UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03174

Touchstone Tax-Free Trust

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: June 30

Date of reporting period: June 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

June 30, 2014

Annual Report

Touchstone Tax-Free Trust

Touchstone Ohio Tax-Free Bond Fund

Touchstone Ohio Tax-Free Money Market Fund

Touchstone Tax-Free Money Market Fund

Table of Contents

This report identifies the Funds' investments on June 30, 2014. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Tax-Free Trust Annual Report. Inside you will find key financial information for the 12 months ended June 30, 2014.

During the period, growth in the U.S. remained subdued, although the unemployment rate declined. Inflation increased, but the U.S. Federal Reserve Board (Fed) did not express concern about sustained inflation growth. Fed policy remained accommodative to keeping interest rates low. However, during the first half of the fiscal year rates rose at the announcement that the Fed would begin tapering its bond purchase program. Economic conditions weakened during the second half of the year due to severe weather. The weaker economy coupled with poor growth in Europe calmed the bond market and interest rates declined over the period.

The municipal market experienced both highs and lows over the course of the fiscal year. In the first half of the period, higher interest rates, credit concerns and negative cash flows from municipal mutual funds led to weak performance. In the second half of the period, however, as Treasury rates dropped from the end of 2013, factors that included improved municipal credit quality, higher taxes, limited new municipal issuance and increased demand for taxable-equivalent yields combined to make municipals strong relative performers for the first six months of 2014. As a result, for the fiscal year overall, the U.S. municipal bond market posted positive performance.

The Touchstone Ohio Tax-Free Bond Fund seeks the highest level of interest income exempt from federal income and Ohio personal income taxes consistent with the protection of capital. It invests primarily in high-quality long-term Ohio municipal bonds and seeks the appropriate alignment of risk and return in an attempt to provide the most favorable opportunity to maximize risk-adjusted performance.

Touchstone’s tax-free money market funds seek current tax-free income combined with liquidity and stability. The Funds seek the highest level of interest income exempt from Federal (and in some cases, state) income tax, consistent with protection of capital by primarily investing in high-quality, short-term municipal obligations.

We believe that focusing on the long-term composition of your investment portfolio is essential to balancing risk and return. We recommend that you work with your financial professional on a regular basis to assess and adjust your asset allocation and diversification strategy as needed to help keep your financial goals on track.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Tax-Free Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Ohio Tax-Free Bond Fund

Sub-Advised by Fort Washington Investment Advisors

Investment Philosophy

The Touchstone Ohio Tax-Free Bond Fund seeks the highest level of interest income exempt from federal income and Ohio personal income taxes, consistent with the protection of capital. It invests primarily in high-quality, long-term Ohio Municipal obligations.

Fund Performance

The Touchstone Ohio Tax-Free Bond Fund (Class A Shares) outperformed its benchmark, the Barclays Municipal Bond Index, for the 12-month period ended June 30, 2014. The Fund’s total return was 6.41 percent (calculated excluding the maximum sales charge) while the total return of the benchmark was 6.14 percent.

Market Environment

During the period, the U.S. economy failed to reach estimated expectations and overall growth remained subpar. Employment continued to be a relative bright spot while the unemployment rate declined. Although inflation increased near the end of the period, the U.S. Federal Reserve Board (Fed) did not express concern that this will lead to a sustained higher level of inflation. The Fed’s quantitative easing (QE) policy remained accommodative; however, interest rates rose temporarily when then Fed Chair, Ben Bernanke, mentioned that the Fed may begin to taper bond purchases. The wind down began in December 2013, when the Fed started reducing purchases by $10 billion per month; it is expected the program will end in the fall of 2014. Nevertheless, U.S. Treasury yields ended the period with minimal change.

For the fiscal year, performance of the municipal market was mixed. Higher interest rates, credit concerns exacerbated by the City of Detroit’s bankruptcy and negative cash flows from municipal mutual funds led to weak performance during the last two quarters of 2013. However, in the first two quarters of 2014, declining interest rates and increasing relative valuations helped municipal bonds post strong total return performance.

Portfolio Review

Fund performance was positively impacted by its shorter-than-benchmark duration during the first half of the year when interest rates rose sharply. As interest rates declined in the second half of the fiscal year, the Fund’s shorter duration detracted from relative performance. Sector allocations to Health Care and Education bonds contributed to performance for the period.

In managing the Fund, we seek a target duration less than the benchmark. To achieve this goal, we emphasized high-quality bonds in the 20-year maturity range. This range is preferred as we believe it allows the Fund to capture most of the yield available along the yield curve while reducing portfolio duration and volatility relative to longer-term securities.

Outlook

Our focus will remain on buying high-quality Ohio municipal bonds that we believe offer the best combination of tax-free yield and total return. Currently, we believe the 15- to 20-year maturity range offers attractive opportunities. In addition, we favor higher coupon bonds which, when combined with our maturity preference, results in a Fund with a shorter duration than the benchmark. Historically, this strategy has worked well.

We believe the bond market will remain challenging as it tries to determine the impact from the wind down of the Fed’s aggressive monetary policy. While the Fed is not expected to raise short-term interest rates in the near future, we believe the reduction of its QE measures later in 2014 is likely to have a negative impact on bonds, which could increase interest rates and push bond prices lower. We believe potential disruptions in the

Management's Discussion of Fund Performance (Unaudited) (Continued)

municipal market could have a negative impact on the sector, but may also provide opportunities to purchase higher-quality bonds at higher yield levels.

Credit quality within the municipal sector remains steady, with revenues improving at a moderate pace. Problems in Puerto Rico that could cause potential disruptions in the market began to resurface late in the period. New legislation passed by the Puerto Rican government caused rating agencies to downgrade Puerto Rico’s general obligation (GO) debt to junk status earlier in the year. The new legislation allowing public finance companies more self-sufficiency has brought additional downgrades for nearly every issuer within Puerto Rico. There is concern about the possibility of more broad-based defaults as the government works through restructuring plans for the public finance corporations. Although this has had no impact on the broader municipal market thus far, we believe there is potential it could evolve into a larger problem. We will monitor these developments closely even though the Fund does not and has not held any Puerto Rican debt.

Management's Discussion of Fund Performance (Unaudited) (Continued)

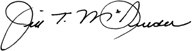

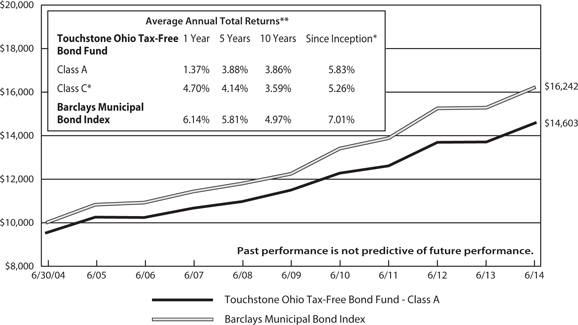

Comparison of the Change in Value of a $10,000 Investment in

the Touchstone Ohio Tax-Free Bond Fund - Class A* and the

Barclays Municipal Bond Index

*The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares based on the difference in loads and fees paid by shareholders in the different classes. Class A and Class C shares commenced operations on April 1, 1985, and November 1, 1993, respectively. Class C shares performance was calculated using the historical performance of Class A shares for the periods prior to November 1, 1993. The returns have been restated for sales charges and for fees applicable to Class C shares.

**The average annual total returns shown above are adjusted for maximum applicable sales charges. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 4.99% of the NAV (or 4.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00% that will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed if redeemed within a one-year period from date of purchase.

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

The Barclays Municipal Bond Index is a widely recognized unmanaged Index of municipal bonds with maturities of at least one year.

Tabular Presentation of Portfolios of Investments (Unaudited)

June 30, 2014

The tables below provide each Fund’s investments by credit quality and security type. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone Ohio Tax-Free Bond Fund | | | | |

| Credit Quality* | | | (% of Investment Securities) | |

| AAA/Aaa | | | 4.7 | % |

| AA/Aa | | | 51.5 | |

| A/A | | | 39.8 | |

| BBB/Baa | | | 4.0 | |

| Total | | | 100.0 | % |

| | | | | |

| Portfolio Allocation | | | (% of Net Assets) | |

| Fixed Rate Revenue and | | | | |

| General Obligation Bonds | | | 96.8 | % |

| Variable Rate | | | | |

| Demand Notes | | | 2.8 | |

| Other Assets/Liabilities (net) | | | 0.4 | |

| Total | | | 100.0 | % |

| Touchstone Ohio Tax-Free Money Market Fund | | | | |

| Credit Quality | | | (% of Investment Securities) | |

| A-1/P-1/MIG1/SP1-+ | | | 85.9 | % |

| FW1** | | | 14.1 | |

| Total | | | 100.0 | % |

| | | | | |

| Portfolio Allocation | | | (% of Net Assets) | |

| Variable Rate Demand Notes | | | 78.3 | % |

| Fixed Rate Revenue and | | | | |

| General Obligation Bonds | | | 22.5 | |

| Other Assets/Liabilities (net) | | | (0.8 | ) |

| Total | | | 100.0 | % |

| Touchstone Tax-Free Money Market Fund | | | | |

| Credit Quality | | | (% of Investment Securities) | |

| A-1/P-1/MIG1/SP1-+ | | | 88.7 | % |

| FW1** | | | 11.3 | |

| Total | | | 100.0 | % |

| | | | | |

| Portfolio Allocation | | | (% of Net Assets) | |

| Variable Rate Demand Notes | | | 69.9 | % |

| Fixed Rate Revenue and | | | | |

| General Obligation Bonds | | | 31.3 | |

| Other Assets/Liabilities (net) | | | (1.2 | ) |

| Total | | | 100.0 | % |

* Credit quality may be rated by Standard & Poor's, Moody's and Fitch. If all three agencies rate the bond, the middle or common rating is used; if two of the agencies rate the bond, the lower rating is used; if one agency rates the bond, that rating is used, if none of the agencies rate the bond, the bond will be classified as not-rated.

** Equivalent to Standard & Poor's and Moody's highest short-term ratings of A-1 and P-1, respectively, based upon independent research conducted by Fort Washington Investment Advisors, Inc.

