| Will I have to pay brokerage commissions if | | If you are a registered stockholder and you tender your |

| I tender my Shares? | | Shares directly to the depositary, you will not incur any |

| | | brokerage commissions. If you hold Shares through a broker, |

| | | dealer, commercial bank, trust company or other nominee, |

| | | we urge you to consult your broker, dealer, commercial bank, |

| | | trust company or other nominee to determine whether |

| | | transaction costs are applicable.See Section 3. |

| |

| What are the United States federal income tax | | Generally, you will be subject to United States federal |

| consequences if I tender my Shares? | | income taxation when you receive cash from us in exchange |

| | | for Shares tendered pursuant to the Offer. The cash received |

| | | in exchange for tendered Shares generally will be treated for |

| | | United States federal income tax purposes either as (1) |

| | | consideration received in respect of a sale or exchange of the |

| | | tendered Shares or (2) a distribution from Engelhard in |

| | | respect of its stock.See Section 14.The payment of cash to |

| | | a Non-U.S. Holder pursuant to the Offer will be subject to |

| | | United States federal income tax withholding at a rate of |

| | | 30%, subject to reduction or exemption if specified |

| | | requirements are met.We urge stockholders to consult their |

| | | own tax advisors to determine the particular tax |

| | | consequences to them of participating in the Offer, |

| | | including the applicability and effect of any state, local or |

| | | non-U.S. tax laws. |

| |

| Will I have to pay any stock transfer tax if | | If you are the registered holder and you instruct the |

| I tender my Shares? | | depositary in the Letter of Transmittal to make the payment |

| | | for the Shares directly to you, then generally you will not |

| | | incur any stock transfer tax.See Section 5. |

| |

| To whom can I talk if I have questions? | | The information agent and the dealer managers can help |

| | | answer your questions. The information agent is MacKenzie |

| | | Partners, Inc., and the dealer managers are J.P. Morgan |

| | | Securities Inc. and Merrill Lynch & Co. Their respective |

| | | contact information is set forth on the back cover page of |

| | | this Offer to Purchase. |

INTRODUCTIONTo the Holders of our Common Stock and Holders of Vested Options:

We invite our stockholders and option holders to tender shares of our common stock, $1.00 par value per share (the “Shares”), together with the associated Series A Junior Participating Preferred Stock Purchase Rights (the “Rights”), issued pursuant to the Rights Agreement, dated October 1, 1998, between the Company and ChaseMellon Shareholder Services, L.L.C., for purchase by us. Each Share is coupled with an associated Right that we will acquire with the Shares. Upon the terms and subject to the conditions set forth in this Offer to Purchase and in the accompanying Letter of Transmittal, we are offering to purchase up to 26,000,000 Shares at a price of $45.00 per share, net to the seller in cash, without interest. We will not pay any additional consideration for the Rights. The number of Shares to be purchased by Engelhard includes Option Shares as described in Section 3. As used in this Offer to Purchase, unless otherwise noted, the term “Shares” includes Option Shares. The Memo to Optionees and Notice of Instructions (Options) (together, the “Optionee Materials”) applicable to Option Shares described in Section 3 are also part of the terms of the Offer.

The Offer will expire at 5:00 p.m., New York City time, on Monday, June 5, 2006, unless extended (such date and time, as the same may be extended, the “Expiration Date”). We may, in our sole discretion, extend the period of time in which the Offer will remain open. Engelhard expressly reserves the right to extend the Offer until the final determination of the election for members of the Board of Directors at the Company’s annual meeting.

We will buy up to 26,000,000 Shares that are properly tendered and not properly withdrawn. However, because of the proration and conditional tender provisions described in this Offer to Purchase, we may not purchase all of the Shares tendered if more than the number of Shares we seek are properly tendered. We will return tendered Shares that we do not purchase to the tendering stockholders at our expense as promptly as practicable after the expiration of the Offer.See Section 1.

Stockholders and option holders must complete the Letter of Transmittal or Optionee Materials, as applicable, in order to properly tender Shares.

We will pay the purchase price, net to the tendering stockholders in cash, without interest, for all Shares that we purchase in the Offer. Tendering stockholders whose Shares are registered in their own names and who tender directly to Mellon Investor Services LLC, the depositary in the Offer, and holders of vested options who tender underlying Option Shares will not be obligated to pay brokerage fees or commissions or, except as set forth in Instruction 9 to the Letter of Transmittal, stock transfer taxes on the purchase of Shares by us under the Offer. If you own your Shares through a bank, broker, dealer, trust company or other nominee and that person tenders your Shares on your behalf, that person may charge you a fee for doing so. You should consult your bank, broker, dealer, trust company or other nominee to determine whether any charges will apply.

The Offer is not conditioned upon any minimum number of Shares being tendered. The Offer is, however, subject to certain other conditions.See Section 7.

OUR BOARD OF DIRECTORS HAS UNANIMOUSLY APPROVED THE OFFER AND RECOMMENDS YOU TENDER YOUR SHARES INTO THE OFFER. YOU SHOULD READ CAREFULLY THE INFORMATION IN THIS OFFER TO PURCHASE, INCLUDING OUR REASONS FOR MAKING THE OFFER, AND IN THE LETTER OF TRANSMITTAL AND OPTIONEE MATERIALS BEFORE MAKING YOUR DECISION WHETHER TO TENDER YOUR SHARES.SEE SECTION 2.

If, at the Expiration Date, more than 26,000,000 Shares are properly tendered and not properly withdrawn, we will buy Shares on a pro rata basis from all other stockholders who properly tender Shares other than stockholders who tender conditionally and whose conditions are not satisfied.

See Section 1, Section 5andSection 6, respectively, for additional information concerning proration and conditional tender procedures.

6

Holders of options granted under the Engelhard Corporation Stock Option Plan of 1991, the Engelhard Corporation 2002 Long Term Incentive Plan, the Engelhard Corporation Directors Stock Option Plan and the Engelhard Corporation Stock Option Plan of 1999 for Certain Key Employees (collectively, the “Stock Option Plans”) who wish to exercise their options only to the extent underlying Option Shares are actually purchased in the Offer and tender any of such Option Shares in the Offer should follow the separate instructions and procedures described in Section 3. Instructions for the tender of Option Shares must be received by Merrill Lynch & Co. prior to the Expiration Date.

Holders of vested but unexercised options to purchase Shares also may exercise such options for cash and tender some or all of the Shares issued upon such exercise by following instructions and procedures set forth in Section 3 applicable to stockholders tendering Shares that are not Option Shares. Such an exercise of an option cannot be revoked even if the Shares received upon exercise and tendered in the Offer are not purchased for any reason.

As of April 28, 2006, we had 124,007,192 Shares issued and outstanding and 5,233,822 vested stock options. The 26,000,000 Shares that we are offering to purchase represent approximately 20% of the Company’s outstanding Shares, including Shares underlying exerciseable options, as of April 28, 2006. The Shares are listed and traded on the NYSE under the symbol “EC.”See Section 8.We urge stockholders to obtain current market quotations for the Shares.

THE TENDER OFFER

1. Number of Shares; Proration.

General.Upon the terms and subject to the conditions of the Offer, Engelhard will purchase 26,000,000 Shares, or such fewer number of Shares as are properly tendered and not properly withdrawn in accordance with Section 4, before the scheduled Expiration Date of the Offer, at a price of $45.00 per share, net to the seller in cash, without interest. See Section 3 with respect to Option Shares.

The term “Expiration Date” means 5:00 p.m., New York City time, on Monday, June 5, 2006, unless and until Engelhard, in its sole discretion, shall have extended the period of time during which the Offer will remain open, in which event the term “Expiration Date” shall refer to the latest time and date at which the Offer, as so extended by Engelhard, shall expire.See Section 15for a description of Engelhard’s right to extend, delay, terminate or amend the Offer. In the event of an over-subscription of the Offer as described below, Shares validly tendered will be subject to proration. The withdrawal rights and proration period expire on the Expiration Date; provided that tendered shares may be withdrawn after 12:00 Midnight, New York City time, on June 30, 2006 unless theretofore accepted for payment as provided in this Offer to Purchase.

