- Company Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Aegion DEF 14ADefinitive proxy

Filed: 6 Mar 20, 2:33pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

___________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

|

☐ | Preliminary Proxy Statement |

|

|

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ | Definitive Proxy Statement |

|

|

☐ | Definitive Additional Materials |

|

|

☐ | Soliciting Material Pursuant to Sec. 240.14a-12 |

Aegion Corporation

(Name of Registrant as Specified in its Charter)

_________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

☒ | No fee required. |

|

|

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|

|

(1) | Title of each class of securities to which transaction applies: |

|

|

(2) | Aggregate number of securities to which transaction applies: |

|

|

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) | Proposed maximum aggregate value of transaction: |

|

|

(5) | Total fee paid: |

|

|

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) | Amount Previously Paid: |

|

|

(2) | Form, Schedule or Registration Statement No.: |

|

|

(3) | Filing Party: |

|

|

(4) | Date Filed: |

2020 Notice of Annual Meeting and

Proxy Statement

AEGION CORPORATION

17988 Edison Avenue

Chesterfield, Missouri 63005

Notice of 2020 Annual Meeting of Stockholders

|  Location Location | Proxy Voting | ||

8:30 a.m., local time On Wednesday, April 22, 2020 | DoubleTree by Hilton 16625 Swingley Ridge Road Chesterfield, Missouri 63017 | Your vote is important. Please vote via proxy promptly so your shares may be represented, even if you plan to attend the Annual Meeting. | ||

You may vote by Internet, by telephone or by requesting a printed copy of the proxy materials. | ||||

Record Date and Voting You are entitled to vote if you were a stockholder of record at the close of business on February 25, 2020 (the “Record Date”). Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at the meeting. There were 30,803,728 shares of our common stock outstanding on the Record Date.

Items of Business |

|

BY INTERNET www.proxyvote.com

BY TELEPHONE Toll-Free 1-800-690-6903

BY MAIL Follow instructions on your proxy card | ||

| 1 | To elect seven members to our Board of Directors, each for a term extending until our 2021 Annual Meeting of Stockholders | |||

| 2 | To conduct an advisory vote to approve named executive officer compensation | |||

| 3 | To ratify the appointment of PricewaterhouseCoopers LLP as our independent auditors for the year ending December 31, 2020 | |||

| 4 | To transact such other business that properly comes before the meeting or any adjournment thereof | |||

Notice and Access Instead of mailing a printed copy of our proxy materials, including our Annual Report on Form 10-K, to each stockholder of record, we are providing access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all stockholders. Accordingly, on March 10, 2020, we began mailing a Notice of Internet Availability of Proxy Materials (the “E-Proxy Notice”) to all stockholders of record as of the Record Date, and posted our proxy materials on the website referenced in the E-Proxy Notice (www.proxyvote.com). As more fully described in the E-Proxy Notice, all stockholders may choose to access our proxy materials on the website referred to in the E-Proxy Notice and/or may request a printed set of our proxy material. In addition, the E-Proxy Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Attending the Annual Meeting See page 71 “Questions and Answers about the Annual Meeting and Voting” for details.

By Order of the Board of Directors,

Mark A. Menghini Senior Vice President, General Counsel and Secretary

March 6, 2020 | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on April 22, 2020.

The proxy statement and Annual Report on Form 10-K are available on the Internet at www.proxyvote.com.

The following information applicable to the Annual Meeting may be found in the proxy statement and accompanying proxy card:

● The date, time and location of the meeting; ● A list of the matters intended to be acted on and our recommendations regarding those matters; ● Any control/identification numbers that you need to access your proxy card; and ● Information about attending the meeting and voting in person. | |||

ABOUT AEGION

Our Mission

To keep infrastructure working better, safer and longer for customers throughout the world.

Our Company

Aegion is a multinational company providing pipeline services including the protection, rehabilitation, engineering and design of infrastructure projects for a wide range of industries.

We are industry pioneers and continue to develop transformational solutions to rehabilitate, maintain and strengthen aging infrastructure, especially pipelines in the wastewater, water, energy, mining and refining industries.

Above all else, Aegion strives to protect our communities through Stronger. Safer. Infrastructure.®

Our Values

| Zero Incidents are Possible. Ensuring the safety of each employee is our top priority. Every Aegion Employee is empowered to deliver best-in-class safety performance at all times. |

| Do What’s Right. We are fair, ethical and respectful in all situations and interactions. We value the varied strengths, experiences and backgrounds of others. |

| Be Better. We never settle for the status quo and strive each day to do better and to be better. We recognize we will be better and achieve growth by intentionally creating a culture of inclusion through acquiring and retaining a diverse workforce. |

| We Solve Problems. We exceed expectations by working together to identify and solve problems. We believe that problem solving requires looking at challenges and opportunities from fresh and diverse perspectives. |

| Results Matter. Although our company has many parts, our common mission is driven by accountability. We encourage collaboration with one another to maximize our potential and realize the profitable growth our stockholders expect. |

AEGION AT A GLANCE

Aegion divides its operations into three operating platforms:

Infrastructure Solutions – Our proven technologies provide a superior alternative for the installation, rehabilitation and strengthening of municipal and industrial pipelines, as well as public and commercial infrastructure worldwide.

Corrosion Protection – We provide asset management for the world’s oil, gas and mining resources, including the integrity of the pipelines and other structures that transport and store those resources.

Energy Services – With a best-in-class safety culture, we deliver engineering, fabrication, procurement, construction, maintenance and turnaround services to oil and gas facilities.

OUR BRANDS

INFRASTRUCTURE SOLUTIONS | CORROSION PROTECTION | ENERGY SERVICES |

|

|

|

|

|

|

|

|

|

|

| |

| ||

|

SAFETY, CSR AND SUSTAINABILITY

Safety, Our Highest Priority

As a diversified company, Aegion works across various industries with a variety of different products, services and applications. Regardless of industry, safety is the highest priority of every aspect of our business. Moreover, we help our clients work safely through AllSafe Services, which specializes in providing safety professionals and safety attendants who oversee and monitor the safe execution of construction, maintenance and turnaround activities.

Every Aegion employee is expected to deliver best-in-class safety performance at all times. We truly believe that zero incidents are possible.

Company-wide, Aegion adheres to four main life-saving rules:

✔ | Fall Protection: No work will occur on platforms, decks, scaffolds or any work surface in excess of 4 feet (1.2 meters) in height, without appropriate guard rails or fall protection equipment. |

✔ | Confined Space: No work can take place in a confined space without first completing a documented atmospheric test with a calibrated gas meter and complying with the conditions of a confined space entry permit. |

✔ | Electrical Lockout/Tagout: Workers must employ safe practices when working with electrical power systems. |

✔ | Safe Driving: All occupants of a motor vehicle will wear their seat belts 100% of the time and operate in full compliance with all local driving laws. |

CSR and Sustainability

A key component of Aegion’s mission is to utilize our products and services to protect communities through Stronger. Safer. Infrastructure.® However, we are also focused on, and committed to, socially responsible and sustainable operations within Aegion. We have taken steps toward ensuring we operate in a robustly sustainable way, such as the adoption of social responsibility and environmental policies and a business partner code of conduct, as well as renewing our focus on creating a diverse and inclusive workplace.

However, we believe we can do more. To that end, in 2019 we launched an initiative to further our commitment to sustainability. We are currently undergoing a sustainability assessment and developing an approach to expand our disclosures and provide more transparency to our investors and key stakeholders on key sustainability initiatives. We have further established a sustainability committee focused on aligning our sustainability initiatives with our business objectives and promoting shared value for our stakeholders.

We look forward to providing future updates on our sustainability efforts and our progress toward our sustainability goals.

PROXY SUMMARY

This summary highlights information contained elsewhere is this proxy statement. This summary does not contain all of the information that you should consider. You should read this proxy statement in its entirety before voting. As used in this proxy statement, unless the context otherwise indicates or requires, references to “Aegion”, “we”, “us” and “our” mean Aegion Corporation and its consolidated subsidiaries.

