The following table sets forth information concerning individual grants of stock options made under the 2002 Long Term Incentive Plan in December 2005 for services rendered during 2005 by each of the named Executive Officers.

(1) Options have a ten-year term and vest in four equal annual installments beginning on the first anniversary of the date of grant. Vesting will be accelerated upon the occurrence of a "change in control." For information as to what constitutes a "change in control," see "Employment Contracts, Termination of Employment and Change in Control Arrangements" on page 21.

(2) The Black-Scholes option pricing model was chosen to estimate the grant date present value of the options set forth in this table. Our use of this model should not be construed as an endorsement of its accuracy at valuing options. All stock option valuation models, including the Black-Scholes model, require a prediction about the future movement of the stock price. The real value of the options in this table depends upon the actual changes in the market price of the Common Stock during the applicable period. The model assumes:

(a) an option term of 6.75 years, which represents anticipated exercise trends for the named Executive Officers;

(b) interest rate of 4.37% that represents the current yield curve as of the grant date;

(c) an average volatility of approximately 29.87% calculated using average weekly stock prices for the 6.75 years prior to the grant date; and

(d) dividend yield of 1.60% (the annual dividend rate on the grant date divided by the option exercise price). The following table sets forth information concerning each exercise of stock options during 2005 by each of the named Executive Officers and the value of unexercised options at December 31, 2005.

Long-Term Incentive Plan - Awards in Fiscal 2005

The table below sets forth information concerning the grant of performance units to each of the named

Executive Officers.

Number of

Shares, Units

or Other Rights Performance Estimated Future Payout (1)

---------------------------

Name Granted (1) Period Until Payout Threshold ($) Target ($) Maximum ($)

- ----------------------------- --------------- ------------------- ------------- ---------- -----------

Barry W. Perry ............... 1,000,000 12/31/2007 0 1,000,000 2,000,000

Michael A. Sperduto .......... 171,893 12/31/2007 0 171,893 343,786

Arthur A. Dornbusch, II ...... 170,063 12/31/2007 0 170,063 340,126

Edward T. Wolynic ............ 153,734 12/31/2007 0 153,734 307,468

John C. Hess ................. 83,310 12/31/2007 0 83,310 166,620

| (1) | The long-term performance units were granted as performance units under the 2002 Long Term Incentive Plan. The performance period for the long-term performance units began on January 1, 2005. The value of each long-term performance unit was initially set at $1.00 per unit, and it will increase or decrease based on the performance of the Company in relation to the performance metrics specified annually by the Compensation Committee of the Board of Directors and set forth in the form of long-term performance unit award letter, a form of which is filed as an exhibit to Engelhard’s 2005 Form 10-K filed with the SEC. Upon a change in control (as defined in the 2002 Long Term Incentive Plan) of the Company each long-term performance unit will be valued at $2.00, its maximum value, and that value will be paid in cash at the time of the change in control. |

PENSION PLANS

The following table shows estimated annual pension benefits payable to a covered participant at normal retirement age under our qualified defined benefit pension plan, as well as the non-qualified supplemental retirement program. This non-qualified plan provides benefits that would otherwise be denied to participants by reason of certain Internal Revenue Code limitations on qualified plan benefits and provides enhanced benefits for certain named key executives, including the individuals named in the Summary Compensation Table, based on remuneration that is covered under the plans and years of service with Engelhard and its subsidiaries.

Pension Plan Table

Years of Service

---------------------------------------------------------------------------------

Final Average Pay 15 Years 20 Years 25 Years 30 Years 35 Years

- --------------------------------------- ----------- ---------- ----------- ---------- ----------

$ 400,000 ......................... $ 132,294 $ 180,294 $ 228,294 $ 276,294 $ 276,294

600,000 ......................... 204,294 276,294 348,294 420,294 420,294

800,000 ......................... 276,294 372,294 468,294 564,294 564,294

1,000,000 ......................... 348,294 468,294 588,294 708,294 708,294

1,200,000 ......................... 420,294 564,294 708,294 852,294 852,294

1,400,000 ......................... 492,294 660,294 828,294 996,294 996,294

1,600,000 ......................... 564,294 756,294 948,294 1,140,294 1,140,294

1,800,000 ......................... 636,294 852,294 1,068,294 1,284,294 1,284,294

2,000,000 ......................... 708,294 948,294 1,188,294 1,428,294 1,428,294

2,200,000 ......................... 780,294 1,044,294 1,308,294 1,572,294 1,572,294

2,400,000 ......................... 852,294 1,140,294 1,428,294 1,716,294 1,716,294

2,600,000 ......................... 924,294 1,236,294 1,548,294 1,860,294 1,860,294

2,800,000 ......................... 996,294 1,332,294 1,668,294 2,004,294 2,004,294

3,000,000 ......................... 1,068,294 1,428,294 1,788,294 2,148,294 2,148,294

3,200,000 ......................... 1,140,294 1,524,294 1,908,294 2,292,294 2,292,294

3,400,000 ......................... 1,212,294 1,620,294 2,028,294 2,436,294 2,436,294

3,600,000 ......................... 1,284,294 1,716,294 2,148,294 2,580,294 2,580,294

19

A participant’s remuneration covered by our pension plans is his or her average monthly earnings, consisting of base salary and regular cash bonuses, if any (as reported in the Summary Compensation Table), for the highest 60 consecutive calendar months out of the 120 completed calendar months next preceding termination of employment. With respect to each of the individuals named in the Summary Compensation Table on page 17, credited years of service under the plans as of December 31, 2005 are as follows: Mr. Perry, 17 years; Mr. Sperduto, 22 years; Mr. Dornbusch, 29 years; Mr. Wolynic, 10 years; and Mr. Hess, 21 years. Benefits shown are computed as a straight line single life annuity beginning at age 65 and the benefits listed in the Pension Plan Table are not subject to any deduction for Social Security or other offset amounts.

20

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT

AND CHANGE IN CONTROL ARRANGEMENTS

Engelhard entered into an employment agreement with Mr. Perry dated as of August 2, 2001. The initial term of the agreement was extended until December 31, 2003. Mr. Perry’s employment agreement is automatically extended for successive periods so that the remaining term shall always be twelve months, unless notice of intention not to extend shall have been given in writing twelve months prior to the expiration of any extended term. The agreement will terminate no later than December 31, 2011. The agreement provides for an annual salary of not less than $750,000 for calendar year 2001, $900,000 for calendar year 2002 and $1,000,000 for calendar year 2003, with increases thereafter to be determined by the Compensation Committee of the Board of Directors. In addition, the employment agreement provides for participation in Engelhard’s annual incentive program with target award amounts (not less than one-third of which shall be in the form of a cash bonus) of 75% of the annual salary for 2001, 100% of the annual salary for 2002, and 125% of the annual salary for 2003 and thereafter. The agreement (and similar arrangements established by the Compensation Committee) also provided for a formula-based grant of additional equity awards for 2001, 2002, 2003 and 2004 if Engelhard’s average closing stock price and the total return on Engelhard’s Common Stock met designated targets. Mr. Perry received awards under these arrangements for 2001 and 2003. Mr. Perry also received an additional five years of credited service under our supplemental retirement program, is entitled to participate in the benefit plans of Engelhard and is entitled to certain other perquisites. The agreement as amended also provides for payment of $100,000 per year to be used by Mr. Perry for financial planning, legal, tax planning and similar services or for life insurance in lieu of any death benefit or survivors’ coverage other than that generally available to all executives, to be allocated as determined by Mr. Perry.