If we:

increase or decrease the price to be paid for Shares,

materially increase or decrease the dealer managers’ fee; or

increase or decrease the number of Shares being sought in the Offer, unless, in the case of an increase in thenumber of Shares being sought, such increase does not exceed 2% of the outstanding Shares; and

the Offer is scheduled to expire at any time earlier than the expiration of a period ending on the tenth business day from, and including, the date that we first publish, send or give notice, in the manner specified in Section 15, of any such increase or decrease, we will extend the Offer until the expiration of ten business days from the date that we first publish notice of such increase or decrease. For the purposes of the Offer, a “business day” means any day other than a Saturday, Sunday or United States federal holiday and consists of the time period from 12:01 a.m. through 12:00 Midnight, New York City time.

Engelhard will purchase all Shares properly tendered (and not properly withdrawn), upon the terms and subject to the conditions of the Offer, including the proration and conditional tender provisions of the Offer.

7

Engelhard will not purchase Shares that it does not accept in the Offer because of proration provisions or conditional tenders. Shares tendered and not purchased, including Shares that Engelhard does not accept for purchase due to proration or conditional tenders, will be returned to the tendering stockholder, or, in the case of Shares tendered by book-entry transfer, will be credited to the account maintained with the book-entry transfer facility by the participant therein who so delivered the Shares, at Engelhard’s expense and without expense to the tendering stockholders, as promptly as practicable after the Expiration Date or termination of the Offer. Stockholders also can specify the order in which Engelhard will purchase tendered Shares in the event that, as a result of the proration provisions or otherwise, Engelhard purchases some but not all of the tendered Shares pursuant to the Offer.

If the number of Shares properly tendered and not properly withdrawn prior to the Expiration Date is fewer than or equal to 26,000,000 Shares, Engelhard will, upon the terms and subject to the conditions of the Offer, purchase all such Shares.

Priority of Purchases.Upon the terms and subject to the conditions of the Offer, if more than 26,000,000 Shares have been properly tendered and not properly withdrawn prior to the Expiration Date, Engelhard will purchase properly tendered Shares on the following basis:

First, subject to the conditional tender provisions described in Section 6, we will purchase all Shares on apro rata basis with appropriate adjustments to avoid purchases of fractional Shares, as described below.

Second, only if necessary to permit us to purchase 26,000,000 Shares, Shares conditionally tendered (forwhich the condition was not initially satisfied), will, to the extent feasible, be selected for purchase byrandom lot. To be eligible for purchase by random lot, stockholders whose Shares are conditionally tenderedmust have tendered all of their Shares.

Option Shares will be subject to the proration provisions. Optionees who tender Option Shares may direct the order in which such options will be exercised. If the optionee does not so direct, then options will be exercised based on exercise price, with the lowest priced options exercised first.

Engelhard may not purchase all of the Shares that a stockholder tenders in the Offer.

Proration.If proration of tendered Shares is required, Engelhard will determine the proration factor as soon as practicable following the Expiration Date. Subject to adjustment to avoid the purchase of fractional Shares and subject to the provisions governing conditional tenders described in Section 6 of this Offer to Purchase, proration for each stockholder that tenders Shares will be based on the ratio of the total number of Shares that we accept for purchase to the total number of Shares including Option Shares properly tendered (and not properly withdrawn) by all stockholders.

Because of the difficulty in determining the number of Shares properly tendered, including Shares tendered by guaranteed delivery procedures, as described in Section 3, and not properly withdrawn, and because of the conditional tender provisions, Engelhard does not expect that it will be able to announce the final proration factor or commence payment for any Shares purchased under the Offer until approximately five business days after the Expiration Date. The preliminary results of any proration will be announced by press release as promptly as practicable after the Expiration Date. Stockholders may obtain preliminary proration information from the information agent or the dealer managers and may be able to obtain this information from their brokers.

As described in Section 14, the number of Shares that Engelhard will purchase from a stockholder under the Offer may affect the United States federal income tax consequences to that stockholder and, therefore, may be relevant to that stockholder’s decision whether or not to tender Shares. Holders of Shares and Option Shares have the opportunity to designate the order in which such Shares and Option Shares will be purchased in the event that not all such Shares tendered are purchased as a result of proration.

We will mail this Offer to Purchase and the Letter of Transmittal to record holders of Shares and we will furnish this Offer to Purchase to brokers, dealers, commercial banks and trust companies whose names, or the names of whose nominees, appear on Engelhard’s stockholder list or, if applicable, that are listed as participants in a clearing agency’s security position listing for subsequent transmittal to beneficial owners of Shares.

8

2. Purpose of the Tender Offer.

Background

On January 9, 2006, BASF Aktiengesellschaft (“BASF”), through its wholly-owned subsidiary, Iron Acquisition Corporation, made an unsolicited tender offer to acquire all of the outstanding shares of Engelhard common stock for $37 per share in cash. The purpose of the BASF offer is for BASF to acquire control of, and the entire equity interest in, the Company. BASF has stated that it currently intends, as promptly as practicable following consumation of the BASF offer, to have the Company consummate a merger or other similar business combination with Iron Acquisition Corporation or another direct or indirect subsidiary of BASF in connection with its offer. On January 20, 2006, the Board of Directors unanimously determined that BASF’s $37 per share offer was inadequate and not in the best interests of the Company’s shareholders.

Following the determination by the Board of Directors of the Company of the inadequacy of BASF’s $37 per share offer, the Board of Directors, with the assistance of its independent advisors, explored a wide range of strategic alternatives to maximize shareholder value. As part of this process, the Recapitalization Plan was developed. No competitive, third-party transaction, however, materialized.

In response to the Company’s request for BASF to increase its offer following BASF’s access to non-public information, BASF, on April 19, 2006, made a proposal to acquire the Company for $38 per Share in cash. Following receipt of the $38 per Share proposal, the Board of Directors of the Company held a number of meetings to review BASF’s $38 per Share proposal and review the results of its exploration of strategic alternatives, including the Recapitalization Plan that had been developed. Following this review, at its meeting on April 25, 2006, the Board unanimously determined that BASF’s $38 per Share proposal was inadequate and not in the best interests of the Company’s shareholders. Subsequently, on May 1, 2006, BASF increased its offer to $38 per Share and extended its offer to June 5, 2006.

Also at its April 25, 2006 meeting, the Board of Directors of the Company unanimously determined that the Recapitalization Plan represents the best value-creation alternative for and is in the best interests of the Company’s shareholders. Accordingly, the Board unanimously approved the Recapitalization Plan. The Recapitalization Plan was announced on April 26, 2006.

Increase in the Size of the Company’s Board of Directors

BASF—the very same party which has made the $38 per share offer which the Board of Directors has determined is inadequate—has previously stated that if Engelhard does not decide to sell the Company “expeditiously” or if BASFon its own“concludes that [our] exploration of strategic alternatives is not being conducted in the best interests of the Company’s shareholders,” then BASF intends to solicit written consents from our shareholders to amend Engelhard’s bylaws to increase the size of the Board of Directors and fill the newly-created vacancies with hand-picked, BASF nominees. BASF has the ability to continue threatening, and to make, such a consent solicitation regardless of whether their director nominees lose the vote at the Company’s annual meeting. Furthermore, BASF can continue its consent solicitation for as long as it chooses-there is no date by which the solicitation must end.

In order to be able to successfully execute on its strategic business plan, which the Company expects to deliver significant growth and value to its shareholders, the Company determined that it could not afford the distraction resulting from either a lengthy consent solicitation for majority control of the Board of Directors or the threat that one could occur at any time. The Board of Directors and management, as well as other important resources of the Company, would be diverted to focusing on a consent solicitation battle of potentially indefinite duration throughout a critical period for the execution of our strategic business plan. To avoid this potential obstacle to realizing the anticipated benefits of this part of the Recapitalization Plan, the Board of Directors will increase the number of Board members at the Company’s annual meeting of stockholders from six to nine members and ask stockholders to vote to fill these additional director seats.

Accordingly, the Board of Directors has recommended that at the Company’s annual meeting stockholders elect the five Board nominees described in the Company’s Proxy Statement. As a result, the Board will be giving its

9

stockholders the ability to elect a majority of the newly-enlarged Board of Directors (five directors out of nine) at the Company’s annual meeting without the need for, and distraction resulting from, the BASF consent solicitation.

BASF has nominated five individuals for election to the Board of Directors at the Company’s annual meeting, namely the two individuals BASF has previously nominated and three additional individuals whom BASF nominated on May 1, 2006 after the Company announced the Board size would be increased at the annual meeting. If BASF is successful, its nominees will control the elected Board of the Company, and we would expect them to approve BASF’s inadequate $38 per share offer.

