UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |  |

| (Mark One) | | |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended June 30, 2009

OR

| |  |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

to

Commission File Number 1-9728

EPOCH HOLDING CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| |  |

| Delaware | | 20-1938886 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

640 Fifth Avenue, New York, NY 10019

(Address of Principal Executive Offices), (Zip Code)

(212) 303-7200

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| |  |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 per share par value | | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yeso Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yeso Nox

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in rule 12b-2 of the Exchange Act. (Check one).

| |  | |  | |  |

| Large accelerated filero | | Accelerated filerx | | Non-accelerated filero

(Do not Check if a Smaller Reporting Company) | | Smaller reporting companyo |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the proceeding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yeso Noo

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yeso Nox

As of December 31, 2008, the last trading day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of common stock held by nonaffiliates of the registrant was approximately $95.7 million, computed by reference to the closing price of $7.59 on the NASDAQ Capital Market on December 31, 2008.

As of September 9, 2009, there were 22,191,173 shares of the registrant’s common stock, $.01 par value per share, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated herein by reference into the Form 10-K as indicated:

| |  |

| Document | | Part of Form 10-K into Which Incorporated |

Company’s Definitive Proxy Statement for the 2009

Annual Meeting of Shareholders | | Part III |

TABLE OF CONTENTS

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2009

TABLE OF CONTENTS

| |  |

| Form 10-K Item Number: | | Page |

PART I

| | | | |

Item.

| | | | |

1. Business | | | 1 | |

1A. Risk Factors | | | 9 | |

1B. Unresolved Staff Comments | | | 15 | |

2. Properties | | | 15 | |

3. Legal Proceedings | | | 15 | |

4. Submission of Matters to a Vote of Security Holders | | | 15 | |

PART II

| | | | |

5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities | | | 16 | |

6. Selected Financial Data | | | 19 | |

7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations | | | 21 | |

7A. Quantitative and Qualitative Disclosures About Market Risk | | | 42 | |

8. Financial Statements and Supplementary Data | | | 45 | |

9. Changes in and Disagreements with Accountants on Accounting and Financial

Disclosure | | | 74 | |

9A. Controls and Procedures | | | 74 | |

9B. Other Information | | | 74 | |

PART III

| | | | |

10. Directors, Executive Officers and Corporate Governance | | | 75 | |

11. Executive Compensation | | | 75 | |

12. Security Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters | | | 75 | |

13. Certain Relationships and Related Transactions and Director Independence | | | 75 | |

14. Principal Accountant Fees and Services | | | 75 | |

PART IV

| | | | |

15. Exhibits and Financial Statement Schedules | | | 76 | |

| Signatures | | | 78 | |

i

TABLE OF CONTENTS

PART I

Item 1. Business

Forward-Looking Statements

Certain information included, or incorporated by reference in this Annual Report on Form 10-K and other materials filed or to be filed by Epoch Holding Corporation (“Epoch” or the “Company”) with the Securities and Exchange Commission (the “SEC”) contain statements that may be considered forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about the Company, may include projections of the Company’s future financial performance based on the Company’s anticipated growth strategies and trends in the Company’s business. These statements are only predictions based on the Company’s current expectations and projections about future events. There are important factors that could cause the Company’s actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the risks and uncertainties outlined in Item 1A. “Risk Factors.”

These risks and uncertainties are not exhaustive. Other sections of this Annual Report on Form 10-K may include additional factors which could adversely impact the Company’s business and financial performance. Moreover, the Company operates in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for the Company’s management to predict all risks and uncertainties, nor can the Company assess the impact of all factors on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although the Company believes the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, level of activity, performance or achievements. Moreover, neither the Company nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The Company is under no duty to update any of these forward-looking statements after the date of this Annual Report on Form 10-K, nor to conform the Company’s prior statements to actual results or revised expectations, and the Company does not intend to do so.

Forward-looking statements include, but are not limited to, statements about the Company’s:

| • | business strategies and investment policies, |

| • | possible or assumed future results of operations and operating cash flows, |

| • | potential growth opportunities, |

| • | potential operating performance, achievements, productivity improvements, efficiency and cost reduction efforts, |

| • | expectations with respect to the economy, securities markets, the market for mergers and acquisitions activity, the market for asset management activity and other industry trends, |

| • | the effect of future legislation and regulation on the Company. |

1

TABLE OF CONTENTS

Overview

Epoch Holding Corporation is a holding company headquartered in New York, NY whose sole line of business is investment advisory and investment management services. The operations of the Company are conducted through its wholly owned subsidiary, Epoch Investment Partners, Inc. (“EIP”). EIP is a registered investment adviser under the Investment Advisers Act of 1940, as amended (the “Investment Advisers Act”).

The Company uses a fiscal year, which ends on June 30. References to “FY 2009,” “FY 2008,” and “FY 2007” in this document refer to the fiscal years ended June 30, 2009, June 30, 2008, and June 30, 2007, respectively. This Annual Report on Form 10-K may also include “forward-looking statements” which refer to fiscal years subsequent to the historical financial positions and results of operations contained herein. References to future fiscal years also apply to the June 30 year-end. When we use the terms the “Company,” “management,” “we,” “us,” and “our,” we mean Epoch Holding Corporation, a Delaware Corporation, and its consolidated subsidiaries.

Recent Events and FY 2009 Highlights*

The following highlights mark notable accomplishments or events of the Company which transpired during its recent fiscal year of operations:

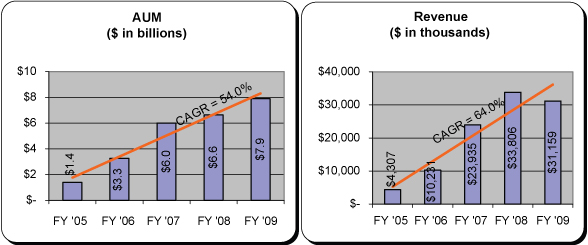

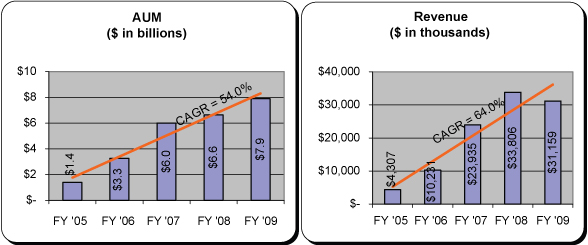

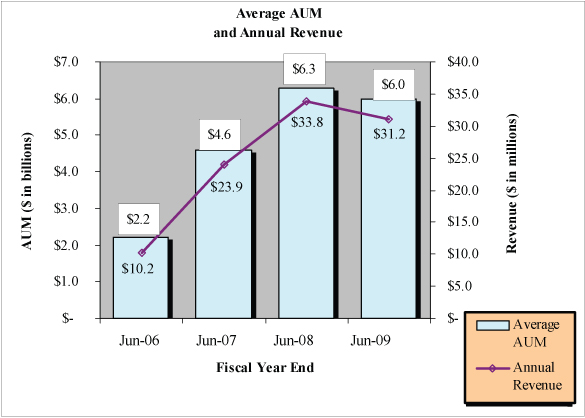

| (1) | Assets under management (“AUM”) at June 30, 2009 were $7.9 billion, a 19% increase from a year ago. |

| (2) | Net AUM inflows were $2.7 billion, despite a challenging market. The Company has experienced positive net inflows every quarter since inception. |

| (3) | During June 2009, the Company was appointed as a sub-advisor to The MainStay Funds family of mutual funds, the retail distribution arm of New York Life Investment Management LLC. The Company was appointed to sub-advise approximately $1.1 billion of assets in six existing portfolios which are managed by New York Life Investment Management LLC. |

| (4) | In March 2009, the Epoch Global Equity Shareholder Yield Fund (“ESPYX”) received the Lipper Fund Award for “best in class” over the past three years in the Global Multi-Cap Value Funds classification. |

| (5) | The Company launched the Epoch U.S. Large Cap Equity Fund in December 2008. |

| (6) | Beginning with the first quarter of FY 2009, the Board of Directors increased the quarterly dividend paid on common shares by 20%, from $0.025 to $0.03 per share. During the second quarter, the Board of Directors declared a special cash dividend of $0.12 per share. |

| (7) | The Board of Directors authorized the repurchase of up to an additional 250,000 shares of its fully diluted outstanding common stock during the third fiscal quarter. This authorization followed the completion of the previous 250,000 share repurchase program. The Company has repurchased approximately 23,000 shares as of June 30, 2009 since the completion of the first repurchase program. |

| (8) | On July 1, 2008, our outstanding Preferred Stock was converted by the holder to Common Stock. The conversion eliminated the holder’s rights to receive the semi-annual dividends on such Preferred Stock. |

| (9) | The Company’s balance sheet continues to strengthen. At June 30, 2009, cash balances were $37.0 million and investments in Company sponsored products were $3.3 million. Combined these represent 73% of total assets. The Company remains debt-free. |

| * | See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, for further financial highlights. |

