UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended December 31, 2011

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number: 1-9728

EPOCH HOLDING CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| | |

| Delaware | | 20-1938886 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

640 Fifth Avenue, New York, NY 10019

(Address of Principal Executive Offices)

(212) 303-7200

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer ¨ | | Accelerated filer þ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | | | (Do not Check if Smaller Reporting Company) | | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of February 2, 2012, there were 23,257,407 shares of the registrant’s common stock, $0.01 par value per share, issued and outstanding.

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

QUARTERLY REPORT ON FORM 10-Q

FOR THE FISCAL QUARTER ENDED DECEMBER 31, 2011

TABLE OF CONTENTS

Items other than those listed above have been omitted because they are not applicable.

i

PART I. FINANCIAL INFORMATION

| Item 1. | Financial Statements. |

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands, except share data)

| | | | | | | | |

| | | December 31,

2011 | | | June 30,

2011 | |

ASSETS | | | | | | | | |

| | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 39,691 | | | $ | 29,128 | |

Accounts receivable | | | 17,528 | | | | 17,183 | |

Deferred income taxes, net | | | 2,580 | | | | 2,344 | |

Held-to-maturity securities, at amortized cost (fair value of $1,076 and $357, respectively)—(Note 3) | | | 1,066 | | | | 355 | |

Prepaid and other current assets | | | 1,918 | | | | 1,034 | |

| | | | | | | | |

Total current assets | | | 62,783 | | | | 50,044 | |

| | |

Held-to-maturity securities, at amortized cost (fair value of $903 and $1,651, respectively)—(Note 3) | | | 874 | | | | 1,605 | |

Other investments, at fair value (cost of $13,192 and $8,360, respectively)—(Note 4) | | | 13,496 | | | | 8,907 | |

Deferred income taxes, net | | | 8,344 | | | | 8,240 | |

Property and equipment, net of accumulated depreciation of $3,819 and $3,282, respectively | | | 1,216 | | | | 1,580 | |

Security deposits | | | 384 | | | | 485 | |

| | | | | | | | |

Total assets | | $ | 87,097 | | | $ | 70,861 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

| | |

Current liabilities: | | | | | | | | |

Accounts payable and accrued liabilities | | $ | 1,324 | | | $ | 1,233 | |

Accrued compensation and benefits | | | 13,336 | | | | 6,549 | |

Dividends payable—(Note 10) | | | 17,487 | | | | — | |

Income taxes payable | | | — | | | | 649 | |

| | | | | | | | |

Total current liabilities | | | 32,147 | | | | 8,431 | |

Deferred rent | | | 613 | | | | 695 | |

| | | | | | | | |

Total liabilities | | | 32,760 | | | | 9,126 | |

| | | | | | | | |

Commitments and contingencies—(Note 6) | | | | | | | | |

| | |

Stockholders’ equity: | | | | | | | | |

Common stock, $0.01 par value per share, 60,000,000 shares authorized; 24,017,609 issued and 23,315,682 outstanding at December 31, 2011 and 23,944,660 issued and 23,364,644 outstanding at June 30, 2011, respectively | | | 240 | | | | 239 | |

Additional paid-in capital | | | 70,041 | | | | 64,737 | |

(Accumulated deficit)/Retained earnings | | | (8,430 | ) | | | 2,041 | |

Accumulated other comprehensive income/(loss), net of tax | | | (106 | ) | | | 183 | |

Less: Treasury stock, at cost, 701,927 and 580,016 shares, respectively | | | (7,408 | ) | | | (5,465 | ) |

| | | | | | | | |

Total stockholders’ equity | | | 54,337 | | | | 61,735 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 87,097 | | | $ | 70,861 | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, | | | Six Months Ended

December 31, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Operating Revenues: | | | | | | | | | | | | | | | | |

Investment advisory and management fees | | $ | 20,694 | | | $ | 16,562 | | | $ | 38,805 | | | $ | 31,357 | |

Performance fees | | | 1,040 | | | | 294 | | | | 1,938 | | | | 474 | |

| | | | | | | | | | | | | | | | |

Total operating revenues | | | 21,734 | | | | 16,856 | | | | 40,743 | | | | 31,831 | |

| | | | | | | | | | | | | | | | |

| | | | |

Operating Expenses: | | | | | | | | | | | | | | | | |

Employee compensation and benefits | | | 8,353 | | | | 7,181 | | | | 16,170 | | | | 13,929 | |

Occupancy and technology | | | 1,330 | | | | 1,168 | | | | 2,515 | | | | 2,207 | |

General and administrative | | | 1,187 | | | | 728 | | | | 2,271 | | | | 1,301 | |

Professional fees and services | | | 805 | | | | 742 | | | | 1,630 | | | | 1,557 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 11,675 | | | | 9,819 | | | | 22,586 | | | | 18,994 | |

| | | | | | | | | | | | | | | | |

Operating Income | | | 10,059 | | | | 7,037 | | | | 18,157 | | | | 12,837 | |

Other income | | | 331 | | | | 217 | | | | 137 | | | | 375 | |

| | | | | | | | | | | | | | | | |

Income Before Income Taxes | | | 10,390 | | | | 7,254 | | | | 18,294 | | | | 13,212 | |

| | | | | | | | | | | | | | | | |

Provision for income taxes | | | 4,527 | | | | 3,185 | | | | 8,013 | | | | 5,797 | |

Income tax benefit from release of valuation allowance—(Note 7) | | | — | | | | (4,964 | ) | | | — | | | | (4,964 | ) |

| | | | | | | | | | | | | | | | |

Total provision for/(benefit from) income taxes | | | 4,527 | | | | (1,779 | ) | | | 8,013 | | | | 833 | |

| | | | | | | | | | | | | | | | |

| | | | |

Net Income | | $ | 5,863 | | | $ | 9,033 | | | $ | 10,281 | | | $ | 12,379 | |

| | | | | | | | | | | | | | | | |

Earnings Per Share:—(Note 8) | | | | | | | | | | | | | | | | |

Basic | | $ | 0.25 | | | $ | 0.40 | | | $ | 0.44 | | | $ | 0.54 | |

| | | | | | | | | | | | | | | | |

Diluted | | $ | 0.25 | | | $ | 0.39 | | | $ | 0.44 | | | $ | 0.54 | |

| | | | | | | | | | | | | | | | |

Weighted-Average Shares Outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 23,285 | | | | 22,827 | | | | 23,320 | | | | 22,807 | |

| | | | | | | | | | | | | | | | |

Diluted | | | 23,471 | | | | 23,028 | | | | 23,496 | | | | 22,990 | |

| | | | | | | | | | | | | | | | |

Cash dividends declared per share | | $ | 0.83 | | | $ | 0.80 | | | $ | 0.89 | | | $ | 0.85 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(in thousands)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, | | | Six Months Ended

December 31, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Net income | | $ | 5,863 | | | $ | 9,033 | | | $ | 10,281 | | | $ | 12,379 | |

| | | | | | | | | | | | | | | | |

Other comprehensive income/(loss), net of tax—(Note 9) | | | | | | | | | | | | | | | | |

Net unrealized gains/(losses) on available-for-sale securities | | | 196 | | | | 171 | | | | (219 | ) | | | 419 | |

Reclassification for net (gains)/losses included in net income | | | (155 | ) | | | (66 | ) | | | (70 | ) | | | (63 | ) |

| | | | | | | | | | | | | | | | |

Other comprehensive income/(loss) | | | 41 | | | | 105 | | | | (289 | ) | | | 356 | |

| | | | | | | | | | | | | | | | |

Comprehensive income | | $ | 5,904 | | | $ | 9,138 | | | $ | 9,992 | | | $ | 12,735 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE YEAR ENDED JUNE 30, 2011 AND SIX MONTHS ENDED DECEMBER 31, 2011

(dollars and shares in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | | Additional

Paid-in

Capital | | | (Accumulated

Deficit)/

Retained

Earnings | | | Accumulated

Other

Comprehensive

Income/(Loss) | | | Treasury Stock | | | Total

Stockholders’

