Table of Contents

As filed with the Securities and Exchange Commission on February 26, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

OR |

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015 |

| |

OR |

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

OR |

| |

o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from to

Commission file number : 001-8382

AKTIEBOLAGET SVENSK EXPORTKREDIT |

(Exact name of Registrant as specified in its charter) |

|

(SWEDISH EXPORT CREDIT CORPORATION) |

(Translation of Registrant’s name into English) |

|

Kingdom of Sweden |

(Jurisdiction of incorporation or organization) |

|

Klarabergsviadukten 61-63, Stockholm, Sweden |

(Address of principal executive offices) |

|

contact person: |

Susanna Rystedt, Swedish Export Credit Corporation, P.O.Box 194, SE-101 23 Stockholm Email: Susanna.Rystedt@sek.se Phone 46-8-613 85 64, Fax 46-8-20 38 94 (1) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:(2)

Title of each class | | Name of each exchange on which registered |

ELEMENTSSM Linked to the SPECTRUM Large Cap U.S. Sector Momentum Index developed by BNP Paribas due August 8, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the Rogers International Commodity Index® — Agriculture Total ReturnSM due October 24, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the Rogers International Commodity Index® — Energy Total ReturnSM due October 24, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the Rogers International Commodity Index® — Metals Total ReturnSM due October 24, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the Rogers International Commodity Index® — Total ReturnSM due October 24, 2022 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the MLCX Biofuels Index (Exchange Series) — Total Return due February 13, 2023 | | NYSE ARCA, Inc. |

| | |

ELEMENTSSM Linked to the MLCX Grains Index — Total Return due February 14, 2023 | | NYSE ARCA, Inc. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Table of Contents

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes o No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP o | | International Financial Reporting Standards as issued

by the International Accounting Standards Board x | | Other o |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o Yes o No

Table of Contents

INTRODUCTORY NOTES

In this annual report on Form 20-F (the “annual report”), unless otherwise specified, all amounts are expressed in Swedish kronor (“Skr”). See Item 3, “Key Information”, for a description of historical exchange-rates and other matters relating to the Swedish kronor.

In this annual report, unless otherwise indicated, all descriptions and financial information relate to the consolidated group consisting of Aktiebolaget Svensk Exportkredit (publ) (Swedish Export Credit Corporation) (the “Parent Company”), including the “State Support System” (the “S-system”), which is described in detail herein, and the Parent Company’s wholly-owned subsidiary Venantius AB (including its wholly-owned subsidiary VF Finans AB) (the “Subsidiary” and together with the Parent Company, “SEK”, the “Consolidated Group” or the “Group”). In certain instances, information relating to the S-system on a stand-alone basis is provided separately. The Consolidated Financial Statements of SEK included in Item 18 (the “Consolidated Financial Statements”) comprise the financial statements of the Parent Company and the Subsidiaries. In certain cases, comparable figures for earlier financial periods are reported in parentheses after the relevant figure for the current period. For example, “(2014: Skr 10 million)” means that the relevant figure for 2014, or as of December 31, 2014, as the context requires, was Skr 10 million.

As used herein, the words “we”, “our”, “us” and “ours” refer to the Parent Company or to the Group, as the context requires.

The Parent Company is a “public company” within the meaning of the Swedish Companies Act (2005:551). A Swedish company, even if its shares are not listed on an exchange and are not publicly traded, may choose to declare itself a “public company”. Only public companies are allowed to raise funds from the public through the issuance of debt instruments. A public company is required to add the notation “publ” to its name, unless it is evident from the company’s name that the company is a public company.

Additional information about SEK, including investor presentations and the Annual Report for the financial year 2015, is available at www.sek.se. Information available on or accessibly through SEK’s website is not incorporated herein by reference.

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. These statements include but are not limited to:

· statements regarding financial projections and estimates and their underlying assumptions;

· statements regarding plans, objectives and expectations relating to future operations and services;

· statements regarding the impact of regulatory initiatives on SEK’s operations;

· statements regarding general industry and macroeconomic growth rates and SEK’s performance relative to them; and

· statements regarding future performance.

Forward-looking statements generally are identified by the words “expect”, “anticipate”, “believe”, “intend”, “estimate”, “should”, and similar expressions.

Forward-looking statements are based on current plans, estimates and projections, and therefore readers should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and SEK undertakes no obligation to update any forward-looking statement in light of new information or future events, although SEK intends to continue to meet its ongoing disclosure obligations under the U.S. securities laws (such as the obligations to file annual reports on Form 20-F and reports on Form 6-K) and under other applicable laws. Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and generally beyond SEK’s control. Readers are cautioned that a number of important factors could cause actual results or outcomes to differ materially from those expressed in, or implied by, forward-looking statements. These factors include, among others, the following:

1

Table of Contents

· Disruptions in the financial markets or economic recessions may have an adverse effect on SEK’s ability to repay its debt;

· SEK is exposed to credit risk even in normal economic circumstances. Disruptions in the financial markets or economic recessions may further negatively affect the credit quality of borrowers and cause other risk to counterparties, which may cause credit losses or affect the value of assets;

· Reduced access to international capital markets for the financing of SEK’s operations, or less favorable financing terms, may have negative impacts on SEK’s profitability and its ability to fulfill its obligations;

· SEK may experience negative changes in the value of its assets or liabilities and may incur other losses related to volatile and illiquid market conditions;

· SEK’s hedging strategies may not prevent losses;

· Fluctuations in foreign currency exchange-rates could harm SEK’s business;

· Increasing competition may adversely affect SEK’s income and business;

· SEK is exposed to significant operational risk;

· Changes in law or regulation may adversely affect SEK’s business;

· Risk related to financial reporting and other deficiencies in internal control over financial reporting and disclosure processes could result in errors, affect operating results and cause investors to lose confidence in our reported results;

· Developments in emerging market countries may adversely affect the Group’s business;

· Negative interest rates may have an impact on SEK’s profitability and

· Natural disasters, social and political unrest and other factors beyond SEK’s control may disrupt financial markets and economic conditions in markets that SEK relies on.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not required as this 20-F is filed as an Annual Report.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not required as this 20-F is filed as an Annual Report.

2

Table of Contents

ITEM 3. KEY INFORMATION

A Selected Financial Data

The following selected consolidated financial data should be read in conjunction with our Consolidated Financial Statements and related notes. The consolidated statement of comprehensive income data for the years ended December 31, 2015, 2014, 2013, 2012 and 2011 and the consolidated statement of financial position data as of December 31, 2015, 2014, 2013, 2012 and 2011 have been derived from SEK’s Consolidated Financial Statements prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standard Board (IASB) (herein “IFRS”).

While complying with IFRS, SEK also complies with additional requirements of the Swedish Annual Accounts Act for Credit Institutions and Securities Companies (1995:1559) (ÅRKL), the Recommendation RFR1. Supplementary Accounting Principles for Groups, issued by the Swedish Financial Reporting Board (RFR) and the accounting regulations of Finansinspektionen (the Swedish FSA) (FFFS 2008:25).

The following information should be read in conjunction with the more detailed discussion contained in Item 5 “Operating and Financial Review and Prospects”.

| | Year Ended December 31, | |

(In Skr mn, unless otherwise stated) | | 2015 | | 2014 | | 2013 | | 2012(1) | | 2011(1) | |

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME DATA | | | | | | | | | | | |

| | | | | | | | | | | |

Net interest revenues | | 1,662 | | 1,578 | | 1,555 | | 1,880 | | 1,871 | |

Operating income | | 2,056 | | 2,078 | | 1,958 | | 1,392 | | 2,500 | |

Operating profit (A) | | 1,535 | | 1,629 | | 1,408 | | 824 | | 1,889 | |

Net profit (after taxes) | | 1,187 | | 1,260 | | 1,090 | | 709 | | 1,400 | |

Dividend per share (Skr) (B) | | 89.22 | | 94.74 | | 81.96 | | 53.29 | | 105.26 | |

Total comprehensive income (C) | | 1,049 | | 1,494 | | 823 | | 868 | | 1,663 | |

Ratios of earnings to fixed charges (D) | | 2.31 | | 1.74 | | 1.54 | | 1.23 | | 1.47 | |

(1) Adjusted, please see Item C below

(A) Operating profit equals operating income minus personnel expenses, other administrative expenses, depreciation and impairment of non-financial assets and net credit losses. See the Consolidated Statement of Comprehensive Income.