2

TABLE OF CONTENTS

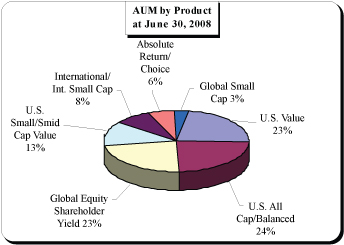

Products

EIP, the sole operating segment of the Company, is a registered investment adviser under the Investment Advisers Act. EIP provides investment advisory and investment management services for retirement plans, mutual funds, endowments, foundations and high net worth individuals. As of June 30, 2009, EIP offered the following investment products to its clients:

| (1) | U.S. All Cap Value — This product is comprised of a broad range of U.S. companies with market capitalizations that resemble stocks in the “Russell 3000,” a U.S. Equity index which measures the performance of the 3,000 largest U.S. companies based upon total market capitalization. |

| (2) | U.S. Value — This product reflects a selection of equities in U.S. companies with market capitalizations generally considered comparable to the “Russell 1000,” a U.S. Equity index which measures the performance of the 1,000 largest companies in the Russell 3000 Index. |

| (3) | U.S. Smid (small/mid) Cap Value — This product comprises U.S. companies with market capitalizations generally considered to be comparable to the “Russell 2500,” a U.S. Equity index which measures the performance of the 2,500 smallest companies in the Russell 3000 Index. |

| (4) | U.S. Small Cap Value — This product comprises U.S. companies with market capitalizations generally considered to be comparable to the “Russell 2000,” a U.S. Equity index which measures the performance of the 2,000 smallest companies in the Russell 3000 Index. |

| (5) | U.S. Choice — This product uses the same security selection process as our other services but the holdings are limited to 20 – 30 U.S. equity positions and are fully invested. The benchmark for this product is the Russell 3000 Index. |

| (6) | International Small Cap — This product draws almost all of its holdings from companies outside the U.S., with “small cap” defined as companies with market capitalization in the bottom 25% of the publicly traded companies in each country where the strategy is applied. The benchmark for this product is the S&P EPAC SmallCap Index. |

| (7) | Global Small Cap — This product seeks to capitalize upon the continuing globalization of the world economy by investing in small cap companies in the U.S. and throughout the world. The benchmark for this product is the S&P Developed SmallCap Index. |

| (8) | Global Choice — This product uses the same security selection process as our other services but the holdings are limited to 20 – 30 global equity positions and are fully invested. The benchmark for this product is the MSCI World Index. |

| (9) | Global Absolute Return — While this product uses the same security selection process of other products offered by EIP, its holdings are generally limited to fewer than 30 positions. Individual positions can be as high as 15% and cash is used to control loss exposure. The objective of this product is absolute positive return. The benchmark for this product is the MSCI World Index. |

| (10) | Global Equity Shareholder Yield — This product seeks to invest in a diversified portfolio of global equity securities with a history of attractive dividend yields and positive growth in free cash flow. The primary objective of this product is to seek a high level of income, with capital appreciation as a secondary investment objective. The benchmark for this product is the S&P Developed BMI World Index. |

| (11) | Balanced Portfolios — This product is available primarily to our high net worth investors. The mix of debt and equity securities is tailored to reflect (i) the client’s tolerance for risk and (ii) the client’s marginal tax rate or other preferences. As a result, the mix can vary among individual clients. The equity components of these portfolios typically reflect EIP’s U.S. All Cap equity structure and generally contain 40 – 60 positions, almost all of which are held in other EIP products. The debt component of the portfolio is largely comprised of high quality bonds. |

3

TABLE OF CONTENTS

Product Development

We have developed several products since our inception. Continued product development has stemmed from our close business relationships with our client base, our investment team’s skill and market knowledge, as well as our responsiveness to client and market demands. The Company continues to focus on further developing new products and investment strategies for our clients.

Performance Highlights

Epoch finished its most recent fiscal year with AUM of $7.9 billion, an increase of 19% from the previous year. Over the past five years, Epoch’s AUM has had a compound annual growth rate of 56.2%.

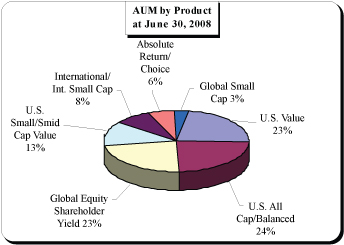

Assets Under Management by Asset Class

($ in Millions)

| |  | |  | |  | |  | |  | |  | |  |

| | As of June 30 |

| Product | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | | CAGR(3) |

| U.S. Value | | $ | 2,340 | | | $ | 1,499 | | | $ | 1,155 | | | $ | 805 | | | $ | — | | | $ | — | | | | 42.7 | % |

| U.S. All Cap Value/Balanced | | | 2,016 | | | | 1,601 | | | | 1,395 | | | | 787 | | | | 519 | | | | 315 | | | | 45.0 | % |

| Global Equity Shareholder Yield | | | 1,515 | | | | 1,538 | | | | 1,323 | | | | 219 | | | | — | | | | — | | | | 90.5 | % |

| U.S. Small Cap Value/Smid | | | 1,074 | | | | 832 | | | | 1,008 | (2) | | | 661 | | | | 549 | | | | 355 | | | | 24.8 | % |

| International/International Small Cap | | | 396 | | | | 548 | | | | 688 | | | | 373 | | | | 271 | | | | 175 | | | | 17.7 | % |

| Global Absolute Return/Choice(1) | | | 375 | | | | 402 | | | | 259 | | | | 111 | | | | — | | | | — | | | | 50.1 | % |

| Global Small Cap | | | 175 | | | | 214 | | | | 173 | (2) | | | 297 | | | | 63 | | | | 3 | | | | 125.5 | % |

| Total assets under management | | $ | 7,891 | | | $ | 6,634 | | | $ | 6,001 | | | $ | 3,253 | | | $ | 1,402 | | | $ | 848 | | | | 56.2 | % |

| (1) | includes U.S. Choice and Global Choice. |

| (2) | In the year ended June 30, 2007, approximately $150 million of AUM transferred from the Global Small Cap product to the U.S. Small Cap Value product. |

| (3) | CAGR — Compound annual growth rate. The compound annual growth rate is calculated by taking the nth root of the total percentage growth rate, where n equals the number of years in the period being considered. |

