To Become Kate Spade & Company Fifth & Pacific Companies, Inc. Business Update January 2014 Exhibit 99.2

4Q13 Earnings Update: • Fifth & Pacific Companies, Inc. – FY 2013 Recap • Kate Spade & Company – Looking Ahead • Kate Spade & Company – 2014 Total Company Outlook • Kate Spade & Company – Areas of Focus • Kate Spade & Company – Year - End 2016 Financial Targets

Fifth & Pacific Companies, Inc. FY 2013 Recap 2

• Expecting company - wide adjusted EBITDA of approximately +50% versus 2012 on a comparable basis* • Continued industry leading growth at Kate Spade • Announced key strategic transactions • Strengthened capital structure ▪ New ABL with advantageous terms ▪ 2 sale - leaseback transactions on administrative properties ▪ Retired convertible bonds via equity exchange transactions 2013: The Year of Transformation 2013 in Review * Results are preliminary and subject to year - end closing adjustment. Adjusted EBITDA excludes the results of Juicy Couture and expenses incurred in connection with all streamlining initiatives, brand - exiting activities, acquisition related costs, non - cash impairment charges , losses on asset disposals, non - c ash share - based compensation expense, income tax provision (benefit), interest expense, net, depreciation and amortization, net, gain on sale of trademark, (losses) on extinguishment o f d ebt and unrealized and certain realized foreign currency gains (losses). The Company expects to report the results of Lucky Brand as discontinued operations in its 2013 Annual Report on F orm 10 - K and estimates that expenses of approximately $2 million included in 2013 Lucky Brand Adjusted EBITDA will remain in continuing operations. 3

• Successfully transitioned U.S. distribution center and logistics business model • Completed major steps in achieving omni - channel capability in U.S. ▪ Strengthened e - commerce presence via partnership with eBay Enterprise and mobile - enabled webstores using DemandWare platform ▪ POS system which provides inventory visibility and “one database” deployed to all stores 2013: The Year of Transformation (cont’d) 2013 in Review 4

• 12/31/2012: First trading day of fiscal 2013 FNP stock price closes at $12.45 • 1/14/2013: Company pre - announces preliminary business results in 4Q12 business update: - Bill McComb, 4Q12 Business Update Press Release • 12/27/2013: Last trading day of fiscal 2013 FNP stock price closes at $31.71 Major Efforts to Unlock Shareholder Value 5 “The management team and Board of Directors of Fifth & Pacific are committed to delivering value to our shareholders. This includes making resource allocation decisions today that support strong long term growth within our current strategy as well as being thoughtful regarding alternatives to our current multi - brand portfolio approach that unlock value.” Year - end total return of +155% • 10/4/2013: Announced signing of definitive agreement to sell the intellectual property of Juicy Couture brand • 12/10/2013: Announced definitive agreement to sell Lucky Brand to an affiliate of Leonard Green & Partners, L.P. Estimated Net Proceeds = $370M - 380M

• Significant growth across major categories • Increased penetration of direct - to - consumer (DTC) channels as a % of total FY 2013 sales ▪ Total DTC sales: 70%+ ▪ Total e - commerce sales: 20%+ • Continued growth of international retail footprint into new regions and new channels ▪ Only beginning to scratch the surface of the international opportunity ▪ Japan preliminary 4Q DTC comp sales growth of +26% ▪ New territories opened in France, Mexico and Turkey Outstanding Performance at Kate Spade 1Q13 +22% * Represents a blend of specialty and outlet stores. Includes comparable specialty & outlet stores, concessions and e - commerce s ales. 4Q13 results are preliminary and are subject to month - end closing adjustments. ** Adjusted results are from continuing operations and exclude all streamlining initiatives, brand - exiting activities and acqui sition costs, non - cash impairment charges, losses on asset disposals, non - cash share - based compensation expense, gain on sale of trademark, loss on extinguishment of debt and foreign curr ency transaction adjustments, net. 2Q13 +27% 3Q13 +31% 4Q13 +30% Direct - to - Consumer Comp Sales* Est. Adjusted EBITDA** FY 2013 ~$130 6 2013 at a Glance

