July 2019 A PORTFOLIO OF POWERFUL COMPANIES A Trust Preferred Security Offering “TruP” NASDAQ: AIRT

Statements in this document, which contain more than historical information, may be considered forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995), which are subject to risks and uncertainties. Actual results may differ materially from those expressed in the forward-looking statements because of important potential risks and uncertainties, including, but not limited to, the risk that contracts with major customers will be terminated or not extended, future economic conditions and their impact on the Company's customers, the Company's ability to recover on its investments, including recently acquired companies, the timing and amounts of future orders under the Company's Global Ground Support subsidiary’s contracts, and risks and uncertainties related to business acquisitions, including the ability to successfully achieve the anticipated benefits of the acquisitions, inflation rates, competition, changes in technology or government regulation, information technology disruptions, and the impact of any future terrorist activities in the United States and abroad. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. The Company is under no obligation, and it expressly disclaims any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. Potential investors should review the Company’s risk factors contained in its reports filed with the Securities and Exchange Commission prior to investing. SAFE HARBOR 2

WHO WE ARE ■ AIR T, INC. (NASDAQ: AIRT) is an industrious American company focused on doing capital allocation right. ■ Founded in 1980, our businesses have a history of growth and cashflow generation. ■ Management owns a significant stake in the company, EXECUTIVE purchased entirely with personal funds in the open market. ■ We are working to build value over the short and long term. SUMMARY OPERATING HIGHLIGHTS 1 of 2 ■ AIR T, INC. operates 12 companies with 850+ employees. ■ In the 5 years current management has operated the business, Revenues and Operating Income have increased 30% and 41% per annum, respectively. ■ For fiscal year end 3/31/2019: Revenues were $250 million, Operating Income was $8.1 million and Adjusted EBITDA* was $13.9 million ■ Tangible book value was $23.2 million and working capital was $18.6 million. ■ BB+ Credit Rating by Egan-Jones (Dec 2018). 3

THE 8% TRUST PREFERRED OFFERING ■ AIR T, INC. is raising long-term capital to fund growth. ○ Step 1: Existing shareholders were given a $4 million dividend in the form of a newly issued 8% fixed income trust preferred security, the Alpha Income Preferred (8% AIP). EXECUTIVE ○ Step 2: Existing shareholders were given tradeable Warrants to acquire $21 million face value 8% AIP. ■ Each Warrant gives the holder the right to purchase the 8% AIP at a discount: $2.50 face value 8% AIP for $2.40. SUMMARY ■ The 8% AIP and Warrants trade on the NASDAQ Global Market under tickers AIRTP and AIRTW, respectively. 2 of 2 WHY INVEST NOW ■ The AIP pays a steady 8% for 30 years. ■ The warrants expire in one year. ■ AIR T, INC. is: ○ Growing ○ Diversified ○ Cash Flowing 4

1. The Offering 2. About AIR T, INC. 3. Our Growth Factors CONTENTS 4. The Trust Preferred “TruP” Offering 5. Why Invest Now 6. Appendix - Risk Factors 5

THE 8% TruP OFFERING 6

Get in on the ground floor of a new securities offering. ■ Through a subsidiary trust, we issued to existing equity shareholders $4 million of a new 8% fixed income trust preferred security, Alpha Income Preferred (“AIP”). Ticker: AIRTP ■ We also issued warrants (Ticker: AIRTW) to acquire $21 million face value AIP. ■ Each warrant allows the holder to purchase $2.50 face value AIP for $2.40 at an 8.3% yield. ■ Earn a steady annual stream of income by exercising the warrants, which will expire on June 7, 2020. 7

ABOUT AIR T, INC. 8

We are an industrious American company established 38 years and growing. ■ Our businesses have a history of growth and cash flow generation. ■ We support dynamic, talented individuals and teams that have demonstrated domain knowledge. ■ We work to activate growth and overcome challenges, ultimately building businesses that flourish over the long-term. ■ Our senior leadership has purchased a significant % of AIRT common stock, with their personal funds, in the open market, demonstrating real alignment with all common shareholders. ■ AIRT’s management team has a track record of successfully allocating capital. 9

$250M $13.9M 4 12 850+ FY 2019 REVENUE FY 2019 ADJ EBITDA CORE SEGMENTS COMPANIES EMPLOYEES COMMERCIAL AIRCRAFT OVERNIGHT AIR CARGO & ENGINES AVIATION GROUND SUPPORT AVIATION GROUND SUPPORT EQUIPMENT SERVICES 10

“Investor-Operator Partnership” is designed to drive short and long-term value creation. “Remember: The best businesses are managed by dynamic individuals within high-performance teams. We are set up to make space for dynamos and support their enterprises. My team seeks to focus resources, activate growth and deliver long-term value creation for everyone associated with AIR T, INC.” - Nick NICK SWENSON CHAIRMAN & CEO 11

SEGMENT 1 Commercial Aircraft & Engines ■ We buy aircraft and engines, then either lease them or part them out. ■ We supply parts to maintenance, repair and overhaul facilities (MRO). ■ Business units include Contrail Aviation Support, JetYard, AirCo and Worthington Aviation Parts, and Stratus Aero Partners. Revenue, FY19 $94.0M Reported EBITDA*, FY19 $17.9M Reported EBITDA*, Q1 FY20 $3.6M *Reported EBITDA excludes Intercompany and Corporate and Other results. It includes the founder’s 21% interest in Contrail. A niche between aircraft owners and MRO shops, this segment will seek to grow by coordinating activities and raising investment capital. 12

SEGMENT 2 Overnight Air Cargo ■ We operate two (2) of the seven (7) FedEx feeder airlines. ■ Business units Mountain Air Cargo and CSA Air have a 38-year history with FedEx. Revenue, FY19 $73.0M Reported EBITDA*, FY19 $2.0M Reported EBITDA*, Q1 FY20 $0.1M Air T Companies Since 1982, 1983 *Reported EBITDA excludes Intercompany and Corporate and Other results. An asset-light, predictable business. 13

SEGMENT 3 Aviation Ground Support Services ■ We provide ground support fleet and facility maintenance services at over 65 North American airports. ■ The segment is comprised of Global Aviation Services. Revenue, FY19 $34.3M Reported EBITDA*, FY19 ($0.8M) Reported EBITDA*, Q1 FY20 $0.3M AIR T Company Since 2007 *Reported EBITDA excludes Intercompany and Corporate and Other results. We’ve invested to grow a strategic nationwide footprint. 14

SEGMENT 4 Aviation Ground Support Equipment ■ We manufacture deicing equipment, scissor lift trucks and other ground support equipment. ■ Sole-source deicer supplier to the US Air Force for 18 years. ■ Highly efficient light manufacturing facility. ■ The segment is comprised of Global Ground Support. Revenue, FY19 $47.2M Reported EBITDA*, FY19 $3.7M Reported EBITDA*, Q1 FY20 $1.4M AIR T Company Since 1998 *Reported EBITDA excludes Intercompany and Corporate and Other results. Segment’s order backlog was $26.1 million as of 3/31/19 compared to $13.3 million a year ago. 15