Meeting Information and Mailing of Proxy Materials

| ● | Date and Time: | April 22, 2020 at 8:30 a.m. (local time) |

| ● | Location: | DoubleTree by Hilton, located at 16625 Swingley Ridge Road, Chesterfield, Missouri 63017 |

| ● | Record Date: | February 25, 2020 |

| ● | Mailing Date: | On or about March 10, 2020, we mailed the E-Proxy Notice, or this Proxy Statement and the proxy card, to our stockholders. |

| ● | Voting: | Stockholders of record are entitled to one vote per share for each director nominee and one vote per share on each other matter to be voted upon at the 2020 Annual Meeting of Stockholders. |

VOTING MATTERS AND BOARD RECOMMENDATIONS

Proposal 1 Election of Directors |

The Board of Directors has nominated seven candidates, each for a term extending until our 2021 Annual Meeting of Stockholders, and recommends that stockholders vote for each nominee based on their specific background, experience, qualifications, attributes and skills, descriptions of which are provided beginning on page 13.

The Board recommends a vote FOR each director nominee. The Board recommends a vote FOR each director nominee. |  Page 12 Page 12 |

BOARD AND CORPORATE GOVERNANCE HIGHLIGHTS

We are committed to maintaining the highest standards of corporate governance. The Board has built a strong and effective governance framework, which has been designed to promote the long-term interest of stockholders and support Board and management accountability.

Director Nominees

Name | Director Since | Committees | Other Public Company Boards (within last 5 years) |

Stephen P. Cortinovis Age: 70 – Independent Former President – Europe, Emerson Electric Co. | 1997 | ● Strategic Planning (Chair) ● Compensation | ● Plexus Corp. (current) |

Stephanie A. Cuskley (Board Chair) Age: 59 – Independent CEO, The Leona M. and Harry B. Helmsley Charitable Trust | 2005 | ● Audit ● Ex officio member of all other standing Board Committees. | ● None |

Walter J. Galvin Age: 73 – Independent Former CFO & Vice Chairman, Emerson Electric Co. | 2014 | ● Audit (Chair) ● Corporate Governance and Nominating | ● Ameren Corporation (former) |

Rhonda Germany Ballintyn Age: 63 – Independent Former VP & Chief Strategy and Marketing Officer, Honeywell International, Inc. | 2017 | ● Corporate Governance and Nominating ● Strategic Planning | ● Univar Solutions Inc. (current) ● Integra LifeSciences Holdings Corp. (current) |

Charles R. Gordon Age: 62 President & CEO, Aegion Corporation | 2009 | ● Strategic Planning | ● None |

M. Richard Smith Age: 72 – Independent Former SVP, Bechtel Corporation and President of its Fossil Power Business Unit | 2009 | ● Corporate Governance and Nominating (Chair) ● Strategic Planning | ● McGrath Rentcorp (current) |

Phillip D. Wright Age: 64 – Independent Former, President & CEO, Williams Energy Services, Inc. | 2011 | ● Compensation (Chair) ● Strategic Planning | ● Piedmont Natural Gas Company (former) |

Corporate Governance Highlights

Aegion’s Board has implemented policies and structures that we believe are among best practices in corporate governance. The Corporate Governance section of this proxy statement, beginning on page 20, describes our governance framework, which includes the following:

Current Board and Governance Information

8 Size of Board | 7 Number of Independent Directors | 13 Board Meetings Held in 2019 | 75 Mandatory Retirement Age | 67 Average Age of Directors |

✓ Separate Chair and CEO ✓ Annual Board and Committee Evaluations ✓ Independent Directors Meet in Executive Sessions ✓ Succession Planning Oversight ✓ Code of Conduct for Director, Officers, Employees and Business Partners | ✓ Board Risk Oversight ✓ Stock Ownership Guidelines for Directors and Executives ✓ Anti-Hedging and Pledging Policies ✓ Clawback Policy and Forfeiture Provisions ✓ Stockholder Outreach Program |

Proposal 2 Advisory Vote on Executive Compensation |

We recommend that you review our Compensation Discussion & Analysis beginning on page 34, which explains in greater detail the philosophy of the Compensation Committee and its actions and decisions in 2019 regarding our compensation programs. While the outcome of this proposal is non-binding, the Board and Compensation Committee will consider the outcome of the vote when making future compensation decisions.

The Board recommends a vote FOR this proposal. The Board recommends a vote FOR this proposal. |  Page 33 Page 33 |

COMPENSATION HIGHLIGHTS

��

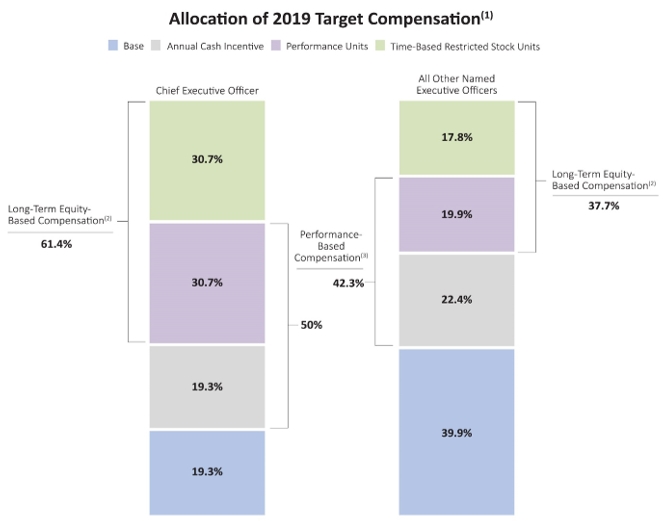

We believe our executive compensation program is well-designed, appropriately aligns executive pay with Company performance and attracts, motivates, rewards and retains individuals who can achieve superior financial results. Specifically, we mix our compensation elements to create a strong correlation between corporate performance and the pay of our executive officers, aligning the interests of our executives with our stockholders. Further, we support our pay for performance philosophy with favorable pay practices. The Compensation Discussion and Analysis section of this proxy statement, beginning on page 34, describes our compensation framework, which includes the following:

61.4% of target CEO pay is long-term equity-based | 50% of target CEO pay is performance-based | 80.20% of CEO reportable compensation was realized | 98.89% Say-on-Pay approval in 2019 | 5.9% Max merit increase in base pay in 2019 |

✓ Independent Advisor to Compensation Committee ✓ No Encouragement of Imprudent Risks ✓ No Tax Gross-Up Payments ✓ Double Trigger for All Change in Control Provisions | ✓ No Employment Agreements with Executive Officers ✓ Post-Vesting Holding Period and Top-End Limits on Performance Units ✓ All Compensation Targeted at 50th Percentile of Benchmarking and Market Data |

Proposal 3 Ratification of the Appointment of Independent Auditors for Year Ending December 31, 2020 |

Our Board of Directors has ratified our Audit Committee’s appointment of PricewaterhouseCoopers LLP as Aegion’s independent registered public accounting firm for the year ending December 31, 2020, and, as a matter of good governance, we are seeking stockholder ratification of that appointment.

