2nd Quarter 2022 Results Investor Presentation Exhibit 99.2

Cautionary Statements 1 This presentation contains forward-looking statements, as defined by federal securities laws, including, among other forward-looking statements, certain plans, expectations and goals. Words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, as well as similar expressions, are meant to identify forward-looking statements. The forward-looking statements in this presentation are based on current expectations and are provided to assist in the understanding of potential future performance. Such forward-looking statements involve numerous assumptions, risks and uncertainties that may cause actual results to differ materially from those expressed or implied in any such statements, including, without limitation, the following: general competitive, economic, unemployment, political and market conditions and fluctuations, including real estate market conditions, and the effects of such conditions and fluctuations on the creditworthiness of borrowers, collateral values, asset recovery values and the value of investment securities; movements in interest rates and their impacts on net interest margin; expectations on credit quality and performance; legislative and regulatory changes; changes in U.S. government monetary and fiscal policy; the impact of the COVID-19 pandemic on the general economy, our customers and the allowance for loan losses; the benefits that may be realized by our customers from government assistance programs and regulatory actions related to the COVID-19 pandemic; the potential impact of the phase-out of the London Interbank Offered Rate (“LIBOR”) or other changes involving LIBOR; competitive pressures on product pricing and services; the cost savings and any revenue synergies expected to result from acquisition transactions, which may not be fully realized within the expected timeframes if at all; the success and timing of other business strategies; our outlook and long-term goals for future growth; and natural disasters, geopolitical events, acts of war or terrorism or other hostilities, public health crises and other catastrophic events beyond our control. For a discussion of some of the other risks and other factors that may cause such forward-looking statements to differ materially from actual results, please refer to the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and the Company’s subsequently filed periodic reports and other filings. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise forward-looking statements.

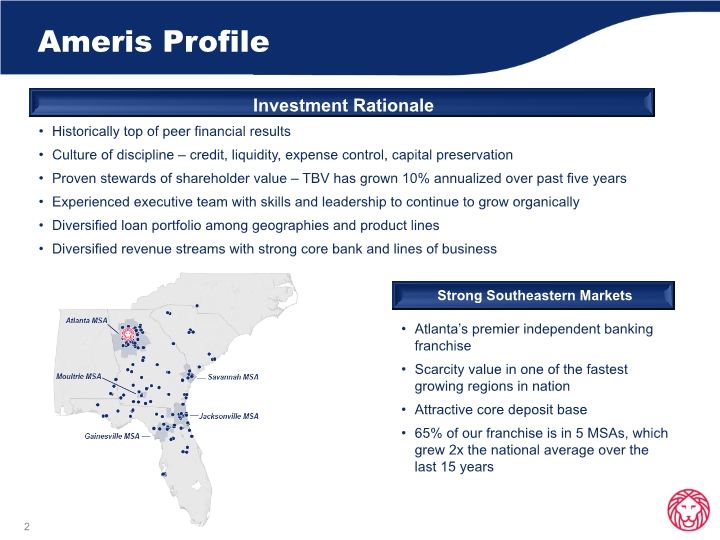

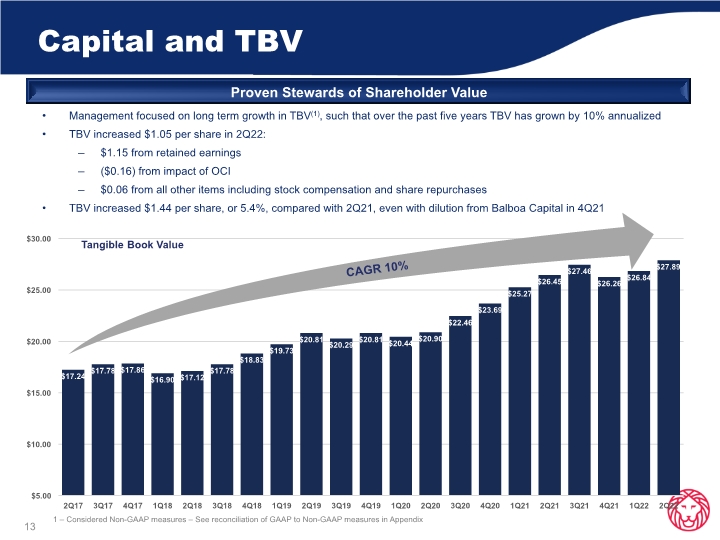

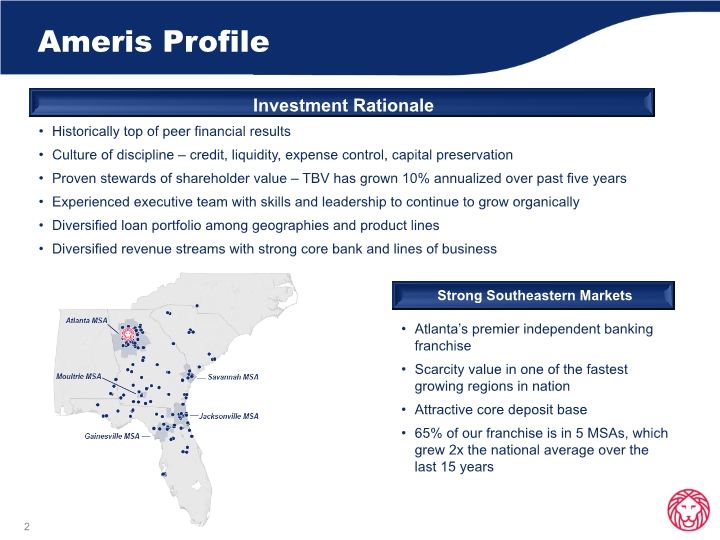

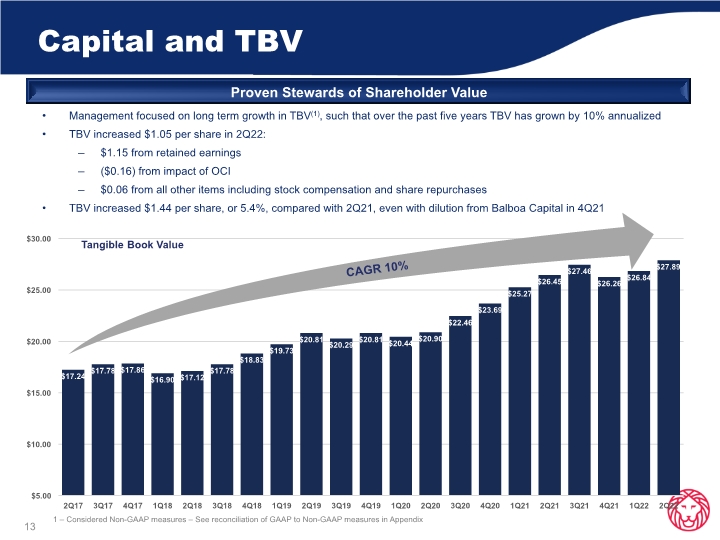

Ameris Profile Investment Rationale Historically top of peer financial results Culture of discipline – credit, liquidity, expense control, capital preservation Proven stewards of shareholder value – TBV has grown 10% annualized over past five years Experienced executive team with skills and leadership to continue to grow organically Diversified loan portfolio among geographies and product lines Diversified revenue streams with strong core bank and lines of business Strong Southeastern Markets Atlanta’s premier independent banking franchise Scarcity value in one of the fastest growing regions in nation Attractive core deposit base 65% of our franchise is in 5 MSAs, which grew 2x the national average over the last 15 years 2

2nd Quarter 2022 Financial Results

2Q 2022 Operating Highlights 4 Net income of $90.1 million, or $1.30 per diluted share Adjusted net income(1) of $81.5 million, or $1.18 per diluted share Growth in tangible book value(1) of $1.05 per share, or 3.9%, to $27.89 at June 30, 2022 Only $0.16 dilution, or less than 1%, in tangible book value(1) from increase in net unrealized losses on available-for-sale securities Improvement in net interest margin of 31bps, from 3.35% for 1Q22 to 3.66% this quarter Organic loan growth of $1.42 billion, or 35.1% annualized (and $1.45 billion, or 36.4% annualized, exclusive of PPP loans) Adjusted ROA(1) of 1.40% Adjusted ROTCE(1) of 17.18% Adjusted efficiency ratio(1) of 53.66% Well positioned to be asset sensitive in rising rate environment Continued growth in noninterest bearing deposits, representing 41.98% of total deposits 1 – Considered Non-GAAP measures – See reconciliation of GAAP to Non-GAAP measures in Appendix

2022 YTD Operating Highlights 5 Net income of $171.8 million, or $2.47 per diluted share Adjusted net income(1) of $156.5 million, or $2.25 per diluted share Growth in tangible book value(1) of $1.63 per share, or 6.2%, to $27.89 at June 30, 2022, compared with $26.26 at December 31, 2021 Improvement in TCE/TA ratio of 53bps to 8.58% at June 30, 2022 Noninterest bearing deposit growth of $488.1 million, or 12.7% annualized Organic loan growth of $1.69 billion, or 21.3% annualized (and $1.80 billion, or 22.9% annualized, exclusive of PPP loans) Improvement in net interest margin of 6bps, from 3.45% for YTD 2021 to 3.51% YTD 2022 Adjusted ROA(1) of 1.35% Adjusted ROTCE(1) of 16.79% 1 – Considered Non-GAAP measures – See reconciliation of GAAP to Non-GAAP measures in Appendix

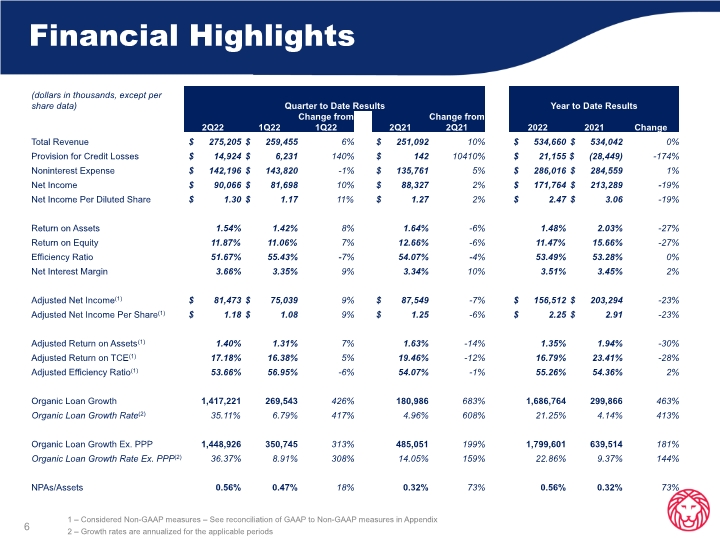

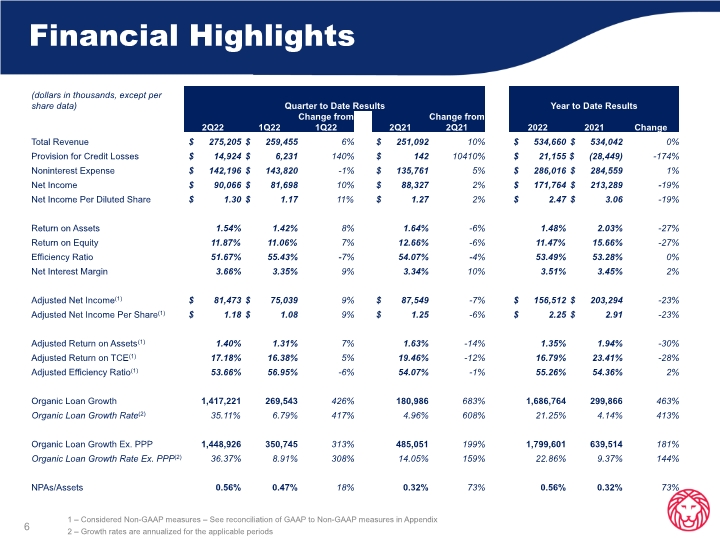

Financial Highlights 6 1 – Considered Non-GAAP measures – See reconciliation of GAAP to Non-GAAP measures in Appendix 2 – Growth rates are annualized for the applicable periods

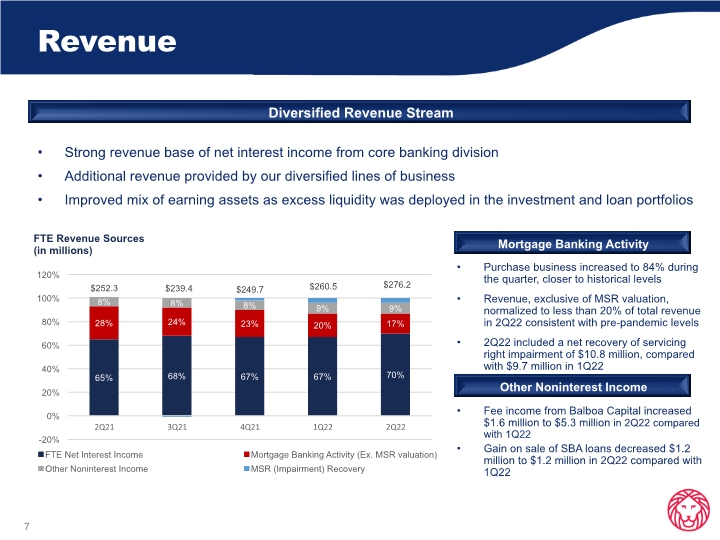

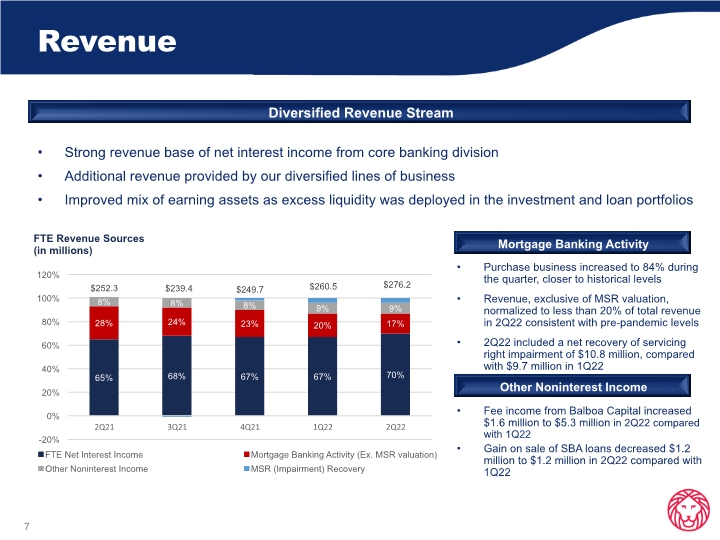

Revenue 7 Strong revenue base of net interest income from core banking division Additional revenue provided by our diversified lines of business Improved mix of earning assets as excess liquidity was deployed in the investment and loan portfolios Diversified Revenue Stream Mortgage Banking Activity Purchase business increased to 84% during the quarter, closer to historical levels Revenue, exclusive of MSR valuation, normalized to less than 20% of total revenue in 2Q22 consistent with pre-pandemic levels 2Q22 included a net recovery of servicing right impairment of $10.8 million, compared with $9.7 million in 1Q22 Other Noninterest Income Fee income from Balboa Capital increased $1.6 million to $5.3 million in 2Q22 compared with 1Q22 Gain on sale of SBA loans decreased $1.2 million to $1.2 million in 2Q22 compared with 1Q22

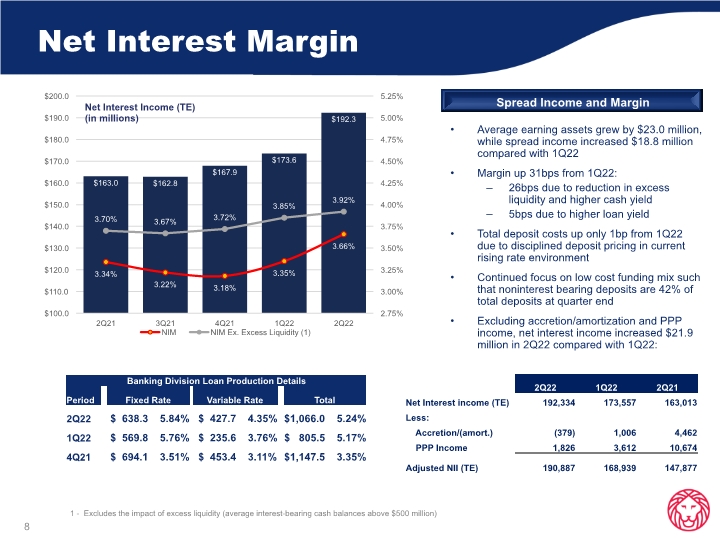

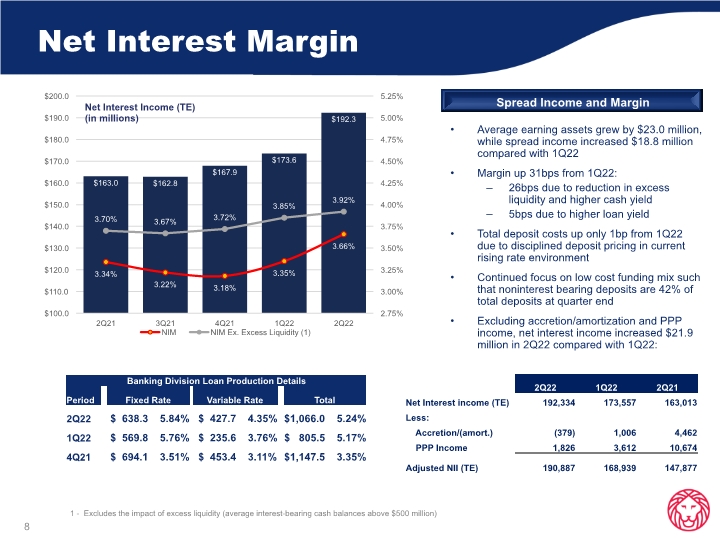

Net Interest Margin 8 Average earning assets grew by $23.0 million, while spread income increased $18.8 million compared with 1Q22 Margin up 31bps from 1Q22: 26bps due to reduction in excess liquidity and higher cash yield 5bps due to higher loan yield Total deposit costs up only 1bp from 1Q22 due to disciplined deposit pricing in current rising rate environment Continued focus on low cost funding mix such that noninterest bearing deposits are 42% of total deposits at quarter end Excluding accretion/amortization and PPP income, net interest income increased $21.9 million in 2Q22 compared with 1Q22: 1 - Excludes the impact of excess liquidity (average interest-bearing cash balances above $500 million) Spread Income and Margin

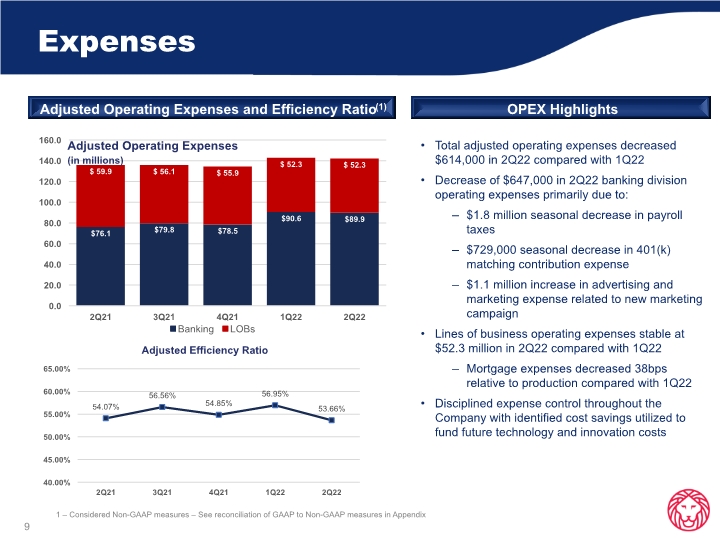

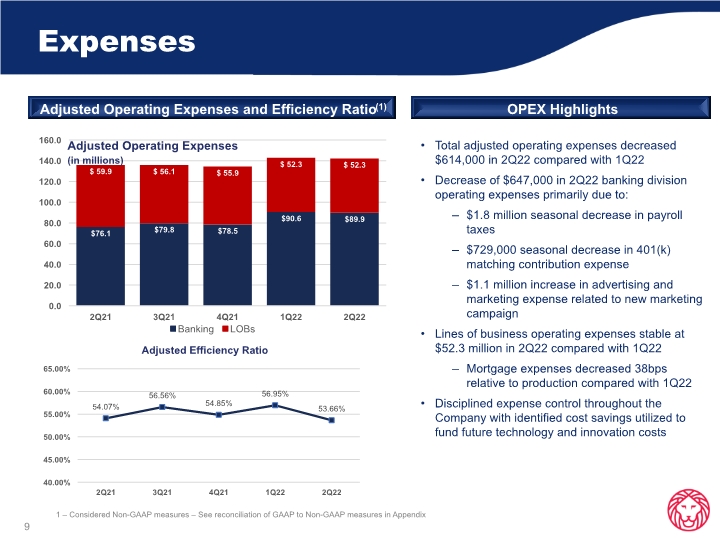

Expenses Adjusted Operating Expenses and Efficiency Ratio(1) OPEX Highlights 9 Total adjusted operating expenses decreased $614,000 in 2Q22 compared with 1Q22 Decrease of $647,000 in 2Q22 banking division operating expenses primarily due to: $1.8 million seasonal decrease in payroll taxes $729,000 seasonal decrease in 401(k) matching contribution expense $1.1 million increase in advertising and marketing expense related to new marketing campaign Lines of business operating expenses stable at $52.3 million in 2Q22 compared with 1Q22 Mortgage expenses decreased 38bps relative to production compared with 1Q22 Disciplined expense control throughout the Company with identified cost savings utilized to fund future technology and innovation costs 1 – Considered Non-GAAP measures – See reconciliation of GAAP to Non-GAAP measures in Appendix

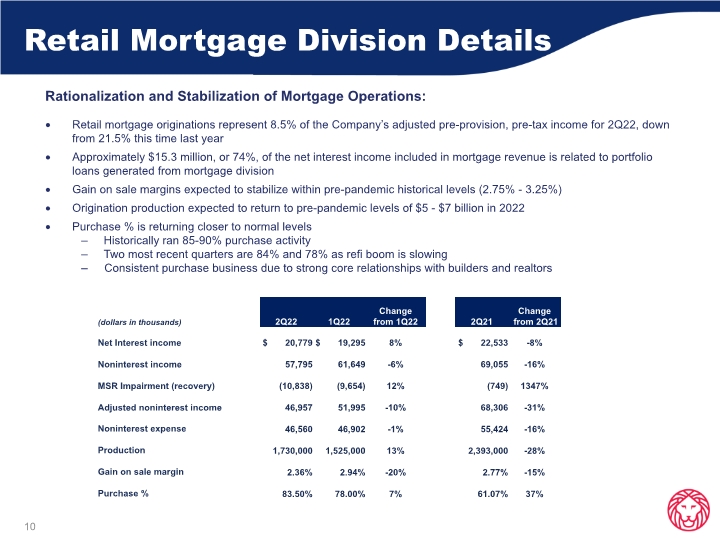

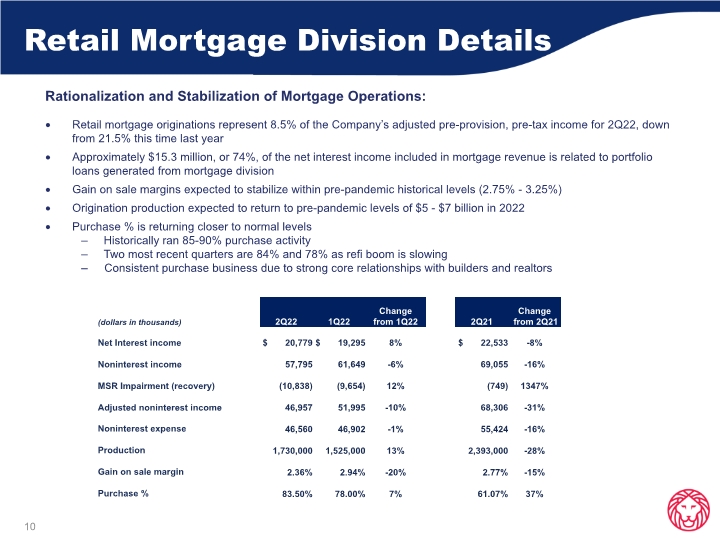

Retail Mortgage Division Details 10 Rationalization and Stabilization of Mortgage Operations: Retail mortgage originations represent 8.5% of the Company’s adjusted pre-provision, pre-tax income for 2Q22, down from 21.5% this time last year Approximately $15.3 million, or 74%, of the net interest income included in mortgage revenue is related to portfolio loans generated from mortgage division Gain on sale margins expected to stabilize within pre-pandemic historical levels (2.75% - 3.25%) Origination production expected to return to pre-pandemic levels of $5 - $7 billion in 2022 Purchase % is returning closer to normal levels Historically ran 85-90% purchase activity Two most recent quarters are 84% and 78% as refi boom is slowing Consistent purchase business due to strong core relationships with builders and realtors

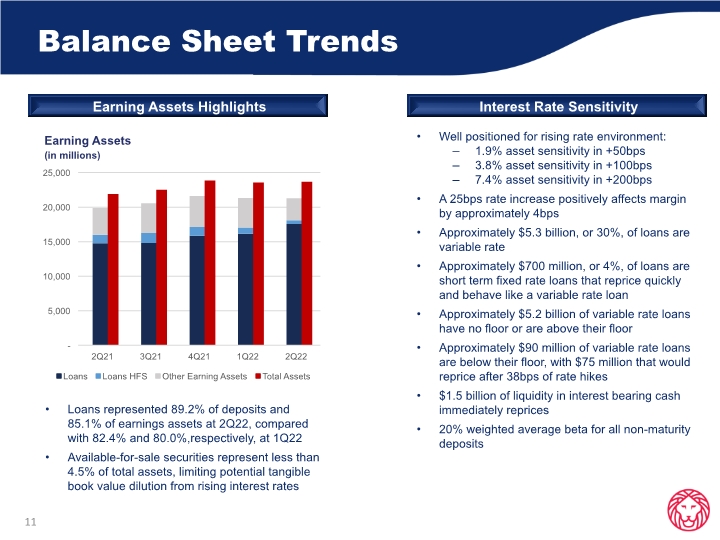

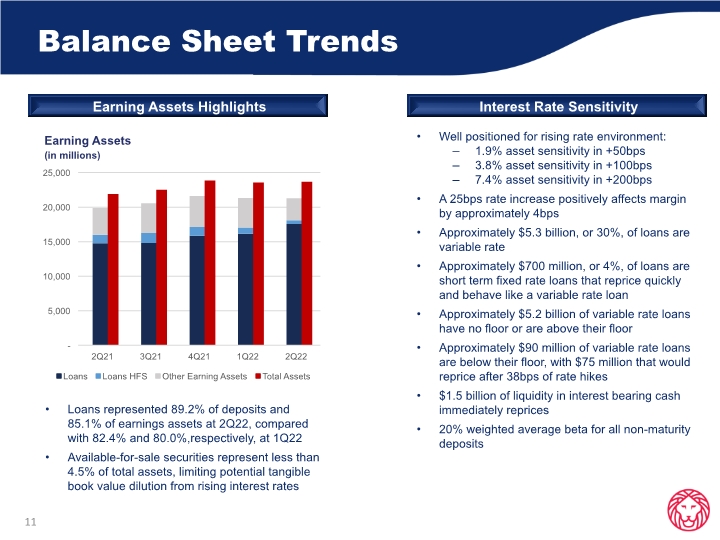

Balance Sheet Trends 11 Well positioned for rising rate environment: 1.9% asset sensitivity in +50bps 3.8% asset sensitivity in +100bps 7.4% asset sensitivity in +200bps A 25bps rate increase positively affects margin by approximately 4bps Approximately $5.3 billion, or 30%, of loans are variable rate Approximately $700 million, or 4%, of loans are short term fixed rate loans that reprice quickly and behave like a variable rate loan Approximately $5.2 billion of variable rate loans have no floor or are above their floor Approximately $90 million of variable rate loans are below their floor, with $75 million that would reprice after 38bps of rate hikes $1.5 billion of liquidity in interest bearing cash immediately reprices 20% weighted average beta for all non-maturity deposits Interest Rate Sensitivity Earning Assets Highlights Loans represented 89.2% of deposits and 85.1% of earnings assets at 2Q22, compared with 82.4% and 80.0%,respectively, at 1Q22 Available-for-sale securities represent less than 4.5% of total assets, limiting potential tangible book value dilution from rising interest rates

Strong Core Deposit Base 12 Deposit Highlights Deposit mix well positioned for future rate increases: Improved deposit mix over the past five years such that noninterest bearing deposits now represent 41.98% of total deposits, a 45% improvement from 28.88% at 2Q17 Excess liquidity of $1.5 billion provides ability to manage deposit costs in rising rate environment Total deposits increased $96.5 million, or 0.5%, in 2Q22 compared with 1Q22 Noninterest-bearing deposits increased $392.7 million, or 5.0% Low cost savings deposits increased $23.2 million, or 2.3% MMDA decreased $260.0 million, or 5.0% Total interest bearing deposit costs increased slightly to 0.17% in 2Q22, compared with 0.14% in 1Q22 and improved from 0.21% in 2Q21

Capital and TBV Proven Stewards of Shareholder Value 13 Management focused on long term growth in TBV(1), such that over the past five years TBV has grown by 10% annualized TBV increased $1.05 per share in 2Q22: $1.15 from retained earnings ($0.16) from impact of OCI $0.06 from all other items including stock compensation and share repurchases TBV increased $1.44 per share, or 5.4%, compared with 2Q21, even with dilution from Balboa Capital in 4Q21 1 – Considered Non-GAAP measures – See reconciliation of GAAP to Non-GAAP measures in Appendix

Loan Diversification and Credit Quality

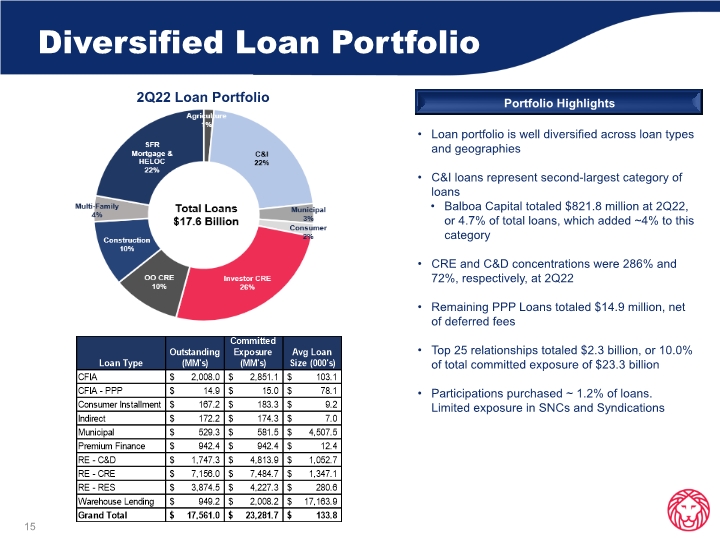

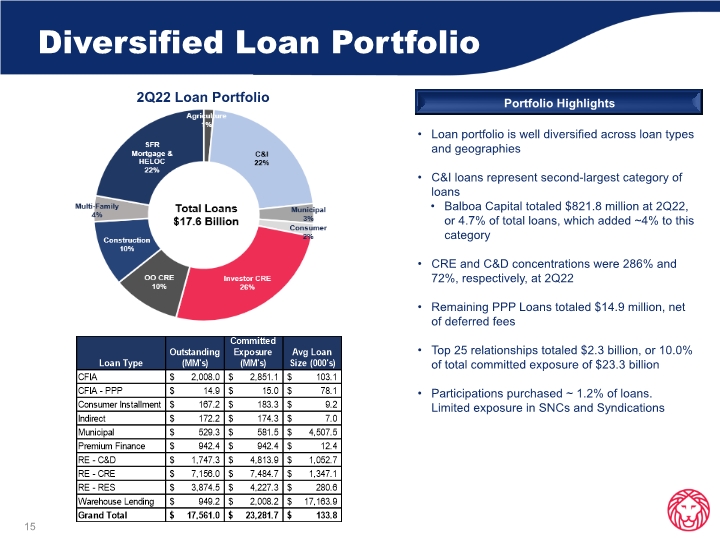

Diversified Loan Portfolio 2Q22 Loan Portfolio 15 Loan portfolio is well diversified across loan types and geographies C&I loans represent second-largest category of loans Balboa Capital totaled $821.8 million at 2Q22, or 4.7% of total loans, which added ~4% to this category CRE and C&D concentrations were 286% and 72%, respectively, at 2Q22 Remaining PPP Loans totaled $14.9 million, net of deferred fees Top 25 relationships totaled $2.3 billion, or 10.0% of total committed exposure of $23.3 billion Participations purchased ~ 1.2% of loans. Limited exposure in SNCs and Syndications Portfolio Highlights

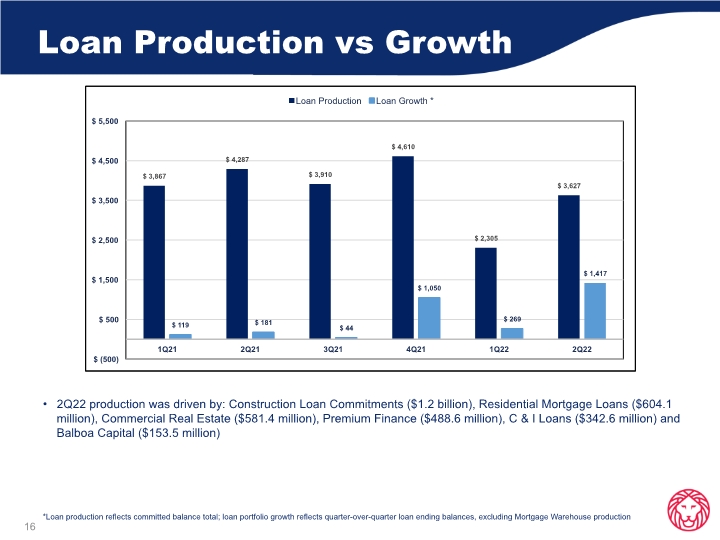

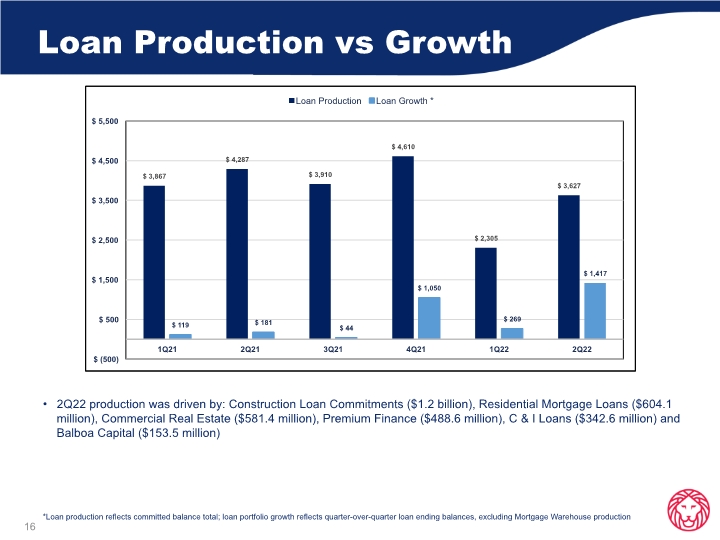

Loan Production vs Growth 16 2Q22 production was driven by: Construction Loan Commitments ($1.2 billion), Residential Mortgage Loans ($604.1 million), Commercial Real Estate ($581.4 million), Premium Finance ($488.6 million), C & I Loans ($342.6 million) and Balboa Capital ($153.5 million) *Loan production reflects committed balance total; loan portfolio growth reflects quarter-over-quarter loan ending balances, excluding Mortgage Warehouse production

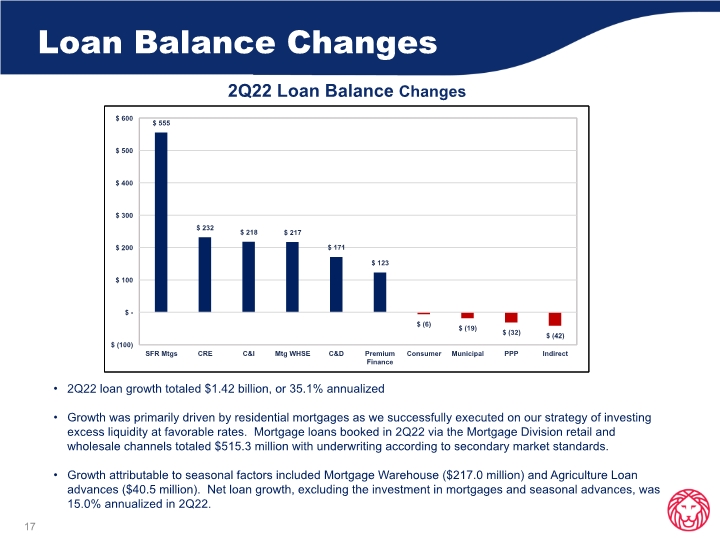

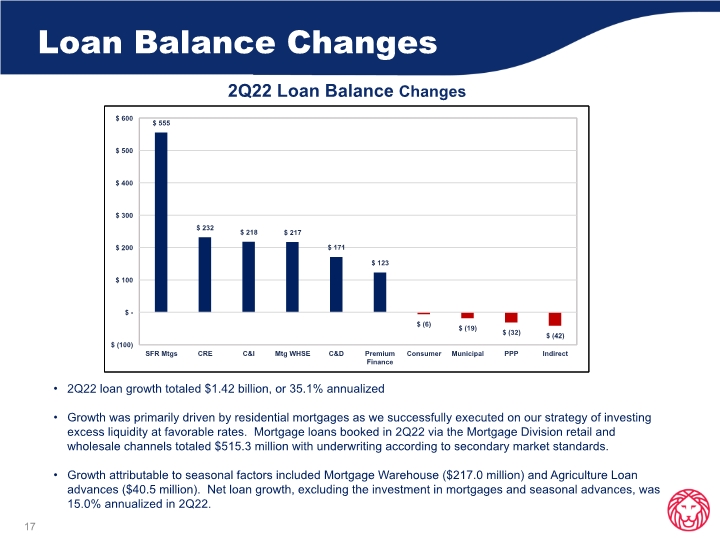

Loan Balance Changes 2Q22 Loan Balance Changes 17 2Q22 loan growth totaled $1.42 billion, or 35.1% annualized Growth was primarily driven by residential mortgages as we successfully executed on our strategy of investing excess liquidity at favorable rates. Mortgage loans booked in 2Q22 via the Mortgage Division retail and wholesale channels totaled $515.3 million with underwriting according to secondary market standards. Growth attributable to seasonal factors included Mortgage Warehouse ($217.0 million) and Agriculture Loan advances ($40.5 million). Net loan growth, excluding the investment in mortgages and seasonal advances, was 15.0% annualized in 2Q22.

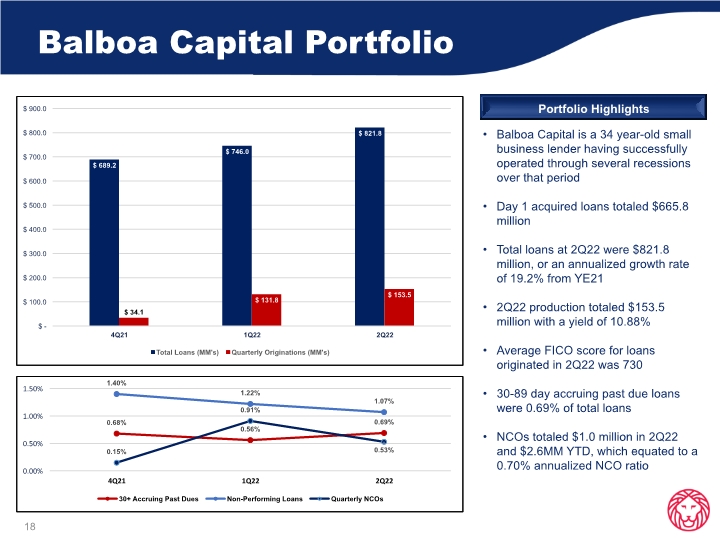

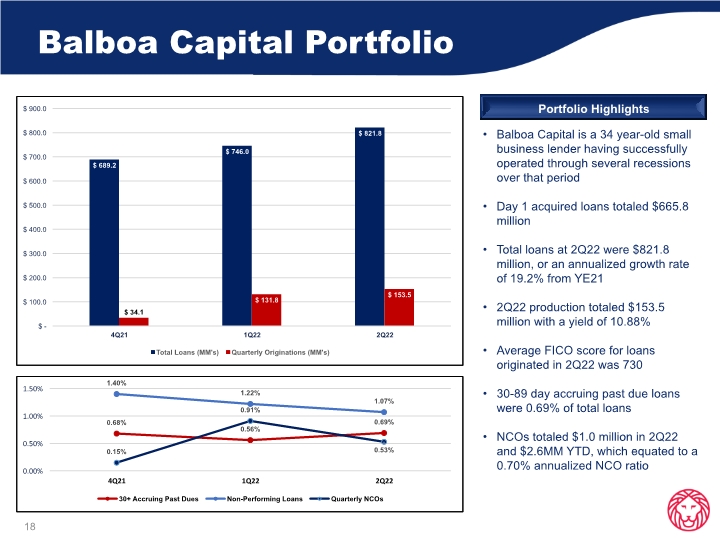

Balboa Capital Portfolio 18 Balboa Capital is a 34 year-old small business lender having successfully operated through several recessions over that period Day 1 acquired loans totaled $665.8 million Total loans at 2Q22 were $821.8 million, or an annualized growth rate of 19.2% from YE21 2Q22 production totaled $153.5 million with a yield of 10.88% Average FICO score for loans originated in 2Q22 was 730 30-89 day accruing past due loans were 0.69% of total loans NCOs totaled $1.0 million in 2Q22 and $2.6MM YTD, which equated to a 0.70% annualized NCO ratio Portfolio Highlights

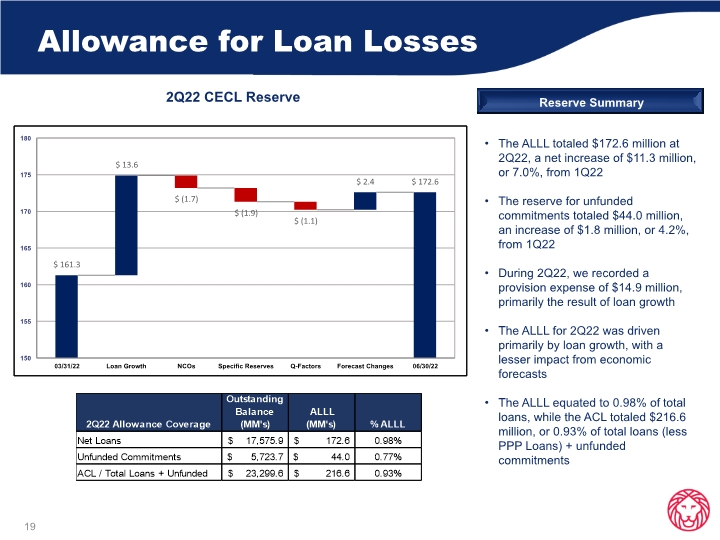

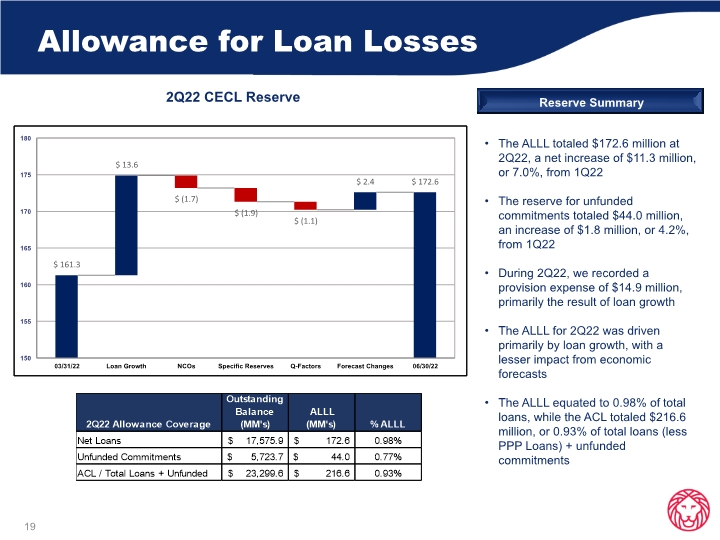

Allowance for Loan Losses 19 The ALLL totaled $172.6 million at 2Q22, a net increase of $11.3 million, or 7.0%, from 1Q22 The reserve for unfunded commitments totaled $44.0 million, an increase of $1.8 million, or 4.2%, from 1Q22 During 2Q22, we recorded a provision expense of $14.9 million, primarily the result of loan growth The ALLL for 2Q22 was driven primarily by loan growth, with a lesser impact from economic forecasts The ALLL equated to 0.98% of total loans, while the ACL totaled $216.6 million, or 0.93% of total loans (less PPP Loans) + unfunded commitments 2Q22 CECL Reserve Reserve Summary

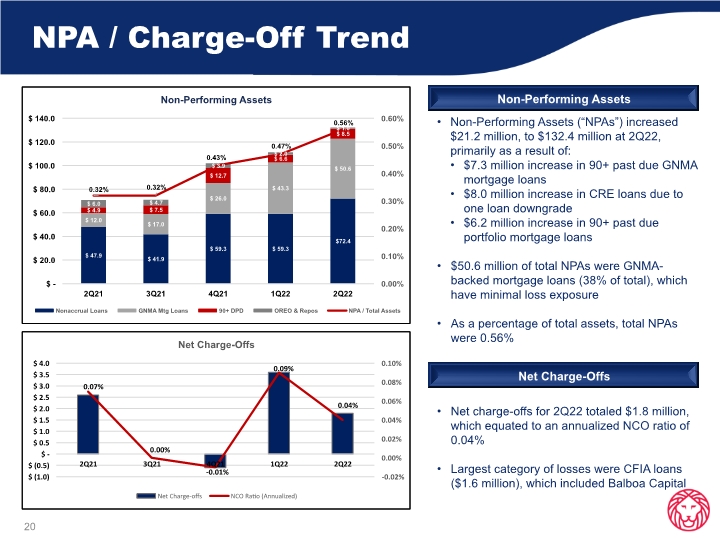

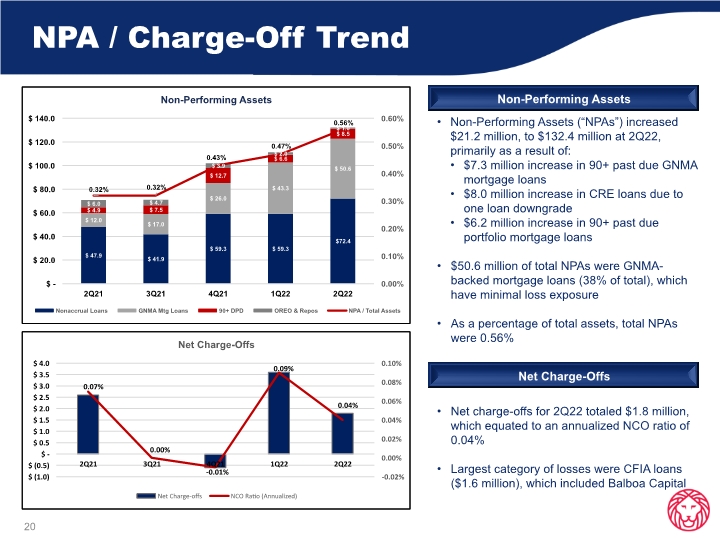

NPA / Charge-Off Trend 20 Non-Performing Assets (“NPAs”) increased $21.2 million, to $132.4 million at 2Q22, primarily as a result of: $7.3 million increase in 90+ past due GNMA mortgage loans $8.0 million increase in CRE loans due to one loan downgrade $6.2 million increase in 90+ past due portfolio mortgage loans $50.6 million of total NPAs were GNMA-backed mortgage loans (38% of total), which have minimal loss exposure As a percentage of total assets, total NPAs were 0.56% Net charge-offs for 2Q22 totaled $1.8 million, which equated to an annualized NCO ratio of 0.04% Largest category of losses were CFIA loans ($1.6 million), which included Balboa Capital Non-Performing Assets Net Charge-Offs

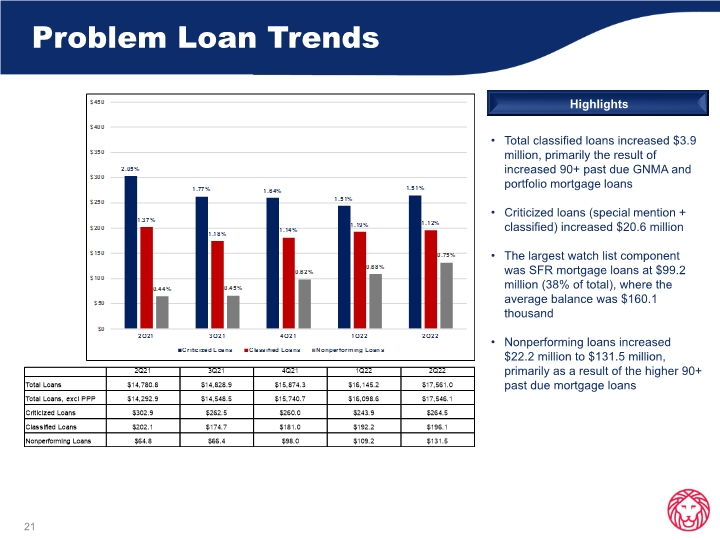

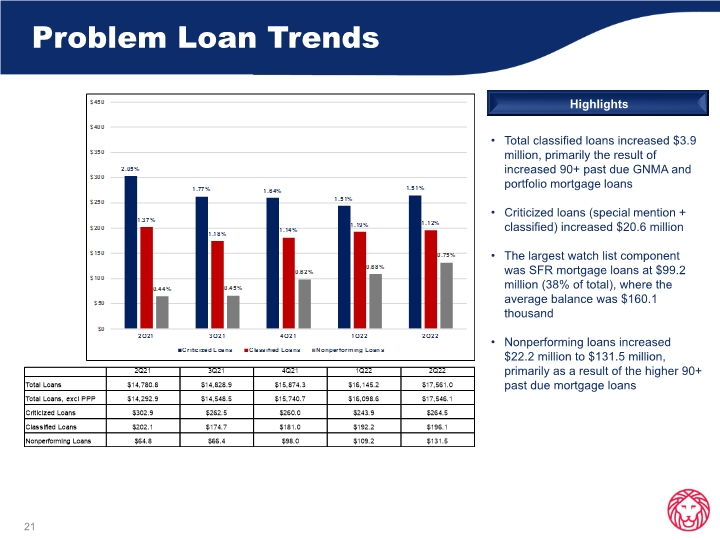

Problem Loan Trends 21 Total classified loans increased $3.9 million, primarily the result of increased 90+ past due GNMA and portfolio mortgage loans Criticized loans (special mention + classified) increased $20.6 million The largest watch list component was SFR mortgage loans at $99.2 million (38% of total), where the average balance was $160.1 thousand Nonperforming loans increased $22.2 million to $131.5 million, primarily as a result of the higher 90+ past due mortgage loans Highlights

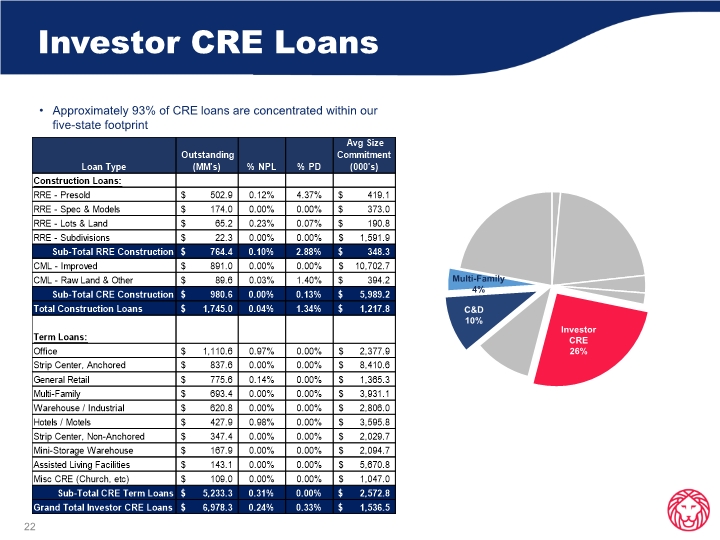

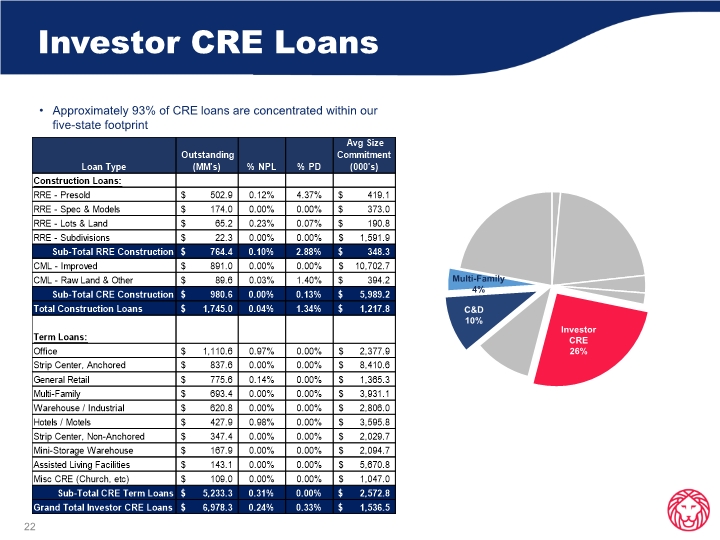

Investor CRE Loans 22 Approximately 93% of CRE loans are concentrated within our five-state footprint

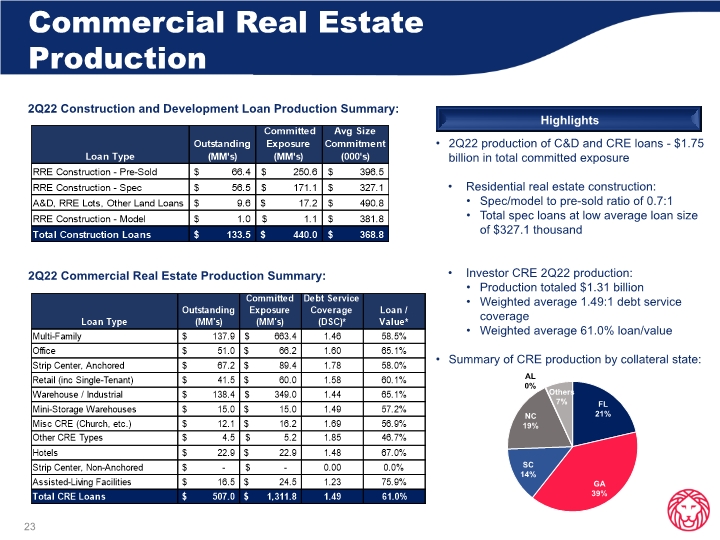

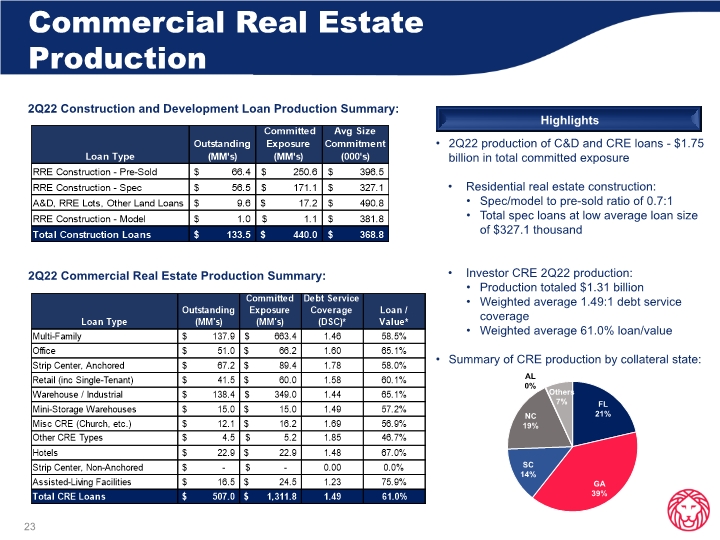

Commercial Real Estate Production 2Q22 Commercial Real Estate Production Summary: 23 2Q22 Construction and Development Loan Production Summary: 2Q22 production of C&D and CRE loans - $1.75 billion in total committed exposure Residential real estate construction: Spec/model to pre-sold ratio of 0.7:1 Total spec loans at low average loan size of $327.1 thousand Investor CRE 2Q22 production: Production totaled $1.31 billion Weighted average 1.49:1 debt service coverage Weighted average 61.0% loan/value Summary of CRE production by collateral state: Highlights

Appendix

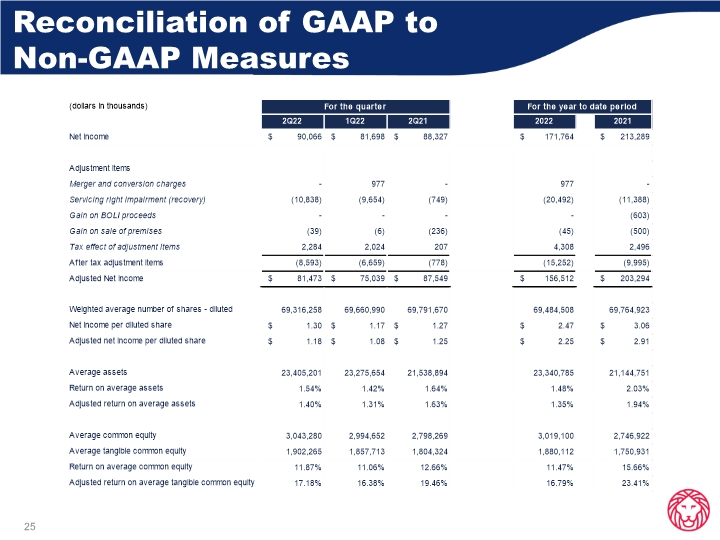

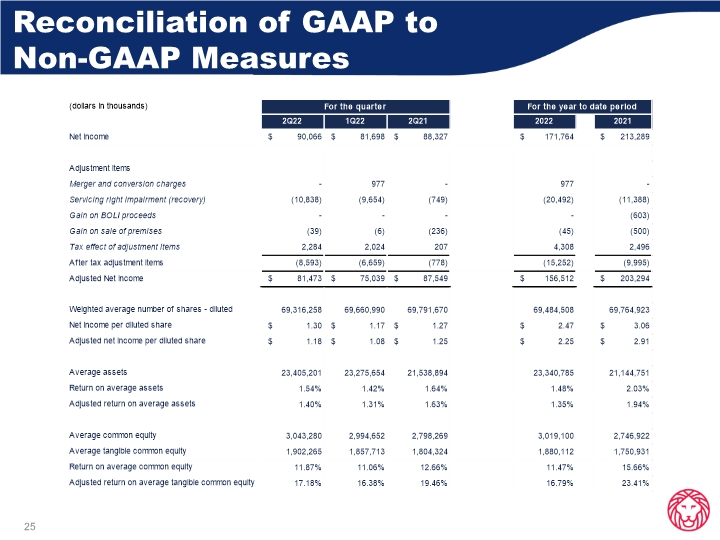

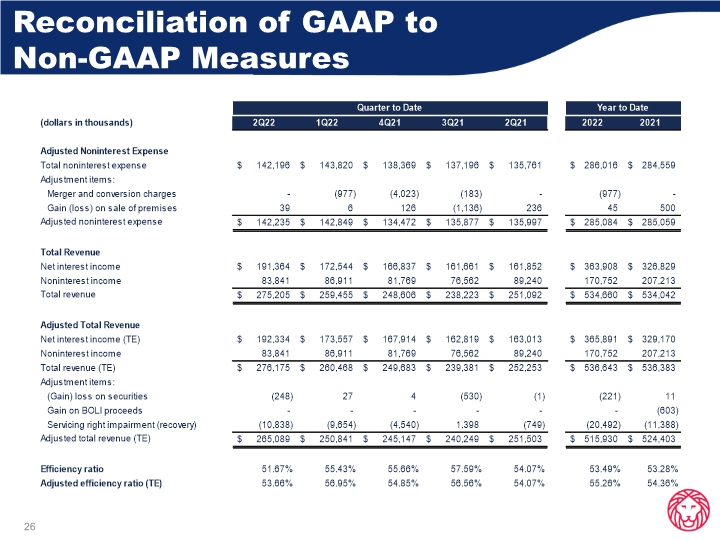

25 Reconciliation of GAAP to Non-GAAP Measures

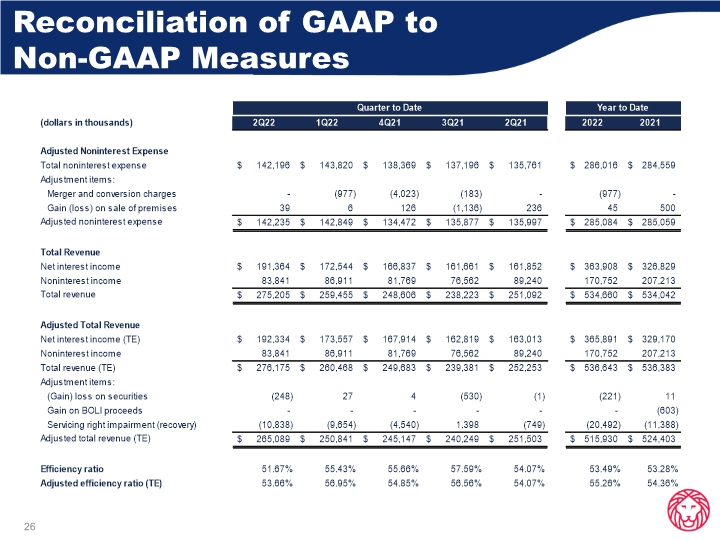

26 Reconciliation of GAAP to Non-GAAP Measures

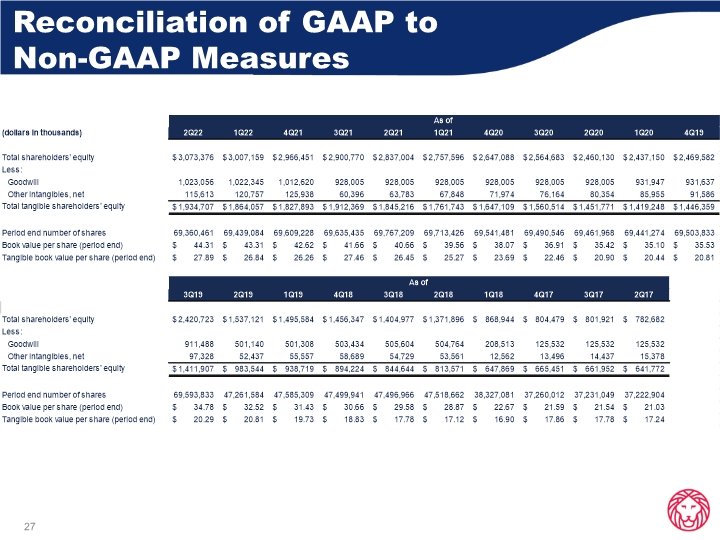

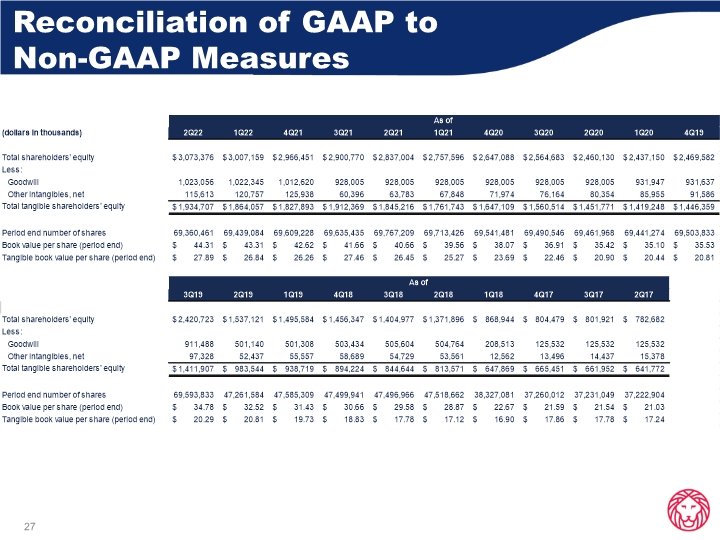

27 Reconciliation of GAAP to Non-GAAP Measures

Ameris Bancorp Press Release & Financial Highlights June 30, 2022