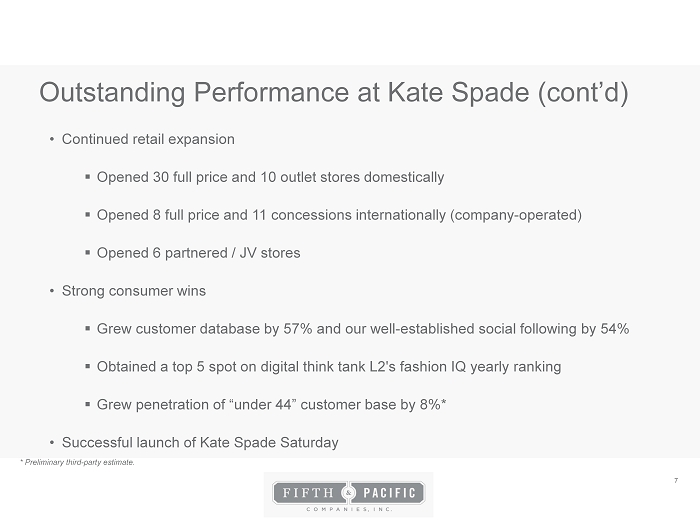

• Continued retail expansion ▪ Opened 30 full price and 10 outlet stores domestically ▪ Opened 8 full price and 11 concessions internationally (company - operated) ▪ Opened 6 partnered / JV stores • Strong consumer wins ▪ Grew customer database by 57% and our well - established social following by 54% ▪ Obtained a top 5 spot on digital think tank L2's fashion IQ yearly ranking ▪ Grew penetration of “under 44” customer base by 8%* • Successful launch of Kate Spade Saturday Outstanding Performance at Kate Spade (cont’d) 7 * Preliminary third - party estimate.

Transaction Updates • Proceeding according to plan • “Business - as - usual” through June 2014 • Announced an agreement to terminate the lease for 5 th Ave store in NYC for $51M ▪ Received $5M non - refundable deposit, on schedule • Results to be reported in continuing operations until disposed 8 * Represents a blend of specialty and outlet stores. Includes comparable specialty & outlet stores, concessions and e - commerce s ales. Juicy Couture Wind Down Sale of Lucky Brand • Preliminary 4Q DTC comp sales +5%* • Transition Services Agreement (TSA) expected to span up to 24 months • Obtained early termination of Hart - Scott - Rodino review • Expect to close the sale of Lucky Brand in early 1Q14

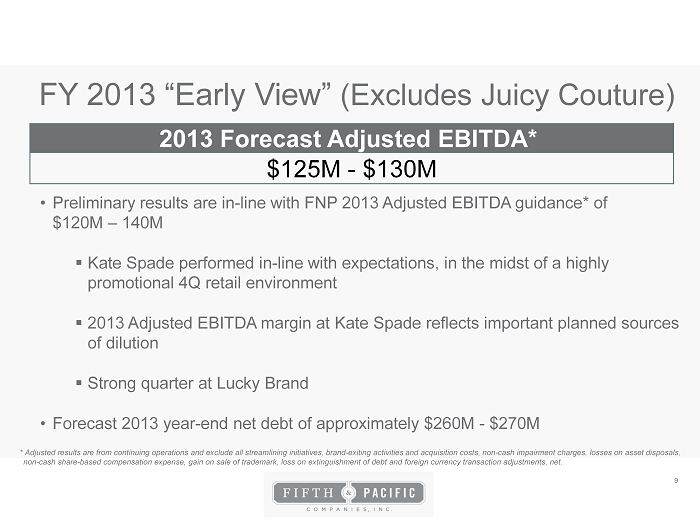

• Preliminary results are in - line with FNP 2013 Adjusted EBITDA guidance* of $120M – 140M ▪ Kate Spade performed in - line with expectations, in the midst of a highly promotional 4Q retail environment ▪ 2013 Adjusted EBITDA margin at Kate Spade reflects important planned sources of dilution ▪ Strong quarter at Lucky Brand • Forecast 2013 year - end net debt of approximately $260M - $270M FY 2013 “Early View” (Excludes Juicy Couture) 2013 Forecast Adjusted EBITDA* $125M - $130M * Adjusted results are from continuing operations and exclude all streamlining initiatives, brand - exiting activities and acquisi tion costs, non - cash impairment charges, losses on asset disposals, non - cash share - based compensation expense, gain on sale of trademark, loss on extinguishment of debt and foreign currency transa ction adjustments, net. 9

