Exhibit 99(a)(21)

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[GRAPHIC]

Successfully

Shaping the Future

Dr. Jürgen Hambrecht, CEO

Ludwigshafen, February 22, 2006

[LOGO]

Our Goal:

Create value across the cycle. Earn a premium on our cost of capital.

In 2005, we earned a premium of 2,354 million Euro on our cost of capital

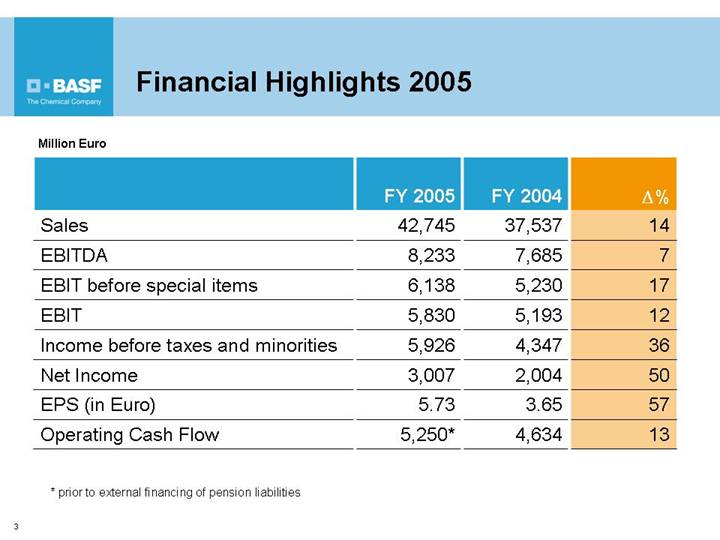

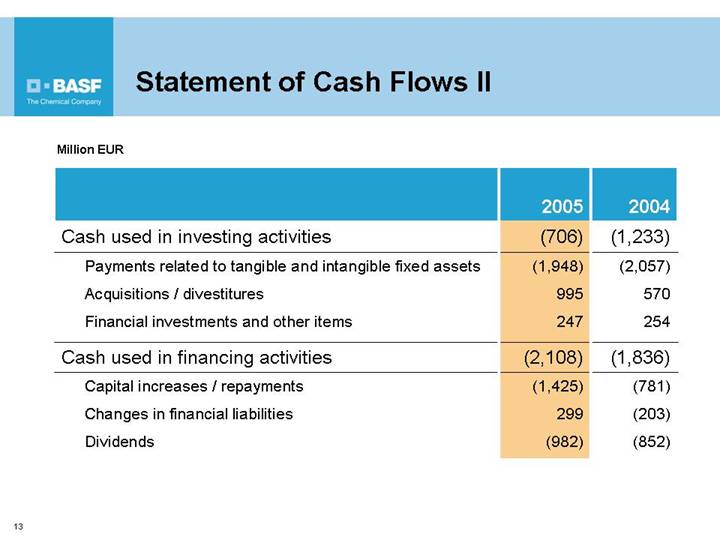

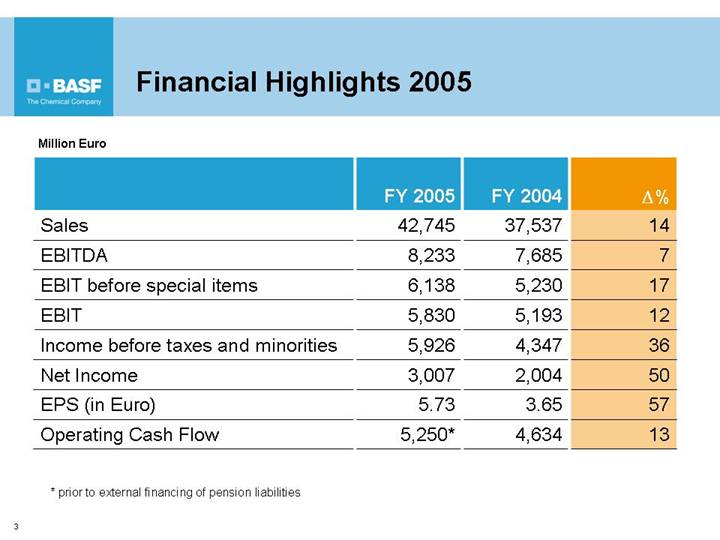

[LOGO] | Financial Highlights 2005 |

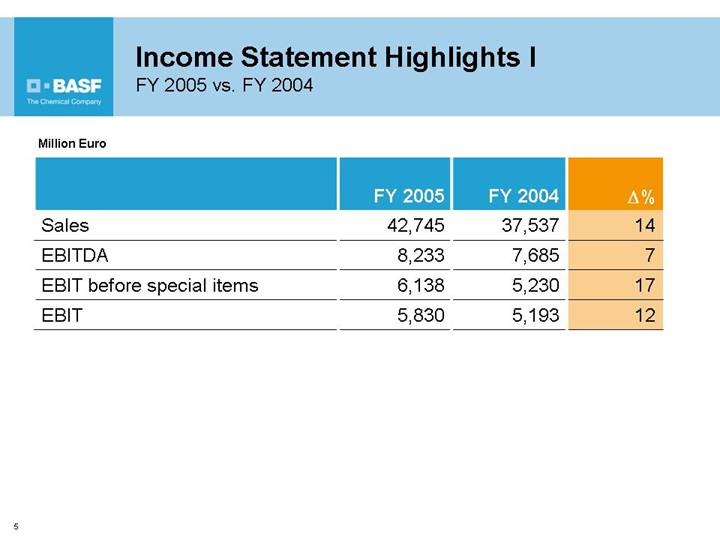

Million Euro

| | FY 2005 | | FY 2004 | |  % %

| |

Sales | | 42,745 | | 37,537 | | 14 | |

EBITDA | | 8,233 | | 7,685 | | 7 | |

EBIT before special items | | 6,138 | | 5,230 | | 17 | |

