Suite 602, China Life Tower

No.16, Chaowai Street

Chaoyang District

Beijing, China

Zip: 100020

Fax: 86-10-85253883

February 13, 2007

VIA EDGAR

Mr. Jim B. Rosenberg

Senior Assistant Chief Accountant

Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Mail Stop 6010

Washington, D.C. 20549

| Re: | China Biopharmaceuticals Holdings, Inc

Form 10-KSB/A for the Fiscal Year Ended December 31, 2005 (Filed August 28, 2006)

Form 10-QSB for the Period Ended June 30, 2006 (Filed August 14, 2006) File No. 000-09987 |

Dear Mr. Rosenberg:

On behalf of CHINA BIOPHARMACEUTICALS HOLDINGS, INC. (the “Company”), I am writing in response to the comments made by the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in its letter dated November 6, 2006 (the “Comment Letter”) with respect to the Company’s annual report on Form 10-KSB for the year ended December 31, 2005, as amended, (the “Form 10-KSB/A”) and Form 10-QSB for the period ended June 30, 2006 (File No. 000-09987) (the “Form 10-QSB”).

For reference purposes, the text of the Comment Letter has been reproduced in bold and italics herein with responses below for each numbered comment.

Form 10-KSB/A for the year ended December 31, 2005

Management’s Discussion and Analysis of Financial Condition and Results of operations, page 23

Critical Accounting Policies -Accounts Receivable, page 24

1

| 1. | We read your response to comment one and your revised disclosures. We are unable to locate the roll forward of the allowance for doubtful accounts. Please advise us where this roll forward is located or provide it to us. |

| | The following table provides the roll forward of the allowance of doubtful accounts: Allowance for doubtful accounts |

| |

|---|

| As of December 31, 2004 | | | | 263,107 | |

| Provision for year 2005 | | | | 262,284 | |

|

| |

| As of December 31, 2005 | | | | 525,391 | |

|

| |

| | We have revised the cash flow statement to show bad debt expense as a non-cash operating activity, modifying the change in accounts receivable appropriately. |

Consolidated Financial Statements

Statements of Cash Flow, page F-6

| 2. | We read your response to comment six and do not concur with the conclusion in your response that restricted cash should be shown as an operating activity. Please provide us with a revised Statement of Cash Flows which presents restricted cash as a financing activity. |

The Statements of Cash Flows has been revised as the followings:

CHINA BIOPHARMACEUTICALS HOLDINGS, INC. AND SUBSIDIARIES

STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2005 AND 2004

| 2005

| | 2004

| |

|---|

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net income | | | $ | 960,685 | | $ | 350,640 | |

| Adjustments to reconcile net income to cash | | |

| provided by (used in) operating activities: | | |

| Depreciation and amortization | | | | 533,549 | | | 41,850 | |

| Bad debt expense | | | | 262,284 | | | 57,322 | |

| Minority interest | | | | 725,542 | | | 105,654 | |

| Change in operating assets and liabilities: | | |

| (Increase) decrease in assets: | | |

| Accounts receivable | | | | -90,526 | | | 4,089,086 | |

| Other receivables and prepayments | | | | -333,509 | | | 60,772 | |

| Advances to suppliers | | | | -936,406 | | | — | |

| Inventories | | | | -3,582,215 | | | -1,472,000 | |

| Increase (decrease) in liabilities: | | | | | | | | |

| Accounts payable | | | | 2,382,038 | | | 3,149,807 | |

| Accounts payable - related parties | | | | 260,757 | | | — | |

| Other payables and accrued liabilities | | | | -303,173 | | | 870,659 | |

| Other payables - related parties | | | | -177,182 | | | 40,332 | |

| Customer deposits | | | | 804,610 | | | 561,050 | |

| Taxes payable | | | | 612,971 | | | 416,915 | |

| Deferred revenue | | | | -441,907 | | | — | |

2

| | |

|---|

| Deferred tax liabilities | | | | — | | | -32,889 | |

| Net cash provided by operating activities | | | | 677,518 | | | 61,026 | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | |

| Other receivables - related parties | | | | -1,014,621 | | | 0 | |

| Purchase of intangible asset | | | | -1,759,592 | | | — | |

| Business acquisitions - cash acquired (paid) | | | | -800,000 | | | 425,396 | |

| Purchase of property and equipment | | | | -436,737 | | | — | |

| Net cash used in investing activities | | | | -2,251,358 | | | -1,334,196 | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | |

| Proceeds from issuance of preferred stock | | | | 1,010,969 | | | — | |

| Proceeds (payments) on loans payable | | | | 2,585,767 | | | 1,655,289 | |

| Proceeds from short-term convertible notes | | | | 425,000 | | | — | |

| Proceeds from long-term debts - related parties | | | | 537,162 | | | — | |

| Increase in minority interest | | | | -1,050,845 | | | — | |

| Restricted cash | | | | -1,329,280 | |

| Distributions to minority interest holders | | | | -,80,547 | | | — | |

| Net cash provided by financing activities | | | | 2,098,226 | | | 1,655,289 | |

| | | |

| EFFECT OF EXCHANGE RATE ON CASH | | | | 35,185 | | | -3,361 | |

| | | |

| INCREASE IN CASH | | | | 559,571 | | | 378,758 | |

| | | |

| CASH, beginning of year | | | | 467,035 | | | 88,277 | |

| | | |

| CASH, end of year | | | $ | 1,026,606 | | $ | 467,035 | |

| | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | | | | | |

| Cash paid for income taxes | | | | 533,414 | | | 109,134 | |

| Cash paid for interest expense | | | $ | 347,729 | | $ | 37,710 | |

Notes to Consolidated Financial Statements, page F-7

Note 2 – Significant Accounting Policies, page F-8

Patent and Development Costs, page F-10

| 3. | We read your response to comment seven and are not able to concur with your conclusion that patented pharmaceutical formulas held for sale should be classified as inventories. Please provide us with the following additional information related to this policy: |

| | • | A discussion with specific references to the authoritative literature that supports your conclusion that these should be classified as inventories rather than intangible assets. ARB43 Chapter 4 defines inventory as those items of tangible personal property and SFAS142 defines intangible assets as those assets that lack physical substance. Therefore, it would appear as though a patent would be an intangible asset. |

| | • | Explain to us in greater detail what the development costs that you state are included in this amount represent and why it is appropriate to capitalize these costs. |

| | • | Provide to us a better discussion of exactly how the sale of these formulas works including whether you retain any rights to these patents after the sale. |

3

| | • | Tell us the amount of patented pharmaceutical formulas held for sale that you included in inventories as of December 31, 2005 and June 30, 2006. |

| | (a) | We agree with the Staff that inventory should only include those items of tangible personal property, and a patent should be presented as intangible. We inaccurately described the policy and have revised Note 2 accordingly. |

| | (b) | In accordance with SFAS 2, “Accounting for Research and Development Costs”, no development cost has been capitalized in our historical financial statements, and all research and development costs have been expensed as incurred. As a result, no patent costs are included in inventory at December 31, 2005 and June 30, 2006. |

| | (c) | Generally we sell our formulas under two methods (i) transfer the title to the formulas and we retain no patent rights, and (ii) license the formula and we retain patent rights. Under the former, we either ask for a payment of lump sum amount or ask for installment payments. Under the latter, we commonly ask for a lump sum payment. |

| | (d) | No patented pharmaceutical formulas were included in inventory as of December 31, 2005 and June 30, 2006. |

