UNITED STATES

SECURITES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03150

BMC FUND, INC.

(Exact name of registrant as specified in charter)

800 HICKORY BLVD. SW

LENOIR, NC 28645

(Address of principal executive offices) (Zip code)

ALAN DEAL

BMC FUND, INC.

800 HICKORY BLVD. SW

LENOIR, NC 28645

(Name and address of agent for service)

Registrant's telephone number including area code: 828-758-6100

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

Item 1. Report to Stockholders.

BMC FUND, INC.

FINANCIAL STATEMENTS AND

ADDITIONAL INFORMATION

Year Ended October 31, 2024

BMC FUND, INC.

TABLE OF CONTENTS

BMC FUND, INC.

LETTER TO SHAREHOLDERS – UNAUDITED

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Year Ended October 31, 2024

TO OUR SHAREHOLDERS: MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

BMC Fund, Inc. (the “Fund”) gained 13.4% during the fiscal year, underperforming the Fund’s Policy Index as defined on page 4 return of 22.9%. The Fund outperformed over the trailing three years, highlighting the Fund’s full-cycle return potential, including both the bear market in 2022 and the run-up since.

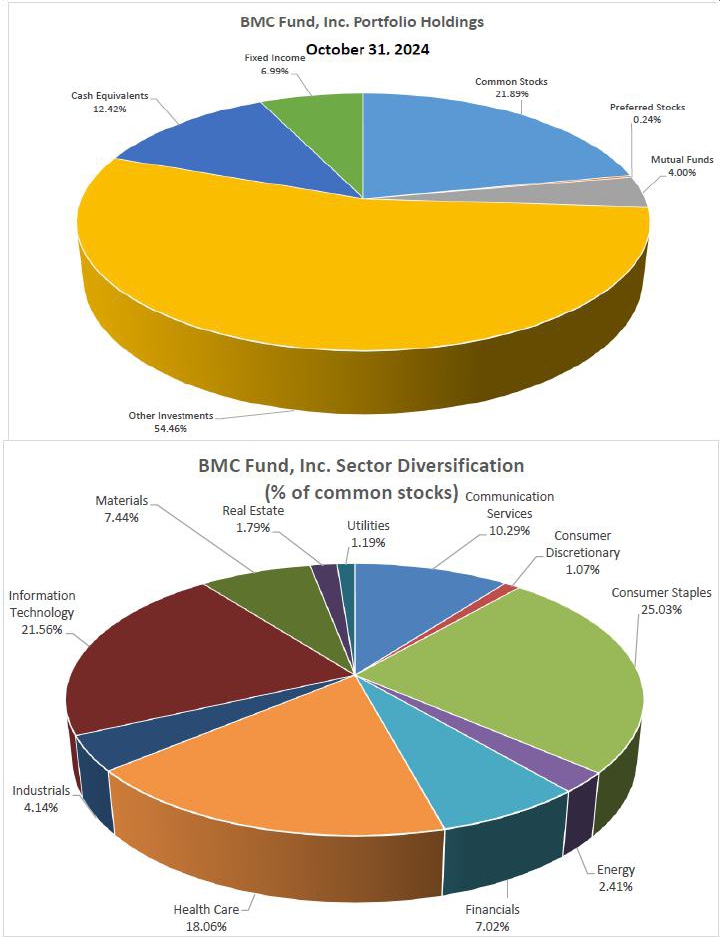

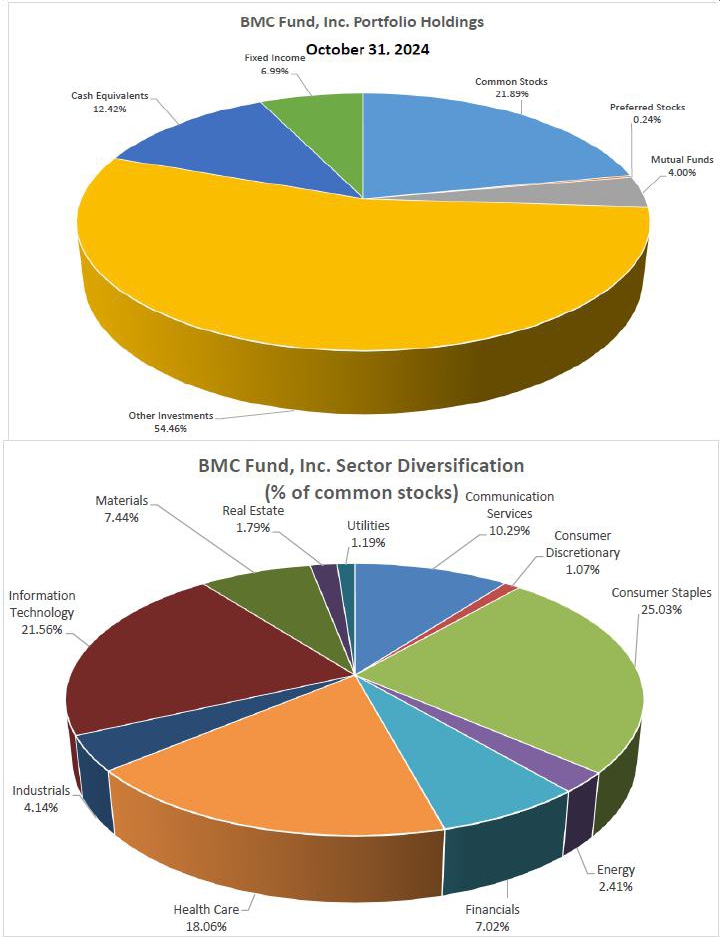

The overweight exposure to limited partnerships (LP), comprising almost 60% of investable assets at fiscal year-end, explains a large part of this dynamic. The LP Portfolio returned 10.6% during the fiscal year, compared to 21.7% for the equity portfolio. Consequently, the LP allocation being well in excess of the 45% benchmark weighting was a drag on relative returns despite continued redemptions over the course of the year. Several pending redemptions and distributions should significantly reduce the Fund’s exposure in the new year, improve overall liquidity, and provide cash on hand to redeploy as opportunities present themselves.

The equity portfolio had a similar impact on relative performance as it generated meaningful returns but lagged its benchmark. Like the overall Fund, the equity portfolio underperformed during the fiscal year, returning 21.7% versus MSCI ACWI 33.4%, but outperformed over the prior three years, returning 11.0% annualized versus 6.0% for the benchmark. This should not come as a surprise. Because valuations often overshoot during strong bull markets, we expect to underperform in the latter innings of bull markets. This approach, though, has been particularly helpful during drawdowns.

Meanwhile, macroeconomic data is sending mixed signals. The labor market remains strong but is incrementally weaker than several months ago. Inflation has returned to just above the Federal Reserve’s target range, but consumers are still being squeezed. Historically, this is a precursor to economic weakness, but recent consumer spending, which drives much of the domestic economy, suggests otherwise. Even with this mixed backdrop, markets continue to reach new highs as investors pile into the large-cap growth companies driving returns.

In the likely event that mixed signals translate into volatile markets rather than the steady upward trends of the last year, we believe the Fund is well positioned. The Fund is partially hedged, with rising liquidity, due to the dynamics previously discussed in the LP portfolio. Following the positive returns across asset classes in recent years and the top-heavy construction of the indices, we believe this sets the Fund up well going forward. However, taking advantage of these opportunities will demand a long-term time horizon and willingness to look quite different from consensus. Thankfully, we are in the unique position to enjoy both.

BMC FUND, INC.

LETTER TO SHAREHOLDERS – UNAUDITED

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Year Ended October 31, 2024

During the year ended October 31, 2024, the Company paid the following dividends per share:

| December 10, 2023 to shareholders of record November 25, 2023 | | $ | .20 | |

| March 10, 2024 to shareholders of record February 25, 2024 | | | .20 | |

| June 10, 2024 to shareholders of record May 25, 2024 | | | .20 | |

| September 10, 2024 to shareholders of record August 25, 2024 | | | .20 | |

| | | | | |

| Total | | $ | .80 | |

The Company paid a dividend of $1.10 per share on December 10, 2024 to shareholders of record November 25, 2024.

The attached Schedule of Investments is a listing of the entire Company’s diversified securities at October 31, 2024 with a total market value of $40,357,029.

| M. Hunt Broyhill |

| | Principal Executive Officer |

BMC FUND, INC.

LETTER TO SHAREHOLDERS – UNAUDITED

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Year Ended October 31, 2024

BMC FUND, INC.

LETTER TO SHAREHOLDERS – UNAUDITED

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Year Ended October 31, 2024

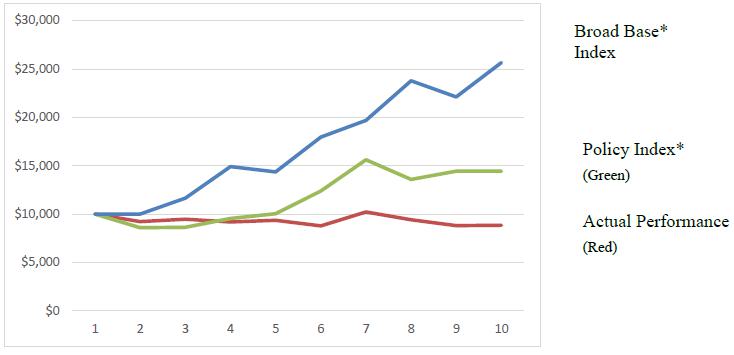

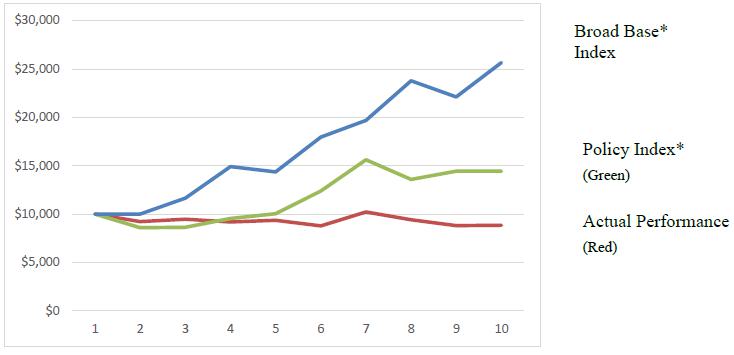

This chart assumes an initial gross investment of $10,000 made on 10/31/2014.

