OMB APPROVAL

OMB Number:

3235-0578

Expires: March 31,

2019

Estimated average

burden hours per

response: 20.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-03153

Russell Investment Company

(Exact name of registrant as specified in charter)

1301 2nd Avenue 18th Floor, Seattle Washington 98101

(Address of principal executive offices) (Zip code)

Mary Beth R. Albaneze, Secretary and Chief Legal Officer

Russell Investment Company

1301 2nd Avenue

18th Floor

Seattle, Washington 98101

206-505-4846

(Name and address of agent for service)

Registrant's telephone number, including area code: 206-505-7877

Date of fiscal year end: October 31

Date of reporting period: November 1, 2015 – April 30, 2016

Item 1. Reports to Stockholders

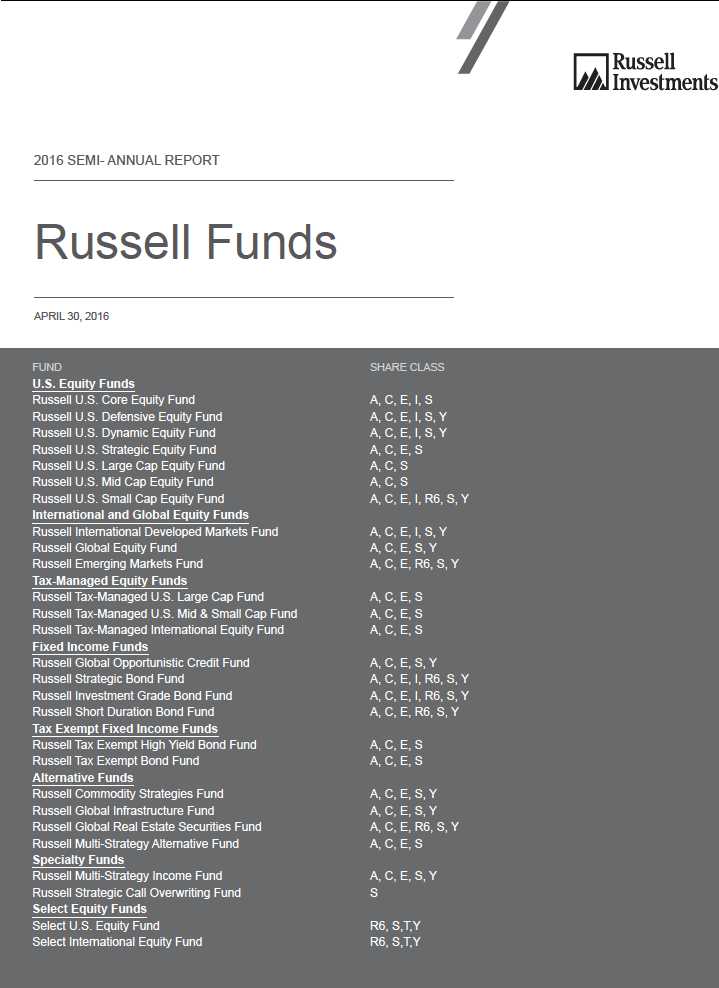

Russell Investment

Company

Russell Investment Company is a

series investment company with

41 different investment portfolios

referred to as Funds. These

financial statements report on 27

of these Funds.

Russell Investment Company

Russell Funds

Semi-annual Report

April 30, 2016 (Unaudited)

Table of Contents

|

| Page |

| Russell U.S. Core Equity Fund | 3 |

| Russell U.S. Defensive Equity Fund | 20 |

| Russell U.S. Dynamic Equity Fund | 38 |

| Russell U.S. Strategic Equity Fund | 56 |

| Russell U.S. Large Cap Equity Fund | 74 |

| Russell U.S. Mid Cap Equity Fund | 90 |

| Russell U.S. Small Cap Equity Fund | 107 |

| Russell International Developed Markets Fund | 130 |

| Russell Global Equity Fund | 158 |

| Russell Emerging Markets Fund | 184 |

| Russell Tax-Managed U.S. Large Cap Fund | 212 |

| Russell Tax-Managed U.S. Mid & Small Cap Fund | 230 |

| Russell Tax-Managed International Equity Fund | 250 |

| Russell Global Opportunistic Credit Fund | 276 |

Russell Strategic Bond Fund | 314 |

| Russell Investment Grade Bond Fund | 360 |

| Russell Short Duration Bond Fund | 400 |

| Russell Tax Exempt High Yield Bond Fund | 428 |

| Russell Tax Exempt Bond Fund | 448 |

| Russell Commodity Strategies Fund | 476 |

| Russell Global Infrastructure Fund | 494 |

| Russell Global Real Estate Securities Fund | 514 |

| Russell Multi-Strategy Alternative Fund | 534 |

| Russell Multi-Strategy Income Fund | 610 |

| Russell Strategic Call Overwriting Fund | 644 |

| Select U.S. Equity Fund | 662 |

| Select International Equity Fund | 686 |

| Notes to Schedules of Investments | 710 |

| Notes to Financial Highlights | 712 |

| Notes to Financial Statements | 714 |

| Basis for Approval of Investment Advisory Contracts | 753 |

| Shareholder Requests for Additional Information | 769 |

| Disclosure of Information about Fund Trustees and Officers | 770 |

| Adviser, Money Managers and Service Providers | 777 |

Russell Investment Company – Russell Funds.

Copyright © Russell Investments 2016. All rights reserved.

Russell Investments is a trade name and registered trademark of Frank Russell Company, a Washington USA

corporation, which operates through subsidiaries worldwide and is part of London Stock Exchange Group.

Fund objectives, risks, charges and expenses should be carefully considered before in-

vesting. A prospectus containing this and other important information must precede or

accompany this material. Please read the prospectus carefully before investing.

Securities distributed through Russell Financial Services, Inc., member FINRA and part of Russell

Investments.

Performance quoted represents past performance and does not guarantee future results. The investment return and

principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their

original cost. Current performance may be lower or higher than the performance data quoted. Current to the most

recent month-end performance data may be obtained by visiting www.russell.com/us/fundperformance.

Russell Investment Company

Russell U.S. Core Equity Fund

Shareholder Expense Example — April 30, 2016 (Unaudited)

| | | | | | |

| Fund Expenses | Please note that the expenses shown in the table are meant |

| The following disclosure provides important information | to highlight your ongoing costs only and do not reflect any |

| regarding the Fund’s Shareholder Expense Example | transactional costs. Therefore, the information under the heading |

| (“Example”). | “Hypothetical Performance (5% return before expenses)” is |

| | useful in comparing ongoing costs only, and will not help you |

| Example | determine the relative total costs of owning different funds. In |

| As a shareholder of the Fund, you incur two types of costs: (1) | addition, if these transactional costs were included, your costs |

| transaction costs, and (2) ongoing costs, including advisory and | would have been higher. | | | | | |

| administrative fees; distribution (12b-1) and/or service fees; | | | | | Hypothetical |

| and other Fund expenses. The Example is intended to help | | | | | Performance (5% |

| you understand your ongoing costs (in dollars) of investing in | | | | Actual | return before |

| the Fund and to compare these costs with the ongoing costs of | Class A | | Performance | | expenses) |

| | Beginning Account Value | | | | | |

| investing in other mutual funds. The Example is based on an | November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| investment of $1,000 invested at the beginning of the period and | Ending Account Value | | | | | |

| held for the entire period indicated, which for this Fund is from | April 30, 2016 | | $ | 992.20 | $ | 1,019.34 |

| November 1, 2015 to April 30, 2016. | Expenses Paid During Period* | | $ | 5.50 | $ | 5.57 |

| |

| Actual Expenses | * Expenses are equal to the Fund's annualized expense ratio of 1.11% |

| | (representing the six month period annualized), multiplied by the average |

| The information in the table under the heading “Actual | account value over the period, multiplied by 182/366 (to reflect the one-half |

| Performance” provides information about actual account values | year period). | | | | | |

| and actual expenses. You may use the information in this column, | | | | | | |

| together with the amount you invested, to estimate the expenses | | | | | Hypothetical |

| | | | | | Performance (5% |

| that you paid over the period. Simply divide your account value by | | | | Actual | return before |

| $1,000 (for example, an $8,600 account value divided by $1,000 | Class C | | Performance | | expenses) |

| = 8.6), then multiply the result by the number in the first column | Beginning Account Value | | | | | |

| in the row entitled “Expenses Paid During Period” to estimate | November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| | Ending Account Value | | | | | |

| the expenses you paid on your account during this period. | April 30, 2016 | | $ | 988.50 | $ | 1,015.61 |

| | Expenses Paid During Period* | | $ | 9.20 | $ | 9.32 |

| Hypothetical Example for Comparison Purposes | | | | | | |

| The information in the table under the heading “Hypothetical | * Expenses are equal to the Fund's annualized expense ratio of 1.86% |

| Performance (5% return before expenses)” provides information | (representing the six month period annualized), multiplied by the average |

| | account value over the period, multiplied by 182/366 (to reflect the one-half |

| about hypothetical account values and hypothetical expenses | year period). | | | | | |

| based on the Fund’s actual expense ratio and an assumed rate of | | | | | | |

| return of 5% per year before expenses, which is not the Fund’s | | | | | Hypothetical |

| actual return. The hypothetical account values and expenses | | | | | Performance (5% |

| | | | | Actual | return before |

| may not be used to estimate the actual ending account balance or | Class E | | Performance | | expenses) |

| expenses you paid for the period. You may use this information | Beginning Account Value | | | | | |

| to compare the ongoing costs of investing in the Fund and other | November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| funds. To do so, compare this 5% hypothetical example with the | Ending Account Value | | | | | |

| | April 30, 2016 | | $ | 992.20 | $ | 1,019.34 |

| 5% hypothetical examples that appear in the shareholder reports | Expenses Paid During Period* | | $ | 5.50 | $ | 5.57 |

| of other funds. | | | | | | |

| | * Expenses are equal to the Fund's annualized expense ratio of 1.11% |

| | (representing the six month period annualized), multiplied by the average |

| | account value over the period, multiplied by 182/366 (to reflect the one-half |

| | year period). | | | | | |

Russell U.S. Core Equity Fund 3

Russell Investment Company

Russell U.S. Core Equity Fund

Shareholder Expense Example, continued — April 30, 2016 (Unaudited)

| | | | | |

| | | | | Hypothetical |

| | | | | Performance (5% |

| | | | Actual | return before |

| Class I | | Performance | | expenses) |

| Beginning Account Value | | | | | |

| November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| Ending Account Value | | | | | |

| April 30, 2016 | | $ | 993.80 | $ | 1,020.98 |

| Expenses Paid During Period* | | $ | 3.87 | $ | 3.92 |

| |

| * Expenses are equal to the Fund's annualized expense ratio of 0.78% |

| (representing the six month period annualized), multiplied by the average |

| account value over the period, multiplied by 182/366 (to reflect the one-half |

| year period). | | | | | |

| |

| | | | | Hypothetical |

| | | | | Performance (5% |

| | | | Actual | return before |

| Class S | | Performance | | expenses) |

| Beginning Account Value | | | | | |

| November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| Ending Account Value | | | | | |

| April 30, 2016 | | $ | 993.40 | $ | 1,020.59 |

| Expenses Paid During Period* | | $ | 4.26 | $ | 4.32 |

| |

| * Expenses are equal to the Fund's annualized expense ratio of 0.86% |

| (representing the six month period annualized), multiplied by the average |

| account value over the period, multiplied by 182/366 (to reflect the one-half |

| year period). | | | | | |

4 Russell U.S. Core Equity Fund

Russell Investment Company

Russell U.S. Core Equity Fund

Schedule of Investments — April 30, 2016 (Unaudited)

| | | | | | | |

| Amounts in thousands (except share amounts) | Amounts in thousands (except share amounts) | |