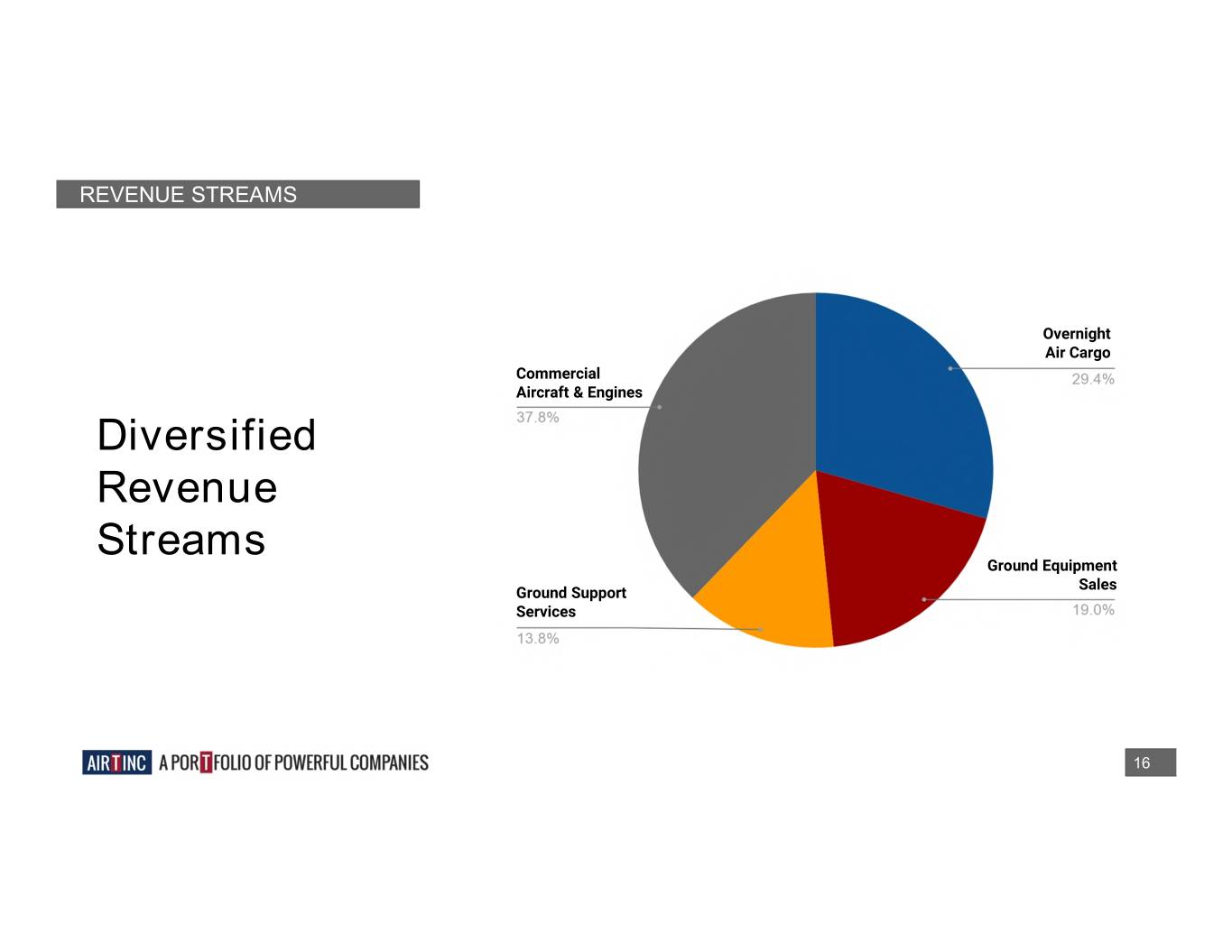

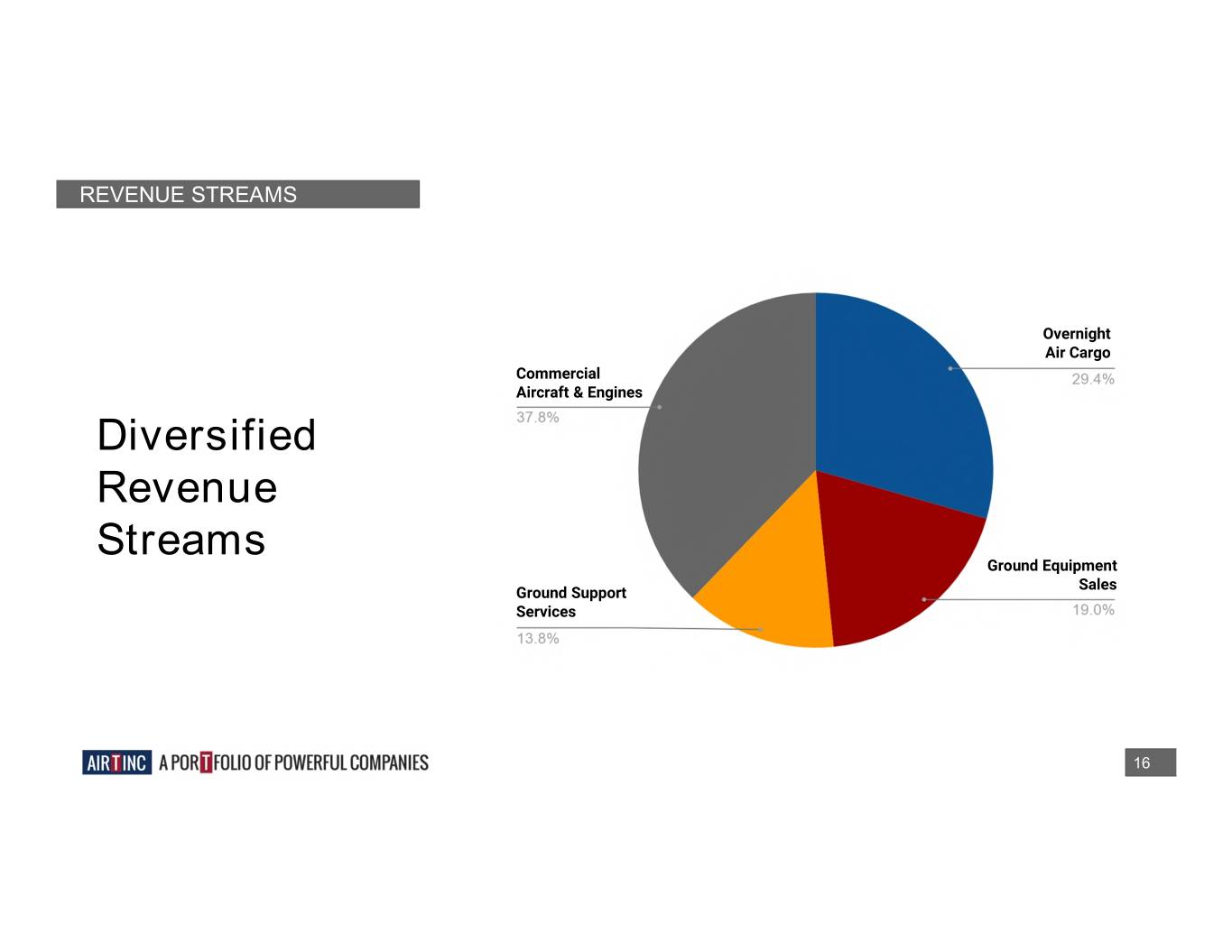

REVENUE STREAMS Overnight Air Cargo Commercial Aircraft & Engines Diversified Revenue Streams Ground Equipment Sales Ground Support Services 16

