- ABCB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ameris Bancorp (ABCB) DEF 14ADefinitive proxy

Filed: 23 Apr 24, 9:41am

☐ | Preliminary Proxy Statement |

☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

| ☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under Section 240.14a-12 |

| ☑ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | Sincerely, | |

| | |  | |

| | | H. Palmer Proctor, Jr. Chief Executive Officer |

| (1) | To elect each of the 13 director nominees named in the accompanying Proxy Statement to serve as a director until our 2025 Annual Meeting of Shareholders and until his or her successor is duly elected and qualified; |

| (2) | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; |

| (3) | To hold an advisory vote on the compensation of our named executive officers; |

| (4) | To hold an advisory vote on the frequency of the advisory vote on the compensation of our named executive officers; and |

| (5) | To transact any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

| | | By Order of the Board of Directors, | |

| | |  | |

| | | Michael T. Pierson Corporate Secretary |

| Date: | | | June 6, 2024 |

| Time: | | | 9:30 a.m. ET |

| Location: | | | Virtual format only, via live audio webcast at www.virtualshareholdermeeting.com/ABCB2024. |

Record Date and Voting: | | | You are entitled to vote at the Annual Meeting if you were a shareholder of record of the Company’s common stock, $1.00 par value per share (the “Common Stock”), as of the close of business on March 28, 2024, the record date for the Annual Meeting (the “Record Date”). Each share of Common Stock represented at the Annual Meeting is entitled to one vote for each director nominee with respect to the proposal to elect directors and one vote for each of the other proposals to be voted on. |

| 1 |

| | Items of Business | | | Board Recommendation | | | Page Number | |

| | To elect each of the 13 director nominees named in this Proxy Statement to serve as a director until the Company’s 2025 Annual Meeting of Shareholders (the “2025 Annual Meeting”) and until his or her successor is duly elected and qualified (Proposal 1) | | | “FOR” | | | | |

| | To ratify the appointment of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2) | | | “FOR” | | | | |

| | To hold an advisory vote on the compensation of our named executive officers (Proposal 3) | | | “FOR” | | | | |

| | To hold an advisory vote on the frequency of the advisory vote on the compensation of our named executive officers (Proposal 4) | | | “1 YEAR” | | | |

| • | Over the internet at www.proxyvote.com, which you are encouraged to do if you have access to the internet; |

| • | By telephone at the number included in your proxy card or Notice of Internet Availability of Proxy Materials (the “Notice”) you previously received; |

| • | For those shareholders who request to receive a paper proxy card in the mail, by completing, signing and returning the proxy card; or |

| • | By attending the Annual Meeting virtually (by visiting www.virtualshareholdermeeting.com/ABCB2024 and entering your control number) and following the voting instructions on the virtual meeting website. |

| 2 |

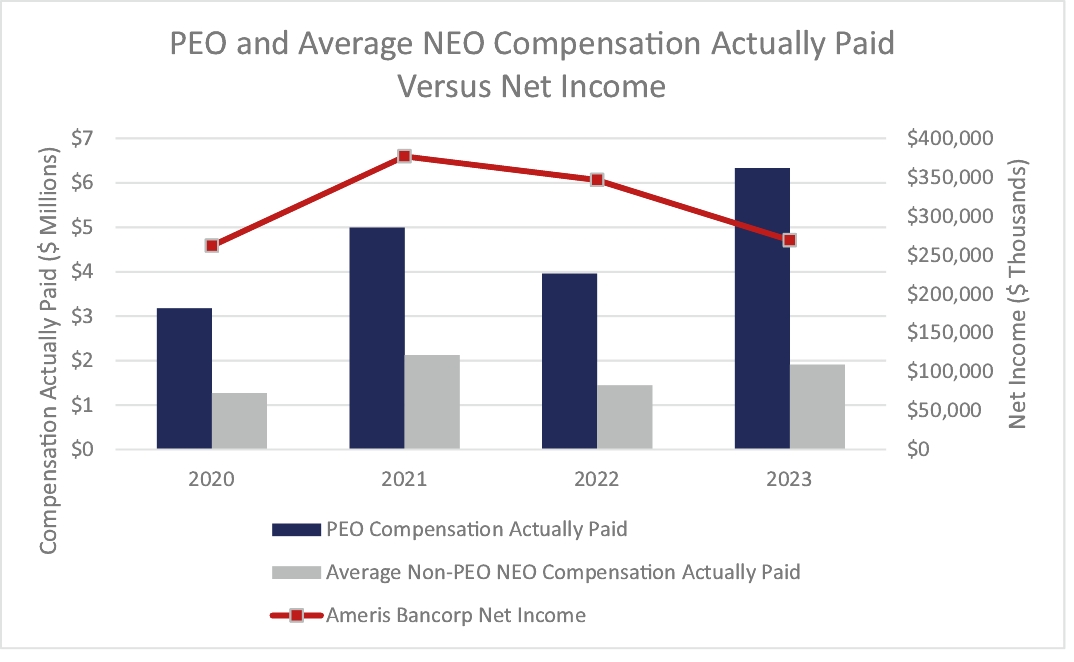

| • | Net income of $269.1 million, or $3.89 per diluted share; |

| • | Adjusted net income of $276.3 million, or $4.00 per diluted share; |

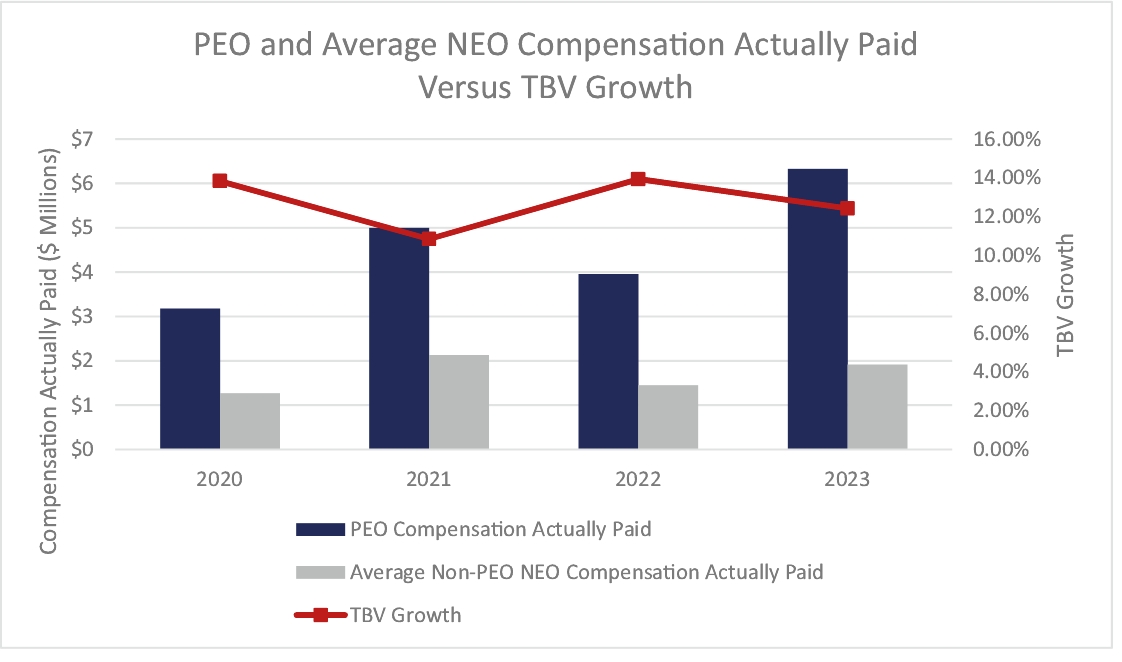

| • | Growth in tangible book value (“TBV Growth”) of $3.72 per share, or 12.4%, to $33.64 at December 31, 2023; |

| • | Increase in the allowance for credit losses to 1.52% of loans, from 1.04% at December 31, 2022, due to forecasted economic conditions, particularly related to commercial real estate price levels; |

| • | Nonperforming portfolio assets, excluding government-guaranteed loans, as a percentage of total assets improved to 0.33% at December 31, 2023, compared with 0.34% at December 31, 2022; |

| • | Adjusted efficiency ratio of 52.58%; |

| • | Organic growth in loans of $414.1 million, or 2.1%; |

| • | Growth in total deposits of $1.25 billion, or 6.4%; and |

| • | Growth in tangible common equity ratio of 97 basis points, or 11.2%, to 9.64% at December 31, 2023. |

| 3 |

| | Name | | | Age | | | Ameris Director Since | | | Primary Occupation | | | Independent | |

| | William I. Bowen, Jr. | | | 59 | | | November 2014 | | | Partner and President of Bowen Donaldson Home for Funerals | | | ✔ | |

| | Rodney D. Bullard | | | 49 | | | July 2019 | | | Chief Executive Officer of The Same House | | | ✔ | |

| | Wm. Millard Choate | | | 71 | | | July 2019 | | | Founder and Chairman of Choate Construction Company | | | ✔ | |

| | R. Dale Ezzell | | | 74 | | | May 2010 | | | Founder and Owner of Wisecards Printing and Mailing | | | ✔ | |

| | Leo J. Hill | | | 68 | | | January 2013 | | | Founder and Owner of Advisor Network Solutions, LLC | | | ✔ | |

| | Daniel B. Jeter | | | 72 | | | April 1997 | | | Chairman and Co-Owner of Standard Discount Corporation | | | ✔ | |

| | Robert P. Lynch | | | 60 | | | February 2000 | | | Vice President and Chief Financial Officer of Lynch Management Company | | | ✔ | |

| | Elizabeth A. McCague | | | 74 | | | August 2016 | | | Chief Financial Officer for Jacksonville Port Authority | | | ✔ | |

| | Claire E. McLean | | | 44 | | | February 2024 | | | Chief Operating Officer and Executive Vice President of Preferred Capital Securities, LLC | | | ✔ | |

| | James B. Miller, Jr. | | | 84 | | | July 2019 | | | Chairman of the Ameris Board of Directors | | | | |

