SUNOPTA INC.

FORM 10-K

For the year ended December 30, 2023

TABLE OF CONTENTS

| SUNOPTA INC. | 1 | December 30, 2023 Form 10-K |

Basis of Presentation

Except where the context otherwise requires, all references in this Annual Report on Form 10-K for the fiscal year ended December 30, 2023 ("Form 10-K") to "SunOpta," the "Company," "we," "us," "our" or similar words and phrases are to SunOpta Inc. and its subsidiaries, taken together.

In this report, all currency amounts presented are expressed in thousands of United States ("U.S.") dollars ("$"), except per share amounts, unless otherwise stated.

Forward-Looking Statements

This Form 10-K contains forward-looking statements that are based on management's current expectations and assumptions and involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and are typically accompanied by words such as "anticipate," "estimate," "target," "intend," "project," "potential," "predict," "continue," "believe," "expect," "can," "could," "would," "should," "may," "might," "plan," "will," "budget," "forecast," the negatives of such terms, and words and phrases of similar impact and include, but are not limited to, references to future financial and operating results, plans, objectives, expectations, and intentions; our expectations regarding the future profitability of our business, including anticipated results of operations, revenue trends, and gross margin profile; the expected impact of the inflationary cost environment on our business, including raw material, packaging, labor, energy, fuel and transportation costs; the expected impact of pricing actions on sales volumes and gross margins; the expected impact of cost containment measures and productivity initiatives; our expectations regarding customer demand, consumer preferences, competition, sales pricing, availability and pricing of raw material inputs, and timing and cost to complete capital expansion projects; our ability to successfully execute on our capital investment plans, and the viability of those plans; disruptions or inefficiencies in the supply chain; the adequacy of internally generated funds and existing sources of liquidity, such as the availability of bank financing; the anticipated sufficiency of future cash flows to enable the payments of interest and repayment of debt, working capital needs, planned capital expenditures; and our ability to obtain additional financing or issue additional debt or equity securities; our intentions related to the potential sale of selected businesses, operations, or assets; our estimates for losses and related insurance recoveries associated with the recall of specific frozen fruit products initiated in the second quarter of 2023; the outcome of litigation to which we may, from time to time, be a party; and other statements that are not historical facts. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on certain assumptions, expectations and analyses we make in light of our experience and our interpretation of current conditions, historical trends and expected future developments, as well as other factors that we believe are appropriate in the circumstances.

Whether actual results and developments will be consistent with and meet our expectations and predictions is subject to many risks and uncertainties. Accordingly, there are important factors that could cause our actual results to differ materially from our expectations and predictions. We believe these factors include, but are not limited to, the impact of global economic conditions, including inflation, interest rates, and energy availability; the potential for economic disruption due to geopolitical events and health crises; our ability to increase pricing to offset, or partially offset, inflationary pressures on the cost of our products; issues affecting our supply chain and procurement of raw materials, including fluctuations in the cost and availability of raw and packaging materials; labor shortages, employee turnover, and labor cost increases; business interruptions due to weather events, natural disasters, other unexpected events or public health crises; the potential loss of one or more of our key customers; our ability to identify, interpret and react to changes in consumer preferences and demand; our ability to effectively respond to competitive factors, including product innovations of our competitors; a failure to realize some or all of the anticipated benefits from our capital investment plans; a failure to successfully integrate or divest businesses, operations, or assets; impairments of long-lived assets or goodwill; a failure of our internal control over financial reporting; occurrence of product recall and withdrawal events; results of litigation and other legal proceedings; changes in government regulations and policies; infringements of our intellectual property; risks associated with our information technology systems, including the threat of data breaches and cyber-attacks; the impacts of severe weather events, natural disasters, and climate change on the supply and cost of raw and packaging materials, as well as energy, fuel and water; the availability and pricing of non-GMO and organic ingredients; global economic and financial conditions on availability of financing and interest rates; the effects of increased debt levels and service obligations on our ability to borrow or the cost of any such additional borrowing on our ability to react to certain economic and industry conditions; and other risks described herein under Part I, Item 1A "Risk Factors."

All forward-looking statements made herein are qualified by these cautionary statements, and our actual results or the developments we anticipate may not be realized. Our forward-looking statements are based only on information currently available to us and speak only as of the date on which they are made. We do not undertake any obligation to publicly update our forward-looking statements, whether written or oral, after the date of this report for any reason, even if new information becomes available or other events occur in the future, except as may be required under applicable securities laws. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report.

| SUNOPTA INC. | 2 | December 30, 2023 Form 10-K |

PART I

Item 1. Business

The Company

SunOpta Inc. was organized under the laws of Canada in 1973. We operate as a manufacturer for leading natural and private label brands and also produce our own propriety brands, including SOWN®, Dream® and West Life™. The core of our product portfolio is a range of plant-based beverages, including oat, almond, soy, coconut and rice milks and creamers, which have a favorable climate profile relative to traditional dairy milks in terms of lower carbon emissions and water usage. Our plant-based offerings include non-genetically modified ("non-GMO"), organic, and gluten-free products. Our consumer products portfolio also includes protein shakes, teas, broths, and fruit snacks. In October 2023, we completed the divestiture of our commodity-based frozen fruit business ("Frozen Fruit"), in order to focus on value-add products in plant-based and healthy snack categories (see below - "Divestiture of Frozen Fruit").

We sell our products through various distribution channels including private label products to retail customers; branded products under co-manufacturing agreements to other branded food companies for their distribution; and our own branded products to retail and foodservice customers. In addition, we also produce liquid and dry ingredients for internal use and for sale to other food and beverage manufacturers.

Our employees and production facilities are principally located in the U.S., as well as Canada. Our corporate headquarters is located in Eden Prairie, Minnesota, together with our innovation center and pilot plant.

Divestiture of Frozen Fruit

On October 12, 2023, we completed the sale of certain assets and liabilities of Frozen Fruit, which included owned facilities of Frozen Fruit located in Edwardsville, Kansas, and Jacona, Mexico. In December 2023, we completed the liquidation of a leased frozen fruit facility located in Oxnard, California. These transactions represent our exit from the processing, packaging and selling of individually quick frozen fruit for retail, foodservice and industrial applications and completes our strategic optimization plan for our non-core, commodity-based businesses, which included the divestiture of our sunflower business ("Sunflower") in October 2022. Frozen Fruit and Sunflower have been classified as discontinued operations.

Customers and Competition

We sell our products through various distribution channels, including foodservice operators, grocery retailers and club stores, branded food companies, and food manufacturers, located principally in the U.S. We generally conduct our business with customers based on purchase orders or pursuant to contracts that are terminable by either party following a designated notice period. However, some of our contracts may extend for several years and/or include volume purchase commitments. A relatively limited number of customers account for a large percentage of our revenues. In 2023, our ten largest customers accounted for approximately 80% of our revenues from continuing operations.

We compete with major branded and private-label food manufacturers that have significantly greater resources and brand recognition than we do. However, we believe that the strategic locations of our manufacturing and distribution facilities, our in-house processing and packaging capabilities, and our innovation center and pilot plant, allows us to compete effectively. For sales of private label and co-manufactured products, the principal competitive factors are product quality, reliability of service, innovation, and price. For sales of our own branded products, the principal competitive factors are consumer brand recognition and loyalty, product quality, promotion, and price.