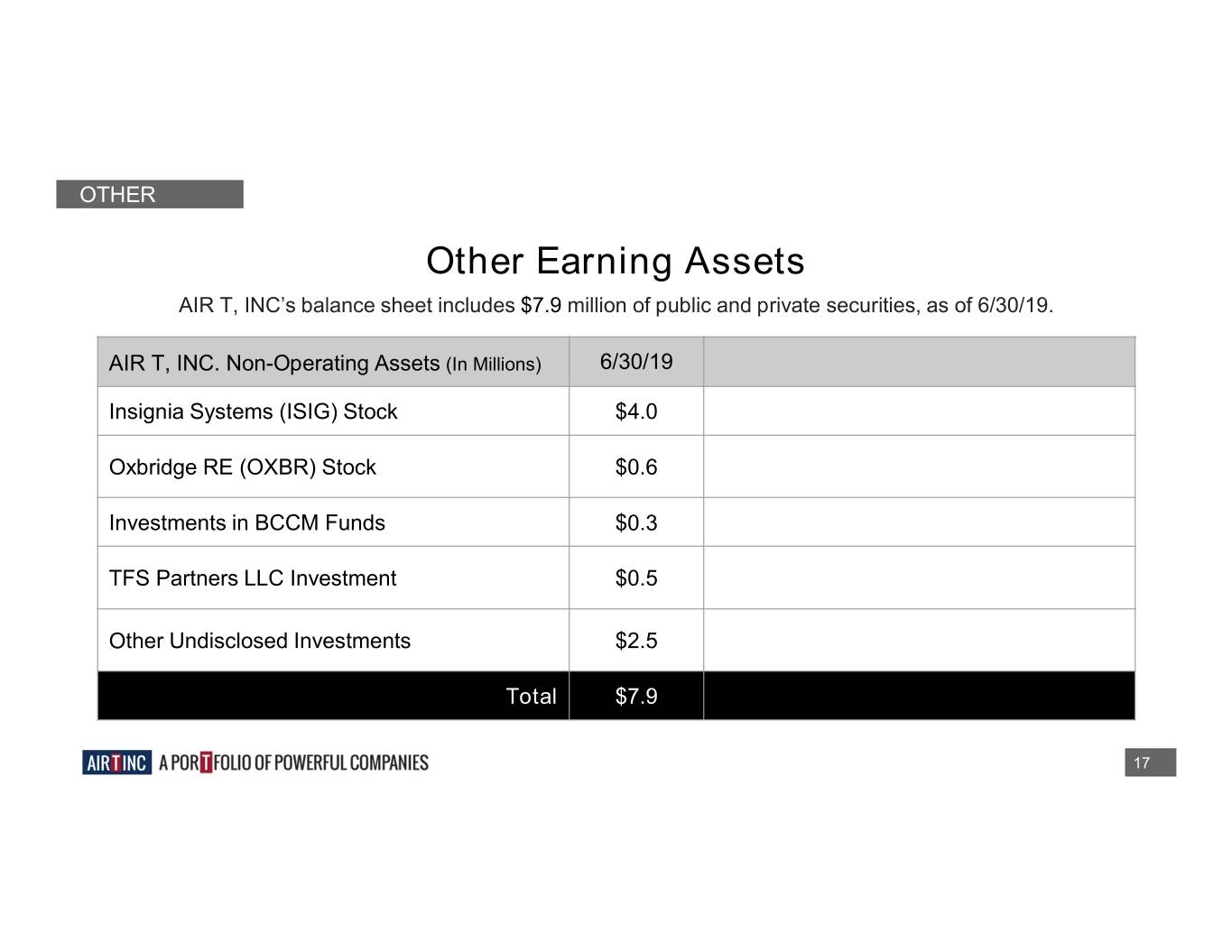

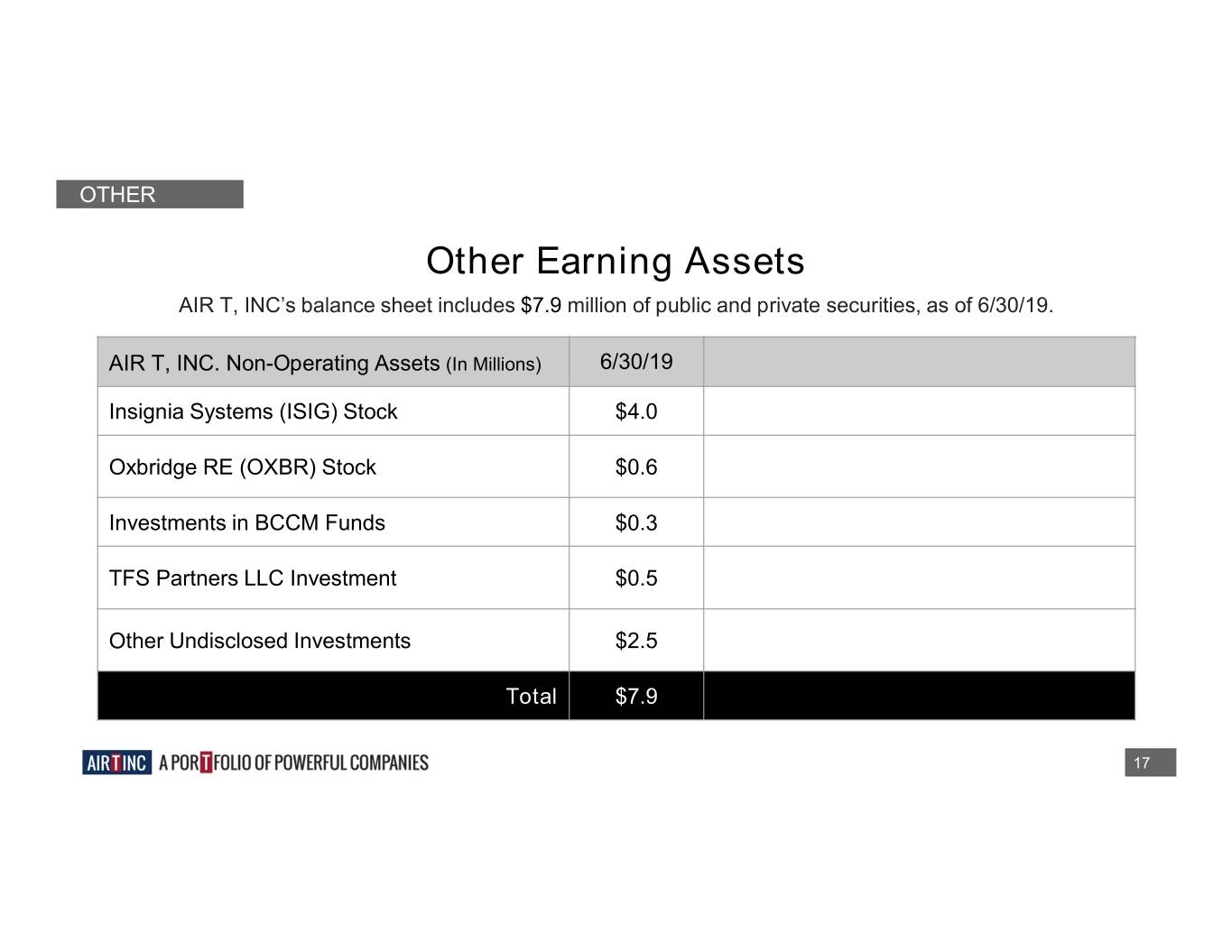

OTHER Other Earning Assets AIR T, INC’s balance sheet includes $7.9 million of public and private securities, as of 6/30/19. AIR T, INC. Non-Operating Assets (In Millions) 6/30/19 Insignia Systems (ISIG) Stock $4.0 Oxbridge RE (OXBR) Stock $0.6 Investments in BCCM Funds $0.3 TFS Partners LLC Investment $0.5 Other Undisclosed Investments $2.5 Total $7.9 17

CAPITALIZATION TABLE AIR T, INC. DIRECT & GUARANTEED Interest Rate Maturity Date 6/30/2019 Pro Forma Revolver Prime - 1% 11/30/2019 $ 14.8 $ 14.8 Term Loans 1mo LIBOR + 2%, 4.50% 1/1/2028 12.8 12.8 Corporate Headquarters Real Estate 1mo LIBOR + 2% 1/1/2028 1.6 1.6 AIR T, INC.’s capital Contrail Guarantee 1.6 1.6 structure is designed to Total Direct & Guaranteed $ 30.8 $ 30.8 appropriately shape our Trust Preferred 8% 6/7/2049 6.1 25.0 bet sizes. NON- AIR T, INC. GUARANTEED For example, AIR T Contrail Revolver 1mo LIBOR + 3% 5/5/2019 - - supports Contrail’s bank Term 1mo LIBOR + 3.75% varies, 2021 22.2 22.2 loans to a limit of $1.6 Less Air T, Inc. Guarantee (1.6) (1.6) million on $22.2m of term Total Contrail 20.6 20.6 AirCo I 7.25%, 7.50%, 8.50% varies, 2019, 2021 7.0 7.0 debt and a $20m Total Non-Air T, Inc. Guaranteed $ 27.5 $ 27.5 revolving credit facility Less: Unamortized Debt Issuance Costs (0.3) (0.3) Total Debt & Preferreds 64.1 83.0 Cash & Cash Equivalents (16.2) (35.1) Net Debt $ 47.9 $ 47.9 18