* Broad Base Index used is SPDR Dow Jones Industrial Average ETF Trust

* Policy Index is calculated as 50% MSCI ACWI, 25% Barclays Aggregate Bond Index, 20% HFRI Hedge Fund Index, 5% Cash

Past performance does not guarantee future results. Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Company distributions or the sale of the Company shares. An investment in the Company involves risk, including loss of principal.

Past performance at a glance

(unaudited)

Average annual total returns for the periods ended 10/31/2024

| Market Value | | 1 year | | | 5 year | | | 10 year | |

| | | | | | | | | | |

| BMC Fund, Inc. | | | 11.3 | % | | | 7.0 | % | | | 5.5 | % |

| | | | | | | | | | | | | |

| Policy Index | | | 1.0 | % | | | 2.0 | % | | | 3.0 | % |

| | | | | | | | | | | | | |

| Broad Base Index | | | 15.0 | % | | | 10.6 | % | | | 11.6 | % |

BMC Fund, Inc. pays management fees to BAM, LLC.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of BMC Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of BMC Fund, Inc. (the “Fund”) as of October 31, 2024, the related statements of operations, changes in net assets, cash flows, and the financial highlights for the year then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2024, the results of its operations, the changes in net assets, cash flows, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial statements and financial highlights for the years ended October 31, 2023, and prior, were audited by other auditors whose report dated January 5, 2024, expressed an unqualified opinion on those financial statements and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2024, by correspondence with the custodians and underlying portfolio funds. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2024.

COHEN & COMPANY, LTD.

Cleveland, Ohio

January 17, 2025

| BMC FUND, INC. | | | | | | | | |

| SCHEDULE OF INVESTMENTS | | | | | | | | |

| October 31, 2024 | |

| | | | | | | | | | | | | | | | | | | | | | Percent | |

| | | | | | Interest | | Base Rate | | | Maturity | | Face | | | | | | Market | | | of Net | |

| Debt Issuer | | | | | Rate | | Floor | | | Date | | Amount | | | Cost | | | Value | | | Assets | |

| | | | | | | | | | | | | | | | | | | | | | | |

| FIXED INCOME: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CORPORATE BONDS: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST CITIZENS | | | | | | SOFR +423. | | | 5.800 | % | | 12/31/2049 | | $ | 250,000 | | | $ | 252,390 | | | $ | 254,998 | | | | |

| FPL GROUP CAP INC | | | | | | SOFR +233 | | | 6.350 | % | | 10/1/2066 | | | 586,000 | | | | 563,064 | | | | 564,013 | | | | |

| PP&L CAP FUNDING FLT RATE | | | | | | SOFR +293 | | | 5.051 | % | | 3/30/2067 | | | 250,000 | | | | 250,000 | | | | 249,325 | | | | |

| TRANSCANADA PIPELINES LTD | | | | | | SOFR +247 | | | 6.350 | % | | 5/15/2067 | | | 250,000 | | | | 199,356 | | | | 231,432 | | | | |

| LEHMAN BROTHERS HLDGS NIKKEI INDEX | | | 1,2,3 | | | | | | 0.000 | % | | 9/29/2008 | | | 3,000,000 | | | | 1,599,171 | | | | - | | | | |

| LEHMAN BROTHERS HLDGS EAFE INDEX | | | 1,2,3 | | | | | | 0.000 | % | | 11/15/2008 | | | 1,000,000 | | | | 524,515 | | | | - | | | | |

| LEHMAN BROTHERS HLDGS MEDIUM TERM NOTE | | | 1,2,3 | | | | | | 0.000 | % | | 3/15/2011 | | | 2,500,000 | | | | 1,331,013 | | | | - | | | | |

| | | | | | | | | | | | | | | | 7,836,000 | | | | 4,719,509 | | | | 1,299,768 | | | 3.22 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GOVERNMENT BONDS: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| US TREASURY NOTE | | | | | | | | | 5.000 | % | | 10/31/2025 | | | 500,000 | | | | 499,933 | | | | 503,205 | | | | |

| US TREASURY NOTE | | | | | | | | | 4.625 | % | | 10/15/2026 | | | 500,000 | | | | 497,885 | | | | 504,240 | | | | |

| US TREASURY NOTE | | | | | | | | | 4.875 | % | | 10/31/2028 | | | 500,000 | | | | 501,619 | | | | 512,930 | | | | |

| | | | | | | | | | | | | | | | 1,500,000 | | | | 1,499,437 | | | | 1,520,375 | | | 3.77 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS IN FIXED INCOME | | | | | | | | | | | | | | $ | 9,336,000 | | | $ | 6,218,946 | | | $ | 2,820,143 | | | 6.99 | % |

See accompanying notes to financial statements.

| BMC FUND, INC. | | | | | |

| SCHEDULE OF INVESTMENTS (Continued) | | | | | |

| October 31, 2024 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Percent | |

| | | | | | Shares | | | | | | Market | | | of Net | |

| Company Name | | | | | | Held | | | Cost | | | Value | | | Assets | |

| | | | | | | | | | | | | | | | | | | | | |

| MUTUAL FUNDS: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| MFC BLACKROCK TAXABLE MUNICIPAL BOND TRUST | | | | | | | 67,658 | | | $ | 1,097,844 | | | $ | 1,124,476 | | | | | |

| PZENA EMERGING MARKETS VALUE INSTITUTIONAL | | | | | | | 27,010 | | | | 273,570 | | | | 362,473 | | | | | |

| ISHARES SILVER TRUST | | | 3 | | | | 1,252 | | | | 21,040 | | | | 37,322 | | | | | |

| SPDR GOLD SHARES | | | 3 | | | | 260 | | | | 25,315 | | | | 65,913 | | | | | |

| VANECK VECTORS GOLD MINERS | | | | | | | 571 | | | | 16,168 | | | | 23,034 | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS IN MUTUAL FUNDS | | | | | | | | | | $ | 1,433,937 | | | $ | 1,613,218 | | | | 4.00 | % |

See accompanying notes to financial statements.

| BMC FUND, INC. | | | | | |

| SCHEDULE OF INVESTMENTS (Continued) | | | | | |

| October 31, 2024 | |

| | | Acquisition | | | | | | | | | Market | | | Percent of | |

| Company Name | | Date | | | | | | Cost | | | Value | | | Net Assets | |

| | | | | | | | | | | | | | | | |

| OTHER INVESTMENTS: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| LIMITED PARTNERSHIPS (NOTE 2): | | | | | | | | | | | | | | | | | | | | |

| BAM CREDIT OPPORTUNITIES FUND | | | 12/8/2020 | | | | 2, 3, 6, 7 | | | $ | 733,155 | | | $ | 939,348 | | | | | |

| ELLIOTT ASSOCIATES, L.P. CL B | | | 11/3/2008 | | | | 2, 3 | | | | 996,415 | | | | 6,885,204 | | | | | |

| GRAHAM INSTITUTIONAL PARTNERS, L.P. | | | 7/1/2016 | | | | 2, 3 | | | | 2,365,123 | | | | 3,338,902 | | | | | |

| GREENLIGHT MASTERS QUALIFIED, L.P. | | | 12/1/2010 | | | | 2, 3 | | | | 350,000 | | | | 2,561,375 | | | | | |

| INFINITY PREMIER FUND, L.P. | | | 11/1/2014 | | | | 2, 3 | | | | 250,000 | | | | 1,367,373 | | | | | |

| MUDRICK DISTRESSED OPPORTUNITY DRAWDOWN FUND II, L.P. | | | 3/1/2019 | | | | 2, 3 | | | | 2,173,117 | | | | 3,727,150 | | | | | |

| OAKTREE ENHANCED INCOME FUND II, L.P. | | | 4/8/2014 | | | | 2, 3 | | | | - | | | | 11,107 | | | | | |

| OLD WELL EMERGING MARKETS FUND, L.P. | | | 4/1/2018 | | | | 2, 3 | | | | 65,070 | | | | 51,126 | | | | | |

| OLD WELL SPECIAL OPPORTUNITIES FUND II, LLC | | | 11/4/2021 | | | | 2, 3 | | | | 113,322 | | | | 54,757 | | | | | |

| SEGRA RESOURCE ONSHORE PARTNERS, L.P. | | | 4/1/2018 | | | | 2, 3 | | | | 125,000 | | | | 740,401 | | | | | |

| SJC ONSHORE DIRECT LENDING FUND IV - 5 YEAR, L.P. | | | 10/1/2020 | | | | 2, 8 | | | | 2,271,862 | | | | 2,302,866 | | | | | |

| TOTAL LIMITED PARTNERSHIPS | | | | | | | | | | | 9,443,064 | | | | 21,979,609 | | | | 54.44 | % |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL OTHER INVESTMENTS | | | | | | | | | | $ | 9,443,064 | | | $ | 21,979,609 | | | | 54.44 | % |