Raw Materials

Our raw materials primarily consist of ingredients and packaging materials. Principal ingredients used in our products include oats, almonds, soybeans, coconut, apple and sugar. For critical raw materials, we identify and qualify alternate sources of supply, where possible. Ingredients are subject to fluctuations in market price caused by weather, growing and harvesting conditions, market conditions, including inflationary cost increases, and other factors beyond our control. Where possible, we mitigate market price volatility by entering into annual purchase arrangements with our suppliers and by incorporating pass-through pricing adjustment clauses into our contracts with customers. The costs of raw materials used in our products also fluctuate due to energy costs, fuel prices, labor availability, and freight and storage demand. Volatility in the cost of our raw materials can adversely affect our performance, as price changes may lag behind changes in costs, and we are not always able to adjust our pricing to reflect changes in raw material costs due to competitive pressures.

| SUNOPTA INC. | 3 | December 30, 2023 Form 10-K |

We rely on our packaging suppliers to ensure delivery of often unique, portable, and convenient consumer packaging formats. In our plant-based beverage processing facilities, we specialize in the use of Tetra Pak processing and packaging equipment in a variety of package sizes, and an array of opening types and extended shelf-life options. Over 95% of our packaging by weight is recyclable, and we are committed to working with our suppliers to innovate and develop new packaging technologies to further reduce the impact on the environment, while maintaining the quality and safety of our products.

Natural gas and electricity are the primary sources of energy used to power our plants and processing equipment, and water is the principal ingredient in many of our products and is essential to our production processes.

Diesel fuel is used in connection with the distribution of our products, and we rely on third-party transportation providers to deliver raw materials, as well as our products to our customers.

Seasonality

Overall, the demand for most of our products does not typically fluctuate significantly in any particular season; however, broth sales are generally higher in the first and fourth quarters of each year.

Product Development

Our 24,000 square foot innovation center and pilot plant located in Eden Prairie, Minnesota, supports our product development team of 21 highly trained and experienced food scientists and technologists that are dedicated to the development of innovative food and beverage offerings and addressing product development opportunities for our customers. These opportunities include new and custom formulations, innovations in packaging formats, and new production processes and applications. Applications and technical support provided to our customers include all aspects of product development from concept to commercial launch, as well as ongoing manufacturing and processing support.

Trademarks

We market our own consumer brands under trademarks that we own, including SOWN, Dream and West Life. While we consider these trademarks to be valuable to the marketing and sale of our proprietary brands, we do not consider any trademark to be of such material importance that its absence would cause a material disruption of our business.

Human Capital

Our Human Capital Management strategy is based on our goal of "Putting the YOU in SunOpta." We develop employee programs, benefits, and compensation to align with four pillars of well-being: physical, financial, social, and emotional. Examples of these initiatives are:

Offering a competitive compensation and benefit package that includes "choices" for each employee to select which works best for them. Our comprehensive benefits package includes health insurance, company-paid life, accident, and disability insurance, 401(k), employee stock purchase plan, paid time off, paid parental and maternity leave programs, flexible schedules, and a tuition reimbursement program. In 2023, we implemented two additional paid personal holidays for our regular, full-time employees called "You Days," which can be taken in recognition of an employee's birthday and work anniversary date. In addition, we added a mental health benefit that provides faster access to care at the individual level of need for employees and their families. As part of our focus on financial wellness, we announced expedited access to our 401(k) plan, beginning in 2024 so employees can realize the benefits of planning for retirement with employer match earlier in their tenure.

We believe it is key to give back to the communities in which we live and work as evidenced by our community service and volunteerism program, which we refer to as "SunOpta Cares." This program provides 24 hours of paid time off for our employees to volunteer with community programs that align with their values. Throughout the year, employees have several opportunities to donate talent and gifts to local charitable organizations.

Talent management and growth is instrumental in developing a sustainable workforce. We provide various opportunities for our employees to learn and grow within SunOpta through individual development plans, on-the-job training, special project assignments, monthly safety training and regular leader led learning sessions. In 2023, we expanded the Foundational Manager Program to all of our plant locations. This offering was created for managers and supervisors with a focus on cross-functional leadership, effective communication, leading through change, influencing with integrity, negotiating, and creative problem solving. We are committed to identifying and developing the talents of our next generation leaders. On an annual basis, we conduct talent assessments across the organization and succession planning for our most critical roles within the organization to identify high potential employees, gaps in capabilities or skills, and bench strength. In 2023, we had the first cohort of the Leadership Impact Program. Participants at the SVP and VP level gathered quarterly throughout the year to focus on leadership skills, strategy, professional growth and completed capstone projects to further the business.

| SUNOPTA INC. | 4 | December 30, 2023 Form 10-K |

- We believe in the power of diversity. We provide training regarding diversity, equity and inclusion for employees to better understand how we can all work together, and be better, by embracing our differences. We foster inclusion by recognizing and supporting activities and initiatives representative of our workforce such as celebrations of Black History month, Hispanic Heritage month, PRIDE, National Native American Heritage month, and our Women's Leadership Program. We continue to foster our Hispanic and Women's Employee Resource Groups by offering programming for awareness, education and collaboration.

We encourage our employees to be guided by our MVBs (Most Valued Behaviors) of speed, dedication, problem solving, passion, entrepreneurship, and customer centricity. We have a peer recognition program which allows employees to recognize others who are demonstrating our MVBs. Our leaders also recognize employees through our quarterly awards program. SunOpta conducts an organizational health survey two times each year to check the pulse of our workforce and look for areas of improvement through the lens of all our employees. We engage in communication efforts such as quarterly town halls and monthly all-company huddles that we believe help employees feel they are a part of SunOpta as a whole, not just their individual department or location.

As of December 31, 2023, we employed 1,174 full-time employees in North America. Our average employee has over four years of service. In 2023, our voluntary turnover was 20% (down from 22% in 2022) across the Company. We continue to focus on increasing employee retention by implementing retention programs and initiatives to increase employee engagement. Employee health and safety is paramount to our success. In addition to our safety training and initiatives at our manufacturing facilities, we track our Total Recordable Incident Rate (TRIR) which ended the year at 1.02, compared to a goal of 1.3.

Environmental, Social and Governance

We are committed to incorporating environmental, social and governance ("ESG") principles into our business strategies and organizational culture. The Corporate Governance Committee of our Board of Directors provides oversight on ESG matters. Details on our ESG commitments and progress are set out in our most recent ESG report (available at sunopta.com/sustainability), which shall not be deemed to be a part of this Form 10-K or incorporated into any of our other filings made with the U.S. Securities and Exchange Commission (the "SEC") or Canadian Securities Administrators (the "CSA").

Regulations

We are subject to a wide range of governmental regulations and policies in the U.S. and Canada. These laws, regulations and policies are implemented, as applicable in each jurisdiction, on the national, federal, state, provincial, and local levels. For example, we are affected by laws and regulations related to seed, fertilizer, and pesticides; the purchasing, harvesting, transportation, and warehousing of agricultural products; the processing, packaging, and sale of food and beverages, including wholesale operations; and product labeling and marketing, food safety and food defense. We are also affected by government-sponsored price supports, acreage set aside programs, and a number of environmental regulations.