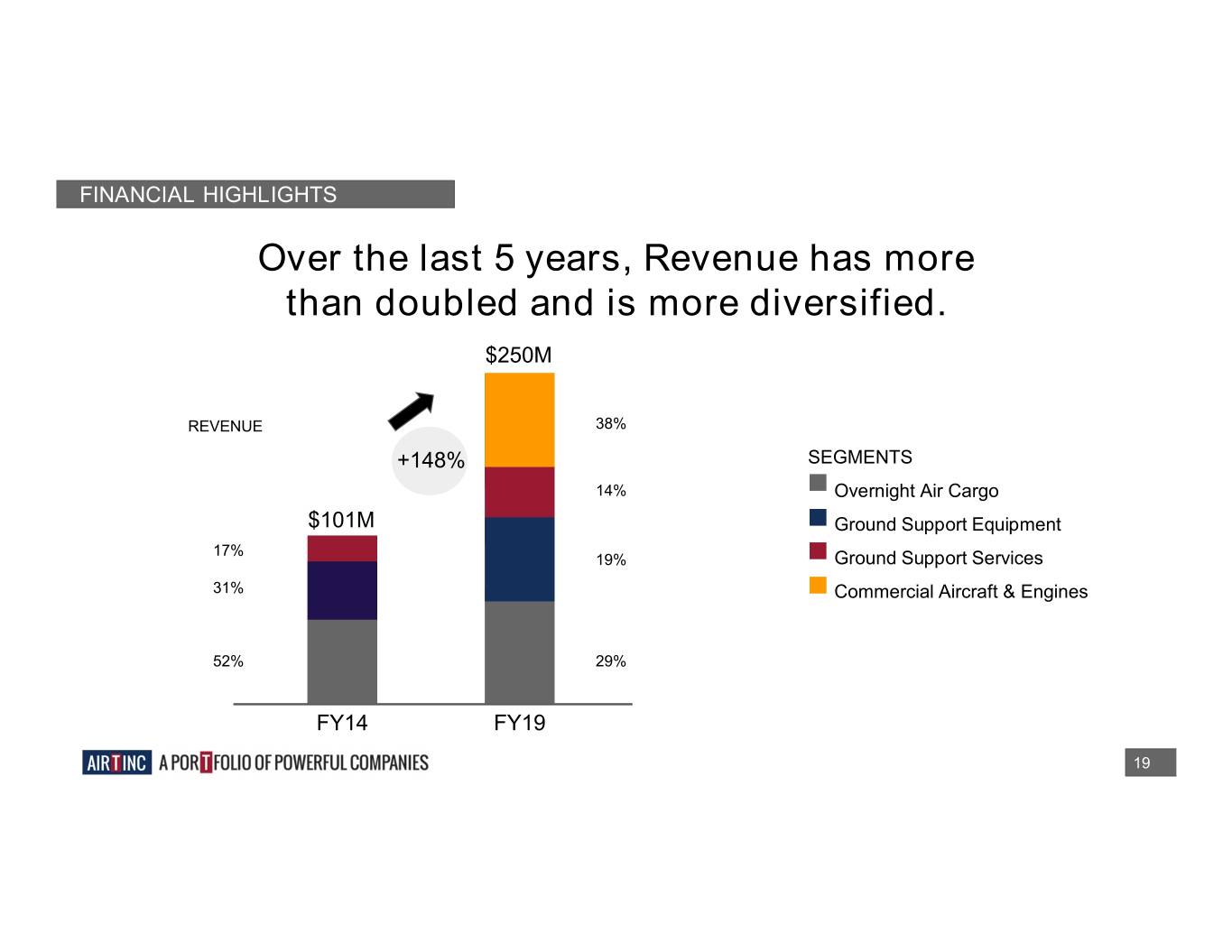

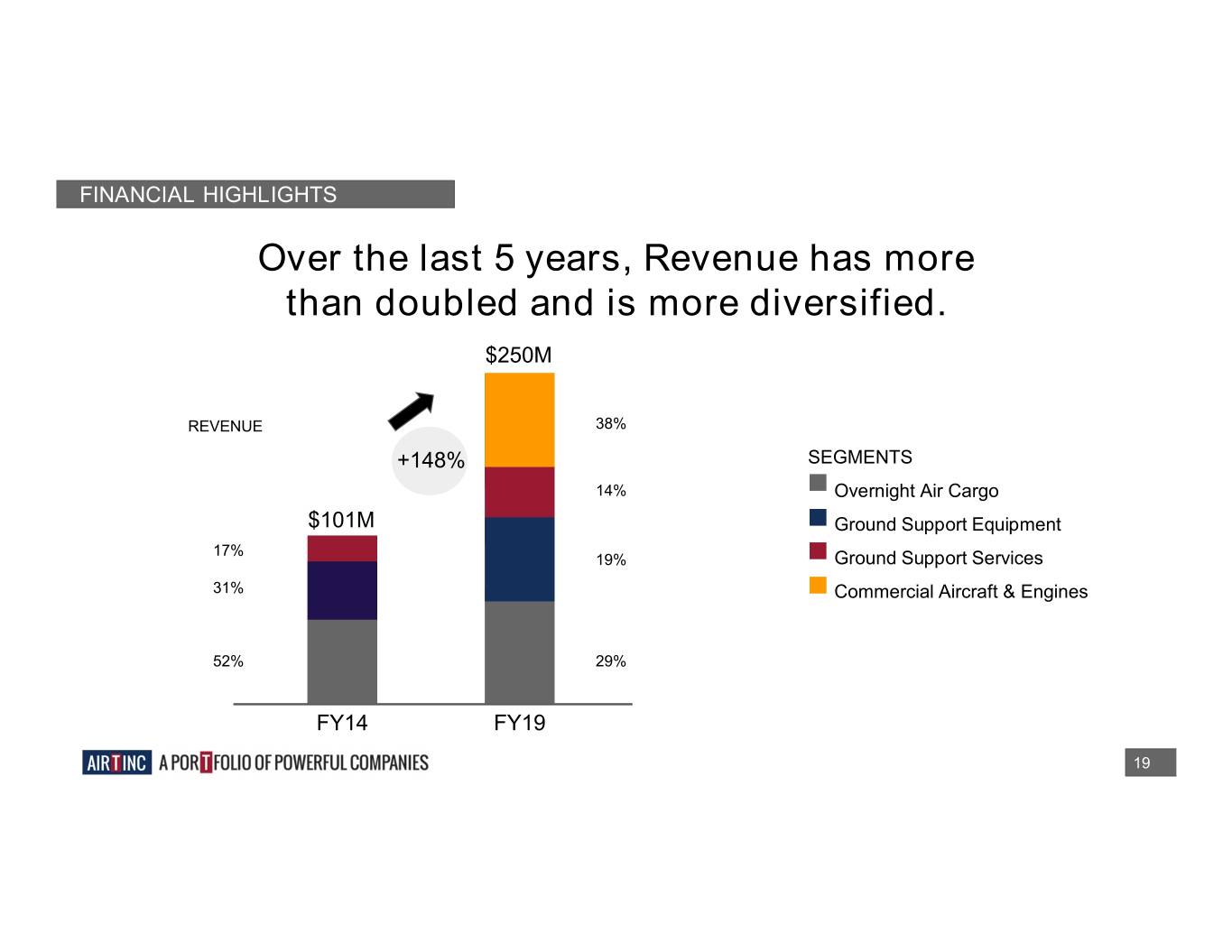

FINANCIAL HIGHLIGHTS Over the last 5 years, Revenue has more than doubled and is more diversified. $250M REVENUE 38% +148% SEGMENTS 14% Overnight Air Cargo $101M Ground Support Equipment 17% 19% Ground Support Services 31% Commercial Aircraft & Engines 52% 29% FY14 FY19 19

FINANCIAL HIGHLIGHTS Year over year, Operating Income and Adjusted EBITDA* grew by 90% and 87%, respectively. Operating Income Adjusted EBITDA* $8.1M $13.9M $4.2M $7.4M *Excludes DTI and the 21% of Contrail operating income, 20 which is a business unit of the Commercial Aircraft & Engines segment.