Equity | |

| | | Shares | | | Amount | | | | | | Shares | | | Amount | | |

Balances at June 30, 2010 | | | 22,787 | | | $ | 233 | | | $ | 56,893 | | | $ | 2,668 | | | $ | (223 | ) | | | 482 | | | $ | (3,956 | ) | | $ | 55,615 | |

Net income | | | — | | | | — | | | | — | | | | 21,566 | | | | — | | | | — | | | | — | | | | 21,566 | |

Other comprehensive income | | | — | | | | — | | | | — | | | | — | | | | 406 | | | | — | | | | — | | | | 406 | |

Issuance and forfeitures of restricted share awards | | | 567 | | | | 5 | | | | 912 | | | | — | | | | — | | | | — | | | | — | | | | 917 | |

Amortization of share-based compensation | | | — | | | | — | | | | 5,391 | | | | — | | | | — | | | | — | | | | — | | | | 5,391 | |

Common stock dividends—(Note 10) | | | — | | | | — | | | | — | | | | (22,193 | ) | | | — | | | | — | | | | — | | | | (22,193 | ) |

Income tax benefit from dividends paid on unvested shares | | | — | | | | — | | | | 466 | | | | — | | | | — | | | | — | | | | — | | | | 466 | |

Exercises of stock options | | | 108 | | | | 1 | | | | 668 | | | | — | | | | — | | | | — | | | | — | | | | 669 | |

Net sales/purchases of shares for employee withholding | | | — | | | | — | | | | 97 | | | | — | | | | — | | | | — | | | | — | | | | 97 | |

Repurchase of common shares | | | (98 | ) | | | — | | | | — | | | | — | | | | — | | | | 98 | | | | (1,509 | ) | | | (1,509 | ) |

Excess income tax benefit from share-based compensation | | | — | | | | — | | | | 310 | | | | — | | | | — | | | | — | | | | — | | | | 310 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at June 30, 2011 | | | 23,364 | | | | 239 | | | | 64,737 | | | | 2,041 | | | | 183 | | | | 580 | | | | (5,465 | ) | | | 61,735 | |

Net income | | | — | | | | — | | | | — | | | | 10,281 | | | | — | | | | — | | | | — | | | | 10,281 | |

Other comprehensive loss—(Note 9) | | | — | | | | — | | | | — | | | | — | | | | (289 | ) | | | — | | | | — | | | | (289 | ) |

Issuance and forfeitures of restricted share awards | | | 16 | | | | — | | | | (19 | ) | | | — | | | | — | | | | — | | | | — | | | | (19 | ) |

Amortization of share-based compensation | | | — | | | | — | | | | 2,819 | | | | — | | | | — | | | | — | | | | — | | | | 2,819 | |

Common stock dividends—(Note 10) | | | — | | | | — | | | | — | | | | (20,752 | ) | | | — | | | | — | | | | — | | | | (20,752 | ) |

Income tax benefit from dividends paid on unvested shares | | | — | | | | — | | | | 433 | | | | — | | | | — | | | | — | | | | — | | | | 433 | |

Exercise of stock options | | | 58 | | | | 1 | | | | 356 | | | | — | | | | — | | | | — | | | | — | | | | 357 | |

Net sales/purchases of shares for employee withholding | | | (51 | ) | | | — | | | | — | | | | — | | | | — | | | | 51 | | | | (943 | ) | | | (943 | ) |

Repurchase of common shares | | | (71 | ) | | | — | | | | — | | | | — | | | | — | | | | 71 | | | | (1,000 | ) | | | (1,000 | ) |

Excess income tax benefit from share-based compensation | | | — | | | | — | | | | 1,715 | | | | — | | | | — | | | | — | | | | — | | | | 1,715 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balances at December 31, 2011 (Unaudited) | | | 23,316 | | | $ | 240 | | | $ | 70,041 | | | $ | (8,430 | ) | | $ | (106 | ) | | | 702 | | | $ | (7,408 | ) | | $ | 54,337 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in thousands)

| | | | | | | | |

| | | Six Months Ended

December 31, | |

| | | 2011 | | | 2010 | |

Cash flows from operating activities: | | | | | | | | |

Net income | | $ | 10,281 | | | $ | 12,379 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

Benefit from deferred income taxes—(Note 7) | | | (116 | ) | | | (5,211 | ) |

Share-based compensation | | | 2,800 | | | | 2,481 | |

Depreciation and amortization | | | 537 | | | | 387 | |

Net realized and unrealized gains on investments | | | (115 | ) | | | (111 | ) |

Equity in net loss/(income) from limited liability company | | | 44 | | | | (69 | ) |

Amortization of bond premiums | | | 21 | | | | 20 | |

Excess income tax benefit from share-based compensation | | | (1,715 | ) | | | (309 | ) |

Income tax benefit from dividends paid on unvested shares | | | (433 | ) | | | (397 | ) |

(Increase)/decrease in operating assets: | | | | | | | | |

Accounts receivable | | | (345 | ) | | | (2,708 | ) |

Prepaid and other current assets | | | (884 | ) | | | 233 | |

Increase/(decrease) in operating liabilities: | | | | | | | | |

Accounts payable and accrued liabilities | | | 91 | | | | 228 | |

Accrued compensation and benefits | | | 6,787 | | | | 1,303 | |

Income taxes payable | | | 1,499 | | | | 816 | |

Deferred rent | | | (82 | ) | | | (71 | ) |

| | | | | | | | |

Net cash provided by operating activities | | | 18,370 | | | | 8,971 | |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Investments in Company-sponsored products and other investments, net | | | (5,032 | ) | | | (3,047 | ) |

Capital expenditures | | | (173 | ) | | | (162 | ) |

Security deposits, net | | | 101 | | | | 510 | |

| | | | | | | | |

Net cash used in investing activities | | | (5,104 | ) | | | (2,699 | ) |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Cash dividends on common stock | | | (3,265 | ) | | | (19,420 | ) |

Repurchase of common shares | | | (1,943 | ) | | | — | |

Excess income tax benefit from share-based compensation | | | 1,715 | | | | 309 | |

Income tax benefit from dividends paid on unvested shares | | | 433 | | | | 397 | |

Proceeds from stock option exercises | | | 357 | | | | 254 | |

Net gain on sale of shares for employee withholding | | | — | | | | 60 | |

| | | | | | | | |

Net cash used in financing activities | | | (2,703 | ) | | | (18,400 | ) |

| | | | | | | | |

Net increase/(decrease) in cash and cash equivalents during period | | | 10,563 | | | | (12,128 | ) |

Cash and cash equivalents at beginning of period | | | 29,128 | | | | 36,447 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 39,691 | | | $ | 24,319 | |

| | | | | | | | |

Supplemental disclosure of cash flow information: | | | | | | | | |

Cash paid for income taxes | | $ | 7,392 | | | $ | 5,375 | |

| | | | | | | | |

Supplemental disclosures of non-cash investing and financing activities: | | | | | | | | |

Net change in unrealized gains on available-for-sale securities, net of tax | | $ | (289 | ) | | $ | 356 | |

| | | | | | | | |

Dividends declared but not yet paid—(Note 10) | | $ | 17,487 | | | $ | — | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 1—Organization and Basis of Presentation

Organization

Epoch Holding Corporation (“Epoch” or the “Company”), a Delaware corporation, is a holding company whose sole line of business is investment advisory and investment management services. The operations of the Company are conducted through its wholly-owned subsidiary, Epoch Investment Partners, Inc. (“EIP”). EIP is a registered investment adviser under the Investment Advisers Act of 1940, as amended. EIP provides investment advisory and investment management services to clients including corporations, retirement plans, public pension funds, endowments, foundations, financial institutions and high net worth individuals. These services are provided through both separately managed accounts and commingled vehicles, such as private investment funds and mutual funds. Headquartered in New York City, the Company’s current investment strategies include U.S. Value, U.S. All Cap Value, Global Equity Shareholder Yield, Global Absolute Return, Global Choice, U.S. Choice, U.S. Smid Cap (small/mid) Value, International Small Cap, U.S. Small Cap Value, Global Small Cap, and Balanced.

