Alternative performance measures (see *)

Alternative performance measures (APMs) are key performance indicators that are not defined under IFRS or in the Capital Requirements Directive IV (CRD IV) or in regulation (EU) No. 575/2013 on prudential requirements for credit institutions and investment firms (CRR). SEK has presented these, either because they are in common use within the industry or because they comply with SEK’s assignment from the Swedish government. The APMs are used internally to monitor and manage operations, and are not considered to be directly comparable with similar key performance indicators presented by other companies. For additional information regarding the APMs, refer to www.sek.se.

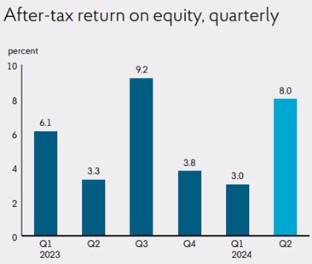

*After-tax return on equity

Net profit, expressed as a percentage per annum of the current year’s average equity (calculated using the opening and closing balances for the report period).

*Average interest-bearing assets

This item includes cash and cash equivalents, treasuries/government bonds, other interest-bearing securities except loans, loans in the form of interest-bearing securities, loans to credit institutions and loans to the public, and is calculated using the opening and closing balances for the reporting period.

*Average interest-bearing liabilities

This item includes borrowing from credit institutions, borrowing from the public and debt securities issued and is calculated using the opening and closing balances for the reporting period.

Basic and diluted earnings per share (Skr)

Net profit divided by the average number of shares, which amounted to 3,990,000 for each period.

*CIRR loans as percentage of new lending

The proportion of officially supported export credits (CIRR) of new lending.

CIRR-system

The CIRR-system comprises of the system of officially supported export credits (CIRR).

Common Equity Tier 1 capital ratio

The capital ratio is the quotient of total common equity tier 1 capital and the total risk exposure amount.

Green bond

A green bond is a bond where the capital is earmarked for various forms of environmental projects.

Green loans

SEK offers green loans that promote the transition to a climate-smart and environmentally sustainable economy. Green loans are categorized under SEK’s framework for green bonds. The purpose is to stimulate green investments that are environmentally sustainable and contribute to one or more of the six environmental objectives in the EU taxonomy.

Leverage ratio

Tier 1 capital expressed as a percentage of the exposure measured under CRR (refer to Note 10).

Liquidity coverage ratio (LCR)

The liquidity coverage ratio is a liquidity metric that shows SEK’s highly liquid assets in relation to the company’s net cash outflows for the next 30 calendar days. An LCR of 100 percent means that the company’s liquidity reserve is of sufficient size to enable the company to manage stressed liquidity outflows over a period of 30 days. Unlike the Swedish FSA’s rules, the EU rules take into account the outflows that correspond to the need to pledge collateral for derivatives that would arise as a result of the effects of a negative market scenario.

Loans

Lending pertains to all credit facilities provided in the form of interest-bearing securities, and credit facilities granted by traditional documentation. SEK considers these amounts to be useful measurements of SEK’s lending volumes. Accordingly, comments on lending volumes in this report pertain to amounts based on this definition.

*Loans, outstanding and undisbursed

The total of loans in the form of interest-bearing securities, loans to credit institutions, loans to the public and loans, outstanding and undisbursed. Deduction is made for cash collateral under the security agreements for derivative contracts and deposits with time to maturity exceeding three months (see the Statement of Financial Position and Note 9).

Net stable funding ratio (NSFR)

This ratio measures stable funding in relation to the company’s illiquid assets over a one-year, stressed scenario in accordance with CRRII.

