Engelhard Response to BASF Offer

COMMITTED TO MAXIMIZING SHAREHOLDER VALUE

FORWARD-LOOKING STATEMENT

Forward-Looking Statements. This document contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. These

statements relate to analyses and other information that are based on forecasts of future

results and estimates of amounts not yet determinable. These statements also relate to

future prospects, developments and business strategies. These forward-looking

statements are identified by their use of terms and phrases such as “anticipate,”

“believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will”

and similar terms and phrases, including references to assumptions. These forward-

looking statements involve risks and uncertainties, internal and external, that may cause

the Company’s actual future activities and results of operations to be materially different

from those suggested or described in this document. These risks, uncertainties and

contingencies include those set forth in Engelhard’s Annual Report on Form 10-K, and

other factors detailed from time to time in its other filings with the SEC, including the

Company’s third quarter 10Q.

Investors are cautioned not to place undue reliance upon these forward-looking

statements, which speak only as of their dates. The Company disclaims any obligation to

update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise, also see Appendix.

1

SUMMARY OF PRINCIPAL EVENTS

JH calls BP to schedule meeting. Purpose of meeting is not disclosed by JH

JH makes unsolicited proposal to acquire Engelhard. The two CEOs agree to discuss the proposal

the following week

Engelhard retains Merrill Lynch & Co. as its financial advisor and Cahill Gordon & Reindel LLP as

its legal counsel

BP advises JH that a Board meeting is scheduled for December 29 at which the BASF offer will be

discussed

Engelhard Board meeting held. Response options are discussed. Board determines it will be

prepared to explore a sale if price is preemptive; $37 per share deemed not preemptive

BP communicates Engelhard Board position to JH

JH indicates to BP he had additional conversations with his board on value and concluded other

competing buyers unlikely, and on this basis $37 per share is a fair price

JH then indicates BASF would increase price to $38 per share if Engelhard holds a due diligence

meeting and information provided supports such a price increase

JH indicates to BP that BASF has not factored in value for potential synergies in arriving at its price

Engelhard Board holds telephonic meeting and reviews JH’s position and concludes $38 per share

is not compelling enough to warrant due diligence and the provision of non-public information

BASF announces it intends to make a hostile offer to acquire Engelhard at $37 per share

BASF files a Tender Offer Statement (the “BASF Offer”) with the SEC communicating its proposed

strategy to acquire Engelhard

Engelhard Board determines the BASF Offer is inadequate and not in the best interests of

Engelhard stockholders

The Board is working to identify and explore alternatives to seek to maximize stockholder value

above the BASF Offer

December 14, 2005

December 21, 2005

December 22, 2005

December 26, 2005

December 29, 2005

December 30, 2005

January 3, 2006

January 20, 2006

Current

_______Date________

____________________ Event________________________

January 9, 2006

January 2, 2006

Note: BP and JH refers to Mr. Barry W. Perry, the Chairman and Chief Executive Officer of Engelhard, and Dr. J ürgen Hambrecht, the Chairman of the Board of Executive Directors of

BASF, respectively.

2

BOARD RESPONSE TO THE BASF OFFER

THE REASONS FOR THE REJECTION

1)

The Offer does not reflect the stand-alone value of Engelhard

2)

The Offer is opportunistic

3)

The Offer does not reflect sharing of significant potential synergy value of a

combination

4)

The Offer represents a low control premium versus precedent transactions

5)

The Offer values Engelhard at a price below recent trading levels

6)

The exploration of alternatives to maximize value could deliver higher value

than the Offer

7)

The Offer is financially inadequate

3

OFFER DOES NOT FULLY REFLECT STAND-ALONE VALUE OF

ENGELHARD

The Board believes the Offer does not fully reflect the value of the Company’s

businesses, including its strong market positions and future growth prospects

The Board believes the Company has positioned itself to take advantage of

attractive growth opportunities which include:

The Board believes these growth opportunities have not been fully factored into

the long-term EPS growth expectations

EPS Growth Comparison (’06E - ’10E)

Wall Street Equity Research Average 10.5% (1)

Engelhard Management Operating Plan (2) ~ 16.5%

Heavy-Duty Diesel

Personal Care and Cosmetics

Energy and Fuel Materials

Pricing and sustainable

productivity gains

(1) Source: First Call Wall Street research average as of January 18, 2006.

(2) Developed in strategic planning process August, 2005. See Appendix for key assumptions.

4

5

Differential

-4.1x

Average

Differential

2005 Average

2004 Average

2003 Average

-1.5x

-0.2x

-1.1x

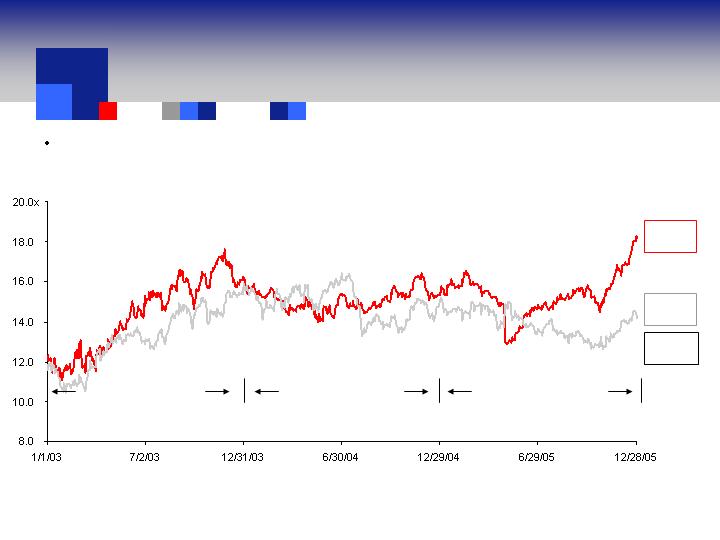

P/E Multiple – Forward 12 months (1)

Engelhard

14.1x

Johnson

Matthey

18.2x

(1) Source: Factset.

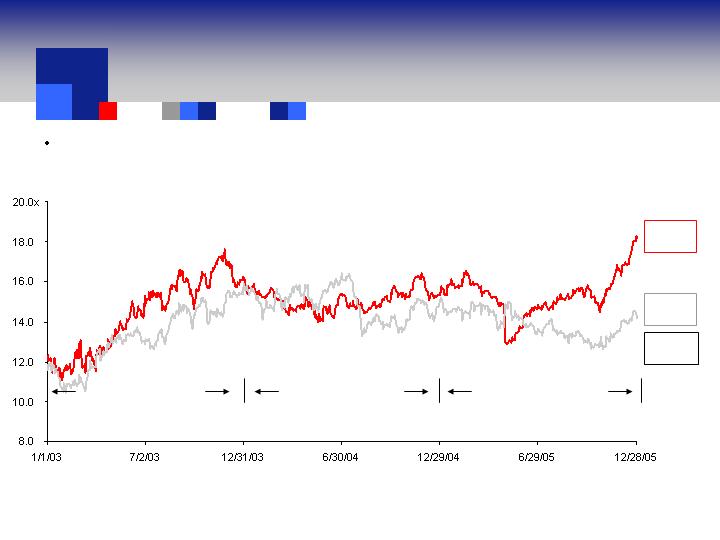

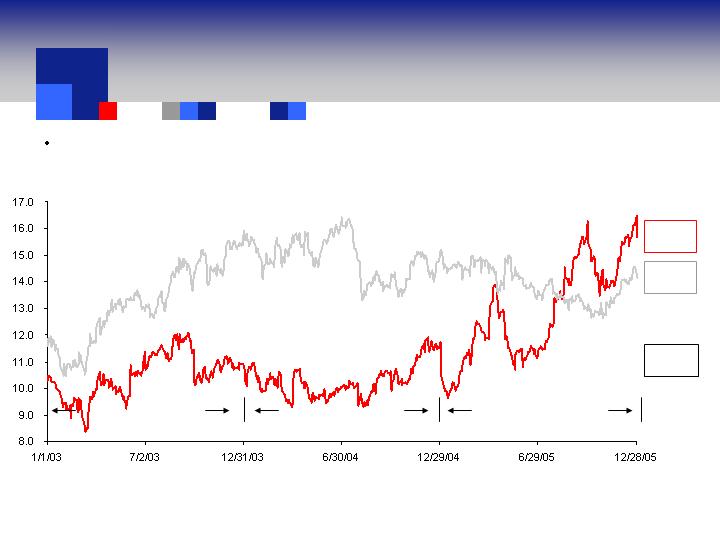

The BASF Offer was made at a time when Engelhard’s P/E multiple was at one of its