Basis of Presentation

The fiscal year-end June 30, 2011 Condensed Consolidated Balance Sheet was derived from audited financial statements and, in accordance with interim financial statement standards, does not include all disclosures required by accounting principles generally accepted in the United States of America (“U.S. GAAP”) for annual financial statements. The unaudited condensed consolidated financial statements of the Company included herein have been prepared in accordance with U.S. GAAP, and in accordance with the instructions to Form 10-Q pursuant to the rules and regulations of the United States Securities and Exchange Commission (“SEC”). Certain information and note disclosures normally included in annual financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to those rules and regulations, although the Company believes that the disclosures made herein are adequate to make the information not misleading.

These financial statements rely, in part, on estimates. Actual results could differ from these estimates. In the opinion of management, these unaudited condensed consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the Company’s financial position, interim results of operations, comprehensive income and cash flows. All material intercompany accounts and transactions have been eliminated in consolidation. The nature of our business is such that the results for the interim periods are not necessarily indicative of the results to be obtained for a full fiscal year. The Company’s unaudited condensed consolidated financial statements and the related notes should be read in conjunction with the consolidated financial statements and the related notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2011.

Certain items previously reported have been reclassified to conform to the current year presentation. Specifically, in the Condensed Consolidated Statements of Income, prior year amounts related to share-based compensation expense have been reclassified and combined with employee compensation and benefits, and depreciation expense has been combined and presented as part of occupancy and technology expenses. Such reclassifications had no impact on net income. There have been no changes in significant accounting policies during the three and six months ended December 31, 2011. For a complete listing of the Company’s significant accounting policies, please refer to the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2011.

6

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 1—Organization and Basis of Presentation (Continued)

Recently Issued Accounting Pronouncements

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS. ASU No. 2011-04 generally provides a uniform framework for fair value measurements and related disclosures between U.S. GAAP and International Financial Reporting Standards (“IFRS”). Additional disclosure requirements in the update include, among other things, the disclosure of all transfers between Level 1 and Level 2 of the fair value hierarchy. ASU No. 2011-04 is effective for the interim and annual periods beginning on or after December 15, 2011. Early adoption is not permitted. The Company adopted this standard in January 2012. The adoption of this standard did not have a material impact on its condensed consolidated financial position, results of operations, or cash flows.

Note 2—Accounts Receivable

The Company’s accounts receivable balances do not include an allowance for doubtful accounts for the periods presented and there have been no bad debt expenses recognized during the three and six months ended December 31, 2011 and 2010. Management believes the December 31, 2011 accounts receivable balances are fully collectible.

Significant Customer

The Company’s client base consists of a large number of geographically diverse clients across many industries. For the three and six months ended December 31, 2011, New York Life Investment Management, through the MainStay Epoch Funds and other funds subadvised by EIP, accounted for approximately 18% of consolidated operating revenues. For the three and six months ended December 31, 2010, this relationship accounted for approximately 19% of consolidated operating revenues. See Note 6 —Strategic Relationship.

Note 3—Held-to-Maturity Securities

The Company’s investment securities classified as held-to-maturity consist of high-grade debt securities. These investments are carried at amortized cost. Gross unrecognized holding gains and losses, and fair values of these securities at December 31, 2011 and June 30, 2011 are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2011 | | | June 30, 2011 | |

| | | Amortized

Cost | | | Gross Unrecognized

Holding | | | Aggregate

Fair

Value | | | Amortized

Cost | | | Gross Unrecognized

Holding | | | Aggregate

Fair

Value | |

| | | | Gains | | | Losses | | | | | Gains | | | Losses | | |

Current | | $ | 1,066 | | | $ | 10 | | | $ | — | | | $ | 1,076 | | | $ | 355 | | | $ | 2 | | | $ | — | | | $ | 357 | |

Long-Term | | | 874 | | | | 29 | | | | — | | | | 903 | | | | 1,605 | | | | 46 | | | | — | | | | 1,651 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 1,940 | | | $ | 39 | | | $ | — | | | $ | 1,979 | | | $ | 1,960 | | | $ | 48 | | | $ | — | | | $ | 2,008 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The fair value of investments in held-to-maturity securities is valued under the market approach through the use of quoted prices for similar investments in active markets.

7

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 3—Held-to-Maturity Securities (Continued)

The contractual maturities of the investment securities classified as held-to-maturity at December 31, 2011 are as follows (in thousands):

| | | | | | | | | | | | |

Contractual Maturities | | Amortized

Cost | | | Aggregate

Fair

Value | | | Weighted-

Average

Interest Rate | |

Less than 1 year | | $ | 1,066 | | | $ | 1,076 | | | | 1.84 | % |

Due after 1 year through 3 years | | | 874 | | | | 903 | | | | 2.62 | % |

| | | | | | | | | | | | |

Total | | $ | 1,940 | | | $ | 1,979 | | | | 2.19 | % |

| | | | | | | | | | | | |

Note 4—Other Investments

The Company’s other investments at December 31, 2011 and June 30, 2011 are summarized as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2011 | | | June 30, 2011 | |

| | | Cost | | | Gross Unrealized | | | Fair

Value | | | Cost | | | Gross Unrealized | | | Fair

Value | |

| | | | Gains | | | Losses | | | | | Gains | | | Losses | | |

Available-for-sale securities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Company-sponsored mutual funds | | $ | 1,212 | | | $ | 43 | | | $ | (191 | ) | | $ | 1,064 | | | $ | 1,185 | | | $ | 91 | | | $ | (97 | ) | | $ | 1,179 | |

Epoch Global Champions separate account | | | 1,000 | | | | — | | | | — | | | | 1,000 | | | | — | | | | — | | | | — | | | | — | |

Investment in limited partnership | | | 4,000 | | | | 182 | | | | — | | | | 4,182 | | | | 4,000 | | | | 144 | | | | — | | | | 4,144 | |

Epoch Global All Cap separate account | | | — | | | | — | | | | — | | | | — | | | | 2,652 | | | | 445 | | | | (36 | ) | | | 3,061 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total available-for-sale securities | | | 6,212 | | | | 225 | | | | (191 | ) | | | 6,246 | | | | 7,837 | | | | 680 | | | | (133 | ) | | | 8,384 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated investment vehicles: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Epoch Global Equity Shareholder Yield Fund, LLC | | | 2,000 | | | | — | | | | (2 | ) | | | 1,998 | | | | — | | | | — | | | | — | | | | — | |

Epoch Global All-Cap Fund, LLC | | | 2,501 | | | | 366 | | | | (92 | ) | | | 2,775 | | | | — | | | | — | | | | — | | | | — | |

Epoch Global Choice Fund, LLC | | | 2,000 | | | | — | | | | (2 | ) | | | 1,998 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total consolidated investment vehicles | | | 6,501 | | | | 366 | | | | (96 | ) | | | 6,771 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity method investment: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Epoch Global Absolute Return Fund, LLC | | | 479 | | | | — | | | | — | | | | 479 | | | | 523 | | | | — | | | | — | | | | 523 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Other Investments | | $ | 13,192 | | | $ | 591 | | | $ | (287 | ) | | $ | 13,496 | | | $ | 8,360 | | | $ | 680 | | | $ | (133 | ) | | $ | 8,907 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

During the three months ended December 31, 2011, the Company closed the Epoch Global All Cap separate account and transferred the portfolio into the Epoch Global All-Cap Fund, LLC. Upon transfer, the Company reclassified approximately $0.3 million in unrealized gains from accumulated other comprehensive income to other income.

8

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 4—Other Investments (Continued)

During the three months ended December 31, 2011, in connection with the launch of several new investment vehicles, the Company invested $4.0 million in two investment limited liability companies. As of December 31, 2011, the Company was the sole investor in these entities. As such, the Company has consolidated the investment activity in these entities within the Company’s financial statements. Investment securities held in the portfolios of consolidated investment vehicles are carried at fair value based upon quoted market prices. Net realized and unrealized gains or losses recognized on investments held in the portfolios of consolidated funds are reflected as a component of other income.