(B) The dividend for the year ended December 31, 2015 is to be proposed to the Annual General Meeting which will be held in April 2016, and is subject to approval at that meeting.

(C) For the years 2012 and 2011 total comprehensive income was amended in 2013 due to the implementation of IAS 19R.

(D) For the purpose of calculating ratios of earnings to fixed charges, earnings consist of net profit for the year, plus taxes and fixed charges. Fixed charges consist of SEK’s interest expenses, including borrowing costs. See also Exhibit 7.1 Statement of Ratios of Earnings to Fixed Charges.

3

Table of Contents

| | December 31, | |

(In Skr mn, unless otherwise stated) | | 2015 | | 2014 | | 2013 | | 2012 (1) | | 2011 (1) | |

CONSOLIDATED STATEMENT OF FINANCIAL POSITION DATA | | | | | | | | | | | |

| | | | | | | | | | | |

Total loans outstanding (E) | | 205,097 | | 218,222 | | 201,477 | | 192,907 | | 195,600 | |

Total assets | | 280,411 | | 325,166 | | 306,554 | | 313,136 | | 319,702 | |

Total debt | | 235,644 | | 284,137 | | 270,822 | | 275,650 | | 276,420 | |

of which subordinated | | 2,088 | | 1,945 | | 1,607 | | 3,013 | | 3,174 | |

Equity (F) | | 16,828 | | 16,157 | | 14,990 | | 14,380 | | 13,932 | |

of which share capital | | 3,990 | | 3,990 | | 3,990 | | 3,990 | | 3,990 | |

Number of shares | | 3,990,000 | | 3,990,000 | | 3,990,000 | | 3,990,000 | | 3,990,000 | |

Total liabilities and equity | | 280,411 | | 325,166 | | 306,554 | | 313,136 | | 319,702 | |

(1) Adjusted, please see item F below

(E) Loans outstanding consist of loans due from commercial and financial institutions including loans in the form of interest bearing securities. Certain deposits with banks and states are not a part of total loans, although they are included in the items Loans to Credit Institutions and Loans to the Public in the statement of financial position. For a reconciliation of loans outstanding, see Note 11 to the Consolidated Financial Statements.

(F) For the years 2012 and 2011 equity was amended in 2013 due to the implementation of IAS 19R.

B Foreign Exchange-rates

The Group’s presentation currency is the Swedish kronor (“Skr”). The following tables set forth, for the periods and dates indicated, information concerning the noon buying rates for cable transfers in Swedish kronor, expressed in Skr per $1.00, as certified for customs purposes by the Federal Reserve Bank of New York.

Calendar Year | | High | | Low | | Average (A) | | Period End | |

2015 | | 8.8390 | | 7.8117 | | 8.4477 | | 8.3524 | |

2014 | | 7.8117 | | 6.3392 | | 6.9339 | | 7.8117 | |

2013 | | 6.8360 | | 6.2940 | | 6.5221 | | 6.5084 | |

2012 | | 7.2850 | | 6.5005 | | 6.7747 | | 6.5156 | |

2011 | | 6.9759 | | 6.0050 | | 6.4941 | | 6.9234 | |

2010 | | 8.0593 | | 6.5145 | | 7.2053 | | 6.7571 | |

(A) The average of the exchange-rates on the last day of each month during the period

Calendar Month 2015 | | High | | Low | |

September | | 8.4607 | | 8.1810 | |

October | | 8.5365 | | 8.1152 | |

November | | 8.7395 | | 8.5162 | |

December | | 8.7025 | | 8.3459 | |

Calendar Month 2016 | | High | | Low | |

January | | 8.6024 | | 8.5057 | |

February 1st until February 19th | | 8.5749 | | 8.344 | |

4

Table of Contents

The noon buying rate on February 19, 2016 was $1.00 = Skr 8.4426

No representation is made that Swedish krona amounts have been, could have been or could be converted into U.S. dollars at the foregoing rates on any of the dates indicated.

C Risk Factors

Disruptions in the financial markets or economic recessions may have an adverse effect on SEK’s ability to repay its debt.

SEK’s financial performance, as represented in its statement of financial position and of comprehensive income, may be adversely affected by a number of factors, many of which are outside the Group’s control. Disruptions in the international financial markets and the worldwide recession that we witnessed a few years ago had both direct and indirect effects on SEK’s profitability, asset quality, and its ability to finance its operations. Such future disruptions or global recessions may reduce the Group’s ability to repay its debt.

In addition, certain economies around the world are currently in recession and some major countries are experiencing slow growth. The decline in commodity prices are also to a large extent an effect of slower growth in the world, particularly the slowdown in growth taking place in China. This, or any return to recessive conditions in any significant market that has recently emerged from recession, may ultimately impact the industrial development of commercial or industrial entities in countries around the world, which could also affect the business volumes, profitability or asset qualities of the Group. There can be no certainty that measures taken by various governments and monetary authorities will succeed in re-establishing, on a sustainable basis, the conditions necessary for economic growth. Therefore, uncertainty remains as to the future global economic outlook, and many countries’ economies could experience long periods of slow growth or recurring recessions.

Additionally, even in the absence of slow economic growth or recessions, other economic circumstances — including, but not limited to, volatility in energy prices, contractions in infrastructure spending, fluctuations in market interest or exchange-rates, and concerns over the financial health of sovereign governments and their instrumentalities — may have negative consequences for the companies and industries that the Group provides financing to (as well as the financial condition of SEK’s financial counterparties) and could, in addition to the other factors cited above, have material adverse effects on the Group’s business prospects, financial condition or ability to fulfill its debt obligations.

SEK is exposed to credit risk even in normal economic circumstances. Disruptions in the financial markets or economic recessions may further negatively affect the credit quality of borrowers and cause other to risk counterparties, which may cause credit losses or affect the value of assets.

Risks arising from the credit quality of borrowers and counterparties and the recoverability of loans and amounts due from counterparties in derivative transactions are inherent in SEK’s businesses. Consequently, SEK may incur credit losses or delinquency in debt repayments even in normal economic circumstances. Financial market disruptions or economic recessions may further affect SEK’s customers and counterparties, negatively affecting their ability to fulfill their obligations. Market and economic disruptions may affect, among other things, business and consumer spending, bankruptcy rates and asset prices, creating a greater likelihood of impact on an increased number of SEK’s customers or counterparties credit demand or that they may become delinquent in their loans or other obligations to SEK. SEK has, in the recent past, been forced to write down the value of some of its assets as a result of disruptions in the financial markets, and SEK may be forced to do so again in future periods. Such disruptions may affect the recoverability and value of SEK’s assets and may necessitate an increase in SEK’s provisions for delinquent and defaulted debt and other provisions, which could in turn have a material adverse effect on SEK’s business and/or its ability to repay its debts.

5

Table of Contents

Reduced access to international capital markets for the financing of SEK’s operations, or less favorable financing terms, may have negative impacts on SEK’s profitability and its ability to fulfill its obligations.

In order to finance its operations, SEK is dependent on the international capital markets, where it competes with other issuers to obtain financing. Although SEK has been able to successfully finance its operations to date, factors outside SEK’s control may have material adverse effects on the Group’s continued ability to obtain such financing or could cause the cost of such financing to increase. Continuing market turmoil and ongoing recessions in certain major countries have made it very difficult for many issuers to obtain financing, especially for debt instruments with longer maturities. Continued market disruptions may make such borrowing more expensive and difficult to obtain, consequently reducing the Group’s profitability and/or its ability to fulfill its obligations. In addition, in the wake of the financial disruptions from 2008 and onwards, there have been proposals of new stricter regulations under the Basel regime with regard to capital adequacy and liquidity coverage. These stricter regulations (many of which have already come into force, while others are expected to become effective in the near future) will mean that, in general, financial institutions will need to have larger own funds in relation to their risk-weighted assets as well as have better matched borrowing in relation to their obligations. Furthermore, tighter rules on which assets can be defined as liquidity reserves as well as stricter requirements on clearing of derivatives are important parts of the regulations. Compliance with such new rules may increase the costs of borrowing for all financial institutions, including SEK.