In the event Engelhard terminates Mr. Perry’s employment other than for cause (as defined in the agreement) or in the event Mr. Perry terminates his employment for good reason (as defined in the agreement), the employment agreement provides that Mr. Perry will receive an amount equal to two times the lesser of (i) 4.5 times his then current annual base salary or (ii) the average for the three calendar years preceding such calculation of the sum of Mr. Perry’s annual base salary, annual bonus and the grant date cash value of equity based awards. Amounts payable pursuant to this termination provision will be reduced, but not below zero, by certain severance amounts paid to Mr. Perry under the Change in Control Agreements described below. Upon any such termination, Mr. Perry will also be entitled to continued benefits for two years following such termination.

Pursuant to our Change in Control Agreements, we will provide severance benefits in the event of a termination of an Executive (as defined), except a termination:

(1) because of death,

(2) because of “Disability,”

(3) by Engelhard for “Cause,” or

(4) by the Executive other than for “Good Reason,”

for the period beginning on the date of a “Potential Change in Control” (as such terms are defined in the Change in Control Agreement) or “change in control” (as defined below) and ending on the third anniversary of the date on which a “change in control” occurs. The severance benefits include:

| (1) | | the payment of salary to the Executive through the date of termination of employment together with salary in lieu of vacation accrued; |

| (2) | | an amount equal to a pro-rated incentive pool award under our Incentive Compensation Plan, determined as set forth in the Agreement; |

| (3) | | an amount equal to two times the sum of the highest annual salary and incentive pool award in effect during any of the preceding 36 months, determined as set forth in the Agreement; |

| (4) | | continued coverage under our life, disability, health, dental and other employee welfare benefit plans for up to two years; |

| (5) | | continued participation and benefit accruals under our Supplemental Retirement Program for two years following the date of termination; and |

21

| (6) | | an amount sufficient, after taxes, to reimburse the Executive for any excise tax under Section 4999 of the Internal Revenue Code of 1986, as amended. |

Each of Messrs. Perry, Sperduto, Dornbusch and Hess is defined as an Executive.

On January 20, 2006, our Board, upon recommendation of the Company’s Compensation Committee, approved a Change in Control Agreement with our Vice President and Chief Technology Officer, Dr. Wolynic. Pursuant to this agreement, we will provide severance benefits to Dr. Wolynic in the event of termination of his employment, except a termination: (1) by Engelhard for “Cause,” or (2) by Dr. Wolynic other than for “Good Reason,” within the period beginning on the date of a “Potential Change in Control” (as such terms are defined in the Change in Control Agreement) or “change in control” (as defined below) and ending on the third anniversary of the date on which a “change in control” occurs.

The severance benefits include:

| (1) | | the payment of salary through the date of termination together with salary in lieu of accrued vacation; |

| (2) | | an amount equal to two times the sum of his base salary and the cash value of his target incentive compensation awards for the year of the change in control, determined as set forth in the agreement; |

| (3) | | continued participation in the Company’s group medical and dental plans for up to two years following the date of termination; and |

| (4) | | an amount sufficient, after taxes, to reimburse the Executive for any excise tax under Section 4999 of the Internal Revenue Code of 1986, as amended. |

Approximately $65.4 million would be payable to all officers, including approximately $61.9 million which would be payable to Executive Officers, assuming a qualifying termination occurred on June 2, 2006 and a share price of $38.00. Amounts payable under the agreements are in addition to the amounts payable under the other plans described herein.

In order to address the uncertainty in the application of the recently adopted rules under the Internal Revenue Code of 1986 governing deferred compensation and to ensure that any amendments necessary to bring the Company’s plans and agreements into compliance with those rules are timely made, on January 20, 2006 our Board, upon recommendation of the Compensation Committee, approved letter agreements with each of the Executive Officers with a Change in Control Agreement with the Company. The letter agreements:

| (1) | | obligate the Company to make timely amendments necessary to bring the Company’s plans and agreements into compliance with the new deferred compensation rules in a manner that does not reduce the economic value to the executives; |

| (2) | | obligate the Executive Officers to not unreasonably withhold their consent to such amendments and report for tax purposes on a basis consistent with the Company’s reporting; and |

| (3) | | provide that the Company will indemnify the Executive Officers, on an after-tax basis, against any additional tax or interest imposed due to failure to comply with the deferred compensation rules. |

In addition, if compliance with the rules requires that payment of amounts to the Executive Officers be deferred from the date otherwise payable, the deferred amounts would be deposited in the Company’s Supplemental Retirement Trust for the benefit of the Executive Officer.

For purposes of our Change in Control Agreements, a “change in control” is triggered if one of the following occurs:

| (1) | | twenty-five percent or more of our outstanding securities entitled to vote in the election of directors shall be beneficially owned, directly or indirectly, by any person or group of persons, other than the groups presently owning the same, or |

| (2) | | a majority of our Board of Directors ceases to consist of the existing membership or successors approved by the existing membership or their similar successors, or |

| (3) | | shareholders approve a reorganization or merger with respect to which the persons who were the beneficial owners of our outstanding voting securities immediately prior thereto do not, following the |

22

| | reorganization or merger, beneficially own more than 60% of the outstanding voting securities of the corporation resulting from the reorganization or merger in substantially the same proportions as their ownership of our voting securities immediately prior thereto, or |

(4) shareholder approval of either:

(a) a complete liquidation or dissolution of Engelhard or

| (b) | | a sale or other disposition of all or substantially all of the assets of Engelhard, other than to a corporation, with respect to which following such sale or other disposition, more than 60% of Engelhard’s outstanding securities entitled to vote generally in the election of directors are thereafter beneficially owned, in substantially the same proportions, by all or substantially all of the individuals and entities who were the beneficial owners of such securities prior to such sale or other disposition. |

Stock Option, Stock Bonus and 2002 Long Term Incentive Plans

Our Key Employees Stock Bonus Plan, our Stock Option Plans and our 2002 Long Term Incentive Plan, in which all of the Executive Officers participate, provide for the acceleration of vesting of awards granted in the event of a “change in control” as defined above, except that a “change in control” is triggered by twenty percent, rather than twenty-five percent, beneficial ownership of Engelhard’s outstanding securities entitled to vote in the election of directors, directly or indirectly, by any person or group of persons, other than the groups presently owning the same. If vesting of awards under the Key Employees Stock Bonus Plan is accelerated, an additional payment will be made to compensate for the loss of tax deferral.

