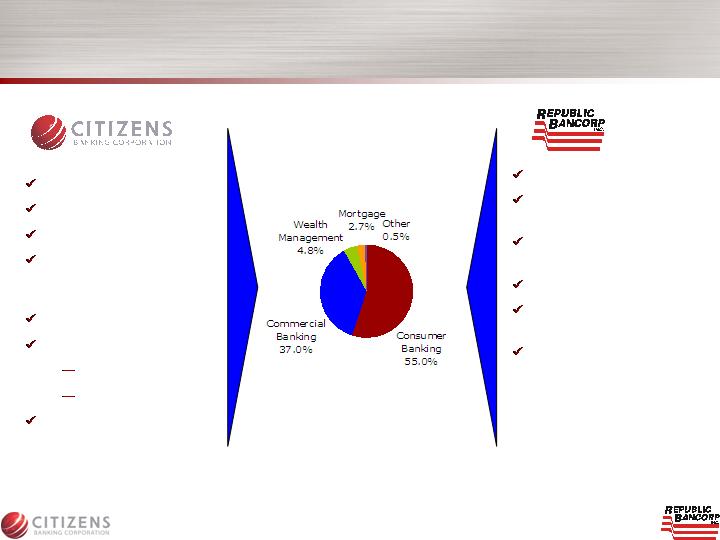

Retail Banking

Consumer

Lending

Commercial

Real Estate

SBA Lending

Mortgage

Banking

Commercial and

Residential

Construction

Lending

Complementary Business Focus and Mix Provide

Significant Potential for Revenue Enhancements

Retail Banking

Commercial Banking

Treasury/Cash Mgmt.

Rate Risk Mgmt. and

International

Services

Wealth Management

Specialty Lending

RV/Marine

Asset Based

Mortgage Banking

1Q06 Net Revenues: $142.4mm

Superior Product Suite

Source: Company filings

10

Unique and Scalable Mortgage

Franchise

2005 Mortgage Originations

(in millions)

Republic’s Mortgage to Retail Cross Sell (%)

One of the Midwest’s top retail mortgage lenders

Focus on building relationships—high mortgage to

retail cross sell capability

Source: Company filings and management data

11

Opportunity to Improve Deposit Mix

and Costs

12

Potential EPS Benefit Related to

Change in Republic’s Deposit Mix

and Pricing

(%)

(%)

Non

-

Interest Bearing

16.3

9.0

Interest

-

Bearing Demand

14.8

6.0

MMDA & Savings

26.3

27.9

Time Deposits

42.6

57.1

Total

100.0

100.0

Cost of Deposits

2.28

2.

81

Source: Company filings

a

s of

3/31/06

Diversified Loan Portfolio

(as of 1Q06)

Citizens

Republic

Citizens Republic

Combined

Source: Company filings and management data

13

Diversified Fee Income Base

(as of 1Q06)

Citizens

Republic

Citizens Republic

Combined

Note: Citizens and combined exclude the $2.9 million

gain on the sale of Royal Oak, MI office building

Source: Company filings and management data

14

Manageable Execution Risk

Key decisions have been made

Senior leadership roles defined at announcement

Other key social issues have been agreed upon

Friendly,

in-market

Merger

Mitigating

Integration Risk

Complementary branch networks with modest branch overlap

Complementary product offerings and capabilities

Strong regional brand

Reasonable and achievable cost savings assumptions (9% of combined expenses)