| | Gloria A. O’Neal | | | 74 | | | July 2019 | | | Community Leader | | | ✔ | |

| | H. Palmer Proctor, Jr. | | | 56 | | | July 2019 | | | Chief Executive Officer of Ameris and the Bank | | | | |

| | William H. Stern | | | 67 | | | November 2013 | | | President and Chief Executive Officer of Stern Development | | | ✔ | |

| 4 |

| Corporate Governance | | | Executive Compensation | |

• Annual Election of All Directors • Approximately 85% of Board Members are Independent • Strong Independent Lead Director of the Board • Independent Audit, Compensation, Corporate Governance and Nominating, and Enterprise Risk Committees of the Board • No Supermajority Voting Requirements in Articles of Incorporation or Bylaws • Formalized Annual Board and Committee Self-Assessments and Director Assessments • Majority Voting for Directors in Uncontested Elections • All Directors Attended at Least 75% of 2023 Meetings • Director Continuing Education • Regular Executive Sessions of Independent Directors • No Poison Pill in Effect | | | • Pay for Performance Philosophy • Independent Compensation Consultant Engaged by Compensation Committee • Annual Advisory Votes on Executive Compensation • Risk Oversight by Board and Committees, Including Enterprise Risk Committee • Limits Imposed on Maximum Incentive Award Payouts • Stock Ownership Requirements for Named Executive Officers and Directors • Insider Trading Policy Prohibits Hedging and Short Sales • Implementation of Mandatory Clawback Policy for Incentive Compensation Paid to Executive Officers | |

| 5 |

| • | The Company’s Proxy Statement for the Annual Meeting; and |

| • | The 2023 Annual Report, which includes the Company’s audited consolidated financial statements. |

| • | View proxy materials for the Annual Meeting on the internet and execute a proxy; and |

| • | Instruct the Company to send future proxy materials to you electronically by e-mail. |

| • | To elect each of the 13 director nominees named in this Proxy Statement to serve as a director until the 2025 Annual Meeting and until his or her successor is duly elected and qualified (Proposal 1); |

| • | To ratify the appointment of KPMG as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2); |

| 6 |

| • | To hold an advisory vote on the compensation of our named executive officers (Proposal 3); and |

| • | To hold an advisory vote on the frequency of the advisory vote on the compensation of our named executive officers (Proposal 4). |

| • | Over the internet at www.proxyvote.com, which you are encouraged to do if you have access to the internet; |

| • | By telephone; or |

| • | For those shareholders who request to receive a paper proxy card in the mail, by completing, signing and returning the proxy card. |

| 7 |

| • | Voting again by telephone or over the internet by 11:59 p.m. ET on June 5, 2024, the day before the Annual Meeting; |

| • | Giving written notice to our Corporate Secretary at 3490 Piedmont Road N.E., Suite 1550, Atlanta, Georgia 30305; |

| • | Delivering a later-dated proxy; or |

| • | By attending the Annual Meeting virtually (by visiting www.virtualshareholdermeeting.com/ABCB2024 and entering your control number) and following the voting instructions on the virtual meeting website. |

| 8 |

| | Proposal | | | Voting Options | | | Vote Required to Elect Directors or to Adopt Proposal | | | Effect of Abstentions | | | Effect of Broker Non-votes | |

| | Election of Directors (Proposal 1) | | | For, Against or Abstain with respect to each director nominee | | | A majority of votes cast (meaning the number of shares voted “for” a director nominee must exceed the votes cast “against” such director nominee)* | | | No effect | | | No effect No broker discretion to vote | |

| | Ratification of the Appointment of KPMG (Proposal 2) | | | For, Against or Abstain | | | Affirmative vote of the holders of a majority of the stock having voting power present in person or represented by proxy at the Annual Meeting | | | Same effect as a vote “against” | | | Brokers have discretion to vote | |

| | Advisory Vote on the Compensation of Our Named Executive Officers | | | For, Against or Abstain | | | Affirmative vote of the holders of a majority of the stock having voting power present in | | | Same effect as a vote “against” | | | No effect No broker discretion to vote | |

| 9 |

| | Proposal | | | Voting Options | | | Vote Required to Elect Directors or to Adopt Proposal | | | Effect of Abstentions | | | Effect of Broker Non-votes | |

| | (Proposal 3) | | | | | person or represented by proxy at the Annual Meeting | | | | | | |||

| | Advisory Vote on the Frequency of the Advisory Vote on the Compensation of Our Named Executive Officers (Proposal 4) | | | 1 Year, 2 Years, 3 Years or Abstain | | | The option of one year, two years or three years that receives the highest number of the votes cast by shareholders will be the frequency for the advisory vote on executive compensation that has been selected by shareholders | | | No effect | | | No effect No broker discretion to vote | |

| * | See “Matters To Be Voted On – Proposal 1 – Election of Directors” for a further description of the vote required to elect directors. |

| 10 |

| | Name | | | Age | | | Ameris Director Since | | | Primary Occupation | | | AC | | | CC | | | NC | | | EC | | | ERC | | | CRC | |

| | William I. Bowen, Jr.* | | | 59 | | | November 2014 | | | Partner and President of Bowen Donaldson Home for Funerals | | | | | | | ✔ | | | | | | | ✔ | | ||||

| | Rodney D. Bullard* | | | 49 | | | July 2019 | | | Chief Executive Officer of The Same House | | | | | ✔ | | | | | | | | | | |||||

| | Wm. Millard Choate* | | | 71 | | | July 2019 | | | Founder and Chairman of Choate Construction Company | | | ✔ | | | | | | | | | | | CH | | ||||

| | R. Dale Ezzell* | | | 74 | | | May 2010 | | | Founder and Owner of Wisecards Printing and Mailing | | | ✔ | | | ✔ | | | | | | | | | | ||||

| | Leo J. Hill* | | | 68 | | | January 2013 | | | Founder and Owner of Advisor Network Solutions, LLC | | | | | CH | | | ✔ | | | ✔ | | | | | | |||

| | Daniel B. Jeter* | | | 72 | | | April 1997 | | | Chairman and Co-Owner of Standard Discount Corporation | | | | | ✔ | | | | | | | ✔ | | | | ||||

| | Robert P. Lynch* | | | 60 | | | February 2000 | | | Vice President and Chief Financial Officer of Lynch Management Company | | | CH FE | | | | | | | | | | | ✔ | | ||||

| | Elizabeth A. McCague* | | | 74 | | | August 2016 | | | Chief Financial Officer for Jacksonville Port Authority | | | | | | | ✔ | | | ✔ | | | CH | | | | |||

| | Claire E. McLean* | | | 44 | | | February 2024 | | | Chief Operating Officer and Executive Vice President of Preferred Capital Securities, LLC | | | | | | | | | | | | | | ||||||

| | James B. Miller, Jr. | | | 84 | | | July 2019 | | | Chairman of the Ameris Board of Directors | | | | | | | | | ✔ | | | | | | |||||

| | Gloria A. O’Neal* | | | 74 | | | July 2019 | | | Community Leader | | | ✔ | | | | | | | | | ✔ | | | | ||||

| | H. Palmer Proctor, Jr. | | | 56 | | | July 2019 | | | Chief Executive Officer of Ameris and the Bank | | | | | | | | | CH | | | | | | |||||

| | William H. Stern* | | | 67 | | | November 2013 | | | President and Chief Executive Officer of Stern Development | | | | | ✔ | | | CH | | | ✔ | | | | | |

| 11 |

| | The Board recommends a vote “FOR” the election of the nominated directors. Proxies will be voted “FOR” the election of the director nominees named above unless otherwise specified. | |

| | The Board recommends that you vote “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Proxies will be voted “FOR” the ratification of this appointment unless otherwise specified. | |

| 12 |

| | The Board recommends that you vote “FOR” the approval of the compensation of our named executive officers as set forth in this Proxy Statement under “Executive Compensation,” including the “Compensation Discussion and Analysis,” the compensation tables and related material. Proxies will be voted “FOR” the approval of the compensation of our named executive officers unless otherwise specified. | |

| 13 |

| | The Board recommends that you vote for the “1 YEAR” option with respect to the frequency of the advisory vote on the compensation of our named executive officers. Proxies will be voted for the “1 YEAR” option unless otherwise specified. | |

| 14 |

| 15 |

| 16 |

| | | | Board Diversity Matrix (As of March 28, 2024) | | ||||||||||||||||||||||||||||||||||||||||

| | | | Bowen | | | Bullard | | | Choate | | | Ezzell | | | Hill | | | Jeter | | | Lynch | | | McCague | | | McLean | | | Miller | | | O'Neal | | | Proctor | | | Stern | | | Veal | | |

| | Total Number of Directors - 14 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||

| | Tenure and Independence | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||

| | Tenure (years) | | | 9 | | | 5 | | | 5 | | | 14 | | | 11 | | | 27 | | | 24 | | | 8 | | | <1 | | | 5 | | | 5 | | | 5 | | | 10 | | | 16 | |

| | Independence | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | | | | • | | | | | • | | | • | | ||

| | Demographics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||

| | Age | | | 59 | | | 49 | | | 71 | | | 74 | | | 68 | | | 72 | | | 60 | | | 74 | | | 44 | | | 84 | | | 74 | | | 56 | | | 67 | | | 75 | |

| | Gender Identity | | | M | | | M | | | M | | | M | | | M | | | M | | | M | | | F | | | F | | | M | | | F | | | M | | | M | | | M | |

| | African American or Black | | | | | • | | | | | | | • | | | | | | | | | | | | | | | | | | | | ||||||||||||

| | Native Hawaiian or Pacific Islander | | | | | | | | | | | | | | | • | | | | | | | | | | | | | | | | |||||||||||||

| | White | | | • | | | | | • | | | • | | | | | • | | | | | • | | | • | | | • | | | • | | | • | | | • | | | • | | |||

| • | Personal characteristics, including leadership, character, integrity, accountability, sound business judgment and personal reputation; |

| • | Successful business or professional experience; |

| • | Various areas of expertise or experience, including financial, strategic and general management; |