4

TABLE OF CONTENTS

The following table shows each product’s composite returns, net of management fees, for the six months, one, three, five, and ten years ended June 30, 2009 as well as through inception as measured against their applicable benchmarks:

| |  | |  | |  | |  | |  | |  | |  |

| Product | | Inception

Date(1) | | Returns*(2) |

| | 6

Months | | 1

Year | | 3

Years | | 5

Years | | 10

Years | | Since

Inception |

| U.S. Value | | | 31-Jul-01 | | | | 7.9 | % | | | (25.9 | )% | | | (4.0 | )% | | | 2.3 | % | | | N/A | | | | 2.2 | % |

| Russell 1000 Value | | | | | | | (2.9 | )% | | | (29.0 | )% | | | (11.1 | )% | | | (2.1 | )% | | | N/A | | | | (0.2 | )% |

| U.S. All Cap Value | | | 31-Jul-94 | | | | 6.3 | % | | | (29.8 | )% | | | (6.3 | )% | | | 0.7 | % | | | 5.6 | % | | | 9.2 | % |

| Russell 3000 Value | | | | | | | (3.0 | )% | | | (28.7 | )% | | | (11.2 | )% | | | (2.1 | )% | | | 0.2 | % | | | 7.3 | % |

| Global Equity Shareholder Yield | | | 31-Dec-05 | | | | 2.7 | % | | | (21.5 | )% | | | (3.7 | )% | | | N/A | | | | N/A | | | | (1.5 | )% |

| S&P Developed BMI Index | | | | | | | 8.2 | % | | | (29.0 | )% | | | (7.6 | )% | | | N/A | | | | N/A | | | | (4.8 | )% |

| U.S. Small Cap Value | | | 31-Dec-02 | | | | 7.1 | % | | | (25.1 | )% | | | (7.0 | )% | | | (0.6 | )% | | | N/A | | | | 5.0 | % |

| Russell 2000 Value | | | | | | | (5.2 | )% | | | (25.2 | )% | | | (12.1 | )% | | | (2.3 | )% | | | N/A | | | | 5.4 | % |

| U.S. Smid Cap Value | | | 31-Aug-06 | | | | 9.1 | % | | | (26.0 | )% | | | N/A | | | | N/A | | | | N/A | | | | (8.1 | )% |

| Russell 2500 Value | | | | | | | (0.6 | )% | | | (26.2 | )% | | | N/A | | | | N/A | | | | N/A | | | | (12.2 | )% |

| International Small Cap Value | | | 31-Jan-05 | | | | 16.2 | % | | | (33.8 | )% | | | (6.9 | )% | | | N/A | | | | N/A | | | | 3.2 | % |

| S&P EPAC SmallCap Index | | | | | | | 17.3 | % | | | (30.1 | )% | | | (7.9 | )% | | | N/A | | | | N/A | | | | 1.0 | % |

| Global Absolute Return | | | 31-Dec-01 | | | | 10.5 | % | | | (19.2 | )% | | | (3.0 | )% | | | 4.1 | % | | | N/A | | | | 7.8 | % |

| MSCI World Index (Net) | | | | | | | 6.4 | % | | | (29.5 | )% | | | (8.0 | )% | | | 0.0 | % | | | N/A | | | | 1.3 | % |

| U.S. Choice | | | 30-Apr-05 | | | | 4.6 | % | | | (26.0 | )% | | | (7.5 | )% | | | N/A | | | | N/A | | | | (2.4 | )% |

| Russell 3000 | | | | | | | 4.2 | % | | | (26.6 | )% | | | (8.3 | )% | | | N/A | | | | N/A | | | | (3.0 | )% |

| Global Choice | | | 30-Sep-05 | | | | 8.8 | % | | | (25.5 | )% | | | (1.9 | )% | | | N/A | | | | N/A | | | | 2.1 | % |

| MSCI World Index (Net) | | | | | | | 6.4 | % | | | (29.5 | )% | | | (8.0 | )% | | | N/A | | | | N/A | | | | (4.2 | )% |

| Global SmallCap | | | 31-Dec-02 | | | | 11.5 | % | | | (25.3 | )% | | | (4.6 | )% | | | 3.3 | % | | | N/A | | | | 8.8 | % |

| S&P Developed SmallCap Index | | | | | | | 12.2 | % | | | (30.9 | )% | | | (8.9 | )% | | | 1.5 | % | | | N/A | | | | 8.7 | % |

| * | Index and product returns assume dividend reinvestment. Product returns are net of management fees. |

| (1) | Epoch Investment Partners became a registered investment adviser under the Investment Advisers Act of 1940 in June 2004. Performance from April 2001 through May 2004 is for Epoch’s investment team and accounts while at Steinberg Priest & Sloane Capital Management, LLC. For the period July 1994 through March 2001, Chief Investment Officer William W. Priest managed the accounts while at Credit Suisse Asset Management and was the only individual responsible for selecting the securities to buy and sell. |

| (2) | Past performance is not indicative of future results. |

EIP earns its revenues from managing client accounts under investment advisory and sub-advisory agreements. Such agreements provide for fees to EIP as a percentage of AUM. Separate account fees are billed on a quarterly basis, in arrears, generally based on the account’s asset value at the end of a quarter. Fees for services performed for mutual funds under advisory and sub-advisory contracts are calculated based upon the daily net asset values of the respective fund, and are generally received in arrears. Advance payments, if received, are deferred and recognized during the periods for which services are provided.

The Company launched the Epoch U.S. Large Cap Equity Fund (“EPLCX”) in December 2008. The Company also sponsors three other mutual funds, the Epoch International Small Cap Fund (“EPIEX”), the Epoch Global Equity Shareholder Yield Fund (“EPSYX”), and the Epoch U.S. All Cap Equity Fund (“EPACX”).

5

TABLE OF CONTENTS

The following table shows each of the Company-sponsored mutual fund’s performance, net of management fees, for the six months and one year ended June 30, 2009 and returns since fund inception as measured against their applicable benchmarks:

| |  | |  | |  | |  | |  | |  |

| Mutual Fund(2) | | Morningstar

Overall

Rating | | Ticker

Symbol | | Inception

Date | | Returns*(1) |

| | 6 Months | | 1 Year | | Inception |

| Epoch International Small Cap Fund | | |  | | | | EPIEX | | | | 25-Jan-05 | | | | 16.1 | % | | | (33.6 | )% | | | 3.0 | % |

| S&P EPAC SmallCap Index | | | | | | | | | | | | | | | 17.3 | % | | | (30.1 | )% | | | 1.0 | % |

| Epoch Global Equity Shareholder Yield Fund | | |  | | | | EPSYX | | | | 27-Dec-05 | | | | 1.9 | % | | | (22.3 | )% | | | (1.9 | )% |

| S&P Developed BMI World Index | | | | | | | | | | | | | | | 8.2 | % | | | (29.0 | )% | | | (4.8 | )% |

| Epoch U.S. All Cap Equity Fund | | |  | | | | EPACX | | | | 25-Jul-05 | | | | 5.5 | % | | | (30.2 | )% | | | (4.6 | )% |

| Russell 3000 | | | | | | | | | | | | | | | 4.2 | % | | | (26.6 | )% | | | (5.1 | )% |

| Epoch U.S. Large Cap Equity Fund | | | NR | | | | EPLCX | | | | 3-Dec-08 | | | | 7.1 | % | | | N/A | | | | 16.3 | % |

| Russell 1000 | | | | | | | | | | | | | | | 4.3 | % | | | | | | | 12.1 | % |

| * | Index and Fund returns assume dividend reinvestment. |

| (1) | Past performance is not indicative of future results. |

| (2) | Represents institutional class of shares. |

NR — Not rated.

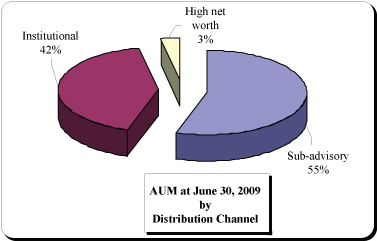

Distribution Channels

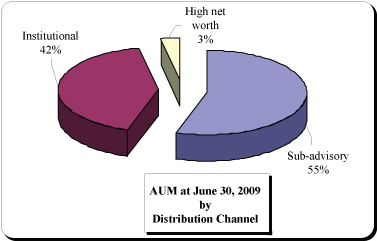

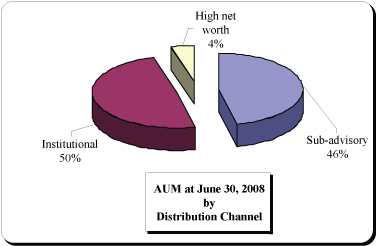

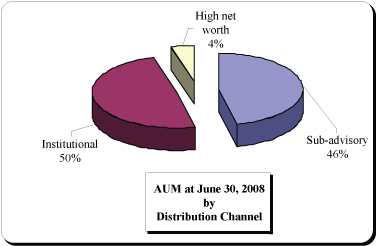

The following table provides information regarding the composition of our AUM and respective compound annual growth rate by distribution channel for each fiscal year since the inception of the Company:

| |  | |  | |  | |  | |  | |  | |  |

| Product | | As of June 30 | | 5 Year

CAGR |

| | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 |

| Sub-advisory | | $ | 4,332 | | | $ | 3,080 | | | | 2,876 | | | $ | 1,715 | | | $ | 922 | | | $ | 609 | | | | 48.1 | % |

| Institutional | | | 3,309 | | | | 3,263 | (1) | | | 2,765 | | | | 1,245 | | | | 233 | | | | 28 | | | | 159.7 | % |

| High net worth | | | 250 | | | | 291 | (1) | | | 360 | | | | 293 | | | | 247 | | | | 211 | | | | 3.5 | % |

| Total assets under management | | $ | 7,891 | | | $ | 6,634 | | | $ | 6,001 | | | $ | 3,253 | | | $ | 1,402 | | | $ | 848 | | | | 56.2 | % |

| (1) | During the fiscal year ended June 30, 2008, approximately $28 million of AUM in separate accounts within the high net worth distribution channel transferred to the Epoch Global Absolute Return Fund, LLC, and approximately $8 million transferred to the Epoch U.S. All Cap Equity Fund, both of which are included within the Institutional distribution channel above. |