If Engelhard’s five director nominees are elected, the effect will be, among other things, to enable the Company to pursue its strategic business plan for two years without the distraction of having to defend against a consent solicitation by BASF that seeks or threatens to change a majority of the Board to support its inadequate hostile tender offer. We strongly believe this outcome is important for successful implementation of the Recapitalization Plan, including the Company’s strategic business plan, and, consequently, its ability to create value for shareholders.

The foregoing discussion of the Board’s position with respect to BASF’s offer is qualified in its entirety by reference to the Schedule 14D-9 filed by Engelhard on January 23, 2006, as amended (the “Schedule 14D-9”).

The Recapitalization Plan

As a result of the review of strategic alternatives to maximize shareholder value described above, the Board of Directors of the Company has unanimously approved the Recapitalization Plan comprised of:

The Offer.The maximum number of Shares eligible to be repurchased in the Offer is 26 million Shares (approximately 20% of the Company’s outstanding Shares including shares underlying exercisable options). The Offer will be financed by third party borrowings. The Company has a commitment, subject to customary conditions, for an unsecured bridge facility from JPMorgan and Merrill Lynch to initially fund the Offer, which is more fully described in Section 9 of this Offer to Purchase. Long-term financing is expected to comprise a mix of hybrid securities (ICONs) and floating- and fixed-rate debt.

Continued Execution of Business Plan.The Recapitalization Plan will allow the Company to continue to execute its strategic business plan. We believe that our recent strong results, including the earnings momentum inherent in our results for the fourth quarter of 2005 and the strong results for the first quarter of 2006, are only the beginning of the fruits which this strategic business plan will bear. The Recapitalization Plan will afford shareholders who do not tender their Shares in the Offer the opportunity to continue to participate in the benefits expected to be delivered from continued execution of our strategic plan.

Cost Savings.The incremental cost savings to be undertaken as part of the Recapitalization Plan is expected to deliver $15 million in annual cost savings beginning in 2007. The Company expects to incur a charge or charges of approximately $20 million in the second half of 2006 in connection with the incremental cost savings.

Anticipated Benefits of Recapitalization Plan

Ability to Realize Inherent Value and Pursue Growth Opportunities.Over the past few years, the Company has implemented a strategic plan to exit its low-margin precious metals fabrication businesses in favor of higher-growth, higher-margin businesses. The Company has made significant investments in a number of attractive businesses with substantial revenue-generation potential, most notably diesel-emission control, energy and fuel materials, personal care and cosmetic materials, separations and polymers.

This strategy has effectively positioned us to capitalize on trends that we believe will lead to increased demand for our high-margin products, including:

10

Anticipated growth in demand for sophisticated emission-control technologies resulting from the phase-inof more stringent heavy duty diesel regulations in Europe in late 2006 and in the U.S. in early 2007, and theintroduction, beginning in 2007, of more stringent clean air regulations in Europe, the U.S. and Asia;

Growing demand worldwide for energy and energy-related materials; and

Growing demand for personal care and cosmetic products driven by the aging and increasing affluence ofthe global population.

We are starting to see tangible results from this strategy, which we believe has only just begun to pay off:

Since BASF commenced its hostile offer, Engelhard has announced two consecutive quarters of strong earnings results. On February 2, 2006, the Company announced fourth-quarter earnings per share (“EPS”) of $0.53 per share. Additionally, on April 26, 2006, Engelhard announced that EPS for the first quarter of 2006 was $0.55, which includes approximately $0.03 of expenses and $0.02 of share dilution due to the impact of the BASF offer. Results for both quarters were meaningfully above Wall Street analysts’ expectations.

For the period of 2006 to 2010 Engelhard expects to achieve the following financial targets (before the positive impact of the Recapitalization Plan):

| | — | An EPS compound annual growth rate of approximately 16%; |

| |

| | — | Approximately 3% operating margin improvement over current levels; |

| |

| | — | Sales compound annual growth rate of 8%; and |

| |

| | — | Return on average capital of 14%-15%. |

The foregoing discussion of the Recapitalization Plan and the anticipated benefits described above are based upon, and qualified in its entirety by, the assumptions discussed in the appendix to the Company’s Investor Presentation filed as Exhibit (a)(5)(D) hereto and incorporated by reference herein. In particular, the forecasted financial targets reflect announced regulations and plant constructions leading to peak growth rates in 2008. Thereafter, growth rates are expected to return to low double-digit levels.

Given what we believe to be our attractive growth opportunities, we have structured the Recapitalization Plan to allow our shareholders to participate in Engelhard’s future growth potential. We believe that BASF, which acknowledges having spent the past two years carefully evaluating Engelhard’s businesses and growth strategy, recognizes the attractiveness of our current market position, technologies and post-2006 growth prospects. We believe BASF’s $38 offer, therefore, represents a calculated attempt to capture value that rightfully belongs to our shareholders by attempting to acquire the Company before those future growth expectations are fully reflected in our stock price.

Strong Earnings Momentum as Compared with Expectations Prior to BASF’s Offer.With $0.53 EPS for fourth quarter 2005 and $0.55 EPS for the first quarter 2006 (which includes approximately $0.03 of expenses and $0.02 of share dilution due to the impact of the BASF offer), we have meaningfully exceeded analysts’ mean EPS estimates for two consecutive quarters. These recent earnings results, publicly announced only after BASF launched its hostile tender offer, further strengthens our confidence in our strategic business plan. Recognizing the future growth prospects inherent in our business model, analysts’ mean EPS estimates for fiscal years 2006 and 2007 have increased from $2.13 and $2.39, respectively, as of December 31, 2005 to a current mean of $2.22 and $2.49, respectively.

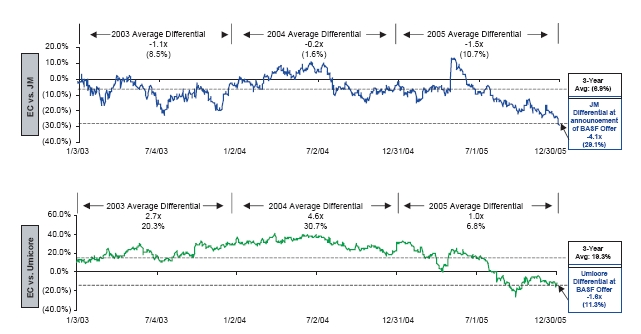

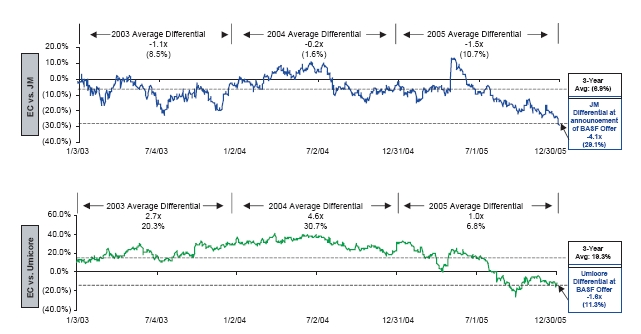

Expected Improvement of Price To Earnings Multiple.Neither the Company nor any other person can predict future price to earnings multiples (P/E multiples). However, BASF’s hostile offer came at a time when the Company’s stock was trading at a forward P/E multiple that was meaningfully lower than the historical relationship that prevailed for several years to the forward P/E multiples of key industry peers (Johnson Matthey and Umicore). The chart below shows the average discount and premium Engelhard traded to Johnson Matthey and Umicore, respectively, over a three-year period ending December 30, 2005:

11

Source: Factset.

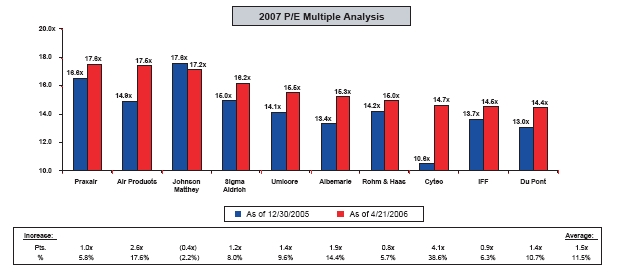

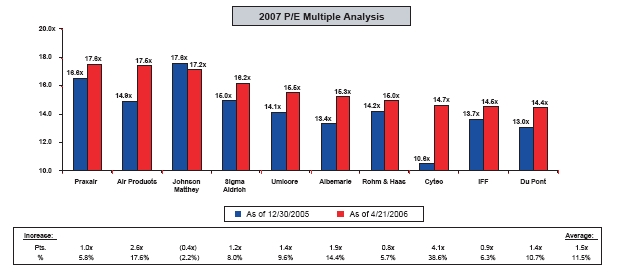

Market multiples for the Company’s industry peers have generally increased since the announcement of the BASF offer. The chart below shows the P/E multiples of the Company and its industry peers as of December 30, 2005 and as of April 21, 2006.

