UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-584

FERRO CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Ohio | | 34-0217820 |

| (State of Corporation) | | (IRS Employer Identification No.) |

| |

6060 Parkland Blvd. Mayfield Heights, OH | | 44124 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 216-875-5600

Securities Registered Pursuant to section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, par value $1.00 | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained here, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

Large accelerated filer ¨ | | Accelerated filer x | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of Ferro Corporation Common Stock, par value $1.00, held by non-affiliates and based on the closing sale price as of June 30, 2012, was approximately $408,872,000.

On February 28, 2013, there were 86,559,660 shares of Ferro Corporation Common Stock, par value $1.00 outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for Ferro Corporation’s 2013 Annual Meeting of Shareholders are incorporated into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

2

PART I

Item 1 — Business

History, Organization and Products

Ferro Corporation was incorporated in Ohio in 1919 as an enameling company. When we use the terms “Ferro,” “we,” “us” or “the Company,” we are referring to Ferro Corporation and its subsidiaries unless we indicate otherwise. Today, we are a leading producer of specialty materials and chemicals that are sold to a broad range of manufacturers who, in turn, make products for many end-use markets. We operate approximately 40 facilities around the world that manufacture the following types of products:

| | • | | Electronic, Color and Glass Materials — Conductive metal powders, polishing materials, glazes, enamels, pigments, decoration colors, and other performance materials; and |

| | • | | Polymer and Ceramic Engineered Materials — Polymer additives, engineered plastic compounds, pigment dispersions, glazes, frits, porcelain enamel, pigments, inks, and high-potency pharmaceutical active ingredients. |

We refer to our products as performance materials and chemicals because we formulate them to perform specific functions in the manufacturing processes and end products of our customers. The products we develop often are delivered to our customers in combination with customized technical service. The value of our products stems from the benefits they deliver in actual use. We develop and deliver innovative products to our customers through our key strengths in:

| | • | | Particle Engineering — Our ability to design and produce very small particles made of a broad variety of materials, with precisely controlled characteristics of shape, size and size distribution. We understand how to disperse these particles within liquid, paste and gel formulations. |

| | • | | Color and Glass Science — Our understanding of the chemistry required to develop and produce pigments that provide color characteristics ideally suited to customers’ applications. We have a demonstrated ability to provide glass-based coatings with properties that precisely meet customers’ needs in a broad variety of applications. |

| | • | | Surface Chemistry and Surface Application Technology — Our understanding of chemicals and materials used to develop products and processes that involve the interface between layers and the surface properties of materials. |

| | • | | Product Formulation — Our ability to develop and manufacture combinations of materials that deliver specific performance characteristics designed to work within customers’ particular products and manufacturing processes. |

| | • | | Polymer Science/Organic Synthesis — Our ability to develop and produce polymers and supporting additives by utilizing organic synthesis expertise to create and modify materials with a variety of innovative characteristics and desired capabilities. We understand how to craft and transform resin systems to fulfill customer requirements. |

We deliver these key technical strengths to our customers in a way that creates additional value through our integrated applications support. Our applications support personnel provide assistance to our customers in their material specification and evaluation, product design and manufacturing process characterization in order to help them optimize the efficient and cost-effective application of our products.

3

We divide our operations into eight business units, which comprise six reportable segments. We have grouped these units by their product group below:

| | |

Polymer and Ceramic Engineered Materials | | Electronic, Color and Glass Materials |

•Polymer Additives | | •Electronic Materials |

•Specialty Plastics | | •Glass Systems(2) |

•Pharmaceuticals | | •Performance Pigments and Colors(2) |

•Tile Coating Systems(1) | | |

•Porcelain Enamel(1) | | |

| | (1) | Tile Coating Systems and Porcelain Enamel are combined into one reportable segment, Performance Coatings, for financial reporting purposes. |

| | (2) | Glass Systems and Performance Pigments and Colors are combined into one reportable segment, Color and Glass Performance Materials, for financial reporting purposes. |

Financial information about our segments is included herein in Note 17 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

Markets and Customers

Ferro’s products are used in a variety of product applications in markets including:

| | |

| •Appliances | | •Household furnishings |

•Automobiles | | •Industrial products |

•Building and renovation | | •Packaging |

•Electronics | | •Pharmaceuticals |

Many of our products are used as coatings on our customers’ products, such as glazes and decorations on tile, glass and dinnerware. Other products are supplied to customers as powders that are used to manufacture electronic components and other products. Still other products are added during our customers’ manufacturing processes to provide desirable properties to their end product. Often, our products are a small portion of the total cost of our customers’ products, but they can be critical to the appearance or functionality of those products.

Our leading customers include manufacturers of ceramic tile, major appliances, construction materials, automobile parts, glass, bottles, vinyl flooring and wall coverings, and pharmaceuticals. Many of our customers, including makers of major appliances and automobile parts, purchase materials from more than one of our business units. Our customer base is well diversified both geographically and by end market.

We generally sell our products directly to our customers. However, a portion of our business uses indirect sales channels, such as agents and distributors, to deliver products to market. In 2012, no single customer or related group of customers represented more than 10% of net sales. In addition, none of our reportable segments is dependent on any single customer or related group of customers.

Backlog of Orders and Seasonality

Generally, there is no significant lead time between customer orders and delivery in any of our business segments. As a result, we do not consider that the dollar amount of backlogged orders believed to be firm is material information for an understanding of our business. We also do not regard any material part of our business to be seasonal. However, customer demand has historically been higher in the second quarter when building and renovation markets are particularly active, and this quarter is normally the strongest for sales and operating profit.

4

Competition

In most of our markets, we have a substantial number of competitors, none of which is dominant. Due to the diverse nature of our product lines, no single competitor directly matches all of our product offerings. Our competition varies by product and by region, and is based primarily on price, product quality and performance, customer service and technical support, and our ability to develop custom products to meet specific customer requirements.

We are a worldwide leader in the production of glass enamels, porcelain enamels, and ceramic glaze coatings. There is strong competition in our markets, ranging from large multinational corporations to local producers. While many of our customers purchase customized products and formulations from us, our customers could generally buy from other sources, if necessary.

Raw Materials and Supplier Relations

Raw materials widely used in our operations include:

| | |

| Metal Oxides: | | Other Inorganic Materials: |

• Aluminum oxide(2)(3) | | • Boric acid(2) |

• Cerium oxide(3) | | • Clay(2) |

• Cobalt oxide(1)(2) | | • Feldspar(2) |

• Nickel oxide(1)(2) | | • Fiberglass(4) |

• Titanium dioxide(1)(2)(3)(4) | | • Lithium(2) |

• Zinc oxide(2) | | • Silica(2) |

• Zirconium dioxide(2) | | • Zircon(2) |

| | |

| Precious and Non-precious Metals: | | Other Organic Materials:(5) |

• Aluminum(2)(3) | | • Butanol |

• Bismuth(1) | | • Phenol |

• Chrome(1)(2) | | • Phthalic anhydride |

• Copper(1)(3) | | • Soybean oil |

• Gold(1)(3) | | • Tallow |

• Palladium(3) | | • Toluene |

• Platinum(3) | | |

• Silver(3) | | Energy: |

| | • Electricity |

Polymers:(4) | | • Natural gas |

• Polyethylene | | |

• Polypropylene | | |

• Polystyrene | | |

• Unsaturated polyester | | |

| | (1) | Primarily used by Glass Systems and Performance Pigments and Colors. |

| | (2) | Primarily used by Tile Coating Systems and Porcelain Enamel. |

| | (3) | Primarily used by Electronic Materials. |

| | (4) | Primarily used by Specialty Plastics. |

| | (5) | Primarily used by Polymer Additives. |

These raw materials make up a large portion of our product costs in certain of our product lines, and fluctuations in the cost of raw materials may have a significant impact on the financial performance of the related businesses. We attempt to pass through to our customers raw material cost increases, including those related to precious metals.

5

We have a broad supplier base and, in many instances, multiple sources of essential raw materials are available worldwide if problems arise with a particular supplier. We maintain many comprehensive supplier agreements for strategic and critical raw materials. We did not encounter raw material shortages in 2012 that significantly affected our manufacturing operations, but we are subject to volatile raw material costs that can affect our results of operations.

Environmental Matters

As part of the production of some of our products, we handle, process, use and store hazardous materials. As a result, we operate manufacturing facilities that are subject to a broad array of environmental laws and regulations in the countries in which we operate, particularly for plant wastes and emissions. In addition, some of our products are subject to restrictions under laws or regulations such as California Proposition 65 or the European Union’s (“EU”) chemical substances directive. The costs to comply with complex environmental laws and regulations are significant and will continue for the industry and us for the foreseeable future. These routine costs are expensed as they are incurred. While these costs may increase in the future, they are not expected to have a material impact on our financial position, liquidity or results of operations. We believe that we are in substantial compliance with the environmental regulations to which our operations are subject and that, to the extent we may not be in compliance with such regulations, non-compliance will not have a materially adverse effect on our financial position, liquidity or results of operations.

Our policy is to operate our plants and facilities in a manner that protects the environment and the health and safety of our employees and the public. We intend to continue to make expenditures for environmental protection and improvements in a timely manner consistent with available technology. Although we cannot precisely predict future environmental spending, we do not expect the costs to have a material impact on our financial position, liquidity or results of operations. Capital expenditures for environmental protection were $0.9 million in 2012, $2.0 million in 2011, and $1.5 million in 2010.

We also accrue for environmental remediation costs when it is probable that a liability has been incurred and we can reasonably estimate the amount. We determine the timing and amount of any liability based upon assumptions regarding future events, and inherent uncertainties exist in such evaluations primarily due to unknown conditions, changing governmental regulations and legal standards regarding liability, and evolving technologies. We adjust these liabilities periodically as remediation efforts progress, the nature and extent of contamination becomes more certain, or as additional technical or legal information becomes available.

Research and Development

We are involved worldwide in research and development activities relating to new and existing products, services and technologies required by our customers’ continually changing markets. Our research and development resources are organized into centers of excellence that support our regional and worldwide major business units. We also conduct research and development activities at our Posnick Center of Innovative Technology in Independence, Ohio. These centers are augmented by local laboratories that provide technical service and support to meet customer and market needs in various geographic areas.

Total expenditures for product and application technology, including research and development, customer technical support and other related activities, were $39.5 million in 2012, $42.4 million in 2011, and $37.2 million in 2010. These amounts include expenditures for company-sponsored research and development activities of approximately $30.0 million in 2012, $30.4 million in 2011, and $27.3 million in 2010.

Patents, Trademarks and Licenses

We own a substantial number of patents and patent applications relating to our various products and their uses. While these patents are of importance to us and we exercise diligence to ensure that they are valid, we do not believe that the invalidity or expiration of any single patent or group of patents would have a material adverse

6

effect on our businesses. Our patents will expire at various dates through the year 2032. We also use a number of trademarks that are important to our businesses as a whole or to a particular segment. We believe that these trademarks are adequately protected.

Employees

At December 31, 2012, we employed 4,948 full-time employees, including 3,360 employees in our foreign consolidated subsidiaries and 1,588 in the United States (“U.S.”). Total employment decreased by 72 in our foreign subsidiaries and by 100 in the U.S. from the prior year end due to the net effect of reductions made in areas where sales activity declined and additions related to new business opportunities.

Collective bargaining agreements cover approximately 19% of our U.S. workforce. Approximately 5% of all U.S. employees are affected by labor agreements that expire in 2013, and we expect to complete renewals of these agreements with no significant disruption to the related businesses. We consider our relations with our employees, including those covered by collective bargaining agreements, to be good.

Our employees in Europe have protections afforded them by local laws and regulations through unions and works councils. Some of these laws and regulations may affect the timing, amount and nature of restructuring and cost reduction programs in that region.

Domestic and Foreign Operations

We began international operations in 1927. Our products are manufactured and/or distributed through our consolidated subsidiaries and unconsolidated affiliates in the following countries:

| | | | | | |

| Consolidated Subsidiaries: | | | | |

• Argentina | | • France | | • Malaysia | | • Taiwan |

• Australia | | • Germany | | • Mexico | | • Thailand |

• Belgium | | • India | | • Netherlands | | • United Kingdom |

• Brazil | | • Indonesia | | • Portugal | | • United States |

• China | | • Italy | | • Russia | | • Venezuela |

• Egypt | | • Japan | | • Spain | | |

| | |

| Unconsolidated Affiliates: | | | | |

• Italy | | • Spain | | • South Korea | | • Thailand |

Financial information for geographic areas is included in Note 17 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K. More than 50% of our net sales are outside of the U.S. Our customers represent more than 30 industries and operate in approximately 100 countries.

Our U.S. parent company receives technical service fees and/or royalties from many of its foreign subsidiaries. As a matter of corporate policy, the foreign subsidiaries have historically been expected to remit a portion of their annual earnings to the U.S. parent company as dividends. To the extent earnings of foreign subsidiaries are not remitted to the U.S. parent company, those earnings are indefinitely re-invested in those subsidiaries.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, including any amendments, will be made available free of charge on our Web site, www.ferro.com, as soon as reasonably practical, following the filing of the reports with the U.S. Securities and Exchange Commission (“SEC”). Our Corporate Governance Principles, Legal and Ethical Policies, Guidelines for Determining Director

7

Independence, and charters for our Audit Committee, Compensation Committee, and Governance and Nomination Committee are available free of charge on our Web site or to any shareholder who requests them from the Ferro Corporation Investor Relations Department located at 6060 Parkland Blvd., Mayfield Heights, Ohio, 44124.

Forward-looking Statements

Certain statements contained here and in future filings with the SEC reflect our expectations with respect to future performance and constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are subject to a variety of uncertainties, unknown risks and other factors concerning our operations and the business environment, which are difficult to predict and are beyond our control.

Item 1A — Risk Factors

Many factors could cause our actual results to differ materially from those suggested by statements contained in this filing and could adversely affect our future financial performance. Such factors include the following:

We sell our products into industries where demand has been unpredictable, cyclical or heavily influenced by consumer spending, and such demand and our results of operations may be further impacted by macro economic circumstances and uncertainty in credit markets.

We sell our products to a wide variety of customers who supply many different market segments. Many of these market segments, such as building and renovation, major appliances, transportation, and electronics, are cyclical or closely tied to consumer demand. Consumer demand is difficult to accurately forecast and incorrect forecasts of demand or unforeseen reductions in demand can adversely affect costs and profitability due to factors such as underused manufacturing capacity, excess inventory, or working capital needs. Our forecasting systems and modeling tools may not accurately predict changes in demand for our products or other market conditions.

Our results of operations are materially affected by conditions in capital markets and economies in the U.S. and elsewhere around the world. General economic conditions around the world deteriorated sharply at the end of 2008, and difficult economic conditions continue to exist in some locations. Concerns over fluctuating prices, energy costs, geopolitical issues, government deficits and debt loads, the availability and cost of credit, the U.S. mortgage market and a weakened real estate market have contributed to increased volatility, diminished expectations, and uncertainty regarding economies around the world. These factors, combined with reduced business and consumer confidence, increased unemployment, and volatile raw materials costs, precipitated an economic slowdown and recession in a number of markets around the world. As a result of these conditions and the continuing effects, our customers may experience cash flow problems and may modify, delay, or cancel plans to purchase our products. Additionally, if customers are not successful in generating sufficient revenue or are precluded from securing financing, they may not be able to pay, or may delay payment of, accounts receivable that are owed to us. A reduction in demand or inability of our current and/or potential customers to pay us for our products may adversely affect our earnings and cash flow.

We have undertaken cost-savings initiatives, including restructuring programs, to improve our operating performance, but we may not be able to implement and/or administer these initiatives in the manner contemplated and these initiatives may not produce the desired results.

We have undertaken cost-savings initiatives, including restructuring programs, and may undertake additional cost-savings initiatives in the future. These initiatives involve, among other things, restructuring programs that involve plant closures and staff reductions. Although we expect these initiatives to help us achieve

8

incremental cost savings and operational efficiencies, we may not be able to implement and/or administer these initiatives, including plant closures and staff reductions, in the manner contemplated, which could cause the initiatives to fail to achieve the desired results. Additionally, the implementation of these initiatives may result in impairment charges, some of which could be material. Even if we do implement and administer these initiatives in the manner contemplated, they may not produce the desired results. Accordingly, the initiatives that we have implemented and those that we may implement in the future may not improve our operating performance and may not help us achieve cost savings. Failure to successfully implement and/or administer these initiatives could have an adverse effect on our financial performance.

We are subject to a number of restrictive covenants under our credit facilities and the indenture governing our senior notes, which could affect our flexibility to fund ongoing operations and strategic initiatives, and, if we are unable to maintain compliance with such covenants, could lead to significant challenges in meeting our liquidity requirements.

Our credit facilities and the indenture governing our senior notes contain a number of restrictive covenants, including those described in more detail in Note 6 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K. These covenants include customary operating restrictions that limit our ability to engage in certain activities, including additional loans and investments; prepayments, redemptions and repurchases of debt; and mergers, acquisitions and asset sales. We are also subject to customary financial covenants under our credit facilities, including a leverage ratio and an interest coverage ratio. These covenants under our credit facilities restrict the amount of our borrowings, reducing our flexibility to fund ongoing operations and strategic initiatives. These facilities and our senior notes are described in more detail in “Capital Resources and Liquidity” under Item 7 and in Note 6 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

The most critical of these ratios is the leverage ratio. As of December 31, 2012, we were in compliance with our maximum leverage ratio covenant of 4.25x as our actual ratio was 3.34x, providing $22.6 million of EBITDA, as defined within our credit facilities and senior notes indenture, cushion on the leverage ratio. Our leverage ratio covenants decrease in 2013 to 3.50x. To the extent that economic conditions in key markets deteriorate or we are unable to meet our business projections and EBITDA falls below approximately $100 million for rolling four quarters, based on reasonably consistent debt levels with those as of December 31, 2012, could make us unable to maintain compliance with our leverage ratio covenant , in which case, our lenders could demand immediate payment of outstanding amounts and we would need to seek alternate financing sources to pay off such debts and to fund our ongoing operations. Such financing may not be available on favorable terms, if at all.

We depend on external financial resources, and the economic environment and credit market uncertainty could interrupt our access to capital markets, borrowings, or financial transactions to hedge certain risks, which could adversely affect our financial condition.

At December 31, 2012, we had approximately $346.8 million of short-term and long-term debt with varying maturities and approximately $121.9 million of off balance sheet arrangements, including consignment arrangements for precious metals, bank guarantees, and standby letters of credit. These arrangements have allowed us to make investments in growth opportunities and fund working capital requirements. In addition, we may enter into financial transactions to hedge certain risks, including foreign exchange, commodity pricing, and sourcing of certain raw materials. Our continued access to capital markets, the stability of our lenders, customers and financial partners and their willingness to support our needs are essential to our liquidity and our ability to meet our current obligations and to fund operations and our strategic initiatives. An interruption in our access to external financing or financial transactions to hedge risk could adversely affect our business prospects and financial condition. See further information regarding our liquidity in “Capital Resources and Liquidity” under Item 7 and in Note 6 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

We strive to improve operating margins through sales growth, price increases, productivity gains, and improved purchasing techniques, but we may not achieve the desired improvements.

We work to improve operating profit margins through activities such as growing sales to achieve increased economies of scale, increasing prices, improving manufacturing processes, and adopting purchasing techniques

9

that lower costs or provide increased cost predictability to realize cost savings. However, these activities depend on a combination of improved product design and engineering, effective manufacturing process control initiatives, cost-effective redistribution of production, and other efforts that may not be as successful as anticipated. The success of sales growth and price increases depends not only on our actions but also on the strength of customer demand and competitors’ pricing responses, which are not fully predictable. Failure to successfully implement actions to improve operating margins could adversely affect our financial performance.

We depend on reliable sources of energy and raw materials, including petroleum-based materials, minerals and other supplies, at a reasonable cost, but the availability of these materials and supplies could be interrupted and/or their prices could escalate and adversely affect our sales and profitability.

We purchase energy and many raw materials, including petroleum-based materials and other supplies, which we use to manufacture our products. Changes in their availability or price could affect our ability to manufacture enough products to meet customers’ demands or to manufacture products profitably. We try to maintain multiple sources of raw materials and supplies where practical, but this may not prevent unanticipated changes in their availability or cost and, for certain raw materials, there may not be alternative sources. We may not be able to pass cost increases through to our customers. Significant disruptions in availability or cost increases could adversely affect our manufacturing volume or costs, which could negatively affect product sales or profitability of our operations.

The global scope of our operations exposes us to risks related to currency conversion rates, new and different regulatory schemes and changing economic, regulatory, social and political conditions around the world.

More than 50% of our net sales during 2012 were outside of the U.S. In order to support global customers, access regional markets and compete effectively, our operations are located around the world. We may encounter difficulties expanding into additional growth markets around the world. Our operations have additional complexity due to economic, regulatory, social and political conditions in multiple locations and we are subject to risks relating to currency conversion rates. Other risks inherent in international operations include the following:

| | • | | New and different legal and regulatory requirements and enforcement mechanisms in local jurisdictions; |

| | • | | U.S. and other export licenses may be difficult to obtain and we may be subject to export duties or import quotas or other trade restrictions or barriers; |

| | • | | Increased costs, and decreased availability, of transportation or shipping; |

| | • | | Credit risk and financial conditions of local customers and distributors; |

| | • | | Risk of nationalization of private enterprises by foreign governments or restrictions on investments; |

| | • | | Potentially adverse tax consequences, including imposition or increase of withholding and other taxes on remittances and other payments by subsidiaries; and |

| | • | | Local political, economic and social conditions, including the possibility of hyperinflationary conditions, deflation, and political instability in certain countries. |

We have subsidiaries in Venezuela, a country that has established rigid controls over the ability of foreign companies to repatriate cash, and in Egypt, a country with recent political instability. Such conditions could potentially impact our ability to recover both the cost of our investments and earnings from those investments. While we attempt to anticipate these changes and manage our business appropriately in each location where we do business, these changes are often beyond our control and difficult to forecast.

The consequences of these risks may have significant adverse effects on our results of operations or financial position, and if we fail to comply with applicable laws and regulations, we could be exposed to civil and criminal penalties, reputational harm, and restrictions on our operations.

10

We have a growing presence in the Asia-Pacific region where it can be difficult for a multi-national company, such as Ferro, to compete lawfully with local competitors, which may cause us to lose business opportunities.

Many of our most promising growth opportunities are in the Asia-Pacific region, including the People’s Republic of China. Although we have been able to compete successfully in those markets to date, local laws and customs can make it difficult for a multi-national company such as Ferro to compete on a “level playing field” with local competitors without engaging in conduct that would be illegal under U.S. or other countries’ anti-bribery laws. Our strict policy of observing the highest standards of legal and ethical conduct may cause us to lose some otherwise attractive business opportunities to local competition in the region.

Regulatory authorities in the U.S., European Union and elsewhere are taking a much more aggressive approach to regulating hazardous materials and other substances, and those regulations could affect sales of our products.

Legislation and regulations concerning hazardous materials and other substances can restrict the sale of products and/or increase the cost of producing them. Some of our products are subject to restrictions under laws or regulations such as California Proposition 65 or the EU’s chemical substances directive. The EU “REACH” registration system requires us to perform studies of some of our products or components of our products and to register the information in a central database, increasing the cost of these products. As a result of such regulations, customers may avoid purchasing some products in favor of less hazardous or less costly alternatives. It may be impractical for us to continue manufacturing heavily regulated products, and we may incur costs to shut down or transition such operations to alternative products. These circumstances could adversely affect our business, including our sales and operating profits.

Our businesses depend on a continuous stream of new products, and failure to introduce new products could affect our sales, profitability and liquidity.

One way that we remain competitive is by developing and introducing new and improved products on an ongoing basis. Customers continually evaluate our products in comparison to those offered by our competitors. A failure to introduce new products at the right time that are price competitive and that provide the features and performance required by customers could adversely affect our sales, or could require us to compensate by lowering prices. In addition, when we invest in new product development, we face risks related to production delays, cost over-runs and unanticipated technical difficulties, which could impact sales, profitability and/or liquidity.

Our strategy includes seeking opportunities in new growth markets, and failure to identify or successfully enter such markets could affect our ability to grow our revenues and earnings.

Certain of our products are sold into mature markets and part of our strategy is to identify and enter into markets growing more rapidly. These growth opportunities may involve new geographies, new product lines, new technologies, or new customers. We may not be successful capitalizing on such opportunities and our ability to increase our revenue and earnings could be impacted.

Sales of our products to certain customers or into certain industries may expose us to different and complex regulatory regimes.

We seek to expand our customer base and the industries into which we sell. Selling products to certain customers or into certain industries, such as governments or the defense industry, requires compliance with regulatory regimes that do not apply to sales involving other customers or industries and that can be complex and difficult to navigate. Our failure to comply with these regulations could result in liabilities or damage to our reputation with customers, which could negatively impact our business, financial condition, or results of operations.

11

We have limited or no redundancy for certain of our manufacturing facilities, and damage to those facilities could interrupt our operations, increase our costs of doing business and impair our ability to deliver our products on a timely basis.

If certain of our existing production facilities become incapable of manufacturing products for any reason, we may be unable to meet production requirements, we may lose revenue and we may not be able to maintain our relationships with our customers. Without operation of certain existing production facilities, we may be limited in our ability to deliver products until we restore the manufacturing capability at the particular facility, find an alternative manufacturing facility or arrange an alternative source of supply. Although we carry business interruption insurance to cover lost revenue and profits in an amount we consider adequate, this insurance does not cover all possible situations. In addition, our business interruption insurance would not compensate us for the loss of opportunity and potential adverse impact on relations with our existing customers resulting from our inability to produce products for them.

We may not be able to complete future acquisitions or successfully integrate future acquisitions into our business, which could adversely affect our business or results of operations.

As part of our strategy, we intend to pursue acquisitions. Our success in accomplishing growth through acquisitions may be limited by the availability and suitability of acquisition candidates and by our financial resources, including available cash and borrowing capacity. Acquisitions involve numerous risks, including difficulty determining appropriate valuation, integrating operations, technologies, services and products of the acquired product lines or businesses, personnel turnover and the diversion of management’s attention from other business matters. In addition, we may be unable to achieve anticipated benefits from these acquisitions in the time frame that we anticipate, or at all, which could adversely affect our business or results of operations.

The markets for our products are highly competitive and subject to intense price competition, which could adversely affect our sales and earnings performance.

Our customers typically have multiple suppliers from which to choose. If we are unwilling or unable to provide products at competitive prices, and if other factors, such as product performance and value-added services do not provide an offsetting competitive advantage, customers may reduce, discontinue, or decide not to purchase our products. If we could not secure alternate customers for lost business, our sales and earnings performance could be adversely affected.

If we are unable to protect our intellectual property rights or to successfully resolve claims of infringement brought against us, our product sales and financial performance could be adversely affected.

Our performance may depend in part on our ability to establish, protect and enforce intellectual property rights with respect to our products, technologies and proprietary rights and to defend against any claims of infringement, which involves complex legal, scientific and factual questions and uncertainties. We may have to rely on litigation to enforce our intellectual property rights. In addition, we may face claims of infringement that could interfere with our ability to use technology or other intellectual property rights that are material to our business operations. If litigation that we initiate is unsuccessful, we may not be able to protect the value of some of our intellectual property. In the event a claim of infringement against us is successful, we may be required to pay royalties or license fees to continue to use technology or other intellectual property rights that we have been using or we may be unable to obtain necessary licenses from third parties at a reasonable cost or within a reasonable time.

Our operations are subject to operating hazards and, as a result, to stringent environmental, health and safety regulations, and compliance with those regulations could require us to make significant investments.

Our production facilities are subject to hazards associated with the manufacture, handling, storage, and transportation of chemical materials and products. These hazards can cause personal injury and loss of life, severe damage to, or destruction of, property and equipment and environmental contamination and other environmental damage and could have an adverse effect on our business, financial condition or results of operations.

12

We strive to maintain our production facilities and conduct our manufacturing operations in a manner that is safe and in compliance with all applicable environmental, health and safety regulations. Compliance with changing regulations may require us to make significant capital investments, incur training costs, make changes in manufacturing processes or product formulations, or incur costs that could adversely affect our profitability, and violations of these laws could lead to substantial fines and penalties. These costs may not affect competitors in the same way due to differences in product formulations, manufacturing locations or other factors, and we could be at a competitive disadvantage, which might adversely affect financial performance.

If we are unable to manage our general and administrative expenses, our business, financial condition or results of operations could be harmed.

The level of our administrative expenses can affect our profitability, and we may not be able to manage our administrative expense in all circumstances. While we attempt to effectively manage such expenses, including through projects designed to create administrative efficiencies, increases in staff-related and other administrative expenses may occur from time to time. Recently, we have made significant efforts to achieve general and administrative cost savings and improve our operational performance. As a part of these initiatives, we have and will continue to consolidate business and management operations and enter into arrangements with third parties offering additional cost savings. It cannot be assured that our strategies to reduce our general and administrative costs and improve our operation performance will be successful or achieve the anticipated savings.

Our multi-jurisdictional tax structure may not provide favorable tax efficiencies.

We conduct our business operations in a number of countries and are subject to taxation in those jurisdictions. While we seek to minimize our worldwide effective tax rate, our corporate structure may not optimize tax efficiency opportunities. We develop our tax position based upon the anticipated nature and structure of our business and the tax laws, administrative practices and judicial decisions now in effect in the countries in which we have assets or conduct business, all of which are subject to change or differing interpretations. In addition, our effective tax rate could be adversely affected by several other factors, including: increases in expenses that are not deductible for tax purposes, the tax effects of restructuring charges or purchase accounting for acquisitions, changes related to our ability to ultimately realize future benefits attributed to our deferred tax assets, including those related to other-than-temporary impairment, and a change in our decision to indefinitely reinvest foreign earnings. Further, we are subject to review and audit by both domestic and foreign tax authorities, which may result in adverse decisions. Increased tax expense could have a negative effect on our operating results and financial condition.

We have significant deferred tax assets, and if we are unable to utilize these assets, our results of operations may be adversely affected.

To fully realize the carrying value of our net deferred tax assets, we will have to generate adequate taxable profits in various tax jurisdictions. At December 31, 2012, we had $27.8 million of net deferred tax assets, after valuation allowances. If we do not generate adequate profits within the time periods required by applicable tax statutes, the carrying value of the tax assets will not be realized. If it becomes unlikely that the carrying value of our net deferred tax assets will be realized, the valuation allowances may need to be increased in our consolidated financial statements, adversely affecting results of operations. Further information on our deferred tax assets is presented in Note 8 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

We may not be successful in implementing our strategies to increase our return on invested capital.

We are taking steps to generate a higher return on invested capital. There are risks associated with the implementation of these steps, which may be difficult to implement and may not generate the intended returns. To the extent we are unsuccessful in achieving these strategies, our results of operations may be adversely affected.

13

We are subject to stringent labor and employment laws in certain jurisdictions in which we operate, we are party to various collective bargaining arrangements, and our relationship with our employees could deteriorate, which could adversely impact our operations.

A majority of our full-time employees are employed outside the U.S. In certain jurisdictions where we operate, labor and employment laws are relatively stringent and, in many cases, grant significant job protection to certain employees, including rights on termination of employment. In addition, in certain countries where we operate, our employees are members of unions or are represented by works councils. We are often required to consult and seek the consent or advice of these unions and/or works councils. These regulations and laws, coupled with the requirement to consult with the relevant unions or works councils, could have a significant impact on our flexibility in managing costs and responding to market changes.

Furthermore, approximately 19% of our U.S. employees as of December 31, 2012, are subject to collective bargaining arrangements or similar arrangements, and approximately 5% are subject to labor agreements that expire in 2013. While we expect to complete renewal of these agreements without significant disruption to our business, there can be no assurance that we will be able to negotiate labor agreements on satisfactory terms or that actions by our employees will not be disruptive to our business. If these workers were to engage in a strike, work stoppage or other slowdown or if other employees were to become unionized, we could experience a significant disruption of our operations and/or higher ongoing labor costs, which could adversely affect our business, financial condition and results of operations.

Employee benefit costs, especially postretirement costs, constitute a significant element of our annual expenses, and funding these costs could adversely affect our financial condition.

Employee benefit costs are a significant element of our cost structure. Certain expenses, particularly postretirement costs under defined benefit pension plans and healthcare costs for employees and retirees, may increase significantly at a rate that is difficult to forecast and may adversely affect our financial results, financial condition or cash flows. Declines in global capital markets may cause reductions in the value of our pension plan assets. Such circumstances could have an adverse effect on future pension expense and funding requirements. Further information regarding our retirement benefits is presented in Note 10 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

Our implementation of new business information systems and processes could adversely affect our results of operations and cash flow.

We have been designing and implementing a new information system and related business processes to consolidate our legacy operating systems into an integrated system, an objective of which is to standardize and streamline business processes. The first stage of implementation occurred during 2012. We may be unable or choose not to complete the implementation in certain locations or in accordance with our timeline and we could incur additional costs. Decisions or constraints related to implementation could result in operating inefficiencies and could impact our ability to perform business transactions. These risks could adversely impact our results of operations, financial condition, and cash flows.

We rely on information systems to conduct our business and interruption, or damage to, or failure or compromise of, these systems may adversely affect our business and results of operations.

We rely on information systems to obtain, process, analyze and manage data to forecast and facilitate the purchase and distribution of our products; to receive, process, and ship orders on a timely basis; to account for other product and service transactions with customers; to manage the accurate billing and collections for thousands of customers; to process payments to suppliers; and to manage data and records relating to our employees, contractors, and other individuals. Our business and results of operations may be adversely affected if these systems are interrupted, damaged, or compromised or if they fail for any extended period of time, due to events including but not limited to programming errors, computer viruses and security breaches. Information

14

privacy and security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of perpetrators of cyber attacks. Although we believe that we have appropriate information privacy and security controls in place, prevention of information and privacy security breaches cannot be assured, particularly as cyber threats continue to evolve. We may be required to expend additional resources to continue to enhance our information privacy and security measures and/or to investigate and remediate any information security vulnerabilities. In addition, third-party service providers are responsible for managing a significant portion of our information systems, and we are subject to risk as a result of possible information privacy and security breaches of those third parties. The consequences of these risks could adversely impact our results of operations, financial condition, and cash flows.

There are risks associated with the manufacture and sale of our products into the pharmaceutical industry.

The manufacture and sale of products into the pharmaceutical industry involves the risk of injury to consumers, as well as commercial risks. Injury to consumers could result from, among other things, tampering by unauthorized third parties or the introduction into the product of foreign objects, substances, chemicals and other agents during the manufacturing, packaging, storage, handling or transportation phases. Shipment of adulterated products may be a violation of law and may lead to an increased risk of exposure to product liability or other claims, product recalls and increased scrutiny by federal and state regulatory agencies. Such claims or liabilities may not be covered by our insurance or by any rights of indemnity or contribution that we may have against third parties. In addition, the negative publicity surrounding any assertion that our products caused illness or injury could have a material adverse effect on our reputation with existing and potential customers, which could negatively impact our business, operating results or financial condition.

We are exposed to lawsuits in the normal course of business, which could harm our business.

We are from time to time exposed to certain legal proceedings, which may include claims involving product liability, infringement of intellectual property rights of third parties and other claims. Due to the uncertainties of litigation, we can give no assurance that we will prevail on claims made against us in the lawsuits that we currently face or that additional claims will not be made against us in the future. We do not believe that lawsuits we currently face are likely to have a material adverse effect on our business, operating results or financial condition. Future claims or lawsuits, if they were to result in a ruling adverse to us, could give rise to substantial liability, which could have a material adverse effect on our business, operating results or financial condition.

We are exposed to intangible asset risk, and a write down of our intangible assets could have an adverse impact to our operating results and financial position.

We have recorded intangible assets, including goodwill, in connection with business acquisitions. We are required to perform goodwill impairment tests on at least an annual basis and whenever events or circumstances indicate that the carrying value may not be recoverable from estimated future cash flows. As a result of our annual and other periodic evaluations, we may determine that the intangible asset values need to be written down to their fair values, which could result in material charges that could be adverse to our operating results and financial position. See further information regarding our goodwill and other intangible assets in “Critical Accounting Policies” under Item 7 and in Note 5 to the consolidated financial statements under Item 8 of this Form 10-K.

Interest rates on some of our borrowings are variable, and our borrowing costs could be adversely affected by interest rate increases.

Portions of our debt obligations have variable interest rates. Generally, when interest rates rise, our cost of borrowings increases. We estimate, based on the debt obligations outstanding at December 31, 2012, that a one percent increase in interest rates would cause interest expense to increase by $0.5 million annually. Continued interest rate increases could raise the cost of borrowings and adversely affect our financial performance. See

15

further information regarding our interest rates on our debt obligations in “Quantitative and Qualitative Disclosures about Market Risk” under Item 7A and in Note 6 to the consolidated financial statements under Item 8 of this Form 10-K.

Many of our assets are encumbered by liens that have been granted to lenders, and those liens affect our flexibility to dispose of property and businesses.

Certain of our debt obligations are secured by substantially all of our assets. These liens could reduce our ability and/or extend the time to dispose of property and businesses, as these liens must be cleared or waived by the lenders prior to any disposition. These security interests are described in more detail in Note 6 to the consolidated financial statements under Item 8 of this Annual Report on Form 10-K.

We may not pay dividends on our common stock at any time in the foreseeable future.

Holders of our common stock are entitled to receive such dividends as our Board of Directors from time to time may declare out of funds legally available for such purposes. Our Board of Directors has no obligation to declare dividends under Ohio law or our amended Articles of Incorporation. We may not pay dividends on our common stock at any time in the foreseeable future. Any determination by our Board of Directors to pay dividends in the future will be based on various factors, including our financial condition, results of operations and current, anticipated cash needs and any limits our then-existing credit facility and other debt instruments place on our ability to pay dividends.

We are exposed to risks associated with acts of God, terrorists and others, as well as fires, explosions, wars, riots, accidents, embargoes, natural disasters, strikes and other work stoppages, quarantines and other governmental actions, and other events or circumstances that are beyond our control.

Ferro is exposed to risks from various events that are beyond our control, which may have significant effects on our results of operations. While we attempt to mitigate these risks through appropriate loss prevention measures, insurance, contingency planning and other means, we may not be able to anticipate all risks or to reasonably or cost-effectively manage those risks that we do anticipate. As a result, our operations could be adversely affected by circumstances or events in ways that are significant and/or long lasting.

The risks and uncertainties identified above are not the only risks that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial also may adversely affect us. If any known or unknown risks and uncertainties develop into actual events, these developments could have material adverse effects on our financial position, results of operations, and cash flows.

Item 1B — Unresolved Staff Comments

None.

Item 2 — Properties

We lease our corporate headquarters offices, which are located at 6060 Parkland Blvd., Mayfield Heights, Ohio. The Company owns other corporate facilities, including a centralized research and development facility, which is located in Independence, Ohio. We own principal manufacturing plants that range in size from 29,000 sq. ft. to over 800,000 sq. ft. Plants we own with more than 250,000 sq. ft. are located in: Spain; Germany; Cleveland, Ohio; Penn Yan, New York; and Mexico. The locations of our principal manufacturing plants by reportable segment are as follows:

Electronic Materials — U.S.: Penn Yan, New York; and South Plainfield, New Jersey. Outside the U.S.: China.

Performance Coatings — U.S.: Cleveland, Ohio. Outside the U.S.: Argentina, Brazil, China, Egypt, France, Indonesia, Italy, Mexico, Spain, Thailand and Venezuela.

16

Color and Glass Performance Materials — U.S.: Washington, Pennsylvania, and Orrville, Ohio. Outside the U.S.: Brazil, China, France, Germany, Mexico, Spain, the United Kingdom and Venezuela.

Polymer Additives — U.S.: Bridgeport, New Jersey; Cleveland, Ohio; Walton Hills, Ohio; and Fort Worth, Texas. Outside the U.S.: Belgium and the United Kingdom.

Specialty Plastics — U.S.: Evansville, Indiana; Plymouth, Indiana; Edison, New Jersey; and Stryker, Ohio. Outside the U.S.: Spain.

Pharmaceuticals — U.S.: Waukegan, Illinois.

Ferro’s revolving credit facility has a security interest in the real estate of the parent company and its domestic material subsidiaries.

In addition, we lease manufacturing facilities for the Electronic Materials segment in Germany, Japan, South Plainfield, New Jersey, and Vista, California; for the Color and Glass Performance Materials segment in Japan and Italy; and for the Specialty Plastics segment in Carpentersville, Illinois. In some instances, the manufacturing facilities are used by two or more segments. Leased facilities range in size from 18,000 sq. ft. to over 100,000 sq. ft. at the plant located in Carpentersville, Illinois.

Item 3 — Legal Proceedings

There are various lawsuits and claims pending against the Company and its consolidated subsidiaries. We do not currently expect the ultimate liabilities, if any, and expenses related to such lawsuits and claims to materially affect the consolidated financial position, results of operations, or cash flows of the Company.

Item 4 — Mine Safety Disclosures

Not applicable.

17

Executive Officers of the Registrant

The executive officers of the Company as of March 5, 2013, are listed below, along with their ages and positions held during the past five years. The year indicates when the individual was named to the indicated position. No family relationship exists between any of Ferro’s executive officers.

Peter T. Thomas — 57

Interim President and Chief Executive Officer, 2012

Vice President, Polymer and Ceramic Engineered Materials, 2009

Vice President, Organic Specialties, 2006

Mark H. Duesenberg — 51

Vice President, General Counsel and Secretary, 2008

Executive Director, Legal and Government Affairs, Lenovo Group Ltd., a global manufacturer of personal computers and electronic devices, 2008

Legal Director — Europe, Middle East and Africa, Lenovo Group Ltd., 2005

Ann E. Killian — 58

Vice President, Human Resources, 2005

Jeffrey L. Rutherford — 52

Vice President and Chief Financial Officer, 2012

Vice President and Chief Financial Officer, Park-Ohio Holdings Corp., an industrial supply chain logistics and diversified manufacturing business, 2008

Senior Vice President and Chief Financial Officer, UAP Holding Corp., an independent distributor of agricultural inputs and professional non-crop products, 2007

18

PART II

Item 5 — Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Our common stock is listed on the New York Stock Exchange under the ticker symbol FOE. On February 28, 2013, we had 1,319 shareholders of record for our common stock, and the closing price of the common stock was $5.10 per share.

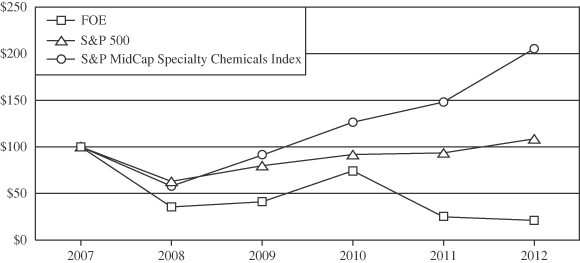

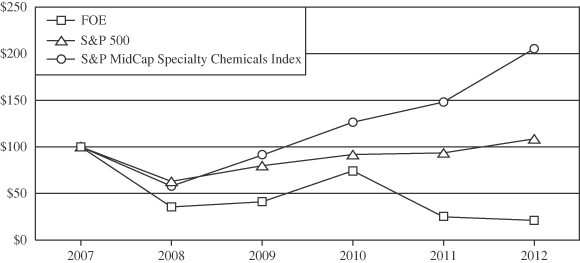

The chart below compares Ferro’s cumulative total shareholder return for the five years ended December 31, 2012, to that of the Standard & Poor’s 500 Index and the Standard & Poor’s MidCap Specialty Chemicals Index. In all cases, the information is presented on a dividend-reinvested basis and assumes investment of $100.00 on December 31, 2007. At December 31, 2012, the closing price of our common stock was $4.18 per share.

COMPARISON OF FIVE-YEAR

CUMULATIVE TOTAL RETURNS

The quarterly high and low intra-day sales prices and dividends declared per share for our common stock during 2012 and 2011 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2012 | | | 2011 | |

| | | High | | | Low | | | Dividends | | | High | | | Low | | | Dividends | |

First Quarter | | $ | 7.50 | | | $ | 4.84 | | | $ | — | | | $ | 17.02 | | | $ | 13.40 | | | $ | — | |

Second Quarter | | | 5.96 | | | | 4.02 | | | | — | | | | 17.84 | | | | 11.62 | | | | — | |

Third Quarter | | | 5.06 | | | | 2.65 | | | | — | | | | 14.28 | | | | 6.00 | | | | — | |

Fourth Quarter | | | 4.28 | | | | 2.38 | | | | — | | | | 7.36 | | | | 4.27 | | | | — | |

If we pay cash dividends in excess of a base dividend amount in any single quarterly period, the conversion rate on our 6.50% Convertible Senior Notes will be increased by formula. The base dividend amount is $0.145 per share, subject to adjustment in certain events.

The restrictive covenants contained in our credit facility limit the amount of dividends we can pay on our common stock. For further discussion, see Management’s Discussion and Analysis of Financial Condition and Results of Operations under Item 7 of this Annual Report on Form 10-K.

19

The following table summarizes purchases of our common stock by the Company and affiliated purchasers during the three months ended December 31, 2012:

| | | | | | | | | | | | | | | | |

| | | Total Number

of Shares

Purchased (1) | | | Average

Price Paid

per Share | | | Total Number

of Shares

Purchased as

Part of

Publicly

Announced

Plans or

Programs | | | Maximum

Number of

Shares that

May Yet Be

Purchased

Under the

Plans or

Programs | |

| | | (In thousands, except for per share amounts) | |

October 1, 2012 to October 31, 2012 | | | — | | | $ | — | | | | — | | | | — | |

November 1, 2012 to November 30, 2012 | | | — | | | | — | | | | — | | | | — | |

December 1, 2012 to December 31, 2012 | | | — | | | | — | | | | — | | | | — | |

Total | | | — | | | | | | | | — | | | | | |

Item 6 — Selected Financial Data

The following table presents selected financial data for the last five years ended December 31st:

| | | | | | | | | | | | | | | | | | | | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (Dollars in thousands, except per share data) | |

| Net sales | | $ | 1,768,631 | | | $ | �� 2,155,792 | | | $ | 2,101,865 | | | $ | 1,657,569 | | | $ | 2,245,152 | |

| Income (loss) from continuing operations | | | (373,034 | ) | | | 5,134 | | | | 15,403 | | | | (17,796 | ) | | | (123,428 | ) |

| Basic earnings (loss) per share from continuing operations attributable to Ferro Corporation common shareholders | | | (4.34 | ) | | | 0.05 | | | | 0.15 | | | | (0.41 | ) | | | (2.91 | ) |

| Diluted earnings (loss) per share from continuing operations attributable to Ferro Corporation common shareholders | | | (4.34 | ) | | | 0.05 | | | | 0.15 | | | | (0.41 | ) | | | (2.91 | ) |

| Cash dividends declared per common share | | | — | | | | — | | | | — | | | | 0.01 | | | | 0.58 | |

| Total assets | | | 1,079,103 | | | | 1,440,651 | | | | 1,434,355 | | | | 1,526,355 | | | | 1,544,117 | |

| Long-term debt, including current portion, and redeemable preferred stock | | | 298,177 | | | | 300,769 | | | | 303,269 | | | | 409,231 | | | | 577,290 | |

In 2008, we sold our Fine Chemicals business, which is presented as discontinued operations in 2008 and 2009.

In 2012, we changed our method of recognizing defined benefit pension and other postretirement benefit expense. Under the new method, we recognize actuarial gains and losses in our operating results in the year in which the gains or losses occur. All prior periods have been adjusted to apply the new method retrospectively.

Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

During 2012, we experienced continued decline in the performance of our Electronic Materials segment, specifically our solar pastes, metal powders and surface finishing products businesses, which ultimately led us to begin exploring strategic options for the solar pastes business during the third quarter of 2012. We also

20

experienced weak demand in Europe, with our Color and Glass Performance Materials, Performance Coatings and Polymer Additives segments the most significantly impacted. On February 6, 2013, we sold assets related to solar pastes and exited the product line.

To further address the challenges that we are facing, in the second quarter of 2012, we initiated cost cutting initiatives to reduce the cost structure of the Performance Coatings business in Europe. We have also taken action to improve Electronic Materials results through actions to restructure the management team and significantly reduce operating costs. Additionally, we have announced cost savings initiatives that are aimed at driving efficiencies across our global footprint. We expect to achieve $25 million to $30 million of cost savings in 2013 and more than $50 million in 2014 through a combination of improved manufacturing efficiency and consolidation of certain global commercial and support functions.

For the year ended December 31, 2012, Ferro’s net loss was $373.0 million, compared with net income of $5.1 million in 2011, and net loss attributable to common shareholders was $374.3 million, compared with net income attributable to common shareholders of $4.2 million in 2011. Our total segment operating income for 2012 was $65.5 million, compared with $160.7 million in 2011. During 2012, we incurred charges totaling $214.8 million related to impairment of the goodwill and certain property, plant and equipment in our Electronic Materials reporting unit, as well as impairments of real estate assets related to certain idled facilities in Europe. Further, we initiated restructuring activities that resulted in total charges of $10.4 million and primarily consisted of actions related to our Performance Coatings business in Europe and certain corporate actions, including exiting the lease of our corporate aircraft.

Outlook

For the full year 2013, we expect organic sales volume growth to approximate global GDP growth, with sales revenue growth expected to track below volume growth primarily due to expected changes in foreign currency rates, including the Euro. The expected improvements in the Company’s cost structure are expected to be partially offset by inflationary pressures on expenditures.

The sale of assets related to our solar pastes business during the first quarter of 2013 is expected to improve segment operating income in Electronic Materials by approximately $16 million annually compared with 2012 results.

Factors that could adversely affect our future financial performance are described under the heading “Risk Factors” in Item 1A.

Results of Operations - Consolidated

Comparison of the years ended December 31, 2012 and 2011

For the year ended December 31, 2012, Ferro net loss was $373.0 million, compared with net income of $5.1 million in 2011. For the year ended December 31, 2012, Ferro net loss attributable to common shareholders was $374.3 million, or $4.34 per share, compared with Ferro net income attributable to common shareholders of $4.2 million, or $0.05 per share, reflecting $0.2 million of preferred stock dividends, in 2011.

Net Sales

| | | | | | | | | | | | | | | | |

| | | 2012 | | | 2011 | | | $ Change | | | % Change | |

| | | (Dollars in thousands) | | | | |

Net sales excluding precious metals | | $ | 1,595,881 | | | $ | 1,756,721 | | | $ | (160,840 | ) | | | (9.2 | )% |

Sales of precious metals | | | 172,750 | | | | 399,071 | | | | (226,321 | ) | | | (56.7 | )% |

Net sales | | | 1,768,631 | | | | 2,155,792 | | | | (387,161 | ) | | | (18.0 | )% |

Cost of sales | | | 1,470,769 | | | | 1,743,560 | | | | (272,791 | ) | | | (15.6 | )% |

Gross profit | | $ | 297,862 | | | $ | 412,232 | | | $ | (114,370 | ) | | | (27.7 | )% |

21

Net sales decreased by 18.0% in the year ended December 31, 2012, compared with the prior year. Lower sales volumes in our Electronic Materials segment, specifically for solar pastes and metal powders, in combination with unfavorable price and mix, and weakness in Europe due to macro economic conditions, were the primary drivers of the decrease. Further, as a result of the decrease in Electronic Materials volumes, precious metals sales decreased 56.7% from 2011, or 58.5% of the overall decrease in sales in 2012. Across our segments, changes in product prices and mix accounted for approximately 8% of sales decline, lower sales volumes reduced sales by approximately 8% and changes in foreign currency exchange rates reduced sales an additional 2%.

Gross Profit

Gross profit decreased 27.7% in 2012 to $297.9 million, compared with $412.2 million in 2011. The most significant driver was the performance of the Electronic Materials segment, which accounted for approximately 80% of the total decline. Weakness in Europe also contributed to the reduction in gross profit, particularly in the Color and Glass Performance Materials, Performance Coatings and Polymer Additives segments. Gross profit percentage declined to 16.8% of net sales from 19.1% of net sales in 2011.

Selling, General and Administrative Expense

Selling, general and administrative (“SG&A”) expenses were $302.7 million in 2012 and $335.3 million in 2011, $32.7 million lower in 2012 compared with 2011; however, as a percentage of net sales, SG&A expenses increased 1.5% to 17.1% in 2012, compared with 15.6% in 2011. The most significant driver of the decline in SG&A expenses in 2012 was the change in accounting principle that was elected during the third quarter of 2012, under which we now recognize actuarial gains and losses on our defined benefit pension and other postretirement benefit plans in the year in which the gains or losses occur. Also contributing to the reduction from 2011 were favorable foreign currency exchange impacts, reduced depreciation and amortization expense, and lower stock-based compensation expense driven by certain personnel actions during the year. Partially offsetting the favorability were increased severance costs, higher bad debt expense, and increased costs related to an initiative to streamline and standardize business processes and improve management information systems tools.

The following represent the components with significant changes between 2012 and 2011:

| | | | | | | | | | | | | | | | |

| | | 2012 | | | 2011 | | | $ Change | | | % Change | |

| | | (Dollars in thousands) | | | | |

Pension and other postretirement benefits | | $ | 29,065 | | | $ | 57,611 | | | $ | (28,546 | ) | | | (49.5 | )% |

Foreign currency exchange | | | (6,244 | ) | | | — | | | | (6,244 | ) | | | NM | |

Depreciation and amortization | | | 11,184 | | | | 15,093 | | | | (3,909 | ) | | | (25.9 | )% |

Stock-based compensation | | | 3,057 | | | | 4,462 | | | | (1,405 | ) | | | (31.5 | )% |

Idle sites | | | 2,077 | | | | 2,612 | | | | (535 | ) | | | (20.5 | )% |

Severance | | | 5,578 | | | | 451 | | | | 5,127 | | | | NM | |

Bad debt | | | 5,217 | | | | 2,349 | | | | 2,868 | | | | 122.1 | % |

Management information systems tools | | | 8,977 | | | | 6,461 | | | | 2,516 | | | | 38.9 | % |

Other | | | — | | | | 1,914 | | | | (2,525 | ) | | | NM | |

Total change | | | | | | | | | | $ | (32,653 | ) | | | | |

NM — Not meaningful

Restructuring and Impairment Charges

| | | | | | | | | | | | | | | | |

| | | 2012 | | | 2011 | | | $ Change | | | % Change | |

| | | (Dollars in thousands) | | | | |

Goodwill | | $ | 153,566 | | | $ | 3,881 | | | $ | 149,685 | | | | NM | |

Property, plant and equipment | | | 46,800 | | | | 4,436 | | | | 42,364 | | | | NM | |

Assets held for sale | | | 14,913 | | | | 3,809 | | | | 11,104 | | | | NM | |

Corporate aircraft | | | 3,214 | | | | — | | | | 3,214 | | | | NM | |

Restructuring | | | 7,326 | | | | 4,904 | | | | 2,422 | | | | 49.4 | % |

Restructuring and impairment | | $ | 225,819 | | | $ | 17,030 | | | $ | 208,789 | | | | NM | |

NM — Not meaningful

22

Restructuring and impairment charges increased significantly in 2012 compared with 2011. The primary driver of the impairment charges taken against goodwill and property, plant and equipment in the current year was the decline in profitability of our solar pastes business and the related impact on the forecast for Electronic Materials. In addition to the impacts related to Electronic Materials, we continued to aggressively liquidate our portfolio of real estate related to idled facilities that is classified as held for sale, which drove incremental impairment charges during the year. Our idled facilities are principally located in Europe, which continued to experience difficult economic conditions. Idled assets in France, the Netherlands and the U.S. were sold in 2012. The restructuring charges incurred in 2012 primarily related to our Performance Coatings business in Europe and the disposal of the leased corporate aircraft.

Interest Expense

Interest expense in 2012 did not change significantly from 2011. The components of interest expense are as follows:

| | | | | | | | | | | | | | | | |

| | | 2012 | | | 2011 | | | $ Change | | | % Change | |

| | | (Dollars in thousands) | | | | |

Interest expense | | $ | 26,808 | | | $ | 27,025 | | | $ | (217 | ) | | | (0.8 | )% |

Interest capitalization | | | (780 | ) | | | (499 | ) | | | (281 | ) | | | 56.3 | % |

Amortization of bank fees | | | 1,951 | | | | 1,883 | | | | 68 | | | | 3.6 | % |

Interest expense | | $ | 27,979 | | | $ | 28,409 | | | $ | (430 | ) | | | (1.5 | )% |

Income Tax Expense

In 2012, income tax expense was $109.5 million, while in the prior year, we recorded income tax expense of $19.3 million. The current year tax expense was driven by a $182.7 million charge to increase the valuation allowances to more accurately measure the portion of the deferred tax assets that more likely than not will be realized, a $4.1 million charge related to the expiration of certain tax credits, and the tax impact of the goodwill impairment. The prior year expense was also affected by an $11.3 million charge to increase the valuation allowances related to deferred tax assets.

Comparison of the years ended December 31, 2011 and 2010

For the year ended December 31, 2011, Ferro net income was $5.1 million, compared with net income of $15.4 million in 2010. For the year ended December 31, 2011, Ferro net income attributable to common shareholders was $4.2 million, or $0.05 per share, reflecting $0.2 million of preferred stock dividends, compared with Ferro net income attributable to common shareholders of $13.2 million, or $0.15 per share, reflecting $0.7 million of preferred stock dividends, in 2010.

Net Sales

| | | | | | | | | | | | | | | | |