April 20, 2012

Kimberly Browning, Esq.

Division of Investment Management

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Prospectus and SAI Contained in Post Effective Amendment No. 166 to the Registration

Statement of Russell Investment Company Filed on February 10, 2012 |

Dear Ms. Browning:

This letter responds to a comment you provided to Jill Damon in a telephonic discussion on Friday, March 30, 2012 regarding the prospectus and SAI contained in Post-Effective Amendment No. 166 to the Registration Statement for Russell Investment Company (the “Trust” or the “Registrant”) filed with the Securities and Exchange Commission on February 10, 2012. This letter responds only to the comment in which you identified certain incomplete portions of the prospectus. A summary of the comment, and a response thereto, are provided below. Registrant will provide responses to your remaining comments as EDGAR correspondence at a later date.

Response to Comment

Capitalized terms have the same meaning as defined in the prospectus and SAI unless otherwise indicated.

| 4. | Comment: As a general matter, the Staff objects to filing a prospectus under 485(a) with certain incomplete information. Please note for future filings with incomplete information, the Staff may not be able to grant acceleration, if requested. |

Response: The Registrant acknowledges the Staff’s position. Certain information was not provided in the 485(a) filing because it was not available at the time of filing (e.g., information in the Annual Fund Operating Expenses table, Example and risk/return performance bar chart and table). Registrant notes that the information required by the Annual Fund Operating Expenses table and Example is based on fiscal year information that is not final until after completion of the Fund’s audit and of subsequent analysis required to calculate amounts needed to update the Annual Fund Operating Expenses table and Example, which is after the annual update 485(a) filing in early February. Further, while information contained in the performance bar chart and table is based on calendar year data that is available at the time of filing in early February, subsequent analysis and internal sign-off are not yet complete. Registrant endeavors to include all available information in its 485(a) filings. Where such information is not determined at the time of the filing, Registrant will provide such information to the Staff supplementally after it becomes available. Please see Appendix A for each Fund’s completed Annual Fund Operating Expenses table, Example and risk/return performance bar chart and table.

Please call me at (617) 728-7139 or John V. O’Hanlon at (617) 728-7111 if you have any questions.

Sincerely,

/s/ Leah Schubert

Leah Schubert

APPENDIX A

2017 RETIREMENT DISTRIBUTION FUND — A SHARES

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)#

| | Class A Shares |

| Advisory Fee...................................................................................................................................................................................................................................................................................... | 0.20% |

| Distribution (12b-1) Fees.................................................................................................................................................................................................................................................................. | 0.25% |

| Other Expenses.................................................................................................................................................................................................................................................................................. | 5.50% |

| Acquired Fund Fees and Expenses................................................................................................................................................................................................................................................ | 0.67% |

| Total Annual Fund Operating Expenses........................................................................................................................................................................................................................................ | 6.62% |

| Less Fee Waivers and Expense Reimbursements......................................................................................................................................................................................................................... | (5.43)% |

| Net Annual Fund Operating Expenses........................................................................................................................................................................................................................................... | 1.19% |

| # | “Total Annual Fund Operating Expenses” and “Net Annual Fund Operating Expenses” have been restated to reflect the proportionate share of the expenses of the Underlying Funds in which the Fund invests. |

| | Until April 29, 2013, RIMCo has contractually agreed to waive up to the full amount of its 0.20% advisory fee and then to reimburse the Fund for other direct expenses to the extent that direct expenses exceed 0.52% of the average daily net assets of the Fund on an annual basis. Direct operating expenses do not include extraordinary expenses or the expenses of other investment companies in which the Fund invests, including the Underlying Funds, which are borne indirectly by the Funds. This waiver and reimbursement may not be terminated during the relevant period except with Board approval. |

Example

| | Class A Shares |

| 1 Year............................................................................................................................................................................................................................................................................................... | $689 |

| 3 Years............................................................................................................................................................................................................................................................................................. | $1,964 |

| 5 Years............................................................................................................................................................................................................................................................................................. | $3,197 |

| 10 Years........................................................................................................................................................................................................................................................................................... | $6,111 |