EBIT | | 5,830 | | 5,193 | | 12 | |

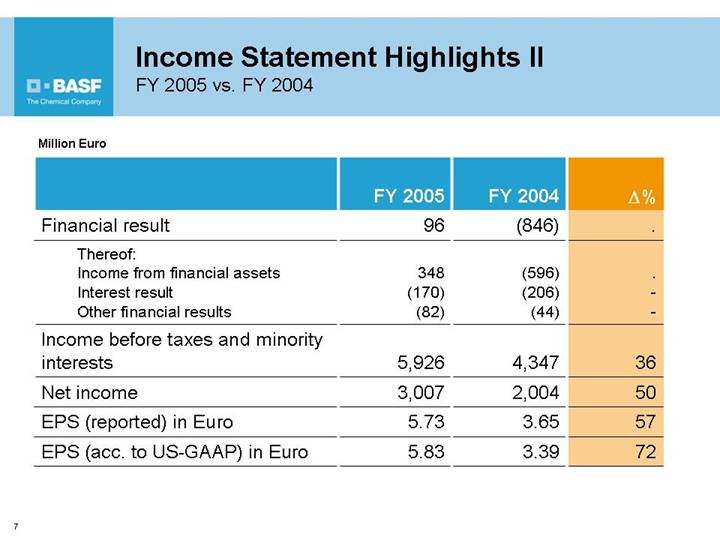

Income before taxes and minorities | | 5,926 | | 4,347 | | 36 | |

Net Income | | 3,007 | | 2,004 | | 50 | |

EPS (in Euro) | | 5.73 | | 3.65 | | 57 | |

Operating Cash Flow | | 5,250 | * | 4,634 | | 13 | |

* prior to external financing of pension liabilities

3

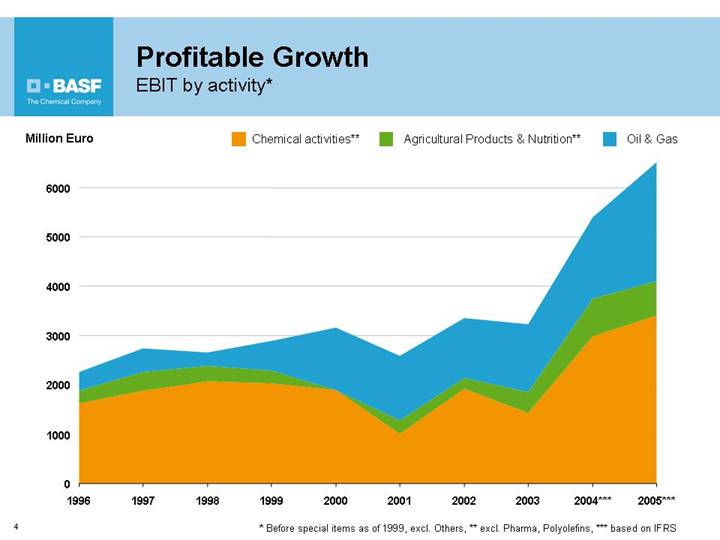

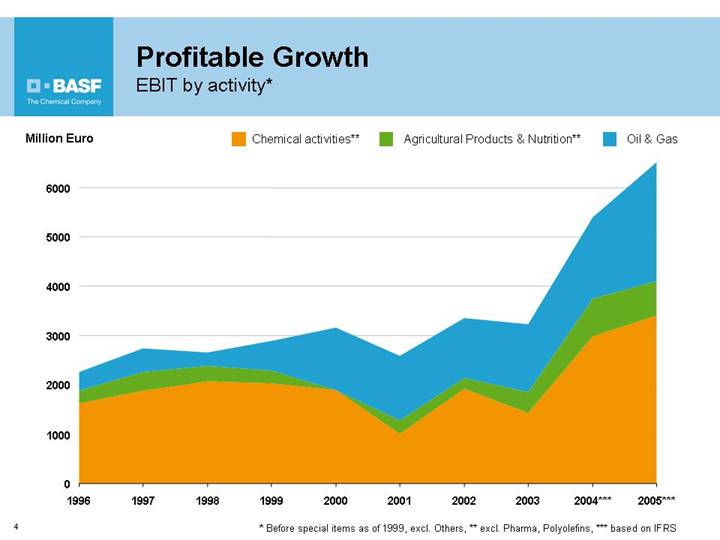

Profitable Growth

EBIT by activity*

Million Euro

[CHART]

* Before special items as of 1999, excl. Others,

** excl. Pharma, Polyolefins,

*** based on IFRS

4

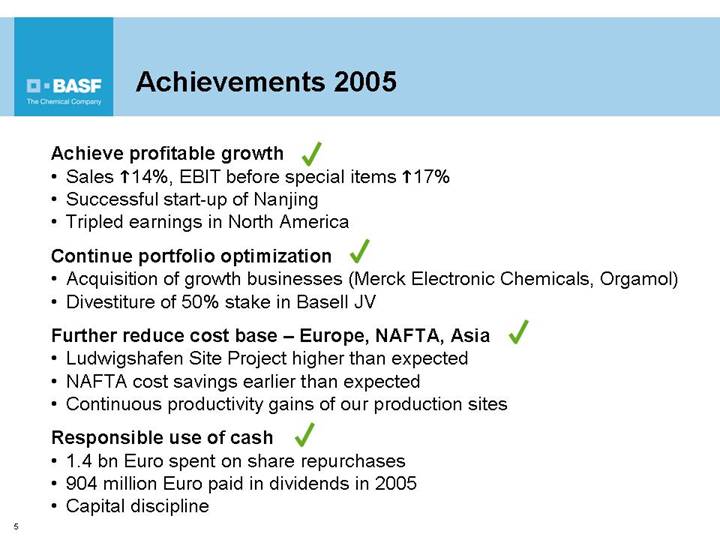

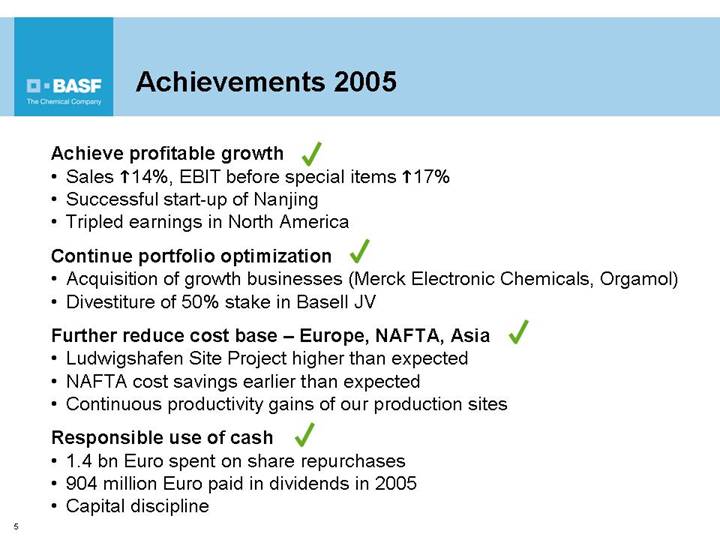

Achievements 2005

Achieve profitable growth

• Sales  14%, EBIT before special items

14%, EBIT before special items  17%

17%

• Successful start-up of Nanjing

• Tripled earnings in North America

Continue portfolio optimization

• Acquisition of growth businesses (Merck Electronic Chemicals, Orgamol)

• Divestiture of 50% stake in Basell JV

Further reduce cost base – Europe, NAFTA, Asia

• Ludwigshafen Site Project higher than expected

• NAFTA cost savings earlier than expected

• Continuous productivity gains of our production sites

Responsible use of cash

• 1.4 bn Euro spent on share repurchases

• 904 million Euro paid in dividends in 2005

• Capital discipline

5

How will BASF generate value in the future?

Strategic Positioning of Business Units

[CHART]

• Half of the businesses are in areas with high growth rates and are subject for expansion / moderate expansion

• Cash Flow will be mainly invested in expanding business units

• Acquisitions will contribute to profitable growth

• Divestitures almost completed

7

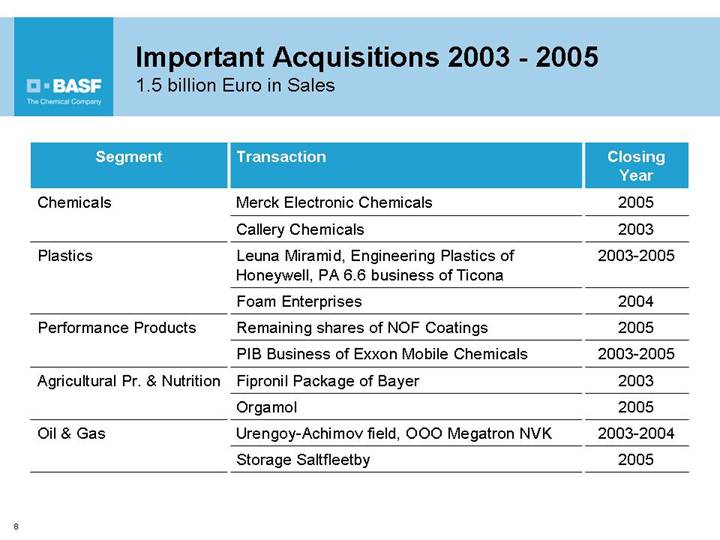

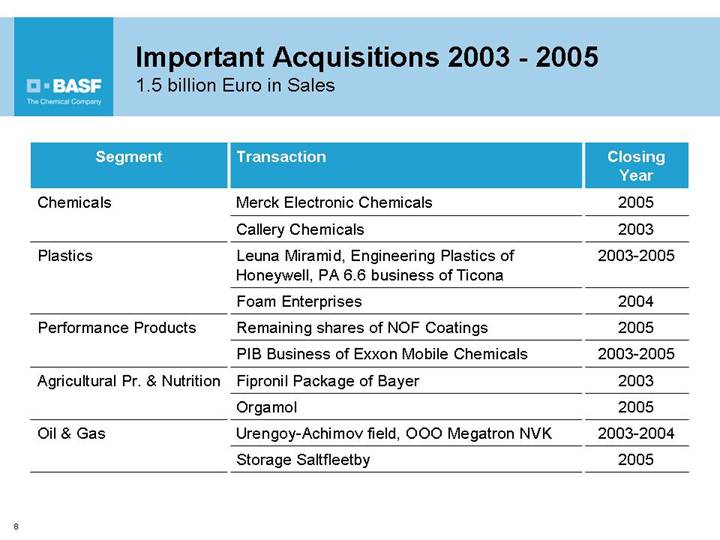

Important Acquisitions 2003 - 2005

1.5 billion Euro in Sales

Segment | | Transaction | | Closing

Year |

| | | | |

Chemicals | | Merck Electronic Chemicals | | 2005 |

| | Callery Chemicals | | 2003 |

Plastics | | Leuna Miramid, Engineering Plastics of Honeywell, PA 6.6 business of Ticona | | 2003-2005 |

| | Foam Enterprises | | 2004 |

Performance Products | | Remaining shares of NOF Coatings | | 2005 |

| | PIB Business of Exxon Mobile Chemicals | | 2003-2005 |

Agricultural Pr. & Nutrition | | Fipronil Package of Bayer | | 2003 |

| | Orgamol | | 2005 |

Oil & Gas | | Urengoy-Achimov field, OOO Megatron NVK | | 2003-2004 |

| | Storage Saltfleetby | | 2005 |

8

Important Divestitures 2003 - 2005

5.3 billion Euro in Sales

Segment | | Transaction | | Closing

Year |

| | | | |

Plastics | | Fiber Business | | 2003 |

| | Joliet (Polystyrene Business and Site) | | 2005 |

| | BASELL (50%) | | 2005 |

Performance Products | | Printing Inks and Printing Systems | | 2004 |

| | Masterbatch Business outside Europe | | 2004 |

| | Furniture and Window Coatings | | 2004 |

| | DyStar (30%) | | 2004 |

Agricultural Pr. & Nutrition | | Soil Fumigants, Phenoxies, Phorates, Triforine, Imazamethabenz | | 2004-2005 |

| | Resende Site | | 2005 |

| | Cramlington Site | | 2004 |

Oil & Gas | | Share in two Gas Distribution Companies in the Czech Republic | | 2005 |

9

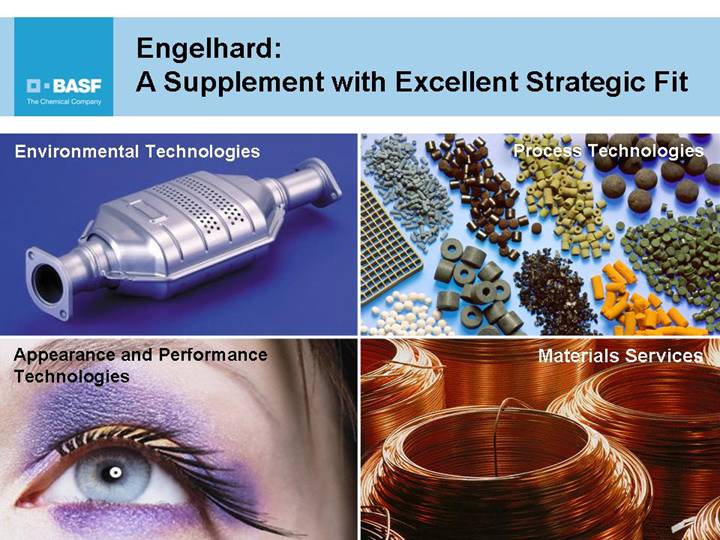

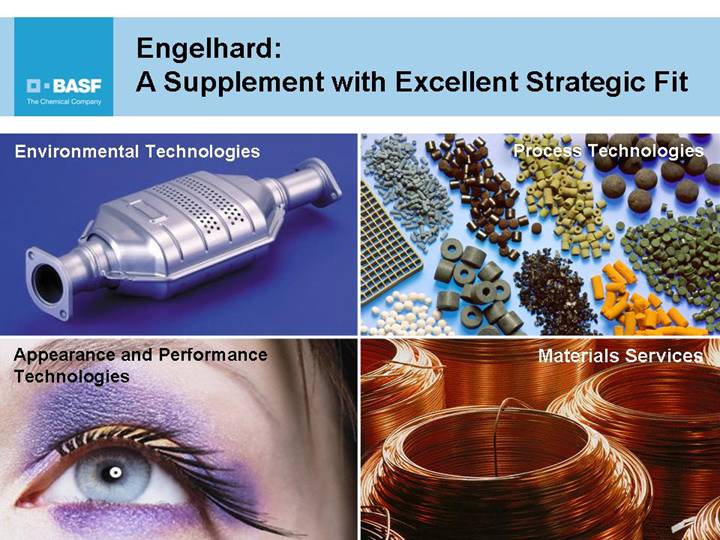

Engelhard:

A Supplement with Excellent Strategic Fit

Environmental Technologies | | Process Technologies |

| | |

[GRAPHIC] | | [GRAPHIC] |

| | |

Appearance and Performance Technologies | | Materials Services |

| | |

[GRAPHIC] | | [GRAPHIC] |

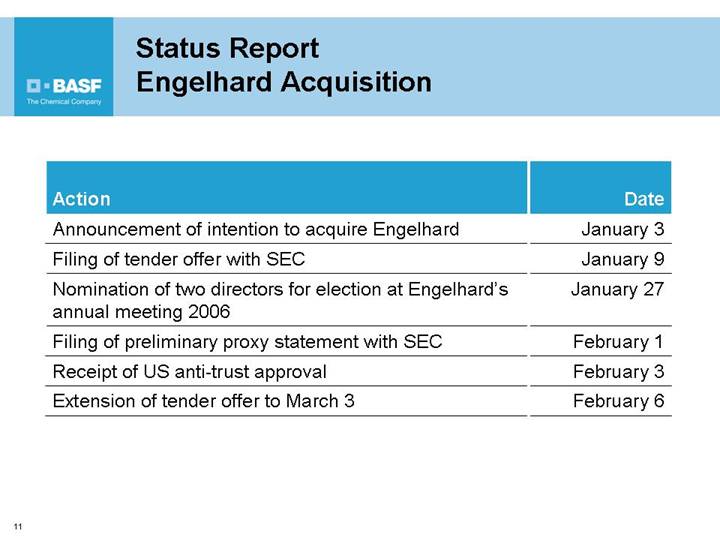

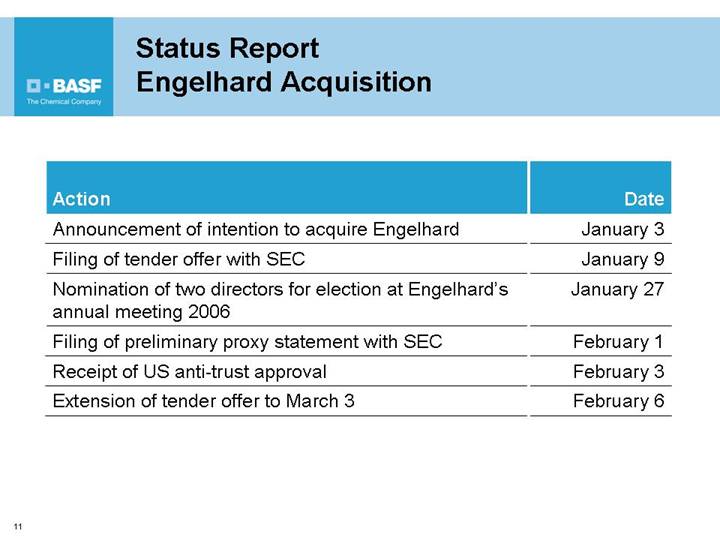

Status Report Engelhard Acquisition

Action | | Date |

Announcement of intention to acquire Engelhard | | January 3 |

Filing of tender offer with SEC | | January 9 |

Nomination of two directors for election at Engelhard’s annual meeting 2006 | | January 27 |

Filing of preliminary proxy statement with SEC | | February 1 |

Receipt of US anti-trust approval | | February 3 |

Extension of tender offer to March 3 | | February 6 |

11

Strong Benefits from Acquistion of Degussa’s Construction Chemicals

Source: Degussa | | |

Sports Flooring | | Concrete Admixtures |

| | |

[GRAPHIC] | | [GRAPHIC] |

| | |

Mortar Modifiers | | Protective Coatings and Sealants |

| | |

[GRAPHIC] | | [GRAPHIC] |

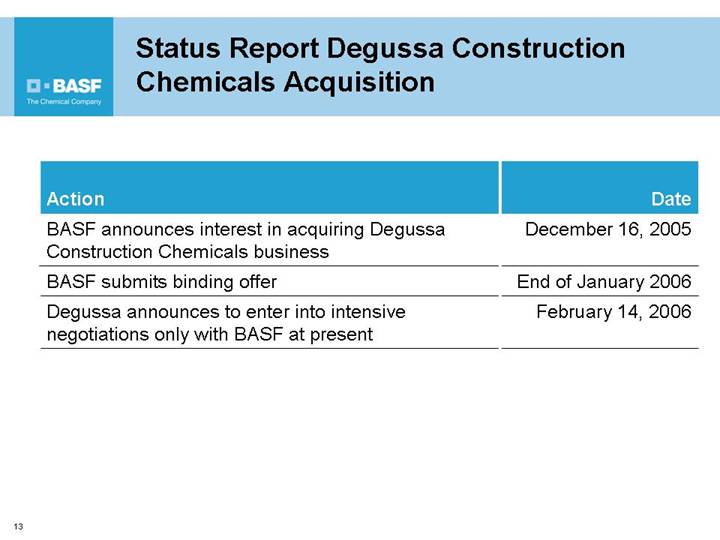

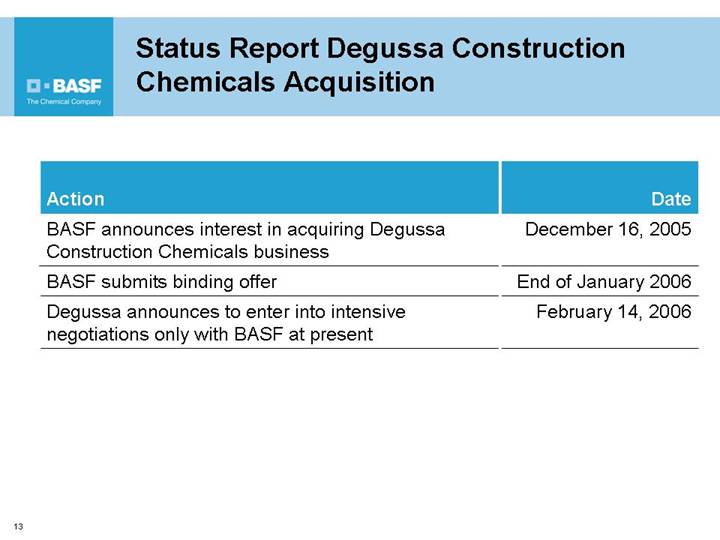

Status Report Degussa Construction Chemicals Acquisition

Action | | Date |

BASF announces interest in acquiring Degussa Construction Chemicals business | | December 16, 2005 |

BASF submits binding offer | | End of January 2006 |

Degussa announces to enter into intensive negotiations only with BASF at present | | February 14, 2006 |

13

Constantly Improving our Cost Base

Restructuring and Reorganization

[CHART]

• Ludwigshafen

EUR 480m (June 2005)

• Antwerp

EUR 50m

(expected end of 2006)

• Europe

EUR 160m (2003)

EUR 90m

(expected end of 2006)

• NAFTA

USD 250m (June 2005)

USD 150m

(expected mid-2007)

Commercial Effectiveness Program NAFTA: USD 200m (expected end of 2007)

14

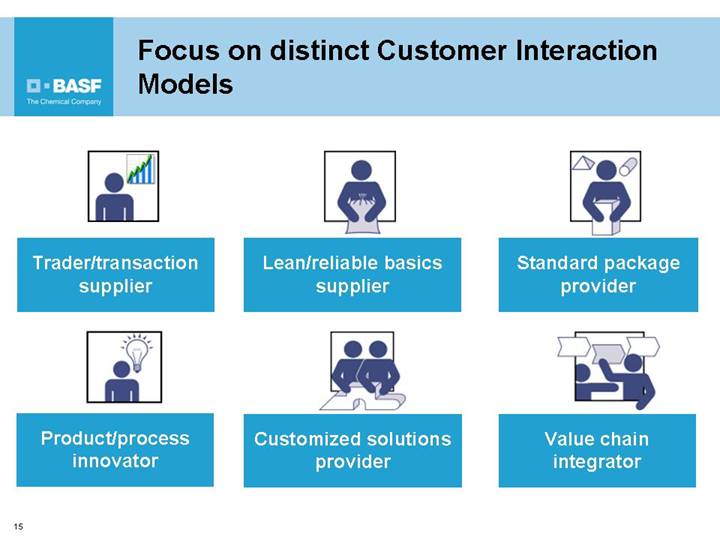

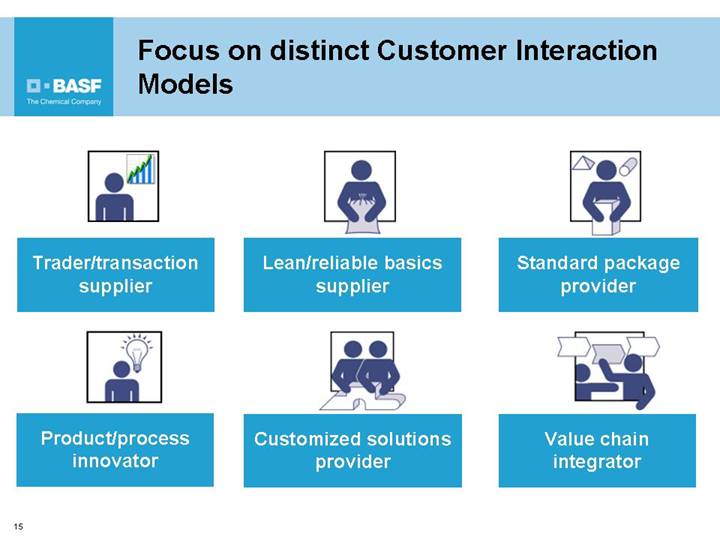

Focus on distinct Customer Interaction Models

[GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] |

| | | | |

Trader/transaction | | Lean/reliable basics | | Standard package |

supplier | | supplier | | provider |

| | | | |

[GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] |

| | | | |

Product/process | | Customized solutions | | Value chain |

innovator | | provider | | integrator |

15

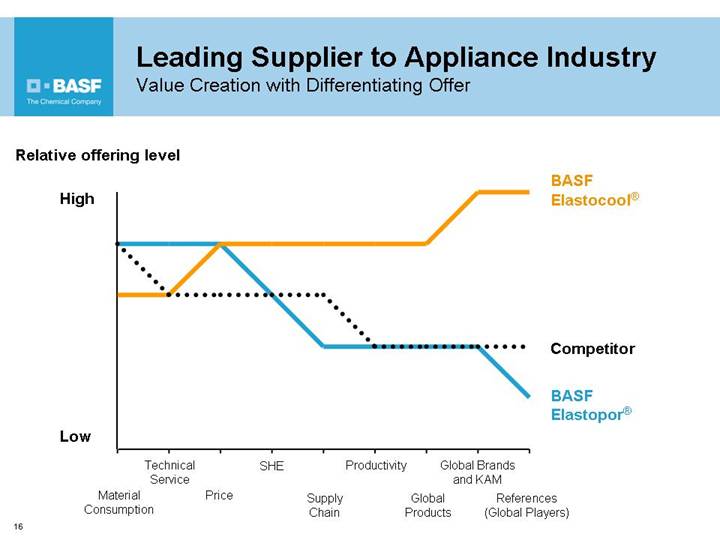

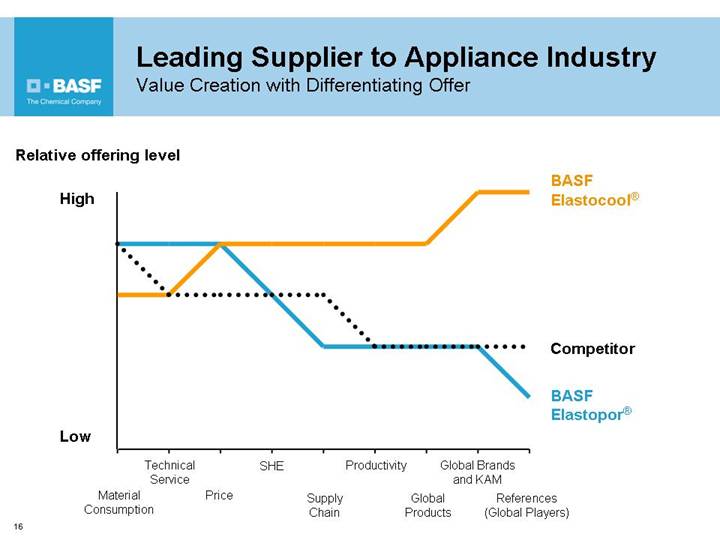

Leading Supplier to Appliance Industry

Value Creation with Differentiating Offer

Relative offering level

[CHART]