The Board recommends a vote FOR this proposal. The Board recommends a vote FOR this proposal. |  Page 68 Page 68 |

Table of Contents

2 | NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS |

3 | ABOUT AEGION |

5 | SAFETY, CSR AND SUSTAINABILITY |

6 | PROXY SUMMARY |

12 | PROPOSAL ONE - ELECTION OF DIRECTORS |

12 | Election Process |

13 | 2020 Nominees |

20 | CORPORATE GOVERNANCE |

20 | Introduction |

20 | Director Qualifications |

20 | Director Independence |

21 | Board Leadership Structure |

22 | Executive Sessions |

22 | The Board’s Role and Responsibilities |

22 | Overview |

22 | Role of Board in Risk Oversight |

22 | Stockholder Engagement |

23 | Board Refreshment and Succession Planning |

23 | Board and Committee Evaluations |

23 | Director Nominations |

24 | Board and Committees Risk Oversight Responsibilities |

25 | Board of Directors and its Committees |

25 | Audit Committee |

26 | Compensation Committee |

26 | Compensation Committee Interlocks and Insider Participation |

27 | Corporate Governance and Nominating Committee |

27 | Strategic Planning Committee |

27 | Corporate Governance Documents |

28 | Related-Party Transactions |

28 | Delinquent Section 16(a) Reports |

29 | Compensation of Directors |

29 | Director Compensation Table |

30 | Additional Information about Director Compensation |

31 | Stock Ownership Policy with Respect to Non-Employee Directors |

33 | PROPOSAL TWO - ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION |

34 | EXECUTIVE COMPENSATION |

34 | Compensation Discussion and Analysis |

34 | Overview & Compensation Philosophy |

35 | Compensation Process |

37 | Say on Pay Results |

37 | Compensation Mix |

38 | Pay for Performance Analysis |

39 | Understanding the Pay of our Chief Executive Officer and Other Named Executive Officers |

39 | 2019 Total Reported Compensation v. Realizable Pay |

40 | Compensation Decisions in 2019 |

40 | 2019 Financial Performance |

40 | 2019 Compensation Decisions by Element of Pay |

49 | Key 2020 Compensation Actions |

49 | Compensation Related Policies |

| 49 | Policies Relating to Compensation |

| 50 | Policies Relating to Equity |

52 | Compensation Committee Report |

53 | Compensation in Last Fiscal Year |

53 | Summary Compensation Table |

54 | Grants of Plan-Based Awards |

55 | Outstanding Equity Awards at Fiscal Year End |

56 | Option Exercises and Stock Vested |

56 | Nonqualified Deferred Compensation |

57 | Severance, Change in Control and Termination |

59 | Potential Post-Employment Payments as of December 31, 2019 |

65 | Pay Ratio Disclosure |

66 | Information Concerning Certain Stockholders |

68 | PROPOSAL THREE – RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR FOR YEAR ENDING DECEMBER 31, 2020 |

68 | Independent Auditor Fees |

70 | Report of Audit Committee |

71 | Questions and Answers about the Meeting and Voting |

76 | Other Information |

76 | Other Matters for 2020 Annual Meeting of Stockholders |

76 | Householding of Materials |

76 | Stockholder Proposals |

77 | Stockholder Communication with Directors |

PROPOSAL ONE

ELECTION OF DIRECTORS |

Election Process

At our 2020 Annual Meeting of Stockholders, stockholders will elect seven directors, each to serve a term of one year or until his or her successor is elected and qualified. Our Board of Directors is currently comprised of eight directors; however, with the scheduled retirement of Juanita H. Hinshaw from the Board of Directors (scheduled to become effective April 22, 2020), our Board of Directors has reduced the number of directors on our Board of Directors to seven, effective as of the date of our Annual Meeting of Stockholders. After reaching the age of 75 on January 23, 2020, Ms. Hinshaw is scheduled to retire from the Board on April 22, 2020, in accordance with our Corporate Governance Guidelines, which dictate that no director shall stand for election after reaching the age of 75. Our Board of Directors is not divided into classes of directors, meaning all of our directors are voted on every year at our Annual Meeting of Stockholders.

Each director nominee named below is presently serving as a director of our Company. All nominees have consented to being named in this Proxy Statement and to serve if elected.

Our By-Laws provide that for director nominees to be elected in an uncontested election, the number of shares voted “FOR” such director must exceed the aggregate number of votes “AGAINST” that director. Our Corporate Governance Guidelines provide that directors standing for re-election submit a contingent resignation in writing annually to the Chair of the Corporate Governance and Nominating Committee to address majority voting in director elections. This resignation becomes effective only if the director fails to receive a sufficient number of votes for re-election at the 2020 Annual Meeting of Stockholders and our Board accepts the resignation. Our Corporate Governance and Nominating Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether action should be taken. The Board will act on the Corporate Governance and Nominating Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date of the certification of the election results. A director whose resignation is being considered will not participate in the Corporate Governance and Nominating Committee’s consideration of its recommendation, if a member thereof, or in the Board’s decision on whether to accept or reject the resignation or take such other actions.

2020 Nominees

| Stephen P. Cortinovis |

Age: 70 | |

Director Since: 1997 | |

Committees: Strategic Planning Committee (Chair), Compensation Committee | |

Principal Occupation: Former President – Europe of Emerson Electric. Co. | |

Recommendation: The Board has determined that Mr. Cortinovis' strong background in the global manufacturing and technology sector, as well as his expertise with large multinational corporations, qualify him to continue to serve as a director of the Company. | |

Experience: Mr. Cortinovis has been co-owner of Lasco Foods, Inc., a privately-held food services industry manufacturer and distributor, since 2005. He was a partner with Bridley Capital Partners Limited, a private equity group, from 2001 until 2007. Mr. Cortinovis was previously with Emerson Electric Co., a publicly-held electrical and electronic manufacturer, from 1977 until 2001, where he held various executive positions including President – Europe from 1995 until 2001. | |

Current Directorships: Plexus Corp., a publicly-held electronic manufacturing services company (since 2003); and Lasco Foods, Inc. | |

Family Relationship: None |

| Stephanie A. Cuskley |

Age: 59 | |

Director Since: 2005; Chair since 2019 | |

Committees: Audit Committee, ex officio member of all other standing committees | |

Principal Occupation: Chief Executive Officer of the Leona M. and Harry B. Helmsley Charitable Trust since 2015. | |

Recommendation: The Board has determined that Ms. Cuskley continues to qualify to serve as a director with her strong financial and investment banking background, as well as her leadership and executive management experience. | |

Experience: Since late 2015, Ms. Cuskley has served as the Chief Executive Officer of the Leona M. and Harry B. Helmsley Charitable Trust, which aspires to improve lives by supporting efforts in the U.S. and around the world in health and select place-based initiatives. From 2009 until late 2015, Ms. Cuskley served as the Chief Executive Officer of NPower, a national nonprofit mobilizing the tech community and providing opportunities to build tech skills of individuals, nonprofits and schools. Prior to NPower, Ms. Cuskley was an investment banker, most recently with JPMorgan Chase. | |

Former Directorships: Avantair, Inc., a publicly-held company | |

Family Relationship: None | |

| Walter J. Galvin |

Age: 73 | |

Director Since: 2014 | |

Committees: Audit Committee (Chair), Corporate Governance and Nominating Committee | |

Principal Occupation: Former Chief Financial Officer and Vice Chairman of Emerson Electric Co. | |

Recommendation: The Board has determined that Mr. Galvin’s wealth of senior management, leadership and financial experience with well-respected public companies qualifies him to continue to serve as a director of the Company. | |

Experience: Mr. Galvin retired from Emerson Electric Co., an electrical and electronic manufacturer, where he served as Vice Chairman from 2009 to 2013, Chief Financial Officer from 1993 to 2010, management member of the Board of Directors from 2000-2013 and, following retirement, a consultant from 2013 to 2015. Mr. Galvin currently serves as a senior advisor to Irving Place Capital, a private equity firm. | |

Former Directorships: Ameren Corporation, a publicly-held company; FM Global, a privately-held mutual insurance company; and United Way of Greater St. Louis, a non-profit | |

Family Relationship: None | |

| Rhonda Germany Ballintyn |

Age: 63 | |

Director Since: 2017 | |

Committees: Corporate Governance and Nominating Committee, Strategic Planning Committee | |

Principal Occupation: Former Corporate Vice President, Chief Strategy and Marketing Officer of Honeywell International Inc. | |

Recommendation: The Board has determined that Ms. Germany Ballintyn’s extensive strategy and marketing background as well as her senior leadership experience, especially in the manufacturing sector, qualifies her to continue to serve as a director of the Company. | |

