UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02105

Fidelity Salem Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | December 31 |

Date of reporting period: | June 30, 2021 |

Item 1.

Reports to Stockholders

Fidelity® International Bond Index Fund

Semi-Annual Report

June 30, 2021

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Investment Summary (Unaudited)

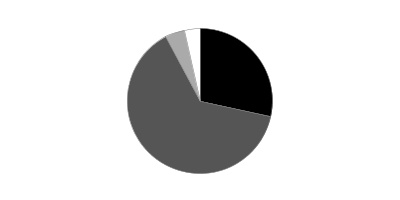

Geographic Diversification (% of fund's net assets)

| As of June 30, 2021 | ||

| Japan | 13.4% | |

| China | 11.2% | |

| France | 7.7% | |

| Canada | 7.3% | |

| Germany | 7.1% | |

| United States of America | 6.3% | |

| Italy | 6.3% | |

| United Kingdom | 5.5% | |

| Spain | 4.5% | |

| Other* | 30.7% | |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and include the effect of futures contracts, as applicable. Foreign currency contracts and other assets and liabilities are included within United States of America, as applicable.

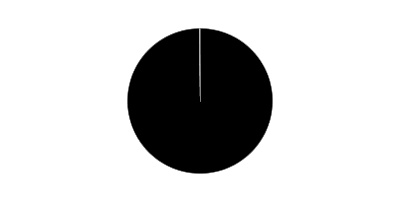

Quality Diversification (% of fund's net assets)

| As of June 30, 2021 | ||

| AAA | 15.6% | |

| AA | 13.6% | |

| A | 19.6% | |

| BBB | 14.3% | |

| BB and Below | 0.4% | |

| Not Rated | 33.0% | |

| Short-Term Investments and Net Other Assets | 3.5% | |

We have used ratings from Moody’s Investors Service, Inc. Where Moody’s® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

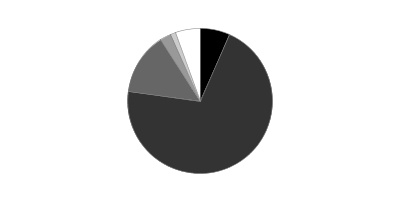

Asset Allocation (% of fund's net assets)

| As of June 30, 2021* | ||

| Corporate Bonds | 28.5% | |

| Government Obligations | 63.7% | |

| Supranational Obligations | 4.3% | |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.5% | |

* Foreign Currency Contracts - (96.5)%

Schedule of Investments June 30, 2021 (Unaudited)

Showing Percentage of Net Assets

| Nonconvertible Bonds - 28.5% | |||

| Principal Amount(a) | Value | ||

| Australia - 0.8% | |||

| New South Wales Treasury Corp.: | |||

| 1% 2/8/24 | AUD | $341,000 | $260,276 |

| 1.25% 3/20/25 | AUD | 803,000 | 616,087 |

| 2% 3/20/31 | AUD | 126,000 | 96,295 |

| Western Australia Treasury Corp.: | |||

| 2.5% 7/23/24 | AUD | 394,000 | 313,744 |

| 3% 10/21/26 | AUD | 560,000 | 463,389 |

| TOTAL AUSTRALIA | 1,749,791 | ||

| Austria - 0.1% | |||

| Autobahn Schnell AG 0.625% 9/15/22 (Reg. S) | EUR | 130,000 | 156,311 |

| OMV AG 2.375% 4/9/32 (Reg. S) | EUR | 76,000 | 106,121 |

| TOTAL AUSTRIA | 262,432 | ||

| Belgium - 0.3% | |||

| Anheuser-Busch InBev SA NV: | |||

| 1.5% 4/18/30 (Reg. S) | EUR | 49,000 | 63,091 |

| 2% 3/17/28 (Reg. S) | EUR | 32,000 | 42,361 |

| 2.25% 5/24/29 (Reg. S) | GBP | 53,000 | 76,994 |

| 3.7% 4/2/40 (Reg. S) | EUR | 131,000 | 210,691 |

| Belfius Bank SA/NV 0% 8/28/26 (Reg. S) | EUR | 100,000 | 117,981 |

| KBC Groep NV 0.5% 12/3/29 (b) | EUR | 100,000 | 118,577 |

| TOTAL BELGIUM | 629,695 | ||

| Canada - 2.6% | |||

| 407 International, Inc. 2.84% 3/7/50 | CAD | 73,000 | 54,845 |

| Altalink LP 3.717% 12/3/46 | CAD | 212,000 | 188,243 |

| Bank of Montreal 3.19% 3/1/28 | CAD | 65,000 | 57,214 |

| Bank of Nova Scotia: | |||

| 0.25% 1/11/24 (Reg. S) | EUR | 797,000 | 960,532 |

| 1.375% 12/5/23 (Reg. S) | GBP | 134,000 | 188,790 |

| 3.1% 2/2/28 | CAD | 85,000 | 74,250 |

| Bell Canada 4.45% 2/27/47 | CAD | 40,000 | 35,283 |

| Canadian Imperial Bank of Commerce 2.43% 6/9/23 | CAD | 91,000 | 75,430 |

| Enbridge Gas, Inc. 3.65% 4/1/50 | CAD | 290,000 | 252,516 |

| Greater Toronto Airports Authority 2.75% 10/17/39 | CAD | 303,000 | 231,894 |

| Hydro One, Inc.: | |||

| 0.71% 1/16/23 | CAD | 127,000 | 102,411 |

| 1.69% 1/16/31 | CAD | 417,000 | 318,607 |

| 3.02% 4/5/29 | CAD | 30,000 | 25,898 |

| Hydro-Quebec 5% 2/15/50 | CAD | 50,000 | 59,601 |

| Manulife Bank of Canada 2.844% 1/12/23 | CAD | 549,000 | 456,446 |

| Pembina Pipeline Corp. 3.62% 4/3/29 | CAD | 80,000 | 69,093 |

| Royal Bank of Canada: | |||

| 0.25% 1/29/24 (Reg. S) | EUR | 779,000 | 939,071 |

| 0.625% 9/10/25 (Reg. S) | EUR | 756,000 | 930,619 |

| 2.609% 11/1/24 | CAD | 102,000 | 85,606 |

| 2.949% 5/1/23 | CAD | 284,000 | 237,957 |

| TELUS Corp. 3.95% 2/16/50 | CAD | 33,000 | 26,675 |

| The Toronto-Dominion Bank: | |||

| 1.943% 3/13/25 | CAD | 252,000 | 207,113 |

| 2.496% 12/2/24 | CAD | 60,000 | 50,263 |

| TransCanada PipeLines Ltd.: | |||

| 3% 9/18/29 | CAD | 30,000 | 25,023 |

| 4.18% 7/3/48 | CAD | 33,000 | 27,257 |

| TOTAL CANADA | 5,680,637 | ||

| China - 4.7% | |||

| China Development Bank: | |||

| 3.34% 7/14/25 | CNY | 49,780,000 | 7,733,584 |

| 3.48% 1/8/29 | CNY | 6,100,000 | 942,042 |

| 3.5% 11/4/46 | CNY | 820,000 | 121,402 |

| 3.68% 2/26/26 | CNY | 5,160,000 | 812,000 |

| 3.7% 10/20/30 | CNY | 4,210,000 | 659,924 |

| TOTAL CHINA | 10,268,952 | ||

| Denmark - 0.2% | |||

| KommuneKredit 0% 9/8/22 (Reg. S) | EUR | 406,000 | 484,422 |

| Finland - 0.2% | |||

| Nordea Mortgage Bank PLC 1% 11/5/24 (Reg. S) | EUR | 180,000 | 223,708 |

| OP Mortgage Bank PLC 1% 11/28/24 (Reg. S) | EUR | 170,000 | 211,338 |

| TOTAL FINLAND | 435,046 | ||

| France - 3.3% | |||

| Aeroports de Paris SA 2.125% 10/2/26 (Reg. S) | EUR | 500,000 | 655,779 |

| AXA SA 3.375% 7/6/47 (Reg. S) (b) | EUR | 100,000 | 135,646 |

| Banque Federative du Credit Mutuel SA: | |||

| 0.375% 1/13/22 (Reg. S) | EUR | 400,000 | 476,496 |

| 1.25% 5/26/27 (Reg. S) | EUR | 100,000 | 126,068 |

| BNP Paribas SA 3.375% 1/23/26 (Reg. S) | GBP | 550,000 | 830,542 |

| BPCE SA 0.25% 1/15/26 (Reg. S) | EUR | 100,000 | 119,629 |

| Caisse d'Amort de la Dette Sociale: | |||

| 0% 2/25/28 (Reg. S) | EUR | 200,000 | 239,126 |

| 0% 11/25/30 (Reg. S) | EUR | 200,000 | 234,129 |

| 0.125% 10/25/23 (Reg. S) | EUR | 300,000 | 360,862 |

| Credit Agricole SA 2.625% 3/17/27 (Reg. S) | EUR | 107,000 | 140,762 |

| Dexia Credit Local SA: | |||

| 0.625% 2/3/24 (Reg. S) | EUR | 100,000 | 121,763 |

| 0.625% 1/17/26 (Reg. S) | EUR | 500,000 | 614,998 |

| 0.75% 1/25/23 (Reg. S) | EUR | 100,000 | 120,865 |

| EDF SA 2% 12/9/49 (Reg. S) | EUR | 200,000 | 254,429 |

| La Poste 1.375% 4/21/32 (Reg. S) | EUR | 400,000 | 511,961 |

| Oseo SA: | |||

| 0.125% 11/25/23 (Reg. S) | EUR | 100,000 | 120,278 |

| 0.125% 3/25/25 (Reg. S) | EUR | 200,000 | 241,582 |

| 0.25% 3/29/30 (Reg. S) | EUR | 100,000 | 120,111 |

| 0.625% 5/25/26 (Reg. S) | EUR | 200,000 | 247,758 |

| RCI Banque SA: | |||

| 0.75% 4/10/23 (Reg. S) | EUR | 41,000 | 49,219 |

| 1.625% 5/26/26 (Reg. S) | EUR | 37,000 | 46,372 |

| RTE EdF Transport SA 0% 9/9/27 (Reg. S) | EUR | 100,000 | 117,136 |

| Societe du Grand Paris EPIC 1.7% 5/25/50 (Reg. S) | EUR | 100,000 | 137,938 |

| Societe Generale SFH 0.25% 9/11/23 (Reg. S) | EUR | 100,000 | 120,394 |

| Societe Nationale des Chemins de Fer Francais 0.625% 4/17/30 (Reg. S) | EUR | 300,000 | 367,391 |