Pursuant to the terms of the plans as previously approved by the Company’s shareholders, upon a change in control of the Company:

| (1) | | 1,189,161 unvested options to purchase shares held by directors and executive officers, with a weighted average exercise price of $28.63 per share, will vest and become exercisable; |

| (2) | | 160,875 unvested shares of restricted stock held by executive officers will vest and no longer be subject to forfeiture; and |

| (3) | | 12,882 unvested restricted stock units held by an executive officer will vest and shares will be distributed pursuant thereto at the time of a change in control. |

In the case of restricted stock units and restricted shares, aggregate additional payments of approximately $365,000 (assuming a change in control date of June 2, 2006 and a share price of $38.00) will be made to executive officers to compensate for the lost tax deferral.

Also, pursuant to the terms of the plan under which they were granted, which was previously approved by the Company’s shareholders, 3,737,567 long-term performance units held by executive officers will vest and will each be valued at $2.00. Such value will be paid in cash at the time of the change in control.

Deferred Compensation Plans; Supplemental Retirement Program

Unless a contrary advance election is made, amounts deferred under our Deferred Compensation Plan for Key Employees will be paid in a lump sum upon a “change in control” (a “change in control” for this purpose will occur if either (1) or (2) in the above definition of “change in control” under the Change in Control Agreements occurs). If payments are so accelerated, an additional payment will be made in order to compensate for the loss of tax deferral. Under our Directors and Executives Deferred Compensation Plans, which provided for elective deferrals of compensation earned for years from 1986 through 1993, deferred amounts will be paid at the time of an “acquisition of a control interest” if the participant has made an advance election to that effect. In the event distribution of deferred amounts is so accelerated, aggregate additional payments of approximately $6.3 million(assuming a change in control date of June 2, 2006 and a share price of $38.00) will be made to current executive officers and directors in order to compensate for the loss of tax deferral resulting from the accelerated payment. In addition, certain supplemental retirement benefits under our Supplemental Retirement Program will vest upon a “change in control” (defined as described above in the case of the Change in Control Agreements).

23

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Under the overall direction of the Compensation Committee of the Board of Directors and in accordance with our Stock Option Plans and Long Term Incentive Plan approved by our shareholders, we have developed and implemented compensation programs designed to:

• Attract and retain key employees who can build and continue to grow a successful company;

• Provide incentives to achieve high levels of company, business, and individual performance; and

• Maintain and enhance alignment of employee and shareholder interests.

The Compensation Committee is composed entirely of Non-employee Directors individually noted as signatories to this report.

The Compensation Committee is responsible for overseeing the development and for review and approval of:

•Overall compensation policy;

| | •Salaries for the Chief Executive Officer and for approximately 18 other senior managers worldwide; |

| | •Aggregate cash incentive awards for Engelhard and specific individual cash awards under the annual plan for the Chief Executive Officer and approximately 18 other senior managers worldwide; |

| | •Plan design and policies related to senior management and employee awards of options and restricted stock; and |

| | •Individual grants under the Stock Option Plans, Stock Bonus Plan and other awards under the Incentive Compensation Plan for Key Employees to the Chief Executive Officer and other senior employees worldwide. |

In exercising those responsibilities and in determining the compensation in particular of Mr. Perry and in general of other senior managers individually reviewed, the Committee examines and sets:

1. Base Salary

The Compensation Committee reviews salaries annually against industry practices as determined by a number of professional outside consultants who conduct annual surveys. Our current competitive target is to pay at or above the median for positions of comparable level. This target is being achieved on average for the professional, technical, and managerial salaried work force. Salary structures are set each year based on our target and its actual competitive position. A market analysis was done on the existing salary structure in 2005 and it was determined that no major structure adjustments were necessary. Likewise, merit budgets are established based on a competitive target, actual competitive position, and our desire to recognize and reward individual contribution. For international employees and non-exempt salaried employees in the United States, structure adjustments and merit budgets are determined based on local market conditions.

Individual merit adjustments are based upon the managers’ quantitative and qualitative evaluation of individual performance, including feedback from customers served, against business objectives such as earnings, return on capital, free cash flow, market share, new customers, and development of new commercial products. Performance is also considered in the context of expectations for behavior and the individuals’ positions in their respective salary-ranges.

Mr. Perry’s salary was increased 3.1% for 2006 in accordance with competitive practice. Base salary continues to be less than one-fourth of total compensation for Mr. Perry and generally less than one-half of total compensation for other senior management. This reflects our emphasis on non-fixed compensation, which varies with Engelhard performance, and on other equity vehicles which are closely aligned with shareholder interests.

2. Annual Cash and Long Term Incentive Compensation

In October 2004, the Compensation Committee adopted a new Incentive Compensation Plan, applicable to key employees worldwide, to replace the prior Management Incentive Plan. The redesigned Plan essentially reduced the amount of equity (stock options and restricted stock) with an approximately corresponding increase to cash bonuses and the introduction of a new Long-Term Performance Unit program.

24

Our Incentive Compensation Plan integrates incentive compensation vehicles (cash bonus awards, long-term performance units, restricted stock and stock options) to link total compensation for the participant with both competitive practice and the performance of Engelhard and/or the applicable business unit and the individual. The Plan facilitates clarity of performance expectations and encourages the identification and commitment to exceptional results.

Overall incentive pools are established consisting of cash, restricted stock and stock options. The level of the pool generated for Engelhard overall and each business group depends upon actual performance against targets established at the beginning of each year (which, for executive officers, is based on Engelhard’s earnings per share). The pools are determined by a formula based on the base salary and band level of each eligible employee in the pool (including specific designations for Mr. Perry) and the actual performance of Engelhard and/or its business units against specific predetermined levels of earnings targets. A threshold level is established for each pool below which incentives will not normally be paid. Engelhard’s Compensation Committee may adjust these pools up or down in its sole discretion. Once each group’s pool is established, individual performance based awards are made based on the individual’s performance and the performance of the group. In addition, through awards of long-term performance units, eligible plan participants will have the opportunity to earn additional cash compensation contingent upon the attainment of cumulative three-year weighted performance objectives. The initial grant is based upon a percentage of base salary, which varies depending on band level.

The value of total direct compensation, which includes both base salary and awards made for services in 2005 under Engelhard’s Incentive Compensation Plan, for all managers eligible under the Plan increased by 11% from 2004. As provided under the Plan, the level of the pool generated for Engelhard overall and each business group depends upon that group’s actual performance against targets established at the beginning of 2005. Once each group’s pool was established, awards were made as described above. In assessing the appropriate level of compensation for Mr. Perry, the Compensation Committee retained an independent compensation consultant, which was charged with reviewing both competitive practice and the Company’s performance against applicable comparator companies to ensure that Mr. Perry’s compensation was properly aligned with shareholders’ interests and to further ensure that his compensation was aligned with performance. As part of this process the Company’s performance against a peer group of companies was assessed; among the measures reviewed were one and three year results for operating margin, return on invested capital, total shareholder return, and return on average assets. In addition to these measures the Compensation Committee considered certain other factors in determining Mr. Perry’s compensation. Among those other factors were his organizational leadership, strategic focus Board, shareholder and analyst relationships and succession planning. As a result of all these considerations the Compensation Committee decided that Mr. Perry’s total direct compensation, which includes base salary plus the value of all awards and grants under the Incentive Compensation Plan, should be generally consistent with the target compensation established by the Compensation Committee for 2005. In addition, the Compensation Committee directed that the same independent compensation consultant retained to assess Mr. Perry’s compensation prepare a similar assessment for all senior executives, using similar methodologies and market data. The Compensation Committee considered the results of that assessment in determining executives’ 2006 base salaries and incentive compensation for 2005.