U.S. Regulations

Our activities in the U.S. are subject to regulation by various governmental agencies, including the Food and Drug Administration ("FDA"), the Federal Trade Commission ("FTC"), the Environmental Protection Agency ("EPA"), the U.S. Department of Agriculture ("USDA"), Occupational Safety and Health Administration ("OSHA"), and the Departments of Commerce and Labor, as well as voluntary regulation by other bodies. Various state and local agencies also regulate our activities.

USDA National Organic Program and Similar Regulations

We manufacture and distribute a number of organic products that are subject to the standards set forth in the Organic Foods Production Act and the regulations adopted thereunder by the National Organic Standards Board. In addition, our organic products may be subject to various state regulations. We believe that we are in material compliance with the organic regulations applicable to our business, and we maintain an organic testing and verification process. Generally, organic food products are produced using:

- agricultural management practices intended to promote and enhance ecosystem health;

| SUNOPTA INC. | 5 | December 30, 2023 Form 10-K |

ingredients produced without genetically engineered seeds or crops, sewage sludge, long-lasting pesticides, herbicides, or fungicides; and

food processing practices intended to protect the integrity of the organic product and disallow irradiation, genetically modified organisms, or synthetic preservatives.

After becoming certified, organic operations must retain records concerning the production, harvesting, and handling of agricultural products that are to be sold as organic for a period of five years. Any organic operation found to be in violation of the USDA organic regulations is subject to potential enforcement actions, which can include financial penalties or suspension or revocation of their organic certificate.

Food Safety, Labeling and Packaging Regulations

As a manufacturer and distributor of food products, we are subject to the Federal Food, Drug and Cosmetic Act, the Fair Packaging and Labeling Act and regulations promulgated thereunder by the FDA and the FTC. This regulatory framework governs the manufacture (including composition and ingredients), labeling, packaging, and safety of food in the U.S. state and local statutes and regulations may impose additional food safety, labeling, and packaging requirements. For instance, the California Safe Drinking Water and Toxic Enforcement Act of 1986 (commonly referred to as "Proposition 65") requires, with a few exceptions, that a specific warning appear on any consumer product sold in California that contains a substance, above certain levels, listed by that state as having been found to cause cancer or birth defects. We believe we are in material compliance with state and local statutes and regulations as they apply to our business.

Environmental Regulations

We are also subject to various U.S. federal, state, and local environmental regulations. Some of the key environmental regulations in the U.S. include, but are not limited to, the following:

- Air quality regulations - air quality is regulated by the EPA and certain city/state air pollution control groups. Emission reports are filed annually.

- Waste treatment/disposal regulations - solid waste is either disposed of by a third-party or, in some cases, we have a permit to haul and apply the sludge to land. Agreements exist with local city sewer districts to treat waste at specified levels of Biological Oxygen Demand ("BOD"), Total Suspended Solids ("TSS") and other constituents. This can require weekly/monthly reporting as well as annual inspection.

- Sewer regulations - we have agreements with the local city sewer districts to treat waste at specified limits of BOD and TSS. This requires weekly/monthly reporting as well as annual inspection.

- Hazardous chemicals regulations - various reports are filed with local, city, and state emergency response agencies to identify potential hazardous chemicals being used in our U.S. facilities.

- Storm-water - all of our U.S. facilities are inspected annually and must comply with an approved storm-water plan to protect water supplies.

Employee Safety Regulations

We are subject to certain safety regulations, including OSHA regulations. These regulations require us to comply with certain manufacturing safety standards to protect our employees from accidents. We believe that we are in material compliance with all employee safety regulations applicable to our business.

| SUNOPTA INC. | 6 | December 30, 2023 Form 10-K |

Canadian Regulations

In Canada, the sale of food is regulated under various federal and provincial laws, principally (but not limited to) the Safe Food for Canadians Act ("SFCA"), the Food and Drugs Act ("FADA"), the Canada Consumer Product Safety Act ("CCPSA"), the Canadian Food Inspection Agency Act ("CFIAA") and the Canadian Environmental Protection Act, 1999 ("CEPA"), along with their supporting regulations. The following is a summary of each of these statutes to the extent that they apply or potentially apply to the Company and its operations:

- Safe Food for Canadians Regulations ("SFCR") (under the SFCA) - the SFCR came into effect on January 15, 2019, and consolidated 14 sets of existing food regulations into a single set of regulations which governs all imported, exported, or inter-provincially traded food products. Some provisions of the SFCA and SFCR also apply intra-provincially. Notably, SFCR replaced the Organic Products Regulations, 2009, the Processed Products Regulations and, to the extent that they related to food products, the Consumer Packaging and Labeling Act and its supporting regulations. Principal elements of the SCFR that may impact the Company include licensing requirements, preventative controls, traceability requirements, commodity-specific requirements, reporting requirements and timelines, an export certificate request process, packaging and labeling requirements to ensure food safety and prevent false or misleading labeling, regulation of the use of grades and grade names, standards of identity and expansion of the certification process for organic products, and other requirements. Timelines for complying with the SFCR requirements vary by food, activity, and size of the food business.

- Food and Drug Regulations (under the FADA) - food and drugs are subject to specific regulatory requirements, including composition (such as food additives, fortification, and food standards), packaging, labeling, advertising, and marketing, and licensing requirements. New requirements regarding nutrition and ingredient labeling and food color were introduced in 2016. In 2022, the Government of Canada, with support from the Canadian Food Inspection Agency (the "CFIA"), amended the Food and Drug Regulations to update the requirements for labelling pre-packaged food products. The amendments to the Food and Drug Regulations are part of the CFIA's initiative to modernize Canada's food labelling system.

- Canadian Food Inspection Agency Act ("CFIAA") - the CFIAA grants power to the CFIA, which is tasked with the administration and enforcement of certain Canadian food legislation. By virtue of the CFIAA and the SFCA, the CFIA has the power to inspect and, if deemed necessary, recall certain products, including fresh fruit and vegetables, processed foods, and organic foods, if the Minister of Health believes that such products pose a risk to the public, animal or plant health.

- Substance Regulations - various regulations under CEPA regulate the importation and use of certain substances in Canada. For example, prior to the importation and use in products, the importer must ensure that all ingredients are found on the Domestic Substances List ("DSL") maintained by Environment and Climate Change Canada. In the event that an ingredient is not found on the DSL, then subject to the amount of the substance imported into Canada and used in products sold in Canada, a filing may become necessary under the New Substances Notification Regulations.

- Canada Consumer Product Safety Act ("CCPSA") - the CCPSA provides oversight and regulation of consumer products with respect to manufacturers, importers, and retailers. It includes, without limitation, the ability to require product recalls, mandatory incident reporting, document retention requirements, increased fines and penalties, and packaging and labeling requirements. While the CCPSA does not apply to food, it does apply to its packaging with respect to safety. It is possible that there will be amendments introduced to the FADA, to capture the essence of the regulatory oversight found in the CCPSA. We have no way of anticipating if and when that may occur.

Environmental Compliance

As described above, we are subject to environmental regulations in the U.S. and Canada. Our business also requires that we have certain permits from various state, provincial and local authorities related to air quality, water consumption and treatment, stormwater discharge, solid waste, land spreading and hazardous waste. We are committed to meeting all applicable environmental compliance requirements.

