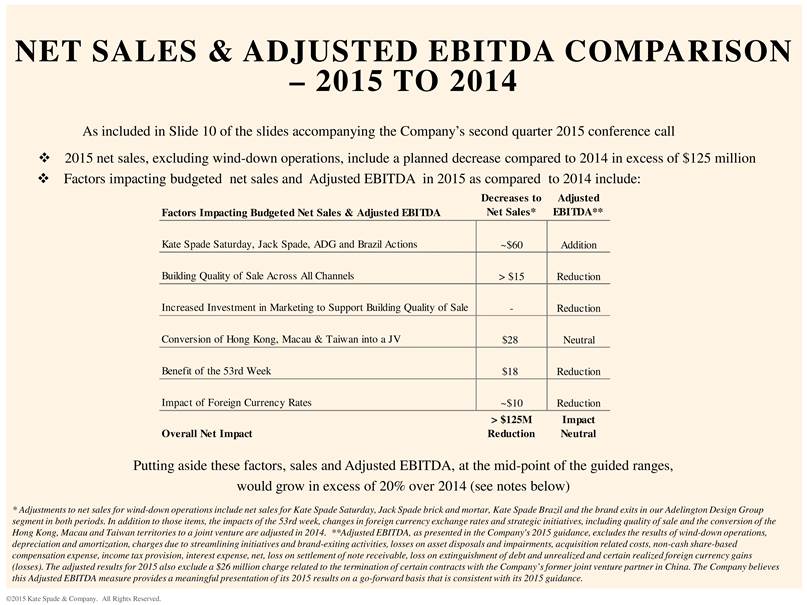

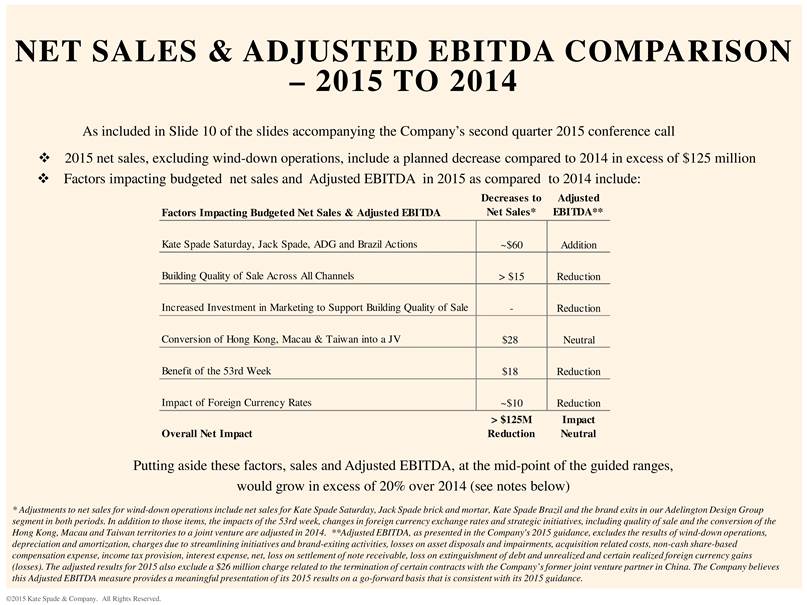

| NET SALES & ADJUSTED EBITDA COMPARISON – 2015 TO 2014 As included in Slide 10 of the slides accompanying the Company’s second quarter 2015 conference call ! 2015 net sales, excluding wind-down operations, include a planned decrease compared to 2014 in excess of $125 million Factors impacting budgeted net sales and Adjusted EBITDA in 2015 as compared to 2014 include: Factors Impacting Budgeted Net Sales & Adjusted EBITDA Decreases to Net Sales* Adjusted EBITDA** Kate Spade Saturday, Jack Spade, ADG and Brazil Actions ~$60 Addition Building Quality of Sale Across All Channels > $15 Reduction Increased Investment in Marketing to Support Building Quality of Sale - Reduction Conversion of Hong Kong, Macau & Taiwan into a JV $28 Neutral Benefit of the 53rd Week $18 Reduction Impact of Foreign Currency Rates ~$10 Reduction Overall Net Impact > $125M Reduction Impact Neutral Putting aside these factors, sales and Adjusted EBITDA, at the mid-point of the guided ranges, would grow in excess of 20% over 2014 (see notes below) * Adjustments to net sales for wind-down operations include net sales for Kate Spade Saturday, Jack Spade brick and mortar, Kate Spade Brazil and the brand exits in our Adelington Design Group segment in both periods. In addition to those items, the impacts of the 53rd week, changes in foreign currency exchange rates and strategic initiatives, including quality of sale and the conversion of the Hong Kong, Macau and Taiwan territories to a joint venture are adjusted in 2014. **Adjusted EBITDA, as presented in the Company's 2015 guidance, excludes the results of wind-down operations, depreciation and amortization, charges due to streamlining initiatives and brand-exiting activities, losses on asset disposals and impairments, acquisition related costs, non-cash share-based compensation expense, income tax provision, interest expense, net, loss on settlement of note receivable, loss on extinguishment of debt and unrealized and certain realized foreign currency gains (losses). The adjusted results for 2015 also exclude a $26 million charge related to the termination of certain contracts with the Company’s former joint venture partner in China. The Company believes this Adjusted EBITDA measure provides a meaningful presentation of its 2015 results on a go-forward basis that is consistent with its 2015 guidance. ©2015 Kate Spade & Company. All Rights Reserved. |