Seizing a World Class Opportunity

Company Updates

Safe Harbor Statement

The forward-looking statements made in this presentation and any subsequent

Q&A are subject to risks, uncertainties and certain assumptions. CHBP’s actual

results may differ materially from those currently anticipated due to a number of

risk factors, including, but not limited to, any comments relating to our financial

performance, the competitive nature of the marketplace, the condition of the

worldwide economy and other factors that have been or will be detailed in the

company’s form 8-K’s for 2003-2006 and subsequent 10KSB’s and 10QSB’s or

other documents filed with the Securities and Exchange Commission. For more

detailed information on the Company, please refer to the Company filings with

Securites and Exchange Commission, which are readily available at

http://www.sec.gov/cgi-bin/browse-edgar?action using the Company’s name or

ticker symbol.

1

Mission Statement

By 2010,

China Biopharmaceuticals Holdings, Inc. plans to be

among the top-tier of Chinese pharmaceutical companies

as measured by market share, profitability, new product

innovation and product quality

2

Investment Highlights

Focused on underpenetrated domestic Chinese market

Demonstrated track record of growing core base business

Accelerating revenue growth with expanding margins

Broad portfolio of currently marketed Rx and OTC products

Fully vertically-integrated R&D and GMP manufacturing capabilities

Multiple near-term new product launches

Strategic relationships with China Pharmaceutical University and China

New Drug Development Center

Industry consolidator with many opportunities for strategic acquisitions

3

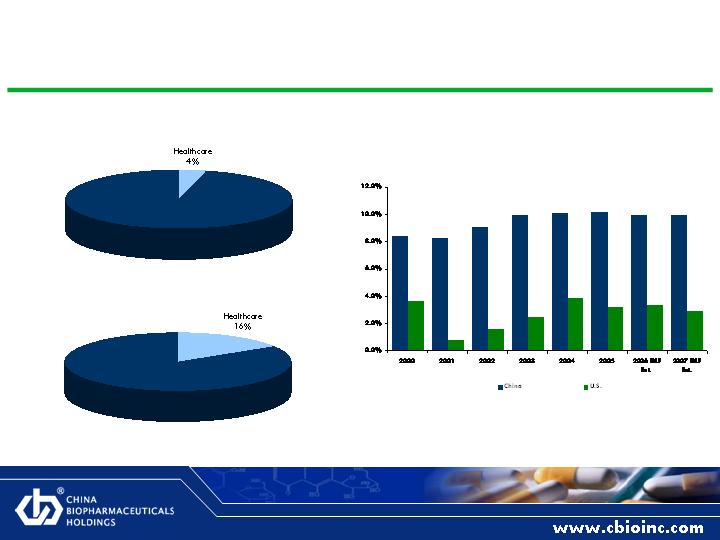

Chinese Pharmaceutical Industry: Poised for Growth

Healthcare as % of China GDP

China vs. U.S. GDP Growth

Healthcare as % of U.S. GDP

Source: The Wall Street Journal

4

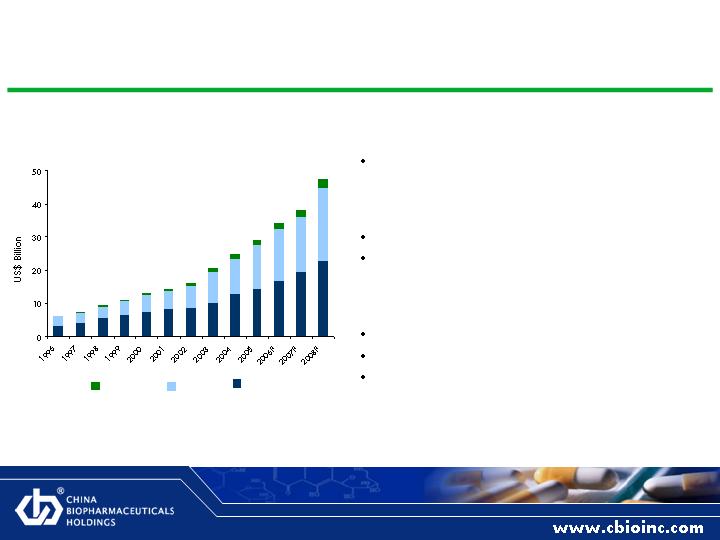

Chinese Pharmaceutical Market Overview

Market Size

2005 pharmaceutical end product sales at

wholesale: US$29.1 billion

Growth

18.6% annual growth rate over last decade

Expected to grow at 17.6% in the next 3

years

Market Segments

Western drugs: 46%

Traditional Chinese Medicine (TCM): 42%

Biological drugs: 12%

Source: China Pharmaceutical Yearbook, China Statistical Yearbook, IMS Health Webpage, China International Economy Consulting

Chinese Pharmaceutical Sales by Sector

Note: 1. Western drug refers to a drug that is produced through chemical synthesis or fermentation

2. Biological drug is produced through extraction from human or animal tissue or organ

TCM

Biological

Western

5

Chinese Pharmaceutical Market Drivers

Aging Population

Proportion of China’s aging population is increasing

Ages 65+ account for only 7.7% of population

Ages 65+ account for 35% of pharmaceutical expenditure

Retail Expansion

OTC channel of retail markets is growing at a 15% CAGR

Consumers have easier access to pharmaceutical products

Healthcare Reforms

Insurance reforms for urban areas

New cooperative healthcare plan for rural areas

Rising Living Standard

Urbanization

Increasing healthcare awareness

Pharmaceutical expenditures currently only 5.6% of disposable income

6

Key Ingredients for Success

Profitability: Focused on higher margin businesses

Growth: Organic growth enhanced through acquisitions

Distribution: Direct sales capability and distributor relationships

Manufacturing: Significant capacity to support growth

R&D: Numerous SFDA Approvals

Products: Rx and OTC; Western and TCM

Quality: Must meet new GMP standards

Status

Company Characteristic

7

Strategic Footprint: High Growth Assets in Place

Nanjing Keyuan

R&D Facilities

Shenyang Enshi

TCM and Western Medicines

Beijing

Headquarters

Suzhou Erye

Antibiotic Focus

8

Operating Subsidiaries

CHBP

Shenyang Enshi Pharmaceutical Co. Ltd.

5 SFDA GMP lines

Over 120 prescription generic and TCM products

Suzhou Erye Pharmaceutical Co. Ltd.

7 SFDA GMP lines

Currently manufacturing 27 antibiotic drugs

Nanjing Keyuan Pharmaceutical R&D Co. Ltd.

Research and development

Average of 3-5 SFDA approvals annually

Successful history of licensing programs

9

Our Presence

Nanjing Keyuan

Shenyang Enshi

Suzhou Erye

Shenyang Enshi

10

Business Strategy

Accelerate growth and profitability of core business

Maximize R&D platform and research alliances

Expand footprint via select, accretive acquisitions

Lever capabilities throughout value chain, including manufacturing and

distribution

11

Accelerating Core Business Growth

Relaunch Enshi OTC brands: powerful new marketing mix

Hired top marketing team from Sanzhu Pharmaceuticals

Raise prices to be in-line with other leading Chinese brands

Target wealthier (top 25%) 300MM consumers on east coast of China

Use direct marketing to maximize sales of high margin products

Assign lower margin products to distributors

Drive growth in Erye prescription products

Multiple near-term product launches

12

Maximizing R&D Potential

Focus on new, high growth, high margin Rx drugs

Launch recently approved Rx drugs, 7 new products anticipated in 2007

Target 30 new product launches through 2010

Acquire new products with strong growth characteristics

Fully utilize development and regulatory relationships

Exclusive agreement with China Pharmaceutical University

Rapid drug approvals from SFDA based on experience and relationships

13

Multiple Near-Term Product Launches

2007

1.4 million

Disseminated Intravascular

Coagulation

Nafamostat (injection)

2007

22.0 million

Acute Heart Failure, Renal Function

Failure

Torasemide (injection)

2007

30.0 million

Allergic Rhinitis

Desloratadine (tablet)

2007

30.0 million

Diabetes

Gliclazide SR (tablet)

2007

100.0 million

Hepatitis B

Adefovir Dipivoxil (tablet)

2007

140.0 million

Digestive System Disease

Nizatidine (injection)

2007

165.0 million

Hypertension, Heart Failure

Torasemide (tablet)

Expected

Launch

Chinese Patient

Population1

Indication

Product

(1) Source: CHBP Estimates

14

Expanding Our Strategic Footprint

Act as an industry consolidator by applying disciplined approach

Proprietary access and negotiated transactions only

Attractive entry valuation and adjustment based on future performance

Accretive to product portfolio, sales channels or R&D capability

Strategic fit with existing development and operational strategy

Significant areas of potential operational and financial synergies

Rigorous due diligence process

Retain strong management with complementary industry expertise

15

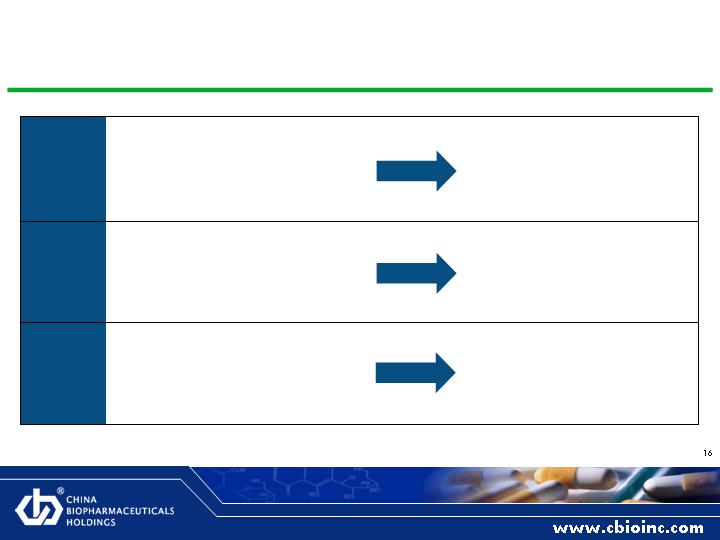

Proven Acquisition Success

Purchases 100% of

Shenyang Enshi Pharmaceutical

Co., Ltd.

Purchases 51% of

SuzhouErye Pharmaceutical

Limited Company

Merges with 90% owner of

Nanjing Keyuan

Pharmaceutical R&D Co., Ltd.

Traditional Chinese

Medicine and Western

medicine manufacturing

capability

Antibiotic product portfolio

Leading R&D capability

June

2006

June

2005

August

2004

16

Optimizing the Value Chain

Increase penetration across China

Expand existing distributor relationships

Form alliances with new distributors in other provinces

Utilize own pharmacy channels to drive acceptance and usage of marketed

products

Drive manufacturing efficiency

Combine assets and reduce duplication in acquired entities

17

CHBP Competitive Advantages

Diversified product portfolio

260 SFDA approved drugs

Products in all segments: OTC, Patented, TCM and Western

~230 OTC drugs and new drugs under production

OTC portfolio represents ~25% of all OTC drugs sold through drug stores

Average gross margin ~40%, with significant room for expansion

Strong R&D platform

Nanjing Keyuan developed ~40 new drugs in 4 years

Represents 80% of all new drug applications in our province

~30 drugs to be introduced in next 5 years

Exclusive agreement with China Pharmaceutical University’s R&D

Laboratory provides additional projects and experts

Selective product out-licensing provides fee and royalty income

18

CHBP Competitive Advantages (Continued)

Vertically-integrated operation

Over 15 SFDA certified GMP lines

Sales and marketing expertise

Proprietary pharmacy network and distribution channel

Access to national distribution channels

Proven management team

Significant PRC sector experience

Demonstrated M&A track record

Management team with excellent OTC experience

19

Case Study:

Synergy of Nanjing Keyuan and Suzhou Erye

In June 2005 acquired 51% of Suzhou Erye by issuance of 3.3 million

shares of CHBP stock and injection of $2.2 million cash as working capital

into company

Core business is production of antibiotics and APIs

2006: Erye showed 13% sales growth and 213% net profit growth despite

2 rounds of price cuts by government

Driven by 2 new antibiotics developed by Keyuan R&D arm

2007: Erye to launch 2 new high margin Rx products

Anticoagulant and Hepatitis B antiviral

Both developed by Keyuan R&D arm

Result: Continued significant growth in both sales and net profit

20

Case Study:

New Enshi Management Team

Enshi acquired June 2006; 80% of its sales are OTC products

CHBP hired new management team to run Enshi

Previously the top management of Sanzhu Pharmaceuticals

Sanzhu generated US$1 billion in annual sales in China

Enshi plans to launch new national commercial campaign

Promote major OTC TCM cardiovascular and Hepatitis B drugs

Increase Enshi’s sales and build brand images

Result: Enshi anticipates significant growth in OTC drug sales in 2007

21

Management

Infogroup Investment Corporation

CFO

Floyd Huang

Shanghai Fuxing Pharmaceutical

SVP, Sales

Xiaohao Liu

China Pharmaceutical University, State

Food and Drug Administration

CTO

Luyong Zhang

Sandong Tungtai Pharmaceutical, China

Pharmaceutical University

President and COO;

CEO, Nanjing Keyuan

Lufan An

China Pharmaceuticals Investment Fund,

Infogroup Investment Corporation,

Shandong China Life S.T. Research Institute

Chairman and CEO

Chris Peng Mao

Experience

Title

Name

22

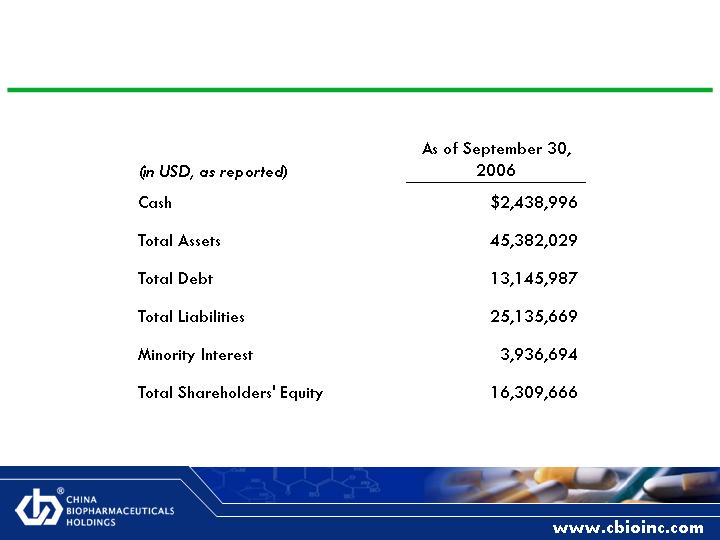

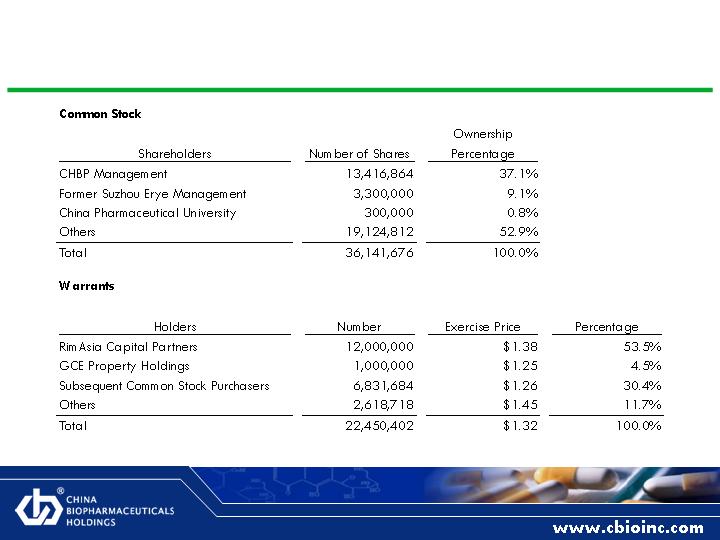

Financial Highlights

Significant revenue and income growth

Acquisition and organic

Cash flow positive

Scaleable model

Ability to make accretive acquisitions

23

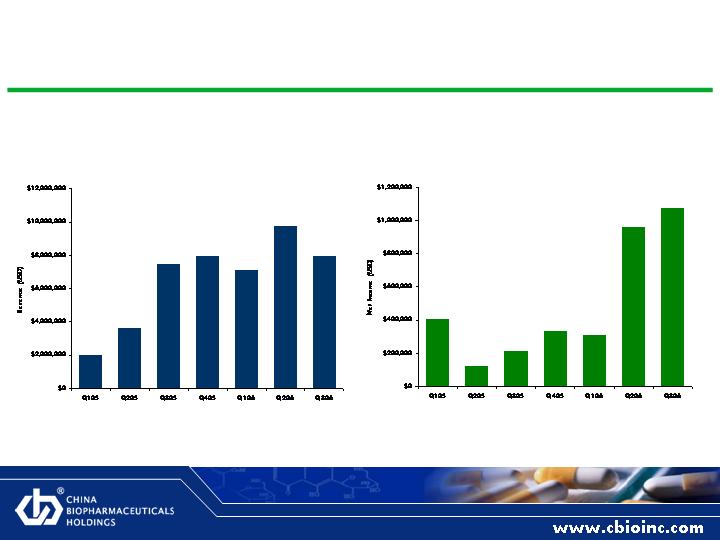

As Reported Revenue and Net Income Growth

Quarterly Revenue, As Reported

Quarterly Net Income, As Reported

24

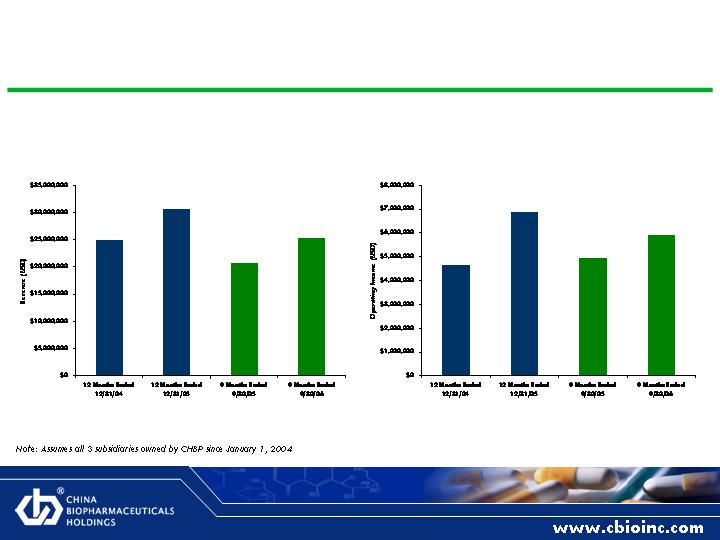

Organic Revenue and Operating Income Growth

Pro Forma Revenue

Pro Forma Operating Income

25

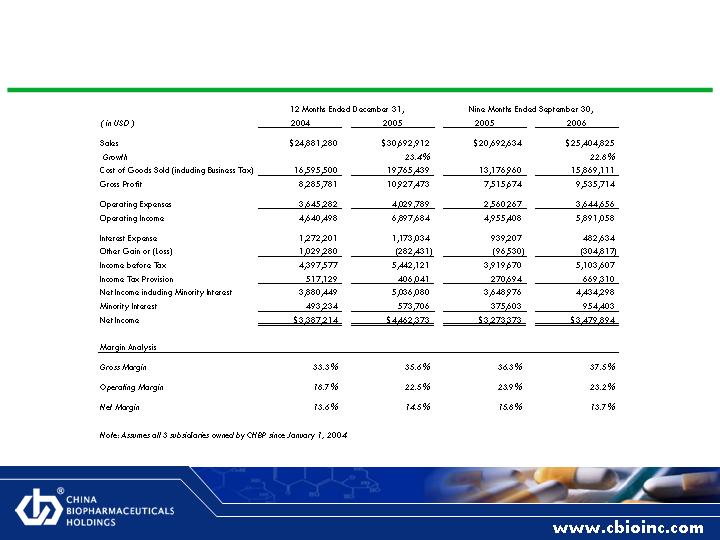

Pro-Forma Income Statement

26