A key factor affecting the cost and availability of financing is SEK’s credit rating. Although the Group currently has favorable credit ratings from various credit rating agencies, those credit ratings depend on many factors, some of which are outside of SEK’s control. Credit rating agencies are also increasing their scrutiny of all issuers, particularly financial institutions. Significant factors in determining SEK’s credit ratings or that otherwise could affect its ability to raise financing include its ownership structure, asset quality, liquidity profile, short- and long-term financial prospects, risk exposures, capital ratios, and prudential measures, as well as government support and SEK’s public policy role. In particular, the public policy role of SEK and corresponding level of government support might receive greater scrutiny from the rating agencies in the near future, as similar institutions within the Nordic region have recently experienced dramatic changes in their government’s definition of their public policy role. Notwithstanding regular confirmation from SEK’s owner (the Swedish State) of its continued support for SEK’s current public policy role, the risk that this view could change in the future cannot be entirely disregarded. Deterioration in any one of these factors or in any combination of these factors may lead rating agencies to downgrade SEK’s credit ratings. If the Group were to experience a downgrade in its credit ratings, it would likely become necessary to offer increased interest margins in the capital markets in order to obtain financing, which would likely substantially lower the Group’s profit margins and earnings, harm its overall liquidity and negatively affect its business and its ability to fulfill its obligations.

SEK may experience negative changes in the value of its assets or liabilities and may incur other losses related to volatile and illiquid market conditions.

Market volatility, illiquid market conditions and disruptions in the credit markets have during certain periods made it difficult to value certain of SEK’s assets and liabilities. For example, SEK is exposed to changes in fair value due to changes in credit spreads on its own debt and due to changes in currency basis spread, which it has not hedged, and such changes in fair value can have a negative impact on SEK’s results as reported under IFRS, even though SEK historically has not experienced any material realized losses related to such exposures. Subsequent valuations, in light of factors then prevailing, may result in significant changes in the value of such assets or liabilities in future periods. In addition, at the time of any sale of any such assets, the prices SEK ultimately realizes will depend on the demand and liquidity in the market at that time and may be materially lower than such assets’ current fair value. Any of these factors could require SEK to negatively change the carrying amount of such assets or liabilities, which may have an adverse effect on the Group’s financial condition in future periods.

SEK’s hedging strategies may not prevent losses.

SEK uses hedging instruments in an attempt to manage interest rate, currency, credit, basis and other market-related risks. If any of the variety of instruments and strategies the Group uses to hedge its exposure to these various types of risk is not effective, the Group may incur losses, impairing its ability to timely repay or refinance its debts. In addition, there can be no assurance that the Group will continue to be able to hedge risks related to current or future assets or liabilities in accordance with its current policies in an efficient manner or at all. Disruptions such as market crises and economic recessions may put a strain on the availability and effectiveness of hedging instruments or strategies and could have an adverse effect on SEK’s financial condition and its ability to fulfill its obligations.

6

Table of Contents

Fluctuations in foreign currency exchange-rates could harm SEK’s business.

As an international lending institution, the Group is subject to some exchange-rate risk. The adequacy of the Group’s financial resources may be impacted by changes in currency exchange-rates that affect the value in Swedish currency of the Group’s foreign-currency obligations. The values of a majority of the items presented in the statement of financial position are subject to fluctuations as a result of changes in the exchange-rate between the Swedish krona and other currencies, such as the U.S. dollar/Swedish krona and the euro/Swedish krona exchange-rates. Even though the Group carefully monitors and hedges its foreign currency exposures, changes in currency exchange-rates adverse to the Group could harm SEK’s business, its profitability and its ability to repay its debts. Furthermore, SEK does not hedge its exposure towards currency exchange-rate effects related to unrealized changes in the fair value of its assets and liabilities. Also, any strengthening of the Swedish krona against other currencies may reduce demand for the products sold overseas by SEK’s Swedish clients and thus reduce demand for its loans from end-purchasers of such products, or cause such clients to experience increased difficulty in repaying their loans to SEK. Such eventualities could therefore have an adverse effect on SEK’s financial condition and its ability to fulfill its obligations. As part of its ordinary business activities, SEK has a material amount of euro-denominated assets reported in its statement of financial position as well as euro-denominated debt. Because of uncertainty surrounding the capacity of Eurozone countries’ ability to handle the financial problems many of these countries are currently experiencing, the euro may fluctuate against the Swedish krona or any other currency in which SEK has assets or liabilities. SEK might therefore be harmed by such fluctuations in exchange-rates. Recent developments in Russia have had a negative impact on SEK’s customers, while recent developments in Greece have only had indirect effects through their impact on financial markets.

Increasing competition may adversely affect SEK’s income and business.

Competition in the Group’s business is based on service, product innovation, product features, price, commission structures, financial strength and name recognition. The Group competes with a large number of other credit institutions, including domestic and foreign banks, as well as with the direct or indirect financing programs of exporters themselves. Some of these institutions offer a broader array of products or have more competitive pricing or greater financial resources with which to compete than does SEK. Increasing competition may have significant negative effects on the Group’s financial performance if the Group is unable to match the products and services of its competitors or has to lower its prices or rates in order to compete for customer business, investments or financing. Such changes could have material adverse effects on SEK’s business and its ability to repay its debts.

SEK is exposed to significant operational risk.

Broadly, operational risk can arise from fraud, errors by employees, failure to document transactions properly or to obtain proper internal authorizations, equipment failures, natural disasters, and information security failures or the failure of external systems such as, for example, those of SEK’s suppliers or counterparties. SEK’s businesses are dependent on the ability to process complex transactions efficiently and accurately. Failure to address operational risk may lead to additional costs, losses or damages to SEK’s reputation which may negatively affect customers’ and investors’ confidence, and thus SEK’s business, financial performance and/or ability to repay its debt. If, for example, SEK failed to properly comply with its obligations under financial guarantee contracts or other credit risk reducing arrangements or if the contracts were not properly drafted, this could result in SEK not being able to effectively seek recourse to such guarantees or other arrangements in the event the relevant borrower was unable to repay its debt to SEK.

There is also a risk that SEK’s reputation will be damaged if SEK fails to comply with current legislation and best practices or in any other way fails to meet its commitments, including those that are not explicit. Although operational risks can be reduced by properly documented processes, adequate systems, a culture of sensitivity to risk, compliance with regulations, effective corporate governance and other factors supporting internal control, such procedures may not be effective in controlling each single operational risk SEK faces. A significant failure in managing our operational risk could materially and adversely affect SEK’s business, financial condition, results of operation and/or ability to repay its debt.

7

Table of Contents

Changes in law or regulation may adversely affect SEK’s business

SEK’s business is subject to regulation and regulatory oversight. Any significant regulatory development could affect the manner in which SEK conducts its business and SEK’s results of operations.

SEK is subject to financial services laws, regulations, administrative actions and policies in each location in which SEK operates. Financial regulators around the world have responded to the recent crisis by proposing significant changes to the regulatory regime applicable to financial service companies such as SEK’s. Changes to the current system of supervision and regulation, or any failure to comply with applicable rules (and particularly those in Sweden) could materially and adversely affect SEK’s business, financial condition or results of operation and/or ability to repay its debt.