Significant Customers

For the fiscal year ended June 30, 2009, CI Investments Inc. (“CI”), a leading Canadian-owned investment management company for whom EIP acts as a sub-advisor, accounted for approximately 13% of consolidated revenues. Genworth Financial Asset Management, Inc. (“Genworth”), a prominent investment adviser, through its investments in the Epoch International Small Cap Fund (“EPIEX”) and the Epoch Global Equity Shareholder Yield Fund (“EPSYX”), as well as separate account mandates, also accounted for approximately 13% of consolidated revenues. The Company’s services and relationships with these clients are important to the Company’s ongoing growth strategy, and retention of these customers is significant to the ongoing results of operations of the Company.

6

TABLE OF CONTENTS

Growth Strategy

As the Company enters its sixth full year of operations, its growth strategy will continue to be focused on the development of distribution channels to offer its various products to a broad array of clients. These efforts have included, and will continue to include, developing relationships with investment advisory consultants, initiating managed accounts with third party institutions, and maintaining strong advisory and sub-advisory relationships.

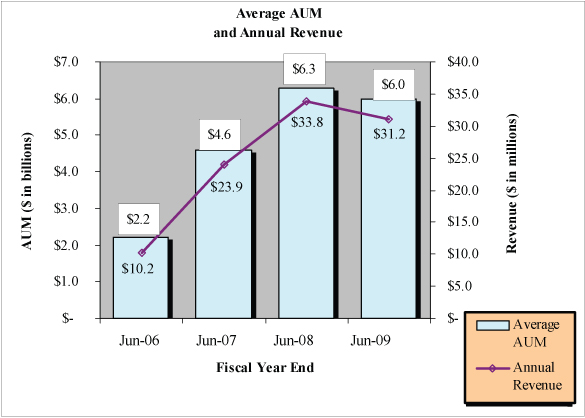

Total AUM and annual revenue since FY 2005, the Company’s first full fiscal year, is set forth in the graphs below.

The Company routinely evaluates its strategic position and maintains a disciplined acquisition and alliance effort that seeks complementary products or new products which could benefit clients. While the Company continues to actively seek such opportunities, there can be no assurance that acquisitions will be identified and consummated on terms that are favorable to the Company, its business and its stockholders. Management believes that opportunities are available, but will only act on opportunities that it believes are accretive to the Company’s long-term business strategy.

Paramount to the continued success of the business and the growth in existing products and retention of clients will be the Company’s ability to attract and retain key employees. The Company believes it offers competitive compensation to its employees, including share-based compensation, which the Company believes promotes a common objective with shareholders.

Competition

The investment advisory and investment management business is highly competitive. The Company continuously encounters competitors in the marketplace who offer similar products and services. Many of the Company’s competitors have well-established national reputations, greater financial resources, and greater market share than the Company. The Company competes primarily on the basis of investment philosophy, performance, product features, range of products, and client service. While the Company believes it will continue to be successful in growing its AUM, it may be necessary to expend additional resources to compete effectively.

Competitive Strengths

We are a global asset management firm with accomplished and experienced professionals that combines in-house research and insight, an absolute return orientation, and a dedication to serving the informed investor. Our professional staff averages over 20 years in our industry. Most importantly, all of our employees are shareholders; ownership binds and is a shared value of the firm.

We are committed to growing and reinvesting in our business. We believe that a company’s capital matters more and more as the costs of doing business have risen in an environment of increasing demands on

7

TABLE OF CONTENTS

compliance and transparency. We are sufficiently capitalized to support operations and continue to grow the business as evidenced by our strong balance sheet.

We are a global firm in both product set and in distribution. We offer a set of investment strategies that allow our clients to access investment opportunities around the world.

Regulation

The Company’s business, as well as the financial services industry, is subject to extensive regulation throughout the world. As a matter of public policy, regulatory bodies are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets. In the U.S., the Securities and Exchange Commission (the “SEC”) is the federal agency responsible for the administration of the federal securities laws. The Financial Industry Regulatory Authority (“FINRA”) and the National Futures Association are voluntary, self-regulatory bodies composed of members that have agreed to abide by the respective bodies’ rules and regulations. Each of these U.S. regulatory organizations may examine the activities of, and may expel, fine and otherwise discipline, member firms and their employees. The laws, rules and regulations comprising this framework of regulation and the interpretation and enforcement of existing laws, rules and regulations are constantly changing. The effect of any such change cannot be predicted and may impact the manner of operation and profitability of the Company.

EIP, the Company’s sole operating subsidiary, is registered as an investment adviser with the SEC. As a registered investment adviser, EIP is subject to the requirements of the Investment Advisers Act and the SEC’s regulations thereunder. Requirements relate to, among other things, principal transactions between an adviser and advisory clients, as well as general anti-fraud prohibitions. The Company is subject to the filing and reporting obligations of the Securities Act of 1933, as amended (the “Securities Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Regulators are empowered to conduct administrative proceedings that can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of an investment adviser or its directors, officers or employees.

The previous descriptions of the regulatory and statutory provisions applicable to the Company and EIP are not complete and are qualified in its entirety by reference to the particular statutory or regulatory provision. Any change in applicable laws or regulations may have a material effect on the Company’s business, prospects and operations.

Employees

As of June 30, 2009, the Company employed 46 full-time employees, including 22 investment management, research and trading professionals, 11 marketing and client service professionals and 13 operations and business management professionals. None of our employees are subject to any collective bargaining agreements.

Available Information

Reports the Company files electronically with the SEC via the SEC’s Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”) may be accessed through the internet. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, at www.sec.gov.

The Company maintains a website which contains current information on operations and other matters. The website address is www.eipny.com. Through the Investor Relations section of our website, and “Link to SEC Website” therein, we make available, free of charge, our Proxy Statement, Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Also available free of charge on our website within the Investors Relations section is our Code of Ethics and Business Conduct and charters for the Audit, Nominating/Corporate Governance, and the Compensation Committees of our Board of Directors.

8

TABLE OF CONTENTS

Item 1A. Risk Factors

As an investment management firm, risk is an inherent part of our business. Capital markets, by their nature, are prone to uncertainty and expose participants to a variety of risks. While the Company devotes significant resources across all of its operations to identify, measure, monitor, manage and analyze market and operating risk, the Company’s business, financial condition, operating results, or share price could be materially adversely affected, however, by any of the following risks. You should carefully consider the risks described below before making an investment decision.

Risks Related to Our Business

Investment performance affects the Company’s AUM relating to existing clients and is one of the most important factors in retaining clients and competing for new asset management business. Poor investment performance could impair the Company’s revenue and growth because:

| • | existing clients might withdraw funds from the Company’s asset management business in favor of better performing products, which would result in lower investment advisory fees; |

| • | third-party financial intermediaries, advisers or consultants may rate the Company’s products poorly, which may result in client withdrawals and reduced asset flows from these third parties or their clients; or |

| • | firms with which the Company has strategic alliances may terminate such relationships with the Company, and future strategic alliances may be unavailable. |

Some members of management are critical to the Company’s success, and the inability to attract and retain key employees could compromise the Company’s future success.