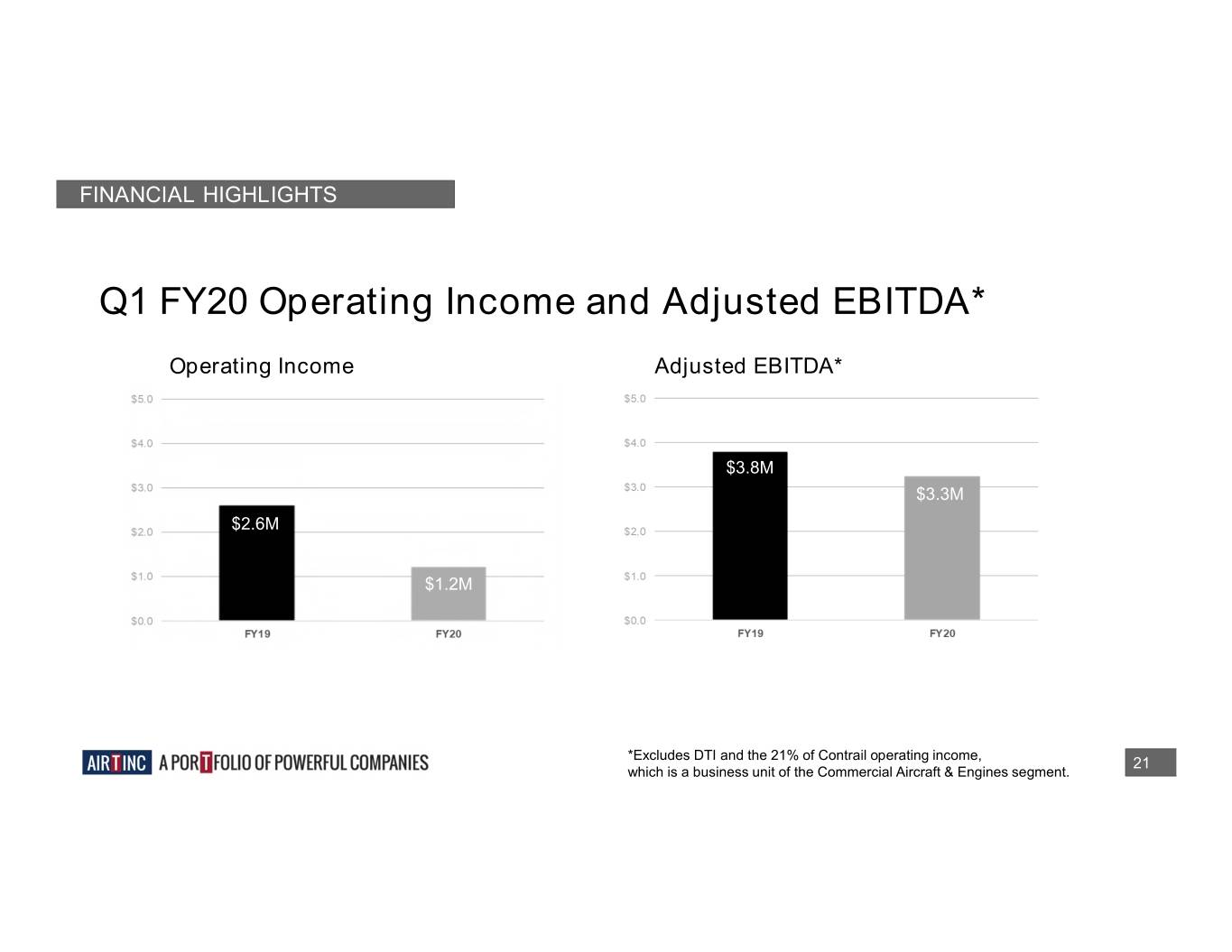

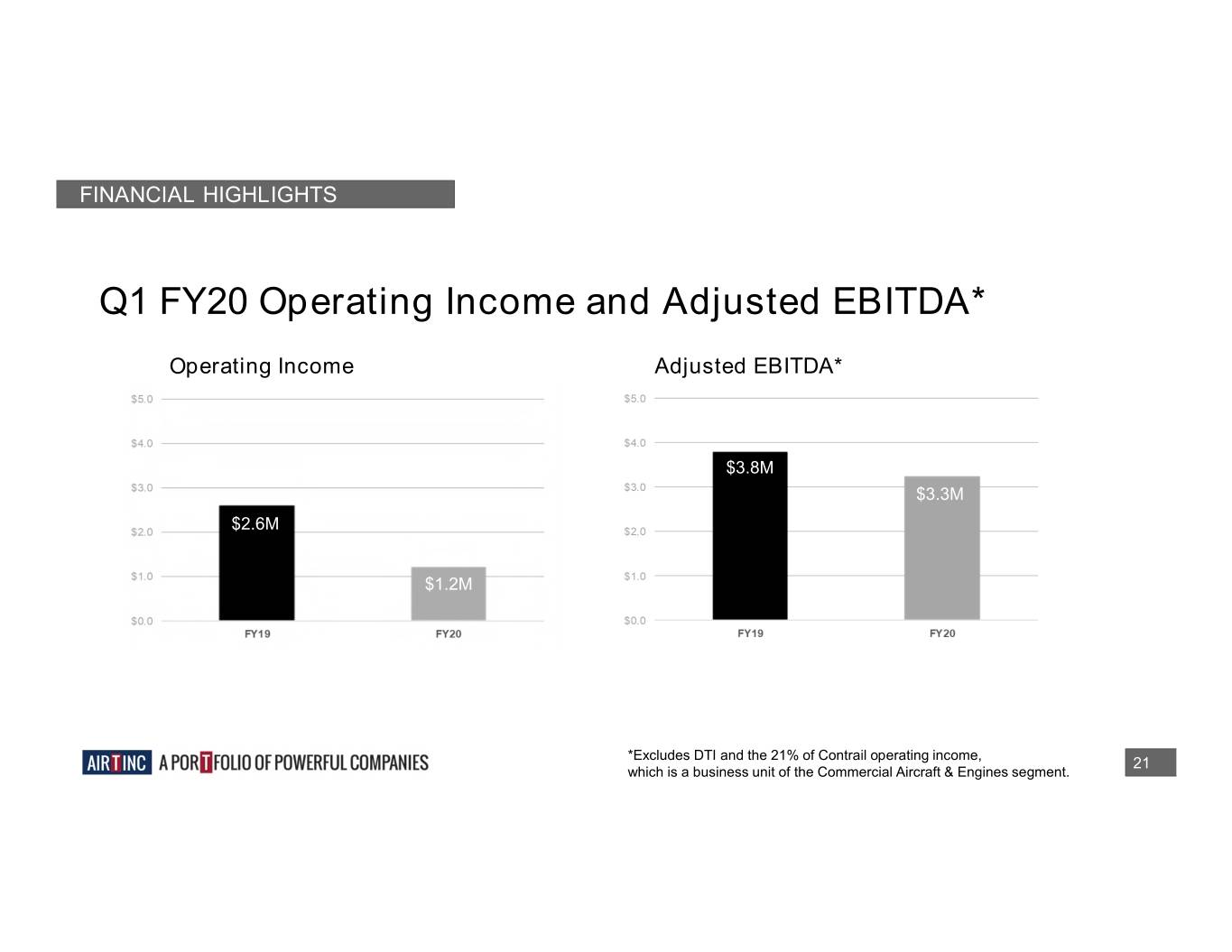

FINANCIAL HIGHLIGHTS Q1 FY20 Operating Income and Adjusted EBITDA* Operating Income Adjusted EBITDA* $2.6M $3.8M $3.3M $2.6M $1.2M $1.2M *Excludes DTI and the 21% of Contrail operating income, 21 which is a business unit of the Commercial Aircraft & Engines segment.

RECONCILIATION TABLE OPERATING INCOME FY18 $0.3M $0.0M $7.4M $2.4M $0.2M $0.0M $1.0M $5.0M $4.2M $0.1M $0.3M FY18 OI DTI 21% Professional Adjusted Air T D&A 21% of 100% of Asset Gain on Adjusted Loss Contrail OI fees Operating Contrail DTI D&A Impairment Sale of EBITDA Income D&A Assets *One-Time Charges include $965k related to accounting restatement and OCA 22