In December 2010, the Basel Committee on Banking Supervision presented an extensive new package of rules known as Basel III, intended to supersede the previous Basel II standard. As of January 1, 2014, new rules according to Basel III came into force within the European Union by means of the Capital Requirements Regulation (CRR) and the Capital Requirements Directive (CRD IV). The CRR is directly applicable legislation in the European Union. The rules of the CRD IV must be transposed into national law, and the new Swedish laws Credit Institutions and Securities Companies (Special Supervision) Act (2014:968) and the capital Buffers Act (2014:966) were enacted and came into effect as of August 2, 2014. In some cases the new rules are subject to transitional arrangements, while in other cases binding rules are still not finalized. The areas in which rules have yet to be finalized include, but are not limited to (i) the minimum requirements on leverage, particularly the minimum leverage ratio of 3.0 percent which is intended to apply from 2018 and which may be increased following the evaluation period and (ii) minimum requirements on net stable funding, for which the final rules are yet to be finalized, and which are expected to apply from 2018 as well. As for regulations regarding deduction from own funds related to prudent valuation, the final regulatory technical standard has been approved for adoption on February 17, 2016, and could therefore significantly affect the reduction needed to be made from own funds with regard to prudent valuation of financial instruments, even though SEK already in 2015 has applied the standard in accordance with the final draft of the regulatory technical standard. On numerous topics the regulations will be further specified by means of binding technical standards or amended according to stated intentions. The implications of such changes are, as yet, not fully known. Furthermore, the new regulations have introduced a higher level of discretion for national supervisory authorities to impose further capital requirements and such decisions may adversely affect SEK. Finally, the Basel Committee on Banking Supervision continuously releases amendments or revisions to the Basel III standard. Such initiatives, following implementation within the European Union, may also adversely affect SEK.

In addition, the European Market Infrastructure Regulation (EMIR) regarding OTC-derivates, central counterparties and trade repositories, came into effect on August 16, 2012. EMIR will impose, in some cases, mandatory central clearing of derivatives. The future clearing obligations according to EMIR will also gradually widen, and the regulation will be further supplemented by means of binding technical standards. During 2016, additional part of the regulation will come into effect related to central clearing of certain OTC-derivatives. SEK are defined as an institution in category 2 in this context, and in November 2015 it was decided that institutions in category 2 will be obliged to clear certain OTC-derivatives from December 2016 for such transactions that was entered into from May 2016. This new regulation may affect SEK’s business by increasing costs and putting restraints on the way SEK can conduct its business with regard to derivatives, if those derivatives are not cleared through a central clearing house. EMIR may thus have a negative impact on cash flows, posting of collaterals, counterparty exposure and financial reporting.

Furthermore, from March 2017, it will be compulsory for SEK to post variation margin on non-cleared derivatives. This may result in significantly higher amount of negative cash flows than under the present regulatory environment.

The Bank Recovery and Resolution Directive (BRRD) entered into force in the European Economic Area as of January 1, 2015. The BRRD has been fully implemented in Swedish law through the Swedish Resolution Act 2016 (2015:1016) as of February 1, 2016. During 2015 part of BRRD was implemented through regulation by Finansinspektionen (the Swedish FSA) which required the establishment of a contingency borrowing plan by SEK. As from 2016 all the requirements in accordance with BRRD have been implemented through legislation in Sweden. Pursuant to BRRD, SEK is subject to minimum requirement for own funds and eligible liabilities, which is a parallel requirement to CRR. The minimum requirement is to be determined individually for each institution by the national resolution authority, which in Sweden is Riksgäldskontoret (the Swedish National Debt Office). SEK has not yet been informed by Swedish National Debt Office which minimum requirement that is applicable to SEK, however it is not probable that the requirements will have an significant impact on minimum requirements on SEK’s capitalization.

The introduction of a debt write-down tool in accordance with BRRD may lead to debt instruments that could be written down or converted into share capital possibly being priced differently and the risk of a write-down being priced in, even though the principle under the regulation is that investors should not be worse off than under an ordinary bankruptcy process. Resolution action should be taken only where necessary in the public interest and any interference with rights of shareholders and creditors which results from resolution action should be compatible with the Charter of Fundamental Rights of the European Union (the Charter). In particular, where creditors within the same class are treated differently in the context of resolution action, such distinctions should be justified in the public interest and proportionate to the risks being addressed and should be neither directly nor indirectly discriminatory on the grounds of nationality. The effect of the introduction of this debt write-down tool on total capital and financing costs, as well as other possible effects, is however, still difficult to assess.

8

Table of Contents

For risk classification and quantification of credit risk, SEK uses an internal ratings-based (IRB) approach, the IRB Foundation Approach. The Swedish FSA has previously, however, granted the company certain exemptions from the IRB approach. For exposures covered by the exemptions the standardized approach is applied rather than the IRB approach. SEK has permanent exemptions for exposures to Swedish central and regional governments, as well as permanent exemptions for some non-material exposures. For exposures to central and regional governments outside Sweden and to multilateral development banks, SEK has an exemption until December 31, 2015. During 2015 the Swedish FSA has revised it views and will not prolong such exemptions. Therefore, SEK has asked the Swedish FSA for permission to apply an IRB approach for those exposures exempted until December 31, 2015 and until such permission has been granted to prolong the time-limited exemptions. Pillar 1 capital requirements for the exposures covered by the application could increase significantly when an IRB approach is applied.

On May 22, 2015, European Banking Authority (EBA) issued guidelines on the management of interest rate risk arising from non-trading activities, or interest risk in the banking book (IRRBB), which came into force on January 1, 2016. The guidelines require a significant higher degree of sophistication with regard to measuring of interest rate risk then previously that may result in increase in capital requirements related to market risk.

Other pending regulations that could also have a negative impact on SEK include IFRS 9, which will replace IAS 39 with regard to accounting rules for financial instruments. The implementation of IFRS 9 may lead to higher costs for SEK.

Risk related to financial reporting and other deficiencies in internal control over financial reporting and disclosure processes could result in errors, affect operating results and cause investors to lose confidence in our reported results.

SEK’s external reporting of financial and non-financial data is reliant on the Group’s internal control over financial reporting including the integrity of systems and people. Failure to report data accurately and in compliance with external standards could result in regulatory action, legal liability and damage to the Group´s reputation. For additional information on SEK’s internal control over financial reporting see Item 15.

Developments in emerging market countries may adversely affect the Group’s business.

The Group operates in a number of emerging markets and its exposure to such markets has increased in recent years, as the number and importance of investment and trade links between Sweden and emerging markets has increased. Economic and political developments in emerging markets, including economic crises or political instability, may have material adverse effects on the Group’s business prospects, results of operations and/or ability to repay its debt.

9

Table of Contents

Negative interest rates may have an impact on SEK’s profitability.

Negative interest rates may result in lower net interest income and might negatively affect the value of assets and liabilities. For example, negative interest rates may render hedges less effective if interest rate is to be paid on the hedge while there is no compensation on the hedged item. Furthermore, increased prepayments on loans and lower spread between rates on assets and liabilities might also have a negative impact on net interest income. Finally, negative interest rates leads to valuation risk due to potential changes in market practice for how to incorporate negative interest rates in the valuation.

Natural disasters, social and political unrest and other factors beyond SEK’s control may disrupt financial markets and economic conditions in markets that SEK relies on.

In order to finance its operations, SEK is dependent on the international capital markets, where it competes with other issuers to obtain financing. Although this has not been the case to date, natural disasters, such as the 2011 earthquake and tsunami in Japan, and/or social and political unrest, such as that seen in a number of Eurozone countries in recent years as well as in Ukraine and Russia recently, may have material adverse effects on the Group’s continued ability to obtain such financing or could cause the cost of such financing to increase.

10

Table of Contents

ITEM 4. INFORMATION ON THE GROUP AND THE PARENT COMPANY

A History and Development

Aktiebolaget Svensk Exportkredit (Swedish Export Credit Corporation) is a “public company” under the Swedish Companies Act (2005:551). It is wholly owned by the Swedish State through the Ministry of Enterprise and Innovation (“Sweden” or the “State”).