Revenue and Revenue Recognition, page F-9

| 4. | We read your response to comment nine and your revised disclosures. For the revenue from ““R&D service,”” based on your previous disclosure and the disclosure on page 23, it appears as though milestone payments are recognized as revenue only when the payment is not refundable and continued performance of future research and development services related to the milestone are not required. Therefore, please provide us in disclosure-type format a discussion that clarifies at what point the payments are not refundable and also at what point continued service is not required. Also please tell us the nature of the milestone goals so we can understand what causes them to be achieved. |

| | Typically, our milestone contracts indicate a specific date or milestone requirement. The funds are no longer refundable when the date has passed; therefore, we recognize revenue on that date. To determine when milestones are achieved, typically, the milestone goals require one or more of the following: (1) a certificate from a licensed authoritative agency, (2) approval/acknowledgement by a governmental agency, such as agency like Food and Drug Administration of the United States, (3) an authoritative professional appraisal report, or (4) an independent technological feasibility report, testing analysis and other form of valuation on the result and value of our products and service. After we receive the certificate, or/and approval and/or report, continued service is not required thus the respective milestone goals are achieved. Therefore, the milestone payment is no longer refundable and revenue is recognized. |

| 5. | We read your response to comment ten and your revised disclosures. For your revenue from sales of product, please provide us in disclosure-type format a break out of revenue for each product or group of similar products in accordance with paragraph 37 of SFAS 131. |

4

| | In 2005, all our commercial drugs sold are prescription drugs. |

| | For the year ended December 31, 2005, revenue from sales of product was $29,669,378 made up of the following product categories. |

| |

|---|

| Intermediary Pharmaceutical products | | | $ | 15,969,276 | |

| Prescription drugs | | | | 12,347,371 | |

| Service | | | | 1,352,731 | |

|

| |

| Total | | | $ | 29,669,378 | |

|

| |

Note 8-Related Party Transactions, page F-17

Long Term Debt-Related Parties, page F-18

| 6. | We read your response to comment eleven and believe that the additional information you provided would be useful to investors. Please provide to us in disclosure type format revised disclosure that includes information similar to that which you provided to us in your response such as the business reasons for the transfer of assets and the fact that you will not be subject to recourse in the event that Erye Jingmao defaults in future filings. |

| | We have added the following disclosure to Note 8 – Related Party Transactions: |

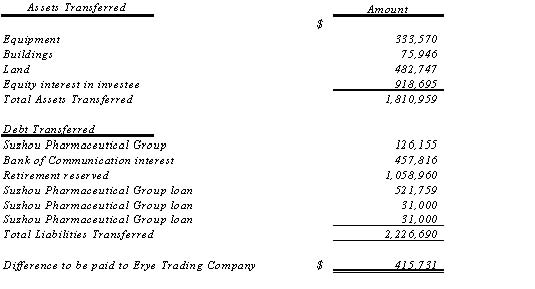

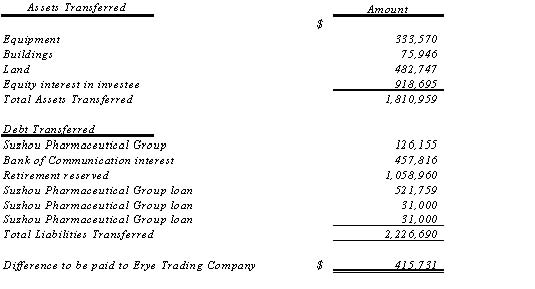

| | The following table lists the assets transferred to and debt assumed by Erye Jingmao from Erye, one of the Company’s subsidiaries: |

| | The transaction was contemplated and performed by Erye (the transferor) and Erye Jingmao (the transferee) in March 2005 before the acquisition of Erye by the Company in order to transfer the assets, which were idle and deemed to be of little usefulness for Erye’s operation, and the debt, which arose in connection with non-operation activities associated with Government’s order when Erye was still a state-owned enterprise before Erye changed its identity into a private business in 2003, for the purpose of facilitating the |

5

| | acquisition of Erye by the Company. Erye Jingmao’s shareholders, who were also the sole group of shareholders, had the intention of purchasing the assets and assuming the long-term liabilities of Erye as listed to make Erye a more attractive acquisition target. Indeed the assets and debt listed above were not relevant with Erye’s normal operation in our view and it also met our requirement to transfer out the items listed above. Since by the time of the transfer, Erye and Erye Jingmao are under common ownership and management control, by referring to paragraph 11 of SFAS 141, the assets and debt transferred out were recorded at book value. We also confirmed with the parties relating to the debt list above and are assured that we shall not be subject to recourse in case Erye Jingmao defaults. |