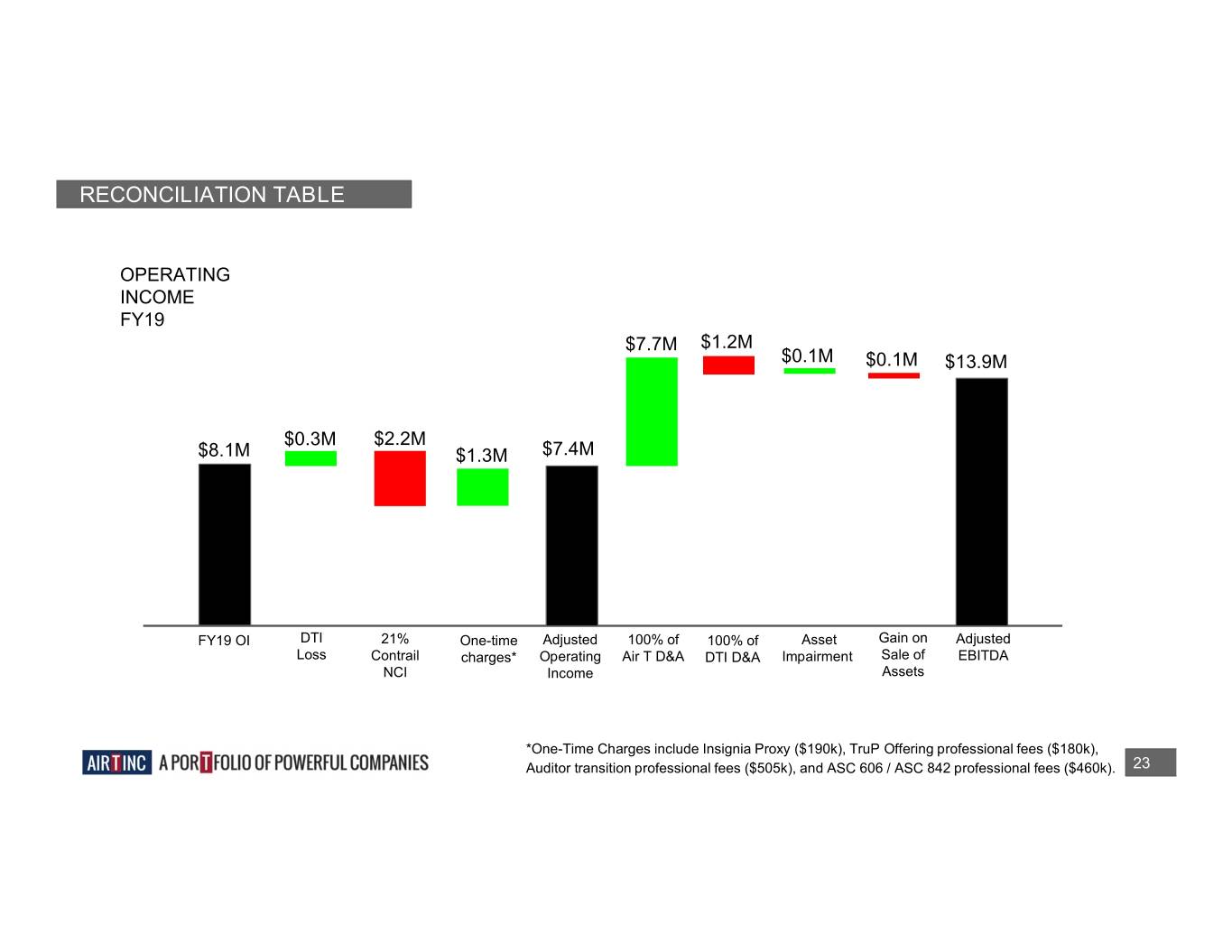

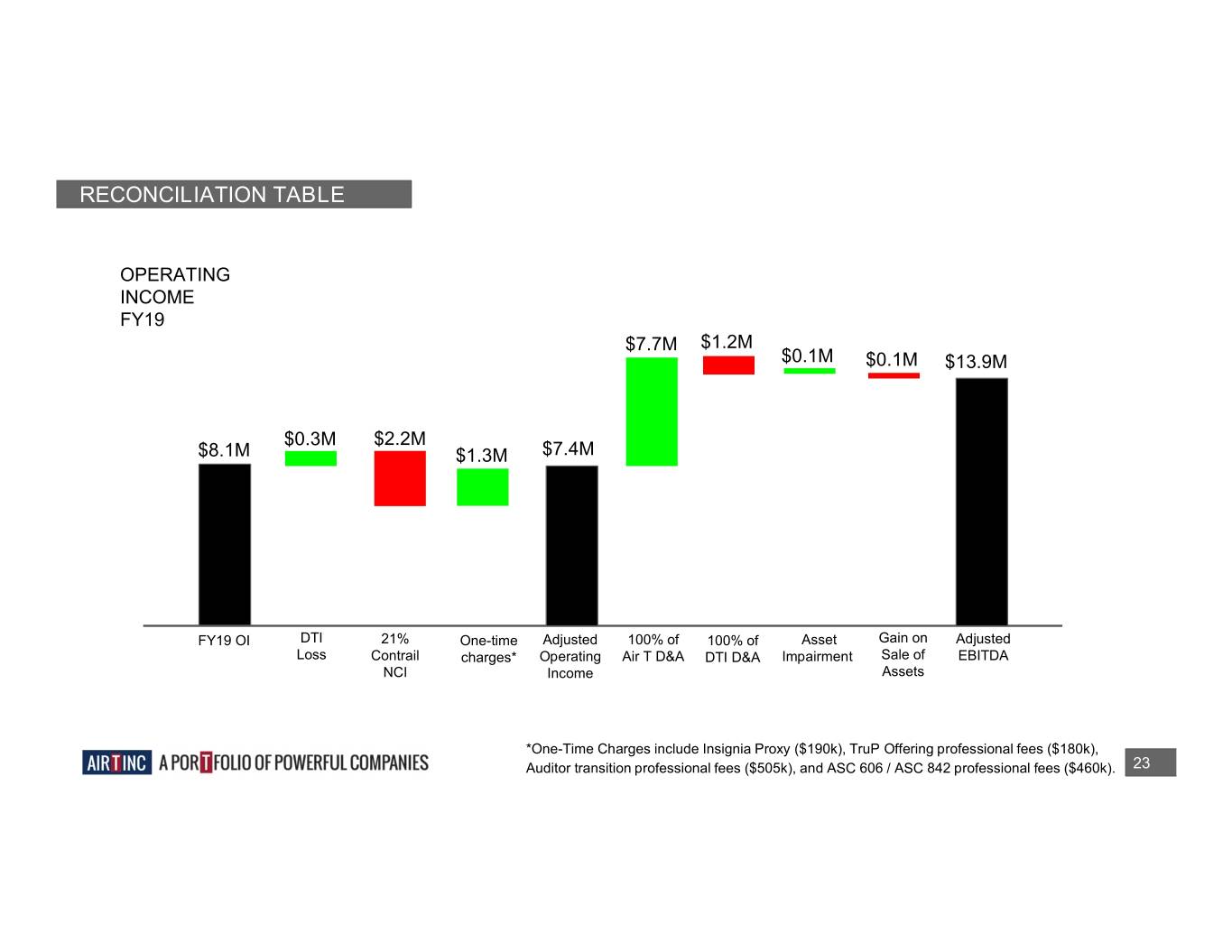

RECONCILIATION TABLE OPERATING INCOME FY19 $7.7M $1.2M $0.1M $0.1M $13.9M $0.3M $2.2M $8.1M $1.3M $7.4M FY19 OI DTI 21% One-time Adjusted 100% of 100% of Asset Gain on Adjusted Loss Contrail charges* Operating Air T D&A DTI D&A Impairment Sale of EBITDA NCI Income Assets *One-Time Charges include Insignia Proxy ($190k), TruP Offering professional fees ($180k), Auditor transition professional fees ($505k), and ASC 606 / ASC 842 professional fees ($460k). 23

FINANCIAL HIGHLIGHTS Since 9/30/2013, the share price of AIRT has increased at 16.9% per annum*. S On June 11, 2019, AIRT executed a 3-for-2 stock split. *Reporting period 9/30/13 to 8/26/19, includes $4m Trust 24 Preferred dividend to common shareholders

