UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | December 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund : FSTZX |

| | | |

This annual shareholder report contains information about Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a modest advance in 2024, rallying during the summer months, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, but falling back in the fourth quarter when the Fed tempered rate-cut expectations for 2025.

•We construct the portfolio using optimization. This approach minimizes the differences between risk exposures of the fund relative to the U.S. Treasury Inflation-Protected Securities index. We attempt to hold all positions held by the index in the same relative proportions.

•Exposures include duration, key rate durations and other factors.

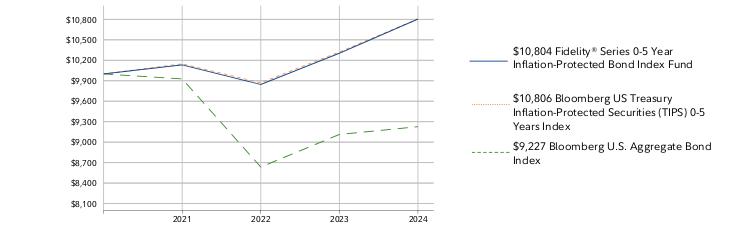

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

August 13, 2021 through December 31, 2024.

Initial investment of $10,000.

Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund | $10,000 | $10,133 | $9,845 | $10,303 |

Bloomberg US Treasury Inflation-Protected Securities (TIPS) 0-5 Years Index | $10,000 | $10,148 | $9,870 | $10,321 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,927 | $8,635 | $9,113 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | Life of Fund A |

| Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund | 4.86% | 2.31% |

| Bloomberg US Treasury Inflation-Protected Securities (TIPS) 0-5 Years Index | 4.69% | 2.31% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | -2.35% |

A From August 13, 2021

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $9,147,192,964 | |

| Number of Holdings | 28 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 28% | |

What did the Fund invest in?

(as of December 31, 2024)

COUPON DISTRIBUTION (% of Fund's net assets) |

| 0.01 - 0.99% | 59.9 | |

| 1 - 1.99% | 18.4 | |

| 2 - 2.99% | 18.8 | |

| 3 - 3.99% | 2.6 | |

| U.S. Treasury Obligations | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | U.S. Treasury Obligations - 99.7 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.3 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 86.3 | |

| US Treasury Bonds | 13.4 | |

| | 99.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914397.100 6398-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® International Bond Index Fund Fidelity® International Bond Index Fund : FBIIX |

| | | |

This annual shareholder report contains information about Fidelity® International Bond Index Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® International Bond Index Fund | $ 6 | 0.06% | |

What affected the Fund's performance this period?

•International bonds advanced in 2024, buoyed by global monetary easing, as most major developed-market central banks - including in the U.S., U.K, Europe and Canada - began to lower policy interest rates after raising them aggressively the previous two years to combat inflation.

•We construct the portfolio using optimization. This approach minimizes the differences between risk exposures of the fund relative to the index. We attempt to hold all positions held by the index in the same relative proportions.

•Exposures include duration, key rate durations, credit quality, sector and issuer allocation, and other factors.

•The fund lagged the index primarily due to costs related to hedging the Chinese Renminbi.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

October 10, 2019 through December 31, 2024.

Initial investment of $10,000.

Fidelity® International Bond Index Fund | $10,000 | $9,887 | $10,315 | $10,135 | $9,036 | $9,712 |

Bloomberg Global Aggregate ex-USD Float Adjusted RIC Diversified Index (Hedged USD) | $10,000 | $9,918 | $10,351 | $10,198 | $9,142 | $9,932 |

Bloomberg Global Aggregate Bond Index | $10,000 | $10,038 | $10,961 | $10,445 | $8,748 | $9,248 |

| | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | Life of Fund A |

| Fidelity® International Bond Index Fund | 4.64% | 0.55% | 0.31% |

| Bloomberg Global Aggregate ex-USD Float Adjusted RIC Diversified Index (Hedged USD) | 5.26% | 1.06% | 0.85% |

| Bloomberg Global Aggregate Bond Index | -1.69% | -1.96% | -1.80% |

A From October 10, 2019

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $917,079,303 | |

| Number of Holdings | 1,817 | |

| Total Advisory Fee | $489,658 | |

| Portfolio Turnover | 19% | |

What did the Fund invest in?

(as of December 31, 2024)

| AAA | 15.7 |

| AA | 12.1 |

| A | 12.0 |

| BBB | 10.5 |

| BB | 0.4 |

| B | 0.0 |

| CCC,CC,C | 0.0 |

| Not Rated | 47.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.7 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

| |

| | AAA - 15.7 |

| | AA - 12.1 |

| | A - 12.0 |

| | BBB - 10.5 |

| | BB - 0.4 |

| | B - 0.0 |

| | CCC,CC,C - 0.0 |

| | Not Rated - 47.6 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 1.7 |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Foreign Government and Government Agency Obligations | 69.1 |

| Corporate Bonds | 28.9 |

| Preferred Securities | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Foreign Government and Government Agency Obligations - 69.1 |

| | Corporate Bonds - 28.9 |

| | Preferred Securities - 0.3 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 1.7 |

| |

| China | 20.4 |

| Japan | 10.3 |

| France | 9.6 |

| Germany | 8.0 |

| Italy | 6.3 |

| Canada | 5.7 |

| United States | 5.4 |

| United Kingdom | 4.6 |

| Multi-national | 4.1 |

| Others | 25.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | China - 20.4 |

| | Japan - 10.3 |

| | France - 9.6 |

| | Germany - 8.0 |

| | Italy - 6.3 |

| | Canada - 5.7 |

| | United States - 5.4 |

| | United Kingdom - 4.6 |

| | Multi-national - 4.1 |

| | Others - 25.6 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| Peoples Republic of China | 13.4 | |

| Japan Government | 9.9 | |

| Italian Republic | 5.6 | |

| French Government | 5.4 | |

| German Federal Republic | 4.2 | |

| China Development Bank | 3.7 | |

| Spanish Kingdom | 3.3 | |

| United Kingdom of Great Britain and Northern Ireland | 3.1 | |

| Korean Republic | 2.1 | |

| Agricultural Development Bank of China | 1.9 | |

| | 52.6 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914393.100 4506-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Inflation-Protected Bond Index Fund Fidelity® Inflation-Protected Bond Index Fund : FIPDX |

| | | |

This annual shareholder report contains information about Fidelity® Inflation-Protected Bond Index Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Inflation-Protected Bond Index Fund | $ 5 | 0.05% | |

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a modest advance in 2024, rallying during the summer months, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, but falling back in the fourth quarter when the Fed tempered rate-cut expectations for 2025.

•We construct the portfolio using optimization. This approach minimizes the differences between risk exposures of the fund relative to the Bloomberg U.S. Treasury Inflation-Protected Securities index. We attempt to hold all positions held by the index in the same relative proportions.

•Exposures include duration, key rate durations and other factors.

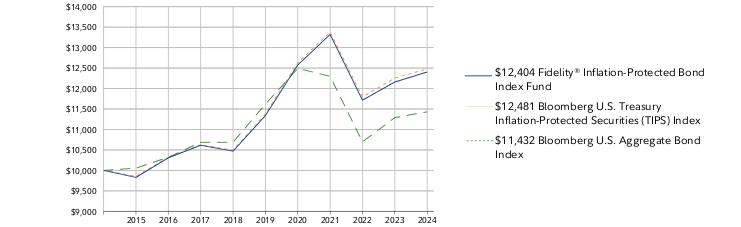

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

December 31, 2014 through December 31, 2024.

Initial investment of $10,000.

Fidelity® Inflation-Protected Bond Index Fund | $10,000 | $9,829 | $10,308 | $10,615 | $10,469 | $11,340 | $12,576 | $13,321 | $11,716 | $12,159 | $12,404 |

Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) Index | $10,000 | $9,856 | $10,318 | $10,628 | $10,494 | $11,378 | $12,629 | $13,381 | $11,796 | $12,256 | $12,481 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $10,055 | $10,321 | $10,687 | $10,688 | $11,620 | $12,492 | $12,299 | $10,699 | $11,291 | $11,432 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Fidelity® Inflation-Protected Bond Index Fund | 2.01% | 1.81% | 2.18% |

| Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) Index | 1.84% | 1.87% | 2.24% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | -0.33% | 1.35% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $8,969,120,308 | |

| Number of Holdings | 49 | |

| Total Advisory Fee | $4,639,266 | |

| Portfolio Turnover | 23% | |

What did the Fund invest in?

(as of December 31, 2024)

COUPON DISTRIBUTION (% of Fund's net assets) |

| 0.01 - 0.99% | 56.2 | |

| 1 - 1.99% | 26.0 | |

| 2 - 2.99% | 13.7 | |

| 3 - 3.99% | 3.5 | |

| U.S. Treasury Obligations | 99.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | U.S. Treasury Obligations - 99.4 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.6 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 77.0 | |

| US Treasury Bonds | 22.4 | |

| | 99.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914344.100 2418-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® SAI International Credit Fund Fidelity® SAI International Credit Fund : FSNDX |

| | | |

This annual shareholder report contains information about Fidelity® SAI International Credit Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® SAI International Credit Fund | $ 42 | 0.41% | |

What affected the Fund's performance this period?

•Global investment-grade bonds gained in 2024, buoyed by global monetary easing, as most major developed-market central banks - including in the U.S., U.K, Europe and Canada - began to lower policy interest rates after raising them aggressively the previous two years to combat inflation.

•At year-end, about 48% of the portfolio was comprised of corporate bond holdings, while24% was in non-benchmark exposure to U.S. government bonds and roughly 9% in non-U.S. government bonds.

•Roughly 57% of the fund was invested in investment-grade securities rated A and above, while 34% was in bonds rated BBB and lower. The fund also had an approximate 6% allocation to cash as of December 31.

•The largest individual relative contributor this period was the fund's position in European property company Heimstaden, real-estate investor Aroundtown bonds and another European property company, Grand City Properties.

•Conversely, the largest individual relative detractor was an exposure to the UK water sector including Southern Water bonds.

•Top fund holdings at year-end included U.S. treasury notes and bonds, KfW, German and Japanese government bonds.

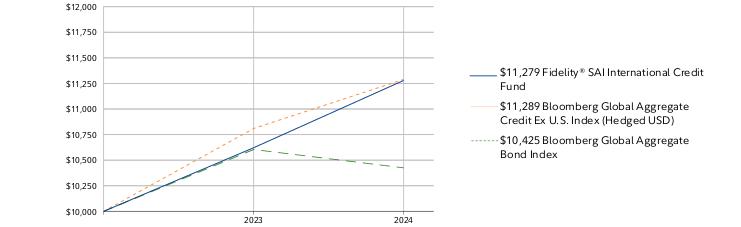

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

March 1, 2023 through December 31, 2024.

Initial investment of $10,000.

Fidelity® SAI International Credit Fund | $10,000 | $10,621 |

Bloomberg Global Aggregate Credit Ex U.S. Index (Hedged USD) | $10,000 | $10,810 |

Bloomberg Global Aggregate Bond Index | $10,000 | $10,604 |

| | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | Life of Fund A |

| Fidelity® SAI International Credit Fund | 6.19% | 6.77% |

| Bloomberg Global Aggregate Credit Ex U.S. Index (Hedged USD) | 4.44% | 6.82% |

| Bloomberg Global Aggregate Bond Index | -1.69% | 2.29% |

A From March 1, 2023

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $706,533,349 | |

| Number of Holdings | 238 | |

| Total Advisory Fee | $1,630,941 | |

| Portfolio Turnover | 64% | |

What did the Fund invest in?

(as of December 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 24.3 |

| AAA | 9.3 |

| A | 11.5 |

| BBB | 34.0 |

| BB | 5.0 |

| B | 1.3 |

| CCC,CC,C | 0.5 |

| D | 0.0 |

| Not Rated | 5.5 |

| Short-Term Investments and Net Other Assets (Liabilities) | 8.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

| |

| | U.S. Government and U.S. Government Agency Obligations - 24.3 |

| | AAA - 9.3 |

| | A - 11.5 |

| | BBB - 34.0 |

| | BB - 5.0 |

| | B - 1.3 |

| | CCC,CC,C - 0.5 |

| | D - 0.0 |

| | Not Rated - 5.5 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 8.6 |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 54.5 |

| U.S. Treasury Obligations | 24.3 |

| Foreign Government and Government Agency Obligations | 8.9 |

| Preferred Securities | 3.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 8.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Corporate Bonds - 54.5 |

| | U.S. Treasury Obligations - 24.3 |

| | Foreign Government and Government Agency Obligations - 8.9 |

| | Preferred Securities - 3.7 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 8.6 |

| |

| United States | 34.9 |

| United Kingdom | 17.5 |

| Germany | 15.5 |

| Netherlands | 4.3 |

| France | 3.9 |

| Luxembourg | 3.5 |

| Canada | 3.3 |

| Japan | 2.6 |

| Denmark | 2.2 |

| Others | 12.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 34.9 |

| | United Kingdom - 17.5 |

| | Germany - 15.5 |

| | Netherlands - 4.3 |

| | France - 3.9 |

| | Luxembourg - 3.5 |

| | Canada - 3.3 |

| | Japan - 2.6 |

| | Denmark - 2.2 |

| | Others - 12.3 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 15.8 | |

| US Treasury Bonds | 8.5 | |

| KfW | 3.9 | |

| Canadian Government | 3.3 | |

| Japan Government | 2.6 | |

| German Federal Republic | 2.1 | |

| Blackstone Property Partners Europe Holdings Sarl | 1.8 | |

| UBS Group AG | 1.6 | |

| NatWest Group PLC | 1.6 | |

| Lloyds Banking Group PLC | 1.5 | |

| | 42.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914415.100 7328-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund : FSTDX |

| | | |

This annual shareholder report contains information about Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund | $ 0 A | 0.00%B | |

A Amount represents less than $.50

B Amount represents less than 0.005%

What affected the Fund's performance this period?

•U.S. taxable investment-grade bonds posted a modest advance in 2024, rallying during the summer months, as the bond market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, but falling back in the fourth quarter when the Fed tempered rate-cut expectations for 2025.

•We construct the portfolio using optimization. This approach minimizes the differences between risk exposures of the fund relative to the U.S. Treasury Inflation-Protected Securities index. We attempt to hold all positions held by the index in the same relative proportions.

•Exposures include duration, key rate durations and other factors.

•The fund outperformed the index primarily due to pricing basis, meaning differences between when the fund and the index are priced on the last day of the year.

How did the Fund perform over the life of Fund?

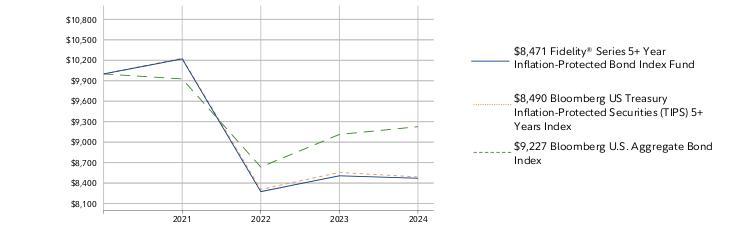

CUMULATIVE PERFORMANCE

August 13, 2021 through December 31, 2024.

Initial investment of $10,000.

Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund | $10,000 | $10,221 | $8,275 | $8,507 |

Bloomberg US Treasury Inflation-Protected Securities (TIPS) 5+ Years Index | $10,000 | $10,230 | $8,308 | $8,556 |

Bloomberg U.S. Aggregate Bond Index | $10,000 | $9,927 | $8,635 | $9,113 |

| | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | Life of Fund A |

| Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund | -0.42% | -4.78% |

| Bloomberg US Treasury Inflation-Protected Securities (TIPS) 5+ Years Index | -0.78% | -4.72% |

| Bloomberg U.S. Aggregate Bond Index | 1.25% | -2.35% |

A From August 13, 2021

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $10,842,479,536 | |

| Number of Holdings | 27 | |

| Total Advisory Fee | $0 | |

| Portfolio Turnover | 26% | |

What did the Fund invest in?

(as of December 31, 2024)

COUPON DISTRIBUTION (% of Fund's net assets) |

| 0.01 - 0.99% | 52.2 | |

| 1 - 1.99% | 40.2 | |

| 2 - 2.99% | 6.0 | |

| 3 - 3.99% | 1.1 | |

| U.S. Treasury Obligations | 99.5 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.5 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | U.S. Treasury Obligations - 99.5 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.5 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 69.3 | |

| US Treasury Bonds | 30.2 | |

| | 99.5 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914398.100 6399-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® SAI Municipal Income Fund Fidelity® SAI Municipal Income Fund : FSMNX |

| | | |

This annual shareholder report contains information about Fidelity® SAI Municipal Income Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® SAI Municipal Income Fund | $ 35 | 0.34% | |

What affected the Fund's performance this period?

•U.S. tax-exempt municipal bonds produced a modest gain in 2024, rallying during the summer months, as the muni market reflected anticipated interest-rate reductions by the U.S. Federal Reserve, but falling back in the fourth quarter, when municipal bond supply swelled and the Fed tempered rate-cut expectations for 2025.

•Against this backdrop, the fund's credit-quality positioning was a key contributor to performance versus the Bloomberg Municipal Bond Index for the fiscal year.

•This included an overweight in lower-quality investment-grade municipal securities - primarily health care and higher education credits - that outperformed as credit spreads tightened. For the same reason, an overweight in bonds from the Puerto Rico Commonwealth Aqueducts and Sewers Authority also added value.

•Underweights in certain high-quality bonds that lagged the index, such as those backed by the New York Transitional Finance Authority Future Tax Secured Revenue, also aided the relative return.

•Pricing factors boosted relative performance as well. Fund holdings are priced by a third-party pricing service and validated daily by Fidelity Management & Research's fair-value processes. Securities within the index, however, are priced by the index provider. These two approaches employ somewhat different methodologies in setting the prices of municipal securities, most of which trade infrequently.

•In contrast, an overweight in lower-coupon tobacco bonds that trailed the index, partly due to their heightened interest-rate sensitivity, detracted from the relative result.

•Exposure to municipal private activity bonds issued for a wood pellet company to fund a project in Mississippi also hurt, as the company declared Chapter 11 bankruptcy.

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

October 2, 2018 through December 31, 2024.

Initial investment of $10,000.

Fidelity® SAI Municipal Income Fund | $10,000 | $10,267 | $11,141 | $11,617 | $11,887 | $10,706 | $11,514 |

Bloomberg 3+ Year Municipal Bond Index | $10,000 | $10,178 | $11,010 | $11,631 | $11,828 | $10,711 | $11,440 |

Bloomberg Municipal Bond Index | $10,000 | $10,167 | $10,933 | $11,503 | $11,678 | $10,682 | $11,366 |

| | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | Life of Fund A |

| Fidelity® SAI Municipal Income Fund | 1.83% | 1.02% | 2.58% |

| Bloomberg 3+ Year Municipal Bond Index | 0.88% | 0.95% | 2.32% |

| Bloomberg Municipal Bond Index | 1.05% | 0.99% | 2.24% |

A From October 2, 2018

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $2,251,283,165 | |

| Number of Holdings | 1,754 | |

| Total Advisory Fee | $6,863,329 | |

| Portfolio Turnover | 10% | |

What did the Fund invest in?

(as of December 31, 2024)

REVENUE SOURCES (% of Fund's net assets) |

| General Obligations | 28.0 | |

| Transportation | 17.4 | |

| Health Care | 13.6 | |

| Education | 9.2 | |

| Special Tax | 8.8 | |

| Housing | 6.0 | |

| Others(Individually Less Than 5%) | 17.0 | |

| 100.0 | |

| |

| AAA | 10.9 |

| AA | 34.3 |

| A | 34.9 |

| BBB | 8.6 |

| BB | 1.1 |

| B | 0.3 |

| CCC,CC,C | 0.0 |

| Not Rated | 3.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.9 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

| |

| | AAA - 10.9 |

| | AA - 34.3 |

| | A - 34.9 |

| | BBB - 8.6 |

| | BB - 1.1 |

| | B - 0.3 |

| | CCC,CC,C - 0.0 |

| | Not Rated - 3.0 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 6.9 |

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

TOP STATES (% of Fund's net assets) |

| Illinois | 10.0 |

| New York | 8.3 |

| Texas | 7.2 |

| New Jersey | 7.1 |

| Pennsylvania | 5.1 |

| | |

How has the Fund changed?

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:- Management fee

- Operating expenses

- Expense reductions

The fund's contractual management fee was reduced during the reporting period. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914383.100 3307-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | |

| | Fidelity® SAI Inflation-Protected Bond Index Fund Fidelity® SAI Inflation-Protected Bond Index Fund : FSPWX |

| | | |

This annual shareholder report contains information about Fidelity® SAI Inflation-Protected Bond Index Fund for the period August 16, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

Fidelity® SAI Inflation-Protected Bond Index Fund A | $ 2 | 0.05% | |

A Expenses for the full reporting period would be higher.

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $10,129,497,606 | |

| Number of Holdings | 49 | |

| Total Advisory Fee | $1,060,569 | |

Portfolio TurnoverA | 8% | |

A Amount not annualized

What did the Fund invest in?

(as of December 31, 2024)

COUPON DISTRIBUTION (% of Fund's net assets) |

| 0.01 - 0.99% | 53.5 | |

| 1 - 1.99% | 29.4 | |

| 2 - 2.99% | 14.7 | |

| 3 - 3.99% | 1.8 | |

| U.S. Treasury Obligations | 99.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | U.S. Treasury Obligations - 99.4 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.6 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 80.1 | |

| US Treasury Bonds | 19.3 | |

| | 99.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916284.100 7702-TSRA-0325 |

Item 2.

Code of Ethics

As of the end of the period, December 31, 2024, Fidelity Salem Street Trust (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Laura M. Bishop is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Ms. Bishop is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by PricewaterhouseCoopers LLP (“PwC”) in each of the last two fiscal years for services rendered to Fidelity Inflation-Protected Bond Index Fund, Fidelity International Bond Index Fund, Fidelity SAI Inflation-Protected Bond Index Fund, Fidelity SAI International Credit Fund, Fidelity SAI Municipal Income Fund, Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund and Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (the “Funds”):

Services Billed by PwC

December 31, 2024 FeesA,C

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity Inflation-Protected Bond Index Fund | $34,800 | $2,900 | $5,500 | $1,300 |

Fidelity International Bond Index Fund | $78,300 | $6,600 | $11,900 | $2,900 |

Fidelity SAI Inflation-Protected Bond Index Fund | $24,700 | $700 | $5,500 | $300 |

Fidelity SAI International Credit Fund | $78,100 | $6,400 | $14,900 | $2,800 |

Fidelity SAI Municipal Income Fund | $52,600 | $4,300 | $8,700 | $1,800 |

Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | $36,100 | $3,100 | $7,600 | $1,300 |

Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | $36,200 | $3,100 | $6,000 | $1,300 |

December 31, 2023 FeesA,B,C

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity Inflation-Protected Bond Index Fund | $35,000 | $3,000 | $5,500 | $1,200 |

Fidelity International Bond Index Fund | $78,600 | $6,700 | $11,900 | $2,800 |

Fidelity SAI Inflation-Protected Bond Index Fund | $- | $- | $- | $- |

Fidelity SAI International Credit Fund | $66,400 | $4,400 | $13,900 | $1,800 |

Fidelity SAI Municipal Income Fund | $55,300 | $4,300 | $9,600 | $1,800 |

Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | $46,200 | $3,100 | $6,000 | $1,300 |

Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | $46,300 | $3,100 | $6,000 | $1,300 |

A Amounts may reflect rounding

B Fidelity SAI International Credit Fund commenced operations on March 1, 2023.

C Fidelity SAI Inflation-Protected Bond Index Fund commenced operations on August 16, 2024.

The following table(s) present(s) fees billed by PwC that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Fidelity Management & Research Company LLC ("FMR") and entities controlling, controlled by, or under common control with FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by PwC

| | |

| December 31, 2024A,C | December 31, 2023A,B,C |

Audit-Related Fees | $9,701,800 | $8,881,200 |

Tax Fees | $61,000 | $1,000 |

All Other Fees | $35,000 | $- |

A Amounts may reflect rounding.

B May include amounts billed prior to the Fidelity SAI International Credit Fund’s commencement of operations.

C May include amounts billed prior to the Fidelity SAI Inflation-Protected Bond Index Fund’s commencement of operations

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by PwC for services rendered to the Fund(s), FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

| | |

Billed By | December 31, 2024A,C | December 31, 2023A,B,C |

PwC | $15,390,000 | $14,424,000 |

A Amounts may reflect rounding.

B May include amounts billed prior to the Fidelity SAI International Credit Fund’ss commencement of operations.

C May include amounts billed prior to the Fidelity SAI Inflation-Protected Bond Index Fund’s commencement of operations

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by PwC to Fund Service Providers to be compatible with maintaining the independence of PwC in its(their) audit of the Fund(s), taking into account representations from PwC, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and FMR’s review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund

Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund

Annual Report

December 31, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

BLOOMBERG ® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg's licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2025 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies (Annual Report)

Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund

Schedule of Investments December 31, 2024

Showing Percentage of Net Assets

| U.S. Treasury Obligations - 99.7% |

| | | Yield (%) (a) | Principal Amount (b) | Value ($) |

| US Treasury Bonds Inflation-Indexed 1.75% 1/15/2028 | | 1.24 to 1.92 | 178,853,599 | 177,581,786 |

| US Treasury Bonds Inflation-Indexed 2% 1/15/2026 | | -1.98 to 2.65 | 117,027,020 | 117,042,352 |

| US Treasury Bonds Inflation-Indexed 2.375% 1/15/2025 | | -2.33 to 4.87 | 296,246,663 | 296,062,671 |

| US Treasury Bonds Inflation-Indexed 2.375% 1/15/2027 | | -1.27 to 2.18 | 224,994,785 | 227,180,194 |

| US Treasury Bonds Inflation-Indexed 2.5% 1/15/2029 | | 1.71 to 1.89 | 171,432,316 | 174,482,521 |

| US Treasury Bonds Inflation-Indexed 3.625% 4/15/2028 | | 1.10 to 1.91 | 24,981,504 | 26,224,574 |

| US Treasury Bonds Inflation-Indexed 3.875% 4/15/2029 | | 1.49 to 2.29 | 196,818,450 | 211,153,206 |

| US Treasury Notes Inflation-Indexed 0.125% 10/15/2025 | | -2.10 to 2.47 | 423,035,940 | 418,165,175 |

| US Treasury Notes Inflation-Indexed 0.125% 10/15/2026 | | -1.83 to 1.97 | 413,782,127 | 402,340,472 |

| US Treasury Notes Inflation-Indexed 0.125% 4/15/2025 | | -2.19 to 3.97 | 336,169,400 | 334,085,192 |

| US Treasury Notes Inflation-Indexed 0.125% 4/15/2026 | | -1.89 to 2.54 | 331,767,682 | 323,853,006 |

| US Treasury Notes Inflation-Indexed 0.125% 4/15/2027 | | -0.44 to 1.89 | 469,112,800 | 449,713,635 |

| US Treasury Notes Inflation-Indexed 0.125% 7/15/2026 | | -1.91 to 2.32 | 415,799,583 | 406,131,837 |

| US Treasury Notes Inflation-Indexed 0.25% 1/15/2025 | | -2.29 to 4.90 | 416,285,071 | 415,679,029 |

| US Treasury Notes Inflation-Indexed 0.25% 7/15/2029 | | 1.59 to 1.80 | 335,047,290 | 310,392,474 |

| US Treasury Notes Inflation-Indexed 0.375% 1/15/2027 | | -1.74 to 2.40 | 336,090,748 | 325,924,639 |

| US Treasury Notes Inflation-Indexed 0.375% 7/15/2025 | | -2.21 to 2.84 | 416,799,426 | 414,287,969 |

| US Treasury Notes Inflation-Indexed 0.375% 7/15/2027 | | -0.17 to 1.69 | 271,054,822 | 261,623,381 |

| US Treasury Notes Inflation-Indexed 0.5% 1/15/2028 | | 1.40 to 1.85 | 420,963,894 | 402,506,982 |

| US Treasury Notes Inflation-Indexed 0.625% 1/15/2026 | | -1.97 to 2.71 | 390,973,677 | 385,617,434 |

| US Treasury Notes Inflation-Indexed 0.75% 7/15/2028 | | 1.66 to 1.76 | 345,949,254 | 332,349,955 |

| US Treasury Notes Inflation-Indexed 0.875% 1/15/2029 | | 1.67 to 1.89 | 318,660,686 | 304,315,392 |

| US Treasury Notes Inflation-Indexed 1.25% 4/15/2028 | | 1.27 to 1.96 | 523,353,547 | 510,007,518 |

| US Treasury Notes Inflation-Indexed 1.625% 10/15/2027 | | 1.32 to 2.23 | 517,673,338 | 514,651,684 |

| US Treasury Notes Inflation-Indexed 1.625% 10/15/2029 | | 1.77 to 1.99 | 479,284,819 | 471,368,778 |

| US Treasury Notes Inflation-Indexed 2.125% 4/15/2029 | | 1.48 to 2.29 | 470,796,044 | 471,480,330 |

| US Treasury Notes Inflation-Indexed 2.375% 10/15/2028 | | 1.38 to 2.43 | 423,984,726 | 430,640,729 |

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $9,217,516,971) | | | | 9,114,862,915 |

| | | | | |

| Money Market Funds - 0.0% |

| | | Yield (%) | Shares | Value ($) |

Fidelity Cash Central Fund (c) (Cost $3,312,713) | | 4.36 | 3,312,051 | 3,312,713 |

| | | | | |

| TOTAL INVESTMENT IN SECURITIES - 99.7% (Cost $9,220,829,684) | 9,118,175,628 |

NET OTHER ASSETS (LIABILITIES) - 0.3% | 29,017,336 |

| NET ASSETS - 100.0% | 9,147,192,964 |

| | |

Legend

| (a) | Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. |

| (b) | Amount is stated in United States dollars unless otherwise noted. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | Shares, end of period | % ownership, end of period |

| Fidelity Cash Central Fund | 86,324,413 | 2,086,913,681 | 2,169,925,277 | 6,985,121 | (104) | - | 3,312,713 | 3,312,051 | 0.0% |

| Total | 86,324,413 | 2,086,913,681 | 2,169,925,277 | 6,985,121 | (104) | - | 3,312,713 | 3,312,051 | |

| | | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2024, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| U.S. Treasury Obligations | 9,114,862,915 | - | 9,114,862,915 | - |

|

| Money Market Funds | 3,312,713 | 3,312,713 | - | - |

| Total Investments in Securities: | 9,118,175,628 | 3,312,713 | 9,114,862,915 | - |

Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund

Financial Statements

| Statement of Assets and Liabilities |

As of December 31, 2024 |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $9,217,516,971) | $ | 9,114,862,915 | | |

Fidelity Central Funds (cost $3,312,713) | | 3,312,713 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $9,220,829,684) | | | $ | 9,118,175,628 |

| Receivable for investments sold | | | | 258,308,207 |

| Receivable for fund shares sold | | | | 7,383,457 |

| Interest receivable | | | | 29,830,677 |

| Distributions receivable from Fidelity Central Funds | | | | 43,232 |

Total assets | | | | 9,413,741,201 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 207,600,045 | | |

| Payable for fund shares redeemed | | 58,939,323 | | |

| Other payables and accrued expenses | | 8,869 | | |

| Total liabilities | | | | 266,548,237 |

| Net Assets | | | $ | 9,147,192,964 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 9,382,866,349 |

| Total accumulated earnings (loss) | | | | (235,673,385) |

| Net Assets | | | $ | 9,147,192,964 |

Net Asset Value, offering price and redemption price per share ($9,147,192,964 ÷ 947,255,571 shares) | | | $ | 9.66 |

| Statement of Operations |

| Year ended December 31, 2024 |

| Investment Income | | | | |

| Interest | | | $ | 257,445,363 |

| Income from Fidelity Central Funds | | | | 6,985,121 |

| Total income | | | | 264,430,484 |

| Expenses | | | | |

| Custodian fees and expenses | $ | 30,922 | | |

| Independent trustees' fees and expenses | | 20,398 | | |

| Miscellaneous | | 1 | | |

| Total expenses before reductions | | 51,321 | | |

| Expense reductions | | (8,024) | | |

| Total expenses after reductions | | | | 43,297 |

| Net Investment income (loss) | | | | 264,387,187 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (42,176,195) | | |

| Fidelity Central Funds | | (104) | | |

| Total net realized gain (loss) | | | | (42,176,299) |

| Change in net unrealized appreciation (depreciation) on investment securities | | | | 146,117,915 |

| Net gain (loss) | | | | 103,941,616 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 368,328,803 |

| Statement of Changes in Net Assets |

| |

| | Year ended December 31, 2024 | | Year ended December 31, 2023 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 264,387,187 | $ | 190,535,717 |

| Net realized gain (loss) | | (42,176,299) | | (80,571,468) |

| Change in net unrealized appreciation (depreciation) | | 146,117,915 | | 194,932,184 |

| Net increase (decrease) in net assets resulting from operations | | 368,328,803 | | 304,896,433 |

| Distributions to shareholders | | (224,620,483) | | (172,713,221) |

| Distributions to shareholders from tax return of capital | | (15,688,981) | | - |

| | | | | |

| Total Distributions | | (240,309,464) | | (172,713,221) |

| Share transactions | | | | |

| Proceeds from sales of shares | | 3,326,150,090 | | 1,554,558,912 |

| Reinvestment of distributions | | 240,309,464 | | 172,713,220 |

| Cost of shares redeemed | | (1,687,529,375) | | (1,226,661,924) |

| | | | | |

Net increase (decrease) in net assets resulting from share transactions | | 1,878,930,179 | | 500,610,208 |

| Total increase (decrease) in net assets | | 2,006,949,518 | | 632,793,420 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 7,140,243,446 | | 6,507,450,026 |

| End of period | $ | 9,147,192,964 | $ | 7,140,243,446 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 342,018,194 | | 164,186,153 |

| Issued in reinvestment of distributions | | 24,825,599 | | 18,315,070 |

| Redeemed | | (173,400,296) | | (129,737,211) |

| Net increase (decrease) | | 193,443,497 | | 52,764,012 |

| | | | | |

Financial Highlights

Fidelity® Series 0-5 Year Inflation-Protected Bond Index Fund |

| |

| Years ended December 31, | | 2024 | | 2023 | | 2022 | | 2021 A |

Selected Per-Share Data | | | | | | | | |

| Net asset value, beginning of period | $ | 9.47 | $ | 9.28 | $ | 10.05 | $ | 10.00 |

| Income from Investment Operations | | | | | | | | |

Net investment income (loss) B,C | | .314 | | .265 | | .531 | | .127 |

| Net realized and unrealized gain (loss) | | .145 | | .166 | | (.814) | | .005 |

| Total from investment operations | | .459 | | .431 | | (.283) | | .132 |

| Distributions from net investment income | | (.251) | | (.241) | | (.477) | | (.071) |

| Distributions from tax return of capital | | (.018) | | - | | (.010) | | (.011) |

| Total distributions | | (.269) | | (.241) | | (.487) | | (.082) |

| Net asset value, end of period | $ | 9.66 | $ | 9.47 | $ | 9.28 | $ | 10.05 |

Total Return D,E | | | | 4.65% | | (2.84)% | | 1.33% |

Ratios to Average Net Assets C,F,G | | | | | | | | |

Expenses before reductions H | | -% | | -% | | -% | | -% I |

Expenses net of fee waivers, if any H | | | | -% | | -% | | -% I |

Expenses net of all reductions H | | -% | | -% | | -% | | -% I |

| Net investment income (loss) | | 3.26% | | 2.81% | | 5.38% | | 3.33% I |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 9,147,193 | $ | 7,140,243 | $ | 6,507,450 | $ | 4,199,988 |

Portfolio turnover rate J | | | | 31% | | 21% K | | 33% K |

AFor the period August 13, 2021 (commencement of operations) through December 31, 2021.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAmount represents less than .005%.

IAnnualized.

JAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs), derivatives or securities that mature within one year from acquisition.

KPortfolio turnover rate excludes securities received or delivered in-kind.

Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund

Schedule of Investments December 31, 2024

Showing Percentage of Net Assets

| U.S. Treasury Obligations - 99.5% |

| | | Yield (%) (a) | Principal Amount (b) | Value ($) |

| US Treasury Bonds Inflation-Indexed 0.125% 2/15/2051 | | -0.53 to 2.31 | 335,917,760 | 185,087,801 |

| US Treasury Bonds Inflation-Indexed 0.125% 2/15/2052 | | -0.15 to 1.73 | 437,818,095 | 237,834,293 |

| US Treasury Bonds Inflation-Indexed 0.25% 2/15/2050 | | -0.56 to 1.32 | 197,097,884 | 115,070,363 |

| US Treasury Bonds Inflation-Indexed 0.625% 2/15/2043 | | -0.58 to 2.27 | 271,707,250 | 199,211,976 |

| US Treasury Bonds Inflation-Indexed 0.75% 2/15/2042 | | -0.62 to 2.43 | 387,671,710 | 297,274,438 |

| US Treasury Bonds Inflation-Indexed 0.75% 2/15/2045 | | -0.53 to 2.04 | 358,901,449 | 260,293,569 |

| US Treasury Bonds Inflation-Indexed 0.875% 2/15/2047 | | -0.53 to 2.45 | 302,819,458 | 219,269,223 |

| US Treasury Bonds Inflation-Indexed 1% 2/15/2046 | | -0.53 to 1.89 | 380,230,432 | 286,644,322 |

| US Treasury Bonds Inflation-Indexed 1% 2/15/2048 | | -0.53 to 2.52 | 210,235,219 | 154,914,860 |

| US Treasury Bonds Inflation-Indexed 1% 2/15/2049 | | -0.54 to 2.38 | 130,633,405 | 95,286,677 |

| US Treasury Bonds Inflation-Indexed 1.375% 2/15/2044 | | -0.55 to 2.49 | 305,854,223 | 254,707,881 |

| US Treasury Bonds Inflation-Indexed 1.5% 2/15/2053 | | 1.43 to 2.56 | 244,243,900 | 195,801,972 |

| US Treasury Bonds Inflation-Indexed 2.125% 2/15/2040 | | -0.74 to 1.92 | 139,384,842 | 134,588,052 |

| US Treasury Bonds Inflation-Indexed 2.125% 2/15/2041 | | -0.70 to 2.36 | 253,058,079 | 244,985,322 |

| US Treasury Bonds Inflation-Indexed 2.125% 2/15/2054 | | 2.00 to 2.49 | 287,065,514 | 265,948,319 |

| US Treasury Bonds Inflation-Indexed 3.375% 4/15/2032 | | -1.11 to 1.74 | 114,144,184 | 123,591,026 |

| US Treasury Notes Inflation-Indexed 0.125% 1/15/2030 | | -1.27 to 2.28 | 650,694,172 | 591,164,065 |

| US Treasury Notes Inflation-Indexed 0.125% 1/15/2031 | | -1.15 to 2.11 | 767,932,723 | 681,786,230 |

| US Treasury Notes Inflation-Indexed 0.125% 1/15/2032 | | -0.71 to 2.47 | 902,368,275 | 782,512,272 |

| US Treasury Notes Inflation-Indexed 0.125% 7/15/2030 | | -1.25 to 2.17 | 759,259,842 | 684,561,418 |

| US Treasury Notes Inflation-Indexed 0.125% 7/15/2031 | | -1.13 to 2.09 | 762,041,813 | 671,043,040 |

| US Treasury Notes Inflation-Indexed 0.625% 7/15/2032 | | 0.09 to 2.03 | 823,086,944 | 735,919,559 |

| US Treasury Notes Inflation-Indexed 1.125% 1/15/2033 | | 1.15 to 1.93 | 884,866,200 | 814,211,701 |

| US Treasury Notes Inflation-Indexed 1.375% 7/15/2033 | | 1.57 to 2.49 | 863,196,785 | 807,800,383 |

| US Treasury Notes Inflation-Indexed 1.75% 1/15/2034 | | 1.69 to 2.25 | 881,499,544 | 845,330,572 |

| US Treasury Notes Inflation-Indexed 1.875% 7/15/2034 | | 1.55 to 2.24 | 932,049,735 | 903,361,268 |

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $12,465,894,673) | | | | 10,788,200,602 |

| | | | | |

| Money Market Funds - 0.1% |

| | | Yield (%) | Shares | Value ($) |

Fidelity Cash Central Fund (c) (Cost $9,356,380) | | 4.36 | 9,354,510 | 9,356,380 |

| | | | | |

| TOTAL INVESTMENT IN SECURITIES - 99.6% (Cost $12,475,251,053) | 10,797,556,982 |

NET OTHER ASSETS (LIABILITIES) - 0.4% | 44,922,554 |

| NET ASSETS - 100.0% | 10,842,479,536 |

| | |

Legend

| (a) | Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. |

| (b) | Amount is stated in United States dollars unless otherwise noted. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | Shares, end of period | % ownership, end of period |

| Fidelity Cash Central Fund | 1,277,209 | 547,137,820 | 539,057,071 | 445,999 | (1,578) | - | 9,356,380 | 9,354,510 | 0.0% |

| Total | 1,277,209 | 547,137,820 | 539,057,071 | 445,999 | (1,578) | - | 9,356,380 | 9,354,510 | |

| | | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2024, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| U.S. Treasury Obligations | 10,788,200,602 | - | 10,788,200,602 | - |

|

| Money Market Funds | 9,356,380 | 9,356,380 | - | - |

| Total Investments in Securities: | 10,797,556,982 | 9,356,380 | 10,788,200,602 | - |

Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund

Financial Statements

| Statement of Assets and Liabilities |

As of December 31, 2024 |

| Assets | | | | |

| Investment in securities, at value - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $12,465,894,673) | $ | 10,788,200,602 | | |

Fidelity Central Funds (cost $9,356,380) | | 9,356,380 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $12,475,251,053) | | | $ | 10,797,556,982 |

| Receivable for fund shares sold | | | | 55,437,946 |

| Interest receivable | | | | 45,920,352 |

| Distributions receivable from Fidelity Central Funds | | | | 34,062 |

Total assets | | | | 10,898,949,342 |

| Liabilities | | | | |

| Payable for investments purchased | $ | 47,656,000 | | |

| Payable for fund shares redeemed | | 8,803,268 | | |

| Other payables and accrued expenses | | 10,538 | | |

| Total liabilities | | | | 56,469,806 |

| Net Assets | | | $ | 10,842,479,536 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 13,486,011,587 |

| Total accumulated earnings (loss) | | | | (2,643,532,051) |

| Net Assets | | | $ | 10,842,479,536 |

Net Asset Value, offering price and redemption price per share ($10,842,479,536 ÷ 1,471,756,492 shares) | | | $ | 7.37 |

| Statement of Operations |

| Year ended December 31, 2024 |

| Investment Income | | | | |

| Interest | | | $ | 393,588,960 |

| Income from Fidelity Central Funds | | | | 445,999 |

| Total income | | | | 394,034,959 |

| Expenses | | | | |

| Custodian fees and expenses | $ | 41,690 | | |

| Independent trustees' fees and expenses | | 26,872 | | |

| Miscellaneous | | 2 | | |

| Total expenses | | | | 68,564 |

| Net Investment income (loss) | | | | 393,966,395 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (369,491,257) | | |

| Fidelity Central Funds | | (1,578) | | |

| Total net realized gain (loss) | | | | (369,492,835) |

| Change in net unrealized appreciation (depreciation) on investment securities | | | | (82,492,244) |

| Net gain (loss) | | | | (451,985,079) |

| Net increase (decrease) in net assets resulting from operations | | | $ | (58,018,684) |

| Statement of Changes in Net Assets |

| |

| | Year ended December 31, 2024 | | Year ended December 31, 2023 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 393,966,395 | $ | 339,995,932 |

| Net realized gain (loss) | | (369,492,835) | | (467,469,438) |

| Change in net unrealized appreciation (depreciation) | | (82,492,244) | | 375,327,641 |

| Net increase (decrease) in net assets resulting from operations | | (58,018,684) | | 247,854,135 |

| Distributions to shareholders | | (352,832,046) | | (314,692,881) |

| Distributions to shareholders from tax return of capital | | (20,783,643) | | - |

| | | | | |

| Total Distributions | | (373,615,689) | | (314,692,881) |

| Share transactions | | | | |

| Proceeds from sales of shares | | 2,862,067,705 | | 2,245,894,953 |

| Reinvestment of distributions | | 373,615,689 | | 314,692,850 |

| Cost of shares redeemed | | (1,846,064,557) | | (1,193,542,124) |

| | | | | |

Net increase (decrease) in net assets resulting from share transactions | | 1,389,618,837 | | 1,367,045,679 |

| Total increase (decrease) in net assets | | 957,984,464 | | 1,300,206,933 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 9,884,495,072 | | 8,584,288,139 |

| End of period | $ | 10,842,479,536 | $ | 9,884,495,072 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 373,482,174 | | 288,482,846 |

| Issued in reinvestment of distributions | | 48,914,975 | | 41,460,846 |

| Redeemed | | (241,211,094) | | (153,699,188) |

| Net increase (decrease) | | 181,186,055 | | 176,244,504 |

| | | | | |

Financial Highlights

Fidelity® Series 5+ Year Inflation-Protected Bond Index Fund |

| |

| Years ended December 31, | | 2024 | | 2023 | | 2022 | | 2021 A |

Selected Per-Share Data | | | | | | | | |

| Net asset value, beginning of period | $ | 7.66 | $ | 7.70 | $ | 10.13 | $ | 10.00 |

| Income from Investment Operations | | | | | | | | |

Net investment income (loss) B,C | | .287 | | .290 | | .579 | | .158 |

| Net realized and unrealized gain (loss) | | (.313) | | (.077) | | (2.494) | | .061 |

| Total from investment operations | | (.026) | | .213 | | (1.915) | | .219 |

| Distributions from net investment income | | (.249) | | (.253) | | (.514) | | (.089) |

| Distributions from net realized gain | | - | | - | | (.001) | | - |

| Distributions from tax return of capital | | (.015) | | - | | - | | - |

| Total distributions | | (.264) | | (.253) | | (.515) | | (.089) |

| Net asset value, end of period | $ | 7.37 | $ | 7.66 | $ | 7.70 | $ | 10.13 |

Total Return D,E | | | | 2.81% | | (19.04)% | | 2.21% |

Ratios to Average Net Assets C,F,G | | | | | | | | |

Expenses before reductions H | | -% | | -% | | -% | | -% I |

Expenses net of fee waivers, if any H | | | | -% | | -% | | -% I |

Expenses net of all reductions H | | -% | | -% | | -% | | -% I |

| Net investment income (loss) | | 3.76% | | 3.73% | | 6.57% | | 4.16% I |

| Supplemental Data | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 10,842,480 | $ | 9,884,495 | $ | 8,584,288 | $ | 7,218,254 |

Portfolio turnover rate J | | | | 31% | | 31% K | | 31% K |

AFor the period August 13, 2021 (commencement of operations) through December 31, 2021.

BCalculated based on average shares outstanding during the period.

CNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

DTotal returns for periods of less than one year are not annualized.

ETotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAmount represents less than .005%.

IAnnualized.

JAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs), derivatives or securities that mature within one year from acquisition.

KPortfolio turnover rate excludes securities received or delivered in-kind.

Notes to Financial Statements

For the period ended December 31, 2024

1. Organization.

Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund and Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (the Funds) are funds of Fidelity Salem Street Trust (the Trust). The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Each Fund is authorized to issue an unlimited number of shares. Shares are offered only to certain other Fidelity funds, Fidelity managed 529 plans, and Fidelity managed collective investment trusts.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.