See accompanying notes to financial statements.

| BMC FUND, INC. |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| | | | | | | | | | | | | Percent | |

| Sectors and | | Shares | | | | | | | Market | | | of Net | |

| Industries | | Held | | Company Name | | Cost | | | Value | | | Assets | |

| | | | | | | | | | | | | | |

| COMMON STOCKS: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| COMMUNICATION SERVICES | | | | | | | | | | | | | | | | | |

| Communication Services | | | 238 | | BCE INC COM | | $ | 10,963 | | | $ | 7,678 | | | | | |

| | | | 63 | | SK TELECOM LTD SPONSORED A | | | 1,262 | | | | 1,434 | | | | | |

| | | | 377 | | TELEFONICA S A SPONSORED A | | | 60 | | | | 1,745 | | | | | |

| | | | | | | | | 12,285 | | | | 10,857 | | | | 0.03 | % |

| | | | | | | | | | | | | | | | | | |

| Media and Entertainment | | | 740 | | ALPHABET INC CAP STK CL C | | | 47,706 | | | | 127,791 | | | | | |

| | | | 10,600 | | WARNER MUSIC GROUP CORP. | | | 329,656 | | | | 338,776 | | | | | |

| | | | | | | | | 377,362 | | | | 466,567 | | | | 1.16 | % |

| | | | | | | | | | | | | | | | | | |

| Interactive Home Entertainment | | | 32,322 | | NINTENDO LTD ADR | | | 348,971 | | | | 432,080 | | | | | |

| | | | | | | | | 348,971 | | | | 432,080 | | | | 1.07 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL COMMUNICATION SERVICES | | | | | | | | 738,618 | | | | 909,504 | | | | 2.25 | % |

| | | | | | | | | | | | | | | | | | |

| CONSUMER DISCRETIONARY | | | | | | | | | | | | | | | | | |

| Hotels, Restaurants & Leisure | | | 2,400 | | SIX FLAGS ENTERTAINMENT CORP | | | 95,287 | | | | 94,584 | | | | | |

| | | | | | | | | 95,287 | | | | 94,584 | | | | 0.24 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | | 95,287 | | | | 94,584 | | | | 0.24 | % |

| | | | | | | | | | | | | | | | | | |

| CONSUMER STAPLES | | | | | | | | | | | | | | | | | |

| Discount Stores | | | 3,100 | | DOLLAR GEN CORP NEW COM | | | 409,390 | | | | 248,124 | | | | | |

| | | | | | | | | 409,390 | | | | 248,124 | | | | 0.61 | % |

| | | | | | | | | | | | | | | | | | |

| Food & Staples Retailing | | | 131 | | KROGER CO COM | | | 4,133 | | | | 7,306 | | | | | |

| | | | 228 | | WAL-MART STORES INC COM | | | 10,261 | | | | 18,684 | | | | | |

| | | | | | | | | 14,394 | | | | 25,990 | | | | 0.06 | % |

| | | | | | | | | | | | | | | | | | |

| Food, Beverage & Tobacco | | | 104 | | COCA COLA CO COM | | | 4,970 | | | | 6,792 | | | | | |

| | | | 4,319 | | COCA COLA FEMSA S A B SPON | | | 325,234 | | | | 360,075 | | | | | |

| | | | 78 | | CONSTELLATION BRANDS CL A | | | 7,076 | | | | 18,123 | | | | | |

| | | | 100 | | GENERAL MILLS INC COM | | | 7,617 | | | | 6,802 | | | | | |

| | | | 10,046 | | PHILIP MORRIS INTL COM | | | 941,615 | | | | 1,333,104 | | | | | |

| | | | | | | | | 1,286,512 | | | | 1,724,896 | | | | 4.27 | % |

| | | | | | | | | | | | | | | | | | |

| Household & Personal Products | | | 126 | | KIMBERLY CLARK CORP COM | | | 17,492 | | | | 16,907 | | | | | |

| | | | 11 | | PROCTER & GAMBLE CO COM | | | 737 | | | | 1,817 | | | | | |

| | | | | | | | | 18,229 | | | | 18,724 | | | | 0.05 | % |

| | | | | | | | | | | | | | | | | | |

| Materials | | | 3,248 | | BALL CORP COM | | | 178,871 | | | | 192,444 | | | | | |

| | | | | | | | | 178,871 | | | | 192,444 | | | | 0.48 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL CONSUMER STAPLES | | | | | | | | 1,907,396 | | | | 2,210,178 | | | | 5.47 | % |

| | | | | | | | | | | | | | | | | | |

| ENERGY | | | | | | | | | | | | | | | | | |

| Energy | | | 250 | | CHENIERE ENERGY, INC. | | | 42,466 | | | | 47,845 | | | | | |

| | | | 1,200 | | CVR ENERGY, INC. | | | 43,491 | | | | 19,080 | | | | | |

| | | | 1,500 | | FREEHOLD ROYALTIES, LTD | | | 19,007 | | | | 14,775 | | | | | |

| | | | 2,000 | | FLEX LNG LTD. | | | 62,848 | | | | 49,000 | | | | | |

| | | | 473 | | SUNOCO INC COM | | | 13,246 | | | | 24,028 | | | | | |

| | | | | | | | | 181,058 | | | | 154,728 | | | | 0.38 | % |

| BMC FUND, INC. |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| | | | | | | | | | | | | Percent | |

| Sectors and | | Shares | | | | | | | Market | | | of Net | |

| Industries | | Held | | Company Name | | Cost | | | Value | | | Assets | |

| | | | | | | | | | | | | | |

| COMMON STOCKS: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Pipelines | | | 181 | | DELEK LOGISTICS PARTNERS LP | | $ | 5,334 | | | $ | 6,981 | | | | | |

| | | | 630 | | ENBRIDGE INC | | | 18,339 | | | | 25,452 | | | | | |

| | | | 329 | | ENERGY TRANSFER OPERATING, L.P. | | | 3,369 | | | | 5,422 | | | | | |

| | | | | | | | | 27,042 | | | | 37,855 | | | | 0.09 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL ENERGY | | | | | | | | 208,100 | | | | 192,583 | | | | 0.48 | % |

| BMC FUND, INC. |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| | | | | | | | | | | | | Percent | |

| Sectors and | | Shares | | | | | | | Market | | | of Net | |

| Industries | | Held | | Company Name | | Cost | | | Value | | | Assets | |

| | | | | | | | | | | | | | |

| COMMON STOCKS: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| FINANCIALS | | | | | | | | | | | | | | | | | |

| Banks | | | 263 | | BANK OF AMERICA CORP COM | | $ | 6,063 | | | $ | 10,999 | | | | | |

| | | | 1 | 3 | SVB FINANCIAL GROUP COM | | | 340 | | | | - | | | | | |

| | | | | | | | | 6,403 | | | | 10,999 | | | | 0.03 | % |

| | | | | | | | | | | | | | | | | | |

| Diversified Financials | | | 1,312 | | ALLIANCE BERNSTEIN HLDG UN | | | 54,060 | | | | 48,610 | | | | | |

| | | | 179 | 3 | BERKSHIRE HATHAWAY INC CL B | | | 36,098 | | | | 80,715 | | | | | |

| | | | 756 | | BLACKSTONE GROUP LP COM | | | 24,342 | | | | 126,819 | | | | | |

| | | | 420 | | CARLYLE GROUP LP COM | | | 9,160 | | | | 21,013 | | | | | |

| | | | 36 | | CME GROUP | | | 5,993 | | | | 8,113 | | | | | |

| | | | 263 | | COMPASS DIVERSIFIED HOLDINGS | | | 3,600 | | | | 5,707 | | | | | |

| | | | 918 | | GOLUB CAPITAL BDC INC COM | | | - | | | | 13,898 | | | | | |

| | | | 51 | | INTERNCONTINENTAL EXCHANGE COM | | | 3,817 | | | | 7,949 | | | | | |

| | | | 52 | | MORGAN STANLEY COM NEW | | | 2,956 | | | | 6,045 | | | | | |

| | | | 2,895 | | THE CHARLES SCHWAB CORPORATION | | | 195,542 | | | | 205,053 | | | | | |

| | | | | | | | | 335,568 | | | | 523,922 | | | | 1.30 | % |

| | | | | | | | | | | | | | | | | | |

| Insurance | | | 79 | | AON PLC SHS CL A | | | 6,409 | | | | 28,983 | | | | | |

| | | | 263 | | OLD REP INTL CORP COM | | | 4,433 | | | | 9,187 | | | | | |

| | | | 129 | | TRAVELERS COMPANIES COM | | | 10,711 | | | | 31,726 | | | | | |

| | | | 526 | | ZURICH INS GROUP LTD SPONS ARD | | | 6,984 | | | | 15,536 | | | | | |

| | | | | | | | | 28,537 | | | | 85,432 | | | | 0.21 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | | 370,508 | | | | 620,353 | | | | 1.54 | % |

| BMC FUND, INC. |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| | | | | | | | | | | | | Percent | |

| Sectors and | | Shares | | | | | | | Market | | | of Net | |

| Industries | | Held | | Company Name | | Cost | | | Value | | | Assets | |

| | | | | | | | | | | | | | |

| COMMON STOCKS: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| HEALTH CARE | | | | | | | | | | | | | | | | | |

| Health Care Equipment & Services | | | 18,497 | | BAXTER INTL INC COM | | $ | 695,100 | | | $ | 660,343 | | | | | |

