Environmental Technologies

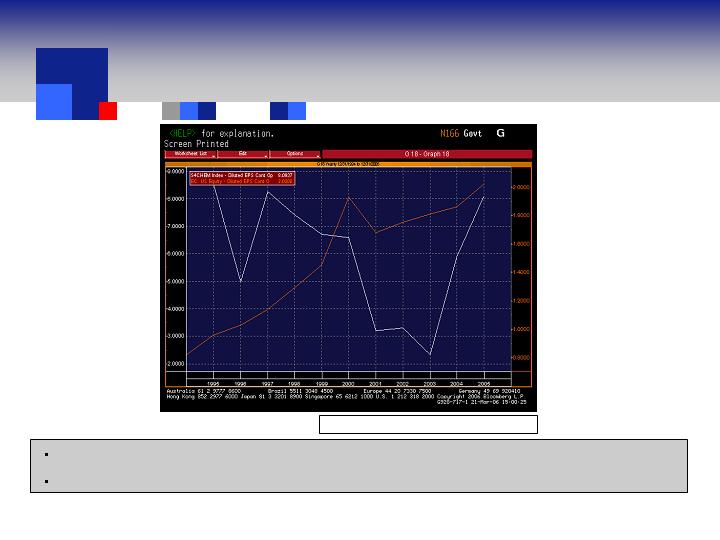

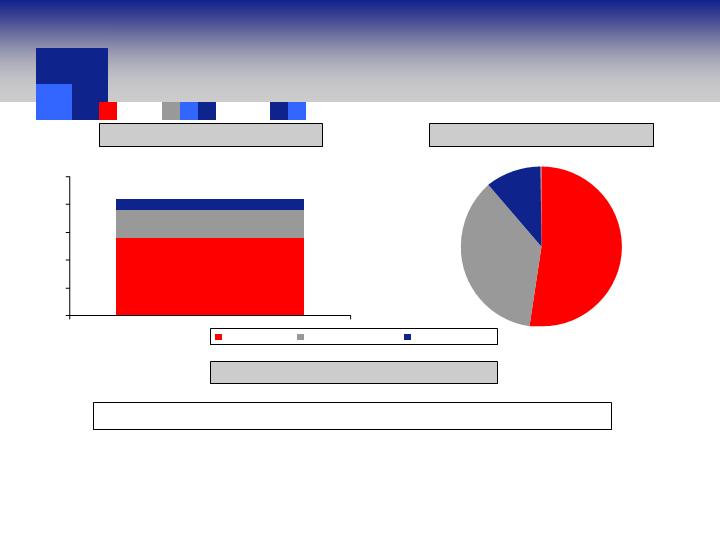

Light Duty Vehicles

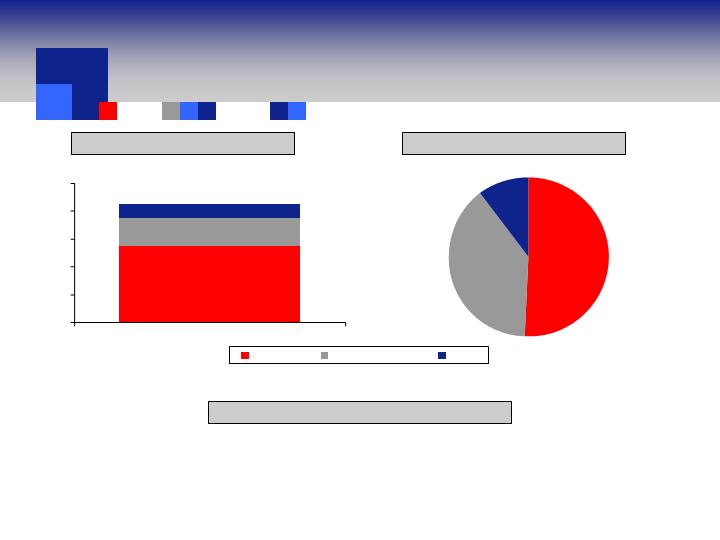

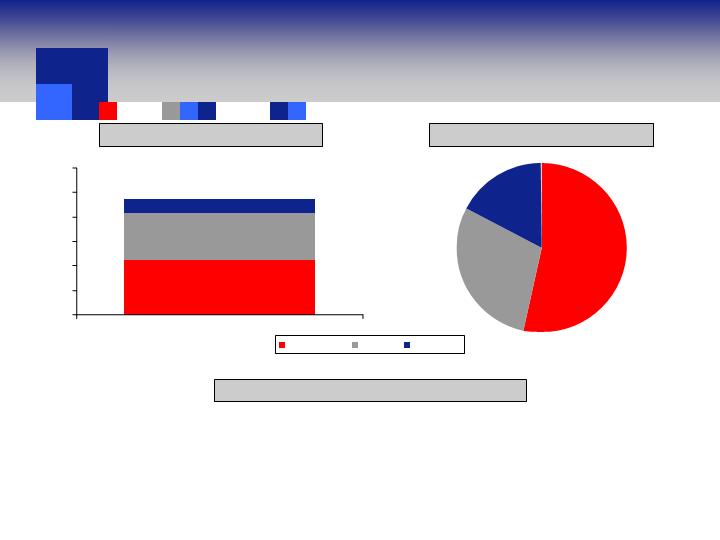

• Light duty vehicle builds will grow globally at 2% over the plan period, from 62 million vehicles in 2005 to 68 million by 2010, driven primarily by increasing living

standards in emerging markets.

• N. America with strictest regulation and largest engines averages almost three catalysts per vehicle. Europe, with increasing penetration rates of catalyzed

soot filters (CSF) will increase to slightly over two catalysts per vehicle. Tightening regulatory standards in developing countries will bring the average in these

regions up to one catalyst per vehicle.

• Increasingly strict regulatory standards and fluctuating precious metal pricing will require more advanced technology with related value pricing.