| | | Principal | Fair | | | Principal | Fair |

| | Amount ($) or | Value | | Amount ($) or | Value |

| | | Shares | $ | | | Shares | $ |

| Common Stocks - 95.1% | | | | Visteon Corp.(Æ) | | 3,300 | 263 |

| Consumer Discretionary - 13.8% | | | | Wal-Mart Stores, Inc. | | 111,930 | 7,485 |

| Amazon.com, Inc.(Æ) | | 9,927 | 6,548 | Walt Disney Co. (The) | | 18,216 | 1,881 |

| AutoZone, Inc.(Æ) | | 1,710 | 1,308 | Whirlpool Corp. | | 10,900 | 1,898 |

| Cable One, Inc.(Æ) | | 320 | 147 | Wynn Resorts, Ltd. | | 7,592 | 670 |

| Carnival Corp. | | 8,767 | 430 | Yum! Brands, Inc. | | 2,937 | 234 |

| CBS Corp. Class B | | 24,965 | 1,396 | | | | |

| Children's Place, Inc. (The) | | 1,100 | 86 | | | | 102,219 |

| Chipotle Mexican Grill, Inc. Class A(Æ) | | 4,575 | 1,926 | | | | |

| Comcast Corp. Class A(Æ) | | 35,019 | 2,128 | Consumer Staples - 6.5% | | | |

| | | | | Altria Group, Inc. | | 137,334 | 8,612 |

| Cooper Tire & Rubber Co. | | 1,300 | 45 | Bunge, Ltd. | | 31,500 | 1,969 |

| Costco Wholesale Corp. | | 15,271 | 2,262 | Clorox Co. (The) | | 2,420 | 303 |

| Darden Restaurants, Inc. | | 5,600 | 349 | Coca-Cola Co. (The) | | 73,412 | 3,289 |

| Deckers Outdoor Corp.(Æ) | | 23,970 | 1,386 | Colgate-Palmolive Co. | | 35,632 | 2,527 |

| Delphi Automotive PLC | | 18,451 | 1,358 | Constellation Brands, Inc. Class A | | 11,263 | 1,758 |

| Dillard's, Inc. Class A | | 5,601 | 395 | Core-Mark Holding Co., Inc. | | 1,900 | 155 |

| Express, Inc.(Æ) | | 1,800 | 33 | CVS Health Corp. | | 5,935 | 596 |

| Fitbit, Inc. Class A(Æ) | | 2,200 | 40 | Dean Foods Co. | | 7,300 | 126 |

| Ford Motor Co. | | 87,700 | 1,189 | Dr Pepper Snapple Group, Inc. | | 8,500 | 773 |

| Gap, Inc. (The) | | 87,300 | 2,024 | General Mills, Inc. | | 1,989 | 122 |

| General Motors Co. | | 114,300 | 3,635 | Hormel Foods Corp. | | 30,300 | 1,168 |

| Goodyear Tire & Rubber Co. (The) | | 21,798 | 631 | Kellogg Co. | | 15,500 | 1,190 |

| Graham Holdings Co. Class B | | 1,882 | 897 | Kimberly-Clark Corp. | | 1,276 | 160 |

| Hilton Worldwide Holdings, Inc. | | 32,219 | 710 | Kraft Heinz Co. (The) | | 884 | 69 |

| Home Depot, Inc. (The) | | 26,081 | 3,492 | Kroger Co. (The) | | 40,000 | 1,416 |

| JC Penney Co., Inc.(Æ) | | 5,000 | 46 | Mondelez International, Inc. Class A | | 136,937 | 5,883 |

| Kohl's Corp. | | 1,396 | 62 | PepsiCo, Inc. | | 39,282 | 4,044 |

| Lennar Corp. Class A | | 72,133 | 3,268 | Philip Morris International, Inc. | | 65,290 | 6,406 |

| Lowe's Cos., Inc. | | 36,900 | 2,805 | Procter & Gamble Co. (The) | | 65,387 | 5,239 |

| Macy's, Inc. | | 32,071 | 1,270 | Reynolds American, Inc. | | 1,819 | 90 |

| Marriott International, Inc. Class A | | 5,277 | 370 | Sysco Corp. | | 3,233 | 149 |

| McDonald's Corp. | | 29,552 | 3,738 | Walgreens Boots Alliance, Inc. | | 3,838 | 304 |

| MGM Resorts International(Æ) | | 62,397 | 1,329 | Whole Foods Market, Inc. | | 66,770 | 1,942 |

| Michael Kors Holdings, Ltd.(Æ) | | 50,938 | 2,631 | | | | |

| Murphy USA, Inc.(Æ) | | 800 | 46 | | | | 48,290 |

| Newell Brands, Inc. | | 35,282 | 1,607 | | | | |

| News Corp. Class A | | 91,800 | 1,140 | Energy - 7.5% | | | |

| Nike, Inc. Class B | | 100,393 | 5,917 | Antero Resources Corp.(Æ) | | 30,900 | 874 |

| NVR, Inc.(Æ) | | 694 | 1,153 | Apache Corp. | | 31,173 | 1,696 |

| Omnicom Group, Inc. | | 1,100 | 91 | BP PLC - ADR | | 154,849 | 5,200 |

| Panera Bread Co. Class A(Æ) | | 3,528 | 757 | California Resources Corp. | | 5,392 | 12 |

| Priceline Group, Inc. (The)(Æ) | | 2,094 | 2,814 | Canadian Natural Resources, Ltd. | | 75,738 | 2,274 |

| PulteGroup, Inc. | | 21,883 | 402 | Chevron Corp. | | 25,560 | 2,612 |

| PVH Corp. | | 13,644 | 1,304 | Cimarex Energy Co. | | 12,009 | 1,307 |

| Ralph Lauren Corp. Class A | | 664 | 62 | Cobalt International Energy, Inc.(Æ) | | 47,400 | 153 |

| Ross Stores, Inc. | | 31,200 | 1,771 | ConocoPhillips | | 74,806 | 3,575 |

| Royal Caribbean Cruises, Ltd. | | 23,477 | 1,817 | Core Laboratories NV | | 13,170 | 1,760 |

| Service Corp. International | | 2,272 | 61 | CVR Energy, Inc. | | 4,700 | 114 |

| Starbucks Corp. | | 55,988 | 3,148 | Devon Energy Corp. | | 99,539 | 3,452 |

| Target Corp. | | 83,247 | 6,618 | Diamond Offshore Drilling, Inc. | | 5,100 | 124 |

| Thomson Reuters Corp. | | 3,948 | 162 | EOG Resources, Inc. | | 6,336 | 523 |

| Time Warner, Inc. | | 35,959 | 2,702 | Exxon Mobil Corp. | | 92,126 | 8,144 |

| Time, Inc. | | 42,500 | 625 | First Solar, Inc.(Æ) | | 2,100 | 117 |

| TJX Cos., Inc. | | 49,507 | 3,754 | FMC Technologies, Inc.(Æ) | | 20,900 | 637 |

| Toll Brothers, Inc.(Æ) | | 9,727 | 265 | Gulfport Energy Corp.(Æ) | | 5,400 | 169 |

| Toyota Motor Corp. - ADR(Æ) | | 12,899 | 1,312 | Helmerich & Payne, Inc. | | 10,552 | 698 |

| Tribune Media Co. Class A | | 12,440 | 480 | Hess Corp. | | 4,288 | 256 |

| Tupperware Brands Corp. | | 12,276 | 713 | HollyFrontier Corp. | | 6,500 | 231 |

| Ulta Salon Cosmetics & Fragrance, Inc.(Æ) | | 11,266 | 2,346 | Kinder Morgan, Inc. | | 34,400 | 611 |

| Under Armour, Inc. Class A(Æ) | | 14,557 | 640 | Laredo Petroleum, Inc.(Æ) | | 18,200 | 222 |

| Viacom, Inc. Class B | | 3,591 | 147 | Magna International, Inc. Class A(Æ) | | 25,767 | 1,083 |

See accompanying notes which are an integral part of the financial statements.

Russell U.S. Core Equity Fund 5

Russell Investment Company

Russell U.S. Core Equity Fund

Schedule of Investments, continued — April 30, 2016 (Unaudited)

| | | | | | | |

| Amounts in thousands (except share amounts) | Amounts in thousands (except share amounts) |

| | | Principal | Fair | | | Principal | Fair |

| | Amount ($) or | Value | | Amount ($) or | Value |

| | | Shares | $ | | | Shares | $ |

| Marathon Oil Corp. | | 42,800 | 603 | FleetCor Technologies, Inc.(Æ) | | 28,257 | 4,371 |

| Marathon Petroleum Corp. | | 19,523 | 763 | Four Corners Property Trust, Inc.(Æ)(ö) | | 989 | 18 |

| Nabors Industries, Ltd. | | 37,300 | 365 | Franklin Resources, Inc. | | 5,398 | 202 |

| National Oilwell Varco, Inc. | | 2,422 | 87 | Genworth Financial, Inc. Class A(Æ) | | 36,200 | 124 |

| NOW, Inc.(Æ) | | 12,800 | 231 | Goldman Sachs Group, Inc. (The) | | 4,110 | 675 |

| Occidental Petroleum Corp. | | 79,444 | 6,089 | Hartford Financial Services Group, Inc. | | 9,524 | 423 |

| Oceaneering International, Inc. | | 30,500 | 1,118 | Hatteras Financial Corp.(ö) | | 51,405 | 817 |

| PBF Energy, Inc. Class A | | 5,200 | 167 | HCP, Inc.(ö) | | 6,009 | 203 |

| Phillips 66(Æ) | | 43,059 | 3,536 | Huntington Bancshares, Inc. | | 26,088 | 262 |

| Pioneer Natural Resources Co.(Æ) | | 7,788 | 1,294 | Iberiabank Corp. | | 3,400 | 201 |

| QEP Resources, Inc. | | 26,500 | 475 | Intercontinental Exchange, Inc. | | 4,561 | 1,095 |

| Rowan Cos. PLC Class A | | 7,000 | 132 | Jones Lang LaSalle, Inc. | | 3,900 | 449 |

| Schlumberger, Ltd. | | 47,563 | 3,821 | JPMorgan Chase & Co. | | 155,696 | 9,840 |

| Seadrill, Ltd.(Æ) | | 36,600 | 175 | KeyCorp | | 169,071 | 2,078 |

| Spectra Energy Corp. | | 9,238 | 289 | KKR & Co., LP | | 177,434 | 2,413 |

| Tesoro Corp. | | 2,672 | 213 | Leucadia National Corp. | | 24,785 | 413 |

| Valero Energy Corp. | | 5,500 | 324 | Lincoln National Corp. | | 7,400 | 322 |

| World Fuel Services Corp. | | 10,400 | 486 | Loews Corp. | | 120,100 | 4,766 |

| WPX Energy, Inc.(Æ) | | 12,600 | 122 | M&T Bank Corp. | | 7,817 | 925 |

| | | | 56,134 | Markel Corp.(Æ) | | 206 | 185 |

| | | | | Marsh & McLennan Cos., Inc. | | 5,602 | 354 |

| Financial Services - 21.4% | | | | MasterCard, Inc. Class A | | 58,174 | 5,642 |

| Aflac, Inc. | | 4,878 | 336 | MetLife, Inc. | | 82,305 | 3,712 |

| Alleghany Corp.(Æ) | | 500 | 261 | Morgan Stanley | | 16,200 | 438 |

| Allstate Corp. (The) | | 33,626 | 2,187 | Morningstar, Inc. | | 4,600 | 383 |

| Ally Financial, Inc.(Æ) | | 17,700 | 315 | Nasdaq, Inc. | | 22,300 | 1,376 |

| American Capital Agency Corp.(ö) | | 20,939 | 385 | Navient Corp. | | 11,775 | 161 |

| American Equity Investment Life Holding | | | | New York Community Bancorp, Inc. | | 10,846 | 163 |

| Co.(Æ) | | 27,800 | 389 | Nomura Holdings, Inc. - ADR(Æ) | | 161,948 | 682 |

| American Express Co. | | 65,400 | 4,279 | Northern Trust Corp. | | 32,199 | 2,289 |