Intellectual Property

The nature of a number of our products and processes requires that we create and maintain patents, trade secrets and trademarks. Our policy is to protect our technology, brands, and trademarks by, among other things, filing patent applications for technology relating to the development of our business in the U.S. and in selected foreign jurisdictions, registering trademarks in the U.S., Canada and selected foreign jurisdictions where we sell products, and maintaining confidentiality agreements with outside parties and employees.

| SUNOPTA INC. | 7 | December 30, 2023 Form 10-K |

Our continued success depends, in part, on our ability to protect our products, trade names and technology under U.S. and international patent laws and other intellectual property laws. We believe that we own or have sufficient rights to use all of the proprietary technology, information and trademarks necessary to manufacture and market our products; however, there is always a risk that patent applications relating to our products or technologies will not result in patents being issued, or, if issued, will be later challenged by a third party, or that current or additional patents will not afford protection against competitors with similar technology.

We also rely on trade secrets and proprietary know-how and confidentiality agreements to protect certain technologies and processes. However, even with these steps taken, our outside partners and contract manufacturers could gain access to our proprietary technology and confidential information. All employees are required to adhere to internal policies, which are intended to further protect our technologies, processes, and trade secrets.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act"), are available free of charge on our website at www.sunopta.com as soon as reasonably practicable after we file such information electronically with, or furnish it to, the SEC and the CSA.

Additionally, the SEC and CSA maintain internet sites that contain reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC and CSA, which can be found at http://www.sec.gov and http://www.sedarplus.ca, respectively.

Item 1A. Risk Factors

Our business, financial condition and results of operations are subject to various risks and uncertainties, including those described below and elsewhere in this report. We believe the most significant of these risks and uncertainties are described below, any of which could adversely affect our business, financial condition and results of operations, as well as our cash flows, liquidity, stock price and/or reputation, and could cause actual results to differ materially from the results contemplated by the forward-looking statements contained in this report. There may be additional risks and uncertainties not presently known to us or that we currently consider immaterial. Consequently, you should not consider the following to be a complete discussion of all possible risks or uncertainties applicable to our business. These risk factors should be read in conjunction with the other information in this report and in the other documents that we file from time to time with the SEC and the CSA.

Risks Related to Our Company, Business and Operations

Deterioration of global economic conditions, an economic recession, periods of inflation, or economic uncertainty in our key markets may adversely affect customer and consumer spending, as well as demand for our products

Global economic conditions can be uncertain and volatile. Our business and results of operations have in the past been, and may continue to be, adversely affected by changes in global economic conditions including inflation, interest rates, consumer spending rates, energy availability and costs, the negative impacts caused by public health crises, such as the COVID-19 pandemic, as well as the potential impacts of geopolitical events, and the effect of governmental initiatives to manage economic conditions. As global economic conditions continue to be volatile or economic uncertainty remains, trends in consumer spending also remain unpredictable and subject to reductions due to credit constraints and uncertainties about the future. Most of our products are purchased by our customers based on end-user demand from consumers. Some of the factors that may influence consumer spending include general economic conditions, high levels of unemployment, health crises, higher consumer debt levels, reductions in net worth based on market declines and uncertainty, home foreclosures and reductions in home values, fluctuating interest rates and credit availability, fluctuating fuel and other energy costs, fluctuating commodity prices, inflationary pressure, tax rates, and general uncertainty regarding the overall future economic environment. Unfavorable economic conditions may lead customers and consumers to delay or reduce purchases of our products and could present challenges in collecting our account receivables on a timely basis. Customer demand for our products may not reach our targets or may decline as distributors and retailers seek to reduce inventory positions if there is an economic downturn or economic uncertainty in our key markets. Economic cycles and related fluctuations in customer demand may have a material adverse effect on our business, financial condition, and results of operations.

| SUNOPTA INC. | 8 | December 30, 2023 Form 10-K |

We may not be able to increase prices to fully offset inflationary pressures on costs, such as raw and packaging materials, labor, energy, fuel and distribution costs, which may impact our business, financial condition, and results of operations

In recent years, we have experienced elevated commodity and supply chain costs, including the costs of raw materials, packaging, labor, energy, fuel, freight and other inputs necessary for the production and distribution of our products, and we expect elevated levels of inflation to continue in 2024. Many of these materials and costs are subject to price fluctuations from a number of factors, including, but not limited to, market conditions, geopolitical events, demand for raw materials, weather, growing and harvesting conditions, energy and fuel costs, currency fluctuations, and other factors beyond our control.

Our attempts to offset these cost pressures, such as through increases in the selling prices of some of our products, may not be successful. Higher product prices may result in lower sales volumes. Consumers may shift to lower priced product offerings, or may forego some purchases altogether, during an economic downturn or times of increased inflationary pressure. To the extent that our efforts to offset cost inflation through price increases, and/or through cost containment measures and productivity initiatives, are not sufficient to offset these increased costs adequately or in a timely manner, and/or if they result in significant decreases in sales volume, our business, financial condition and results of operations may be materially and adversely affected.

If we do not manage our supply chain effectively, our operating results may be adversely affected

Our supply chain is complex and critical to our ability to manufacture, move, and sell products. We rely on third-party suppliers for our raw materials and packaging, as well as the distribution of our products. The inability of any of these suppliers to deliver or perform for us in a timely or cost-effective manner could cause our operating costs to rise and our margins to fall. Many of our products are perishable and require timely processing and transportation to our customers. Additionally, many of our products can only be stored for a limited amount of time before they spoil and cannot be sold. We must continually monitor our inventory and product sales mix against forecasted demand to reduce the risk of not having adequate supplies to meet consumer demand or the risk of having too much inventory that may reach its expiration date. General macroeconomic and conditions, geopolitical events and health crises have increased the challenges of managing our supply chain, and these factors could continue to cause unpredictable supply chain interruptions or other adverse effects on our supply chain. If we are unable to manage our supply chain effectively and ensure that our products are available to meet consumer demand, our operating costs could increase and our margins could decline, which could have a material adverse effect on our business, financial condition, and results of operations.

If we face labor shortages or increased labor costs, our business, financial condition, and results of operations could be adversely affected

Labor is a primary component of operating our business. Our ability to achieve our operating goals depends on our ability to identify, hire, train, and retain qualified employees. We compete with other companies both within and outside of our industry for talented employees. If we are unable to hire and retain employees capable of performing at a high-level, our ability to efficiently operate our manufacturing facilities and overall business could be adversely affected. Our ability to meet our labor needs while controlling labor costs is subject to external factors, such as employment levels, prevailing wage rates, minimum wage legislation, changing demographics, health and other insurance costs, and governmental labor and employment requirements. In addition, a sustained labor shortage or increased turnover rates within our employee base could lead to increased costs, such as increased overtime to meet demand, costs to hire and train new employees, and increased wage rates and employee benefits to attract and retain employees. An overall labor shortage, lack of skilled labor, increased turnover, labor inflation, and changes in applicable employment laws and regulations, could lead to increased labor costs and/or reduced operating efficiencies, which could have a material adverse impact on our business, financial condition, and results of operations.