If key employees were to leave, whether to join a competitor or otherwise, the Company may suffer a decline in revenue or earnings and suffer an adverse effect on the Company’s financial position. Loss of key employees may occur due to perceived opportunity for promotion, increased compensation, work environment or other individual reasons, some of which may be beyond the Company’s control.

Except for the Company’s CEO, there are no employment agreements with any other key employees. The loss of services of one or more key employees, or failure to attract, retain and motivate qualified personnel could negatively impact the business, financial condition, results of operations and future prospects. As with other asset management businesses, future performance depends to a significant degree upon the continued contributions of certain officers, portfolio managers and other key marketing, client service and management personnel. There is substantial competition for these types of skilled personnel.

Negative performance of the securities markets could reduce revenues.

The Company’s investment advisory and investment management business also would be expected to generate lower revenues in a market or general economic downturn. Under the Company’s asset management business arrangements, investment advisory fees the Company receives typically are based on the market value of AUM. Accordingly, a decline in the prices of securities would be expected to cause the Company’s revenue and income to decline by:

| • | causing the value of the Company’s AUM to decrease, which would result in lower investment advisory fees, and/or |

| • | causing some of the Company’s clients to withdraw funds from the Company’s asset management business in favor of investments they perceive as offering greater opportunity or lower risk, which also would result in lower investment advisory fees. |

Our future results are dependent upon maintaining an appropriate level of expenses, which is subject to fluctuation.

The level of our expenses is subject to fluctuation and may increase for the following or other reasons: variations in the level of total compensation expense due to, among other things, incentive compensation, changes in our employee count and mix, and competitive factors. There may also be changes in costs to

9

TABLE OF CONTENTS

maintain and enhance our administrative and operating services infrastructure. In periods of slowing growth or declining revenues, profits and profit margins are adversely affected because certain expenses remain relatively fixed.

The Company’s investment style in the asset management business may underperform other investment approaches, which may result in significant client or asset departures or a reduction in AUM.

Even when securities prices are rising, performance can be affected by investment style. Many of the equity investment strategies in the Company’s asset management business share a common investment orientation towards fundamental security selection. The Company believes this style tends to outperform the market in some market environments and underperform it in others. In particular, a prolonged “growth” environment (i.e., a prolonged period whereby growth stocks outperform value stocks) may cause the Company’s investment strategy to go out of favor with some clients, consultants or third-party intermediaries. In combination with poor performance relative to peers, any changes in personnel, extensive periods in particular market environments, or other difficulties, may result in significant client or asset departures or a reduction in AUM.

Because the Company’s clients can remove the assets the Company manages on short notice, the Company may experience unexpected declines in revenue and profitability.

The Company’s investment advisory and sub-advisory contracts are generally cancellable upon very short notice. Institutional and individual clients, and firms with which the Company has strategic alliances, can terminate their relationship with the Company, reduce the aggregate amount of AUM or shift their funds to other types of accounts with different rate structures for a number of reasons — including investment performance, changes in prevailing interest rates and financial market performance. Poor performance relative to other investment management firms may result in decreased inflows into the Company’s investment products, increased withdrawals from the Company’s investment products, and the loss of institutional or individual accounts or strategic alliances. In addition, the ability to terminate relationships may allow clients to renegotiate for lower fees paid for asset management services.

In addition, in the U.S., as required by the Investment Advisers Act, each of the Company’s investment advisory contracts with the mutual funds the Company advises or sub-advises automatically terminates upon its “assignment,” or transfer of the Company’s responsibility for fund management. Each of the Company’s other investment advisory contracts subject to the provisions of the Investment Advisers Act, as required by this act, provides that the contract may not be “assigned” without the consent of the customer. A sale of a sufficiently large block of shares of the Company’s voting securities or other transactions could be deemed an “assignment” in certain circumstances. An assignment, actual or constructive, will trigger these termination provisions and could adversely affect the Company’s ability to continue managing these client accounts.

To the extent that a technical “assignment” of investment advisory contracts arises, the Company will take the necessary steps to provide clients an opportunity to consent to the continuation of their advisory agreements. Such new agreements may need approval by the stockholders of the respective funds. In the event that any of these clients do not consent to a renewal of their agreement, the Company could lose AUM, which would result in a loss of revenue.

There may not be a consistent pattern in the Company’s financial results from period to period, which may make it difficult for the Company to achieve steady earnings growth on a quarterly basis and may cause the price of the Company’s common stock to decline.

The Company may experience significant fluctuations in revenue and profits. Because our revenues are based on the value of AUM, a decline in the value of AUM would adversely affect our revenues. Because of market fluctuations, it may be difficult for the Company to achieve steady earnings growth on a quarterly basis, which could lead to large adverse movements in the price of the Company’s common stock or increased volatility in the Company’s stock price.

10

TABLE OF CONTENTS

Access to clients through intermediaries is important to the Company’s asset management business, and reductions in referrals from such intermediaries or poor reviews of the Company’s products or the Company’s organization by such intermediaries could materially reduce the Company’s revenue and impair the Company’s ability to attract new clients.

The Company’s ability to market its services relies, in part, on receiving mandates from the client base of international and regional securities firms, banks, insurance companies, defined contribution plan administrators, investment consultants and other intermediaries. To an increasing extent, the Company’s business uses referrals from accountants, lawyers, financial planners and other professional advisers. The inability to have this access could materially adversely affect the Company’s business. In addition, many of these intermediaries review and evaluate the Company’s products and the Company’s organization. Poor reviews or evaluations of either the particular products or of the Company may result in client withdrawals or an inability to attract new assets through such intermediaries.

The Company derives a substantial percentage of its revenues from two significant clients.

CI and Genworth each accounted for approximately 13% of revenues for FY 2009. A loss of either one of these clients could negatively impact results of operations of the Company.

Our reputation is critical to our success.

There have been a number of highly publicized cases involving fraud or other misconduct by employees in the financial services industry, and the Company runs the risk that employee misconduct could occur in the Company’s business, as well. For example, misconduct by employees could involve the improper use or disclosure of confidential information, which could result in regulatory sanctions and serious reputational or financial harm. In the Company’s business, the Company has discretion to trade client assets on the client’s behalf and must do so acting in the best interest of the client. As a result, the Company is subject to a number of obligations and standards, and the violation of those obligations or standards may adversely affect the Company’s clients and the Company. The Company has adopted and implemented a number of insider trading, code of ethics, and other related policies and procedures to address such obligations and standards. It is not always possible to deter employee misconduct, and the precautions the Company takes to detect and prevent this activity may not be effective in all cases.

Various factors may prevent the declaration and payment of common stock dividends.

The Company began to pay a quarterly dividend, commencing in the quarter ended December 31, 2007. However, the payment of dividends in the future is subject to the discretion of the Company’s Board of Directors, and various other factors may prevent us from paying dividends. Our Board of Directors will take into account such matters as general business conditions, the Company’s financial results, contractual obligations, and legal and regulatory restrictions.

The Company may pursue acquisitions or joint ventures that could present unforeseen integration obstacles or costs and could dilute the stock ownership of the Company’s stockholders and holders of the Company’s equity securities.

As part of the Company’s long-term business strategy, the Company may pursue joint ventures and other transactions aimed at expanding the geography and scope of the Company’s operations. The Company expects to explore partnership opportunities that the Company believes to be attractive. While the Company is not currently in negotiations with respect to material acquisitions or joint ventures, the Company routinely assesses its strategic position and may in the future seek acquisitions or other transactions to further enhance the Company’s competitive position. If the Company is not correct when it assesses the value, strengths and weaknesses, liabilities and potential profitability of acquisition candidates or is not successful in integrating the operations of the acquired business, the success of the combined business could be compromised.

Acquisitions and joint ventures involve a number of risks and present financial, managerial and operational challenges, including potential disruption of the Company’s ongoing business and distraction of management, difficulty with integrating personnel and financial and other systems, hiring additional management and other critical personnel and increasing the scope, geographic diversity and complexity of the

11

TABLE OF CONTENTS

Company’s operations. The Company’s clients may react unfavorably to the Company’s acquisition and joint venture strategy, the Company may not realize any anticipated benefits from acquisitions, and the Company may be exposed to additional liabilities of any acquired business or joint venture, any of which could materially adversely affect the Company’s revenue and results of operations. In addition, future acquisitions or joint ventures may involve the issuance of additional shares of the Company’s common stock, which would dilute existing ownership of the Company.