lowest relative points in 3 years compared to Johnson Matthey

OFFER IS OPPORTUNISTIC

6

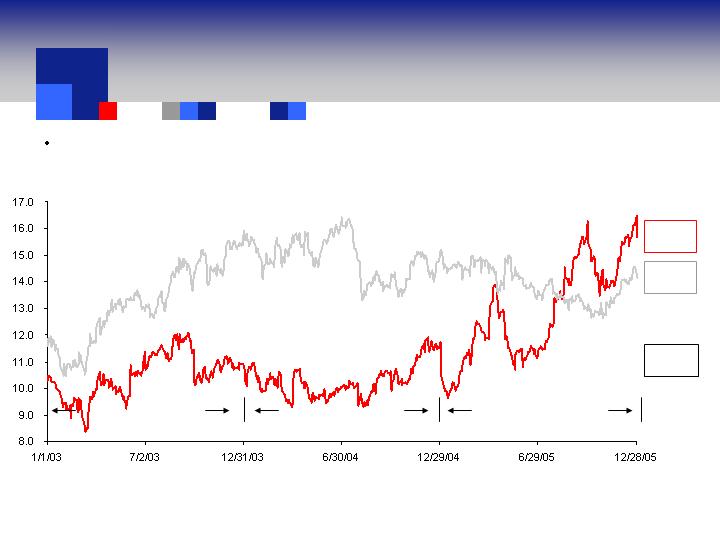

Differential

-1.6x

Average

Differential

2005 Average

2004 Average

2003 Average

1.0x

4.6x

2.7x

P/E Multiple – Forward 12 months (1)

Engelhard

14.1x

Umicore

15.7x

(1) Source: Factset.

The BASF Offer was made at a time when Engelhard’s P/E multiple was at one of its

lowest relative points in 3 years compared to Umicore

OFFER IS OPPORTUNISTIC

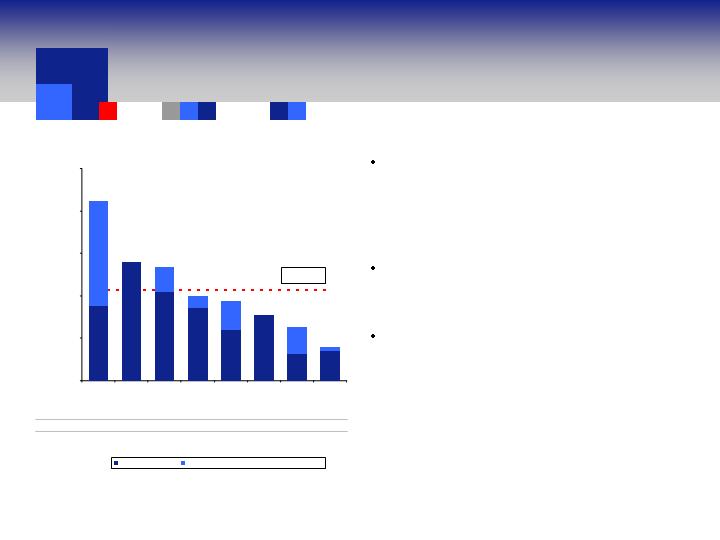

OFFER DOES NOT REFLECT SHARING OF SIGNIFICANT

POTENTIAL SYNERGY VALUE

BASF indicated privately that it did not

factor synergies into its price due to

uncertainties in achieving synergies in M&A

situations (2)

BASF stated publicly it only sees “modest

synergies”

The Board believes the synergy

opportunity available to BASF is significant

based on management estimates and a

review of precedent transactions

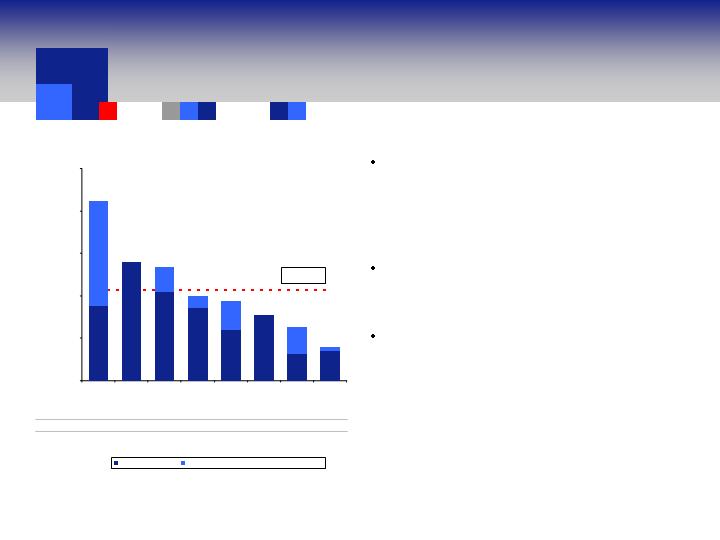

Announced Cost Savings as % of Sales (1)

(1) Represents average of total realized (or revised target) synergies as a % of sales. For recent transactions (Crompton/Great Lakes Chemical and Lubrizol/Noveon), represents revised target synergies.

(2) See Summary of Principal Events, page 2.

