FERRO REPORTS SECOND QUARTER 2018 RESULTS; GAAP EPS INCREASED 40% TO $0.35 AND ADJUSTED EPS INCREASED 18.9% TO $0.44 ALSO MAKES ACQUISITIONS THAT SUPPLEMENT AND EXPAND CURRENT PORTFOLIO OF TECHNOLOGIES, SETTING STAGE FOR FUTURE GROWTH |

| | | | |

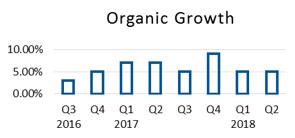

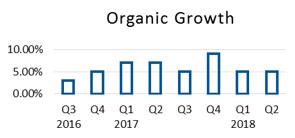

| GAAP EPS increased 40.0% to $0.35 |  | Ferro reported $0.44 of adjusted earnings per share. This was our eighth consecutive quarter of organic growth, and all three business units contributed to the strong results. Ferro’s innovation initiatives resulted in approximately 20% of our revenue in the quarter coming from our new product program pipeline. And our optimization initiatives helped us offset raw material price inflation through product pricing and reformulation. We also continued our momentum in corporate development, making acquisitions that bring to Ferro products with technologies that are excellent additions to our current portfolio and that expand our opportunities for further dynamic innovation and optimization. Peter Thomas Chairman, President and CEO, Ferro Corporation | |

| Adjusted EPS increased 18.9% to $0.44 |

| Net Sales increased 19.4% to $416.2 million |

| Net Income increased 41.1% to $29.7 million, with EBITDA expanding 17.9% to $75.2 million | | |

| Full-year 2018 non-GAAP guidance reaffirmed, despite currency headwinds | |

|

| Organic sales grew 5.4% on constant currency

|

| |

| | | | | | | | |

Key Results * (amounts in millions, except EPS) | | | | | | | | |

| | | | | | | | |

Sales and Gross Profits | Q2 2018 | % Change | YTD | % Change |

Net Sales | $ | 416,239 | | 19.4% | $ | 821,771 | | 22.8% |

Net Sales (Constant Currency) | | 416,239 | | 16.4% | | 821,771 | | 17.2% |

Gross Profit (GAAP) | | 126,645 | | 16.9% | | 245,331 | | 18.4% |

Adjusted Gross Profit (Constant Currency) | | 127,251 | | 12.3% | | 246,916 | | 11.1% |

| | | | | | | | |

Net Income, EBITDA and EPS | Q2 2018 | % Change | YTD | % Change |

Net Income 1 | $ | 29,668 | | 41.1% | $ | 53,059 | | 23.6% |

Adjusted EBITDA | | 75,186 | | 17.9% | | 139,210 | | 16.3% |

GAAP diluted EPS | $ | 0.35 | | 40.0% | $ | 0.62 | | 24.0% |

Adjusted diluted EPS | | 0.44 | | 18.9% | | 0.80 | | 17.6% |

| | | | | | | | |

*Comparative information is relative to prior-year second quarter.

1 Note: Net Income attributable to Ferro Corporation common shareholders.

Segment Results * (amounts in millions, except EPS) | |

| | | | | | | | | | |

| | Performance Coatings | Q2 2018 | % Change | YTD | % Change |

| Net Sales | $ | 193,449 | | 27.5% | $ | 378,097 | | 35.9% |

| Net Sales (Constant Currency) | | 193,449 | | 25.2% | | 378,097 | | 30.0% |

| Gross Profit (GAAP) | | 50,297 | | 25.0% | | 94,062 | | 27.6% |

| Adjusted Gross Profit (Constant Currency) | | 50,205 | | 18.6% | | 93,929 | | 19.1% |

| | | | | | | | | | |

| | Performance Colors & Glass | Q2 2018 | % Change | YTD | % Change |

| Net Sales | $ | 126,027 | | 18.2% | $ | 246,532 | | 17.3% |

| Net Sales (Constant Currency) | | 126,027 | | 14.3% | | 246,532 | | 11.4% |

| Gross Profit (GAAP) | | 45,362 | | 13.2% | | 88,690 | | 14.4% |

| Adjusted Gross Profit (Constant Currency) | | 45,366 | | 9.0% | | 88,694 | | 7.9% |

| | | | | | | | | | |

| | Color Solutions | Q2 2018 | % Change | YTD | % Change |

| Net Sales | $ | 96,763 | | 7.2% | $ | 197,142 | | 9.1% |

| Net Sales (Constant Currency) | | 96,763 | | 4.2% | | 197,142 | | 4.3% |

| Gross Profit (GAAP) | | 31,541 | | 11.0% | | 63,690 | | 12.5% |

| Adjusted Gross Profit (Constant Currency) | | 31,904 | | 7.5% | | 64,643 | | 5.0% |

*Comparative information is relative to prior-year second quarter.

|

Technology & Innovation Advancement |

Since June 29, 2018, we have completed acquisitions and signed definitive acquisition agreements (subject to customary closing conditions) with purchase prices in the aggregate amount of approximately $80 million. These transactions are expected to bring into the Ferro portfolio a range of products with technologies that support future growth, including future acquisitions and advancement into adjacent and new high-end markets that place a premium on innovation. Pending purchase accounting, we expect these acquisitions to be immediately accretive to earnings and to deliver on an annual basis approximately $50 - $60 million in revenue and $16 to $18 million in synergy-adjusted EBITDA.

Synergy-adjusted EBITDA for the transactions excludes the impact of certain items, primarily associated with purchase accounting adjustments, transaction-related expenses and acquisition integration costs, restructuring activities, gains and losses on asset sales concluded by the companies being acquired, and other adjustments to harmonize their accounting results to our standard accounting practices. The impact of adjusting for these items cannot be determined because some of the transactions have not been completed and it is not possible at this time to identify the potential amount or significance of these items for the balance of the year, as they have not occurred yet. Therefore, the Company is unable to reconcile the synergy-adjusted EBITDA guidance for the recent pending and completed acquisitions.