Portfolio of Investments

Touchstone Ohio Tax-Free Bond Fund – June 30, 2014

| Principal | | | | | Interest | | | Maturity | | Market | |

| Amount | | | | | Rate | | | Date | | Value | |

| | | | | | | | | | | | |

| | | | | Fixed Rate Revenue and General Obligation Bonds — 96.8% | | | | | | | | | | |

| $ | 865,000 | | | Fairfield Co OH LTGO Ser 2005 Pre-refunded @ $100 | | | 5.000 | % | | 06/01/15 | | $ | 903,467 | |

| | 1,000,000 | | | Oregon OH CSD UTGO Ser 2005 Pre-refunded @ $100 | | | 5.000 | | | 06/01/15 | | | 1,043,990 | |

| | 170,000 | | | Warren OH Wtr Wks Rev | | | 5.500 | | | 11/01/15 | | | 174,644 | |

| | 250,000 | | | Buckeye Valley OH LSD UTGO Ser A | | | 6.850 | | | 12/01/15 | | | 262,548 | |

| | 415,000 | | | Columbus-Polaris OH Hsg Corp. Pre-refunded @ $100 | | | 7.400 | | | 01/01/16 | | | 451,744 | |

| | 1,000,000 | | | Univ of Cincinnati OH Recpts Ser A Pre-refunded @ $100 | | | 4.750 | | | 06/01/16 | | | 1,071,940 | |

| | 1,000,000 | | | Little Miami OH LSD (Sch Impt) UTGO Pre-refunded @ $100 | | | 5.000 | | | 12/01/16 | | | 1,111,450 | |

| | 750,000 | | | Cleveland OH LTGO Ser A Pre-refunded @ $100 | | | 5.000 | | | 10/01/17 | | | 795,068 | |

| | 1,000,000 | | | Kings OH LSD (Sch Impt) UTGO Pre-refunded @ $100 | | | 5.000 | | | 12/01/17 | | | 1,144,960 | |

| | 500,000 | | | New Albany OH Cmnty Auth Ser C | | | 5.000 | | | 10/01/24 | | | 569,015 | |

| | 2,000,000 | | | Canal Winchester OH LSD UTGO | | | 4.750 | | | 12/01/24 | | | 2,195,240 | |

| | 1,040,000 | | | Franklin Co OH Hosp Rev Impt (The Childrens Hosp Proj.) Ser C | | | 5.000 | | | 05/01/25 | | | 1,077,055 | |

| | 1,500,000 | | | Richland Co OH Hosp Facs Rev (Medcentral Health Sys Oblig) | | | 5.125 | | | 11/15/26 | | | 1,555,875 | |

| | 1,090,000 | | | Fairborn OH CSD (Sch Impt) UTGO | | | 5.000 | | | 12/01/26 | | | 1,174,671 | |

| | 1,000,000 | | | Lakewood OH CSD (Sch Impt) UTGO | | | 5.000 | | | 12/01/26 | | | 1,117,650 | |

| | 1,500,000 | | | OH St Hgr Edl Fac (Univ Dayton) | | | 5.000 | | | 12/01/26 | | | 1,643,430 | |

| | 2,000,000 | | | OH St Hosp Fac Rev (Cleveland Clinic Hlth) Ser B | | | 5.125 | | | 01/01/28 | | | 2,234,020 | |

| | 1,000,000 | | | OH St Hgr Edl Fac Comm (Xavier Univ) Ser C | | | 5.750 | | | 05/01/28 | | | 1,157,820 | |

| | 830,000 | | | Columbus OH CSD (Sch Facs Constr & Impt) UTGO | | | 5.000 | | | 12/01/28 | | | 920,578 | |

| | 1,185,000 | | | Delaware OH LTGO | | | 5.000 | | | 12/01/28 | | | 1,285,749 | |

| | 865,000 | | | Licking Heights OH LSD UTGO | | | 6.400 | | | 12/01/28 | | | 1,186,910 | |

| | 1,500,000 | | | Reynoldsburg OH CSD (Sch Facs Constr & Impt) UTGO | | | 5.250 | | | 12/01/28 | | | 1,686,000 | |

| | 650,000 | | | Greene Co OH Hosp Fac Rev (Kettering Health Network) | | | 5.125 | | | 04/01/29 | | | 683,839 | |

| | 1,000,000 | | | Montgomery Co OH Rev (Catholic Hlth Initiatives) Ser B | | | 5.250 | | | 05/01/29 | | | 1,148,050 | |

| | 345,000 | | | Univ of Toledo OH Ser B | | | 5.000 | | | 06/01/29 | | | 378,289 | |

| | 1,000,000 | | | Cleveland OH Income Tax Rev (Sub Lien Brdgs & Roadways) Ser B | | | 5.000 | | | 10/01/29 | | | 1,101,260 | |

| | 1,000,000 | | | Franklin Co OH Hosp Rev Impt (Nationwide Childrens Hosp) | | | 4.750 | | | 11/01/29 | | | 1,068,770 | |

| | 1,000,000 | | | Columbus OH CSD (Sch Facs Constr & Impt) UTGO | | | 4.500 | | | 12/01/29 | | | 1,085,970 | |

| | 895,000 | | | Milton Union OH Exempted Village SD (Sch Impt) | | | 4.875 | | | 12/01/29 | | | 961,651 | |

| | 320,000 | | | Brookfield OH LSD (Sch Facs Impt) UTGO | | | 5.000 | | | 01/15/30 | | | 349,162 | |

| | 500,000 | | | Hamilton Co OH Hosp Facs Rev (UC Hlth) | | | 5.000 | | | 02/01/30 | | | 553,280 | |

| | 1,000,000 | | | Hamilton Co OH Student Rev (Stratford Heights Proj) | | | 5.000 | | | 06/01/30 | | | 1,071,170 | |

| | 1,000,000 | | | Green OH Cmnty Learning Ctr | | | 4.000 | | | 12/01/30 | | | 1,036,870 | |

| | 500,000 | | | Butler Co OH Hosp Facs (Kettering Health Network Oblig) | | | 5.250 | | | 04/01/31 | | | 543,369 | |

| | 1,000,000 | | | Wright OH St Univ (Gen Recpts) Ser A | | | 5.000 | | | 05/01/31 | | | 1,089,080 | |

| | 1,500,000 | | | Cincinnati OH CSD (Sch Impt) LTGO | | | 5.000 | | | 06/01/31 | | | 1,674,270 | |

| | 750,000 | | | Middleburg Heights OH Hosp Rev (Facs Southwest Gen) | | | 5.125 | | | 08/01/31 | | | 788,790 | |

| | 1,000,000 | | | Mount Healthy OH CSD (Sch Impt) UTGO | | | 5.000 | | | 12/01/31 | | | 1,086,350 | |

| | 1,000,000 | | | Kent OH St Univ Rev (Gen Recpts) Ser A | | | 4.500 | | | 05/01/32 | | | 1,070,030 | |

| | 1,000,000 | | | Hamilton Co OH Hlthcare Facs (Christ Hosp Proj) | | | 5.250 | | | 06/01/32 | | | 1,095,380 | |

| | 1,300,000 | | | Cincinnati OH Wtr Sys Rev Ser B | | | 5.000 | | | 12/01/32 | | | 1,434,290 | |

| | 1,000,000 | | | Cuyahoga Co OH COP (Convention Hotel Proj) | | | 5.000 | | | 12/01/32 | | | 1,105,260 | |

| | 1,000,000 | | | Hamilton Co OH Swr Sys Rev Impt (Greater Cincinnati Met) Ser A | | | 5.000 | | | 12/01/32 | | | 1,094,620 | |

| | 1,060,000 | | | OH St EDR (Enterprise Bd Fd) Ser 7 | | | 4.750 | | | 12/01/32 | | | 1,127,957 | |

| | 1,000,000 | | | Toledo OH CSD (Sch Facs Impt) UTGO | | | 5.000 | | | 12/01/32 | | | 1,130,490 | |

| | 2,000,000 | | | Cincinnati OH EDR (U Square The Loop Proj.) | | | 5.000 | | | 11/01/33 | | | 2,195,040 | |

| | 250,000 | | | Lakewood OH CSD (Sch Facs Impt) UTGO Ser A | | | 5.000 | | | 11/01/33 | | | 277,065 | |

| | 625,000 | | | Hamilton Co OH Hosp Facs Rev (Cincinnati Childrens Hosp) Ser S | | | 5.000 | | | 05/15/34 | | | 694,356 | |

| | | | | Total Fixed Rate Revenue and General Obligation Bonds | | | | | | | | $ | 50,608,482 | |

Touchstone Ohio Tax-Free Bond Fund (Continued)

| Principal | | | | | Interest | | | Maturity | | Market | |

| Amount | | | | | Rate | | | Date | | Value | |

| | | | | | | | | | | | |

| | | | | Variable Rate Demand Notes(A) — 2.8% | | | | | | | | | | |

| $ | 1,000,000 | | | OH St Air Quality Dev Auth (Poll Control Firstenenergy) | | | 2.250 | % | | 08/01/29 | | $ | 1,013,330 | |

| | 415,000 | | | Allen Co OH Hosp Facs Rev (Catholic Healthcare) Ser C (LOC: Union Bank NA) | | | 0.040 | | | 06/01/34 | | | 414,999 | |

| | | | | Total Variable Rate Demand Notes | | | | | | | | $ | 1,428,329 | |

| | | | | | | | | | | | | | | |

| | | | | Total Investment Securities —99.6% | | | | | | | | | | |

| | | | | (Cost $48,374,860) | | | | | | | | $ | 52,036,811 | |

| | | | | | | | | | | | | | | |

| | | | | Other Assets in Excess of Liabilities — 0.4% | | | | | | | | | 234,871 | |

| | | | | | | | | | | | | | | |

| | | | | Net Assets — 100.0% | | | | | | | | $ | 52,271,682 | |

| (A) | Demand Feature - Maturities shown are the final maturities, not the date on which principal could be recovered through the demand feature. |

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation inputs at Reporting Date: | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Municipal Bonds | | $ | — | | | $ | 52,036,811 | | | $ | — | | | $ | 52,036,811 | |

See accompanying Notes to Portfolios of Investments and Notes to Financial Statements.