An interruption at one or more of our manufacturing facilities could negatively affect our business, and our business continuity plan may prove inadequate

We own or lease, manage and operate a number of manufacturing, processing, packaging, storage and office facilities. We may be unable to accept and fulfill customer orders as a result of disasters, health crises (such as the COVID-19 pandemic), business interruptions, or other similar events. Some of our inventory and manufacturing facilities are located in areas that are susceptible to harsh weather, and the production of certain of our products is concentrated in a few geographic areas. Although we have a business continuity plan, our plan might not address all of the issues we may encounter in the event of a disaster or other unanticipated issues. Our business interruption insurance may not adequately compensate us for losses that may occur from any of the foregoing. In the event that a disaster, or other catastrophic event were to destroy any part of any of our facilities or interrupt our operations for any extended period of time, or if harsh weather or health crises prevent us from producing and/or delivering products in a timely manner, our business, financial condition and results of operations could be materially and adversely affected.

| SUNOPTA INC. | 9 | December 30, 2023 Form 10-K |

Our customers generally are not obligated to continue purchasing products from us

Many of our customers buy from us under short-term, binding purchase orders. As a result, these customers are not committed to maintain or increase their sales volumes or orders for the products supplied by us. Decreases in our customers' sales volumes or orders for products supplied by us may have a material adverse effect on our business, financial condition and results of operations. In addition, some customer buying decisions are based on a periodic bidding process. Our sales volume may decrease if our offer is too high and rejected. Alternatively, we risk reducing our margins if our offer is successful but less than our desired price point. Either of these outcomes may adversely affect our results of operations.

Loss of a key customer could materially reduce revenues and earnings

Our relationships with our key customers are critical to the success of our business and our results of operations. For the year ended December 30, 2023, our ten largest customers accounted for approximately 80% of revenues from continuing operations. The loss, decrease or cancellation of business with any of our large customers could materially and adversely affect our business, financial condition, and results of operations.

We operate in a highly competitive industry

We operate businesses in the highly competitive food industry in North America. We compete with large U.S. and international food ingredient and consumer-packaged food companies. These competitors may have financial resources larger than ours and may be able to benefit from economies of scale, pricing advantages, long-standing customer relationships, and greater resources for product innovation, and marketing and promotional activities. In addition, we may have to compete for limited supplies of certain raw materials with competitors having greater resources and stronger supplier relationships than we have. If we are unable to effectively respond to these competitive factors or if the competition in any of our product markets results in price reductions or decreased demand for our products, our business, financial condition and results of operations may be materially and adversely affected.

Product innovations by our competitors could make our food products less competitive

Our competitors include major food manufacturers and consumer-packaged food companies. Many of these companies are engaged in the development of food ingredients and packaged food products and frequently introduce new products into the market. If our competitors introduce products that are more appealing to the tastes and dietary habits of consumers or considered to be of higher quality or value than our products, our sales and market share could decline, which may have a material adverse effect on our profitability.

Consumer food preferences are difficult to predict and may change

Our success depends, in part, on our ability to predict, identify, and interpret the tastes and dietary habits of consumers and to offer products to our customers that appeal to those preferences on a timely and affordable basis. Consumer preferences and trends change based on a number of factors, including product taste and nutrition, food allergies, sustainability values, and animal welfare concerns. Our failure to anticipate and respond to changing consumer preferences on a timely basis could result in reduced demand and price decreases for our products, which could have a material adverse effect on our business, financial condition, and results of operations.

We may not realize some or all of the anticipated benefits of our capital investment plans in the anticipated time frame or at all

We have recently completed the largest capital expansion in our company's history, which included the construction of our new plant-based beverage facility in Midlothian, Texas. Our capital investment plans often require a substantial amount of management, operational, and financial resources, which may divert our attention and resources from existing businesses, potentially disrupting our operations and adversely affecting our relationships with customers and suppliers. In addition, delays and unexpected costs in connection with the completion of capital expansion projects, or changes in demand and pricing for our products may occur that could result in us not realizing all or any of the anticipated benefits of our capital investment plans on our expected timetable or at all, and there can be no assurance that any benefits we realize from our capital investments will be sufficient to offset the costs that we may incur.

| SUNOPTA INC. | 10 | December 30, 2023 Form 10-K |

Our operations are subject to the general risks associated with acquisitions and divestitures

We regularly review strategic opportunities to grow our business through acquisitions of complementary businesses or assets. Additionally, we have made several significant divestitures in recent years that aligned with our strategic priority of optimizing our non-core, commodity-based businesses and focusing on value-add opportunities. Potential risks associated with these transactions include the inability to consummate a transaction on favorable terms, the diversion of management's attention from other business concerns, the potential loss of key employees and customers of current or acquired companies, the inability to integrate or divest operations successfully, the possible assumptions of unknown liabilities, potential disputes with buyers or sellers, potential impairment charges, and the inherent risks in entering markets or lines of business in which the Company has limited or no prior experience. Any or all of these risks could have a material and adverse impact on our business, financial condition, and results of operations. In addition, acquisitions outside the U.S. or Canada may present unique challenges and increase our exposure to the risks associated with foreign operations.

In October 2023, we completed the sale of certain assets and liabilities of Frozen Fruit to Natures Touch Mexico, S. de R.L. de C.V. and Nature's Touch Frozen Fruits, LLC (the "Purchasers") for an estimated aggregate purchase price of approximately $141 million. The estimated aggregate purchase price is subject to post-closing adjustments based on a determination of the final net working capital as of the closing date of the transaction on October 12, 2023. Our estimate of the final net working capital allocation, which is recognized as part of the loss from discontinued operations in the consolidated statement of operations for the year ended December 30, 2023, may be subject to change, which could be material, as the parties are currently in the process of reconciling the final aggregate purchase price, including the resolution of certain disputed items, in accordance with the procedures set forth in the Asset Purchase Agreement. A change in the aggregate purchase price could have a material impact on our consolidated results of operations, financial condition and cash flows.

In addition, a portion of the aggregate purchase price was in the form of secured seller promissory notes due in three years and with a stated principal amount of $20.0 million in the aggregate (the "Seller Promissory Notes") that the Company entered into with the Purchasers and Nature's Touch Frozen Foods, LLC (collectively the "Loan Parties"). The Seller Promissory Notes are secured by a second-priority lien on certain assets of Frozen Fruit acquired by the Purchasers. While we assessed the Seller Promissory Notes to be collectible as at December 30, 2023, a deterioration in the liquidity of the Loan Parties could impact the collectability of the Seller Promissory Notes.

Impairment charges related to long-lived assets or goodwill could adversely impact our financial condition and results of operations

As at December 30, 2023, we had $319.9 million of property, plant and equipment, $105.9 million of operating lease right-of-use assets, and $21.9 million of intangible assets, as well as $4.0 million of goodwill. In addition, prior to fiscal 2019, we recognized accumulated impairment losses of $213.8 million related to goodwill that arose from business acquisitions.

We perform impairment assessments for our long-lived assets annually, or at any time when events occur that could affect the value of these assets. If the results of such assessments were to show that the carrying value of our long-lived assets was not recoverable and the fair value of these assets was less than the carrying value, we would be required to recognize a charge for impairment, and the amount of the impairment charge could be material. Factors which could result in an impairment of a long-lived assets include, but are not limited to, reduced demand or pricing for our products due to increased competition, the loss of a significant customer or market share, or a current expectation that, more likely than not, a long-lived asset may be disposed of before the end of its previously estimated useful life.