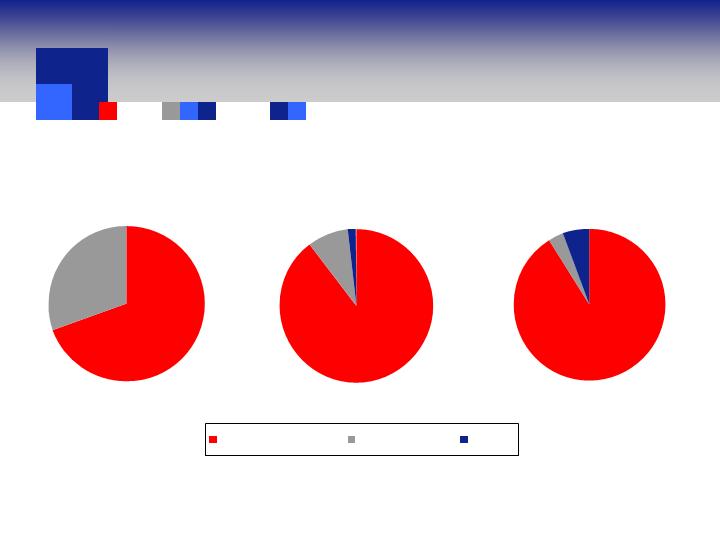

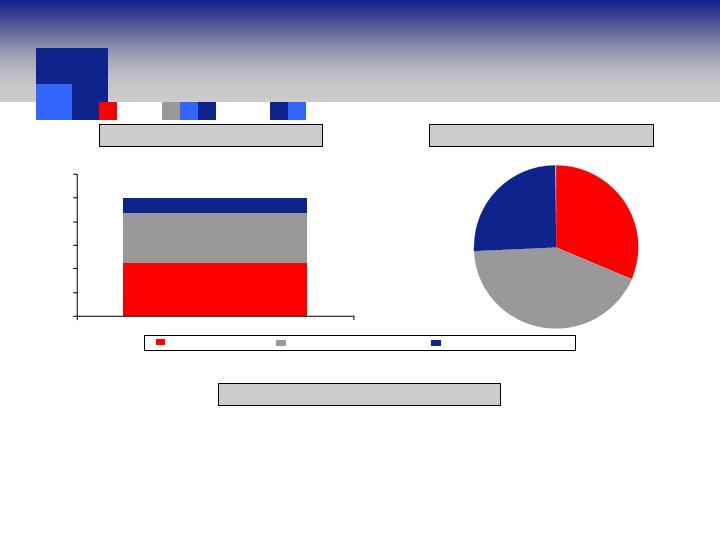

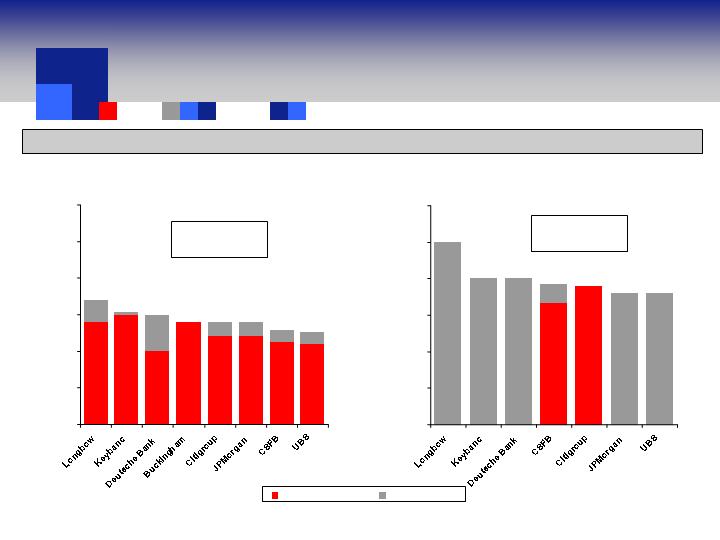

• Net effect of the above is that the global market for light duty emission control catalysts will grow at a 5% CAGR, from $1.5B in 2005 to $1.9B by 2010. Of the

$1.9B in 2010, $1.4B relates to gasoline with the remaining $0.5B relating to light-duty diesel, primarily in Europe.

• Gasoline:

1. Global segment will grow from 103M catalysts in 2005 to 115M by 2010, a 2.2% CAGR, with an average catalyst manufacturing charge of $12/catalyst.

2. N. America and Europe will show minimal growth with Japan and Korea flat. Most of the growth will come from emerging markets, led by China.

3. Stricter regulations will be adopted in the emerging markets over the plan period. China and India will begin Euro 3 this year and Euro 4 by 2008-10. Brazil

will adopt a US Tier 2 program in 2009. Russia will begin to implement Euro 2 this year and Euro 3 by 2008.

• Light-duty Diesel:

1. Europe, which accounts for 75% of the market, will grow from 9.4M vehicles in 2005 to almost 12M by 2010, a 5% CAGR. A large percentage of the

remaining 25% is produced in Japan and Korea for export into Europe.

2. The biggest driver for this growth is the diesel penetration rate growing from 46% this year to 50% by 2010.

3. The catalyst market for light-duty diesels in Europe is currently forecasted to be almost $400M by the end of 2010. The largest growth opportunity is the

accelerated adoption rate of CSF’s.

4. Euro 4, which began phasing in 2004 (2005 new platforms) has not been filter (CSF) forcing. However, several European countries became aware that

ambient air quality standards were being exceeded in urban areas, primarily due to particulate matter. Driving restrictions on unfiltered vehicles were

discussed as a possible solution which prompted OEM’s to “voluntarily” install filters.

5. Awareness of particulate matter has forced the EU to accelerate the adoption of Euro 5 for light-duty diesel (now projected for 2009). Euro 5 reduces

particulate emissions by 80% vs. Euro 4 and will be filter forcing for a majority of diesel vehicles.