7

Additional Realized (or Revised Target) Synergies

Announced Synergies

Noveon

Lubrizol /

/ Witco

& Knowles

Crompton

Morton

Hass /

Rohm and

Chemical

Lakes

/ Great

Crompton

Dearborn

Betz-

Hercules /

Lilly

Valspar /

Allen

Boake

IFF / Bush

Carbide

Union

Dow /

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

0.5%

3.5%

3.2%

3.5%

1.4%

2.9%

12.4%

3.1%

5.9%

8.6%

10.4%

8.8%

Acquiror /

Target

Date Aug-99 Sep-00 Jun-00 Jul-98 Mar-05 Feb-99 Jun-99 Apr-04

Transaction

Value ($M) $11,670 $974 $975 $2,957 $1,800 $4,857 $2,029 $1,840

Mean: 10.7%

4.0%

6.3%

7.7%

9.4%

10.0%

13.3%

14.0%

21.2%

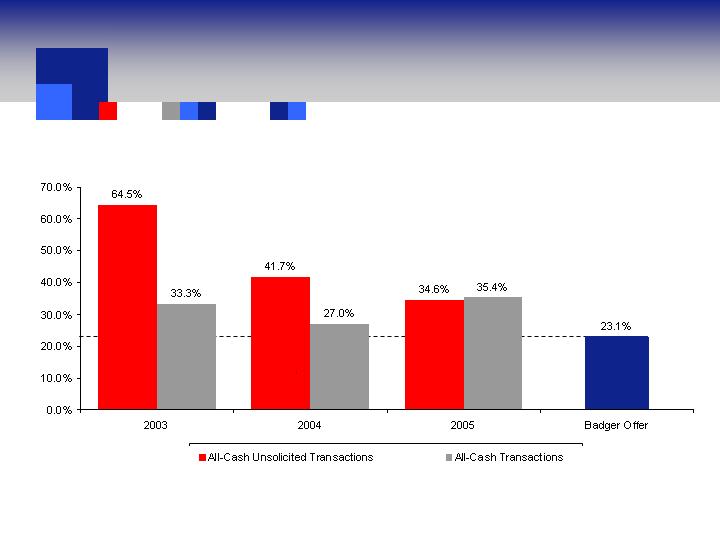

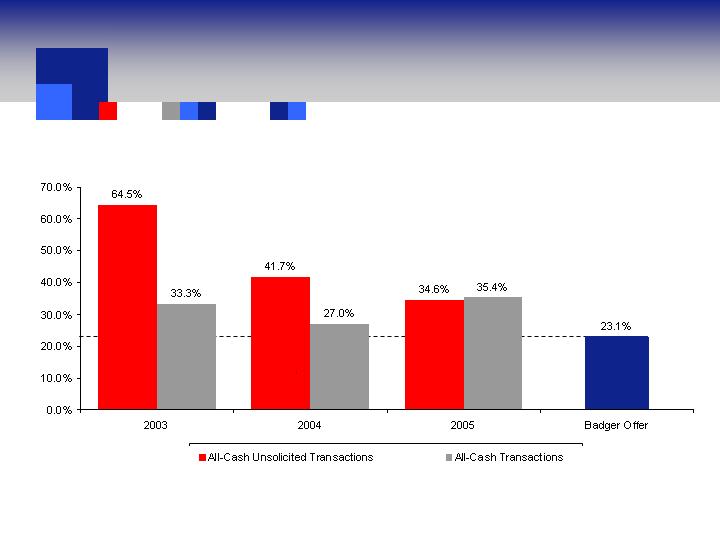

OFFER REPRESENTS A LOW CONTROL PREMIUM VERSUS

PRECEDENT TRANSACTIONS

BASF Offer represents a premium of 22.7% and 23.1% for 1-day and 4-weeks prior to

announcement (1)

Source: SDC Platinum.

(1) January 3, 2006 is the day on which the BASF offer was publicly announced.

(2) Represents average premium offered in transactions above $1 billion versus target share price 4 weeks prior to announcement, for deals completed in 2003, 2004 and 2005.

Excludes premiums of announcements subsequently withdrawn.

(3) Based on Engelhard closing share price of $30.06 on December 6, 2005, 4 weeks prior to BASF’s unsolicited proposal.

8

(3)

(2)

(2)

EXPLORATION OF ALTERNATIVES TO MAXIMIZE VALUE COULD

DELIVER HIGHER VALUE THAN OFFER

Your Board is focused on aggressively exploring strategic alternatives to

maximize stockholder value

This strategy may include a sale of the entire company

The Board has retained Merrill Lynch & Co. to assist in the review of these

alternatives

The Board believes that alternatives to the Offer could provide stockholders

with greater value

The Board believes that tendering into

the Offer before the Board and its advisors have had

the opportunity to fully explore alternatives could

interfere with the ability of the Board to effect a

financially superior alternative

9

STAND-ALONE BUSINESS HIGHLIGHTS

Engelhard is one of the largest surface and materials science companies in the world

The Company has made significant investments in recent years in both organic

growth initiatives and strategic acquisitions

Engelhard has demonstrated a strong commitment to R&D

Engelhard has streamlined its business portfolio and used the proceeds to invest in

higher-margin businesses

Over the last several years, Engelhard has exited legacy precious-metal

fabrication businesses

Engelhard is expected to benefit from numerous global trends over the next several

years which include:

Significant increase in demand projected for sophisticated emission-control

technologies as more stringent regulatory guidelines take effect globally

Worldwide growing demand for energy, energy-related materials and

environmentally friendly fuels

10

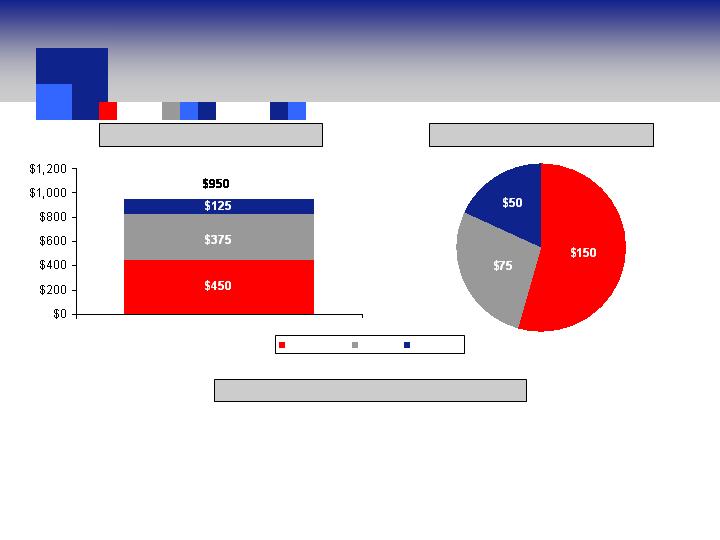

11

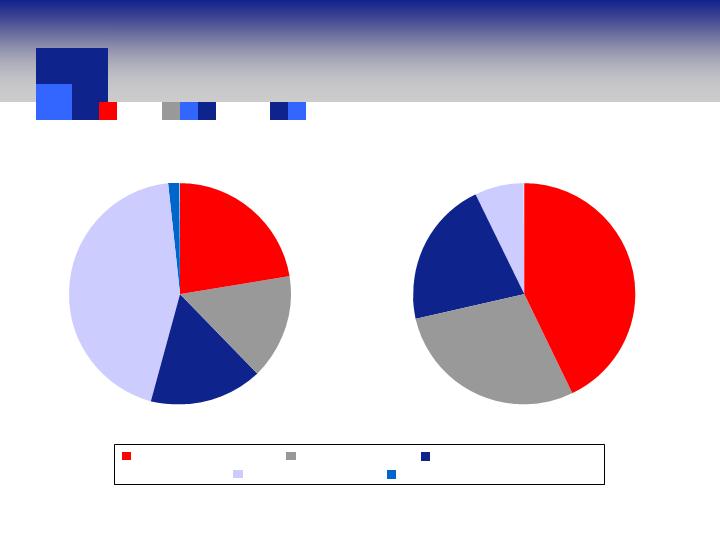

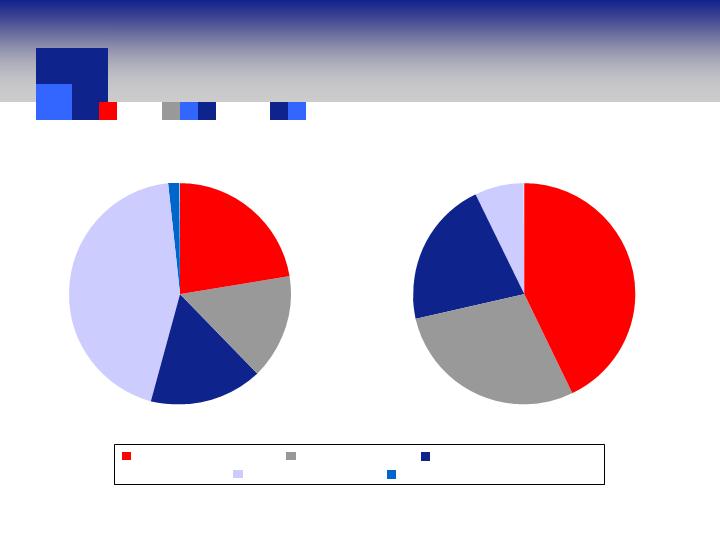

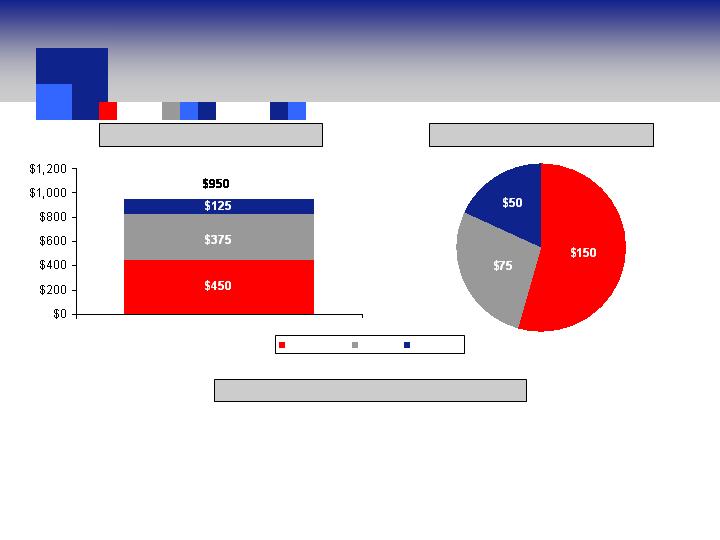

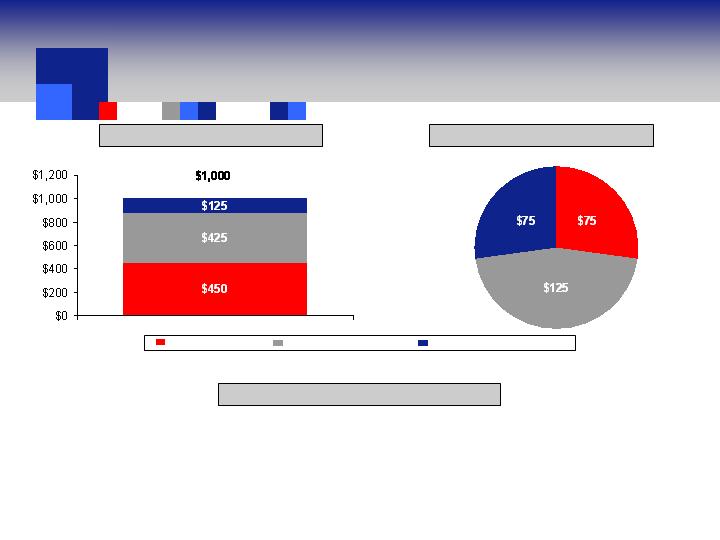

29%

$100

43%

$150

21%

$75

7%

$25

15%

$675

2%

$75

23%

$1,000

16%

$725

44%

$1,950

Appearance & Performance Tech.

Environmental Technologies

Process Technologies

Materials Services

Ventures

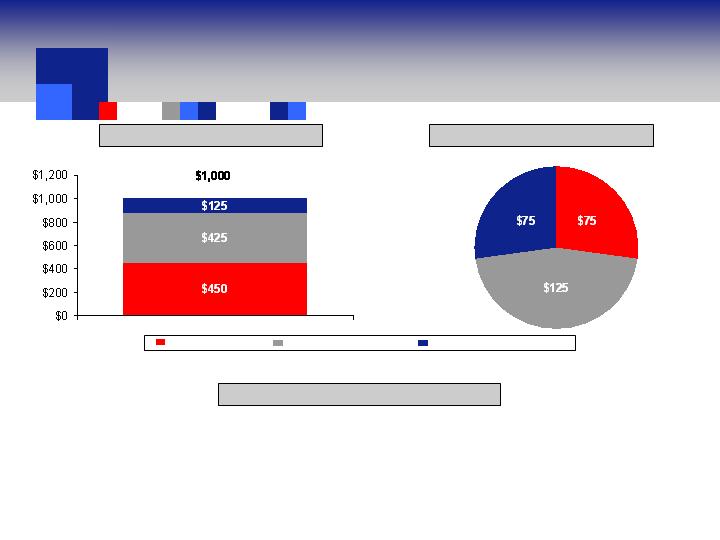

OVERVIEW OF THE BUSINESS SEGMENTS

Engelhard technology platforms enable growth in expanding markets

2005E Sales: $4,425mm (1)

2005E Operating Earnings: $350mm (1) (2)

Note: Dollars in millions, rounded to the nearest $25 million.

(1) 2005E financial information is based on Wall Street equity research, and in addition incorporates Ventures, which is based on guidance from Engelhard Management.

(2) Operating earnings does not include unallocated corporate expense.