Experience: Ms. Germany Ballintyn retired from Honeywell International Inc., a publicly-held producer of commercial and consumer products, engineering services and aerospace systems, where she served as Vice President, Chief Strategy and Marketing Officer from 2002-2017. Prior to Honeywell, she held the positions of Vice President and Partner at Booz, Allen & Hamilton, a publicly-held management and technology consulting firm. Ms. Germany Ballintyn also held management positions with Chem Systems Inc. and Union Carbide Corporation. | |

Current Directorships: Univar Solutions Inc., a publicly-held global chemical distributor; Integra LifeSciences Holdings Corp., a publicly-held medical technology company; UMGCV, a non-profit supporting higher education; Hypertherm, Inc., a privately-held designer and manufacturer of cutting products; and Zapata Computing, Inc., a privately-held software solutions company | |

Family Relationship: None | |

| Charles R. Gordon |

Age: 62 | |

Director Since: 2009 | |

Committees: Strategic Planning Committee | |

Principal Occupation: President and Chief Executive Officer of Aegion Corporation | |

Recommendation: The Board has determined that Mr. Gordon’s extensive senior management experience in the water and wastewater industries, as well as his in-depth knowledge of our Company and its operation as President and CEO continue to qualify him to serve as a director of the Company. | |

Experience: Mr. Gordon has served as our President and Chief Executive since 2014 and served as our interim Chief Executive Officer from May 2014 to October 2014. He previously served as the Chief Executive Officer of Natural Systems Utilities, LLC, a privately-held wastewater treatment company, from February 2014 until his appointment as our interim Chief Executive Officer. Mr. Gordon also served as President and Chief Operating Officer of Nuverra Environmental Solutions, Inc., a publicly-held environmental solutions company, from 2010-2013. He previously held the positions of President and Chief Executive Officer of Siemens Water Technologies, now known as Evoqua Water Technologies, a water solutions and services company, from 2008-2010, Executive Vice President of Siemens Water & Wastewater Systems Group from 2005-2008 and Executive Vice President of Siemens Water & Wastewater Services and Products Group from 2003-2005. | |

Other Directorships: None | |

Family Relationship: None | |

| M. Richard Smith |

Age: 72 | |

Director Since: 2009 | |

Committees: Corporate Governance and Nominating Committee (Chair), Strategic Planning Committee | |

Principal Occupation: Former Senior Vice President of Bechtel Corporation and President of its business unit, Fossil Power | |

Recommendation: The Board has determined that Mr. Smith’s global business experience in the energy industry, including the mining and oil and gas sectors, qualifies him to continue to serve as a director of the Company. | |

Experience: Mr. Smith served as a consultant to the Board of Sithe Global Power, LLC from 2008 until 2016. He also served as Interim Chief Executive Officer of SkyFuel, Inc. from February through November 2010 and as a member of its Board until December 2011. Mr. Smith previously served as the Chief Executive Officers of Intergen NV and in various management positions at affiliated Bechtel companies and PG&E Corporation. | |

Current Directorships: McGrath Rentcorp., a publicly-held diversified business-to-business rental company | |

Former Directorships: USEC Inc. (now known as Centrus Energy Corporation), a publicly-held supplier of nuclear fuel and services to the nuclear power industry | |

Family Relationship: None | |

| Phillip D. Wright |

Age: 64 | |

Director Since: 2011 | |

Committees: Compensation Committee (Chair), Strategic Planning Committee | |

Principal Occupation: Former Senior Vice President – Corporate Development of The Williams Companies, Inc. | |

Recommendation: The Board has determined that Mr. Wright continues to qualify to serve as a director of the Company based on his extensive managerial experience in the energy industry, including numerous executive positions, as well as his in-depth knowledge of the oil and gas sectors. | |

Experience: Mr. Wright previously served as President of Williams Gas Pipeline Company (2005-2011), Senior Vice President and Chief Restructuring Officer of The Williams Companies, Inc. (2002-2005), and President and Chief Executive Officer of Williams Energy Services LLC (2001-2002). Prior to Williams, Mr. Wright held roles in operations, engineering and commercial management for thirteen years with Conoco, Inc. He formerly served as a director and chairman of the Interstate Natural Gas Association of America, as a former chairman of the Association of Oil Pipelines of America, and as former First Vice Chairman of the Southern Gas Association. | |

Former Directorships: Piedmont Natural Gas Company, a publicly-held energy services company that was acquired by Duke Energy in 2016 | |

Family Relationship: None | |

RECOMMENDATION OF BOARD OF DIRECTORS

Our Board of Directors recommends a vote “FOR” the election of each of the seven nominees named herein as directors. Unless otherwise directed, the persons named as proxies on the proxy card intend to vote “FOR” the election of each of the nominees. If any nominee should become unavailable for election, the shares will be voted for such substitute nominee as may be proposed by our Board of Directors. However, we are not aware of any circumstances that would prevent any of the nominees from serving.

The Board recommends a vote “FOR” this proposal.

The Board recommends a vote “FOR” this proposal.

CORPORATE GOVERNANCE

Introduction

Our Board of Directors maintains a strong commitment to corporate governance and has implemented policies and procedures that we believe are among the best practices in corporate governance.

We maintain a corporate governance section on our website that contains copies of our principal governance documents. The corporate governance section, which may be found at www.aegion.com under “Investors – Corporate Governance,” contains the following documents:

● | Amended and Restated Certificate of Incorporation |

● | Amended and Restated By-Laws |

● | Corporate Governance Guidelines |

● | Code of Ethics |

● | Code of Conduct |

● | Insider Trading Policy |

● | Audit Committee Charter |

● | Compensation Committee Charter |

● | Corporate Governance and Nominating Committee Charter |

● | Strategic Planning Committee Charter |

Director Qualifications

Our Corporate Governance and Nominating Committee has determined that a candidate for election to our Board of Directors must possess certain core competencies, with each member contributing particular knowledge, expertise or experience in one or more of the following:

● | Strategy and Vision |

● | Sound Business Judgment |

● | Knowledge of Management Trends |

● | Industry Knowledge |

● | Crisis Response Ability |

● | Knowledge of Accounting and Finance |

Our Corporate Governance Guidelines place limits on the number of boards on which Aegion directors may serve. Such limits provide that while serving as a director of Aegion, no outside director will serve as a director for more than two other publicly-traded companies and that no inside director will serve as a director of any more than one other publicly-traded company. Any proposed service in excess of this limit will be considered on a case-by-case basis.

Director Independence

The rules of The Nasdaq Stock Market LLC (“Nasdaq”) require that a majority of our Board of Directors be independent. Our Corporate Governance Guidelines require that, with the exception of the Chief Executive Officer, the Board be comprised entirely of outside, independent directors. For a director to be considered independent, our Board must determine that the director does not have any direct or indirect material relationship with us. To assist us in determining director independence, and as permitted by Nasdaq rules, the Board previously established categorical standards that conform to, or are more exacting than, the independence requirements in the Nasdaq listing standards. These standards are contained in our Corporate Governance Guidelines, which may be found on our website at www.aegion.com under “Investors – Corporate Governance”.

Based on these independence standards, our Board of Directors has affirmatively determined that the following directors are independent and meet our categorical independence standards:

Stephen P. Cortinovis | Juanita H. Hinshaw (retiring April 22, 2020) | |

Stephanie A. Cuskley | M. Richard Smith | |

Walter J. Galvin | Phillip D. Wright | |

Rhonda Germany Ballintyn |

In determining the independence of the directors, our Board reviews various transactions, relationships and arrangements of individual directors, as well as considers ordinary course transactions between us and other entities with which the directors are associated, none of which were determined to constitute a material relationship with us. Mmes. Cuskley, Germany Ballintyn and Hinshaw and Messrs. Cortinovis, Galvin, Smith and Wright have no relationship with Aegion, except as a director and stockholder.