The Parent Company was founded in 1962 in order to strengthen the competitiveness of the Swedish export industry by meeting a need for long-term lending for both exporters and their foreign customers. SEK’s objective is to engage in financing activities in accordance with the Swedish Banking and Financing Business Act and, in connection therewith, to promote the development of Swedish commerce and industry as well as otherwise engaging in Swedish and international financing activities on commercial terms. The duration of the Parent Company is indefinite.

The address of the Parent Company’s principal executive office is AB Svensk Exportkredit (Swedish Export Credit Corporation), Klarabergsviadukten 61-63, Stockholm, Sweden; and the Parent Company’s telephone number is +46-8-613-83 00. The Parent Company’s authorized representative in the United States is Business Sweden; Business Sweden’s contact information is as follows:

Business Sweden New York

The News Building,

220 E 42nd Street

Suite 409A,

New York, NY 10017

Tel. No.: (212) 507-9001

usa@business-sweden.se

B Business Overview

SEK provides financial solutions for the Swedish export industry with the aim of promoting the development and international competitiveness of Swedish industry and trade. Its business activities are focused on lending to Swedish exporters and their customers through corporate lending, export lending, structured financing, project financing, trade financing and leasing. SEK offers its financial solutions to corporations and financial institutions as well as domestic and international investors. SEK extends loans on commercial terms at prevailing fixed or floating market interest rates in “SEK exclusive of the S-system”, as well as loans on State-supported terms at fixed interest rates that may be lower than prevailing fixed market rates in the “State Support System” (the “S-system”). The S-system is administered on behalf of the State by SEK in return for compensation.

SEK’s mission has developed over the years since SEK began its operations in 1962. From its roots in export loans, SEK’s product range over time has expanded. However, SEK is still a niche operator in the financial market. SEK works mainly with lending and as a result SEK acts as a complement to banks which are active in Sweden. SEK’s unique position means that SEK works cooperatively with banks and other financial institutions. Over the years, SEK has been active in the creation of new financial solutions. SEK’s niche specialization in long-term export-related financing, combined with its financial capacity and flexible organization, are key factors in the management of its operations. SEK’s borrowing activities in the international capital markets have given SEK expertise in financial instruments.

SEK believes that its relationships with domestic, Nordic and other international investors and partners strengthen its ability to develop financial solutions which meet its customers’ requirements. This network of relationships enables SEK to participate in co-financing arrangements.

In 2015, SEK’s new lending to Swedish exporters and their customers amounted to Skr 104.6 billion (2014: Skr 57.1 billion), of which end-customer finance amounted to Skr 85.3 billion (2014: Skr 33.9 billion) and the volume of corporate lending was Skr 19.3 billion (2014: Skr 23.2 billion).

11

Table of Contents

The main reason behind the extraordinarily high volume of new lending was our signing of the financing agreement, in the third quarter, for Brazil’s purchase of the Gripen fighter aircraft from Saab. This is SEK’s largest ever lending transaction and comprises a loan from SEK corresponding to a total of Skr 41.9 billion.

In summer 2015, demand from Swedish exporters for SEK’s lending increased and continued in the same vein for the entire second half of 2015. SEK’s assessment is that the underlying reason is a combination of rising concern in capital markets around the world and a general increase in Swedish exporters’ activity due to improved economic conditions, particularly in Europe. During 2015, SEK has not only received numerous inquiries, primarily concerning export credits, but also closed many business deals. Another explanation for the increase in new lending is that SEK now reaches more Swedish companies than ever before. Since the start of 2015, SEK’s services have become available to medium-sized exporters, and SEK have dedicated separate resources to assist this group. Several companies have discovered the added value of having another source of financing as a complement to their bank or banks.

We are continuing the development of our initiatives in sustainable financing. In 2015, we issued our first green bond for a total of USD 500 million. Our new lending to green projects totalled Skr 988 million in 2015. The underlying projects of the total green portfolio help to reduce carbon dioxide emissions in the world and reflect the Swedish environmental expertise. During the year, we approved loans to five large international projects with characterized by potentially high sustainability risks. These were all subject to our in-depth examination and assessed as meeting OECD guidelines for social and environmental issues. We updated our Sustainable Business Policy to include the Equator Principles as a reference for examining and financing projects. We initiated a project to develop our responsibility for human rights in conjunction with export credits. To improve capital efficiency and because of extremely low margins on liquidity investments, we reduced the size of the liquidity portfolio during the year. However, we continue to have healthy new lending capacity, sufficient to be able to secure long-term financing for Swedish exporters.

During 2015, SEK had a credit facility with the Swedish National Debt Office of Skr 80 billion, in order to further enhance the ability to promote the Swedish export industry. SEK has not yet utilized the credit facility. In December 2015, the Swedish parliament decided that the credit facility for 2016 should amount to Skr 125 billion. The credit facility is only available for loans covered by the State’s export credit support (CIRR).

The Board of Directors has resolved to propose at the Annual General Meeting that a total dividend of Skr 356 million (2014: Skr 378 million) be paid in accordance with company’s dividend policy.

SEK has not made any material capital expenditure, nor engaged in any other material divestitures or acquisitions (including interests in other companies) during the three financial years preceding the date of this report.

Competition

SEK is the only institution authorized by the Swedish State to grant export financing loans under the S-system. With support from the State, SEK helps Swedish export companies compete with other export companies within OECD member countries which have similar support from their respective domestic export credit agencies, which also provide government-supported export credits. SEK’s lending exclusive of the S-system, faces competition from other Swedish and foreign financial institutions, as well as from direct and indirect financing programs of exporters themselves.

The following table summarizes SEK’s loans outstanding, including the S-system and debt outstanding as of December 31, 2015 and 2014:

| | At December 31, | |

Skr mn | | 2015 | | 2014 | |

Total loans outstanding(A) | | 205,097 | | 218,222 | |

Total debt outstanding (B) | | 235,644 | | 284,137 | |

12

Table of Contents

(A) Loans outstanding consist of loans due from commercial and financial institutions including loans in the form of interest bearing securities. For a reconciliation of loans outstanding, see Note 11 to the Consolidated Financial Statements.

(B) Includes subordinated debt of Skr 2,088 million and Skr 1,945 million as of December 31, 2015 and 2014, respectively.

Lending Operations — General

The following table sets forth certain data regarding the Group’s lending operations, including the S-system, during the two-year period ending December 31, 2015:

| | Year ended December 31, | |

Skr mn | | 2015 | | 2014 | |

Offers of long-term loans accepted | | 104,583 | | 57,118 | |

Total loan disbursements | | -56,404 | | -57,495 | |

Total loan repayments | | 70,777 | | 65,171 | |

Total net increase/ (decrease) in loans outstanding | | -13,125 | | 16,745 | |

Loans outstanding | | 205,097 | | 218,222 | |

Loan commitments outstanding but undisbursed | | 63,438 | | 16,028 | |

(A) If a loan has been accepted by the borrower it can be disbursed immediately. However, disbursement may be delayed due to a number of factors. In some cases, an accepted loan may never be disbursed, including as a result of changes in the commercial and financial institutions’ need for the funds. Currency exchange-rate effects also affect the amount of loan commitments that will result in loans outstanding. Therefore, the volume of loans accepted does not equal the volume of loan disbursements as presented in the Statement of Cash Flows in the Consolidated Financial Statements for a single financial year. Loans accepted but not yet disbursed are presented under the heading “Commitments” as “Committed undisbursed loans”.

Total loans outstanding by type of loan:

Skr mn | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

End-customer finance | | 118,284 | | 128,165 | | 155,137 | | 103,973 | | 101,142 | |

Corporate lending | | 86,813 | | 90,057 | | 46,340 | | 88,934 | | 94,458 | |

Total | | 205,097 | | 218,222 | | 201,477 | | 192,907 | | 195,600 | |

Most of the loans granted by SEK are granted to purchasers of Swedish exports. Measured by revenues, the largest markets for the export of goods from Sweden are in Western Europe. However, exports to other markets, including less developed markets, are also important. Accordingly, the need for export financing may be related to transactions involving buyers in many different countries, with varying levels of creditworthiness. Pursuant to its credit risk exposure policy, SEK is selective in accepting such risk exposure. This policy seeks to ensure that SEK is neither dependent on the creditworthiness of individual buyers of Swedish goods and services, nor on the countries in which they are domiciled, but rather on the creditworthiness of individual counterparties to which SEK accepts credit risk exposure. For additional information on SEK’s approach to risk, see Note 26 and Note 29 to the Consolidated Financial Statements.