| | | | 157 | 3 | DAVITA HEALTHCARE PART COM | | | 12,098 | | | | 21,950 | | | | | |

| | | | 23,401 | | FRESENIUS MED CARE AG SPONSORED ADR | | | 457,217 | | | | 457,255 | | | | | |

| | | | 365 | 3 | HOLOGIC INC COM | | | 18,730 | | | | 29,518 | | | | | |

| | | | 48 | | LABORATORY CORP AMER HLDGS | | | 5,942 | | | | 10,957 | | | | | |

| | | | 331 | | MCKESSON CORP COM | | | 143,213 | | | | 165,695 | | | | | |

| | | | 206 | | QUEST DIAGNOSTICS INC COM | | | 24,052 | | | | 31,895 | | | | | |

| | | | 24 | | STRYKER CORP | | | 4,486 | | | | 8,551 | | | | | |

| | | | | | | | | 1,360,838 | | | | 1,386,164 | | | | 3.43 | % |

| | | | | | | | | | | | | | | | | | |

| Pharmaceuticals & Biotechnology | | | 180 | | ABBVIE INC | | | 14,611 | | | | 36,697 | | | | | |

| | | | 524 | | ASTRAZENECA PLC SPONSORED | | | 13,125 | | | | 37,283 | | | | | |

| | | | 79 | | BRISTOL MYERS SQUIBB CO CO | | | 4,564 | | | | 4,406 | | | | | |

| | | | 135 | | ELI LILLY & CO COM | | | 5,947 | | | | 112,015 | | | | | |

| | | | 48 | 3 | FORTREA HOLDINGS INC. | | | 980 | | | | 807 | | | | | |

| | | | 20 | 3 | IQVIA HOLDINGS INC COM | | | 1,982 | | | | 4,116 | | | | | |

| | | | 79 | | MERCK & CO INC COM | | | 5,654 | | | | 8,083 | | | | | |

| | | | 200 | | PFIZER INC COM | | | 7,864 | | | | 5,660 | | | | | |

| | | | | | | | | 54,727 | | | | 209,067 | | | | 0.52 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | | 1,415,565 | | | | 1,595,231 | | | | 3.95 | % |

| | | | | | | | | | | | | | | | | | |

| INDUSTRIALS | | | | | | | | | | | | | | | | | |

| Capital Goods | | | 208 | | ABB LTD SPONSORED ADR | | | 5,057 | | | | 11,522 | | | | | |

| | | | | | | | | 5,057 | | | | 11,522 | | | | 0.03 | % |

| | | | | | | | | | | | | | | | | | |

| Commercial Services & Supplies | | | 12,000 | | RENTOKIL INITIAL PLC | | | 346,288.00 | | | | 304,200.00 | | | | | |

| | | | 24 | | WASTE MGMT INC DEL COM | | | 836 | | | | 5,180 | | | | | |

| | | | | | | | | 347,124 | | | | 309,380 | | | | 0.77 | % |

| | | | | | | | | | | | | | | | | | |

| Transportation | | | 313 | | FORTRESS TRANS INFRST COM | | | 4,997 | | | | 42,080 | | | | | |

| | | | 313 | | FTAI INFRASTRUCTURE INC. | | | - | | | | 2,526 | | | | | |

| | | | | | | | | 4,997 | | | | 44,606 | | | | 0.11 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | | 357,178 | | | | 365,508 | | | | 0.91 | % |

| BMC FUND, INC. |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| | | | | | | | | | | | | Percent | |

| Sectors and | | Shares | | | | | | | Market | | | of Net | |

| Industries | | Held | | Company Name | | Cost | | | Value | | | Assets | |

| | | | | | | | | | | | | | |

| COMMON STOCKS: | | | | | | | | | | | | | | | | | |

| INFORMATION TECHNOLOGY | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Hardware & Equipment | | | 535 | | CISCO SYSTEMS INC | | $ | 20,733 | | | $ | 29,302 | | | | | |

| | | | 498 | | CORNING INC COM | | | 10,201 | | | | 23,700 | | | | | |

| | | | | | | | | 30,934 | | | | 53,002 | | | | 0.13 | % |

| | | | | | | | | | | | | | | | | | |

| Software & Services | | | 2,000 | | EVOLUTION AB ADR | | | 198,382.00 | | | | 187,850.00 | | | | | |

| | | | 61 | | MICROSOFT CORP COM | | | 8,924 | | | | 24,787 | | | | | |

| | | | 1,750 | 3 | NICE, LTD | | | 304,442 | | | | 303,975 | | | | | |

| | | | 238 | | ORACLE CORP COM | | | 15,727 | | | | 39,946 | | | | | |

| | | | | | | | | 527,475 | | | | 556,558 | | | | 1.38 | % |

| | | | | | | | | | | | | | | | | | |

| Technology Hardware & Equipment | | | 629 | | APPLE INC COM | | | 44,179 | | | | 142,097 | | | | | |

| | | | 2,470 | | INTEL CORP COM | | | 101,920 | | | | 53,154 | | | | | |

| | | | 102 | | NETAPP INC COM | | | 5,350 | | | | 11,762 | | | | | |

| | | | 140 | | SEAGATE TECHNOLOGY SHS | | | 5,333 | | | | 14,052 | | | | | |

| | | | | | | | | 156,782 | | | | 221,065 | | | | 0.55 | % |

| | | | | | | | | | | | | | | | | | |

| Technology | | | 2,934 | 3 | FISERV INC COM | | | 342,866 | | | | 580,639 | | | | | |

| | | | 5,505 | | FIDELITY NATIONAL INFORMATION SERVICES | | | 333,442 | | | | 493,964 | | | | | |

| | | | | | | | | 676,308 | | | | 1,074,603 | | | | 2.66 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL INFORMATION TECHNOLOGY | | | | | | | | 1,391,499 | | | | 1,905,228 | | | | 4.72 | % |

| | | | | | | | | | | | | | | | | | |

| MATERIALS | | | 23,767 | 3 | AVANTOR, INC. | | | 490,490.00 | | | | 531,668.00 | | | | | |

| | | | 500 | | BHP GROUP LIMITED | | | 27,434 | | | | 27,730 | | | | | |

| | | | 158 | | CHEMOURS CO COM | | | 2,551 | | | | 2,869 | | | | | |

| | | | 400 | | CVR PARTNERS, LP | | | 50,841 | | | | 26,472 | | | | | |

| | | | 104 | | DOW CHEM CO COM | | | 5,163 | | | | 5,136 | | | | | |

| | | | 20 | | MITSUI & CO LTD SPONSORED | | | 3,643 | | | | 8,303 | | | | | |

| | | | 500 | | RIO TINTO GROUP | | | 30,368 | | | | 32,445 | | | | | |

| | | | 600 | | SOCIEDAD QUIMICA MINER SPON ADR | | | 49,514 | | | | 23,034 | | | | | |

| TOTAL MATERIALS | | | | | | | | 660,004 | | | | 657,657 | | | | 1.63 | % |

| BMC FUND, INC. |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| | | | | | | | | | | | | Percent | |

| Sectors and | | Shares | | | | | | | Market | | | of Net | |

| Industries | | Held | | Company Name | | Cost | | | Value | | | Assets | |

| | | | | | | | | | | | | | |

| COMMON STOCKS: | | | | | | | | | | | | | | | | | |

| REAL ESTATE | | | | | | | | | | | | | | | | | |

| Real Estate | | | 101 | | DIGITAL RLTY TR INC COM | | $ | 11,872 | | | $ | 18,001 | | | | | |

| | | | 630 | | EASTERLY GOVT PPTYS COM | | | 12,410 | | | | 8,543 | | | | | |

| | | | 524 | | HANNON ARMSTRONG SUST COM | | | 8,023 | | | | 18,335 | | | | | |

| | | | 840 | | IRON MTN INC NEW COM | | | 34,076 | | | | 103,933 | | | | | |

| | | | 789 | | MEDICAL PPTYS TR INC COM | | | 10,742 | | | | 3,653 | | | | | |

| | | | 1 | 3 | NET LEASE OFFICE PROPERTIES | | | - | | | | 30 | | | | | |

| | | | 104 | | OMEGA HEALTHCARE INVS COM | | | 3,026 | | | | 4,417 | | | | | |

| | | | 22 | | W P CAREY & CO LLC COM | | | 1,405 | | | | 1,226 | | | | | |

| | | | | | | | | 81,554 | | | | 158,138 | | | | 0.39 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL REAL ESTATE | | | | | | | | 81,554 | | | | 158,138 | | | | 0.39 | % |

| | | | | | | | | | | | | | | | | | |

| UTILITIES | | | 100 | | AMERICAN STS WTR CO COM | | | 8,027 | | | | 8,246 | | | | | |

| | | | 339 | | DOMINION RES INC VA COM | | | 17,456 | | | | 20,181 | | | | | |

| | | | 174 | | DUKE ENERGY CORP COM | | | 15,663 | | | | 20,057 | | | | | |

| | | | 51 | | ENTERGY CORP NEW COM | | | 3,539 | | | | 7,894 | | | | | |

| | | | 180 | | NEXTERA ENERGY INC COM | | | 13,503 | | | | 14,265 | | | | | |

| | | | 262 | | SOUTHERN CO COM | | | 11,431 | | | | 23,850 | | | | | |

| | | | 116 | | WEC ENERGY GROUP INC COM | | | 4,622 | | | | 11,081 | | | | | |

| TOTAL UTILITIES | | | | | | | | 74,241 | | | | 105,574 | | | | 0.26 | % |

| | | | | | | | | | | | | | | | | | |

| RIGHTS ATTACHED TO COMMON STOCKS | | | | | | | | | | | | | | | | | |

| | | | 725 | 3 | OCCIDENTAL PETROLEUM CORP COM | | | - | | | | 20,626 | | | | | |

| | | | | | | | | - | | | | 20,626 | | | | 0.05 | % |

| | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS IN COMMON STOCKS | | | | | | | $ | 7,299,950 | | | $ | 8,835,164 | | | | 21.89 | % |