Note 15-Business Combinations, page F-22

| 7. | We read your response to comment fifteen. Please explain to us how you arrived at the original value of $1.00 per share for the common stock issued in the Hengyi and Erye acquisitions. Based on your decision to amend the common stock value, please tell us your consideration of whether the original valuation was an error. Final1y, please tell us how you determined the values assigned to all issuances of common shares prior to December 19, 2005 when the stock began trading. |

| | We respectfully note the Staff’s comment. However, we do not believe the original valuation was an error. We arrived at the original value of $1.00 based on our management’s estimate. Prior to the two acquisitions, there was a potential bid of approximately $1.00/share to purchase common stock of the Company. So our management considered the bid price as a quotation for the transactions. During the post-acquisition period, the allocation period for accounting purposes, the Company obtained appraisals on each of the acquisitions and appropriately adjusted the recorded costs. |

| | Prior to December 19, 2005, we determined our stock price based on negotiations with those companies or individuals who agreed to accept stock for their services. |

| | On March 8, 2005, the Company issued 300,000 shares of common stock to China Pharmaceutical University located in Nanjing, China, pursuant to a joint laboratory agreement and agreed to invest approximately $30,000 into the laboratory in the next five years. Both parties to the transaction determined the value of the 300,000 shares was $30,000, or $0.10 per share. |

| | On May 15, 2005, we issued 50,000 shares of common stock for consulting service with an agreed upon value of$7,000, or $0.14 per share. |

| | On May 23, 2005, the Company issued 600,000 shares of common stock to engage Mrs. Robin Smith for consulting service with an agreed upon value of $60,000, or $0.10 per share. |

| | On June 1, 2005, we issued 65,000 shares of common stock for consulting service with an agreed upon value of $26,000, or $0.40 per share. |

| | On June 17, 2005, we issued 3,300,000 shares of our common stock to acquire the net assets of Erye’s, appraised at $1,650,000, or $0.50 per share. |

6

| | On September 1, 2005, we issued 76,500 shares of common stock for consulting service valued at $38,250, or$0.50 per share. |

| | We issued 406,459 shares of common stock for consulting service valued at $162,585 in the period of October through December 2005, or $0.40 per share. |

Note 16-Shareholders’Equity, page F-24

Private placement closed on December 31, 2004 (the ““Notes Private Placement”), page F-24

| 8. | We read your response to comment sixteen. Please tell us whether there is also a penalty provision in the registration rights agreement for when a registration statement ceases to be effective. Please better explain to us why you feel that the penalty provision does not cause you to fail paragraph 12 including a discussion of the current registration status for all shares subject to such an agreement as well as any limits to the amount of penalty to be paid. In addition, please tell us how you applied the guidance in EITF 00-19 in determining whether the conversion feature should be bifurcated from the convertible debt instrument given that the shares into which is convertible contain similar provisions. |

| | We respectfully note the Staff’s comment. The registration rights agreement requires the Company to pay damages if the registration statement ceases to be effective for 30 days during the five year period subsequent to its effective date. We believe the penalty provision more closely follows SFAS 5, “Accounting for Contingencies”, and the penalties are accrued as incurred, which are consistent with the concept discussed in EITF 05-4, “The Effect of a Liquidated Damages Clause on a Freestanding Financial Instrument Subject to EITF Issue No. 00-19, ‘Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock”. |

| | At each balance sheet date, we reassess our ability to meet the obligation to all the holders of our warrants and decided that we were able to meet the obligation to issue common stock upon exercise of the warrants outstanding at that time since at that date we have sufficient authorized but not issued common stock, which were then 163,151,601. There is no requirement for net cash settlement on the warrants. And, the registration rights agreement specifically excludes the warrants. So, according to paragraph 7 of EITF Issue 00-19, it is appropriate to classify the warrants as equity instruments. |

| | Pursuant to EITF 05-2, The Meaning of ““Conventional Convertible Debt Instrument”” in EITF Issue 00-19, ““Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’‘s Own Stock”", the Company’s convertible debt is conventional convertible debt because it is convertible into a fixed number of shares. As such, the conversion feature was not bifurcated or treated as a derivative instrument. |

Form 10-QSB – June 30, 2006

Consolidated Statements of Cash Flows, page 7

| 9. | Please explain to us how the dividend paid to Eyre’s former shareholders represents an investing activity. |

7

We acknowledge that the payment of dividend should be classified as a financing activity and have revised the cash flow statement accordingly.