SEK relies to a large extent on guarantees in its lending. The guarantors are principally made up of government export credit agencies, such as the Swedish Exports Credit Guarantee Board (EKN), the Export Import Bank of the United States (USEXIM), the Exports Credits Guarantee Department of the United Kingdom (ECGD), Compagnie Financière pour la Commerce Exterieure (Coface) of France and Euler Hermes Kreditversicherungs AG of Germany, as well as financial institutions and, to a lesser extent, non-financial corporations. Credit risk is allocated to a guarantor in accordance with SEK’s policy and therefore, when disclosing net credit risk exposures, the majority of SEK’s guaranteed credit exposure is shown as exposure to sovereign counterparties. At year-end 2015, government export credit agencies guaranteed a total of Skr 160,0 billion (year-end 2014: Skr 173.5 billion), or 49.0 percent (year-end 2014: 46.9 percent) of SEK’s total credit exposures. Skr 106.2 billion (year-end 2014: Skr 118.8 billion) covered corporate exposures, Skr 1.9 billion (year-end 2014: Skr 2.6 billion) covered exposures to financial institutions, Skr 0.6 billion (year-end 2014: Skr 0.6 billion) covered exposures to regional governments and Skr 51.3 billion (year-end 2014: Skr 51.5 billion) covered sovereign exposures.

13

Table of Contents

The following tables show SEK’s gross and net credit exposures, respectively, to counterparties by geography and type of counterparty (taking into account applicable guarantees but not collateral) as of December 31, 2015 and 2014.

Gross exposure by region and exposure class, as of December 31, 2015

Skr billion | | Middle

East/Africa | | Asia excl.

Japan | | Japan | | North

America | | Oceania | | Latin

America | | Sweden | | West

European

countries

excl. Sweden | | Central- East

European

countries | | Total | |

Central governments | | 2.2 | | 9.9 | | — | | 1.3 | | — | | 42.8 | | 1.2 | | 2.2 | | — | | 59.6 | |

Regional governments | | 0.6 | | — | | — | | — | | — | | — | | 5.6 | | 1.1 | | 0.0 | | 7.3 | |

Multilateral development banks | | — | | — | | — | | — | | — | | — | | — | | 0.0 | | — | | 0.0 | |

Financial institutions | | 2.5 | | 4.7 | | 0.0 | | 4.7 | | 2.2 | | 2.1 | | 13.4 | | 17.6 | | 0.4 | | 47.6 | |

Corporates | | 20.1 | | 19.9 | | 3.8 | | 26.6 | | 0.3 | | 12.5 | | 67.7 | | 48.7 | | 11.3 | | 210.9 | |

Securitization positions | | — | | — | | — | | — | | — | | — | | — | | 0.8 | | — | | 0.8 | |

Total | | 25.4 | | 34.5 | | 3.8 | | 32.6 | | 2.5 | | 57.4 | | 87.9 | | 70.4 | | 11.7 | | 326.2 | |

Gross exposure by region and exposure class, as of December 31, 2014

Skr billion | | Middle

East/Africa | | Asia excl.

Japan | | Japan | | North

America | | Oceania | | Latin

America | | Sweden | | West

European

countries

excl. Sweden | | Central- East

European

countries | | Total | |

Central governments | | 2.2 | | 8.4 | | — | | 0.4 | | — | | 43.0 | | 7.9 | | 4.8 | | 0.0 | | 66.7 | |

Regional governments | | 0.7 | | — | | — | | — | | — | | — | | 11.8 | | 0.5 | | — | | 13.0 | |

Multilateral development banks | | — | | — | | — | | — | | — | | — | | — | | 0.3 | | — | | 0.3 | |

Financial institutions | | 1.5 | | 3.6 | | 0.2 | | 12.5 | | 4.0 | | 2.0 | | 14.2 | | 23.5 | | 0.4 | | 61.9 | |

Corporates | | 17.6 | | 22.5 | | 14.0 | | 27.0 | | 0.5 | | 12.1 | | 70.2 | | 45.2 | | 12.9 | | 222.0 | |

Securitization positions | | — | | — | | — | | 1.1 | | 1.2 | | — | | — | | 4.1 | | — | | 6.4 | |

Total | | 22.0 | | 34.5 | | 14.2 | | 41.0 | | 5.7 | | 57.1 | | 104.1 | | 78.4 | | 13.3 | | 370.3 | |

Item 4B Net exposure

Net exposure by region and exposure class, as of December 31, 2015

Skr billion | | Middle

East/Africa | | Asia excl.

Japan | | Japan | | North

America | | Oceania | | Latin

America | | Sweden | | West

European

countries

excl. Sweden | | Central- East

European

countries | | Total | |

Central governments | | — | | 4.9 | | — | | 5.9 | | — | | 0.8 | | 137.6 | | 20.3 | | 3.1 | | 172.6 | |

Regional governments | | — | | — | | — | | — | | — | | — | | 12.7 | | 1.3 | | — | | 14.0 | |

Multilateral development banks | | — | | — | | — | | — | | — | | — | | — | | 0.0 | | — | | 0.0 | |

Financial institutions | | 2.5 | | 4.6 | | 0.5 | | 3.9 | | 2.2 | | 2.1 | | 8.6 | | 27.2 | | 0.4 | | 52.0 | |

Corporates | | 1.1 | | 1.4 | | 0.5 | | 5.5 | | — | | 1.8 | | 60.0 | | 16.3 | | 0.2 | | 86.8 | |

Securitization positions | | — | | — | | — | | — | | — | | — | | — | | 0.8 | | — | | 0.8 | |

Total | | 3.6 | | 10.9 | | 1 | | 15.3 | | 2.2 | | 4.7 | | 218.9 | | 65.9 | | 3.7 | | 326.2 | |

Net exposure by region and exposure class, as of December 31, 2014

Skr billion | | Middle

East/Africa | | Asia excl.

Japan | | Japan | | North

America | | Oceania | | Latin

America | | Sweden | | West

European

countries

excl. Sweden | | Central- East

European

countries | | Total | |

Central governments | | — | | 3.5 | | — | | 4.4 | | — | | 0.8 | | 155.7 | | 23.9 | | 2.6 | | 190.9 | |

Regional governments | | — | | — | | — | | — | | — | | — | | 18.5 | | 2.4 | | — | | 20.9 | |

Multilateral development banks | | — | | — | | — | | — | | — | | — | | — | | 0.3 | | — | | 0.3 | |

Financial institutions | | 1.4 | | 3.3 | | 0.3 | | 11.5 | | 4.0 | | 1.9 | | 9.1 | | 35.6 | | 0.4 | | 67.5 | |

Corporates | | 0.7 | | 0.9 | | 2.3 | | 5.6 | | 0.1 | | 1.0 | | 58.9 | | 14.4 | | 0.5 | | 84.4 | |

Securitization positions | | — | | — | | — | | 1 | | 1.2 | | — | | — | | 4.1 | | — | | 6.3 | |

Total | | 2.1 | | 7.7 | | 2.6 | | 22.5 | | 5.3 | | 3.7 | | 242.2 | | 80.7 | | 3.5 | | 370.3 | |

SEK has no exposure to subprime, Alt-A, negative amortizing or other loans that it would characterize as high-risk lending, including loans which have been modified or would otherwise qualify as distressed debt, other than the limited amount of such assets disclosed in Note 9 to the Consolidated Financial Statements.