Performance

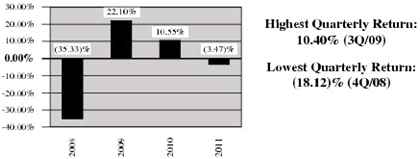

A Shares Calendar Year Total Returns

Average annual total returns for the periods ended December 31, 2011 | 1 Year | Since Inception |

| Return Before Taxes................................................................................................................................................................................................................................... | (8.99)% | (5.60)% |

| Return After Taxes on Distributions....................................................................................................................................................................................................... | (9.60)% | (6.51)% |

| Return After Taxes on Distributions and Sale of Fund Shares........................................................................................................................................................... | (5.83)% | (5.19)% |

| Barclays Capital U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes)................................................................................................ | 7.84% | 6.38% |

Russell 1000® Index (reflects no deduction for fees, expenses or taxes)........................................................................................................................................... | 1.50% | (1.42)% |

| Russell Developed ex-U.S. Large Cap Index (net of tax on dividends from foreign holdings) (reflects no deduction for fees, expenses or taxes).............. | (12.35)% | (7.66)% |

2017 RETIREMENT DISTRIBUTION FUND — S SHARES

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)#

| | Class S Shares |

| Advisory Fee...................................................................................................................................................................................................................................................................................... | 0.20% |

| Distribution (12b-1) Fees.................................................................................................................................................................................................................................................................. | 0.00% |

| Other Expenses.................................................................................................................................................................................................................................................................................. | 3.40% |

| Acquired Fund Fees and Expenses................................................................................................................................................................................................................................................ | 0.66% |

| Total Annual Fund Operating Expenses........................................................................................................................................................................................................................................ | 4.26% |

| Less Fee Waivers and Expense Reimbursements......................................................................................................................................................................................................................... | (3.33)% |

| Net Annual Fund Operating Expenses........................................................................................................................................................................................................................................... | 0.93% |

| # | “Total Annual Fund Operating Expenses” and “Net Annual Fund Operating Expenses” have been restated to reflect the proportionate share of the expenses of the Underlying Funds in which the Fund invests. |

| | Until April 29, 2013, RIMCo has contractually agreed to waive up to the full amount of its 0.20% advisory fee and then to reimburse the Fund for other direct expenses to the extent that direct expenses exceed 0.27% of the average daily net assets of the Fund on an annual basis. Direct operating expenses do not include extraordinary expenses or the expenses of other investment companies in which the Fund invests, including the Underlying Funds, which are borne indirectly by the Funds. This waiver and reimbursement may not be terminated during the relevant period except with Board approval. |

Example

| | Class S Shares |

| 1 Year............................................................................................................................................................................................................................................................................................ | $ 95 |

| 3 Years.......................................................................................................................................................................................................................................................................................... | $988 |

| 5 Years........................................................................................................................................................................................................................................................................................... | $1,895 |

| 10 Years......................................................................................................................................................................................................................................................................................... | $4,220 |

Performance

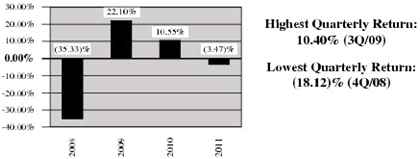

S Shares Calendar Year Total Returns

Average annual total returns for the periods ended December 31, 2011 | 1 Year | Since Inception |

| Return Before Taxes............................................................................................................................................................................................................................ | (1.87)% | (4.00)% |

| Return After Taxes on Distributions................................................................................................................................................................................................. | (2.52)% | (4.90)% |

| Return After Taxes on Distributions and Sale of Fund Shares..................................................................................................................................................... | (1.20)% | (3.85)% |

| Barclays Capital U.S. Aggregate Bond Index (reflects no deduction for fees, expenses or taxes)......................................................................................... | 7.84% | 6.38% |

Russell 1000® Index (reflects no deduction for fees, expenses or taxes)..................................................................................................................................... | 1.50% | (1.42)% |

| Russell Developed ex-U.S. Large Cap Index (net of tax on dividends from foreign holdings) (reflects no deduction for fees, expenses or taxes)........ | (12.35)% | (7.66)% |