Our Board also considered contributions by us to charitable organizations with which the directors may be associated. No director is related to any executive or significant stockholder of Aegion, nor is any director, with the exception of Mr. Gordon, a current or former employee of Aegion.

Board Leadership Structure

Our Chair of the Board is a non-executive position, which we have kept separated from the Chief Executive Officer position since July 2003. Ms. Cuskley has served as Chair of the Board since April 24, 2019. Our Board recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chair. As such, our Board believes that having separate positions, with an independent non-executive director serving as Chair, is the appropriate leadership structure for our Company at this time and demonstrates our commitment to good corporate governance. This structure allows Mr. Gordon, Aegion’s President and Chief Executive Officer, to maintain his focus on our strategic direction and the management of our day-to-day operations and performance, while Ms. Cuskley is able to lead our Board in its fundamental role of providing advice to, and independent oversight of, management. Our Chair of the Board acts as a regular liaison between our Board and our executive management, consulting regularly with our executives over business matters and providing immediate consultation and advice on material business decisions that require prompt attention.

Pursuant to our Board’s delegation of authority policy, certain approval authorizations have been delegated to our Chair of the Board. Any approvals made by the Chair are reported to our full Board at its next regularly scheduled meeting.

Ms. Cuskley is also a member of the Audit Committee and, as Chair of the Board, an ex officio member of each of the other standing Board committees.

Mr. Cortinovis has served as Vice Chair of the Board since June 27, 2013. As Vice Chair, Mr. Cortinovis assists the Chair of the Board in the performance of her duties.

Executive Sessions

Our independent directors meet in executive session, without management, as appropriate. Ms. Cuskley, the Chair of the Board, serves as the presiding director for those executive sessions.

THE BOARD’S ROLE AND RESPONSIBILITIES

Overview

Our Board of Directors oversees, monitors and directs management in the long-term interests of Aegion and our stockholders. The Board’s key responsibilities include:

● | Establishing the appropriate “Tone at the Top” |

● | Choosing and monitoring performance of the CEO and establishing succession plans |

● | Setting standards for and monitoring compliance, responding appropriately to any “red flags” |

● | Interviewing and nominating director candidates and monitoring the Board’s performance |

● | Approving our long-term and annual operating plan |

● | Monitoring performance and providing advice to management |

● | Determining risk appetite; setting standards for managing risk and monitoring risk management |

● | Reviewing corporate governance guidelines and committee charters |

Role of Board in Risk Oversight

As part of its oversight function, the Board is actively involved in overseeing risk management through, either as a whole or through its Committees, regular discussions with management regarding our risk exposures, their potential impact on our company and the steps needed to manage them. The Board exercises its oversight responsibility with respect to key external, strategic, operational and financial risks and discusses the effectiveness of current efforts to mitigate certain focus risks as identified by senior management and the Board. See page 24 for additional detail regarding the risk oversight responsibilities of the Board and its Committees.

Stockholder Engagement

In an effort to continuously improve our governance and compensation practices, our Board and Compensation Committee are committed to constructive engagement with our stockholders and regularly reviews and responds to their expressed views. Our Board and Compensation Committee places considerable weight on stockholder feedback in making decisions impacting our governance processes and compensation programs. In addition, the Board and Compensation Committee routinely review executive compensation practices.

As part of our long-standing stockholder outreach program, in 2019 we attended and presented at multiple industry-specific investor conferences in key North American markets, which included numerous meetings with current and prospective shareholders. We also hosted periodic stockholder meetings and phone calls to discuss Aegion’s investment thesis, as well as corporate governance and executive compensation matters.

Board Refreshment and Succession Planning

We are committed to a strong board refreshment process. As part of our commitment to board refreshment, we impose a mandatory director retirement age of 75. We also annually review committee chairs, committee composition and individual director skills and qualifications. Further our Corporate Governance and Nominating Committee, typically with the assistance of a third-party search firm, identifies and considers new director candidates who have expertise that would complement and enhance the current Board’s skills and experience. Our commitment to board refreshment has resulted in a Board with a well-balanced tenure, with two of our directors having 15+ years on our board, three of our directors having between 10-15 years on our board, one of our directors having 7-10 years on our board and two of our directors having less than 7 years on our board.

Board and Committee Evaluations

Our Board recognizes the critical role of annual Board and committee evaluations to ensure the Board and each committee are functioning effectively. The Corporate Governance and Nominating Committee annually reviews the Board and committee evaluation process in consideration of recent best practices and input from the directors.

Director Nominations

When identifying nominees to serve as a director of Aegion, our Corporate Governance and Nominating Committee considers candidates with diverse business and professional experience, skills, gender and ethnic background, as appropriate, in light of the current composition and needs of our Board. The Corporate Governance and Nominating Committee may engage a third party to assist in identifying potential director nominees.

The Board recognizes the benefits of a diversified board and believes that any search for potential director candidates should consider diversity as to gender, ethnic background, skills and personal and professional experiences. The composition of our current Board reflects these diversities.

Any stockholder may nominate one or more persons for election as one of our directors at the annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our By-Laws. See “Stockholders Proposals” in this proxy statement and our By-Laws, which may be found on our website at www.aegion.com at “Investors – Corporate Governance”.

The Corporate Governance and Nominating Committee will consider candidates identified through the processes described above and will evaluate the candidates, including incumbents, based on the same criteria. The Corporate Governance and Nominating Committee also considers the contributions of incumbent directors as Board members and the benefits to us arising from their experience on the Board. Although the Corporate Governance and Nominating Committee will consider candidates identified by stockholders, the Corporate Governance and Nominating Committee has sole discretion whether to recommend those candidates to the Board.

BOARD AND COMMITTEES RISK OVERSIGHT RESPONSIBILITIES

Although the Board is ultimately responsible for risk oversight, the Board is assisted in discharging its risk oversight responsibility by the Audit, Compensation, Corporate Governance and Nominating and the Strategic Planning Committees. Each committee oversees management of risks, including, but not limited to, the areas of risk summarized below, and periodically reports to the Board on those areas of risk.

Audit Committee | Compensation Committee | Corporate Governance and Nominating Committee | Strategic Planning Committee |

Oversees management of risks related to our financial statements, the financial reporting process and internal controls. | Oversees management of risks related to our compensation policies and practices applicable to executives, employee benefit plans and the administration of equity plans. | Oversees management of risks related to succession planning for the Chief Executive Officer and other members of executive management, Corporate Governance and our Ethics and Compliance Program. | Oversees management of risks related to the development of the ongoing strategic planning process and initiatives and risk management programs. |

BOARD OF DIRECTORS AND ITS COMMITTEES

Our Board held 13 meetings and acted by unanimous written consent twice during 2019. All directors serving on the Board during 2019 attended 75% or more of the Board Meetings and the committee meetings on which they served during 2019.

Our Board currently has, and appoints the members of, four standing committees, an Audit Committee, a Compensation Committee, a Corporate Governance and Nominating Committee and a Strategic Planning Committee. Each standing Board committee is comprised entirely of independent non-employee directors as defined by the rules applicable to companies listed on Nasdaq, with the exception of the Strategic Planning Committee, in which Mr. Gordon, our President and Chief Executive Officer, serves as a member. The Board may also, from time to time, establish such other Committees as it deems necessary.

Each of our standing Board committees has adopted a written charter that is posted on our website at www.aegion.com under “Investors – Corporate Governance – Committee Charters”. Attendance at committee meetings is open to every director, regardless of whether he or she is a member of the committee. Occasionally, our Board may convene joint meetings of certain committees and the Board.