Portfolio of Investments

Touchstone Ohio Tax-Free Money Market Fund – June 30, 2014

| Principal | | | | | Interest | | | Maturity | | | |

| Amount | | | | | Rate | | | Date | | Value | |

| | | | | | | | | | | | |

| | | | | Variable Rate Demand Notes(A) — 78.3% | | | | | | | | | | |

| $ | 4,075,000 | | | OH St (Infra Impt) UTGO Ser B | | | 0.050 | % | | 08/01/17 | | $ | 4,075,000 | |

| | 280,000 | | | Hamilton Co OH Econ Dev Rev (The General Protestant) (LOC: PNC Bank NA) | | | 0.150 | | | 12/01/17 | | | 280,000 | |

| | 4,000,000 | | | DE Co OH Port Auth Eco (Columbus Zoological Pk) Ser 2006 (LOC: JP Morgan Chase Bank NA) | | | 0.070 | | | 08/01/18 | | | 4,000,000 | |

| | 2,000,000 | | | OH St (Infra Impt) UTGO Ser B | | | 0.030 | | | 08/01/21 | | | 2,000,000 | |

| | 1,055,000 | | | OH St Univ (The) | | | 0.060 | | | 12/01/21 | | | 1,055,000 | |

| | 1,635,000 | | | Hamilton Co OH Econ Dev Rev (Samuel W Bell Home Proj) (LOC: U.S. Bank NA) | | | 0.060 | | | 04/01/22 | | | 1,635,000 | |

| | 2,290,000 | | | Columbiana Co OH Rev (East Liverpool Area) Ser Y (LOC: PNC Bank NA) | | | 0.070 | | | 10/01/23 | | | 2,290,000 | |

| | 2,290,000 | | | Port Gtr Cincinnati OH Dev Auth Rev (Cincinnati Zoo) (LOC: U.S. Bank NA) | | | 0.220 | | | 11/01/23 | | | 2,290,000 | |

| | 800,000 | | | Cleveland OH Arpt Sys Rev Ser D (LOC: Bank of America NA) | | | 0.080 | | | 01/01/24 | | | 800,000 | |

| | 2,100,000 | | | Butler Co OH Hlthcare Facs Rev (Colonial Sr Svcs Inc Proj) (LOC: U.S. Bank NA) | | | 0.060 | | | 07/01/24 | | | 2,100,000 | |

| | 1,000,000 | | | OH St (Common Schs) UTGO Ser A | | | 0.030 | | | 03/15/25 | | | 1,000,000 | |

| | 3,000,000 | | | OH St Wtr Dev Auth Rev (Multi Modal Wtr Dev Timken) Ser 2014 (LOC: Northern Trust Company) | | | 0.080 | | | 11/01/25 | | | 3,000,000 | |

| | 430,000 | | | Port Gtr Cincinnati OH Dev Auth Rev (Cincinnati Zoo Proj) (LOC: U.S. Bank NA) | | | 0.220 | | | 11/01/25 | | | 430,000 | |

| | 3,000,000 | | | OH St Air Quality Dev Auth Rev (OH Valley Elec Corp) Ser A (LOC: Bank of Nova Scotia) | | | 0.050 | | | 02/01/26 | | | 3,000,000 | |

| | 4,600,000 | | | OH St Air Quality Dev Auth Rev (OH Valley Elec Corp) Ser C (LOC: Bank of Tokyo-Mitsubishi UFJ) | | | 0.060 | | | 02/01/26 | | | 4,600,000 | |

| | 5,355,000 | | | Columbus OH (San Swr) UTGO Ser 1 | | | 0.030 | | | 12/01/26 | | | 5,355,000 | |

| | 810,000 | | | Stark Co OH Port Auth Hlthcare Facs Rev (Canton Sch) (LOC: PNC Bank NA) | | | 0.130 | | | 02/01/27 | | | 810,000 | |

| | 1,800,000 | | | OH St Univ (The) | | | 0.040 | | | 12/01/27 | | | 1,800,000 | |

| | 6,345,000 | | | Hamilton Co OH Econ Dev Rev (St Xavier H.S. Proj) (LOC: PNC Bank NA) | | | 0.060 | | | 04/01/28 | | | 6,345,000 | |

| | 2,020,000 | | | Hamilton Co OH Hosp Facs Rev (Children's Hosp Med Ctr) (LOC: JP Morgan Chase Bank NA) | | | 0.060 | | | 05/15/28 | | | 2,020,000 | |

| | 900,000 | | | Franklin Co OH Hosp Rev (Sub Doctors Ohiohealth) Ser B (LOC: PNC Bank N.A.) | | | 0.060 | | | 12/01/28 | | | 900,000 | |

| | 900,000 | | | Blue Ash OH EDR (Ursuline Academy Proj) (LOC: PNC Bank NA) | | | 0.060 | | | 06/01/31 | | | 900,000 | |

| | 2,300,000 | | | OH St Hgr Edl Fac Rev (Case Western Reserve University Proj) Ser A (SPA: Wells Fargo Bank NA) | | | 0.020 | | | 10/01/31 | | | 2,300,000 | |

| | 4,400,000 | | | OH St Hgr Edu Fac Rev (Case Western Reserve University Proj) Ser A (SPA: Wells Fargo Bank NA) | | | 0.020 | | | 10/01/31 | | | 4,400,000 | |

| | 1,100,000 | | | Columbus OH Swr Rev Ser B | | | 0.030 | | | 06/01/32 | | | 1,100,000 | |

| | 1,620,000 | | | Cambridge OH Hosp Facs Rev (Southeastern Ohio Regl Med) (LOC: PNC Bank NA) | | | 0.070 | | | 12/01/32 | | | 1,620,000 | |

| | 355,000 | | | OH St Hgr Edl Fac Rev (Marietta College Proj) (LOC: JP Morgan Chase Bank NA) | | | 0.070 | | | 12/01/32 | | | 355,000 | |

| | 5,500,000 | | | Cleveland OH Wtrwks Rev Ser Q (LOC: Bank of NY Mellon) | | | 0.050 | | | 01/01/33 | | | 5,500,000 | |

| | 3,030,000 | | | Hamilton Co OH Hlthcare Fac (Children's Home Cincinnati) (LOC: U.S. Bank NA) | | | 0.060 | | | 03/01/33 | | | 3,030,000 | |

| | 3,400,000 | | | OH St Air Quality Dev Auth (Poll Firstenergy Nucle) Ser B (LOC: Bank of Nova Scotia) | | | 0.040 | | | 10/01/33 | | | 3,400,000 | |

| | 4,500,000 | | | Franklin Co OH Hosp Rev (Nationwide Hosp) Ser D (SPA: Bank Of NY Mellon) | | | 0.050 | | | 11/01/33 | | | 4,500,000 | |

| | 1,730,000 | | | Columbus OH Regl Arpt Auth Rev (Cap Fdg OASBO Pg) Ser A (LOC: U.S. Bank NA) | | | 0.050 | | | 03/01/34 | | | 1,730,000 | |

| | 6,520,000 | | | Allen Co OH Hosp Facs Rev (Catholic Healthcare) Ser C (LOC: Union Bank NA) | | | 0.040 | | | 06/01/34 | | | 6,520,000 | |

| | 3,050,000 | | | Akron Bath Copley Joint Township OH (Hosp Facs Summa Hlth Sys) Ser B (LOC: JP Morgan Chase Bank NA) | | | 0.060 | | | 11/01/34 | | | 3,050,000 | |

| | 1,781,000 | | | Hamilton OH MFH Rev (Affordable Housing) Ser B (LOC: FHLB) | | | 0.170 | | | 01/01/35 | | | 1,781,000 | |

| | 2,550,000 | | | Butler Co OH Capital Funding (CCAO Low Cost Cap) Ser A (LOC: U.S. Bank NA) | | | 0.050 | | | 06/01/35 | | | 2,550,000 | |

| | 1,700,000 | | | OH St Univ (The) Ser B (LIQ: Wells Fargo Bank N.A) | | | 0.030 | | | 06/01/35 | | | 1,700,000 | |

| | 2,000,000 | | | OH St Univ (The) Ser E | | | 0.060 | | | 06/01/35 | | | 2,000,000 | |

| | 700,000 | | | Columbus OH Regl Arpt Auth Cap (OASBO Expaned Asset Sr Ser) (LOC: U.S. Bank NA) | | | 0.050 | | | 07/01/35 | | | 700,000 | |

| | 4,610,000 | | | Butler Co OH Port Auth Econ (Impt Great Miami Vy) (LOC: JP Morgan Chase Bank NA) | | | 0.080 | | | 09/01/37 | | | 4,610,000 | |

| | 4,805,000 | | | Lancaster OH Port Auth Gas Rev (SPA: Royal Bank of Canada) | | | 0.060 | | | 05/01/38 | | | 4,805,000 | |

Touchstone Ohio Tax-Free Money Market Fund (Continued)

| Principal | | | | | Interest | | | Maturity | | | |

| Amount | | | | | Rate | | | Date | | Value | |

| | | | | | | | | | | | |

| | | | | Variable Rate Demand Notes(A) — 78.3% (Continued) | | | | | | | | | | |

| $ | 2,300,000 | | | OH St Hgr Edl Fac Comm ((Hosp Cleveland Clinic Hlth Sys)) (LIQ: Bank of NY Mellon Trust) (LIQ: Wells Fargo N.A.) | | | 0.010 | % | | 01/01/39 | | $ | 2,300,000 | |

| | 4,400,000 | | | OH St Hgr Edl Fac Commis Hosp (Cleveland Clinic Hlth Sys) (LIQ: Bank of NY Mellon Trust) | | | 0.030 | | | 01/01/39 | | | 4,400,000 | |

| | 5,800,000 | | | Montgomery Co OH Rev (Miami VY Hosp) Ser B (SPA: Barclays Bank PLC) | | | 0.020 | | | 11/15/39 | | | 5,800,000 | |

| | 800,000 | | | Centerville OH Hlthcare Rev (Bethany Lutheran Vlg Proj) Ser B (LOC: PNC Bank NA) | | | 0.060 | | | 11/01/40 | | | 800,000 | |

| | 2,500,000 | | | Franklin Co OH Hosp Rev (Impt Nationwide Hosp Proj) Ser B | | | 0.030 | | | 11/01/40 | | | 2,500,000 | |

| | | | | Total Variable Rate Demand Notes | | | | | | | | $ | 122,136,000 | |

| | | | | | | | | | | | | | | |

| | | | | Fixed Rate Revenue and General Obligation Bonds — 22.5% | | | | | | | | | | |

| | 150,000 | | | Columbus OH LTGO Ser 2 | | | 5.000 | | | 07/01/14 | | | 150,000 | |

| | 100,000 | | | Columbus OH UTGO Ser 1 | | | 5.000 | | | 07/01/14 | | | 99,999 | |

| | 100,000 | | | Columbus OH (Ltd Tax) LTGO Ser 2 Pre-refunded @ $100 | | | 5.000 | | | 07/01/14 | | | 100,000 | |

| | 1,180,000 | | | Kirtland OH (BANS Var Purp) LTGO | | | 1.000 | | | 07/02/14 | | | 1,180,013 | |

| | 2,900,000 | | | Williams Co OH (BANS Bldg Impt) UTGO | | | 1.250 | | | 07/31/14 | | | 2,901,783 | |

| | 1,700,000 | | | American Muni Pwr, Inc. OH (BANS Elec Sys Impt) | | | 1.000 | | | 08/07/14 | | | 1,700,173 | |

| | 380,000 | | | Miami OH Univ (Gen Recpts) | | | 3.000 | | | 09/01/14 | | | 381,769 | |

| | 100,000 | | | Miami Univ OH | | | 4.000 | | | 09/01/14 | | | 100,620 | |

| | 125,000 | | | Miami Univ OH (St Univ Ohio) | | | 5.000 | | | 09/01/14 | | | 125,963 | |

| | 145,000 | | | OH St (Infrastructure Impt) UTGO Ser A | | | 5.000 | | | 09/01/14 | | | 146,146 | |

| | 420,000 | | | New Albany OH Cmnty Auth Cmnty Ser C | | | 3.000 | | | 10/01/14 | | | 422,835 | |

| | 1,000,000 | | | Hamilton OH (BANS Various Purpose) LTGO | | | 1.000 | | | 10/02/14 | | | 1,001,012 | |

| | 1,850,000 | | | Dayton OH CSD UTGO Ser B | | | 1.250 | | | 10/15/14 | | | 1,855,088 | |

