UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | August 31 |

Date of reporting period: | February 28, 2023 |

Item 1.

Reports to Stockholders

Contents

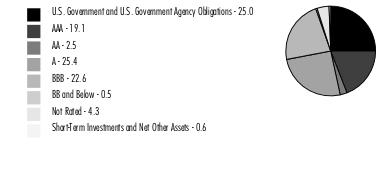

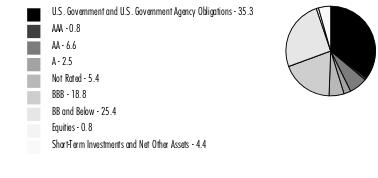

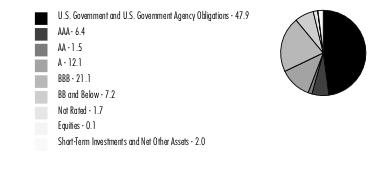

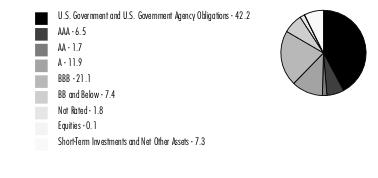

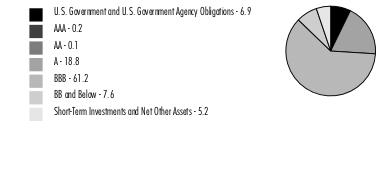

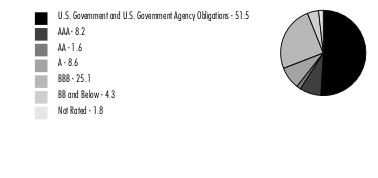

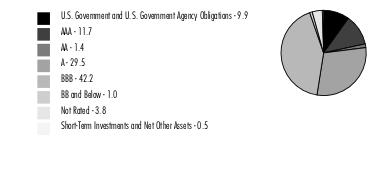

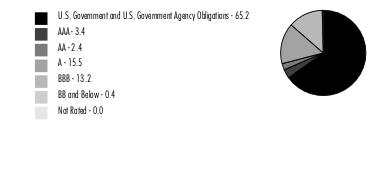

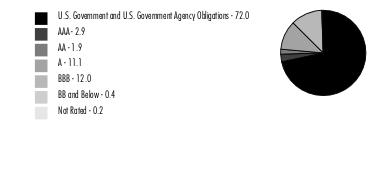

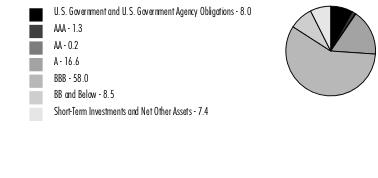

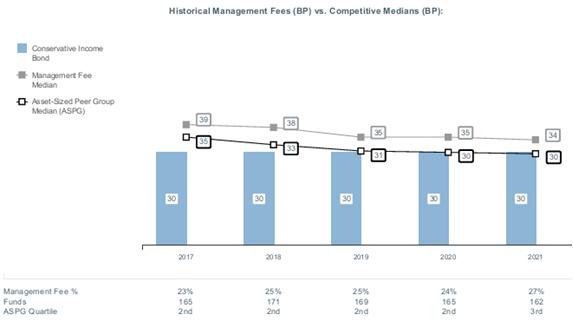

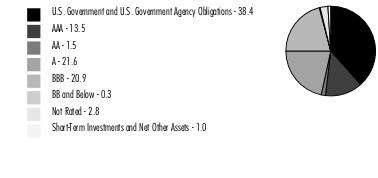

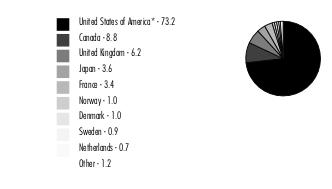

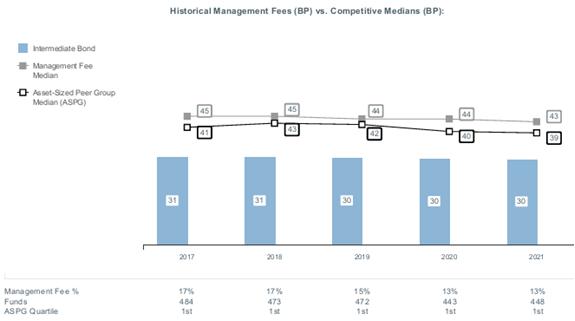

Quality Diversification (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

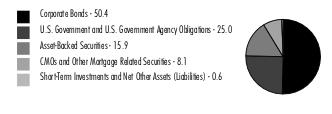

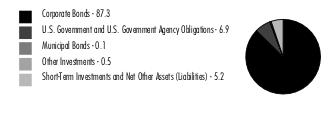

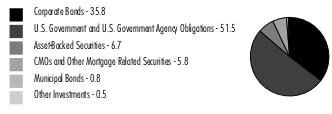

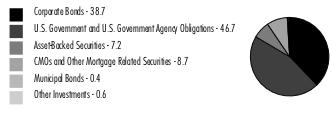

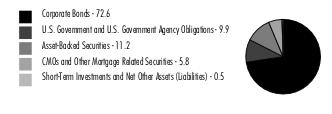

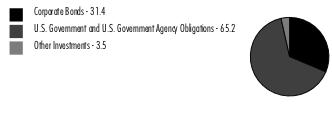

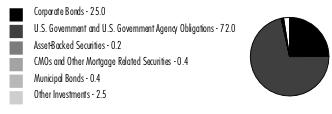

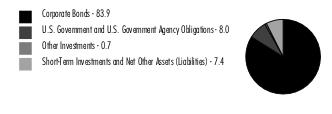

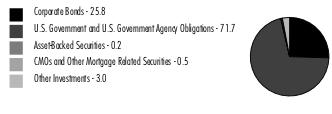

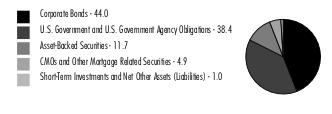

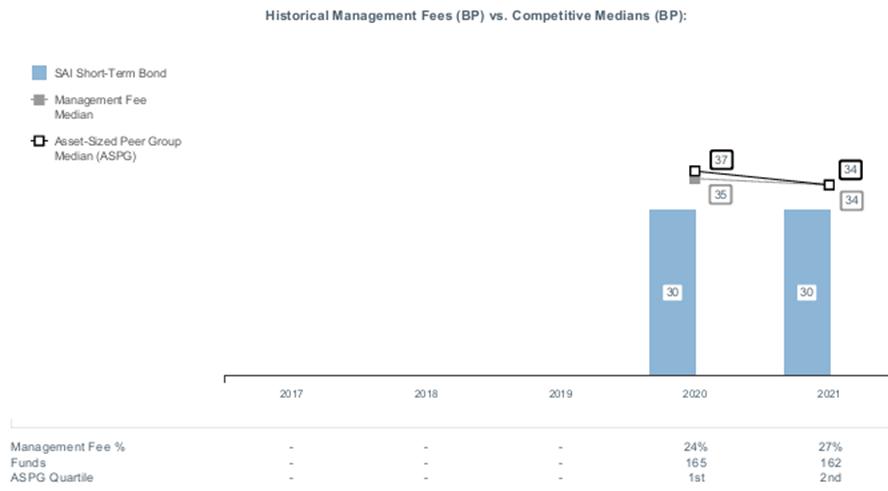

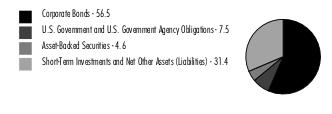

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 20% |

Futures - 9.2% |

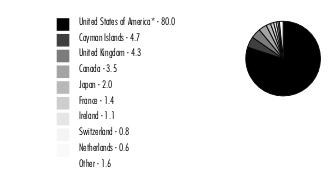

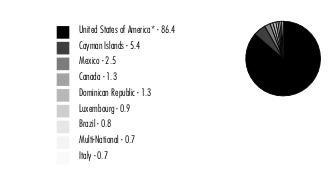

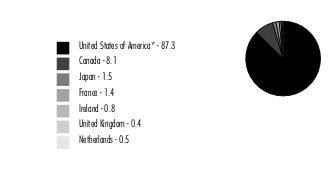

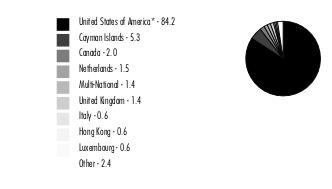

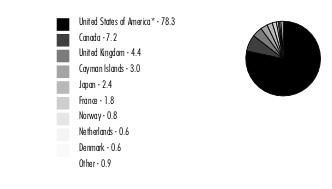

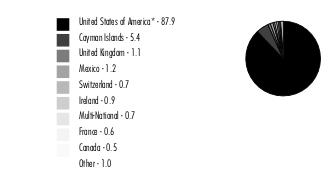

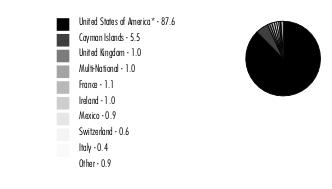

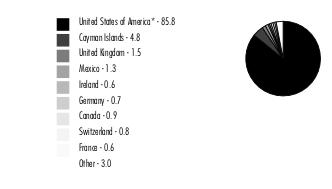

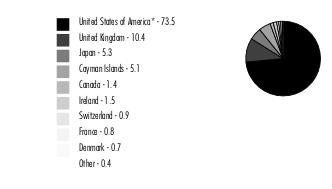

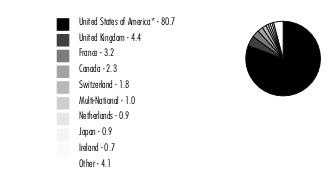

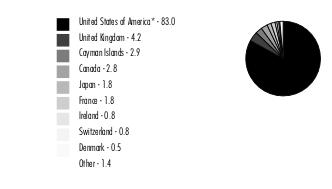

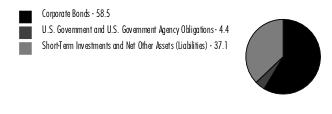

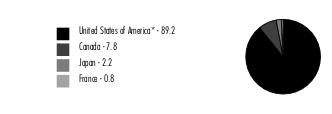

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable. |

| Nonconvertible Bonds - 50.4% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| COMMUNICATION SERVICES - 1.7% | |||

| Diversified Telecommunication Services - 1.2% | |||

| AT&T, Inc. 0.9% 3/25/24 | 10,610 | 10,118 | |

| NTT Finance Corp.: | |||

| 0.373% 3/3/23 (b) | 8,340 | 8,339 | |

| 0.583% 3/1/24 (b) | 3,469 | 3,304 | |

| Verizon Communications, Inc.: | |||

| U.S. Secured Overnight Fin. Rate (SOFR) Averages Index + 0.500% 4.913% 3/22/24 (c)(d) | 5,170 | 5,167 | |

| 0.75% 3/22/24 | 3,860 | 3,678 | |

| 30,606 | |||

| Media - 0.1% | |||

| Magallanes, Inc.: | |||

| 3.428% 3/15/24 (b) | 1,645 | 1,605 | |

| 3.638% 3/15/25 (b) | 901 | 859 | |

| 2,464 | |||

| Wireless Telecommunication Services - 0.4% | |||

| Rogers Communications, Inc. 2.95% 3/15/25 (b) | 4,725 | 4,481 | |

| T-Mobile U.S.A., Inc. 3.5% 4/15/25 | 7,030 | 6,734 | |

| 11,215 | |||

TOTAL COMMUNICATION SERVICES | 44,285 | ||

| CONSUMER DISCRETIONARY - 3.3% | |||

| Automobiles - 2.7% | |||

| BMW U.S. Capital LLC: | |||

| 3.25% 4/1/25 (b) | 8,000 | 7,715 | |

| 3.45% 4/12/23 (b) | 12,171 | 12,146 | |

| Daimler Finance North America LLC: | |||

| 0.75% 3/1/24 (b) | 8,516 | 8,133 | |

| 5.5% 11/27/24 (b) | 5,640 | 5,654 | |

| General Motors Financial Co., Inc.: | |||

| U.S. Secured Overnight Fin. Rate (SOFR) Index + 1.200% 5.7531% 11/17/23 (c)(d) | 10,000 | 10,007 | |

| 1.05% 3/8/24 | 1,943 | 1,856 | |

| 1.25% 1/8/26 | 6,779 | 5,996 | |

| 4.15% 6/19/23 | 4,200 | 4,184 | |

| Volkswagen Group of America Finance LLC: | |||

| 0.875% 11/22/23 (b) | 8,525 | 8,249 | |

| 3.125% 5/12/23 (b) | 5,897 | 5,869 | |

| 3.95% 6/6/25 (b) | 2,950 | 2,852 | |

| 72,661 | |||

| Distributors - 0.2% | |||

| Genuine Parts Co. 1.75% 2/1/25 | 4,784 | 4,464 | |

| Multiline Retail - 0.3% | |||

| Dollar General Corp. 4.25% 9/20/24 | 6,347 | 6,235 | |

| Specialty Retail - 0.1% | |||

| Lowe's Companies, Inc. 4.4% 9/8/25 | 3,318 | 3,261 | |

TOTAL CONSUMER DISCRETIONARY | 86,621 | ||

| CONSUMER STAPLES - 2.8% | |||

| Beverages - 0.4% | |||

| Constellation Brands, Inc. 3.6% 5/9/24 | 7,000 | 6,858 | |

| Dr. Pepper Snapple Group, Inc. 0.75% 3/15/24 | 5,000 | 4,756 | |

| 11,614 | |||

| Food & Staples Retailing - 0.3% | |||

| 7-Eleven, Inc. 0.8% 2/10/24 (b) | 1,912 | 1,826 | |

| Mondelez International Holdings Netherlands BV 0.75% 9/24/24 (b) | 7,661 | 7,117 | |