14

Table of Contents

Provisions for incurred impairment losses are made if and when SEK determines that it is probable that the obligor under a loan, or another financial asset held, and any existing guarantee or collateral, will fail to cover SEK’s full claim. Such determinations are made for each individual loan or asset. Objective evidence consists of significant financial difficulties affecting the issuer or debtor, outstanding or delayed payments or other observable factors, which suggest a measurable decrease in expected future cash flows. If there is objective evidence that an impairment loss on loans or other financial assets has been incurred, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the financial asset’s original effective interest rate. The amount of the loss is recognized in profit or loss.

After such individual determinations have been made and if there is no objective evidence for impairment of an individually assessed financial asset, regardless of whether the asset is individually material or not, SEK includes the asset in a group of financial assets with similar credit risk characteristics and determines collectively any need for impairment of such assets. The need for impairment is related to loan losses which have been incurred as of the balance sheet date but have not yet been identified as individual loan losses. The reserve related to such impairment not linked to a specific counterparty is based on internal assessments of the credit quality of SEK’s assets, as manifested in, among other things, the credit ratings of counterparties, as determined either externally by a credit rating agency or internally in accordance with SEK’s own model for credit rating. If there is objective evidence for a general downward trend with regard to such rating this could constitute evidence for a need for an additional provision.

The following tables show SEK’s net credit losses and changes in reserves of financial assets, respectively, for the periods indicated.

Net credit losses

| | For the Year Ended December 31, | |

Skr mn | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Credit losses | | -33 | | -30 | | -68 | | -72 | | -125 | |

Reversal of previous write-downs | | 279 | | 378 | | 22 | | 37 | | 14 | |

Net impairments and reversals | | 246 | | 348 | | -46 | | -35 | | -111 | |

Established losses | | -211 | | -277 | | -3 | | -2 | | -4 | |

Recovered credit losses | | 1 | | 2 | | 10 | | 14 | | 4 | |

Net credit losses | | 36 | | 73 | | -39 | | -23 | | -111 | |

of which related to loans(1) | | 35 | | 11 | | -32 | | -48 | | -78 | |

related to liquidity placements(1) | | 1 | | 62 | | -7 | | 25 | | -33 | |

(1)For the definition of loans and liquidity investments, see Note 11 to the Consolidated Financial Statements.

Changes in reserves of financial assets

| | For the Year Ended December 31, | |

Skr mn | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

Opening balance | | -464 | | -757 | | -711 | | -676 | | -565 | |

Reserves used to cover write-offs (charge-offs) | | -9 | | -5 | | — | | — | | — | |

Net impairments and reversals | | 246 | | 348 | | -46 | | -35 | | -111 | |

Currency effects | | -9 | | -50 | | 0 | | — | | — | |

Closing balance | | -236 | | -464 | | -757 | | -711 | | -676 | |

of which related to loans(1) | | -228 | | -236 | | -260 | | -221 | | -161 | |

of related to liquidity placements(1) | | -8 | | -228 | | -497 | | -490 | | -515 | |

(1) For the definition of loans and liquidity investments, see Note 11 to the Consolidated Financial Statements.

15

Table of Contents

SEK exclusive of the S-system

Outside of the S-system, (or in “SEK exclusive of the S-system,” as we refer to the business of SEK other than the S-system), SEK reports loans in the following categories:

Loan Types and Underwriting Policies

(a) Lending to Swedish exporters (corporate lending)

(b) Lending to international buyers of Swedish capital goods and services (end-customer finance)

· export credits;

· loans for the funding of export lease agreements;

· trade finance;

· project finance

SEK’s credit underwriting policies and requirements are similar regardless of loan type. The majority of our loans are guaranteed by export credit agencies or banks, or by credit default swaps issued by banks or other financial institutions.

SEK’s initial loan offer and subsequent commitment set forth the maximum principal amount of the loan, the currency in which the loan will be denominated, and the repayment and disbursement schedule.

Loans outstanding (exclusive of those under the S-system) as of the dates indicated were distributed among SEK’s various categories of loans as follows:

Loans outstanding (exclusive of the S-system) by type of loans:

| | As of December 31, | |

Skr mn | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

End-customer finance | | 74,207 | | 79,867 | | 111,890 | | 64,474 | | 66,915 | |

Corporate lending | | 86,813 | | 90,057 | | 46,340 | | 88,934 | | 94,458 | |

Total | | 161,020 | | 169,924 | | 158,230 | | 153,408 | | 161,373 | |

Interest Rates

Outside the S-system, export financing is extended at prevailing market rates of interest. The Group normally makes loan offers at a quoted interest rate that is subject to change prior to acceptance of the loan offer (a non-binding offer). When a borrower accepts a non-binding loan offer, the interest rate is normally set at the then-prevailing market rate (which might have changed since the loan commitment was made), and a binding loan commitment arises. Binding offers can also be provided and are offers with a higher degree of commitment to the customer with regard to disbursement of the loan than non-binding offers, regardless of whether the interest rate is fixed or not.

16

Table of Contents

Guarantees and Credit Default Swaps

If a guarantee or credit default swap is entered into for risk-mitigating purposes, the instrument protects a pre-defined amount of SEK’s exposure with respect to the principal amount of the underlying loan (and in some cases interest) as long as the issuer of the guarantee or credit default swap is financially sound. The amount so protected is ordinarily 75%-100% of the principal amount. Most of the counterparties against whom SEK accepts net exposures are rated by one or more of the internationally recognized rating agencies. For export loans, where the ultimate borrower may have relatively low creditworthiness, guarantees from export credit agencies (“ECAs”) and banks are normally used.

Loan Maturities

SEK was founded in 1962 in order to strengthen the competitiveness of the Swedish export industry by meeting a perceived need for long-term loans for both exporters and their foreign customers. SEK’s historical role and competitive advantage (and one that continues today) has therefore been in the provision of long-term financing in order to promote the Swedish export industry. Since many of the projects the export industry engages in are long-term projects, both with regard to disbursement periods and repayment periods, SEK’s loans often have longer terms than those of normal commercial loan products offered by commercial banks. However, SEK also meets its customers’ needs by providing short-term financing when required. SEK’s loan maturities therefore range from very short-term loans (with terms of three to six months) through loans for as long as 20 or 30 years.

Offers granted by the Group for loans that borrowers accepted (exclusive of those under the S-system) were distributed among SEK’s various categories of loans as follows as of December 31, 2015 and December 31, 2014.

Offers accepted, type of loan

Skr billion | | 2015 | | 2014 | |

End-customer finance | | 34.5 | | 28.2 | |

Corporate lending | | 19.3 | | 23.2 | |

Total | | 53.8 | | 51.4 | |

Of the total volume of offers accepted during 2015, Skr 3.4 billion (2014: Skr 2.8 billion) had not been disbursed at the end of the respective reporting period. If a loan has been accepted by the borrower it can be disbursed immediately. However, disbursement may be delayed due to a number of factors. In some cases, an accepted loan may never be disbursed, including as a result of changes in the customer’s need for the funds. Currency exchange-rate effects also affect the amount of loan commitments that will result in loans outstanding.

Currency

SEK extends loans in different currencies, depending on the needs of its borrowers. Before the Group makes any loan commitment, it ensures that the currency in which the loan is to be funded is expected to be available for the entire loan period at an interest rate (taking into account the costs of foreign exchange derivatives) that, as of the day the commitment is made, results in a margin that the Group deems sufficient. The Group borrows, on an aggregate basis, at maturities corresponding to or exceeding those of prospective loans. The Group may accordingly decide not to hedge particular loan commitments for movements in interest rate risk until sometime after they are made. Interest rate risks associated with such unhedged commitments are monitored closely and may not exceed interest rate risk limits established by the Parent Company’s Board of Directors. SEK’s policies are described in Note 29 to the Consolidated Financial Statements.

