UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | August 31 |

Date of reporting period: | February 28, 2021 |

Item 1.

Reports to Stockholders

Fidelity® Investment Grade Bond Fund

Semi-Annual Report

February 28, 2021

Includes Fidelity and Fidelity Advisor share classes

Contents

Board Approval of Investment Advisory Contracts and Management Fees | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

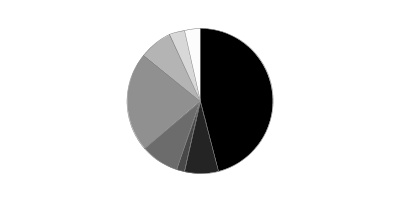

The information in the following tables is based on the combined investments of the Fund and its pro-rata share of the investments of Fidelity's Fixed-Income Central Funds.Quality Diversification (% of fund's net assets)

| As of February 28, 2021 | ||

| U.S. Government and U.S. Government Agency Obligations | 45.9% | |

| AAA | 7.6% | |

| AA | 1.7% | |

| A | 8.5% | |

| BBB | 22.2% | |

| BB and Below | 7.3% | |

| Not Rated | 3.3% | |

| Short-Term Investments and Net Other Assets | 3.5% | |

We have used ratings from Moody’s Investors Service, Inc. Where Moody’s® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. Securities rated BB or below were rated investment grade at the time of acquisition.

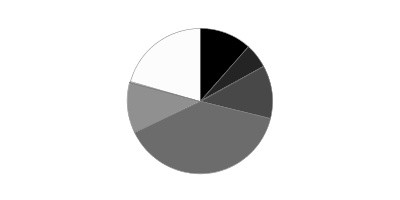

Asset Allocation (% of fund's net assets)

| As of February 28, 2021*,**,*** | ||

| Corporate Bonds | 36.5% | |

| U.S. Government and U.S. Government Agency Obligations | 45.9% | |

| Asset-Backed Securities | 6.6% | |

| CMOs and Other Mortgage Related Securities | 6.5% | |

| Municipal Bonds | 0.4% | |

| Other Investments | 0.6% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.5% | |

* Foreign investments - 10.8%

** Futures and Swaps - 2.5%

*** Written options - (1.1)%

An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of any securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or institutional.fidelity.com, as applicable.

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments.

Schedule of Investments February 28, 2021 (Unaudited)