| 8,943 | |||

| Food Products - 0.7% | |||

| Conagra Brands, Inc. 0.5% 8/11/23 | 5,758 | 5,635 | |

| JDE Peet's BV 0.8% 9/24/24 (b) | 6,779 | 6,240 | |

| Mondelez International, Inc. 2.125% 3/17/24 | 7,500 | 7,266 | |

| 19,141 | |||

| Tobacco - 1.4% | |||

| Altria Group, Inc. 2.35% 5/6/25 | 1,269 | 1,190 | |

| BAT Capital Corp. 3.222% 8/15/24 | 10,014 | 9,651 | |

| BAT International Finance PLC 1.668% 3/25/26 | 6,714 | 5,962 | |

| Imperial Tobacco Finance PLC 3.125% 7/26/24 (b) | 7,381 | 7,081 | |

| Philip Morris International, Inc.: | |||

| 2.875% 5/1/24 | 6,658 | 6,463 | |

| 5% 11/17/25 | 5,425 | 5,393 | |

| 35,740 | |||

TOTAL CONSUMER STAPLES | 75,438 | ||

| ENERGY - 2.9% | |||

| Energy Equipment & Services - 0.0% | |||

| Baker Hughes Co. 1.231% 12/15/23 | 1,575 | 1,526 | |

| Oil, Gas & Consumable Fuels - 2.9% | |||

| Canadian Natural Resources Ltd. 2.05% 7/15/25 | 4,512 | 4,167 | |

| ConocoPhillips Co. 2.4% 3/7/25 | 2,991 | 2,832 | |

| Enbridge, Inc.: | |||

| 0.55% 10/4/23 | 10,000 | 9,708 | |

| 2.15% 2/16/24 | 1,167 | 1,130 | |

| 2.5% 2/14/25 | 1,218 | 1,150 | |

| Energy Transfer LP: | |||

| 4.2% 9/15/23 | 1,944 | 1,931 | |

| 4.25% 3/15/23 | 5,208 | 5,206 | |

| Enterprise Products Operating LP 5.05% 1/10/26 | 4,128 | 4,119 | |

| EQT Corp. 5.678% 10/1/25 | 5,225 | 5,157 | |

| Equinor ASA 1.75% 1/22/26 | 1,409 | 1,286 | |

| Kinder Morgan Energy Partners LP 3.5% 9/1/23 | 3,732 | 3,700 | |

| MPLX LP: | |||

| 1.75% 3/1/26 | 10,071 | 9,006 | |

| 4.5% 7/15/23 | 1,148 | 1,144 | |

| Occidental Petroleum Corp. 2.9% 8/15/24 | 2,755 | 2,638 | |

| Phillips 66 Co.: | |||

| 0.9% 2/15/24 | 8,080 | 7,735 | |

| 3.85% 4/9/25 | 8,057 | 7,821 | |

| Pioneer Natural Resources Co. 0.55% 5/15/23 | 6,522 | 6,458 | |

| The Williams Companies, Inc. 5.4% 3/2/26 | 1,346 | 1,346 | |

| 76,534 | |||

TOTAL ENERGY | 78,060 | ||

| FINANCIALS - 30.2% | |||

| Banks - 17.1% | |||

| Bank of America Corp.: | |||

| U.S. Secured Overnight Fin. Rate (SOFR) Index + 1.290% 5.08% 1/20/27 (c)(d) | 6,000 | 5,937 | |

| 0.81% 10/24/24 (c) | 7,030 | 6,810 | |

| 0.976% 4/22/25 (c) | 8,000 | 7,561 | |

| 1.843% 2/4/25 (c) | 10,000 | 9,636 | |

| 3.841% 4/25/25 (c) | 7,500 | 7,345 | |

| 4.827% 7/22/26 (c) | 5,015 | 4,933 | |

| Bank of Montreal 4.25% 9/14/24 | 7,000 | 6,877 | |

| Bank of Nova Scotia 0.8% 6/15/23 | 11,078 | 10,901 | |

| Banque Federative du Credit Mutuel SA 4.524% 7/13/25 (b) | 5,542 | 5,416 | |

| Barclays PLC: | |||

| 1.007% 12/10/24 (c) | 4,487 | 4,320 | |

| 2.852% 5/7/26 (c) | 4,878 | 4,567 | |

| 4.338% 5/16/24 (c) | 7,085 | 7,058 | |

| 5.304% 8/9/26 (c) | 2,578 | 2,540 | |

| BNP Paribas SA 3.5% 3/1/23 (b) | 5,640 | 5,640 | |

| BPCE SA 1.625% 1/14/25 (b) | 9,500 | 8,829 | |

| Canadian Imperial Bank of Commerce: | |||

| 0.95% 6/23/23 | 16,765 | 16,549 | |

| 3.945% 8/4/25 | 6,059 | 5,870 | |

| Citigroup, Inc.: | |||

| 0.981% 5/1/25 (c) | 4,488 | 4,238 | |

| 2.014% 1/25/26 (c) | 8,000 | 7,461 | |

| 3.106% 4/8/26 (c) | 6,714 | 6,376 | |

| 4.14% 5/24/25 (c) | 7,000 | 6,871 | |

| 5.61% 9/29/26 (c) | 5,000 | 5,000 | |

| Danske Bank A/S: | |||

| 3.875% 9/12/23 (b) | 7,592 | 7,521 | |

| 6.466% 1/9/26 (b)(c) | 3,260 | 3,280 | |

| DNB Bank ASA 0.856% 9/30/25 (b)(c) | 10,000 | 9,234 | |

| HSBC Holdings PLC: | |||

| 0.976% 5/24/25 (c) | 8,400 | 7,902 | |

| 1.162% 11/22/24 (c) | 8,100 | 7,815 | |

| 1.645% 4/18/26 (c) | 6,806 | 6,235 | |

| 3.95% 5/18/24 (c) | 5,000 | 4,978 | |

| Huntington National Bank 5.699% 11/18/25 (c) | 5,500 | 5,508 | |

| Intesa Sanpaolo SpA 3.25% 9/23/24 (b) | 10,000 | 9,525 | |

| JPMorgan Chase & Co.: | |||

| 0.824% 6/1/25 (c) | 6,568 | 6,162 | |

| 1.514% 6/1/24 (c) | 13,972 | 13,835 | |

| 3.845% 6/14/25 (c) | 7,500 | 7,321 | |

| KeyBank NA 4.15% 8/8/25 | 2,003 | 1,954 | |

| KeyCorp 3.878% 5/23/25 (c) | 2,344 | 2,293 | |

| Lloyds Banking Group PLC: | |||

| 0.695% 5/11/24 (c) | 5,464 | 5,403 | |

| 4.716% 8/11/26 (c) | 7,515 | 7,327 | |

| Mitsubishi UFJ Financial Group, Inc.: | |||

| 0.848% 9/15/24 (c) | 8,059 | 7,846 | |

| 0.953% 7/19/25 (c) | 7,000 | 6,535 | |

| 0.962% 10/11/25 (c) | 8,775 | 8,101 | |

| 2.193% 2/25/25 | 9,124 | 8,549 | |

| 4.788% 7/18/25 (c) | 4,000 | 3,946 | |

| Mizuho Financial Group, Inc.: | |||

| 0.849% 9/8/24 (c) | 4,265 | 4,153 | |

| 2.651% 5/22/26 (c) | 6,307 | 5,882 | |

| National Bank of Canada 0.55% 11/15/24 (c) | 3,356 | 3,236 | |

| NatWest Group PLC: | |||

| 2.359% 5/22/24 (c) | 5,310 | 5,264 | |

| 3.875% 9/12/23 | 14,202 | 14,063 | |

| 5.847% 3/2/27 (c) | 5,500 | 5,503 | |

| NatWest Markets PLC 0.8% 8/12/24 (b) | 4,320 | 4,024 | |

| PNC Bank NA 2.5% 8/27/24 | 6,217 | 5,974 | |

| Rabobank Nederland New York Branch 3.875% 8/22/24 | 7,890 | 7,734 | |

| Regions Financial Corp. 2.25% 5/18/25 | 3,950 | 3,692 | |

| Royal Bank of Canada 2.55% 7/16/24 | 8,572 | 8,255 | |

| Santander Holdings U.S.A., Inc.: | |||

| 3.5% 6/7/24 | 7,230 | 7,039 | |

| 5.807% 9/9/26 (c) | 3,956 | 3,955 | |

| Societe Generale: | |||

| 2.226% 1/21/26 (b)(c) | 10,000 | 9,294 | |

| 2.625% 10/16/24 (b) | 1,249 | 1,186 | |

| 3.875% 3/28/24 (b) | 4,871 | 4,772 | |

| 4.351% 6/13/25 (b) | 4,500 | 4,392 | |

| Sumitomo Mitsui Financial Group, Inc. 0.508% 1/12/24 | 804 | 771 | |

| Svenska Handelsbanken AB 0.625% 6/30/23 (b) | 10,340 | 10,184 | |

| The Toronto-Dominion Bank 2.35% 3/8/24 | 7,500 | 7,273 | |

| Truist Financial Corp.: | |||

| 4.26% 7/28/26 (c) | 5,500 | 5,361 | |

| 5.9% 10/28/26 (c) | 7,375 | 7,487 | |

| U.S. Bancorp 5.727% 10/21/26 (c) | 6,750 | 6,833 | |

| Wells Fargo & Co.: | |||

| 1.654% 6/2/24 (c) | 8,218 | 8,137 | |

| 2.164% 2/11/26 (c) | 20,142 | 18,824 | |

| 455,293 | |||

| Capital Markets - 5.4% | |||

| Credit Suisse AG: | |||

| 0.495% 2/2/24 | 8,000 | 7,542 | |

| 0.52% 8/9/23 | 7,000 | 6,773 | |

| Credit Suisse Group AG 6.373% 7/15/26 (b)(c) | 4,600 | 4,327 | |

| Deutsche Bank AG New York Branch: | |||

| 0.898% 5/28/24 | 2,427 | 2,287 | |

| 0.962% 11/8/23 | 5,352 | 5,191 | |

| 1.447% 4/1/25 (c) | 5,743 | 5,436 | |

| 2.129% 11/24/26 (c) | 5,000 | 4,481 | |

| 2.222% 9/18/24 (c) | 20,476 | 20,015 | |

| Goldman Sachs Group, Inc.: | |||

| 0.657% 9/10/24 (c) | 10,000 | 9,720 | |

| 1.757% 1/24/25 (c) | 10,000 | 9,625 | |

| 5.7% 11/1/24 | 5,500 | 5,532 | |

| Intercontinental Exchange, Inc. 3.65% 5/23/25 | 4,172 | 4,066 | |

| Morgan Stanley: | |||

| 0.731% 4/5/24 (c) | 7,335 | 7,298 | |

| 0.79% 5/30/25 (c) | 8,500 | 7,960 | |

| 3.62% 4/17/25 (c) | 5,750 | 5,617 | |

| 3.737% 4/24/24 (c) | 7,548 | 7,526 | |

| 4% 7/23/25 | 6,714 | 6,543 | |

| 4.679% 7/17/26 (c) | 4,223 | 4,141 | |

| UBS AG London Branch 1.375% 1/13/25 (b) | 5,623 | 5,223 | |

| UBS Group AG: | |||

| 1.008% 7/30/24 (b)(c) | 8,398 | 8,231 | |

| 4.49% 8/5/25 (b)(c) | 7,500 | 7,389 | |

| 144,923 | |||

| Consumer Finance - 4.0% | |||

| AerCap Ireland Capital Ltd./AerCap Global Aviation Trust: | |||

| U.S. Secured Overnight Fin. Rate (SOFR) Index + 0.680% 5.1017% 9/29/23 (c)(d) | 7,000 | 6,966 | |

| 1.15% 10/29/23 | 7,000 | 6,793 | |

| 1.65% 10/29/24 | 7,750 | 7,189 | |

| 1.75% 1/30/26 | 5,724 | 5,060 | |

| 4.875% 1/16/24 | 2,014 | 1,994 | |

| Ally Financial, Inc.: | |||

| 3.05% 6/5/23 | 5,730 | 5,691 | |

| 5.125% 9/30/24 | 6,284 | 6,229 | |

| American Express Co.: | |||

| 2.25% 3/4/25 | 3,469 | 3,263 | |

| 3.375% 5/3/24 | 6,000 | 5,863 | |

| Capital One Financial Corp.: | |||

| 1.343% 12/6/24 (c) | 6,500 | 6,265 | |

| 2.6% 5/11/23 | 4,486 | 4,464 | |

| 4.166% 5/9/25 (c) | 10,090 | 9,864 | |

| 4.985% 7/24/26 (c) | 2,457 | 2,417 | |

| Hyundai Capital America 1% 9/17/24 (b) | 7,995 | 7,439 | |

| John Deere Capital Corp. 3.4% 6/6/25 | 4,589 | 4,427 | |

| Synchrony Financial: | |||

| 4.25% 8/15/24 | 9,435 | 9,207 | |

| 4.375% 3/19/24 | 8,076 | 7,964 | |

| Toyota Motor Credit Corp. 5.4% 11/10/25 | 6,500 | 6,564 | |

| 107,659 | |||

| Diversified Financial Services - 1.6% | |||

| Athene Global Funding: | |||

| 0.95% 1/8/24 (b) | 7,220 | 6,939 | |

| 1% 4/16/24 (b) | 7,000 | 6,583 | |

| 1.716% 1/7/25 (b) | 6,500 | 6,024 | |

| Blackstone Private Credit Fund 4.7% 3/24/25 | 7,096 | 6,844 | |

| Corebridge Financial, Inc. 3.5% 4/4/25 (b) | 812 | 777 | |

| GA Global Funding Trust 1.25% 12/8/23 (b) | 8,200 | 7,918 | |

| Jackson Financial, Inc. 1.125% 11/22/23 | 8,613 | 8,347 | |

| 43,432 | |||

| Insurance - 2.1% | |||

| American International Group, Inc. 2.5% 6/30/25 | 4,476 | 4,213 | |

| Equitable Financial Life Global Funding: | |||

| 0.5% 11/17/23 (b) | 10,000 | 9,646 | |

| 1.1% 11/12/24 (b) | 8,150 | 7,587 | |

| Great-West Lifeco U.S. Finance 2020 LP 0.904% 8/12/25 (b) | 3,527 | 3,135 | |

| MassMutual Global Funding II 4.15% 8/26/25 (b) | 5,651 | 5,492 | |

| Metropolitan Life Global Funding I 0.9% 6/8/23 (b) | 5,675 | 5,608 | |

| Pacific Life Global Funding II 1.2% 6/24/25 (b) | 5,535 | 5,008 | |

| Principal Life Global Funding II U.S. Secured Overnight Fin. Rate (SOFR) Index + 0.450% 4.8969% 4/12/24 (b)(c)(d) | 3,616 | 3,616 | |

| Protective Life Global Funding: | |||

| 0.502% 4/12/23 (b) | 8,500 | 8,456 | |

| 3.218% 3/28/25 (b) | 1,703 | 1,618 | |

| 54,379 | |||

TOTAL FINANCIALS | 805,686 | ||

| HEALTH CARE - 2.6% | |||

| Biotechnology - 0.3% | |||

| Amgen, Inc. 5.25% 3/2/25 (e) | 8,000 | 7,982 | |

| Health Care Providers & Services - 1.0% | |||

| Cigna Group 0.613% 3/15/24 | 1,965 | 1,871 | |

| CVS Health Corp. 5% 2/20/26 | 7,000 | 6,961 | |

| Elevance Health, Inc. 0.45% 3/15/23 | 9,394 | 9,378 | |

| Humana, Inc. 0.65% 8/3/23 | 8,872 | 8,698 | |

| 26,908 | |||

| Life Sciences Tools & Services - 0.6% | |||

| PerkinElmer, Inc. 0.85% 9/15/24 | 8,310 | 7,732 | |

| Thermo Fisher Scientific, Inc. 1.215% 10/18/24 | 8,500 | 7,965 | |

| 15,697 | |||

| Pharmaceuticals - 0.7% | |||

| AstraZeneca Finance LLC 0.7% 5/28/24 | 6,275 | 5,935 | |

| Bayer U.S. Finance II LLC 4.25% 12/15/25 (b) | 6,748 | 6,527 | |

| GSK Consumer Healthcare Capital 3.125% 3/24/25 | 7,390 | 7,027 | |

| 19,489 | |||

TOTAL HEALTH CARE | 70,076 | ||

| INDUSTRIALS - 2.6% | |||

| Aerospace & Defense - 0.5% | |||

| Raytheon Technologies Corp. 5% 2/27/26 | 3,832 | 3,826 | |

| The Boeing Co.: | |||

| 1.95% 2/1/24 | 3,500 | 3,380 | |

| 4.875% 5/1/25 | 4,713 | 4,647 | |

| 11,853 | |||

| Airlines - 0.3% | |||

| Delta Air Lines, Inc. 2.9% 10/28/24 | 7,598 | 7,230 | |

| Commercial Services & Supplies - 0.3% | |||

| Republic Services, Inc. 0.875% 11/15/25 | 10,000 | 8,865 | |

| Industrial Conglomerates - 0.2% | |||

| Siemens Financieringsmaatschappij NV 0.65% 3/11/24 (b) | 5,142 | 4,893 | |

| Machinery - 0.5% | |||

| Daimler Trucks Finance North America LLC: | |||

| 1.625% 12/13/24 (b) | 2,657 | 2,485 | |

| 5.2% 1/17/25 (b) | 2,880 | 2,861 | |

| Parker Hannifin Corp. 3.65% 6/15/24 | 7,000 | 6,843 | |

| 12,189 | |||

| Road & Rail - 0.4% | |||

| Canadian Pacific Railway Co. 1.35% 12/2/24 | 12,296 | 11,462 | |

| Trading Companies & Distributors - 0.2% | |||

| Air Lease Corp.: | |||

| 0.7% 2/15/24 | 2,930 | 2,792 | |

| 0.8% 8/18/24 | 3,717 | 3,451 | |

| 6,243 | |||

| Transportation Infrastructure - 0.2% | |||

| Avolon Holdings Funding Ltd. 2.875% 2/15/25 (b) | 7,000 | 6,511 | |

TOTAL INDUSTRIALS | 69,246 | ||

| INFORMATION TECHNOLOGY - 1.4% | |||

| Electronic Equipment & Components - 0.1% | |||

| Dell International LLC/EMC Corp. 5.45% 6/15/23 | 2,804 | 2,802 | |

| IT Services - 0.3% | |||

| The Western Union Co.: | |||

| 2.85% 1/10/25 | 1,585 | 1,505 | |

| 4.25% 6/9/23 | 6,025 | 6,002 | |

| 7,507 | |||

| Semiconductors & Semiconductor Equipment - 0.3% | |||

| Analog Devices, Inc. U.S. Secured Overnight Fin. Rate (SOFR) Index + 0.250% 4.6746% 10/1/24 (c)(d) | 4,150 | 4,108 | |

| Microchip Technology, Inc. 0.983% 9/1/24 | 4,231 | 3,952 | |

| 8,060 | |||

| Software - 0.7% | |||

| Oracle Corp. 5.8% 11/10/25 | 7,000 | 7,083 | |

| VMware, Inc.: | |||

| 0.6% 8/15/23 | 8,000 | 7,826 | |

| 1% 8/15/24 | 5,608 | 5,240 | |

| 20,149 | |||

TOTAL INFORMATION TECHNOLOGY | 38,518 | ||

| MATERIALS - 0.4% | |||

| Chemicals - 0.4% | |||

| Celanese U.S. Holdings LLC 5.9% 7/5/24 | 7,100 | 7,092 | |

| Nutrien Ltd. 5.9% 11/7/24 | 3,720 | 3,740 | |

| 10,832 | |||

| REAL ESTATE - 0.3% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.3% | |||

| American Tower Corp. 1.3% 9/15/25 | 2,980 | 2,679 | |

| Crown Castle International Corp. 1.35% 7/15/25 | 700 | 636 | |

| Welltower Op 3.625% 3/15/24 | 3,276 | 3,208 | |

| 6,523 | |||

| UTILITIES - 2.2% | |||

| Electric Utilities - 1.1% | |||

| Duke Energy Corp. U.S. Secured Overnight Fin. Rate (SOFR) Index + 0.250% 4.6101% 6/10/23 (c)(d) | 6,139 | 6,134 | |

| FirstEnergy Corp.: | |||

| 1.6% 1/15/26 | 747 | 665 | |

| 2.05% 3/1/25 | 4,143 | 3,865 | |

| Florida Power & Light Co. 2.85% 4/1/25 | 1,893 | 1,812 | |

| PPL Electric Utilities Corp. 3 month U.S. LIBOR + 0.250% 4.9739% 9/28/23 (c)(d) | 3,666 | 3,656 | |

| Southern Co.: | |||

| U.S. Secured Overnight Fin. Rate (SOFR) Averages Index + 0.370% 4.9251% 5/10/23 (c)(d) | 6,389 | 6,386 | |

| 0.6% 2/26/24 | 3,086 | 2,939 | |

| Tampa Electric Co. 3.875% 7/12/24 | 4,057 | 3,963 | |

| 29,420 | |||

| Gas Utilities - 0.2% | |||

| CenterPoint Energy Resources Corp. 3 month U.S. LIBOR + 0.500% 5.2786% 3/2/23 (c)(d) | 4,082 | 4,082 | |

| Dominion Gas Holdings LLC 2.5% 11/15/24 | 1,475 | 1,407 | |

| 5,489 | |||

| Independent Power and Renewable Electricity Producers - 0.1% | |||

| Emera U.S. Finance LP 0.833% 6/15/24 | 3,897 | 3,656 | |

| Multi-Utilities - 0.8% | |||

| CenterPoint Energy, Inc. U.S. Secured Overnight Fin. Rate (SOFR) Averages Index + 0.650% 5.2048% 5/13/24 (c)(d) | 5,926 | 5,898 | |

| DTE Energy Co. 4.22% 11/1/24 | 7,490 | 7,325 | |

| NiSource, Inc. 0.95% 8/15/25 | 2,976 | 2,683 | |

| Sempra Energy 3.3% 4/1/25 | 2,834 | 2,713 | |

| WEC Energy Group, Inc. 5% 9/27/25 | 2,638 | 2,614 | |

| 21,233 | |||

TOTAL UTILITIES | 59,798 | ||

| TOTAL NONCONVERTIBLE BONDS (Cost $1,395,285) | 1,345,083 | ||

| U.S. Treasury Obligations - 24.3% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| U.S. Treasury Notes: | |||

| 0.25% 7/31/25 (f) | 123,941 | 111,663 | |

| 0.25% 10/31/25 | 101,409 | 90,563 | |

| 3.875% 1/15/26 | 180,000 | 176,916 | |

| 4.125% 10/31/27 | 135,000 | 134,325 | |

| 4.25% 9/30/24 | 30,257 | 29,916 | |

| 4.5% 11/30/24 | 5,000 | 4,964 | |

| 4.5% 11/15/25 | 100,000 | 99,832 | |

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $657,671) | 648,179 | ||

| U.S. Government Agency - Mortgage Securities - 0.3% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| Fannie Mae - 0.3% | |||

| 4.5% 3/1/39 to 9/1/49 | 6,087 | 5,978 | |

| 5.5% 11/1/34 | 1,169 | 1,186 | |

| 7.5% 11/1/31 | 0 | 0 | |

TOTAL FANNIE MAE | 7,164 | ||

| Freddie Mac - 0.0% | |||

| 8.5% 5/1/26 to 7/1/28 | 11 | 11 | |

| Ginnie Mae - 0.0% | |||

| 7% to 7% 1/15/25 to 8/15/32 | 134 | 138 | |

| TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $7,895) | 7,313 | ||

| Asset-Backed Securities - 15.9% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| Aimco: | |||

| Series 2021-10A Class AR, 3 month U.S. LIBOR + 1.060% 5.8753% 7/22/32 (b)(c)(d) | 8,770 | 8,658 | |

| Series 2021-BA Class AR, 3 month U.S. LIBOR + 1.100% 5.8924% 1/15/32 (b)(c)(d) | 8,883 | 8,772 | |

| AIMCO CLO Ltd. Series 2022-12A Class AR, CME TERM SOFR 3 MONTH INDEX + 1.170% 5.8276% 1/17/32 (b)(c)(d) | 5,000 | 4,961 | |

| American Express Credit Account Master Trust: | |||

| Series 2021-1 Class A, 0.9% 11/15/26 | 9,780 | 9,111 | |

| Series 2022-2 Class A, 3.39% 5/15/27 | 8,500 | 8,195 | |

| Series 2022-3 Class A, 3.75% 8/15/27 | 7,000 | 6,795 | |

| Series 2022-4 Class A, 4.95% 10/15/27 | 4,492 | 4,491 | |

| AmeriCredit Automobile Receivables Trust Series 2021-3 Class A3, 0.76% 8/18/26 | 7,993 | 7,652 | |

| Ares LII CLO Ltd. Series 2021-52A Class A1R, 3 month U.S. LIBOR + 1.050% 5.8653% 4/22/31 (b)(c)(d) | 7,663 | 7,567 | |

| Bank of America Credit Card Master Trust: | |||

| Series 2020-A1 Class A1, 0.34% 5/15/26 | 4,973 | 4,789 | |

| Series 2021-A1 Class A1, 0.44% 9/15/26 | 9,066 | 8,597 | |

| Series 2022-A1 Class A1, 3.53% 11/15/27 | 7,895 | 7,635 | |

| BMW Vechicle Lease Trust 2023-1 Series 2023-1 Class A3, 5.16% 11/25/25 | 3,820 | 3,815 | |

| Capital One Multi-Asset Execution Trust: | |||

| Series 2021-A3 Class A3, 1.04% 11/15/26 | 9,890 | 9,218 | |

| Series 2022-A1 Class A1, 2.8% 3/15/27 | 12,000 | 11,447 | |

| Series 2022-A2 Class A, 3.49% 5/15/27 | 7,000 | 6,769 | |

| Series 2022-A3 Class A, 4.95% 10/15/27 | 5,420 | 5,412 | |

| CarMax Auto Owner Trust: | |||

| Series 2020-4 Class A3, 0.5% 8/15/25 | 3,012 | 2,936 | |

| Series 2021-1 Class A3, 0.34% 12/15/25 | 3,298 | 3,185 | |

| Carmax Auto Owner Trust Series 2022-4 Class A2A, 5.34% 12/15/25 | 5,081 | 5,080 | |

| Carvana Auto Receivables Trust: | |||

| Series 2021-P2 Class A3, 0.49% 3/10/26 | 5,558 | 5,366 | |

| Series 2021-P3 Class A3, 0.7% 11/10/26 | 6,606 | 6,204 | |

| Cedar Funding Ltd.: | |||

| Series 2021-10A Class AR, 3 month U.S. LIBOR + 1.100% 5.9077% 10/20/32 (b)(c)(d) | 2,196 | 2,165 | |

| Series 2021-14A Class A, 3 month U.S. LIBOR + 1.100% 5.8924% 7/15/33 (b)(c)(d) | 9,276 | 9,136 | |

| Cent CLO LP Series 2021-21A Class A1R3, 3 month U.S. LIBOR + 0.970% 5.7846% 7/27/30 (b)(c)(d) | 7,884 | 7,801 | |

| Chase Issuance Trust Series 2022-A1 Class A, 3.97% 9/15/27 | 6,734 | 6,558 | |

| Countrywide Home Loans, Inc. Series 2004-2 Class 3A4, 1 month U.S. LIBOR + 0.500% 5.117% 7/25/34 (c)(d) | 129 | 122 | |

| Dell Equipment Finance Trust: | |||

| Series 2020-2 Class A3, 0.57% 10/23/23 (b) | 744 | 741 | |

| Series 2021-1 Class A3, 0.43% 5/22/26 (b) | 2,444 | 2,407 | |

| Discover Card Execution Note Trust: | |||

| Series 2021-A1 Class A1, 0.58% 9/15/26 | 4,839 | 4,503 | |

| Series 2022-A1 Class A1, 1.96% 2/15/27 | 4,911 | 4,613 | |

| Series 2022-A2 Class A, 3.32% 5/15/27 | 7,150 | 6,890 | |

| Series 2022-A3 Class A3, 3.56% 7/15/27 | 6,653 | 6,428 | |

| DLLAD LLC Series 2021-1A Class A2, 0.35% 9/20/24 (b) | 1,607 | 1,589 | |

| Donlen Fleet Lease Funding Series 2021-2 Class A2, 0.56% 12/11/34 (b) | 2,474 | 2,396 | |

| Eaton Vance CLO, Ltd. Series 2021-1A Class AR, 3 month U.S. LIBOR + 1.100% 5.8924% 4/15/31 (b)(c)(d) | 8,070 | 7,996 | |

| Enterprise Fleet Financing Series 2023-1 Class A2, 5.51% 1/22/29 (b) | 4,908 | 4,911 | |

| Enterprise Fleet Financing LLC: | |||

| Series 2020-1 Class A2, 1.78% 12/22/25 (b) | 699 | 697 | |

| Series 2020-2 Class A2, 0.61% 7/20/26 (b) | 2,613 | 2,561 | |

| Series 2021-1 Class A2, 0.44% 12/21/26 (b) | 1,303 | 1,266 | |

| Series 2021-2 Class A2, 0.48% 5/20/27 (b) | 4,746 | 4,561 | |

| Series 2022-3 Class A2, 4.38% 7/20/29 (b) | 1,191 | 1,170 | |

| Ford Credit Floorplan Master Owner Trust Series 2020-1 Class A1, 0.7% 9/15/25 | 12,164 | 11,859 | |

| GM Financial Automobile Leasing Trust Series 2023-1 Class A3, 5.16% 4/20/26 | 4,665 | 4,662 | |

| GM Financial Consumer Automobile Receivables Series 2022-2 Class A3, 3.1% 2/16/27 | 6,602 | 6,381 | |

| GMF Floorplan Owner Revolving Trust: | |||

| Series 2020-1 Class A, 0.68% 8/15/25 (b) | 3,218 | 3,150 | |

| Series 2020-2 Class A, 0.69% 10/15/25 (b) | 6,742 | 6,548 | |

| Hyundai Auto Receivables Trust Series 2020-C Class A3, 0.38% 5/15/25 | 3,546 | 3,461 | |

| Madison Park Funding XXXII, Ltd. / Madison Park Funding XXXII LLC Series 2021-32A Class A1R, 3 month U.S. LIBOR + 1.000% 5.8153% 1/22/31 (b)(c)(d) | 6,559 | 6,497 | |

| Marlette Funding Trust: | |||

| Series 2021-3A Class A, 0.65% 12/15/31 (b) | 611 | 606 | |

| Series 2022-1A Class A, 1.36% 4/15/32 (b) | 1,700 | 1,679 | |

| Series 2022-2A Class A, 4.25% 8/15/32 (b) | 3,941 | 3,892 | |

| MMAF Equipment Finance LLC: | |||

| Series 2019-B Class A3, 2.01% 12/12/24 (b) | 2,236 | 2,198 | |

| Series 2022-B Class A2, 5.57% 9/9/25 (b) | 4,064 | 4,060 | |

| Niagara Park CLO, Ltd. Series 2021-1A Class AR, 3 month U.S. LIBOR + 1.000% 5.7924% 7/17/32 (b)(c)(d) | 8,390 | 8,272 | |

| OneMain Direct Auto Receivables Trust Series 2021-1A Class A, 0.87% 7/14/28 (b) | 8,012 | 7,487 | |

| Palmer Square Loan Funding, Ltd. Series 2021-2A Class A1, 3 month U.S. LIBOR + 0.800% 5.7153% 5/20/29 (b)(c)(d) | 5,524 | 5,483 | |

| Palmer Square Loan Funding, Ltd. / Palmer Square Loan Funding LLC Series 2022-1A Class A1, CME TERM SOFR 3 MONTH INDEX + 1.050% 5.6819% 4/15/30 (b)(c)(d) | 6,908 | 6,830 | |

| Park Place Securities, Inc. Series 2005-WCH1 Class M4, 1 month U.S. LIBOR + 1.240% 5.862% 1/25/36 (c)(d) | 147 | 144 | |

| Prpm 2021-5, LLC Series 2021-5 Class A1, 1.793% 6/25/26 (b)(c) | 4,529 | 4,096 | |

| Santander Consumer Auto Receivables Trust Series 2021-AA Class A3, 0.33% 10/15/25 (b) | 2,543 | 2,503 | |

| Santander Drive Auto Receivables Trust Series 2022-5 Class A3, 4.11% 8/17/26 | 4,564 | 4,508 | |

| Santander Retail Auto Lease Trust: | |||

| Series 2020-B Class A3, 0.57% 4/22/24 (b) | 5,130 | 5,065 | |

| Series 2021-A Class A3, 0.51% 7/22/24 (b) | 3,936 | 3,857 | |

| Sofi Consumer Loan Program Series 2023-1S Class A, 5.81% 5/15/31 (b) | 3,329 | 3,328 | |

| Symphony CLO XXI, Ltd. Series 2021-21A Class AR, 3 month U.S. LIBOR + 1.060% 5.8524% 7/15/32 (b)(c)(d) | 6,342 | 6,265 | |

| Symphony CLO XXIII Ltd. Series 2021-23A Class AR, 3 month U.S. LIBOR + 1.020% 5.8124% 1/15/34 (b)(c)(d) | 8,047 | 7,966 | |

| TCI-Flatiron CLO Ltd. / LLC Series 2021-1A Class AR, 3 month U.S. LIBOR + 0.960% 5.8366% 11/18/30 (b)(c)(d) | 8,441 | 8,366 | |

| TCI-Symphony CLO Series 2021-1A Class AR, 3 month U.S. LIBOR + 0.920% 5.7224% 7/15/30 (b)(c)(d) | 8,996 | 8,905 | |

| Terwin Mortgage Trust Series 2003-4HE Class A1, 1 month U.S. LIBOR + 0.860% 5.477% 9/25/34 (c)(d) | 140 | 135 | |

| Tesla Auto Lease Trust Series 2021-A Class A3, 0.56% 3/20/25 (b) | 6,423 | 6,274 | |

| Toyota Auto Loan Extended Note Trust Series 2020-1A Class A, 1.35% 5/25/33 (b) | 4,906 | 4,500 | |

| Trapeza CDO XII Ltd./Trapeza CDO XII, Inc. Series 2007-12A Class B, 3 month U.S. LIBOR + 0.560% 5.3484% 4/6/42 (b)(c)(d) | 261 | 199 | |

| Upstart Securitization Trust: | |||

| Series 2021-2 Class A, 0.91% 6/20/31 (b) | 616 | 610 | |

| Series 2021-3 Class A, 0.83% 7/20/31 (b) | 1,441 | 1,416 | |

| Series 2021-4 Class A, 0.84% 9/20/31 (b) | 2,416 | 2,355 | |

| Series 2021-5 Class A, 1.31% 11/20/31 (b) | 3,100 | 3,014 | |

| 3.12% 3/20/32 (b) | 4,400 | 4,285 | |

| VCAT Asset Securitization, LLC: | |||

| Series 2021-NPL1 Class A1, 2.2891% 12/26/50 (b) | 1,006 | 952 | |

| Series 2021-NPL2 Class A1, 2.115% 3/27/51 (b) | 4,487 | 4,195 | |

| Series 2021-NPL3 Class A1, 1.743% 5/25/51 (b)(c) | 5,709 | 5,208 | |

| Verizon Master Trust: | |||

| Series 2021-1 Class A, 0.5% 5/20/27 | 6,240 | 5,892 | |

| Series 2021-2 Class A, 0.99% 4/20/28 | 8,190 | 7,655 | |

| Series 2022-5 Class A1A, 3.72% 7/20/27 | 3,412 | 3,365 | |

| Voya CLO Ltd. Series 2021-1A Class A1R, 3 month U.S. LIBOR + 0.950% 5.7424% 4/17/30 (b)(c)(d) | 8,048 | 7,970 | |

| Wheels SPV LLC Series 2021-1A Class A, 1 month U.S. LIBOR + 0.280% 4.8713% 8/20/29 (b)(c)(d) | 3,390 | 3,361 | |

| World Omni Automobile Lease Securitization Trust Series 2020-B Class A3, 0.45% 2/15/24 | 765 | 764 | |

| TOTAL ASSET-BACKED SECURITIES (Cost $437,741) | 425,384 | ||

| Collateralized Mortgage Obligations - 2.7% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| Private Sponsor - 2.3% | |||

| Ajax Mortgage Loan Trust sequential payer Series 2021-B Class A, 2.239% 6/25/66 (b)(c) | 2,570 | 2,399 | |

| Angel Oak Mortgage Trust Series 2021-8 Class A1, 1.82% 11/25/66 (b) | 4,944 | 4,152 | |

| Brass PLC Series 2021-10A Class A1, 0.669% 4/16/69 (b)(c) | 952 | 907 | |

| Cascade Funding Mortgage Trust: | |||

| Series 2021-EBO1 Class A, 0.9849% 11/25/50 (b)(c) | 1,457 | 1,368 | |

| Series 2021-HB5 Class A, 0.8006% 2/25/31 (b) | 1,123 | 1,086 | |

| Series 2021-HB6 Class A, 0.8983% 6/25/36 (b) | 1,511 | 1,434 | |

| Series 2021-HB7 Class A, 1.1512% 10/27/31 (b) | 1,879 | 1,763 | |

| Cfmt 2022-Ebo2 sequential payer Series 2022-EBO2 Class A, 3.169% 7/25/54 (b) | 1,250 | 1,208 | |

| CFMT 2022-Hb8 LLC sequential payer Series 2022-HB8 Class A, 3.75% 4/25/25 (b) | 5,935 | 5,661 | |

| Csmc 2021-Rpl9 Trust sequential payer Series 2021-RPL9 Class A1, 2.4364% 2/25/61 (b) | 6,989 | 6,426 | |

| Finance of America HECM Buyout sequential payer Series 2022-HB1 Class A, 2.6948% 2/25/32 (b)(c) | 5,383 | 5,195 | |

| GCAT Trust sequential payer Series 2021-NQM7 Class A1, 1.915% 8/25/66 (b) | 2,689 | 2,334 | |

| Legacy Mortgage Asset Trust Series 2021-GS5 Class A1, 2.25% 7/25/67 (b)(c) | 5,818 | 5,227 | |

| New York Mortgage Trust sequential payer Series 2021-SP1 Class A1, 1.6696% 8/25/61 (b) | 2,087 | 1,872 | |

| Oceanview Mortgage Loan Trust sequential payer Series 2020-1 Class A1A, 1.7329% 5/28/50 (b) | 2,402 | 2,130 | |

| Oceanview Trust sequential payer Series 2021-1 Class A, 1.2187% 12/29/51 (b)(c) | 2,069 | 1,984 | |

| Preston Ridge Partners Mortgage Trust: | |||

| sequential payer Series 2021-8 Class A1, 1.743% 9/25/26 (b)(c) | 5,188 | 4,634 | |

| Series 2021-2 Class A1, 2.115% 3/25/26 (b) | 3,992 | 3,759 | |

| Series 2021-RPL1 Class A1, 1.319% 7/25/51 (b) | 896 | 784 | |

| Series 2021-RPL2 Class A1, 1.455% 10/25/51 (b)(c) | 1,128 | 995 | |

| PRET LLC Series 2022-RN1 Class A1, 3.721% 7/25/51 (b) | 3,623 | 3,316 | |

| RMF Buyout Issuance Trust sequential payer: | |||

| Series 2021-HB1 Class A, 1.2586% 11/25/31 (b) | 2,208 | 2,083 | |

| Series 2022-HB1 Class A, 4.272% 4/25/32 (b) | 1,014 | 979 | |

| Sequoia Mortgage Trust floater Series 2004-6 Class A3B, 6 month U.S. LIBOR + 0.880% 6.0669% 7/20/34 (c)(d) | 2 | 1 | |

TOTAL PRIVATE SPONSOR | 61,697 | ||

| U.S. Government Agency - 0.4% | |||

| Fannie Mae: | |||

| floater Series 2015-27 Class KF, 1 month U.S. LIBOR + 0.300% 4.917% 5/25/45 (c)(d) | 2,745 | 2,718 | |

| sequential payer Series 2001-40 Class Z, 6% 8/25/31 | 49 | 49 | |

| Series 2016-27: | |||

Class HK, 3% 1/25/41 | 2,923 | 2,733 | |

Class KG, 3% 1/25/40 | 1,348 | 1,261 | |

| Series 2016-42 Class FL, 1 month U.S. LIBOR + 0.350% 4.967% 7/25/46 (c)(d) | 3,107 | 3,091 | |

| Freddie Mac Series 3949 Class MK, 4.5% 10/15/34 | 309 | 304 | |

TOTAL U.S. GOVERNMENT AGENCY | 10,156 | ||

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $77,644) | 71,853 | ||

| Commercial Mortgage Securities - 5.8% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| BAMLL Commercial Mortgage Securities Trust: | |||

| floater Series 2022-DKLX Class A, CME Term SOFR 1 Month Index + 1.150% 5.713% 1/15/39 (b)(c)(d) | 1,838 | 1,811 | |

| sequential payer Series 2019-BPR Class ANM, 3.112% 11/5/32 (b) | 2,246 | 2,050 | |

| Benchmark Mortgage Trust: | |||

| sequential payer Series 2021-B31 Class A1, 1.357% 12/15/54 | 5,451 | 5,016 | |

| Series 2018-B7 Class A1, 3.436% 5/15/53 | 455 | 451 | |

| BLOX Trust floater sequential payer Series 2021-BLOX Class A, 1 month U.S. LIBOR + 0.750% 5.338% 9/15/26 (b)(c)(d) | 4,272 | 4,038 | |

| BPR Trust floater Series 2022-OANA Class A, CME Term SOFR 1 Month Index + 1.890% 6.4605% 4/15/37 (b)(c)(d) | 6,214 | 6,101 | |

| BX Commercial Mortgage Trust floater: | |||

| Series 2021-PAC Class A, 1 month U.S. LIBOR + 0.680% 5.2771% 10/15/36 (b)(c)(d) | 3,704 | 3,620 | |

| Series 2021-VINO Class A, 1 month U.S. LIBOR + 0.650% 5.2403% 5/15/38 (b)(c)(d) | 3,400 | 3,328 | |

| Series 2022-LP2 Class A, CME Term SOFR 1 Month Index + 1.010% 5.5754% 2/15/39 (b)(c)(d) | 4,334 | 4,269 | |

| BX Trust: | |||

| floater: | |||

Series 2021-ACNT Class A, 1 month U.S. LIBOR + 0.850% 5.438% 11/15/38 (b)(c)(d) | 3,607 | 3,546 | |

Series 2021-BXMF Class A, 1 month U.S. LIBOR + 0.630% 5.2239% 10/15/26 (b)(c)(d) | 3,376 | 3,294 | |

Series 2022-GPA Class A, CME Term SOFR 1 Month Index + 2.160% 6.7275% 10/15/39 (b)(c)(d) | 1,533 | 1,530 | |

| floater sequential payer Series 2021-SOAR Class A, 5.258% 6/15/38 (b)(c) | 3,606 | 3,542 | |

| floater, sequential payer: | |||

Series 2019-IMC Class A, 1 month U.S. LIBOR + 1.000% 5.588% 4/15/34 (b)(c)(d) | 4,300 | 4,224 | |

Series 2019-XL Class A, CME Term SOFR 1 Month Index + 1.030% 5.597% 10/15/36 (b)(c)(d) | 6,185 | 6,154 | |

| CF Hippolyta Issuer LLC sequential payer: | |||

| Series 2020-1 Class A1, 1.69% 7/15/60 (b) | 7,471 | 6,689 | |

| Series 2021-1A Class A1, 1.53% 3/15/61 (b) | 4,365 | 3,791 | |

| CGDB Commercial Mortgage Trust floater Series 2019-MOB Class A, 1 month U.S. LIBOR + 0.950% 5.5379% 11/15/36 (b)(c)(d) | 1,678 | 1,653 | |

| CHC Commercial Mortgage Trust floater Series 2019-CHC Class A, 1 month U.S. LIBOR + 1.120% 5.708% 6/15/34 (b)(c)(d) | 6,209 | 6,034 | |

| Citigroup Commercial Mortgage Trust sequential payer: | |||

| Series 2014-GC21 Class AAB, 3.477% 5/10/47 | 478 | 471 | |

| Series 2016-GC36 Class AAB, 3.368% 2/10/49 | 1,980 | 1,908 | |

| COMM Mortgage Trust sequential payer: | |||

| Series 2014-CR18 Class ASB, 3.452% 7/15/47 | 915 | 910 | |

| Series 2020-SBX Class A, 1.67% 1/10/38 (b) | 6,921 | 6,129 | |

| Credit Suisse Mortgage Trust: | |||

| floater Series 2019-ICE4 Class A, 1 month U.S. LIBOR + 0.980% 5.568% 5/15/36 (b)(c)(d) | 8,003 | 7,963 | |

| sequential payer Series 2020-NET Class A, 2.2569% 8/15/37 (b) | 1,073 | 964 | |

| CSAIL 2018-CX12 Commercial Mortgage Trust sequential payer Series 2018-CX12 Class ASB, 4.1628% 8/15/51 | 3,364 | 3,222 | |

| CSMC Trust Series 2017-CHOP Class A, 1 month U.S. LIBOR + 0.750% 5.338% 7/15/32 (b)(c)(d) | 7,508 | 7,145 | |

| ELP Commercial Mortgage Trust floater Series 2021-ELP Class A, 1 month U.S. LIBOR + 0.700% 5.289% 11/15/38 (b)(c)(d) | 5,020 | 4,888 | |

| Extended Stay America Trust floater Series 2021-ESH Class A, 1 month U.S. LIBOR + 1.080% 5.668% 7/15/38 (b)(c)(d) | 1,717 | 1,691 | |

| GS Mortgage Securities Trust: | |||

| floater Series 2021-IP Class A, 1 month U.S. LIBOR + 0.950% 5.538% 10/15/36 (b)(c)(d) | 2,194 | 2,081 | |

| Series 2011-GC5 Class A/S, 5.1538% 8/10/44 (b)(c) | 5,371 | 5,291 | |

| JPMorgan Chase Commercial Mortgage Securities Trust: | |||

| floater Series 2019-BKWD Class A, 1 month U.S. LIBOR + 1.250% 5.838% 9/15/29 (b)(c)(d) | 2,788 | 2,650 | |

| Series 2013-LC11 Class A/S, 3.216% 4/15/46 | 3,949 | 3,624 | |

| Life Financial Services Trust floater Series 2022-BMR2 Class A1, CME Term SOFR 1 Month Index + 1.290% 5.8577% 5/15/39 (b)(c)(d) | 4,992 | 4,973 | |

| LIFE Mortgage Trust floater Series 2021-BMR Class A, 1 month U.S. LIBOR + 0.700% 5.288% 3/15/38 (b)(c)(d) | 3,374 | 3,312 | |

| Merit floater Series 2021-STOR Class A, 1 month U.S. LIBOR + 0.700% 5.288% 7/15/38 (b)(c)(d) | 1,937 | 1,897 | |

| Morgan Stanley BAML Trust sequential payer Series 2016-C28: | |||

| Class A3, 3.272% 1/15/49 | 1,640 | 1,543 | |

| Class ASB, 3.288% 1/15/49 | 1,697 | 1,639 | |

| Morgan Stanley Capital I Trust: | |||

| sequential payer Series 2019-MEAD Class A, 3.17% 11/10/36 (b) | 4,896 | 4,563 | |

| Series 2019-H7 Class A1, 2.327% 7/15/52 | 1,502 | 1,464 | |

| OPG Trust floater Series 2021-PORT Class A, 1 month U.S. LIBOR + 0.480% 5.072% 10/15/36 (b)(c)(d) | 5,675 | 5,510 | |

| SREIT Trust floater Series 2021-MFP Class A, 1 month U.S. LIBOR + 0.730% 5.3187% 11/15/38 (b)(c)(d) | 3,363 | 3,291 | |

| Wells Fargo Commercial Mortgage Trust sequential payer: | |||

| Series 2015-LC22 Class ASB, 3.571% 9/15/58 | 2,555 | 2,475 | |

| Series 2017-RC1 Class ASB, 3.453% 1/15/60 | 3,269 | 3,151 | |

| WF-RBS Commercial Mortgage Trust sequential payer: | |||

| Series 2013-C14 Class ASB, 2.977% 6/15/46 | 101 | 100 | |

| Series 2014-C20 Class ASB, 3.638% 5/15/47 | 452 | 446 | |

| TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $161,665) | 154,442 | ||

| Money Market Funds - 0.5% | |||

| Shares | Value ($) (000s) | ||

Fidelity Cash Central Fund 4.63% (g) (Cost $12,341) | 12,338,945 | 12,341 | |

| TOTAL INVESTMENT IN SECURITIES - 99.9% (Cost $2,750,242) | 2,664,595 |

NET OTHER ASSETS (LIABILITIES) - 0.1% | 3,071 |

| NET ASSETS - 100.0% | 2,667,666 |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) (000s) | Value ($) (000s) | Unrealized Appreciation/ (Depreciation) ($) (000s) | |

| Purchased | |||||

| Treasury Contracts | |||||

| CBOT 2-Year U.S. Treasury Note Contracts (United States) | 1,061 | Jun 2023 | 216,154 | (491) | (491) |

| CBOT 5-Year U.S. Treasury Note Contracts (United States) | 284 | Jun 2023 | 30,404 | (38) | (38) |

| TOTAL FUTURES CONTRACTS | (529) | ||||

| The notional amount of futures purchased as a percentage of Net Assets is 9.2% | |||||

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $729,525,000 or 27.3% of net assets. |

| (c) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (d) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (e) | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| (f) | Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $1,515,000. |

| (g) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| Affiliate (Amounts in thousands) | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.63% | 6,183 | 257,014 | 250,856 | 197 | - | - | 12,341 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 4.63% | - | 230,443 | 230,443 | 44 | - | - | - | 0.0% |

| Total | 6,183 | 487,457 | 481,299 | 241 | - | - | 12,341 | |

| Valuation Inputs at Reporting Date: | ||||

Description (Amounts in thousands) | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Corporate Bonds | 1,345,083 | - | 1,345,083 | - |

| U.S. Government and Government Agency Obligations | 648,179 | - | 648,179 | - |

| U.S. Government Agency - Mortgage Securities | 7,313 | - | 7,313 | - |

| Asset-Backed Securities | 425,384 | - | 425,384 | - |

| Collateralized Mortgage Obligations | 71,853 | - | 71,853 | - |

| Commercial Mortgage Securities | 154,442 | - | 154,442 | - |

| Money Market Funds | 12,341 | 12,341 | - | - |

| Total Investments in Securities: | 2,664,595 | 12,341 | 2,652,254 | - |

Derivative Instruments: | ||||

| Liabilities | ||||

Futures Contracts | (529) | (529) | - | - |

| Total Liabilities | (529) | (529) | - | - |

| Total Derivative Instruments: | (529) | (529) | - | - |

Primary Risk Exposure / Derivative Type | Value | |

| (Amounts in thousands) | Asset ($) | Liability ($) |

| Interest Rate Risk | ||

Futures Contracts (a) | 0 | (529) |

| Total Interest Rate Risk | 0 | (529) |

| Total Value of Derivatives | 0 | (529) |

| Statement of Assets and Liabilities | ||||

| Amounts in thousands (except per-share amounts) | February 28, 2023 (Unaudited) | |||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Unaffiliated issuers (cost $2,737,901) | $ | 2,652,254 | ||

Fidelity Central Funds (cost $12,341) | 12,341 | |||

| Total Investment in Securities (cost $2,750,242) | $ | 2,664,595 | ||

| Receivable for investments sold | 90,163 | |||

| Receivable for fund shares sold | 14,706 | |||

| Interest receivable | 14,066 | |||

| Distributions receivable from Fidelity Central Funds | 67 | |||

| Receivable from investment adviser for expense reductions | 9 | |||

| Other receivables | 8 | |||

Total assets | 2,783,614 | |||

| Liabilities | ||||

| Payable for investments purchased | ||||

Regular delivery | $ | 101,274 | ||

Delayed delivery | 7,995 | |||

| Payable for fund shares redeemed | 4,797 | |||

| Distributions payable | 766 | |||

| Accrued management fee | 666 | |||

| Distribution and service plan fees payable | 58 | |||

| Payable for daily variation margin on futures contracts | 27 | |||

| Other affiliated payables | 358 | |||

| Other payables and accrued expenses | 7 | |||

| Total Liabilities | 115,948 | |||

| Net Assets | $ | 2,667,666 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 2,809,375 | ||

| Total accumulated earnings (loss) | (141,709) | |||

| Net Assets | $ | 2,667,666 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($215,531 ÷ 26,220 shares) (a) | $ | 8.22 | ||

| Maximum offering price per share (100/98.50 of $8.22) | $ | 8.35 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($53,178 ÷ 6,469 shares) (a) | $ | 8.22 | ||

| Maximum offering price per share (100/98.50 of $8.22) | $ | 8.35 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($29,436 ÷ 3,597 shares) (a) | $ | 8.18 | ||

| Short-Term Bond : | ||||

Net Asset Value , offering price and redemption price per share ($1,979,347 ÷ 240,896 shares) | $ | 8.22 | ||

| Class I : | ||||

Net Asset Value , offering price and redemption price per share ($241,087 ÷ 29,328 shares) | $ | 8.22 | ||

| Class Z : | ||||

Net Asset Value , offering price and redemption price per share ($149,087 ÷ 18,147 shares) | $ | 8.22 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

| Amounts in thousands | Six months ended February 28, 2023 (Unaudited) | |||

| Investment Income | ||||

| Interest | $ | 36,070 | ||

| Income from Fidelity Central Funds (including $44 from security lending) | 241 | |||

| Total Income | 36,311 | |||

| Expenses | ||||

| Management fee | $ | 4,082 | ||

| Transfer agent fees | 1,471 | |||

| Distribution and service plan fees | 347 | |||

| Fund wide operations fee | 704 | |||

| Independent trustees' fees and expenses | 5 | |||

| Total expenses before reductions | 6,609 | |||

| Expense reductions | (34) | |||

| Total expenses after reductions | 6,575 | |||

| Net Investment income (loss) | 29,736 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (36,666) | |||

| Futures contracts | (4,954) | |||

| Total net realized gain (loss) | (41,620) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 18,207 | |||

| Futures contracts | (215) | |||

| Total change in net unrealized appreciation (depreciation) | 17,992 | |||

| Net gain (loss) | (23,628) | |||

| Net increase (decrease) in net assets resulting from operations | $ | 6,108 | ||

| Statement of Changes in Net Assets | ||||

| Amount in thousands | Six months ended February 28, 2023 (Unaudited) | Year ended August 31, 2022 | ||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 29,736 | $ | 26,764 |

| Net realized gain (loss) | (41,620) | (24,983) | ||

| Change in net unrealized appreciation (depreciation) | 17,992 | (132,210) | ||

| Net increase (decrease) in net assets resulting from operations | 6,108 | (130,429) | ||

| Distributions to shareholders | (22,576) | (34,111) | ||

| Share transactions - net increase (decrease) | (110,499) | (366,829) | ||

| Total increase (decrease) in net assets | (126,967) | (531,369) | ||

| Net Assets | ||||

| Beginning of period | 2,794,633 | 3,326,002 | ||

| End of period | $ | 2,667,666 | $ | 2,794,633 |

| Fidelity Advisor® Short-Term Bond Fund Class A |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.27 | $ | 8.73 | $ | 8.89 | $ | 8.72 | $ | 8.53 | $ | 8.64 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .082 | .061 | .082 | .153 | .178 | .123 | ||||||

| Net realized and unrealized gain (loss) | (.071) | (.441) | (.065) | .168 | .171 | (.114) | ||||||

| Total from investment operations | .011 | (.380) | .017 | .321 | .349 | .009 | ||||||

| Distributions from net investment income | (.061) | (.054) | (.118) | (.151) | (.159) | (.119) | ||||||

| Distributions from net realized gain | - | (.026) | (.059) | - | - | - | ||||||

| Total distributions | (.061) | (.080) | (.177) | (.151) | (.159) | (.119) | ||||||

| Net asset value, end of period | $ | 8.22 | $ | 8.27 | $ | 8.73 | $ | 8.89 | $ | 8.72 | $ | 8.53 |

Total Return C,D,E | .14% | (4.38)% | .20% | 3.73% | 4.13% | .12% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .65% H | .65% | .65% | .65% | .65% | .65% | ||||||

| Expenses net of fee waivers, if any | .65% H | .65% | .65% | .65% | .65% | .65% | ||||||

| Expenses net of all reductions | .65% H | .65% | .65% | .65% | .65% | .65% | ||||||

| Net investment income (loss) | 2.02% H | .72% | .93% | 1.75% | 2.08% | 1.43% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 216 | $ | 225 | $ | 234 | $ | 222 | $ | 175 | $ | 143 |

Portfolio turnover rate I | 56% H | 52% | 64% J | 67% J | 46% | 56% |

| Fidelity Advisor® Short-Term Bond Fund Class M |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.27 | $ | 8.73 | $ | 8.89 | $ | 8.72 | $ | 8.53 | $ | 8.64 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .082 | .060 | .082 | .152 | .177 | .122 | ||||||

| Net realized and unrealized gain (loss) | (.071) | (.441) | (.065) | .169 | .171 | (.114) | ||||||

| Total from investment operations | .011 | (.381) | .017 | .321 | .348 | .008 | ||||||

| Distributions from net investment income | (.061) | (.053) | (.118) | (.151) | (.158) | (.118) | ||||||

| Distributions from net realized gain | - | (.026) | (.059) | - | - | - | ||||||

| Total distributions | (.061) | (.079) | (.177) | (.151) | (.158) | (.118) | ||||||

| Net asset value, end of period | $ | 8.22 | $ | 8.27 | $ | 8.73 | $ | 8.89 | $ | 8.72 | $ | 8.53 |

Total Return C,D,E | .13% | (4.39)% | .19% | 3.72% | 4.12% | .10% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .66% H | .65% | .65% | .66% | .67% | .67% | ||||||

| Expenses net of fee waivers, if any | .66% H | .65% | .65% | .66% | .67% | .67% | ||||||

| Expenses net of all reductions | .66% H | .65% | .65% | .66% | .67% | .66% | ||||||

| Net investment income (loss) | 2.01% H | .71% | .93% | 1.74% | 2.06% | 1.42% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 53 | $ | 57 | $ | 67 | $ | 73 | $ | 71 | $ | 70 |

Portfolio turnover rate I | 56% H | 52% | 64% J | 67% J | 46% | 56% |

| Fidelity Advisor® Short-Term Bond Fund Class C |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.24 | $ | 8.72 | $ | 8.88 | $ | 8.72 | $ | 8.52 | $ | 8.64 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .047 | (.012) | .007 | .078 | .104 | .049 | ||||||

| Net realized and unrealized gain (loss) | (.082) | (.437) | (.058) | .158 | .181 | (.123) | ||||||

| Total from investment operations | (.035) | (.449) | (.051) | .236 | .285 | (.074) | ||||||

| Distributions from net investment income | (.025) | (.005) | (.050) | (.076) | (.085) | (.046) | ||||||

| Distributions from net realized gain | - | (.026) | (.059) | - | - | - | ||||||

| Total distributions | (.025) | (.031) | (.109) | (.076) | (.085) | (.046) | ||||||

| Net asset value, end of period | $ | 8.18 | $ | 8.24 | $ | 8.72 | $ | 8.88 | $ | 8.72 | $ | 8.52 |

Total Return C,D,E | (.42)% | (5.17)% | (.58)% | 2.73% | 3.36% | (.86)% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | 1.53% H | 1.51% | 1.51% | 1.51% | 1.51% | 1.51% | ||||||

| Expenses net of fee waivers, if any | 1.53% H | 1.51% | 1.51% | 1.51% | 1.51% | 1.51% | ||||||

| Expenses net of all reductions | 1.52% H | 1.51% | 1.51% | 1.51% | 1.51% | 1.51% | ||||||

| Net investment income (loss) | 1.15% H | (.15)% | .08% | .89% | 1.20% | .57% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 29 | $ | 27 | $ | 33 | $ | 43 | $ | 33 | $ | 52 |

Portfolio turnover rate I | 56% H | 52% | 64% J | 67% J | 46% | 56% |

| Fidelity® Short-Term Bond Fund |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.27 | $ | 8.73 | $ | 8.88 | $ | 8.72 | $ | 8.52 | $ | 8.64 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .090 | .078 | .100 | .171 | .195 | .140 | ||||||

| Net realized and unrealized gain (loss) | (.071) | (.442) | (.055) | .158 | .181 | (.123) | ||||||

| Total from investment operations | .019 | (.364) | .045 | .329 | .376 | .017 | ||||||

| Distributions from net investment income | (.069) | (.070) | (.136) | (.169) | (.176) | (.137) | ||||||

| Distributions from net realized gain | - | (.026) | (.059) | - | - | - | ||||||

| Total distributions | (.069) | (.096) | (.195) | (.169) | (.176) | (.137) | ||||||

| Net asset value, end of period | $ | 8.22 | $ | 8.27 | $ | 8.73 | $ | 8.88 | $ | 8.72 | $ | 8.52 |

Total Return C,D | .23% | (4.19)% | .51% | 3.82% | 4.47% | .20% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .45% G | .45% | .45% | .45% | .45% | .45% | ||||||

| Expenses net of fee waivers, if any | .45% G | .45% | .45% | .45% | .45% | .45% | ||||||

| Expenses net of all reductions | .45% G | .45% | .45% | .45% | .45% | .45% | ||||||

| Net investment income (loss) | 2.22% G | .91% | 1.13% | 1.95% | 2.28% | 1.64% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 1,979 | $ | 2,086 | $ | 2,568 | $ | 4,420 | $ | 5,017 | $ | 4,617 |

Portfolio turnover rate H | 56% G | 52% | 64% I | 67% I | 46% | 56% |

| Fidelity Advisor® Short-Term Bond Fund Class I |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 8.27 | $ | 8.73 | $ | 8.89 | $ | 8.72 | $ | 8.53 | $ | 8.64 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .088 | .073 | .095 | .166 | .191 | .135 | ||||||

| Net realized and unrealized gain (loss) | (.071) | (.441) | (.065) | .168 | .171 | (.113) | ||||||

| Total from investment operations | .017 | (.368) | .030 | .334 | .362 | .022 | ||||||

| Distributions from net investment income | (.067) | (.066) | (.131) | (.164) | (.172) | (.132) | ||||||

| Distributions from net realized gain | - | (.026) | (.059) | - | - | - | ||||||

| Total distributions | (.067) | (.092) | (.190) | (.164) | (.172) | (.132) | ||||||

| Net asset value, end of period | $ | 8.22 | $ | 8.27 | $ | 8.73 | $ | 8.89 | $ | 8.72 | $ | 8.53 |

Total Return C,D | .21% | (4.24)% | .34% | 3.88% | 4.29% | .26% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .50% G | .50% | .50% | .50% | .51% | .51% | ||||||

| Expenses net of fee waivers, if any | .50% G | .50% | .50% | .50% | .51% | .51% | ||||||

| Expenses net of all reductions | .50% G | .50% | .50% | .50% | .51% | .51% | ||||||

| Net investment income (loss) | 2.17% G | .86% | 1.08% | 1.89% | 2.22% | 1.58% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 241 | $ | 253 | $ | 269 | $ | 291 | $ | 334 | $ | 367 |

Portfolio turnover rate H | 56% G | 52% | 64% I | 67% I | 46% | 56% |

| Fidelity Advisor® Short-Term Bond Fund Class Z |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 A | ||||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 8.27 | $ | 8.73 | $ | 8.88 | $ | 8.72 | $ | 8.51 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .094 | .085 | .107 | .178 | .190 | |||||

| Net realized and unrealized gain (loss) | (.071) | (.441) | (.055) | .159 | .189 | |||||

| Total from investment operations | .023 | (.356) | .052 | .337 | .379 | |||||

| Distributions from net investment income | (.073) | (.078) | (.143) | (.177) | (.169) | |||||

| Distributions from net realized gain | - | (.026) | (.059) | - | - | |||||

| Total distributions | (.073) | (.104) | (.202) | (.177) | (.169) | |||||

| Net asset value, end of period | $ | 8.22 | $ | 8.27 | $ | 8.73 | $ | 8.88 | $ | 8.72 |

Total Return D,E | .28% | (4.10)% | .60% | 3.91% | 4.50% | |||||

Ratios to Average Net Assets C,F,G | ||||||||||

| Expenses before reductions | .40% H | .40% | .40% | .40% | .40% H | |||||

| Expenses net of fee waivers, if any | .36% H | .36% | .36% | .36% | .36% H | |||||

| Expenses net of all reductions | .36% H | .36% | .36% | .36% | .36% H | |||||

| Net investment income (loss) | 2.31% H | 1.00% | 1.22% | 2.04% | 2.43% H | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (in millions) | $ | 149 | $ | 146 | $ | 155 | $ | 118 | $ | 116 |

Portfolio turnover rate I | 56% H | 52% | 64% J | 67% J | 46% |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Fidelity Short-Term Bond Fund | $8 |

| Gross unrealized appreciation | $1,583 |

| Gross unrealized depreciation | (83,685) |

| Net unrealized appreciation (depreciation) | $(82,102) |

| Tax cost | $2,746,168 |

| Short-term | $(12,394) |

| Long-term | (10,129) |

| Total capital loss carryforward | $(22,523) |

| Interest Rate Risk | Interest rate risk relates to the fluctuations in the value of interest-bearing securities due to changes in the prevailing levels of market interest rates. |

| Purchases ($) | Sales ($) | |

| Fidelity Short-Term Bond Fund | 185,700 | 207,072 |

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | -% | .15% | $166 | $19 |

| Class M | -% | .15% | 41 | - A |

| Class C | .75% | .25% | 140 | 24 |

| $347 | $43 |

| Retained by FDC | |

| Class A | $18 |

| Class M | 2 |

Class C A | - B |

| $20 |

| Amount | % of Class-Level Average Net Assets A | |

| Class A | $162 | .15 |

| Class M | 44 | .16 |

| Class C | 23 | .16 |

| Short-Term Bond | 1,015 | .10 |

| Class I | 188 | .15 |

| Class Z | 39 | .05 |

| $1,471 |

| Fidelity Short-Term Bond Fund | .05% |

| Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Fidelity Short-Term Bond Fund | $5 | $- | $- |

| Expense Limitations | Reimbursement | |

| Class Z | .36% | $33 |

| Expense Limitations | |

| Class A | None |

| Class M | None |

| Class C | None |

| Short-Term Bond | None |

| Class I | .30% |

| Class Z | None |

Six months ended February 28, 2023 | Year ended August 31, 2022 | |

| Fidelity Short-Term Bond Fund | ||

| Distributions to shareholders | ||

| Class A | $1,634 | $2,129 |

| Class M | 405 | 583 |

| Class C | 88 | 119 |

| Short-Term Bond | 17,044 | 26,668 |

| Class I | 2,035 | 2,734 |

| Class Z | 1,370 | 1,878 |

Total | $22,576 | $34,111 |

| Shares | Shares | Dollars | Dollars | |

Six months ended February 28, 2023 | Year ended August 31, 2022 | Six months ended February 28, 2023 | Year ended August 31, 2022 | |

| Fidelity Short-Term Bond Fund | ||||

| Class A | ||||

| Shares sold | 5,953 | 19,288 | $48,861 | $163,691 |

| Reinvestment of distributions | 179 | 234 | 1,467 | 1,991 |

| Shares redeemed | (7,171) | (19,072) | (58,832) | (162,116) |

| Net increase (decrease) | (1,039) | 450 | $(8,504) | $3,566 |

| Class M | ||||

| Shares sold | 352 | 1,266 | $2,895 | $10,745 |

| Reinvestment of distributions | 47 | 65 | 386 | 558 |

| Shares redeemed | (854) | (2,054) | (7,009) | (17,437) |

| Net increase (decrease) | (455) | (723) | $(3,728) | $(6,134) |

| Class C | ||||

| Shares sold | 1,277 | 1,751 | $10,419 | $14,829 |

| Reinvestment of distributions | 10 | 13 | 85 | 115 |

| Shares redeemed | (932) | (2,316) | (7,611) | (19,617) |

| Net increase (decrease) | 355 | (552) | $2,893 | $(4,673) |

| Short-Term Bond | ||||

| Shares sold | 31,111 | 41,855 | $254,482 | $354,127 |

| Reinvestment of distributions | 1,652 | 2,640 | 13,556 | 22,511 |

| Shares redeemed | (44,197) | (86,466) | (362,667) | (732,749) |

| Net increase (decrease) | (11,434) | (41,971) | $(94,629) | $(356,111) |

| Class I | ||||

| Shares sold | 10,506 | 17,325 | $86,131 | $145,973 |

| Reinvestment of distributions | 237 | 298 | 1,948 | 2,543 |

| Shares redeemed | (11,989) | (17,812) | (98,502) | (150,956) |

| Net increase (decrease) | (1,246) | (189) | $(10,423) | $(2,440) |

| Class Z | ||||

| Shares sold | 6,036 | 9,084 | $49,436 | $76,963 |

| Reinvestment of distributions | 133 | 165 | 1,093 | 1,406 |

| Shares redeemed | (5,686) | (9,349) | (46,637) | (79,406) |

| Net increase (decrease) | 483 | (100) | $3,892 | $(1,037) |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2022 to February 28, 2023). |

Annualized Expense Ratio- A | Beginning Account Value September 1, 2022 | Ending Account Value February 28, 2023 | Expenses Paid During Period- C September 1, 2022 to February 28, 2023 | |||||||

| Fidelity® Short-Term Bond Fund | ||||||||||

Class A ** | .65% | |||||||||

| Actual | $ 1,000 | $ 1,001.40 | $ 3.23 | |||||||

Hypothetical- B | $ 1,000 | $ 1,021.57 | $ 3.26 | |||||||

Class M ** | .66% | |||||||||

| Actual | $ 1,000 | $ 1,001.30 | $ 3.28 | |||||||

Hypothetical- B | $ 1,000 | $ 1,021.52 | $ 3.31 | |||||||

Class C ** | 1.53% | |||||||||

| Actual | $ 1,000 | $ 995.80 | $ 7.57 | |||||||

Hypothetical- B | $ 1,000 | $ 1,017.21 | $ 7.65 | |||||||

Fidelity® Short-Term Bond Fund ** | .45% | |||||||||

| Actual | $ 1,000 | $ 1,002.30 | $ 2.23 | |||||||

Hypothetical- B | $ 1,000 | $ 1,022.56 | $ 2.26 | |||||||

Class I ** | .50% | |||||||||

| Actual | $ 1,000 | $ 1,002.10 | $ 2.48 | |||||||

Hypothetical- B | $ 1,000 | $ 1,022.32 | $ 2.51 | |||||||

Class Z ** | .36% | |||||||||

| Actual | $ 1,000 | $ 1,002.80 | $ 1.79 | |||||||

Hypothetical- B | $ 1,000 | $ 1,023.01 | $ 1.81 | |||||||

Annualized Expense Ratio- A | Expenses Paid | |||||

| Fidelity® Short-Term Bond Fund | ||||||

| Class A | .50% | |||||

| Actual | $ 2.48 | |||||

Hypothetical - B | $ 2.51 | |||||

| Class M | .51% | |||||

| Actual | $ 2.53 | |||||

Hypothetical - B | $ 2.56 | |||||

| Class C | 1.38% | |||||

| Actual | $ 6.83 | |||||

Hypothetical - B | $ 6.90 | |||||

| Fidelity® Short-Term Bond Fund | .30% | |||||

| Actual | $ 1.49 | |||||

Hypothetical - B | $ 1.51 | |||||

| Class I | .30% | |||||

| Actual | $ 1.49 | |||||

Hypothetical - B | $ 1.51 | |||||

| Class Z | .25% | |||||

| Actual | $ 1.24 | |||||

Hypothetical - B | $ 1.25 | |||||

| A Annualized expense ratio reflects expenses net of applicable fee waivers. | ||||||

| B 5% return per year before expenses |

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

|

Contents

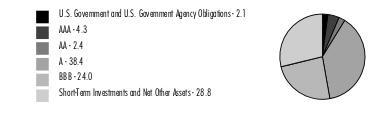

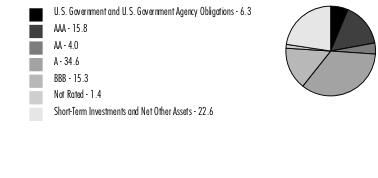

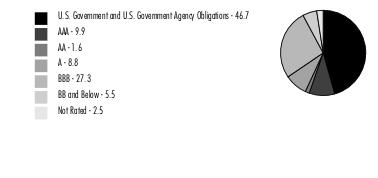

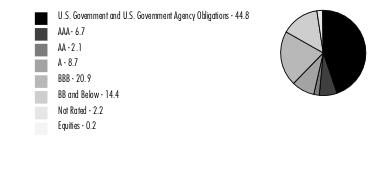

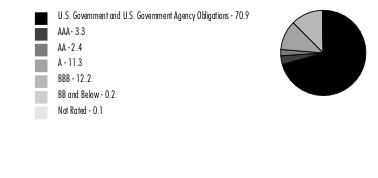

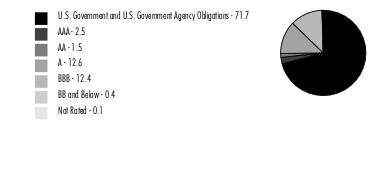

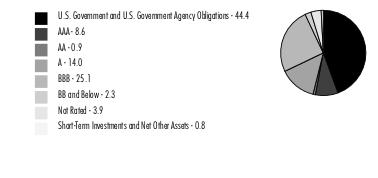

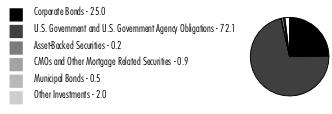

Quality Diversification (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

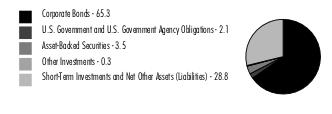

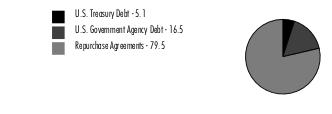

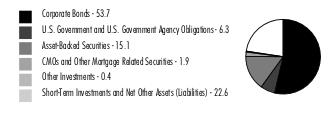

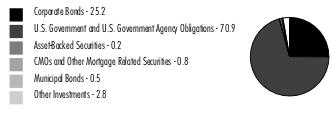

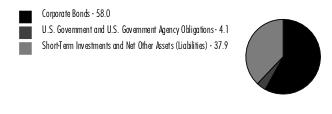

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 13.6% |

Futures and Swaps - 4.2% |

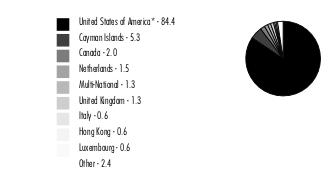

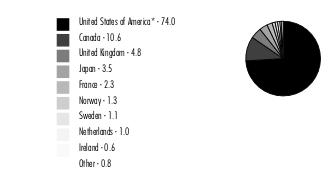

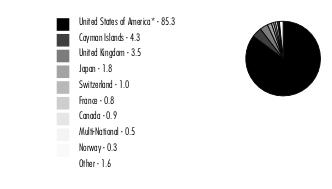

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable. |

| Nonconvertible Bonds - 10.6% | |||

Principal Amount (a) | Value ($) | ||

| COMMUNICATION SERVICES - 2.1% | |||

| Media - 1.2% | |||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp.: | |||

| 3.7% 4/1/51 | 250,000 | 152,867 | |

| 5.5% 4/1/63 | 130,000 | 101,048 | |

| Magallanes, Inc.: | |||

| 5.05% 3/15/42 (b) | 10,000 | 8,101 | |

| 5.141% 3/15/52 (b) | 16,000 | 12,542 | |

| Sirius XM Radio, Inc. 4.125% 7/1/30 (b) | 140,000 | 113,782 | |

| 388,340 | |||

| Wireless Telecommunication Services - 0.9% | |||

| Millicom International Cellular SA: | |||

| 4.5% 4/27/31 (b) | 310,000 | 250,325 | |

| 6.25% 3/25/29 (b) | 72,000 | 65,160 | |

| 315,485 | |||

TOTAL COMMUNICATION SERVICES | 703,825 | ||

| CONSUMER DISCRETIONARY - 1.0% | |||

| Household Durables - 1.0% | |||

| Toll Brothers Finance Corp. 4.875% 3/15/27 | 360,000 | 345,467 | |

| ENERGY - 3.6% | |||

| Oil, Gas & Consumable Fuels - 3.6% | |||

| DCP Midstream Operating LP: | |||

| 5.125% 5/15/29 | 12,000 | 11,551 | |

| 5.85% 5/21/43 (b)(c) | 260,000 | 257,296 | |

| Kinder Morgan, Inc. 3.6% 2/15/51 | 600,000 | 405,468 | |

| MPLX LP: | |||

| 5% 3/1/33 | 100,000 | 93,823 | |

| 5.65% 3/1/53 | 100,000 | 92,079 | |

| Petroleos Mexicanos 7.69% 1/23/50 | 250,000 | 175,613 | |

| Targa Resources Corp.: | |||

| 4.2% 2/1/33 | 130,000 | 113,183 | |

| 4.95% 4/15/52 | 130,000 | 103,985 | |

| 1,252,998 | |||

| FINANCIALS - 2.4% | |||

| Banks - 1.3% | |||

| Bank of America Corp. 2.299% 7/21/32 (c) | 280,000 | 218,973 | |

| Intesa Sanpaolo SpA 5.71% 1/15/26 (b) | 250,000 | 239,303 | |

| 458,276 | |||

| Consumer Finance - 0.8% | |||

| Capital One Financial Corp.: | |||

| 5.468% 2/1/29 (c) | 18,000 | 17,672 | |

| 5.817% 2/1/34 (c) | 32,000 | 31,073 | |

| Ford Motor Credit Co. LLC 3.375% 11/13/25 | 250,000 | 230,268 | |

| 279,013 | |||

| Diversified Financial Services - 0.3% | |||

| Blackstone Private Credit Fund 4.7% 3/24/25 | 61,000 | 58,834 | |

| Corebridge Financial, Inc.: | |||

| 3.85% 4/5/29 (b) | 7,000 | 6,323 | |

| 3.9% 4/5/32 (b) | 9,000 | 7,875 | |

| 4.35% 4/5/42 (b) | 2,000 | 1,649 | |

| 4.4% 4/5/52 (b) | 6,000 | 4,783 | |

| 79,464 | |||

TOTAL FINANCIALS | 816,753 | ||

| HEALTH CARE - 0.6% | |||

| Health Care Providers & Services - 0.6% | |||

| Centene Corp. 4.625% 12/15/29 | 120,000 | 109,739 | |

| Prime Healthcare Foundation, Inc. 7% 12/1/27 | 110,000 | 107,889 | |

| 217,628 | |||

| INFORMATION TECHNOLOGY - 0.3% | |||

| Software - 0.3% | |||

| Oracle Corp. 3.85% 4/1/60 | 160,000 | 106,647 | |

| REAL ESTATE - 0.0% | |||

| Equity Real Estate Investment Trusts (REITs) - 0.0% | |||

| American Homes 4 Rent LP: | |||

| 3.625% 4/15/32 | 8,000 | 6,759 | |

| 4.3% 4/15/52 | 6,000 | 4,598 | |

| 11,357 | |||

| UTILITIES - 0.6% | |||

| Electric Utilities - 0.6% | |||

| DPL, Inc. 4.125% 7/1/25 | 200,000 | 187,865 | |

| Multi-Utilities - 0.0% | |||

| Puget Energy, Inc. 4.224% 3/15/32 | 15,000 | 13,263 | |

TOTAL UTILITIES | 201,128 | ||

| TOTAL NONCONVERTIBLE BONDS (Cost $4,139,695) | 3,655,803 | ||

| U.S. Treasury Obligations - 34.7% | |||

Principal Amount (a) | Value ($) | ||

| U.S. Treasury Bonds 2.875% 5/15/52 | 4,240,000 | 3,471,997 | |

| U.S. Treasury Notes: | |||

| 3.5% 1/31/30 | 1,600,000 | 1,545,250 | |

| 4.125% 11/15/32 | 6,880,000 | 6,989,649 | |

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $12,456,816) | 12,006,896 | ||

| Asset-Backed Securities - 12.3% | |||

Principal Amount (a) | Value ($) | ||

| Allegro CLO XV, Ltd. / Allegro CLO VX LLC Series 2022-1A Class B, CME TERM SOFR 3 MONTH INDEX + 2.050% 6.689% 7/20/35 (b)(c)(d) | 250,000 | 246,438 | |

| Ares XXXIV CLO Ltd. Series 2020-2A Class BR2, 3 month U.S. LIBOR + 1.600% 6.3924% 4/17/33 (b)(c)(d) | 250,000 | 243,407 | |

| Cedar Funding Ltd. Series 2022-15A Class B, CME TERM SOFR 3 MONTH INDEX + 1.800% 6.439% 4/20/35 (b)(c)(d) | 750,000 | 722,631 | |

| Columbia Cent Clo 32 Ltd. / Coliseum Series 2022-32A Class B1, CME TERM SOFR 3 MONTH INDEX + 2.400% 7.0586% 7/24/34 (b)(c)(d) | 100,000 | 96,590 | |

| DB Master Finance LLC Series 2021-1A Class A23, 2.791% 11/20/51 (b) | 246,875 | 198,145 | |

| Dominos Pizza Master Issuer LLC Series 2021-1A Class A2II, 3.151% 4/25/51 (b) | 933,375 | 778,357 | |

| Horizon Aircraft Finance Ltd. Series 2019-1 Class A, 3.721% 7/15/39 (b) | 194,506 | 165,328 | |

| Magnetite XXIX, Ltd. / Magnetite XXIX LLC Series 2021-29A Class B, 3 month U.S. LIBOR + 1.400% 6.1924% 1/15/34 (b)(c)(d) | 650,000 | 634,997 | |

| Planet Fitness Master Issuer LLC Series 2022-1A Class A2II, 4.008% 12/5/51 (b) | 496,250 | 411,512 | |

| SYMP Series 2022-32A Class B, CME TERM SOFR 3 MONTH INDEX + 1.850% 6.5035% 4/23/35 (b)(c)(d) | 760,000 | 741,967 | |

| TOTAL ASSET-BACKED SECURITIES (Cost $4,447,826) | 4,239,372 | ||

| Commercial Mortgage Securities - 1.8% | |||

Principal Amount (a) | Value ($) | ||

| BPR Trust floater Series 2022-OANA Class B, CME Term SOFR 1 Month Index + 2.440% 7.0095% 4/15/37 (b)(c)(d) | 11,000 | 10,794 | |

| BX Trust floater Series 2022-IND: | |||

| Class C, CME Term SOFR 1 Month Index + 2.290% 6.8518% 4/15/37 (b)(c)(d) | 252,068 | 245,684 | |

| Class D, CME Term SOFR 1 Month Index + 2.830% 7.4008% 4/15/37 (b)(c)(d) | 9,336 | 9,003 | |

| Life Financial Services Trust floater Series 2022-BMR2: | |||

| Class B, CME Term SOFR 1 Month Index + 1.790% 6.3564% 5/15/39 (b)(c)(d) | 100,000 | 99,605 | |

| Class C, CME Term SOFR 1 Month Index + 2.090% 6.6556% 5/15/39 (b)(c)(d) | 100,000 | 98,780 | |

| Class D, CME Term SOFR 1 Month Index + 2.540% 7.1044% 5/15/39 (b)(c)(d) | 100,000 | 98,516 | |

| VLS Commercial Mortgage Trust sequential payer Series 2020-LAB Class A, 2.13% 10/10/42 (b) | 100,000 | 78,385 | |

| TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $646,582) | 640,767 | ||

| Municipal Securities - 0.5% | |||

Principal Amount (a) | Value ($) | ||

| Chicago Board of Ed.: | |||

| Series 2009 G, 1.75% 12/15/25 | 120,000 | 105,107 | |

| Series 2010 C, 6.319% 11/1/29 | 60,000 | 58,729 | |

| TOTAL MUNICIPAL SECURITIES (Cost $170,962) | 163,836 | ||

| Foreign Government and Government Agency Obligations - 4.1% | |||

Principal Amount (a) | Value ($) | ||

| Brazilian Federative Republic: | |||

| 5.625% 2/21/47 | 140,000 | 114,083 | |

| 10% 1/1/27 | BRL | 1,000,000 | 174,909 |

| Dominican Republic: | |||

| 5.5% 2/22/29 (b) | 250,000 | 231,297 | |

| 6% 2/22/33 (b) | 250,000 | 226,219 | |

| United Mexican States: | |||

| 7.75% 5/29/31 | MXN | 6,900,000 | 343,222 |

| 7.75% 11/13/42 | MXN | 7,300,000 | 342,563 |

| TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $1,486,493) | 1,432,293 | ||

| Fixed-Income Funds - 32.9% | |||

| Shares | Value ($) | ||

| Fidelity Floating Rate Central Fund (e) | 48,526 | 4,698,805 | |

| Fidelity High Income Central Fund (e) | 17,875 | 1,825,981 | |

| Fidelity International Credit Central Fund (e) | 60,878 | 4,830,070 | |

| TOTAL FIXED-INCOME FUNDS (Cost $12,475,578) | 11,354,856 | ||

| Preferred Securities - 1.3% | |||

Principal Amount (a) | Value ($) | ||

| ENERGY - 0.7% | |||

| Oil, Gas & Consumable Fuels - 0.7% | |||

| Enbridge, Inc. 5.75% 7/15/80 (c) | 250,000 | 236,254 | |

| FINANCIALS - 0.6% | |||

| Banks - 0.6% | |||

| Bank of Nova Scotia 4.9% (c)(f) | 240,000 | 233,016 | |

| TOTAL PREFERRED SECURITIES (Cost $516,717) | 469,270 | ||

| Money Market Funds - 0.4% | |||

| Shares | Value ($) | ||

Fidelity Cash Central Fund 4.63% (g) (Cost $123,913) | 123,888 | 123,913 | |

| TOTAL INVESTMENT IN SECURITIES - 98.6% (Cost $36,464,582) | 34,087,006 |

NET OTHER ASSETS (LIABILITIES) - 1.4% | 469,262 |

| NET ASSETS - 100.0% | 34,556,268 |

| Forward Foreign Currency Contracts | ||||||

Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation/ (Depreciation) ($) | ||

| USD | 344,349 | MXN | 6,365,000 | BNP Paribas S.A. | 3/30/23 | (1,581) |

| TOTAL FORWARD FOREIGN CURRENCY CONTRACTS | (1,581) | |||||

| Unrealized Depreciation | (1,581) | |||||

| BRL | - | Brazilian real |

| MXN | - | Mexican peso |

| USD | - | U.S. dollar |

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $6,304,794 or 18.2% of net assets. |

| (c) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (d) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (e) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-PORT and is available upon request or at the SEC's website at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or institutional.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (f) | Security is perpetual in nature with no stated maturity date. |

| (g) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.63% | 2,250,044 | 6,593,080 | 8,719,211 | 31,406 | - | - | 123,913 | 0.0% |

| Fidelity Floating Rate Central Fund | 6,441,145 | 234,483 | 1,970,000 | 234,483 | (81,046) | 74,223 | 4,698,805 | 0.2% |

| Fidelity High Income Central Fund | 1,001,612 | 844,607 | - | 44,607 | (143) | (20,095) | 1,825,981 | 0.1% |

| Fidelity International Credit Central Fund | 6,065,161 | 280,592 | 1,150,000 | 280,594 | (225,908) | (139,775) | 4,830,070 | 1.3% |

| Total | 15,757,962 | 7,952,762 | 11,839,211 | 591,090 | (307,097) | (85,647) | 11,478,769 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Corporate Bonds | 3,655,803 | - | 3,655,803 | - |

| U.S. Government and Government Agency Obligations | 12,006,896 | - | 12,006,896 | - |

| Asset-Backed Securities | 4,239,372 | - | 4,239,372 | - |

| Commercial Mortgage Securities | 640,767 | - | 640,767 | - |

| Municipal Securities | 163,836 | - | 163,836 | - |

| Foreign Government and Government Agency Obligations | 1,432,293 | - | 1,432,293 | - |

| Fixed-Income Funds | 11,354,856 | 11,354,856 | - | - |

| Preferred Securities | 469,270 | - | 469,270 | - |

| Money Market Funds | 123,913 | 123,913 | - | - |

| Total Investments in Securities: | 34,087,006 | 11,478,769 | 22,608,237 | - |

Derivative Instruments: | ||||

| Assets | ||||

Forward Foreign Currency Contracts | - | - | - | - |

| Total Assets | - | - | - | - |

| Liabilities | ||||

Forward Foreign Currency Contracts | (1,581) | - | (1,581) | - |

| Total Liabilities | (1,581) | - | (1,581) | - |

| Total Derivative Instruments: | (1,581) | - | (1,581) | - |

Primary Risk Exposure / Derivative Type | Value | |

| Asset ($) | Liability ($) | |

| Foreign Exchange Risk | ||

Forward Foreign Currency Contracts (a) | 0 | (1,581) |

| Total Foreign Exchange Risk | 0 | (1,581) |

| Total Value of Derivatives | 0 | (1,581) |

| Statement of Assets and Liabilities | ||||