See accompanying notes to financial statements.

| BMC FUND, INC. |

| SCHEDULE OF INVESTMENTS (Continued) |

| October 31, 2024 |

| | | | | | | Coupon | | | | | | | | | | | | | | | Percent | |

| | | | | | | Interest | | | Maturity | | | Shares | | | | | | Market | | | of Net | |

| Company Name | | | | | | Rate | | | Date | | | Held | | | Cost | | | Value | | | Assets | |

| | | | | | | | | | | | | | | | | | | | | | | |

| PREFERRED STOCKS: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| COMPASS DIV HOLDINGS FIXED FLTG RAT CUM PFD | | | 4, 5 | | | | 7.875 | % | | N/A | | | | 4,000 | | | $ | 93,349 | | | $ | 97,880 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS IN PREFERRED STOCKS | | | | | | | | | | | | | | | | | $ | 93,349 | | | $ | 97,880 | | | 0.24 | % |

See accompanying notes to financial statements.

| BMC FUND, INC. |

| SCHEDULE OF INVESTMENTS (Concluded) |

| October 31, 2024 |

| | | | | | | | Market | | | Percent of | |

| | | Company Name | | Cost | | | Value | | | Net Assets | |

| | | | | | | | | | | | |

| Short-term Investments | | MFB NI Treasury Money Market Fund | | $ | 5,011,015 | | | $ | 5,011,015 | | | | 12.41 | % |

| | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS - MARKET VALUE | | | | | 29,500,261 | | | | 40,357,029 | | | | 99.97 | % |

| | | | | | | | | | | | | | | |

| TOTAL OTHER ASSETS IN EXCESS OF LIABILITIES | | | | | | | | | 13,656 | | | | 0.03 | % |

| | | | | | | | | | | | | | | |

| TOTAL NET ASSETS | | | | | | | | $ | 40,370,685 | | | | 100.00 | % |

1In default

2Market value ratified by the Company's Board of Directors per policy.

3Non-income producing security

4Perpetual security. Maturity date is not applicable.

5Variable rate security. The rate shown is the coupon as of the end of the reporting period.

6Affiliate Investment

7Unfunded Commitment of $250,000

8Unfunded Commitment of $268,471

See accompanying notes to financial statements.

BMC FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2024

| ASSETS | | | |

| Affiliated Investment security (cost - $733,155) | | $ | 939,348 | |

| Unaffiliated Investment securities (cost - $28,767,106) | | | 39,417,681 | |

| Cash | | | 110,509 | |

| Receivables, accrued interest and dividends | | | 73,955 | |

| Other assets | | | 1,863 | |

| | | | | |

| Total assets | | | 40,543,356 | |

| | | | | |

| LIABILITIES: | | | | |

| Accounts payable and accrued expenses | | | 89,111 | |

| Accounts payable to affiliates | | | 83,560 | |

| | | | | |

| Total liabilities | | | 172,671 | |

| | | | | |

| NET ASSETS AT OCTOBER 31, 2024 - EQUIVALENT TO $21.37 PER SHARE ON 1,888,788 SHARES OF COMMON STOCK OUTSTANDING | | $ | 40,370,685 | |

| | | | | |

| SUMMARY OF SHAREHOLDERS' EQUITY: | | | | |

| Common stock, par value $5.00 per share - authorized 70,000,000 shares; outstanding, 1,888,788 shares | | $ | 9,443,940 | |

| Additional paid in capital | | | 25,005,766 | |

| Total disributable earnings (loss) | | | 5,920,979 | |

| | | | | |

| NET ASSETS APPLICABLE TO COMMON STOCK OUTSTANDING | | $ | 40,370,685 | |

See accompanying notes to financial statements.

BMC FUND, INC.

STATEMENT OF OPERATIONS

Year Ended October 31, 2024

| INVESTMENT INCOME: | | | |

| Income: | | | |

| Interest - fixed income | | $ | 327,929 | |

| Dividend income (net of $9,631 foreign tax) | | | 502,790 | |

| | | | | |

| Total income | | | 830,719 | |

| | | | | |

| Expenses: | | | | |

| Legal and professional fees | | | 5,272 | |

| Audit fees | | | 141,032 | |

| Directors' fees (Note 6) | | | 14,000 | |

| Investment expense | | | 93,062 | |

| Investment advisor's fees (Note 7) | | | 258,664 | |

| Salaries and related expenses (Note 7) | | | 154,748 | |

| Other related party expenses (Note 7) | | | 74,871 | |

| Other expense | | | 18,789 | |

| | | | | |

| Total expenses | | | 760,438 | |

| | | | | |

| Net investment income (loss) | | | 70,281 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | |

| Realized gain from unaffiliated investments sold | | | 2,216,152 | |

| | | | | |

| Change in unrealized appreciation of affiliated investments | | | 60,427 | |

| Change in unrealized appreciation of unaffiliated investments | | | 1,907,129 | |

| Total change in unrealized appreciation of investments | | | 1,967,556 | |

| | | | | |

| Net realized and unrealized gain (loss) | | | 4,183,708 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 4,253,989 | |

See accompanying notes to financial statements.

BMC FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

Years Ended October 31, 2024 and 2023

| | | 2024 | | | 2023 | |

| INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS: | | | | | | | | |

| Net investment income (loss) | | $ | 70,281 | | | $ | 103,038 | |

| Net realized gains from unaffiliated investment securities sold, | | | 2,216,152 | | | | 1,628,061 | |

| Change in unrealized appreciation of affiliated investments | | | 60,427 | | | | 51,672 | |

| Change in unrealized appreciation of unaffiliated investments | | | 1,907,129 | | | | 331,463 | |

| | | | | | | | | |

| Net increase (decrease) in net assets resulting from operations | | | 4,253,989 | | | | 2,114,234 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Distributable earnings | | | (1,511,030 | ) | | | (1,133,274 | ) |

| Return of capital | | | - | | | | (3,519,978 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 2,742,959 | | | | (2,539,018 | ) |

| | | | | | | | | |

| NET ASSETS AT BEGINNING OF PERIOD | | | 37,627,726 | | | | 40,166,744 | |

| | | | | | | | | |

| NET ASSETS AT END OF PERIOD | | $ | 40,370,685 | | | $ | 37,627,726 | |

See accompanying notes to financial statements.

BMC FUND, INC.

STATEMENT OF CASH FLOWS

Year Ended October 31, 2024

| Cash flows from operating activities: | | | | |

| | | | | |

| Net increase in net assets from operations | | $ | 4,253,989 | |

| Realized (gains)/losses from investments sold | | | (2,216,152 | ) |

| Total change in unrealized (appreciation)/depreciation from affiliated and unaffilated investments | | | (1,967,556 | ) |

| (Increase)/decrease in short-term money market investments | | | (2,335,834 | ) |

| Purchases of investments securities | | | (5,209,592 | ) |

| Proceed from sales of investment securities | | | 7,028,492 | |

| Return of capital on securities | | | 1,551,509 | |

| Amortization of bond premiums | | | 401 | |

| Accretion of bond discounts | | | (80,752 | ) |

| Changes in assets and liabilities | | | | |

| (Increase)/Decrease in assets: | | | | |

| Receivables, accrued interest and dividends | | | 45,805 | |

| Other assets | | | 283 | |

| Increase/(Decrease) in liabilities: | | | | |

| Accounts payable to affiliates | | | 9,523 | |

| Accounts payable and accrued expenses | | | 80,999 | |

| Net cash provided by operating activities | | | 1,161,115 | |

| | | | | |

| Cash flows from financing activities: | | | | |

| Cash distributions paid | | | (1,511,030 | ) |

| Net cash used in financing activities | | | (1,511,030 | ) |

| | | | | |

| Net change in cash | | | (349,915 | ) |

| | | | | |

| Beginning cash as of October 31, 2023 | | | 460,424 | |

| | | | | |

| Ending cash as of October 31, 2024 | | $ | 110,509 | |

See accompanying notes to financial statements.

BMC FUND, INC.

FINANCIAL HIGHLIGHTS

Years Ended October 31, 2024, 2023, 2022, 2021, 2020, 20219, 20218, 2017, 2016 and 2015

The following table presents financial information divided into three parts: per share operating performance, total investment return and ratios and supplemental data for the years ended October 31, 2024, 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016 and 2015. The first part, per share operating performance, details the changes on a per share basis of the Company's beginning net asset value to its ending net asset value. The second part, total investment return, is based on the market price of the Company's shares of stock. Part three, ratios and supplemental data, provides additional financial information related to the Company's performance.