| American International Group, Inc. | | 8,692 | 485 | PayPal Holdings, Inc.(Æ) | | 26,800 | 1,050 |

| Ameriprise Financial, Inc. | | 20,017 | 1,920 | PNC Financial Services Group, Inc. (The) | | 71,230 | 6,253 |

| Aspen Insurance Holdings, Ltd. | | 21,000 | 973 | Popular, Inc.(Æ) | | 28,023 | 833 |

| Assurant, Inc. | | 10,800 | 913 | Principal Financial Group, Inc. | | 35,400 | 1,511 |

| AvalonBay Communities, Inc.(ö) | | 3,430 | 606 | PrivateBancorp, Inc. Class A | | 1,100 | 46 |

| Bank of America Corp. | | 700,221 | 10,195 | Prudential Financial, Inc. | | 16,158 | 1,255 |

| Bank of New York Mellon Corp. (The) | | 18,000 | 724 | Public Storage(ö) | | 2,070 | 507 |

| BankUnited, Inc. | | 40,835 | 1,409 | Regions Financial Corp. | | 307,662 | 2,886 |

| BB&T Corp. | | 15,699 | 555 | Reinsurance Group of America, Inc. Class A | 16,200 | 1,543 |

| Berkshire Hathaway, Inc. Class B(Æ) | | 45,535 | 6,624 | Santander Consumer USA Holdings, Inc.(Æ) | 150,084 | 1,977 |

| BlackRock, Inc. Class A | | 776 | 277 | Signature Bank(Æ) | | 3,521 | 485 |

| Blackstone Group, LP (The) | | 72,814 | 1,998 | Simon Property Group, Inc.(ö) | | 1,904 | 383 |

| BOK Financial Corp. | | 2,000 | 120 | SL Green Realty Corp.(ö) | | 5,700 | 599 |

| Capital One Financial Corp. | | 35,778 | 2,590 | State Street Corp. | | 132,459 | 8,252 |

| CBL & Associates Properties, Inc.(ö) | | 14,800 | 173 | SunTrust Banks, Inc. | | 34,732 | 1,450 |

| Chubb, Ltd. | | 3,994 | 471 | SVB Financial Group(Æ) | | 1,460 | 152 |

| Citigroup, Inc. | | 127,109 | 5,883 | Synchrony Financial(Æ) | | 98,303 | 3,005 |

| Citizens Financial Group, Inc. | | 88,203 | 2,015 | TFS Financial Corp. | | 18,253 | 327 |

| CME Group, Inc. Class A | | 7,108 | 653 | Travelers Cos., Inc. (The) | | 7,450 | 819 |

| CNA Financial Corp. | | 11,700 | 370 | Two Harbors Investment Corp.(ö) | | 87,607 | 686 |

| Comerica, Inc. | | 33,300 | 1,479 | US Bancorp | | 39,078 | 1,668 |

| Cullen/Frost Bankers, Inc. | | 2,736 | 175 | Visa, Inc. Class A | | 91,693 | 7,082 |

| Discover Financial Services | | 28,279 | 1,591 | Voya Financial, Inc. | | 45,593 | 1,480 |

| East West Bancorp, Inc. | | 6,800 | 255 | Wells Fargo & Co. | | 260,613 | 13,025 |

| Endurance Specialty Holdings, Ltd. | | 16,900 | 1,081 | Western Alliance Bancorp(Æ) | | 4,000 | 146 |

| Equinix, Inc.(ö) | | 7,962 | 2,630 | Xenia Hotels & Resorts, Inc.(ö) | | 9,300 | 143 |

| Equity Residential(ö) | | 2,855 | 194 | XL Group PLC Class A | | 10,800 | 353 |

| FactSet Research Systems, Inc. | | 2,590 | 390 | | | | 159,282 |

| Federal Realty Investment Trust(ö) | | 7,980 | 1,214 | | | | |

| Fifth Third Bancorp | | 14,696 | 269 | | | | |

See accompanying notes which are an integral part of the financial statements.

6 Russell U.S. Core Equity Fund

Russell Investment Company

Russell U.S. Core Equity Fund

Schedule of Investments, continued — April 30, 2016 (Unaudited)

| | | | | | | |

| Amounts in thousands (except share amounts) | | Amounts in thousands (except share amounts) | |

| | | Principal | Fair | | | Principal | Fair |

| | Amount ($) or | Value | | Amount ($) or | Value |

| | | Shares | $ | | | Shares | $ |

| Health Care - 12.3% | | | | Hexcel Corp. | | 15,667 | 709 |

| Abbott Laboratories | | 6,607 | 257 | International Flavors & Fragrances, Inc. | | 1,300 | 155 |

| AbbVie, Inc. | | 50,044 | 3,053 | International Paper Co. | | 39,100 | 1,692 |

| Alexion Pharmaceuticals, Inc.(Æ) | | 5,529 | 770 | Louisiana-Pacific Corp.(Æ) | | 53,582 | 911 |

| Allergan PLC(Æ) | | 7,448 | 1,613 | LyondellBasell Industries NV Class A | | 1,621 | 134 |

| Allscripts Healthcare Solutions, Inc.(Æ) | | 26,500 | 355 | Masco Corp. | | 41,200 | 1,265 |

| Alnylam Pharmaceuticals, Inc.(Æ) | | 3,600 | 241 | Monsanto Co. | | 21,591 | 2,023 |

| Amgen, Inc. | | 18,434 | 2,918 | MRC Global, Inc.(Æ) | | 3,100 | 43 |

| Anacor Pharmaceuticals, Inc.(Æ) | | 17,307 | 1,086 | Newmont Mining Corp. | | 10,200 | 357 |

| Anthem, Inc. | | 12,350 | 1,739 | Nucor Corp. | | 16,700 | 831 |

| Baxalta, Inc. | | 4,912 | 206 | Owens-Illinois, Inc.(Æ) | | 8,400 | 155 |

| Baxter International, Inc. | | 4,568 | 202 | PPG Industries, Inc. | | 20,524 | 2,266 |

| Becton Dickinson and Co. | | 2,071 | 334 | Praxair, Inc. | | 1,377 | 162 |

| Biogen, Inc.(Æ) | | 772 | 212 | Reliance Steel & Aluminum Co. | | 15,238 | 1,127 |

| Bio-Rad Laboratories, Inc. Class A(Æ) | | 4,030 | 572 | Rio Tinto PLC - ADR | | 39,500 | 1,329 |

| Bristol-Myers Squibb Co. | | 47,900 | 3,457 | Sherwin-Williams Co. (The) | | 4,160 | 1,195 |

| Cardinal Health, Inc. | | 24,500 | 1,922 | Westlake Chemical Corp. | | 19,100 | 959 |

| Celgene Corp.(Æ) | | 7,075 | 732 | WestRock Co. | | 1,526 | 64 |

| Centene Corp.(Æ) | | 1,200 | 74 | | | | 27,468 |

| Cerner Corp.(Æ) | | 51,417 | 2,887 | | | | |

| Cigna Corp. | | 11,781 | 1,632 | Producer Durables - 9.5% | | | |

| CR Bard, Inc. | | 3,520 | 747 | 3M Co. | | 3,884 | 650 |

| DexCom, Inc.(Æ) | | 13,329 | 858 | Accenture PLC Class A(Æ) | | 21,992 | 2,483 |

| Edwards Lifesciences Corp.(Æ) | | 20,286 | 2,155 | AECOM(Æ) | | 19,130 | 622 |

| Eli Lilly & Co. | | 52,333 | 3,953 | AerCap Holdings NV(Æ) | | 43,272 | 1,731 |

| Endo International PLC(Æ) | | 13,128 | 354 | American Airlines Group, Inc. | | 70,940 | 2,461 |

| Express Scripts Holding Co.(Æ) | | 5,052 | 373 | Ametek, Inc. | | 1,742 | 84 |

| Gilead Sciences, Inc. | | 22,426 | 1,978 | Automatic Data Processing, Inc. | | 31,077 | 2,748 |

| Horizon Pharma PLC(Æ) | | 56,034 | 861 | B/E Aerospace, Inc. | | 16,402 | 798 |

| Humana, Inc. | | 3,965 | 702 | Boeing Co. (The) | | 2,271 | 306 |

| ICU Medical, Inc.(Æ) | | 390 | 39 | Carlisle Cos., Inc. | | 756 | 77 |

| Intuitive Surgical, Inc.(Æ) | | 2,310 | 1,447 | Caterpillar, Inc. | | 17,843 | 1,387 |

| Jazz Pharmaceuticals PLC(Æ) | | 4,408 | 664 | CH Robinson Worldwide, Inc. | | 8,900 | 632 |

| Johnson & Johnson | | 134,289 | 15,051 | Chicago Bridge & Iron Co. | | 23,044 | 927 |

| Magellan Health, Inc.(Æ) | | 8,000 | 564 | Colfax Corp.(Æ) | | 7,100 | 230 |

| Mallinckrodt PLC(Æ) | | 13,115 | 820 | CSX Corp. | | 7,853 | 214 |

| McKesson Corp. | | 4,980 | 836 | Cummins, Inc. | | 1,228 | 144 |

| Medtronic PLC | | 66,624 | 5,273 | Danaher Corp. | | 4,324 | 418 |

| Merck & Co., Inc. | | 121,663 | 6,672 | Deere & Co. | | 1,629 | 137 |

| Mylan NV(Æ) | | 55,285 | 2,306 | Delta Air Lines, Inc. | | 84,349 | 3,515 |

| Pfizer, Inc. | | 329,805 | 10,788 | Eaton Corp. PLC | | 15,071 | 954 |

| Regeneron Pharmaceuticals, Inc.(Æ) | | 4,944 | 1,862 | Emerson Electric Co. | | 5,848 | 319 |

| ResMed, Inc. | | 18,500 | 1,032 | Esterline Technologies Corp.(Æ) | | 4,800 | 330 |

| Stryker Corp. | | 19,749 | 2,153 | Expeditors International of Washington, Inc. | | 24,300 | 1,206 |

| TESARO, Inc.(Æ) | | 22,936 | 950 | FedEx Corp. | | 19,501 | 3,220 |

| Thermo Fisher Scientific, Inc. | | 17,074 | 2,463 | Fluor Corp. | | 1,691 | 92 |

| UnitedHealth Group, Inc. | | 8,801 | 1,159 | General Dynamics Corp. | | 2,221 | 312 |

| Valeant Pharmaceuticals International, Inc. | | | | General Electric Co. | | 70,076 | 2,155 |

| (Æ) | | 29,790 | 994 | Honeywell International, Inc. | | 47,362 | 5,412 |

| Zimmer Biomet Holdings, Inc. | | 1,480 | 171 | Huntington Ingalls Industries, Inc. | | 7,424 | 1,075 |

| | | | 91,487 | Illinois Tool Works, Inc. | | 2,752 | 288 |

| | | | | Kansas City Southern | | 19,285 | 1,827 |

| Materials and Processing - 3.7% | | | | KBR, Inc. | | 2,700 | 42 |

| Air Products & Chemicals, Inc. | | 1,046 | 153 | L-3 Communications Holdings, Inc. Class 3 | | 2,790 | 367 |

| Axiall Corp. | | 2,200 | 52 | Lockheed Martin Corp. | | 10,195 | 2,369 |

| CRH PLC - ADR(Æ) | | 158,000 | 4,599 | Moog, Inc. Class A(Æ) | | 3,811 | 186 |

| Dow Chemical Co. (The) | | 66,870 | 3,518 | Norfolk Southern Corp. | | 29,623 | 2,669 |

| Eastman Chemical Co. | | 7,903 | 604 | Northrop Grumman Corp. | | 14,820 | 3,057 |

| Ecolab, Inc. | | 26,221 | 3,015 | Orbital ATK, Inc. | | 3,300 | 287 |

| EI du Pont de Nemours & Co. | | 2,283 | 150 | Quanta Services, Inc.(Æ) | | 8,800 | 209 |

See accompanying notes which are an integral part of the financial statements.