FY 2013 Preliminary Results* * Represents a blend of specialty and outlet stores. Includes comparable specialty & outlet stores, concessions and e - commerce sales. ** As of December 29, 2012. Results are preliminary and subject to month - end closing adjustments. Est. Net Sales Lucky Brand ~520 Adelington Design Group ~60 Corporate/Other** -- kate spade ~$742 Est. Adjusted EBITDA Contribution ($ in Millions) $1,320 – $1,325 ~46 ~14 ~(65) ~$130 $125 – $130 * Results are preliminary, subject to year - end closing adjustments and exclude approximately $460 million of Juicy Couture net s ales and $2 million of Adjusted EBITDA. ** Adjusted EBITDA excludes the results of Juicy Couture and expenses incurred in connection with all streamlining initiative s, brand - exiting activities, acquisition related costs, non - cash impairment charges, losses on asset disposals, non - cash share - based compensation expense, income tax provision (benefit), intere st expense, net, depreciation and amortization, net, gain on sale of trademark, (losses) on extinguishment of debt and unrealized and certain realized foreign currency gains (losses). T he Company expects to report the results of Lucky Brand as discontinued operations in its 2013 Annual Report on Form 10 - K and estimates that expenses of approximately $2 million included in Lucky Brand 2013 Adjusted EBITDA will remain in continuing operations. 10

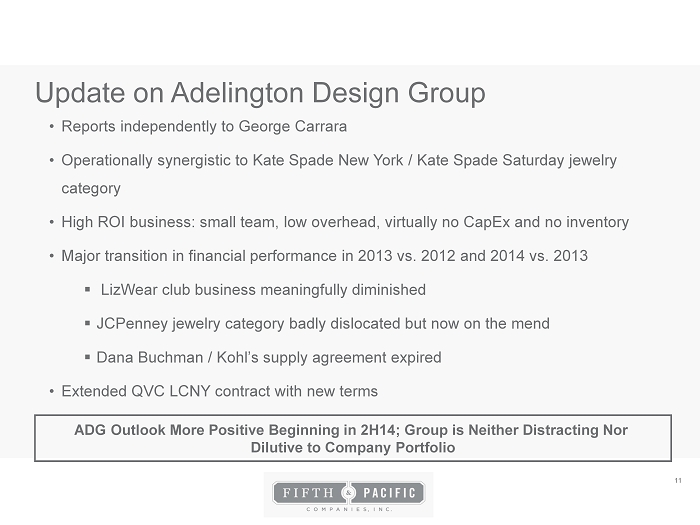

Update on Adelington Design Group • Reports independently to George Carrara • Operationally synergistic to Kate Spade New York / Kate Spade Saturday jewelry category • High ROI business: small team, low overhead, virtually no CapEx and no inventory • Major transition in financial performance in 2013 vs. 2012 and 2014 vs. 2013 ▪ LizWear club business meaningfully diminished ▪ JCPenney jewelry category badly dislocated but now on the mend ▪ Dana Buchman / Kohl’s supply agreement expired • Extended QVC LCNY contract with new terms 11 ADG Outlook More Positive Beginning in 2H14; Group is Neither Distracting Nor Dilutive to Company Portfolio

12 Kate Spade & Company Looking Ahead SKY’S THE LIMIT

Introducing Kate Spade & Company • Fifth & Pacific Companies, Inc. is changing its name to Kate Spade & Company in February 2014 ▪ Reflects the Company’s mono - brand focus ▪ At that time, the Company will begin trading as NYSE:KATE • Management transition is also scheduled following the release of 4Q final earnings results on February 25 th , 2014 ▪ Craig Leavitt to succeed William McComb as CEO ▪ George Carrara promoted to President and COO ▪ Deborah Lloyd retains role as Chief Creative Officer ▪ Expect to name Thomas Linko, current COO/CFO of Juicy Couture, as CFO after Juicy wind down is substantially complete ▪ Craig Leavitt & Deborah Lloyd will join the Company’s Board of Directors 13