PER SHARE OPERATING

PERFORMANCE | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| Net asset value, beginning of period | | $ | 19.92 | | | $ | 21.27 | | | $ | 23.09 | | | $ | 19.84 | | | $ | 21.16 | | | $ | 20.77 | | | $ | 21.42 | | | $ | 20.83 | | | $ | 21.22 | | | $ | 22.62 | |

| Net investment income | | | 0.04 | | | | 0.05 | | | | (0.02 | ) | | | 0.04 | | | | 0.25 | | | | 0.34 | | | | 0.27 | | | | 0.27 | | | | 0.22 | | | | 0.35 | |

| Net gains (losses) on investments | | | 2.21 | | | | 1.06 | | | | (0.95 | ) | | | 4.21 | | | | (0.57 | ) | | | 1.05 | | | | 0.08 | | | | 1.32 | | | | 0.39 | | | | (0.73 | ) |

| Total from investment operations | | | 2.25 | | | | 1.11 | | | | (0.97 | ) | | | 4.25 | | | | (0.32 | ) | | | 1.39 | | | | 0.35 | | | | 1.59 | | | | 0.61 | | | | (0.38 | ) |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | 0.02 | | | | - | | | | 0.05 | | | | 0.42 | | | | 0.05 | | | | 0.33 | | | | 0.32 | | | | 0.20 | | | | 0.23 | | | | 0.36 | |

| Distributions from capital gains | | | 0.71 | | | | 0.60 | | | | - | | | | 0.14 | | | | 0.28 | | | | 0.08 | | | | 0.37 | | | | 0.35 | | | | - | | | | 0.44 | |

| Distributions from return of capital | | | 0.07 | | | | 1.86 | | | | 0.80 | | | | 0.44 | | | | 0.67 | | | | 0.59 | | | | 0.31 | | | | 0.45 | | | | 0.77 | | | | 0.22 | |

| Total distributions | | | 0.80 | | | | 2.46 | | | | 0.85 | | | | 1.00 | | | | 1.00 | | | | 1.00 | | | | 1.00 | | | | 1.00 | | | | 1.00 | | | | 1.02 | |

| Net asset value, end of period | | $ | 21.37 | | | $ | 19.92 | | | $ | 21.27 | | | $ | 23.09 | | | $ | 19.84 | | | $ | 21.16 | | | $ | 20.77 | | | $ | 21.42 | | | $ | 20.83 | | | $ | 21.22 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per share market value, end of period1 | | $ | 21.31 | | | $ | 20.13 | | | $ | 21.27 | | | $ | 22.79 | | | $ | 18.00 | | | $ | 18.00 | | | $ | 18.00 | | | $ | 18.00 | | | $ | 18.00 | | | $ | 18.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENT RETURN | | | 11.31 | % | | | 5.22 | % | | | -4.21 | % | | | 21.45 | % | | | -1.52 | % | | | 6.69 | % | | | 1.63 | % | | | 7.63 | % | | | 2.87 | % | | | -1.68 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 40,371 | | | $ | 37,628 | | | $ | 40,167 | | | $ | 43,609 | | | $ | 97,875 | | | $ | 104,397 | | | $ | 102,458 | | | $ | 105,657 | | | $ | 102,751 | | | $ | 104,684 | |

| Ratio of expenses to average net assets2 | | | 1.93 | % | | | 1.88 | % | | | 2.17 | % | | | 1.86 | % | | | 1.12 | % | | | 1.06 | % | | | 1.01 | % | | | 1.03 | % | | | 1.07 | % | | | 0.98 | % |

| Ratio of net investment income to average net assets3 | | | 0.18 | % | | | 0.27 | % | | | (0.12 | )% | | | 0.17 | % | | | 1.21 | % | | | 1.64 | % | | | 1.28 | % | | | 1.26 | % | | | 1.06 | % | | | 1.59 | % |

| Portfolio turnover rate | | | 13.97 | % | | | 22.38 | % | | | 17.88 | % | | | 9.79 | % | | | 20.22 | % | | | 12.94 | % | | | 14.18 | % | | | 24.07 | % | | | 15.09 | % | | | 17.10 | % |

1 Based on net asseet value for which transactions may have been sold in a private transaction recent sales. Prior years based on stock trades, which are very limited, during those years. Ratios do not reflect the Fund's proportionate share of income, expenses and incentive allocations of the underlying limited partnership investments.

2 Average is computed on a quarterly basis. The per share data is calculated using average outstanding shares.

3 Average is computed on a quarterly basis.

See accompanying notes to financial statements.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2023

BMC Fund, Inc. (the “Company”) is a closed-end, diversified investment company registered under the Investment Company Act of 1940, as amended. Prior to becoming a regulated investment company on April 1, 1981, BMC Fund, Inc. operated as a regular corporation. The following is a summary of significant accounting policies followed by the Company in the preparation of its financial statements.

Under the Company’s organizational documents, its officers and Board of Directors (“Board”) are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the Company may enter into contracts with vendors and others that provide for general indemnifications. The Company’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company. However, based on experience, the fund expects that risk of loss to be remote.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

A. Basis of Presentation - The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) as detailed in the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”). The Company also follows the accounting and reporting guidance applicable to investment companies in ASC Topic 946, Financial Services – Investment Companies.

B. Investment Valuations – The investment securities and valuation of fixed income and mutual funds are stated at fair value as determined by closing prices on national securities exchanges or based on inputs other than quoted prices on national securities exchanges. Investment securities include corporate bonds, mutual funds, and common and preferred stocks.

Pursuant to rule 2a-5 under the 1940 Act, the Board has designated the Fund’s investment adviser Broyhill Asset Management (“BAM” or the “Adviser”), as the valuation designee with respect to the fair valuation of the fund’s portfolio securities, subject to oversight by and periodic reporting to the Board. Fair valued securities are those for which market quotations are not readily available, including circumstances under which the Adviser determines that prices received are not reflective of their market values.

The investments in limited partnerships, other investments and venture capital are stated at estimated fair value as determined by the management of these investments and are approved by the Company’s Valuation Committee after giving consideration to historical and projected financial results, economic conditions, financial condition of investee and other factors and events subject to change, and ratified by the Company’s Board of Directors. Because of the inherent uncertainty of those valuations, the estimated values may differ significantly from the values that would have been used had a ready market value for the investments existed, and these differences could be material.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2023

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

Pursuant to ASC Topic 820, Fair Value Measurement, the Fund may elect to use net asset value per share or its equivalent (“NAV”) as a practical expedient to measure the Company’s interest in Limited Partnerships at fair value, unless it is probable that the investment will be sold at a value different from its NAV. However, in order for the Company to use this methodology, the investment company must calculate NAV in a manner consistent with the measurement principles established by ASC Topic 820. The Company is using the practical expedient.

C. Investment Transactions – Investment transactions are accounted for on the date the order to buy or sell is executed. Realized gains and losses on investments are determined on the basis of specific identification of issues sold or matured. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities using the effective interest method. Realized gains and losses on foreign currency transactions are included with realized gains and losses on investments.

For the year ended October 31, 2024, the Company purchased and sold securities in the amount of $5,209,592 and $7,028,492, respectively.

D. Option Writing – When the Company writes an option, an amount equal to the premium received by the Company is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Company on the expiration date as realized gains from investments. No options were written in current year. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether the Company has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Company. The Company as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option.

E. Income Taxes – No federal tax provision is required as it is the Company’s policy to comply with the provisions of Subchapter M of the Internal Revenue Code of 1954, as amended, including the distribution to its shareholders of substantially all of its income and any capital gains not offset by capital losses. Also, no state income tax provision has been provided because the states in which the Company has income recognize the tax exempt status of a regulated investment company.

The Company did not have an accrual for uncertain tax positions as deductions taken and benefits accrued are based on widely understood administrative practices and procedures, and are based on clear and unambiguous tax law. Tax returns for all years 2021 and thereafter are subject to possible future examinations by tax authorities.

F. Dividend Policy – It is the Company’s policy to pay quarterly distributions during the year in sufficient amounts to meet the requirements to maintain its status as a regulated investment company.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2023

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

G. Cash and Short-Term Investments – For purposes of financial reporting, the Company considers all investments at financial institutions with original maturities of three months or less to be equivalent to cash. Short-term money market investments managed by third party investors are included in investment securities.

H. Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

I. Fair Value Measurements – Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the "exit price") in an orderly transaction between market participants at the measurement date.

In determining fair value, the Company uses various valuation techniques. A fair value hierarchy for inputs is used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs are to be used when available. Valuation techniques that are consistent with the market or income approach are used to measure fair value. The fair value hierarchy is categorized into three levels based on the inputs as follows:

Level 1 - Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access.

Level 2 - Valuations based on inputs, other than quoted prices included in Level 1, that are observable either directly or indirectly.

Level 3 - Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

Fair value is a market-based measure, based on assumptions of prices and inputs considered from the perspective of a market participant that are current as of the measurement date, rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, the Company's own assumptions are set to reflect those that market participants would use in pricing the asset or liability at the measurement date.

The availability of valuation techniques and observable inputs can vary from investment to investment and are affected by a wide variety of factors, including the type of investment, whether the investment is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Because of the inherent uncertainty of valuation, those estimated values may be materially higher or lower than the values that would have been used had a ready market for the investments existed. Accordingly, the degree of judgment exercised by the Company in determining fair value is greatest for investments categorized in Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2023

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes fair value information for assets and liabilities measured on a recurring basis as of October 31, 2024.

| Asset Description | | Quoted Prices

in Active

Markets for

Identical Assets

(Level 1) | | | Significant

Other

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

| Fixed Income | | $ | 2,820,143 | | | $ | - | | | $ | - | | | $ | 2,820,143 | (1) |

| Mutual Funds | | | 1,613,218 | | | | - | | | | - | | | | 1,613,218 | |

| Common Stocks – Publicly Traded | | | 8,835,164 | | | | - | | | | - | | | | 8,835,164 | |

| Preferred Stocks – Publicly Traded | | | 97,880 | | | | - | | | | - | | | | 97,880 | |

| Short-term Investments | | | 5,011,015 | | | | - | | | | - | | | | 5,011,015 | |

| Limited Partnerships – Measured at NAV (2) | | | - | | | | - | | | | - | | | | 21,979,609 | |

| Total Investments | | $ | 18,377,420 | | | $ | | | | $ | - | | | $ | 40,357,029 | |

(1) There are fixed income securities valued at $0.