Showing Percentage of Net Assets

| Nonconvertible Bonds - 35.2% | |||

| Principal Amount (000s) | Value (000s) | ||

| COMMUNICATION SERVICES - 3.6% | |||

| Diversified Telecommunication Services - 1.5% | |||

| AT&T, Inc.: | |||

| 2.55% 12/1/33 (a) | $1,806 | $1,745 | |

| 3.8% 12/1/57 (a) | 17,133 | 16,289 | |

| 4.3% 2/15/30 | 34,036 | 39,034 | |

| 4.75% 5/15/46 | 24,566 | 28,272 | |

| 4.9% 6/15/42 | 4,363 | 5,142 | |

| 5.55% 8/15/41 | 7,917 | 10,044 | |

| 6.2% 3/15/40 | 1,454 | 1,946 | |

| Verizon Communications, Inc.: | |||

| 2.987% 10/30/56 (a) | 869 | 783 | |

| 3.15% 3/22/30 | 6,996 | 7,504 | |

| 4.329% 9/21/28 | 19,797 | 23,037 | |

| 4.5% 8/10/33 | 3,429 | 4,090 | |

| 4.862% 8/21/46 | 14,251 | 17,582 | |

| 5.012% 4/15/49 | 82 | 104 | |

| 155,572 | |||

| Entertainment - 0.3% | |||

| The Walt Disney Co.: | |||

| 2.2% 1/13/28 | 6,562 | 6,804 | |

| 2.65% 1/13/31 | 10,500 | 11,004 | |

| 4.7% 3/23/50 | 7,961 | 10,191 | |

| 27,999 | |||

| Media - 1.5% | |||

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp.: | |||

| 2.8% 4/1/31 | 25,400 | 25,720 | |

| 3.7% 4/1/51 | 15,400 | 14,647 | |

| 4.464% 7/23/22 | 3,780 | 3,955 | |

| 4.908% 7/23/25 | 2,932 | 3,347 | |

| 5.375% 5/1/47 | 22,326 | 26,244 | |

| 5.75% 4/1/48 | 11,014 | 13,578 | |

| Comcast Corp.: | |||

| 3.4% 4/1/30 | 1,770 | 1,968 | |

| 3.75% 4/1/40 | 622 | 702 | |

| 4.65% 7/15/42 | 1,628 | 2,038 | |

| Discovery Communications LLC: | |||

| 3.625% 5/15/30 | 4,063 | 4,469 | |

| 4.65% 5/15/50 | 10,998 | 12,748 | |

| Fox Corp.: | |||

| 4.709% 1/25/29 | 1,385 | 1,625 | |

| 5.476% 1/25/39 | 1,366 | 1,754 | |

| 5.576% 1/25/49 | 906 | 1,193 | |

| Time Warner Cable LLC: | |||

| 4% 9/1/21 | 8,096 | 8,165 | |

| 4.5% 9/15/42 | 544 | 600 | |

| 5.5% 9/1/41 | 966 | 1,182 | |

| 5.875% 11/15/40 | 7,077 | 9,010 | |

| 6.55% 5/1/37 | 3,601 | 4,900 | |

| 6.75% 6/15/39 | 6,233 | 8,594 | |

| 7.3% 7/1/38 | 2,390 | 3,416 | |

| 149,855 | |||

| Wireless Telecommunication Services - 0.3% | |||

| T-Mobile U.S.A., Inc.: | |||

| 3.75% 4/15/27 (a) | 6,800 | 7,490 | |

| 3.875% 4/15/30 (a) | 20,000 | 21,988 | |

| 4.5% 4/15/50 (a) | 2,885 | 3,206 | |

| 32,684 | |||

| TOTAL COMMUNICATION SERVICES | 366,110 | ||

| CONSUMER DISCRETIONARY - 1.8% | |||

| Automobiles - 0.7% | |||

| General Motors Co. 5.4% 10/2/23 | 11,588 | 12,918 | |

| General Motors Financial Co., Inc.: | |||

| 3.7% 5/9/23 | 5,526 | 5,854 | |

| 4% 1/15/25 | 15,000 | 16,386 | |

| 4.25% 5/15/23 | 858 | 921 | |

| 4.375% 9/25/21 | 3,354 | 3,431 | |

| 5.2% 3/20/23 | 7,090 | 7,731 | |

| Volkswagen Group of America Finance LLC: | |||

| 2.9% 5/13/22 (a) | 6,678 | 6,874 | |

| 3.125% 5/12/23 (a) | 5,817 | 6,130 | |

| 3.35% 5/13/25 (a) | 9,370 | 10,153 | |

| 70,398 | |||

| Hotels, Restaurants & Leisure - 0.0% | |||

| Starbucks Corp. 1.3% 5/7/22 | 3,483 | 3,522 | |

| Household Durables - 0.5% | |||

| D.R. Horton, Inc. 2.6% 10/15/25 | 9,432 | 9,994 | |

| Lennar Corp.: | |||

| 4.75% 11/29/27 | 15,563 | 18,014 | |

| 5% 6/15/27 | 8,419 | 9,850 | |

| Toll Brothers Finance Corp.: | |||

| 4.35% 2/15/28 | 2,908 | 3,228 | |

| 4.875% 11/15/25 | 32 | 36 | |

| 4.875% 3/15/27 | 10,045 | 11,476 | |

| 5.625% 1/15/24 | 838 | 943 | |

| 53,541 | |||

| Internet & Direct Marketing Retail - 0.2% | |||

| Alibaba Group Holding Ltd.: | |||

| 2.125% 2/9/31 | 3,090 | 2,996 | |

| 2.7% 2/9/41 | 16,100 | 15,054 | |

| 18,050 | |||

| Leisure Products - 0.1% | |||

| Hasbro, Inc.: | |||

| 2.6% 11/19/22 | 1,815 | 1,876 | |

| 3% 11/19/24 | 4,130 | 4,425 | |

| 6,301 | |||

| Specialty Retail - 0.3% | |||

| AutoNation, Inc. 4.75% 6/1/30 | 909 | 1,072 | |

| AutoZone, Inc. 4% 4/15/30 | 21,631 | 24,662 | |

| O'Reilly Automotive, Inc. 4.2% 4/1/30 | 1,273 | 1,469 | |

| 27,203 | |||

| TOTAL CONSUMER DISCRETIONARY | 179,015 | ||

| CONSUMER STAPLES - 3.0% | |||

| Beverages - 1.1% | |||

| Anheuser-Busch InBev Finance, Inc.: | |||

| 4.7% 2/1/36 | 4,168 | 5,024 | |

| 4.9% 2/1/46 | 9,089 | 10,872 | |

| Anheuser-Busch InBev Worldwide, Inc.: | |||

| 3.5% 6/1/30 | 8,200 | 9,064 | |

| 4.35% 6/1/40 | 3,930 | 4,569 | |

| 4.5% 6/1/50 | 9,000 | 10,378 | |

| 4.6% 6/1/60 | 7,261 | 8,348 | |

| 4.75% 1/23/29 | 18,172 | 21,494 | |

| 4.75% 4/15/58 | 3,562 | 4,235 | |

| 5.45% 1/23/39 | 3,537 | 4,548 | |

| 5.55% 1/23/49 | 8,082 | 10,517 | |

| 5.8% 1/23/59 (Reg. S) | 8,567 | 11,820 | |

| Constellation Brands, Inc. 4.75% 11/15/24 | 2,399 | 2,740 | |

| PepsiCo, Inc.: | |||

| 2.625% 3/19/27 | 712 | 768 | |

| 2.75% 3/19/30 | 6,600 | 7,066 | |

| 111,443 | |||

| Food & Staples Retailing - 0.9% | |||

| Sysco Corp.: | |||

| 3.3% 2/15/50 | 3,840 | 3,793 | |

| 6.6% 4/1/40 | 14,365 | 20,444 | |

| 6.6% 4/1/50 | 42,857 | 63,463 | |

| Walgreens Boots Alliance, Inc. 3.3% 11/18/21 | 1,216 | 1,235 | |

| 88,935 | |||

| Food Products - 1.0% | |||

| General Mills, Inc. 2.875% 4/15/30 | 797 | 844 | |

| JBS U.S.A. LLC/JBS U.S.A. Finance, Inc. 6.75% 2/15/28 (a) | 3,000 | 3,292 | |

| JBS U.S.A. Lux SA / JBS Food Co. 5.5% 1/15/30 (a) | 38,000 | 42,560 | |

| Kraft Heinz Foods Co.: | |||

| 3% 6/1/26 | 5,000 | 5,306 | |

| 3.875% 5/15/27 | 12,300 | 13,445 | |

| 4.375% 6/1/46 | 4,122 | 4,491 | |

| 4.625% 1/30/29 | 14,700 | 17,031 | |

| 5.2% 7/15/45 | 8,219 | 9,877 | |

| 7.125% 8/1/39 (a) | 5,618 | 8,239 | |

| 105,085 | |||

| Personal Products - 0.0% | |||

| Estee Lauder Companies, Inc. 3.125% 12/1/49 | 3,472 | 3,655 | |

| TOTAL CONSUMER STAPLES | 309,118 | ||

| ENERGY - 2.7% | |||

| Oil, Gas & Consumable Fuels - 2.7% | |||

| Canadian Natural Resources Ltd. 3.45% 11/15/21 | 1,673 | 1,695 | |

| Columbia Pipeline Group, Inc. 4.5% 6/1/25 | 538 | 609 | |

| DCP Midstream Operating LP: | |||

| 3.875% 3/15/23 | 1,968 | 2,027 | |

| 4.75% 9/30/21 (a) | 1,411 | 1,422 | |

| 5.6% 4/1/44 | 1,707 | 1,771 | |

| 5.85% 5/21/43 (a)(b) | 2,821 | 2,504 | |

| Enable Midstream Partners LP 3.9% 5/15/24 (b) | 549 | 587 | |

| Enbridge Energy Partners LP 4.2% 9/15/21 | 1,656 | 1,674 | |

| Enbridge, Inc.: | |||

| 4% 10/1/23 | 2,296 | 2,476 | |

| 4.25% 12/1/26 | 923 | 1,052 | |

| Energy Transfer Partners LP: | |||

| 3.75% 5/15/30 | 2,274 | 2,404 | |

| 4.2% 9/15/23 | 759 | 817 | |

| 4.25% 3/15/23 | 830 | 879 | |

| 4.5% 4/15/24 | 952 | 1,044 | |

| 4.95% 6/15/28 | 2,591 | 2,953 | |

| 5% 5/15/50 | 5,083 | 5,382 | |

| 5.25% 4/15/29 | 1,549 | 1,796 | |

| 5.8% 6/15/38 | 1,445 | 1,668 | |

| 6% 6/15/48 | 941 | 1,096 | |

| 6.25% 4/15/49 | 1,064 | 1,272 | |

| Hess Corp.: | |||

| 4.3% 4/1/27 | 834 | 926 | |

| 7.125% 3/15/33 | 839 | 1,103 | |

| 7.3% 8/15/31 | 1,023 | 1,348 | |

| 7.875% 10/1/29 | 2,921 | 3,897 | |

| Kinder Morgan Energy Partners LP 5% 10/1/21 | 920 | 934 | |

| Marathon Petroleum Corp. 5.125% 3/1/21 | 1,000 | 1,000 | |

| MPLX LP: | |||

| 3 month U.S. LIBOR + 1.100% 1.3304% 9/9/22 (b)(c) | 2,046 | 2,047 | |

| 4.8% 2/15/29 | 816 | 955 | |

| 4.875% 12/1/24 | 1,247 | 1,410 | |

| 5.5% 2/15/49 | 2,450 | 2,977 | |

| Occidental Petroleum Corp.: | |||

| 2.9% 8/15/24 | 3,821 | 3,719 | |

| 3.2% 8/15/26 | 514 | 492 | |

| 3.5% 8/15/29 | 1,621 | 1,550 | |

| 4.3% 8/15/39 | 236 | 209 | |

| 4.4% 8/15/49 | 236 | 208 | |

| 5.55% 3/15/26 | 3,038 | 3,243 | |

| 6.45% 9/15/36 | 2,750 | 3,135 | |

| 6.6% 3/15/46 | 3,032 | 3,404 | |

| 7.5% 5/1/31 | 3,937 | 4,626 | |

| Ovintiv, Inc.: | |||

| 5.15% 11/15/41 | 2,000 | 2,061 | |

| 8.125% 9/15/30 | 3,357 | 4,460 | |

| Petrobras Global Finance BV 7.25% 3/17/44 | 17,308 | 19,924 | |

| Petroleos Mexicanos: | |||

| 6.49% 1/23/27 | 1,757 | 1,838 | |

| 6.5% 3/13/27 | 5,805 | 6,023 | |

| 6.75% 9/21/47 | 14,189 | 12,419 | |

| 6.84% 1/23/30 | 8,589 | 8,632 | |

| 6.95% 1/28/60 | 4,247 | 3,736 | |

| 7.69% 1/23/50 | 67,826 | 64,428 | |

| Plains All American Pipeline LP/PAA Finance Corp.: | |||

| 3.55% 12/15/29 | 1,242 | 1,275 | |

| 3.65% 6/1/22 | 2,386 | 2,450 | |

| 4.65% 10/15/25 | 26,960 | 29,896 | |

| Regency Energy Partners LP/Regency Energy Finance Corp. 5.875% 3/1/22 | 1,450 | 1,505 | |

| Sabine Pass Liquefaction LLC 4.5% 5/15/30 | 9,286 | 10,621 | |

| Sunoco Logistics Partner Operations LP 5.4% 10/1/47 | 1,026 | 1,126 | |

| The Williams Companies, Inc.: | |||

| 3.5% 11/15/30 | 9,960 | 10,819 | |

| 3.7% 1/15/23 | 510 | 536 | |

| Western Gas Partners LP: | |||

| 3.95% 6/1/25 | 764 | 772 | |

| 4.65% 7/1/26 | 1,129 | 1,169 | |

| 4.75% 8/15/28 | 781 | 818 | |

| 5.375% 6/1/21 | 3,036 | 3,036 | |

| 6.5% 2/1/50 | 7,720 | 8,883 | |

| 268,738 | |||

| FINANCIALS - 16.7% | |||

| Banks - 8.5% | |||

| Bank of America Corp.: | |||

| 1.922% 10/24/31 (b) | 20,000 | 19,415 | |

| 2.884% 10/22/30 (b) | 50,000 | 52,936 | |

| 3.004% 12/20/23 (b) | 6,352 | 6,639 | |

| 3.3% 1/11/23 | 1,679 | 1,773 | |

| 3.419% 12/20/28 (b) | 3,280 | 3,618 | |

| 3.5% 4/19/26 | 3,838 | 4,271 | |

| 3.95% 4/21/25 | 32,873 | 36,381 | |

| 4% 1/22/25 | 16,960 | 18,781 | |

| 4.1% 7/24/23 | 900 | 979 | |

| 4.183% 11/25/27 | 4,363 | 4,942 | |

| 4.2% 8/26/24 | 5,249 | 5,826 | |

| 4.25% 10/22/26 | 23,937 | 27,423 | |

| 4.45% 3/3/26 | 11,356 | 13,003 | |

| Banque Federative du Credit Mutuel SA 3 month U.S. LIBOR + 0.730% 0.954% 7/20/22 (a)(b)(c) | 4,861 | 4,902 | |