a. Annual Cash Incentive Program

| | This program is designed to provide focus on expected annual results and recognition of accomplishment for the year. |

| | For 2005, actual cash payments determined under the Incentive Compensation Plan, including the cash incentive payments to all Executive Officers, were 94% of the competitively defined pool as factored for performance. |

| | For the year 2005, Mr. Perry received a cash incentive award of $1,300,000, compared with $1,760,000 for 2004. Total cash compensation paid to eligible participants reflects competitive practice for results achieved and is projected to be around the 75th percentile of competitive practice for those employees in businesses whose achievement of targeted results and whose individual performance warrants such compensation. |

25

b. Restricted Stock

| | Providing for vesting of shares in equal amounts over a period of five years, the Key Employees Stock Bonus Plan is designed to align key employee and shareholder long-term interests by providing designated employees an equity interest in Engelhard. Eligible employees are reviewed annually for award grants determined in the manner previously described. |

| | The total restricted stock value under the Incentive Compensation Plan granted to Executive Officers and other participants for 2005 was 87% of the plan generated pool. The Committee determines the dollar amount of the restricted stock pool for the year, which is then converted to restricted stock. |

| | For the year 2005, Mr. Perry received a restricted stock award of 27,030 shares under the Key Employees Stock Bonus Plan. For 2004, Mr. Perry received a restricted stock award of 15,420 shares under the Key Employees Stock Bonus Plan. |

c. Stock Options

| | Our Stock Option Plans have been designed to link employee compensation growth directly to growth in share price. Senior managers worldwide, including all the Executive Officers, are reviewed for annual stock option grants determined under the Incentive Compensation Plan in the manner previously described. Options vest in equal increments over four years, are granted with an exercise price equal to the fair market value per share on the date of grant, and normally have a ten-year life. Options granted for 2005 under the Incentive Compensation Plan were 87% of the pool generated. |

| | For the year 2005, Mr. Perry received 200,000 stock option awards under the Incentive Compensation Plan. He received 258,688 stock options for 2004. |

| | In light of the expiration of certain options held by employees during a company-mandated blackout period in 2005, the Compensation Committee authorized cash awards to those employees in an aggregate amount of $895,537, which represented the economic value of the expired options as of the expiration date of the options. |

d. Long-Term Performance Units

| | As part of the Incentive Compensation Plan, long-term performance units were granted to key employees, including all of the Executive Officers. The long-term performance units were granted as performance units under the 2002 Long Term Incentive Plan. The performance period for the long-term performance units began on January 1, 2005 and will end on December 31, 2007. The value of each long-term performance unit was initially set at $1.00 per unit, and it will increase or decrease based on the performance of the Company in relation to the performance metrics set forth in the award agreements. An aggregate of 1,854,440 long-term performance units were awarded to Executive Officers for 2005, including an award of 1,000,000 units to Mr. Perry. Upon a “change in control” of the Company each long-term performance unit will be valued at $2.00, its maximum value, and that value will be paid in cash at the time of the change in control. |

| | The Committee directs the purchase of compensation survey information from several independent professional consultants in order to review the base, annual cash incentive, and total compensation of Mr. Perry and other individual senior managers and employee groups. The Committee is generally satisfied that relevant competitive data and achievements of Engelhard indicate the compensation design supported the objectives of attracting and retaining key talent, providing incentives for superior performance, and aligning employee and shareholder interests. |

| | Section 162(m) of the Internal Revenue Code generally limits the deductible amount of annual compensation paid to certain individual executive officers (i.e., the chief executive officer and the four other most highly compensated executive officers of Engelhard) to no more than $1 million each. The Committee is aware of this limitation and will continue to consider tax consequences as well as other relevant factors in connection with compensation decisions. |

Compensation Committee

Marion H. Antonini James V. Napier Henry R. Slack26

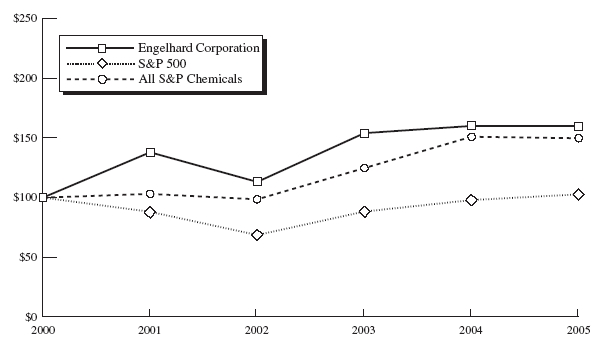

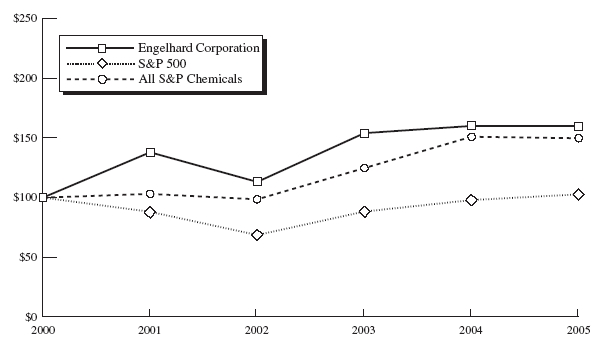

Performance Graph

Comparison of Five-Year Cumulative Total Returns

Among Engelhard Corporation, S&P 500 Index

and All S&P Chemicals

December 31,

2000 2001 2002 2003 2004 2005

------ ------ ------ ------ ------ ------

Engelhard Corporation ............................. 100.00 138.00 113.15 154.07 160.08 159.98

S&P 500 Index ..................................... 100.00 88.11 68.64 88.33 97.94 102.75

All S&P Chemicals ................................. 100.00 103.09 98.55 124.76 151.03 149.76

(a) Assumes $100 invested on December 31, 2000 in each referenced group with reinvestment of dividends.

(b) The All S&P Chemicals index includes all 41companies (including Engelhard) in all chemical subindices from the S&P 1500.

27

REPORT OF AUDIT COMMITTEE

General

The primary purpose of the Audit Committee is to assist the Board of Directors’ oversight of (a) the integrity of Engelhard’s financial statements, (b) the independent auditor’s qualifications and independence, (c) the performance of Engelhard’s internal audit function and independent auditors and (d) Engelhard’s compliance with legal and regulatory requirements. The Audit Committee has the sole authority to appoint and terminate Engelhard’s independent auditors. The Audit Committee is composed of all independent directors and operates under a written charter adopted and approved by the Board of Directors. During the fiscal year 2005, the Audit Committee held 10 meetings.

It is not the responsibility of the Audit Committee to plan or conduct audits, determine that Engelhard’s financial statements are in all material respects complete and accurate in accordance with generally accepted accounting principles, or to certify Engelhard’s financial statements. This is the responsibility of management and the independent auditors. It is also not the responsibility of the Audit Committee to guarantee the independent auditor’s report or to assure compliance with laws and regulations and Engelhard’s Policies of Business Conduct.