Source: Factset. Based on Wall Street Research.

While there can be no assurance as to the future movement of P/E multiples, we believe that our forward P/E multiple should reflect a relationship to key industry peers more in line with historical levels, and should benefit from (a) the strength of Engelhard’s earnings performance in recent quarters, (b) the expected robust and sustained earnings growth for the years ahead and (c) the general rise in industry multiples since BASF commenced its offer.

The Recapitalization Plan Offers Engelhard Shareholders Partial Liquidity at an Attractive Price Coupled with Continued Participation in the Company’s Future Growth Potential Resulting in a Superior Value Proposition Versus BASF’s $38 Per Share Offer.The Recapitalization Plan provides Engelhard shareholders with the opportunity to achieve liquidity at an attractive price while continuing to participate in the Company’s future

12

growth. By tendering Shares into the Offer, as the Board of Directors of the Company recommends that stockholders do, stockholders will have the opportunity to receive for a portion of their shares an amount of cash in excess of what BASF is offering on a per Share basis. At the same time, and subject to the maximum number of shares to be repurchased in the Offer, the Recapitalization Plan allows stockholders to remain substantially invested in Engelhard and participate in the Company’s future growth potential.

Engelhard’s Board of Directors believes that the Recapitalization Plan offers superior value to BASF’s $38 per Share offer. Merrill Lynch undertook an analysis of potential share price derivations based solely on various illustrative forward P/E multiples and our projected 2007 EPS of $2.55(1)based on Wall Street consensus and adjusted for the Recapitalization Plan. This analysis calculates a hypothetical blended value per share of the Recapitalization Plan, by giving approximately 20% weight to the $45 per Share price in the Offer and approximately 80% weight to the various implied Share prices set forth in the chart below. The implied Share prices in the chart below were calculated based solely on the projected $2.55 EPS in 2007 and two hypothetical P/E multiples: (1) the current Johnson Matthey 2007 forward P/E multiple adjusted for the three-year average P/E multiple discount as shown in the chart above and (2) the current Umicore 2007 forward P/E multiple adjusted for the one-year premium as shown in the chart above. The analysis shows the resulting illustrative blended value of the Recapitalization Plan to an Engelhard stockholder of $41.70 or $42.80.

Utilizing the same two forward P/E multiple point discount and premium and applying them to the current 2010 forward P/E multiples for Johnson Matthey and Umicore, respectively, Merrill Lynch conducted an additional analysis of potential share price derivations by substituting the projected 2007 EPS of $2.55 for our projected 2010 EPS of $4.22(2)The analysis shows the resulting illustrative blended value of the Recapitalization Plan to an Engelhard stockholder of $52.29 and $50.85.

| | | | | | | | | | Illustrative Blended Price Per |

| | | Hypothetical | | Resultant | | Implied Price Per | | Share Assuming Pro |

| | | Engelhard | | 2010 Forward | | Share Based on | | Rata Participation in |

| | | Premium/(Discount) | | P/E Multiple(3) | | $4.22 Projected EPS | | Self Tender |

| |

|

| |

| |

| |

|

| Based on 2010P EPS | | | | | | | | | |

| |

| Engelhard Relative to | | | | | | | | | |

| Johnson Matthey | | (6.9 | %) | | 12.8 | | $54.13 | | $52.29 |

| (JM Currently at 13.8x) | | | | | | | | | |

| | | | | | | | | | |

| Engelhard Relative to | | | | | | | | | |

| Umicore | | 6.8 | % | | 12.4 | | $52.33 | | $50.85 |

| (Umicore Currently at 11.6x) | | | | | | | | | |

__________| (1) | Based on projected Wall Street Consensus 2007 earnings per share of $2.49 and which we have adjusted for the estimated impact of ($0.52) of additional interest expense, $0.09 of incremental cost saving, and $0.49 due to the reduced number of Shares outstanding. |

| (2) | Based on management operating plan developed in August 2005 of 2010 EPS of $3.95 and adjusted for the impact of $(0.50) of additional interest expense, $0.09 of incremental cost saving and $0.67 due to the reduced number of Shares. |

| (3) | Applied Johnson Matthey’s long-term projected annual EPS growth rate of 8.0% based on Wall Street research to 2007 EPS of Johnson Matthey to derive 2010 forward P/E multiple of 13.8x. Applied Umicore’s long-term projected annual EPS growth rate of 10.1% based on Wall Street research to 2007 EPS of Umicore to derive 2010 forward P/E multiple of 11.6x. Based on share price as of April 21, 2006. |

13

The chart below represents the required Engelhard Share price and implied 2007 P/E multiple to deliver various hypothetical blended values of the Recapitalization Plan (giving approximately 20% weight to the $45 per share Offer price and approximately 80% weight to the series of Share prices) ranging between $38 and $45 per share.

The above charts of hypothetical blended values are illustrative only and are based on assumptions as to future P/E multiples and future earnings per share. No assurance can be given as to which multiples may apply in the future or as to future earnings. Stockholders are urged to read carefully various risks and uncertainties associated with the Company and its performance and assumptions relating to the Recapitalization Plan included in “Forward-Looking Statements—Risk Factors” and in the Company’s Investor Presentation filed as Exhibit (a)(5)(D) hereto.

Financing

Engelhard has a committed bridge credit facility, subject to customary conditions, from Merrill Lynch and JPMorgan to initially fund the purchase of Shares in the Offer, having the terms and conditions in the Commitment Letter described in Section 9. The bridge financing is expected to be refinanced with permanent financing consisting of a mix of hybrid securities and floating- and fixed-rate debt within 12 months of the closing of the Offer. See Sections 9 and 10.

General

The Engelhard Board of Directors has unanimously approved the Offer and recommends to stockholders that they tender their Shares into the Offer. Stockholders should carefully evaluate all information in the Offer, should consult their own investment and tax advisors, and should make their own decisions about whether to tender Shares, and, if so, how many Shares to tender.

Engelhard will retire Shares that it acquires pursuant to the Offer and will return those Shares to the status of authorized but unissued stock that will be available for Engelhard to issue without further stockholder action (except as required by applicable law or the rules of the NYSE or any other securities exchange on which the Shares may then be listed) for various purposes including, without limitation, acquisitions, raising additional capital and the satisfaction of obligations under existing or future employee or director benefit or compensation programs.

| (1) | Based on Wall Street research average 2007 EPS projections and stock price. Average long-term projected EPS growth rate per First Call as of April 21, 2006. |

| |

14

3. Procedures for Tendering Shares.

Proper Tender of Shares.For stockholders to properly tender Shares under the Offer:

the depositary must receive, at the depositary’s address set forth on the back cover page of this Offer toPurchase, Share certificates (or confirmation of receipt of such Shares under the procedure for book-entrytransfer set forth below), together with a properly completed and duly executed Letter of Transmittal,including any required signature guarantees, or an “agent’s message,” and any other documents required bythe Letter of Transmittal, before the Offer expires, or

the tendering stockholder must comply with the guaranteed delivery procedure set forth below.

If a broker, dealer, commercial bank, trust company or other nominee holds your Shares, it is likely they have an earlier deadline for you to act to instruct them to accept the Offer on your behalf. We urge you to contact your broker, dealer, commercial bank, trust company or other nominee to find out their applicable deadline.

The term “agent’s message” means a message transmitted by the book-entry transfer facility to, and received by, the depositary, which states that the book-entry transfer facility has received an express acknowledgment from the participant in the book-entry transfer facility tendering the Shares that the participant has received and agrees to be bound by the terms of the Letter of Transmittal and that Engelhard may enforce the agreement against the participant.

We urge stockholders who hold Shares through brokers, dealers, commercial banks, trust companies or other nominees to consult the brokers, dealers, commercial banks, trust companies or other nominees to determine whether transaction costs are applicable if they tender Shares through the brokers, dealers, commercial banks, trust companies or other nominees and not directly to the depositary.