| UNEDIC: | |||

| 0% 11/25/28 (Reg. S) | EUR | 100,000 | 119,066 |

| 0.875% 5/25/28 (Reg. S) | EUR | 400,000 | 506,359 |

| 1.25% 10/21/27 (Reg. S) | EUR | 100,000 | 129,209 |

| TOTAL FRANCE | 7,265,868 | ||

| Germany - 3.3% | |||

| Bayer AG 1.375% 7/6/32 (Reg. S) | EUR | 300,000 | 364,168 |

| Bremen Freie Hansestadt 0.4% 8/20/49 (Reg. S) | EUR | 29,000 | 32,578 |

| Commerzbank AG: | |||

| 0.01% 3/11/30 | EUR | 53,000 | 62,807 |

| 0.5% 12/4/26 (Reg. S) | EUR | 58,000 | 69,775 |

| 1.25% 1/9/34 | EUR | 58,000 | 77,121 |

| Daimler AG: | |||

| 0.375% 11/8/26 (Reg. S) | EUR | 23,000 | 27,685 |

| 1.125% 8/8/34 (Reg. S) | EUR | 27,000 | 33,014 |

| 1.5% 7/3/29 (Reg. S) | EUR | 44,000 | 56,733 |

| 2.625% 4/7/25 (Reg. S) | EUR | 472,000 | 615,944 |

| Deutsche Bahn Finance BV 1.375% 7/7/25 (Reg. S) | GBP | 28,000 | 39,781 |

| Deutsche Bank AG: | |||

| 1.625% 1/20/27 (Reg. S) | EUR | 300,000 | 373,816 |

| 2.625% 12/16/24 (Reg. S) | GBP | 200,000 | 288,825 |

| Deutsche Telekom AG 3.125% 2/6/34 (Reg. S) | GBP | 60,000 | 93,704 |

| E.ON AG 0.25% 10/24/26 (Reg. S) | EUR | 69,000 | 82,413 |

| KfW: | |||

| 0% 6/30/23 (Reg. S) | EUR | 173,000 | 207,566 |

| 0% 9/30/26 (Reg. S) | EUR | 70,000 | 84,514 |

| 0.01% 5/5/27 (Reg. S) | EUR | 38,000 | 45,848 |

| 0.05% 9/29/34 (Reg. S) | EUR | 302,000 | 349,670 |

| 0.125% 6/7/23 | EUR | 1,609,000 | 1,934,380 |

| 0.875% 9/15/26 (Reg. S) | GBP | 43,000 | 60,380 |

| 1.125% 12/7/21 (Reg. S) | GBP | 145,000 | 201,397 |

| 1.25% 8/28/23 | NOK | 380,000 | 44,477 |

| 1.375% 12/9/24 (Reg. S) | GBP | 151,000 | 215,547 |

| 1.375% 2/2/28 | SEK | 310,000 | 38,108 |

| 1.5% 7/24/24 | AUD | 82,000 | 63,279 |

| 2.9% 6/6/22 | AUD | 364,000 | 280,060 |

| 3.2% 9/11/26 | AUD | 118,000 | 97,997 |

| Land Niedersachsen 1.125% 9/12/33 (Reg. S) | EUR | 70,000 | 91,660 |

| Land Nordrhein-Westfalen: | |||

| 0.2% 4/9/30 | EUR | 142,000 | 171,521 |

| 0.5% 11/25/39 (Reg. S) | EUR | 72,000 | 85,399 |

| 0.625% 7/21/31 (Reg. S) | EUR | 24,000 | 29,992 |

| 0.8% 7/30/49 (Reg. S) | EUR | 104,000 | 129,876 |

| 1.55% 6/16/48 (Reg. S) | EUR | 85,000 | 124,527 |

| Landwirtschaftliche Rentenbank: | |||

| 0.05% 12/18/29 (Reg. S) | EUR | 42,000 | 50,301 |

| 0.875% 12/15/26 (Reg. S) | GBP | 19,000 | 26,625 |

| 2.6% 3/23/27 (Reg. S) | AUD | 60,000 | 48,397 |

| NRW.BANK 1% 6/15/22 (Reg. S) | GBP | 300,000 | 418,224 |

| UniCredit Bank AG: | |||

| 0.25% 1/15/32 (Reg. S) | EUR | 39,000 | 46,787 |

| 0.85% 5/22/34 (Reg. S) | EUR | 102,000 | 129,645 |

| Volkswagen Financial Services AG: | |||

| 1.5% 10/1/24 (Reg. S) | EUR | 36,000 | 44,691 |

| 2.5% 4/6/23 | EUR | 35,000 | 43,395 |

| 3.375% 4/6/28 (Reg. S) | EUR | 32,000 | 45,142 |

| TOTAL GERMANY | 7,327,769 | ||

| Ireland - 0.1% | |||

| GE Capital European Funding 4.625% 2/22/27 | EUR | 100,000 | 146,949 |

| Italy - 0.6% | |||

| Assicurazioni Generali SpA 5.5% 10/27/47 (Reg. S) (b) | EUR | 100,000 | 146,037 |

| Intesa Sanpaolo SpA: | |||

| 0.875% 6/27/22 (Reg. S) | EUR | 100,000 | 119,871 |

| 2.125% 5/26/25 (Reg. S) | EUR | 323,000 | 411,082 |

| Snam Rete Gas SpA 0% 5/12/24 (Reg. S) | EUR | 110,000 | 130,875 |

| UniCredit SpA 2.2% 7/22/27 (Reg. S) (b) | EUR | 490,000 | 617,569 |

| TOTAL ITALY | 1,425,434 | ||

| Japan - 0.1% | |||

| Takeda Pharmaceutical Co. Ltd. 2% 7/9/40 | EUR | 157,000 | 200,127 |

| Luxembourg - 0.7% | |||

| CK Hutchison Group Telecom Finance SA 0.375% 10/17/23 (Reg. S) | EUR | 887,000 | 1,060,801 |

| DH Europe Finance II SARL 1.35% 9/18/39 | EUR | 192,000 | 231,314 |

| Medtronic Global Holdings SCA 0.25% 7/2/25 | EUR | 100,000 | 120,076 |

| Nestle Finance International Ltd. 1.25% 11/2/29 (Reg. S) | EUR | 30,000 | 38,553 |

| TOTAL LUXEMBOURG | 1,450,744 | ||

| Mexico - 0.3% | |||

| America Movil S.A.B. de CV: | |||

| 0.75% 6/26/27 | EUR | 100,000 | 121,037 |

| 1.5% 3/10/24 | EUR | 100,000 | 123,377 |

| 2.125% 3/10/28 | EUR | 200,000 | 262,836 |

| Petroleos Mexicanos 4.75% 2/26/29 (Reg. S) | EUR | 100,000 | 117,374 |

| TOTAL MEXICO | 624,624 | ||

| Multi-National - 0.1% | |||

| EUROFIMA 0.15% 10/10/34 (Reg. S) | EUR | 191,000 | 218,228 |

| Netherlands - 2.0% | |||

| ABN AMRO Bank NV: | |||

| 0.375% 1/14/35 (Reg. S) | EUR | 200,000 | 238,591 |

| 1.375% 1/12/37 (Reg. S) | EUR | 400,000 | 542,278 |

| Airbus Group NV 2.375% 6/9/40 (Reg. S) | EUR | 166,000 | 228,248 |

| Bank Nederlandse Gemeenten NV: | |||

| 1% 6/17/22 (Reg. S) | GBP | 262,000 | 365,281 |

| 2.25% 8/30/22 | EUR | 140,000 | 171,375 |

| 3.3% 7/17/28 (Reg. S) | AUD | 97,000 | 81,263 |

| BAT Netherlands Finance BV 3.125% 4/7/28 (Reg. S) | EUR | 100,000 | 134,922 |

| BMV Finance NV: | |||

| 0.125% 7/13/22 (Reg. S) | EUR | 457,000 | 544,816 |

| 0.625% 10/6/23 (Reg. S) | EUR | 32,000 | 38,695 |

| 1.5% 2/6/29 (Reg. S) | EUR | 86,000 | 111,811 |

| Daimler International Finance BV 1.375% 6/26/26 (Reg. S) | EUR | 44,000 | 55,697 |

| E.ON International Finance BV 1.5% 7/31/29 (Reg. S) | EUR | 34,000 | 43,762 |

| ENEL Finance International NV 0.375% 6/17/27 (Reg. S) | EUR | 100,000 | 119,904 |

| ING Groep NV: | |||

| 2.125% 5/26/31 (Reg. S) (b) | EUR | 400,000 | 504,181 |

| 3% 2/18/26 (Reg. S) | GBP | 100,000 | 149,615 |

| JAB Holdings BV 2.5% 6/25/29 | EUR | 100,000 | 133,578 |

| Nederlandse Waterschapsbank NV 3.3% 5/2/29 (Reg. S) | AUD | 40,000 | 33,582 |

| Rabobank Nederland 1.25% 3/23/26 (Reg. S) | EUR | 79,000 | 99,699 |

| Schlumberger Finance BV 2% 5/6/32 (Reg. S) | EUR | 230,000 | 308,736 |

| Siemens Financieringsmaatschappij NV: | |||

| 0.125% 9/5/29 (Reg. S) | EUR | 24,000 | 28,389 |

| 1.75% 2/28/39 (Reg. S) | EUR | 23,000 | 31,436 |

| Volkswagen Financial Services AG 2.25% 4/12/25 (Reg. S) | GBP | 26,000 | 37,588 |

| Volkswagen International Finance NV: | |||

| 1.125% 10/2/23 (Reg. S) | EUR | 100,000 | 121,818 |

| 1.625% 1/16/30 (Reg. S) | EUR | 45,000 | 57,941 |

| 4.125% 11/16/38 (Reg. S) | EUR | 200,000 | 330,516 |

| TOTAL NETHERLANDS | 4,513,722 | ||

| Norway - 1.0% | |||

| DNB Naeringskreditt A/S 0.375% 11/14/23 (Reg. S) | EUR | 850,000 | 1,027,130 |

| Eika BoligKreditt A/S 0.625% 10/28/21 (Reg. S) | EUR | 135,000 | 160,687 |

| Equinor ASA 1.375% 5/22/32 (Reg. S) | EUR | 241,000 | 308,737 |

| Kommunalbanken A/S 1.5% 12/15/23 (Reg. S) | GBP | 100,000 | 142,292 |

| Telenor ASA: | |||

| 0% 9/25/23 (Reg. S) | EUR | 253,000 | 301,612 |

| 0.75% 5/31/26 (Reg. S) | EUR | 100,000 | 122,529 |

| 1.125% 5/31/29 (Reg. S) | EUR | 157,000 | 197,699 |

| TOTAL NORWAY | 2,260,686 | ||

| Spain - 1.1% | |||

| Abertis Infraestructuras SA 2.375% 9/27/27 (Reg. S) | EUR | 400,000 | 522,657 |

| Banco Bilbao Vizcaya Argentaria SA 2.575% 2/22/29 (Reg. S) (b) | EUR | 100,000 | 124,954 |

| Banco Santander SA: | |||

| 1.375% 1/5/26 (Reg. S) | EUR | 100,000 | 124,277 |

| 3.125% 1/19/27 (Reg. S) | EUR | 100,000 | 134,550 |

| CaixaBank SA 2.375% 2/1/24 (Reg. S) | EUR | 800,000 | 1,006,398 |

| Comunidad de Madrid 1.571% 4/30/29 (Reg. S) | EUR | 316,000 | 411,431 |

| TOTAL SPAIN | 2,324,267 | ||

| Sweden - 1.1% | |||

| Kommuninvest I Sverige AB: | |||

| 0.75% 2/22/23 (Reg. S) | SEK | 990,000 | 117,127 |

| 1% 11/12/26 (Reg. S) | SEK | 830,000 | 99,755 |

| Lansforsakringar Hypotek AB: | |||

| 1.25% 9/17/25 | SEK | 400,000 | 48,569 |

| 1.5% 9/16/26 (Reg. S) | SEK | 5,600,000 | 688,774 |

| Nordea Hypotek AB 1% 9/17/25 | SEK | 1,700,000 | 204,414 |

| Skandinaviska Enskilda Banken AB 0.75% 11/15/27 (Reg. S) | EUR | 100,000 | 125,415 |