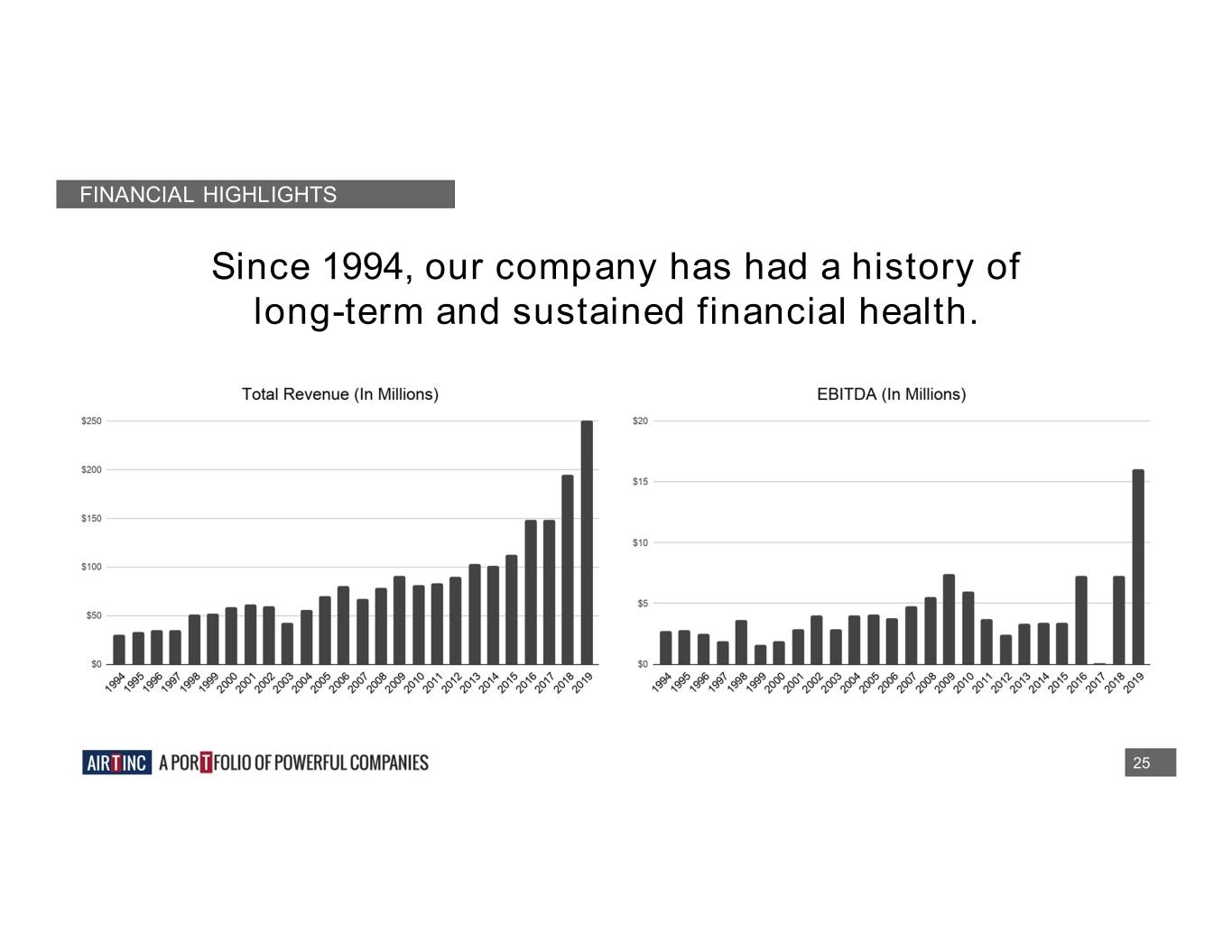

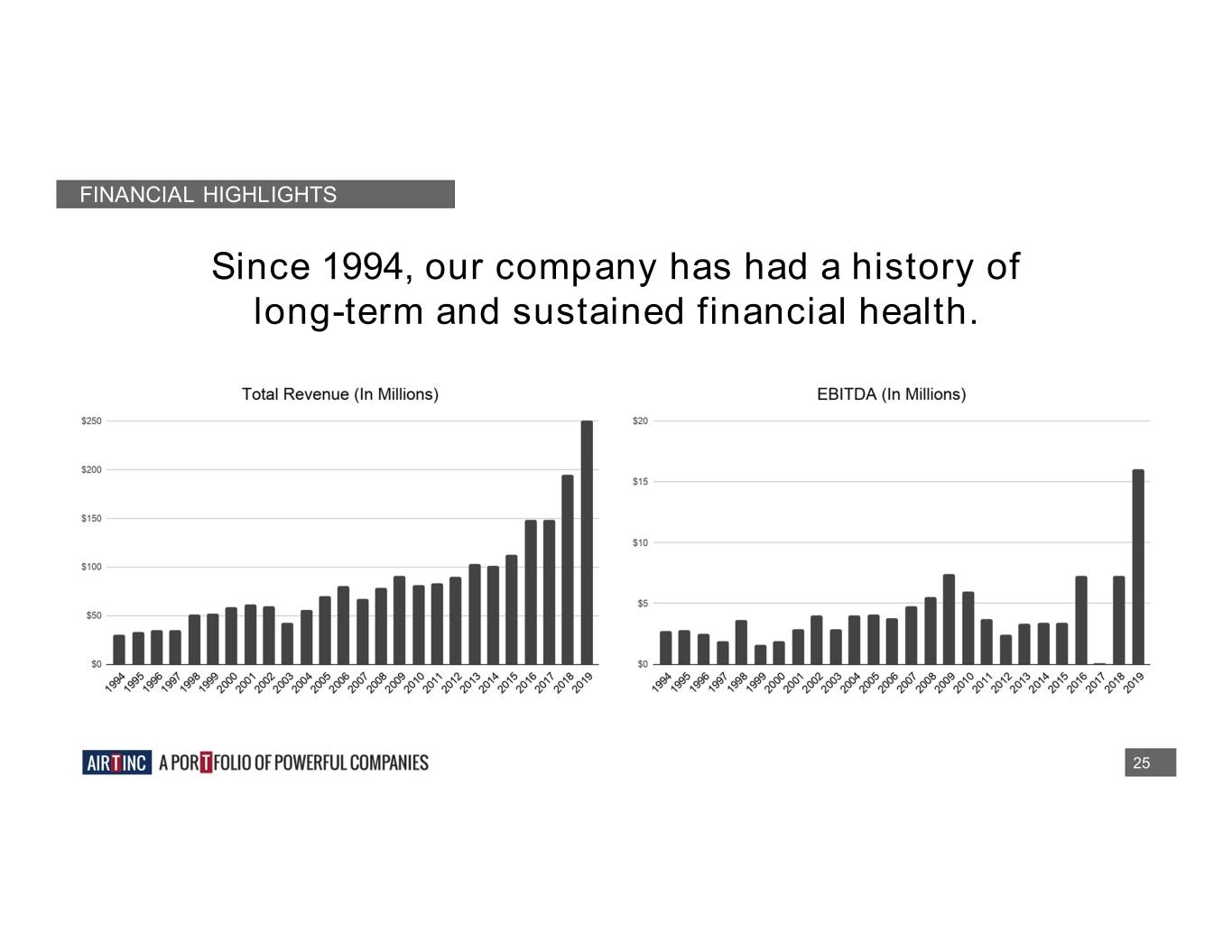

FINANCIAL HIGHLIGHTS Since 1994, our company has had a history of long-term and sustained financial health. 25

GROWTH FACTORS 26

GROWTH FACTORS Our 4 growth strategies are... ■ Invest to build our current high-performing businesses. ■ Seek to acquire new cash-flow generating businesses. ■ Identify great marketable securities or alternative assets. ■ Create unique investment products and fund through third-party capital partnerships. 27

GROWTH FACTOR 1 We plan to reinvest in projects at our high-performing businesses by... ■ Purchasing commercial aircraft for trading, leasing and part-out. ■ Purchasing engine parts inventory. ■ Funding deicer builds for Global Ground Support. 28

GROWTH FACTOR 2 We seek to acquire new cash-flow generating businesses by... ■ Identifying and acquiring high- performing businesses with edge in the marketplace, which either complement our current portfolio or diversify into industries beyond aviation. 29

GROWTH FACTOR 3 We plan to identify great marketable securities or alternative assets by... ■ Searching for another committed activist opportunity. ■ Investing in distressed and high yield securities. ■ Investing in small cap securities. ■ Further investing in our current portfolio securities. 30

GROWTH FACTOR 4 We plan to create unique investment products with outside capital partners by... ■ Offering thoughtful and sustainable products. ■ Attracting and retaining sophisticated investment professionals and creating space for talented asset managers. 31

THE 8% TruP OFFERING 32

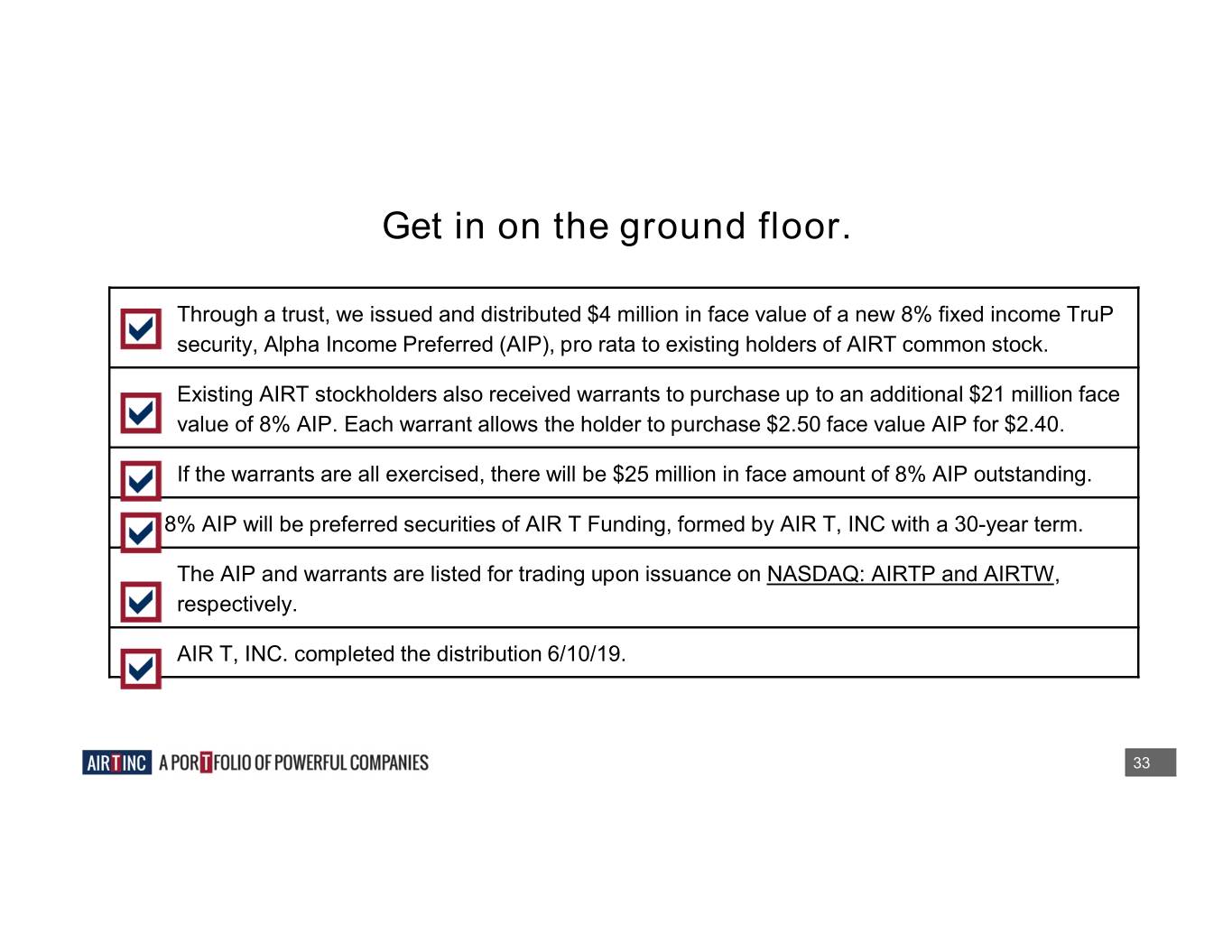

Get in on the ground floor. Through a trust, we issued and distributed $4 million in face value of a new 8% fixed income TruP security, Alpha Income Preferred (AIP), pro rata to existing holders of AIRT common stock. Existing AIRT stockholders also received warrants to purchase up to an additional $21 million face value of 8% AIP. Each warrant allows the holder to purchase $2.50 face value AIP for $2.40. If the warrants are all exercised, there will be $25 million in face amount of 8% AIP outstanding. The 8% AIP will be preferred securities of AIR T Funding, formed by AIR T, INC with a 30-year term. The AIP and warrants are listed for trading upon issuance on NASDAQ: AIRTP and AIRTW, respectively. AIR T, INC. completed the distribution 6/10/19. 33