6. Grow Engelhard’s market share in Europe from 24% to 35% by 2008.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005.

Appendix

Financial Assumptions

Key Assumptions

57

Environmental Technologies (Cont’d)

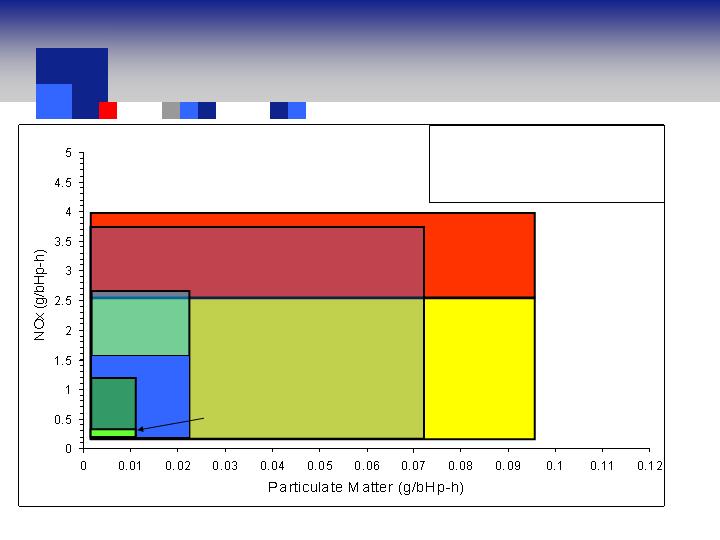

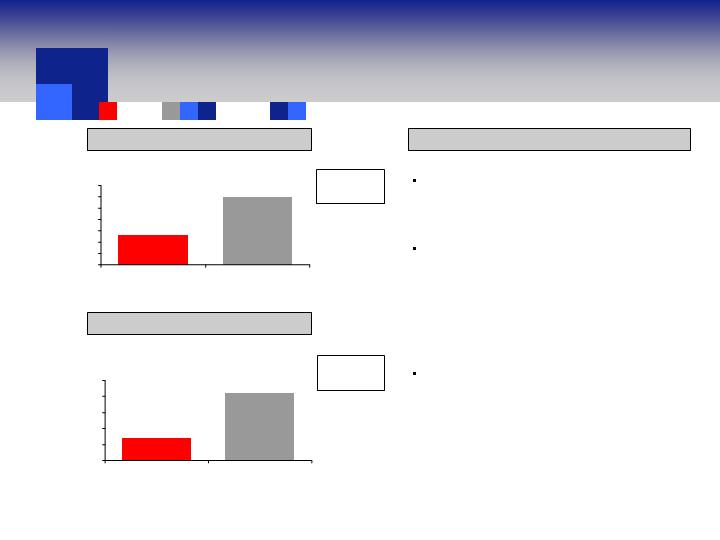

Heavy-Duty Diesel (HDD)

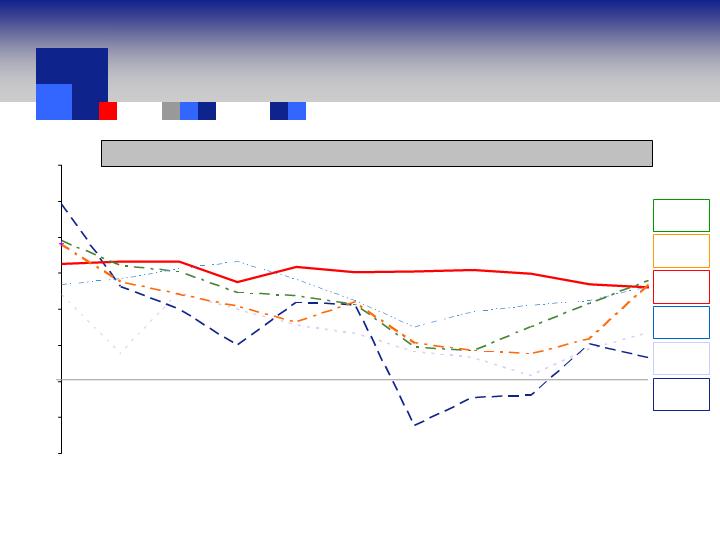

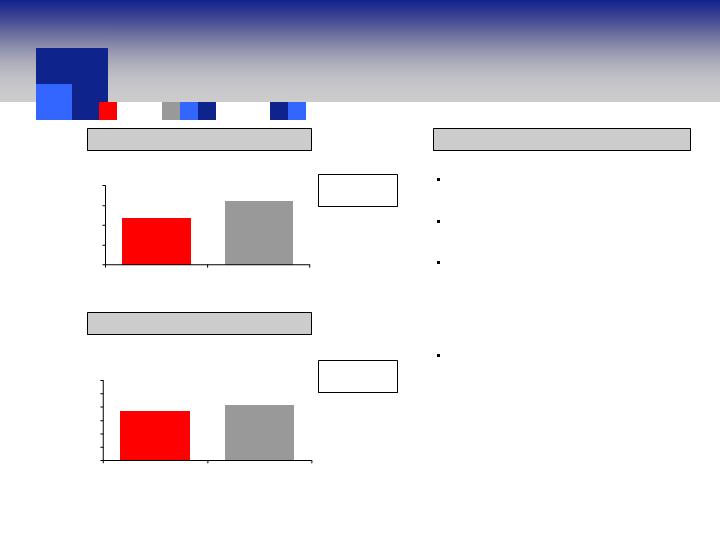

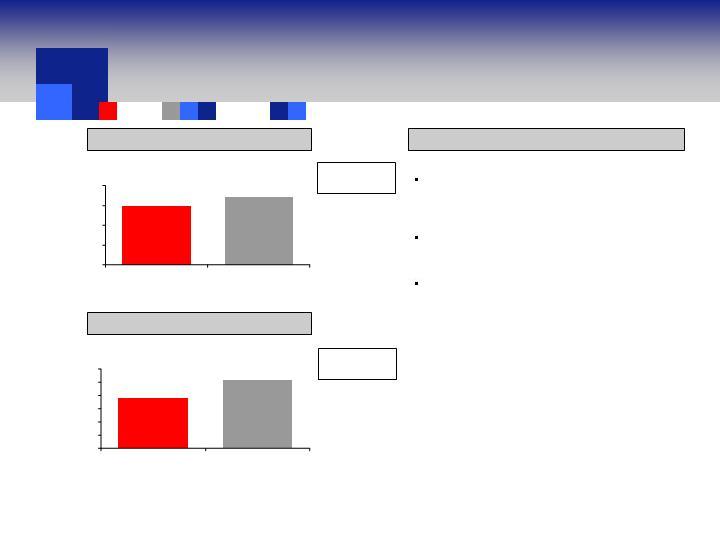

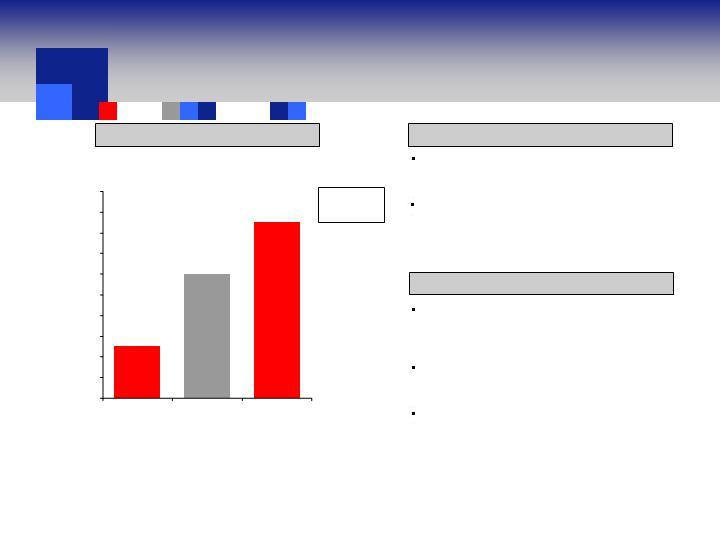

• HDD engine demand will increase only 1% per year, from 1.6M engines in 2005 to 1.7M engines in 2010 in the U.S., Europe and Japan.

• However, tightening regulations will increase the catalyst market from 1.4M units in 2005 to 5M units in 2010.

• Market Revenues (ex-PGM/ex-substrate) are projected to grow from $100M in 2005 to $330M-$370M in 2010.

• For On-Road, US 2007 & 2010, Euro 4 & 5 and Japan 2005 & 2009 are “On Track” for implementation.

• Successful fleet testing of US07 emission systems in 2006.

• Non-vanadium SCR will be required in US, Europe and Japan.

• European tax incentive programs will drive early adoption of CSF’s.

• New off-road regulations begin in 2008 and are not included in sales or earnings estimates.

Stationary Source

• The Food Service market will grow from $3M in 2005 to $10M in 2010 driven by pending charbroiler regulations (2007). Addresses fine particulate control and health and safety

benefits for ventless ovens.

• Successful development of differentiated mercury sorbent technology for coal-fired power plants assumed for 2008-2010.

Temperature Sensing

• Market will grow from $225M in 2005 to $300M in 2010, a CAGR of 6%.

• Engelhard will improve on its 8% market share through three growth strategies:

1. Accelerate optical thermometry commercialization by penetrating new markets.

2. Continue Asia geographic expansion.

3. Add wafer thermocouple technology to complete Engelhard temperature measurement portfolio.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005.

Appendix

Financial Assumptions

Key Assumptions

58

Appendix

Financial Assumptions

Key Assumptions

Process Technologies

Chemicals

• Gas Economy catalyst market forecast to approximate $350M in 2006 with a CAGR of 15%.

• Additional Gas Economy catalyst growth from:

1. Planned expansion from current “gas-to-liquids” (GTL) customer.

2. Leveraging Fischer-Tropsch catalyst technology to other major GTL players.

3. Leverage our syngas position from Nanjing acquisition.

• Successful entry into unserved petrochemical markets, including ethane based styrene, ethane based acetic acid, propane based acrylic acid and propane based propylene

oxide, based on current commercial agreements.

• Growth rates for catalyst markets for oleochemicals, petrochemicals and fine chemicals range from 2% to 10%.

Petroleum Refining

• FCC additives growth approximating 22%:

1. Underlying market growth of 10%.

2. Additional growth from the expansion into environmental and gasoline conversion additive technologies to meet increasing global demands of propylene and petrochemical

feedstocks and regulatory compliance.

• Entry into new refining market areas by leveraging Engelhard technology through prospective licensing agreements, including hydrocracking, deep catalytic cracking and

reforming.

• FCC market growth only projected at 2% with additional income from productivity gains.

• Natural gas price used was $7.25 per MMBTU. Adverse variances are expected to be substantially covered by surcharges and other pricing actions.

Polyolefins

• Polypropylene growth approximating 26%:

1. Assumed growth of 7% in proprietary catalyst representing underlying market growth of 5-6% and remaining growth through differentiation and acceleration of our technology

development into the packaging and film markets.

2. Growth in volume from new licenses.

• Continuation of entry into polyethylene market.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005.

59

Appendix

Financial Assumptions

Key Assumptions

Appearance and Performance Technologies

Personal Care Materials

• 7% growth per year in delivery systems for personal care through 2009. In the case of commodity vitamins (30% of market) where Engelhard does not participate, the rate is 5%.

For more specialized actives, such as unique extracts from plants, the growth rate is closer to 10%.

• Additional sales/earnings from expanding the product offerings globally from the acquisitions made in the U.S. and France in 2004 and 2005.

• Additional earnings from optimizing synergies in technology, manufacturing and sales as Engelhard continues to integrate the two acquisitions.

Effects

• Market for effect pigments in cosmetics and personal care will grow at 7% per year. The market growth rate for industrial applications will be 4-5%. Growth in the automotive

market will be lower.

• Expanding Engelhard’s innovation track into new programs beyond mica and borosilicate glass, bismuth and film by focusing R&D on technology platforms and away from line

extensions will add $15M to sales.

• Cost reductions will add $10M to earnings by 2010.

• Faster innovation and an applications lab in China will work to counter Chinese competition, as well as pay attention to costs.

Kaolin

• Recover $10M in sales and $4M in earnings from strikes in Finland and Canada.

• $20M in sales in 2010 from Décor Growth Program (decorative laminate paper market with substitution for TiO2).

• Crop Protectants (Surround) will add $32M of sales and $10M of earnings by 2010.

• Cost reduction initiatives will add $12M in earnings.

• Natural gas price used was $7.25 per MMBTU. Adverse variances are expected to be substantially covered by surcharges and other pricing actions.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005.

60

Appendix

Financial Assumptions

Key Assumptions

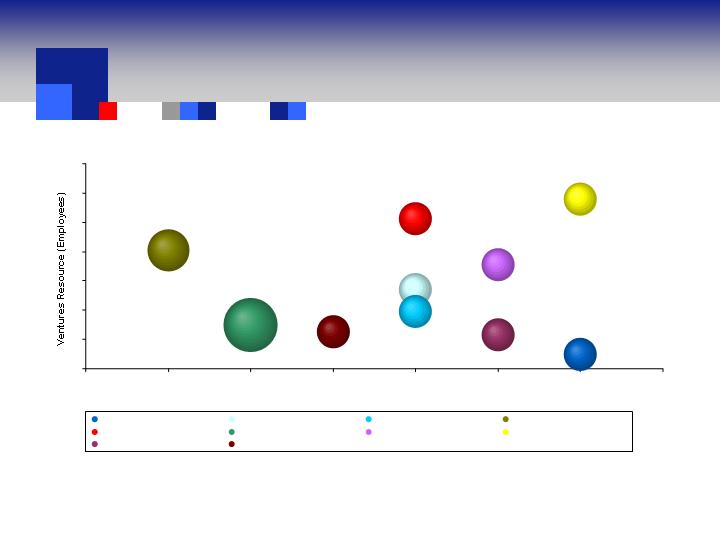

Ventures

Alumina business acquired in 2005 accounts for $12M of 2010 operating earnings with modest growth rates.

• Frac Sand accounts for $9M of 2010 operating earnings and depends mostly on continued demand from the energy sector.

• Aseptrol/Water Treatment are slated to generate $7M of operating earnings related to health requirements.

• Nothing included in sales and earnings for Ceramic Proppants and Battery Materials programs.

Corporate

• Share buy-back programs, enabled by operating cash flows, will offset the dilutive impact of equity-based awards under employee benefit plans. Diluted shares outstanding for

Operating Plan period are 122 million.

Share buy-back programs, enabled by operating cash flows, will offset the dilutive impact of equity-based awards under employee benefit plans. Diluted shares outstanding post-

recapitalization plan are 101 million.

• The average effective tax rate for the Operating Plan period on a standalone basis is 24%, with the 2010 period at 25%.

The average effective tax rate post-recapitalization is 25% with the 2010 period at 26%.

• Equity earnings from the Company’s equity method joint ventures, which primarily serve the Japanese and Korean automotive catalyst markets, have conservatively been held

constant throughout the plan period, despite a 25% CAGR over the past three years.

Note: Based on Engelhard Management Operating Plan estimates developed August, 2005, except post-recapitalization items as noted.

61