| Stadshypotek AB: | |||

| 1.5% 6/1/23 (Reg. S) | SEK | 5,000,000 | 601,356 |

| 1.5% 3/1/24 (Reg. S) | SEK | 1,000,000 | 121,300 |

| Swedbank Hypotek AB: | |||

| 0.45% 8/23/23 (Reg. S) | EUR | 190,000 | 229,732 |

| 1% 9/18/24 (Reg. S) | SEK | 800,000 | 96,008 |

| TOTAL SWEDEN | 2,332,450 | ||

| Switzerland - 0.9% | |||

| Credit Suisse Group AG: | |||

| 0.65% 1/14/28 (Reg. S) (b) | EUR | 100,000 | 118,518 |

| 1.25% 7/17/25 (Reg. S) (b) | EUR | 100,000 | 121,692 |

| 3.25% 4/2/26 (Reg. S) (b) | EUR | 505,000 | 659,707 |

| Pfandbrief Schweiz Hypo 0% 7/29/24 (Reg. S) | CHF | 40,000 | 43,915 |

| Pfandbriefbank Schweizerischer Hypothekarinstitute AG: | |||

| 0.1% 12/3/31 (Reg. S) | CHF | 195,000 | 211,681 |

| 0.5% 11/24/28 (Reg. S) | CHF | 40,000 | 45,272 |

| UBS Group AG 0.25% 1/29/26 (Reg. S) (b) | EUR | 669,000 | 796,219 |

| TOTAL SWITZERLAND | 1,997,004 | ||

| United Kingdom - 2.2% | |||

| Barclays PLC: | |||

| 2% 2/7/28 (Reg. S) (b) | EUR | 335,000 | 407,235 |

| 3.375% 4/2/25 (Reg. S) (b) | EUR | 701,000 | 905,280 |

| BP Capital Markets PLC 1.637% 6/26/29 (Reg. S) | EUR | 100,000 | 128,527 |

| HSBC Holdings PLC: | |||

| 1.5% 12/4/24 (Reg. S) (b) | EUR | 930,000 | 1,145,093 |

| 3% 7/22/28 (b) | GBP | 110,000 | 163,965 |

| LCR Finance PLC 5.1% 3/7/51 | GBP | 93,000 | 240,599 |

| Lloyds Bank PLC 0.125% 9/23/29 (Reg. S) | EUR | 100,000 | 119,115 |

| Lloyds Banking Group PLC: | |||

| 0.5% 11/12/25 (Reg. S) (b) | EUR | 130,000 | 156,319 |

| 0.625% 1/15/24 (b) | EUR | 100,000 | 119,939 |

| 2.25% 10/16/24 | GBP | 100,000 | 143,999 |

| 3.5% 4/1/26 (Reg. S) (b) | EUR | 404,000 | 538,849 |

| Royal Bank of Scotland Group PLC: | |||

| 3 month EURIBOR + 1.080% 1.75% 3/2/26 (Reg. S) (b)(c) | EUR | 110,000 | 137,412 |

| 3.622% 8/14/30 (Reg. S) (b) | GBP | 411,000 | 606,350 |

| Standard Chartered PLC 0.85% 1/27/28 (Reg. S) (b) | EUR | 107,000 | 129,998 |

| TOTAL UNITED KINGDOM | 4,942,680 | ||

| United States of America - 2.8% | |||

| Altria Group, Inc. 2.2% 6/15/27 | EUR | 398,000 | 509,412 |

| Apple, Inc. 0.5% 11/15/31 | EUR | 171,000 | 205,634 |

| AT&T, Inc.: | |||

| 0.25% 3/4/26 | EUR | 100,000 | 119,200 |

| 2.9% 12/4/26 | GBP | 752,000 | 1,125,583 |

| Citigroup, Inc. 2.75% 1/24/24 | GBP | 204,000 | 295,956 |

| Fidelity National Information Services, Inc. 1.5% 5/21/27 | EUR | 417,000 | 524,452 |