WHY INVEST NOW 34

Be part of this investment opportunity. AIR T, INC. is a 38-year established yet growing company with hard assets. Our leadership has a long history of cash generation, and a strong track record of success in the asset management business. This offering is beneficial because it offers participants an 8% return to holders of the security, and in doing so provides a steady stream of income while diversifying portfolios and reducing overall asset allocation risk. The window of opportunity for the 8% TruP offering, and the ability to exercise the warrants, is limited and will expire within one year 6/7/20. We want to be partners with our investment community and will diligently use the offering’s proceeds to fund our M&A and growth capital for our portfolio companies. 35

APPENDIX Risk Factors Adjusted EBITDA Reconciliation 36

For more detail and explanation, please see the Company’s S-1 filed with the SEC. SUMMARY RISK FACTORS The purchase of securities of Air T, Inc., the “Company,” is highly speculative and involves a very high degree of risk. An investment in the Company is suitable only for persons who can afford the loss of their entire investment. Accordingly, in making an investment decision with respect to the Company’s securities, investors should carefully consider all material risk factors, including the risks, uncertainties and additional information set forth below as well as set forth in (i) our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Currents Reports on Form 8-K, and our definitive proxy statements, all which are filed with the SEC, and (ii) our prospectus, filed as a part of our Registration Statement on Form S-1, which is filed with the SEC, and any supplement to the prospectus, including information in any documents subsequently incorporated by reference into the prospectus. Additional risks not presently known or are currently deemed immaterial could also materially and adversely affect our financial condition, results of operations, business and prospects. Risks Related to Our Dependence on Significant Customers ● We are significantly dependent on our contractual relationship with FedEx Corporation, the loss of which would have a material adverse effect on our business, results of operations and financial position. ● Changes in our agreements with FedEx subject us to greater operating risks. ● Because of our dependence on FedEx, we are subject to the risks that may affect FedEx’s operations. ● A material reduction in the aircraft we fly for FedEx could materially adversely affect our business and results of operations. ● Our ground support services segment has been dependent upon the revenues from two significant customers, the loss of which could materially impact the segment’s results. 37

For more detail and explanation, please see the Company’s S-1 filed with the SEC. SUMMARY RISK FACTORS Other Business Risks ● Our business, financial condition and results of operations are dependent upon those of our individual businesses, and our aggregate investment in particular industries. ● Sales of deicing equipment can be affected by weather conditions. ● Our results of operations may be affected by the value of securities we hold for investment and we may be unable to liquidate our investments in a timely manner at full value. ● Our business may be adversely affected by information technology disruptions. ● Labor inflation could impact our profitability. ● Legacy technology systems require a unique technical skillset which is becoming more scarce. ● Future acquisitions and dispositions of our businesses and investments are possible, changing the components of our assets and liabilities, and if unsuccessful or unfavorable, could reduce the value of our securities. ● We face numerous risks and uncertainties as we expand our business. ● The failure of our information technology systems could adversely impact our reputation and financial performance. ● We may not be able to insure certain risks economically. ● We could experience significant increases in operating costs and reduced profitability due to competition for skilled management and staff employees in our operating businesses. ● Legal liability may harm our business. ● Future cash flows from operations or through financings may not be sufficient to enable the Company to meet its obligations, and this would likely have a material adverse effect on its businesses, financial condition and results of operations, and credit market volatility may affect our ability to refinance our existing debt, borrow funds under our existing lines of credit or incur additional debt. 38

For more detail and explanation, please see the Company’s S-1 filed with the SEC. SUMMARY RISK FACTORS Continued - Other Business Risks ● Liens on our engines or aircraft could exceed the value of such assets, which could negatively affect our ability to repossess, lease or sell a particular engine or aircraft. ● In certain countries, an engine affixed to an aircraft may become an accession to the aircraft and we may not be able to exercise our ownership rights over the engine. ● Compliance with the regulatory requirements imposed on us as a public company results in significant costs that may have an adverse effect on our results. ● We are subject to governmental regulation and our failure to comply with these regulations could cause the government to withdraw or revoke our authorizations and approvals to do business and could subject us to penalties and sanctions that could harm our business. ● We have a concentrated shareholder base which has the power to contest the outcome of most matters submitted to the stockholders for approval and could affect our stock prices adversely if selling a substantial amount of stock. ● Our business might suffer if we were to lose the services of certain key employees. ● To service our debt and meet our other cash needs, we will require a significant amount of cash, which may not be available. ● Despite our substantial indebtedness, we might incur significantly more debt. ● We may be unable to generate sufficient returns on our aircraft and engine investments. ● A return to historically high fuel prices or continued volatility in fuel prices could affect the profitability of the aviation industry and our lessees’ ability to meet their lease payment obligations to us. ● Interruptions in the capital markets could impair our lessees’ ability to finance their operations, which could prevent the lessees from complying with payment obligations to us. ● Our lessees may fail to properly maintain our aircraft or engines. ● Our lessees may fail to adequately insure our aircraft or engines. 39

For more detail and explanation, please see the Company’s S-1 filed with the SEC. SUMMARY RISK FACTORS Continued - Other Business Risks ● Our business strategy includes acquisitions, and acquisitions entail numerous risks, including the risk of management diversion and increased costs and expenses, all of which could negatively affect the Company’s profitability. ● We may sustain losses in our investment portfolio that could adversely affect our results of operations, financial condition and liquidity. ● Newly enacted U.S. government tax reform could have a negative impact on the results of future operations. ● We are affected by the risks faced by commercial aircraft operators and maintenance, repair and overhaul companies (“MROs”) because they are our customers. ● Our engine values and lease rates, which are dependent on the status of the types of aircraft on which engines are installed, and other factors, could decline. ● Upon termination of a lease, we may be unable to enter into new leases or sell the airframe, engine or its parts on acceptable terms. ● Failures by lessees to meet their maintenance and recordkeeping obligations under our leases could adversely affect the value of our leased engines and aircraft and our ability to lease the engines and aircraft in a timely manner following termination of the leases. ● Our operating results vary and comparisons to results for preceding periods may not be meaningful. ● We may not be able to repossess an engine or aircraft when the lessee defaults, and even if we are able to repossess the engine or aircraft, we may have to expend significant funds in the repossession, remarketing and leasing of the asset. ● We and our customers operate in a highly regulated industry and changes in laws or regulations may adversely affect our ability to lease or sell our engines or aircraft. ● Our aircraft, engines or parts could cause bodily injury or property damage, exposing us to liability claims. ● An increase in interest rates or in our borrowing margin would increase the cost of servicing our debt and could reduce our profitability. ● We have risks in managing our portfolio of engines to meet customer needs. ● Our inability to maintain sufficient liquidity could limit our operational flexibility and also impact our ability to make payments on our obligations as they come due. 40

For more detail and explanation, please see the Company’s S-1 filed with the SEC. SUMMARY RISK FACTORS Continued - Other Business Risks ● If our lessees fail to cooperate in returning our aircraft or engines following lease terminations, we may encounter obstacles and are likely to incur significant costs and expenses conducting repossessions. ● If our lessees fail to discharge aircraft liens for which they are responsible, we may be obligated to pay to discharge the liens. ● If our lessees encounter financial difficulties and we restructure or terminate our leases, we are likely to obtain less favorable lease terms. ● We may enter into strategic ventures that pose risks, including a lack of complete control over the enterprise, and potential unforeseen risks, any of which could adversely impact our financial results. ● Our policies and procedures designed to ensure compliance with applicable laws, including anti-bribery and corruption laws, may not be effective in all instances to prevent violations and as a result we may be subject to related governmental investigations. ● Foreign exchange rate fluctuations could adversely impact our aggregate foreign currency exposure. ● Cash may not be available to meet our financial obligations when due or enable us to capitalize on investment opportunities when they arise. ● Deficiencies in our public company financial reporting and disclosures could adversely impact our reputation. Risks Related to the Offering ● The ranking of the Company’s obligations under the junior subordinated debentures and the guarantee creates a risk that Air T Funding may not be able to pay amounts due to holders of the Capital Securities. ● The Company has the option to extend the interest payment period; tax consequences of a deferral of interest payments. ● Tax event redemption or investment company act redemption ● The Company may cause the Junior Subordinated Debentures to be distributed to the holders of the Capital Securities. ● There are limitations on direct actions against the Company and on rights under the guarantee. ● The covenants in the Indenture are limited. 41

For more detail and explanation, please see the Company’s S-1 filed with the SEC. SUMMARY RISK FACTORS Continued - Risks Related to the Offering ● Holders of the Capital Securities will generally have limited voting rights. ● There is no existing public market for the Capital Securities; market prices may fluctuate based on numerous factors. 42

Adjusted EBITDA Reconciliation 43

Q1 Adjusted EBITDA Reconciliation 44