Likewise, we perform an annual impairment test for goodwill, or at any time when events occur that could indicate that more likely than not the carrying value of a reporting unit exceeds its fair value. Indicators of goodwill impairment include, but are not limited to, a decline in general economic conditions, an increased competitive environment in which a reporting unit operates, a negative trend in the financial performance and cash flows of the reporting unit, and a more-likely-than-not expectation of selling or disposing of all, or a portion, of a reporting unit.

For the year ended December 30, 2023, on a continuing operations basis, we did not recognize any impairment charges related to our long-lived assets or goodwill. Within discontinued operations, we incurred a pre-tax loss on the sale of Frozen Fruit of $119.8 million, of which a significant portion was comprised of the carrying value of the long-lived assets of the business.

Future impairments of long-lived assets and/or goodwill could materially and adversely impact our business, financial condition, and results of operations.

| SUNOPTA INC. | 11 | December 30, 2023 Form 10-K |

If we lose the services of our key executives, our business could suffer

Our prospects depend to a significant extent on the continued service of our key executives, and our continued growth depends on our ability to identify, recruit, and retain key management personnel. We do not typically carry key person life insurance on our executive officers. If we lose the services of our key executives or fail to identify, recruit, and retain key management personnel, our business, financial condition and results of operations may be materially and adversely impacted.

Failure of our internal control over financial reporting could harm our business and financial results

Our management is responsible for establishing and maintaining effective internal control over financial reporting. Internal control over financial reporting is a process to provide reasonable assurance regarding the reliability of financial reporting for external purposes in accordance with United States generally accepted accounting principles. Because of its inherent limitations, internal control over financial reporting is not intended to provide absolute assurance that we would prevent or detect a misstatement of our financial statements or fraud. Any failure to maintain an effective system of internal control over financial reporting could limit our ability to report our financial results accurately and in a timely manner, or to detect and prevent fraud. A significant financial reporting failure or material weakness in internal control over financial reporting could cause a loss of investor confidence and/or a decline in the market price of our stock. In connection with the preparation of our consolidated financial statements as of and for the fiscal year ended December 31, 2022, we identified a material weakness in our internal control over financial reporting. This material weakness was remediated during the fiscal year ended December 30, 2023. The identified material weakness and associated remediation efforts are further described in Part II, Item 9A of this Form 10-K. Even after any identified material weaknesses have been remediated, investors may lose confidence in our reported financial information and the market price of our common shares may decline.

Risks Related to Litigation and Government Regulations

Product recalls and withdrawals and product liability claims could have a material adverse effect on our business

We sell products for human consumption, which involves risks such as product contamination or spoilage, misbranding, product tampering, and other adulteration of food products. Consumption of a contaminated, spoiled, tampered, or adulterated product may result in personal illness or injury. Under certain circumstances, we may be required to recall or withdraw products, which may be costly and time consuming, and may require the diversion of management's time and resources from business operations. The costs of a recall or withdrawal may include product destruction costs, temporary plant closings, and compliance or remediation costs. In addition, a product recall or withdrawal may cause us to lose future revenues from, or relationships with, one or more material customers, and the impact of the recall or withdrawal could affect our customers' willingness to continue to purchase related or unrelated products from us or could otherwise hinder our ability to grow our business with those customers. Further, we could be subject to claims or lawsuits relating to an actual or alleged illness or injury, and we could incur liabilities that are not insured or that exceed our insurance coverage. Even if product liability claims against us are not successful or fully pursued, these claims could be costly and time consuming to defend against, and the negative publicity surrounding any such claims could adversely affect our reputation. Any of these events could have a material and adverse effect on our business, results of operations, financial condition and cash flows.

In the second quarter of 2023, we announced our subsidiary, Sunrise Growers Inc., had issued a voluntary recall of specific frozen fruit products linked to pineapple provided by a third-party supplier due to possible contamination by Listeria monocytogenes. To date, we have recognized losses of $7.3 million related to this recall, net of estimated insurance recoveries of $4.8 million. We may incur additional losses related to this recall that are unforeseen at this time and we may need to revise our insurance estimate as we work with our insurance providers to substantiate the losses incurred to date. In addition, in the third quarter of 2023, we withdrew specific batches of aseptically-packaged product from a customer due to the discovery of a faulty seal that was traced to an equipment misconfiguration by a third-party service provider. The equipment issue was identified and resolved in the third quarter of 2023, and none of the withdrawn product made it into the consumer marketplace. We have recognized losses of $3.4 million related to the withdrawal, net of expected recoveries from the service provider. Our recovery estimate may need to be revised as we work with the service provider to substantiate our losses.

Potential liabilities and costs from litigation could adversely affect our business

We are, or may become, party to various lawsuits and claims arising in the normal course of business, which may include lawsuits or claims relating to commercial contracts, product recalls, product liability, the marketing and labeling of products, employment matters, environmental matters, data protection, intellectual property, and other aspects of our business. There is no guarantee that we will be successful in defending ourselves in these actions and we could incur substantial costs and fees in defending ourselves or in asserting our rights in these actions. The results of litigation and other legal proceedings are inherently unpredictable and resolutions or dispositions of lawsuits and claims by settlement or otherwise could have a material adverse effect on our business, results of operations, financial condition and cash flows.

| SUNOPTA INC. | 12 | December 30, 2023 Form 10-K |

New laws or regulations or changes in existing laws or regulations could adversely affect our business

The food industry is subject to a variety of federal, state, local, and foreign laws and regulations, including, but not limited to, those related to food safety, food labeling, and environmental matters. Governmental regulations also affect taxes and levies, healthcare costs, energy usage, and labor issues, all of which may have a direct or indirect effect on our business or those of our customers or suppliers. Changes in these laws or regulations, or the introduction of new laws or regulations, could increase the costs of doing business for the Company, our customers, or suppliers, or restrict our actions, causing our results of operations to be adversely affected.

Risks Related to Intellectual Property and Information Technology

We rely on protection of our intellectual property and proprietary rights

Our success depends in part on our ability to protect our intellectual property rights. We rely primarily on patent, copyright, trademark, and trade secret laws to protect our proprietary technologies. Our policy is to protect our technology by, among other things, filing patent applications for technology relating to the development of our business in the U.S. and in selected foreign jurisdictions. Our trademarks and brand names are registered in the U.S., Canada, and other jurisdictions. We intend to keep these filings current and seek protection for new trademarks to the extent consistent with business needs. We also rely on trade secrets and proprietary know-how and confidentiality agreements to protect certain of the technologies and processes that we use. The failure of any patents, trademarks, trade secrets or other intellectual property rights to provide protection to our technologies would make it easier for our competitors to offer similar products, which could result in lower revenues and/or margins and could have a material adverse effect on our business, financial condition and results of operations.