16

Focus on Market Driven Innovations

BASF Innovation Strategy |

| | | | |

Product | | Process | | New Fields of |

Innovations | | Innovations | | Technology |

| | | | |

Tailor-made business models |

• R&D expenditures 2005: 1.06 billion Euro

• 8% increase in R&D expenditure planned for 2006

• Five growth clusters defined:

• Nanotechnology

• Energy Management

• Plant Biotechnology

• White Biotechnology

• Raw Material Changes

17

Agenda 2006

• Continue profitable growth

• Further efficiency improvement and cost reductions

• Focus cash flow on investments in most promising businesses

• Acquire more customer oriented and innovation driven businesses

• Integrate acquisition targets successfully

• Innovate for growth

18

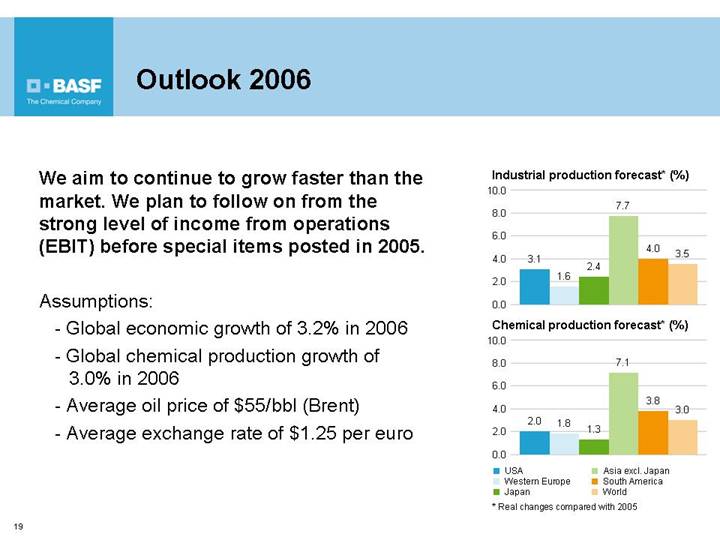

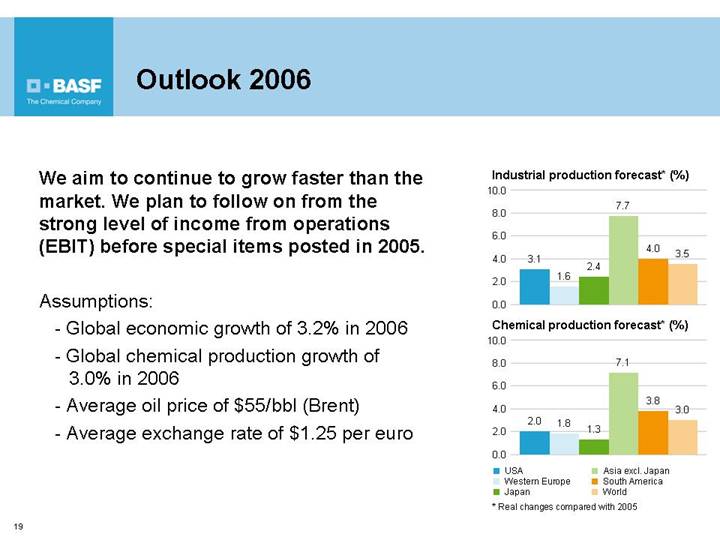

Outlook 2006

We aim to continue to grow faster than the market. We plan to follow on from the strong level of income from operations (EBIT) before special items posted in 2005.

Assumptions:

• Global economic growth of 3.2% in 2006

• Global chemical production growth of 3.0% in 2006

• Average oil price of $55/bbl (Brent)

• Average exchange rate of $1.25 per euro

Industrial production forecast* (%)

[CHART]

Chemical production forecast* (%)

[CHART]

* Real changes compared with 2005

19

Disclaimer

This presentation contains forward-looking statements under the US Private Securities Litigation Reform Act of 1995. These statements are based on current expectations, estimates and projections of BASF management and currently available information. They are not guarantees of future performance, involve certain risks and uncertainties that are difficult to predict and are based upon assumptions as to future events that may not prove to be accurate.

Many factors could cause the actual results, performance or achievements of BASF to be materially different from those that may be expressed or implied by such statements. Such factors include those discussed in BASF’s Form 20-F filed with the Securities and Exchange Commission. We do not assume any obligation to update the forward-looking statements contained in this presentation.

20

[LOGO]