14 Kate Spade & Company 2014 Total Company Outlook SEIZE THE DAY

Line Item Estimate Notes $115M - $125M 10 - 13% ($50M) - ($55M) Net of TSAs; Goal: 4 - 5% of Net Sales $40M - $45M ~$100M ~$40M International growth opportunities 65 - 70 Company-operated, including concessions $30M - $45M Debt recap planned in 1H14 38% - 40% $450M+ After the close of the sale of Lucky Brand ~124M (Excludes Lucky Brand and Juicy Couture Results) Kate Spade Brand Adjusted EBITDA Margins increase ~100bps vs. 2013 Adjusted EBITDA* DTC Comp Sales: Unallocated Corporate Costs** Total Kate Spade Normalized Tax Rate NOL Balance FY Basic Share Count Depreciation & Amortization Capital Expenditures Other Investments Planned New Store Openings Interest Expense 2014 Financial Outlook * Adjusted results are from continuing operations and exclude all streamlining initiatives, brand - exiting activities and acquisi tion costs, non - cash impairment charges, losses on asset disposals, non - cash share - based compensation expense, gain on sale of trademark, loss on extinguishment of debt and foreign curr ency transaction adjustments, net. **Includes costs associated with the following functions: corporate finance, investor relations, communications, legal, human re sources and information technology shared services and corporate facilities. Driven by Kate Spade Adjusted EBITDA of $165M - $175M 15

16 Kate Spade & Company Areas of Focus “Your plan calls for total reported Revenue to reach ≥ $1.2B and for Brand Adjusted EBITDA margin expansion from 18% to ≥ 25% by year - end 2016. How do you get there?”

Kate Spade & Company Areas of Focus • Fuel Kate Spade New York top line momentum • Evolve our industry leading customer experience ▪ Strengthen our channel agnostic approach • Enhance use of partnerships for margin expansion • Increase investment in marketing ▪ Funded via expense productivity • Strengthen foundation of Kate Spade Saturday brand for future growth 17

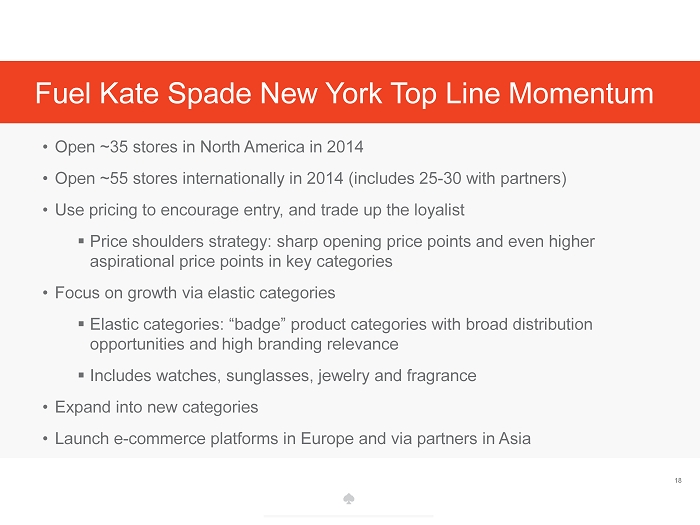

Fuel Kate Spade New York Top Line Momentum 18 • Open ~35 stores in North America in 2014 • Open ~55 stores internationally in 2014 (includes 25 - 30 with partners) • Use pricing to encourage entry, and trade up the loyalist ▪ Price shoulders strategy: sharp opening price points and even higher aspirational price points in key categories • Focus on growth via elastic categories ��� Elastic categories: “badge” product categories with broad distribution opportunities and high branding relevance ▪ Includes watches, sunglasses, jewelry and fragrance • Expand into new categories • Launch e - commerce platforms in Europe and via partners in Asia

• More targeted communication to consumers using improved CRM capability • Roll out “gold service” selling and service program to A - level stores • Expand e - commerce site with broad Kate Spade New York offering: “Global Flagship” ▪ Madison Avenue collection ▪ Customization • Tablet optimization (to add to mobile site optimization) • New media as channels Evolve Our Industry Leading Customer Experience 19

Enhance Use of Partnerships for Margin Expansion 20 • International partnerships (India, Russia, Asia and South America) • Travel retail • Accelerate product licensing initiatives (including sub - brands) • Technology collaborations • Home: bigger, sooner

Increase Investment in Marketing 21 • Move from 2 campaigns to 4 to achieve consistent advertising presence • Leverage new media for increased digital spend and social media • Deploy our enhanced CRM capability • Continue to improve quality of sale: increased units per transaction, higher full price mix, increased conversion • Acquiring new full price customers • Within store rollout plan, launch new flagships and international e - commerce sites

Strengthen Foundation of Kate Spade Saturday for Future Growth 22 • Apply early learnings to product assortment and marketing mix ▪ Marketing investment (similar to LY) redeployed • Growing customer base beyond Kate Spade New York • Focus on e - commerce • Testing store formats to gain learnings Moving toward tipping point in brand awareness 22