Other operational risks may disrupt the Company’s business, result in regulatory action against the Company, or limit the Company’s growth.

The Company’s business is dependent on communications and information systems, including those of the Company’s vendors. Any failure or interruption of these systems, whether caused by fire, other natural disaster, power or telecommunications failure, act of terrorism or war or otherwise, could materially adversely affect the Company’s operating results. Although the Company has back-up systems in place, the Company’s back-up procedures and capabilities in the event of a failure or interruption may not be adequate.

The Company relies heavily on its financial, accounting, trading, compliance and other data processing systems. If any of these systems do not operate properly or are disabled, the Company could suffer financial loss, a disruption of the Company’s business, liability to clients, regulatory intervention or reputational damage. The inability of the Company’s systems to accommodate an increasing volume of transactions also could constrain the Company’s ability to expand its businesses. The Company expects that it will need to continue to upgrade and expand these capabilities in the future to avoid disruption of, or constraints on, the Company’s operations.

The Company may be exposed to data security risks.

A failure to safeguard the integrity and confidentiality of client data from the infiltration by an unauthorized user that is either stored on or transmitted between our information systems or to other third party service provider systems may lead to modifications or theft of critical and sensitive data pertaining to our clients. The costs incurred to correct client data and prevent further unauthorized access could be extensive.

Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and stock price.

We have documented and tested our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent auditors regarding the Company’s internal control over financial reporting. We are in compliance with Section 404 of the Sarbanes-Oxley Act as of June 30, 2009. However, if we fail to maintain adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. In addition, failure to maintain an effective internal control environment could cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our stock price.

Fluctuations in foreign currency exchange rates could lower the Company’s net income or negatively impact the portfolios of the Company’s clients and may affect the levels of the Company’s AUM.

Although most portfolios are in U.S. dollar base currency, certain client portfolios are invested in securities denominated in foreign currencies. Foreign currency fluctuations can adversely impact investment performance for a client’s portfolio. Accordingly, foreign currency fluctuations may affect the levels of the Company’s AUM. As the Company’s AUM includes assets that are denominated in currencies other than U.S. dollars, an increase in the value of the U.S. dollar relative to those non-U.S. currencies may result in a decrease in the dollar value of the Company’s AUM, which, in turn, would result in lower U.S. dollar denominated revenue in the Company’s business. Additionally, while this risk could be limited by foreign currency hedging, some risks cannot be hedged and there is no guarantee that the Company’s hedging activity would be successful. Poor performance could result in decreased AUM, stemming from withdrawal of client assets or a decrease in new assets being raised in the relevant product. Presently, the Company neither participates in hedging activities nor does it have any derivative financial instruments.

12

TABLE OF CONTENTS

Certain changes in accounting and/or financial reporting standards issued by the Financial Accounting Standards Board (“FASB”), the SEC or other standard-setting bodies could have a material adverse impact on the Company’s financial position or results of operations.

The Company is subject to the application of U.S. generally accepted accounting principles (“GAAP”), which periodically are revised and/or expanded. As such, the Company periodically is required to adopt new or revised accounting and/or financial reporting standards issued by recognized accounting standard setters or regulators, including the FASB and the SEC. It is possible that future requirements, including the recently proposed implementation of International Financial Reporting Standards (“IFRS”), could change the Company’s current application of GAAP, resulting in a material adverse impact on the Company’s financial position or results of operations.

Sales of a substantial number of shares of our common stock may adversely affect the market price of our common stock.

Sales of a substantial number of shares of our common stock in the public market, or the perception that such sales could occur, could adversely affect the market price of our common stock.

Risks Related to Our Industry

The Company faces strong competition from financial services firms, many of whom have the ability to offer clients a wider range of products and services than the Company can offer, which could lead to pricing pressures that could materially adversely affect the Company’s revenue and profitability.

The financial services industry is intensely competitive and the Company expects it to remain so. In addition to performance, the Company competes on the basis of a number of factors including the quality of the Company’s employees, transaction execution, the Company’s products and services, innovation, reputation and price. The Company believes that it will experience pricing pressures in the future as some of the Company’s competitors seek to obtain increased market share by reducing fees.

The Company faces increased competition due to a trend toward consolidation.

In recent years, there has been substantial consolidation and convergence among companies in the financial services industry. In particular, a number of large commercial banks, insurance companies and other broad-based financial services firms have established or acquired asset managers or have merged with other financial institutions. Many of these firms have the ability to offer a wide range of products, from loans, deposit-taking and insurance to brokerage and asset management services, which may enhance their competitive position. They also have the ability to support financial advisory services, with commercial banking, insurance and other financial services revenue in an effort to gain market share, which could result in pricing pressure in the Company’s business.

Any event that negatively affects the asset management industry could have a material adverse effect on the Company.

Any event affecting the asset management industry that results in a general decrease in AUM or a significant general decline in the number of advisory clients or accounts could negatively impact revenues. Future growth and success depends, in part, upon the growth of the asset management industry.

The financial services industry faces substantial litigation and regulatory risks, and the Company may face damage to the Company’s professional reputation and legal liability if the Company’s services are not regarded as satisfactory or for other reasons.

As a financial services firm, the Company depends, to a large extent, on the Company’s relationships with its clients and the Company’s reputation for integrity and high-caliber professional services to attract and retain clients. As a result, if a client is not satisfied with the Company’s services, such dissatisfaction may be more damaging to the Company’s business than to other types of businesses.

13

TABLE OF CONTENTS

In recent years, the volume of claims and amount of damages claimed in litigation and regulatory proceedings against financial advisers has been increasing. In the Company’s business, the Company makes investment decisions on behalf of its clients which could result in substantial losses. This may subject the Company to the risk of legal liabilities or actions alleging negligent misconduct, breach of fiduciary duty or breach of contract. These risks often may be difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time. The Company’s engagements typically include broad indemnities from the Company’s clients and provisions designed to limit the Company’s exposure to legal claims relating to the Company’s services, but these provisions may not protect the Company or may not be adhered to in all cases. The Company also may be subject to claims arising from disputes with employees for alleged discrimination or harassment, among other things. These risks often may be difficult to assess or quantify, and their existence and magnitude often remain unknown for substantial periods of time. As a result, the Company may incur significant legal expenses in defending against litigation. Substantial legal liability or significant regulatory action against the Company could materially adversely affect the Company’s business, financial condition or results of operations or cause significant reputational harm to the Company, which could seriously harm the Company’s business.

Due to the extensive laws and regulations to which the Company is subject, management is required to devote substantial time and effort to legal and regulatory compliance issues. In addition, the regulatory environment in which the Company operates is subject to change. The Company may be adversely affected as a result of new or revised legislation or regulations or by changes in the interpretation or enforcement of existing laws and regulations.

Extensive regulation of the Company’s business limits the Company’s activities and results in ongoing exposure to the potential for significant penalties, including fines or limitations on the Company’s ability to conduct its business.

The financial services industry is subject to extensive regulation. The Company is subject to regulation by governmental and self-regulatory organizations in the jurisdictions in which the Company operates around the world. Many of these regulators, including U.S. and non-U.S. government agencies and self-regulatory organizations, as well as state securities commissions in the U.S., are empowered to conduct administrative proceedings that can result in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion of an investment adviser. The requirements imposed by the Company’s regulators are designed to ensure the integrity of the financial markets and to protect customers and other third parties who deal with the Company and are not designed to protect the Company’s stockholders. Consequently, these regulations often serve to limit the Company’s activities, including customer protection and market conduct requirements.