(2) Certain investments measured at fair value using the net asset value per share (or its equivalent) as a practical expedient and have not been categorized in the fair value hierarchy. The fair value amounts presented in these tables are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Schedule of Investments.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2023

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

J. Investments in Limited Partnerships - As of October 31, 2024, the Company was invested in limited partnerships. Each of these investments has certain restrictions with respect to rights of withdrawal by the Company as specified in the respective agreements. Generally, the Company is required to provide notice of its intent to withdraw after the investment has been maintained for a certain period of time. The management agreements of the limited partnerships provide for compensation to the managers in the form of fees ranging from 0.5% to 2% annually of net assets and performance incentive allowances or fees ranging from 10% to 20% of net profits earned.

The following table summarizes the Company's investments in other limited partnerships as of October 31, 2024. The Company's investments in limited partnerships have certain redemption and liquidity restrictions which are described in the below table.

Investment

Limited Partnerships | | Redemptions

Notice Period | | Redemptions

Permitted | | Investment

Strategy |

| BAM Credit Opportunities Fund (7) | | N/A | | N/A | | Credit Fund of Funds |

| Elliott Associates, L.P. (1) (2) | | 60 days | | Jan. 1 or July 1 | | Multi-Strategy |

| Graham Institutional Partners, L.P. (3) | | 60 days | | Annually | | Long/Short Technology |

| Greenlight Masters Qualified, L.P. (4) | | 105 days | | December 31 | | Equity Fund of Funds |

| Infinity Premier Fund, L.P. (5) (6) | | 95 days | | Quarterly | | Fund of Funds |

| Mudrick Distressed Opportunity Drawdown Fund II, L.P. (5) (6) | | 90 days | | Quarterly | | Distressed Credit |

| Oaktree Enhanced Income Fund II, L.P. (7) (10) | | N/A | | N/A | | Credit |

| Old Well Emerging Markets Fund, L.P. (8) (10) | | 60 days | | Quarterly | | Emerging Market Equities |

| Old Well Special Opportunities Fund II, LLC (7) (10) | | N/A | | N/A | | Private Equity |

| Segra Resource Onshore Partners, L.P. (9) | | 60 days | | Quarterly | | Commodities |

| SJC Onshore Direct Lending Fund IV–5 Year, L.P. (7) | | N/A | | N/A | | Direct Credit |

| | | | | | | |

(1) There is a gate provision if requests for redemptions would cause a decline in aggregate net asset value of 20%. In addition to the 20% withdrawal limitation, a partner may not withdraw more than 25% of the capital in its Class B capital account on any withdrawal date.

(2) There is a capital surcharge of 1 3/4% for a partial or full withdrawal which may be waived in whole or in part.

(3) Minimum withdrawal of $500,000 or for all of limited partner’s interest in the partnership, if less. A limited partner may not take a partial withdrawal if it would cause the partnership’s aggregate net asset value to be less than $5,000,000. General partner may permit a smaller withdrawal or waive the latter requirement.

(4) There is a gate provision regarding requests for redemptions, subject to various unspecified terms.

(5) Withdrawals of capital contributed less than 12 months preceding the withdrawal date will be subject to a reduction equal to 3% of the requested withdrawal amount.

(6) There is a gate provision if aggregate requested withdrawal amounts exceed 25% of the aggregate partner capital of the partnership, each limited partner who has submitted a timely request will receive a pro rata portion of the requested withdrawal, and any balance will be considered a timely withdrawal request with respect to the next withdrawal date.

(7) Redemptions are not permitted.

(8) Withdrawals of capital contributions may be up to 1/4 of the balance of partner’s capital account.

(9) There is a gate provision regarding requests for more than 25% of its capital account.

(10) In liquidation.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2023

| 2. | SIGNIFICANT ACCOUNTING POLICIES (Continued) |

The Company is subject to credit risk to the extent that the investment managers of the underlying limited partnerships are unable to fulfill their obligations according to their organizational documents. The Company, through its investments in limited partnerships, is subject to risk inherent when investing in securities and private investments. In connection with its investments, the Company is subject to the market and credit risk of those investments held or sold short by the limited partnerships. Due to the nature of the Company's investments, the above described risks are limited to the Company's investment balances and unfunded commitment of $268,471 to the limited partnership of SJC Onshore Direct Lending Fund and $250,000 to the BAM Credit Opportunities Fund.

The Company is allocating operating expenses, including salaries and office rent on shared space with an affiliate, based on a reasonable basis of what is necessary to support the Company. See note 7 for further information.

| 3. | UNREALIZED APPRECIATION AND DEPRECIATION ON INVESTMENTS |

(tax basis)

The amount of net unrealized appreciation (depreciation) and the cost of investment securities for tax purposes, including short-term securities as of October 31, 2024, were as follows:

| Gross appreciation (excess of value over tax cost) | | $ | 14,399,857 | |

| Gross depreciation (excess of tax cost over value) | | | (9,683,155 | ) |

| Net unrealized appreciation | | $ | 4,716,702 | |

| Cost of investments for income tax purposes | | $ | 35,640,327 | |

The differences between book-basis and tax-basis unrealized appreciation/(depreciation) is attributable to the tax treatment of partnership investments.

The Company had $0 cash pledged as collateral for options on October 31, 2024. No options were written in the current year.

| 5. | DISTRIBUTIONS TO SHAREHOLDERS |

Classifications of distributions, net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Company.

On December 10, 2023, a distribution of $0.20 per share was paid to shareholders of record on November 25, 2023.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2023

On March 10, 2024, a distribution of $0.20 per share was paid to shareholders of record on February 25, 2024.

On June 10, 2024, a distribution of $0.20 per share was paid to shareholders of record on May 25, 2024.

On September 10, 2024, a distribution of $0.20 per share was paid to shareholders of record on August 25, 2024.

The tax character of distributions paid during the fiscal years 2024 and 2023 was as follows:

| | | 2024 | | | 2023 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 1,205,032 | | | $ | 784,318 | |

| Long-term capital gains | | | 305,998 | | | | - | |

| | | $ | 1,511,030 | | | $ | 784,318 | |

The tax components of distributable earnings are determined in accordance with income tax regulations, which may differ from composition of net assets reported under generally accepted accounting principles. During the current fiscal year, permanent differences primarily due to a prior year true-up and the tax treatment of partnership investments resulted in a net decrease in distributable earnings of $11,153,462 and a net increase in additional paid-in capital of $ 11,153,462. These reclassifications had no effect on the net assets. Capital loss carryforwards utilized during the year ended October 31, 2024 was $336,007. As of October 31, 2024, the components of distributable earnings/(deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 1,204,277 | |

| Unrealized capital gains | | | 4,716,702 | |

| Total accumulated earnings (deficit) | | $ | 5,920,979 | |

| 6. | ADVISORY BOARD AND REMUNERATION OF DIRECTORS |

The Company does not have an advisory board. The independent directors are paid an annual fee of $3,000 plus $1,000 for each meeting attended in person or $500 for each meeting attended by telephone. In addition, all directors are reimbursed for their reasonable expenses incurred in attending meetings.

BMC FUND, INC.

NOTES TO FINANCIAL STATEMENTS

Year Ended October 31, 2023

The Company leases office space from Broyhill Investments, Inc., which is controlled by M. Hunt Broyhill, who is an officer of the Company. The expense associated with this related party lease for the year ended October 31, 2024 amounted to $29,460 (included in the other related party expenses on the statement of operations) and the lease is for a 12 month period. Broyhill Investments, Inc. also acts as a common paymaster for payroll and other shared services. This service is provided at no cost to the Company. All amounts paid by Broyhill Investments, Inc. on behalf of the Company are reimbursed by the Company. Hunt Broyhill also has ownership in Broyhill Asset Management, LLC which serves as the financial advisor for BMC, Fund, Inc. The outstanding payable related to these transactions at October 31, 2024 was $83,560. The expense to Broyhill Asset Management (“BAM”), LLC for financial advisory services was $258,664 for the year ended October 31, 2024, as governed by an agreement with BAM .The advisory expenses is calculated at .65% of the net asset value at the beginning of each quarter of the fund. Broyhill Investments, Inc. charges the Company a percentage of payroll for employees who are responsible for the Company’s operations. Also, allocated back to the Company is a 3% safe harbor amount of Broyhill Investment, Inc.’s 401k plan which amounted to $4,182 (included in the salaries and related expenses on the statement of operations) for the year ended October 31, 2024, based on the company match.

The Company has committed investing $1,000,000 in the BAM Credit Opportunities Fund which is partly managed by M. Hunt Broyhill. This is the affiliated investment in the financial statements.

| | | Fair Value | | | Purchases | | | Net Change In

Unrealized | | | Fair Value | |

| | | 10/31/2023 | | | at Cost | | | Appreciation | | | 10/31/2024 | |

| BAM Credit Ops | | $ | 878,921 | | | | - | | | $ | 60,427 | | | $ | 939,348 | |

Selected securities at the end of the year have significant investment impairment issues. These selected securities have an aggregate cost basis of $3,454,699 and have been assigned no value at October 31, 2024.

There were no impairment charges during the year. The Company received $6,801 in proceeds related to the impaired securities during the twelve months ended October 31, 2024, which was recognized as realized gains in the Statement of Operations.