| Barclays Bank PLC: | |||

| 1.7% 5/12/22 | 3,331 | 3,382 | |

| 10.179% 6/12/21 (a) | 1,105 | 1,134 | |

| Barclays PLC: | |||

| 2.852% 5/7/26 (b) | 9,444 | 9,964 | |

| 4.375% 1/12/26 | 2,821 | 3,192 | |

| 4.836% 5/9/28 | 3,683 | 4,193 | |

| 5.088% 6/20/30 (b) | 11,424 | 13,262 | |

| 5.2% 5/12/26 | 26,475 | 30,121 | |

| BNP Paribas SA 2.219% 6/9/26 (a)(b) | 9,008 | 9,337 | |

| BPCE SA 4.875% 4/1/26 (a) | 4,662 | 5,373 | |

| CIT Group, Inc. 3.929% 6/19/24 (b) | 2,035 | 2,155 | |

| Citigroup, Inc.: | |||

| 2.976% 11/5/30 (b) | 50,000 | 53,049 | |

| 4.075% 4/23/29 (b) | 16,389 | 18,665 | |

| 4.125% 7/25/28 | 4,363 | 4,944 | |

| 4.3% 11/20/26 | 1,115 | 1,271 | |

| 4.4% 6/10/25 | 11,914 | 13,381 | |

| 4.412% 3/31/31 (b) | 21,454 | 24,957 | |

| 4.45% 9/29/27 | 55,258 | 63,746 | |

| 4.6% 3/9/26 | 5,613 | 6,441 | |

| 5.3% 5/6/44 | 6,000 | 7,917 | |

| 5.5% 9/13/25 | 4,886 | 5,778 | |

| Citizens Financial Group, Inc. 2.638% 9/30/32 (a) | 4,614 | 4,610 | |

| Commonwealth Bank of Australia 3.61% 9/12/34 (a)(b) | 2,250 | 2,384 | |

| Fifth Third Bancorp 8.25% 3/1/38 | 694 | 1,150 | |

| HSBC Holdings PLC: | |||

| 4.25% 3/14/24 | 905 | 990 | |

| 4.95% 3/31/30 | 1,541 | 1,853 | |

| 5.25% 3/14/44 | 656 | 848 | |

| Intesa Sanpaolo SpA: | |||

| 5.017% 6/26/24 (a) | 836 | 911 | |

| 5.71% 1/15/26 (a) | 33,406 | 37,641 | |

| JPMorgan Chase & Co.: | |||

| 2.956% 5/13/31 (b) | 5,034 | 5,260 | |

| 4.125% 12/15/26 | 9,713 | 11,133 | |

| 4.493% 3/24/31 (b) | 17,000 | 20,158 | |

| NatWest Markets PLC 2.375% 5/21/23 (a) | 10,214 | 10,634 | |

| Rabobank Nederland 4.375% 8/4/25 | 3,024 | 3,417 | |

| Royal Bank of Scotland Group PLC: | |||

| 3.073% 5/22/28 (b) | 5,536 | 5,870 | |

| 4.8% 4/5/26 | 12,145 | 13,983 | |

| 5.125% 5/28/24 | 19,005 | 21,246 | |

| 6% 12/19/23 | 24,003 | 27,230 | |

| 6.1% 6/10/23 | 36,812 | 40,924 | |

| 6.125% 12/15/22 | 13,833 | 15,091 | |

| Societe Generale: | |||

| 1.488% 12/14/26 (a)(b) | 13,930 | 13,844 | |

| 4.25% 4/14/25 (a) | 4,491 | 4,908 | |

| Synchrony Bank 3% 6/15/22 | 2,516 | 2,591 | |

| UniCredit SpA 6.572% 1/14/22 (a) | 4,200 | 4,399 | |

| Wells Fargo & Co.: | |||

| 2.406% 10/30/25 (b) | 4,928 | 5,194 | |

| 3.196% 6/17/27 (b) | 40,441 | 44,015 | |

| 4.3% 7/22/27 | 16,184 | 18,682 | |

| 4.478% 4/4/31 (b) | 15,500 | 18,322 | |

| 5.013% 4/4/51 (b) | 22,853 | 30,561 | |

| Westpac Banking Corp. 4.11% 7/24/34 (b) | 3,103 | 3,420 | |

| 854,420 | |||

| Capital Markets - 4.5% | |||

| Affiliated Managers Group, Inc. 4.25% 2/15/24 | 881 | 969 | |

| Ares Capital Corp.: | |||

| 3.875% 1/15/26 | 16,340 | 17,460 | |

| 4.2% 6/10/24 | 7,281 | 7,908 | |

| Credit Suisse Group AG: | |||

| 2.593% 9/11/25 (a)(b) | 9,092 | 9,564 | |

| 3.75% 3/26/25 | 6,137 | 6,725 | |

| 4.194% 4/1/31 (a)(b) | 30,399 | 34,647 | |

| 4.55% 4/17/26 | 1,859 | 2,143 | |

| Deutsche Bank AG 4.5% 4/1/25 | 8,603 | 9,171 | |

| Deutsche Bank AG New York Branch: | |||

| 3.3% 11/16/22 | 4,654 | 4,853 | |

| 3.729% 1/14/32 (b) | 8,509 | 8,466 | |

| 4.1% 1/13/26 | 5,262 | 5,756 | |

| 5% 2/14/22 | 7,035 | 7,320 | |

| Goldman Sachs Group, Inc.: | |||

| 2.876% 10/31/22 (b) | 6,719 | 6,828 | |

| 3.272% 9/29/25 (b) | 60,430 | 65,524 | |

| 3.5% 4/1/25 | 12,527 | 13,701 | |

| 3.8% 3/15/30 | 49,000 | 55,632 | |

| 4.25% 10/21/25 | 7,670 | 8,651 | |

| 6.75% 10/1/37 | 24,081 | 35,131 | |

| Intercontinental Exchange, Inc. 3.75% 12/1/25 | 1,287 | 1,428 | |

| Morgan Stanley: | |||

| 3 month U.S. LIBOR + 0.930% 1.1524% 7/22/22 (b)(c) | 2,232 | 2,239 | |

| 3.125% 7/27/26 | 9,330 | 10,199 | |

| 3.622% 4/1/31 (b) | 35,865 | 39,959 | |

| 3.625% 1/20/27 | 10,480 | 11,757 | |

| 3.7% 10/23/24 | 3,002 | 3,313 | |

| 3.875% 4/29/24 | 2,765 | 3,041 | |

| 4.431% 1/23/30 (b) | 53,331 | 62,452 | |

| 4.875% 11/1/22 | 6,287 | 6,740 | |

| 5% 11/24/25 | 13,117 | 15,312 | |

| State Street Corp.: | |||

| 2.825% 3/30/23 (b) | 737 | 758 | |

| 2.901% 3/30/26 (b) | 691 | 745 | |

| 458,392 | |||

| Consumer Finance - 1.9% | |||

| AerCap Ireland Capital Ltd./AerCap Global Aviation Trust: | |||

| 2.875% 8/14/24 | 5,100 | 5,312 | |

| 3.5% 5/26/22 | 185 | 191 | |

| 4.125% 7/3/23 | 2,684 | 2,855 | |

| 4.45% 4/3/26 | 2,472 | 2,703 | |

| 4.875% 1/16/24 | 3,901 | 4,258 | |

| 6.5% 7/15/25 | 4,349 | 5,098 | |

| Ally Financial, Inc.: | |||

| 1.45% 10/2/23 | 3,119 | 3,171 | |

| 3.05% 6/5/23 | 11,466 | 12,057 | |

| 3.875% 5/21/24 | 7,111 | 7,731 | |

| 4.625% 3/30/25 | 2,237 | 2,517 | |

| 5.125% 9/30/24 | 2,258 | 2,577 | |

| 5.8% 5/1/25 | 19,772 | 23,193 | |

| 8% 11/1/31 | 3,172 | 4,542 | |

| Capital One Financial Corp.: | |||

| 3.65% 5/11/27 | 15,715 | 17,486 | |

| 3.8% 1/31/28 | 6,614 | 7,434 | |

| Discover Financial Services: | |||

| 3.95% 11/6/24 | 1,184 | 1,301 | |

| 4.1% 2/9/27 | 8,206 | 9,271 | |

| 4.5% 1/30/26 | 3,562 | 4,055 | |

| Ford Motor Credit Co. LLC: | |||

| 3.096% 5/4/23 | 12,100 | 12,289 | |

| 4.063% 11/1/24 | 18,137 | 18,997 | |

| 5.584% 3/18/24 | 4,908 | 5,295 | |

| 5.596% 1/7/22 | 4,576 | 4,713 | |

| Synchrony Financial: | |||

| 2.85% 7/25/22 | 1,278 | 1,316 | |

| 3.75% 8/15/21 | 920 | 929 | |

| 3.95% 12/1/27 | 5,215 | 5,744 | |

| 4.25% 8/15/24 | 7,369 | 8,091 | |

| 4.375% 3/19/24 | 5,520 | 6,059 | |

| 5.15% 3/19/29 | 7,283 | 8,647 | |

| 187,832 | |||

| Diversified Financial Services - 0.4% | |||

| Brixmor Operating Partnership LP: | |||

| 4.05% 7/1/30 | 6,803 | 7,534 | |

| 4.125% 6/15/26 | 3,253 | 3,655 | |

| 4.125% 5/15/29 | 12,222 | 13,628 | |

| Equitable Holdings, Inc. 3.9% 4/20/23 | 425 | 455 | |

| Park Aerospace Holdings Ltd. 5.5% 2/15/24 (a) | 4,907 | 5,337 | |

| Pine Street Trust I 4.572% 2/15/29 (a) | 4,516 | 5,282 | |

| Pine Street Trust II 5.568% 2/15/49 (a) | 4,529 | 5,998 | |

| Voya Financial, Inc. 3.125% 7/15/24 | 1,580 | 1,705 | |

| 43,594 | |||

| Insurance - 1.4% | |||

| AIA Group Ltd. 3.375% 4/7/30 (a) | 8,169 | 8,927 | |

| American International Group, Inc. 3.4% 6/30/30 | 17,400 | 19,078 | |

| Five Corners Funding Trust II 2.85% 5/15/30 (a) | 11,366 | 12,071 | |

| Liberty Mutual Group, Inc.: | |||

| 3.95% 5/15/60 (a) | 10,260 | 11,216 | |

| 4.569% 2/1/29 (a) | 1,534 | 1,816 | |

| Lincoln National Corp. 3.4% 1/15/31 | 9,415 | 10,382 | |

| Marsh & McLennan Companies, Inc. 4.8% 7/15/21 | 855 | 860 | |

| MetLife, Inc. 4.55% 3/23/30 | 19,500 | 23,436 | |

| Metropolitan Life Global Funding I U.S. SECURED OVERNIGHT FINL RATE (SOFR) INDX + 0.500% 0.53% 5/28/21 (a)(b)(c) | 22,531 | 22,555 | |

| New York Life Insurance Co. 3.75% 5/15/50 (a) | 1,978 | 2,199 | |

| Pacific LifeCorp 5.125% 1/30/43 (a) | 1,657 | 2,069 | |

| Pricoa Global Funding I 5.375% 5/15/45 (b) | 1,988 | 2,204 | |

| Progressive Corp. 3.2% 3/26/30 | 949 | 1,058 | |

| Prudential Financial, Inc.: | |||

| 3.935% 12/7/49 | 2,764 | 3,162 | |

| 4.5% 11/16/21 | 813 | 837 | |

| Swiss Re Finance Luxembourg SA 5% 4/2/49 (a)(b) | 1,800 | 2,063 | |

| Teachers Insurance & Annuity Association of America 3.3% 5/15/50 (a) | 4,631 | 4,704 | |

| Unum Group: | |||

| 4% 6/15/29 | 3,614 | 3,991 | |

| 4.5% 3/15/25 | 8,253 | 9,250 | |

| 5.75% 8/15/42 | 1,024 | 1,235 | |

| 143,113 | |||

| TOTAL FINANCIALS | 1,687,351 | ||

| HEALTH CARE - 2.3% | |||

| Biotechnology - 0.5% | |||

| AbbVie, Inc. 3.2% 11/21/29 | 43,367 | 46,885 | |

| Health Care Providers & Services - 0.4% | |||

| Anthem, Inc. 3.3% 1/15/23 | 2,729 | 2,869 | |

| Centene Corp.: | |||

| 3.375% 2/15/30 | 5,110 | 5,252 | |

| 4.25% 12/15/27 | 5,450 | 5,675 | |

| 4.625% 12/15/29 | 8,470 | 9,139 | |

| 4.75% 1/15/25 | 4,335 | 4,443 | |

| Cigna Corp. 4.375% 10/15/28 | 4,187 | 4,884 | |

| CVS Health Corp. 3.625% 4/1/27 | 1,944 | 2,162 | |

| HCA Holdings, Inc. 4.75% 5/1/23 | 87 | 94 | |

| Toledo Hospital: | |||

| 5.325% 11/15/28 | 1,513 | 1,777 | |

| 6.015% 11/15/48 | 2,871 | 3,658 | |

| 39,953 | |||

| Pharmaceuticals - 1.4% | |||

| Bayer U.S. Finance II LLC: | |||

| 4.25% 12/15/25 (a) | 49,732 | 56,010 | |

| 4.375% 12/15/28 (a) | 58,400 | 67,766 | |

| Elanco Animal Health, Inc.: | |||

| 4.912% 8/27/21 (b) | 680 | 689 | |

| 5.272% 8/28/23 (b) | 2,148 | 2,309 | |

| 5.9% 8/28/28 (b) | 905 | 1,050 | |

| Teva Pharmaceutical Finance Netherlands III BV 2.2% 7/21/21 | 473 | 473 | |

| Utah Acquisition Sub, Inc. 3.95% 6/15/26 | 1,304 | 1,456 | |

| Viatris, Inc.: | |||

| 1.65% 6/22/25 (a) | 1,203 | 1,221 | |

| 2.7% 6/22/30 (a) | 6,115 | 6,198 | |

| 3.85% 6/22/40 (a) | 2,664 | 2,825 | |

| 4% 6/22/50 (a) | 4,600 | 4,776 | |

| Zoetis, Inc. 3.25% 2/1/23 | 764 | 800 | |

| 145,573 | |||

| TOTAL HEALTH CARE | 232,411 | ||

| INDUSTRIALS - 1.4% | |||

| Aerospace & Defense - 0.4% | |||

| BAE Systems PLC 3.4% 4/15/30 (a) | 2,547 | 2,779 | |

| The Boeing Co.: | |||

| 5.04% 5/1/27 | 4,840 | 5,578 | |

| 5.15% 5/1/30 | 14,840 | 17,292 | |

| 5.705% 5/1/40 | 4,840 | 6,098 | |

| 5.805% 5/1/50 | 4,840 | 6,243 | |

| 5.93% 5/1/60 | 4,840 | 6,350 | |

| 44,340 | |||

| Building Products - 0.0% | |||

| Masco Corp. 4.45% 4/1/25 | 657 | 743 | |

| Industrial Conglomerates - 0.4% | |||

| General Electric Co.: | |||

| 3.45% 5/1/27 | 1,589 | 1,745 | |

| 3.625% 5/1/30 | 3,695 | 4,032 | |

| 4.25% 5/1/40 | 14,600 | 16,213 | |

| 4.35% 5/1/50 | 11,664 | 12,972 | |

| 34,962 | |||

| Road & Rail - 0.0% | |||

| CSX Corp. 3.8% 4/15/50 | 1,525 | 1,712 | |

| Trading Companies & Distributors - 0.5% | |||

| Air Lease Corp.: | |||

| 0.7% 2/15/24 | 9,054 | 8,972 | |

| 2.25% 1/15/23 | 1,128 | 1,158 | |

| 3% 9/15/23 | 368 | 386 | |

| 3.375% 6/1/21 | 1,236 | 1,245 | |

| 3.375% 7/1/25 | 7,888 | 8,385 | |

| 3.75% 2/1/22 | 1,846 | 1,890 | |

| 3.75% 6/1/26 | 15,000 | 16,244 | |

| 3.875% 4/1/21 | 1,333 | 1,333 | |

| 4.25% 2/1/24 | 4,331 | 4,724 | |

| 4.25% 9/15/24 | 1,473 | 1,618 | |

| 45,955 | |||

| Transportation Infrastructure - 0.1% | |||

| Avolon Holdings Funding Ltd.: | |||

| 3.625% 5/1/22 (a) | 1,257 | 1,280 | |

| 3.95% 7/1/24 (a) | 5,580 | 5,843 | |

| 4.375% 5/1/26 (a) | 2,047 | 2,172 | |

| 5.25% 5/15/24 (a) | 3,116 | 3,393 | |

| BNSF Funding Trust I 6.613% 12/15/55 (b) | 868 | 999 | |

| 13,687 | |||

| TOTAL INDUSTRIALS | 141,399 | ||

| INFORMATION TECHNOLOGY - 1.2% | |||

| Electronic Equipment & Components - 0.1% | |||

| Diamond 1 Finance Corp./Diamond 2 Finance Corp.: | |||

| 5.45% 6/15/23 (a) | 3,397 | 3,726 | |

| 5.85% 7/15/25 (a) | 1,437 | 1,691 | |

| 6.02% 6/15/26 (a) | 1,159 | 1,389 | |

| 6.1% 7/15/27 (a) | 2,638 | 3,234 | |

| 6.2% 7/15/30 (a) | 2,284 | 2,902 | |

| 12,942 | |||

| Semiconductors & Semiconductor Equipment - 0.7% | |||

| Broadcom, Inc.: | |||

| 1.95% 2/15/28 (a) | 2,435 | 2,400 | |

| 2.45% 2/15/31 (a) | 20,716 | 20,118 | |

| 2.6% 2/15/33 (a) | 20,716 | 19,889 | |

| 3.5% 2/15/41 (a) | 16,728 | 16,670 | |

| 3.75% 2/15/51 (a) | 7,851 | 7,741 | |

| NVIDIA Corp.: | |||

| 2.85% 4/1/30 | 2,157 | 2,320 | |

| 3.5% 4/1/50 | 4,671 | 5,068 | |

| 74,206 | |||

| Software - 0.4% | |||

| Oracle Corp.: | |||

| 2.5% 4/1/25 | 6,375 | 6,757 | |

| 2.8% 4/1/27 | 6,375 | 6,857 | |

| 2.95% 4/1/30 | 6,400 | 6,887 | |

| 3.6% 4/1/50 | 6,370 | 6,675 | |

| 3.85% 4/1/60 | 6,400 | 6,915 | |

| 34,091 | |||

| Technology Hardware, Storage & Peripherals - 0.0% | |||

| Hewlett Packard Enterprise Co. 4.4% 10/15/22 (b) | 2,004 | 2,120 | |

| TOTAL INFORMATION TECHNOLOGY | 123,359 | ||

| MATERIALS - 0.0% | |||

| Metals & Mining - 0.0% | |||

| Anglo American Capital PLC 4.125% 4/15/21 (a) | 705 | 707 | |

| Corporacion Nacional del Cobre de Chile (Codelco): | |||

| 3.625% 8/1/27 (a) | 947 | 1,033 | |

| 4.5% 8/1/47 (a) | 961 | 1,072 | |

| 2,812 | |||

| REAL ESTATE - 1.7% | |||

| Equity Real Estate Investment Trusts (REITs) - 1.4% | |||

| Alexandria Real Estate Equities, Inc.: | |||

| 2% 5/18/32 | 6,718 | 6,545 | |

| 4.9% 12/15/30 | 4,519 | 5,516 | |

| Boston Properties, Inc.: | |||

| 3.25% 1/30/31 | 4,526 | 4,801 | |

| 4.5% 12/1/28 | 2,824 | 3,303 | |

| Corporate Office Properties LP: | |||

| 2.25% 3/15/26 | 2,339 | 2,399 | |

| 5% 7/1/25 | 1,435 | 1,626 | |

| Duke Realty LP: | |||

| 3.25% 6/30/26 | 372 | 408 | |

| 3.625% 4/15/23 | 975 | 1,030 | |

| Healthcare Trust of America Holdings LP: | |||

| 3.1% 2/15/30 | 1,129 | 1,197 | |

| 3.5% 8/1/26 | 1,176 | 1,301 | |

| Healthpeak Properties, Inc. 3.5% 7/15/29 | 540 | 596 | |

| Highwoods/Forsyth LP 3.2% 6/15/21 | 334 | 335 | |

| Hudson Pacific Properties LP 4.65% 4/1/29 | 6,288 | 7,188 | |

| Lexington Corporate Properties Trust: | |||

| 2.7% 9/15/30 | 2,571 | 2,587 | |

| 4.4% 6/15/24 | 599 | 651 | |

| Omega Healthcare Investors, Inc.: | |||

| 3.375% 2/1/31 | 4,780 | 4,899 | |

| 3.625% 10/1/29 | 5,204 | 5,461 | |

| 4.375% 8/1/23 | 3,083 | 3,328 | |

| 4.5% 1/15/25 | 1,271 | 1,385 | |

| 4.5% 4/1/27 | 452 | 501 | |

| 4.75% 1/15/28 | 7,132 | 7,954 | |

| 4.95% 4/1/24 | 557 | 611 | |

| 5.25% 1/15/26 | 2,371 | 2,694 | |

| Realty Income Corp. 3.25% 1/15/31 | 1,277 | 1,389 | |

| Retail Opportunity Investments Partnership LP: | |||

| 4% 12/15/24 | 405 | 431 | |

| 5% 12/15/23 | 312 | 335 | |

| Retail Properties America, Inc.: | |||

| 4% 3/15/25 | 8,142 | 8,568 | |

| 4.75% 9/15/30 | 13,258 | 14,329 | |

| Simon Property Group LP: | |||

| 2.45% 9/13/29 | 1,897 | 1,927 | |

| 3.375% 12/1/27 | 3,864 | 4,250 | |

| SITE Centers Corp.: | |||

| 3.625% 2/1/25 | 967 | 1,008 | |

| 4.25% 2/1/26 | 1,683 | 1,804 | |

| Store Capital Corp.: | |||

| 2.75% 11/18/30 | 2,849 | 2,842 | |

| 4.625% 3/15/29 | 1,396 | 1,588 | |

| Ventas Realty LP: | |||

| 3% 1/15/30 | 6,770 | 7,087 | |

| 3.125% 6/15/23 | 652 | 685 | |

| 4% 3/1/28 | 1,358 | 1,530 | |

| 4.125% 1/15/26 | 630 | 713 | |

| 4.75% 11/15/30 | 10,898 | 12,899 | |

| VEREIT Operating Partnership LP: | |||

| 2.2% 6/15/28 | 1,146 | 1,146 | |

| 2.85% 12/15/32 | 1,410 | 1,407 | |

| 3.4% 1/15/28 | 1,957 | 2,114 | |

| Weingarten Realty Investors 3.375% 10/15/22 | 288 | 297 | |

| WP Carey, Inc.: | |||

| 3.85% 7/15/29 | 1,045 | 1,162 | |

| 4% 2/1/25 | 2,162 | 2,374 | |

| 4.6% 4/1/24 | 3,364 | 3,725 | |

| 139,926 | |||

| Real Estate Management & Development - 0.3% | |||

| Brandywine Operating Partnership LP: | |||

| 3.95% 2/15/23 | 4,946 | 5,188 | |

| 3.95% 11/15/27 | 2,767 | 2,914 | |

| 4.1% 10/1/24 | 2,463 | 2,648 | |

| 4.55% 10/1/29 | 1,135 | 1,244 | |

| CBRE Group, Inc. 4.875% 3/1/26 | 4,953 | 5,766 | |

| Essex Portfolio LP 3.875% 5/1/24 | 1,215 | 1,321 | |

| Mack-Cali Realty LP: | |||

| 3.15% 5/15/23 | 2,256 | 2,280 | |

| 4.5% 4/18/22 | 429 | 438 | |

| Mid-America Apartments LP 4% 11/15/25 | 522 | 583 | |

| Post Apartment Homes LP 3.375% 12/1/22 | 317 | 330 | |

| Tanger Properties LP: | |||

| 3.125% 9/1/26 | 1,660 | 1,718 | |

| 3.75% 12/1/24 | 1,630 | 1,745 | |

| 3.875% 12/1/23 | 748 | 785 | |

| 3.875% 7/15/27 | 6,943 | 7,351 | |

| 34,311 | |||

| TOTAL REAL ESTATE | 174,237 | ||

| UTILITIES - 0.8% | |||

| Electric Utilities - 0.2% | |||

| Cleco Corporate Holdings LLC 3.375% 9/15/29 | 2,932 | 3,038 | |

| DPL, Inc. 4.35% 4/15/29 | 2,835 | 3,153 | |

| Duquesne Light Holdings, Inc.: | |||

| 2.532% 10/1/30 (a) | 1,869 | 1,863 | |

| 5.9% 12/1/21 (a) | 2,456 | 2,544 | |

| Exelon Corp.: | |||

| 4.05% 4/15/30 | 1,893 | 2,168 | |

| 4.7% 4/15/50 | 843 | 1,050 | |

| FirstEnergy Corp.: | |||

| 4.25% 3/15/23 | 2,843 | 3,010 | |

| 7.375% 11/15/31 | 3,623 | 4,983 | |

| IPALCO Enterprises, Inc. 3.7% 9/1/24 | 1,240 | 1,347 | |

| 23,156 | |||

| Gas Utilities - 0.0% | |||

| Nakilat, Inc. 6.067% 12/31/33 (a) | 766 | 966 | |

| Southern Natural Gas Co./Southern Natural Issuing Corp. 4.4% 6/15/21 | 443 | 444 | |

| 1,410 | |||

| Independent Power and Renewable Electricity Producers - 0.2% | |||

| The AES Corp.: | |||

| 3.3% 7/15/25 (a) | 10,148 | 10,880 | |

| 3.95% 7/15/30 (a) | 8,852 | 9,671 | |

| 20,551 | |||

| Multi-Utilities - 0.4% | |||

| Berkshire Hathaway Energy Co.: | |||

| 3.7% 7/15/30 (a) | 1,064 | 1,208 | |

| 4.05% 4/15/25 (a) | 13,567 | 15,121 | |

| Consolidated Edison Co. of New York, Inc.: | |||

| 3.35% 4/1/30 | 855 | 945 | |

| 3.95% 4/1/50 | 1,501 | 1,702 | |

| NiSource, Inc.: | |||

| 2.95% 9/1/29 | 7,262 | 7,688 | |

| 5.95% 6/15/41 | 1,097 | 1,471 | |

| Puget Energy, Inc.: | |||

| 4.1% 6/15/30 | 3,951 | 4,412 | |

| 5.625% 7/15/22 | 2,087 | 2,199 | |

| 6% 9/1/21 | 2,012 | 2,067 | |

| Sempra Energy 6% 10/15/39 | 1,733 | 2,332 | |

| WEC Energy Group, Inc. 3 month U.S. LIBOR + 2.110% 2.3063% 5/15/67 (b)(c) | 1,164 | 1,073 | |

| 40,218 | |||

| TOTAL UTILITIES | 85,335 | ||

| TOTAL NONCONVERTIBLE BONDS | |||

| (Cost $3,321,520) | 3,569,885 | ||

| U.S. Treasury Obligations - 29.9% | |||

| U.S. Treasury Bonds: | |||

| 1.25% 5/15/50 | $639,000 | $516,042 | |

| 1.375% 8/15/50 | 261,100 | 217,978 | |

| 1.875% 2/15/51 | 116,995 | 110,780 | |

| U.S. Treasury Notes: | |||

| 0.125% 6/30/22 | 1,281,800 | 1,282,259 | |

| 0.125% 8/31/22 | 480,000 | 480,019 | |

| 0.875% 11/15/30 (d) | 392,780 | 374,491 | |

| 3.125% 11/15/28 | 38,238 | 43,678 | |

| TOTAL U.S. TREASURY OBLIGATIONS | |||

| (Cost $3,193,549) | 3,025,247 | ||

| Asset-Backed Securities - 6.6% | |||

| AASET Trust: | |||

| Series 2018-1A Class A, 3.844% 1/16/38 (a) | $8,865 | $8,819 | |

| Series 2019-1 Class A, 3.844% 5/15/39 (a) | 3,089 | 3,117 | |

| Series 2019-2: | |||

| Class A, 3.376% 10/16/39 (a) | 5,102 | 5,132 | |

| Class B, 4.458% 10/16/39 (a) | 931 | 877 | |

| Aimco Series 2019-10A Class A, 3 month U.S. LIBOR + 1.320% 1.5424% 7/22/32 (a)(b)(c) | 7,607 | 7,613 | |

| AIMCO CLO Ltd.: | |||

| Series 2020-11A Class A1, 3 month U.S. LIBOR + 1.380% 1.6046% 10/15/31 (a)(b)(c) | 6,499 | 6,512 | |

| Series 2021-12A Class A, 3 month U.S. LIBOR + 1.210% 1.4356% 1/17/32 (a)(b)(c) | 9,800 | 9,807 | |

| Allegany Park CLO, Ltd. / Allegany Series 2020-1A Class A, 3 month U.S. LIBOR + 1.330% 1.554% 1/20/33 (a)(b)(c) | 2,910 | 2,919 | |

| Apollo Aviation Securitization Equity Trust Series 2020-1A: | |||

| Class A, 3.351% 1/16/40 (a) | 2,865 | 2,866 | |

| Class B, 4.335% 1/16/40 (a) | 473 | 445 | |

| Ares CLO Series 2019-54A Class A, 3 month U.S. LIBOR + 1.320% 1.5613% 10/15/32 (a)(b)(c) | 4,806 | 4,816 | |

| Ares CLO Ltd. Series 2020-58A Class A, 3 month U.S. LIBOR + 1.220% 1.4558% 1/15/33 (a)(b)(c) | 9,160 | 9,171 | |

| Ares LV CLO Ltd. Series 2020-55A Class A1, 3 month U.S. LIBOR + 1.700% 1.9413% 4/15/31 (a)(b)(c) | 6,888 | 6,904 | |

| Ares XLI CLO Ltd. / Ares XLI CLO LLC: | |||

| Series 2016-41A Class AR, 3 month U.S. LIBOR + 1.200% 1.4413% 1/15/29 (a)(b)(c) | 5,768 | 5,767 | |

| Series 2021-41A Class AR2, 1 month U.S. LIBOR + 1.070% 1.07% 4/15/34 (a)(b)(c)(e) | 9,992 | 9,992 | |

| Ares XXXIV CLO Ltd. Series 2020-2A Class AR2, 3 month U.S. LIBOR + 1.250% 1.4734% 4/17/33 (a)(b)(c) | 16,288 | 16,342 | |

| Babson CLO Ltd./Cayman Islands Series 2020-1A Class A1, 3 month U.S. LIBOR + 1.400% 1.6413% 10/15/32 (a)(b)(c) | 10,448 | 10,475 | |

| Barings CLO Ltd. Series 2021-4A Class A, 3 month U.S. LIBOR + 1.220% 1.444% 1/20/32 (a)(b)(c) | 9,800 | 9,809 | |

| Beechwood Park CLO Ltd. Series 2019-1A Class A1, 3 month U.S. LIBOR + 1.330% 1.5534% 1/17/33 (a)(b)(c) | 7,272 | 7,304 | |

| Blackbird Capital Aircraft Series 2016-1A: | |||

| Class A, 4.213% 12/16/41 (a) | 3,853 | 3,864 | |

| Class AA, 2.487% 12/16/41 (a)(b) | 641 | 643 | |

| Bristol Park CLO, Ltd. Series 2020-1A Class AR, 3 month U.S. LIBOR + 0.990% 1.2313% 4/15/29 (a)(b)(c) | 6,524 | 6,522 | |

| Castlelake Aircraft Securitization Trust Series 2019-1A: | |||

| Class A, 3.967% 4/15/39 (a) | 5,424 | 5,435 | |

| Class B, 5.095% 4/15/39 (a) | 2,147 | 2,070 | |

| Castlelake Aircraft Structured Trust: | |||

| Series 2018-1 Class A, 4.125% 6/15/43 (a) | 3,424 | 3,450 | |

| Series 2021-1A: | |||

| Class A, 3.474% 1/15/46 (a) | 3,104 | 3,147 | |

| Class B, 6.656% 1/15/46 (a) | 1,939 | 1,946 | |

| Cedar Funding Ltd.: | |||

| Series 2019-10A Class A, 3 month U.S. LIBOR + 1.340% 1.564% 10/20/32 (a)(b)(c) | 3,832 | 3,851 | |

| Series 2019-11A Class A1A, 3 month U.S. LIBOR + 1.350% 1.5744% 5/29/32 (a)(b)(c) | 2,558 | 2,564 | |

| Cedar Funding XII CLO Ltd. / Cedar Funding XII CLO LLC Series 2020-12A Class A, 3 month U.S. LIBOR + 1.270% 1.5101% 10/25/32 (a)(b)(c) | 5,300 | 5,319 | |

| CEDF: | |||

| Series 2018-6A Class AR, 3 month U.S. LIBOR + 1.090% 1.314% 10/20/28 (a)(b)(c) | 1,790 | 1,791 | |

| Series 2021-6A Class ARR, 3 month U.S. LIBOR + 1.050% 0% 4/20/34 (a)(b)(c)(e) | 8,665 | 8,665 | |

| Cent CLO Ltd. / Cent CLO Series 2020-29A Class A1N, 3 month U.S. LIBOR + 1.700% 1.924% 7/20/31 (a)(b)(c) | 7,685 | 7,726 | |

| Columbia Cent CLO 31 Ltd. Series 2021-31A Class A1, 3 month U.S. LIBOR + 1.200% 1.3474% 4/20/34 (a)(b)(c) | 9,800 | 9,800 | |

| Columbia Cent CLO Ltd. / Columbia Cent CLO Corp. Series 2021-30A Class A1, 3 month U.S. LIBOR + 1.310% 1.534% 1/20/34 (a)(b)(c) | 12,900 | 12,927 | |

| DB Master Finance LLC: | |||

| Series 2017-1A: | |||

| Class A2I, 3.629% 11/20/47 (a) | 12,060 | 12,330 | |

| Class A2II, 4.03% 11/20/47 (a) | 3,370 | 3,570 | |

| Series 2019-1A: | |||

| Class A23, 4.352% 5/20/49 (a) | 605 | 652 | |

| Class A2II, 4.021% 5/20/49 (a) | 814 | 863 | |

| Dominos Pizza Master Issuer LLC Series 2017-1A Class A2I, 3 month U.S. LIBOR + 1.250% 1.4678% 7/25/47 (a)(b)(c) | 6,593 | 6,600 | |

| Dryden 68 CLO Ltd. 3 month U.S. LIBOR + 1.310% 1.5513% 7/15/32 (a)(b)(c) | 6,350 | 6,355 | |

| Dryden CLO, Ltd.: | |||

| Series 2019-75A Class AR, 3 month U.S. LIBOR + 1.200% 1.4413% 7/15/30 (a)(b)(c) | 3,971 | 3,970 | |

| Series 2019-76A Class A1, 3 month U.S. LIBOR + 1.330% 1.554% 10/20/32 (a)(b)(c) | 7,839 | 7,871 | |

| Series 2021-83A Class A, 3 month U.S. LIBOR + 1.220% 1.4573% 1/18/32 (a)(b)(c) | 4,100 | 4,104 | |

| Dryden CLO, Ltd. / Dryden CLO, LLC Series 2020-85A Class A1, 3 month U.S. LIBOR + 1.350% 1.5633% 10/15/32 (a)(b)(c) | 7,751 | 7,779 | |

| Dryden Senior Loan Fund: | |||

| Series 2018-70A Class A1, 3 month U.S. LIBOR + 1.170% 1.3934% 1/16/32 (a)(b)(c) | 1,808 | 1,816 | |

| Series 2019-72A Class A, 3 month U.S. LIBOR + 1.330% 1.5238% 5/15/32 (a)(b)(c) | 4,433 | 4,435 | |

| Series 2020-78A Class A, 3 month U.S. LIBOR + 1.180% 1.4034% 4/17/33 (a)(b)(c) | 4,300 | 4,328 | |

| Eaton Vance CLO, Ltd.: | |||

| Series 2020-1A Class A, 3 month U.S. LIBOR + 1.650% 1.8913% 10/15/30 (a)(b)(c) | 8,500 | 8,533 | |

| Series 2020-2A Class A1, 3 month U.S. LIBOR + 1.370% 1.5603% 10/15/32 (a)(b)(c) | 9,600 | 9,616 | |

| Eaton Vance CLO, Ltd. / Eaton Vance CLO LLC Series 2021-1A Class A13R, 3 month U.S. LIBOR + 1.250% 1.4101% 1/15/34 (a)(b)(c) | 2,050 | 2,050 | |

| Flatiron CLO Ltd. Series 2019-1A Class A, 3 month U.S. LIBOR + 1.320% 1.5138% 11/16/32 (a)(b)(c) | 5,330 | 5,346 | |

| Flatiron CLO Ltd. / Flatiron CLO LLC Series 2020-1A Class A, 3 month U.S. LIBOR + 1.300% 1.5483% 11/20/33 (a)(b)(c) | 9,100 | 9,179 | |

| Ford Credit Floorplan Master Owner Trust: | |||

| Series 2018-1 Class B, 3.1% 5/15/23 | 15,490 | 15,694 | |

| Series 2019-2 Class A, 3.06% 4/15/26 | 7,032 | 7,560 | |

| Series 2019-3 Class A1, 2.23% 9/15/24 | 3,461 | 3,561 | |

| Series 2019-4 Class A, 2.44% 9/15/26 | 1,010 | 1,072 | |

| Series 2020-2 Class B, 1.32% 9/15/27 | 4,000 | 3,990 | |

| GM Financial Automobile Leasing Trust Series 2020-1 Class A2A, 1.67% 4/20/22 | 2,349 | 2,358 | |

| GMF Floorplan Owner Revolving Trust: | |||

| Series 2018-2 Class A2, 3.13% 3/15/23 (a) | 3,997 | 4,002 | |

| Series 2018-4 Class A2, 1 month U.S. LIBOR + 0.410% 0.5174% 9/15/23 (a)(b)(c) | 2,627 | 2,631 | |

| Series 2020-1 Class C, 1.48% 8/15/25 (a) | 4,912 | 4,998 | |

| Series 2020-2 Class C, 1.31% 10/15/25 (a) | 6,000 | 6,061 | |

| Horizon Aircraft Finance I Ltd. Series 2018-1 Class A, 4.458% 12/15/38 (a) | 1,932 | 1,951 | |

| Horizon Aircraft Finance Ltd. Series 2019-1 Class A, 3.721% 7/15/39 (a) | 2,809 | 2,817 | |

| Lucali CLO Ltd. Series 2021-1A Class A, 3 month U.S. LIBOR + 1.210% 1.4484% 1/15/33 (a)(b)(c) | 4,700 | 4,703 | |

| Madison Park Funding Series 2020-19A Class A1R2, 3 month U.S. LIBOR + 0.920% 1.1424% 1/22/28 (a)(b)(c) | 5,075 | 5,075 | |

| Madison Park Funding L Ltd. / Madison Park Funding L LLC Series 2021-50A Class A, 3 month U.S. LIBOR + 1.140% 1.14% 4/19/34 (a)(b)(c)(e) | 10,220 | 10,220 | |

| Madison Park Funding Ltd. Series 2019-37A Class A1, 3 month U.S. LIBOR + 1.300% 1.5413% 7/15/32 (a)(b)(c) | 5,884 | 5,888 | |

| Madison Park Funding XLV Ltd./Madison Park Funding XLV LLC Series 2020-45A Class A, 3 month U.S. LIBOR + 1.650% 1.8913% 7/15/31 (a)(b)(c) | 8,330 | 8,349 | |

| Madison Park Funding XXXIII Ltd. Series 2019-33A Class A, 3 month U.S. LIBOR + 1.330% 1.5713% 10/15/32 (a)(b)(c) | 2,535 | 2,549 | |

| Magnetite XVI, Ltd. / Magnetite XVI, LLC Series 2015-16A Class AR, 3 month U.S. LIBOR + 0.800% 1.0234% 1/18/28 (a)(b)(c) | 6,552 | 6,530 | |

| Magnetite XXI Ltd.: | |||

| Series 2019-21A Class A, 3 month U.S. LIBOR + 1.280% 1.504% 4/20/30 (a)(b)(c) | 4,379 | 4,380 | |

| Series 2019-24A Class A, 3 month U.S. LIBOR + 1.330% 1.5713% 1/15/33 (a)(b)(c) | 24,000 | 24,075 | |

| Series 2021-21A Class AR, 3 month U.S. LIBOR + 1.020% 0% 4/20/34 (a)(b)(c) | 8,363 | 8,363 | |

| Magnetite XXIX, Ltd. / Magnetite XXIX LLC Series 2021-29A Class A, 3 month U.S. LIBOR + 0.990% 0.99% 1/15/34 (a)(b)(c)(e) | 8,900 | 8,900 | |

| Mercedes-Benz Master Owner Trust Series 2019-BA Class A, 2.61% 5/15/24 (a) | 6,827 | 7,022 | |

| Milos CLO, Ltd. Series 2020-1A Class AR, 3 month U.S. LIBOR + 1.070% 1.294% 10/20/30 (a)(b)(c) | 6,552 | 6,554 | |

| Mortgage Repurchase Agreement Financing Trust Series 2020-5 Class A1, 1 month U.S. LIBOR + 1.000% 1.1205% 8/10/23 (a)(b)(c) | 18,032 | 17,984 | |

| New Century Home Equity Loan Trust Series 2005-4 Class M2, 1 month U.S. LIBOR + 0.760% 0.8826% 9/25/35 (b)(c) | 11 | 11 | |

| Niagara Park CLO, Ltd. Series 2019-1A Class A, 3 month U.S. LIBOR + 1.300% 1.5234% 7/17/32 (a)(b)(c) | 5,105 | 5,111 | |

| Nissan Master Owner Trust Receivables Series 2019-B Class A, 1 month U.S. LIBOR + 0.430% 0.5374% 11/15/23 (b)(c) | 8,520 | 8,541 | |

| Planet Fitness Master Issuer LLC: | |||

| Series 2018-1A: | |||

| Class A2I, 4.262% 9/5/48 (a) | 28,772 | 28,811 | |

| Class A2II, 4.666% 9/5/48 (a) | 3,155 | 3,173 | |

| Series 2019-1A Class A2, 3.858% 12/5/49 (a) | 4,671 | 4,453 | |

| Project Silver Series 2019-1 Class A, 3.967% 7/15/44 (a) | 9,353 | 9,365 | |

| Santander Retail Auto Lease Trust Series 2019-C Class A2A, 1.89% 9/20/22 (a) | 1,557 | 1,567 | |

| Sapphire Aviation Finance Series 2020-1A: | |||

| Class A, 3.228% 3/15/40 (a) | 15,997 | 15,949 | |

| Class B, 4.335% 3/15/40 (a) | 522 | 470 | |

| SBA Tower Trust: | |||

| Series 2019, 2.836% 1/15/50 (a) | 5,278 | 5,588 | |

| 1.884% 7/15/50 (a) | 3,008 | 3,102 | |

| 2.328% 7/15/52 (a) | 2,300 | 2,380 | |

| Stratus CLO Ltd. Series 2020-1A Class A, 3 month U.S. LIBOR + 1.980% 2.204% 5/1/28 (a)(b)(c) | 7,741 | 7,747 | |

| Symphony CLO XXIII Ltd. Series 2020-23A Class A, 3 month U.S. LIBOR + 1.320% 1.4867% 1/15/34 (a)(b)(c) | 5,410 | 5,420 | |

| Symphony CLO XXVI Ltd. / Symphony CLO XXVI LLC Series 2021-26A Class AR, 3 month U.S. LIBOR + 1.080% 1.08% 4/20/33 (a)(b)(c)(e) | 7,800 | 7,800 | |

| Taconic Park CLO, Ltd. Series 2020-1A Class A1R, 3 month U.S. LIBOR + 1.000% 1.224% 1/20/29 (a)(b)(c) | 4,376 | 4,383 | |

| Terwin Mortgage Trust Series 2003-4HE Class A1, 1 month U.S. LIBOR + 0.860% 0.5476% 9/25/34 (b)(c) | 5 | 4 | |

| Thunderbolt Aircraft Lease Ltd. Series 2018-A Class A, 4.147% 9/15/38 (a)(b) | 6,122 | 6,107 | |

| Thunderbolt III Aircraft Lease Ltd. Series 2019-1 Class A, 3.671% 11/15/39 (a) | 7,367 | 7,313 | |

| Trapeza CDO XII Ltd./Trapeza CDO XII, Inc. Series 2007-12A Class B, 3 month U.S. LIBOR + 0.560% 0.7973% 4/6/42 (a)(b)(c) | 491 | 314 | |

| Treman Park CLO, Ltd. Series 2018-1A Class ARR, 3 month U.S. LIBOR + 1.070% 1.294% 10/20/28 (a)(b)(c) | 12,224 | 12,225 | |

| Verde CLO Ltd. Series 2019-1A Class A, 3 month U.S. LIBOR + 1.350% 1.5913% 4/15/32 (a)(b)(c) | 4,965 | 4,965 | |

| Voya Series 2020-1A Class A, 3 month U.S. LIBOR + 1.700% 1.9234% 7/16/31 (a)(b)(c) | 8,331 | 8,354 | |

| Voya CLO Ltd.: | |||

| Series 2017-1A Class A1, 3 month U.S. LIBOR + 1.250% 1.4734% 4/17/30 (a)(b)(c) | 6,481 | 6,497 | |

| Series 2019-2A Class A, 3 month U.S. LIBOR + 1.270% 1.494% 7/20/32 (a)(b)(c) | 5,397 | 5,401 | |

| Voya CLO Ltd./Voya CLO LLC: | |||

| Series 2020-2A Class A1, 3 month U.S. LIBOR + 1.600% 1.8234% 7/19/31 (a)(b)(c) | 8,500 | 8,517 | |

| Series 2020-3A Class A1, 3 month U.S. LIBOR + 1.300% 1.4965% 10/20/31 (a)(b)(c) | 12,000 | 12,066 | |

| World Omni Automobile Lease Securitization Trust Series 2020-A Class A2, 1.71% 11/15/22 | 819 | 826 | |

| TOTAL ASSET-BACKED SECURITIES | |||

| (Cost $665,898) | 671,551 | ||

| Collateralized Mortgage Obligations - 0.3% | |||

| Private Sponsor - 0.3% | |||

| CSMC Series 2014-3R: | |||

| Class 2A1, 1 month U.S. LIBOR + 0.700% 0% 5/27/37(a)(b)(c)(f) | 338 | 0 | |

| Class AA1, 1 month U.S. LIBOR + 0.280% 0.4739% 5/27/37 (a)(b)(c) | 639 | 598 | |

| Mortgage Repurchase Agreement Financing Trust: | |||

| floater Series 2020-3 Class A1, 1 month U.S. LIBOR + 1.250% 1.3705% 1/23/23 (a)(b)(c) | 3,934 | 3,935 | |

| Series 2020-4 Class A1, 1 month U.S. LIBOR + 1.350% 1.4705% 4/23/23 (a)(b)(c) | 18,687 | 18,686 | |

| Permanent Master Issuer PLC floater Series-1A Class 1A1, 3 month U.S. LIBOR + 0.550% 0.7913% 7/15/58 (a)(b)(c) | 5,000 | 5,006 | |

| Sequoia Mortgage Trust floater Series 2004-6 Class A3B, 6 month U.S. LIBOR + 0.880% 1.14% 7/20/34 (b)(c) | 1 | 1 | |

| Silverstone Master Issuer PLC floater: | |||

| Series 2018-1A Class 1A, 3 month U.S. LIBOR + 0.390% 0.6136% 1/21/70 (a)(b)(c) | 3,136 | 3,140 | |

| Series 2019-1A Class 1A, 3 month U.S. LIBOR + 0.570% 0.7936% 1/21/70 (a)(b)(c) | 3,175 | 3,182 | |

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | |||

| (Cost $34,622) | 34,548 | ||

| Commercial Mortgage Securities - 6.2% | |||

| BAMLL Commercial Mortgage Securities Trust: | |||

| floater Series 2019-RLJ Class A, 1 month U.S. LIBOR + 1.050% 1.162% 4/15/36 (a)(b)(c) | 8,900 | 8,872 | |

| floater sequential payer Series 2020-JGDN Class A, 1 month U.S. LIBOR + 2.750% 2.862% 11/15/30 (a)(b)(c) | 8,340 | 8,358 | |

| sequential payer Series 2019-BPR Class ANM, 3.112% 11/5/32 (a) | 3,676 | 3,744 | |

| Series 2019-BPR: | |||

| Class BNM, 3.465% 11/5/32 (a) | 825 | 796 | |

| Class CNM, 3.7186% 11/5/32 (a)(b) | 341 | 317 | |

| BANK sequential payer: | |||

| Series 2018-BN10 Class A5, 3.688% 2/15/61 | 2,479 | 2,773 | |

| Series 2019-BN21 Class A5, 2.851% 10/17/52 | 5,732 | 6,115 | |

| Series 2019-BN24 Class A3, 2.96% 11/15/62 | 6,283 | 6,725 | |

| Bayview Commercial Asset Trust floater: | |||

| Series 2003-2 Class M1, 1 month U.S. LIBOR + 1.270% 1.3926% 12/25/33 (a)(b)(c) | 7 | 7 | |

| Series 2005-3A: | |||

| Class A2, 1 month U.S. LIBOR + 0.600% 0.5176% 11/25/35 (a)(b)(c) | 24 | 23 | |

| Class M1, 1 month U.S. LIBOR + 0.660% 0.5576% 11/25/35 (a)(b)(c) | 12 | 11 | |

| Class M2, 1 month U.S. LIBOR + 0.730% 0.6076% 11/25/35 (a)(b)(c) | 17 | 16 | |

| Class M3, 1 month U.S. LIBOR + 0.760% 0.6276% 11/25/35 (a)(b)(c) | 15 | 13 | |

| Class M4, 1 month U.S. LIBOR + 0.900% 0.7176% 11/25/35 (a)(b)(c) | 18 | 17 | |

| Series 2005-4A: | |||

| Class A2, 1 month U.S. LIBOR + 0.390% 0.5076% 1/25/36 (a)(b)(c) | 60 | 57 | |

| Class B1, 1 month U.S. LIBOR + 1.400% 1.5176% 1/25/36 (a)(b)(c)(f) | 15 | 29 | |

| Class M1, 1 month U.S. LIBOR + 0.450% 0.5676% 1/25/36 (a)(b)(c) | 19 | 19 | |

| Class M2, 1 month U.S. LIBOR + 0.470% 0.5876% 1/25/36 (a)(b)(c) | 14 | 13 | |

| Class M3, 1 month U.S. LIBOR + 0.500% 0.6176% 1/25/36 (a)(b)(c) | 20 | 19 | |

| Class M4, 1 month U.S. LIBOR + 0.610% 0.7276% 1/25/36 (a)(b)(c) | 20 | 18 | |

| Class M5, 1 month U.S. LIBOR + 0.650% 0.7676% 1/25/36 (a)(b)(c) | 20 | 17 | |

| Class M6, 1 month U.S. LIBOR + 0.700% 0.8176% 1/25/36 (a)(b)(c) | 22 | 18 | |

| Series 2006-1: | |||

| Class A2, 1 month U.S. LIBOR + 0.540% 0.4776% 4/25/36 (a)(b)(c) | 19 | 18 | |

| Class M1, 1 month U.S. LIBOR + 0.570% 0.4976% 4/25/36 (a)(b)(c) | 12 | 11 | |

| Class M2, 1 month U.S. LIBOR + 0.600% 0.5176% 4/25/36 (a)(b)(c) | 12 | 11 | |

| Class M3, 1 month U.S. LIBOR + 0.630% 0.5376% 4/25/36 (a)(b)(c) | 19 | 17 | |

| Class M4, 1 month U.S. LIBOR + 0.780% 0.6376% 4/25/36 (a)(b)(c) | 11 | 9 | |

| Class M5, 1 month U.S. LIBOR + 0.840% 0.6776% 4/25/36 (a)(b)(c) | 11 | 9 | |

| Class M6, 1 month U.S. LIBOR + 0.960% 0.7576% 4/25/36 (a)(b)(c) | 11 | 9 | |

| Series 2006-2A: | |||

| Class M1, 1 month U.S. LIBOR + 0.460% 0.4276% 7/25/36 (a)(b)(c) | 18 | 16 | |

| Class M2, 1 month U.S. LIBOR + 0.490% 0.4476% 7/25/36 (a)(b)(c) | 13 | 11 | |

| Class M3, 1 month U.S. LIBOR + 0.520% 0.4676% 7/25/36 (a)(b)(c) | 19 | 18 | |

| Class M4, 1 month U.S. LIBOR + 0.630% 0.5376% 7/25/36 (a)(b)(c) | 12 | 10 | |

| Class M5, 1 month U.S. LIBOR + 0.700% 0.5876% 7/25/36 (a)(b)(c) | 16 | 13 | |

| Series 2006-3A Class M4, 1 month U.S. LIBOR + 0.430% 0.5476% 10/25/36 (a)(b)(c) | 11 | 35 | |

| Series 2006-4A: | |||

| Class A2, 1 month U.S. LIBOR + 0.270% 0.3876% 12/25/36 (a)(b)(c) | 144 | 135 | |

| Class M1, 1 month U.S. LIBOR + 0.290% 0.4076% 12/25/36 (a)(b)(c) | 21 | 19 | |

| Class M2, 1 month U.S. LIBOR + 0.310% 0.4276% 12/25/36 (a)(b)(c) | 27 | 23 | |

| Class M3, 1 month U.S. LIBOR + 0.340% 0.4576% 12/25/36 (a)(b)(c) | 15 | 12 | |

| Series 2007-1 Class A2, 1 month U.S. LIBOR + 0.270% 0.3876% 3/25/37 (a)(b)(c) | 36 | 34 | |

| Series 2007-2A: | |||

| Class A1, 1 month U.S. LIBOR + 0.270% 0.3876% 7/25/37 (a)(b)(c) | 106 | 100 | |

| Class A2, 1 month U.S. LIBOR + 0.320% 0.4376% 7/25/37 (a)(b)(c) | 99 | 79 | |

| Class M1, 1 month U.S. LIBOR + 0.370% 0.4876% 7/25/37 (a)(b)(c) | 34 | 31 | |

| Class M2, 1 month U.S. LIBOR + 0.410% 0.5276% 7/25/37 (a)(b)(c) | 41 | 34 | |

| Class M3, 1 month U.S. LIBOR + 0.490% 0.6076% 7/25/37 (a)(b)(c) | 37 | 39 | |

| Series 2007-3: | |||

| Class A2, 1 month U.S. LIBOR + 0.290% 0.4076% 7/25/37 (a)(b)(c) | 36 | 33 | |

| Class M1, 1 month U.S. LIBOR + 0.310% 0.4276% 7/25/37 (a)(b)(c) | 19 | 17 | |

| Class M2, 1 month U.S. LIBOR + 0.340% 0.4576% 7/25/37 (a)(b)(c) | 21 | 18 | |

| Class M3, 1 month U.S. LIBOR + 0.370% 0.4876% 7/25/37 (a)(b)(c) | 33 | 30 | |

| Class M4, 1 month U.S. LIBOR + 0.500% 0.6176% 7/25/37 (a)(b)(c) | 52 | 47 | |

| Class M5, 1 month U.S. LIBOR + 0.600% 0.7176% 7/25/37 (a)(b)(c) | 22 | 19 | |

| Benchmark Mortgage Trust: | |||

| sequential payer: | |||

| Series 2018-B4 Class A5, 4.121% 7/15/51 | 806 | 923 | |

| Series 2019-B10 Class A4, 3.717% 3/15/62 | 1,426 | 1,602 | |

| Series 2019-B13 Class A4, 2.952% 8/15/57 | 8,383 | 8,962 | |

| Series 2019-B14 Class A5, 3.0486% 12/15/62 | 3,454 | 3,721 | |

| Series 2018-B8 Class A5, 4.2317% 1/15/52 | 10,843 | 12,549 | |

| BFLD Trust floater sequential payer Series 2020-OBRK Class A, 1 month U.S. LIBOR + 2.050% 2.162% 11/15/28 (a)(b)(c) | 6,788 | 6,856 | |

| BX Commercial Mortgage Trust: | |||

| floater: | |||

| Series 2018-BIOA: | |||

| Class E, 1 month U.S. LIBOR + 1.950% 2.0631% 3/15/37 (a)(b)(c) | 10,300 | 10,309 | |

| Class F, 1 month U.S. LIBOR + 2.470% 2.5831% 3/15/37 (a)(b)(c) | 2,590 | 2,592 | |

| Series 2020-BXLP: | |||

| Class B, 1 month U.S. LIBOR + 1.000% 1.112% 12/15/36 (a)(b)(c) | 4,365 | 4,365 | |

| Class C, 1 month U.S. LIBOR + 1.120% 1.232% 12/15/36 (a)(b)(c) | 3,363 | 3,363 | |

| Class D, 1 month U.S. LIBOR + 1.250% 1.362% 12/15/36 (a)(b)(c) | 4,358 | 4,358 | |

| Series 2020-FOX Class B, 1 month U.S. LIBOR + 1.350% 1.462% 11/15/32 (a)(b)(c) | 5,900 | 5,922 | |

| floater sequential payer: | |||

| Series 2020-BXLP Class A, 1 month U.S. LIBOR + 0.800% 0.912% 12/15/36 (a)(b)(c) | 19,718 | 19,733 | |

| Series 2020-FOX Class A, 1 month U.S. LIBOR + 1.000% 1.112% 11/15/32 (a)(b)(c) | 7,360 | 7,383 | |

| BX Trust: | |||

| floater: | |||

| Series 2018-EXCL: | |||

| Class A, 1 month U.S. LIBOR + 1.088% 1.1996% 9/15/37 (a)(b)(c) | 5,535 | 5,308 | |

| Class D, 1 month U.S. LIBOR + 2.620% 2.737% 9/15/37 (a)(b)(c) | 1,374 | 1,089 | |

| Series 2018-IND: | |||

| Class B, 1 month U.S. LIBOR + 0.900% 1.012% 11/15/35 (a)(b)(c) | 1,281 | 1,281 | |

| Class C, 1 month U.S. LIBOR + 1.100% 1.212% 11/15/35 (a)(b)(c) | 6,410 | 6,412 | |

| Class F, 1 month U.S. LIBOR + 1.800% 1.912% 11/15/35 (a)(b)(c) | 1,473 | 1,474 | |

| Series 2019-IMC: | |||

| Class B, 1 month U.S. LIBOR + 1.300% 1.412% 4/15/34 (a)(b)(c) | 2,644 | 2,631 | |

| Class C, 1 month U.S. LIBOR + 1.600% 1.712% 4/15/34 (a)(b)(c) | 1,748 | 1,726 | |

| Class D, 1 month U.S. LIBOR + 1.900% 2.012% 4/15/34 (a)(b)(c) | 1,835 | 1,807 | |

| Series 2019-XL: | |||

| Class B, 1 month U.S. LIBOR + 1.080% 1.192% 10/15/36 (a)(b)(c) | 2,539 | 2,541 | |

| Class C, 1 month U.S. LIBOR + 1.250% 1.362% 10/15/36 (a)(b)(c) | 3,192 | 3,195 | |

| Class D, 1 month U.S. LIBOR + 1.450% 1.562% 10/15/36 (a)(b)(c) | 4,522 | 4,526 | |

| Class E, 1 month U.S. LIBOR + 1.800% 1.912% 10/15/36 (a)(b)(c) | 6,355 | 6,359 | |

| Series 2020-BXLP Class E, 1 month U.S. LIBOR + 1.600% 1.712% 12/15/36 (a)(b)(c) | 3,570 | 3,569 | |

| floater, sequential payer: | |||

| Series 2019-IMC Class A, 1 month U.S. LIBOR + 1.000% 1.112% 4/15/34 (a)(b)(c) | 5,741 | 5,734 | |

| Series 2019-XL Class A, 1 month U.S. LIBOR + 0.920% 1.032% 10/15/36 (a)(b)(c) | 12,598 | 12,620 | |

| CF Hippolyta Issuer LLC sequential payer Series 2020-1: | |||

| Class A1, 1.69% 7/15/60 (a) | 20,065 | 20,183 | |

| Class A2, 1.99% 7/15/60 (a) | 13,266 | 13,121 | |

| CGMS Commercial Mortgage Trust Series 2017-MDRA Class A, 3.656% 7/10/30 (a) | 7,072 | 7,226 | |

| CHC Commercial Mortgage Trust floater Series 2019-CHC: | |||

| Class A, 1 month U.S. LIBOR + 1.120% 1.232% 6/15/34 (a)(b)(c) | 7,526 | 7,479 | |

| Class B, 1 month U.S. LIBOR + 1.500% 1.612% 6/15/34 (a)(b)(c) | 1,288 | 1,260 | |

| Class C, 1 month U.S. LIBOR + 1.750% 1.862% 6/15/34 (a)(b)(c) | 1,456 | 1,401 | |

| Citigroup Commercial Mortgage Trust sequential payer Series 2020-GC46 Class A5, 2.717% 2/15/53 | 13,351 | 14,050 | |

| COMM Mortgage Trust: | |||

| sequential payer: | |||

| Series 2014-CR18 Class A5, 3.828% 7/15/47 | 1,366 | 1,491 | |

| Series 2020-SBX Class A, 1.67% 1/10/38 (a) | 22,582 | 22,718 | |

| Series 2013-CR13 Class AM, 4.449% 11/10/46 | 2,011 | 2,189 | |

| Credit Suisse Mortgage Trust: | |||

| floater Series 2019-ICE4: | |||

| Class A, 1 month U.S. LIBOR + 0.980% 1.092% 5/15/36 (a)(b)(c) | 11,788 | 11,807 | |

| Class B, 1 month U.S. LIBOR + 1.230% 1.342% 5/15/36 (a)(b)(c) | 14,528 | 14,574 | |

| Class C, 1 month U.S. LIBOR + 1.430% 1.542% 5/15/36 (a)(b)(c) | 2,018 | 2,021 | |

| sequential payer Series 2020-NET Class A, 2.2569% 8/15/37 (a) | 2,586 | 2,646 | |

| Series 2018-SITE: | |||

| Class A, 4.284% 4/15/36 (a) | 2,941 | 2,932 | |

| Class B, 4.5349% 4/15/36 (a) | 861 | 852 | |

| Class C, 4.782% 4/15/36 (a)(b) | 561 | 541 | |

| Class D, 4.782% 4/15/36 (a)(b) | 1,122 | 1,008 | |

| DBCCRE Mortgage Trust sequential payer Series 2014-ARCP Class A, 4.2382% 1/10/34 (a) | 15,370 | 16,451 | |

| DBUBS Mortgage Trust Series 2011-LC3A Class C, 5.3363% 8/10/44 (a)(b) | 4,500 | 4,514 | |

| GB Trust floater Series 2020-FLIX: | |||

| Class A, 1 month U.S. LIBOR + 1.120% 1.232% 8/15/37 (a)(b)(c) | 5,900 | 5,947 | |

| Class B, 1 month U.S. LIBOR + 1.350% 1.462% 8/15/37 (a)(b)(c) | 1,240 | 1,244 | |

| Class C, 1 month U.S. LIBOR + 1.600% 1.712% 8/15/37 (a)(b)(c) | 670 | 676 | |

| GS Mortgage Securities Trust: | |||

| sequential payer Series 2020-GC45 Class A5, 2.9106% 2/13/53 | 12,592 | 13,429 | |

| Series 2011-GC5 Class A/S, 5.209% 8/10/44 (a) | 8,951 | 9,005 | |

| JP Morgan Chase Commercial Mortgage Securities Trust sequential payer: | |||

| Series 2020-NNN Class AFX, 2.8123% 1/16/37 (a) | 31,484 | 32,554 | |

| Series 2021-2NU Class A, 1.9739% 1/5/40 (a) | 25,800 | 26,010 | |

| JPMBB Commercial Mortgage Securities Trust Series 2013-C14 Class A/S, 4.4093% 8/15/46 | 654 | 696 | |

| JPMDB Commercial Mortgage Securities Trust sequential payer Series 2019-COR6 Class A4, 3.0565% 11/13/52 | 1,823 | 1,961 | |

| JPMorgan Chase Commercial Mortgage Securities Corp. Series 2012-CBX Class A/S, 4.2707% 6/15/45 | 1,309 | 1,360 | |

| JPMorgan Chase Commercial Mortgage Securities Trust: | |||

| Series 2013-LC11 Class A/S, 3.216% 4/15/46 | 1,177 | 1,228 | |

| Series 2018-WPT: | |||

| Class AFX, 4.2475% 7/5/33 (a) | 2,821 | 2,995 | |

| Class CFX, 4.9498% 7/5/33 (a) | 485 | 513 | |

| Class DFX, 5.3503% 7/5/33 (a) | 955 | 1,009 | |

| Class EFX, 5.5422% 7/5/33 (a) | 1,020 | 1,052 | |

| Ladder Capital Commercial Mortgage Securities Trust Series 2014-909 Class B, 3.59% 5/15/31 (a) | 14,859 | 14,868 | |

| Merit floater Series 2020-HILL Class A, 1 month U.S. LIBOR + 1.150% 1.262% 8/15/37 (a)(b)(c) | 2,588 | 2,599 | |

| Morgan Stanley BAML Trust: | |||

| sequential payer Series 2016-C28 Class A3, 3.272% 1/15/49 | 9,235 | 9,911 | |

| Series 2012-C6 Class A/S, 3.476% 11/15/45 | 3,389 | 3,507 | |

| Morgan Stanley Capital Barclays Bank Trust sequential payer Series 2016-MART Class A, 2.2004% 9/13/31 (a) | 2,317 | 2,319 | |

| Morgan Stanley Capital I Trust: | |||

| sequential payer Series 2019-MEAD Class A, 3.17% 11/10/36 (a) | 7,903 | 8,252 | |

| Series 2011-C3 Class AJ, 5.2442% 7/15/49 (a)(b) | 14,900 | 15,045 | |

| Series 2018-H4 Class A4, 4.31% 12/15/51 | 1,756 | 2,027 | |

| Series 2019-MEAD: | |||

| Class B, 3.1771% 11/10/36 (a)(b) | 1,142 | 1,152 | |

| Class C, 3.1771% 11/10/36 (a)(b) | 1,096 | 1,089 | |

| Natixis Commercial Mortgage Securities Trust sequential payer Series 2019-1776 Class A, 2.5073% 10/15/36 (a) | 13,077 | 13,401 | |

| NYT Mortgage Trust floater Series 2019-NYT Class A, 1 month U.S. LIBOR + 1.200% 1.312% 12/15/35 (a)(b)(c) | 22,356 | 22,400 | |

| Prima Capital Ltd. floater sequential payer Series 2021-9A Class A, 1 month U.S. LIBOR + 1.450% 1.57% 12/15/37 (a)(b)(c) | 6,194 | 6,192 | |

| RETL floater Series 2019-RVP Class C, 1 month U.S. LIBOR + 2.100% 2.212% 3/15/36 (a)(b)(c) | 4,700 | 4,676 | |

| UBS Commercial Mortgage Trust Series 2012-C1 Class A/S, 4.171% 5/10/45 | 12,718 | 13,076 | |

| VLS Commercial Mortgage Trust: | |||

| sequential payer Series 2020-LAB Class A, 2.13% 10/10/42 (a) | 9,860 | 9,799 | |

| Series 2020-LAB Class B, 2.453% 10/10/42 (a) | 510 | 511 | |

| Wells Fargo Commercial Mortgage Trust: | |||

| floater Series 2016-C32 Class A3FL, 1 month U.S. LIBOR + 1.420% 1.5283% 1/15/59 (b)(c) | 25,404 | 26,343 | |