Based on the Audit Committee’s review of the audited financial statements as of and for the fiscal year ended December 31, 2005 and its discussions with management regarding such audited financial statements, its receipt of written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1(Independence Discussions With Audit Committees), its discussions with the independent auditors regarding such auditor’s independence, the matters required to be discussed by the Statement on Auditing Standards 61(Communication With Audit Committees) and other matters the Audit Committee deemed relevant and appropriate, the Audit Committee recommended to the Board of Directors that the audited financial statements as of and for the fiscal year ended December 31, 2005 be included in Engelhard’s Annual Report on Form 10-K for such fiscal year.

Audit Committee

| Douglas G. Watson | David L. Burner | James V. Napier |

The foregoing Audit Committee Report shall not be incorporated by reference into any of Engelhard’s prior or future filings with the SEC, except as otherwise explicitly specified by Engelhard in any such filing.

28

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Ernst & Young LLP (“E&Y”) expects to have a representative at the meeting who will have the opportunity to make a statement and who will be available to answer appropriate questions.

Fees Billed to Engelhard by E&Y during each of the fiscal years ended December 31, 2005 and December 31, 2004

Audit Fees

The aggregate audit fees billed to Engelhard by E&Y, which consists principally of services rendered in connection with the audit of Engelhard’s financial statements included in Engelhard’s Annual Report on Form 10-K and internal controls over financial reporting for Fiscal Year 2005, the review of Engelhard’s financial statements included in Engelhard’s Quarterly Reports on Form 10-Q during the fiscal year ended December 31, 2005 and statutory audits in non-U.S. locations, totaled $5,369,000 as compared to $5,199,000 for the fiscal year ended December 31, 2004.

Audit-Related Fees

The aggregate fees billed to Engelhard by E&Y during each of the fiscal years ended December 31, 2005 and December 31, 2004 for audit-related services totaled $614,000 and $400,000, respectively. Audit-related fees consist principally of fees for due diligence reviews, audits of financial statements of certain employee benefit plans and audits of government research programs.

Tax Fees

The aggregate fees billed to Engelhard by E&Y during each of the fiscal years ended December 31, 2005 and December 31, 2004 for tax services totaled $892,000 and $762,000, respectively. Tax fees consist of tax planning and tax compliance services.

All Other Fees

No other fees were incurred or billed to Engelhard by E&Y during each of the fiscal years ended December 31, 2005 and December 31, 2004, other than those described above.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee considered and concluded that the provision of non-audit services by E&Y is compatible with maintaining auditor independence.

Audit fees are reviewed and explicitly approved by the Audit Committee on an annual basis. Engelhard’s Audit Committee has established detailed policies and procedures for the pre-approval of audit, audit-related, tax and other services. These procedures include review and approval of the nature of permissible services in 31 specific service categories. The Audit Committee has pre-approved fees within nine service categories. Additionally, and notwithstanding any pre-approval, any individual service for $100,000 or more requires explicit review and approval of the Audit Committee before the auditor is engaged. The Chairman of the Audit Committee has authority to approve engagements within permitted service categories on an interim basis, subject to review at the next Audit Committee meeting.

2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors is required by law and applicable New York Stock Exchange rules to be directly responsible for the appointment, compensation and retention of the Company’s independent registered public accounting firm. The Audit Committee has appointed E&Y as the independent registered public accounting firm for the year ending December 31, 2006. While shareholder ratification is not required by the Company’s By-laws or otherwise, the Board of Directors is submitting the selection of E&Y to the shareholders for ratification as part of good corporate governance practices. If the shareholders fail to ratify the selection, the Audit Committee may, but is not required to, reconsider whether to retain E&Y. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent registered public accounting firms at any time during the year if it determines that such a change would be in the best interest of the Company and its shareholders.

29

The Board of Directors recommends a vote FOR the proposal to ratify the selection of E&Y as the Company’s independent registered public accounting firm to audit the Company’s consolidated financial statements for the year ending December 31, 2006. The persons designated as proxies will vote FOR the ratification of E&Y as the Company’s independent registered public accounting firm, unless otherwise directed.

FUTURE SHAREHOLDER PROPOSALS

How do I make a proposal for the 2007 Annual Meeting?

The deadline for you to submit a proposal pursuant to Rule 14a-8 of the Exchange Act for inclusion in our proxy statement and form of proxy for the 2007 Annual Meeting of Shareholders (the “2007 Annual Meeting”) is December 29, 2006. Any shareholder proposal submitted outside of the processes of Rule 14a-8 of the Exchange Act must be received by us after February 3, 2007 and before March 6, 2007. If received by us after March 6, 2007, then our proxy for the 2007 Annual Meeting may confer discretionary authority to vote on such matter without any discussion of such matter in the proxy statement for the 2007 Annual Meeting.

HOUSEHOLDING

The SEC has adopted amendments to its rules regarding delivery of proxy statements and annual reports to shareholders sharing the same address. We may now satisfy these delivery rules by delivering a single proxy statement and annual report to an address shared by two or more of our shareholders. This delivery method is referred to as “householding” and can result in significant cost savings for us. In order to take advantage of this opportunity, we have delivered only one proxy statement and annual report to multiple shareholders who share an address, unless we received contrary instructions from the impacted shareholders prior to the mailing date. We undertake to deliver promptly, upon written or oral request, a separate copy of the proxy statement or annual report, as requested, to any shareholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of a proxy statement or annual report, either now or in the future, send your request in writing to us at the following address: Investor Relations Department, Engelhard Corporation, 101 Wood Avenue, Iselin New Jersey 08830.

If you are currently a shareholder sharing an address with another shareholder and wish to have your future proxy statements and annual reports householded (i.e., receive only one copy of each document for your household) please contact us at the above address.

PARTICIPANTS IN THE SOLICITATION

Under applicable regulations of the SEC, each member of the Engelhard Board, the director nominees at this year’s Meeting and Messrs. Dresner, Lowen, Wolynic and Bell may be deemed to be a “participant” in Engelhard’s solicitation of proxies in connection with the meeting. For information on each participant please refer toAppendix B to the proxy statement.

OTHER MATTERS

At the date of this proxy statement, the Board of Directors has no knowledge of any business other than that described herein which will be presented for consideration at the meeting. In the event any other business is presented at the meeting, the persons named in the enclosed proxy will vote such proxy thereon in accordance with their judgment in the best interests of Engelhard.

By Order of the Board of DirectorsARTHUR A. DORNBUSCH, II

Vice President, General Counsel

and Secretary

May 12, 2006

30

APPENDIX A

Engelhard Corporation

Director Independence Standards

The Board of Directors of Engelhard Corporation (the “Company”) has adopted the following standards to assist it in making determinations of independence in accordance with the NYSE Corporate Governance rules.