Revenue enhancements have been identified but not included in the pro forma

financials

Experienced

Management

Teams

Successful acquisition integration a core competency of both management teams

Compatible service-oriented corporate cultures and strategies

Repositions balance sheet to mitigate interest rate risk, improve liquidity,

reduce reliance on wholesale funding, and improve quality of earnings

Aligns credit policies, guidelines, discipline, and processes - moving the

combined organization to Citizens’ standards and practices

Risk

Management

15

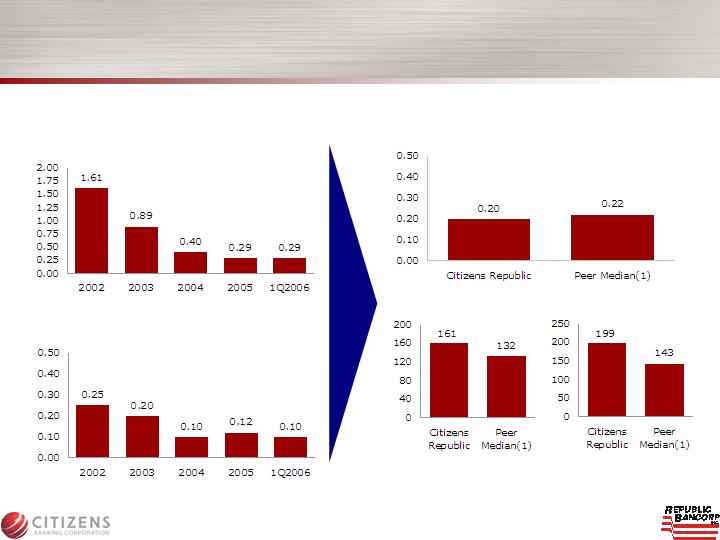

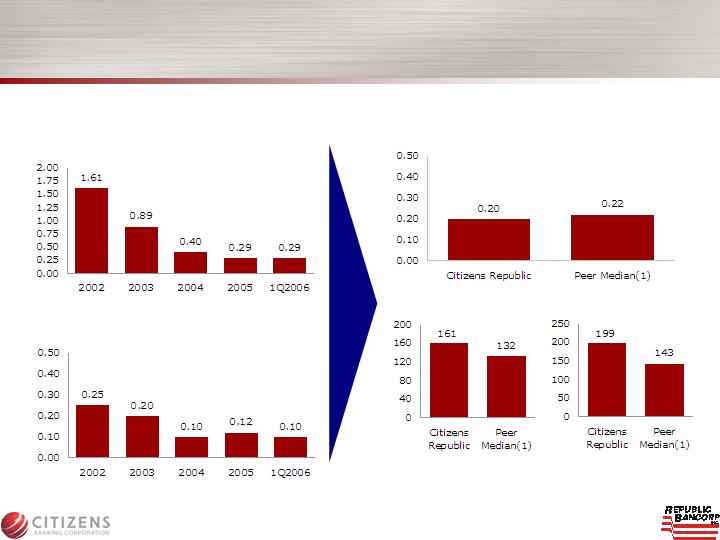

Strong Credit Quality —

Compares Favorably to Peers

Net Charge-Off/Total Loans (%)

Net Charge-Off/Total Loans (%)

Allowance/NPAs (%)

Source: Company filings and SNL Financial

(1)

Peers include FMBI, FMER, MAFB, ONB, PRK and SKYF

Allowance/NPLs (%)

Citizens

Republic

Note: 2005 excludes the 4Q05 $9.1 mil insurance settlement; 2005 as

reported NCO% = 13bps.