| | 2,000,000 | | | American Muni Pwr-Ohio, Inc. OH (BANS) | | | 1.000 | | | 10/23/14 | | | 2,001,253 | |

| | 675,000 | | | Dayton OH CSD (Sch Facs Construction & Im) UTGO Ser A | | | 0.000 | | | 11/01/14 | | | 674,402 | |

| | 500,000 | | | Lakewood OH CSD (Sch Facs Impt) UTGO Ser A | | | 2.000 | | | 11/01/14 | | | 502,994 | |

| | 200,000 | | | Lakewood OH CSD (Sch Facs Impt) UTGO Ser B | | | 2.000 | | | 11/01/14 | | | 201,193 | |

| | 500,000 | | | OH St Hgr Edl Fac Commis (Denison Univ Proj) | | | 2.000 | | | 11/01/14 | | | 502,820 | |

| | 145,000 | | | OH St Hgr Edl Fac Commis (Denison Univ Proj) Pre-refunded @ $100 | | | 4.500 | | | 11/01/14 | | | 147,061 | |

| | 100,000 | | | OH St Hgr Edl Fac Commis (Denison Univ Proj) Pre-refunded @ $100 | | | 5.000 | | | 11/01/14 | | | 101,564 | |

| | 175,000 | | | OH St Hgr Edl Fac Rev (Denison Univ Proj) | | | 4.500 | | | 11/01/14 | | | 177,479 | |

| | 100,000 | | | Montgomery Co OH Rev (Miami Valley Hosp) Ser A Pre-refunded @ $100 | | | 6.000 | | | 11/15/14 | | | 102,131 | |

| | 100,000 | | | Montgomery Co OH Rev (Miami Valley Hosp) Ser A Pre-refunded @ $100 | | | 6.250 | | | 11/15/14 | | | 102,225 | |

| | 1,315,000 | | | American Muni Pwr, Inc. OH (BANS Elec Sys Impt City of Bow) | | | 1.125 | | | 11/19/14 | | | 1,315,891 | |

| | 1,145,000 | | | Pataskala OH (BANS) LTGO Ser B | | | 1.500 | | | 11/19/14 | | | 1,149,976 | |

| | 1,000,000 | | | Pataskala OH (BANS Various Purpose) LTGO Ser A | | | 1.650 | | | 11/19/14 | | | 1,005,239 | |

| | 100,000 | | | Butler Co OH (Ltd Tax Purp) LTGO | | | 4.000 | | | 12/01/14 | | | 101,538 | |

| | 100,000 | | | Chillico OH CSD (The) (Sch Impt) UTGO Pre-refunded @ $100 | | | 5.000 | | | 12/01/14 | | | 101,973 | |

| | 100,000 | | | Cincinnati OH Wtr Sys Rev Ser A | | | 4.000 | | | 12/01/14 | | | 101,564 | |

| | 150,000 | | | Cuyahoga Co OH (Cap Impt) LTGO Pre-refunded @ $100 | | | 5.000 | | | 12/01/14 | | | 152,981 | |

| | 125,000 | | | Cuyahoga Falls OH LTGO | | | 2.250 | | | 12/01/14 | | | 126,039 | |

| | 100,000 | | | Lakewood OH CSD (Sch Impt) UTGO | | | 4.500 | | | 12/01/14 | | | 101,752 | |

| | 500,000 | | | Lakewood OH CSD (Sch Impt) UTGO Pre-refunded @ $100 | | | 5.250 | | | 12/01/14 | | | 510,505 | |

| | 125,000 | | | New Albany OH Plain Local Sch (Ref Various Purpose) UTGO | | | 2.000 | | | 12/01/14 | | | 125,911 | |

| | 460,000 | | | OH St Univ (The) (Unrefunded) Ser A | | | 5.000 | | | 12/01/14 | | | 469,077 | |

| | 1,485,000 | | | Toledo OH CSD (Sch Facs Impt) UTGO | | | 2.000 | | | 12/01/14 | | | 1,495,857 | |

| | 1,870,000 | | | Cuyahoga Falls OH (BANS Various Purpose) LTGO | | | 1.000 | | | 12/04/14 | | | 1,875,978 | |

| | 150,000 | | | OH St Major New State Infras Ser 2005-1 | | | 5.000 | | | 12/15/14 | | | 153,212 | |

| | 1,665,000 | | | Mason OH (BANS Bldg Acq & Impt) LTGO | | | 1.250 | | | 12/16/14 | | | 1,672,562 | |

| | 525,000 | | | OH St Hosp Fac Rev (Cleveland Clinic Hlth) Ser B | | | 5.000 | | | 01/01/15 | | | 537,432 | |

| | 200,000 | | | OH St Hgr Edl Fac Commis (Univ Hosp Hlth Sys) Ser 2009 A Pre-refunded @ $100 | | | 6.750 | | | 01/15/15 | | | 206,950 | |

Touchstone Ohio Tax-Free Money Market Fund (Continued)

| Principal | | | | | Interest | | | Maturity | | | |

| Amount | | | | | Rate | | | Date | | Value | |

| | | | | | | | | | | | |

| | | | | Fixed Rate Revenue and General Obligation Bonds — 22.5% (Continued) | | | | | | | | | | |

| $ | 100,000 | | | OH St Hgr Edl Fac Commis (Univ Hosp Hlth Sys) Ser 2009 A Pre-refunded @ $100 | | | 7.000 | % | | 01/15/15 | | $ | 103,610 | |

| | 2,500,000 | | | North Royalton OH (BANS Muni Bldg Construction & Impt) LTGO | | | 1.000 | | | 04/08/15 | | | 2,512,448 | |

| | 811,000 | | | Maple Heights OH CSD (BANS) LTGO | | | 1.250 | | | 04/09/15 | | | 815,674 | |

| | 100,000 | | | Centerville OH CSD (Sch Impt) UTGO Pre-refunded @ $100 | | | 4.000 | | | 06/01/15 | | | 103,356 | |

| | 270,000 | | | OH St Univ Ser A Pre-refunded @ $100 | | | 5.000 | | | 06/01/15 | | | 281,599 | |

| | 2,600,000 | | | Lake Co OH Cmnty Clg Dist (TANS) LTGO | | | 1.000 | | | 06/04/15 | | | 2,607,785 | |

| | 1,455,000 | | | Euclid OH (BANS Various Purpose) Special Tax | | | 1.125 | | | 06/11/15 | | | 1,461,753 | |

| | 1,415,000 | | | Kirtland OH (BANS Various Purpose) LTGO | | | 1.000 | | | 06/30/15 | | | 1,423,419 | |

| | | | | Total Fixed Rate Revenue and General Obligation Bonds | | | | | | | | $ | 35,192,604 | |

| | | | | | | | | | | | | | | |

| | | | | Total Investment Securities —100.8% | | | | | | | | | | |

| | | | | (Cost $157,328,604) | | | | | | | | $ | 157,328,604 | |

| | | | | | | | | | | | | | | |

| | | | | Liabilities in Excess of Other Assets — (0.8%) | | | | | | | | | (1,243,112 | ) |

| | | | | | | | | | | | | | | |

| | | | | Net Assets — 100.0% | | | | | | | | $ | 156,085,492 | |

| (A) | Demand Feature - Maturities shown are the final maturities, not the date on which principal could be recovered through the demand feature. |

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation inputs at Reporting Date: | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Municipal Bonds | | $ | — | | | $ | 157,328,604 | | | $ | — | | | $ | 157,328,604 | |

See accompanying Notes to Portfolios of Investments and Notes to Financial Statements.

Portfolio of Investments

Touchstone Tax-Free Money Market Fund – June 30, 2014

| Principal | | | | | Interest | | | Maturity | | | |

| Amount | | | | | Rate | | | Date | | Value | |

| | | | | | | | | | | | |

| | | | | Variable Rate Demand Notes(A) — 69.9% | | | | | | | | | | |

| $ | 750,000 | | | Lincoln Co WY Poll Control Rev (Exxon Proj) Ser A | | | 0.010 | % | | 11/01/14 | | $ | 750,000 | |

| | 210,000 | | | Franklin Co OH IDR (Ohio Girl Scout Council Proj) (LOC: PNC Bank N.A.) | | | 0.420 | | | 09/01/18 | | | 210,000 | |

| | 1,005,000 | | | Coshocton Co OH Hosp Facs Rev (Mem Hosp Proj) (LOC: JP Morgan Chase NA) | | | 0.050 | | | 03/01/19 | | | 1,005,000 | |

| | 1,150,000 | | | Summit Co OH IDR (S A Comunale Inc. Proj) (LOC: PNC Bank NA) | | | 0.110 | | | 06/01/19 | | | 1,150,000 | |

| | 750,000 | | | Lawrenceburg IN PCR (Ind Mich Pwr Co) (LOC: Bank of Nova Scotia) | | | 0.050 | | | 10/01/19 | | | 750,000 | |

| | 355,000 | | | Jackson WI IDR (J 5 Enterprise LLC Proj) Ser A (LOC: BMO Harris Bank NA) | | | 0.410 | | | 05/01/20 | | | 355,000 | |

| | 195,000 | | | Lancaster NE IDR (Garner Inds Inc) Ser B (LOC: Wells Fargo Bank NA) | | | 0.350 | | | 11/01/20 | | | 195,000 | |

| | 275,000 | | | S.W. IL Dev Auth (Deli Star Ventures Proj) (LOC: BMO Harris Bank NA) | | | 0.410 | | | 07/01/21 | | | 275,000 | |

| | 1,175,000 | | | IA St Fin Auth Small Busines Rev (Terrace Ctr Assoc L.P.) (LOC: Wells Fargo Bank NA) | | | 0.160 | | | 03/01/22 | | | 1,175,000 | |

| | 600,000 | | | Hamilton Co OH Hosp Facs Rev (Beechwood Home Proj) (LOC: PNC Bank NA) | | | 0.080 | | | 07/01/22 | | | 600,000 | |

| | 1,000,000 | | | Columbia AL IDB Poll (AL Pwr Co Proj) Ser E | | | 0.080 | | | 10/01/22 | | | 1,000,000 | |

| | 1,200,000 | | | Pima Co AZ IDA (Tucscon Elec) (LOC: Bank of NY Mellon Trust) | | | 0.080 | | | 12/01/22 | | | 1,200,000 | |

| | 835,000 | | | Milwaukee WI Redev Auth (Fred Usinger Inc Proj) (LOC: M&I Marshall & Ilsley) | | | 0.260 | | | 12/01/23 | | | 835,000 | |

| | 1,300,000 | | | Cuyahoga Co OH Arpt Fac (Corporate Wings Proj) (LOC: Privatebank And Trust) | | | 0.260 | | | 04/01/25 | | | 1,300,000 | |

| | 1,020,000 | | | Springfield MO IDA (Dmp Pptys LLC Proj) (LOC: Guaranty Bank) | | | 0.160 | | | 08/01/25 | | | 1,020,000 | |