The Company faces the risk of significant intervention by regulatory authorities, including extended investigation and surveillance activity, adoption of costly or restrictive new regulations and judicial or administrative proceedings that may result in substantial penalties. Among other things, the Company could be fined or be prohibited from engaging in some of the Company’s business activities. In addition, the regulatory environment in which the Company operates is subject to modifications and further regulation. New laws, regulations, or changes in the enforcement of existing laws or regulations applicable to the Company and the Company’s clients also may adversely affect the Company’s business, and the Company’s ability to function in this environment will depend on the Company’s ability to constantly monitor and react to these changes. In addition, the regulatory environment in which the Company’s clients operate may impact the Company’s business. For example, changes in antitrust laws or the enforcement of antitrust laws could affect the level of mergers and acquisitions activity and changes in state laws may limit investment activities of state pension plans.

In particular, for asset management businesses in general, there have been a number of highly publicized regulatory inquiries that focus on the mutual funds industry. These inquiries already have resulted in increased scrutiny in the industry and new rules and regulations for mutual funds and their investment managers. This regulatory scrutiny, along with rulemaking initiatives, may result in an increase in operational and compliance costs or the assessment of significant fines or penalties against the Company and may otherwise limit the Company’s ability to engage in certain activities.

14

TABLE OF CONTENTS

In addition, financial services firms are subject to numerous conflicts of interests or perceived conflicts. The Company has adopted various policies, controls and procedures to address or limit actual or perceived conflicts and regularly seeks to review and update the Company’s policies, controls and procedures. However, these policies and procedures may result in increased costs, additional operational personnel, and increased regulatory risk. Failure to adhere to these policies and procedures may result in regulatory sanctions or client litigation.

Specific regulatory changes also may have a direct impact on the revenue of the Company’s asset management business. In addition to regulatory scrutiny and potential fines and sanctions, regulators continue to examine different aspects of the asset management industry. These regulatory changes and other proposed or potential changes may result in a reduction of revenue associated with asset management.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Company’s headquarters and operations are located in New York, NY. Business is conducted at a location with approximately 10,000 square feet under a long-term lease that expires in September 2015. To accommodate for the growth in business, the Company entered into a sublease agreement for an additional 3,100 square feet at its Company headquarters in February 2007. This sublease expires in June 2010.

The Company is also the primary party to another lease in New York, NY with approximately 8,500 square feet, which expires in November 2010. This property is subleased to an unrelated third party.

During December 2008, in an effort to consolidate marketing efforts and reduce costs, the Company closed its two-employee marketing office in Sherman Oaks, CA. The office lease at this location expired in January 2009.

Management believes the office space utilized by the Company is adequate for its existing operating needs. Management, however, is in active discussions concerning future space capacity in relation to projected staffing levels, and anticipates obtaining additional space at its Company headquarters during the second quarter of fiscal year 2010.

Item 3. Legal Proceedings

From time to time, the Company or its subsidiaries may become parties to claims, legal actions and complaints arising in the ordinary course of business. Management is not aware of any claims which would have a material adverse effect on its consolidated financial position, results of operations, or cash flows.

Item 4. Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of the Company’s security holders during the fourth quarter of our fiscal year ended June 30, 2009.

15

TABLE OF CONTENTS

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s common stock trades on the NASDAQ Capital Market under the trading symbol “EPHC.”

Stock Performance Graph

The graph and table that follow compares the performance of an investment in our Common Stock from June 30, 2004 through June 30, 2009 with the Russell 2000 Index, the Dow Jones U.S. Asset Managers Total Stock Market Index*, a composite of publicly traded asset management companies, and an index comprised of public companies with the Standard Industrial Classification (“SIC”) Code 6282, Investment Advice. The graph assumes a $100 investment in our Common Stock on June 30, 2004, and an equal investment in each of the selected indices, including reinvestment of dividends, if any. The performance shown in the graph represents past performance and should not be considered an indication of future performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Epoch Holding Corporation, The Russell 2000 Index,

The Dow Jones US Asset Managers TSM Index* and SIC Code 6282

| * | Formerly known as the Dow Jones Asset Manager’s Wilshire Index. |

The foregoing graph shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in any previous or future documents filed by the Company with the SEC under the Securities Act or the Exchange Act, except to the extent that the Company specifically incorporates the information by reference in any such document.

16

TABLE OF CONTENTS

The following table sets forth for the periods indicated the high and low reported sale prices, quarter-end closing prices for the common stock and dividends declared per share:

| |  | |  | |  | |  |

| | Common Stock Price

Ranges | | Closing

Price ($) | | Dividend

Declared ($) |

| | | High ($) | | Low ($) |

FY 2009

| | | | | | | | | | | | | | | | |

| Fourth Quarter (6/30) | | | 8.64 | | | | 6.10 | | | | 8.64 | | | | 0.03 | |

| Third Quarter (3/31) | | | 7.50 | | | | 4.08 | | | | 6.87 | | | | 0.03 | |

| Second Quarter (12/31) | | | 10.46 | | | | 6.42 | | | | 7.59 | | | | 0.15 | (a) |

| First Quarter (9/30) | | | 11.95 | | | | 8.52 | | | | 10.55 | | | | 0.03 | |

FY 2008

| | | | | | | | | | | | | | | | |

| Fourth Quarter (6/30) | | | 12.62 | | | | 9.11 | | | | 9.11 | | | | 0.025 | |

| Third Quarter (3/31) | | | 14.38 | | | | 10.01 | | | | 11.98 | | | | 0.025 | |

| Second Quarter (12/31) | | | 15.00 | | | | 11.05 | | | | 15.00 | | | | 0.025 | |

| First Quarter (9/30) | | | 16.42 | | | | 10.63 | | | | 14.08 | | | | — | |

| (a) | includes special dividend of $0.12 per share |

The closing price for our common stock as reported on the NASDAQ Capital Market on September 9, 2009 was $8.52.

As of September 9, 2009 there were approximately 1,063 holders of record of the Company’s common stock. As many of the shares are held in street nominee name, management believes the number of beneficial owners of our common stock is substantially higher.

Dividends on Common Stock

The Company commenced declaring and paying quarterly cash dividends on its common stock in the second quarter of the fiscal year ended June 30, 2008. A total of $1.5 million of dividends were declared and paid during the fiscal year ended June 30, 2008.

Effective with the first quarter of fiscal year 2009, the Company increased its quarterly dividend rate by 20%, from $0.025 to $0.03 per share. A total of $2.7 million of regular dividends were declared and paid during the fiscal year ended June 30, 2009. The Company expects quarterly dividends going forward to be paid in February, May, August and November of each fiscal year, and anticipates a total annual dividend of $0.12 per common share. However, the actual declaration of future cash dividends, and the establishment of record and payment dates, is subject to determination by the Board of Directors each quarter after its review of the Company’s financial performance, as well as general business conditions, capital requirements, and any contractual, legal and regulatory restrictions. The Company may change its dividend policy at any time.

Special Cash Dividend

As a result of the Company’s strong cash position and debt-free balance sheet, the Board of Directors declared a special cash dividend on December 19, 2008 of $0.12 per share. The dividend was paid on January 15, 2009 to all shareholders of record at the close of business on December 31, 2008. The aggregate dividend payment totaled approximately $2.6 million.

Dividends on Preferred Stock

On July 1, 2008, the holder of the 10,000 shares of Series A Convertible Preferred Stock (“the Preferred Stock”) outstanding, with a face value of $10,000,000, converted the Preferred Stock to 1,666,667 shares of common stock. Accordingly, the Preferred Stock has been cancelled and the conversion eliminated the holder’s rights to receive the semi-annual dividends on the Preferred Stock.

17

TABLE OF CONTENTS

Rule 10b5-1 Plans

Our executive officers may purchase or sell shares of our common stock in the market from time to time. The Company’s management encourages these officers to make these transactions through plans that comply with Exchange Act Rule 10b5-1(c). The Company does not receive any proceeds related to these transactions.