Our business operations could be disrupted if our information technology systems fail to perform adequately or are breached

The efficient operation of our business depends on our information technology systems to process, transmit, and store electronic information. We rely on our information technology systems, including the internet, to effectively manage our business data, supply chain, order entry and fulfillment, and other business processes. Information technology systems are also integral to our internal and external financial reporting. Furthermore, a significant portion of the communications between, and storage of personal data of, our personnel, customers and suppliers depends on information technology. Our information technology systems, some of which are dependent on services provided by third parties, may be susceptible to physical or electronic break-in, damage, disruption, or shutdown due to computer viruses, hacker attacks, and other cybersecurity risks, hardware failures, telecommunications failures, user errors or malfeasance, catastrophic events, natural disasters, fires, or other factors which may be beyond our control. Furthermore, the rapid evolution and increased adoption of artificial intelligence technologies may intensify our cybersecurity risks. If we are unable to anticipate, prevent, or adequately respond to and resolve these failures, disruptions or breaches, our business may be materially disrupted, and we may suffer other adverse consequences such as significant data loss, financial or reputational damage or penalties, legal claims or proceedings, remediation costs, or loss of revenues or customers. Consequently, any failure or breach of our information technology systems could have a material adverse effect on our business, financial condition and results of operations.

Risks Related to Weather, Climate Change, and Other External Factors

Adverse weather conditions and natural disasters could impose costs on our business

Ingredients for our products are vulnerable to adverse weather conditions and natural disasters, including windstorms, hurricanes, earthquakes, floods, droughts, fires, and temperature and precipitation extremes, some of which are recurring but difficult to predict, as well as crop disease and infestation. Severe weather conditions may occur with higher frequency or may be less predictable in the future due to the effects of climate change. Unfavorable growing and harvesting conditions could reduce both crop size and crop quality. In extreme cases, entire harvests may be lost in some geographic areas. Adverse weather conditions or natural disasters may adversely affect our supply of raw materials or prevent or impair our ability to ship products as planned. These factors may increase raw material acquisition and production costs, decrease our sales volumes and revenues, and lead to additional charges to earnings, which could have a material adverse effect on our business, financial condition, and results of operations.

| SUNOPTA INC. | 13 | December 30, 2023 Form 10-K |

Climate change, or legal, regulatory or market measures to address climate change, may negatively affect our business, financial condition and results of operations

Long-term climate change impacts on global temperatures, weather patterns, and the frequency and severity of extreme weather and natural disasters may negatively impact the price or availability of ingredients and packaging materials (such as corrugated cardboard) that are necessary for our products. We may also be subjected to decreased availability of and/or less favorable pricing for water, which could adversely impact our manufacturing operations.

There is an increased focus by U.S. federal, state and local regulatory and legislative bodies, as well as foreign bodies, regarding environmental policies relating to climate change, regulating greenhouse gas emissions, energy policies, and sustainability. Increased compliance costs and expenses due to the impacts of climate change and additional legal or regulatory requirements regarding climate change may cause disruptions in, or an increase in the costs associated with, the running of our manufacturing facilities and our business, as well as increase distribution and supply chain costs. In addition, compliance with any such legal or regulatory requirements may require us to make significant changes in our business operations and strategy, which will likely require us to devote substantial time and attention to these matters and cause us to incur additional costs. Even if we make changes to align ourselves with such legal or regulatory requirements, we may still be subject to significant penalties or potential litigation if such laws and regulations are interpreted and applied in a manner inconsistent with our practices. The effects of climate change and legal or regulatory initiatives to address climate change could have a long-term adverse impact on our business and results of operations.

Additionally, we might fail to effectively address increased attention from customers, consumers, investors, activists and other stakeholders on climate change and related environmental sustainability matters. Such failure, or the perception that we have failed to act responsibly regarding climate change, whether or not valid, could result in adverse publicity and negatively affect our business and reputation. In addition, customers and consumers may choose to stop purchasing our products or purchase products from another company or a competitor, and our business, financial condition and results of operations may be materially and adversely affected.

Furthermore, we may from time to time establish and publicly announce goals and commitments to reduce our impact on the environment. Our ability to achieve any stated goal or commitment is subject to numerous factors and conditions, many of which are outside of our control. Examples of such factors include evolving regulatory requirements affecting sustainability standards or disclosures, the development of new environmental technologies to address climate change, and the availability of financing to support climate-related projects. In addition, we may determine that it is in the best interest of our company and our shareholders to prioritize other business investments over the achievement of our current environmental goals and commitments based on economic conditions, changes in our business strategy, or pressure from investors or other stakeholders. If we fail to achieve or are perceived to have failed or been delayed in achieving, or improperly report our progress toward achieving our goals and commitments, it could negatively affect customer and consumer preference for our products or investor confidence in our business, as well as expose us to enforcement actions and litigation.

Our business may be adversely affected by the availability of non-GMO and organic commodities and ingredients

Our ability to ensure a continuing supply of non-GMO and organic ingredients at competitive prices depends on many factors beyond our control, including the number and size of farms that grow non-GMO and organic crops. The non-GMO and organic raw materials that we use in the production of our products, including, among others grains, nuts, fruits, sweeteners, and flavorings, are vulnerable to adverse weather conditions and natural disasters, such as floods, droughts, water scarcity, temperature extremes, frosts, earthquakes, and pestilences. Natural disasters and adverse weather conditions can reduce crop size and crop quality, which in turn could reduce our supplies of and/or increase the price of non-GMO and organic raw materials. If our supplies of non-GMO and organic raw materials are reduced, we may not be able to find enough supplemental supply sources on favorable terms, if at all, which could impact our ability to supply product to our customers and adversely affect our business, financial condition, and results of operations.

Risks Related to Our Indebtedness and Liquidity

Increases in interest rates may negatively impact our cost of borrowing and access to capital financing

To address inflation, the U.S. Federal Reserve implemented tighter monetary policies beginning in 2022, causing interest rates to rise significantly, which negatively impacted the cost of borrowing on our variable rate debt beginning in 2022. As at December 30, 2023, we had approximately $212 million of variable rate debt outstanding under our credit agreement. We expect interest rates to remain at elevated levels in 2024, and we continue to be exposed to further changes in interest rates, which could have a material negative impact on our business, financial condition, results of operations and cash flows.

| SUNOPTA INC. | 14 | December 30, 2023 Form 10-K |

Our level of indebtedness could adversely affect our financial condition and prevent us from fulfilling our debt obligations

As at December 30, 2023, we have a significant amount of indebtedness outstanding as a result of the capital investments we have made in recent years. The level of our indebtedness and the degree to which we are leveraged could adversely affect our business, financial condition, and results of operations, including, without limitation, increasing our exposure to interest rate fluctuations and impairing our ability to obtain additional financing for working capital, capital expenditures, debt service requirements, acquisitions, or other general corporate purposes. In addition, we may have to use a substantial portion of our cash flow to pay principal and interest on our indebtedness, which may reduce the funds available to us for other purposes. If we do not generate sufficient cash flows to satisfy our debt service obligations, we may have to undertake alternative financing plans, such as refinancing or restructuring our debt, selling assets, reducing or delaying capital expenditures, or seeking to raise additional capital. A high level of indebtedness and leverage could also make us more vulnerable to economic downturns and adverse industry conditions and may compromise our ability to capitalize on business opportunities, and to react to competitive pressures as compared to our competitors.