9. SUBSEQUENT EVENTS

In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. Management has determined there are no subsequent events that would require disclosure in the Fund’s financial statements.

BMC FUND, INC.

DIRECTORS AND OFFICERS (Unaudited)

Year Ended October 31, 2024

The following table provides information about the directors and the officers of the Fund:

Directors Who Are Interested Persons

Name,

Address and Age | | Position(s)

Held

with Fund | | Term of Office

and

Length of

Time Served | | Principal Occupation(s) During Past

5 Years | | Other

Directorships Held

by Director

During at Least

the Past 5 Years |

| M. Hunt Broyhill (60) 1870 9th Street Court, NW Hickory, NC 28601 | | Director

Chairman

President

Vice President | | Since 2008

Since 2014

Since 2007

2001-2007 | | Chairman of the Fund since October 2022 and February 2014 till February 2021; President of the Fund since February 2007; former Vice President of the Fund (2001-2007); Chief Executive of Broyhill Asset Management, LLC (1997-present); Director and President of Broyhill Investments, Inc. (1988-present); Director (1983-present) and President of Broyhill Family Foundation, Inc. (1988-present); | | Capitala Finance Corp. (Feb. 2013- 2021), Flagship REIT (2018 – Present) |

Directors Who Are Not Interested Persons

Name,

Address and Age | | Position(s)

Held

with Fund | | Term of

Office and

Length of

Time Served | | Principal

Occupation(s)

During Past

5 Years | | Other

Directorships Held

by Director

During at Least

the Past 5 Years |

| David Stevens (64) 422 Huntington Woods St. Lenoir, NC 28645 | | Director | | Since 2023 | | President of Smith, Stevens, and Ford, CPA | | None |

| | | | | | | | | |

Mark E. Roberts (62) 511 Tarrytown Center

Rocky Mount, NC 27804 | | Director | | Since 2014 | | Chief Investment Officer of Ironsides Asset Advisors, LLC, a registered investment advisory firm (2009-present); Chief Investment Officer of Biltmore Family Offices, LLC (May 2013-January 2017); former Director of Global Equities and Hedges Strategies, State of North Carolina Retirement System (2003-2009) | | None |

BMC FUND, INC.

DIRECTORS AND OFFICERS (Unaudited)

Year Ended October 31, 2024

Other Executive Officers

Name,

Address and Age | | Positions

Held

with Fund | | Length of

Time

Served | | Principal

Occupation

During Past

5 Years | | Directorships Held

by Officer

During at Least

the Past 5 Years |

| Danny A. Gilbert (58) 603 Stonecroft Court SE Lenoir, NC 28645 | | Vice President and Chief Financial Officer | | Since 2018

Since 2020 | | Vice President (since February 2018) and Chief Financial Officer of the Fund since January 2020; Chief Compliance Officer of the Fund (June 2017-December 2019); Vice President of Broyhill Family Foundation, Inc. (2019-present); former Assistant City manager and Finance Director, City of Lenoir, NC (2006-2016) | | None |

| | | | | | | | | |

| Alan R. Deal (60) 5304 Grace Drive Hickory, NC 28601 | | Chief Compliance Officer | | Since 2020 | | Chief Compliance Officer of the Fund since January 2020; former Controller, Protect Plus and Imagine One Companies (August 2002-April 2019) | | None |

| | | | | | | | | |

| Leah Geates (39) 802 Lower Creek Dr. NE Lenoir, NC 28645 | | Secretary | | Since 2022 | | Secretary of the Fund since February 2022 | | None |

BMC FUND, INC.

ADDITIONAL INFORMATION (Unaudited)

Year Ended October 31, 2024

| Investment Advisory Agreement Approval (Unaudited) |

The Board of Directors (the “Board”), including the Directors who are not “interested persons” (as that terms is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) (the “Independent Directors”) voting separately, reviewed and approved the renewal of the Investment Advisory Agreement (the “Advisory Agreement”) between Broyhill Asset Management, LLC (the “Adviser”) and BMC Fund, Inc. a registered closed-end fund under the Investment Company Act of 1940, as amended (the “Trust”), on behalf of its sole series of the same name (the “Fund”). The approval took place at a meeting held on August 22, 2024 (the “Meeting”) at which all of the Independent Directors and the Interested Director participated in-person.

Prior to the meeting, the Board requested, received, reviewed and considered a substantial amount of information from the Adviser related to the renewal of the Advisory Agreement between the Adviser and the Trust (the “Support Materials”). The Support Materials included, among other things, information regarding: (1) the Adviser’s organizational structure, management, personnel and proposed services to the Fund; (2) the fees to be paid by the Fund to the Adviser for services rendered under the Advisory Agreement, and (3) the Adviser’s compliance program, including the Adviser’s Code of Ethics.

In considering the Support Materials and reaching its conclusion to approve the renewal of the Advisory Agreement, the Board reviewed and analyzed the Factors as set forth below. The Directors did not identify any particular Factor or information that was most relevant to their consideration to renew the Advisory Agreement.

Nature, Extent and Quality of Services. The Directors reviewed the services being provided by the Adviser to the Fund as set forth in the Advisory Agreement. The Directors also noted that during the past year, the Adviser had not experienced any issues under its compliance program, and that the Adviser has not been subject to any litigation. The Directors also considered the experience of the Adviser’s personnel servicing the Fund, as well as the Adviser’s compliance environment and the Fund’s performance. The Directors concluded that they are satisfied with the quality, extent, and nature of the services provided by the Adviser.

Cost of Advisory Services and Profitability. The Directors considered the cost of the advisory services that Broyhill Asset Management provides to the Fund and the Adviser’s profitability with respect to the Fund, as well as the Adviser’s overall financial condition as it relates to the Adviser’s ability to provide the services called for in the Advisory Agreement. The Directors also considered that the fee arrangement of the Fund with the Adviser currently involves a contractual advisory fee of .65%, based on the net asset value of the assets in the beginning balance of the fiscal year quarter. The Directors considered the advisory fees paid to the Adviser during a twelve-month period and the Adviser’s expenses incurred over that period, as well as an estimation of the Adviser’s operational overhead allocable to the services provided to the Fund.

BMC FUND, INC.

ADDITIONAL INFORMATION (Unaudited)

Year Ended October 31, 2024

SUPPLEMENTAL INFORMATION

M. Hunt Broyhill, Chairman and President/Chief Investment Officer, is primarily responsible for the day-to-day management of the Company’s portfolio. Mr. Hunt Broyhill has been President since 2001. He has been engaged in asset management for various institutions and high net worth individuals for more than five years.

Change in Independent Registered Public Accounting Firm

On June 19, 2024, FORVIS, LLC (“FORVIS”) was not re-appointed as the independent registered public accounting firm of BMC Fund, Inc. (the “Fund”). The Audit Committee of the Board of Directors approved the replacement of FORVIS.

The report of FORVIS on the financial statements of the Fund for the two fiscal years ended October 31, 2023 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainties, audit scope or accounting principles. During the fiscal year ended October 31, 2023 and during the subsequent interim period through June 19, 2024: (i) there were no disagreements between the registrant and FORVIS on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of FORVIS, would have caused it to make reference to the subject matter of the disagreements in its report on the financial statements of the Fund for such years or interim period; and (ii) there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

On June 19, 2024, the Audit Committee of the Board of Trustees also approved the appointment of Cohen & Company, Ltd. (“Cohen”) as the Fund’s independent registered public accounting firm for the 2024 fiscal year.

During the two fiscal years ended October 31, 2023, and during the subsequent interim period through June 19, 2024, neither the registrant, nor anyone acting on its behalf, consulted with Cohen on behalf of the Fund regarding the application of accounting principles to a specified transaction (either completed or proposed), the type of audit opinion that might be rendered on the Fund’s financial statements, or any matter that was either: (i) the subject of a “disagreement,” as defined in Item 304(a)(1)(iv) of Regulation S-K and the instructions thereto; or (ii) “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K.

BMC FUND, INC.

ADDITIONAL INFORMATION (Unaudited)

Year Ended October 31, 2024

Investment Objectives

The overall investment objective of the Fund is to provide a maximum level of income for shareholders consistent with maintaining the Fund’s long-term purchasing power. This investment objective may not be changed without shareholder approval. The specific goals of the Fund are in order of importance:

| 1) | Preservation of capital |

| 2) | Current income |

| 3) | Moderate growth |

Performance Objectives

A five percent return on the Fund’s assets is desired to be distributed annually for dividend income. Additional modest growth is desired to at least offset inflation risk.

| • | Investment Horizon: The Fund’s asset allocation and investment guidelines are driven by a long-term time horizon. Accordingly, interim fluctuations should be viewed with this perspective in mind. Short-term performance shortfalls are not of critical interest unless they suggest failures in strategy execution or impact required distributions. Notwithstanding that possibility, manager and asset class performance shall be evaluated on a rolling one, three and five year basis. |

| • | Liquidity Requirements: The Fund aims to distribute five percent of the value of its assets annually to shareholders. Therefore, a minimum of five percent of the value of the Fund should be held in cash and cash equivalents or instruments that can be quickly converted to cash with no significant adverse change in value as a result of the liquidation. |

| • | Risk Tolerance: The Fund seeks to generate returns that are proportional to its risk profile, recognizing that some level of risk must be assumed to achieve the fund’s long-term investment objectives. The objectives and structure of the Fund should be implemented and measured in a manner which seeks low volatility, accepting the possibility of less than average returns in the best years but seeking preservation of capital in the bad years. |

Asset Allocation Plan