12

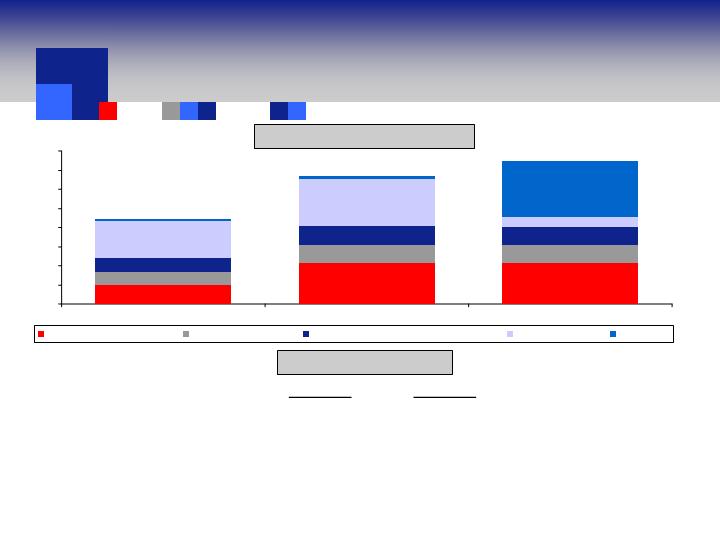

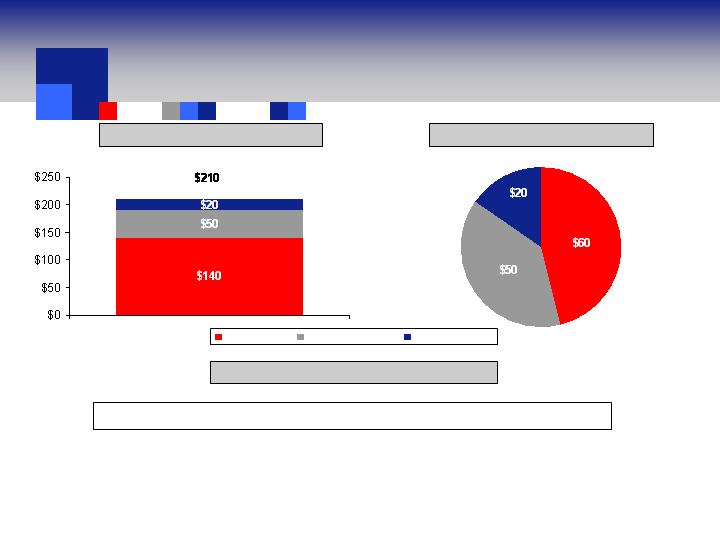

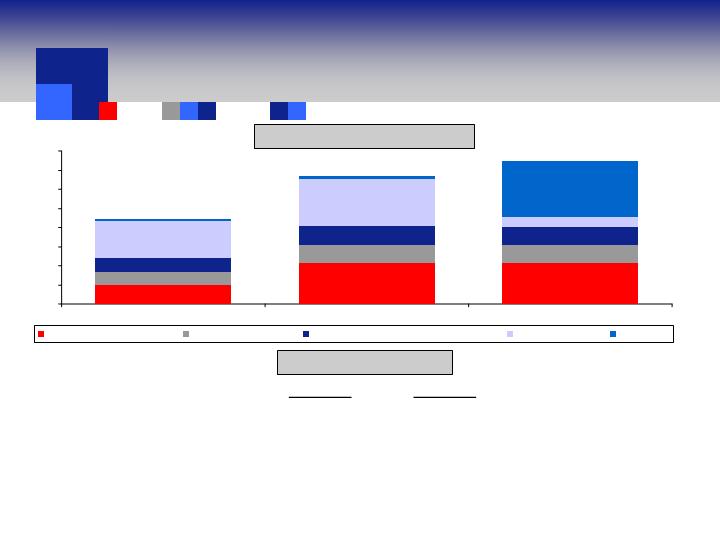

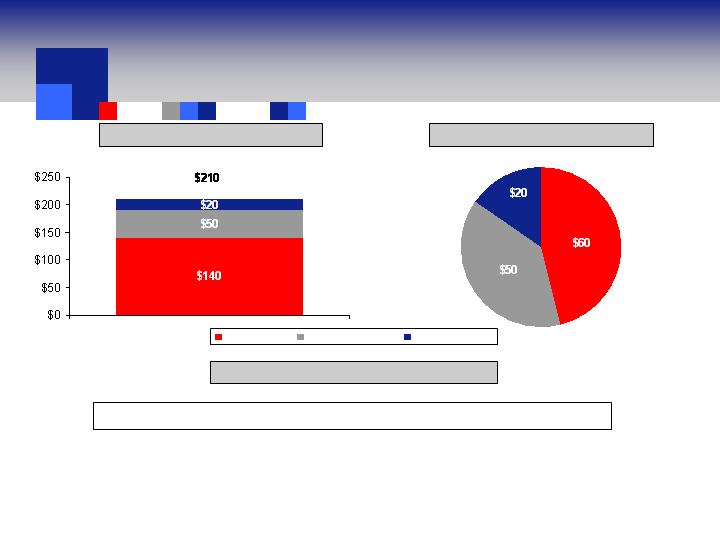

$1,000

$2,125

$950

$1,000

$1,950

$2,425

$675

$725

$200

$75

16%

7%

7%

4%

22%

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

2005E

2010E

'05E-'10E CAGR

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

$4,425

$6,700

9%

(3)

$3.95

(4)

$1.94

EPS

10.6%

7.9%

Oper. Earnings Margin

$6,700

$4,425

Sales

2010E

2005E

Ventures

Materials Services

Appearance & Performance Technologies

Process Technologies

Environmental Technologies

(1)

2005E financial information is based on Wall Street equity research and Ventures data as per Engelhard management guidance. 2010E financial information based on

Engelhard Management Operating Plan estimates developed in August, 2005. See Appendix for key assumptions. All financial information rounded to the nearest $25mm.

(2) Financial numbers includes Ventures segment (reported in the Company’s “All Other” category).

(3) Operating earnings does not include unallocated corporate expense.

(4) Source: First Call as of January 23, 2006.

Key Financial Targets (2)

$’s in Millions

Engelhard 5 Year Sales Target (1)

5-YEAR GROWTH AND MARGIN TARGETS

FINANCIAL GOALS / EXPECTATIONS

2006 (1)

Double digit earnings growth from Technology Segments

$100+ million free cash flow

13% return on average total capital

Maintain financial flexibility

2006-2010 (1)

EPS growth of approximately 16.5%

Over 300 Bps Operating Margin improvement

Revenues 8% CAGR

Cumulative Free Cash Flow $500+ million

ROAC 14%-15%

(1) Based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions.

13

ENVIRONMENTAL TECHNOLOGIES

OVERVIEW

Marketing Cost-effective

Compliance

Global presence; diverse

markets & customers

Increasingly stringent

environmental regulations

Technology-driven

products and processes

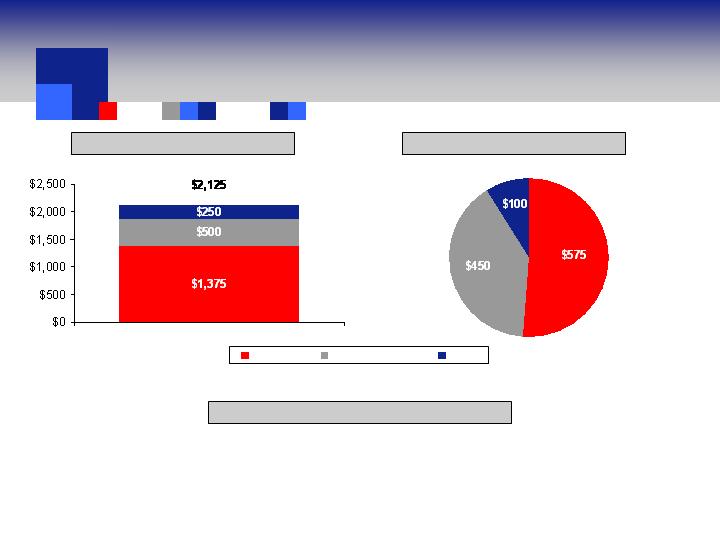

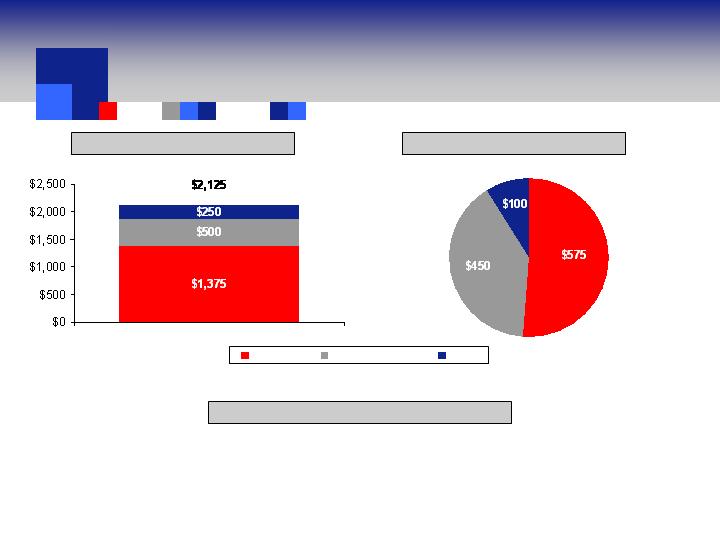

Sales $1,000 $2,125

’06E - ’10E Operating

Earnings Growth

Note: Dollars in millions. All financial information rounded to nearest $25 million and includes pass-through of substrates for

medium and heavy-duty diesel.

(1) 2005E financial information is based on Wall Street equity research.

(2) 2010E financial information is based on Engelhard Management Operating Plan estimates developed August, 2005.

See Appendix for key assumptions.

2005E (1)

2010E (2)

Low teens

14

Note: Above 2010E financial information based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions.

Numbers rounded to the nearest $25mm.

(1) Other includes retrofit, motorcycle, other mobile sources, stationary and EMS.

(2) Percentage numbers are 2005E-2010E CAGR of the respective market.

ENVIRONMENTAL TECHNOLOGIES -

FINANCIAL TARGETS

$1,125

Incremental Sales from ’05E to ’10E (2)

2010E Sales Target

2010E Operating Earnings Target of $250 million

Other (1)

Heavy Duty Diesel

Automotive

58%

11%

11%

15

ENVIRONMENTAL TECHNOLOGIES – GROWTH OPPORTUNITIES

Increasingly stringent regulations around the world

Approximately 70% operating earnings growth in the heavy-duty diesel market (1)

Technology leadership position

Specific strengths in engine and catalyst technology

Expansion into a broad range of developing markets and geographies

Sustainable productivity gains

Great levels of compliance with existing regulations

Engelhard’s base global auto-catalyst business expected to grow at more than 5%,

excluding medium- and heavy-duty diesel

(1) Based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions.