Equity Compensation Plan Information

The following table provides information regarding the status of the Company’s equity plans at June 30, 2009:

| |  | |  | |  |

| Plan Category | | Number of Securities

to Be Issued Upon

Exercise of

Outstanding Options

(A) | | Weighted-Average

Exercise Price of

Outstanding Options

(B) | | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding

Securities Reflected

in Column

(A)) (C) |

| Equity compensation plans approved by security holders | | | 1,090,060 | (1) | | $ | 7.86 | | | | 1,998,026 | (3) |

| Equity compensation plans not approved by security holders | | | 575,000 | (2) | | | 12.59 | | | | — | |

| Total | | | 1,665,060 | | | $ | 9.49 | | | | 1,998,026 | |

| (1) | Includes 630,060 stock options granted in January 2009 under Epoch’s Amended and Restated 2004 Omnibus Long-Term Incentive Compensation Plan and the remaining 460,000 stock options granted under the J Net 1992 Incentive and Nonqualified Stock Option Plan (the “1992 Plan”). The 1992 Plan expired on September 30, 2002 and the options under this plan will remain outstanding until they are exercised, cancelled or expire. The options under the 1992 Plan have a remaining contractual life of less than one year. See Note 10 to the Consolidated Financial Statements for further information regarding the plans. |

| (2) | Represents the remaining 500,000 stock options granted on June 21, 2000 and the remaining 75,000 stock options granted on September 14, 1999 to former J Net employees and its board of directors. The contractual life of these options is less than one year. See Note 10 to the Consolidated Financial Statements, under Other Nonqualified Stock Options, for further information regarding these options. |

| (3) | The 1,998,026 shares may be issued under our Amended and Restated 2004 Omnibus Long-Term Incentive Compensation Plan as options, restricted stock awards or any other form of equity compensation. |

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

On June 24, 2008, the Company’s Board of Directors approved the repurchase of up to a maximum of 250,000 shares, or just over 1%, of the Company’s fully diluted outstanding common stock. The repurchase plan called for the repurchases to be made in the open market and/or in privately negotiated transactions from time to time in compliance with applicable laws, rules and regulations, including Rule 10b-18 under the Securities Exchange Act of 1934, as amended, subject to prevailing market and business conditions. The plan did not obligate the Company to purchase any particular number of shares, and may be suspended or discontinued at any time. The repurchase plan expired on June 30, 2009. The Company completed this repurchase plan by February 2009.

In March 2009, the Company’s Board of Directorsauthorized the Company to repurchase up to an additional 250,000 shares pursuant to the same conditions, except the repurchase plan does not contain an expiration date.

The Company did not have any purchases of its equity securities that are registered pursuant to Section 12(b) of the Exchange Act during the three months ended June 30, 2009.

18

TABLE OF CONTENTS

In addition to the repurchase program previously noted, the Company withheld approximately 21 thousand shares from employees during the fourth quarter of FY 2009 as part of a share-withholding program to satisfy employees’ payroll tax liabilities attributable to the vesting of restricted stock awards.

Item 6. Selected Financial Data

The table on the following page presents selected financial data of the Company. This data was derived from the Company’s consolidated financial statements and reflects the operations and financial position of the Company at the dates and periods indicated.

The following selected historical consolidated financial data should be read in conjunction with Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Item 8, “Financial Statements and Supplementary Data,” of this Form 10-K.

19

TABLE OF CONTENTS

Selected Financial Data

(Dollars in Thousands, Except Share Data)

| |  | |  | |  | |  | |  |

| | For the Years Ended June 30, |

| | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 |

Consolidated Statements of Operations Data:

| | | | | | | | | | | | | | | | | | | | |

| Investment advisory and management fees | | $ | 30,535 | | | $ | 33,634 | | | $ | 22,964 | | | $ | 10,136 | | | $ | 4,120 | |

| Performance fees | | | 624 | | | | 172 | | | | 971 | | | | 95 | | | | 187 | |

| Total operating revenues | | | 31,159 | | | | 33,806 | | | | 23,935 | | | | 10,231 | | | | 4,307 | |

Expenses:

| | | | | | | | | | | | | | | | | | | | |

| Employee related costs (excluding share-based compensation) | | | 15,919 | | | | 17,711 | | | | 13,878 | | | | 8,641 | | | | 5,777 | |

| Share-based compensation | | | 4,496 | | | | 4,176 | | | | 6,267 | | | | 4,670 | | | | 3,427 | |

| Other expenses | | | 7,296 | | | | 8,065 | | | | 6,307 | | | | 3,975 | | | | 3,378 | |

| Total operating expenses | | | 27,711 | | | | 29,952 | | | | 26,452 | | | | 17,286 | | | | 12,582 | |

| Operating income (loss) | | | 3,448 | | | | 3,854 | | | | (2,517 | ) | | | (7,055 | ) | | | (8,275 | ) |

| Other income(1) | | | 5,110 | | | | 6,049 | | | | 10,509 | | | | 1,106 | | | | 1,167 | |

| Provision for (benefit from) income taxes(2) | | | 2,698 | | | | 867 | | | | 99 | | | | (227 | ) | | | — | |

| Income (loss) from continuing operations, net of taxes | | | 5,860 | | | | 9,036 | | | | 7,893 | | | | (5,722 | ) | | | (7,108 | ) |

| Income from discontinued operations, net of $0 taxes | | | — | | | | — | | | | — | | | | — | | | | 571 | |

| Net income (loss) | | | 5,860 | | | | 9,036 | | | | 7,893 | | | | (5,722 | ) | | | (6,537 | ) |

| Cumulative preferred stock dividends | | | — | | | | 460 | | | | 299 | | | | — | | | | — | |

| Non-cash charge attributable to beneficial conversion feature of preferred stock | | | — | | | | — | | | | 700 | | | | — | | | | — | |

| Net income (loss) available to common stockholders | | $ | 5,860 | | | $ | 8,576 | | | $ | 6,894 | | | $ | (5,722 | ) | | $ | (6,537 | ) |

| |

Balance Sheet Data(5):

| | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 37,055 | | | $ | 37,436 | | | $ | 3,097 | | | $ | 2,234 | | | $ | 739 | |

| Short-term investments | | $ | — | | | $ | — | | | $ | 21,850 | | | $ | 5,400 | | | $ | 7,600 | |

| Accounts receivable | | $ | 7,523 | | | $ | 6,391 | | | $ | 6,293 | | | $ | 2,486 | | | $ | 1,221 | |

| Total assets | | $ | 55,007 | | | $ | 54,349 | | | $ | 39,374 | | | $ | 13,568 | | | $ | 13,031 | |

| Long term borrowings | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Total liabilities | | $ | 5,217 | | | $ | 9,004 | | | $ | 3,931 | | | $ | 4,713 | | | $ | 3,454 | |

| Total stockholders’ equity | | $ | 49,790 | | | $ | 45,345 | | | $ | 35,443 | | | $ | 8,855 | | | $ | 9,577 | |

| |

Common Share Data:

| | | | | | | | | | | | | | | | | | | | |

Earnings (loss) per share from continuing operations:

| | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.26 | | | $ | 0.42 | | | $ | 0.35 | | | $ | (0.31 | ) | | $ | (0.39 | ) |

| Diluted | | $ | 0.26 | | | $ | 0.41 | | | $ | 0.35 | | | $ | (0.31 | ) | | $ | (0.39 | ) |

| Cash dividends declared per common share(3) | | $ | 0.24 | | | $ | 0.075 | | | $ | — | | | $ | — | | | $ | — | |

Weighted average shares outstanding:

| | | | | | | | | | | | | | | | | | | | |

| Basic | | | 22,133 | | | | 20,181 | | | | 19,726 | | | | 18,724 | | | | 18,025 | |

| Diluted | | | 22,133 | | | | 21,911 | | | | 20,807 | | | | 18,724 | | | | 18,025 | |

| |

Other Supplemental Data:

| | | | | | | | | | | | | | | | | | | | |

| Operating margin | | | 11 | % | | | 11 | % | | | (11 | )% | | | (69 | )% | | | (192 | )% |

| Working capital | | $ | 41,897 | | | $ | 36,792 | | | $ | 32,685 | | | $ | 6,945 | | | $ | 7,367 | |

| Current ratio(4) | | | 10.8 | | | | 5.6 | | | | 12.6 | | | | 3.0 | | | | 4.3 | |

| Cash provided by (used in) operations | | $ | 855 | | | $ | 11,349 | | | $ | 2,389 | | | $ | (1,133 | ) | | $ | (5,909 | ) |

| Assets under management (in millions): | | $ | 7,891 | | | $ | 6,634 | | | $ | 6,001 | | | $ | 3,253 | | | $ | 1,402 | |