Signature Guarantees.Except as otherwise provided below, all signatures on a Letter of Transmittal must be guaranteed by a financial institution (including most banks, savings and loans associations and brokerage houses) which is a participant in the Securities Transfer Agents Medallion Program. Signatures on a Letter of Transmittal need not be guaranteed if:

the Letter of Transmittal is signed by the registered holder (which term, for purposes of this Section 3, shallinclude any participant in The Depository Trust Company, referred to as the “book-entry transfer facility,”whose name appears on a security position listing as the owner of the Shares) of the Shares tenderedtherewith and the holder has not completed either the box captioned “Special Delivery Instructions” or thebox captioned “Special Payment Instructions” in the Letter of Transmittal; or

if Shares are tendered for the account of a bank, broker, dealer, credit union, savings association or otherentity which is a member in good standing of the Securities Transfer Agents Medallion Program or a bank,broker, dealer, credit union, savings association or other entity which is an “eligible guarantor institution,”as such term is defined in Rule 17Ad-15 under the Exchange Act.See Instruction 1 of the Letter ofTransmittal.

If a Share certificate is registered in the name of a person other than the person executing a Letter of Transmittal, or if payment is to be made to a person other than the registered holder, then the certificate must be endorsed or accompanied by an appropriate stock power, in either case signed exactly as the name of the registered holder appears on the Share certificate, with the signature guaranteed by an eligible guarantor institution.

Engelhard will make payment for Shares tendered and accepted for payment in the Offer only after the depositary timely receives Share certificates or a timely confirmation of the book-entry transfer of the Shares into the depositary’s account at the book-entry transfer facility as described above, a properly completed and duly executed Letter of Transmittal, or an agent’s message in the case of a book-entry transfer, and any other documents required by the Letter of Transmittal.

Method of Delivery.The method of delivery of all documents, including Share certificates, the Letter of Transmittal, the Optionee Materials and any other required documents, is at the election and risk of the tendering stockholder. If you choose to deliver required documents by mail, we recommend that you use registered mail with return receipt requested, properly insured.

15

Book-Entry Delivery.The depositary will establish an account with respect to the Shares for purposes of the Offer at the book-entry transfer facility within two business days after the date of this Offer to Purchase, and any financial institution that is a participant in the book-entry transfer facility’s system may make book-entry delivery of the Shares by causing the book-entry transfer facility to transfer Shares into the depositary’s account in accordance with the book-entry transfer facility’s procedures for transfer. Although participants in the book-entry transfer facility may effect delivery of Shares through a book-entry transfer into the depositary’s account at the book-entry transfer facility, either

properly completed and duly executed Letter of Transmittal, including any required signature guarantees,or an agent’s message, and any other required documents must, in any case, be transmitted to and receivedby the depositary at its address set forth on the back cover page of this Offer to Purchase before theExpiration Date, or

the guaranteed delivery procedure described below must be followed.

Delivery of the Letter of Transmittal and any other required documents to the book-entry transfer facility does not constitute delivery to the depositary.

Holders of vested options to purchase Shares who wish to exercise their options only to the extent underlying Option Shares are purchased in the Offer and tender of those Option Shares, should follow the separate instructions described below under “Special Procedures for Holders of Option Shares.”

Holders of vested options to purchase shares may also exercise their options and tender the Shares received upon exercise in accordance with the instructions and procedures described in Section 3 with respect to Shares generally. The exercise of an option cannot be revoked even if the Shares received upon the exercise and tendered in the Offer are not purchased for any reason.

Special Procedures for Holders of Option Shares

Option Shares underlying options which are being exercised only to the extent the underlying Option Shares are actually purchased in the Offer may not be tendered by a Letter of Transmittal. Proper tender of these Option Shares may only be made by following the separate instructions and procedures as described below.

Option Shares.Holders of vested (but unexercised) options to purchase Shares granted under the Stock Option Plans may instruct Engelhard that Option Shares subject to such options will be tendered but that such options will be exercised only to the extent such Option Shares are actually purchased in the Offer, such exercise to be effective at the time the Option Shares subject to the options are accepted for payment and the proration percentage is determined in the Offer. In such case, the option exercise will be effected by Engelhard withholding the exercise price and any taxes, including employment taxes, required to be withheld upon exercise of the options from the cash proceeds otherwise payable to the option holders in the Offer. If the Company does not purchase an Option Share for any reason, the option covering the Option Share will not be deemed exercised and will remain outstanding. Option holders must follow the procedures set forth in the Letter to Optionees and the Notice of Instructions (Options), mailed to them with this Offer to Purchase, if they want to tender into the Offer. Option holders are urged to read the Letter to Optionees and the Notice of Instructions (Options) carefully.

Option holders eligible to exercise their options as set forth above may direct on the Notice of Instructions (Options) the order in which an option holder wishes to have his or her options exercised. If an option holder does not direct the order in which he or she wishes to have the options exercised, then options will be exercised in order of exercise price, beginning with options having the lowest exercise price.

U.S. Federal Backup Withholding Tax.Under the U.S. federal income tax backup withholding rules, 28% of the gross proceeds payable to a stockholder or other payee pursuant to the Offer must be withheld and remitted to the United States Treasury, unless the stockholder or other payee provides his or her taxpayer identification number (employer identification number or social security number) to the depositary and certifies under penalties of perjury that such number is correct or otherwise establishes an exemption. In addition, if the depositary is not provided with the correct taxpayer identification number or another adequate basis for exemption, the taxpayer

16

may be subject to certain penalties imposed by the Internal Revenue Service. Therefore, each tendering stockholder should complete and sign the Substitute Form W-9 included as part of the Letter of Transmittal so as to provide the information and certification necessary to avoid backup withholding unless the stockholder otherwise establishes to the satisfaction of the depositary that the stockholder is not subject to backup withholding. Certain stockholders (including, among others, all corporations and certain Non-U.S. Holders (as defined below in Section 14)) are not subject to these backup withholding and reporting requirements. In order for a Non-U.S. Holder to qualify as an exempt recipient, that stockholder must submit an IRS Form W-8BEN or other applicable form, signed under penalties of perjury, attesting to that stockholder’s exempt status. Tendering stockholders can obtain the applicable forms from the depositary.See Instruction 10 of the Letter of Transmittal.

TO PREVENT U.S. FEDERAL BACKUP WITHHOLDING TAX ON THE GROSS PAYMENTS MADE TO YOU FOR SHARES PURCHASED PURSUANT TO THE OFFER, IF YOU DO NOT OTHERWISE ESTABLISH AN EXEMPTION FROM SUCH WITHHOLDING, YOU MUST PROVIDE THE DEPOSITARY WITH YOUR CORRECT TAXPAYER IDENTIFICATION NUMBER AND PROVIDE OTHER INFORMATION BY COMPLETING THE SUBSTITUTE FORM W-9 INCLUDED WITH THE LETTER OF TRANSMITTAL.

Withholding for Non-U.S. Holders.Gross proceeds payable pursuant to the Offer to a Non-U.S. Holder or his or her agent will be subject to withholding of U.S. federal income tax at a rate of 30%, unless a reduced rate of withholding is applicable pursuant to an income tax treaty or an exemption from withholding is applicable because such gross proceeds are effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States (and if an income tax treaty applies, the gross proceeds are generally attributable to a United States permanent establishment maintained by such Non-U.S. Holder). In order to claim a reduction of or an exemption from withholding tax, a Non-U.S. Holder must deliver to the depositary a validly completed and executed IRS Form W-8BEN (with respect to income tax treaty benefits) or W-8ECI (with respect to amounts effectively connected with the conduct of a trade or business within the United States) claiming such reduction or exemption before the payment is made. A Non-U.S. Holder that qualifies for an exemption from withholding by delivering IRS Form W-8ECI generally will be subject to U.S. federal income tax on income derived from the sale of Shares pursuant to the Offer at the rates applicable to U.S. Holders. Additionally, in the case of a corporate non-U.S. Holder, such income may be subject to branch profits tax at a rate of 30% (or a lower rate specified in an applicable income tax treaty). Tendering Non-U.S. Holders can obtain the applicable IRS forms from the depositary.

A Non-U.S. Holder may be eligible to obtain a refund of all or a portion of any tax withheld (1) if such holder meets the “complete redemption,” “substantially disproportionate” or “not essentially equivalent to a dividend” tests described in Section 14 or (2) if such holder is otherwise able to establish that no tax or a reduced amount of tax is due.We urge Non-U.S. Holders to consult their own tax advisors regarding the particular tax consequences to them of participating in the Offer, including the application of U.S. federal income tax withholding, their potential eligibility for a withholding tax reduction or exemption, and the refund procedure.

For a discussion of certain material United States federal income tax consequences to tendering stockholders,see Section 14.

Guaranteed Delivery.If a stockholder desires to tender Shares into the Offer and the stockholder’s Share certificates are not immediately available or the stockholder cannot deliver the Share certificates to the depositary before the Expiration Date, or the stockholder cannot complete the procedure for book-entry transfer on a timely basis, or if time will not permit all required documents to reach the depositary before the Expiration Date, the stockholder may nevertheless tender the Shares, provided that the stockholder satisfies all of the following conditions:

the stockholder makes the tender by or through an eligible guarantor institution;

the depositary receives by hand, mail, overnight courier or facsimile transmission, before the ExpirationDate, a properly completed and duly executed notice of guaranteed delivery in the form Engelhard hasprovided, specifying the price at which the stockholder is tendering Shares, including (where required) asignature guarantee by an eligible guarantor institution in the form set forth in such notice of guaranteeddelivery; and

17

the depositary receives the Share certificates, in proper form for transfer, or confirmation of book-entrytransfer of the Shares into the depositary’s account at the book-entry transfer facility, together with aproperly completed and duly executed Letter of Transmittal, or a manually signed facsimile thereof, andincluding any required signature guarantees, or an agent’s message, and any other documents required bythe Letter of Transmittal, within three NYSE trading days after the date of receipt by the depositary of thenotice of guaranteed delivery.

Return of Unpurchased Shares.The depositary will return certificates for unpurchased Shares as promptly as practicable after the expiration or termination of the Offer or the proper withdrawal of the Shares, as applicable, or, in the case of Shares tendered by book-entry transfer at the book-entry transfer facility, the depositary will credit the Shares to the appropriate account maintained by the tendering stockholder at the book-entry transfer facility, in each case without expense to the stockholder.

Determination of Validity; Rejection of Shares; Waiver of Defects; No Obligation to Give Notice of Defects.Engelhard will determine, in its sole discretion, all questions as to the number of Shares that it will accept and the validity, form, eligibility (including time of receipt) and acceptance for payment of any tender of Shares, and its determination will be final and binding on all parties. Engelhard reserves the absolute right to reject any or all tenders of any Shares that it determines are not in proper form or the acceptance for payment of or payment for which Engelhard determines may be unlawful. Engelhard also reserves the absolute right to waive any defect or irregularity in any tender with respect to any particular Shares or any particular stockholder, and Engelhard’s interpretation of the terms of the Offer will be final and binding on all parties. No tender of Shares will be deemed to have been properly made until the stockholder cures, or Engelhard waives, all defects or irregularities. None of Engelhard, the depositary, the information agent, the dealer managers or any other person will be under any duty to give notification of any defects or irregularities in any tender or incur any liability for failure to give this notification.

Tendering Stockholder’s Representation and Warranty; Engelhard’s Acceptance Constitutes an Agreement.A tender of Shares under any of the procedures described above will constitute the tendering stockholder’s acceptance of the terms and conditions of the Offer, as well as the tendering stockholder’s representation and warranty to Engelhard that:

the stockholder has a net long position in the Shares or equivalent securities at least equal to the Sharestendered within the meaning of Rule 14e-4 of the Exchange Act (“Rule 14e-4”), and

the tender of Shares complies with Rule 14e-4.

It is a violation of Rule 14e-4 for a person, directly or indirectly, to tender Shares for that person’s own account unless, at the time of tender and at the end of the proration period or period during which Shares are accepted by lot (including any extensions thereof), the person so tendering:

| | | has a net long position equal to or greater than the amount tendered in |

| |

| | | | the Shares, or |

| |

| | | | securities immediately convertible into, or exchangeable or exercisable for, the Shares, and |

| |

| | | will deliver or cause to be delivered the Shares in accordance with the terms of the Offer. |

Rule 14e-4 provides a similar restriction applicable to the tender or guarantee of a tender on behalf of another person. Engelhard’s acceptance for payment of Shares tendered under the Offer will constitute a binding agreement between the tendering stockholder and Engelhard upon the terms and conditions of the Offer.

Lost or Destroyed Certificates.Stockholders whose Share certificate for part or all of their Shares has been lost, stolen, misplaced or destroyed may contact Mellon Investor Services LLC the transfer agent for Engelhard Shares, at the address and telephone number set forth on the back cover of this Offer to Purchase, for instructions as to obtaining a replacement Share certificate. That Share certificate will then be required to be submitted together with the Letter of Transmittal in order to receive payment for Shares that are tendered and accepted for payment. The stockholder may have to post a bond to secure against the risk that the Share certificate may subsequently

18

emerge. We urge stockholders whose Share certificate has been lost, stolen, misplaced or destroyed to contact Mellon Investor Services LLC immediately in order to permit timely processing of this documentation.

Stockholders must deliver Share certificates, together with a properly completed and duly executed Letter of Transmittal, including any signature guarantees, or an agent’s message, and any other required documents to the depositary and not to Engelhard, the dealer managers or the information agent. Engelhard, the dealer managers or the information agent will not forward any such documents to the depositary and delivery to Engelhard, the dealer managers or the information agent will not constitute a proper tender of Shares.

4. Withdrawal Rights.

Stockholders may withdraw Shares tendered into the Offer at any time prior to the Expiration Date. Thereafter, such tenders are irrevocable, except that they may be withdrawn after 12:00 Midnight, New York City time, on Friday, June 30, 2006 unless theretofore accepted for payment as provided in this Offer to Purchase.

For a withdrawal to be effective, the depositary must timely receive a written or facsimile transmission notice of withdrawal at the depositary’s address set forth on the back cover page of this Offer to Purchase. Any such notice of withdrawal must specify the name of the tendering stockholder, the number of Shares that the stockholder wishes to withdraw and the name of the registered holder of the Shares. If the Share certificates to be withdrawn have been delivered or otherwise identified to the depositary, then, before the release of the Share certificates, the serial numbers shown on the Share certificates must be submitted to the depositary and the signature(s) on the notice of withdrawal must be guaranteed by an eligible guarantor institution, unless the Shares have been tendered for the account of an eligible guarantor institution.

If a stockholder has tendered Shares under the procedure for book-entry transfer set forth in Section 3, any notice of withdrawal also must specify the name and the number of the account at the book-entry transfer facility to be credited with the withdrawn Shares and must otherwise comply with the book-entry transfer facility’s procedures. Engelhard will determine all questions as to the form and validity (including the time of receipt) of any notice of withdrawal, in its sole discretion, and such determination will be final and binding. None of Engelhard, the depositary, the information agent, the dealer managers or any other person will be under any duty to give notification of any defects or irregularities in any notice of withdrawal or incur any liability for failure to give this notification.

A stockholder may not rescind a withdrawal and Engelhard will deem any Shares that a stockholder properly withdraws not properly tendered for purposes of the Offer, unless the stockholder properly re-tenders the withdrawn Shares before the Expiration Date by following one of the procedures described in Section 3.

Holders of Option Shares who wish to withdraw the tender of their Option Shares must follow the instructions found in the Optionee Materials sent to them with this Offer to Purchase.

5. Purchase of Shares and Payment of Purchase Price.

Upon the terms and subject to the conditions of the Offer, as promptly as practicable following the Expiration Date, Engelhard will accept for payment and pay for, and thereby purchase, Shares properly tendered and not properly withdrawn prior to the Expiration Date.

For purposes of the Offer, Engelhard will be deemed to have accepted for payment, and therefore purchased, Shares that are properly tendered and are not properly withdrawn, subject to the proration and conditional tender provisions of the Offer, only when, as and if it gives oral or written notice to the depositary of its acceptance of the Shares for payment under the Offer.

Upon the terms and subject to the conditions of the Offer, as promptly as practicable after the Expiration Date, Engelhard will accept for payment and pay $45.00 per share for up to 26,000,000 Shares if properly tendered and not properly withdrawn, or such fewer number of Shares as are properly tendered and not properly withdrawn.

19

Engelhard will pay for Shares that it purchases under the Offer by depositing the aggregate purchase price for these Shares with the depositary, which will act as agent for tendering stockholders for the purpose of receiving payment from Engelhard and transmitting payment to the tendering stockholders.

In the event of proration, Engelhard will determine the proration factor and pay for those tendered Shares accepted for payment as soon as practicable after the Expiration Date; however, Engelhard does not expect to be able to announce the final results of any proration and commence payment for Shares purchased until approximately five business days after the Expiration Date. The preliminary results of any proration will be announced by press release promptly after the Expiration Date. Shares tendered and not purchased, including Shares that Engelhard does not accept for purchase due to proration or conditional tenders, will be returned to the tendering stockholder, or, in the case of Shares tendered by book-entry transfer, will be credited to the account maintained with the book-entry transfer facility by the participant therein who so delivered the Shares, at Engelhard’s expense and without expense to the tendering stockholders, as promptly as practicable after the Expiration Date or termination of the Offer.Under no circumstances will Engelhard pay interest on the purchase price regardless of any delay in making the payment.If certain events occur, Engelhard may not be obligated to purchase Shares under the Offer. See Section 7.

Engelhard will pay all stock transfer taxes, if any, payable on the transfer to it of Shares purchased under the Offer. If, however,

payment of the purchase price is to be made to any person other than the registered holder, or

if tendered certificates are registered in the name of any person other than the person signing the Letter ofTransmittal,

then the amount of all stock transfer taxes, if any (whether imposed on the registered holder or the other person), payable on account of the transfer to the person will be deducted from the purchase price unless satisfactory evidence of the payment of the stock transfer taxes, or exemption therefrom, is submitted.See Instruction 7 of the Letter of Transmittal.

6. Conditional Tender of Shares.

In the event of an over-subscription of the Offer where more than 26,000,000 Shares are properly tendered into the Offer and not properly withdrawn, Shares tendered prior to the Expiration Date will be subject to proration.See Section 1. As discussed in Section 14, the number of Shares to be purchased from a particular stockholder may affect the tax treatment of the purchase to the stockholder and the stockholder’s decision whether to tender. Accordingly, a stockholder may tender Shares subject to the condition that Engelhard must purchase a specified minimum number of the stockholder’s Shares tendered pursuant to a Letter of Transmittal if Engelhard purchases any Shares tendered. Any stockholder desiring to make a conditional tender must so indicate in the box entitled “Conditional Tender” in the Letter of Transmittal and indicate the minimum number of Shares that Engelhard must purchase if Engelhard purchases any Shares. We urge each stockholder to consult with his or her own financial or tax advisors.

After the Expiration Date, if more than 26,000,000 Shares are properly tendered and not properly withdrawn, so that we must prorate our acceptance of and payment for tendered Shares, we will calculate a preliminary proration percentage based upon all Shares properly tendered, conditionally or unconditionally. If the effect of this preliminary proration would be to reduce the number of Shares that we purchase from any stockholder below the minimum number specified, the Shares conditionally tendered will automatically be regarded as withdrawn (except as provided in the next paragraph). All Shares tendered by a stockholder subject to a conditional tender that are withdrawn as a result of proration will be returned at our expense to the tendering stockholder.

After giving effect to these withdrawals, we will accept the remaining Shares properly tendered, conditionally or unconditionally, on a pro rata basis, if necessary. If conditional tenders that would otherwise be regarded as withdrawn would cause the total number of Shares that we purchase to fall below 26,000,000, then to the extent feasible we will select enough of the Shares conditionally tendered that would otherwise have been withdrawn to permit us to purchase such number of Shares. In selecting among the conditional tenders, we will select by random

20

lot, treating all tenders by a particular taxpayer as a single lot, and will limit our purchase in each case to the designated minimum number of Shares to be purchased. To be eligible for purchase by random lot, stockholders whose Shares are conditionally tendered must have tendered all of their Shares.

Optionees are not eligible to make a conditional tender for any Option Shares subject to an unexercised option.

7. Conditions of the Offer.

Notwithstanding any other provision of the Offer, Engelhard will not be required to accept for payment, purchase or pay for any Shares tendered, and may terminate or amend the Offer or may postpone the acceptance for payment of, or the purchase of and the payment for Shares tendered, subject to Rule 13e-4(f) under the Exchange Act, if, at any time on or after May 5, 2006 and before the Expiration Date, any of the following events shall have occurred (or shall have been reasonably determined by Engelhard to have occurred) that, in Engelhard’s reasonable judgment and regardless of the circumstances giving rise to the event or events, make it inadvisable to proceed with the Offer or with acceptance for payment:

| | | there shall have been threatened, instituted or pending any action or proceeding by any government or governmental, regulatory or administrative agency, authority or tribunal or any other person, domestic or foreign, before any court, authority, agency or tribunal that directly or indirectly challenges the making of the Offer, the acquisition of some or all of the Shares under the Offer or otherwise relates in any manner to the Offer; |

| |

| | | there shall have been any action threatened, instituted, pending or taken, or approval withheld, or any statute, rule, regulation, judgment, order or injunction threatened, proposed, sought, promulgated, enacted, entered, amended, enforced or deemed to be applicable to the Offer or Engelhard or any of its subsidiaries, by any court or any authority, agency or tribunal that, in Engelhard’s reasonable judgment, would or might, directly or indirectly; |

| |

| | | | make the acceptance for payment of, or payment for, some or all of the Shares illegal or otherwise restrict or prohibit completion of the Offer; or |

| |

| | | | delay or restrict the ability of Engelhard, or render Engelhard unable, to accept for payment or pay for some or all of the Shares; |

| |

| | | Engelhard shall not have obtained sufficient financing for the purchase of all Shares sought in the Offer (and to pay related fees and expenses); |

| |

| | | the Board of Directors of Engelhard shall have approved a transaction that it determines provides greater value to shareholders; |

| |

| | | BASF shall have amended or modified its offer to increase the price per share to be paid pursuant thereto, or made any other material change to the terms or conditions of the BASF offer and the Company’s Board of Directors determines, in its sole discretion, to recommend such amended BASF offer; or |

| |

| | | the Board of Directors, a majority of which comprises nominees designated by BASF, shall have determined to terminate the Offer. |

The foregoing conditions are for the sole benefit of Engelhard and may be waived by Engelhard, in whole or in part, at any time and from time to time, before the Expiration Date, in its sole discretion. Engelhard’s failure at any time to exercise any of the foregoing rights shall not be deemed a waiver of any of these rights, and each of these rights shall be deemed an ongoing right that may be asserted at any time and from time to time. Any determination or judgment by Engelhard concerning the events described above will be final and binding on all parties.

21

8. Price Range of Shares; Dividends; Rights Agreement.

The Shares are listed and traded on the NYSE under the trading symbol “EC.” The following table sets forth the high and low sales prices for Engelhard common stock and cash dividends paid for each of the quarterly periods presented.

| High | | Low | | Dividend |

|

| |

| |

|

| |

| 2004 | | | | | |

| First Quarter | $30.29 | | $26.66 | | $0.11 |

| Second Quarter | 32.31 | | 27.55 | | 0.11 |

| Third Quarter | 32.72 | | 26.63 | | 0.11 |

| Fourth Quarter | 30.98 | | 26.49 | | 0.11 |

| |

| 2005 | | | | | |

| First Quarter | $30.82 | | $28.64 | | $0.12 |

| Second Quarter | 31.37 | | 27.68 | | 0.12 |

| Third Quarter | 29.96 | | 27.35 | | 0.12 |

| Fourth Quarter | 31.11 | | 26.80 | | 0.12 |

| |

| 2006 | | | | | |

| First Quarter | $40.92 | | $30.37 | | $0.12 |

| Second Quarter (through May 3, 2006) | 39.89 | | 38.18 | | — |

We publicly announced the Offer on April 26, 2006, before the opening of trading on the NYSE on that date. On April 25, 2006, the reported closing price of the Shares on the NYSE was $38.30 per share. On May 3, 2006, the last trading day prior to the printing of this Offer to Purchase, the reported closing price of the Shares on the NYSE was $38.24.We urge stockholders to obtain current market quotations for the Shares.

Rights Agreement

On October 1, 1998, the Board of Directors of Engelhard declared a dividend distribution of one Right for each outstanding Share of the Company. The distribution was payable to holders of record on November 13, 1998. Each Right entitles the registered holder to purchase from the Company one one-thousandth of a share of Series A Junior Participating Preferred Stock (the “Preferred Stock”), at a price of $100 per one one-thousandth of a share, subject to adjustment. The description and terms of the Rights are set forth in the Rights Agreement between the Company and ChaseMellon Shareholder Services, L.L.C., as Rights Agent. A copy of the Rights Agreement is included as an exhibit hereto and incorporated by reference herein.

9. Source and Amount of Funds.

Assuming that 26,000,000 Shares are purchased in the Offer at a price of $45.00 per share, the aggregate purchase price will be $1,170,000,000. Engelhard expects that its related fees and expenses for the Offer will be approximately $4.0 million. Engelhard anticipates that it will enter into an unsecured bridge facility, for which the Commitment Letter has been provided, and obtain all of the funds necessary to purchase Shares tendered in the Offer, and to pay related fees and expenses, through available borrowings under such bridge facility.

Pursuant to a commitment letter from JPMorgan Chase Bank, N.A., J.P. Morgan Securities Inc., Merrill Lynch Bank USA and Merrill Lynch Pierce Fenner & Smith dated as of April 25, 2006 (the “Commitment Letter”), JPMorgan Chase Bank, N.A. and Merrill Lynch Bank USA have committed to provide us, subject to customary conditions, with a $1.5 billion bridge facility which will mature on the date that is 364 days after its effective date (the “Bridge Loan”). A copy of the Commitment Letter is included as an exhibit (b)(1) hereto and incorporated by reference herein. In addition, JPMorgan Chase Bank, N.A. is acting as agent for our existing revolving credit agreement consisting of a $800 million revolving credit facility which matures on March 7, 2010 (the “Credit Facility”). We have requested that the lenders under the Credit Facility amend the Credit Facility to permit us to enter into the Bridge Loan. Proceeds from the Bridge Loan will be used to finance the Offer. Additional amounts

22

from the Credit Facility and Bridge Loan will be used for general corporate purposes and acquisitions and other liquidity support. The Credit Facility is, and the Bridge Loan will be, an unsecured loan which rankspari passuwith our existing senior indebtedness. The Bridge Loan is expected to initially bear interest at a rate per annum equal to LIBOR plus 0.525%, assuming that the Company’s senior unsecured long-term debt ratings is at least BBB or Baa2. In addition, we expect to pay a facility fee at a rate per annum of 0.10% on the aggregate amount of the commitments under the Bridge Loan. Loans under the Credit Facility are expected to initially bear interest at a rate per annum equal to LIBOR plus 0.35%, subject to the same ratings assumptions as the Bridge Loan. In addition, we expect to pay a facility fee at a rate per annum of 0.15% on the aggregate amount of commitments (used or unused) under the Credit Facility, and we may be required to pay a utilization fee of 0.125% on the drawn portion of the Credit Facility if the aggregate outstanding amount of loans exceeds 50% of the total Credit Facility. The documentation for the Bridge Loan will contain covenants and events of default consistent with those in the Credit Facility and financial covenants customary for a facility of this type. Availability of proceeds of the Bridge Loan will be subject to satisfaction of the following conditions:

the Company not being subject to material contractual or other restrictions that would be violated by theBridge Loan;

there not having occurred since December 31, 2005 any material adverse change in the business, assets,condition (financial or otherwise), or results of operations of the Company and its subsidiaries, taken as awhole;

there not having occurred and being continuing any material disruption of or material adverse change infinancial, banking or capital markets since April 25, 2006 that would have a material adverse effect on thesyndication of the Bridge Loan;

prior to and during the syndication of the Bridge Loan, there shall be no competing issues of debt securitiesor commercial bank facilities of the Company being offered, placed, arranged or managed (except for theanticipated amendment of the Credit Facility and any long-term financing to refinance the Bridge Loan);

the Company having a rating of Baa3 or better from Moody’s Investors Service, Inc. and BBB- or betterfrom Standard and Poor’s Ratings Services, in each case, relating to the unsecured, long-term, senior debtof the Company; and

other customary conditions for similar credit facilities.

The Bridge Loan is expected to be repaid by the issuance of new notes, consisting of the following:

Hybrid debt securities: $800 million of ICONs, which are expected to have a 60 year maturity, and call datesranging from 5 years to 30 years.

Senior unsecured notes: $400 million of senior unsecured notes expected to rankpari passuwith our existingsenior indebtedness. These are expected to bear fixed and/or floating rates and have maturities ranging fromtwo to ten years.

There can be no assurances as to when or on what terms the refinancing will occur. The Commitment Letter does not commit JPMorgan Chase Bank, N.A. or Merrill Lynch Bank USA to provide such refinancing. Engelhard believes that the borrowings under the Bridge Loan will be sufficient to purchase Shares tendered in the Offer and related fees and expenses and has no alternative financing plans, although Engelhard expects to refinance the Bridge Loan with the long-term financing described above within 12 months.

10. Certain Information Concerning Engelhard.

Engelhard is a surface and materials science company that develops technologies to improve customers’ products and processes. A Fortune 500 company, Engelhard is a world-leading provider of technologies for environmental, process, appearance and performance applications. For more information, visit Engelhard on the Internet atwww.engelhard.com.

23

Engelhard is a leading global supplier of materials technology to the cosmetic and personal care industries. The Company’s comprehensive approach to personal care materials is built on innovative science that helps create beauty. Engelhard develops active ingredients that address the stresses of time, environment and lifestyle that negatively affect skin such as sun exposure, dryness and aging. These innovative ingredients are supplemented with aesthetic enhancers, preservatives and pigments to provide a single source for personal care and cosmetic formulation needs.

Our executive offices are located at 101 Wood Avenue, Iselin, New Jersey 08830. Our Internet address is www.engelhard.com. The information contained on our web site or connected to our web site is not incorporated by reference into this Offer to Purchase and should not be considered part of this Offer to Purchase.

Selected Historical Financial Information and Selected Pro Forma Financial Information.The following table shows (a) selected historical financial information as of and for the fiscal year ended December 31, 2005 and (b) selected pro forma financial information for the same periods, giving effect to the Offer to purchase 26,000,000 Shares at $45.00 per share. The pro forma information is based on our historical financial information for the year ended December 31, 2005 and gives effect to the Offer as if the Offer were completed on January 1, 2005 for purposes of income statement information and on December 31, 2005 for balance sheet information. The pro forma information assumes that Engelhard would have used borrowings under the Bridge Loan for which the Commitment Letter has been provided to finance the Offer and reflects the related impact on interest income and interest expense. The pro forma information assumes the subsequent refinancing of the Bridge Loan with long-term debt. The impact on interest income and interest expense reflected in the pro forma financial information was based on the average interest rates currently available to Engelhard. The pro forma financial information is intended for informational purposes only and does not purport to be indicative of the results that would actually have been obtained if the Offer had been completed at the dates indicated or the results that may be obtained in the future. Actual results may differ significantly from those shown in the pro forma information.

24

ENGELHARD CORPORATION

PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEETS

AS AT DECEMBER 31, 2005

| | | | As Reported | | | Bridge | | | Pro forma | | Long-term | | | Pro forma |

| | | | December 31, | | | Loan | | | After Bridge | | Financing | | | After Long-term |

| | | | 2005 | | | Adjustments(1) | | | Loan | | Adjustments(2) | | | Financing |

| | |

|

| | |

|

| | |

|

| |

|

| | |

|

|

| (Thousands) (Unaudited) | | | | | | | | | | | | | | | | | | |

| Cash | | | $ | 41,619 | | | $ | 49,724 | (A) | | $ | 91,343 | | $ | (23,500 | )(E) | | $ | 67,843 |

| Receivables, net | | | 526,962 | | | | | | | | 526,962 | | | | | | | 526,962 |

| Committed metal positions | | | 904,953 | | | | | | | | 904,953 | | | | | | | 904,953 |

| Inventories | | | 532,638 | | | | | | | | 532,638 | | | | | | | 532,638 |

| Other current assets | | | 145,392 | | | | | | | | 145,392 | | | | | | | 145,392 |

| |

|

| | |

|

| | |

|

| |

|

| | |

|

|

| Total current assets | | | 2,151,564 | | | | 49,724 | | | | 2,201,288 | | | (23,500 | ) | | | 2,177,788 |

| Investments | | | 204,495 | | | | | | | | 204,495 | | | | | | | 204,495 |

| Property, plant and equipment, net | | | 936,193 | | | | | | | | 936,193 | | | | | | | 936,193 |

| Goodwill | | | 400,719 | | | | | | | | 400,719 | | | | | | | 400,719 |

| Other intangible and noncurrent assets | | | 186,007 | | | | | | | | 186,007 | | | 23,500 | (F) | | | 209,507 |

| |

|

| | |

|

| | |

|

| |

|

| | |

|

|