Environmental Technologies will be a significant driver of growth

16

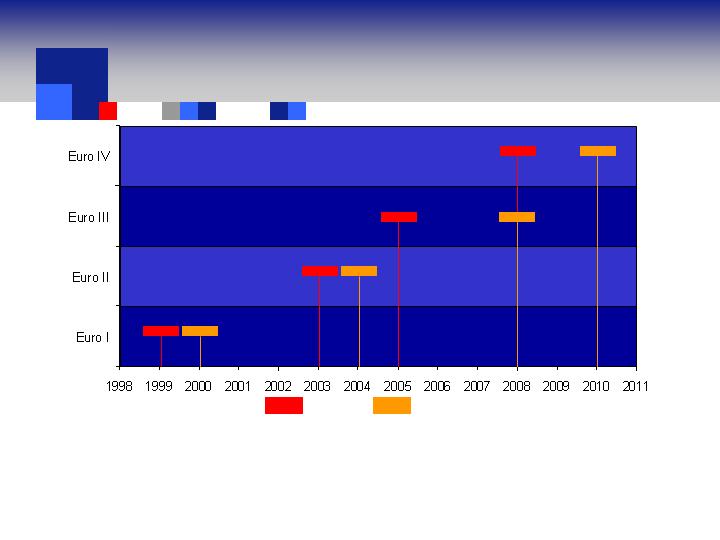

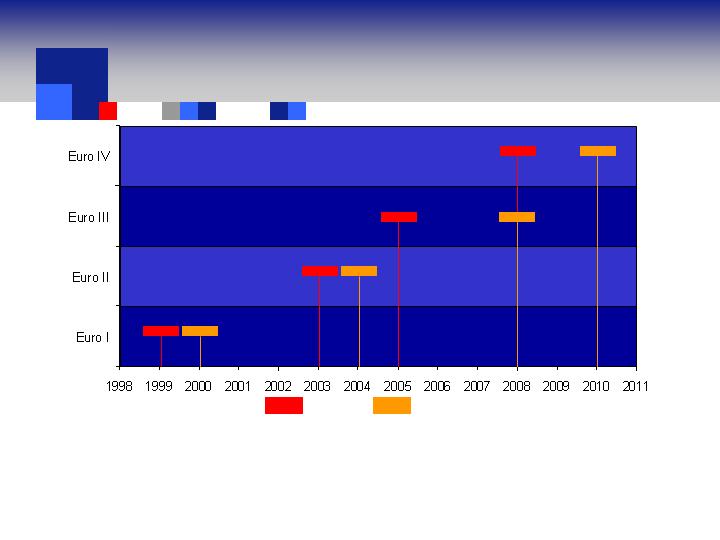

ENVIRONMENTAL TECHNOLOGIES – GROWTH OPPORTUNITIES

INCREASINGLY STRINGENT REGULATIONS

Overview of Upcoming Regulations Calendar

Changes in regulation should fuel double-digit operating earnings growth from 2005 to 2010 for

the segment (1)

17

(1) Based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions.

Regulation Event

Segment Impact

Timing

U.S. Diesel

Market

Medium

-

and Heavy

-

Duty Diesel

Off

-

road Diesel

Medium

-

and Heavy

-

Duty

Diesel

Locomotive and Marine

January 2007

January 2008

January 2010

January 2011

European Diesel

Market

(Euro IV

& Euro V)

Heavy

-

Duty Diesel

–

New models

Heavy

-

Duty Diesel

–

All models

Diesel and Gas Auto

Light

-

Duty Diesel

October 2005

October 2006

January 2008

January 2010

China Diesel

Market

(Euro III & IV)

Light

-

Duty Diesel

Mid 2007 &

Mid 2010

ENVIRONMENTAL TECHNOLOGIES – GROWTH OPPORTUNITIES

EXPANSION INTO DEVELOPING MARKETS AND GEOGRAPHICS

Beijing

Shanghai

Guangzhou

National

Chinese auto market is expected to grow at 20% annually with

Engelhard having a market share of 30% (1)

(1) Source: Based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions.

18

PROCESS TECHNOLOGIES

OVERVIEW

Marketing Process

Productivity

Technology/market

development

Environmental regulations

Value Pricing

Sales $675 $950

’06E - ’10E Operating

Earnings Growth

2005E (1)

2010E (2)

Mid teens

Note: Dollars in millions. All dollar amounts rounded to the nearest $25 million.

(1) 2005E financial information is based on Wall Street equity research.

(2) 2010E financial information is based on Engelhard Management Operating Plan estimates developed August, 2005.

See Appendix for key assumptions.

19

Markets Served

Polyolefins

Refining

Chemical

PROCESS TECHNOLOGIES

20

PROCESS TECHNOLOGIES – GROWTH OPPORTUNITIES

Growth initiatives include:

Increased product offerings to previously unserved refining markets including diesel, distillate and

petrochemical feedstock markets

Continued expansion of the gas-to-liquids market with Fischer-Tropsch and Syngas technology;

continue to leverage those technologies in the emerging gas economy

Expansion into various unserved petrochemical markets based on current commercial agreements

Increased synergies from leveraging DMS technology platform to expand FCC

Leverage Lynx polyolefins success in polyethylene catalyst market

Process Technologies is poised to achieve double-digit operating earnings

growth in 2006 to 2010 (1)

(1) Based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions.

21

PROCESS TECHNOLOGIES -

FINANCIAL TARGETS

2010E Sales Target

$275

Incremental Sales from ’05E to ’10E (2)

Note: Above financial information based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions. Numbers

rounded to the nearest $25mm.

(1) Precious Metals revenues included in Chemicals.

(2) Percentage numbers are 2005E-2010E CAGR of the respective market.

Chemicals (1)

Refining

Polyolefins

8%

5%

11%

2010E Operating Earnings Target of $200 million

22

APPEARANCE & PERFORMANCE TECHNOLOGIES

OVERVIEW

Enabling Marketing of

Enhanced Image &

Functionality

Develop markets

Leverage assets

Enrich product mix

Pricing and sustainable

productivity gains

Sales $725 $1,000

’06E - ’10E

Operating

Earnings Growth

2005E (1)

2010E (2)

Double-digit

Note: Dollars in millions and rounded to the nearest $25 million.

(1) 2005E financial information is based on Wall Street equity research.

(2) 2010E financial information is based on Engelhard Management Operating Plan estimates developed August, 2005.

See Appendix for key assumptions.