| Ford Motor Credit Co. LLC 2.33% 11/25/25 | EUR | 100,000 | 122,492 |

| General Electric Co.: | |||

| 0.875% 5/17/25 | EUR | 110,000 | 133,900 |

| 2.125% 5/17/37 | EUR | 110,000 | 141,545 |

| Goldman Sachs Group, Inc.: | |||

| 2% 11/1/28 (Reg. S) | EUR | 51,000 | 66,747 |

| 3.125% 7/25/29 (Reg. S) | GBP | 27,000 | 41,443 |

| 3.375% 3/27/25 (Reg. S) | EUR | 488,000 | 648,610 |

| IBM Corp. 0.5% 9/7/21 | EUR | 140,000 | 166,290 |

| Philip Morris International, Inc. 1.45% 8/1/39 | EUR | 100,000 | 114,980 |

| Procter & Gamble Co. 1.8% 5/3/29 | GBP | 381,000 | 556,889 |

| Prologis LP 2.25% 6/30/29 | GBP | 154,000 | 226,685 |

| The Coca-Cola Co. 0.375% 3/15/33 | EUR | 329,000 | 377,163 |

| Thermo Fisher Scientific, Inc.: | |||

| 0.125% 3/1/25 | EUR | 100,000 | 119,132 |

| 1.875% 10/1/49 | EUR | 106,000 | 133,621 |

| Verizon Communications, Inc. 3.375% 10/27/36 | GBP | 277,000 | 444,079 |

| Wells Fargo & Co. 2.125% 9/24/31 (Reg. S) | GBP | 110,000 | 154,533 |

| TOTAL UNITED STATES OF AMERICA | 6,228,346 | ||

| TOTAL NONCONVERTIBLE BONDS | |||

| (Cost $60,965,781) | 62,769,873 | ||

| Government Obligations - 63.7% | |||

| Australia - 1.7% | |||

| Australian Commonwealth: | |||

| 0.25% 11/21/24 (Reg. S) | AUD | 57,000 | 42,503 |

| 0.25% 11/21/25 (Reg. S) | AUD | 811,000 | 597,348 |

| 1.25% 5/21/32 | AUD | 140,000 | 101,594 |

| 1.75% 6/21/51 (Reg. S) | AUD | 718,000 | 475,499 |

| 2.75% 5/21/41(Reg. S) | AUD | 276,000 | 227,459 |

| 3% 3/21/47 | AUD | 122,000 | 104,694 |

| 3.25% 4/21/25 (Reg. S) | AUD | 56,000 | 46,294 |

| Queensland Treasury Corp.: | |||

| 1.75% 8/21/31 (Reg. S) (d) | AUD | 435,000 | 324,471 |

| 3.25% 7/21/28 (Reg. S) (d) | AUD | 154,000 | 130,278 |

| 3.5% 8/21/30 (Reg. S) (d) | AUD | 58,000 | 50,362 |

| Treasury Corp. of Victoria: | |||

| 1% 11/20/23 | AUD | 1,493,000 | 1,140,387 |

| 1.5% 11/20/30 | AUD | 253,000 | 185,884 |

| 2.25% 10/29/21 | AUD | 530,000 | 400,344 |

| TOTAL AUSTRALIA | 3,827,117 | ||

| Austria - 1.2% | |||

| Austrian Republic: | |||

| 0% 9/20/22 (Reg. S) (d) | EUR | 41,000 | 49,000 |

| 0% 4/20/23 (Reg. S) (d) | EUR | 156,000 | 187,060 |

| 0% 7/15/23 (Reg. S) (d) | EUR | 184,000 | 220,929 |

| 0% 7/15/24 (Reg. S) (d) | EUR | 179,000 | 216,006 |

| 0% 2/20/30 (Reg. S) (d) | EUR | 162,000 | 193,526 |

| 0% 10/20/40 (Reg. S) (d) | EUR | 85,000 | 92,196 |

| 0.5% 2/20/29 (Reg. S) (d) | EUR | 677,000 | 845,228 |

| 0.75% 10/20/26 (Reg. S) (d) | EUR | 70,000 | 88,182 |

| 0.75% 2/20/28 (Reg. S) (d) | EUR | 65,000 | 82,446 |

| 0.75% 3/20/51 (Reg. S) (d) | EUR | 330,000 | 403,549 |

| 1.2% 10/20/25 (Reg. S) (d) | EUR | 77,000 | 98,156 |

| 2.4% 5/23/34(Reg. S) (d) | EUR | 40,000 | 60,911 |

| 3.15% 6/20/44(Reg. S) (d) | EUR | 10,000 | 18,812 |

| 4.15% 3/15/37 (d) | EUR | 20,000 | 37,899 |

| TOTAL AUSTRIA | 2,593,900 | ||

| Belgium - 1.7% | |||

| Belgian Kingdom: | |||

| 0.1% 6/22/30 (Reg. S) | EUR | 175,000 | 210,267 |

| 0.2% 10/22/23 (Reg. S) (d) | EUR | 109,000 | 131,781 |

| 0.4% 6/22/40 (d) | EUR | 327,000 | 372,909 |

| 0.5% 10/22/24 (Reg. S) (d) | EUR | 124,000 | 152,491 |

| 0.8% 6/22/25 (Reg. S) (d) | EUR | 105,000 | 131,233 |

| 0.8% 6/22/27 (d) | EUR | 39,000 | 49,474 |

| 0.9% 6/22/29 (d) | EUR | 1,373,000 | 1,764,464 |

| 1% 6/22/26 (Reg. S) (d) | EUR | 71,000 | 90,359 |

| 1.25% 4/22/33 (Reg. S) | EUR | 24,000 | 32,079 |

| 1.45% 6/22/37 (Reg. S) (d) | EUR | 84,000 | 114,878 |

| 1.6% 6/22/47 (d) | EUR | 30,000 | 41,978 |

| 1.7% 6/22/50 (d) | EUR | 23,000 | 32,925 |

| 1.9% 6/22/38(Reg. S) (d) | EUR | 101,000 | 147,153 |

| 2.25% 6/22/57 (Reg. S) (d) | EUR | 84,000 | 139,130 |

| 3.75% 6/22/45(Reg. S) | EUR | 20,000 | 39,399 |

| 4% 3/28/32 | EUR | 30,000 | 50,548 |

| 5.5% 3/28/28 | EUR | 40,000 | 66,398 |

| Walloon Region 1.05% 6/22/40 (Reg. S) | EUR | 100,000 | 120,852 |

| TOTAL BELGIUM | 3,688,318 | ||

| Canada - 4.7% | |||

| Alberta Province: | |||

| 0.5% 4/16/25 (Reg. S) | EUR | 100,000 | 122,038 |

| 2.05% 6/1/30 | CAD | 260,000 | 211,469 |

| 2.55% 12/15/22 | CAD | 160,000 | 132,922 |

| 3.1% 6/1/50 | CAD | 231,000 | 200,073 |

| British Columbia Province: | |||

| 2.3% 6/18/26 | CAD | 210,000 | 177,848 |

| 2.95% 6/18/50 | CAD | 251,000 | 218,564 |

| Canada Housing Trust No. 1: | |||

| 1.75% 6/15/30 (d) | CAD | 130,000 | 105,376 |

| 2.35% 6/15/23 (d) | CAD | 585,000 | 488,392 |

| 2.55% 12/15/23 (d) | CAD | 1,800,000 | 1,517,440 |

| Canadian Government: | |||

| 0.25% 3/1/26 | CAD | 121,000 | 94,371 |

| 0.5% 12/1/30 | CAD | 531,000 | 394,733 |

| 1% 6/1/27 | CAD | 58,000 | 46,552 |

| 1.25% 11/1/21 | CAD | 170,000 | 137,568 |

| 1.25% 6/1/30 | CAD | 216,000 | 172,943 |

| 1.5% 8/1/21 | CAD | 20,000 | 16,149 |

| 1.5% 9/1/24 | CAD | 58,000 | 47,960 |

| 1.75% 3/1/23 | CAD | 340,000 | 280,366 |

| 2% 6/1/28 | CAD | 50,000 | 42,585 |

| 2% 12/1/51 | CAD | 54,000 | 45,158 |

| Manitoba Province 3.2% 3/5/50 | CAD | 256,000 | 228,874 |

| New Brunswick Province 3.05% 8/14/50 | CAD | 227,000 | 195,909 |

| Newfoundland Province: | |||

| 2.65% 10/17/50 | CAD | 167,000 | 125,746 |

| 3.3% 10/17/46 | CAD | 50,000 | 42,853 |

| Ontario Province: | |||

| 0.375% 6/14/24 (Reg. S) | EUR | 100,000 | 121,155 |

| 0.375% 4/8/27 (Reg. S) | EUR | 283,000 | 344,791 |

| 1.75% 9/8/25 | CAD | 401,000 | 331,074 |

| 2.05% 6/2/30 | CAD | 59,000 | 48,143 |

| 2.3% 9/8/24 | CAD | 53,000 | 44,581 |

| 2.4% 6/2/26 | CAD | 49,000 | 41,545 |

| 2.6% 9/8/23 | CAD | 1,796,000 | 1,508,547 |

| 2.65% 12/2/50 | CAD | 49,000 | 39,657 |

| 2.7% 6/2/29 | CAD | 1,703,000 | 1,466,454 |

| 2.8% 6/2/48 | CAD | 33,000 | 27,632 |

| Quebec Province: | |||

| 1.9% 9/1/30 | CAD | 131,000 | 105,802 |

| 2.3% 9/1/29 | CAD | 1,179,000 | 990,366 |

| 3.5% 12/1/45 | CAD | 130,000 | 123,105 |

| Saskatchewan Province 3.1% 6/2/50 | CAD | 193,000 | 170,448 |

| TOTAL CANADA | 10,409,189 | ||

| Chile - 0.1% | |||

| Chilean Republic: | |||

| 1.25% 1/29/40 | EUR | 114,000 | 132,303 |

| 1.875% 5/27/30 | EUR | 100,000 | 131,159 |

| TOTAL CHILE | 263,462 | ||

| China - 6.5% | |||

| Peoples Republic of China: | |||

| 2.93% 12/10/22 | CNY | 9,090,000 | 1,414,551 |

| 3.25% 6/6/26 | CNY | 29,410,000 | 4,616,789 |

| 3.27% 11/19/30 | CNY | 30,780,000 | 4,822,285 |

| 3.86% 7/22/49 | CNY | 22,330,000 | 3,549,499 |

| TOTAL CHINA | 14,403,124 | ||

| Colombia - 0.1% | |||

| Titulos de Tesoreria B 7.25% 10/18/34 | COP | 916,000,000 | 238,114 |

| Croatia - 0.2% | |||

| Croatia Republic: | |||

| 1.125% 6/19/29 (Reg. S) | EUR | 151,000 | 184,006 |

| 2.7% 6/15/28 | EUR | 200,000 | 272,248 |

| TOTAL CROATIA | 456,254 | ||

| Cyprus - 0.1% | |||

| Republic of Cyprus: | |||

| 2.375% 9/25/28 (Reg. S) | EUR | 84,000 | 115,371 |

| 2.75% 6/27/24 (Reg. S) | EUR | 32,000 | 41,485 |

| 3.75% 7/26/23 (Reg. S) | EUR | 44,000 | 56,683 |

| TOTAL CYPRUS | 213,539 | ||

| Czech Republic - 0.4% | |||

| Czech Republic: | |||

| 0.1% 4/17/22 | CZK | 7,310,000 | 338,039 |

| 0.45% 10/25/23 | CZK | 5,390,000 | 245,392 |

| 1.2% 3/13/31 | CZK | 5,250,000 | 230,567 |

| 2% 10/13/33 | CZK | 2,230,000 | 105,300 |

| TOTAL CZECH REPUBLIC | 919,298 | ||

| Denmark - 0.4% | |||

| Danish Kingdom: | |||

| 0.25% 11/15/22 (Reg. S) (d) | DKK | 554,000 | 89,304 |

| 0.25% 11/15/52 (Reg. S) (d) | DKK | 610,000 | 90,410 |

| 0.5% 11/15/27 | DKK | 1,518,000 | 253,629 |

| 0.5% 11/15/29(Reg. S) (d) | DKK | 3,008,000 | 503,574 |

| TOTAL DENMARK | 936,917 | ||

| Finland - 0.5% | |||

| Finnish Government: | |||

| 0% 9/15/23 (Reg. S) (d) | EUR | 209,000 | 251,362 |

| 0% 9/15/24 (d) | EUR | 84,000 | 101,594 |

| 0.5% 4/15/26 (Reg. S) (d) | EUR | 44,000 | 54,682 |

| 0.5% 9/15/28 (Reg. S) (d) | EUR | 400,000 | 500,918 |

| 1.125% 4/15/34 (Reg. S) (d) | EUR | 166,000 | 220,890 |

| 2.625% 7/4/42 (d) | EUR | 20,000 | 34,449 |

| TOTAL FINLAND | 1,163,895 | ||

| France - 4.4% | |||

| French Government: | |||

| 0% 2/25/23 (Reg. S) | EUR | 455,000 | 545,204 |

| 0% 3/25/24(Reg. S) | EUR | 268,000 | 323,114 |

| 0% 3/25/25(Reg. S) | EUR | 1,375,000 | 1,662,607 |

| 0% 2/25/26 (Reg. S) | EUR | 191,000 | 231,117 |

| 0% 11/25/29 (Reg. S) | EUR | 194,000 | 231,315 |

| 0% 11/25/30 (Reg. S) | EUR | 165,000 | 195,063 |

| 0.25% 11/25/26(Reg. S) | EUR | 118,000 | 144,743 |