| | 1,000,000 | | | Saint Charles Co MO IDA (Patriot Machine Inc Proj) (LOC: U.S. Bank NA) | | | 0.190 | | | 06/01/27 | | | 1,000,000 | |

| | 1,120,000 | | | Lexington-Fayette KY Urban Cnty (Eastland Parkway) (LOC: Traditional Bank, Inc.) | | | 0.210 | | | 09/01/27 | | | 1,120,000 | |

| | 500,000 | | | Lexington-Fayette KY Urban Cnty (Liberty Ridge) (LOC: Traditional Bank Inc) | | | 0.310 | | | 12/01/27 | | | 500,000 | |

| | 870,000 | | | Hendersonville TN IDB (Windsor Park Proj) (LIQ: FNMA) | | | 0.080 | | | 02/15/28 | | | 870,000 | |

| | 300,000 | | | MS St Business Fin Co (Chevron Usa Inc Proj) Ser A | | | 0.030 | | | 12/01/30 | | | 300,000 | |

| | 200,000 | | | OH St Hgr Edu Fac Rev (Case Western Reserve University Proj) Ser A (SPA: Wells Fargo Bank NA) | | | 0.020 | | | 10/01/31 | | | 200,000 | |

| | 1,100,000 | | | Columbus OH Swr Rev Ser B | | | 0.030 | | | 06/01/32 | | | 1,100,000 | |

| | 700,000 | | | Duval Cnty FL HFA (Glades Apts Proj.) (LOC: FHLMC) | | | 0.060 | | | 10/01/32 | | | 700,000 | |

| | 755,000 | | | Crawfordsville IN MF HSG Rev (Autumn Woods Phase II) Ser B (LOC: FHLB) | | | 0.240 | | | 01/01/33 | | | 755,000 | |

| | 670,000 | | | Allen Co OH Hosp Facs Rev (Catholic Healthcare) Ser C (LOC: Union Bank NA) | | | 0.040 | | | 06/01/34 | | | 670,000 | |

| | 1,000,000 | | | VT St Edl & Hlth Bldg (North Country Hosp Proj) Ser A (LOC: TD Banknorth NA) | | | 0.020 | | | 10/01/34 | | | 1,000,000 | |

| | 1,000,000 | | | New York NY UTGO Ser I6 (LOC: Bank Of NY Mellon Trust) | | | 0.030 | | | 04/01/36 | | | 1,000,000 | |

| | 1,050,000 | | | Palm Beach Co FL Rev (Henry Morrison Flagler Proj) (LOC: Northern Trust Company) | | | 0.060 | | | 11/01/36 | | | 1,050,000 | |

| | 5,000 | | | Sarasota Co FL Public Hosp (Sarasota Mem Hosp) Ser A (LOC: Northern Trust Company) | | | 0.010 | | | 07/01/37 | | | 5,000 | |

| | 925,000 | | | MA St Dev Fin Agy Rev (Seven Hills Fndtn) Ser A (LOC: TD Banknorth NA) | | | 0.050 | | | 09/01/38 | | | 925,000 | |

| | 1,000,000 | | | IL St Fin Auth Rev (Lake Forest College Proj) (LOC: Northern Trust Company) | | | 0.060 | | | 10/01/38 | | | 1,000,000 | |

| | 400,000 | | | Chatom AL IDB (Powersouth Energy Coop Proj) Ser A (SPA: National Rural Utilities Finance) | | | 0.500 | | | 11/15/38 | | | 400,000 | |

| | 620,000 | | | NY St Dorm Auth Rev (FFT Senior Cmntys Inc) (LOC: HSBC Bank USA NA) | | | 0.050 | | | 07/01/39 | | | 620,000 | |

| | | | | Total Variable Rate Demand Notes | | | | | | | | $ | 25,035,000 | |

| | | | | | | | | | | | | | | |

| | | | | Fixed Rate Revenue and General Obligation Bonds — 31.3% | | | | | | | | | | |

| | 150,000 | | | Broward Co FL Sch Brd COP Ser C Pre-refunded @ $100 | | | 5.250 | | | 07/01/14 | | | 150,000 | |

| | 115,000 | | | Compton Cmnty Clg Dist UTGO Ser A Pre-refunded @ $100 | | | 5.000 | | | 07/01/14 | | | 115,000 | |

| | 305,000 | | | GA St UTGO Ser D Pre-refunded @ $100 | | | 5.000 | | | 07/01/14 | | | 305,000 | |

| | 155,000 | | | GA St UTGO Ser C Pre-refunded @ $100 | | | 5.500 | | | 07/01/14 | | | 155,000 | |

| | 100,000 | | | MD St Hlth & Hgr Edl (Civista Med Ctr) Pre-refunded @ $100 | | | 5.000 | | | 07/01/14 | | | 100,000 | |

| | 100,000 | | | Modesto CA Irr Dist (Cap Impts) COP Ser A Pre-refunded @ $100 | | | 5.000 | | | 07/01/14 | | | 100,000 | |

| | 100,000 | | | San Francisco CA Bay Area Rapid Trans Dist Pre-refunded @ $100 | | | 4.500 | | | 07/01/14 | | | 100,000 | |

| | 100,000 | | | San Francisco CA Bay Area Rapid Trans Dist Pre-refunded @ $100 | | | 4.625 | | | 07/01/14 | | | 100,000 | |

| | 100,000 | | | Cobb Co GA Dev Auth Univ Fac (Kennesaw St Univ Hsg) Pre-refunded @ $100 | | | 5.250 | | | 07/15/14 | | | 100,190 | |

| | 600,000 | | | Williams Co OH (BANS Bldg Impt) UTGO | | | 1.250 | | | 07/31/14 | | | 600,369 | |

| | 500,000 | | | Bay Area CA Infrastructure Fin (St Pmt Acceleration Nts) Pre-refunded @ $100 | | | 5.000 | | | 08/01/14 | | | 502,021 | |

| | 100,000 | | | Ionia Co MI (Wtr & Swr Impt) LTGO Pre-refunded @ $100 | | | 3.800 | | | 08/01/14 | | | 100,292 | |

Touchstone Tax-Free Money Market Fund (Continued)

| Principal | | | | | Interest | | | Maturity | | | |

| Amount | | | | | Rate | | | Date | | Value | |

| | | | | | | | | | | | |

| | | | | Fixed Rate Revenue and General Obligation Bonds — 31.3% (Continued) | | | | | | | | | | |

| $ | 300,000 | | | Los Rios CA Cmnty Clg Dist (Election 2002) UTGO Ser C Pre-refunded @ $102 | | | 4.250 | % | | 08/01/14 | | $ | 306,964 | |

| | 100,000 | | | MA St Wtr Poll Abat Ser A | | | 5.000 | | | 08/01/14 | | | 100,395 | |

| | 100,000 | | | Orange Co FL Sch Brd COP Ser A Pre-refunded @ $100 | | | 5.000 | | | 08/01/14 | | | 100,401 | |

| | 100,000 | | | Tracy CA Jt Unif Sch Dist (Election 2006) UTGO Pre-refunded @ $100 | | | 4.500 | | | 08/01/14 | | | 100,351 | |

| | 315,000 | | | AMP, Inc. OH (BANS Elec Sys) Revenue Notes | | | 1.000 | | | 08/07/14 | | | 315,032 | |

| | 200,000 | | | IL St Fin Auth Rev (Northwestern Mem Hosp) Ser A Pre-refunded @ $100 | | | 5.500 | | | 08/15/14 | | | 201,266 | |

| | 295,000 | | | IL St Fin Auth Rev (Northwestern Mem Hosp) Ser B Pre-refunded @ $100 | | | 6.000 | | | 08/15/14 | | | 297,077 | |

| | 100,000 | | | MA St Sch Bldg Auth Rev Ser A | | | 5.000 | | | 08/15/14 | | | 100,579 | |

| | 500,000 | | | NY NY UTGO Ser C1 Pre-refunded @ $100 | | | 4.000 | | | 08/15/14 | | | 502,284 | |

| | 200,000 | | | AZ St Univ (Research Infrastructure Proj) COP Pre-refunded @ $100 | | | 5.250 | | | 09/01/14 | | | 201,659 | |

| | 405,000 | | | Pittsburgh PA Sch Dist UTGO Ser A | | | 3.000 | | | 09/01/14 | | | 406,866 | |

| | 125,000 | | | Watts Bar TN Utility Dist Wtrw Pre-refunded @ $100 | | | 4.625 | | | 09/01/14 | | | 125,910 | |

| | 125,000 | | | TX St Univ Sys Fing Rev (Unrefunded) Pre-refunded @ $100 | | | 5.000 | | | 09/15/14 | | | 126,192 | |

| | 100,000 | | | Covington TN UTGO | | | 3.550 | | | 10/01/14 | | | 100,817 | |

| | 190,000 | | | Harris Co TX (Unrefunded Bal Ref Perm Impt) LTGO Ser A Pre-refunded @ $100 | | | 5.250 | | | 10/01/14 | | | 192,374 | |

| | 100,000 | | | Jea FL St Johns River Pwr Park (Issue Three) Ser 3 Pre-refunded @ $100 | | | 5.500 | | | 10/01/14 | | | 101,285 | |

| | 240,000 | | | Saint Johns Co FL Sales Tax Ser A Pre-refunded @ $100 | | | 5.250 | | | 10/01/14 | | | 242,911 | |

| | 100,000 | | | SC St Transprtn Infrastructure Ser A Pre-refunded @ $100 | | | 5.250 | | | 10/01/14 | | | 101,250 | |

| | 215,000 | | | Spring Grove PA Area Sch Dist LTGO Ser B Pre-refunded @ $100 | | | 4.500 | | | 10/01/14 | | | 217,291 | |

| | 100,000 | | | Tallahassee FL Capital Bonds Pre-refunded @ $100 | | | 5.000 | | | 10/01/14 | | | 101,183 | |

| | 250,000 | | | Hamilton OH (BANS Various Purpose) LTGO | | | 1.000 | | | 10/02/14 | | | 250,253 | |

| | 200,000 | | | AMP-Ohio, Inc. OH (BANS) Revenue Notes | | | 1.000 | | | 10/23/14 | | | 200,125 | |

| | 100,000 | | | Palm Beach Co FL Public Impt (Biomedical Resh Park Proj) Ser A Pre-refunded @ $100 | | | 4.375 | | | 11/01/14 | | | 101,375 | |

| | 300,000 | | | Montgomery Co PA Hgr Edu & Hlth Sys (Catholic Hlth East) Ser C Pre-refunded @ $100 | | | 5.375 | | | 11/15/14 | | | 305,781 | |

| | 100,000 | | | OR St Dept Of Transprtn Hwy Ser B Pre-refunded @ $100 | | | 5.250 | | | 11/15/14 | | | 101,860 | |

| | 100,000 | | | Greenville Co SC Sch Dist IN (Bldg Equity Sooner Tomorrow) Pre-refunded @ $100 | | | 5.000 | | | 12/01/14 | | | 101,921 | |