Audit Committee

Chair | Principal Functions and Additional Information | |

| Mr. Galvin | ● Monitors our financial reporting process and internal control system, including the scope and results of internal controls; | |

Committee Members Ms. Cuskley Ms. Hinshaw | ● Oversees the preparation and integrity of our financial statements; | |

● Monitors our compliance with legal and regulatory financial requirements; | ||

● Responsible for the appointment, retention, compensation and termination of our independent auditors; | ||

Meetings Held in 2019 8 | ● Evaluates and oversees the independence, qualifications and performance of our independent auditors; | |

● Approval of the professional services provided by our independent auditors; | ||

● Responsible for the appointment, retention, compensation and termination of our internal auditors; | ||

● Oversees the work and performance of our internal audit function; and | ||

● Prepares the Report of the Audit Committee contained within this proxy statement as required by the U.S. Securities and Exchange Commission. |

The Audit Committee’s activities are intended to involve guidance and oversight and not to diminish the primary responsibility of management for our financial statements and internal controls.

Based on the findings of the Audit Committee, our Board has determined that each of Mmes. Cuskley and Hinshaw and Mr. Galvin are “audit committee financial experts,” as defined in the rules promulgated by the U.S. Securities and Exchange Commission and as required of Nasdaq-listed companies.

Compensation Committee

Chair Mr. Wright | Principal Functions and Additional Information | |

● Establish and design the overall executive compensation plans, policies and programs; | ||

Committee Members Mr. Cortinovis Ms. Hinshaw | ● Determines the compensation level of our Chief Executive Officer, other executive officers, and certain other highly compensated key employees; | |

● Oversees our disclosures relating to compensation plans, policies and programs; | ||

Meetings Held in 2019 7 | ● Oversees the Compensation Discussion and Analysis included in this proxy statement and issues a report confirming the Compensation Committee’s review and approval of the Compensation Discussion and Analysis; | |

Actions by Written Consent in 2019 5 | ● Administers and makes recommendations with respect to our incentive compensation plans and stock-based plans; and | |

● Reviews and oversees risks arising from or in connection with our compensation policies and programs for all employees. |

Our Board has adopted a written charter for the Compensation Committee under which there is no express authorization for the Compensation Committee to delegate its authority with respect to the determination of executive and director compensation, with the caveat that director compensation is recommended by the Compensation Committee to the Board for final approval.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee was, during the year ended December 31, 2019, or had previously been, an officer or employee of Aegion or any of its subsidiaries. Nor did any member of the Compensation Committee have any material interest in a transaction of Aegion or a business relationship with or any indebtedness to, Aegion. No interlocking relationship existed during the year ended December 31, 2019 between any member of the Board of Directors or the Compensation Committee and an executive officer of Aegion.

Corporate Governance and Nominating Committee

Chair Mr. Smith | Principal Functions and Additional Information | |

● Advises our Board on corporate governance principles, including developing and recommending to our Board a set of corporate governance guidelines; ● Oversees our enterprise risk management and compliance programs; | ||

Committee Members Mr. Galvin Ms. Germany Ballintyn | ||

● Identifies qualified individuals to recommend as potential Board members to our stockholders; | ||

● Reviews and oversees leadership development strategies; and | ||

Meetings Held in 2019 4 | ● Oversees risks associated with our Company, membership and structure of our Board, succession planning for directors and executive officers, and corporate governance. |

Strategic Planning Committee

Chair Mr. Cortinovis | Principal Functions and Additional Information | |

● Oversees the development and implementation of long-term strategic plans; | ||

Committee Members Ms. Germany Ballintyn Mr. Gordon Mr. Smith Mr. Wright | ● Assists management in the development, refining and implementation of long-term strategic and annual business plans; | |

● Reviews large projects, bids and other contractual arrangements with management; | ||

● Provides recommendations to the Board relating to strategic initiatives and material programs and services; and | ||

● Approves revenue-producing proposals, contracts or agreements and amendments or extensions thereto. | ||

Meetings Held in 2019 4 |

CORPORATE GOVERNANCE DOCUMENTS

Based on the recommendation of our Board’s standing committees, our Board has adopted corporate governance documents to assist in regulating risk and to improve corporate performance and accountability in creating long-term shareholder value. These corporate governance documents include:

● | Corporate Governance Guidelines |

● | Board Standing Committee Charters |

● | Code of Ethics for our Chief Executive Officer, Chief Financial Officer and senior financial employees |

● | Code of Conduct |

Each of the above listed corporate governance documents, as well as our By-Laws, may be found on our website, www.aegion.com under “Investors – Corporate Governance”. If our Code of Ethics is amended or a waiver of our Code of Ethics or Code of Conduct is granted to any of our officers or directors, we will disclose the amendment or waiver on our website or as required by law.

RELATED-PARTY TRANSACTIONS

Pursuant to its charter, our Audit Committee is responsible for reviewing and approving all transactions of our Company in which a related person has a direct or indirect material interest and the amount involved exceeds $120,000. It is our policy that executive management notify our Audit Committee of any transaction that may be deemed a related-party transaction. Upon such a notification, the Audit Committee will meet to review the terms of such a transaction and make any necessary determinations.

We maintain various written policies and procedures relating to the review, approval or ratification of transactions in which we, or any of our directors, officers or employees, may have a direct or indirect material interest. Our Code of Conduct, which may be found on our website at www.aegion.com under “Investors – Corporate Governance,” prohibits our directors, officers and employees from engaging in specified activities that may constitute a conflict of interest with the Company without prior approval of management, our Board or our Audit Committee, as appropriate. Activities that may constitute a conflict of interest with our Company and require prior approval include: (a) investing in or being an officer or employee of one of our customers, suppliers, subcontractors or competitors; (b) having a business interest in a company competing with or doing business with our Company; (c) receiving any benefit, either direct or indirect, from the investment in or association with a company that our Company may have otherwise received; and (d) engaging in a transaction with our Company personally or through an affiliate.

Additionally, we require each of our directors and officers to complete a comprehensive questionnaire each year that, among other things, identifies any transactions or potential transactions with us in which the director or officer, or a family member or associated entity, has any interest, financial or otherwise. Our directors and officers are also required to update their information if there are changes throughout the year.

We believe that these policies and procedures ensure that all related-party transactions are appropriately reviewed and, if required, disclosed pursuant to the rules of the Securities and Exchange Commission.

For 2019, we had no related-party transactions.

DELINQUENT SECTION 16(a) REPORTS

To our knowledge, based solely upon a review of copies of reports received by us pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended, and written representations that no other reports were required to be filed, we believe that all filing requirements applicable to our directors and officers under Section 16(a) with respect to 2019 were satisfied.

COMPENSATION OF DIRECTORS

Director Compensation Table

The following table sets forth information concerning compensation earned by our non-employee directors in fiscal year 2019:

Name | Year | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation ($) | Total ($) | |||||||||||||||

Stephen P. Cortinovis | 2019 | $ | 102,000 | $ | 102,000 | – | – | – | – | $ | 204,000 | ||||||||||||

Stephanie A. Cuskley (2) | 2019 | 132,750 | 176,400 | – | – | – | – | 309,150 | |||||||||||||||

Walter J. Galvin (3) | 2019 | – | 198,000 | – | – | – | – | 198,000 | |||||||||||||||

Rhonda Germany Ballintyn | 2019 | 91,000 | (4) | 102,000 | 193,000 | ||||||||||||||||||

Juanita H. Hinshaw | 2019 | 97,000 | 102,000 | – | – | – | – | 199,000 | |||||||||||||||

M. Richard Smith | 2019 | 97,000 | 102,000 | – | – | – | – | 199,000 | |||||||||||||||

Alfred L. Woods (5) | 2019 | 47,667 | – | – | – | – | – | 47,667 | |||||||||||||||

Phillip D. Wright (6) | 2019 | – | 202,750 | – | – | – | – | 202,750 | |||||||||||||||