| 0.5% 5/25/25 | EUR | 182,000 | 224,469 |

| 0.5% 5/25/26 | EUR | 33,000 | 40,941 |

| 0.5% 5/25/29 (Reg. S) | EUR | 75,000 | 93,307 |

| 0.5% 5/25/40 (Reg. S) (d) | EUR | 2,834,000 | 3,290,546 |

| 0.75% 5/25/28 (Reg. S) | EUR | 32,000 | 40,514 |

| 0.75% 5/25/52 (Reg. S) (d) | EUR | 637,000 | 721,560 |

| 1% 11/25/25(Reg. S) | EUR | 36,000 | 45,492 |

| 1% 5/25/27 | EUR | 122,000 | 156,052 |

| 1.25% 5/25/34(Reg. S) | EUR | 137,000 | 181,922 |

| 1.25% 5/25/36(Reg. S) (d) | EUR | 201,000 | 266,850 |

| 1.5% 5/25/31(Reg. S) | EUR | 182,000 | 246,472 |

| 1.5% 5/25/50 (Reg. S) (d) | EUR | 139,000 | 191,478 |

| 1.75% 6/25/39 (Reg. S) (d) | EUR | 221,000 | 317,969 |

| 1.75% 5/25/66 (d) | EUR | 33,000 | 49,198 |

| 2% 5/25/48 (d) | EUR | 124,000 | 189,205 |

| 4.75% 4/25/35 | EUR | 100,000 | 190,157 |

| TOTAL FRANCE | 9,579,295 | ||

| Germany - 3.8% | |||

| German Federal Republic: | |||

| 0% 4/8/22(Reg. S) | EUR | 74,000 | 88,189 |

| 0% 4/14/23 (Reg. S) | EUR | 143,000 | 171,661 |

| 0% 10/10/25 (Reg. S) | EUR | 841,000 | 1,024,400 |

| 0% 8/15/26(Reg. S) | EUR | 57,000 | 69,612 |

| 0% 11/15/27 (Reg. S) | EUR | 2,811,000 | 3,436,224 |

| 0% 8/15/29(Reg. S) | EUR | 31,000 | 37,861 |

| 0% 2/15/30 (Reg. S) | EUR | 58,000 | 70,804 |

| 0% 8/15/30 (Reg. S) | EUR | 507,000 | 617,699 |

| 0% 5/15/35 (Reg. S) | EUR | 1,034,000 | 1,227,708 |

| 0% 8/15/50 | EUR | 523,000 | 570,041 |

| 0.5% 2/15/26(Reg. S) | EUR | 474,000 | 591,532 |

| 1.25% 8/15/48 | EUR | 185,000 | 276,702 |

| 2.5% 7/4/44 | EUR | 20,000 | 36,376 |

| 4% 1/4/37 | EUR | 40,000 | 77,247 |

| 4.75% 7/4/40 | EUR | 20,000 | 44,908 |

| TOTAL GERMANY | 8,340,964 | ||

| Hungary - 0.4% | |||

| Hungarian Republic: | |||

| 1% 11/26/25 | HUF | 30,380,000 | 98,351 |

| 1.5% 8/23/23 | HUF | 63,350,000 | 214,559 |

| 1.625% 4/28/32 (Reg. S) | EUR | 246,000 | 310,709 |

| 2.5% 10/24/24 | HUF | 46,750,000 | 161,561 |

| 3% 6/26/24 | HUF | 7,530,000 | 26,383 |

| TOTAL HUNGARY | 811,563 | ||

| Indonesia - 0.6% | |||

| Indonesian Republic: | |||

| 2.15% 7/18/24 (Reg. S) | EUR | 129,000 | 161,690 |

| 2.625% 6/14/23 | EUR | 100,000 | 124,230 |

| 6.375% 4/15/42 | IDR | 900,000,000 | 54,621 |

| 6.5% 6/15/25 | IDR | 717,000,000 | 51,797 |

| 6.5% 2/15/31 | IDR | 1,409,000,000 | 96,346 |

| 7% 9/15/30 | IDR | 1,979,000,000 | 140,577 |

| 7.375% 5/15/48 | IDR | 1,449,000,000 | 100,681 |

| 7.5% 4/15/40 | IDR | 5,579,000,000 | 393,223 |

| 8.125% 5/15/24 | IDR | 1,101,000,000 | 82,689 |

| 8.375% 4/15/39 | IDR | 1,794,000,000 | 136,591 |

| TOTAL INDONESIA | 1,342,445 | ||

| Ireland - 0.5% | |||

| Irish Republic: | |||

| 0% 10/18/22 (Reg. S) | EUR | 40,000 | 47,788 |

| 0.2% 10/18/30 (Reg. S) | EUR | 86,000 | 103,191 |

| 0.4% 5/15/35 (Reg. S) | EUR | 221,000 | 262,942 |

| 0.9% 5/15/28 (Reg. S) | EUR | 32,000 | 40,755 |

| 1% 5/15/26(Reg. S) | EUR | 188,000 | 238,113 |

| 1.1% 5/15/29 (Reg. S) | EUR | 209,000 | 270,618 |

| 1.5% 5/15/50 (Reg. S) | EUR | 105,000 | 144,519 |

| 3.4% 3/18/24 (Reg.S) | EUR | 28,000 | 36,770 |

| TOTAL IRELAND | 1,144,696 | ||

| Israel - 0.5% | |||

| Israeli State: | |||

| 1% 3/31/30 | ILS | 1,067,000 | 324,235 |

| 1.5% 11/30/23 | ILS | 912,000 | 288,679 |

| 1.5% 1/16/29 (Reg. S) | EUR | 335,000 | 434,077 |

| 1.5% 5/31/37 | ILS | 325,000 | 94,567 |

| 3.75% 3/31/47 | ILS | 30,000 | 11,815 |

| TOTAL ISRAEL | 1,153,373 | ||

| Italy - 5.7% | |||

| Buoni del Tesoro Poliennali: | |||

| 0.05% 1/15/23 (d) | EUR | 652,000 | 778,481 |

| 0.35% 2/1/25 | EUR | 32,000 | 38,559 |

| 0.85% 1/15/27 (Reg. S) (d) | EUR | 81,000 | 99,359 |

| 0.9% 4/1/31 | EUR | 82,000 | 98,359 |

| 0.95% 8/1/30 (Reg. S) | EUR | 142,000 | 172,044 |

| 1% 7/15/22 (Reg. S) | EUR | 335,000 | 403,150 |

| 1.35% 4/1/30 (Reg. S) | EUR | 96,000 | 120,565 |

| 1.45% 5/15/25 | EUR | 80,000 | 100,404 |

| 1.6% 6/1/26 | EUR | 179,000 | 227,707 |

| 1.65% 3/1/32 (d) | EUR | 575,000 | 735,947 |

| 1.7% 9/1/51 (Reg. S) (d) | EUR | 341,000 | 391,431 |

| 1.75% 7/1/24(Reg. S) | EUR | 185,000 | 232,087 |

| 1.8% 3/1/41 (Reg. S) (d) | EUR | 336,000 | 415,960 |

| 2.05% 8/1/27 | EUR | 32,000 | 41,943 |

| 2.25% 9/1/36 (Reg. S) (d) | EUR | 143,000 | 193,027 |

| 2.3% 10/15/21 | EUR | 130,000 | 155,395 |

| 2.45% 9/1/33 (d) | EUR | 205,000 | 282,528 |

| 2.45% 9/1/50 (Reg. S) (d) | EUR | 77,000 | 104,381 |

| 2.5% 12/1/24 | EUR | 90,000 | 116,312 |

| 2.5% 11/15/25 | EUR | 1,155,000 | 1,518,550 |

| 2.7% 3/1/47 (d) | EUR | 116,000 | 164,925 |

| 3% 8/1/29 | EUR | 2,038,000 | 2,880,852 |

| 3.1% 3/1/40 (Reg. S) (d) | EUR | 341,000 | 511,472 |

| 3.75% 9/1/24 | EUR | 80,000 | 106,661 |

| 3.85% 9/1/49 (d) | EUR | 416,000 | 718,377 |

| Italian Republic: | |||

| 0% 5/30/22 | EUR | 807,000 | 960,838 |

| 1.45% 3/1/36 (Reg. S) (d) | EUR | 433,000 | 529,100 |

| 4.5% 3/1/26 (d) | EUR | 50,000 | 71,568 |

| 5% 3/1/25 (d) | EUR | 80,000 | 112,627 |

| 5% 8/1/34 (d) | EUR | 20,000 | 34,942 |

| 5% 8/1/39 (d) | EUR | 20,000 | 37,297 |

| 6.5% 11/1/27 | EUR | 50,000 | 82,153 |

| TOTAL ITALY | 12,437,001 | ||

| Japan - 13.3% | |||

| Japan Government: | |||

| , yield at date of purchase -0.1508% 5/1/22 | JPY | 71,650,000 | 646,085 |

| 0.1% 12/20/21 | JPY | 9,350,000 | 84,242 |

| 0.1% 8/1/22 | JPY | 64,600,000 | 582,828 |

| 0.1% 9/20/22 | JPY | 31,100,000 | 280,635 |

| 0.1% 3/20/23 | JPY | 192,700,000 | 1,740,813 |

| 0.1% 6/20/23 | JPY | 4,350,000 | 39,318 |

| 0.1% 9/20/23 | JPY | 14,600,000 | 132,056 |

| 0.1% 6/20/24 | JPY | 180,200,000 | 1,633,097 |

| 0.1% 9/20/24 | JPY | 5,600,000 | 50,777 |

| 0.1% 12/20/24 | JPY | 4,300,000 | 39,011 |

| 0.1% 3/20/26 | JPY | 19,900,000 | 180,822 |

| 0.1% 6/20/26 | JPY | 48,600,000 | 441,716 |

| 0.1% 9/20/26 | JPY | 20,350,000 | 184,952 |

| 0.1% 12/20/26 | JPY | 9,700,000 | 88,223 |

| 0.1% 3/20/27 | JPY | 13,300,000 | 120,995 |

| 0.1% 9/20/27 | JPY | 9,750,000 | 88,757 |

| 0.1% 12/20/27 | JPY | 7,850,000 | 71,475 |

| 0.1% 3/20/28 | JPY | 4,750,000 | 43,250 |

| 0.1% 6/20/28 | JPY | 6,750,000 | 61,458 |

| 0.1% 12/20/28 | JPY | 4,300,000 | 39,134 |

| 0.1% 3/20/29 | JPY | 11,450,000 | 104,178 |

| 0.1% 6/20/29 | JPY | 3,900,000 | 35,468 |

| 0.1% 9/20/29 | JPY | 636,700,000 | 5,786,093 |

| 0.1% 12/20/29 | JPY | 7,900,000 | 71,740 |

| 0.1% 3/20/30 | JPY | 15,400,000 | 139,737 |

| 0.1% 6/20/30 | JPY | 58,500,000 | 530,515 |

| 0.1% 9/20/30 | JPY | 210,300,000 | 1,905,090 |

| 0.2% 6/20/36 | JPY | 179,250,000 | 1,599,140 |

| 0.3% 12/20/24 | JPY | 7,650,000 | 69,879 |

| 0.3% 12/20/25 | JPY | 37,150,000 | 340,478 |

| 0.3% 6/20/39 | JPY | 58,150,000 | 515,627 |

| 0.3% 9/20/39 | JPY | 56,150,000 | 496,528 |

| 0.3% 12/20/39 | JPY | 61,650,000 | 544,292 |

| 0.3% 6/20/46 | JPY | 69,100,000 | 582,394 |

| 0.4% 6/20/25 | JPY | 12,550,000 | 115,331 |

| 0.4% 9/20/25 | JPY | 44,650,000 | 410,770 |

| 0.4% 3/20/36 | JPY | 28,300,000 | 260,097 |

| 0.4% 3/20/40 | JPY | 51,800,000 | 465,158 |

| 0.4% 6/20/40 | JPY | 10,450,000 | 93,574 |

| 0.4% 9/20/40 | JPY | 67,500,000 | 603,955 |

| 0.4% 6/20/49 | JPY | 9,150,000 | 77,057 |

| 0.4% 9/20/49 | JPY | 5,450,000 | 45,743 |

| 0.4% 3/20/50 | JPY | 35,400,000 | 296,236 |

| 0.4% 3/20/56 | JPY | 132,650,000 | 1,072,794 |

| 0.5% 9/20/36 | JPY | 37,400,000 | 347,984 |

| 0.5% 12/20/38 | JPY | 15,550,000 | 143,174 |

| 0.5% 9/20/46 | JPY | 15,100,000 | 133,330 |

| 0.5% 3/20/49 | JPY | 10,450,000 | 90,586 |

| 0.5% 3/20/59 | JPY | 6,350,000 | 52,499 |

| 0.6% 12/20/36 | JPY | 12,050,000 | 113,650 |

| 0.6% 6/20/37 | JPY | 3,900,000 | 36,728 |

| 0.6% 12/20/37 | JPY | 6,700,000 | 63,003 |

| 0.6% 6/20/50 | JPY | 15,150,000 | 133,513 |

| 0.7% 9/20/38 | JPY | 143,050,000 | 1,361,560 |

| 0.7% 6/20/48 | JPY | 13,100,000 | 120,077 |

| 0.7% 12/20/48 | JPY | 10,800,000 | 98,630 |

| 0.8% 9/20/22 | JPY | 30,850,000 | 280,750 |

| 0.8% 9/20/47 | JPY | 10,200,000 | 96,002 |

| 0.9% 9/20/48 | JPY | 249,150,000 | 2,390,759 |

| 1% 12/20/35 | JPY | 18,450,000 | 183,935 |

| 1.2% 3/20/35 | JPY | 19,650,000 | 200,280 |

| 1.4% 3/20/55 | JPY | 5,500,000 | 59,402 |

| 1.6% 6/20/30 | JPY | 4,600,000 | 47,276 |

| 1.6% 3/20/33 | JPY | 4,300,000 | 45,262 |

| 1.6% 12/20/33 | JPY | 33,050,000 | 350,004 |

| 1.7% 12/20/22 | JPY | 28,850,000 | 266,577 |

| TOTAL JAPAN | 29,326,499 | ||