| • | Expertise or experience in various industries, including banking and financial services, hospitality, construction, consumer finance, automotive, real estate, timber, agricultural and mediation services, as well as with various non-profit organizations; |

| • | Residence in the Bank’s market areas; |

| • | Willingness and ability to commit the necessary time to fully discharge the responsibilities of a director in connection with the affairs of the Company; and |

| • | A demonstrated commitment to the success of the Company. |

| 17 |

| 18 |

| 19 |

| 20 |

| 21 |

WILLIAM I. BOWEN, JR. | ||||||

| | | Age: 59 Ameris Bancorp director since November 2014 Ameris Bank director since November 2014 | | | Board Committees: Corporate Governance and Nominating Credit Risk |

| Mr. Bowen resides in our Tifton, Georgia market, and he currently serves as Chairman of the community board of the Bank for that market. He has served as a member of the community board since 2012. Mr. Bowen is a partner and the President of Bowenz Donaldson Home for Funerals. He also serves as managing partner of Bowen Farming Enterprises, LLC, a timber, cattle, cotton and peanut farming operation, Bowen Land and Timber, LLC, Bowen Family Partnership and Fulwood Family Partnership, a farming and real estate development firm. He also serves as Vice Chairman of Tift Regional Medical Center, Chairman of Southwell Ambulatory and Chairman of the Georgia Board of Funeral Service. Mr. Bowen holds a bachelor’s degree in business administration from the University of Georgia. His extensive business experience and knowledge of the local economy, as well as his expertise in the real estate and farming industries, make Mr. Bowen a valuable resource for the Board. | ||||||

| 22 |

RODNEY D. BULLARD | ||||||

| | | Age: 49 Ameris Bancorp director since July 2019 Ameris Bank director since July 2019 | | | Board Committees: Compensation |

| Prior to the Company’s acquisition of Fidelity, Mr. Bullard served as a director of Fidelity and Fidelity Bank since 2018. He is the Chief Executive Officer of The Same House, a public benefit corporation dedicated to furthering economic mobility and bridging social division, which he established in January 2023. Previously, he led Global Social Responsibility at Chick-fil-A, Inc., which included Vice President of Corporate Social Responsibility for Chick-fil-A, Inc., and served as Executive Director of Chick-fil-A Foundation from 2011 to 2022. Mr. Bullard served as Assistant United States Attorney for the Northern District of Georgia from 2009 to 2011 and as Legislative Liaison/Counsel in the Office of the Secretary of the Air Force, The Pentagon from 2006 to 2009. Mr. Bullard’s qualifications to serve as director include degrees earned in the Advanced Management Program from Harvard Business School; master of business administration degree from Terry College of Business, University of Georgia; and juris doctor degree from Duke Law School, and his various business and legal positions held during his career. | ||||||

WM. MILLARD CHOATE | ||||||

| | | Age: 71 Ameris Bancorp director since July 2019 Ameris Bank director since July 2019 | | | Board Committees: Audit Credit Risk (Chair) |

| Prior to the Company’s acquisition of Fidelity, Mr. Choate served as a director of Fidelity and Fidelity Bank since 2010. Mr. Choate is the founder and currently serves as Chairman of Choate Construction Company, a commercial construction and interior construction firm founded in Atlanta, Georgia in 1989. Mr. Choate holds bachelor’s degrees in economics and business from Vanderbilt University. The experience Mr. Choate received founding his company and establishing all operations, procedures, banking, insurance and bonding relationships, marketing, preconstruction estimating and technology, in addition to his degrees in economics and business, qualify him to serve as a director. | ||||||

| 23 |

R. DALE EZZELL | ||||||

| | | Age: 74 Ameris Bancorp director since May 2010 Ameris Bank director since May 2010 | | | Board Committees: Audit Compensation |

| Mr. Ezzell served as a director of Southland Bank, formerly a wholly owned subsidiary of the Company, from 1983 until the merger of Southland Bank into the Bank in 2006. He also served as Southland Bank’s Chairman from 1995 until such merger. Mr. Ezzell currently serves as Chairman of the Bank’s community board in Dothan, Alabama. Mr. Ezzell is the founder and owner of Wisecards Printing and Mailing, a direct mail advertising business in Abbeville, Alabama. Prior to establishing Wisecards in 2001, he served as President and Chief Executive Officer of Ezzell’s Inc., which operated several department stores in southeast Alabama and southwest Georgia, from 1987 to 2000. Mr. Ezzell holds a bachelor’s degree in engineering from Auburn University and resides in our Abbeville, Alabama market. His years as a director of a subsidiary bank, along with his varied business and practical experience, give him a valuable understanding of the issues faced by the Company and its customers. | ||||||

LEO J. HILL | ||||||

| | | Age: 68 Ameris Bancorp director since January 2013 Ameris Bank director since January 2013 | | | Board Committees: Compensation (Chair) Corporate Governance and Nominating Executive |

| Mr. Hill has served as the Board’s Lead Independent Director since September 2019. Mr. Hill is the founder and owner of Advisor Network Solutions, LLC, a consulting services firm, and he currently serves as Lead Independent Director of Transamerica Mutual Funds. Prior to his service with Transamerica, Mr. Hill held various positions in banking, including Senior Vice President and Senior Loan Administration Officer for Wachovia Bank of Georgia’s southeastern corporate lending unit, President and Chief Executive Officer of Barnett Treasure Coast Florida with Barnett Banks and Market President of Sun Coast Florida with Bank of America. He has a bachelor’s degree in management and a master’s degree in finance, both from Georgia State University, and he has completed Louisiana State University’s Graduate School of Banking. With his wide-ranging professional and banking background, he brings a wealth of business and management experience to the Board. | ||||||

| 24 |

DANIEL B. JETER | ||||||

| | | Age: 72 Ameris Bancorp director since April 1997 Ameris Bank director since April 2002 | | | Board Committees: Compensation Enterprise Risk |

| Mr. Jeter served as the Board’s Lead Independent Director from July 2019 to September 2019, and from January 2018 to September 2018. Prior to first serving as Lead Independent Director in 2018, and again in late 2018 through June 2019, he served as Chairman of the Board of the Company and of the board of directors of the Bank from May 2007 through December 2017. He also serves on the community bank board for the Company’s Moultrie, Georgia market. Mr. Jeter is the Chairman and co-owner of Standard Discount Corporation, a family-owned consumer finance company. He joined Standard in 1979 and is an officer and director of each of Standard’s affiliates, including Colquitt Loan Company, Globe Loan Company of Hazelhurst, Globe Loan Company of Tifton, Globe Loan Company of Moultrie, Peach Finance Company, Personal Finance Service of Statesboro and Globe Financial Services of Thomasville. He is co-owner of Classic Insurance Company and President of Cavalier Insurance Company, both of which are re-insurance companies. Mr. Jeter is also a partner in a real estate partnership that develops owner-occupied commercial properties for office and professional use. He serves as a director and an officer of the Georgia Industrial Loan Corporation and as a director of Allied Business Systems. He received a bachelor’s degree in business administration from the University of Georgia. Mr. Jeter’s extensive experience in financial services, with a particular emphasis on lending activities, gives him invaluable insight into, and affords him a greater understanding of, the Company’s operations in his service as a director. | ||||||

ROBERT P. LYNCH | ||||||

| | | Age: 60 Ameris Bancorp director since February 2000 Ameris Bank director since February 2006 | | | Board Committees: Audit (Chair) Credit Risk |

| Mr. Lynch is the Vice President and Chief Financial Officer of Lynch Management Company, which owns and manages seven automobile dealerships located in the Southeast. He has been with Lynch Management Company for more than 30 years. Mr. Lynch’s family also owns and operates Shady Dale Farm, a beef cattle operation located in Shady Dale, Georgia. He holds a bachelor’s degree in business administration from the University of Florida. Mr. Lynch resides in our Jacksonville, Florida market and currently serves as a member of the community board of the Bank for that market. His business experience is extensive and varied, which gives him a firsthand understanding of the challenges faced by not only the Company but also its commercial customers, as well as opportunities available to the Company and its commercial customers. This understanding informs his service as a director and is a key benefit to the Board. | ||||||

| 25 |

ELIZABETH A. MCCAGUE | ||||||

| | | Age: 74 Ameris Bancorp director since August 2016 Ameris Bank director since August 2016 | | | Board Committees: Corporate Governance and Nominating Executive Enterprise Risk (Chair) |

| Ms. McCague currently serves as Chief Financial Officer for the Jacksonville Port Authority. She previously served as Interim Executive Director and Plan Administrator for the Jacksonville Police and Fire Pension Fund, where she was responsible for the management of the $1.6 billion pension portfolio and the administration of benefits. Ms. McCague provides mediation services for resolution of financial disputes through her business, McCague & Company, LLC. Ms. McCague has previously served on the UF Health Hospital Jacksonville board as the chair of the finance committee. She also has previously served as co-chair of the University of Florida Capital Campaign, a six-year, $1.5 billion effort, and chair of the North Florida Bank’s Advisory Board. She was also formerly the Chief Operating Officer of a software development company. She holds a bachelor’s degree in business administration from the University of Florida and a master of business administration degree from Jacksonville University. She resides in our Jacksonville, Florida market. Ms. McCague’s business experience is extensive and diverse, which provides valuable insight for the Bank and its customers. | ||||||

| CLAIRE E. MCLEAN | ||||||

| | | Age: 44 Ameris Bancorp director since February 2024 Ameris Bank director since February 2024 | | | Board Committees: None |

| Ms. McLean has served as Chief Operating Officer and Executive Vice President of Preferred Capital Securities, LLC and as President of its affiliate, Preferred Shareholder Services, since September 2023. Preferred Capital Services is an independent, third-party managing broker-dealer focused on the wholesale distribution of alternative investments to independent broker-dealers and registered investment advisors across the United States and Puerto Rico. Ms. McLean began her career in public accounting in September 2003 at Ernst & Young LLP, where she ultimately served as managing director in the Assurance Services practice from July 2018 until September 2023. She holds a bachelor of science and a master of accountancy from Auburn University. Ms. McLean’s extensive finance and accounting experience qualifies her to serve as a director. | ||||||

| 26 |

JAMES B. MILLER, JR. | ||||||

| | | Age: 84 Ameris Bancorp director since July 2019 Ameris Bank director since July 2019 | | | Board Committees: Executive |