23

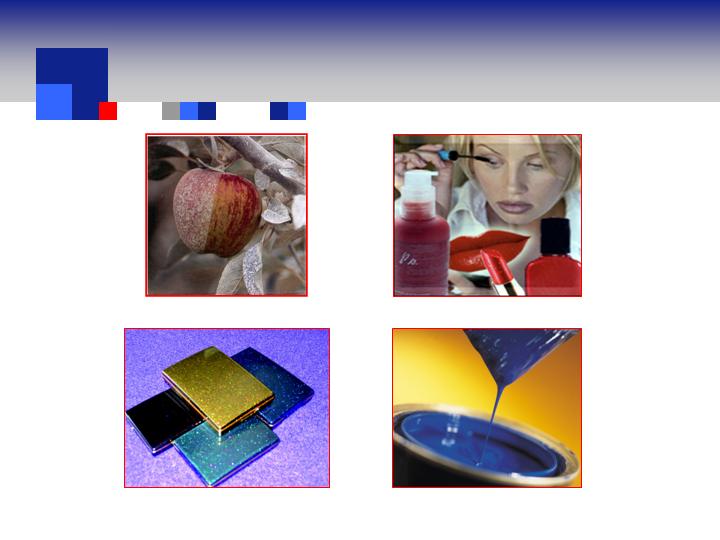

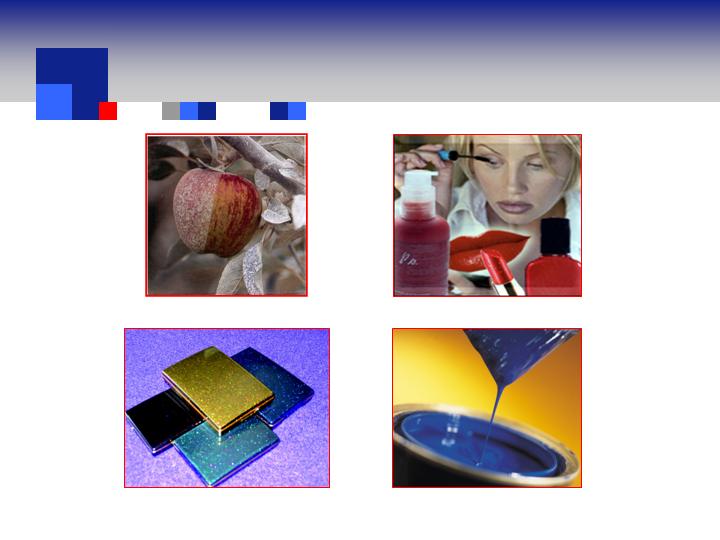

DIVERSE MARKET BASE

Personal Care and Cosmetics

Surround® Crop Protectant

Plastics and Packaging

Paints and Coatings

24

APPEARANCE & PERFORMANCE TECHNOLOGIES –

GROWTH OPPORTUNITIES

Worldwide leadership position in personal care and cosmetics

Expected to achieve double-digit operating earnings growth supported by technology leadership and

strong customer relationships

Growth strategy in personal care meets increased demand from baby boomers

Globalization

Continued growth in world market, especially China

Significant margin improvement in kaolin market

Improved product mix – less dependence on paper

Decreased paper market exposure from 70% in 2000 to 30% in 2006

Kaolin is an important value driver in leveraging Engelhard’s DMS technology platform

Cash-flow generation including tax benefit

Strength in paints and coatings market augmented by penetration in agriculture and construction materials

Differentiation: Offerings allow customization, create self-appeal, improved appearance and functionality

Growth initiatives supported by stable productivity gains and pricing

Appearance & Performance Technologies is positioned for double-digit

growth

25

APPEARANCE & PERFORMANCE TECHNOLOGIES –

FINANCIAL TARGETS

Incremental Sales from ’05E to ’10E (2)

2010E Sales Target

$275

Note: Above financial information based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions.

Numbers rounded to the nearest $25mm.

(1)

Specialty Minerals includes kaolin and attapulgite.

(2)

Percentage numbers are 2005E-2010E CAGR of the respective market.

Specialty Minerals (1)

Effects Materials and Colors

Personal Care Materials

7%

20%

4%

2010E Operating Earnings Target of $175 million

26

VENTURES – GROWTH OPPORTUNITIES

Drive to become the global leading supplier of non-carbon separation and

purification technologies to the gas, fuel and water markets that generate $200

million in revenues in 2010

Oil and gas well stimulation materials allow for earnings growth, given supply

shortages and strong exploration and production activities

Increased cost of fossil fuels will provide growth opportunities in alternative

energy sources including fuel cells, photovoltaics, biofuels and battery materials

Ventures systematically develops adjacent space opportunities that

leverage attractive markets and new technologies

27

VENTURES –

FINANCIAL TARGETS

Incremental Sales from ’05E to ’10E (2)

2010E Sales Target

$130

Note: Above financial information based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions.

Numbers rounded to the nearest $10mm.

(1) Energy Materials includes Proppants and Fuel Cell.

(2)

Percentage numbers are 2005E-2010E CAGR of the respective market.

Alumina/Silica

Energy Materials (1)

Water Treatment

12%

NA

NA

Programs commercialized to date will yield $14 million in operating earnings in 2006

2010E Operating Earnings Target of $40 million

28

MATERIALS SERVICES

OVERVIEW

Enabling Technology

Businesses

$2- $3 million operating

income per quarter; with

upside

High returns on invested

capital

Source of cash

Risk management

Enabler for catalyst sales

Sales $1,950 $2,425

2010E (2)

2005E (1)

Note: Dollars in millions and rounded to the nearest $25 million.

(1) 2005E financial information is based on Wall Street equity research.

(2) 2010E financial information is based on Engelhard Management Operating Plan estimates developed August, 2005. See Appendix for key assumptions.

29

MATERIALS SERVICES – CORE STRENGTHS

Experienced management team with knowledge in specific markets

Assay Services

Inventory management

Logistics and security

Precious-metal-based solutions

Refining and recycling

30

CONCLUSION

After careful consideration, including a thorough review of the BASF Offer with

the Company’s legal and financial advisors, the Board unanimously determined

that the BASF Offer is inadequate and not in the best interests of Engelhard

stockholders (other than BASF and its affiliates)

Engelhard’s business plan, fueled by several different value opportunities, is

expected to generate earnings growth and return on capital in the mid-teens

over the next several years

This growth opportunity is something the Wall Street community has only

begun to appreciate

The BASF Offer, from a variety of value metrics, undervalues the upside in the

Company share price

Tendering into the Offer before the Board and its advisors have had the

opportunity to fully explore alternatives could interfere with the ability of the

Board to effect a financially superior alternative

31

Appendix

32

FORWARD-LOOKING STATEMENT

REGARDING FUTURE PERFORMANCE

The Company does not as a matter of course make detailed public projections as to future performance or earnings. The

projections were not prepared with a view to public disclosure or compliance with the published guidelines of the SEC or the

guidelines established by the American Institute of Certified Public Accountants regarding projections or forecasts. The

projections do not purport to present operations in accordance with accounting principles generally accepted in the U.S. The

Company’s independent accountants have not examined, compiled or otherwise applied procedures to the projections and,

accordingly, do not express an opinion or any other form of assurance with respect to the projections. The Company’s

internal financial forecasts are prepared solely for internal use and capital budgeting and other management decisions and

are subjective in many respects and thus susceptible to interpretations and periodic revisions based on actual experience and

business developments.

The projections also reflect numerous assumptions made by management of the Company with respect to industry

performance, general business, economic, market and financial conditions and other matters, all of which are difficult to

predict and many of which are beyond the Company’s control. Accordingly, there can be no assurance that the assumptions

made in preparing the projections will prove accurate. It is expected that there will be differences between actual and

projected results, and actual results may be materially greater or less than those contained in the projections. The inclusion

of the projections herein should not be regarded as an indication that the Company or its affiliates or representatives

considered or considers the projections herein should be relied upon as such.

Neither the Company nor any of its affiliates or representatives have made or makes any representations to any person

regarding the ultimate performance of the Company compared to the information contained in the projections and none of

them intends to update or otherwise revise the projections to reflect circumstances existing after the date when made or to

reflect the occurrence of future events even in the event that any or all of the assumptions underlying the projections shown

to be in error.

33

KEY ASSUMPTIONS

Environmental Technologies

Light Duty Vehicles

• Light duty vehicle builds will grow globally at 2% over the plan period, from 62 million vehicles in 2005 to 68 million by 2010, driven primarily by increasing living standards in

emerging markets.

• N. America with strictest regulation and largest engines averages almost three catalysts per vehicle. Europe, with increasing penetration rates of catalyzed soot filters (CSF) will

increase to slightly over two catalysts per vehicle. Tightening regulatory standards in developing countries will bring the average in these regions up to one catalyst per vehicle.