Employment Relationships

A director will be deemed to be independent unless, within the preceding three years:

• such director| | • is or was an employee of the Company or any of the Company’s subsidiaries, other than an interim Chairman or Chief Executive Officer or other executive officer; |

• is a current partner of the Company's internal or external auditor; o is a current employee of the Company's internal or external auditor; or| | • was (but is no longer) a partner or employee of the Company’s internal or external auditor who personally worked on the Company’s audit within that time. |

• any immediate family member of such director o is or was an executive officer of the Company or any of the Company's subsidiaries; o is a current partner of the Company's internal or external auditor;| | • is a current employee of the Company’s internal or external auditor who participates in the firm’s audit, assurance or tax compliance (but not tax planning) practice; or |

| | • was (but is no longer) a partner or employee of the Company’s internal or external auditor who personally worked on the Company’s audit within that time. |

Compensation Relationships

A director will be deemed to be independent unless, within the preceding three years:

• such director has received during any twelve-month period more than $100,000 in direct compensation from the Company or any of its subsidiaries other than: (i) director and committee fees; (ii) pension or other forms of deferred compensation for prior service; provided, however, that such compensation is not contingent in any way on continued service; and (iii) compensation received for former service as an interim Chairman or Chief Executive Officer or other executive officer; or

• an immediate family member of such director has received during any twelve-month period more than $100,000 in direct compensation from the Company or any of its subsidiaries as a director or executive officer other than: (i) director and committee fees and (ii) pension or other forms of deferred compensation for prior service; provided, however, that such compensation is not contingent in any way on continued service.

Commercial Relationships

A director will be deemed to be independent unless:

• such director is a current employee of another company that has made payments to, or received payments from, the Company or any of its subsidiaries for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues; or

• an immediate family member of such director is a current executive officer of another company that has made payments to, or received payments from, the Company or any of its subsidiaries for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues.

A-1

Charitable Relationships

A director will be deemed to be independent unless such director is an executive officer of a tax-exempt organization that, within the preceding three years, received contributions from the Company or any of its subsidiaries in an amount which, in any single fiscal year, exceeded the greater of $1 million or 2% of such tax-exempt organization’s consolidated gross revenues; unless the Board determines such relationships not to be material or otherwise consistent with a Director’s independence.

Interlocking Directorates

A director will be deemed to be independent unless, within the preceding three years:

• such director is or was employed as an executive officer of another company where any of the Company’s or its subsidiaries’ present executive officers at the same time serves or served on that company’s compensation committee; or

• an immediate family member of such director is or was employed as an executive officer of another company where any of the Company’s or its subsidiaries’ present executives at the same time serves or served on that company’s compensation committee.

Other Relationships

For relationships not specifically mentioned above, the determination of whether a director has a material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company), and therefore would not be independent, will be made by the Board of Directors after taking into account all relevant facts and circumstances. For purposes of these standards, a director who is solely a director and/or a non-controlling shareholder of another company that has a relationship with the Company will not be considered to have a material relationship based solely on such relationship that would impair such director’s independence.

For purposes of the standards set forth above, “immediate family member” means any of such director’s spouse, parents, children, siblings, mothers and fathers-in-law, sons and daughters-in-law and brothers and sisters-in-law (other than those who are no longer family members as a result of legal separation or divorce, or those who have died or become incapacitated) and anyone (other than a domestic employee) who shares such director’s home. For purposes of the standards set forth above, “executive officer” means the Company’s president, principal financial officer, principal accounting officer (or, if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division or function (such as sales, administration or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the Company. Officers of the Company’s subsidiaries shall be deemed officers of the Company if they perform such policy-making functions for the Company.

These standards shall be interpreted in a manner consistent with the New York Stock Exchange Corporate Governance Rules.

A-2

APPENDIX B

Information Concerning the Solicitation of Proxies

Engelhard is soliciting the proxies solicited by this proxy statement. Engelhard will solicit proxies by mail, telephone, facsimile, press releases and in person. Solicitations may be made by directors, officers and employees of Engelhard, none of whom will receive additional compensation for such solicitations. Engelhard will request banks, brokerage houses and other custodians, nominees and fiduciaries to forward all of its solicitation materials to the beneficial owners of the shares they hold of record. Engelhard will reimburse these record holders for customary clerical and mailing expenses incurred by them in forwarding these materials to customers.

Engelhard has retained MacKenzie to assist it in connection with Engelhard’s communications with its shareholders with respect to the offer, as information agent with respect to the self-tender offer and such other advisory services as may be requested from time to time by Engelhard. Engelhard has agreed to pay MacKenzie customary compensation for its services and reimbursement of out-of-pocket expenses in connection therewith. Engelhard has also agreed to indemnify MacKenzie against certain liabilities arising out of or in connection with the engagement. MacKenzie estimates it will use approximately 50 employees to solicit proxies from individuals, brokers, bank nominees and other institutional holders.

Engelhard has retained Merrill Lynch & Co. (“Merrill”) as its independent financial advisor in connection with Engelhard’s analysis and consideration of, and response to, the offer and with respect to any acquisition of control over Engelhard, as well as a co-dealer manager with respect to the self-tender offer. For these services, Engelhard has agreed to pay Merrill customary fees for such services; to reimburse Merrill for all reasonable and customary expenses, including reasonable attorneys fees and disbursements; and to indemnify Merrill and certain related persons against liabilities related to, arising out of or in connection with the engagement.

In connection with Merrill’s engagement as financial advisor, it is possible that certain employees of Merrill may communicate in person, by telephone or otherwise with a limited number of institutions, brokers or other persons who are shareholders of Engelhard for the purpose of assisting in the solicitation of proxies for the annual meeting. Merrill will not receive any fee for, or in connection with, such solicitation activities apart from the fees to which it may otherwise be entitled to receive as described above. Except as otherwise provided below, Merrill does not admit that it or any of its directors, officers, employees or affiliates is a “participant,” as defined in Schedule 14A promulgated by the SEC, or that Schedule 14A requires the disclosure of certain information concerning Merrill.

JP Morgan Securities Inc. (“JPMorgan”) was retained as a financial advisor to Engelhard to render a fairness opinion to the Board of Directors with respect to the consideration to be received by Engelhard in connection with any acquisition by a third party of a material portion of Engelhard. Engelhard has agreed to pay JPMorgan customary fees for such services; to reimburse JPMorgan for all expenses, including reasonable fees and disbursements of legal counsel; and to indemnify them and certain related persons against certain liabilities related to, arising out of, or in connection with its engagement. In connection with the self-tender offer, J.P. Morgan will act as co-dealer manager.

Each of JPMorgan and JP Morgan Chase (“JPMorgan Chase”) and their affiliates, and Merrill Lynch and their affiliates, in the past have provided, and in the future may provide financial advisory and financing services to the Company, for which services they have received, and would expect to receive, compensation. In addition, JPMorgan Chase, an affiliate of JPMorgan, and Merrill Lynch and their respective affiliates have provided a commitment letter, subject to customary conditions, to provide a bridge credit facility to initially fund the self-tender offer pursuant to which they will be paid customary fees as described in Section 9 of the Offer to Purchase.