23 Kate Spade & Company Year - End 2016 Financial Targets BE DAZZLING

Year - End 2016 Financial Targets 24 Year - End 2016 Targets (Last Reviewed in 2013 Investor Day) Adjusted Brand EBITDA Margin ≥ 25% Reported Net Sales Target ≥ $1.2B Total Retail Footprint ~$2.1B International at 1/3 of Total Retail Footprint

As the Company has not completed its quarter and year - end fiscal close and its analysis of fiscal 2013, and the audit of its 2013 financial statements is not complete, the results presented in this presentation are estimated and preliminary, and, therefore, may change. No party has audited or reviewed the 2013 financial information. Estimates of 2013 GAAP results and reconciliation of the various non - GAAP measures in this presentation are not provided in this presentation as the Company has not yet completed its accounting for discontinued operations, certain streamlining initiatives and brand exiting activities and other items. No reconciliations of 2014 Adjusted EBITDA to GAAP measures are provided because they are not available. In this presentation, Adjusted EBITDA, net of foreign currency transaction adjustments is defined as income (loss) from continuing operations, adjusted to exclude income tax provision (benefit), interest expense, net, depreciation and amortization, net, gain on sale of trademark, losses on extinguishment of debt, expenses incurred in connection with the Company’s streamlining initiatives, brand - exiting activities, acquisition related costs, non - cash impairment charges, losses on asset disposals and non - cash share - based compensation expense. The Company believes that the adjusted results represent a more meaningful presentation of its historical operations and financial performance since these results provide period to period comparisons that are consistent and more easily understood. We present the above - described Adjusted EBITDA measure because we consider it an important supplemental measure of our performance and believe it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Presentation of Non - GAAP Financial Information 25

Statements contained in, or incorporated by reference into, this presentation, filings by us with the Securities and Exchange Co mmission (“SEC”), our press releases, and oral statements made by, or with the approval of, our authorized personnel, that relate to our future performance or future e ven ts are forward - looking statements under the Private Securities Litigation Reform Act of 1995. Such statements are indicated by words or phrases such as “intend,” “antici pat e,” “plan,” “estimate,” “target,” “aim,” “forecast,” “project,” “expect,” “believe,” “we are optimistic that we can,” “current visibility indicates that we forecast,” “c ontemplation” or “currently envisions” and similar phrases. Although we believe that the expectations reflected in these forward - looking statements are reasonable, these expectati ons may not prove to be correct or we may not achieve the financial results, savings or other benefits anticipated in the forward - looking statements. These forward - lo oking statements are necessarily estimates reflecting the best judgment of our senior management and involve a number of risks and uncertainties, some of which may be b eyo nd our control, that could cause actual results to differ materially from those suggested by the forward - looking statements, including, without limitation: our ability to complete the transition to a mono - brand business centered on the KATE SPADE family of brands, including our ability to successfully complete the transition of our ma nag ement and operations; our ability to operate as a mono - brand company and to successfully implement our long - term strategic plans; our ability to expand into markets outside of the U.S., such as India, Russia, South East Asia, and South America, as well as continued expansion in China, Japan and Brazil, including our ability to promote brand awareness in our international markets, find suitable partners in certain of those markets and hire and retain key employees for those markets ; o ur ability to maintain targeted profit margins and levels of promotional activity; our ability to expand our retail footprint with profitable store locations; our ability t o c ontinue the growth of our KATE SPADE SATURDAY business, including our ability to attract new customers; our ability to implement operational improvements and realize econo mie s of scale in finished product and raw material costs in connection with growth in our business; our ability to successfully engage; our ability to expand the KATE SPA DE family of brands into new product categories; our ability to successfully implement our marketing initiatives; our ability to complete the sale of the LUCKY BR AND business and risks associated with the transaction, including our ability to collect the full amount of principal and interest due and owing pursuant to a three yea r n ote to be issued by Leonard Green Partners, L.P. to us as partial consideration for the purchase of the LUCKY BRAND business and our ability to comply with our transiti on service requirements; risks associated with the transition of the JUICY COUTURE business, including our ability to complete the transition plan for the JUICY COUTURE bus ine ss in a satisfactory manner and to manage the associated transition costs, our ability to timely implement the transition plan in a manner that will positively imp act our financial condition and results of operations, the impact of the transition plan and the recently announced future plans for the Juicy Couture brand on our rela tio nships with our employees and our major customers and vendors, and unanticipated expenses and charges that may occur as a result of the transition plan, litigation r isk s, including litigation regarding employment and worker’s compensation, our ability to continue to have the necessary liquidity, through cash flows from operations and av ail ability under our amended and restated revolving credit facility (as amended to date, the “Amended Facility”), may be adversely impacted by a number of factors, inc lud ing the level of our operating cash flows, our ability to maintain established levels of availability under, and to comply with the financial and other covenants includ ed in, our Amended Facility and the borrowing base requirement in our Amended Facility that limits the amount of borrowings we may make based on a formula of, among other thi ngs, eligible cash, accounts receivable and inventory and the minimum availability covenant in our Amended Facility that requires us to maintain availability in exce ss of an agreed upon level; restrictions in the credit and capital markets, which would impair our ability to access additional sources of liquidity, if needed; general econ omi c conditions in the United States, Asia, Europe and other parts of the world, including the impact of income tax changes and debt reduction efforts in the United States; lev els of consumer confidence, consumer spending and purchases of discretionary items, including fashion apparel and related products, such as ours; changes in the cost of ra w m aterials, labor, advertising and transportation which could impact prices of our products; the dependence of our CAUTIONARY STATEMENT REGARDING FORWARD - LOOKING STATEMENTS 26

ADELINGTON DESIGN GROUP business on third party arrangements and partners; our ability to anticipate and respond to constantl y c hanging consumer demands and tastes and fashion trends, across multiple brands, product lines, shopping channels and geographies; our ability to attract a nd retain talented, highly qualified executives, and maintain satisfactory relationships with our employees; risks associated with our arrangement to continue to operate our Ohio di stribution facility with a third - party operations and labor management company that provides distribution operations services, including risks related to increased operating e xpe nses, systems capabilities and operating under a third party arrangement; our dependence on a limited number of large US department store customers, and the risk of c ons olidations, restructurings, bankruptcies and other ownership changes in the retail industry and financial difficulties at our larger department store customers; our a bil ity to adequately establish, defend and protect our trademarks and other proprietary rights; the impact of the highly competitive nature of the markets within which we opera te, both within the US and abroad; our reliance on independent foreign manufacturers, including the risk of their failure to comply with safety standards or our policies reg ard ing labor practices; risks associated with our buying/sourcing agreement with Li & Fung Limited, which results in a single third party foreign buying/sourcing agent for a s ign ificant portion of our products; a variety of legal, regulatory, political and economic risks, including risks related to the importation and exportation of product, tarif fs and other trade barriers; our ability to adapt to and compete effectively in the current quota environment in which general quota has expired on apparel products, but political ac tiv ity seeking to re - impose quota has been initiated or threatened; whether we will be successful operating the KATE SPADE business in Japan and the risks associated wi th such operation; risks associated with the reduction of our brand portfolio to the KATE SPADE and ADELINGTON DESIGN GROUP businesses; our exposure to currency fluctuati ons ; risks associated with material disruptions in our information technology systems, both owned and licensed, and with our third - party e - commerce platforms and op erations; risks associated with privacy breaches; risks associated with credit card fraud and identity theft; risks associated with third party service providers, bo th domestic and overseas, including service providers in the area of e - commerce; limitations on our ability to utilize all or a portion of our US deferred tax assets if we experience an “ownership change”; and the outcome of current and future litigation and other proceedings in which we are involved. The list of factors above is illustrative, but by no means exhaustive. All forward - looking statements should be evalu ated with the understanding of their inherent uncertainty. All subsequent written and oral forward - looking statements concerning the matters addressed in this press release and attributab le to us or any person acting on our behalf are qualified by these cautionary statements. Forward - looking statements are based on current expectations only and are not guar antees of future performance, and are subject to certain risks, uncertainties and assumptions, including those described in this press release, and in the Company’ s A nnual Report on Form 10 - K for the year ended December 29, 2012, and Quarterly Reports on Form 10 - Q for the quarterly periods ended March 30, 2013, June 29, 2013 and Septembe r 28, 2013, each filed with the SEC, including in the sections entitled “Item 1A - Risk Factors” and “Statement on Forward Looking Statements.” We may change our inten tions, beliefs or expectations at any time and without notice, based upon any change in our assumptions or otherwise. Should one or more of these risks or uncertainties ma terialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. In addition, som e factors are beyond our control. We undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, fut ure events or otherwise. CAUTIONARY STATEMENT REGARDING FORWARD - LOOKING STATEMENTS 27