Russell U.S. Core Equity Fund 7

Russell Investment Company

Russell U.S. Core Equity Fund

Schedule of Investments, continued — April 30, 2016 (Unaudited)

| | | | | | | | |

| Amounts in thousands (except share amounts) | | Amounts in thousands (except share amounts) | | |

| | | Principal | Fair | | | Principal | | Fair |

| | Amount ($) or | Value | | Amount ($) or | | Value |

| | | Shares | $ | | | Shares | | $ |

| Raytheon Co. | | 49,143 | 6,209 | Marvell Technology Group, Ltd. | | 38,500 | | 384 |

| Rockwell Automation, Inc. | | 8,712 | 989 | Micron Technology, Inc.(Æ) | | 179,824 | | 1,933 |

| Rollins, Inc. | | 4,700 | 126 | Microsoft Corp. | | 194,075 | | 9,679 |

| Ryder System, Inc. | | 914 | 63 | MicroStrategy, Inc. Class A(Æ) | | 3,700 | | 663 |

| S&P Global, Inc.(Æ) | | 9,107 | 973 | NCR Corp.(Æ) | | 7,200 | | 209 |

| Southwest Airlines Co. | | 78,400 | 3,497 | NetApp, Inc. | | 40,100 | | 948 |

| Stanley Black & Decker, Inc. | | 27,900 | 3,123 | NetScout Systems, Inc.(Æ) | | 37,000 | | 824 |

| Teekay Corp. | | 1,800 | 20 | NXP Semiconductors NV(Æ) | | 29,633 | | 2,527 |

| Terex Corp. | | 65,122 | 1,556 | ON Semiconductor Corp.(Æ) | | 7,900 | | 75 |

| Textron, Inc. | | 14,850 | 574 | Oracle Corp. | | 94,696 | | 3,775 |

| Trinity Industries, Inc. | | 39,700 | 775 | Palo Alto Networks, Inc.(Æ) | | 3,678 | | 555 |

| Triumph Group, Inc. | | 23,400 | 847 | QUALCOMM, Inc. | | 20,614 | | 1,041 |

| Tyco International PLC | | 2,588 | 100 | Red Hat, Inc.(Æ) | | 39,408 | | 2,891 |

| Union Pacific Corp. | | 6,803 | 593 | Rovi Corp.(Æ) | | 4,100 | | 72 |

| United Continental Holdings, Inc.(Æ) | | 4,308 | 197 | Salesforce.com, Inc.(Æ) | | 28,436 | | 2,155 |

| United Parcel Service, Inc. Class B | | 8,601 | 904 | Sanmina Corp.(Æ) | | 2,400 | | 57 |

| United Technologies Corp. | | 24,724 | 2,580 | SAP SE - ADR | | 16,609 | | 1,306 |

| Waste Management, Inc. | | 3,973 | 234 | Symantec Corp. | | 75,302 | | 1,253 |

| WW Grainger, Inc. | | 353 | 83 | SYNNEX Corp. | | 800 | | 66 |

| Xylem, Inc. | | 33,348 | 1,393 | Synopsys, Inc.(Æ) | | 29,700 | | 1,411 |

| | | | 70,776 | Texas Instruments, Inc. | | 5,955 | | 340 |

| | | | | Verint Systems, Inc.(Æ) | | 21,500 | | 728 |

| Technology - 14.8% | | | | Viavi Solutions, Inc. Class W(Æ) | | 59,900 | | 390 |

| 3D Systems Corp.(Æ) | | 8,100 | 143 | VMware, Inc. Class A(Æ) | | 6,600 | | 376 |

| Activision Blizzard, Inc.(Æ) | | 33,340 | 1,149 | Western Digital Corp. | | 33,200 | | 1,357 |

| Adobe Systems, Inc.(Æ) | | 22,565 | 2,126 | Zynga, Inc. Class A(Æ) | | 120,600 | | 287 |

| Advanced Micro Devices, Inc.(Æ) | | 182,500 | 648 | | | | | 109,683 |

| Alibaba Group Holding, Ltd. - ADR(Æ) | | 17,721 | 1,363 | | | | | |

| Alphabet, Inc. Class A(Æ) | | 6,090 | 4,311 | Utilities - 5.6% | | | | |

| Alphabet, Inc. Class C(Æ) | | 14,151 | 9,807 | Ameren Corp. | | 4,800 | | 230 |

| Anixter International, Inc.(Æ) | | 14,000 | 872 | American Electric Power Co., Inc. | | 29,670 | | 1,884 |

| Apple, Inc. | | 124,845 | 11,703 | American Water Works Co., Inc. | | 8,600 | | 626 |

| Applied Materials, Inc. | | 50,448 | 1,033 | AT&T, Inc. | | 262,597 | | 10,194 |

| Arista Networks, Inc.(Æ) | | 3,900 | 260 | Calpine Corp.(Æ) | | 57,870 | | 913 |

| ARM Holdings PLC - ADR(Æ) | | 56,841 | 2,341 | China Mobile, Ltd. - ADR | | 27,655 | | 1,591 |

| ARRIS International PLC(Æ) | | 16,800 | 383 | Consolidated Edison, Inc. | | 6,900 | | 515 |

| Avnet, Inc. | | 3,055 | 126 | Dominion Resources, Inc. | | 19,068 | | 1,363 |

| Broadcom, Ltd.(Æ) | | 17,668 | 2,575 | DTE Energy Co. | | 15,300 | | 1,364 |

| Brocade Communications Systems, Inc. | | 33,100 | 318 | Duke Energy Corp. | | 6,939 | | 547 |

| CA, Inc. | | 36,200 | 1,074 | Edison International | | 18,000 | | 1,273 |

| Cisco Systems, Inc. | | 160,977 | 4,425 | Entergy Corp. | | 66,100 | | 4,969 |

| Cognizant Technology Solutions Corp. Class | | | | Eversource Energy | | 4,400 | | 248 |

| A(Æ) | | 7,381 | 431 | Exelon Corp. | | 18,400 | | 646 |

| Coherent, Inc.(Æ) | | 700 | 65 | FirstEnergy Corp. | | 11,900 | | 388 |

| comScore, Inc.(Æ) | | 13,750 | 421 | Idacorp, Inc. | | 1,800 | | 131 |

| Dolby Laboratories, Inc. Class A | | 10,400 | 495 | NextEra Energy, Inc. | | 24,089 | | 2,832 |

| Electronic Arts, Inc.(Æ) | | 11,559 | 715 | PG&E Corp. | | 14,136 | | 823 |

| EMC Corp. | | 10,045 | 262 | Pinnacle West Capital Corp. | | 2,600 | | 189 |

| Facebook, Inc. Class A(Æ) | | 50,828 | 5,976 | Southern Co. (The) | | 51,515 | | 2,581 |

| Finisar Corp.(Æ) | | 26,300 | 433 | Sprint Corp.(Æ) | | 34,100 | | 117 |

| Gartner, Inc.(Æ) | | 6,300 | 549 | T-Mobile US, Inc.(Æ) | | 8,000 | | 314 |

| Groupon, Inc. Class A(Æ) | | 37,800 | 137 | Verizon Communications, Inc. | | 152,533 | | 7,770 |

| Harris Corp. | | 16,193 | 1,296 | | | | | 41,508 |

| Hewlett Packard Enterprise Co.(Æ) | | 77,581 | 1,293 | | | | | |

| Intel Corp. | | 252,000 | 7,631 | Total Common Stocks | | | | |

| International Business Machines Corp. | | 38,443 | 5,610 | | | | | |

| Juniper Networks, Inc. | | 21,800 | 510 | (cost $593,967) | | | | 706,847 |

| Lam Research Corp. | | 27,561 | 2,106 | | | | | |

| Leidos Holdings, Inc. | | 9,000 | 446 | Short-Term Investments - 4.8% | | | | |

| LinkedIn Corp. Class A(Æ) | | 10,755 | 1,348 | Russell U.S. Cash Management Fund | | 33,659,880 | (8) | 33,660 |

| | | | | United States Treasury Bills | | | | |

See accompanying notes which are an integral part of the financial statements.

8 Russell U.S. Core Equity Fund

Russell Investment Company

Russell U.S. Core Equity Fund

Schedule of Investments, continued — April 30, 2016 (Unaudited)

Amounts in thousands (except share amounts)

| | | | |

| | | | Principal | Fair |

| | | Amount ($) or | Value |

| | | | Shares | $ |

| 0.490% due 06/16/16 | | | 1,500 | 1,500 |

| 0.303% due 08/11/16 | | | 500 | 499 |

| Total Short-Term Investments | | | | |

| (cost $35,658) | | | | 35,659 |

| Total Investments 99.9% | | | | |

| (identified cost $629,625) | | | | 742,506 |

| Other Assets and Liabilities, Net | | | | |

| - 0.1% | | | | 512 |

| Net Assets - 100.0% | | | | 743,018 |

See accompanying notes which are an integral part of the financial statements.

Russell U.S. Core Equity Fund 9

Russell Investment Company

Russell U.S. Core Equity Fund

Schedule of Investments, continued — April 30, 2016 (Unaudited)

| | | | | | | | | | | | | | |

| Futures Contracts | | | | | | | | | | | | | | |

| Amounts in thousands (except contract amounts) | | | | | | | | | | | | |

| | | | | | | | | | | | | Unrealized | |

| | | | | | | | | | | | | Appreciation | |

| | | | | | Number of | | Notional | Expiration | | (Depreciation) | |

| | | | | | Contracts | | Amount | Date | | | $ | |

| Long Positions | | | | | | | | | | | | | | |

| Russell 1000 Mini Index Futures | | | | | 62 | | USD | | 7,071 | 06/16 | | | 7 | |

| S&P 500 E-Mini Index Futures | | | | | 275 | | USD | 28,313 | 06/16 | | | (18 | ) |

| Total Unrealized Appreciation (Depreciation) on Open Futures Contracts | | | | | | | | | | | (11 | ) |

| |

| |

| Presentation of Portfolio Holdings | | | | | | | | | | | | | | |

| |

| Amounts in thousands | | | | | | | | | | | | | | |

| | | | | | Fair Value | | | | | | | | |

| Portfolio Summary | | Level 1 | | Level 2 | | Level 3 | | Total | | % of Net Assets | |

| Common Stocks | | | | | | | | | | | | | | |

| Consumer Discretionary | $ | 102,219 | | $ | — | $ | | — | $ | 102,219 | | | 13.8 | |

| Consumer Staples | | 48,290 | | | — | | | — | | 48,290 | | | 6.5 | |

| Energy | | 56,134 | | | — | | | — | | 56,134 | | | 7.5 | |

| Financial Services | | 159,282 | | | — | | | — | | 159,282 | | | 21.4 | |

| Health Care | | 91,487 | | | — | | | — | | 91,487 | | | 12.3 | |

| Materials and Processing | | 27,468 | | | — | | | — | | 27,468 | | | 3.7 | |

| Producer Durables | | 70,776 | | | — | | | — | | 70,776 | | | 9.5 | |

| Technology | | 109,683 | | | — | | | — | | 109,683 | | | 14.8 | |

| Utilities | | 41,508 | | | — | | | — | | 41,508 | | | 5.6 | |

| Short-Term Investments(a) | | — | | | 1,999 | | | — | | 35,659 | | | 4.8 | |

| Total Investments | | 706,847 | | | 1,999 | | | — | | 742,506 | | | 99.9 | |

| Other Assets and Liabilities, Net | | | | | | | | | | | | | 0.1 | |

| | | | | | | | | | | | | | 100.0 | |

| Other Financial Instruments | | | | | | | | | | | | | | |

| Futures Contracts | | (11 | ) | | — | | | — | | (11 | ) | | (—)* | |

| Total Other Financial Instruments** | $ | (11 | ) | $ | — | $ | | — | $ | (11 | ) | | | |

* Less than .05% of net assets.

** Futures and foreign currency exchange contract values reflect the unrealized appreciation (depreciation) on the instruments.

(a) Certain Investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified in the

fair value levels. Accordingly, the total fair value amounts presented in the table may not reconcile to the sum of the individual levels but are intended to permit

reconciliation to the amounts presented in the Schedule of Investments.