The 2018 guidance is being maintained, despite foreign currency headwinds. The guidance assumption has been updated to reflect a USD/EUR exchange rate of 1.16, compared to an exchange rate of 1.20 in our prior guidance. Also, the 2018 guidance assumes no acquisitions, exceptional optimization program spend or divestitures in 2018.

| | | |

| | | Adjusted Free Cash |

| Adjusted | Adjusted | Flow from Operations |

| EBITDA | EPS | Conversion1 |

2018 Guidance | $270 - $275M | $1.55 - $1.60 | 40% - 45% |

Currency Exposure 2017 Weighting | | 2018 Guidance FX sensitivity |

EUR - Euro | 35% to 40% | | % Change | Operating Profit |

CNY -Yuan Renminbi | 5% to 7% | | +1 all FX change | ~ $1.4 million to ~$1.6 million |

MXN – Mexican Peso | 4% to 6% | | +1 Euro change | ~$0.9 million to ~$1.1 million |

EGP – Egyptian Pound | 2% to 5% | | | |

The results and guidance in this release, including in the highlights above, contain references to non-GAAP measures from continuing operations. Reconciliations of historical GAAP to non-GAAP results can be found at the end of this release.

1 Note: Adjusted free cash flow is defined as GAAP Operating Cash Flow, less Capex, plus cash used for restructuring, acquisition related professional fees, divested businesses and assets, and certain optimization projects (including Capital).

Ferro is providing adjusted diluted EPS, adjusted EBITDA and adjusted free cash flow from operations conversion guidance on a continuing operations basis. While it is likely that Ferro could incur charges for items excluded from adjusted diluted EPS, adjusted EBITDA and adjusted free cash flow from operations conversion such as mark-to-market adjustments of pension and other postretirement benefit obligations, restructuring and impairment charges, and legal and professional expenses related to certain business development activities, it is not possible, without unreasonable effort, to identify the amount or significance of these items or the potential for other transactions that may impact future GAAP net income and cash flow from operating activities. Management does not believe these items to be representative of underlying business performance. Management is unable to reconcile, without unreasonable effort, the Company's forecasted range of these adjusted non-GAAP financial measures to their most directly comparable GAAP financial measures.

Constant Currency

Constant currency results reflect the remeasurement of 2017 reported and adjusted local currency results using 2018 exchange rates, which reproduces constant currency comparative figures to 2018 reported and adjusted results. These non-GAAP financial measures should not be considered as a substitute for the measures of financial performance prepared in accordance with GAAP.

Conference Call

Ferro will conduct an investor teleconference at 10:00 a.m. EDT Thursday, July 26, 2018. Investors can access this conference via any of the following:

• Webcast can be accessed by clicking on the Investor link at the top of Ferro’s website at ferro.com.

• Live telephone: Call 800-909-7944 within the U.S. or +1 212-231-2935 outside the U.S. Please join the call at least 10 minutes before the start time.

• Webcast replay: Available on Ferro’s Investor website at ferro.com beginning at approximately 12:00 noon Eastern Time on July 26, 2018

• Telephone replay: Call 800-633-8284 within the U.S. or +1 402-977-9140 outside the U.S. (for both U.S. and outside the U.S. access code is 21891850).

• Presentation material & podcast: Earnings presentation material and podcasts can be accessed through the Investor Information portion of the Company’s Web site at ferro.com.

About Ferro Corporation

Ferro Corporation (www.ferro.com) is a leading global supplier of technology-based functional coatings and color solutions. Ferro supplies functional coatings for glass, metal, ceramic and other substrates and color solutions in the form of specialty pigments and colorants for a broad range of industries and applications. Ferro products are sold into the building and construction, automotive, electronics, industrial products, household furnishings and appliance markets. The Company’s reportable segments include: Performance Coatings (metal and ceramic coatings), Performance Colors and Glass (glass coatings), and Color Solutions. Headquartered in Mayfield Heights, Ohio, the Company has approximately 5,620 associates globally and reported 2017 sales of $1.4 billion.

Cautionary Note on Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of federal securities laws. These statements are subject to a variety of uncertainties, unknown risks, and other factors concerning the Company’s operations and business environment. Important factors that could cause actual results to differ materially from those suggested by these forward-looking statements and that could adversely affect the Company’s future financial performance include the following:

| · | | demand in the industries into which Ferro sells its products may be unpredictable, cyclical, or heavily influenced by consumer spending; |

| · | | Ferro’s ability to successfully implement and/or administer its optimization initiatives, including its investment and restructuring programs, and to produce the desired results; |

| · | | currency conversion rates and economic, social, political, and regulatory conditions in the U.S. and around the world including the impact of tariffs; |

| · | | challenges associated with a multi-national company such as Ferro competing lawfully with local competitors in certain regions of the world; |

| · | | Ferro’s ability to identify suitable acquisition candidates, complete acquisitions (including those pending acquisitions noted in this press release), effectively integrate the acquired businesses and achieve the expected synergies, as well as the acquisitions being accretive and Ferro achieving the expected returns on invested capital; |

| · | | the effectiveness of the Company’s efforts to improve operating margins through sales growth, price increases, productivity gains, and improved purchasing techniques; |

| · | | Ferro’s ability to successfully introduce new products and services or enter into new growth markets; |

| · | | the impact of damage to, or the interruption, failure or compromise of the Company’s information systems; |

| · | | the implementation and operations of business information systems and processes; |

| · | | restrictive covenants in the Company’s credit facilities could affect its strategic initiatives and liquidity; |

| · | | Ferro’s ability to access capital markets, borrowings, or financial transactions; |

| · | | the availability of reliable sources of energy and raw materials at a reasonable cost; |

| · | | increasingly aggressive domestic and foreign governmental regulation of hazardous and other materials and regulations affecting health, safety and the environment; |

| · | | competitive factors, including intense price competition; |

| · | | Ferro’s ability to protect its intellectual property, including trade secrets, or to successfully resolve claims of infringement brought against it; |

| · | | sale of products and materials into highly regulated industries; |

| · | | our ability to address safety, human health, product liability and environmental risks associated with our current and historical products, product life cycle and production processes; |

| · | | limited or no redundancy for certain of the Company’s manufacturing facilities and possible interruption of operations at those facilities; |

| · | | management of Ferro’s general and administrative expenses; |

Cautionary Note on Forward-Looking Statements (continued)

| · | | Ferro’s multi-jurisdictional tax structure and its ability to reduce its effective tax rate, including the impact of the Company’s performance on its ability to utilize significant deferred tax assets; |

| · | | the effectiveness of strategies to increase Ferro’s return on invested capital, and the short-term impact that acquisitions may have on return on invested capital; |

| · | | stringent labor and employment laws and relationships with the Company’s employees; |

| · | | the impact of requirements to fund employee benefit costs, especially post-retirement costs; |

| · | | implementation of business processes and information systems, including the outsourcing of functions to third parties; |

| · | | risks associated with the manufacture and sale of material into industries making products for sensitive applications; |

| · | | the impact of the Tax Cuts and Jobs Act on our business; |

| · | | exposure to lawsuits governmental investigations and proceedings relating to current and historical operations and products; |

| · | | risks and uncertainties associated with intangible assets; |

| · | | Ferro’s borrowing costs could be affected adversely by interest rate increases; |

| · | | liens on the Company’s assets by its lenders affect its ability to dispose of property and businesses; |

| · | | amount and timing of any repurchase of Ferro’s common stock; and |

| · | | other factors affecting the Company’s business that are beyond its control, including disasters, accidents and governmental actions. |