• Increasingly strict regulatory standards and fluctuating precious metal pricing will require more advanced technology with related value pricing.

• Net effect of the above is that the global market for light duty emission control catalysts will grow at a 5% CAGR, from $1.5B in 2005 to $1.9B by 2010. Of the $1.9B in 2010,

$1.4B relates to gasoline with the remaining $0.5B relating to light-duty diesel, primarily in Europe.

• Gasoline:

1. Global segment will grow from 103M catalysts in 2005 to 115M by 2010, a 2.2% CAGR, with an average catalyst manufacturing charge of $12/catalyst.

2. N. America and Europe will show minimal growth with Japan and Korea flat. Most of the growth will come from emerging markets, led by China.

3. Stricter regulations will be adopted in the emerging markets over the plan period. China and India will begin Euro 3 this year and Euro 4 by 2008-10. Brazil will adopt a US Tier

2 program in 2009. Russia will begin to implement Euro 2 this year and Euro 3 by 2008.

• Light-duty Diesel:

1. Europe, which accounts for 75% of the market, will grow from 9.4M vehicles in 2005 to almost 12M by 2010, a 5% CAGR. A large percentage of the remaining 25% is

produced in Japan and Korea for export into Europe.

2. The biggest driver for this growth is the diesel penetration rate growing from 46% this year to 50% by 2010.

3. The catalyst market for light-duty diesels in Europe is currently forecasted to be almost $400M by the end of 2010. The largest growth opportunity is the accelerated adoption

rate of CSF’s.

4. Euro 4, which began phasing in 2004 (2005 new platforms) has not been filter (CSF) forcing. However, several European countries became aware that ambient air quality

standards were being exceeded in urban areas, primarily due to particulate matter. Driving restrictions on unfiltered vehicles were discussed as a possible solution which

prompted OEM’s to “voluntarily” install filters.

5. Awareness of particulate matter has forced the EU to accelerate the adoption of Euro 5 for light-duty diesel (now projected for 2009). Euro 5 reduces particulate emissions by

80% vs. Euro 4 and will be filter forcing for a majority of diesel vehicles.

6. Grow EC’s market share in Europe from 24% to 35% by 2008.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005.

34

KEY ASSUMPTIONS

Environmental Technologies (Cont’d)

Heavy-Duty Diesel

• HDD engine demand will increase only 1% per year, from 1.6M engines in 2005 to 1.7M engines in 2010 in the U.S., Europe and Japan.

• However, tightening regulations will increase the catalyst market from 1.4M units in 2005 to 5M units in 2010.

• Revenues (ex-PGM/ex-substrate) are projected to grow from $100M in 2005 to $330M in 2010.

• For On-Road, US 2007 & 2010, Euro 4 & 5 and Japan 2005 & 2009 are “On Track” for implementation.

• Successful fleet testing of US07 emission systems in 2006.

• Non-vanadium SCR will be required in US, Europe and Japan.

• European tax incentive programs will drive early adoption of CSF’s.

• New off-road regulations begin in 2008 and are not included in revenues or earnings estimates.

Stationary Source

• The Food Service market will grow from $3M in 2005 to $10M in 2010 driven by pending charbroiler regulations (2007). Addresses fine particulate control and health and safety

benefits for ventless ovens.

• Successful development of differentiated mercury sorbent technology for coal-fired power plants assumed for 2008-2010.

Temperature Sensing

• Market will grow from $225M in 2005 to $300M in 2010, a CAGR of 6%.

• EC will improve on its 8% market share through three growth strategies:

1. Accelerate optical thermometry commercialization by penetrating new markets.

2. Continue Asia geographic expansion.

3. Add wafer thermocouple technology to complete EC temperature measurement portfolio.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005.

35

KEY ASSUMPTIONS

Process Technologies

Chemicals

• Gas Economy catalyst market forecast to approximate $350M in 2006 with a CAGR of 15%.

• Additional Gas Economy catalyst growth from:

1. Planned expansion from current “gas-to-liquids” (GTL) customer.

2. Leveraging Fischer-Tropsch catalyst technology to other major GTL players.

3. Leverage our syngas position from Nanjing acquisition.

• Successful entry into unserved petrochemical markets, including ethane based styrene, ethane based acetic acid, propane based acrylic acid and propane based propylene

oxide, based on current commercial agreements.

• Growth rates for catalyst markets for oleochemicals, petrochemicals and fine chemicals range from 2% to 10%.

Petroleum Refining

• FCC Additives growth approximating 22%:

1. Underlying market growth of 10%.

2. Additional growth from the expansion into environmental and gasoline conversion additive technologies to meet increasing global demands of propylene and petrochemical

feedstocks and regulatory compliance.

• Entry into new refining market areas by leveraging EC technology through prospective licensing agreements, including hydrocracking, deep catalytic cracking and reforming.

• FCC market growth only projected at 2% with additional income from productivity gains.

• Natural gas price used was $7.25 per MMBTU. Adverse variances are expected to be substantially covered by surcharges and other pricing actions.

Polyolefins

• Polypropylene growth approximating 26%:

1. Assumed growth of 7% in proprietary catalyst representing underlying market growth of 5-6% and remaining growth through differentiation and acceleration of our technology

development into the packaging and film markets.

2. Growth in volume from new licenses.

• Continuation of entry into polyethylene market.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005.

36

KEY ASSUMPTIONS

Appearance and Performance Technologies

Personal Care Materials

• 7% growth per year in delivery systems for personal care through 2009. In the case of commodity vitamins (30% of market) where we don’t participate, the rate is 5%. For more

specialized actives, such as unique extracts from plants, the growth rate is closer to 10%.

• Additional revenues/earnings from expanding the product offerings globally from the acquisitions made in the U.S. and France in 2004 and 2005.

• Additional earnings from optimizing synergies in technology, manufacturing and sales as we continue to integrate the two acquisitions.

Effects

• Market for effects pigments in cosmetics and personal care will grow at 7% per year. The market growth rate for industrial applications will be 4-5%. Growth in the automotive

market will be lower.

• Expanding our innovation track into new programs beyond mica and borosilicate glass, bismuth and film by focusing R&D on technology platforms and away from line extensions

will add $15M to revenues.

• Cost reductions will add $10M to earnings by 2010.

• Faster innovation and an applications lab in China will work to counter Chinese competition. As well as paying attention to costs.

Kaolin

• Recover $10M in revenue and $4M in earnings from strikes in Finland and Canada.

• $24M in revenue in 2010 from Décor Growth Program (decorative laminate paper market with substitution for TiO2).

• Crop Protectants (Surround) will add $28M of revenues and $10M of earnings by 2010.

• Cost reduction initiatives will add $12M in earnings.

• Natural gas price used was $7.25 per MMBTU. Adverse variances are expected to be substantially covered by surcharges and other pricing actions.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005.

37

KEY ASSUMPTIONS

Ventures

Alumina business acquired in 2005 accounts for $12M of 2010 operating earnings with modest growth rates.

• Frac Sand accounts for $9M of 2010 operating earnings and depends mostly on continued demand from the energy sector.

• Aseptrol/Water Treatment are slated to generate $7M of operating earnings related to health requirements.

• Nothing included in revenues and earnings for Ceramic Proppants and Battery Materials programs.

Corporate

• Share buy-back programs, enabled by operating cash flows, will offset the dilutive impact of employee benefit plans. Diluted shares outstanding

for Operating Plan period are 122 million.

• The average effective tax rate for the Operating Plan period is 23%, with the 2010 period at 24%.

• Equity earnings from the Company’s equity method joint ventures, which primarily serve the Japanese and Korean automotive catalyst markets,

have conservatively been held constant throughout the plan period, despite a 25% CAGR over the past three years.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005.

38