| | 100,000 | | | King Cnty WA Sch Dist #411 ISS UTGO Ser B Pre-refunded @ $100 | | | 5.250 | | | 12/01/14 | | | 102,048 | |

| | 100,000 | | | Newport Beach CA Rev (Hoag Memorial Hosp Presb) Ser A Pre-refunded @ $100 | | | 4.625 | | | 12/01/14 | | | 101,800 | |

| | 250,000 | | | Volusia Co FL Tour Dev Tax Rev Pre-refunded @ $100 | | | 5.000 | | | 12/01/14 | | | 254,935 | |

| | 140,000 | | | Atlanta GA Arpt Passenger Fac (Sub Lien Gen) Ser J Pre-refunded @ $100 | | | 5.000 | | | 01/01/15 | | | 143,294 | |

| | 120,000 | | | Chicago IL (Proj & Ref ) UTGO | | | 5.500 | | | 01/01/15 | | | 123,056 | |

| | 100,000 | | | Crow Wing Co (Cap Impt) UTGO Ser A Pre-refunded @ $100 | | | 5.000 | | | 02/01/15 | | | 102,772 | |

| | 100,000 | | | KY St Infrastructure Aut (Wastewtr & Drinking Wtr) Ser A | | | 5.000 | | | 02/01/15 | | | 102,771 | |

| | 150,000 | | | Woodbridge Twp NJ (Gen Impt) UTGO Pre-refunded @ $100 | | | 4.100 | | | 02/01/15 | | | 153,363 | |

| | 100,000 | | | Allen TX Indep Sch Dist UTGO | | | 5.000 | | | 02/15/15 | | | 102,957 | |

| | 100,000 | | | Highland Park TX Indep Sch Dis UTGO Pre-refunded @ $100 | | | 5.000 | | | 02/15/15 | | | 102,954 | |

| | 350,000 | | | NJ St Econ Dev Auth (Sch Facs Constr) Ser L Pre-refunded @ $100 | | | 5.000 | | | 03/01/15 | | | 360,926 | |

| | 415,000 | | | TX St (Unrefunded Transptrn Commn Mob) UTGO Pre-refunded @ $100 | | | 5.000 | | | 04/01/15 | | | 429,650 | |

| | 500,000 | | | Springboro OH (BANS) LTGO | | | 1.000 | | | 04/02/15 | | | 502,436 | |

| | 500,000 | | | North Royalton OH (BANS Muni Bldg Construction) LTGO | | | 1.000 | | | 04/08/15 | | | 502,490 | |

| | 400,000 | | | Lake Co OH Cmnty Clg Dist (TANS) LTGO | | | 1.000 | | | 06/04/15 | | | 401,198 | |

| | 300,000 | | | Euclid OH (BANS Various Purpose) Special Tax | | | 1.125 | | | 06/11/15 | | | 301,392 | |

| | | | | Total Fixed Rate Revenue and General Obligation Bonds | | | | | | | | $ | 11,219,316 | |

| | | | | | | | | | | | | | | |

| | | | | Total Investment Securities —101.2% | | | | | | | | | | |

| | | | | (Cost $36,254,316) | | | | | | | | | 36,254,316 | |

| | | | | | | | | | | | | | | |

| | | | | Liabilities in Excess of Other Assets — (1.2%) | | | | | | | | | (419,693 | ) |

| | | | | | | | | | | | | | | |

| | | | | Net Assets — 100.0% | | | | | | | | $ | 35,834,623 | |

Touchstone Tax-Free Money Market Fund (Continued)

| (A) | Demand Feature - Maturities shown are the final maturities, not the date on which principal could be recovered through the demand feature. |

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Municipal Bonds | | $ | — | | | $ | 36,254,316 | | | $ | — | | | $ | 36,254,316 | |

See accompanying Notes to Portfolios of Investments and Notes to Financial Statements.

Notes to Portfolios of Investments

June 30, 2014

Floating and variable rate demand notes (“put bonds”) earn interest at a coupon rate which fluctuates at specified intervals, usually daily, monthly or semi-annually. The maturity dates shown in the Portfolio of Investments are the final maturity dates. The interest rates shown in the Portfolio of Investments are the coupon rates in effect at June 30, 2014.

Put bonds may be redeemed at the discretion of the holder on specified dates prior to maturity. Mandatory put bonds are automatically redeemed at a specified put date unless action is taken by the holder to prevent redemption.

Bonds denoted as pre-refunded are anticipated to be redeemed prior to their scheduled maturity. The dates indicated in the Portfolio of Investments are the stipulated pre-refunded dates.

Portfolio Abbreviations:

AMP – American Municipal Power

BANS – Bond Anticipation Notes

CCAO – County Commissioner's Association of Ohio

COP – Certificates of Participation

CSD – City School District

EDR – Economic Development Revenue

FHLB – Federal Home Loan Bank

FHLMC – Federal Home Loan Mortgage Corporation

FNMA – Federal National Mortgage Association

HFA – Housing Finance Authority/Agency

IDA – Industrial Development Authority/Agency

IDB – Industrial Development Board

IDR – Industrial Development Revenue

LIQ – Liquidity Facility

LLC – Limited Liability Company

LOC – Letter of Credit

LSD – Local School District

LTGO – Limited Tax General Obligation

MFH – Multi-Family Housing

OASBO – Ohio Association of School Business Officials

PCR – Pollution Control Revenue

PLC - Public Limited Company

SD – School District

SPA – Stand-by Purchase Agreement

TANS – Tax Anticipation Notes

UTGO – Unlimited Tax General Obligation

Portfolio Composition

June 30, 2014 (Unaudited)

As of June 30, 2014, the Touchstone Ohio Tax-Free Bond Fund and the Touchstone Ohio Tax-Free Money Market Fund were invested exclusively in debt obligations issued by the State of Ohio and its political subdivisions, agencies, authorities and instrumentalities and by other issuers, the interest from which is exempt from Ohio personal income tax. As of June 30, 2014, 37.2% of the portfolio securities of the Touchstone Tax-Free Money Market Fund were invested in the State of Ohio, 6.3% in the State of Missouri, 6.3% in the State of Florida, 4.6% in the State of Indiana, 4.0% in the State of Alabama, 3.9% in the State of Wisconsin, 3.9% in the State of Illinois, 3.8% in the State of New York, 3.4% in the Commonwealth of Kentucky, 3.3% in the State of Texas, 3.2% in the State of Vermont, 2.7% in the State of Arizona, 2.5% in the State of Washington, 2.4% in the Commonwealth of Massachusetts, 2.2% in the State of Iowa, 2.1% in the State of Colorado, 1.8% in the State of California, 1.8% in the State of Tennessee, 1.0% in the State of Georgia, 0.7% in the District of Columbia, 0.7% in the Commonwealth of Virginia, 0.6% in the State of Michigan, 0.5% in the State of South Carolina, 0.4% in the State of Nebraska, 0.3% in the State of Kansas, 0.2% in the State of Maryland and 0.2% in the State of North Carolina.

The Touchstone Ohio Tax-Free Bond Fund and the Touchstone Ohio Tax-Free Money Market Fund are each non-diversified Funds under the Investment Company Act of 1940. Thus, the Funds may invest in fewer issuers than those of a diversified fund. As of June 30, 2014, there were no investments of 10% or greater in any one issuer held by either Fund.

The Touchstone Ohio Tax-Free Money Market Fund and the Touchstone Tax-Free Money Market Fund each invest in municipal securities maturing in 397 days or less and having a short-term rating in one of the top two ratings categories by at least two nationally recognized statistical rating organizations (or by one such organization if a security is rated by only that organization) or, if unrated, are determined by the Funds’ advisor, under the supervision of the Board of Trustees of the Trust, to be of comparable quality.

The percentage of investments for each Fund as of June 30, 2014 classified by security type, was as follows:

| | | Ohio Tax-Free | | | Ohio Tax-Free | | | Tax-Free | |

| | | Bond | | | Money Market | | | Money Market | |

| | | Fund | | | Fund | | | Fund | |

| General Obligations | | | 29.7 | % | | | 15.0 | % | | | 6.5 | % |

| Prerefunded/Escrowed to Maturity | | | 12.5 | % | | | 1.3 | % | | | 21.9 | % |

| Variable Rate Demand Notes | | | 2.7 | % | | | 77.6 | % | | | 69.1 | % |

| Certificate of Participation | | | 2.1 | % | | | 0.0 | % | | | 0.0 | % |

| Special Tax | | | 0.0 | % | | | 0.9 | % | | | 0.8 | % |

| Fixed Rate Revenue Bonds | | | 53.0 | % | | | 5.2 | % | | | 1.7 | % |

| Total Investments | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

This page intentionally left blank.

Statements of Assets and Liabilities

June 30, 2014

| | | Touchstone | | | Touchstone | | | Touchstone | |

| | | Ohio | | | Ohio | | | Tax-Free | |

| | | Tax-Free | | | Tax-Free | | | Money | |

| | | Bond | | | Money Market | | | Market | |

| | | Fund | | | Fund | | | Fund | |

| Assets | | | | | | | | | | | | |

| Investments securities | | | | | | | | | | | | |

| At amortized cost or at original cost for Touchstone Ohio Tax-Free Bond Fund | | $ | 48,374,860 | | | $ | 157,328,604 | | | $ | 36,254,316 | |

| Investments, at market value | | | 52,036,811 | | | | 157,328,604 | | | | 36,254,316 | |

| Cash | | | 32,065 | | | | 4,457 | | | | 49,717 | |

| Interest receivable | | | 345,639 | | | | 226,380 | | | | 151,697 | |

| Receivable for capital shares sold | | | 10,059 | | | | 12,458 | | | | 6,500 | |

| Receivable from Investment Advisor | | | — | | | | — | | | | 5,959 | |

| Prepaid expenses | | | 4,653 | | | | 8,069 | | | | 5,571 | |

| Total Assets | | | 52,429,227 | | | | 157,579,968 | | | | 36,473,760 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Dividends payable | | | 42,072 | | | | 770 | | | | — | |

| Payable for capital shares redeemed | | | 41,356 | | | | 18,859 | | | | 7,183 | |

| Payable for investments purchased | | | — | | | | 1,423,419 | | | | 590,878 | |

| Payable to Investment Advisor | | | 23,004 | | | | 11,223 | | | | — | |

| Payable to other affiliates | | | 11,177 | | | | 432 | | | | 5,263 | |

| Payable to Trustees | | | 3,190 | | | | 3,190 | | | | 3,190 | |

| Payable for professional services | | | 19,940 | | | | 20,914 | | | | 19,786 | |

| Other accrued expenses and liabilities | | | 16,806 | | | | 15,669 | | | | 12,837 | |

| Total Liabilities | | | 157,545 | | | | 1,494,476 | | | | 639,137 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 52,271,682 | | | $ | 156,085,492 | | | $ | 35,834,623 | |

| | | | | | | | | | | | | |

| Net assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 48,673,479 | | | $ | 156,088,954 | | | $ | 35,838,007 | |

| Accumulated net investment loss | | | (24,103 | ) | | | (351 | ) | | | — | |

| Accumulated net realized losses on investments | | | (39,645 | ) | | | (3,111 | ) | | | (3,384 | ) |

| Net unrealized appreciation on investments | | | 3,661,951 | | | | — | | | | — | |

| Net Assets | | $ | 52,271,682 | | | $ | 156,085,492 | | | $ | 35,834,623 | |

See accompanying Notes to Financial Statements.