Engelhard estimates that total costs relating to the solicitation of proxies (excluding costs relating to the offer) are expected to be approximately $1,000,000, including fees payable to MacKenzie. To date, Engelhard has incurred approximately $300,000 in communicating with its shareholders in connection with this proxy solicitation. Actual expenditures may vary materially from this estimate, however, as many of the expenditures cannot be readily predicted. The entire expense of preparing, assembling, printing and mailing this proxy statement and any other related materials and the cost of communicating with Engelhard’s shareholders will be borne by Engelhard.

B-1

Information Concerning Participants in the Solicitation

Under applicable SEC regulations, Messrs. Antonini, Slack, Sperduto, Burner, Minigh, Napier, Lebec, Perry, Watson, Bell, Dresner, Lowen and Wolynic may be deemed to be “participants” in our solicitation of proxies for the meeting. The following is provided for those individuals.

Name, Present Principal Occupation and Principal Business Address for each Participant

Name Present Principal Occupation Principal Business Address

- ----------------------------- ----------------------------- --------------------------

DIRECTORS & DIRECTOR NOMINEES

Marion H. Antonini Operating Principal, Kohlberg & Company 101 Wood Avenue

Iselin, NJ 08830

Henry R. Slack Chairman, Terra Industries, Inc. 325 Columbia Turnpike

Florham Park, NJ 07932

Michael A. Sperduto Vice President and Chief Financial Officer, 101 Wood Avenue

Engelhard Corporation Iselin, NJ 08830

David L. Burner Retired Chairman & CEO, 101 Wood Avenue

Goodrich Corporation Iselin, NJ 08830

Howard L. Minigh Owner, HM Advisors, LLC 81 Alize Drive

Kinnelon, NJ 07405

James V. Napier Retired Chairman of the Board, 3325 Lenox Road

Scientific-Atlanta, Inc. Suite 750

Atlanta, GA 30326

<R>

Alain Lebec Member and Senior Managing 622 Third Avenue

Director of Brock Capital Group LLC New York, NY 10017

</R>

Barry W. Perry Chairman and Chief Executive 101 Wood Avenue

Officer, Engelhard Corporation Iselin, NJ 08830

Douglas G. Watson Chief Executive Officer, 52 Liberty Corner Rd.

Pittencrieff Glen Associates Far Hills, NJ 07931

EXECUTIVE OFFICERS, OFFICERS AND

EMPLOYEES WHO ARE NOT DIRECTORS

OR DIRECTOR NOMINEES

Gavin A. Bell Vice President, Investor Relations, 101 Wood Avenue

Engelhard Corporation Iselin, NJ 08830

Mark Dresner Vice President, Corporate Communications, 101 Wood Avenue

Engelhard Corporation Iselin, NJ 08830

Ted Lowen Director, Corporate Communications 101 Wood Avenue

Iselin, NJ 08830

Edward T. Wolynic Vice President and Chief Technology Officer 101 Wood Avenue

Iselin, NJ 08830

Ownership of Engelhard

To the extent not already included in this proxy statement, the number of shares of Engelhard Common Stock directly or indirectly beneficially owned as of March 15, 2006 by the Participants listed above is set forth below. The information includes shares that may be acquired by the exercise of stock options within sixty days of such date.

Name Shares Percent

- --------------------------------------------- -------- -------

Gavin A. Bell ............................... 4,134 *

Mark Dresner ................................ 179,081 *

Ted Lowen ................................... 12,654 *

* Represents beneficial ownership of less than 1%.

B-2

Except as otherwise set forth in this proxy statement, none of Messrs. Antonini, Slack, Sperduto, Burner, Minigh, Napier, Lebec, Perry, Watson, Bell, Dresner, Lowen and Wolynic (i) is the beneficial or record owner of any shares of our Common Stock, (ii) has purchased or sold any shares of our Common Stock since January 1, 2004, borrowed any funds for the purpose of acquiring or holding any shares of our Common Stock, or is or was within the past year a party to any contract, arrangement or understanding with any person with respect to any shares of our Common Stock, or (iii) was in the past ten years convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

Arrangements with Engelhard

Except as otherwise set forth in this proxy statement, none of Messrs. Antonini, Slack, Sperduto, Burner, Minigh, Napier, Lebec, Perry, Watson, Bell, Dresner, Lowen and Wolynic nor any of their associates, has any arrangement or understanding with any person (i) with respect to any future employment by Engelhard or its affiliates or (ii) with respect to future transactions to which Engelhard or any of its affiliates will or may be a party, or any material interest, direct or indirect, in any transaction that has occurred since January 1, 2005, or any currently proposed transaction or series of similar transactions, which Engelhard or any of its affiliates was or is to be a party and in which the amount involved exceeds $60,000.

Transactions in Ownership of Engelhard Common Stock

The following table sets forth the acquisitions and dispositions of shares of our Common Stock made by Messrs. Antonini, Slack, Sperduto, Burner, Napier, Perry, Watson, Bell, Dresner, Lowen and Wolynic since January 1, 2004. Neither Mr. Minigh nor Mr. Lebec, acquired or disposed of shares of our Common Stock since January 1, 2004. Unless otherwise indicated, all transactions were in the public market other than acquisitions pursuant to deferred compensation plans or acquisitions upon exercise of options and none of the purchase price or market value of those shares is represented by funds borrowed or otherwise obtained for the purpose of acquiring and holding such securities:

Date of Nature of No. of

Name Transaction Transaction Shares Transaction Type

- ------------------- ----------- ----------- --------- ------------------------------------------------------

Antonini, Marion 3/15/2006 Acquisition 1,208.41 Acquired pursuant to deferred compensation plans

12/15/2005 Acquisition 1,233.57 Acquired pursuant to deferred compensation plans

12/07/2005 Disposition 15,000.00 Sale upon exercise of options

9/15/2005 Acquisition 1,169.72 Acquired pursuant to deferred compensation plans

6/15/2005 Acquisition 1,739.23 Acquired pursuant to deferred compensation plans

3/15/2005 Acquisition 1,356.03 Acquired pursuant to deferred compensation plans

12/15/2004 Acquisition 1,095.89 Acquired pursuant to deferred compensation plans

9/15/2004 Acquisition 1,023.34 Acquired pursuant to deferred compensation plans

6/15/2004 Acquisition 1,413.20 Acquired pursuant to deferred compensation plans

3/15/2004 Acquisition 1,314.74 Acquired pursuant to deferred compensation plans

Bell, Gavin A. 2/1/2006 Disposition 54.00 Transfer to satisfy minimum withholding tax obligation

on vesting of restricted share awards pursuant to plan

Burner, David 3/15/2006 Acquisition 3.71 Acquired pursuant to deferred compensation plans

12/15/2005 Acquisition 5.04 Acquired pursuant to deferred compensation plans

9/15/2005 Acquisition 5.21 Acquired pursuant to deferred compensation plans

6/15/2005 Acquisition 684.80 Acquired pursuant to deferred compensation plans

3/15/2005 Acquisition 2.17 Acquired pursuant to deferred compensation plans

12/15/2004 Acquisition 1.97 Acquired pursuant to deferred compensation plans

9/15/2004 Acquisition 2.10 Acquired pursuant to deferred compensation plans

6/15/2004 Acquisition 536.36 Acquired pursuant to deferred compensation plans

B-3

Date of Nature of No. of

Name Transaction Transaction Shares Transaction Type

- -------------------- ----------- ----------- -------- ------------------------------------------