16

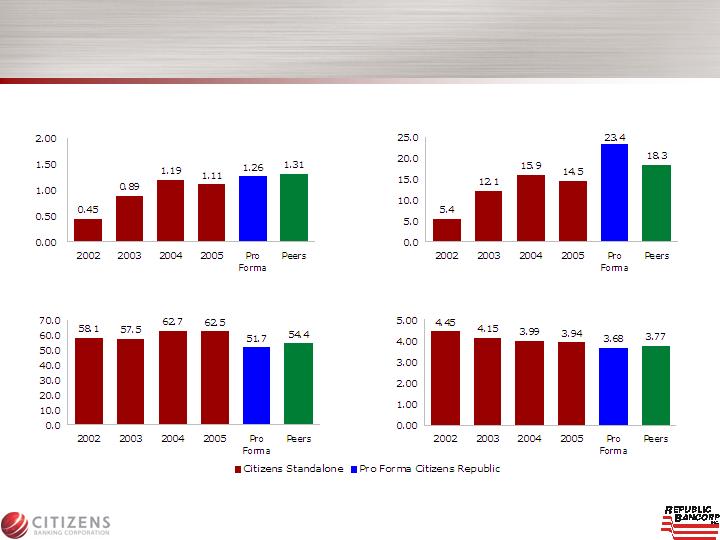

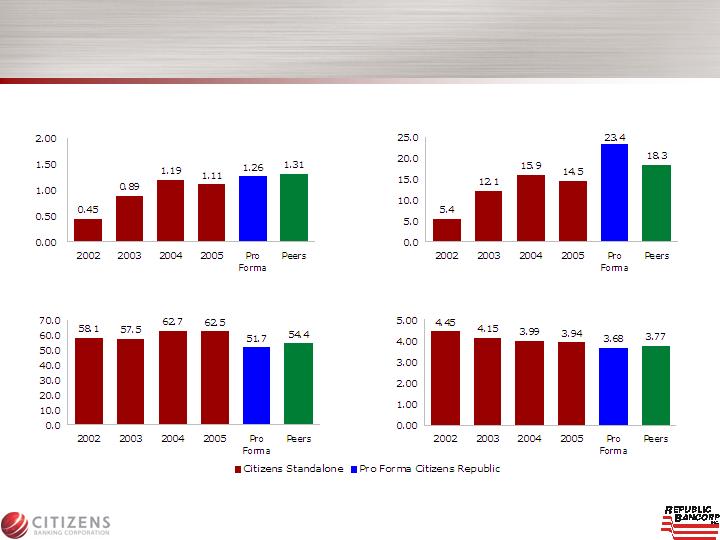

Enhanced Financial Returns

ROATA - Cash (%)(1)(2)

ROATCE - Cash (%)(1)(2)

Efficiency Ratio - Cash (%)(1)(3)

Net Interest Margin (%)(1)(2)

(1)

Peers include FMBI, FMER, MAFB, ONB, PRK and SKYF as of 3/31/06

(2)

Pro Forma includes purchase accounting adjustments and balance sheet restructuring

(3)

Pro Forma includes identified cost savings

Source: Company filings, SNL Financial, and management data

17

Sources of Cost Savings

Annual cost savings already identified

$28 million or 9% of combined expense base

70% phase-in for 2007 and 100% thereafter

Anticipated $87 million pre-tax restructuring costs

18

Sources of Cost Savings/Restructuring Costs

(

1

)

Includes severance, change of controls for Republic & Citizens, and retention

(

2

)

Includes fixed asset write-offs and branding including signage & collateral materials

(

3

)

Includes capital improvements/conversion costs, advisory fees, other balance sheet fees, contract costs and restricted stock

(

$mm

)

Fully Phased-in

Annual Cost Savings

Restructuring

Costs

Personnel

$16

$

4

0

(1)

Facilities/Branches

2

17

(2)

Systems/Other

10

30

(3)

Total (Pre-tax)

$28

$

87

Favorable Pricing

19

Citizens/Republic

Median of Comparable

Transactions (1)

Price/Forward Earnings (x)

15.4

(

2

)

19.9

Price/Forward Earnings with Cost Savings (x) (3)

12.

2

14.1

Price/Book Value (x)

2.5

8

(

4

)

2.21

Price/Tangible Book Value (x)

2.

60

(

4

)

3.04

(1)

Bank and thrift transactions between $500 million and $2.5 billion announced after 1/1/04

(2)

Based on I/B/E/S estimates

(3)

Assumes fully phased-in cost savings

(4)

Financial data as of 3/31/06

20

Pro Forma Financial Impact Analysis (1)

2007

($mm, except per share data)

70% Phase-in

Phase-in 100%

Citizen’s Stand Alone Net Income

(2

)(

3

)

88

88

Republic Stand Alone Net Income

(2

)(

3

)

70

70

Cost Savings (After-tax)

(

2

)(

4

)

13

18

Other Adjustments (After-tax)

(

2

)(

5

)

(14)

(14)

Pro Forma Net Income

157

162

Pro Forma Avg. Fully-Diluted Shares (mm)

-

76

76

Pro Forma GAAP EPS

2.07

2.13

Pro Forma Cash EPS

2.16

2.23

Impact to Citizens Republic

Accretion/(Dilution) to GAAP EPS (%)

0.9

4.0

Accretion/(Dilution) to Cash EPS (%)

3.3

6.3

(1)

Based on 0.515 exchange ration for an implied transaction value of $1,048 mm and 15% cash/ 85% stock consideration

(2)

Assumes 35% tax rate

(3)

Assumes 2007 GAAP EPS estimates for Citizens of $2.05 and Republic of $0.93

(4)

Assumes $28mm in pre-tax cost savings phased-in 70% in 2007 and 100% in 2008

-

(5)

CDI amortization, net of Republic’s existing CDI amortization, cost of financing, and funding of restructuring costs (5.00%

pre-tax), includes impact of balance sheet restructuring and purchase accounting mark-to-market adjustments