For a description of the Levels see note 2 in the Notes to Financial Statements.

For disclosure on transfers between Levels 1, 2 and 3 during the period ended April 30, 2016, see note 2 in the Notes to Financial

Statements.

See accompanying notes which are an integral part of the financial statements.

10 Russell U.S. Core Equity Fund

Russell Investment Company

Russell U.S. Core Equity Fund

Fair Value of Derivative Instruments — April 30, 2016 (Unaudited)

Amounts in thousands

| | | | |

| | | Equity | |

| Derivatives not accounted for as hedging instruments | Contracts | |

| Location: Statement of Assets and Liabilities - Assets | | | |

| Variation margin on futures contracts* | | $ | 7 | |

| Location: Statement of Assets and Liabilities - Liabilities | | | |

| Variation margin on futures contracts* | | $ | 18 | |

| | | Equity | |

| Derivatives not accounted for as hedging instruments | Contracts | |

| Location: Statement of Operations - Net realized gain (loss) | | | |

| Futures contracts | | $ | 2,012 | |

| Location: Statement of Operations - Net change in unrealized appreciation (depreciation) | | | |

| Futures contracts | | $ | (2,365 | ) |

* Includes cumulative appreciation/depreciation of futures contracts as reported in the Schedule of Investments. Only variation margin is reported within the

Statement of Assets and Liabilities.

For further disclosure on derivatives see note 2 in the Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Russell U.S. Core Equity Fund 11

Russell Investment Company

Russell U.S. Core Equity Fund

Balance Sheet Offsetting of Financial and Derivative Instruments —

April 30, 2016 (Unaudited)

| | | | | | | | | |

| Amounts in thousands | | | | | | | | | |

| |

| Offsetting of Financial Liabilities and Derivative Liabilities | | | | | | | | |

| | | | | Gross | Net Amounts | |

| | | | | Amounts | of Liabilities | |

| | | | Gross | Offset in the | Presented in | |

| | | Amounts of | Statement of | the Statement | |

| | | | Recognized | Assets and | of Assets and | |

| Description | Location: Statement of Assets and Liabilities - Liabilities | Liabilities | Liabilities | | Liabilities | |

| Futures Contracts | Variation margin on futures contracts | $ | 228 | | $ | — $ | 228 | |

| Total Financial and Derivative Liabilities | | | 228 | | | — | 228 | |

| Financial and Derivative Liabilities not subject to a netting agreement | | (228 | ) | — | (228 | ) |

| Total Financial and Derivative Liabilities subject to a netting agreement | $ | — | | $ | — $ | — | |

For further disclosure on derivatives and counterparty risk see note 2 in the Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

12 Russell U.S. Core Equity Fund

Russell Investment Company

Russell U.S. Core Equity Fund

Statement of Assets and Liabilities — April 30, 2016 (Unaudited)

| | |

| Amounts in thousands | | |

| Assets | | |

| Investments, at identified cost | $ | 629,625 |

| Investments, at fair value(>) | | 742,506 |

| Receivables: | | |

| Dividends and interest | | 843 |

| Dividends from affiliated Russell funds | | 9 |

| Investments sold | | 10,730 |

| Fund shares sold | | 95 |

| Prepaid expenses | | 12 |

| Total assets | | 754,195 |

| Liabilities | | |

| Payables: | | |

| Investments purchased | | 9,289 |

| Fund shares redeemed | | 1,021 |

| Accrued fees to affiliates | | 520 |

| Other accrued expenses | | 119 |

| Variation margin on futures contracts | | 228 |

| Total liabilities | | 11,177 |

| Net Assets | $ | 743,018 |

See accompanying notes which are an integral part of the financial statements.

Russell U.S. Core Equity Fund 13

Russell Investment Company

Russell U.S. Core Equity Fund

Statement of Assets and Liabilities, continued — April 30, 2016 (Unaudited)

| | | |

| Amounts in thousands | | | |

| Net Assets Consist of: | | | |

| Undistributed (overdistributed) net investment income | $ | 58 | |

| Accumulated net realized gain (loss) | | 16,755 | |

| Unrealized appreciation (depreciation) on: | | | |

| Investments | | 112,881 | |

| Futures contracts | | (11 | ) |

| Shares of beneficial interest | | 244 | |

| Additional paid-in capital | | 613,091 | |

| Net Assets | $ | 743,018 | |

| Net Asset Value, offering and redemption price per share: | | | |

| Net asset value per share: Class A(#) | $ | 30.60 | |

| Maximum offering price per share (Net asset value plus sales charge of 5.75%): Class A | $ | 32.47 | |

| Class A — Net assets | $ | 29,942,370 | |

| Class A — Shares outstanding ($.01 par value) | | 978,645 | |

| Net asset value per share: Class C(#) | $ | 30.01 | |

| Class C — Net assets | $ | 43,946,548 | |

| Class C — Shares outstanding ($.01 par value) | | 1,464,474 | |

| Net asset value per share: Class E(#) | $ | 30.63 | |

| Class E — Net assets | $ | 7,044,786 | |

| Class E — Shares outstanding ($.01 par value) | | 229,983 | |

| Net asset value per share: Class I(#) | $ | 30.52 | |

| Class I — Net assets | $ | 372,500,309 | |

| Class I — Shares outstanding ($.01 par value) | | 12,204,924 | |

| Net asset value per share: Class S(#) | $ | 30.54 | |

| Class S — Net assets | $ | 289,583,905 | |

| Class S — Shares outstanding ($.01 par value) | | 9,481,406 | |

| Amounts in thousands | | | |

| (>) Investments in affiliates, Russell U.S. Cash Management Fund | $ | 33,660 | |

| |

| (#) Net asset value per share equals class level net assets divided by class level shares of beneficial interest outstanding. | | | |

See accompanying notes which are an integral part of the financial statements.

14 Russell U.S. Core Equity Fund

Russell Investment Company

Russell U.S. Core Equity Fund

Statement of Operations — For the Period Ended April 30, 2016 (Unaudited)

| | | |

| Amounts in thousands | | | |

| Investment Income | | | |

| Dividends | $ | 8,783 | |

| Dividends from affiliated Russell funds | | 45 | |

| Interest | | 1 | |

| Total investment income | | 8,829 | |

| Expenses | | | |

| Advisory fees | | 2,213 | |

| Administrative fees | | 194 | |

| Custodian fees | | 104 | |

| Distribution fees - Class A | | 38 | |

| Distribution fees - Class C | | 169 | |

| Transfer agent fees - Class A | | 31 | |

| Transfer agent fees - Class C | | 45 | |

| Transfer agent fees - Class E | | 7 | |

| Transfer agent fees - Class I | | 246 | |

| Transfer agent fees - Class S | | 312 | |

| Professional fees | | 44 | |

| Registration fees | | 45 | |

| Shareholder servicing fees - Class C | | 56 | |

| Shareholder servicing fees - Class E | | 9 | |

| Trustees’ fees | | 15 | |

| Printing fees | | 29 | |

| Miscellaneous | | 11 | |

| Total expenses | | 3,568 | |

| Net investment income (loss) | | 5,261 | |

| Net Realized and Unrealized Gain (Loss) | | | |

| Net realized gain (loss) on: | | | |

| Investments | | 24,430 | |

| Futures contracts | | 2,012 | |

| Net realized gain (loss) | | 26,442 | |

| Net change in unrealized appreciation (depreciation) on: | | | |

| Investments | | (41,344 | ) |

| Futures contracts | | (2,365 | ) |

| Net change in unrealized appreciation (depreciation) | | (43,709 | ) |

| Net realized and unrealized gain (loss) | | (17,267 | ) |

| Net Increase (Decrease) in Net Assets from Operations | $ | (12,006 | ) |

See accompanying notes which are an integral part of the financial statements.

Russell U.S. Core Equity Fund 15

Russell Investment Company

Russell U.S. Core Equity Fund

Statements of Changes in Net Assets

| | | | | | |

| | | Period | | | | |

| | Ended April 30, 2016 | | Fiscal Year Ended | |

| Amounts in thousands | (Unaudited) | | October 31, 2015 | |

| Increase (Decrease) in Net Assets | | | | | | |

| Operations | | | | | | |

| Net investment income (loss) | $ | 5,261 | | $ | 13,597 | |

| Net realized gain (loss) | | 26,442 | | | 271,961 | |

| Net change in unrealized appreciation (depreciation) | | (43,709 | ) | | (198,051 | ) |

| Net increase (decrease) in net assets from operations | | (12,006 | ) | | 87,507 | |

| Distributions | | | | | | |

| From net investment income | | | | | | |

| Class A | | (186 | ) | | (404 | ) |

| Class C | | (109 | ) | | (300 | ) |

| Class E | | (44 | ) | | (108 | ) |

| Class I | | (3,114 | ) | | (7,732 | ) |

| Class S | | (2,272 | ) | | (5,525 | ) |

| Class Y | | — | | | (1,675 | ) |

| From net realized gain | | | | | | |

| Class A | | (6,287 | ) | | (5,083 | ) |

| Class C | | (9,369 | ) | | (7,688 | ) |

| Class E | | (1,460 | ) | | (1,465 | ) |

| Class I | | (86,408 | ) | | (78,180 | ) |

| Class S | | (64,637 | ) | | (59,594 | ) |

| Class Y | | — | | | (95,647 | ) |

| Net decrease in net assets from distributions | | (173,886 | ) | | (263,401 | ) |

| Share Transactions* | | | | | | |

| Net increase (decrease) in net assets from share transactions | | (21,302 | ) | | (684,853 | ) |

| Total Net Increase (Decrease) in Net Assets | | (207,194 | ) | | (860,747 | ) |

| Net Assets | | | | | | |

| Beginning of period | | 950,212 | | | 1,810,959 | |

| End of period | $ | 743,018 | | $ | 950,212 | |

| Undistributed (overdistributed) net investment income included in net assets | $ | 58 | | $ | 522 | |

See accompanying notes which are an integral part of the financial statements.

16 Russell U.S. Core Equity Fund

Russell Investment Company

Russell U.S. Core Equity Fund

Statements of Changes in Net Assets, continued

* Share transaction amounts (in thousands) for the periods ended April 30, 2016 and October 31, 2015 were as follows:

| | | | | | | | | | | | |

| | | 2016 (Unaudited) | | | 2015 | | |

| | | Shares | | | Dollars | | | Shares | | | Dollars | |

| Class A | | | | | | | | | | | | |

| Proceeds from shares sold | | 24 | | $ | 770 | | | 100 | | $ | 3,876 | |

| Proceeds from reinvestment of distributions | | 212 | | | 6,407 | | | 142 | | | 5,454 | |

| Payments for shares redeemed | | (153 | ) | | (4,791 | ) | | (185 | ) | | (7,192 | ) |

| Net increase (decrease) | | 83 | | | 2,386 | | | 57 | | | 2,138 | |

| Class C | | | | | | | | | | | | |

| Proceeds from shares sold | | 28 | | | 865 | | | 69 | | | 2,655 | |

| Proceeds from reinvestment of distributions | | 315 | | | 9,325 | | | 209 | | | 7,944 | |

| Payments for shares redeemed | | (199 | ) | | (6,083 | ) | | (232 | ) | | (8,925 | ) |

| Net increase (decrease) | | 144 | | | 4,107 | | | 46 | | | 1,674 | |

| Class E | | | | | | | | | | | | |

| Proceeds from shares sold | | 6 | | | 181 | | | 13 | | | 525 | |

| Proceeds from reinvestment of distributions | | 49 | | | 1,492 | | | 41 | | | 1,562 | |

| Payments for shares redeemed | | (26 | ) | | (794 | ) | | (117 | ) | | (4,525 | ) |

| Net increase (decrease) | | 29 | | | 879 | | | (63 | ) | | (2,438 | ) |

| Class I | | | | | | | | | | | | |

| Proceeds from shares sold | | 306 | | | 9,348 | | | 804 | | | 30,527 | |

| Proceeds from reinvestment of distributions | | 2,927 | | | 88,113 | | | 2,215 | | | 85,273 | |

| Payments for shares redeemed | | (3,938 | ) | | (124,987 | ) | | (3,340 | ) | | (130,628 | ) |

| Net increase (decrease) | | (705 | ) | | (27,526 | ) | | (321 | ) | | (14,828 | ) |

| Class S | | | | | | | | | | | | |

| Proceeds from shares sold | | 285 | | | 8,815 | | | 829 | | | 32,394 | |

| Proceeds from reinvestment of distributions | | 2,173 | | | 65,470 | | | 1,658 | | | 63,868 | |

| Payments for shares redeemed | | (2,390 | ) | | (75,433 | ) | | (2,991 | ) | | (116,150 | ) |

| Net increase (decrease) | | 68 | | | (1,148 | ) | | (504 | ) | | (19,888 | ) |

| Class Y(1) | | | | | | | | | | | | |

| Proceeds from shares sold | | — | | | — | | | 158 | | | 6,425 | |

| Proceeds from reinvestment of distributions | | — | | | — | | | 2,529 | | | 97,322 | |

| Payments for shares redeemed | | — | | | — | | | (19,070 | ) | | (755,258 | ) |

| Net increase (decrease) | | — | | | — | | | (16,383 | ) | | (651,511 | ) |

| Total increase (decrease) | | (381 | ) | $ | (21,302 | ) | | (17,168 | ) | $ | (684,853 | ) |

| |

| (1) For the period November 1, 2014 to May 1, 2015 (final redemption). | | | | | | | | | | | | |

See accompanying notes which are an integral part of the financial statements.