Statements of Assets and Liabilities (Continued)

| | | Touchstone | | | Touchstone | | | Touchstone | |

| | | Ohio | | | Ohio | | | Tax-Free | |

| | | Tax-Free | | | Tax-Free | | | Money | |

| | | Bond | | | Money Market | | | Market | |

| | | Fund | | | Fund | | | Fund | |

| Pricing of Class A Shares | | | | | | | | | | | | |

| Net assets applicable to Class A shares | | $ | 44,938,776 | | | $ | 64,580,118 | | | $ | 12,957,092 | |

| Shares of beneficial interest outstanding | | | | | | | | | | | | |

| (unlimited number of shares authorized, no par value) | | | 3,819,861 | | | | 64,575,861 | | | | 12,961,949 | |

| Net asset value price per share* | | $ | 11.76 | | | $ | 1.00 | | | $ | 1.00 | |

| Maximum offering price per share | | $ | 12.35 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | |

| Pricing of Class C Shares | | | | | | | | | | | | |

| Net assets applicable to Class C shares | | $ | 7,332,906 | | | $ | — | | | $ | — | |

| Shares of beneficial interest outstanding | | | | | | | | | | | | |

| (unlimited number of shares authorized, no par value) | | | 622,474 | | | | — | | | | — | |

| Net asset value, offering price per share** | | $ | 11.78 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | |

| Pricing of Class S Shares | | | | | | | | | | | | |

| Net assets applicable to Class S shares | | $ | — | | | $ | — | | | $ | 22,877,531 | |

| Shares of beneficial interest outstanding | | | | | | | | | | | | |

| (unlimited number of shares authorized, no par value) | | | — | | | | — | | | | 22,886,383 | |

| Net asset value, offering price and redemption price per share | | $ | — | | | $ | — | | | $ | 1.00 | |

| | | | | | | | | | | | | |

| Pricing of Institutional Class Shares | | | | | | | | | | | | |

| Net assets applicable to Institutional Class shares | | $ | — | | | $ | 91,505,374 | | | $ | — | |

| Shares of beneficial interest outstanding | | | | | | | | | | | | |

| (unlimited number of shares authorized, no par value) | | | — | | | | 91,500,110 | | | | — | |

| Net asset value, offering price and redemption price per share | | $ | — | | | $ | 1.00 | | | $ | — | |

* There is no sales load on subscriptions of $1 million or more. Redemptions that were part of $1 million subscriptions may be subject to a contingent deferred sales load if redeemed within a one-year period from the date of purchase.

** Redemption price per share varies by length of time shares are held.

See accompanying Notes to Financial Statements.

Statements of Operations

For the Year Ended June 30, 2014

| | | Touchstone | | | Touchstone | | | Touchstone | |

| | | Ohio | | | Ohio | | | Tax-Free | |

| | | Tax-Free | | | Tax-Free | | | Money | |

| | | Bond | | | Money Market | | | Market | |

| | | Fund | | | Fund | | | Fund | |

| Investment Income | | | | | | | | | | | | |

| Interest | | $ | 2,179,618 | | | $ | 270,202 | | | $ | 82,052 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Investment advisory fees | | | 255,096 | | | | 841,654 | | | | 214,211 | |

| Administration fees | | | 82,850 | | | | 285,829 | | | | 69,613 | |

| Compliance fees and expenses | | | 1,669 | | | | 1,669 | | | | 1,669 | |

| Custody fees | | | 2,871 | | | | 8,153 | | | | 5,683 | |

| Professional fees | | | 22,691 | | | | 31,542 | | | | 22,659 | |

| Transfer Agent fees, Class A | | | 16,517 | | | | 22,082 | | | | 4,260 | |

| Transfer Agent fees, Class C | | | 3,532 | | | | — | | | | — | |

| Transfer Agent fees, Class S | | | — | | | | — | | | | 17,594 | |

| Transfer Agent fees, Institutional Class | | | — | | | | 43 | | | | — | |

| Registration fees, Class A | | | 7,594 | | | | 11,588 | | | | 10,472 | |

| Registration fees, Class C | | | 5,241 | | | | — | | | | — | |

| Registration fees, Class S | | | — | | | | — | | | | 4,957 | |

| Registration fees, Institutional Class | | | — | | | | 5,210 | | | | — | |

| Reports to Shareholders, Class A | | | 7,148 | | | | 9,178 | | | | 5,218 | |

| Reports to Shareholders, Class C | | | 6,250 | | | | — | | | | — | |

| Reports to Shareholders, Class S | | | — | | | | — | | | | 9,291 | |

| Reports to Shareholders, Institutional Class | | | — | | | | 7,146 | | | | — | |

| Distribution expenses, Class A | | | 110,792 | | | | 178,088 | | | | 33,321 | |

| Distribution expenses, Class C | | | 67,023 | | | | — | | | | — | |

| Distribution expenses, Class S | | | — | | | | — | | | | 103,299 | |

| Trustee fees | | | 13,005 | | | | 12,996 | | | | 13,007 | |

| Other expenses | | | 21,255 | | | | 18,726 | | | | 11,038 | |

| Total Expenses | | | 623,534 | | | | 1,433,904 | | | | 526,292 | |

| Fees waived and/or reimbursed by the Advisor and/or Affiliates | | | (139,604 | ) | | | (1,181,264 | ) | | | (448,499 | ) |

| Net Expenses | | | 483,930 | | | | 252,640 | | | | 77,793 | |

| | | | | | | | | | | | | |

| Net Investment Income | | | 1,695,688 | | | | 17,562 | | | | 4,259 | |

| | | | | | | | | | | | | |

| Realized and Unrealized Gains on Investments | | | | | | | | | | | | |

| Net realized gains on investments | | | 98,641 | | | | — | | | | — | |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,289,582 | | | | — | | | | — | |

| Net Realized and Unrealized Gain on Investments | | | 1,388,223 | | | | — | | | | — | |

| Change in Net Assets Resulting from Operations | | $ | 3,083,911 | | | $ | 17,562 | | | $ | 4,259 | |

See accompanying Notes to Financial Statements.

Statements of Changes in Net Assets

| | | Touchstone | |

| | | Ohio Tax-Free | |

| | | Bond Fund | |

| | | For the | | | For the | |

| | | Year | | | Year | |

| | | Ended | | | Ended | |

| | | June 30, 2014 | | | June 30, 2013 | |

| From Operations | | | | | | | | |

| Net investment income | | $ | 1,695,688 | | | $ | 1,865,473 | |

| Net realized gains (losses) on investments | | | 98,641 | | | | 139,014 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,289,582 | | | | (1,910,620 | ) |

| Change in Net Assets from Operations | | | 3,083,911 | | | | 93,867 | |

| | | | | | | | | |

| Distributions to Shareholders from: | | | | | | | | |

| Net investment income, Class A | | | (1,515,111 | ) | | | (1,684,236 | ) |

| Net investment income, Class C | | | (178,576 | ) | | | (179,334 | ) |

| Net investment income, Class S | | | — | | | | — | |

| Net investment income, Institutional Class | | | — | | | | — | |

| Net realized gains, Class A | | | (132,491 | ) | | | (301,631 | ) |

| Net realized gains, Class C | | | (19,648 | ) | | | (41,263 | ) |

| Total Distributions | | | (1,845,826 | ) | | | (2,206,464 | ) |

| | | | | | | | | |

| Net Decrease from Share Transactions (A) | | | (2,747,110 | ) | | | (1,848,885 | ) |

| | | | | | | | | |

| Total Decrease in Net Assets | | | (1,509,025 | ) | | | (3,961,482 | ) |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 53,780,707 | | | | 57,742,189 | |

| End of period | | $ | 52,271,682 | | | $ | 53,780,707 | |

| Accumulated Net Investment Loss | | $ | (24,103 | ) | | $ | (26,103 | ) |

| (A) | For details on share transactions by class, see Statements of Changes in Net Assets - Capital Stock Activity on pages 24-25. |

See accompanying Notes to Financial Statements.

Statements of Changes in Net Assets (Continued)

| Touchstone | | | Touchstone | |

| Ohio Tax-Free | | | Tax-Free | |

| Money Market Fund | | | Money Market Fund | |

| For the | | | For the | | | For the | | | For the | |

| Year | | | Year | | | Year | | | Year | |

| Ended | | | Ended | | | Ended | | | Ended | |

| June 30, 2014 | | | June 30, 2013 | | | June 30, 2014 | | | June 30, 2013 | |

| | | | | | | | | | | |

| $ | 17,562 | | | $ | 18,870 | | | $ | 4,259 | | | $ | 4,037 | |

| | — | | | | — | | | | — | | | | (39 | ) |

| | — | | | | — | | | | — | | | | — | |

| | 17,562 | | | | 18,870 | | | | 4,259 | | | | 3,998 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | (7,075 | ) | | | (8,195 | ) | | | (1,306 | ) | | | (1,441 | ) |

| | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | (2,953 | ) | | | (2,596 | ) |

| | (10,486 | ) | | | (10,675 | ) | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | |

| | (17,561 | ) | | | (18,870 | ) | | | (4,259 | ) | | | (4,037 | ) |

| | | | | | | | | | | | | | | |

| | (10,038,585 | ) | | | (6,955,904 | ) | | | (3,798,414 | ) | | | (151,419 | ) |

| | | | | | | | | | | | | | | |

| | (10,038,584 | ) | | | (6,955,904 | ) | | | (3,798,414 | ) | | | (151,458 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | 166,124,076 | | | | 173,079,980 | | | | 39,633,037 | | | | 39,784,495 | |

| $ | 156,085,492 | | | $ | 166,124,076 | | | $ | 35,834,623 | | | $ | 39,633,037 | |

| $ | (351 | ) | | $ | (352 | ) | | $ | — | | | $ | (1 | ) |

Statements of Changes in Net Assets - Capital Stock Activity

| | | Touchstone | |

| | | Ohio Tax-Free | |

| | | Bond Fund | |

| | | For the Year | | | For the Year | |

| | | Ended | | | Ended | |

| | | June 30, 2014 | | | June 30, 2013 | |

| | | Shares | | | Dollars | | | Shares | | | Dollars | |

| Class A | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 295,046 | | | $ | 3,403,775 | | | | 373,219 | | | $ | 4,485,408 | |

| Reinvestment of distributions | | | 103,168 | | | | 1,185,918 | | | | 116,605 | | | | 1,402,624 | |

| Cost of shares redeemed | | | (659,240 | ) | | | (7,522,933 | ) | | | (688,859 | ) | | | (8,196,758 | ) |

| Change from Class A Share Transactions | | | (261,026 | ) | | | (2,933,240 | ) | | | (199,035 | ) | | | (2,308,726 | ) |

| Class C | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 88,833 | | | | 1,030,070 | | | | 102,873 | | | | 1,238,447 | |

| Reinvestment of distributions | | | 11,584 | | | | 133,392 | | | | 11,841 | | | | 142,658 | |

| Cost of shares redeemed | | | (85,592 | ) | | | (977,332 | ) | | | (77,296 | ) | | | (921,264 | ) |

| Change from Class C Share Transactions | | | 14,825 | | | | 186,130 | | | | 37,418 | | | | 459,841 | |

| Class S | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | — | | | | — | | | | — | | | | — | |

| Reinvestment of distributions | | | — | | | | — | | | | — | | | | — | |

| Cost of shares redeemed | | | — | | | | — | | | | — | | | | — | |

| Change from Class S Share Transactions | | | — | | | | — | | | | — | | | | — | |

| Institutional Class | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | — | | | | — | | | | — | | | | — | |

| Reinvestment of distributions | | | — | | | | — | | | | — | | | | — | |

| Cost of shares redeemed | | | — | | | | — | | | | — | | | | — | |

| Change from Institutional Class Share Transactions | | | — | | | | — | | | | — | | | | — | |

| Net Decrease from Share Transactions | | | (246,201 | ) | | $ | (2,747,110 | ) | | | (161,617 | ) | | $ | (1,848,885 | ) |

See accompanying Notes to Financial Statements.