The Company also invested $1.0 million in a new separate account, Epoch Global Champions. This investment is accounted for as available-for-sale securities. Unrealized gains or losses from available-for-sale securities are recorded in accumulated other comprehensive income/(loss), net of tax, as a separate component of stockholders’ equity until realized.

The unrealized losses in the available-for-sale securities for each period presented have been unrealized for twelve months or more. Management has reviewed its investment securities for other-than-temporary impairment in accordance with its accounting policy outlined in Note 2 of the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2011. When evaluating whether an unrealized loss on an available-for-sale investment is other than temporary, management reviews such factors as extent and duration of the loss, reduction or cessation of dividend payments, and overall financial condition of the issuer.

Based on management’s assessment, the Company does not believe that the declines are other-than-temporary for all periods presented. The gross unrealized losses from available-for-sale securities were primarily caused by overall weakness in the financial markets and world economy. Management expects the securities will recover their value over time, and management has the intent and ability to hold these investments until such recovery occurs.

Proceeds as well as realized gains and losses recognized from investments classified as available-for-sale during the periods presented are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Three Months Ended December 31, | |

| | | 2011 | | | 2010 | |

| | | Proceeds | | | Gross Realized | | | Proceeds | | | Gross Realized | |

| | | | Gains | | | Losses | | | | Gains | | | Losses | |

Epoch Global All Cap separate account | | $ | 261 | | | $ | 25 | | | $ | (49 | ) | | $ | 592 | | | $ | 93 | | | $ | (11 | ) |

Company-sponsored mutual funds | | | 20 | | | | 20 | | | | — | | | | 35 | | | | 35 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 281 | | | $ | 45 | | | $ | (49 | ) | | $ | 627 | | | $ | 128 | | | $ | (11 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | For the Six Months Ended December 31, | |

| | | 2011 | | | 2010 | |

| | | Proceeds | | | Gross Realized | | | Proceeds | | | Gross Realized | |

| | | | Gains | | | Losses | | | | Gains | | | Losses | |

Epoch Global All Cap separate account | | $ | 1,634 | | | $ | 80 | | | $ | (254 | ) | | $ | 1,034 | | | $ | 130 | | | $ | (54 | ) |

Company-sponsored mutual funds | | | 20 | | | | 20 | | | | — | | | | 35 | | | | 35 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 1,654 | | | $ | 100 | | | $ | (254 | ) | | $ | 1,069 | | | $ | 165 | | | $ | (54 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

9

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 4—Other Investments (Continued)

Realized gains and losses from available-for-sale securities are included in other income in the Condensed Consolidated Statements of Income using the specific identification method.

Derivatives

On a limited basis, the Company utilizes derivative financial instruments, consisting of foreign exchange spot contracts, to facilitate purchases and to hedge market price risk and currency risk exposure associated with its purchases of foreign securities in its investments in separate accounts and consolidated funds seeded for product development purposes. These derivative financial instruments are closed out within the settlement period of the related security purchase – generally within 3 days. The Company does not use derivative financial instruments for speculative purposes and does not anticipate doing so in the future. The Company’s derivative instruments are entered into with a counterparty where a legal right of set-off exists under master netting agreements enforceable by law. Due to the short-term nature of the Company’s derivative instruments, the unrealized and realized gains and losses to date have been negligible. The Company’s derivative instruments are recorded at their net fair values and are included in other investments on the condensed consolidated balance sheets. The Company elected not to apply hedge accounting to its derivative instruments. Gains and losses on the Company’s derivatives not designated as hedging instruments are included in other income/(loss) on the condensed consolidated statements of income.

As of December 31, 2011, the Company had foreign exchange spot contracts outstanding with one counterparty, all of which were settled in January 2012.

Note 5—Fair Value Measurements

Fair value is defined as the price in a transaction to sell an asset or paid to transfer a liability (i.e. the “exit price”) in an orderly transaction between market participants at the measurement date. The Company utilizes a three-level valuation hierarchy for disclosure of fair value measurements in accordance with FASB Accounting Standard Codification Topic 820. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability as of the reported date. The three levels are defined as follows:

| | • | | Level 1—unadjusted quoted prices in active markets that are available for identical assets or liabilities as of the reported date. |

| | • | | Level 2—quoted prices in markets that are not active or other pricing inputs that are either directly or indirectly observable as of the reported date. |

| | • | | Level 3—prices or valuation techniques that are both significant to the fair value measurement and unobservable as of the reported date. These financial instruments do not have active markets and are measured using management’s best estimate of fair value, where the inputs into the determination of fair value require significant management judgment or estimation. |

Assets and liabilities measured and reported at fair value are classified and disclosed in one of the above categories based on the nature of the inputs that are significant to the fair value measurement in its entirety. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s classification within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement.

10

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 5—Fair Value Measurements (Continued)

Other Investments

Other investments primarily consist of investments in Company-sponsored investment vehicles, including mutual funds, an investment strategy separate account, and three limited liability companies; and an investment in a non-affiliated investment limited partnership.

The investments in the mutual funds and in the separate account are accounted for as available-for-sale securities and valued under the market approach through the use of unadjusted quoted market prices available in an active market, and are classified within Level 1 of the valuation hierarchy. The fair value of these investments at December 31, 2011 was $2.1 million.

During the three months ended December 31, 2011, the Company closed the Epoch Global All Cap separate account and transferred the assets into a new Company-sponsored investment limited liability company. The Company also invested $4.0 million in two additional new Company-sponsored investment limited liability companies. At December 31, 2011, the Company was the sole investor of these limited liability companies and therefore accounted for these investments as consolidated investment vehicles. The Company also invested $1.0 million in a new Company-sponsored separate account, Epoch Global Champions. This investment is accounted for as available-for-sale.

During the fiscal year ended June 30, 2011, the Company invested $4.0 million in a non-affiliated investment limited partnership. At December 31, 2011, the Company held less than a 2% ownership interest in this limited partnership. This investment is accounted for as available-for-sale and is valued based upon the Company’s ownership interest in the partnership’s net assets. The value of net assets is based on the underlying assets and liabilities of the limited partnership, which primarily include exchange-listed common stocks and money market funds. This investment seeks to generate capital appreciation. The Company’s investment may be redeemed as of the end of the partnership’s fiscal year, provided that 30 days prior written notice is given to the general partner. Redemptions may be more frequent at the option of the general partner. There is no lock-up and the Company has no unfunded commitments. The investment limited partnership is classified within Level 2 of the valuation hierarchy. The fair value of this investment at December 31, 2011 was $4.2 million.

11

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 5—Fair Value Measurements (Continued)

The following table presents, for each of the hierarchy levels previously described, the Company’s assets that are measured at fair value as of December 31, 2011 and June 30, 2011, respectively (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2011 | | | June 30, 2011 | |

| | | Fair Value

Measurements | | | Level 1 | | | Level 2 | | | Level 3 | | | Fair Value

Measurements | | | Level 1 | | | Level 2 | | | Level 3 | |

Available-for-sale: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Company-sponsored mutual funds | | $ | 1,064 | | | $ | 1,064 | | | $ | — | | | $ | — | | | $ | 1,179 | | | $ | 1,179 | | | $ | — | | | $ | — | |

Epoch Global Champions separate account | | | 1,000 | | | | 1,000 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Investment in limited partnership | | | 4,182 | | | | — | | | | 4,182 | | | | — | | | | 4,144 | | | | — | | | | 4,144 | | | | — | |

Epoch Global All Cap separate account | | | — | | | | — | | | | — | | | | — | | | | 3,061 | | | | 3,061 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total available-for-sale securities | | | 6,246 | | | | 2,064 | | | | 4,182 | | | | — | | | | 8,384 | | | | 4,240 | | | | 4,144 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated investment vehicles: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Epoch Global Equity Shareholder Yield Fund, LLC | | | 1,998 | | | | 1,998 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Epoch Global All-Cap Fund, LLC | | | 2,775 | | | | 2,775 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Epoch Global Choice Fund, LLC | | | 1,998 | | | | 1,998 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total consolidated funds | | | 6,771 | | | | 6,771 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total investments measured at fair value | | $ | 13,017 | | | $ | 8,835 | | | $ | 4,182 | | | $ | — | | | $ | 8,384 | | | $ | 4,240 | | | $ | 4,144 | | | $ | — | |

| | | �� | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

There were no transfers into or out of the Level 1, 2 and 3 categories in the fair value measurement hierarchy for the periods presented.

The investment in the Epoch Global Absolute Return Fund, LLC is accounted for under the equity method, whereby the Company records its percentage share of realized and unrealized earnings or losses in the Condensed Consolidated Statements of Income. Consequently, this investment is not recorded at, but approximates, fair value. The total carrying value of this investment was $0.5 million at December 31, 2011 and June 30, 2011.

Note 6—Commitments and Contingencies

Employment Agreements

Besides the employment contract with our Chief Executive Officer dated December 20, 2010, there are no employment contracts with any other officer or employee of the Company. There are written agreements with certain employees, which provide for sales commissions or bonuses, subject to the attainment of certain performance criteria or continuation of employment. Such commitments under the various agreements total approximately $2.7 million at December 31, 2011. Of this amount, approximately $1.4 million is included in accrued compensation and benefits in the Condensed Consolidated Balance Sheet at December 31, 2011. An additional $0.1 million will be accrued during the remainder of the fiscal year ending June 30, 2012 and shortly thereafter. Approximately $1.2 million represents restricted stock awards to be issued during the remainder of the fiscal year ending June 30, 2012 and shortly thereafter.

12

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 6—Commitments and Contingencies (Continued)

Strategic Relationship

In July 2009, EIP entered into a strategic relationship with New York Life Investments, whereby the MainStay Group of Funds adopted the Company’s family of mutual funds (the “Epoch Funds”). The adoption was completed in November 2009. EIP is responsible for the day-to-day investment management of the funds through a sub-advisory relationship, while MainStay Investments (“MainStay”), the retail distribution arm of New York Life Investments, is responsible for the distribution and administration of the funds. Each former Epoch Fund is now co-branded as a “MainStay Epoch” Fund.

In addition to an existing sub-advisory relationship between EIP and New York Life Investments for certain funds, and the adoption of the Epoch Funds indicated above, EIP and New York Life Investments have entered into an arrangement wherein, among other things, EIP and an affiliate of New York Life Investments have established a distribution and administration relationship with respect to certain separately managed account and unified managed account strategies, and for a period of three years commencing November 2009 New York Life Investments agrees to pay certain additional base fees and meet minimum distribution targets.

Legal Matters

From time to time, the Company or its subsidiaries may become parties to claims, legal actions and complaints arising in the ordinary course of business. Management is not aware of any claims which would have a material effect on its condensed consolidated financial position, results of operations, or cash flows.

Note 7—Provision For/(Benefit From) Income Taxes

The Company accounts for income taxes under the asset and liability method. Deferred tax assets and liabilities arise from temporary differences between book and tax basis using the enacted statutory tax rates and laws that will be in effect when such differences are expected to reverse. Deferred tax assets are recognized for temporary differences that will result in deductible amounts in future years. Deferred tax liabilities are recognized for temporary differences that will result in taxable income in future years. The Company must assess the likelihood that its deferred tax assets will be realized based upon the consideration of all available evidence, using a “more likely than not” standard. To the extent the Company believes that recovery is not likely, it must establish a valuation allowance. To the extent the Company establishes a valuation allowance or changes this allowance in a reporting period, the Company must include an expense or benefit within the tax provision of its condensed consolidated statements of income.

Prior to December 31, 2010, the Company maintained a valuation allowance on certain deferred tax assets, relating to acquired net operating losses and alternative minimum tax credits, since the likelihood of the realization of those assets was not “more likely than not”. The Company has continuously evaluated additional facts representing positive and negative evidence in the determination of the realizability of those deferred tax assets. As of December 31, 2010, the Company concluded that sufficient positive evidence existed from earnings history, pre-tax income growth rates, current operating income levels, and the outlook for sustained profitability, to conclude that it is more likely than not that these assets will be fully realized in future operating periods. Therefore, the Company released a valuation allowance of $5.0 million as a discrete benefit from income taxes during the three months ended December 31, 2010. If future operating and business conditions were to differ

13

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 7—Provision For/(Benefit From) Income Taxes (Continued)

significantly, the Company will reassess the ability to realize the deferred tax assets. If it is more likely than not that the Company would not realize the deferred tax assets, then all or a portion of the valuation allowance may need to be re-established, which would result in a charge to tax expense.

The release of the above valuation allowance resulted in a non-recurring increase in the Company’s basic earnings per share of $0.22 and $0.21 and diluted earnings per share of $0.21 and $0.22 for the three and six months ended December 31, 2010, respectively.

Note 8—Earnings Per Share

Basic earnings per share (“EPS”) is computed by dividing net income by the weighted-average number of common shares outstanding during the period.

Diluted EPS is computed by dividing net income, adjusted for the effect of dilutive securities, by the weighted-average number of common and common equivalent shares outstanding during the period. Common equivalent shares are excluded from the computation if the effect is anti-dilutive. The Company uses the treasury stock method to reflect the dilutive effect of outstanding stock options.

The Company had 406,290 and 531,209 outstanding employee stock options at December 31, 2011 and 2010, respectively. The calculation of diluted EPS included all of the outstanding stock options.

The table below presents the computation of basic and diluted EPS for the three and six months ended December 31, 2011 and 2010, respectively (in thousands, except per share data):

| | | | | | | | | | | | | | | | |

| | | Three Months

Ended

December 31, | | | Six Months Ended

December 31, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Numerator: | | | | | | | | | | | | | | | | |

Net income | | $ | 5,863 | | | $ | 9,033 | | | $ | 10,281 | | | $ | 12,379 | |

| | | | | | | | | | | | | | | | |

Denominator: | | | | | | | | | | | | | | | | |

Weighted-average common shares outstanding | | | 23,285 | | | | 22,827 | | | | 23,320 | | | | 22,807 | |

Net common stock equivalents assuming the exercise of in-the-money stock options | | | 186 | | | | 201 | | | | 176 | | | | 183 | |

| | | | | | | | | | | | | | | | |

Weighted-average common and common equivalent shares outstanding, assuming dilution | | | 23,471 | | | | 23,028 | | | | 23,496 | | | | 22,990 | |

| | | | | | | | | | | | | | | | |

Earnings Per Share: | | | | | | | | | | | | | | | | |

Basic | | $ | 0.25 | | | $ | 0.40 | | | $ | 0.44 | | | $ | 0.54 | |

| | | | | | | | | | | | | | | | |

Diluted | | $ | 0.25 | | | $ | 0.39 | | | $ | 0.44 | | | $ | 0.54 | |

| | | | | | | | | | | | | | | | |

14

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

Note 9—Other Comprehensive Income

The components of other comprehensive income/(loss) include the changes in fair value of available-for-sale securities for the three and six months ended December 31, 2011 and 2010 are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | |

| | | 2011 | | | 2010 | |

| | | Pre-tax

Amount | | | Tax

(Expense)/

Benefit | | | Net-of-tax

Amount | | | Pre-tax

Amount | | | Tax

(Expense)/

Benefit | | | Net-of-tax

Amount | |

Net unrealized gains/(losses) on available-for-sale securities | | $ | 347 | | | $ | (151 | ) | | $ | 196 | | | $ | 298 | | | $ | (127 | ) | | $ | 171 | |

Reclassifications for net (gains)/ losses included in net income | | | (274 | ) | | | 119 | | | | (155 | ) | | | (115 | ) | | | 49 | | | | (66 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 73 | | | $ | (32 | ) | | $ | 41 | | | $ | 183 | | | $ | (78 | ) | | $ | 105 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Six Months Ended December 31, | |

| | | 2011 | | | 2010 | |

| | | Pre-tax

Amount | | | Tax

(Expense)/

Benefit | | | Net-of-tax

Amount | | | Pre-tax

Amount | | | Tax

(Expense)/

Benefit | | | Net-of-tax

Amount | |

Net unrealized gains/(losses) on available-for-sale securities | | $ | (388 | ) | | $ | 169 | | | $ | (219 | ) | | $ | 730 | | | $ | (311 | ) | | $ | 419 | |

Reclassifications for net (gains)/ losses included in net income | | | (123 | ) | | | 53 | | | | (70 | ) | | | (110 | ) | | | 47 | | | | (63 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | (511 | ) | | $ | 222 | | | $ | (289 | ) | | $ | 620 | | | $ | (264 | ) | | $ | 356 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Note 10—Special Dividend

In November 2011 the Board of Directors declared a special cash dividend of $0.75 per share on the Company’s common stock. The dividend was paid in January 2012. The aggregate dividend payment totaled approximately $17.5 million.

In November 2010, the Board of Directors declared a special cash dividend of $0.75 per share on the Company’s common stock. The dividend was paid in December 2010. The aggregate dividend payment totaled approximately $17.1 million.

15

EPOCH HOLDING CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

FOR THE THREE AND SIX MONTHS ENDED DECEMBER 31, 2011 AND 2010

(Unaudited)

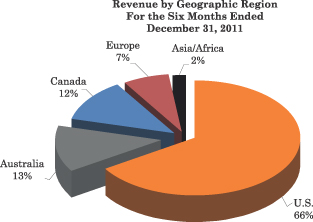

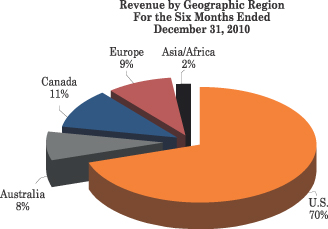

Note 11—Geographic Area Information

The Company operates under one business segment, investment management. Geographical information pertaining to the Company’s operating revenues is presented below. The amounts are aggregated by the client’s domicile (in thousands):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, | | | Six Months Ended

December 31, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

United States | | $ | 14,672 | | | $ | 11,957 | | | $ | 27,088 | | | $ | 22,202 | |

Australia | | | 2,817 | | | | 1,293 | | | | 5,376 | | | | 2,541 | |

Canada | | | 2,427 | | | | 1,903 | | | | 4,728 | | | | 3,661 | |

Europe | | | 1,467 | | | | 1,417 | | | | 2,866 | | | | 2,888 | |

Asia/Africa | | | 350 | | | | 286 | | | | 685 | | | | 539 | |

| | | | | | | | | | | | | | | | |

Total operating revenues | | $ | 21,733 | | | $ | 16,856 | | | $ | 40,743 | | | $ | 31,831 | |

| | | | | | | | | | | | | | | | |

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Set forth on the following pages is management’s discussion and analysis of our financial condition and results of operations for the three and six months ended December 31, 2011 and 2010. Such information should be read in conjunction with our unaudited condensed consolidated financial statements together with the notes to the unaudited condensed consolidated financial statements. When we use the terms “Company,” “Firm,” “management,” “we,” “us,” and “our,” we mean Epoch Holding Corporation, a Delaware corporation, and its consolidated subsidiaries.

Forward-Looking Statements

Certain information included or incorporated by reference in this Quarterly Report on Form 10-Q and other materials filed or to be filed by Epoch Holding Corporation (“Epoch” or the “Company”) with the United States Securities and Exchange Commission (“SEC”) contain statements that may be considered forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about our Company, may include projections of our future financial performance based on our anticipated growth strategies and trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by our forward-looking statements. In particular, you should consider the risks and uncertainties outlined in “Factors Which May Affect Future Results.”

These risks and uncertainties are not exhaustive. Other sections of this Quarterly Report on Form 10-Q may include additional factors which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this Quarterly Report on Form 10-Q, nor to conform our prior statements to actual results or revised expectations, and we do not intend to do so.

Forward-looking statements include, but are not limited to, statements about our:

| | • | | expectations with respect to the economy, securities markets, the market for asset management activity and other industry trends, |

| | • | | strategic relationships, |

| | • | | recruitment and retention of employees, |

| | • | | possible or assumed future results of operations and operating cash flows, |

17

| | • | | potential operating performance, achievements, productivity improvements, technological changes, efficiency and cost reduction efforts, |

| | • | | realization of deferred tax assets, |

| | • | | expected tax rates, and |

| | • | | the effect of future legislation and regulation on our Company. |

Reports we file electronically with the SEC via the SEC’s Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”) may be accessed through the internet. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, at www.sec.gov. In addition, the public may read and copy any material that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

We maintain a website which contains current information on operations and other matters. The website address is www.eipny.com. Through the Investor Relations section of our website, and the “Financial Information” tab therein, we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statement, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our website also includes information concerning purchases and sales of our equity securities by our executive officers and directors. The information on our website is not, and shall not be deemed to be a part hereof or incorporated into this or any other filings with the SEC.

Also available free of charge on our website within the Investors Relations section, and the “Corporate Governance” tab therein, is our Code of Ethics and Business Conduct, as well as charters for the Audit, Nominating/Corporate Governance, and the Compensation Committees of our Board of Directors.

Factors Which May Affect Future Results

There are numerous factors which may affect our results of operations. These include, but are not limited to, the ability to attract and retain clients, performance of the financial markets and invested assets we manage, retention of key employees and members of management, and significant changes in regulations.

In addition, our ability to expand or alter our investment strategy offerings and distribution network, whether through acquisitions or internal development, is critical to our long-term success and has inherent risks. This success is dependent on the ability to identify and fund those developments or acquisitions on terms which are favorable to us. There can be no assurance that any of these operating factors or acquisitions can be achieved or, if undertaken, will be successful.

Other risks and uncertainties that we do not presently consider to be material or of which we are not presently aware may become important factors that affect us in the future.

These and other risks related to our Company are discussed in detail under Part I, Item 1A., “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2011.

Critical Accounting Estimates

Our significant accounting estimates are described in Note 2 of the Notes to the Consolidated Financial Statements, as well as Management’s Discussion and Analysis of Financial Condition and Results of Operations, in our Annual Report on Form 10-K for the fiscal year ended June 30, 2011, and have not changed from those described therein.

18

Overview

We are a global asset management firm with accomplished and experienced professionals. Our professional investment staff averages over 20 years of industry experience. Our Company was formed with the specific goal of responding to paradigm shifts occurring within the sources of global equity investment returns and within the structure of the investment management business as a whole.

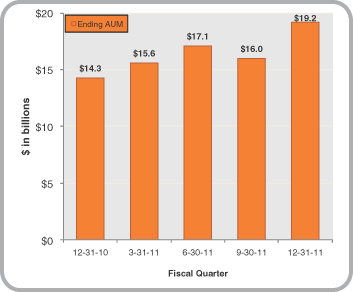

We had approximately $19.2 billion in assets under management (“AUM”) as of December 31, 2011. We remain debt-free and continue to have substantial capital resources available to fund current operations and implement our long-term growth strategy.

Our operating subsidiary, Epoch Investment Partners, Inc. (“EIP”), is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Our sole line of business is to provide investment advisory and investment management services to our clients including corporations, retirement plans, public pension funds, endowments, foundations, financial institutions, and high net worth individuals. These services are provided through both separately managed accounts and commingled vehicles, such as private investment funds and mutual funds. Our investment strategies are primarily distributed through sub-advisory and institutional channels.

Our client base consists of a large number of geographically diverse clients across many industries. For the three and six months ended December 31, 2011, we generated approximately 33% and 34%, respectively, of our total revenue from clients domiciled outside the U.S.

Revenues are generally derived as a percentage of AUM. Therefore, among other factors, our revenues are dependent upon:

| | • | | performance of financial markets, |

| | • | | performance of our investment strategies, |

| | • | | our ability to retain existing clients and attract new ones, and |

| | • | | changes in the composition of AUM. |

Our most significant operating expense is employee compensation and benefits, comprising fixed salaries, variable incentive compensation, share-based compensation, and employee benefits. Variable incentive compensation is primarily based upon management fee revenue, operating income, and investment performance. Our level of compensation reflects our plan to maintain competitive compensation levels to retain key personnel.

Our discussion and analysis of our financial condition and results of operations is based upon our Condensed Consolidated Financial Statements, which have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”). The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses and related disclosures of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including those related to incentive compensation, share-based compensation, effective income tax rate, valuation of deferred tax assets, and fair value. We base our estimates on historical experience and on various assumptions that we believe to be reasonable under current circumstances. Actual results may differ from these estimates.

AUM Fair Value Measurement

AUM consists of actively traded securities. The fair value of these securities is determined by an independent pricing service, which uses publicly available, unadjusted, quoted market prices for measurement. We substantiate the values obtained with another independent pricing service to confirm that all prices are valid. There is no judgment involved in the calculation of AUM in a manner that would directly impact our revenue recognition.

19

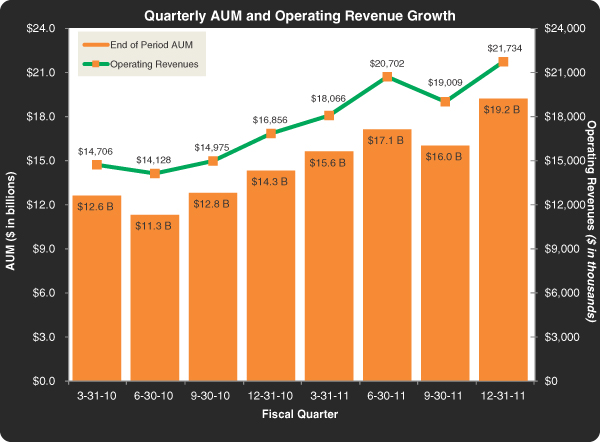

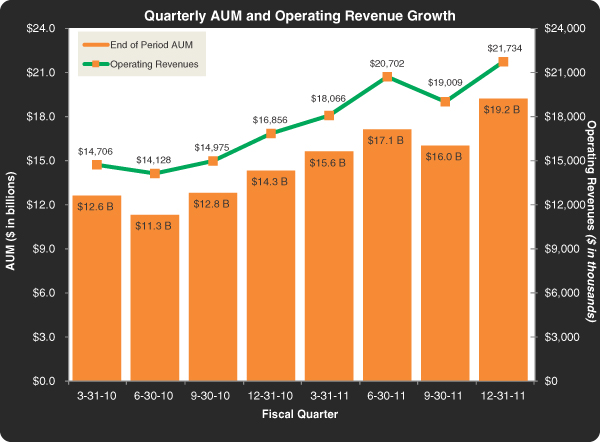

Key Performance Indicators

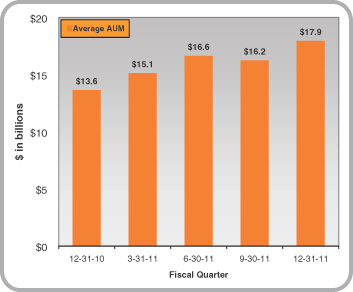

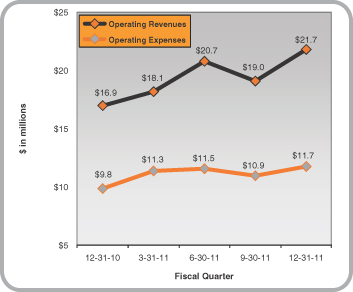

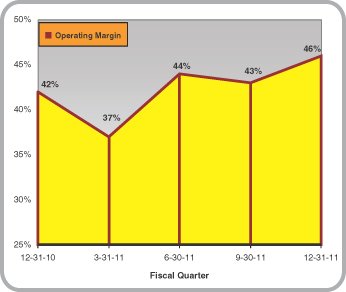

We monitor a variety of key performance indicators to evaluate our business results. The charts that follow depict our quarterly performance in certain key financial measures over the past five quarters:

| | (3) | Operating Revenues vs. Operating Expenses |

| * | defined as operating income divided by operating revenue. |

20

Financial and Business Highlights

During the three months ended December 31, 2011, substantial inflows and favorable market performance led to an increase in our operating revenues and operating margin. Some highlights as of December 31, 2011 were as follows:

| | • | | Our AUM was $19.2 billion at December 31, 2011, an increase of $3.2 billion, or 20%, from $16.0 billion at the previous quarter ended September 30, 2011. AUM increased by $4.9 billion, or 34%, from $14.3 billion at December 31, 2010. |

| | • | | Net client inflows during the quarter were approximately $1.6 billion, with approximately $0.8 billion from new client accounts. Approximately $0.6 billion of net inflows occurred during the last month of the quarter. |

| | • | | More than half of our investment strategies exceeded their respective benchmarks for the three months ended December 31, 2011. All of our investment strategies have exceeded their respective benchmarks for the 5 year period ended December 31, 2011. |

| | • | | Total operating revenues increased 29% from the same period a year ago as a result of higher AUM levels. |

| | • | | Operating expenses increased by 19% from the same period a year ago. Increased employee compensation, stemming from additions to our investment and client relations teams and an increase in incentive compensation, was the primary reason for the increase. |

| | • | | Our operating margin was approximately 46%, compared with 42% for the comparable period a year ago, as we continue to benefit from revenue growth and our operating leverage. |

| | • | | Basic earnings per share increased to $0.25 for the three months ended December 31, 2011, a 39% increase compared to $0.18 for the same period a year ago, after removing the effect of a $5.0 million tax valuation allowance release in the prior year period. |

| | • | | At December 31, 2011, working capital was $30.6 million. Liquid assets, comprising cash, cash equivalents and accounts receivable, were $57.2 million. We remain debt-free. |

| | • | | In October 2011, our Board approved an increase in the quarterly dividend from $0.06 to $0.08 per share and authorized the repurchase of up to an additional 350,000 shares of outstanding common stock under the Company’s share repurchase plan. |

| | • | | A special dividend of $0.75 per share, or approximately $17.5 million in aggregate, was declared in November 2011 and paid in January 2012. |

21

The table below presents key operating and financial indicators for the three and six months ended December 31, 2011 and 2010, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Six Months Ended | |

| | | December 31, | | | Change | | | December 31, | | | Change | |

| | | 2011 | | | 2010 | | | Amt | | | % | | | 2011 | | | 2010 | | | Amt | | | % | |

Operating Indicators

($ in millions): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AUM at end of the period | | $ | 19,217 | | | $ | 14,326 | | | $ | 4,891 | | | | 34 | % | | $ | 19,217 | | | $ | 14,326 | | | $ | 4,891 | | | | 34 | % |

Average AUM for the period | | $ | 17,925 | | | $ | 13,647 | | | $ | 4,278 | | | | 31 | % | | $ | 17,042 | | | $ | 12,898 | | | $ | 4,144 | | | | 32 | % |

Net client flows | | $ | 1,588 | | | $ | 275 | | | $ | 1,313 | | | | 477 | % | | $ | 3,143 | | | $ | 257 | | | $ | 2,886 | | | | 1,123 | % |

| | | | | | | | |

Financial Indicators:

($ in thousands, except share data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating Revenue | | $ | 21,734 | | | $ | 16,856 | | | $ | 4,878 | | | | 29 | % | | $ | 40,743 | | | $ | 31,831 | | | $ | 8,912 | | | | 28 | % |

Operating Income | | $ | 10,059 | | | $ | 7,037 | | | $ | 3,022 | | | | 43 | % | | $ | 18,157 | | | $ | 12,837 | | | $ | 5,320 | | | | 41 | % |

Net Income | | $ | 5,863 | | | $ | 9,033 | | | $ | (3,170 | ) | | | (35 | %) | | $ | 10,281 | | | $ | 12,379 | | | $ | (2,098 | ) | | | (17 | %) |

Earnings Per Share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.25 | | | $ | 0.40 | | | $ | (0.15 | ) | | | (38 | %) | | $ | 0.44 | | | $ | 0.54 | | | $ | (0.10 | ) | | | (19 | %) |

Diluted | | $ | 0.25 | | | $ | 0.39 | | | $ | (0.14 | ) | | | (36 | %) | | $ | 0.44 | | | $ | 0.54 | | | $ | (0.10 | ) | | | (19 | %) |

Operating Margin(1) | | | 46 | % | | | 42 | % | | | 4 | % | | | | | | | 45 | % | | | 40 | % | | | 5 | % | | | | |

| | | | | | | | |

Adjusted Financial Indicators*

($ in thousands, except share data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Income | | $ | 5,863 | | | $ | 4,069 | | | $ | 1,794 | | | | 44 | % | | $ | 10,281 | | | $ | 7,415 | | | $ | 2,866 | | | | 39 | % |

Earnings Per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.25 | | | $ | 0.18 | | | $ | 0.07 | | | | 39 | % | | $ | 0.44 | | | $ | 0.33 | | | $ | 0.11 | | | | 33 | % |

Diluted | | $ | 0.25 | | | $ | 0.18 | | | $ | 0.07 | | | | 39 | % | | $ | 0.44 | | | $ | 0.32 | | | $ | 0.12 | | | | 38 | % |

| * | The effect of the release of a valuation allowance on certain deferred tax assets during the three months ended December 31, 2010 was removed from these calculations to make the financial indicators comparable to the current year periods presented. The prior year release caused the following increases: an increase in net income by approximately $5.0 million and basic earnings per share by $0.22 and $0.21 in the three and six-month periods ending December 31, 2010, respectively. The effect on diluted earnings per share was an increase of $0.21 and $0.22 per share in the three and six months ended December 31, 2010, respectively. |

| (1) | Defined as operating income divided by total operating revenues. |

Business Environment

As an investment management and advisory firm, our results are impacted by the prevailing global economic climate, including such factors as corporate profitability, investor confidence, and interest rates. These factors can directly affect investor sentiment and global equity markets.

During the three months ended December 31, 2011 the broad market indexes rallied from earlier losses in the year and finished with a strong quarter, with returns ranging from 8% to 12%. The unemployment rate began to slowly decline, falling from 9.1% in September to 8.6% in November, the lowest level in two and a half years. The quarter ended on a positive note resulting from improving economic data from the housing and labor markets. Equity markets were extremely volatile, once again driven primarily by the European debt crisis. Concerns continued that global economic growth is slowing and that several countries could be slipping into a recession.

22

Broad Market Indices*

| | | | | | | | | | | | |

| | | Period Ended December 31, 2011 | |

Index | | Three Months | | | Six Months | | | Twelve Months | |

Dow Jones Industrial Average(1) | | | 12.8 | % | | | (0.2 | %) | | | 8.4 | % |

NASDAQ Composite(2) | | | 8.2 | % | | | (5.5 | %) | | | (0.8 | %) |

S&P 500(3) | | | 11.8 | % | | | (3.7 | %) | | | 2.1 | % |

MSCI World (net)(4) | | | 7.6 | % | | | (10.3 | %) | | | (5.5 | %) |

| | * | Assumes dividend re-investment |

| | (1) | Dow Jones Industrial Average is a trademark of Dow Jones & Company, which is not affiliated with Epoch. |

| | (2) | NASDAQ is a trademark of the NASDAQ Stock Market, Inc., which is not affiliated with Epoch. |

| | (3) | S&P is a trademark of the Standard & Poor’s, a division of the McGraw-Hill Companies, Inc., which is not affiliated with Epoch. |

| | (4) | MSCI World is a trademark of MSCI, Inc., which is not affiliated with Epoch. |

Business Outlook

We believe that slow economic growth in the U.S. will continue, as unemployment, while declining slightly during the past few months, remains historically high. Concerns over the European debt crisis will persist. International stocks could begin to rebound once investors perceive a definitive plan of action for resolving Europe’s debt issues is in place.

Despite lingering economic uncertainties, we believe equities remain far more attractive in this business environment than fixed income securities. Stock selection will be crucial. We remain focused on identifying companies producing significant free cash flow and led by management with a history of effective capital allocation. We believe this approach, combined with a portfolio construction process directed at providing superior long-term returns on a risk-adjusted basis, will continue to lead to demand for our investment services.

Given our strong, liquid balance sheet, our history of long-term investment performance, and our expanding distribution, we believe we continue to be well positioned for the future.

23

Assets under Management (“AUM”)

The graph below depicts our quarterly AUM and revenue growth over the past eight quarters:

24

AUM and Flows

Our AUM levels benefitted from significant client inflows and favorable market performance during the three months ended December 31, 2011. We continued to attract new assets to our investment strategies, with many strategies outperforming their respective benchmarks for the quarter. On a year-over-year basis, we further expanded our institutional and sub-advisory channels and our client base. The following table sets forth the changes in our AUM for the periods presented (dollars in millions):

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

December, | | | Six Months Ended

December, | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

Beginning of period AUM | | $ | 15,972 | | | $ | 12,765 | | | $ | 17,087 | | | $ | 11,344 | |

| | | | | | | | | | | | | | | | |

Client flows: | | | | | | | | | | | | | | | | |

Inflows/new accounts | | | 1,982 | | | | 651 | | | | 3,862 | | | | 1,010 | |

Outflows/closed accounts | | | (394 | ) | | | (376 | ) | | | (719 | ) | | | (753 | ) |

| | | | | | | | | | | | | | | | |

Net inflows | | | 1,588 | | | | 275 | | | | 3,143 | | | | 257 | |

Market performance | | | 1,657 | | | | 1,286 | | | | (1,013 | ) | | | 2,725 | |

| | | | | | | | | | | | | | | | |

Net change | | | 3,245 | | | | 1,561 | | | | 2,130 | | | | 2,982 | |

| | | | | | | | | | | | | | | | |

End of period AUM | | $ | 19,217 | | | $ | 14,326 | | | $ | 19,217 | | | $ | 14,326 | |

| | | | | | | | | | | | | | | | |

Percent change in total AUM | | | 20 | % | | | 12 | % | | | 12 | % | | | 26 | % |

Net inflows/Beginning of period AUM | | | 10 | % | | | 2 | % | | | 18 | % | | | 2 | % |

For the three and six months ended December 31, 2011, approximately 46% and 47%, respectively, of investment advisory and management fees were earned from services to mutual funds under advisory and sub-advisory contracts. These fees are calculated based upon daily net asset values. Approximately 54% and 53%, respectively, of fees were earned from services provided for separate accounts whose fees are calculated based upon asset values at the end of the period.

Investment Philosophy

We are global equity investors with a long-term perspective on the drivers of shareholder return. Our investment philosophy is focused on achieving superior long-term, risk-adjusted returns by investing in companies that generate free cash flow, appropriately allocate capital to create returns for shareholders, have understandable business models, possess transparent financial statements, and are undervalued relative to our investment team’s value determinations. Security selection and portfolio construction processes are designed to reduce the likelihood of significant losses in declining markets while participating in returns from rising markets.

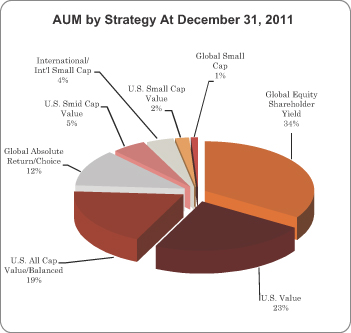

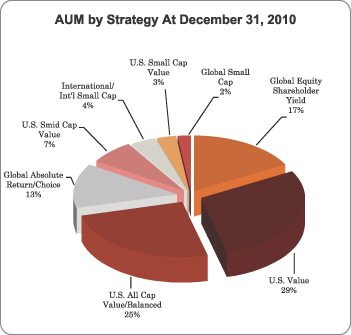

Investment Strategies

The table below depicts our investment strategies’ AUM as of December 31, 2011, September 30, 2011 and December 31, 2010, respectively, as well as the three-month and one-year changes (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | December 31,

2011 | | | September 30,

2011 | | | December 31,

2010 | | | 3-Month

Change | | | 1-Year

Change | |