,

r

Strategic Rationale

Enhances scale and overall franchise value

Improves geographic footprint—expands presence in

attractive markets

Diversifies revenue mix through complementary lines

of business

Manageable execution risk

GAAP and Cash EPS accretive in 2007

Creating a Leading Midwestern Franchise

21

Appendix

Combined Balance Sheet

23

Source: Company filings and management data

For the Period Ended

3/31/06

Estimated at Close

($mm)

Citizens

Republic

12/31/06

(1)

Assets:

Cash and Investment Securities

1,767

1,

277

2,

687

Net Loans

5,490

4,

729

9,606

Goodwill and Intangibles

65

4

7

78

Other Assets

341

23

4

6

49

Total Assets

7,

66

3

6,

244

13,7

20

Liabilities and Equity:

Deposits

5,

524

3,

084

8,

545

Borrowings

1,3

80

2,

690

3,1

62

Other Liabilities

82

6

3

29

2

Total Liabilities

6,986

5,

837

11,99

9

Capital Securities

25

–

182

Common Equity

6

52

4

0

7

1,

54

0

Total Liabilities and Equity

7,

663

6,

244

1

3,7

20

Capital Ratios:

TCE/TA

(2)

7.

72

%

6.

4

5

%

5.89

%

Tier 1

10

.

09

%

11.12

%

9.80

%

(1)

Includes purchase accounting adjustments, balance sheet restructuring and merger synergies/costs

(2)

Includes assumed divestiture levels

Loan Portfolio

More balanced loan portfolio

Loan Composition—As of 3/31/06

24

Citizens

Republic

Combined

($mm)

Total

3/31/06

% of

Total

Total

3/31/06

% of

Total

Total

3/31/06

% of

Total

Commercial

1,689

30.2

28

0.6

1,717

16.6

Commercial Real Estate

1,419

25.

4

1,727

36.4

3,146

30.5

Residential Mortgage

549

9.8

2,267

47.8

2,816

2

7.2

Home Equity

901

16.1

551

11.6

1,452

14.0

Direct Consumer - Other

208

3.7

174

3.6

382

3.7

Indirect Consumer

826

14.8

-

-

826

8.0

Total Loans

5,592

100.0

4,

7

47

100.0

10,

3

39

100.0

Held for Sale

13

–

25

–

38

–

Total Gross Loans

5,605

–

4,

7

72

–

10,

377

–

Yield on Loans

6.83

%

–

6.32

%

–

6.60

%

–

Source: Company filings and management data

Deposit Profile

Deposit Composition—As of 3/31/06

25

Citizens

Republic

Combined

($mm)

Total

3/31/06

% of

Total

Total

3/31/06

% of

Total

Total

3/31/06

% of

Total

Noninterest-Bearing

900

16.3

278

9.0

1,178

13.7

Interest-Bearing Demand

816

14.8

186

6.0

1,002

11.6

MMDA & Savings

1,453

26.3

859

27.9

2,312

26

.9

Time Deposits

2,355

42.6

1,761

57.1

4,116

47.8

Total Deposits

5,524

100.0

3,084

100.0

8,60

8

100.0

Cost of Total Deposits

2.28

%

–

2.8

1

%

–

2.47

%

–

Source: Company filings

Pro Forma Market Position(1)

26

State

Branches

(No.)

Deposits

($mm)

Rank

(No.)

Cumulative %

of Franchise

Michigan

189

6,581

7

79.1

Wisconsin

54

1,057

13

91.8

Ohio

16

377

39

96.3

Iowa

11

305

33

100.0

Top 10

Markets

Flint, MI

(2

)

33

1,969

1

23.7

Lansing

-

East Lansing, MI

(2

)

18

1,118

1

37.1

Detroit

-

Warren

-

Livonia, MI

36

906

9

48.0

Saginaw

-

Saginaw Township North, MI

16

496

1

54.0

Jackson, MI

13

407

2

58.8

Cleveland

-

Elyria

-

Mentor, OH

12

342

16

62.9

Ann Arbor, MI

8

207

10

65.4

Green Bay, WI

9

174

10

67.5

Bay City, MI

5

160

4

69.5

Appleton, WI

5

160

7

71.4

(1)

Does not include the impact of potential divestitures

(2)

Includes Corporate Public Funds deposit balances

Source: SNL Financial as of 6/30/05