Notes to Consolidated Financial Statements, page 8

Note 7-Other Assets, page 17

| 10. | We read your response to comment seventeen and we believe the additional information you provided would be useful to investors. Given that the failure of the drug candidates is what triggers the repayment of these amounts, please provide to us in disclosure type format a discussion of the likelihood of repayment under those conditions as well the financial conditions of the counter parties and how you determined that the balances would be collected. |

| | We have added the following disclosures to Note 7. |

| | We are in constant contact with the companies performing the research and are effectively monitoring the progress of the research projects as well as the financial condition of such companies. According to the information obtained, we believe both of the two companies are able to meet their obligation. |

Note 8- Related Parties Transactions, page 15

| 11. | We read your response to comment eighteen and your revised disclosures. Please tell us when the three installments are due from the shareholders. In addition, please explain to us why you classified the ““Long Term Other Receivables- Related Parties” within operating activities in the statement of cash flows. Finally, we note that the nature of the receivable was disclosed in the amended l0-QSB for March 31, 2006 but was not disclosed in the 10-QSB for the period ended June 30, 2006. Please confirm that this information will be included in future filings. |

| | The first installment was due and paid on September 30, 2006 and the second on September 30, 2007 and the third on December 31, 2007. |

| | We reconsider the classification of “Long-term Other Receivables-Related Parties” and acknowledge that it is more appropriate to reclassify it as investing activity. The statement of cash flows has been revised accordingly. |

| | We confirm that the required information disclosing the nature of the receivable will be included the future fillings. |

Management's Discussion and Analysis of Financial Condition and Results of Operations, page 31

Critical Accounting Policies — Accounts Receivable, page 33

| 12. | Please provide to us in disclosure-type format a discussion of your days sales outstanding and an aging of your accounts receivable similar to what you provided in your amended Form 10-KSB for December 31, 2005. |

8

| | The days sales outstanding was 99 days for the first half year of 2006, compared to 75 days for the comparative period of 2006, we attribute the deceleration in collection of accounts receivable to the inclusion of accounts receivable of Enshi which was acquired on June 6, 2006 and then was consolidated into the financial statements of the Company. Excluding receivables from Enshi, the days sales outstanding was 77; the days sales outstanding from Enshi were 160 days. |

| | 3 months

| | 6 months

| | 9 months

| | Over 9 months

| | Over 1 year

|

|---|

Total

|

| Amount

|

| %

|

| Amount

|

| %

|

| Amount

|

| %

|

| Amount

|

| %

|

| Amount

|

| %

|

|

|---|

| $11,886,152 | | | | 5,134,818 | | | 43.20% | | | 2,386,739 | | | 20.08% | | | 2,032,532 | | | 17.10% | | | 1,604,631 | | | 13.50% | | | 727,433 | | | 6.12% | |

|

Form 8-K filed July 5, 2006

| 13. | In accordance with Item 9.01(a)(2) of Form8-K, please file an amended report that includes the audit report for Enshi’s financial statements. Also explain to us why you did not provide pro forma information for this acquisition. |

| | We confirm that we will file an amendment to the form 8-K that includes the audit report for the Enshi’s financial statements, in which we will include the pro forma information required. |

The Company acknowledges that:

| | • | The Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

| | • | Staff comments or changes to disclosure in response to Staff comments in the filings reviewed by the Staff do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | The Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

* * * *

If you have any questions regarding the foregoing responses to your comments, please contact the undersigned at 8610-8525-1616 or Howard H. Jiang, the Company’s outside legal counsel, at (212) 626-4917 (email: Howard.Jiang@Bakernet.com ; fax: 212-310-1682).

Very truly yours,

/s/ Chris Mao Peng

Chief Executive Officer

9