(1) | Represents the aggregate grant date fair value, computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, “Compensation–Stock Compensation,” with respect to deferred stock units awarded on: (a) January 1, 2019, in the amount of 1,438 to Mr. Galvin; (b) January 1, 2019, in the amount of 1,453 to Mr. Wright; (c) April 1, 2019, in the amount of 1,330 to Mr. Galvin; (d) April 1, 2019, in the amount of 1,343 to Mr. Wright; (e) April 24, 2019, in the following amounts: 5,100 to each of Messrs. Cortinovis, Galvin, Smith and Wright and Mmes. Germany Ballintyn and Hinshaw; and 8,820 to Ms. Cuskley; (f) April 24, 2019, in the amount of 63 to Mr. Wright; (g) July 1, 2019, in the amount of 1,319 to Mr. Galvin; (h) July 1, 2019, in the amount of 1,401 to Mr. Wright; (i) October 1, 2019, in the amount of 1,167 to Mr. Galvin; and (j) October 1, 2019, in the amount of 1,240 to Mr. Wright. See footnotes (3) and (5) below for additional information regarding the awards of deferred stock units to Messrs. Galvin and Wright, respectively. Please refer to Note 11, “Equity-Based Compensation,” in the Notes to Consolidated Financial Statements contained in our Annual Report on Form 10-K filed on March 2, 2020, for a discussion regarding the valuation of our stock awards. The aggregate number of deferred stock unit awards outstanding at December 31, 2019 was as follows: Mr. Cortinovis, 30,827; Ms. Cuskley, 63,869; Mr. Galvin, 51,844; Ms. Germany Ballintyn, 15,007; Ms. Hinshaw, 36,058; Mr. Smith, 17,328; Mr. Woods, 0; and Mr. Wright, 32,951. |

(2) | Ms. Cuskley became Chair of the Board on April 24, 2019. |

(3) | As described in more detail below, our directors are permitted to receive deferred stock units in lieu of cash fees. Pursuant to this option, Mr. Galvin elected to receive deferred stock units in lieu of all cash fees payable to Mr. Galvin in 2019. See footnote (1) above for additional information regarding the number of deferred stock units Mr. Galvin received on January 1, 2019, April 1, 2019, July 1, 2019 and October 1, 2019 in lieu of the cash fee that would have otherwise been payable to Mr. Galvin for board and committee service during each of the first, second, third and fourth quarters of 2019, respectively. |

(4) | Ms. Germany Ballintyn has elected to defer 100% of her cash compensation through the Company’s non-qualified deferred compensation plan. See pages 48 and 56-57 for additional details regarding this plan. Ms. Germany Ballintyn contributed $91,000 to the plan in 2019, had aggregate earnings of $28,927 in 2019 and had a balance of $201,311 in the plan as of December 31, 2019. The earnings do not constitute above-market earnings and Ms. Germany Ballintyn in not eligible for any Company matching contributions. |

(5) | Mr. Woods retired from the Board of Directors, effective April 24, 2019. |

(6) | As described in more detail below, our directors are permitted to receive deferred stock units in lieu of cash fees. Pursuant to this option, Mr. Wright elected to receive deferred stock units in lieu of all cash fees payable to Mr. Wright in 2019. See footnote (1) above for additional detail regarding the number of deferred stock units Mr. Wright received on January 1, 2019, April 1, 2019, April 24, 2019, July 1, 2019 and October 1, 2019, each in lieu of the cash fee that would have otherwise been payable to Mr. Wright for board and committee service during each of the first, second, third and fourth quarters of 2019, respectively. The grant of 63 shares to Mr. Wright on April 24, 2019 was due to an increase in the cash fees payable to Mr. Wright for the second quarter of 2019 resulting from his appointment as Chair of the Compensation Committee on April 24, 2019. |

Additional Information about Director Compensation

The Corporate Governance and Nominating Committee is responsible for reviewing and recommending to the Board of Directors the general guidelines for determining the form of director compensation. Based on these guidelines, the Compensation Committee then reviews and recommends to the Board of Directors any changes in the amount of director compensation that will enhance the Company’s ability to attract and retain qualified directors.

During 2019, the Board did not increase the annual cash fees paid to non-employee directors. Each non-employee director, other than Ms. Cuskley, was compensated at a rate of $67,000 per year, plus reimbursed for related business travel expenses. Ms. Cuskley, our Chair, was compensated at a rate of $143,000 per year (pro-rated for the portion of the year that she served as Chair), plus reimbursed for related business travel expenses. Directors were not paid meeting fees in 2019.

Non-employee directors, other than Ms. Cuskley, received the following additional annual compensation for serving on Board committees:

Board Committee | Chair Compensation | Member Compensation | ||||||

Audit Committee | $ | 20,000 | $ | 15,000 | ||||

Compensation Committee | 20,000 | 15,000 | ||||||

Corporate Governance and Nominating Committee | 15,000 | 9,000 | ||||||

Strategic Planning and Finance Committee | 20,000 | 15,000 | ||||||

The foregoing annual compensation for serving on Board committees, which was not increased in 2019, has not increased since 2011.

Non-employee directors are eligible to receive grants of stock options and/or awards of deferred stock units under our Non-Employee Director Equity Plan from time to time. Since 2013, our non-employee directors, other than our Chair, have received an annual equity grant of $102,000, and our Chair has received an annual equity grant of $176,400, in each case payable in deferred stock units. Each award is based on the closing price of our common stock on the Nasdaq Global Select Market on the date of the award. For 2019, the annual equity grant resulted in an award on April 24, 2019 of 5,100 deferred stock units to each of Messrs. Cortinovis, Galvin, Smith and Wright and Mmes. Germany Ballintyn and Hinshaw and 8,820 deferred stock units to Ms. Cuskley. Annual equity grants made pursuant to our Non-Employee Director Equity Plan (as amended and restated) became subject to a one-year minimum vesting requirement in 2019.

In order to facilitate compliance with our stock ownership requirements as well as further align the interests of our directors with those of our stockholders, we permit our non-employee directors to elect to receive deferred stock units in lieu of the cash fees payable for board and committee service. In 2019, Messrs. Galvin and Wright elected to receive all cash fees for board and committee service in the form of deferred stock units. As a result, Mr. Galvin received 5,254 deferred stock units in lieu of the $96,000 cash fee that would have otherwise been payable to Mr. Galvin for board and committee service during 2019. Mr. Wright received 5,437 deferred stock units in lieu of the $100,750 cash fee that would have otherwise been payable to Mr. Wright for board and committee service during 2019.

Each deferred stock unit represents our obligation to transfer one share of our common stock to the director in the future. Following termination of the director’s service on our Board or on any other distribution date after a mandatory deferral period as the director may elect, shares of our common stock equal to the number of deferred stock units reflected in the director’s account will be distributed to the director. Currently, pursuant to the Non-Employee Director Equity Plan, directors are required to defer the distribution of annual awards of deferred stock units for at least three years and the distribution of deferred stock units awarded in lieu of the payment of cash fees for at least one year, in each case unless there is a termination of a director’s service on our Board and such director has elected to have deferred stock units distributed on termination.

In December 2017, we amended our Voluntary Deferred Compensation Plan, effective January 1, 2018, to open the plan to our non-employee directors. Our non-employee directors may elect to defer between 1% and 100% of their cash compensation pursuant to the terms of the Voluntary Deferred Compensation Plan. Non-employee directors are not eligible for matching contributions or discretionary contributions under the Voluntary Deferred Compensation Plan.

There were no agreements or arrangements between any of our directors and any person or entity other than the Company relating to compensation or other payment in connection with any director’s candidacy or service.

Stock Ownership Policy with Respect to Non-Employee Directors

We have a policy with respect to required levels of stock ownership for our non-employee directors. Under the policy, each current non-employee director is required to beneficially own (and retain thereafter) the greater of: (a) 10,000 shares of our common stock; and (b) the number of shares of our common stock having a value equal to five times the amount of the non-employee director’s annual cash retainer, excluding any cash retainer paid for service on a Committee of the Board (where the number of shares is determined by dividing such value by the average closing price of our common stock for the ten trading days prior to December 31); provided, however, that for the Chair, the amount of the annual cash retainer shall be the amount paid to our other non-employee directors. This ensures that the stock ownership requirement for our directors is proportional to the price of our common stock as well as our directors’ compensation for service on our Board. The required ownership amount is recalculated annually as of January 1, based on the director’s annual cash retainer as of December 31 of the immediately preceding year.

Each non-employee director is required to beneficially own (and retain thereafter) the requisite number of shares of our common stock no later than the third anniversary of his or her election or appointment. In the event there is a significant decline in the price of our common stock that causes a director’s holdings to fall below the applicable threshold, such director is not required to purchase additional shares to meet the threshold but our policy provides that such director shall not sell or transfer any shares until the threshold has again been achieved.

As of January 1, 2020, each non-employee director was in compliance with the stock ownership requirements of this policy as set forth below:

Non-Employee Director | Date Subject to Policy | Retainer Multiplied by 5 | 10-Day Average Closing Price | Required Share Ownership as of January 1, 2020 | Actual Share Ownership as of January 1, 2020 | |||||||||||||||

Stephen P. Cortinovis | July 25, 2006 | $335,000 | $22.80 | 14,693 | 89,000 | |||||||||||||||

Stephanie A. Cuskley (1) | July 25, 2006 | 335,000 | 22.80 | 14,693 | 68,028 | |||||||||||||||

Walter J. Galvin | October 10, 2014 | 335,000 | 22.80 | 14,693 | 63,844 | |||||||||||||||

Rhonda Germany Ballintyn (2) | January 4, 2017 | 335,000 | 22.80 | n/a | 20,807 | |||||||||||||||

Juanita H. Hinshaw | July 25, 2006 | 335,000 | 22.80 | 14,693 | 72,074 | |||||||||||||||

M. Richard Smith | December 15, 2009 | 335,000 | 22.80 | 14,693 | 57,744 | |||||||||||||||

Phillip D. Wright | November 10, 2011 | 335,000 | 22.80 | 14,693 | 66,798 | |||||||||||||||

(1) | For purposes of determining the required ownership of our Chair, the annual cash retainer used is the amount paid to our other non-employee directors (i.e., $67,000). |

(2) | Ms. Germany Ballintyn was appointed to our Board on January 4, 2017 and, as such, is not required to be in compliance with the stock ownership policy as of January 1, 2020. However, Ms. Germany Ballintyn’s stock ownership was sufficient as of January 1, 2020 to be in compliance. |

PROPOSAL TWO

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION |

We are seeking an advisory vote from our stockholders to approve the compensation of our Named Executive Officers, as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K (including in the Compensation and Discussion Analysis section (“CD&A”), compensation tables and accompanying narrative disclosures). Item 402 of Regulation S-K of the Securities and Exchange Commission sets forth what companies must include in their CD&A and compensation tables. As required by Section 14A of the Securities Exchange Act of 1934, as amended, this is an advisory vote, which means that our Board will consider our stockholders’ vote on this proposal when making future compensation decisions for our Named Executive Officers. We plan to hold this vote annually.

As discussed in the CD&A, our Compensation Committee (the “Committee”), with assistance from its independent compensation consultant, has structured our compensation program to emphasize pay for performance. The compensation opportunities provided to our Named Executive Officers, as well as our other executives, are highly dependent on our and each individual’s performance, which in turn drives the enhancement of stockholder value. The Committee will continue to emphasize responsible compensation arrangements designed to attract, motivate, reward and retain executive talent required to achieve our corporate objectives and to align with the interests of our long-term stockholders.

For the reasons discussed in the “Compensation Discussion and Analysis,” accompanying compensation tables and related narrative disclosures in this proxy statement, the Board unanimously recommends that stockholders vote “FOR” the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and accompanying narrative discussion set forth in this Proxy Statement, is hereby approved.”

Although the resolution is non-binding, the Board and Committee will consider the outcome of the vote when making future compensation decisions.

In deciding how to vote on this proposal, you are encouraged to carefully review the description of the Committee’s executive compensation philosophy and its decisions, as well as the favorable compensation policies and practices of the Company, all as set forth in the CD&A.

RECOMMENDATION OF BOARD OF DIRECTORS

Our Board of Directors recommends a vote “FOR” the advisory vote to approve named executive officer compensation.

The Board recommends a vote “FOR” this proposal.

The Board recommends a vote “FOR” this proposal.

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis provides information about our 2019 compensation program for the following executive officers (collectively, our “Named Executive Officers”):

Named Executive Officer | Position |

Charles R. Gordon | President and Chief Executive Officer |

David F. Morris | Executive Vice President and Chief Financial Officer |

Mark A. Menghini | Senior Vice President, General Counsel and Secretary |

John L. Heggemann | Senior Vice President, Corporate Controller and Chief Accounting Officer |

Stephen P. Callahan(1) | Former Senior Vice President – Global Human Resources and HS&E |

(1) | Mr. Callahan resigned as Senior Vice President – Global Human Resources and HS&E effective February 24, 2020. |

This discussion also contains forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs.

Overview & Compensation Philosophy

We emphasize a total compensation approach in establishing individual executive compensation levels, with each element of compensation serving a specific purpose. In this context, the foundation of all decisions regarding our executive compensation program is a pay for performance philosophy. Our pay for performance philosophy requires the achievement of financial goals and business objectives designed to drive profitable growth coupled with service requirements to encourage retention of executive talent. We believe that the continuation of this philosophy will in turn drive stockholder value over time.

We also believe that our executive compensation decisions should be consistent with, and designed to facilitate, good corporate governance practices. Accordingly, we:

✓ | utilize independent compensation consultants that do not perform any other work for the Company or our management team; |

✓ | devote significant time to succession planning efforts; |

✓ | adopt and maintain compensation programs that do not encourage imprudent risk; |

✓ | do not enter into employment agreements with our executive officers; |

✓ | include double-trigger change in control provisions for accelerated vesting of our long-term incentive awards; |

✓ | target all components of compensation at the 50th percentile of our peer group companies; |

✓ | maintain appropriate stock ownership guidelines, which prohibit the sale of shares (other than shares used to pay applicable taxes and/or the exercise price for stock options) until compliance is achieved; |

✓ | consider benchmarking and market data in making compensation decisions; |

✓ | do not permit or include problematic pay practices such as the repricing of “underwater” stock options without stockholder approval, excessive perquisites or tax gross-up payments (including in the event of a change in control); |

✓ | maintain anti-hedging, anti-pledging and incentive compensation clawback policies; |

✓ | maintain a robust stockholder outreach program; |

✓ | elect directors annually by a majority vote standard (except in contested elections); |

✓ | separate the roles of Chairperson of the Board and Chief Executive Officer; |

✓ | ensure that all of our directors are independent other than our Chief Executive Officer; and |

✓ | mitigate the potential dilutive effect of equity awards through share repurchase programs. |

The Committee is responsible for establishing our compensation philosophy and for establishing individual executive compensation. In doing so, the Committee has developed a compensation philosophy that strives to ensure that:

• | our executive compensation aligns the interests of our executives with those of our stockholders by rewarding the achievement of specific annual, long-term and strategic goals, with the ultimate objective of increasing stockholder value; |

• | our executive compensation attracts, retains and incentivizes top talent by providing a competitive and equitable compensation package relative to the compensation paid to similarly situated executives of our peer group; |

• | our executive compensation includes performance and/or service requirements for vesting or retention of equity awards; |

• | our executive compensation is based on the executive’s combined and individual commitment, experience, level of responsibility and contribution to our business goals; and |

• | our executive compensation policies enhance our business interests by encouraging innovation on the part of our executives and other key employees balanced by appropriate levels of risk taking. |

The Committee also considers:

• | the tax and accounting effects of compensation when determining the elements, structure and amounts of our executives’ total compensation packages; and |

• | whether our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on our Company. The Committee has determined that the Company’s current compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. |

Compensation Process