Mr. Miller has served as Chairman of the Board since July 2019. Prior to the Company’s acquisition of Fidelity, Mr. Miller served as Chairman of the Board and Chief Executive Officer of Fidelity since its inception in 1979. He graduated from Florida State University and Vanderbilt Law School. Mr. Miller served as a civilian army lawyer at Redstone Arsenal Facility in Huntsville, Alabama. He clerked at the Florida Supreme Court and served as Chairman of Ageka Wohnungsbau GmbH in Berlin, Germany, and other family investment companies since 1971. Mr. Miller was elected a director of Fidelity Bank in 1976. He has served on many community boards including serving as Chairman of the Dekalb County pension board for 20 years. He previously served as a director of Interface, Inc. and now serves as a director of American Software, Inc. Mr. Miller’s employment agreement with the Company provides that Mr. Miller will serve as Chairman and a member of the boards of directors of the Company and the Bank until June 30, 2022 (which is the date his employment with the Company ended in accordance with his employment agreement) and that any age restrictions relating to membership on such boards shall be waived for Mr. Miller. Accordingly, in connection with the Company’s acquisition of Fidelity, the Board determined to exclude Mr. Miller from the Company’s requirement for directors to retire from the Board at the annual meeting of the shareholders following the date that the director reaches age 75. | ||||||

GLORIA A. O’NEAL | ||||||

| | | Age: 74 Ameris Bancorp director since July 2019 Ameris Bank director since July 2019 | | | Board Committees: Audit Enterprise Risk |

| Prior to the Company’s acquisition of Fidelity, Ms. O’Neal served as director of Fidelity and Fidelity Bank since 2018. Ms. O’Neal is a community leader who brings unique experience to the Board. She has served on many non-profit boards, including Rotary, and was a Court Appointed Special Advocate for Dekalb County and Treasurer of a preschool in Dahlonega. She remains active in a number of community outreach activities. She directs a monthly food ministry that benefits the needs of the local community and is a member of Women of Jeremiah’s Place, a non-profit organization providing financial counseling and transitional housing to homeless families. In 2014, after 33 years of service, she retired from Fidelity Bank to pursue her volunteer work. Ms. O’Neal last served at Fidelity Bank as Executive Vice President and Chief Risk Officer, after having been Internal Auditor. She has extensive experience with risk management, regulatory requirements, credit administration, operations and financial reporting, among other aspects of banking. Ms. O’Neal’s extensive banking experience qualifies her to serve as a director. | ||||||

| 27 |

H. PALMER PROCTOR, JR. | ||||||

| | | Age: 56 Ameris Bancorp director since July 2019 Ameris Bank director since July 2019 | | | Board Committees: Executive (Chair) |

Mr. Proctor has served as Chief Executive Officer of Ameris Bancorp and Ameris Bank since July 2019, and as Vice Chairman of the Board since July 2022. Prior to the Company’s acquisition of Fidelity, Mr. Proctor served as President of Fidelity since April 2006, as Chief Executive Officer of Fidelity Bank since April 2017, as President of Fidelity Bank since October 2004, and as a director of Fidelity and Fidelity Bank since 2004. Mr. Proctor also has served as a director of Brown and Brown, Inc., an independent insurance intermediary, since 2012, and serves as a member of the Advisory Board of Allied Financial and a director of Choate Construction Company. Mr. Proctor also served as Chairman of the Georgia Bankers Association from 2017 to 2018. With experience as an executive of Fidelity and the Company, Mr. Proctor offers expertise in financial services and a unique understanding of our markets, operations and competition, all of which qualifies him to serve as a director. Mr. Proctor’s employment agreement with the Company provides that Mr. Proctor will serve as a member of the boards of directors of Ameris and the Bank. | ||||||

WILLIAM H. STERN | ||||||

| | | Age: 67 Ameris Bancorp director since November 2013 Ameris Bank director since November 2013 | | | Board Committees: Compensation Corporate Governance and Nominating (Chair) Executive |

| Mr. Stern has been President and Chief Executive Officer of Stern Development, a real estate development firm doing work throughout the Southeast, since 1980. He currently serves as Chairman of the Board of the South Carolina State Ports Authority and as a member of the board of the South Carolina Coordinating Council for Economic Development. Mr. Stern currently serves as Chairman of the Bank’s community board for the State of South Carolina. His knowledge of the real estate industry, in addition to his extensive business experience and economic background, makes Mr. Stern a valuable resource for the Board. | ||||||

| 28 |

| • | Monitoring the integrity of the Company’s financial reporting process and systems of internal controls of the Company regarding finance, accounting and associated legal compliance; |

| • | Monitoring compliance with legal and regulatory requirements in relation to accounting and financial reporting processes and reporting, internal controls and auditing matters; |

| • | Monitoring the independence, qualifications and performance of the Company’s independent registered public accounting firm and internal auditing services; and |

| • | Providing a vehicle for communication among the independent registered public accounting firm, management, internal audit and the Board. |

| • | Establish the compensation for the Company’s executive officers; and |

| • | Act on such other matters relating to compensation as it deems appropriate, including an annual evaluation of our Chief Executive Officer and the design and oversight of all compensation and benefit programs in which the Company’s employees and officers are eligible to participate. |

| • | Considering, and making recommendations to the Board regarding, the size and composition of the Board, |

| • | Recommending and nominating candidates to fill Board vacancies that may occur and |

| • | Recommending to the Board the director nominees for whom the Board will solicit proxies. |

| 29 |

| | Director Name | | | Number of Meetings in 2023 | |

| | Board of Directors | | | 6 | |

| | Audit Committee | | | 5 | |

| | Compensation Committee | | | 5 | |

| | Corporate Governance and Nominating Committee | | | 4 | |

| | Executive Committee | | | 3 | |

| | Enterprise Risk Committee | | | 4 | |

| | Credit Risk Committee | | | 4 | |

| 30 |

| • | Annual Cash Retainer — each non-employee director receives an annual cash retainer at a rate of $60,000 per year. |

| • | Annual Equity Retainer — each non-employee director receives an annual award of time-based restricted stock with a value of approximately $85,000 per year. The restricted stock award vests on the earlier of: (i) the one-year anniversary of the date of grant; and (ii) the date of the Company’s next annual meeting of shareholders. |

| • | Non-executive Chair — receives an additional annual cash retainer at a rate of $80,000 per year. |

| • | Lead Independent Director — receives an additional annual cash retainer at a rate of $45,000 per year. |

| • | Committee Chair Retainer — the chair of each committee, if not an employee of the Company, receives an additional annual cash retainer at the rate set forth below: |

| • | Audit Committee — $30,000 per year. |

| • | Compensation Committee — $20,000 per year. |

| • | Corporate Governance and Nominating Committee — $20,000 per year. |

| • | Enterprise Risk Committee — $30,000 per year. |

| • | Executive Committee — $10,000 per year. |

| • | Credit Risk Committee — $10,000 per year. |

| • | Community Boards — each non-employee director with membership on one of the Bank’s community boards receives an additional monthly fee of $400, or $600 if serving as chair. |

| 31 |

| | Name | | | Fees Earned or Paid in Cash | | | Stock Awards(1) | | | Option Awards | | | Non-Equity Incentive Plan Compensation | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings | | | All Other Compensation | | | Total | |

| | William I. Bowen, Jr. | | | $67,200 | | | $85,024 | | | $ — | | | $ — | | | $ — | | | $1,034 | | | $153,258 | |

| | Rodney D. Bullard | | | $60,000 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $146,058 | |

| | Wm. Millard Choate | | | $70,000 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $156,058 | |

| | R. Dale Ezzell | | | $65,000 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $151,058 | |

| | Leo J. Hill | | | $125,000 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $211,058 | |

| | Daniel B. Jeter | | | $64,800 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $150,858 | |

| | Robert P. Lynch | | | $94,800 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $180,858 | |

| | Elizabeth A. McCague | | | $90,000 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $176,058 | |

| | James B. Miller, Jr. | | | $140,000 | | | $85,024 | | | $— | | | $— | | | $ — | | | $907,235 | | | $1,132,259 | |

| | Gloria A. O’Neal | | | $60,000 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $146,058 | |

| | William H. Stern | | | $87,200 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $173,258 | |

| | Jimmy D. Veal | | | $67,200 | | | $85,024 | | | $— | | | $— | | | $ — | | | $1,034 | | | $153,258 | |

| (1) | The stock award amount represents the fair value of the stock awards as calculated in accordance with GAAP. The shares were issued on June 5, 2023 and the fair value was $33.54 per share. The shares vest on the earlier of June 5, 2024 and the date of the Annual Meeting, provided that the grantee continues to serve as a director of the Company through the vesting date. |

| (2) | Includes the following amounts paid to Mr. Miller pursuant to the Miller Employment Agreement (as defined below): (i) $900,000 in respect of restrictive covenants; (ii) $6,833 for COBRA continuation benefits; and (iii) $402 for dividends on restricted stock. |

| 32 |

| 33 |

| | Name, Age and Term as Officer | | | Position | | | Principal Occupation for the Last Five Years and Other Directorships | |

| | H. Palmer Proctor, Jr., 56 Officer since 2019 | | | Chief Executive Officer | | | Chief Executive Officer of the Company and the Bank since July 2019, and Vice Chairman of the Board since July 2022. Prior to the Company’s acquisition of Fidelity, President of Fidelity since April 2006; Chief Executive Officer of Fidelity Bank since April 2017; President of Fidelity Bank since October 2004; and a director of Fidelity and Fidelity Bank since 2004. Also, has served as a director of Brown and Brown, Inc., an independent insurance intermediary, since 2012, and serves as a member of the Advisory Board of Allied Financial and a director of Choate Construction Company and Inspire Brands. Mr. Proctor also served as Chairman of the Georgia Bankers Association from 2017 to 2018. | |