The risks and uncertainties identified above are not the only risks the Company faces. Additional risks and uncertainties not presently known to the Company or that it currently believes to be immaterial also may adversely affect the Company. Should any known or unknown risks and uncertainties develop into actual events, these developments could have material adverse effects on our business, financial condition and results of operations.

This release contains time-sensitive information that reflects management’s best analysis only as of the date of this release. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events, information, or circumstances that arise after the date of this release.

Additional information regarding these risks can be found in our Annual Report on Form 10-K for the year ended December 31, 2017.

Ferro Corporation

Investor Contact:

Kevin Cornelius Grant, 216.875.5451

Head of Investor Relations

kevincornelius.grant@ferro.com

or

Media Contact:

Mary Abood, 216.875.5401

Director, Corporate Communications

mary.abood@ferro.com

Table 1

Ferro Corporation and Subsidiaries

Consolidated Statements of Operations (unaudited)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(In thousands, except per share amounts) | | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| | | | | | | | | | | | |

Net sales | | $ | 416,239 | | $ | 348,632 | | $ | 821,771 | | $ | 669,187 |

Cost of sales | | | 289,594 | | | 240,290 | | | 576,440 | | | 462,051 |

Gross profit | | | 126,645 | | | 108,342 | | | 245,331 | | | 207,136 |

Selling, general and administrative expenses | | | 70,124 | | | 62,981 | | | 143,216 | | | 122,427 |

Restructuring and impairment charges | | | 3,768 | | | 3,224 | | | 7,874 | | | 6,242 |

Other expense (income): | | | | | | | | | | | | |

Interest expense | | | 8,200 | | | 6,449 | | | 16,162 | | | 12,673 |

Interest earned | | | (186) | | | (175) | | | (387) | | | (355) |

Foreign currency losses, net | | | 2,660 | | | 4,868 | | | 4,500 | | | 4,554 |

Loss on extinguishment of debt | | | 3,226 | | | - | | | 3,226 | | | 3,905 |

Miscellaneous (income) expense, net | | | (1,372) | | | 1,071 | | | (597) | | | (1,493) |

Income before income taxes | | | 40,225 | | | 29,924 | | | 71,337 | | | 59,183 |

Income tax expense | | | 10,364 | | | 8,695 | | | 17,878 | | | 15,833 |

Net income | | | 29,861 | | | 21,229 | | | 53,459 | | | 43,350 |

Less: Net income attributable to noncontrolling interests | | | 193 | | | 204 | | | 400 | | | 427 |

Net income attributable to Ferro Corporation common shareholders | | $ | 29,668 | | $ | 21,025 | | $ | 53,059 | | $ | 42,923 |

Earnings per share attributable to Ferro Corporation common shareholders: | | | | | | | | | | | | |

Basic earnings per share | | | 0.35 | | | 0.25 | | | 0.63 | | | 0.51 |

Diluted earnings per share | | | 0.35 | | | 0.25 | | | 0.62 | | | 0.50 |

| | | | | | | | | | | | |

Shares outstanding: | | | | | | | | | | | | |

Weighted-average basic shares | | | 84,341 | | | 83,673 | | | 84,284 | | | 83,602 |

Weighted-average diluted shares | | | 85,589 | | | 85,277 | | | 85,545 | | | 85,080 |

End-of-period basic shares | | | 84,137 | | | 83,694 | | | 84,137 | | | 83,694 |

Table 2

Ferro Corporation and Subsidiaries

Segment Net Sales and Gross Profit (unaudited)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(Dollars in thousands) | | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

Segment Net Sales | | | | | | | | | | | | |

Performance Coatings | | $ | 193,449 | | $ | 151,746 | | $ | 378,097 | | $ | 278,311 |

Performance Colors and Glass | | | 126,027 | | | 106,637 | | | 246,532 | | | 210,155 |

Color Solutions | | | 96,763 | | | 90,249 | | | 197,142 | | | 180,721 |

Total segment net sales | | $ | 416,239 | | $ | 348,632 | | $ | 821,771 | | $ | 669,187 |

| | | | | | | | | | | | |

Segment Gross Profit | | | | | | | | | | | | |

Performance Coatings | | $ | 50,297 | | $ | 40,246 | | $ | 94,062 | | $ | 73,735 |

Performance Colors and Glass | | | 45,362 | | | 40,087 | | | 88,690 | | | 77,505 |

Color Solutions | | | 31,541 | | | 28,416 | | | 63,690 | | | 56,598 |

Other costs of sales | | | (555) | | | (407) | | | (1,111) | | | (702) |

Total gross profit | | $ | 126,645 | | $ | 108,342 | | $ | 245,331 | | $ | 207,136 |

| | | | | | | | | | | | |

Selling, general and administrative expenses | | | | | | | | | | | | |

Strategic services | | $ | 39,643 | | $ | 33,013 | | $ | 80,821 | | $ | 64,673 |

Functional services | | | 26,524 | | | 24,835 | | | 53,042 | | | 48,068 |

Incentive compensation | | | 2,531 | | | 2,465 | | | 5,497 | | | 4,295 |

Stock-based compensation | | | 1,426 | | | 2,668 | | | 3,856 | | | 5,391 |

Total selling, general and administrative expenses | | $ | 70,124 | | $ | 62,981 | | $ | 143,216 | | $ | 122,427 |

| | | | | | | | | | | | |

Table 3

Ferro Corporation and Subsidiaries

Consolidated Balance Sheets (unaudited)