17

Table of Contents

The following table shows the currency breakdown of loan offers accepted for loans with maturities exceeding one year for each year in the two-year period ending December 31, 2015.

| | Percentage of loan offers accepted | |

Currency in which loan is denominated | | 2015 | | 2014 | |

Swedish kronor | | 34 | % | 22 | % |

Euros | | 14 | % | 20 | % |

U.S. dollars | | 47 | % | 51 | % |

Other | | 5 | % | 7 | % |

Total | | 100 | % | 100 | % |

S-system

The S-system was established by the Swedish State on July 1, 1978, as a State-sponsored export-financing program designed to maintain the competitive position of Swedish exporters of durable goods and services in world markets. With respect to the financing of services, this could relate, for example, to services provided by the exporter to a customer in connection with the export of goods.

After a trial period, in April 1984 the Swedish Parliament extended the S-system indefinitely. The S-system today comprises the normal export-financing program at CIRR (Commercial Interest Reference Rate) rates and a concessionary loan program (with a foreign aid element), as more fully described below. Pursuant to arrangements established in 1978 and amended from time to time thereafter, the Group administers the S-system on behalf of the State in return for compensation based mainly on outstanding loan volumes.

SEK’s net compensation for administrating the S-system is recognized as part of interest revenues in the statement of comprehensive income. Pursuant to a resolution adopted by the sole shareholder at the Annual General Meeting in April 2012, the difference between interest revenues and net commission revenues related to lending and liquid assets under the S-system, on the one hand, and interest expenses related to borrowing, all other financing costs and any net foreign exchange losses incurred by SEK under the S-system, on the other hand, are reimbursed by (or paid to) the Swedish State.

SEK treats the S-system as a separate operation for accounting purposes. Although the deficits (or surpluses) of programs under the S-system are reimbursed by (or paid to) the State, any loan losses that may be incurred under such programs are not reimbursed by the State. Accordingly, SEK has to obtain appropriate credit support for these loans as well. All of the lending under the S-system is reported on SEK’s statement of financial position. SEK has consequently presented the operations of the S-system in the statement of comprehensive income as the amount of net commission received, accounted for as interest income rather than presenting the gross amounts collected and paid in accordance with the agreement with the Swedish State. In general, loans under the program are made with State guarantees administered by the EKN. All such loans granted by SEK must also undergo SEK’s customary approval process.

The following table sets forth the volumes of offers accepted, undisbursed loans at year end, new loans disbursed and loans outstanding at year-end under the various programs in the S-system for each year in the two-year period ended December 31, 2015.

The volume of offers accepted in the S-system increased significantly during 2015 as compared to 2014. This is mainly related to one large transaction executed during 2015. Of the total amount of outstanding loans, loans in the S-system amounted to Skr 44.1 billion (year-end 2014: Skr 48.3 billion), representing a decrease of 9 percent from year-end 2014. The decrease of credits in the S-system is partly due to currency exchange-rate effects because of the strengthening of the USD against the Swedish krona during 2015.

18

Table of Contents

| | Concessionary Loan Program | | CIRR-loans | | Total | |

Skr mn | | 2015 | | 2014 | | 2015 | | 2014 | | 2015 | | 2014 | |

Offers accepted | | — | | — | | 50,825 | | 5,668 | | 50,825 | | 5,668 | |

Not disbursed loans at year-end | | 40 | | 47 | | 54,598 | | 7,482 | | 54,638 | | 7,529 | |

New loans disbursed | | 16 | | 10 | | 6,027 | | 7,610 | | 6,043 | | 7,620 | |

Loans outstanding at year-end | | 949 | | 921 | | 43,128 | | 47,377 | | 44,077 | | 48,298 | |

The following table sets forth the volume of loans outstanding in the S-system by type of loan as of December 31 in each of the years indicated.

Loans outstanding in the S-system by type of loans

Skr mn | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | |

End-customer finance | | 44,077 | | 48,298 | | 43,247 | | 39,499 | | 34,227 | |

Corporate lending | | — | | — | | — | | — | | — | |

Total | | 44,077 | | 48,298 | | 43,247 | | 39,499 | | 34,227 | |

Loan Types and Underwriting Policies

Within the S-system, SEK extends loans only for the medium- and long-term financing of durable goods exports. S-system lending includes financing in cooperation with intergovernmental organizations and foreign ECAs. SEK’s credit underwriting policies and requirements for S-system loans are similar regardless of loan type. The majority of these loans are also guaranteed by export credit agencies. SEK’s initial loan offer and subsequent commitment set forth the maximum principal amount of a loan, the currency in which the loan will be denominated, the repayment schedule and the disbursement schedule.

Interest Rates

Because Sweden is a member of the Organization for Economic Cooperation and Development (the “OECD”), the S-system is designed to comply with the Arrangement on Guidelines for Officially Supported Export Credits of the OECD (the “OECD Consensus”). The OECD Consensus establishes minimum interest rates, required down payments and maximum loan periods for government-supported export loan programs.

SEK offers S-system financing at commercial interest reference rates (“CIRR”) established by the OECD in accordance with the OECD Consensus. The CIRR rates for new loans are subject to periodic review and adjustment by the OECD. The OECD Consensus stipulates that loan offers may remain valid for a period of not more than 120 days. EU rules and Swedish regulations state that the commercial contract must be signed within such 120 day period. Thereafter, the CIRR rate can be locked in for a maximum period of six months in order for the loan agreement to be finalized. No commitment fee is charged by SEK for CIRR loans. The arranging/agent bank, generally a commercial bank, receives compensation of 0.25 percent per annum, based on the outstanding loan amount, to cover its costs for arranging and managing loans.

SEK participates with government agencies in an export-financing program (the “Concessionary Credit Program”) financed by the Swedish State to promote exports to certain developing countries, incorporating a foreign aid element of at least 35 percent. SEK has a portfolio of such credits but Sweden is no longer providing new Concessionary Credits under the program. Terms varied according to the per capita income of the importing country.

The aid element is reflected in the form of lower rates of interest and/or deferred repayment schedules, and the Swedish government reimburses SEK through the S-system for the costs incurred as a result of SEK’s participation in such program as well as costs if any in the CIRR financing.

19

Table of Contents

Guarantees

In general, loans under the S-system are guaranteed by the EKN. If a guarantee is entered into for risk-mitigating purposes it protects a pre-defined amount of SEK’s exposure with respect to principal (and in some cases interest) as long as the issuer of the guarantee is financially sound. All credits granted by SEK within the S-system must also undergo SEK’s customary credit approval process.

Loan Maturities

Under the S-system, loan maturities generally range from one year up to 20-30 years.

Credit Support for Outstanding Loans

The Group’s policies with regard to counterparty exposures are described in detail in Note 29 to the Consolidated Financial Statements.

The following table illustrates the counterparties for the Group’s outstanding loans and guarantees as of December 31, 2015 and December 31, 2014. Although most loans fall into more than one category for any given loan, this table reflects only the counterparty (either borrower or guarantor) that SEK believes to be the stronger in terms of creditworthiness.

| | 2015 | | 2014 | |

Loan credit exposure to Swedish State guarantees via EKN(A) | | 34 | % | 39 | % |

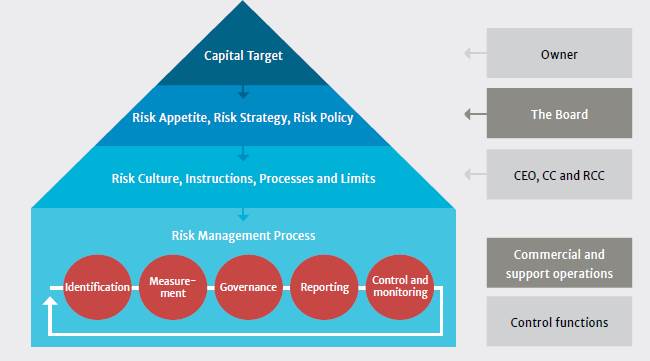

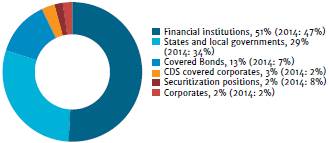

Loan credit exposure to Swedish credit institutions(B) | | 3 | % | 3 | % |