| | Lawton E. Bassett, III, 55 Officer since 2016 | | | Corporate Executive Vice President, Chief Banking Officer and Bank President | | | Chief Banking Officer of the Company and Bank President since February 2017; Corporate Executive Vice President since February 2016; Chief Banking Officer for Alabama and Georgia from February 2016 through January 2017; and Regional President and Market President from 2006 through January 2017. From 2003 through 2006, served as President and Chief Executive Officer of Citizens Security Bank, formerly a wholly owned subsidiary of the Company. Prior to joining the Company, served in various commercial lending and leadership roles at Barnett Bank and SunTrust. | |

| | Nicole S. Stokes, 49 Officer since 2018 | | | Corporate Executive Vice President and Chief Financial Officer | | | Corporate Executive Vice President and Chief Financial Officer of the Company and the Bank since January 2018; Chief Financial Officer of the Bank since June 2016; and Senior Vice President and Controller from December 2010 through May 2016. | |

| | Ross L. Creasy, 50 Officer since 2019 | | | Corporate Executive Vice President and Chief Information Officer | | | Corporate Executive Vice President and Chief Information Officer of the Company and the Bank since July 2019. Prior to the Company’s acquisition of Fidelity, Chief Information Officer of Fidelity Bank since July 2018, during which Mr. Creasy oversaw Technology and Operations. Prior to joining Fidelity, served in various positions with E*TRADE, Capital One and the Federal Reserve. | |

| 34 |

| | Name, Age and Term as Officer | | | Position | | | Principal Occupation for the Last Five Years and Other Directorships | |

| | James A. LaHaise, 63 Officer since 2014 | | | Corporate Executive Vice President and Chief Strategy Officer | | | Corporate Executive Vice President and Chief Strategy Officer of the Company and the Bank since October 2018; Executive Vice President and Corporate Banking Executive from February 2017 through September 2018; Executive Vice President and Chief Banking Officer for Florida and South Carolina from February 2016 through January 2017; Executive Vice President, Commercial Banking Executive from June 2014 until February 2016; President and Chief Executive Officer of Coastal Bankshares, Inc. and The Coastal Bank from January 2013 until they were acquired by the Company in June 2014; and Executive Vice President and Chief Banking Officer of The Coastal Bank from May 2007 through December 2012. | |

| | William D. McKendry, 55 Officer since 2017 | | | Corporate Executive Vice President and Chief Risk Officer | | | Corporate Executive Vice President and Chief Risk Officer of the Company and the Bank since September 2017; Executive Vice President and Chief Risk Officer for Bank of North Carolina from December 2011 to September 2017; and Deputy General Auditor for First Citizens Bancshares from June 2004 to October 2011. | |

| | Michael T. Pierson, 54 Officer since 2019 | | | Corporate Executive Vice President, Chief Governance Officer and Corporate Secretary | | | Corporate Executive Vice President and Chief Governance Officer of the Company and the Bank since March 2020; Corporate Secretary of the Company and the Bank since January 2022; and Executive Vice President and Chief Operations Officer of Ameris and Ameris Bank from July 2019 to March 2020. Prior to the Company’s acquisition of Fidelity, served in various leadership roles at Fidelity and Fidelity Bank for 21 years, including Head of Commercial Banking, Mergers and Acquisitions and Chief Risk Officer. | |

| | Jody L. Spencer, 52 Officer since 2019 | | | Corporate Executive Vice President and Chief Legal Officer | | | Corporate Executive Vice President and Chief Legal Officer of the Company and the Bank since July 2019; attorney at Rogers & Hardin LLP from March 2001 to July 2019, serving as a partner from January 2008 to July 2019. | |

| | Douglas D. Strange, 54 Officer since 2024 | | | Corporate Executive Vice President and Chief Credit Officer | | | Chief Credit Officer of the Company and the Bank since April 2024; Managing Director of Credit Administration from January 2018 through March 2024; Executive Vice President of Colquitt Regional Medical Center from 2016 through 2017; Regional Credit Officer of the Bank from 2008 through 2015; and Senior Lender for the Bank from 2005 through 2008, with several years’ experience prior to joining Ameris Bank in various lending and underwriting roles and as a certified public accountant. | |

| 35 |

| | NEO | | | Position | |

| | H. Palmer Proctor, Jr. | | | Chief Executive Officer | |

| | Nicole S. Stokes | | | Corporate Executive Vice President and Chief Financial Officer | |

| | Lawton E. Bassett, III | | | Corporate Executive Vice President, Chief Banking Officer and Bank President | |

| | Jon S. Edwards | | | Corporate Executive Vice President and Chief Credit Officer | |

| | James A. LaHaise | | | Corporate Executive Vice President and Chief Strategy Officer | |

| • | Certain relevant 2023 business performance highlights; |

| • | Shareholder outreach; |

| • | Our compensation philosophy and the objectives of our compensation program; |

| • | What our compensation program is designed to reward; |

| • | Our process for determining executive officer compensation, including: |

| − | the role and responsibility of the Compensation Committee; |

| − | the role of the Chief Executive Officer and other NEOs; |

| − | the role of compensation consultants; and |

| − | benchmarking and other market analyses; |

| • | Elements of compensation provided to our executive officers, including: |

| − | the purpose of each element of compensation; |

| − | why we elect to pay each element of compensation; |

| − | how we determine the levels or payout opportunities for each element; |

| − | decisions on final payments for each element and how these align with performance; and |

| − | compensation program design changes for 2023; and |

| • | Other compensation and benefit policies affecting our executive officers. |

| 36 |

| • | Net income of $269.1 million, or $3.89 per diluted share; |

| • | Adjusted net income of $276.3 million, or $4.00 per diluted share; |

| • | TBV Growth of $3.72 per share, or 12.4%, to $33.64 at December 31, 2023; |

| • | Increase in the allowance for credit losses to 1.52% of loans, from 1.04% at December 31, 2022, due to forecasted economic conditions, particularly related to commercial real estate price levels; |

| • | Nonperforming portfolio assets, excluding government-guaranteed loans, as a percentage of total assets improved to 0.33% at December 31, 2023, compared with 0.34% at December 31, 2022; |

| • | Adjusted efficiency ratio of 52.58%; |

| • | Organic growth in loans of $414.1 million, or 2.1%; |

| • | Growth in total deposits of $1.25 billion, or 6.4%; and |

| • | Growth in tangible common equity ratio of 97 basis points, or 11.2%, to 9.64% at December 31, 2023. |

| • | Aligning the interests of our NEOs with those of our shareholders by delivering a substantial portion of each executive’s total compensation opportunity through performance-based incentives; |

| 37 |

| • | Attracting, retaining and motivating talented executives with significant industry knowledge and the experience and leadership capability to achieve success; and |

| • | Providing a strong link between pay and performance by using cash- and equity-based incentives to reward for the achievement of short- and long-term goals that align with the Company’s strategic priorities. |

| • | Competitive Compensation Opportunity. Our compensation levels are benchmarked to peers and industry comparators that are comparable to the Company in terms of factors such as asset size, geography and business model. We target annual pay levels for our NEOs based on a competitive range between the 50th and 75th percentiles of this market data. |

| • | Well-Balanced Compensation Program. The structure of our executive compensation program includes a balanced mix of cash and equity compensation with a strong emphasis on performance-based and at-risk compensation. |

| • | Alignment with Annual Goals. We use cash-based incentives that reward our NEOs for the achievement of both the financial and operating objectives of the Company and individual performance objectives, which together support our business strategy. |

| • | Performance-Based Long-Term Incentives. To strengthen the alignment between pay and performance and ensure retention of key talent, 60% of our equity-based long-term incentive compensation awarded in 2023 is tied to the achievement of longer-term (three-year) financial and strategic goals, while 40% of our equity-based long-term incentive compensation awarded in 2023 is tied to restricted stock awards that vest in equal installments over a three-year period from the date of grant. |

| • | Limited Perquisites. We provide our NEOs with minimal perquisites that are consistent with competitive market practice. |

| • | Independent Decision Makers. Our Compensation Committee of independent directors works closely with an independent compensation consultant to monitor our executive compensation program to ensure alignment with market trends and practices, our business plans and long-term strategy, and the interests of our shareholders. |

| 38 |

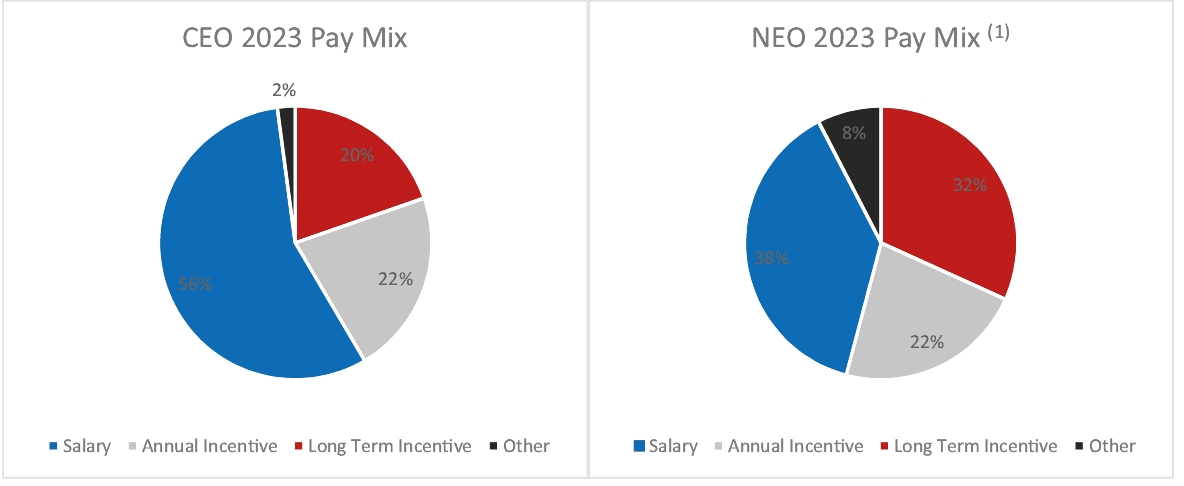

| (1) | The percentages in this graph exclude the compensation of the Chief Executive Officer. |

| 39 |

| 40 |

| | Company | | | Total Assets (12/31/2023) | | | Company | | | Total Assets (12/31/2023) | |

| | Cadence Bank | | | $48.9 | | | Simmons First National Corporation | | | $27.3 | |

| | Pinnacle Financial Partners, Inc. | | | $48.0 | | | United Community Banks, Inc. | | | $27.3 | |

| | SouthState Corporation | | | $44.9 | | | Home Bancshares, Inc. | | | $22.7 | |

| | UMB Financial Corporation | | | $44.0 | | | Atlantic Union Bankshares Corporation | | | $21.2 | |

| | Hancock Whitney Corporation | | | $35.6 | | | Independent Bank Group, Inc. | | | $19.0 | |

| | Bank OZK | | | $34.2 | | | Trustmark Corporation | | | $18.7 | |

| | Commerce Bancshares, Inc. | | | $31.7 | | | Renasant Corporation | | | $17.4 | |

| | United Bankshares, Inc. | | | $29.9 | | | Hilltop Holdings Inc. | | | $16.5 | |

| | Median | | | $28.6 | | ||||||

| | Ameris Bancorp | | | $25.2 | | ||||||

| | Component | | | Type | | | Objectives | |

| | Base Salary | | | Fixed | | | • Attract and retain executives • Compensate executive for level of responsibility and experience | |

| | Short-Term (Annual) Incentives | | | Variable | | | • Reward achievement of the Company’s annual financial and operational goals • Promote accountability and strategic decision-making | |

| | Long-Term Incentives | | | Variable | | | • Align management and shareholder goals by linking management compensation to share price over extended period • Encourage long-term, strategic decision-making • Reward achievement of long-term Company performance goals • Promote accountability • Retain key executives | |

| | Perquisites and Other Personal Benefits | | | Fixed | | | • Foster the health and well-being of executives • Attract and retain executives | |

| | Retirement Income and Savings Plans | | | Fixed | | | • Retain key executives • Reward employee loyalty and long-term service | |

| | Post-Termination Compensation and Benefits | | | Fixed | | | • Attract and retain executives • Promote continuity in management • Promote equitable separations between the Company and its executives | |

| 41 |

| • | The executive’s performance; |

| • | The performance of the Company; |

| • | The performance of the individual business or corporate function for which the executive is responsible; |

| • | The nature and importance of the position and role within the Company; |

| • | The scope of the executive’s responsibility; and |

| • | The current compensation package in place for the executive, including the executive’s current annual salary and potential awards under the Company’s incentive plan. |

| | | | 2022 Base Salary | | | 2023 Base Salary | | | Total Adjustment | | |

| | H. Palmer Proctor, Jr. | | | $885,000 | | | $925,000 | | | 5% | |

| | Nicole S. Stokes | | | $471,000 | | | $485,000 | | | 3% | |

| | Lawton E. Bassett, III | | | $500,000 | | | $500,000 | | | 0% | |

| | Jon S. Edwards | | | $402,000 | | | $414,000 | | | 3% | |

| | James A. LaHaise | | | $442,000 | | | $455,000 | | | 3% | |

| 42 |

| | Performance Measure | | | Weight | |

| | Credit Quality | | | 33.0% | |

| | ROA (Return on Assets) | | | 34.0% | |

| | Efficiency Ratio | | | 33.0% | |

| | Named Executive Officer | | | Threshold (% of salary) | | | Target (% of salary) | | | Maximum (% of salary) | |

| | H. Palmer Proctor, Jr. | | | 55.00% | | | 110.00% | | | 187.00% | |

| | Nicole S. Stokes | | | 37.50% | | | 75.00% | | | 127.50% | |

| | Lawton E. Bassett, III | | | 32.50% | | | 65.00% | | | 110.50% | |

| | Jon S. Edwards | | | 32.50% | | | 65.00% | | | 110.50% | |

| | James A. LaHaise | | | 37.50% | | | 75.00% | | | 127.50% | |

| 43 |

| | | | 33% Weight Credit Quality | | | 34% Weight ROA(2) | | | 33% Weight Efficiency Ratio | | |

| | Threshold | | | 0.50% | | | 25th percentile | | | 59.00% | |

| | Target Minimum | | | 0.40% | | | 50th percentile | | | 56.00% | |

| | Target Maximum | | | 0.35% | | | 60th percentile | | | 55.00% | |

| | Maximum | | | 0.25% | | | 75th percentile | | | 52.00% | |

| | Actual | | | 0.33%(1) | | | 1.06% | | | 52.58% | |

| | Actual Payout Percentage | | | 130.00% | | | 97.12% | | | 160.33% | |

| | Total Weighted Payout = 128.83% | | | | | | |||||

| (1) | Excludes serviced mortgage nonaccrual loans guaranteed by The Government National Mortgage Association (“Ginnie Mae” or “GNMA”). Credit Quality, as adjusted for such loans, is a non-GAAP measure. See “Reconciliation of GAAP and Non-GAAP Financial Measures” in Exhibit A to this Proxy Statement for a reconciliation to the most comparable GAAP measure. |

| (2) | The Threshold, Target Minimum, Target Maximum and Maximum levels were calculated as 0.81%, 1.07%, 1.11% and 1.23%, respectively, based upon the indicated percentiles of the return on assets of companies comprising the KBW Regional Banking Index. |

| | Named Executive Officer | | | Base Salary X | | | Target (% of salary) X | | | Company Achievement X | | | Individual Performance = | | | Actual Incentive Payout | |

| | H. Palmer Proctor, Jr. | | | $925,000 | | | 110% | | | 128.83% | | | 110% | | | $1,441,926 | |

| | Nicole S. Stokes | | | $485,000 | | | 75% | | | 128.83% | | | 110% | | | $515,480 | |

| | Lawton E. Bassett, III | | | $500,000 | | | 65% | | | 128.83% | | | 110% | | | $460,566 | |

| | Jon S. Edwards | | | $414,000 | | | 65% | | | 128.83% | | | 110% | | | $381,349 | |

| | James A. LaHaise | | | $455,000 | | | 75% | | | 128.83% | | | 110% | | | $483,594 | |

| 44 |

| • | Performance and contribution of the executive officer; |

| • | Prior awards issued to the executive officer; |

| • | The current amount and intrinsic value of unvested equity held by the executive officer; |

| • | Current number of shares owned by the executive officer; |

| • | Proportion of total compensation on an annual basis consisting of equity awards; and |

| • | Market data for the annual value of equity awarded to comparable positions. |

| | Named Executive Officer | | | LTI Target | |

| | H. Palmer Proctor, Jr. | | | $2,600,000 | |

| | Nicole S. Stokes | | | $600,000 | |

| | Lawton E. Bassett, III | | | $500,000 | |

| | Jon S. Edwards | | | $500,000 | |

| | James A. LaHaise | | | $600,000 | |

| 45 |

| • | Performance Stock Units (60% of long-term incentive award) – All NEOs received performance stock units on February 23, 2023. These performance stock units are awards that will be earned based upon the Compensation Committee’s assessment of the performance achievement of two, equally-weighted long-term financial objectives. The following scale applies to all performance stock unit awards: (i) Threshold performance will result in the NEOs earning 25% of the shares; (ii) Target performance will result in the NEOs earning 100% of the shares; and (iii) Maximum performance will result in the NEOs earning 200% of the shares. Failure to attain the Threshold level of performance will result in the forfeiture of all shares potentially issuable in connection with such performance stock unit awards. |

| • | Fifty percent of the award was based on relative three-year TBV Growth, exclusive of the impact of changes in accumulated other comprehensive income (“AOCI”), of the Company ranked in terms of a percentile in relation to the three-year TBV Growth, exclusive of changes in AOCI, for the same period of a peer group consisting of the companies comprising the KBW Nasdaq Regional Banking Index (“KRX”) objectives. In addition, the performance stock units awards have a relative Total Shareholder Return (“TSR”) modifier comparing the TSR of the Company to that of the KRX. The Targets and corresponding performance range requires meaningful growth over the three-year performance period. Elsewhere in this Proxy Statement, we also refer to these awards as Internal Metric Performance Stock Units or “IM PSUs.” |

| • | Fifty percent of the award was based on relative return on tangible common equity (“ROTCE”), exclusive of changes in AOCI, of the Company ranked in terms of a percentile in relation to the three-year ROTCE, exclusive of changes in AOCI, for the same period of a peer group consisting of the companies comprising the KRX. In addition, the performance stock units awards have a relative TSR modifier comparing the TSR of the Company to that of the KRX. Elsewhere in this Proxy Statement, we also refer to these awards as Total Shareholder Return Performance Stock Units or “TSR PSUs.” Dividend equivalents accrue, and are credited, with respect to the IM PSU and TSR PSU awards to the extent dividends are paid on the Common Stock, but are paid out only when, and if, the award is earned. Awards earned will vest on December 31, 2025, which is the end of the three-year performance period, and shares in respect of such awards will become issuable upon the Compensation Committee’s certification of the Company’s performance for the performance period, which would be expected to occur in the first quarter of 2026. If the Company delivers three-year TSR that falls between the 25th and 75th percentiles, relative to the KRX, then no adjustment to the payout determined by the TBV Growth and ROTCE goals will be applied. However, if performance is below the 25th percentile of the KRX, then a 20% discount will be applied to the earned award. Further, if performance is above the 75th percentile of the KRX, then a 20% premium would be applied to the earned award. Regardless of performance, the total award cannot exceed 200% of Target. |

| • | Time-based Restricted Stock (40% of long-term incentive award) – Shares of restricted stock are awarded subject to transfer and vesting restrictions. Restricted stock awards are intended to build stock ownership and foster executive retention. All of the NEOs received restricted stock awards on February 23, 2023. All of these restricted stock awards have voting rights and vest in equal installments over a three-year period. Dividend equivalents on the restricted stock awards will accrue and be credited with respect to such awards to the extent dividends are paid on the Common Stock, but will only be paid out when, and if, such awards vest. |

| 46 |

| | Performance Condition | | | 2021 Internal Metric Performance Stock Units | | |||||||||

| | Threshold | | | Target | | | Maximum | | | Actual | | |||

| | TBV Growth | | | $31.53 | | | $36.03 | | | $40.94 | | | $35.60 | |

| | Incentive Payout | | | 25% | | | 100% | | | 200% | | | 93% | |

| | NEO | | | Number of Shares Issued | |

| | H. Palmer Proctor, Jr. | | | 6,540 | |

| | Nicole S. Stokes | | | 2,012 | |

| | Lawton E. Bassett, III | | | 1,760 | |

| | Jon S. Edwards | | | 1,510 | |

| | James A. LaHaise | | | 1,760 | |

| | Performance Condition | | | 2021 Total Shareholder Return Performance Stock Units | | |||||||||

| | Threshold | | | Target | | | Maximum | | | Actual | | |||

| | ROTCE | | | 12.20% | | | 13.52% | | | 15.70% | | | 17.56% | |

| | Incentive Payout | | | 25% | | | 100% | | | 200% | | | 200% | |

| | NEO | | | Number of Shares Issued | |

| | H. Palmer Proctor, Jr. | | | 14,032 | |

| | Nicole S. Stokes | | | 4,318 | |

| | Lawton E. Bassett, III | | | 3,778 | |

| | Jon S. Edwards | | | 3,238 | |

| | James A. LaHaise | | | 3,778 | |

| 47 |

| 48 |

| (i) | “cause” means: (a) the commission of an act by the employee involving gross negligence, willful misconduct or moral turpitude that is materially damaging to the business, customer relations, operations or prospects of the Company or the Bank that brings the Company or the Bank into public disrepute or disgrace; (b) the commission of an act by the employee constituting dishonesty or fraud against the Company or the Bank; (c) the employee is convicted of, or pleads guilty or nolo contendere to, any crime involving breach of trust or moral turpitude or any felony; or (d) a consistent pattern of failure by the employee to follow the reasonable written instructions or policies of the employee’s supervisor or the Board. |

| (ii) | “good reason” means: (a) a material reduction in the employee’s rate of regular compensation from the Bank; (b) a relocation of the employee’s principal place of employment by more than 50 miles, other than to an office or location closer to the employee’s home residence and except for required travel on Bank business to an extent substantially consistent with the employee’s business travel obligations as of the date of relocation; or (c) a material reduction in the employee’s authority, duties, title or responsibilities, other than any change resulting solely from a change in the publicly-traded status of the Company or the Bank; provided, however, that the employee must provide timely notice to the Company and the Bank of the condition the employee contends is Good Reason, and the Company and the Bank must have a period of 30 days to remedy the Good Reason. |

| 49 |

| (i) | “cause” means: (a) the willful and continued failure of the employee to perform the employee’s duties with the Company and the Bank, other than any such failure resulting from disability, or to follow the directives of the Board or a more senior executive of the Company or the Bank, following written notice; (b) the employee’s willful misconduct or gross negligence in connection with the Company’s or the Bank’s business or relating to the employee’s duties under the Severance Agreement; (c) a willful act by the employee which constitutes a material breach of the employee’s fiduciary duty to the Company or the Bank; (d) the employee’s habitual substance abuse; (e) the employee’s being convicted of, or pleading guilty or nolo contendere to, a felony or a crime involving moral turpitude; (f) the employee’s willful theft, embezzlement or act of comparable dishonesty against the Company or the Bank; (g) a material breach by the employee of the Severance Agreement, which breach is not cured (if curable) by the employee within a specified period following notice; or (h) conduct by the employee that results in the permanent removal of the employee from the employee’s position as an officer or employee of the Company or the Bank pursuant to a written order by any banking regulatory agency with authority or jurisdiction over the Company or the Bank, as the case may be. |

| (ii) | “good reason” means: (a) a material reduction in the aggregate amount of the employee’s base salary plus annual and long-term incentive compensation opportunities; (b) a material diminution in the employee’s authority, duties or responsibilities; (c) a material change in the geographic location at which the employee must regularly perform the services to be performed by the employee pursuant to the Severance Agreement; and (d) any other action or inaction that constitutes a material breach by the Company and the Bank of the Severance Agreement; provided, however, that the employee must provide notice to the Company and the Bank of the condition the employee contends is good reason within 90 days after the initial existence of the condition, and the Company and the Bank must have a period of 30 days to remedy the condition. If the condition is not remedied within such 30-day period, then the employee must provide a notice of termination within 30 days after the end of the remedy period. |

| (iii) | “change of control” means, subject to certain exceptions, the occurrence of any of the following events: (a) any individual, entity or group (a “Person”) becomes the beneficial owner of 30% or |

| 50 |

| 51 |

| 52 |

| 53 |

| 54 |

| | Name and Principal Position | | | Year | | | Salary | | | Bonus | | | Stock Awards(1)(2) | | | Option Awards | | | Non-Equity Incentive Plan Compensation | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings | | | All Other Compensation(3) | | | Total | |

| | H. Palmer Proctor, Jr. Chief Executive Officer | | | 2023 | | | $918,333 | | | $— | | | $2,629,751 | | | $— | | | $1,441,926 | | | $— | | | $98,204 | | | $5,088,214 | |

| | 2022 | | | $879,167 | | | $— | | | $2,008,597 | | | $— | | | $1,465,458 | | | $— | | | $50,201 | | | $4,403,423 | | |||

| | 2021 | | | $850,000 | | | $— | | | $1,317,066 | | | $— | | | $1,219,240 | | | $— | | | $51,200 | | | $3,437,506 | | |||

| | Nicole S. Stokes Corporate EVP and CFO | | | 2023 | | | $482,667 | | | $— | | | $606,862 | | | $— | | | $515,480 | | | $15,462 | | | $46,105 | | | $1,666,576 | |

| | 2022 | | | $468,000 | | | $— | | | $602,578 | | | $— | | | $531,765 | | | $19,745 | | | $30,059 | | | $1,652,147 | | |||

| | 2021 | | | $450,833 | | | $— | | | $405,266 | | | $— | | | $422,359 | | | $10,286 | | | $35,183 | | | $1,323,927 | | |||

| | Lawton E. Bassett, III EVP and Banking Group President | | | 2023 | | | $500,000 | | | $— | | | $505,709 | | | $— | | | $460,566 | | | $38,429 | | | $45,908 | | | $1,550,612 | |

| | 2022 | | | $500,000 | | | $— | | | $502,149 | | | $— | | | $489,239 | | | $46,576 | | | $25,028 | | | $1,562,992 | | |||

| | 2021 | | | $500,000 | | | $— | | | $354,584 | | | $— | | | $466,180 | | | $26,867 | | | $29,283 | | | $1,376,914 | | |||

| | Jon S. Edwards Corporate EVP and Chief Credit Officer | | | 2023 | | | $412,000 | | | $— | | | $505,709 | | | $— | | | $381,349 | | | $110,005 | | | $42,687 | | | $1,451,750 | |

| | 2022 | | | $399,333 | | | $— | | | $502,149 | | | $— | | | $393,348 | | | $134,560 | | | $24,707 | | | $1,454,097 | | |||

| | 2021 | | | $384,167 | | | $— | | | $303,994 | | | $— | | | $359,891 | | | $80,864 | | | $28,382 | | | $1,157,298 | | |||

| | James A. LaHaise Corporate EVP and Chief Strategy Officer | | | 2023 | | | $452,833 | | | $— | | | $606,862 | | | $— | | | $483,594 | | | $97,355 | | | $45,858 | | | $1,686,502 | |

| | 2022 | | | $439,167 | | | $— | | | $602,578 | | | $— | | | $499,024 | | | $110,444 | | | $27,775 | | | $1,678,988 | | |||

| | 2021 | | | $416,667 | | | $— | | | $354,584 | | | $— | | | $396,253 | | | $74,456 | | | $33,179 | | | $1,275,139 | |

| (1) | Represents the aggregate grant date fair values of the awards. For all years presented, grants were made in the form of: (i) restricted stock awards, which vest in equal installments over a three-year period; (ii) IM PSUs, which for 2023 are based on relative TBV Growth of the Company, exclusive of changes in AOCI, ranked in terms of a percentile in relation to the three-year TBV Growth, exclusive of changes in AOCI, for the same period of a peer group consisting of the companies comprising the KRX and are subject to a TSR modifier comparing the TSR of the Company to that of the KRX and prior to 2023 which were based on internal TBV Growth objectives over a three-year period; and (iii) TSR PSUs, which are based on relative ROTCE of the Company ranked in terms of a percentile in relation to the three-year ROTCE for the same period of a peer group consisting of the companies comprising the KRX and are subject to a TSR modifier comparing the TSR of the Company to that of the KRX. See the Grants of Plan-Based Awards under “Executive Compensation-Compensation Tables.” |

| (2) | The fair value of the performance stock units granted to each NEO as of the grant date, assuming maximum performance, is as follows: Mr. Proctor, $2,999,196; Ms. Stokes, $692,122; Mr. Bassett, $576,722; Mr. Edwards, $576,722; and Mr. LaHaise, $692,122. |

| (3) | Details on the amounts reported for All Other Compensation in 2023 are set forth in the following supplementary table. |

| | Named Executive Officer | | | Auto Provision(a) | | | Dividends | | | Employer 401(k) Match | | | Health and Welfare(b) | | | Life Insurance | |

| | H. Palmer Proctor, Jr. | | | $7,536 | | | $56,495 | | | $13,200 | | | $15,715 | | | $5,258 | |

| | Nicole S. Stokes | | | $— | | | $18,600 | | | $11,250 | | | $15,715 | | | $540 | |

| | Lawton E. Bassett, III | | | $3,300 | | | $20,969 | | | $13,200 | | | $6,891 | | | $1,548 | |

| | Jon S. Edwards | | | $— | | | $18,120 | | | $13,200 | | | $8,991 | | | $2,376 | |

| | James A. LaHaise | | | $— | | | $18,465 | | | $13,200 | | | $11,817 | | | $2,376 | |

| (a) | Amounts reported in the table reflect the personal-use levels of this perquisite. |

| (b) | Amounts incurred by the Company for the employer’s cost of providing health and welfare benefits. |

| 55 |

| | Name | | | Plan/Grant Date | | | Award Type | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | | | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | | | All Other Stock Awards: Number of Shares of Stock or Units (#)(3) | | | Grant Date Fair Value of Stock Awards(4) | | ||||||||||||

| | Threshold ($) | | | Target ($) | | | Maximum ($) | | | Threshold (#) | | | Target (#) | | | Maximum (#) | | |||||||||||||||

| | H. Palmer Proctor, Jr. | | | 2/23/2023 | | | STI | | | 508,750 | | | 1,017,500 | | | 1,729,750 | | | — | | | — | | | — | | | — | | | — | |

| | | | 2/23/2023 | | | RSA | | | — | | | — | | | — | | | — | | | — | | | — | | | 21,537 | | | 1,040,022 | | |

| | | | 2/23/2023 | | | IM PSU | | | — | | | — | | | — | | | 4,038 | | | 16,152 | | | 32,304 | | | — | | | 794,840 | | |

| | | | 2/23/2023 | | | TSR PSU | | | — | | | — | | | — | | | 4,038 | | | 16,153 | | | 32,306 | | | — | | | 794,889 | | |

| | Nicole S. Stokes | | | 2/23/2023 | | | STI | | | 181,875 | | | 363,750 | | | 618,375 | | | — | | | — | | | — | | | — | | | — | |

| | | | 2/23/2023 | | | RSA | | | — | | | — | | | — | | | — | | | — | | | — | | | 4,970 | | | 240,001 | | |

| | | | 2/23/2023 | | | IM PSU | | | — | | | — | | | — | | | 932 | | | 3,727 | | | 7,454 | | | — | | | 183,406 | | |

| | | | 2/23/2023 | | | TSR PSU | | | — | | | — | | | — | | | 932 | | | 3,728 | | | 7,456 | | | — | | | 183,455 | | |

| | Lawton E. Bassett, III | | | 2/23/2023 | | | STI | | | 162,500 | | | 325,000 | | | 552,500 | | | — | | | — | | | — | | | — | | | — | |

| | | | 2/23/2023 | | | RSA | | | — | | | — | | | — | | | — | | | — | | | — | | | 4,142 | | | 200,017 | | |

| | | | 2/23/2023 | | | IM PSU | | | — | | | — | | | — | | | 777 | | | 3,106 | | | 6,212 | | | — | | | 152,846 | | |

| | | | 2/23/2023 | | | TSR PSU | | | — | | | — | | | — | | | 777 | | | 3,106 | | | 6,212 | | | — | | | 152,846 | | |

| | Jon S. Edwards | | | 2/23/2023 | | | STI | | | 134,550 | | | 269,100 | | | 457,470 | | | — | | | — | | | — | | | — | | | | |

| | | | 2/23/2023 | | | RSA | | | — | | | — | | | — | | | — | | | — | | | — | | | 4,142 | | | 200,017 | | |

| | | | 2/23/2023 | | | IM PSU | | | — | | | — | | | — | | | 777 | | | 3,106 | | | 6,212 | | | — | | | 152,846 | | |

| | | | 2/23/2023 | | | TSR PSU | | | — | | | — | | | — | | | 777 | | | 3,106 | | | 6,212 | | | — | | | 152,846 | | |

| | James A. LaHaise | | | 2/23/2023 | | | STI | | | 170,625 | | | 341,250 | | | 580,125 | | | — | | | — | | | — | | | — | | | — | |

| | | | 2/23/2023 | | | RSA | | | — | | | — | | | — | | | — | | | — | | | — | | | 4,970 | | | 240,001 | | |

| | | | 2/23/2023 | | | IM PSU | | | — | | | — | | | — | | | 932 | | | 3,727 | | | 7,454 | | | — | | | 183,406 | | |

| | | | 2/23/2023 | | | TSR PSU | | | — | | | — | | | — | | | 932 | | | 3,728 | | | 7,456 | | | — | | | 183,455 | | |

| STI | | | = Short Term (Annual) Incentives |

| RSA | | | = Restricted Stock Award |

| IM PSU | | | = Internal Metric Performance Stock Units |

| TSR PSU | | | = Total Shareholder Return Performance Stock Units |

| (1) | The amounts shown under the Target column reflect the possible payment if performance measures are achieved at Target level under the short-term incentive plan as approved by the Board on February 23, 2023. The amounts shown under the Threshold column reflect the possible minimum payment level under the short-term incentive plan, which is 50% of Target. The amounts shown under the Maximum column reflect the maximum possible payment under the short-term incentive plan, which is 170% of Target. |

| (2) | Amounts represent the estimated Threshold, Target and Maximum payouts as of the grant date for the NEOs’ 2023 awards of performance stock units. The actual value realized by the NEO for the 2023 performance stock units will not be determined until the time of vesting. |

| (3) | Amounts represent the NEOs’ 2023 restricted stock award. The grant date fair value of the restricted stock awards approved by the Board for all NEOs and granted on February 23, 2023 was $48.29 per share. |

| (4) | Amounts granted pursuant to the 2021 Plan as described in the “Executive Compensation-Compensation Discussion and Analysis.” Assumptions used to calculate fair market value are provided in Note 15 to the Company’s consolidated financial statement included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. |

| 56 |

| | Name | | | Award Type | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested | | | Date Equity Fully Vests | |

| | H. Palmer Proctor, Jr. | | | RSA | | | 4,677 | | | $248,115 | | | | | | | 2/18/2024(1) | | ||

| | RSA | | | 14,166 | | | $751,506 | | | | | | | 2/24/2024(2)(7) | | |||||

| | IM PSU(8) | | | | | | | 10,480 | | | $555,964 | | | 12/31/2024(3) | | |||||

| | TSR PSU(8) | | | | | | | 10,480 | | | $555,964 | | | 12/31/2024(4) | | |||||

| | RSA | | | 14,166 | | | $751,506 | | | | | | | 2/24/2025(2)(7) | | |||||

| | IM PSU(8) | | | | | | | 16,152 | | | $856,864 | | | 12/31/2025(5) | | |||||

| | TSR PSU(8) | | | | | | | 16,153 | | | $856,917 | | | 12/31/2025(6) | | |||||

| | RSA | | | 7,179 | | | $380,846 | | | | | | | 2/24/2026(7) | | |||||

| | Nicole S. Stokes | | | RSA | | | 1,439 | | | $76,339 | | | | | | | 2/18/2024(1) | | ||

| | RSA | | | 3,753 | | | $199,097 | | | | | | | 2/24/2024(2)(7) | | |||||

| | IM PSU(8) | | | | | | | 3,144 | | | $166,789 | | | 12/31/2024(3) | | |||||

| | TSR PSU(8) | | | | | | | 3,144 | | | $166,789 | | | 12/31/2024(4) | | |||||

| | RSA | | | 3,753 | | | $199,097 | | | | | | | 2/24/2025(2)(7) | | |||||

| | IM PSU(8) | | | | | | | 3,727 | | | $197,717 | | | 12/31/2025(5) | | |||||

| | TSR PSU(8) | | | | | | | 3,728 | | | $197,770 | | | 12/31/2025(6) | | |||||

| | RSA | | | 1,656 | | | $87,851 | | | | | | | 2/24/2026(7) | | |||||

| | Lawton E. Bassett, III | | | RSA | | | 1,259 | | | $66,790 | | | | | | | 2/18/2024(1) | | ||

| | RSA | | | 3,128 | | | $165,940 | | | | | | | 2/24/2024(2)(7) | | |||||

| | IM PSU(8) | | | | | | | 2,620 | | | $138,991 | | | 12/31/2024(3) | | |||||

| | TSR PSU(8) | | | | | | | 2,620 | | | $138,991 | | | 12/31/2024(4) | | |||||

| | RSA | | | 3,128 | | | $165,940 | | | | | | | 2/24/2025(2)(7) | | |||||

| | IM PSU(8) | | | | | | | 3,106 | | | $164,773 | | | 12/31/2025(5) | | |||||

| | TSR PSU(8) | | | | | | | 3,106 | | | $164,773 | | | 12/31/2025(6) | | |||||

| | RSA | | | 1,380 | | | $73,209 | | | | | | | 2/24/2026(7) | | |||||

| | Jon S. Edwards | | | RSA | | | 1,079 | | | $57,241 | | | | | | | 2/18/2024(1) | | ||

| | RSA | | | 3,128 | | | $165,940 | | | | | | | 2/24/2024(2)(7) | | |||||

| | IM PSU(8) | | | | | | | 2,620 | | | $138,991 | | | 12/31/2024(3) | | |||||

| | TSR PSU(8) | | | | | | | 2,620 | | | $138,991 | | | 12/31/2024(4) | | |||||

| | RSA | | | 3,128 | | | $165,940 | | | | | | | 2/24/2025(2)(7) | | |||||

| | IM PSU(8) | | | | | | | 3,106 | | | $164,773 | | | 12/31/2025(5) | | |||||

| | TSR PSU(8) | | | | | | | 3,106 | | | $164,773 | | | 12/31/2025(6) | | |||||

| | RSA | | | 1,380 | | | $73,209 | | | | | | | 2/24/2026(7) | |

| 57 |

| | Name | | | Award Type | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested | | | Date Equity Fully Vests | |

| | James A. LaHaise | | | RSA | | | 1,259 | | | $66,790 | | | | | | | 2/18/2024(1) | | ||

| | RSA | | | 3,753 | | | $199,097 | | | | | | | 2/24/2024(2)(7) | | |||||

| | IM PSU(8) | | | | | | | 3,144 | | | $166,789 | | | 12/31/2024(3) | | |||||

| | TSR PSU(8) | | | | | | | 3,144 | | | $166,789 | | | 12/31/2024(4) | | |||||