| Korea (South) - 3.3% | |||

| Korean Republic: | |||

| 0.75% 3/10/23 | KRW | 1,632,970,000 | 1,433,230 |

| 1.125% 9/10/25 | KRW | 359,480,000 | 310,641 |

| 1.125% 9/10/39 | KRW | 321,370,000 | 237,914 |

| 1.25% 12/10/22 | KRW | 164,870,000 | 146,111 |

| 1.375% 9/10/24 | KRW | 836,330,000 | 735,647 |

| 1.375% 12/10/29 | KRW | 41,420,000 | 34,744 |

| 1.375% 6/10/30 | KRW | 368,030,000 | 306,880 |

| 1.5% 12/10/26 | KRW | 32,000,000 | 27,756 |

| 1.5% 12/10/30 | KRW | 763,790,000 | 640,833 |

| 1.5% 9/10/40 | KRW | 260,680,000 | 204,846 |

| 1.625% 6/10/22 | KRW | 703,200,000 | 626,050 |

| 1.875% 3/10/22 | KRW | 28,940,000 | 25,779 |

| 1.875% 3/10/51 | KRW | 335,740,000 | 275,075 |

| 2% 9/10/22 | KRW | 672,950,000 | 602,037 |

| 2% 3/10/49 | KRW | 381,850,000 | 322,743 |

| 2.125% 3/10/47 | KRW | 29,200,000 | 25,369 |

| 2.25% 9/10/23 | KRW | 448,940,000 | 404,485 |

| 2.375% 12/10/27 | KRW | 50,660,000 | 45,949 |

| 2.375% 12/10/28 | KRW | 514,930,000 | 468,048 |

| 2.375% 9/10/38 | KRW | 26,620,000 | 24,062 |

| 2.625% 6/10/28 | KRW | 121,650,000 | 112,012 |

| 2.625% 3/10/48 | KRW | 48,020,000 | 45,963 |

| 3% 3/10/23 | KRW | 160,920,000 | 146,579 |

| 3.375% 9/10/23 | KRW | 41,520,000 | 38,407 |

| TOTAL KOREA (SOUTH) | 7,241,160 | ||

| Latvia - 0.1% | |||

| Latvian Republic 1.375% 9/23/25 (Reg. S) | EUR | 100,000 | 126,861 |

| Lithuania - 0.1% | |||

| Lithuanian Republic: | |||

| 0.5% 6/19/29 (Reg. S) | EUR | 32,000 | 39,291 |

| 2.125% 10/22/35 (Reg. S) | EUR | 57,000 | 84,185 |

| TOTAL LITHUANIA | 123,476 | ||

| Luxembourg - 0.0% | |||

| Grand Duchy of Luxembourg 0% 4/28/25 (Reg. S) | EUR | 35,000 | 42,266 |

| Malaysia - 0.5% | |||

| Malaysian Government: | |||

| 3.478% 6/14/24 | MYR | 170,000 | 42,347 |

| 3.729% 3/31/22 | MYR | 1,277,000 | 311,875 |

| 3.757% 5/22/40 | MYR | 1,474,000 | 333,808 |

| 3.9% 11/30/26 | MYR | 152,000 | 38,963 |

| 3.906% 7/15/26 | MYR | 171,000 | 43,474 |

| 4.059% 9/30/24 | MYR | 219,000 | 55,469 |

| 4.119% 11/30/34 | MYR | 416,000 | 101,038 |

| 4.128% 8/15/25 | MYR | 405,000 | 103,270 |

| 4.736% 3/15/46 | MYR | 90,000 | 22,733 |

| 4.921% 7/6/48 | MYR | 50,000 | 12,905 |

| 4.935% 9/30/43 | MYR | 150,000 | 39,074 |

| TOTAL MALAYSIA | 1,104,956 | ||

| Mexico - 1.1% | |||

| United Mexican States: | |||

| 1.125% 1/17/30 | EUR | 100,000 | 116,352 |

| 2.875% 4/8/39 | EUR | 185,000 | 228,111 |

| 5.75% 3/5/26 | MXN | 1,481,000 | 72,345 |

| 6.75% 3/9/23 | MXN | 5,589,000 | 285,808 |

| 7.25% 12/9/21 | MXN | 11,022,200 | 558,810 |

| 8% 9/5/24 | MXN | 17,600,000 | 930,094 |

| 8% 11/7/47 | MXN | 2,772,000 | 146,099 |

| TOTAL MEXICO | 2,337,619 | ||

| Netherlands - 1.0% | |||

| Dutch Government: | |||

| 0% 1/15/27 (Reg. S) (d) | EUR | 35,000 | 42,550 |

| 0% 7/15/30 (Reg. S) (d) | EUR | 168,000 | 202,391 |

| 0% 1/15/52 (Reg. S) (d) | EUR | 208,000 | 220,633 |

| 0.25% 7/15/25 (d) | EUR | 91,000 | 111,598 |

| 0.25% 7/15/29(Reg. S) (d) | EUR | 836,000 | 1,032,045 |

| 0.5% 7/15/26(Reg. S) (d) | EUR | 32,000 | 39,914 |

| 0.5% 1/15/40 (Reg. S) (d) | EUR | 166,000 | 207,536 |

| 0.75% 7/15/27 (Reg. S) (d) | EUR | 106,000 | 134,797 |

| 2.5% 1/15/33 (d) | EUR | 80,000 | 122,909 |

| 4% 1/15/37 (d) | EUR | 30,000 | 57,059 |

| TOTAL NETHERLANDS | 2,171,432 | ||

| New Zealand - 0.3% | |||

| New Zealand Government: | |||

| 0.5% 5/15/24 | NZD | 318,000 | 220,722 |

| 1.5% 5/15/31 | NZD | 181,000 | 123,360 |

| 1.75% 5/15/41 | NZD | 152,000 | 92,470 |

| 2.75% 4/15/25 | NZD | 140,000 | 104,453 |

| TOTAL NEW ZEALAND | 541,005 | ||

| Norway - 0.1% | |||

| Kingdom of Norway: | |||

| 1.375% 8/19/30 (Reg. S) (d) | NOK | 1,001,000 | 116,678 |

| 1.5% 2/19/26 (Reg. S) (d) | NOK | 295,000 | 34,865 |

| 1.75% 2/17/27 (Reg. S) (d) | NOK | 884,000 | 105,850 |

| TOTAL NORWAY | 257,393 | ||

| Peru - 0.1% | |||

| Peruvian Republic: | |||

| 5.94% 2/12/29 | PEN | 362,000 | 102,797 |

| 6.15% 8/12/32 | PEN | 684,000 | 185,871 |

| TOTAL PERU | 288,668 | ||

| Poland - 0.7% | |||

| Polish Government: | |||

| 0% 2/10/25 (Reg. S) | EUR | 41,000 | 48,989 |

| 1% 3/7/29 (Reg. S) | EUR | 309,000 | 393,716 |

| 1.25% 10/25/30 | PLN | 396,000 | 100,555 |

| 2% 3/8/49 (Reg. S) | EUR | 17,000 | 24,798 |

| 2.5% 1/25/23 | PLN | 1,093,000 | 296,813 |

| 2.5% 4/25/24 | PLN | 1,910,000 | 527,572 |

| 4% 10/25/23 | PLN | 97,000 | 27,534 |

| 4% 4/25/47 | PLN | 96,000 | 33,792 |

| TOTAL POLAND | 1,453,769 | ||

| Portugal - 0.5% | |||

| Portugal Obrigacoes Do Tesouro: | |||

| 0.9% 10/12/35 (Reg. S) (d) | EUR | 84,000 | 102,114 |

| 1.95% 6/15/29 (Reg. S) (d) | EUR | 458,000 | 623,603 |

| 2.875% 10/15/25 (Reg. S) (d) | EUR | 22,000 | 29,786 |

| 2.875% 7/21/26(Reg. S) (d) | EUR | 196,000 | 270,101 |

| Portuguese Republic 2.25% 4/18/34 (d) | EUR | 108,000 | 154,308 |

| TOTAL PORTUGAL | 1,179,912 | ||

| Romania - 0.0% | |||

| Romanian Republic: | |||

| 2.875% 5/26/28 (Reg. S) | EUR | 32,000 | 42,291 |

| 4.125% 3/11/39 | EUR | 35,000 | 49,057 |

| TOTAL ROMANIA | 91,348 | ||

| Russia - 0.3% | |||

| Ministry of Finance of the Russian Federation: | |||

| 6.5% 2/28/24 | RUB | 2,875,000 | 39,090 |

| 7.05% 1/19/28 | RUB | 3,503,000 | 48,160 |

| 7.25% 5/10/34 | RUB | 7,600,000 | 105,216 |

| 7.6% 7/20/22 | RUB | 4,237,000 | 58,748 |

| 7.65% 4/10/30 | RUB | 29,590,000 | 420,544 |

| 7.7% 3/23/33 | RUB | 2,462,000 | 35,262 |

| TOTAL RUSSIA | 707,020 | ||

| Saudi Arabia - 0.1% | |||

| Kingdom of Saudi Arabia 2% 7/9/39 (Reg. S) | EUR | 163,000 | 199,257 |

| Singapore - 0.3% | |||

| Republic of Singapore: | |||

| 2% 2/1/24 | SGD | 147,000 | 113,417 |

| 2.125% 6/1/26 | SGD | 271,000 | 213,033 |

| 2.25% 8/1/36 | SGD | 305,000 | 237,946 |

| 2.375% 7/1/39 | SGD | 191,000 | 152,509 |

| 2.75% 3/1/46 | SGD | 20,000 | 17,268 |

| TOTAL SINGAPORE | 734,173 | ||

| Slovakia - 0.2% | |||

| Slovakia Republic: | |||

| 0% 11/13/23 | EUR | 50,000 | 60,079 |

| 0.25% 5/14/25 (Reg. S) | EUR | 84,000 | 102,292 |

| 1% 10/9/30 (Reg. S) | EUR | 110,000 | 142,362 |

| 1.625% 1/21/31 (Reg. S) | EUR | 117,000 | 161,459 |

| 3% 2/28/23 (Reg. S) | EUR | 52,000 | 65,452 |

| TOTAL SLOVAKIA | 531,644 | ||

| Slovenia - 0.2% | |||

| Republic of Slovenia: | |||

| 1.1875% 3/14/29 (Reg. S) | EUR | 110,000 | 143,313 |

| 1.25% 3/22/27 (Reg. S) | EUR | 84,000 | 108,807 |

| 2.125% 7/28/25 (Reg. S) | EUR | 64,000 | 84,240 |

| TOTAL SLOVENIA | 336,360 | ||

| Spain - 3.4% | |||

| Spanish Kingdom: | |||

| 0% 4/30/23 | EUR | 32,000 | 38,294 |

| 0.25% 7/30/24(Reg. S) (d) | EUR | 148,000 | 179,123 |

| 0.35% 7/30/23 | EUR | 179,000 | 215,967 |

| 0.45% 10/31/22 | EUR | 23,000 | 27,638 |

| 0.5% 4/30/30 (Reg. S) (d) | EUR | 143,000 | 172,659 |

| 0.6% 10/31/29 (Reg. S) (d) | EUR | 32,000 | 39,116 |

| 0.8% 7/30/27 (Reg. S) (d) | EUR | 85,000 | 106,004 |

| 1% 10/31/50 (Reg. S) (d) | EUR | 508,000 | 543,904 |

| 1.2% 10/31/40 (Reg. S) (d) | EUR | 84,000 | 101,040 |

| 1.25% 10/31/30 (Reg. S) (d) | EUR | 457,000 | 586,653 |

| 1.4% 4/30/28 (Reg. S) (d) | EUR | 100,000 | 129,559 |

| 1.45% 10/31/27 (d) | EUR | 100,000 | 129,708 |

| 1.45% 4/30/29 (Reg. S) (d) | EUR | 2,826,000 | 3,687,726 |

| 1.5% 4/30/27 (Reg. S) (d) | EUR | 157,000 | 203,799 |

| 1.6% 4/30/25 (d) | EUR | 243,000 | 310,005 |

| 1.85% 7/30/35 (Reg. S) (d) | EUR | 272,000 | 368,355 |

| 1.95% 4/30/26 (Reg. S) (d) | EUR | 40,000 | 52,471 |

| 1.95% 7/30/30 (Reg. S) (d) | EUR | 26,000 | 35,362 |

| 2.15% 10/31/25 (Reg. S) (d) | EUR | 44,000 | 57,783 |

| 2.35% 7/30/33 (Reg. S) (d) | EUR | 70,000 | 99,731 |

| 2.7% 10/31/48 (d) | EUR | 189,000 | 293,914 |

| 5.15% 10/31/28 (d) | EUR | 80,000 | 129,997 |

| TOTAL SPAIN | 7,508,808 | ||

| Sweden - 0.0% | |||

| Sweden Kingdom 0.75% 11/12/29 (d) | SEK | 265,000 | 32,273 |

| Switzerland - 0.6% | |||

| Switzerland Confederation: | |||

| 0% 6/22/29 (Reg. S) | CHF | 601,000 | 667,950 |

| 0% 6/26/34 (Reg. S) | CHF | 24,000 | 26,287 |

| 0% 7/24/39 (Reg. S) | CHF | 383,000 | 413,652 |

| 1.25% 5/28/26 | CHF | 35,000 | 41,255 |

| 3.5% 4/8/33 | CHF | 45,000 | 69,682 |

| TOTAL SWITZERLAND | 1,218,826 | ||

| Thailand - 0.7% | |||

| Kingdom of Thailand: | |||

| 1.45% 12/17/24 | THB | 5,595,000 | 178,344 |

| 1.6% 12/17/29 | THB | 4,153,000 | 129,132 |