Dresner, Mark 02/01/2006 Disposition 867.00 Transfer to satisfy minimum withholding tax obligation

on vesting of restricted share awards pursuant to plan

12/02/2005 Disposition 1,050.00 Sale upon exercise of options

12/02/2005 Disposition 8,100.00 Sale upon exercise of options

2/3/2004 Acquisition 4,275.00 Acquired upon exercise of options pursuant to

Stock Option Plan

2/3/2004 Disposition 3,332.00 Transfer to pay exercise price and withholding

obligation upon exercise of options

Lowen, Ted 2/1/2006 Disposition 218.00 Transfer to satisfy minimum withholding tax obligation

on vesting of restricted share awards pursuant to plan

Napier, James V. 3/15/2006 Acquisition 598.86 Acquired pursuant to deferred compensation plans

12/15/2005 Acquisition 609.54 Acquired pursuant to deferred compensation plans

12/13/2005 Disposition 3,000.00 Sale upon exercise of options

9/15/2005 Acquisition 471.21 Acquired pursuant to deferred compensation plans

6/15/2005 Acquisition 977.60 Acquired pursuant to deferred compensation plans

3/15/2005 Acquisition 489.29 Acquired pursuant to deferred compensation plans

12/15/2004 Acquisition 394.89 Acquired pursuant to deferred compensation plans

9/15/2004 Acquisition 372.64 Acquired pursuant to deferred compensation plans

6/15/2004 Acquisition 746.90 Acquired pursuant to deferred compensation plans

3/15/2004 Acquisition 644.62 Acquired pursuant to deferred compensation plans

Perry, Barry 12/06/2005 Disposition 7,500.00 Sale upon exercise of options*

12/05/2005 Disposition 10,000.00 Sale upon exercise of options*

12/02/2005 Disposition 10,000.00 Sale upon exercise of options*

12/01/2005 Disposition 10,000.00 Sale upon exercise of options*

11/01/2005 Disposition 40,000.00 Sale upon exercise of options*

Slack, Henry 3/15/2006 Acquisition 12.09 Acquired pursuant to deferred compensation plans

12/15/2005 Acquisition 16.42 Acquired pursuant to deferred compensation plans

9/15/2005 Acquisition 16.98 Acquired pursuant to deferred compensation plans

6/15/2005 Acquisition 696.05 Acquired pursuant to deferred compensation plans

3/15/2005 Acquisition 13.19 Acquired pursuant to deferred compensation plans

12/15/2004 Acquisition 12.02 Acquired pursuant to deferred compensation plans

9/15/2004 Acquisition 12.80 Acquired pursuant to deferred compensation plans

6/15/2004 Acquisition 546.35 Acquired pursuant to deferred compensation plans

3/15/2004 Acquisition 10.42 Acquired pursuant to deferred compensation plans

Sperduto, Michael A. 11/17/2005 Disposition 20,550.00 Sale upon exercise of options

Watson, Douglas 3/15/2006 Acquisition 75.66 Acquired pursuant to deferred compensation plans

12/15/2005 Acquisition 113.33 Acquired pursuant to deferred compensation plans

11/29/2005 Acquisition 3,000.00 Shares acquired upon exercise of options

11/29/2005 Disposition 4,012.00 Sale

9/15/2005 Acquisition 117.20 Acquired pursuant to deferred compensation plans

6/15/2005 Acquisition 791.93 Acquired pursuant to deferred compensation plans

3/15/2005 Acquisition 107.05 Acquired pursuant to deferred compensation plans

12/15/2004 Acquisition 112.20 Acquired pursuant to deferred compensation plans

9/15/2004 Acquisition 119.54 Acquired pursuant to deferred compensation plans

6/15/2004 Acquisition 645.98 Acquired pursuant to deferred compensation plans

3/15/2004 Acquisition 114.36 Acquired pursuant to deferred compensation plans

Wolynic, Edward T. 01/03/2006 Disposition 18,475 Sale upon exercise of options*

11/29/2005 Disposition 4,275 Sale upon exercise of options

* Pursuant to a Rule 10b5-1 Sales Plan.

B-4

NOTICE OF

ANNUAL MEETING

OF

SHAREHOLDERS

AND PROXY

STATEMENT

June 2, 2006

101 WOOD AVENUE, ISELIN, NEW JERSEY 08830

PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF THE COMPANY

FOR THE ANNUAL MEETING OF SHAREHOLDERS-JUNE 2, 2006

P

R

O

X

Y

The undersigned hereby constitutes and appoints Barry W. Perry and Arthur A. Dornbusch, II, and each of them, his true and lawful agents and proxies with full power of substitution in each, to represent the undersigned at the Annual Meeting of Shareholders of ENGELHARD CORPORATION to be held at the North Maple Inn at Basking Ridge, 300 North Maple Avenue, Basking Ridge, NJ 07920 on Friday, June 2, 2006 at 10:00 a.m. Eastern Daylight Savings Time and at any adjournments thereof, on all matters coming before said meeting.

The shares represented by this proxy will be voted as instructed by you and in the discretion of the proxies on all other matters. You are encouraged to specify your choices by marking the appropriate boxes, but you need not mark any boxes if you wish to vote in accordance with the recommendation of the Board of Directors. See reverse side for the recommendation of the Board of Directors. This proxy, if properly executed and delivered, will revoke all prior proxies related to the shares.

ADDRESS CHANGE/COMMENTS (MARK THE CORRESPONDING BOX ON THE REVERSE SIDE)

----------------------------------------------------------------------------------------------------------------------------------------

^ FOLD AND DETACH HERE ^

Dear Shareholder(s)

Enclosed you will find material relating to the Company’s 2006 Annual Meeting of Shareholders. The notice of the annual meeting and proxy statement describe the formal business to be transacted at the meeting, as summarized on the attached proxy card.

Whether or not you expect to attend the Annual Meeting, please complete the reverse side of the attached proxy card and return promptly in the accompanying envelope, which requires no postage if mailed in the United States. Please remember that your vote is important to us.

ENGELHARD CORPORATION

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER(S). IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” ITEMS 1 AND 2.

Please mark

your vote as [X]

indicated in

this example

1. Election of Directors; 01 Marion H. Antonini 02 Alain Lebec 03 Howard L. Minigh 04 Henry R. Slack 05 Michael A. Sperduto | FOR [ ] | WITHHELD [ ] |

| (To withhold vote for any individual nominee write that name below.) |

| | |

| | |

2. Ratification of the appointment of Ernst & Young LLP as independent registered public accounting firm. | FOR AGAINST ABSTAIN [ ] [ ] [ ] |

| |

3. In their discretion, upon other matters as they may properly come before the meeting. |

SIGNATURE(S)________________________ TITLE___________________ DATE______________

Please mark, sign and return promptly using the enclosed envelope. Executors, administrators, trustees, etc. should give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer.

--------------------------------------------------------------------------------------------------------------------------------------------

^ FOLD AND DETACH HERE ^

You can view the Annual Report and Proxy Statement on the Internet at http://www.proxyvoting.com/ec