| sequential payer: | |||

| Series 2015-C26 Class A4, 3.166% 2/15/48 | 8,381 | 9,026 | |

| Series 2015-C29 Class ASB, 3.4% 6/15/48 | 3,334 | 3,519 | |

| Series 2019-C52 Class A5, 2.892% 8/15/52 | 2,411 | 2,565 | |

| Series 2015-SG1 Class ASB, 3.556% 9/15/48 | 2,949 | 3,116 | |

| Series 2018-C48 Class A5, 4.302% 1/15/52 | 2,498 | 2,887 | |

| WF-RBS Commercial Mortgage Trust: | |||

| sequential payer Series 2014-C24 Class A4, 3.343% 11/15/47 | 7,819 | 8,355 | |

| Series 2012-C9 Class A/S, 3.388% 11/15/45 | 4,134 | 4,281 | |

| TOTAL COMMERCIAL MORTGAGE SECURITIES | |||

| (Cost $626,776) | 630,803 | ||

| Municipal Securities - 0.4% | |||

| Chicago Board of Ed. Series 2009 G, 1.75% 12/15/25 | 3,960 | 3,798 | |

| Illinois Gen. Oblig.: | |||

| Series 2003: | $ | $ | |

| 4.95% 6/1/23 | 2,110 | 2,191 | |

| 5.1% 6/1/33 | 13,950 | 15,584 | |

| Series 2010-1, 6.63% 2/1/35 | 1,285 | 1,519 | |

| Series 2010-3: | |||

| 6.725% 4/1/35 | 1,710 | 2,034 | |

| 7.35% 7/1/35 | 875 | 1,075 | |

| Series 2010-5, 6.2% 7/1/21 | 187 | 190 | |

| New Jersey Econ. Dev. Auth. State Pension Fdg. Rev. Series 1997, 7.425% 2/15/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 7,201 | 9,370 | |

| TOTAL MUNICIPAL SECURITIES | |||

| (Cost $33,412) | 35,761 | ||

| Foreign Government and Government Agency Obligations - 0.3% | |||

| Indonesian Republic: | |||

| 3.85% 10/15/30 | $10,505 | $11,601 | |

| 4.2% 10/15/50 | 7,915 | 8,627 | |

| 4.45% 4/15/70 | 9,715 | 10,738 | |

| State of Qatar 3.4% 4/16/25 (a) | 4,105 | 4,483 | |

| TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS | |||

| (Cost $32,025) | 35,449 | ||

| Bank Notes - 0.1% | |||

| Discover Bank 4.682% 8/9/28 (b) | 1,865 | 1,995 | |

| KeyBank NA 6.95% 2/1/28 | 725 | 930 | |

| RBS Citizens NA 2.55% 5/13/21 | 780 | 782 | |

| Regions Bank 6.45% 6/26/37 | 2,685 | 3,709 | |

| Synchrony Bank 3.65% 5/24/21 | 3,042 | 3,056 | |

| TOTAL BANK NOTES | |||

| (Cost $8,925) | 10,472 | ||

| Shares | Value (000s) | ||

| Fixed-Income Funds - 13.9% | |||

| Fidelity Mortgage Backed Securities Central Fund (g) | 11,476,125 | $1,273,047 | |

| Fidelity Specialized High Income Central Fund (g) | 1,368,721 | 136,133 | |

| TOTAL FIXED-INCOME FUNDS | |||

| (Cost $1,386,053) | 1,409,180 | ||

| Principal Amount (000s) | Value (000s) | ||

| Preferred Securities - 0.2% | |||

| FINANCIALS - 0.2% | |||

| Banks - 0.2% | |||

| Bank of Nova Scotia 4.65% (b)(h) | 8,146 | 8,302 | |

| Barclays Bank PLC 7.625% 11/21/22 | 11,014 | 12,344 | |

| TOTAL PREFERRED SECURITIES | |||

| (Cost $20,327) | 20,646 | ||

| Shares | Value (000s) | ||

| Money Market Funds - 11.6% | |||

| Fidelity Cash Central Fund 0.07% (i) | 798,558,610 | 798,718 | |

| Fidelity Securities Lending Cash Central Fund 0.08% (i)(j) | 372,063,736 | 372,101 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $1,170,818) | 1,170,819 | ||

| TOTAL INVESTMENT IN SECURITIES - 104.7% | |||

| (Cost $10,493,925) | 10,614,361 | ||

| NET OTHER ASSETS (LIABILITIES) - (4.7)% | (480,814) | ||

| NET ASSETS - 100% | $10,133,547 |

Values shown as $0 in the Schedule of Investments may reflect amounts less than $500.

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $1,769,668,000 or 17.5% of net assets.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(d) Security or a portion of the security is on loan at period end.

(e) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(f) Level 3 security

(g) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-PORT and is available upon request or at the SEC's website at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or institutional.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(h) Security is perpetual in nature with no stated maturity date.

(i) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(j) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| (Amounts in thousands) | |

| Fidelity Cash Central Fund | $442 |

| Fidelity Mortgage Backed Securities Central Fund | 28,374 |

| Fidelity Securities Lending Cash Central Fund | 241 |

| Fidelity Specialized High Income Central Fund | 4,204 |

| Total | $33,261 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

The value, beginning of period, for the Fidelity Cash Central Fund was $974,394. Net realized gain (loss) and change in net unrealized appreciation (depreciation) on Fidelity Cash Central Fund is presented in the Statement of Operations, if applicable. Purchases and sales of the Fidelity Cash Central Fund were $1,437,533 and $1,613224, respectively, during the period.

Fiscal year to date information regarding the Fund’s investments in non-Money Market Central Funds, including the ownership percentage, is presented below.

| Fund (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Mortgage Backed Securities Central Fund | $1,270,856 | $28,374 | $-- | $-- | $(26,183) | $1,273,047 | 55.8% |

| Fidelity Specialized High Income Central Fund | 132,651 | 4,204 | -- | -- | (722) | 136,133 | 35.3% |

| Total | $1,403,507 | $32,578 | $-- | $-- | $(26,905) | $1,409,180 |

Investment Valuation

The following is a summary of the inputs used, as of February 28, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | ||||

| Investments in Securities: | ||||

| Corporate Bonds | $3,569,885 | $-- | $3,569,885 | $-- |

| U.S. Government and Government Agency Obligations | 3,025,247 | -- | 3,025,247 | -- |

| Asset-Backed Securities | 671,551 | -- | 671,551 | -- |

| Collateralized Mortgage Obligations | 34,548 | -- | 34,548 | -- |

| Commercial Mortgage Securities | 630,803 | -- | 630,774 | 29 |

| Municipal Securities | 35,761 | -- | 35,761 | -- |

| Foreign Government and Government Agency Obligations | 35,449 | -- | 35,449 | -- |

| Bank Notes | 10,472 | -- | 10,472 | -- |

| Fixed-Income Funds | 1,409,180 | 1,409,180 | -- | -- |

| Preferred Securities | 20,646 | -- | 20,646 | -- |

| Money Market Funds | 1,170,819 | 1,170,819 | -- | -- |

| Total Investments in Securities: | $10,614,361 | $2,579,999 | $8,034,333 | $29 |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 89.2% |

| Cayman Islands | 4.5% |

| United Kingdom | 2.1% |

| Mexico | 1.1% |

| Others (Individually Less Than 1%) | 3.1% |

| 100.0% |

The information in the above tables is based on the combined investments of the fund and its pro-rata share of the investments of Fidelity's Fixed-Income Central Funds

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| Amounts in thousands (except per-share amounts) | February 28, 2021 (Unaudited) | |

| Assets | ||

| Investment in securities, at value (including securities loaned of $365,123) — See accompanying schedule: Unaffiliated issuers (cost $7,937,054) | $8,034,362 | |

| Fidelity Central Funds (cost $2,556,871) | 2,579,999 | |

| Total Investment in Securities (cost $10,493,925) | $10,614,361 | |

| Receivable for fund shares sold | 29,042 | |

| Interest receivable | 45,442 | |

| Distributions receivable from Fidelity Central Funds | 94 | |

| Receivable from investment adviser for expense reductions | 70 | |

| Other receivables | 192 | |

| Total assets | 10,689,201 | |

| Liabilities | ||

| Payable for investments purchased | ||

| Regular delivery | $69,557 | |

| Delayed delivery | 45,577 | |

| Payable for fund shares redeemed | 62,339 | |

| Distributions payable | 1,918 | |

| Accrued management fee | 2,559 | |

| Distribution and service plan fees payable | 86 | |

| Other affiliated payables | 1,322 | |

| Other payables and accrued expenses | 195 | |

| Collateral on securities loaned | 372,101 | |

| Total liabilities | 555,654 | |

| Net Assets | $10,133,547 | |

| Net Assets consist of: | ||

| Paid in capital | $10,022,190 | |

| Total accumulated earnings (loss) | 111,357 | |

| Net Assets | $10,133,547 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($203,410 ÷ 24,254 shares)(a) | $8.39 | |

| Maximum offering price per share (100/96.00 of $8.39) | $8.74 | |

| Class M: | ||

| Net Asset Value and redemption price per share ($35,241 ÷ 4,200 shares)(a) | $8.39 | |

| Maximum offering price per share (100/96.00 of $8.39) | $8.74 | |

| Class C: | ||

| Net Asset Value and offering price per share ($41,727 ÷ 4,968 shares)(a) | $8.40 | |

| Investment Grade Bond: | ||

| Net Asset Value, offering price and redemption price per share ($7,033,404 ÷ 837,871 shares) | $8.39 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($1,643,440 ÷ 195,579 shares) | $8.40 | |

| Class Z: | ||

| Net Asset Value, offering price and redemption price per share ($1,176,325 ÷ 139,887 shares) | $8.41 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Amounts in thousands | Six months ended February 28, 2021 (Unaudited) | |

| Investment Income | ||

| Dividends | $609 | |

| Interest | 83,140 | |

| Income from Fidelity Central Funds (including $241 from security lending) | 13,090 | |

| Total income | 96,839 | |

| Expenses | ||

| Management fee | $14,905 | |

| Transfer agent fees | 5,099 | |

| Distribution and service plan fees | 499 | |

| Fund wide operations fee | 2,540 | |

| Independent trustees' fees and expenses | 15 | |

| Miscellaneous | 9 | |

| Total expenses before reductions | 23,067 | |

| Expense reductions | (263) | |

| Total expenses after reductions | 22,804 | |

| Net investment income (loss) | 74,035 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 580 | |

| Fidelity Central Funds | 15 | |

| Capital gain distributions from Fidelity Central Funds | 20,171 | |

| Total net realized gain (loss) | 20,766 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (145,172) | |

| Fidelity Central Funds | (26,905) | |

| Total change in net unrealized appreciation (depreciation) | (172,077) | |

| Net gain (loss) | (151,311) | |

| Net increase (decrease) in net assets resulting from operations | $(77,276) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Amounts in thousands | Six months ended February 28, 2021 (Unaudited) | Year ended August 31, 2020 |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $74,035 | $151,718 |

| Net realized gain (loss) | 20,766 | 531,508 |

| Change in net unrealized appreciation (depreciation) | (172,077) | (140,096) |

| Net increase (decrease) in net assets resulting from operations | (77,276) | 543,130 |

| Distributions to shareholders | (352,780) | (156,517) |

| Share transactions - net increase (decrease) | 1,330,241 | (427,409) |

| Total increase (decrease) in net assets | 900,185 | (40,796) |

| Net Assets | ||

| Beginning of period | 9,233,362 | 9,274,158 |

| End of period | $10,133,547 | $9,233,362 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Investment Grade Bond Fund Class A

| Six months ended (Unaudited) February 28, | Years endedAugust 31, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $8.76 | $8.25 | $7.71 | $7.97 | $8.03 | $7.74 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | .051 | .158 | .199 | .178 | .151 | .197 |

| Net realized and unrealized gain (loss) | (.118) | .518 | .565 | (.277) | (.071) | .278 |

| Total from investment operations | (.067) | .676 | .764 | (.099) | .080 | .475 |

| Distributions from net investment income | (.050) | (.166) | (.224) | (.161) | (.140) | (.185) |

| Distributions from net realized gain | (.253) | – | – | – | – | – |