| 1.6% 6/17/35 | THB | 3,108,000 | 90,140 |

| 2.125% 12/17/26 | THB | 3,013,000 | 99,556 |

| 2.4% 12/17/23 | THB | 18,518,000 | 600,889 |

| 3.3% 6/17/38 | THB | 9,866,000 | 345,152 |

| 3.65% 6/20/31 | THB | 2,464,000 | 89,303 |

| 3.775% 6/25/32 | THB | 1,580,000 | 58,038 |

| 3.85% 12/12/25 | THB | 1,091,000 | 38,499 |

| TOTAL THAILAND | 1,629,053 | ||

| United Kingdom - 3.3% | |||

| United Kingdom, Great Britain and Northern Ireland: | |||

| 0.125% 1/31/23 (Reg. S) | GBP | 501,000 | 693,678 |

| 0.25% 7/31/31 (Reg. S) | GBP | 338,000 | 441,112 |

| 0.375% 10/22/30 (Reg. S) | GBP | 371,000 | 495,755 |

| 0.625% 6/7/25 | GBP | 34,000 | 47,728 |

| 0.625% 7/31/35 (Reg. S) | GBP | 77,000 | 100,302 |

| 0.625% 10/22/50 (Reg. S) | GBP | 701,000 | 823,952 |

| 1% 4/22/24(Reg. S) | GBP | 144,000 | 203,884 |

| 1.25% 7/22/27 | GBP | 42,000 | 60,886 |

| 1.25% 10/22/41 (Reg. S) | GBP | 1,513,076 | 2,105,828 |

| 1.5% 7/22/47 | GBP | 120,000 | 175,586 |

| 1.625% 10/22/54 (Reg. S) | GBP | 263,000 | 403,535 |

| 1.75% 9/7/37 (Reg. S) | GBP | 227,000 | 343,325 |

| 1.75% 1/22/49(Reg. S) | GBP | 742,000 | 1,149,530 |

| 4.25% 9/7/39 | GBP | 13,000 | 27,154 |

| 4.25% 12/7/40 | GBP | 19,000 | 40,365 |

| 4.25% 12/7/55 | GBP | 30,000 | 77,101 |

| TOTAL UNITED KINGDOM | 7,189,721 | ||

| TOTAL GOVERNMENT OBLIGATIONS | |||

| (Cost $140,858,451) | 140,295,963 | ||

| Supranational Obligations - 4.3% | |||

| African Development Bank: | |||

| 0.125% 10/7/26 | EUR | 41,000 | 49,549 |

| 0.875% 5/24/28 | EUR | 87,000 | 110,088 |

| Asian Development Bank: | |||

| 0.2% 5/25/23 | EUR | 130,000 | 156,167 |

| 1.125% 12/15/25 | GBP | 32,000 | 45,403 |

| 1.375% 3/7/25 | GBP | 25,000 | 35,725 |

| 2.45% 1/17/24 | AUD | 65,000 | 51,240 |

| 3.3% 8/8/28 | AUD | 55,000 | 46,395 |

| Council of Europe Development Bank: | |||

| 0% 4/9/27 (Reg. S) | EUR | 33,000 | 39,827 |

| 0.125% 5/25/23 | EUR | 23,000 | 27,622 |

| 0.375% 10/27/22 (Reg. S) | EUR | 49,000 | 58,824 |

| 0.625% 6/15/22 (Reg. S) | GBP | 188,000 | 261,144 |

| 1.125% 12/15/21 (Reg. S) | GBP | 91,000 | 126,419 |

| European Financial Stability Facility: | |||

| 0% 11/17/22 (Reg. S) | EUR | 79,000 | 94,444 |

| 0.05% 10/17/29 (Reg. S) | EUR | 23,000 | 27,531 |

| 0.7% 1/20/50 (Reg. S) | EUR | 176,000 | 211,763 |

| 0.75% 5/3/27 (Reg. S) | EUR | 43,000 | 54,004 |

| 0.875% 4/10/35 (Reg. S) | EUR | 610,000 | 778,018 |

| 1.45% 9/5/40 (Reg. S) | EUR | 23,000 | 31,859 |

| European Investment Bank: | |||

| 0% 9/9/30 (Reg. S) | EUR | 109,000 | 129,429 |

| 0.05% 10/13/34 (Reg. S) | EUR | 457,000 | 526,533 |

| 0.375% 7/16/25 | EUR | 577,000 | 706,880 |

| 0.375% 4/14/26 (Reg. S) | EUR | 413,000 | 507,734 |

| 0.875% 12/15/23 (Reg. S) | GBP | 145,000 | 203,522 |

| 1% 9/21/26 (Reg. S) | GBP | 226,000 | 319,319 |

| 1.375% 3/7/25 (Reg. S) | GBP | 61,000 | 87,186 |

| 1.5% 1/26/24 | NOK | 740,000 | 87,198 |

| 1.75% 7/30/24 (Reg. S) | CAD | 69,000 | 57,180 |

| 1.75% 11/12/26 (Reg. S) | SEK | 240,000 | 29,939 |

| 2.375% 1/18/23 (Reg. S) | CAD | 294,000 | 244,182 |

| 2.7% 1/12/23 | AUD | 72,000 | 56,042 |

| 3% 9/28/22 | EUR | 220,000 | 272,663 |

| European Stability Mechanism: | |||

| 0% 1/17/22 (Reg. S) | EUR | 39,000 | 46,382 |

| 0.01% 3/4/30 | EUR | 35,000 | 41,674 |

| 0.75% 9/5/28 (Reg. S) | EUR | 48,000 | 60,677 |

| 0.875% 7/18/42 (Reg. S) | EUR | 34,000 | 43,065 |

| 1.125% 5/3/32 (Reg. S) | EUR | 47,000 | 61,875 |

| 1.2% 5/23/33 (Reg. S) | EUR | 37,000 | 49,131 |

| 1.85% 12/1/55 (Reg. S) | EUR | 100,000 | 163,731 |

| European Union: | |||

| 0% 11/4/25 (Reg. S) | EUR | 797,000 | 963,205 |

| 0% 7/4/35 (Reg. S) | EUR | 241,000 | 273,464 |

| 0.1% 10/4/40 (Reg. S) | EUR | 135,000 | 148,046 |

| 0.3% 11/4/50 (Reg. S) | EUR | 125,000 | 134,520 |

| 1.125% 4/4/36 (Reg. S) | EUR | 94,000 | 123,444 |

| Inter-American Development Bank: | |||

| 1.25% 12/15/25 | GBP | 308,000 | 439,333 |

| 3.15% 6/26/29 | AUD | 120,000 | 100,319 |

| International Bank for Reconstruction & Development: | |||

| 1% 12/19/22 | GBP | 19,000 | 26,598 |

| 1% 12/21/29 | GBP | 248,000 | 346,565 |

| 1.2% 8/8/34 | EUR | 23,000 | 30,490 |

| 1.8% 7/26/24 | CAD | 87,000 | 72,158 |

| 2.2% 2/27/24 | AUD | 207,000 | 162,436 |

| 2.25% 1/17/23 | CAD | 93,000 | 76,970 |

| 2.5% 8/3/23 | CAD | 68,000 | 56,769 |

| 2.8% 1/12/22 | AUD | 89,000 | 67,700 |

| International Finance Corp.: | |||

| 1.375% 9/13/24 | CAD | 196,000 | 160,685 |

| 2.8% 8/15/22 | AUD | 469,000 | 362,234 |

| 3.15% 6/26/29 (Reg. S) | AUD | 90,000 | 75,417 |

| Nordic Investment Bank 1.125% 12/15/23 (Reg. S) | GBP | 40,000 | 56,477 |

| TOTAL SUPRANATIONAL OBLIGATIONS | |||

| (Cost $9,328,137) | 9,577,194 | ||

| Shares | Value | ||

| Money Market Funds - 1.1% | |||

| Fidelity Cash Central Fund 0.06% (e) | |||

| (Cost $2,413,936) | 2,413,453 | 2,413,936 | |

| TOTAL INVESTMENT IN SECURITIES - 97.6% | |||

| (Cost $213,566,305) | 215,056,966 | ||

| NET OTHER ASSETS (LIABILITIES) - 2.4% | 5,295,566 | ||

| NET ASSETS - 100% | $220,352,532 |

| Forward Foreign Currency Contracts | ||||||

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation/(Depreciation) | ||

| CAD | 233,568 | USD | 188,483 | Bank Of America NA | 7/6/21 | $(62) |

| EUR | 649,485 | USD | 770,225 | State Street Bank And Tr Co | 7/6/21 | (33) |

| JPY | 78,154,314 | USD | 703,594 | JPMorgan Chase Bank | 7/6/21 | (79) |

| USD | 7,315,445 | AUD | 9,430,000 | Citibank NA | 8/20/21 | 241,824 |

| USD | 240,835 | CAD | 292,000 | BNP Paribas | 8/20/21 | 5,281 |

| USD | 65,530 | CAD | 81,000 | Bank Of America NA | 8/20/21 | 188 |

| USD | 250,160 | CAD | 310,000 | Bank Of America NA | 8/20/21 | 84 |

| USD | 12,974,452 | CAD | 15,675,000 | Bank Of America NA | 8/20/21 | 329,519 |

| USD | 1,553,850 | CHF | 1,396,000 | Canadian Imperial Bk Commerce | 8/20/21 | 43,072 |

| USD | 23,379,099 | CNY | 151,483,000 | BNP Paribas | 8/20/21 | (1,778) |

| USD | 1,756,836 | CNY | 11,424,000 | Goldman Sachs Bank USA | 8/20/21 | (6,419) |

| USD | 255,821 | COP | 944,900,000 | Goldman Sachs Bank USA | 8/20/21 | 4,649 |

| USD | 860,222 | CZK | 17,921,000 | Brown Brothers Harriman & Co. | 8/20/21 | 27,210 |

| USD | 96,530 | CZK | 2,017,000 | Goldman Sachs Bank USA | 8/20/21 | 2,775 |

| USD | 876,422 | DKK | 5,321,000 | BNP Paribas | 8/20/21 | 27,140 |

| USD | 90,661 | DKK | 552,000 | Bank Of America NA | 8/20/21 | 2,557 |

| USD | 99,005,543 | EUR | 80,815,000 | Canadian Imperial Bk Commerce | 8/20/21 | 3,081,034 |

| USD | 50,067 | EUR | 41,000 | JPMorgan Chase Bank | 8/20/21 | 1,402 |

| USD | 299,761 | EUR | 246,000 | JPMorgan Chase Bank | 8/20/21 | 7,767 |

| USD | 381,794 | EUR | 320,000 | JPMorgan Chase Bank | 8/20/21 | 1,965 |

| USD | 78,778 | EUR | 66,000 | JPMorgan Chase Bank | 8/20/21 | 438 |

| USD | 415,958 | EUR | 341,000 | JPMorgan Chase Bank | 8/20/21 | 11,204 |

| USD | 556,298 | EUR | 458,000 | State Street Bank And Tr Co | 8/20/21 | 12,668 |

| USD | 937,708 | EUR | 790,000 | State Street Bank And Tr Co | 8/20/21 | 6 |

| USD | 52,532 | EUR | 43,000 | State Street Bank And Tr Co | 8/20/21 | 1,492 |

| USD | 17,174,115 | GBP | 12,116,000 | Brown Brothers Harriman & Co. | 8/20/21 | 412,077 |

| USD | 182,489 | GBP | 131,000 | JPMorgan Chase Bank | 8/20/21 | 1,255 |

| USD | 93,527 | GBP | 67,000 | JPMorgan Chase Bank | 8/20/21 | 835 |

| USD | 93,212 | GBP | 66,000 | State Street Bank And Tr Co | 8/20/21 | 1,903 |

| USD | 1,077,628 | IDR | 15,682,500,000 | BNP Paribas | 8/20/21 | 459 |

| USD | 722,875 | ILS | 2,359,000 | Brown Brothers Harriman & Co. | 8/20/21 | (1,065) |

| USD | 28,671,594 | JPY | 3,115,550,000 | Brown Brothers Harriman & Co. | 8/20/21 | 615,951 |

| USD | 126,980 | JPY | 13,900,000 | JPMorgan Chase Bank | 8/20/21 | 1,810 |

| USD | 84,817 | JPY | 9,350,000 | JPMorgan Chase Bank | 8/20/21 | 619 |

| USD | 907,351 | JPY | 100,750,000 | JPMorgan Chase Bank | 8/20/21 | 94 |

| USD | 103,145 | JPY | 11,250,000 | JPMorgan Chase Bank | 8/20/21 | 1,838 |

| USD | 91,492 | JPY | 10,150,000 | State Street Bank And Tr Co | 8/20/21 | 91 |

| USD | 7,196,336 | KRW | 8,123,800,000 | BNP Paribas | 8/20/21 | 8,804 |

| USD | 1,808,520 | MXN | 36,249,000 | Brown Brothers Harriman & Co. | 8/20/21 | 1,320 |