Our debt and equity agreements restrict how we may operate our business, and our business may be materially and adversely affected if these restrictions prevent us from implementing our business plan

The agreements governing our debt and preferred equity instruments contain restrictive covenants that limit the discretion of our management with respect to certain business matters. These covenants place restrictions on, among other things, our ability to obtain additional debt financing or preferred equity, to create other liens, to complete a merger, amalgamation, or consolidation, to make certain distributions or make certain payments, investments and guarantees and to sell or otherwise dispose of certain assets. These restrictions may hinder our ability to execute on our growth strategy or prevent us from implementing parts of our business plan.

Our business could be materially and adversely affected if we are unable to meet the financial covenants of our credit agreement

Our credit agreement requires us to maintain a minimum fixed charge coverage ratio and a maximum consolidated total net leverage ratio. Our ability to comply with the financial covenants under the credit agreement will depend on the success of our businesses, our operating results, and our ability to achieve our financial forecasts. Various risks, uncertainties and events beyond our control could affect our ability to comply with the financial covenants and terms of the credit agreement. Failure to comply with the financial covenants and other terms could result in an event of default and the acceleration of amounts owing under the credit agreement unless we are able to negotiate a waiver. The lenders could condition any such waiver on an amendment to the credit agreement on terms, including, but not limited to, the payment of consent fees, which may be unfavorable to us. If we fail to comply with the financial covenants and we are unable to negotiate a covenant waiver or replace or refinance the credit agreement on favorable terms, our business, financial condition and results of operations could be materially and adversely impacted.

We may require additional capital, which may not be available on favorable terms or at all

Our working capital requirements, capital investment plans, and our ability to acquire complementary businesses or assets often require significant financial resources. Our ability to raise capital, through debt or equity financing, is directly related to our ability to both continue to grow our revenues and improve the profitability of our operations. Debt or equity financing may not be available to us on favorable terms or at all. In addition, any potential debt financing could adversely affect our financial condition and increase our exposure to interest rate changes, while any potential equity financing would dilute our current shareholders and may result in a decrease in our share price if we are unable to realize adequate returns.

Our ability to maintain current levels of working capital may be adversely affected if we are unable to utilize supply chain financing ("SCF") programs to accelerate payment terms for certain customers

To improve working capital efficiency, we utilize SCF programs offered by some of our major customers that allow us to monetize our receivables from those customers earlier than our payment terms would provide. To the extent that these various SCF programs were terminated, our financial condition, cash flows, and liquidity could be adversely affected by higher working capital levels due to delays in collecting accounts receivables. If working capital is negatively impacted by the termination of these programs, and we are unable to secure alternative financing sources, we may have to increase our debt borrowings, along with the associated interest expense.

| SUNOPTA INC. | 15 | December 30, 2023 Form 10-K |

Risks Related to Significant Investors and Shareholder Activism

Our significant investor may have interests that conflict with those of our debtholders and other stakeholders

As at December 30, 2023, Oaktree Capital Management L.P., a private equity investor (together with its affiliates, "Oaktree") held an approximately 20% voting interest in the Company and has nominated two members of our Board of Directors. The interests of Oaktree may differ from the interests of our other stakeholders in material respects. For example, Oaktree may have an interest in directly or indirectly pursuing acquisitions, divestitures, financings, or other transactions that, in their judgment, could enhance their other equity investments, even though such transactions might involve risks to us, including risks to our liquidity and financial condition. Oaktree is in the business of making or advising on investments in companies, including businesses that may directly or indirectly compete with certain portions of our business. Oaktree may also pursue acquisition opportunities that may be complementary to our business, and, as a result, those acquisition opportunities may not be available to us.

Our other large investors do not have specific rights beyond those of smaller holders of our common shares. However, a concentration of ownership within our large investors could potentially be disadvantageous to, or conflict with, interests of our debtholders or smaller shareholders. In addition, if any significant shareholder were to sell or otherwise transfer all or a large percentage of its holdings, we could find it difficult to raise capital, if needed, through the sale of additional equity securities.

Our business could be negatively impacted as a result of shareholder activism or an unsolicited takeover proposal or a proxy contest

In recent years, proxy contests and other forms of shareholder activism have been directed against numerous public companies. If a proxy contest or an unsolicited takeover proposal is made with respect to us, we could incur significant costs in defending the Company, which would have an adverse effect on our financial results. Shareholder activists may also seek to involve themselves in the governance, strategic direction, and operations of the Company. Such proposals may disrupt our business and divert the attention of our management and employees, and any perceived uncertainties as to our future direction resulting from such a situation could result in the loss of potential business opportunities, be exploited by our competitors, cause concern to our current or potential customers, and make it more difficult to attract and retain qualified personnel and business partners, all of which could adversely affect our business. In addition, actions of activist shareholders may cause significant fluctuations in our stock price based on temporary or speculative market perceptions or other factors that do not necessarily reflect the underlying fundamentals and prospects of our business.

Risks Related to Ownership of our Common Shares

Our share price is subject to significant volatility

Our share price may be highly volatile compared to larger public companies, which increases the chance of larger than normal price swings that could reduce predictability in the price of our common shares and impair investment decisions. In addition, price and volume trading volatility in the stock markets can have a substantial effect on our share price, frequently for reasons other than our operating performance. These broad market fluctuations could adversely affect the market price of our common shares.

Periods of volatility in the overall market and the market price of a company's securities is often followed by securities class action litigation alleging material misstatements or omissions in disclosures provided to shareholders. Such litigation, if instituted against us, could result in substantial costs and a diversion of our management's attention and resources.

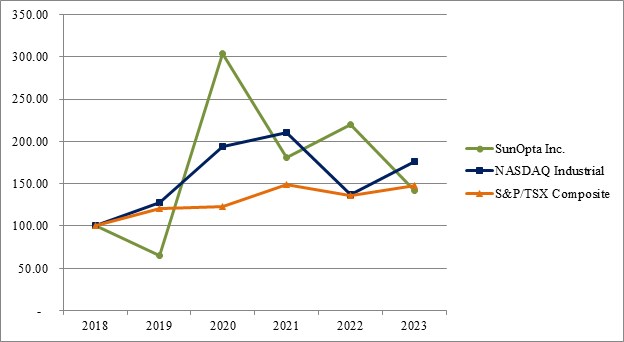

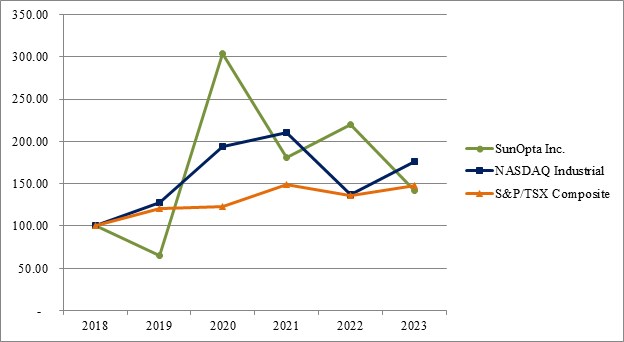

Our debt instruments restrict, and our future debt instruments may restrict, our ability to pay dividends to our shareholders, and we do not currently intend to pay any cash dividends on our common shares in the foreseeable future; therefore, our shareholders may not be able to receive a return on their common shares until their shares are sold