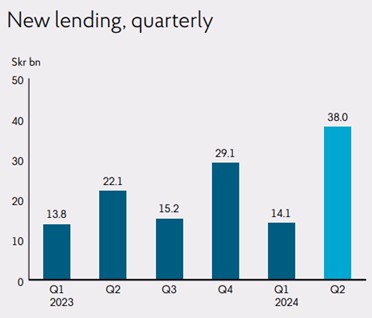

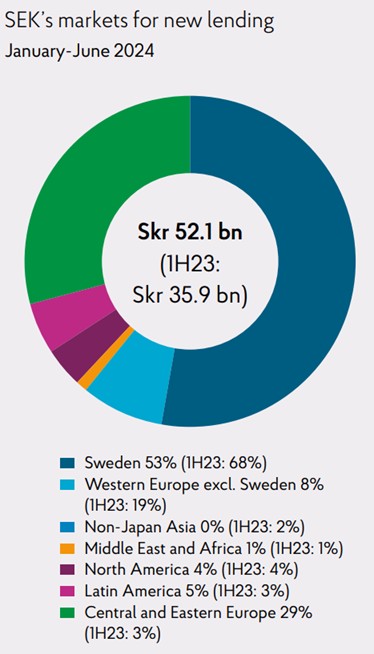

*New lending

New lending includes all new committed loans, irrespective of tenor. Not all new lending is reported in the Consolidated Statement of Financial Position and the Consolidated Statement of Cash Flows since certain portions comprise committed undisbursed loans (see Note 9). The amounts reported for committed undisbursed loans may change when presented in the Consolidated Statement of Financial Position due to changes in exchange rates, for example.

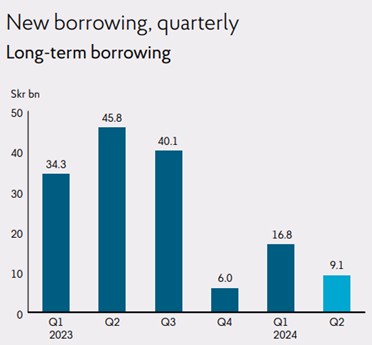

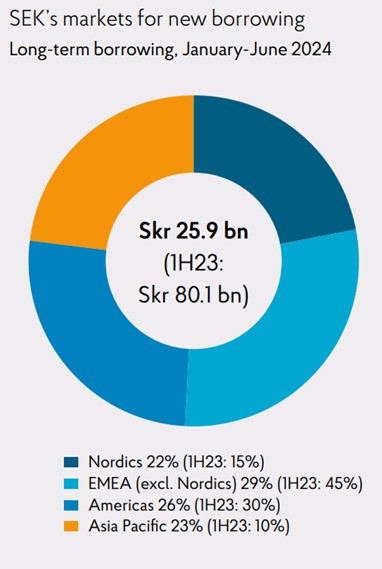

*New long-term borrowings

New borrowings with maturities exceeding one year, for which the amounts are based on the trade date.

*Outstanding senior debt

The total of borrowing from credit institutions, borrowing from the public and debt securities issued.

Own credit risk

Net fair value change due to credit risk on financial liabilities designated as at fair value through profit or loss.

Repurchase and redemption of own debt

The amounts are based on the trade date.

Social loans

Social loans are categorized according to SEK’s “Sustainability bond framework”. The purpose is to stimulate investments that are socially sustainable, such as in healthcare, education, basic infrastructure, or food security.

Sustainability classified loans

Sustainability classified loans refer to green, social and sustainability-linked loans.

Sustainability-linked loans

Sustainability-linked loans consist of working capital finance that promote the borrower’s sustainability efforts, which in turn support environmental and socially sustainable economic activities and growth. SEK’s sustainability-linked loans are based on International Loan Market Association’s (LMA) Sustainability-Linked Loan Principles.

Swedish exporters

SEK’s clients that directly or indirectly promote Swedish export.

Tier 1 capital ratio

The capital ratio is the quotient of total tier 1 capital and the total risk exposure amount.

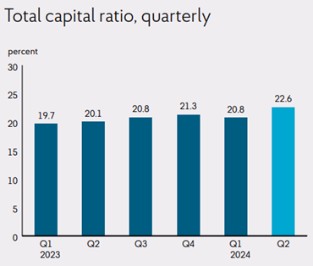

Total capital ratio

The capital ratio is the quotient of total Own funds and the total risk exposure amount.