Statements of Changes in Net Assets - Capital Stock Activity (Continued)

| Touchstone | | | Touchstone | |

| Ohio Tax-Free | | | Tax-Free | |

| Money Market Fund | | | Money Market Fund | |

| For the Year | | | For the Year | | | For the Year | | | For the Year | |

| Ended | | | Ended | | | Ended | | | Ended | |

| June 30, 2014 | | | June 30, 2013 | | | June 30, 2014 | | | June 30, 2013 | |

| Shares | | | Dollars | | | Shares | | | Dollars | | | Shares | | | Dollars | | | Shares | | | Dollars | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 92,647,241 | | | $ | 92,647,241 | | | | 119,641,807 | | | $ | 119,641,807 | | | | 2,926,726 | | | $ | 2,926,726 | | | | 2,436,605 | | | $ | 2,436,605 | |

| | 7,061 | | | | 7,061 | | | | 8,163 | | | | 8,163 | | | | 1,305 | | | | 1,305 | | | | 1,404 | | | | 1,404 | |

| | (108,415,868 | ) | | | (108,415,868 | ) | | | (115,393,911 | ) | | | (115,393,911 | ) | | | (3,240,666 | ) | | | (3,240,666 | ) | | | (4,032,547 | ) | | | (4,032,547 | ) |

| | (15,761,566 | ) | | | (15,761,566 | ) | | | 4,256,059 | | | | 4,256,059 | | | | (312,635 | ) | | | (312,635 | ) | | | (1,594,538 | ) | | | (1,594,538 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | — | | | | 52,623,013 | | | | 52,623,013 | | | | 51,658,323 | | | | 51,658,323 | |

| | — | | | | — | | | | — | | | | — | | | | 2,913 | | | | 2,913 | | | | 2,593 | | | | 2,593 | |

| | — | | | | — | | | | — | | | | — | | | | (56,111,705 | ) | | | (56,111,705 | ) | | | (50,217,797 | ) | | | (50,217,797 | ) |

| | — | | | | — | | | | — | | | | — | | | | (3,485,779 | ) | | | (3,485,779 | ) | | | 1,443,119 | | | | 1,443,119 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 172,238,589 | | | | 172,238,589 | | | | 216,567,513 | | | | 216,567,513 | | | | — | | | | — | | | | — | | | | — | |

| | 34 | | | | 34 | | | | 73 | | | | 73 | | | | — | | | | — | | | | — | | | | — | |

| | (166,515,642 | ) | | | (166,515,642 | ) | | | (227,779,549 | ) | | | (227,779,549 | ) | | | — | | | | — | | | | — | | | | — | |

| | 5,722,981 | | | | 5,722,981 | | | | (11,211,963 | ) | | | (11,211,963 | ) | | | — | | | | — | | | | — | | | | — | |

| | (10,038,585 | ) | | $ | (10,038,585 | ) | | | (6,955,904 | ) | | $ | (6,955,904 | ) | | | (3,798,414 | ) | | $ | (3,798,414 | ) | | | (151,419 | ) | | $ | (151,419 | ) |

Financial Highlights

Touchstone Ohio Tax-Free Bond Fund — Class A

Selected Data for a Share Outstanding Throughout Each Period

| | | Year Ended June 30, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Net asset value at beginning of period | | $ | 11.47 | | | $ | 11.90 | | | $ | 11.36 | | | $ | 11.55 | | | $ | 11.22 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.39 | | | | 0.39 | | | | 0.41 | | | | 0.42 | | | | 0.42 | |

| Net realized and unrealized gains (losses) on investments | | | 0.33 | | | | (0.36 | ) | | | 0.55 | | | | (0.10 | ) | | | 0.33 | |

| Total from investment operations | | | 0.72 | | | | 0.03 | | | | 0.96 | | | | 0.32 | | | | 0.75 | |

| Distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.39 | ) | | | (0.39 | ) | | | (0.41 | ) | | | (0.42 | ) | | | (0.42 | ) |

| Realized capital gains | | | (0.04 | ) | | | (0.07 | ) | | | (0.01 | ) | | | (0.09 | ) | | | — | |

| Total distributions | | | (0.43 | ) | | | (0.46 | ) | | | (0.42 | ) | | | (0.51 | ) | | | (0.42 | ) |

| Net asset value at end of period | | $ | 11.76 | | | $ | 11.47 | | | $ | 11.90 | | | $ | 11.36 | | | $ | 11.55 | |

| Total return(A) | | | 6.41 | % | | | 0.13 | % | | | 8.60 | % | | | 2.85 | % | | | 6.77 | % |

| Ratios and supplemental data: | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of period (000's) | | $ | 44,939 | | | $ | 46,803 | | | $ | 50,946 | | | $ | 47,991 | | | $ | 53,947 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % |

| Gross expenses | | | 1.10 | % | | | 1.09 | % | | | 1.12 | % | | | 1.15 | % | | | 1.15 | % |

| Net investment income | | | 3.42 | % | | | 3.25 | % | | | 3.51 | % | | | 3.67 | % | | | 3.66 | % |

| Portfolio turnover rate | | | 25 | % | | | 24 | % | | | 33 | % | | | 26 | % | | | 33 | % |

Touchstone Ohio Tax-Free Bond Fund — Class C

Selected Data for a Share Outstanding Throughout Each Period

| | | Year Ended June 30, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Net asset value at beginning of period | | $ | 11.48 | | | $ | 11.92 | | | $ | 11.37 | | | $ | 11.57 | | | $ | 11.23 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.31 | | | | 0.30 | | | | 0.32 | | | | 0.34 | | | | 0.34 | |

| Net realized and unrealized gains (losses) on investments | | | 0.34 | | | | (0.37 | ) | | | 0.56 | | | | (0.11 | ) | | | 0.34 | |

| Total from investment operations | | | 0.65 | | | | (0.07 | ) | | | 0.88 | | | | 0.23 | | | | 0.68 | |

| Distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.31 | ) | | | (0.30 | ) | | | (0.32 | ) | | | (0.34 | ) | | | (0.34 | ) |

| Realized capital gains | | | (0.04 | ) | | | (0.07 | ) | | | (0.01 | ) | | | (0.09 | ) | | | — | |

| Total distributions | | | (0.35 | ) | | | (0.37 | ) | | | (0.33 | ) | | | (0.43 | ) | | | (0.34 | ) |

| Net asset value at end of period | | $ | 11.78 | | | $ | 11.48 | | | $ | 11.92 | | | $ | 11.37 | | | $ | 11.57 | |

| Total return(A) | | | 5.70 | % | | | (0.70 | )% | | | 7.87 | % | | | 1.99 | % | | | 6.06 | % |

| Ratios and supplemental data: | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of period (000's) | | $ | 7,333 | | | $ | 6,978 | | | $ | 6,797 | | | $ | 6,169 | | | $ | 6,459 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % | | | 1.60 | % |

| Gross expenses | | | 2.01 | % | | | 1.99 | % | | | 2.07 | % | | | 2.06 | % | | | 1.96 | % |

| Net investment income | | | 2.67 | % | | | 2.50 | % | | | 2.76 | % | | | 2.92 | % | | | 2.91 | % |

| Portfolio turnover rate | | | 25 | % | | | 24 | % | | | 33 | % | | | 26 | % | | | 33 | % |

| (A) | Total returns shown exclude the effect of applicable sales loads. If these charges were included, the returns would be lower. |

See accompanying Notes to Financial Statements.

Financial Highlights (Continued)

Touchstone Ohio Tax-Free Money Market Fund — Class A

Selected Data for a Share Outstanding Throughout Each Period

| | | Year Ended June 30, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Net asset value at beginning of period | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | (A) | | | — | (A) | | | — | (A) | | | — | (A) | | | — | (A) |

| Net realized gains (losses) on investments | | | — | | | | — | | | | (— | )(A) | | | (— | )(A) | | | — | (A) |

| Total from investment operations | | | — | (A) | | | — | (A) | | | — | (A) | | | — | (A) | | | — | (A) |

| Distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (— | )(A) | | | (— | )(A) | | | (— | )(A) | | | (— | )(A) | | | (— | )(A) |

| Realized capital gains | | | — | | | | — | | | | — | | | | (— | )(A) | | | — | |

| Total distributions | | | (— | )(A) | | | (— | )(A) | | | (— | )(A) | | | (— | )(A) | | | (— | )(A) |

| Net asset value at end of period | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| Total return | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.04 | % |

| Ratios and supplemental data: | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of period (000's) | | $ | 64,580 | | | $ | 80,342 | | | $ | 76,086 | | | $ | 76,640 | | | $ | 105,251 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 0.14 | % | | | 0.24 | % | | | 0.29 | % | | | 0.40 | % | | | 0.62 | %(B) |

| Gross expenses | | | 0.99 | % | | | 0.98 | % | | | 1.00 | % | | | 1.01 | % | | | 0.99 | % |

| Net investment income | | | 0.01 | % | | | 0.01 | % | | | 0.00 | %(A) | | | 0.01 | % | | | 0.04 | % |

Touchstone Ohio Tax-Free Money Market Fund — Institutional Class

Selected Data for a Share Outstanding Throughout Each Period

| | | Year Ended June 30, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Net asset value at beginning of period | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | | | $ | 1.000 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | (A) | | | — | (A) | | | — | (A) | | | — | (A) | | | 0.002 | |

| Net realized gains (losses) on investments | | | — | | | | — | | | | (— | )(A) | | | (— | )(A) | | | — | (A) |