Russell U.S. Core Equity Fund 17

Russell Investment Company

Russell U.S. Core Equity Fund

Financial Highlights — For the Periods Ended

For a Share Outstanding Throughout Each Period.

| | | | | | | | | | | | | | | | | |

| | | $ | | $ | | | $ | | | $ | | | $ | | | $ | |

| | Net Asset Value, | | Net | | | Net Realized | | | Total from | | | Distributions | | | Distributions | |

| | Beginning of | | Investment | | | and Unrealized | | | Investment | | | from Net | | | from Net | |

| | | Period | | Income(Loss) (a)(d) | | | Gain (Loss) | | | Operations | | | Investment Income | | | Realized Gain | |

| Class A | | | | | | | | | | | | | | | | | |

| April 30, 2016* | | 38.50 | | .17 | | | (.59 | ) | | (.42 | ) | | (.21 | ) | | (7.27 | ) |

| October 31, 2015 | | 43.30 | | .31 | | | 1.44 | | | 1.75 | | | (.44 | ) | | (6.11 | ) |

| October 31, 2014 | | 38.17 | | .39 | | | 5.12 | | | 5.51 | | | (.38 | ) | | — | |

| October 31, 2013 | | 30.29 | | .31 | | | 7.88 | | | 8.19 | | | (.31 | ) | | — | |

| October 31, 2012 | | 27.08 | | .21 | | | 3.23 | | | 3.44 | | | (.23 | ) | | — | |

| October 31, 2011 | | 26.05 | | .17 | | | 1.03 | | | 1.20 | | | (.17 | ) | | — | |

| | | | | | | | | | | | | | | | | | |

| Class C | | | | | | | | | | | | | | | | | |

| April 30, 2016* | | 37.90 | | .06 | | | (.60 | ) | | (.54 | ) | | (.08 | ) | | (7.27 | ) |

| October 31, 2015 | | 42.78 | | .02 | | | 1.42 | | | 1.44 | | | (.21 | ) | | (6.11 | ) |

| October 31, 2014 | | 37.78 | | .08 | | | 5.07 | | | 5.15 | | | (.15 | ) | | — | |

| October 31, 2013 | | 30.01 | | .05 | | | 7.80 | | | 7.85 | | | (.08 | ) | | — | |

| October 31, 2012 | | 26.89 | | (.01 | ) | | 3.20 | | | 3.19 | | | (.07 | ) | | — | |

| October 31, 2011 | | 25.91 | | (.03 | ) | | 1.03 | | | 1.00 | | | (.02 | ) | | — | |

| | | | | | | | | | | | | | | | | | |

| Class E | | | | | | | | | | | | | | | | | |

| April 30, 2016* | | 38.53 | | .17 | | | (.59 | ) | | (.42 | ) | | (.21 | ) | | (7.27 | ) |

| October 31, 2015 | | 43.33 | | .31 | | | 1.43 | | | 1.74 | | | (.43 | ) | | (6.11 | ) |

| October 31, 2014 | | 38.17 | | .40 | | | 5.13 | | | 5.53 | | | (.37 | ) | | — | |

| October 31, 2013 | | 30.29 | | .32 | | | 7.87 | | | 8.19 | | | (.31 | ) | | — | |

| October 31, 2012 | | 27.06 | | .23 | | | 3.21 | | | 3.44 | | | (.21 | ) | | — | |

| October 31, 2011 | | 26.02 | | .20 | | | 1.03 | | | 1.23 | | | (.19 | ) | | — | |

| | | | | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | | | | |

| April 30, 2016* | | 38.42 | | .23 | | | (.60 | ) | | (.37 | ) | | (.26 | ) | | (7.27 | ) |

| October 31, 2015 | | 43.24 | | .44 | | | 1.43 | | | 1.87 | | | (.58 | ) | | (6.11 | ) |

| October 31, 2014 | | 38.10 | | .52 | | | 5.13 | | | 5.65 | | | (.51 | ) | | — | |

| October 31, 2013 | | 30.24 | | .42 | | | 7.86 | | | 8.28 | | | (.42 | ) | | — | |

| October 31, 2012 | | 27.04 | | .31 | | | 3.22 | | | 3.53 | | | (.33 | ) | | — | |

| October 31, 2011 | | 26.01 | | .27 | | | 1.02 | | | 1.29 | | | (.26 | ) | | — | |

| | | | | | | | | | | | | | | | | | |

| Class S | | | | | | | | | | | | | | | | | |

| April 30, 2016* | | 38.45 | | .22 | | | (.61 | ) | | (.39 | ) | | (.25 | ) | | (7.27 | ) |

| October 31, 2015 | | 43.26 | | .41 | | | 1.43 | | | 1.84 | | | (.54 | ) | | (6.11 | ) |

| October 31, 2014 | | 38.12 | | .49 | | | 5.13 | | | 5.62 | | | (.48 | ) | | — | |

| October 31, 2013 | | 30.26 | | .39 | | | 7.86 | | | 8.25 | | | (.39 | ) | | — | |

| October 31, 2012 | | 27.04 | | .28 | | | 3.23 | | | 3.51 | | | (.29 | ) | | — | |

| October 31, 2011 | | 26.01 | | .24 | | | 1.03 | | | 1.27 | | | (.24 | ) | | — | |

| | | | | | | | | | | | | | | | | | |

| Class Y(j) | | | | | | | | | | | | | | | | | |

| October 31, 2015(9) | | 43.19 | | .26 | | | 2.13 | | | 2.39 | | | (.38 | ) | | (6.11 | ) |

| October 31, 2014 | | 38.06 | | .58 | | | 5.11 | | | 5.69 | | | (.56 | ) | | — | |

| October 31, 2013 | | 30.21 | | .46 | | | 7.85 | | | 8.31 | | | (.46 | ) | | — | |

| October 31, 2012 | | 27.02 | | .33 | | | 3.23 | | | 3.56 | | | (.37 | ) | | — | |

| October 31, 2011 | | 25.99 | | .29 | | | 1.03 | | | 1.32 | | | (.29 | ) | | — | |

| | | | | | | | | | | | | | | | | | |

See accompanying notes which are an integral part of the financial statements.

18 Russell U.S. Core Equity Fund

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | % | | % | | % | | |

| | | | | $ | | | | | $ | | | Ratio of Expenses | Ratio of Expenses | Ratio of Net | | |

| | | | | Net Asset Value, | | % | | | Net Assets, | | | to Average | to Average | Investment Income | | % |

| | $ | | | End of | | Total | | | End of Period | | | Net Assets, | Net Assets, | to Average | | Portfolio |

| Total Distributions | | | Period | | Return(b)(c) | | | (000 | ) | | Gross(e) | Net(d)(e) | Net Assets(d)(e) | | Turnover Rate)(b) |

| (7.48 | ) | | 30.60 | | (.78 | ) | | 29,942 | | | 1.11 | | 1.11 | | 1.11 | | 35 |

| (6.55 | ) | | 38.50 | | 4.17 | | | 34,474 | | | 1.09 | | 1.09 | | .79 | | 103 |

| (.38 | ) | | 43.30 | | 14.49 | | | 36,334 | | | 1.08 | | 1.08 | | .95 | | 73 |

| (.31 | ) | | 38.17 | | 27.19 | | | 33,491 | | | 1.07 | | 1.07 | | .90 | | 97 |

| (.23 | ) | | 30.29 | | 12.73 | | | 29,349 | | | 1.07 | | 1.07 | | .72 | | 117 |

| (.17 | ) | | 27.08 | | 4.60 | | | 29,238 | | | 1.07 | | 1.07 | | .62 | | 90 |

| (7.35 | ) | | 30.01 | | (1.15 | ) | | 43,947 | | | 1.86 | | 1.86 | | .36 | | 35 |

| (6.32 | ) | | 37.90 | | 3.39 | | | 50,046 | | | 1.84 | | 1.84 | | .04 | | 103 |

| (.15 | ) | | 42.78 | | 13.66 | | | 54,530 | | | 1.83 | | 1.83 | | .21 | | 73 |

| (.08 | ) | | 37.78 | | 26.23 | | | 55,105 | | | 1.82 | | 1.82 | | .16 | | 97 |

| (.07 | ) | | 30.01 | | 11.89 | | | 53,222 | | | 1.82 | | 1.82 | | (.02 | ) | 117 |

| (.02 | ) | | 26.89 | | 3.81 | | | 61,417 | | | 1.82 | | 1.82 | | (.13 | ) | 90 |

| (7.48 | ) | | 30.63 | | (.78 | ) | | 7,045 | | | 1.11 | | 1.11 | | 1.11 | | 35 |

| (6.54 | ) | | 38.53 | | 4.14 | | | 7,752 | | | 1.09 | | 1.09 | | .80 | | 103 |

| (.37 | ) | | 43.33 | | 14.52 | | | 11,449 | | | 1.08 | | 1.08 | | .97 | | 73 |

| (.31 | ) | | 38.17 | | 27.18 | | | 19,657 | | | 1.07 | | 1.06 | | .95 | | 97 |

| (.21 | ) | | 30.29 | | 12.78 | | | 25,075 | | | 1.07 | | 1.02 | | .81 | | 117 |

| (.19 | ) | | 27.06 | | 4.67 | | | 67,675 | | | 1.07 | | .99 | | .71 | | 90 |

| (7.53 | ) | | 30.52 | | (.62 | ) | | 372,500 | | | .78 | | .78 | | 1.45 | | 35 |

| (6.69 | ) | | 38.42 | | 4.48 | | | 496,057 | | | .76 | | .76 | | 1.12 | | 103 |

| (.51 | ) | | 43.24 | | 14.90 | | | 572,064 | | | .75 | | .75 | | 1.28 | | 73 |

| (.42 | ) | | 38.10 | | 27.59 | | | 579,477 | | | .74 | | .74 | | 1.23 | | 97 |

| (.33 | ) | | 30.24 | | 13.13 | | | 597,630 | | | .74 | | .74 | | 1.07 | | 117 |

| (.26 | ) | | 27.04 | | 4.95 | | | 887,294 | | | .74 | | .74 | | .96 | | 90 |

| (7.52 | ) | | 30.54 | | (.66 | ) | | 289,584 | | | .86 | | .86 | | 1.37 | | 35 |

| (6.65 | ) | | 38.45 | | 4.42 | | | 361,883 | | | .84 | | .84 | | 1.04 | | 103 |

| (.48 | ) | | 43.26 | | 14.80 | | | 428,952 | | | .83 | | .83 | | 1.20 | | 73 |

| (.39 | ) | | 38.12 | | 27.51 | | | 450,265 | | | .82 | | .82 | | 1.15 | | 97 |

| (.29 | ) | | 30.26 | | 13.01 | | | 440,333 | | | .82 | | .82 | | .99 | | 117 |

| (.24 | ) | | 27.04 | | 4.87 | | | 1,509,859 | | | .82 | | .82 | | .87 | | 90 |

| (6.49 | ) | | 39.09 | | 5.88 | | | — | | | .64 | | .64 | | 1.30 | | 41 |

| (.56 | ) | | 43.19 | | 15.02 | | | 707,630 | | | .63 | | .63 | | 1.42 | | 73 |

| (.46 | ) | | 38.06 | | 27.74 | | | 989,520 | | | .62 | | .62 | | 1.35 | | 97 |

| (.37 | ) | | 30.21 | | 13.24 | | | 1,031,582 | | | .64 | | .64 | | 1.16 | | 117 |

| (.29 | ) | | 27.02 | | 5.06 | | | 1,239,602 | | | .64 | | .64 | | 1.05 | | 90 |

See accompanying notes which are an integral part of the financial statements.

Russell U.S. Core Equity Fund 19

Russell Investment Company

Russell U.S. Defensive Equity Fund

Shareholder Expense Example — April 30, 2016 (Unaudited)

| | | | | | |

| Fund Expenses | Please note that the expenses shown in the table are meant |

| The following disclosure provides important information | to highlight your ongoing costs only and do not reflect any |

| regarding the Fund’s Shareholder Expense Example | transactional costs. Therefore, the information under the heading |

| (“Example”). | “Hypothetical Performance (5% return before expenses)” is |

| | useful in comparing ongoing costs only, and will not help you |

| Example | determine the relative total costs of owning different funds. In |

| As a shareholder of the Fund, you incur two types of costs: (1) | addition, if these transactional costs were included, your costs |

| transaction costs, including sales charges (loads) on certain | would have been higher. | | | | | |

| purchase or redemption payments, and (2) ongoing costs, | | | | | Hypothetical |

| including advisory and administrative fees; distribution (12b-1) | | | | | Performance (5% |

| and/or service fees; and other Fund expenses. The Example is | | | | Actual | return before |

| intended to help you understand your ongoing costs (in dollars) | Class A | | Performance | | expenses) |

| | Beginning Account Value | | | | | |

| of investing in the Fund and to compare these costs with the | November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| ongoing costs of investing in other mutual funds. The Example | Ending Account Value | | | | | |

| is based on an investment of $1,000 invested at the beginning of | April 30, 2016 | | $ | 1,020.70 | $ | 1,018.80 |

| the period and held for the entire period indicated, which for this | Expenses Paid During Period* | | $ | 6.13 | $ | 6.12 |

| Fund is from November 1, 2015 to April 30, 2016. | * Expenses are equal to the Fund's annualized expense ratio of 1.22% |

| | (representing the six month period annualized), multiplied by the average |

| Actual Expenses | account value over the period, multiplied by 182/366 (to reflect the one-half |

| The information in the table under the heading “Actual | year period). | | | | | |

| Performance” provides information about actual account values | | | | | | |

| and actual expenses. You may use the information in this column, | | | | | Hypothetical |

| | | | | | Performance (5% |

| together with the amount you invested, to estimate the expenses | | | | Actual | return before |

| that you paid over the period. Simply divide your account value by | Class C | | Performance | | expenses) |

| $1,000 (for example, an $8,600 account value divided by $1,000 | Beginning Account Value | | | | | |

| = 8.6), then multiply the result by the number in the first column | November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| | Ending Account Value | | | | | |

| in the row entitled “Expenses Paid During Period” to estimate | April 30, 2016 | | $ | 1,016.80 | $ | 1,015.07 |

| the expenses you paid on your account during this period. | Expenses Paid During Period* | | $ | 9.88 | $ | 9.87 |

| Hypothetical Example for Comparison Purposes | * Expenses are equal to the Fund's annualized expense ratio of 1.97% |

| The information in the table under the heading “Hypothetical | (representing the six month period annualized), multiplied by the average |

| | account value over the period, multiplied by 182/366 (to reflect the one-half |

| Performance (5% return before expenses)” provides information | year period). | | | | | |

| about hypothetical account values and hypothetical expenses | | | | | | |

| based on the Fund’s actual expense ratio and an assumed rate of | | | | | Hypothetical |

| return of 5% per year before expenses, which is not the Fund’s | | | | | Performance (5% |

| | | | | Actual | return before |

| actual return. The hypothetical account values and expenses | Class E | | Performance | | expenses) |

| may not be used to estimate the actual ending account balance or | Beginning Account Value | | | | | |

| expenses you paid for the period. You may use this information | November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| to compare the ongoing costs of investing in the Fund and other | Ending Account Value | | | | | |

| | April 30, 2016 | | $ | 1,020.60 | $ | 1,018.80 |

| funds. To do so, compare this 5% hypothetical example with the | Expenses Paid During Period* | | $ | 6.13 | $ | 6.12 |

| 5% hypothetical examples that appear in the shareholder reports | | | | | | |

| of other funds. | * Expenses are equal to the Fund's annualized expense ratio of 1.22% |

| | (representing the six month period annualized), multiplied by the average |

| | account value over the period, multiplied by 182/366 (to reflect the one-half |

| | year period). | | | | | |

20 Russell U.S. Defensive Equity Fund

Russell Investment Company

Russell U.S. Defensive Equity Fund

Shareholder Expense Example, continued — April 30, 2016 (Unaudited)

| | | | | |

| | | | | Hypothetical |

| | | | | Performance (5% |

| | | | Actual | return before |

| Class I | | Performance | | expenses) |

| Beginning Account Value | | | | | |

| November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| Ending Account Value | | | | | |

| April 30, 2016 | | $ | 1,022.30 | $ | 1,020.44 |

| Expenses Paid During Period* | | $ | 4.48 | $ | 4.47 |

| * Expenses are equal to the Fund's annualized expense ratio of 0.89% |

| (representing the six month period annualized), multiplied by the average |

| account value over the period, multiplied by 182/366 (to reflect the one-half |

| year period). | | | | | |

| | | | | Hypothetical |

| | | | | Performance (5% |

| | | | Actual | return before |

| Class S | | Performance | | expenses) |

| Beginning Account Value | | | | | |

| November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| Ending Account Value | | | | | |

| April 30, 2016 | | $ | 1,021.90 | $ | 1,020.04 |

| Expenses Paid During Period* | | $ | 4.88 | $ | 4.87 |

| * Expenses are equal to the Fund's annualized expense ratio of 0.97% |

| (representing the six month period annualized), multiplied by the average |

| account value over the period, multiplied by 182/366 (to reflect the one-half |

| year period). | | | | | |

| | | | | Hypothetical |

| | | | | Performance (5% |

| | | | Actual | return before |

| Class Y | | Performance | | expenses) |

| Beginning Account Value | | | | | |

| November 1, 2015 | | $ | 1,000.00 | $ | 1,000.00 |

| Ending Account Value | | | | | |

| April 30, 2016 | | $ | 1,022.90 | $ | 1,021.03 |

| Expenses Paid During Period* | | $ | 3.87 | $ | 3.87 |

| * Expenses are equal to the Fund's annualized expense ratio of 0.77% |

| (representing the six month period annualized), multiplied by the average |

| account value over the period, multiplied by 182/366 (to reflect the one-half |

| year period). | | | | | |

Russell U.S. Defensive Equity Fund 21

Russell Investment Company

Russell U.S. Defensive Equity Fund

Schedule of Investments — April 30, 2016 (Unaudited)

| | | | | | | |

| Amounts in thousands (except share amounts) | | Amounts in thousands (except share amounts) | |

| | | | | | | Principal | Fair |

| | | Principal | Fair | | Amount ($) or | Value |

| | Amount ($) or | Value | | | Shares | $ |

| | | Shares | $ | | | | |

| Common Stocks - 94.8% | | | | Altria Group, Inc.(Û) | | 100,946 | 6,330 |

| Consumer Discretionary - 11.5% | | | | Archer-Daniels-Midland Co. | | 6,878 | 275 |

| Aaron's, Inc. Class A | | 22,900 | 600 | Bunge, Ltd. | | 29,829 | 1,864 |

| AutoZone, Inc.(Æ)(Û) | | 2,769 | 2,119 | Campbell Soup Co. | | 4,421 | 273 |

| Bed Bath & Beyond, Inc.(Æ) | | 4,350 | 206 | Casey's General Stores, Inc. | | 2,360 | 264 |

| Brinker International, Inc. | | 6,557 | 304 | Clorox Co. (The) | | 3,331 | 417 |

| Cable One, Inc.(Æ) | | 1,141 | 524 | Coca-Cola Co. (The)(Û) | | 268,994 | 12,051 |

| Charter Communications, Inc. Class A(Æ) | | 1,214 | 258 | Coca-Cola Enterprises, Inc. | | 41,646 | 2,186 |

| Children's Place, Inc. (The) | | 7,700 | 600 | Colgate-Palmolive Co. | | 2,571 | 182 |

| Chipotle Mexican Grill, Inc. Class A(Æ) | | 3,290 | 1,385 | Constellation Brands, Inc. Class A | | 5,672 | 885 |

| Choice Hotels International, Inc. | | 8,426 | 427 | Core-Mark Holding Co., Inc. | | 13,883 | 1,134 |

| Comcast Corp. Class A(Æ)(Û) | | 142,391 | 8,652 | CVS Health Corp. | | 102,189 | 10,270 |

| Cooper Tire & Rubber Co. | | 8,200 | 283 | Dean Foods Co. | | 22,500 | 388 |

| Costco Wholesale Corp.(Û) | | 33,841 | 5,013 | Dr Pepper Snapple Group, Inc. | | 54,232 | 4,930 |

| Darden Restaurants, Inc. | | 7,700 | 479 | Flowers Foods, Inc. | | 12,100 | 232 |

| Delphi Automotive PLC | | 3,342 | 246 | Hershey Co. (The) | | 14,086 | 1,312 |

| Dick's Sporting Goods, Inc. | | 8,482 | 393 | Hormel Foods Corp. | | 47,400 | 1,827 |

| Dollar General Corp. | | 110,284 | 9,033 | Ingredion, Inc. | | 1,585 | 182 |

| Domino's Pizza, Inc. | | 10,847 | 1,311 | JM Smucker Co. (The) | | 19,680 | 2,499 |

| Foot Locker, Inc. | | 12,094 | 743 | Kimberly-Clark Corp. | | 25,897 | 3,242 |

| Gentex Corp. | | 3,727 | 60 | Kroger Co. (The) | | 87,622 | 3,101 |

| Genuine Parts Co. | | 2,711 | 260 | Molson Coors Brewing Co. Class B | | 30,146 | 2,883 |

| Graham Holdings Co. Class B | | 3,045 | 1,451 | Mondelez International, Inc. Class A | | 129,697 | 5,572 |

| Home Depot, Inc. (The) | | 69,817 | 9,348 | PepsiCo, Inc.(Û) | | 100,542 | 10,352 |

| J Alexander's Holdings, Inc.(Æ) | | 5,956 | 61 | Philip Morris International, Inc. | | 141,470 | 13,881 |

| John Wiley & Sons, Inc. Class A | | 491 | 24 | Procter & Gamble Co. (The) | | 218,479 | 17,504 |

| Lowe's Cos., Inc. | | 94,804 | 7,207 | Reynolds American, Inc. | | 118,372 | 5,871 |

| Marriott International, Inc. Class A | | 19,548 | 1,370 | Sysco Corp. | | 46,000 | 2,119 |

| McDonald's Corp.(Û) | | 54,292 | 6,867 | United Natural Foods, Inc.(Æ) | | 18,800 | 671 |

| Murphy USA, Inc.(Æ) | | 18,100 | 1,039 | Walgreens Boots Alliance, Inc. | | 3,604 | 286 |

| New York Times Co. (The) Class A | | 18,200 | 233 | Whole Foods Market, Inc. | | 46,400 | 1,349 |

| News Corp. Class A | | 120,000 | 1,490 | | | | 114,332 |

| Nike, Inc. Class B | | 50,665 | 2,986 | | | | |

| Nordstrom, Inc. | | 1,098 | 56 | Energy - 5.6% | | | |

| NVR, Inc.(Æ) | | 1,424 | 2,366 | Antero Resources Corp.(Æ) | | 46,600 | 1,319 |

| Omnicom Group, Inc. | | 73,644 | 6,110 | Chevron Corp. | | 92,269 | 9,428 |

| O'Reilly Automotive, Inc.(Æ) | | 5,780 | 1,518 | Columbia Pipeline Group, Inc. | | 32,177 | 824 |

| Penske Automotive Group, Inc. | | 13,600 | 532 | ConocoPhillips | | 4,045 | 193 |

| Polaris Industries, Inc. | | 1,279 | 125 | CVR Energy, Inc. | | 23,000 | 558 |

| Ralph Lauren Corp. Class A | | 271 | 25 | EQT Corp. | | 2,239 | 157 |

| Ross Stores, Inc. | | 58,972 | 3,349 | Exxon Mobil Corp.(Û) | | 202,150 | 17,870 |

| Scripps Networks Interactive, Inc. Class A | | 1,156 | 72 | First Solar, Inc.(Æ) | | 2,200 | 123 |

| Starbucks Corp. | | 24,888 | 1,400 | FMC Technologies, Inc.(Æ) | | 40,607 | 1,238 |

| Target Corp. | | 15,541 | 1,236 | Marathon Petroleum Corp. | | 12,500 | 489 |

| Thomson Reuters Corp. | | 7,902 | 325 | National Oilwell Varco, Inc. | | 18,900 | 681 |

| Thor Industries, Inc. | | 471 | 30 | NOW, Inc.(Æ) | | 41,000 | 741 |

| Time Warner, Inc. | | 23,724 | 1,783 | Occidental Petroleum Corp. | | 84,134 | 6,449 |

| Time, Inc. | | 97,500 | 1,433 | Oceaneering International, Inc. | | 42,239 | 1,548 |

| TJX Cos., Inc. | | 62,997 | 4,777 | Phillips 66(Æ) | | 1,089 | 89 |

| TRI Pointe Group, Inc.(Æ) | | 35,800 | 415 | Rice Energy, Inc.(Æ) | | 82,364 | 1,426 |

| Tribune Media Co. Class A | | 19,407 | 748 | Royal Dutch Shell PLC Class A - ADR(Æ) | | 90,590 | 4,791 |

| Twenty-First Century Fox, Inc. Class A(Æ) | | 64,688 | 1,958 | TransCanada Corp. | | 33,190 | 1,377 |

| VF Corp. | | 23,114 | 1,457 | Valero Energy Corp. | | 5,600 | 330 |

| Visteon Corp.(Æ) | | 7,000 | 558 | World Fuel Services Corp. | | 8,800 | 411 |

| Wal-Mart Stores, Inc.(Û) | | 95,267 | 6,371 | WPX Energy, Inc.(Æ) | | 18,600 | 180 |

| Walt Disney Co. (The) | | 20,192 | 2,085 | | | | 50,222 |

| Wolverine World Wide, Inc. | | 34,200 | 648 | | | | |

| | | | 104,349 | Financial Services - 16.9% | | | |

| | | | | Aflac, Inc. | | 92,617 | 6,388 |

| Consumer Staples - 12.7% | | | | Alexander's, Inc.(ö) | | 106 | 41 |

See accompanying notes which are an integral part of the financial statements.

22 Russell U.S. Defensive Equity Fund

Russell Investment Company

Russell U.S. Defensive Equity Fund

Schedule of Investments, continued — April 30, 2016 (Unaudited)

| | | | | | | |

| Amounts in thousands (except share amounts) | | Amounts in thousands (except share amounts) | |

| | | Principal | Fair | | | Principal | Fair |

| | Amount ($) or | Value | | Amount ($) or | Value |

| | | Shares | $ | | | Shares | $ |

| Alexandria Real Estate Equities, Inc.(ö)(Û) | | 10,800 | 1,004 | Liberty Property Trust(ö) | | 5,370 | 187 |

| Alleghany Corp.(Æ) | | 406 | 212 | Loews Corp. | | 7,216 | 286 |

| Allied World Assurance Co. Holdings AG | | 2,051 | 73 | M&T Bank Corp. | | 4,656 | 551 |

| Allstate Corp. (The) | | 20,597 | 1,340 | Markel Corp.(Æ) | | 2,294 | 2,063 |

| American Equity Investment Life Holding | | | | Marsh & McLennan Cos., Inc. | | 96,460 | 6,091 |

| Co.(Æ) | | 30,400 | 426 | MasterCard, Inc. Class A(Û) | | 47,719 | 4,628 |

| American Express Co. | | 11,745 | 768 | MetLife, Inc. | | 9,846 | 444 |

| American Financial Group, Inc. | | 10,497 | 725 | MFA Financial, Inc.(ö) | | 7,932 | 55 |

| American Tower Corp.(ö) | | 5,334 | 559 | Morningstar, Inc. | | 6,037 | 502 |

| AmTrust Financial Services, Inc. | | 58,610 | 1,456 | Nasdaq, Inc. | | 25,200 | 1,555 |

| Annaly Capital Management, Inc.(ö) | | 5,414 | 56 | New York Community Bancorp, Inc. | | 10,298 | 155 |

| Arch Capital Group, Ltd.(Æ) | | 3,149 | 222 | Old Republic International Corp. | | 34,000 | 629 |

| Arthur J Gallagher & Co. | | 47,348 | 2,180 | Paramount Group, Inc.(ö) | | 93,908 | 1,568 |

| Aspen Insurance Holdings, Ltd. | | 27,249 | 1,263 | Parkway Properties, Inc.(ö) | | 38,000 | 625 |

| Assurant, Inc. | | 19,189 | 1,623 | People's United Financial, Inc. | | 7,849 | 122 |

| AvalonBay Communities, Inc.(ö) | | 9,028 | 1,596 | PNC Financial Services Group, Inc. (The)(Û) | 52,214 | 4,583 |

| Axis Capital Holdings, Ltd. | | 2,563 | 137 | Post Properties, Inc.(ö) | | 10,404 | 597 |

| Bank of America Corp. | | 5,592 | 81 | Principal Financial Group, Inc. | | 68,489 | 2,923 |

| Bank of New York Mellon Corp. (The) | | 6,551 | 264 | ProAssurance Corp. | | 864 | 41 |

| BB&T Corp. | | 48,225 | 1,706 | Progressive Corp. (The)(Æ) | | 13,700 | 447 |

| Berkshire Hathaway, Inc. Class B(Æ) | | 71,763 | 10,440 | Public Storage(ö) | | 1,924 | 471 |

| BlackRock, Inc. Class A | | 1,756 | 626 | Raymond James Financial, Inc. | | 8,993 | 469 |

| BOK Financial Corp. | | 438 | 26 | Regency Centers Corp.(ö) | | 19,252 | 1,419 |

| Boston Properties, Inc.(ö) | | 4,380 | 564 | Regions Financial Corp. | | 58,400 | 548 |

| Broadridge Financial Solutions, Inc. | | 3,044 | 182 | Reinsurance Group of America, Inc. Class A | 28,832 | 2,745 |

| Brown & Brown, Inc. | | 1,875 | 66 | RenaissanceRe Holdings, Ltd. | | 1,169 | 130 |

| Capital One Financial Corp. | | 7,674 | 556 | Senior Housing Properties Trust(ö) | | 5,968 | 105 |

| CBL & Associates Properties, Inc.(ö) | | 127,100 | 1,485 | Signature Bank(Æ) | | 3,200 | 441 |

| Chubb, Ltd. | | 28,711 | 3,384 | Simon Property Group, Inc.(ö) | | 18,496 | 3,721 |

| Cincinnati Financial Corp. | | 4,173 | 275 | Starwood Property Trust, Inc.(ö) | | 4,624 | 90 |

| Citigroup, Inc. | | 1,358 | 63 | State Street Corp. | | 84,540 | 5,267 |

| Citizens Financial Group, Inc.(Û) | | 75,900 | 1,734 | SunTrust Banks, Inc. | | 14,600 | 609 |

| CME Group, Inc. Class A | | 795 | 73 | SVB Financial Group(Æ) | | 2,800 | 292 |

| CNA Financial Corp. | | 22,822 | 721 | Tanger Factory Outlet Centers, Inc.(ö) | | 1,336 | 47 |

| Comerica, Inc. | | 41,876 | 1,859 | TCF Financial Corp. | | 116,578 | 1,590 |

| Commerce Bancshares, Inc. | | 1,378 | 65 | Torchmark Corp. | | 3,202 | 185 |

| Cullen/Frost Bankers, Inc. | | 26,932 | 1,723 | Total System Services, Inc. | | 33,400 | 1,708 |

| Discover Financial Services | | 2,875 | 162 | Travelers Cos., Inc. (The) | | 27,254 | 2,995 |

| East West Bancorp, Inc. | | 27,348 | 1,025 | Unum Group | | 38,400 | 1,314 |

| Endurance Specialty Holdings, Ltd. | | 25,276 | 1,617 | US Bancorp | | 74,513 | 3,181 |

| Equifax, Inc. | | 10,689 | 1,285 | Validus Holdings, Ltd. | | 2,147 | 99 |

| Equity LifeStyle Properties, Inc. Class A(ö) | | 10,345 | 709 | Visa, Inc. Class A(Û) | | 103,543 | 7,998 |

| Equity One, Inc.(ö) | | 24,200 | 685 | Voya Financial, Inc. | | 49,602 | 1,611 |

| Equity Residential(ö) | | 3,714 | 253 | Wells Fargo & Co.(Û) | | 243,393 | 12,165 |

| EverBank Financial Corp. | | 42,881 | 647 | White Mountains Insurance Group, Ltd.(Æ) | | 144 | 120 |

| Everest Re Group, Ltd. | | 9,647 | 1,784 | WP Glimcher, Inc.(ö) | | 154,100 | 1,617 |

| Fidelity National Information Services, Inc. | | 31,284 | 2,058 | WR Berkley Corp. | | 49,377 | 2,765 |

| FNF Group | | 1,442 | 46 | Xenia Hotels & Resorts, Inc.(ö) | | 63,461 | 976 |

| FNFV Group(Æ) | | 23,142 | 249 | XL Group PLC Class A | | 66,218 | 2,167 |

| Global Payments, Inc. | | 25,783 | 1,861 | | | | 152,444 |

| Goldman Sachs Group, Inc. (The) | | 3,280 | 538 | | | | |

| Great Western Bancorp, Inc. | | 10,600 | 334 | Health Care - 15.7% | | | |

| Hanover Insurance Group, Inc. (The) | | 12,342 | 1,058 | Abbott Laboratories | | 229,381 | 8,923 |

| HCP, Inc.(ö) | | 5,465 | 185 | Aetna, Inc. | | 29,258 | 3,285 |

| Huntington Bancshares, Inc. | | 17,144 | 172 | Agilent Technologies, Inc. | | 6,026 | 247 |

| Iberiabank Corp. | | 28,500 | 1,681 | Alexion Pharmaceuticals, Inc.(Æ) | | 602 | 84 |

| Intercontinental Exchange, Inc. | | 3,878 | 931 | Allergan PLC(Æ) | | 1,351 | 293 |

| Invesco, Ltd. | | 19,057 | 591 | Allscripts Healthcare Solutions, Inc.(Æ) | | 63,600 | 852 |

| Jack Henry & Associates, Inc. | | 21,994 | 1,782 | Alnylam Pharmaceuticals, Inc.(Æ) | | 7,800 | 523 |