| | | | | | |

| | | | | | |

(Dollars in thousands) | | June 30, | | December 31, |

| | 2018 | | 2017 |

ASSETS | | | | | | |

Current assets | | | | | | |

Cash and cash equivalents | | $ | 44,886 | | $ | 63,551 |

Accounts receivable, net | | | 395,858 | | | 354,416 |

Inventories | | | 381,763 | | | 324,180 |

Other receivables | | | 66,519 | | | 67,137 |

Other current assets | | | 25,765 | | | 16,448 |

Total current assets | | | 914,791 | | | 825,732 |

Other assets | | | | | | |

Property, plant and equipment, net | | | 334,997 | | | 321,742 |

Goodwill | | | 199,172 | | | 195,369 |

Intangible assets, net | | | 179,154 | | | 187,616 |

Deferred income taxes | | | 109,404 | | | 108,025 |

Other non-current assets | | | 36,294 | | | 43,718 |

Total assets | | $ | 1,773,812 | | $ | 1,682,202 |

| | | | | | |

LIABILITIES AND EQUITY | | | | | | |

Current liabilities | | | | | | |

Loans payable and current portion of long-term debt | | $ | 25,739 | | $ | 25,136 |

Accounts payable | | | 201,380 | | | 211,711 |

Accrued payrolls | | | 39,904 | | | 48,201 |

Accrued expenses and other current liabilities | | | 75,114 | | | 70,151 |

Total current liabilities | | | 342,137 | | | 355,199 |

Other liabilities | | | | | | |

Long-term debt, less current portion | | | 815,015 | | | 726,491 |

Postretirement and pension liabilities | | | 161,179 | | | 166,680 |

Other non-current liabilities | | | 71,769 | | | 77,152 |

Total liabilities | | | 1,390,100 | | | 1,325,522 |

Equity | | | | | | |

Total Ferro Corporation shareholders’ equity | | | 374,628 | | | 344,814 |

Noncontrolling interests | | | 9,084 | | | 11,866 |

Total liabilities and equity | | $ | 1,773,812 | | $ | 1,682,202 |

Table 4

Ferro Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows (unaudited)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(Dollars in thousands) | | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

Cash flows from operating activities | | | | | | | | | | | | |

Net income | | $ | 29,861 | | $ | 21,229 | | $ | 53,459 | | $ | 43,350 |

Gain on sale of assets | | | 59 | | | 866 | | | 288 | | | 1,285 |

Depreciation and amortization | | | 13,574 | | | 11,781 | | | 26,966 | | | 23,156 |

Interest amortization | | | 903 | | | 953 | | | 1,773 | | | 1,432 |

Restructuring and impairment | | | 3,050 | | | 1,046 | | | 5,479 | | | 3,874 |

Loss on extinguishment of debt | | | 3,226 | | | - | | | 3,226 | | | 3,905 |

Accounts receivable | | | (18,107) | | | (21,564) | | | (50,764) | | | (48,183) |

Inventories | | | (36,544) | | | (11,545) | | | (65,364) | | | (28,659) |

Accounts payable | | | 5,608 | | | 5,934 | | | (1,531) | | | 14,122 |

Other current assets and liabilities, net | | | (12,065) | | | (1,846) | | | (18,800) | | | (5,111) |

Other adjustments, net | | | 7,045 | | | 6,221 | | | 7,593 | | | 5,534 |

Net cash (used in) provided by operating activities | | | (3,390) | | | 13,075 | | | (37,675) | | | 14,705 |

Cash flows from investing activities | | | | | | | | | | | | |

Capital expenditures for property, plant and equipment and other long lived assets | | | (22,887) | | | (10,128) | | | (43,569) | | | (16,894) |

Business acquisitions, net of cash acquired | | | (2,568) | | | (14,752) | | | (4,920) | | | (14,752) |

Other investing activities | | | 9 | | | 143 | | | 31 | | | 145 |

Net cash used in investing activities | | | (25,446) | | | (24,737) | | | (48,458) | | | (31,501) |

Cash flows from financing activities | | | | | | | | | | | | |

Net (repayments) under loans payable | | | (11,570) | | | (1,660) | | | (1,828) | | | (5,645) |

Proceeds from revolving credit facility - 2014 Credit Facility | | | - | | | - | | | - | | | 15,628 |

Principal payments on revolving credit facility - 2014 Credit Facility | | | - | | | - | | | - | | | (327,183) |

Principal payments on term loan facility - 2014 Credit Facility | | | - | | | - | | | - | | | (243,250) |

Proceeds from term loan facility - Credit Facility | | | - | | | - | | | - | | | 623,827 |

Principal payments on term loan facility - Credit Facility | | | (302,396) | | | (1,596) | | | (304,060) | | | (1,596) |

Principal payments on term loan facility - Amended Credit Facility | | | (2,050) | | | | | | (2,050) | | | - |

Proceeds from revolving credit facility - Credit Facility | | | 15,400 | | | - | | | 134,950 | | | - |

Principal payments on revolving credit facility - Credit Facility | | | (133,583) | | | - | | | (212,950) | | | - |

Proceeds from revolving credit facility - Amended Credit Facility | | | 580 | | | - | | | 580 | | | - |

Proceeds from term loan facility - Amended Credit Facility | | | 466,075 | | | - | | | 466,075 | | | - |

Payment of debt issuance costs | | | (3,466) | | | (215) | | | (3,466) | | | (12,927) |

Acquisition related contingent consideration payment | | | - | | | - | | | (348) | | | - |

Purchase of treasury stock | | | (6,014) | | | - | | | (6,014) | | | - |

Other financing activities | | | (254) | | | (540) | | | (2,387) | | | (930) |

Net cash provided by financing activities | | | 22,722 | | | (4,011) | | | 68,502 | | | 47,924 |

Effect of exchange rate changes on cash and cash equivalents | | | (2,296) | | | 1,710 | | | (1,034) | | | 2,156 |

(Decrease) increase in cash and cash equivalents | | | (8,410) | | | (13,963) | | | (18,665) | | | 33,284 |

Cash and cash equivalents at beginning of period | | | 53,296 | | | 92,829 | | | 63,551 | | | 45,582 |

Cash and cash equivalents at end of period | | $ | 44,886 | | $ | 78,866 | | $ | 44,886 | | $ | 78,866 |

Cash paid during the period for: | | | | | | | | | | | | |

Interest | | $ | 9,136 | | $ | 8,179 | | $ | 16,450 | | $ | 14,714 |

Income taxes | | $ | 9,803 | | $ | 5,416 | | $ | 14,378 | | $ | 9,513 |

Table 5

Ferro Corporation and Subsidiaries

Supplemental Information

Reconciliation of Reported Income to Adjusted Income

For the Three Months Ended June 30 (unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

�� | | | | | | | | | | | | | | | | | | | | | |

(Dollars in thousands, except per share amounts) | | | Cost of sales | | | Selling general and administrative expenses | | | Restructuring and impairment charges | | | Other expense, net | | | Income tax expense3 | | | Net income attributable to common shareholders | | | Diluted earnings per share |

| | | | | | | | | | | | | | | | | | | | | |

| | 2018 |

| | | | | | | | | | | | | | | | | | | | | |

As reported | | $ | 289,594 | | $ | 70,124 | | $ | 3,768 | | $ | 12,528 | | $ | 10,364 | | $ | 29,668 | | $ | 0.35 |

Special items: | | | | | | | | | | | | | | | | | | | | | |

Restructuring | | | - | | | - | | | (3,768) | | | - | | | - | | | 3,768 | | | 0.04 |

Acquisition related professional fees | | | (364) | | | (3,149) | | | - | | | - | | | - | | | 3,513 | | | 0.04 |

Costs related to optimization projects | | | (242) | | | (1,467) | | | - | | | - | | | - | | | 1,709 | | | 0.02 |

Costs related to divested businesses and assets | | | - | | | 131 | | | - | | | - | | | - | | | (131) | | | - |

Other1 | | | - | | | - | | | - | | | (1,631) | | | - | | | 1,631 | | | 0.02 |

Tax on special items | | | - | | | - | | | - | | | - | | | 2,874 | | | (2,874) | | | (0.03) |

Total special items4 | | | (606) | | | (4,485) | | | (3,768) | | | (1,631) | | | 2,874 | | | 7,616 | | | 0.09 |

As adjusted | | $ | 288,988 | | $ | 65,639 | | $ | - | | $ | 10,897 | | $ | 13,238 | | $ | 37,284 | | $ | 0.44 |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | 2017 |

| | | | | | | | | | | | | | | | | | | | | |

As reported | | $ | 240,290 | | $ | 62,981 | | $ | 3,224 | | $ | 12,213 | | $ | 8,695 | | $ | 21,025 | | $ | 0.25 |

Special items: | | | | | | | | | | | | | | | | | | | | | |

Restructuring | | | - | | | - | | | (3,224) | | | - | | | - | | | 3,224 | | | 0.04 |

Acquisition related professional fees | | | (1,508) | | | (4,332) | | | - | | | - | | | - | | | 5,840 | | | 0.07 |

Costs related to optimization projects | | | (53) | | | (69) | | | - | | | - | | | - | | | 122 | | | - |

Costs related to divested businesses and assets | | | (70) | | | (622) | | | - | | | - | | | - | | | 692 | | | 0.01 |

Other2 | | | - | | | - | | | - | | | (4,159) | | | - | | | 4,159 | | | 0.05 |

Tax on special items | | | - | | | - | | | - | | | - | | | 3,851 | | | (3,851) | | | (0.05) |

Total special items4 | | | (1,631) | | | (5,023) | | | (3,224) | | | (4,159) | | | 3,851 | | | 10,186 | | | 0.12 |

As adjusted | | $ | 238,659 | | $ | 57,958 | | $ | - | | $ | 8,054 | | $ | 12,546 | | $ | 31,211 | | $ | 0.37 |

| (1) | | The adjustments to “Other expense, net” primarily relate to debt extinguishment charges, fees expensed associated with the Amended Credit Facility and a gain recognized on increasing our ownership interest in FMU. |

| (2) | | The adjustments to “Other expense, net” primarily relate to the FX loss incurred on our Euro-denominated term loan, a loss on an equity method investment, and a loss on an asset sale during the quarter. |

| (3) | | The tax rate reflects the reported tax rate, adjusted for special items being tax effected at the respective statutory rate where the item originated. |

| (4) | | Due to rounding, total earnings per share related to special items does not always add to the total adjusted earnings per share. |

It should be noted that adjusted income, earnings per share and other adjusted items referred to above are financial measures not required by, or presented in accordance with, accounting principles generally accepted in the United States (U.S. GAAP). These non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with U.S. GAAP, and a reconciliation of these financial measures to the most comparable U.S. GAAP financial measures is presented. We believe this data provides investors with additional information on the underlying operations and trends of the business and enables period-to-period comparability of financial performance.

Table 6

Ferro Corporation and Subsidiaries

Supplemental Information

Reconciliation of Reported Income to Adjusted Income

For the Six Months Ended June 30 (unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

(Dollars in thousands, except per share amounts) | | | Cost of sales | | | Selling general and administrative expenses | | | Restructuring and impairment charges | | | Other expense, net | | | Income tax expense3 | | | Net income attributable to common shareholders | | | Diluted earnings per share |

| �� | | | | | | | | | | | | | | | | | | | | |

| | 2018 |

| | | | | | | | | | | | | | | | | | | | | |

As reported | | $ | 576,440 | | $ | 143,216 | | $ | 7,874 | | $ | 22,904 | | $ | 17,878 | | $ | 53,059 | | $ | 0.62 |

Special items: | | | | | | | | | | | | | | | | | | | | | |

Restructuring | | | - | | | - | | | (7,874) | | | - | | | - | | | 7,874 | | | 0.09 |

Acquisition related professional fees | | | (952) | | | (5,795) | | | - | | | - | | | - | | | 6,747 | | | 0.08 |

Costs related to optimization projects | | | (633) | | | (2,365) | | | - | | | - | | | - | | | 2,998 | | | 0.04 |

Costs related to divested businesses and assets | | | - | | | (384) | | | - | | | - | | | - | | | 384 | | | - |

Other1 | | | - | | | - | | | - | | | (2,435) | | | - | | | 2,435 | | | 0.03 |

Tax on special items | | | - | | | - | | | - | | | - | | | 5,267 | | | (5,267) | | | (0.06) |

Total special items4 | | | (1,585) | | | (8,544) | | | (7,874) | | | (2,435) | | | 5,267 | | | 15,171 | | | 0.18 |

As adjusted | | $ | 574,855 | | $ | 134,672 | | $ | - | | $ | 20,469 | | $ | 23,145 | | $ | 68,230 | | $ | 0.80 |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | 2017 |

| | | | | | | | | | | | | | | | | | | | | |

As reported | | $ | 462,051 | | $ | 122,427 | | $ | 6,242 | | $ | 19,284 | | $ | 15,833 | | $ | 42,923 | | $ | 0.50 |

Special items: | | | | | | | | | | | | | | | | | | | | | |

Restructuring | | | - | | | - | | | (6,242) | | | - | | | - | | | 6,242 | | | 0.07 |

Acquisition related professional fees | | | (4,087) | | | (6,357) | | | - | | | - | | | - | | | 10,444 | | | 0.12 |

Costs related to optimization projects | | | (111) | | | (431) | | | - | | | - | | | - | | | 542 | | | 0.01 |

Costs related to divested businesses and assets | | | (70) | | | (785) | | | - | | | - | | | - | | | 855 | | | 0.01 |

Other2 | | | - | | | - | | | - | | | (5,333) | | | - | | | 5,333 | | | 0.06 |

Tax on special items | | | - | | | - | | | - | | | - | | | 8,538 | | | (8,538) | | | (0.10) |

Total special items4 | | | (4,268) | | | (7,573) | | | (6,242) | | | (5,333) | | | 8,538 | | | 14,878 | | | 0.17 |

As adjusted | | $ | 457,783 | | $ | 114,854 | | $ | - | | $ | 13,951 | | $ | 24,371 | | $ | 57,801 | | $ | 0.68 |

| (1) | | The adjustments to “Other expense, net” primarily relate to debt extinguishment charges, fees expensed associated with the Amended Credit Facility, a gain recognized on increasing our ownership interest in FMU, earn out adjustments for acquisitions and other acquisition related costs. |

| (2) | | The adjustments to “Other expense, net” primarily relate to the FX loss incurred on our Euro-denominated term loan, a loss on an equity method investment, the loss/gain on an asset sale, debt extinguishment costs and a reduction of a contingent liability in Argentina. |

| (3) | | The tax rate reflects the reported tax rate, adjusted for special items being tax effected at the respective statutory rate where the item originated. |

| (4) | | Due to rounding, total earnings per share related to special items does not always add to the total adjusted earnings per share. |

It should be noted that adjusted income, earnings per share and other adjusted items referred to above are financial measures not required by, or presented in accordance with, accounting principles generally accepted in the United States (U.S. GAAP). These non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with U.S. GAAP, and a reconciliation of these financial measures to the most comparable U.S. GAAP financial measures is presented. We believe this data provides investors with additional information on the underlying operations and trends of the business and enables period-to-period comparability of financial performance.

Table 7

Ferro Corporation and Subsidiaries

Supplemental Information

Constant Currency Schedule of Adjusted Operating Profit (unaudited)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Three Months Ended |

(Dollars in thousands) | | June 30, |

| | 2017 | | Adjusted 20171 | | 2018 | | 2018 vs Adjusted 2017 |

Segment net sales | | | | | | | | | | | | |

Performance Coatings | | $ | 151,746 | | $ | 154,472 | | $ | 193,449 | | $ | 38,977 |

Performance Colors and Glass | | | 106,637 | | | 110,255 | | | 126,027 | | | 15,772 |

Color Solutions | | | 90,249 | | | 92,834 | | | 96,763 | | | 3,929 |

Total segment net sales | | $ | 348,632 | | $ | 357,561 | | $ | 416,239 | | $ | 58,678 |

| | | | | | | | | | | | |

Segment adjusted gross profit | | | | | | | | | | | | |

Performance Coatings | | $ | 40,889 | | $ | 42,314 | | $ | 50,205 | | $ | 7,891 |

Performance Colors and Glass | | | 40,405 | | | 41,639 | | | 45,366 | | | 3,727 |

Color Solutions | | | 28,962 | | | 29,667 | | | 31,904 | | | 2,237 |

Other costs of sales | | | (283) | | | (294) | | | (224) | | | 70 |

Total adjusted gross profit2 | | $ | 109,973 | | $ | 113,326 | | $ | 127,251 | | $ | 13,925 |

| | | | | | | | | | | | |

Adjusted selling, general and administrative expenses | | | | | | | | | | | | |

Strategic services | | $ | 32,715 | | $ | 34,296 | | $ | 39,581 | | $ | 5,285 |

Functional services | | | 20,110 | | | 19,831 | | | 22,101 | | | 2,270 |

Incentive compensation | | | 2,465 | | | 2,523 | | | 2,531 | | | 8 |

Stock-based compensation | | | 2,668 | | | 2,668 | | | 1,426 | | | (1,242) |

Total adjusted selling, general and administrative expenses3 | | $ | 57,958 | | $ | 59,318 | | $ | 65,639 | | $ | 6,321 |

| | | | | | | | | | | | |

Adjusted operating profit | | $ | 52,015 | | $ | 54,008 | | $ | 61,612 | | $ | 7,604 |

Adjusted operating profit as a % of net sales | | | 14.9% | | | 15.1% | | | 14.8% | | | |

| (1) | | Reflects the remeasurement of 2017 reported and adjusted local currency results using 2018 exchange rates, resulting in constant currency comparative figures to 2018 reported and adjusted results. See Table 5 for non-GAAP adjustments applicable to the three month period. |

| (2) | | Refer to Table 5 for the reconciliation of adjusted gross profit for the three months ended June 30, 2018 and 2017, respectively. |

| (3) | | Refer to Table 5 for the reconciliation of SG&A expenses to adjusted SG&A expenses for the three months ended June 30, 2018 and 2017, respectively. |

It should be noted that adjusted 2017 results is a financial measure not required by, or presented in accordance with, accounting principles generally accepted in the United States (U.S. GAAP). This non-GAAP financial measure should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with U.S. GAAP and a reconciliation of this financial measure to the most comparable U.S. GAAP financial measures is presented. We believe this data provides investors with additional information on the underlying operations and trends of the business and enables period-to-period comparability of financial performance.

Table 8

Ferro Corporation and Subsidiaries

Supplemental Information

Constant Currency Schedule of Adjusted Operating Profit (unaudited)

| | | | | | | | | | | | |

| | Six Months Ended |

(Dollars in thousands) | | June 30, |

| | 2017 | | Adjusted 20171 | | 2018 | | 2018 vs Adjusted 2017 |

Segment net sales | | | | | | | | | | | | |

Performance Coatings | | $ | 278,311 | | $ | 290,760 | | $ | 378,097 | | $ | 87,337 |

Performance Colors and Glass | | | 210,155 | | | 221,361 | | | 246,532 | | | 25,171 |

Color Solutions | | | 180,721 | | | 188,940 | | | 197,142 | | | 8,202 |

Total segment net sales | | $ | 669,187 | | $ | 701,061 | | $ | 821,771 | | $ | 120,710 |

| | | | | | | | | | | | |

Segment adjusted gross profit | | | | | | | | | | | | |

Performance Coatings | | $ | 74,378 | | $ | 78,856 | | $ | 93,929 | | $ | 15,073 |

Performance Colors and Glass | | | 78,290 | | | 82,238 | | | 88,694 | | | 6,456 |

Color Solutions | | | 59,262 | | | 61,551 | | | 64,643 | | | 3,092 |

Other costs of sales | | | (526) | | | (469) | | | (350) | | | 119 |

Total adjusted gross profit2 | | $ | 211,404 | | $ | 222,176 | | $ | 246,916 | | $ | 24,740 |

| | | | | | | | | | | | |

Adjusted selling, general and administrative expenses | | | | | | | | | | | | |

Strategic services | | $ | 64,300 | | $ | 68,636 | | $ | 80,680 | | $ | 12,044 |

Functional services | | | 40,868 | | | 42,586 | | | 44,646 | | | 2,060 |

Incentive compensation | | | 4,295 | | | 4,530 | | | 5,490 | | | 960 |

Stock-based compensation | | | 5,391 | | | 5,391 | | | 3,856 | | | (1,535) |

Total adjusted selling, general and administrative expenses3 | | $ | 114,854 | | $ | 121,143 | | $ | 134,672 | | $ | 13,529 |

| | | | | | | | | | | | |

Adjusted operating profit | | $ | 96,550 | | $ | 101,033 | | $ | 112,244 | | $ | 11,211 |

Adjusted operating profit as a % of net sales | | | 14.4% | | | 14.4% | | | 13.7% | | | |

| (1) | | Reflects the remeasurement of 2017 reported and adjusted local currency results using 2018 exchange rates, resulting in constant currency comparative figures to 2018 reported and adjusted results. See Table 6 for non-GAAP adjustments applicable to the six month period. |

| (2) | | Refer to Table 6 for the reconciliation of adjusted gross profit for the six months ended June 30, 2018 and 2017, respectively. |

| (3) | | Refer to Table 6 for the reconciliation of SG&A expenses to adjusted SG&A expenses for the six months ended June 30, 2018 and 2017, respectively. |

It should be noted that adjusted 2017 results is a financial measure not required by, or presented in accordance with, accounting principles generally accepted in the United States (U.S. GAAP). This non-GAAP financial measure should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with U.S. GAAP and a reconciliation of this financial measure to the most comparable U.S. GAAP financial measures is presented. We believe this data provides investors with additional information on the underlying operations and trends of the business and enables period-to-period comparability of financial performance.

Table 9

Ferro Corporation and Subsidiaries

Supplemental Information

Reconciliation of Net income attributable to Ferro Corporation

common shareholders to Adjusted EBITDA (unaudited)

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

(Dollars in thousands) | | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| | | | | | | | | | | | | | | | |

Net income attributable to Ferro Corporation common shareholders | | $ | 29,668 | | | $ | 21,025 | | | $ | 53,059 | | | $ | 42,923 | |

Net income attributable to noncontrolling interests | | | 193 | | | | 204 | | | | 400 | | | | 427 | |

Restructuring and impairment charges | | | 3,768 | | | | 3,224 | | | | 7,874 | | | | 6,242 | |

Other expense, net | | | 4,328 | | | | 5,764 | | | | 6,742 | | | | 6,611 | |

Interest expense | | | 8,200 | | | | 6,449 | | | | 16,162 | | | | 12,673 | |

Income tax expense | | | 10,364 | | | | 8,695 | | | | 17,878 | | | | 15,833 | |

Depreciation and amortization | | | 14,477 | | | | 12,734 | | | | 28,739 | | | | 24,588 | |

Less: interest amortization expense and other | | | (903) | | | | (953) | | | | (1,773) | | | | (1,432) | |

Cost of sales adjustments1 | | | 606 | | | | 1,631 | | | | 1,585 | | | | 4,268 | |

SG&A adjustments1 | | | 4,485 | | | | 5,023 | | | | 8,544 | | | | 7,573 | |

Adjusted EBITDA | | $ | 75,186 | | | $ | 63,796 | | | $ | 139,210 | | | $ | 119,706 | |

| | | | | | | | | | | | | | | | |

Net sales | | $ | 416,239 | | | $ | 348,632 | | | $ | 821,771 | | | $ | 669,187 | |

Adjusted EBITDA as a % of net sales | | | 18.1 | % | | | 18.3 | % | | | 16.9 | % | | | 17.9 | % |

| (1) | | For details of Non-GAAP adjustments, refer to Table 5 and Table 6 for the reconciliation of cost of sales to adjusted cost of sales and SG&A to adjusted SG&A for the three and six months ended June 30, 2018 and 2017, respectively. |

It should be noted that adjusted EBITDA is a financial measure not required by, or presented in accordance with, accounting principles generally accepted in the United States (U.S. GAAP). This non-GAAP financial measure should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with U.S. GAAP and a reconciliation of this financial measure to the most comparable U.S. GAAP financial measure is presented. We believe this data provides investors with additional information on the underlying operations and trends of the business and enables period-to-period comparability of financial performance.

Table 10

Ferro Corporation and Subsidiaries

Supplemental Information

Change in Net Debt (unaudited)

| | | | | | | | | | | | | |

(Dollars in thousands) | | Three Months Ended | | Six Months Ended | |

| | June 30, | | June 30, | |

| | 2018 | | 2017 | | 2018 | | 2017 | |

Beginning of period | | | | | | | | | | | | | |

Gross debt | | $ | 815,930 | | $ | 643,173 | | $ | 759,078 | | $ | 578,205 | |

Cash | | | 53,296 | | | 92,829 | | | 63,551 | | | 45,582 | |

Debt, net of cash | | | 762,634 | | | 550,344 | | | 695,527 | | | 532,623 | |

| | | | | | | | | | | | | |

Unamortized debt issuance costs | | | 7,163 | | | 8,206 | | | 7,451 | | | 3,720 | |

Debt, net of cash and unamortized debt issuance costs | | | 755,471 | | | 542,138 | | | 688,076 | | | 528,903 | |

| | | | | | | | | | | | | |

End of period | | | | | | | | | | | | | |

Gross debt | | | 846,039 | | | 668,993 | | | 846,039 | | | 668,993 | |

Cash | | | 44,886 | | | 78,866 | | | 44,886 | | | 78,866 | |

Debt, net of cash | | | 801,153 | | | 590,127 | | | 801,153 | | | 590,127 | |

| | | | | | | | | | | | | |

Unamortized debt issuance costs | | | 5,285 | | | 8,079 | | | 5,285 | | | 8,079 | |

Debt, net of cash and unamortized debt issuance costs | | | 795,868 | | | 582,048 | | | 795,868 | | | 582,048 | |

| | | | | | | | | | | | | |

Change from FX on Euro term loan debt | | | 2,258 | | | (19,259) | | | (5,657) | | | (19,232) | |

FX on Cash | | | (2,298) | | | 1,711 | | | (1,036) | | | 2,157 | |

Assumption of debt from acquisitions | | | - | | | (7,975) | | | - | | | (7,975) | |

| | | | | | | | | | | | | |

Period increase in debt, net of cash, unamortized debt issuance costs and FX | | $ | (38,479) | | $ | (14,260) | | $ | (98,933) | | $ | (32,454) | |

| | | | | | | | | | | | | |

Period increase in debt, net of cash and unamortized debt issuance costs | | $ | (40,397) | | $ | (39,910) | | $ | (107,792) | | $ | (53,145) | |

It should be noted that the change in net debt is a financial measure not required by, or presented in accordance with, accounting principles generally accepted in the United States (U.S. GAAP). This non-GAAP financial measure should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with U.S. GAAP and a reconciliation of this financial measure to the most comparable U.S. GAAP financial measure is presented. We believe that given the significant cash and cash equivalents on the balance sheet that the change in cash against outstanding debt, net debt, between periods is a meaningful measure.

Table 11

Ferro Corporation and Subsidiaries

Supplemental Information

Reconciliation of Net Cash Provided by Operating Activities (GAAP) to

Adjusted Free Cash Flow from Continuing Operations (Non-GAAP) (unaudited)

| | | | | | | | | | | | |

(Dollars in thousands) | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

Cash flows from operating activities | | | | | | | | | | | | |

Net income | | $ | 29,861 | | $ | 21,229 | | $ | 53,459 | | $ | 43,350 |

Gain on sale of assets | | | 59 | | | 866 | | | 288 | | | 1,285 |

Depreciation and amortization | | | 13,574 | | | 11,781 | | | 26,966 | | | 23,156 |

Interest amortization | | | 903 | | | 953 | | | 1,773 | | | 1,432 |

Restructuring and impairment | | | 3,050 | | | 1,046 | | | 5,479 | | | 3,874 |

Loss on extinguishment of debt | | | 3,226 | | | - | | | 3,226 | | | 3,905 |

Accounts receivable | | | (18,107) | | | (21,564) | | | (50,764) | | | (48,183) |

Inventories | | | (36,544) | | | (11,545) | | | (65,364) | | | (28,659) |

Accounts payable | | | 5,608 | | | 5,934 | | | (1,531) | | | 14,122 |

Other current assets and liabilities, net | | | (12,065) | | | (1,846) | | | (18,800) | | | (5,111) |

Other adjustments, net | | | 7,045 | | | 6,221 | | | 7,593 | | | 5,534 |

Net cash (used in) provided by operating activities (GAAP) | | $ | (3,390) | | $ | 13,075 | | $ | (37,675) | | $ | 14,705 |

Less: Capital Expenditures | | | (22,887) | | | (10,128) | | | (43,569) | | | (16,894) |

Free Cash Flow from Continuing Operations (Non-GAAP) | | | (26,277) | | | 2,947 | | | (81,244) | | | (2,189) |

Plus: cash used for restructuring | | | 1,842 | | | 2,177 | | | 3,520 | | | 2,367 |

Plus: cash used for capital expenditures related to optimization projects(1) | | | 13,694 | | | - | | | 19,902 | | | - |

Plus: Cash used for net working capital investment related to optimization projects(2) | | | - | | | - | | | 2,051 | | | - |

Plus: Cash used for acquisition related professional fees(3) | | | 4,178 | | | 2,537 | | | 5,003 | | | 4,212 |

Plus: Cash used for optimization projects(3) | | | 1,709 | | | 122 | | | 2,998 | | | 542 |

Plus: Cash used for divested businesses and assets(3) | | | (131) | | | 588 | | | 384 | | | 751 |

Adjusted Free Cash Flow from Continuing Operations (Non-GAAP) | | | (4,985) | | | 8,371 | | | (47,386) | | | 5,683 |

| | | | | | | | | | | | |

| (1) | | The adjustment to capital expenditures represents capital spend for certain optimization projects that are not expected to recur in the long-term at the current rate. See Table 10 for the reconciliation of period change in debt, net of cash, unamortized debt issuance costs, FX and assumption of debt from acquisitions. |

| (2) | | The adjustment to net working capital represents spend for the build in inventory related to optimization projects noted in (1) above. This build in inventory is considered to be outside of the normal operations of the underlying business, and expected to be temporary in nature. |

| (3) | | The adjustment represents those cash outlays for (a) acquisitions related professional fees, (b) costs related to certain optimization projects, and (c) costs related to divested businesses and assets, as detailed in the description of adjustments in Table 5 and Table 6 for the three and six months ended June 30, 2018 and 2017, respectively. |

It should be noted that adjusted free cash flow from continuing operations is a financial measures not required by, or presented in accordance with, accounting principles generally accepted in the United States (GAAP). The non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with GAAP and a reconciliation of the financial measures to the most comparable U.S. GAAP financial measures is presented. We believe this data provides investors with additional information on the underlying operations and trends of the business, and enables period-to-period comparability of the financial performance of the business. Additionally, certain elements of these measures are used in the calculation of certain incentive compensation programs for management.