| USD | 231,376 | MXN | 4,664,000 | State Street Bank And Tr Co | 8/20/21 | (1,149) |

| USD | 1,126,750 | MYR | 4,667,000 | Goldman Sachs Bank USA | 8/20/21 | 4,937 |

| USD | 406,921 | NOK | 3,370,000 | Brown Brothers Harriman & Co. | 8/20/21 | 15,426 |

| USD | 562,582 | NZD | 783,000 | Bank Of America NA | 8/20/21 | 15,338 |

| USD | 304,455 | PEN | 1,140,000 | Goldman Sachs Bank USA | 8/20/21 | 8,358 |

| USD | 771,072 | PLN | 2,851,000 | Brown Brothers Harriman & Co. | 8/20/21 | 23,230 |

| USD | 257,015 | PLN | 955,000 | Citibank NA | 8/20/21 | 6,510 |

| USD | 716,763 | RUB | 53,530,000 | Goldman Sachs Bank USA | 8/20/21 | (9,735) |

| USD | 2,162,608 | SEK | 17,978,000 | Bank Of America NA | 8/20/21 | 60,943 |

| USD | 744,391 | SGD | 992,000 | Bank Of America NA | 8/20/21 | 6,770 |

| USD | 1,577,799 | THB | 49,606,000 | JPMorgan Chase Bank | 8/20/21 | 31,515 |

| USD | 532,674 | HUF | 152,834,000 | Brown Brothers Harriman & Co. | 8/23/21 | 17,391 |

| TOTAL FORWARD FOREIGN CURRENCY CONTRACTS | $5,019,429 | |||||

| Unrealized Appreciation | 5,039,749 | |||||

| Unrealized Depreciation | (20,320) | |||||

For the period, the average contract value for forward foreign currency contracts was $214,825,197. Contract value represents contract amount in United States dollars plus or minus unrealized appreciation or depreciation, respectively.

Currency Abbreviations

AUD – Australian dollar

CAD – Canadian dollar

CHF – Swiss franc

CNY – Chinese yuan

COP – Colombian peso

CZK – Czech koruna

DKK – Danish krone

EUR – European Monetary Unit

GBP – British pound

HUF – Hungarian forint

IDR – Indonesian rupiah

ILS – Israeli shekel

JPY – Japanese yen

KRW – Korean won

MXN – Mexican peso

MYR – Malyasian ringgit

NOK – Norwegian krone

NZD – New Zealand dollar

PEN – Peruvian new sol

PLN – Polish zloty

RUB – Russian ruble

SEK – Swedish krona

SGD – Singapore dollar

THB – Thai baht

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Amount is stated in United States dollars unless otherwise noted.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(d) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $31,302,324 or 14.2% of net assets.

(e) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $594 |

| Total | $594 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Cash Central Fund 0.06% | $5,482,134 | $36,006,223 | $39,074,403 | $(18) | $-- | $2,413,936 | 0.0% |

| Total | $5,482,134 | $36,006,223 | $39,074,403 | $(18) | $-- | $2,413,936 |

Investment Valuation

The following is a summary of the inputs used, as of June 30, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Corporate Bonds | $62,769,873 | $-- | $62,769,873 | $-- |

| Government Obligations | 140,295,963 | -- | 140,295,963 | -- |

| Supranational Obligations | 9,577,194 | -- | 9,577,194 | -- |

| Money Market Funds | 2,413,936 | 2,413,936 | -- | -- |

| Total Investments in Securities: | $215,056,966 | $2,413,936 | $212,643,030 | $-- |

| Derivative Instruments: | ||||

| Assets | ||||

| Forward Foreign Currency Contracts | $5,039,749 | $-- | $5,039,749 | $-- |

| Total Assets | $5,039,749 | $-- | $5,039,749 | $-- |

| Liabilities | ||||

| Forward Foreign Currency Contracts | $(20,320) | $-- | $(20,320) | $-- |

| Total Liabilities | $(20,320) | $-- | $(20,320) | $-- |

| Total Derivative Instruments: | $5,019,429 | $-- | $5,019,429 | $-- |

Value of Derivative Instruments

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of June 30, 2021. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements.

| Primary Risk Exposure / Derivative Type | Value | |

| Asset | Liability | |

| Foreign Exchange Risk | ||

| Forward Foreign Currency Contracts(a) | $5,039,749 | $(20,320) |

| Total Foreign Exchange Risk | 5,039,749 | (20,320) |

| Total Value of Derivatives | $5,039,749 | $(20,320) |

(a) Gross value is presented in the Statement of Assets and Liabilities in the unrealized appreciation/depreciation on forward foreign currency contracts line-items.

The following table is a summary of the Fund's derivatives inclusive of potential netting arrangements.

| Counterparty | Value of Derivative Assets | Value of Derivative Liabilities | Collateral Received(a) | Collateral Pledged(b) | Net(b) |

| Bank of America, N.A. | $ 415,399 | $(62) | $-- | $-- | $415,337 |

| BNP Paribas SA | 41,684 | (1,178) | -- | -- | 39,906 |

| Brown Brothers Harriman & Co | 1,112,605 | (1,065) | -- | -- | 1,111,540 |

| CIBC | 3,124,106 | -- | -- | -- | 3,124,106 |

| Citibank NA | 248,334 | -- | -- | -- | 248,334 |

| Goldman Sachs Bank USA | 20,719 | (16,154) | -- | -- | 4,565 |

| JPMorgan Chase Bank | 60,742 | (79) | -- | -- | 60,663 |

| State Street Bank And Tr Co | 16,160 | (1,182) | -- | -- | 14,978 |

| Total | $5,039,749 | $(20,320) |

(a) Reflects collateral received from or pledged to an individual counterparty, excluding any excess or initial collateral amounts.

(b) Net represents the receivable / (payable) that would be due from / (to) the counterparty in an event of default. Netting may be allowed across transactions traded under the same legal agreement with the same legal entity. Please refer to Derivative Instruments - Risk Exposures and the Use of Derivative Instruments section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| June 30, 2021 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value — See accompanying schedule: Unaffiliated issuers (cost $211,152,369) | $212,643,030 | |

| Fidelity Central Funds (cost $2,413,936) | 2,413,936 | |

| Total Investment in Securities (cost $213,566,305) | $215,056,966 | |

| Foreign currency held at value (cost $61,797) | 60,908 | |

| Receivable for investments sold | 1,571,961 | |

| Unrealized appreciation on forward foreign currency contracts | 5,039,749 | |

| Receivable for fund shares sold | 211,530 | |

| Dividends receivable | 3,376 | |

| Interest receivable | 1,163,695 | |

| Distributions receivable from Fidelity Central Funds | 61 | |

| Total assets | 223,108,246 | |

| Liabilities | ||

| Payable for investments purchased | $2,506,171 | |

| Unrealized depreciation on forward foreign currency contracts | 20,320 | |

| Payable for fund shares redeemed | 216,830 | |

| Accrued management fee | 10,847 | |

| Other payables and accrued expenses | 1,546 | |

| Total liabilities | 2,755,714 | |

| Net Assets | $220,352,532 | |

| Net Assets consist of: | ||

| Paid in capital | $221,552,566 | |

| Total accumulated earnings (loss) | (1,200,034) | |

| Net Assets | $220,352,532 | |

| Net Asset Value, offering price and redemption price per share ($220,352,532 ÷ 21,945,783 shares) | $10.04 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended June 30, 2021 (Unaudited) | ||

| Investment Income | ||

| Interest | $789,879 | |

| Income from Fidelity Central Funds | 594 | |

| Total income | 790,473 | |

| Expenses | ||

| Management fee | $60,385 | |

| Independent trustees' fees and expenses | 248 | |

| Interest | 46 | |

| Total expenses | 60,679 | |

| Net investment income (loss) | 729,794 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 16,996 | |

| Fidelity Central Funds | (18) | |

| Forward foreign currency contracts | 3,866,134 | |

| Foreign currency transactions | (6,776,640) | |

| Total net realized gain (loss) | (2,893,528) | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers (net of increase in deferred foreign taxes of $1,476) | (10,222,919) | |

| Forward foreign currency contracts | 9,317,773 | |

| Assets and liabilities in foreign currencies | (34,053) | |

| Total change in net unrealized appreciation (depreciation) | (939,199) | |

| Net gain (loss) | (3,832,727) | |

| Net increase (decrease) in net assets resulting from operations | $(3,102,933) |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended June 30, 2021 (Unaudited) | Year ended December 31, 2020 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $729,794 | $456,355 |

| Net realized gain (loss) | (2,893,528) | (4,873,829) |

| Change in net unrealized appreciation (depreciation) | (939,199) | 7,580,478 |

| Net increase (decrease) in net assets resulting from operations | (3,102,933) | 3,163,004 |

| Distributions to shareholders | (299,353) | (804,372) |

| Share transactions | ||

| Proceeds from sales of shares | 69,949,187 | 183,921,925 |

| Reinvestment of distributions | 279,665 | 741,140 |

| Cost of shares redeemed | (31,105,597) | (18,511,624) |

| Net increase (decrease) in net assets resulting from share transactions | 39,123,255 | 166,151,441 |

| Total increase (decrease) in net assets | 35,720,969 | 168,510,073 |

| Net Assets | ||

| Beginning of period | 184,631,563 | 16,121,490 |

| End of period | $220,352,532 | $184,631,563 |

| Other Information | ||

| Shares | ||

| Sold | 6,938,893 | 18,178,523 |

| Issued in reinvestment of distributions | 27,883 | 72,797 |

| Redeemed | (3,078,282) | (1,827,610) |

| Net increase (decrease) | 3,888,494 | 16,423,710 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity International Bond Index Fund

| Six months ended (Unaudited) June 30, | Years endedDecember 31, | ||

| 2021 | 2020 | 2019 A | |

| Selected Per–Share Data | |||

| Net asset value, beginning of period | $10.22 | $9.87 | $10.00 |

| Income from Investment Operations | |||

| Net investment income (loss)B | .036 | .054 | .010 |

| Net realized and unrealized gain (loss) | (.201) | .372 | (.123) |

| Total from investment operations | (.165) | .426 | (.113) |

| Distributions from net investment income | (.015) | (.076) | (.009) |

| Distributions from net realized gain | – | – | (.008) |

| Total distributions | (.015) | (.076) | (.017) |

| Net asset value, end of period | $10.04 | $10.22 | $9.87 |

| Total ReturnC | (1.61)% | 4.33% | (1.13)% |

| Ratios to Average Net AssetsD,E | |||

| Expenses before reductions | .06%F | .06% | .06%F |

| Expenses net of fee waivers, if any | .06%F | .06% | .06%F |

| Expenses net of all reductions | .06%F | .06% | .06%F |

| Net investment income (loss) | .73%F | .54% | .45%F |

| Supplemental Data | |||

| Net assets, end of period (000 omitted) | $220,353 | $184,632 | $16,121 |

| Portfolio turnover rateG | 37%F | 5% | 3%H |

A For the period October 10, 2019 (commencement of operations) to December 31, 2019.

B Calculated based on average shares outstanding during the period.

C Total returns for periods of less than one year are not annualized.

D Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

F Annualized

G Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

H Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended June 30, 2021

1. Organization.

Fidelity International Bond Index Fund (the Fund) is a non-diversified fund of Fidelity Salem Street Trust (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio(a) |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% to .01% |

(a) Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments