Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

CTZ+A similar filings

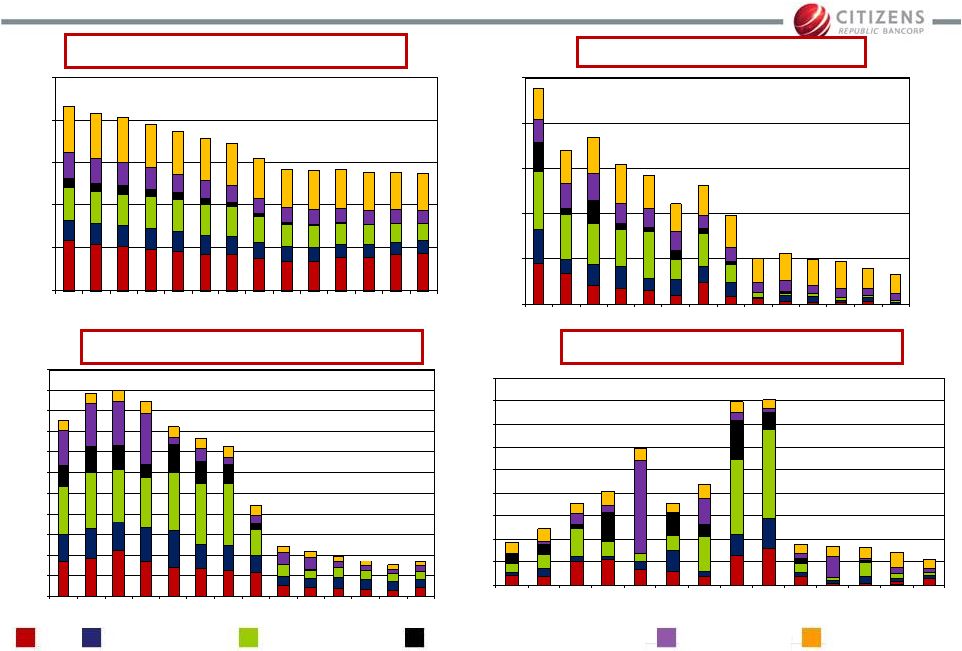

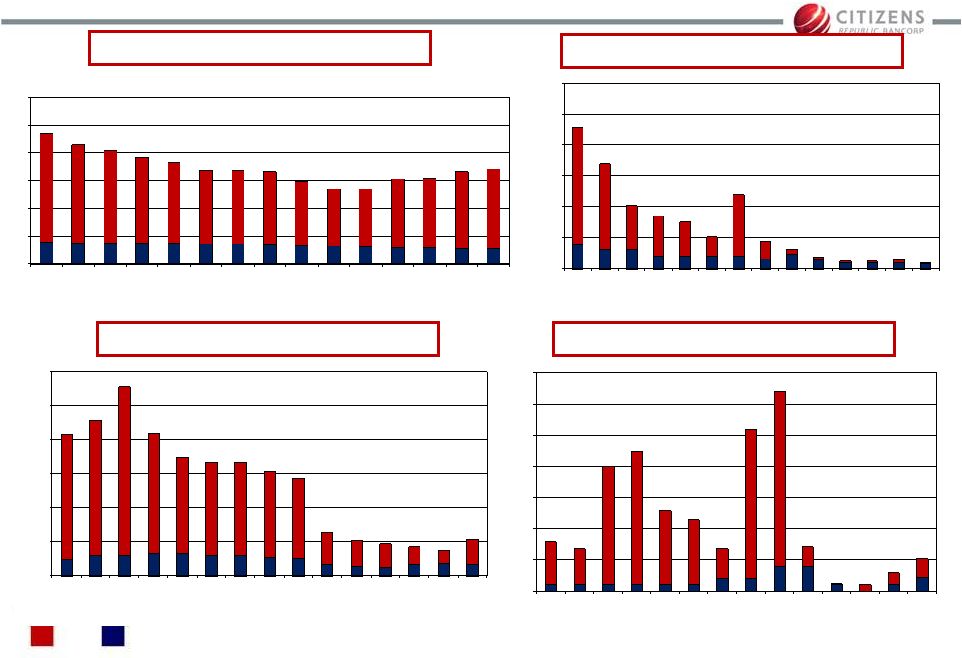

- 26 Oct 12 Discussions and statements in this presentation that are not statements of

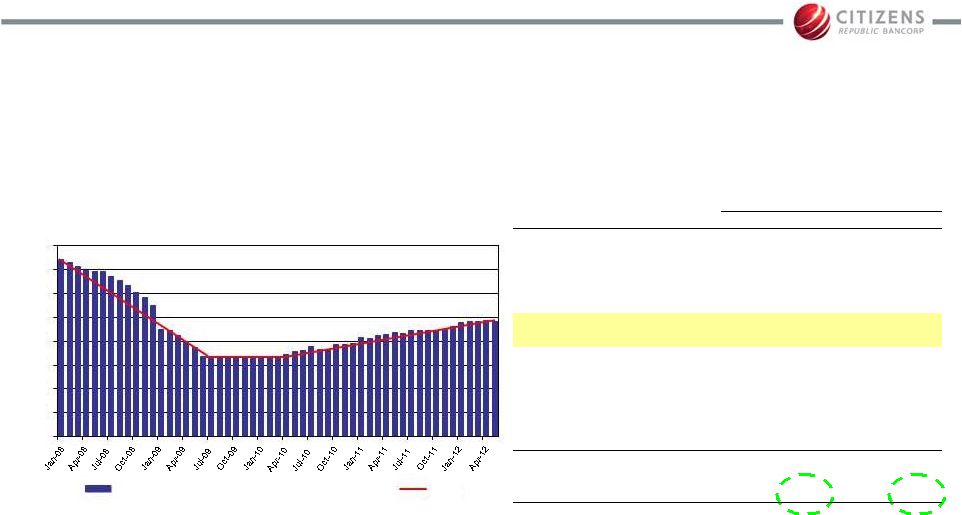

- 25 Oct 12 Citizens Republic Bancorp Reports Solid Third Quarter Results

- 14 Sep 12 Entry into a Material Definitive Agreement

- 30 Jul 12 Discussions and statements in this presentation that are not statements of

- 26 Jul 12 Citizens Republic Bancorp Reports Fifth Consecutive Quarterly Profit and Restores Deferred Tax Asset

- 1 May 12 Departure of Directors or Certain Officers

- 27 Apr 12 Regulation FD Disclosure

Filing view

External links